Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to Section 240.14a-12 | |

AKAMAI TECHNOLOGIES, INC.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| 1 | Title of each class of securities to which transaction applies:

| |||

| 2 | Aggregate number of securities to which transaction applies:

| |||

| 3 | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| 4 | Proposed maximum aggregate value of transaction:

| |||

| 5 | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials: | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1 | Amount previously paid:

| |||

| 2 | Form, Schedule or Registration Statement No.:

| |||

| 3 | Filing party:

| |||

| 4 | Date Filed:

| |||

Table of Contents

Dear Fellow Stockholders:

2020 was a year unlike any other. As the world dealt with the COVID-19 pandemic, the internet became even more critical to everyday life—and needed on a scale the world has never experienced. As we have for the last 20-plus years, Akamai rose to the challenge to help ensure our customers’ online experiences were fast, intelligent, and secure.

Our largest Media and Carrier customers saw demand surge following stay-at-home orders, and our platform provided them with great performance at global scale, delivering a year’s worth of increased traffic in just a few weeks. Our network team raced to nearly double our capacity this year, overcoming lockdowns in the field, shuttered data centers, and supply chain disruptions.

Our IT team enabled our global organization to transition to remote work in just 10 days. Marketing shifted quickly to virtual events, driving a significant increase in both digital event attendance and social engagement. And our Services and Support teams transitioned to 100% remote customer support instantly while maintaining excellent customer satisfaction ratings.

As more retailing went online, we supported many of the world’s largest commerce companies, enabling our customers to surpass e-commerce records on Singles Day in Asia and on Black Friday and Cyber Monday in the United States. We also offered flexible contract terms to help customers in the Travel and Hospitality industries weather the COVID-19 storm, focusing on winning these customers for the long term.

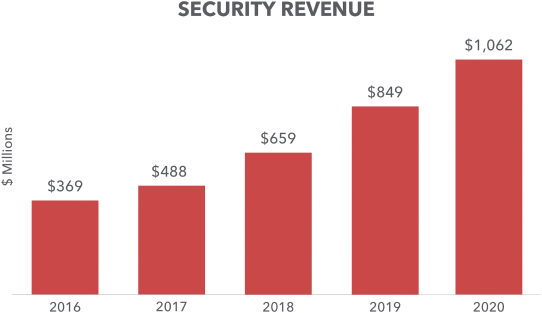

Cyberattackers were busier than ever this year, taking advantage of the distraction and increased vulnerability associated with the pandemic. Akamai responded by helping to keep our customers safe when they needed us most. Our security business grew 25% in 2020 and surpassed $1 billion in revenue, increasing from just $25 million in 2012. It developed into a growth engine of our business and an area of where we expect continued investment and innovation, building on our new products and technologies like Page Integrity Manager, Secure Web Gateway, and Multi-factor Authentication.

While 2020 was a year of disruption for many sectors of the economy, we achieved several notable milestones. We grew our total revenue 11% to more than $3 billion, exceeded our operating margin goal for 2020, and delivered record earnings per share.

We’re proud of the results we achieved in 2020 and are confident about our future. We believe Akamai is well-positioned to capitalize on substantial market opportunities in cloud security, “serverless” edge computing, and online video streaming, with particular focus on Asia Pacific and Latin America. And we continued to deliver our results the right way, living our values and striving to be a great place to work and a company that cares about the communities where we work and live.

I want to thank our more than 8,000 employees for their very hard work on behalf of our many customers and the billions of internet users around the world. Despite the pandemic and social unrest in many of our communities, Akamai employees maintained their can-do attitude and customer-first mindset, enabling our platform to manage more traffic, more web transactions and more cyberattacks than ever before. Their creativity, teamwork and tenacity are key to what makes Akamai such a unique and strong company.

We hope you can attend Akamai’s 2021 Annual Meeting of Stockholders to be held on June 3, 2021, at 9:30 a.m., Eastern time. In light of continued public health and travel concerns that our stockholders may have and recommendations that public health officials have issued given the COVID-19 situation, we will once again hold our stockholder meeting as a virtual-only meeting. The meeting will also be available through a link on our investor relations website (www.ir.akamai.com). Details regarding how to access the meeting and the business to be conducted at the meeting are more fully described in the accompanying Notice of 2021 Annual Meeting of Stockholders and Proxy Statement.

Your vote is important. Whether or not you plan to attend the Annual Meeting of Stockholders, please vote as soon as possible. Voting by proxy will ensure your representation at the meeting if you do not attend in person. Please review the instructions on the proxy card regarding your voting options.

We wish continued good health and well-being to all in 2021.

/s/ Dr. Tom Leighton |

Dr. Tom Leighton |

| Chief Executive Officer |

Table of Contents

AKAMAI TECHNOLOGIES, INC.

145 BROADWAY

CAMBRIDGE, MASSACHUSETTS 02142

NOTICE OF 2021 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 3, 2021

The 2021 Annual Meeting of Stockholders (the “Annual Meeting”) of Akamai Technologies, Inc. (“Akamai” or the “Company”) will be held on Thursday, June 3, 2021, at 9:30 a.m., Eastern time, exclusively via the internet at a virtual web conference at www.meetingcenter.io/290664094. The password for the meeting will be AKAM2021.

In light of the ongoing COVID-19 pandemic, for the health and well-being of our stockholders, employees and directors, we have determined that the Annual Meeting will be held exclusively online in a virtual meeting format, via the internet, with no physical in-person meeting. Stockholders attending our virtual Annual Meeting will be able to attend, vote and submit questions. Further information about how to attend the Annual Meeting online, vote your shares online during the meeting and submit questions during the meeting is included in the accompanying proxy statement.

At the Annual Meeting, we expect stockholders will consider and vote upon the following matters:

| (1) | To elect eleven nominees currently serving as members of our Board of Directors and named in the attached proxy statement to serve on our Board of Directors for a one-year term expiring at the 2022 Annual Meeting of Stockholders; |

| (2) | To approve an amendment and restatement of our 2013 Stock Incentive Plan that will include (i) a 3,000,000 share increase in the number of shares of common stock authorized for issuance thereunder and (ii) an extension of the expiration date of the plan to June 3, 2031; |

| (3) | To approve, on an advisory basis, our named executive officer compensation; |

| (4) | To ratify the selection of PricewaterhouseCoopers LLP as our independent auditors for the fiscal year ending December 31, 2021; and |

| (5) | To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

Stockholders of record at the close of business on April 9, 2021, are entitled to notice of, and to vote at, the Annual Meeting and any adjournment or postponement thereof. The stock transfer books of Akamai will remain open for the purchase and sale of Akamai’s common stock.

A complete list of stockholders of record will be available at least 10 days prior to the meeting at 145 Broadway, Cambridge, Massachusetts 02142. This list will also be available to stockholders of record during the Annual Meeting for examination at www.meetingcenter.io/290664094.

All stockholders are cordially invited to attend the Annual Meeting online.

| By order of the Board of Directors, |

/s/ Aaron S. Ahola |

AARON S. AHOLA |

| Executive Vice President, General Counsel and Secretary |

Cambridge, Massachusetts

April 23, 2021

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING ONLINE, PLEASE SUBMIT YOUR PROXY OR VOTING INSTRUCTIONS AT YOUR EARLIEST CONVENIENCE. MOST STOCKHOLDERS HAVE A CHOICE OF VOTING OVER THE INTERNET, BY TELEPHONE OR BY MAIL. SENDING IN YOUR PROXY WILL NOT PREVENT YOU FROM VOTING YOUR SHARES ONLINE DURING THE ANNUAL MEETING IF YOU DESIRE TO DO SO, AND YOUR PROXY IS REVOCABLE AT YOUR OPTION BEFORE IT IS EXERCISED.

FURTHER INFORMATION ABOUT HOW TO ATTEND THE ANNUAL MEETING ONLINE, VOTE YOUR SHARES ONLINE DURING THE MEETING AND SUBMIT QUESTIONS DURING THE MEETING IS INCLUDED IN THE ACCOMPANYING PROXY STATEMENT.

Table of Contents

Table of Contents

AKAMAI TECHNOLOGIES, INC.

145 BROADWAY

CAMBRIDGE, MASSACHUSETTS 02142

PROXY STATEMENT

THIS PROXY STATEMENT IS FURNISHED IN CONNECTION WITH THE SOLICITATION OF PROXIES BY THE BOARD OF DIRECTORS OF AKAMAI TECHNOLOGIES, INC., OR AKAMAI OR THE COMPANY, FOR USE AT THE 2021 ANNUAL MEETING OF STOCKHOLDERS, WHICH WE REFER TO IN THIS DOCUMENT AS THE ANNUAL MEETING, TO BE HELD EXCLUSIVELY ONLINE VIA THE INTERNET AT A VIRTUAL WEB CONFERENCE AT HTTP://WWW.MEETINGCENTER.IO/290664094 AT 9:30 A.M., EASTERN TIME, ON JUNE 3, 2021, AND AT ANY ADJOURNMENT OR POSTPONEMENT OF THAT MEETING. THE PASSWORD FOR THE MEETING WILL BE AKAM2021. You may obtain instructions for how to access the Annual Meeting online by contacting Investor Relations, Akamai Technologies, Inc., 145 Broadway, Cambridge, Massachusetts 02142; telephone: 617-444-3000.

Our Annual Report to Stockholders for the year ended December 31, 2020 is being mailed to our stockholders with the mailing of the Notice of 2021 Annual Meeting of Stockholders and this Proxy Statement on or about April 23, 2021.

Important Notice Regarding the Availability of Proxy Materials for the 2021 Annual Meeting of Stockholders to be Held on June 3, 2021:

This Proxy Statement and the 2020 Annual Report to Stockholders are available for viewing, printing and downloading at www.akamai.com/html/investor/financial_reports.html.

You may obtain a copy of our Annual Report on Form 10-K for the year ended December 31, 2020, as filed with the Securities and Exchange Commission, which we sometimes refer to herein as the Commission, except for exhibits thereto, without charge upon written request to Akamai Technologies, Inc., 145 Broadway, Cambridge, Massachusetts 02142, Attn: Investor Relations. Exhibits will be provided upon written request and payment of an appropriate processing fee.

Certain documents referenced in this Proxy Statement are available on our website at www.akamai.com. We are not including the information contained on our website, or any information that may be accessed by links on our website, as part of, or incorporating it by reference into, this Proxy Statement.

This Proxy Statement contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to risks and uncertainties and are based on the beliefs and assumptions of our management based on information currently available to them. Use of words such as “believes,” “expects,” “anticipates,” “intends,” “plans,” “should,” “may,” “could,” or similar expressions indicates a forward-looking statement. Forward-looking statements are not guarantees of future performance and involve risks, uncertainties and assumptions. Important factors that could cause actual results to differ materially from the forward-looking statements include, but are not limited to, inability to grow revenue, particularly from increased sales of security solutions, or inability to increase profitability as projected; lack of market acceptance of new solutions; cyberattacks that we are not able to successfully defend against, and other factors set forth under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2020, which accompanies this Proxy Statement. We disclaim any obligation to update any forward-looking statements as a result of new information, future events or otherwise.

/1/

Table of Contents

Below are highlights of important information you will find in this Proxy Statement. As it is only a summary, please review the complete Proxy Statement before you vote.

Our Mission and Purpose

Akamai’s mission is to deliver value to our customers; empowering them to manage successful online businesses by protecting their digital assets and enabling superior individual experiences. Our purpose in pursuing this mission is to help bring the world closer together by making the internet safe, fast and reliable for people around the globe.

Our Strategy

We operate in a technology landscape that is rapidly evolving, driving enterprises to enhance their digital capabilities to improve productivity, transform customer experiences, increase brand awareness, and drive competitive advantage. At the same time, security threats are growing more prevalent and advanced. Enterprise applications are moving from behind the firewall to the cloud - making cybersecurity more complex to achieve than yesterday’s strategy of a perimeter defense. More consumers are “cutting the cord” and consuming entertainment over the internet rather than through traditional cable, and they are increasingly using mobile devices to consume content and shop. With the COVID-19 pandemic and related shutdowns, we saw dramatic growth in the movement of activities to the internet - accelerating the trends discussed above. As more people watched entertainment, played games, shopped and socialized online and entire corporate workforces moved to a remote posture, we saw an acceleration in attack traffic and other security threats.

Our strategy is to leverage our unique Intelligent Edge Platform and creative employees to provide our customers with innovative, market-leading products that enable opportunities and address challenges in this evolving landscape.

In addition to delivering value to our customers, we believe it is important for Akamai to:

| 🌑 | invest in the health, safety and development of our employees; |

| 🌑 | deal fairly and ethically with our suppliers and partners; |

| 🌑 | support the communities in which we live and work; |

| 🌑 | operate in an environmentally sustainable way; and |

| 🌑 | generate long-term value for our stockholders. |

/2/

Table of Contents

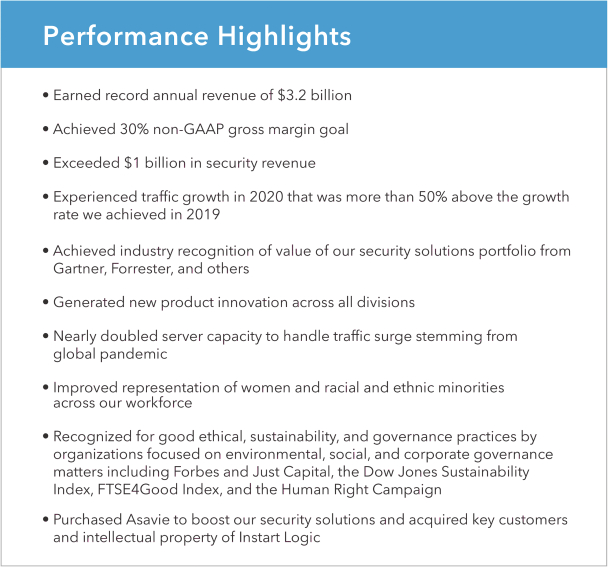

Akamai 2020 Performance Highlights

In 2020, Akamai registered achievements across our operations, including the following highlights.

/3/

Table of Contents

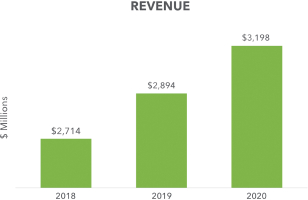

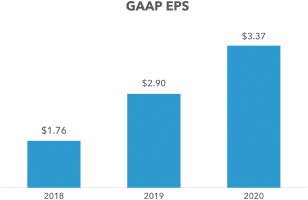

From a financial perspective, we have increased our revenue in each of the past three fiscal years and have been profitable over that same period. The charts below show our revenue and earnings per share, calculated in accordance with generally accepted accounting principles in the United States, or GAAP, for the past three fiscal years.

|

|

In particular, our security business has grown rapidly in recent years as shown below:

/4/

Table of Contents

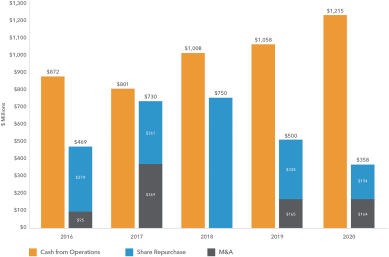

Over the past five years, we have successfully generated cash from operations to use in strategic initiatives. We believe we have effectively deployed that cash in stock repurchases and acquisition activity as reflected in the chart below.

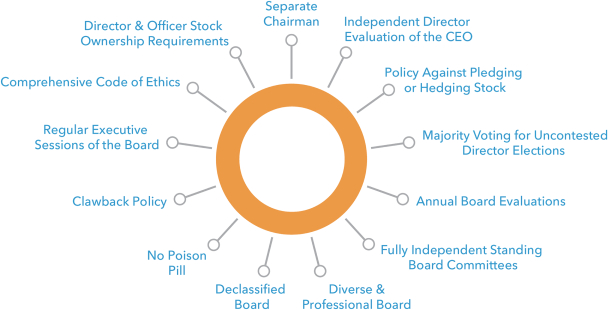

Corporate Governance Snapshot

Akamai’s governance structure reflects our commitment to advancing the long-term interests of our stockholders, maintaining accountability, diversity, ethical conduct and alignment of interests between leadership and investors. Highlights of our governance profile include:

/5/

Table of Contents

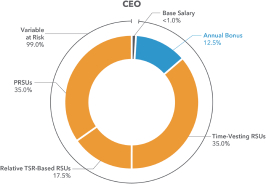

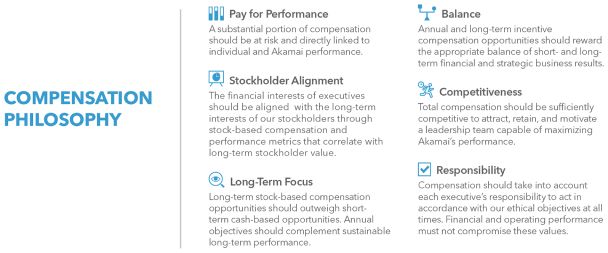

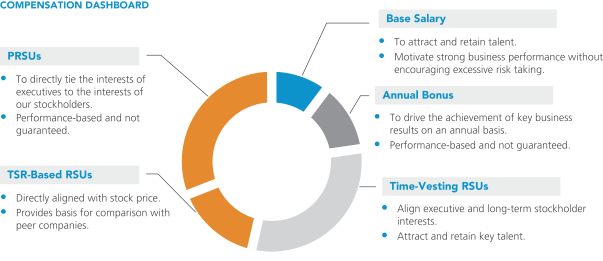

Executive Compensation Overview

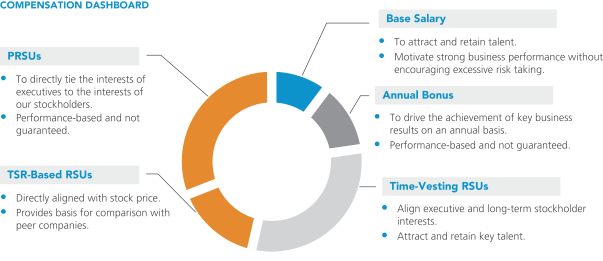

Akamai has developed an executive compensation program that is designed to closely align executive compensation with performance by allocating a majority of target compensation to performance-based equity awards that directly link the value of executive compensation to our stock price performance and tying annual bonuses to performance against specific financial measures. Key aspects of our 2020 executive compensation program are highlighted below.

|  |

In 2021, we introduced a change to our annual bonus plan for Akamai executives. While maintaining the core revenue and profitability financial metrics, the 2021 annual bonus plan incorporates a payout modifier based on our achievement against designated environmental, social and governance objectives established by the Talent, Leadership & Compensation Committee of the Board of Directors. These goals are centered on employee diversity, inclusion and engagement as well as environmental sustainability metrics. We adopted this change to help drive accountability within the management team for advancing Akamai’s environmental, social and corporate governance goals.

/6/

Table of Contents

Part One – Corporate Governance Highlights – Our Commitment to Environmental, Social and Governance Matters

Akamai is committed to maintaining and enhancing our record of excellence in environmental, social and governance (ESG) matters by continually refining our corporate governance policies, working to improve our energy efficiency and reduce our environmental impact, fostering a diverse and inclusive workplace and contributing to the communities in which we live and work. We also place great value on input from our investors and other stakeholders and engage regularly with them to gain insights into the governance and social issues they care about most.

In 2021, Akamai announced the establishment of a new ESG Office comprised of members of our management team. This office is charged with enabling a global ESG strategy that integrates our business goals with all ESG efforts across the enterprise, including sustainability, inclusion, diversity and engagement and the Akamai Foundation.

/7/

Table of Contents

Good Governance

Overview of the Board of Directors

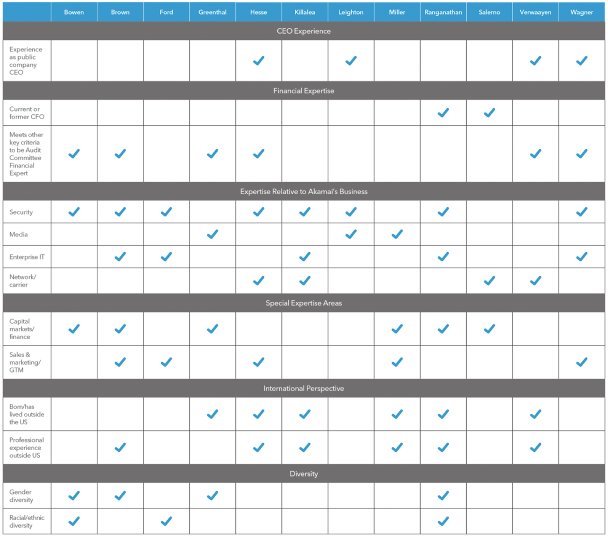

Our Board of Directors, which we will often reference as the Board below, currently consists of 12 individuals with a range of backgrounds as reflected in the graphic below. Collectively, they bring industry expertise, leadership skills and financial sophistication to our corporate governance. Below is a skills matrix displaying key attributes of our Board members.

/8/

Table of Contents

Board Refreshment and Diversity

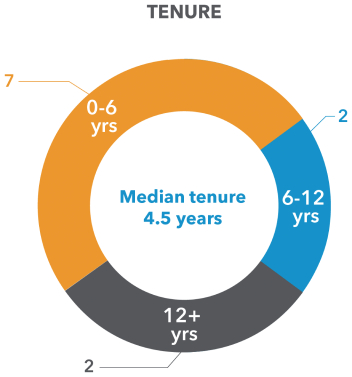

Akamai believes that having an independent, diverse, active and engaged Board has been key to our success. We also believe that new perspectives and ideas are critical to a forward-looking and strategic Board. Our goal is to seek a balance between new points of view and the valuable experience and familiarity that longer-serving directors bring to the boardroom. Since our 2017 annual meeting, we have seen five incumbent directors transition off the Board and have added five new directors. In considering nominations for re-election, we take into account whether a director has served for more than 10 years on the Board as one factor in our holistic approach. A summary of the tenure of our current independent directors is reflected in the graph below:

Female and/or minority directors currently make up 42% of the total Board. Ms. Bowen and Mr. Ford identify as Black; Ms. Ranganathan identifies as South Asian; and Mses. Bowen, Brown, Greenthal and Ranganathan identify as women. In considering new Board members, we have adopted a policy that requires that the initial list of individuals under consideration by the Board’s Environmental Social and Governance Committee, or the ESG Committee, include individuals who represent diverse backgrounds, including diversity of gender and race or ethnicity. If a search firm is used, the search firm is instructed to do the same.

/9/

Table of Contents

Board Evaluations

A key component of our approach is a robust annual Board evaluation process. Led by our Chair of the Board and the Chair of the ESG Committee, this review is intended to elicit the views of all directors about what makes the Board effective, what improvements can be made, how their peers are most effective and whether steps should be taken to improve contributions and their views on the performance of the Board and its committees over the past year. The evaluation has taken a variety of forms including written surveys, interviews conducted by an outside consultant and interviews conducted by our Board Chair. The ESG Committee also regularly oversees and plans for director succession and refreshment of the Board to ensure a mix of skills, experience, tenure, and diversity that promotes and supports the Company’s long-term strategy. In doing so, the ESG Committee takes into consideration the overall needs, composition and size of the Board, as well as the criteria adopted by the Board regarding director candidate qualifications.

Ethics

We have adopted a written Code of Ethics that applies to all of our directors, executive officers and other employees (including our principal executive officer and our principal financial and accounting officer). Our Code of Ethics is available on our website at www.ir.akamai.com/corporate-governance/highlights. We did not waive any provisions of the Code of Ethics for our directors or executive officers during the year ended December 31, 2020. If we amend, or grant a waiver under, our Code of Ethics that applies to our executive officers or directors, we intend to post information about such amendment or waiver on our website at www.akamai.com. We have also adopted Corporate Governance Guidelines, a copy of which is also available on our website at www.ir.akamai.com/corporate-governance/highlights.

/10/

Table of Contents

Engagement with Stakeholders

Akamai and our employees are dedicated to delivering value to investors, providing excellent service to our customers, offering a great place to work and contributing to the communities in which we operate. Some of the key areas of focus as we work with our stakeholders on ESG matters are highlighted below.

Commitment to Customers

At Akamai, we are focused on helping our customers navigate a rapidly-evolving technology landscape so that they can maintain the security of their operations that touch the internet, improve productivity, transform customer experiences, increase brand awareness and drive competitive advantage. With our Intelligent Edge Platform and creative and innovative employees, we believe we are uniquely situated to provide this assistance.

In a tumultuous 2020, we rose to the challenges caused by the global COVID-19 pandemic and other developments. With media and carrier customers seeing demand surge following stay-at-home orders, our network team nearly doubled capacity during the year, overcoming lockdowns in the field, shuttered data centers and supply chain disruptions. As a result, customers experienced great performance at global scale, delivering a year’s worth of increased traffic in just a few weeks. As more retailing went online, we provided

/11/

Table of Contents

extra support for some of the largest e-commerce companies in the world and offered flexible contract terms to help customers in the travel and hospitality industries weather the COVID-19 storm, focusing on winning these customers for the long term.

The pandemic also saw a surge in activity by cyberattackers, taking advantage of the distraction and increased vulnerability associated with the pandemic. We responded by providing vital security solutions for our customers to facilitate online business and remote work.

Promoting Diversity and Inclusion in the Workplace

Akamai is committed to providing a work environment and culture where all employees feel that they can contribute and perform to the best of their abilities. Our diverse workforce combines workers from different backgrounds and experiences. We believe that bringing together a diverse workforce in an inclusive environment captures the experiences, cultures, talents, and thought perspectives that will drive innovation and our business strategy in a collaborative manner. Akamai is a global company. Our aim is to understand and build on our cross-cultural competence, and by doing so, improve the way we work in our global community.

Our Diversity & Inclusion Strategy has five focus areas:

| 🌑 | Education – developing a common understanding of, and commitment to, inclusive and diverse mindsets and behaviors; |

| 🌑 | Accountability – our leaders are charged with driving accountability across their teams for making Akamai an inclusive and diverse workplace; |

| 🌑 | Governance – establishing a structure to enable us to manage, measure and report our successes and gaps; |

| 🌑 | Inclusivity – reinforcing this value through our events, communications, job descriptions and interview practices; and |

| 🌑 | Talent Management – cultivating more diverse teams across all levels of our organization. |

We have implemented a number of initiatives to foster inclusivity, including: forming a Diversity & Inclusion Steering Committee of senior leaders across all parts of the business and regions that drives our progress in this area and executes the strategy outlined above; incorporating an ESG component in our executive bonus plan; incorporating diversity and inclusion goals in both our corporate level annual Mission Critical Goals and the individual performance goals of our senior personnel; supporting eleven Employee Resource Groups that are employee-led, voluntary internal global networks open for all to come together to help collaborate, share ideas, and discuss issues among colleagues with similar characteristics or common interests; and introducing a company-wide program that is intended to enhance our corporate culture by promoting an inclusive approach to decision making and innovation.

/12/

Table of Contents

We are an equal opportunity employer. To help us improve the diversity of our workforce, we participate in or sponsor professional development and recruiting forums such as the Massachusetts Conference for Women, National Society of Black Engineers, Society of Hispanic Engineers, and Hack.Diversity. We also offer Akamai Technical Academy, a technical training program targeted primarily at underrepresented talent (gender, ethnicity, experiential, generational, veterans) who are interested in pursuing a technical career path, but may not be formally educated in science, mathematics or engineering. The program consists of six months of Akamai-specific classroom training, after which participants are placed in a variety of contract roles across the organization, with the intention to convert them to permanent employees after a minimum of six months. We are a member of the Massachusetts Technology Leadership Council Tech Compact for Social Justice, committing to make change towards racial equality in our company.

Our Supplier Diversity Program seeks to identify and engage suppliers for a wide range of products and services compatible with Akamai’s current needs — from office supplies, to computer equipment and peripherals, office equipment maintenance and repair, food service, and printing to name a few examples. We are committed to developing mutually beneficial and successful partnerships with small businesses including companies owned by women, minorities, veterans, and people who are socially and economically disadvantaged or have disabilities.

Environmental Sustainability

Akamai is committed to mitigating the environmental impact of our operations. We have adopted a Sustainability Policy to reflect our belief that Akamai can and should operate with a minimal environmental footprint. We strive to run our network as efficiently as possible to be mindful of our power usage and to minimize the negative environmental impacts of our operations. We also aim to decarbonize the energy we need to operate by sourcing renewable energy where we can.

In the management of our network, we utilize both hardware and software efficiencies to cut excess usage and proactively eliminate inefficiencies to lessen our carbon emissions. Our hardware initiatives center on improving the efficiency of the servers we use by reducing their power consumption while increasing throughput. Increasing throughput leads to a more efficient platform, which reduces our environmental footprint while providing superior performance for our customers and their end users. We also make our network more efficient by developing software to only use the necessary hardware resources. Our platform only caches (stores) information that is deemed relevant and likely to be accessed again by another end user in the same geographical location. To minimize the resource drain and emissions related to power usage from space utilization and processing energy from infrequently accessed web content — “one-hit wonders” — we use machine-learning algorithms based on the type of content, its popularity, its location, and more, to see if this data is worth the resources that would be required to store it. By decreasing the amount of one-hit wonders, Akamai is able to lessen our carbon emissions output and use less energy.

/13/

Table of Contents

These efforts have enabled us to continue to decouple network growth from emissions. In 2020, we reduced our Scope 2 emissions (indirect greenhouse gas emissions) by more than 50% from 2019 levels, while growing the network by more than 60%.

Endeavoring to ensure that our network runs as efficiently as possible is only one component of our sustainability strategy. We also source renewable energy to power our operations. In 2015, we set a public goal to source renewable energy for 50% of our controlled data center operations by 2020. We are proud to have met this target. This was achieved, in part, by investing in net-new grid-connected renewable energy projects. To date, we have invested in three projects: a wind farm in Texas, a solar array in Virginia, and a wind farm in Illinois. We also work with our data center partners to procure attestable renewable energy sources to further mitigate our operations in their facilities.

We are proud to take a leadership role in environmental sustainability. We helped spearhead the first renewable buyers consortium, a virtual power purchase agreement with Apple, Etsy, and Swiss Re to enable support for renewable energy projects. These projects are made possible through collaboration with groups such as the Renewable Energy Buyers Alliance (REBA) and the Future of Internet Power (FoIP) to make renewable energy procurement easier. We help our customers understand their energy usage by providing customized reports detailing their emissions on our platform based on server and energy usage. In our own reporting, we work with a third-party auditor that focuses on the accuracy of our carbon emissions reporting in Scopes 1, 2, and 3. Our auditor adheres to the ISO 14063-3: Greenhouse gases — Part 3: specification with guidance for the validation and verification of greenhouse gas statements. We reconcile our impact annually and routinely follow recognized procedures to lower our greenhouse gas emission footprint in the areas where we can have the most material impact. We report under the following frameworks: Carbon Data Project, Dow Jones Sustainability Indices, EcoVadis, FTSE4Good, Global Reporting Initiatives, Just Capital and Sustainability Accounting Standards Board.

Employee Well-Being, Health & Safety; Human Rights

Our employees are our most valuable asset as they are fundamental to our innovation, the operation and ongoing enhancement of the Akamai Intelligent Edge Platform, the fostering and maintenance of relationships with our customers and the management of our operations. We focus on the development of our people through fostering inclusion and engagement, offering competitive compensation and benefits, providing training and development opportunities, and implementing health and safety procedures.

We have a demonstrated a history of investing in our workforce by offering competitive salaries, wages, and benefits. Our compensation and benefits philosophy is to maximize the effectiveness of pay and benefits programs to attract and retain the high caliber individuals needed to drive the success of our business, while balancing cost-effectiveness and competitive factors. Our benefits programs (which vary by country and region) include healthcare and insurance benefits, health savings and flexible spending accounts, paid time off, family leave, family care resources, flexible work schedules, adoption and fertility

/14/

Table of Contents

assistance, employee assistance programs, tuition assistance, and holistic wellness programs. Our wellness programs include educational offerings on healthy lifestyles, access to mental health experts, and access to ergonomic advice and equipment.

COVID-19 Response

In March 2020, when the COVID-19 pandemic became widespread, Akamai took many steps to safeguard the health and well-being of our customers and employees. In particular, we:

| 🌑 | Closed access to our offices for most employees so, at year end, approximately 99% of our employees were working remotely; |

| 🌑 | Implemented enhanced health and safety protocols in all of our offices for those requiring access to an Akamai site; |

| 🌑 | Expanded our wellness programs to offer courses on, among other things, caregiving during the pandemic and vaccine information; |

| 🌑 | Introduced new collaboration tools and techniques and provided a productivity reimbursement program to assist all employees with purchasing equipment to support remote work; |

| 🌑 | Provided four wellness days to allow additional paid time off for employees specifically to encourage mental and physical health; |

| 🌑 | Guaranteed sick pay for contractors we retain; |

| 🌑 | Provided frequent information updates by our CEO and Chief Human Resources Officer related to the impact of the pandemic on our operations as well as the initiatives we adopted to assist employees to cope with the situation; and |

| 🌑 | Maintained a rigorous process for assessing whether any office can reopen (and remain open) based on local government regulations, local health trends and business needs. |

In 2016, we adopted a Human Rights Policy. We believe that the internet can facilitate greater understanding among people across the globe and that we can play an important role in making that happen. We also believe that respect for human rights is fundamental to unlocking the potential of the internet and an essential value for the communities in which we operate. We are committed to ensuring that our employees, the people who work for our contractors, customers and suppliers, and individuals in the communities affected by our activities are treated with dignity and respect. Our Human Rights Policy is intended to advance these ideals.

Community Involvement

We recognize that the communities in which we live and operate are also stakeholders in our business. We address a wide range of issues to help our neighbors, including directing

/15/

Table of Contents

relief to communities ravaged by wildfires, encouraging and supporting volunteerism by our employees, responding to COVID-19 relief efforts and supporting initiatives to promote racial justice.

The centerpiece of our employee volunteer efforts is our Danny Lewin Community Care Days program. Each year we honor and celebrate our co-founder Danny Lewin’s spirit with a global initiative to encourage employees to give back to our local communities through events such as participating in blood drives, working at food banks, repairing homes, refreshing playgrounds and creating care packages for ill children. Group volunteer activities are organized for employees in many of our offices worldwide. All of our full-time employees are approved to take the equivalent of up to 16 hours of paid volunteer time per calendar year for approved volunteer activities that take place during their regularly scheduled workday.

The Akamai Foundation plays a key role in Akamai’s community outreach. Its core mission is to close the gender and diversity gap in technology and help foster the next generation of innovators by advancing access to science and mathematics education. In 2020, it provided more than 30 grants worldwide to organizations focused on this cause. With the global pandemic outbreak last year, the foundation pivoted to provide COVID-19 relief funds to charitable organizations in 16 countries. Additionally, amid prominent incidents in the U.S. that gave rise to increased focus on equal justice, the organization instituted a gift-matching program for employees and others to non-profits focused on human rights and racial equality. In late 2020, Akamai made an additional $20 million endowment contribution to the foundation to provide further support for its mission to demonstrate our long-term commitment and proactive social leadership role.

/16/

Table of Contents

Stockholder Engagement

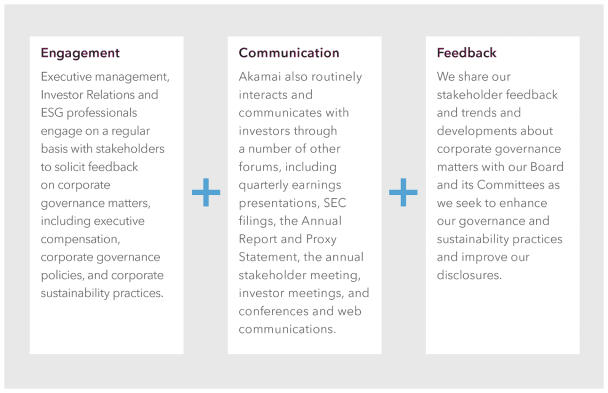

Our management and Board are committed to driving stockholder value and communicating with our investors and other stakeholders. Our stockholder engagement model is summarized below:

Our Stockholder Engagement Process

During 2020, we conducted outreach to all of our 25 largest stockholders and other investors, who collectively held approximately 54% of our outstanding shares, to express an interest in meeting with them to discuss governance or executive compensation matters at Akamai. We engaged with more than 40% of those investors and discussed a broad range of operational, strategic and governance topics with them. These engagement efforts and meaningful conversations provided the Board and management with a valuable understanding of investors’ perspectives and an opportunity to exchange views. When the Board conducted its regular reviews of governance and executive compensation, it discussed the input that we received, and the evaluation process was reflective of those views. We were encouraged by the feedback we received and look forward to continuing our dialogue with our stockholders in the coming year.

/17/

Table of Contents

One result of our engagement with stockholders in recent years was a decision by the Board to recommend that stockholders approve declassification of the structure of the Board. We presented that matter at the 2018 Annual Meeting of Stockholders, and it was approved. The Board is now fully declassified, and all directors standing for election will be elected to one-year terms.

Commitment to Privacy Best Practices

Our customers trust us to help make the internet fast, intelligent, and secure. We understand that how we process personal data is an important part of that trust. We are committed to the data protection rights of internet users, customers and employees and compliance with the data protection laws of the countries in which we operate. Akamai’s Data Protection and Privacy Program is aimed at protecting the personal data that we process based on respect for the data subject’s privacy concerns by implementing appropriate security safeguards. Our program has four main components:

Awareness

| 🌑 | Promoting a culture of respect for, and thoughtful consideration of, privacy and personal data protection throughout Akamai. |

| 🌑 | Communicating to our employees timely information about changes in privacy laws, regulations, and standards that affect our business. |

| 🌑 | Instilling understanding of different cultures and practices around the world related to the use of individual personal information. |

Policies and Procedures

| 🌑 | Implementing privacy protection policies and related operational procedures (in harmony with our Information Security Compliance Program) that are designed to enable compliance with the law consistent with our business commitments and needs. |

| 🌑 | Utilizing privacy by design tools to timely raise, consider, and address privacy concerns at the early stage of service and product development. |

Training

| 🌑 | Conducting trainings designed to promote awareness and provide employees with privacy-related information pertinent to their roles and responsibilities. |

Accountability and Transparency

| 🌑 | Maintaining accountability standards consistent with those articulated by the Organization for Economic Co-operation and Development (OECD) in its Guidelines Governing the Protection of Privacy and Transborder Flows of Personal Data. |

| 🌑 | Communicating with our employees, customers and the public about our data protection and privacy practices. |

/18/

Table of Contents

Public Policy

Akamai believes that responsible corporate citizenship requires active engagement in legislative and regulatory processes. Our engagement with policymakers and advocacy on public policy issues are coordinated by our Global Public Policy group. Members of the Global Public Policy team work closely with our senior leadership to identify legislative and regulatory priorities, both regionally and globally, that will protect and advance our business interests, increase stockholder value and promote the free and responsible use of the internet. The group also works to educate and inform policymakers about Akamai’s technology and solutions and how the internet itself works.

As part of Akamai’s engagement in the public policy process, we participate in a number of trade associations around the world that advocate for and shape public policy positions that are important to our industry. Trade associations also provide educational, training and professional networking opportunities for their members. We participate in these associations for such opportunities and to help build consensus on issues that we believe will serve our customers and investors. Our membership and participation in these organizations are not an endorsement of all of the activities and positions of these organizations. Accordingly, there may be instances where their positions diverge from ours.

We have not formed a political action committee nor have we donated to individual political candidates or parties.

/19/

Table of Contents

The Board of Directors

The Board currently consists of twelve persons. Set forth below is information about the professional experiences of each of our eleven nominees for election at the 2021 Annual Meeting, including his or her specific experience, qualifications and attributes that we believe qualify him or her to serve on the Board. We have included their age and committee memberships as of March 1, 2021 (other than with respect to Ms. Bowen who joined the Board on April 2, 2021 and was appointed to committees on that date).

Fred Salerno announced in March 2021 that he would retire as a member and Chair of the Board effective at the 2021 Annual Meeting. Mr. Salerno has been a director since 2002. We thank him for the leadership he has provided to Akamai for nearly two decades. The Board has voted to reduce its size to eleven members effective as of the 2021 Annual Meeting.

Nominees for Director for Terms That Will Expire in 2022

Sharon Bowen, age 64 Director since 2021 Audit Committee, ESG Committee

|

Commissioner of the United States Commodity Futures Trading Commission from June 2014 until retirement in September 2017

Senior Associate and Partner at the law firm Latham & Watkins between 1988 and May 2014

Other Current Boards

Intercontinental Exchange, a provider of marketplace infrastructure, data services and technology solutions for a diverse set of asset classes

Bakkt Holdings, a provider of institutional and retail solutions for digital assets

Neuberger Berman Group, an investment management firm

| |

Deep regulatory, securities, market risk and public policy expertise

Corporate finance, mergers and acquisition, strategic transactions and corporate governance expertise from her role as a partner in a global law firm

Experience leading ESG initiatives and programs

| ||

/20/

Table of Contents

Marianne Brown, age 62 Director since 2020 Audit Committee, Finance Committee

|

Retired former executive at Fidelity National Information Services, Inc., or FIS, a global financial services technology company, where she was Corporate Executive Vice President and Co-Chief Operating Office from January 2018 through December 2019

Chief Operating Officer, Institutional and Wholesale Business of FIS from December 2015 through December 2018, when FIS acquired SunGard Financial Systems LLC, a financial software and technology services company

Other Current Boards

The Charles Schwab Corporation, an investment services firm

Northup Grumman, an aerospace and defense technology company

VMW are, a provider of cloud computing and virtualization software and services

| |

Extensive leadership experience in technology sales and product management to provide insight into the likely perspectives of Akamai’s current and potential customers

Executive oversight of go-to-market initiatives and organizational and investment strategy

Demonstrated ability to execute and integrate acquisitions

| ||

Monte Ford, age 61 Director since 2013 TL&C Committee, ESG Committee

|

Principal Partner of CIO Strategy Exchange, a membership organization for chief information officers, since 2016

Network Partner at Brightwood Capital Partners, a venture capital firm, since 2013

Other Current Boards

Iron Mountain, a provider of storage and other information management services

JetBlue, an airline

The Michaels Companies, an arts and crafts retailer

| |

Experience as an information technology executive at Aptean Software and American Airlines, including serving as a chief executive officer and as a CIO overseeing all aspects of information systems and business analytics functions

Helps fellow Board members and management understand what Akamai’s current and potential customers expect and want from our solutions and to provide actionable insight into our innovation initiatives

Provides valuable advice and counsel regarding potential improvements to our internal IT systems

Contributes a personal perspective on diversity and inclusion issues impacting Akamai and our environment

| ||

/21/

Table of Contents

Jill Greenthal, age 64 Director since 2007 Audit Committee, Finance Committee Chair

|

Senior Advisor in the Private Equity Group of The Blackstone Group, a global asset manager, since 2007

Other Current Boards

Cars.com, an online automotive marketplace

Houghton Mifflin Harcourt, an educational content company

Prior Public Company Boards in Last 5 Years

TEGNA Inc.

FLEX LTD.

| |

Rich experience as a leading investment banker and advisor, a role that has given her a deep understanding of capital markets and mergers and acquisitions

Insight into financial and strategic aspects of financial matters such as debt and equity financing transactions and acquisitions

Experience working with other internet and media companies as they have built their businesses enables her to provide valuable counsel to both our management and fellow directors

| ||

Dan Hesse, age 67 Director since 2016 Audit Committee, ESG Committee Chair

|

Former President and CEO, Sprint Corporation, a telecommunications provider, December 2007 to August 2014

Other Current Boards

PNC Corporation, a financial institution

Tech and Energy Transition Corporation, a non-operating special purpose acquisition company formed for the purpose of effecting the acquisition of one or more businesses that is focused on targets that use or facilitate disruptive, differentiated technology to build, enable, service or manage businesses or infrastructure undergoing transformation | |

Insight into mobile and telecommunications industry affords important insight into strategy deliberations

Experience as a chief executive officer enables him to advise on leadership, management and operational issues

Leverages experience overseeing a large, complex technology company to provide valuable guidance and perspective

Understanding of corporate governance issues, particularly social responsibility matters, contributes to his ability to provide a leadership role as chair of our ESG Committee

| ||

/22/

Table of Contents

Tom Killalea, age 53 Director since 2018 Audit Committee, TL&C Committee

|

President, Aionle LLC, a consulting firm, since November 2014

VP Technology, Amazon.com, a multi-national technology company from 2008 to 2014

Other Current Boards

Capital One Financial Corp., a financial services company

MongoDB, a database technology company

Prior Public Company Boards in Last 5 Years

Carbon Black Xoom Technologies

| |

Professional focus on internet security issues, a key area of emphasis in Akamai’s strategic plan

Experience with digital innovation and focus on customer experience

Understanding of the content delivery network business through his work at Amazon

Extensive corporate governance experience serving on several public company boards

| ||

Tom Leighton, age 64 Director since 1998

|

Chief Executive Officer, Akamai, since January 2013

Chief Scientist, Akamai from 1998 to 2012

Professor of Applied Mathematics at the Massachusetts Institute of Technology since 1982 (on leave)

| |

Co-founder and key developer of the software underlying our platform

Unparalleled understanding of our technology and how the internet works

Crucial source of industry information, technical and market trends and how Akamai can address those needs

Provides the Board with vital information about the strategic and operational challenges and opportunities facing us

| ||

/23/

Table of Contents

Jonathan Miller, age 64 Director since 2015 TL&C Committee, ESG Committee

|

CEO of Integrated Media Co., an investment company, since February 2018

Advisor at Advancit Capital, a venture capital firm focusing on early-stage companies, since January 2018, having previously served as a partner since 2013

Other Current Boards

AMC Networks, an entertainment company

Interpublic Group of Companies, a marketing solutions provider

J2 Global, which provides telecommunications solutions as well as technology, gaming and lifestyle content

Advancit Acquisition I, a non-operating special purpose acquisition company formed for the purpose of effecting the acquisition of one or more businesses; focusing on media and technology targets in North America and Europe

Prior Public Company Boards in Last 5 Years

TripAdvisor Shutterstock

| |

Insight into the challenges, goals and priorities of media companies such as those that are key current and prospective customers

Key participant in the rapid development of the internet as a global platform for video and audio entertainment

Deep understanding of the ongoing evolution of digital media

Involvement with early-stage media and technology companies gives our management and the Board a window into developments that could shape our industry in the future

| ||

Madhu Ranganathan, age 56 Director since 2019 Audit Committee Chair, Finance Committee

|

Chief Financial Officer of Open Text Corporation, a provider of enterprise information management solutions since April 2018.

Executive Vice President and Chief Financial Officer for 24/7 Customer, Inc., a provider of customer engagement technology solutions, from June 2008 to March 2018

Other Current Boards

Bank of Montreal, a financial services company

Prior Public Company Boards in Last 5 Years

Service Source International

| |

Extensive public-company financial expertise that enables her to qualify as an “audit committee financial expert” (as defined by Commission rules) and advise management and other directors on complex accounting and internal control matters

Experience in developing global software and SaaS companies to provide insight from both a customer and an operational perspective

Oversight of acquisition programs position her well to participate in the Finance Committee’s oversight of Akamai’s M&A program

Understanding of complex global tax matters

| ||

/24/

Table of Contents

Ben Verwaayen, age 68 Director since 2013 TL&C Committee Chair, ESG Committee

|

General Partner of Keen Venture Partners, a venture capital firm, since 2017

Former Chief Executive Officer of Alcatel-Lucent, a provider of communications equipment and solutions from 2008 to 2013

Other Current Boards

Renewi, a waste-to-product company that collects and processes waste and then sells the recyclates and energy it produces

Ofcom, the regulatory and competition authority for the broadcasting, telecommunications and postal industries of the United Kingdom

| |

Brings an international perspective to Board deliberations, helping us better understand non-U.S. markets, public policy issues and how to operate with a global employee base

CEO experience enables him to provide significant guidance to our CEO on management, leadership and operational issues

Ability to leverage knowledge of telecommunications industry to advise us on carrier strategy and network relationships

Deep understanding of motivational aspects of executive compensation approaches and applicable international issues

| ||

Bill Wagner, age 54 Director since 2018 TL&C Committee, Finance Committee

|

President and CEO of LogMeIn, Inc., a software-as-a-service company, since December 2015, having previously served from May 2013 through November 2015 as its President and Chief Operating Officer. In 2020, LogMeIn, Inc. transitioned from being a publicly-traded company to being privately held.

Other Current Boards

LogMeIn, Inc. | |

Extensive sales and marketing experience in the software industry brings a valuable perspective on the company’s go-to-market operations

Current experience as a chief executive officer of a large software company and formerly as a CEO of a publicly-traded software company enables him to provide valuable counsel to the CEO and Board on matters related to strategy, leadership and operations.

Brings a customer perspective on how companies purchase, deploy and rely on Akamai solutions to enable and secure their businesses

Experience successfully executing mergers, acquisitions and divestitures position him well to participate in the Finance Committee’s oversight of Akamai’s M&A program

| ||

/25/

Table of Contents

Our Executive Officers

Our executive officers as of March 1, 2021 were:

| Tom Leighton, age 64, was elected Akamai’s Chief Executive Officer in January 2013, having previously served as our Chief Scientist since he co-founded the company in 1998. As discussed above, Dr. Leighton also serves on the Board. | |

| Aaron Ahola, age 51, was named our Executive Vice President, General Counsel and Corporate Secretary in May 2019. From October 2017 through April 2019, he was Senior Vice President, General Counsel and Corporate Secretary. Mr. Ahola joined Akamai in April 2000. During his tenure, he has served in a variety of positions, including as Vice President and Deputy General Counsel from 2011 to 2017 and our Chief Privacy Officer from 2008 until 2017. | |

| Robert Blumofe, age 56, became Akamai’s Chief Technology Officer on March 1, 2021. From April 2016 through February 2021, he was our Executive Vice President, Platform and General Manager of the Enterprise Division, having previously served as our Executive Vice President – Platform since January 2013. Before taking on that role, Mr. Blumofe served in a variety of positions at Akamai since joining us in 1999. | |

| Paul Joseph, age 47, became our Executive Vice President – Global Sales in March 2021. Mr. Joseph joined Akamai in January 2000 and has served in a variety of roles during his tenure with us. From September 2018 through February 2021, he was Senior Vice President, Global Sales for our Media and Carrier Division. Between October 2017 and August 2018, he served as Vice President Field Business Development in our Media Division. From March 2016 through September 2017, he was Vice President of our America Channel Sales group. | |

/26/

Table of Contents

| Adam Karon, age 49, joined Akamai in February 2005 and has served in numerous leadership positions during his tenure with us. He was named our Chief Operating Officer and General Manager Edge Technology Group effective March 1, 2021. From March 2017 through February 2021, he was Executive Vice President and General Manager of the Media and Carrier Division. He served as Senior Vice President, Global Services and Support from January 2014 through February 2017. | |

| Rick McConnell, age 55, became Akamai’s President and General Manager of the Security Technology Group effective March 1, 2021. From May 2016 through February 2021, he was President and General Manager of the Web Division. He previously served as President – Products and Development from January 2013 through May 2016, having previously held other executive titles since joining us in November 2011. Prior to joining Akamai, Mr. McConnell was in a number of executive positions at Cisco Systems. Mr. McConnell was Chief Executive Officer of Latitude Communications, which was acquired by Cisco in January 2004. | |

| Edward McGowan, age 50, became Akamai’s Executive Vice President and Chief Financial Officer in March 2019. Mr. McGowan began his career at Akamai in 2000 and has served in numerous roles across the organization since that time, including as Senior Vice President, Finance, between September 2018 and February 2019; Senior Vice President, Global Sales Media & Carrier Division from January 2017 through August 2018; Vice President, Global Carrier Strategy & Sales from April 2013 through December 2016. | |

| Kim Salem-Jackson, age 45, became our Executive Vice President and Chief Marketing Officer on March 1, 2021. Ms. Salem-Jackson joined us as Vice President of Global Marketing in August 2017 before being promoted to Senior Vice President Marketing and Corporate Communications in November 2019. Prior to joining Akamai, Ms. Salem-Jackson had been Senior Vice President of Worldwide Marketing and Business Development at Informatica, a provider of enterprise cloud management solutions, from August 2015 to August 2017 after holding a number of management roles at the company since joining it in 2008. | |

/27/

Table of Contents

| Mani Sundaram, age 45, became our Executive Vice President Global Services & Support and CIO in November 2019. Mr. Sundaram began his career at Akamai in February 2007 and has held a variety of positions during his tenure with us. Most recently, he was Senior Vice President Global Services and Support from March 2017 until November 2019, after serving as Vice President Global Services from January 2015 through February 2017. | |

| Anthony Williams, age 47, became our Executive Vice President and Chief Human Resources Officer in January 2020. He joined Akamai in April 2015 as Vice President, Talent Acquisition and Diversity and served in that role until January 2018 when his title became Vice President, International HR, Talent Acquisition & Diversity. Prior to Akamai, Mr. Williams held a wide range of global human resource positions at First Data Corporation, Newell Rubbermaid and Time Warner – Turner Broadcasting System. | |

/28/

Table of Contents

Security Ownership of Certain Beneficial Owners and Management

The following table includes information as to the number of shares of our common stock beneficially owned as of March 15, 2021, by the following:

| 🌑 | each person known to us to be the beneficial owner of more than 5% of our outstanding shares of common stock; |

| 🌑 | each of our directors; |

| 🌑 | our Named Executive Officers, who consist of (i) our principal executive officer, (ii) each person who served as our principal financial officer during 2020; and (iii) our three other most highly compensated executive officers in 2020; and |

| 🌑 | all of our executive officers and directors as of March 15, 2021 as a group. |

Beneficial ownership is determined in accordance with the rules of the Commission and includes voting and/or investment power with respect to shares. Unless otherwise indicated below, to our knowledge, all persons named in the table have sole voting and investment power with respect to the shares of common stock identified below, except to the extent authority is shared by spouses under applicable law. Beneficial ownership includes any shares that the person has the right to acquire within 60 days after March 15, 2021, through the exercise of any stock option or other equity right. Unless otherwise indicated, the address of each person identified in the table below is c/o Akamai Technologies, Inc., 145 Broadway, Cambridge, Massachusetts 02142. On March 15, 2021, there were 163,689,489 shares of our common stock outstanding.

/29/

Table of Contents

| Name of Beneficial Owner | Number of Shares of Common Stock Beneficially Owned | Percentage of Common Stock Outstanding (%) | ||||||||||||||||||

5% Stockholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

The Vanguard Group (1) |

|

|

|

|

|

|

|

|

| 17,608,178 | 10.8 | |||||||||

BlackRock, Inc. (2) |

|

|

|

|

|

|

|

|

| 14,258,519 | 8.7 | |||||||||

Directors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

Sharon Bowen |

|

|

|

|

|

|

|

|

| 0 | * | |||||||||

Marianne Brown |

|

|

|

|

|

|

|

|

| 27 | * | |||||||||

Monte Ford |

|

|

|

|

|

|

|

|

| 22,187 | * | |||||||||

Jill Greenthal (3) |

|

|

|

|

|

|

|

|

| 41,697 | * | |||||||||

Dan Hesse (4) |

|

|

|

|

|

|

|

|

| 20,723 | * | |||||||||

Tom Killalea (5) |

|

|

|

|

|

|

|

|

| 11,495 | * | |||||||||

Tom Leighton (6) |

|

|

|

|

|

|

|

|

| 2,260,863 | 1.4 | |||||||||

Jonathan Miller |

|

|

|

|

|

|

|

|

| 20,567 | * | |||||||||

Madhu Ranganathan |

|

|

|

|

|

|

|

|

| 0 | * | |||||||||

Fred Salerno (7) |

|

|

|

|

|

|

|

|

| 5,522 | * | |||||||||

Ben Verwaayen (8) |

|

|

|

|

|

|

|

|

| 26,224 | * | |||||||||

Bill Wagner (9) |

|

|

|

|

|

|

|

|

| 8,495 | * | |||||||||

Other Named Executive Officers |

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Robert Blumofe |

|

|

|

|

|

|

|

|

| 38,297 | * | |||||||||

Adam Karon |

|

|

|

|

|

|

|

|

| 35,433 | * | |||||||||

Rick McConnell |

|

|

|

|

|

|

|

|

| 61,915 | * | |||||||||

Edward McGowan (10) |

|

|

|

|

|

|

|

|

| 25,187 | * | |||||||||

All executive officers and directors as of March 15, 2021 as a group (21 persons) (11) |

|

|

|

|

|

|

|

|

| 2,659,648 | 1.6 | |||||||||

| * | Percentage is less than 1% of the total number of outstanding shares of our common stock. |

| (1) | The information reported is based on a Schedule 13G/A filed with the Commission on February 10, 2021 by The Vanguard Group, Inc., or Vanguard, which reports its address as 100 Vanguard Boulevard, Malvern, Pennsylvania 19355. Vanguard reports that it holds sole dispositive power with respect to 16,867,428 shares, shared voting power with respect to 299,127 shares and shared dispositive power with respect to 740,750 shares. |

/30/

Table of Contents

| (2) | The information reported is based on a Schedule 13G/A filed with the Commission on February 5, 2021 by BlackRock, Inc., or BlackRock, which reports its address as 55 East 52nd Street, New York, New York 10055. BlackRock reports that it holds sole dispositive power with respect to 14,258,519 shares and sole voting power with respect to 12,518,527 shares held by it. |

| (3) | Includes 8,658 shares issuable in respect of deferred stock units, or DSUs, that have vested but not yet been distributed. |

| (4) | Includes 13,034 shares issuable in respect of DSUs that have vested but not yet been distributed. |

| (5) | Includes 1,867 shares issuable upon vesting of restricted stock units, or RSUs, within 60 days after March 15, 2021 and 2,936 shares issuable in respect of DSUs that have vested but not yet been distributed. |

| (6) | Includes 129,321 shares held by Dr. Leighton in a trustee capacity with respect to which he disclaims beneficial ownership. |

| (7) | Includes 1,000 shares held by a charitable foundation of which Mr. Salerno is a trustee and with respect to which he disclaims beneficial ownership. |

| (8) | Consists of shares issuable in respect of DSUs that have vested but not yet been distributed. |

| (9) | Includes 1,867 shares issuable upon vesting of RSUs within 60 days after March 15, 2021. |

| (10) | Includes 463 shares issuable upon vesting of RSUs within 60 days after March 15, 2021 |

| (11) | Includes 6,623 shares issuable upon vesting of RSUs within 60 days after March 15, 2021 and 50,852 shares issuable in respect of DSUs that have vested but not yet been distributed. |

Board Leadership and Role in Risk Oversight

Chair of the Board

In March 2018, Fred Salerno was elected as our independent Chair of the Board. In this role, he works with his fellow directors and management to prepare Board meeting agendas, chairs meetings of the Board (including its independent director sessions) and our annual stockholder meetings and informs other directors about the overall progress of Akamai. Mr. Salerno also provides leadership and advice to management on key strategic initiatives and seeks to ensure effective communication among the committees of the Board. He leads discussions on the performance of the Chief Executive Officer and succession planning for executive officers and other key management positions. Mr. Salerno also led our 2020 board evaluation process.

In March 2021, Mr. Salerno announced that he would retire from service on the Board effective at the time of the Annual Meeting. Dan Hesse has been elected to succeed Mr. Salerno as independent Chair of the Board, effective following the Annual Meeting.

Roles of Chair of the Board and CEO

Currently, the roles of Chair of the Board and Chief Executive Officer are held by two different individuals. We believe this structure represents an appropriate allocation of roles and responsibilities at this time. Mr. Salerno, as a strong independent director, has been able to play a key role in ensuring Board effectiveness, management oversight and adherence to good governance principles, and it is expected that Mr. Hesse will be similarly effective in this role following the Annual Meeting. Dr. Leighton is then better able to focus on our day-to-day business and strategy, meet with investors and convey the management perspective to other directors.

/31/

Table of Contents

Risk Oversight

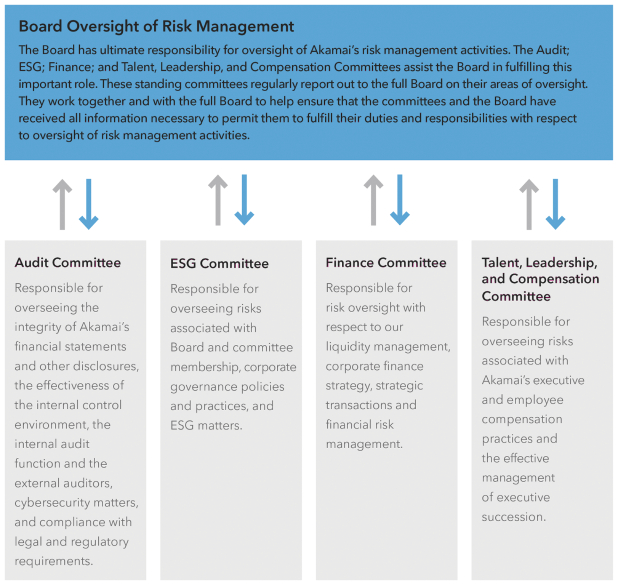

The Board has an active role in supervising management’s oversight of Akamai’s risks as described in the graphic below:

Board and Committee Oversight of Risk Management

The Board and our management team have increased their focus on cybersecurity risk oversight and management in recent years. Our information security leadership meets with the Audit Committee on a quarterly basis to discuss management’s process for identifying, tracking and mitigating cybersecurity risks, progress on mitigation initiatives and industry-wide developments related to security matters. All of our employees are required to take annual security compliance training. We have not had a data breach during the last three years.

/32/

Table of Contents

Board Committees

The standing committees of the Board consist of an Audit Committee, an Environmental, Social and Governance (ESG) Committee (formerly known as the Nominating and Corporate Governance Committee), a Finance Committee and a Talent, Leadership and Compensation (TL&C) Committee (formerly known as the Compensation Committee). Each committee operates under a charter that has been approved by the Board. Copies of the charters are posted in the Investor Relations section of our website at www.ir.akamai.com. The Board has determined that all of the members of each of the four standing committees of the Board are independent as defined under The Nasdaq Stock Market, Inc. Listing Rules, or the Nasdaq Rules, including, in the case of all members of the Audit Committee, the independence requirements of Rule 10A-3 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, and, in the case of all members of the TL&C Committee, the independence requirements under Rule 10C-1 under the Exchange Act. Membership on each standing committee as of March 1, 2021 is reflected in the chart below.

Membership in Standing Committees as of March 1, 2021

| Audit | ESG | Finance | TL&C | |||||

Marianne Brown | X | X | ||||||

Monte Ford | X | X | ||||||

Jill Greenthal | X | X* | ||||||

Dan Hesse | X | X* | ||||||

Tom Killalea | X | X | ||||||

Jonathan Miller | X | X | ||||||

Madhu Ranganathan | X* | X | ||||||

Fred Salerno | X | X | X | |||||

Ben Verwaayen | X | X* | ||||||

Bill Wagner | X | X | ||||||

| * | Committee Chair |

In April 2021, Ms. Bowen was elected to the Board and was appointed to the Audit Committee and the ESG Committee, and the Board approved a shift of Mr. Hesse from the Audit Committee to the TL&C Committee and Mr. Killalea from the TL&C Committee to the Finance Committee.

The Audit Committee assists the Board in overseeing the financial and accounting reporting processes and audits of our financial statements, which includes reviewing the professional services provided by our independent auditors, the independence of such auditors from our management, our annual financial statements and our system of internal financial and IT controls including cybersecurity matters. The Audit Committee also reviews such other

/33/

Table of Contents

matters with respect to our accounting, auditing and financial reporting practices and procedures as it may find appropriate or may be brought to its attention. The Board has determined that each of Fred Salerno and Madhu Ranganathan is an “audit committee financial expert” within the meaning of Item 407(d)(5)(ii) under Regulation S-K promulgated by the Commission under the Exchange Act. The Audit Committee held nine meetings in 2020.

The ESG Committee is responsible for, among other things, identifying individuals qualified to become members of the Board; recommending to the full Board the persons to be nominated for election as directors and to each of its committees; overseeing self-evaluation of the Board, including the performance of individual directors; and reviewing and making recommendations to the Board with respect to corporate governance practices. The ESG Committee also reviews management’s initiatives with respect to environmental, social and governance matters (including charitable activities of the Akamai Foundation). The ESG Committee held seven meetings in 2020.

The Finance Committee is responsible for, among other things, reviewing matters pertaining to the capital structure and corporate finance strategy, oversight of the Treasury function, review of proposed acquisitions and similar strategic transactions, ongoing evaluation and assessment of completed acquisitions, oversight of our defined contribution and other retirement plans, review of Akamai’s insurance program and assisting and advising management on its operating plans, including any specific plans in place from time to time related to margin improvement or other financial goals. The Finance Committee held nine meetings in 2020.

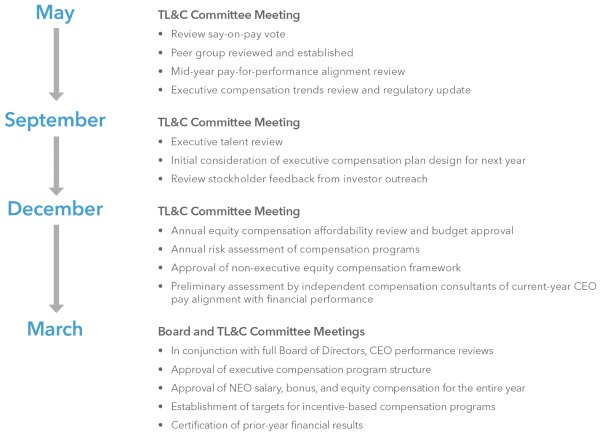

The TL&C Committee assists the Board in discharging its responsibilities relating to the compensation of our executive officers, including determining the compensation of our Chief Executive Officer and other executive officers, administering our bonus, incentive compensation and stock plans, approving equity grants and approving the salaries and other benefits of our executive officers. In addition, the TL&C Committee consults with our management regarding our benefit plans and compensation policies and practices as well as our leadership development initiatives. The TL&C Committee is directly responsible for the appointment and oversight of our independent compensation consultants and other advisors it retains. The TL&C Committee held five meetings in 2020.

Meeting Attendance

The Board held seven meetings during 2020. Each incumbent director attended more than 75% of the total number of meetings of the Board and each committee on which he or she served during the fiscal year ended December 31, 2020. All directors are expected to attend regular Board meetings, Board committee meetings for committees on which he or she serves and our annual meeting of stockholders. All of our directors then in office attended the 2020 Annual Meeting of Stockholders.

/34/

Table of Contents

Determination of Independence

Under the Nasdaq Rules, a director of Akamai will only qualify as an “independent director” if, in the opinion of the Board, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. The Board has determined that each member of the Board, other than Dr. Leighton, is an “independent director” as defined under Nasdaq Rule 5605(a)(2).

In making its independence determination with respect to Mr. Wagner, the Board considered that, in 2020, Akamai sold approximately $1.5 million of products and services to LogMeIn, Inc., where Mr. Wagner is an executive officer. The amount of sales and the amount of purchases in 2020 were less than 1% of LogMeIn’s annual revenues and less than 1% of Akamai’s annual revenues and the transactions were conducted in the ordinary course of business, on commercial terms and on an arms’-length basis. We expect similar commercial arrangements to recur in 2021.

In making its independence determination with respect to Ms. Ranganathan, the Board considered that, in 2020, Akamai sold approximately $0.7 million of products and services to, and purchased approximately $21,000 of products and services from, Open Text Corporation, where Ms. Ranganathan is an executive officer. The amount of sales and the amount of purchases in 2020 were less than 1% of Open Text’s annual revenues and less than 1% of Akamai’s annual revenues and the transactions were conducted in the ordinary course of business, on commercial terms and on an arms’-length basis. We expect similar commercial arrangements to recur in 2021.

Our independent directors meet separately as part of each Board meeting and at other times as appropriate. In the independent director sessions, Mr. Salerno and the other independent directors review management performance, assess the focus and content of meetings of the Board and establish the strategic issues that the Board believes should be the focus of management’s attention to drive short-term and longer-term business success. Mr. Salerno then provides feedback to the Chief Executive Officer and other members of management on their performance and important issues on which the independent members of the Board believe management should focus.

Director Compensation