Exhibit 99.2

UNITED STATES BANKRUPTCY COURT

DISTRICT OF DELAWARE

----------------------------------------------------------------------------------- | x | |

| : | |

In re | : | Chapter 11 |

| : | |

Panolam Holdings Co., et al., | : | Case No. 09- ( ) |

| : | |

| : | (Jointly Administered) |

Debtors. | : | |

| : | |

------------------------------------------------------------------------------------ | x | |

DISCLOSURE STATEMENT RELATING TO THE DEBTORS’ JOINT

PREPACKAGED PLAN OF REORGANIZATION UNDER CHAPTER 11 OF THE

BANKRUPTCY CODE OF PANOLAM HOLDINGS CO., PANOLAM HOLDINGS II

CO., PANOLAM INDUSTRIES INTERNATIONAL, INC., PANOLAM INDUSTRIES,

INC., PIONEER PLASTICS CORPORATION, NEVAMAR HOLDINGS CORP.,

NEVAMAR HOLDCO, LLC AND NEVAMAR COMPANY, LLC

WEIL, GOTSHAL & MANGES LLP

Attorneys for Debtors and

Debtors in Possession

767 Fifth Avenue

New York, New York 10153

Telephone: (212) 310-8000

- and -

RICHARDS, LAYTON & FINGER, P.A.

Attorneys for Debtors and

Debtors in Possession

One Rodney Square

P.O. Box 551

Wilmington, Delaware 19899

Telephone: (302) 651-7700

Dated: September 30, 2009

PANOLAM HOLDINGS CO.

20 Progress Drive

Shelton, CT 06484

| | September 30, 2009 |

| | |

To: | The holders of Senior Lender Credit Agreement Revolver Claims; |

| The holders of Senior Lender Credit Agreement Term Claims; |

| The holders of Noteholder Credit Agreement Claims; |

| The holders of Senior Subordinated Notes Claims; and |

| The holders of Equity Interests in Panolam Holdings Co. |

We deliver to you herewith the attached disclosure statement (the “Disclosure Statement”) distributed pursuant to sections 1125 and 1126(b) of title 11 of the United States Code (the “Bankruptcy Code”) and ballots so that you may vote to accept or reject the proposed joint prepackaged chapter 11 plan of reorganization (the “Plan”) of Panolam Holdings Co., Panolam Holdings II Co. (“Holdings II”), Panolam Industries International, Inc. (“Panolam”), Panolam Industries, Inc., Pioneer Plastics Corporation, Nevamar Holding Corp., Nevamar Holdco, LLC, and Nevamar Company, LLC (collectively, the “Debtors”), according to the ballot applicable to your respective notes or other claims. The Debtors intend to use those votes that are returned to their voting agent, Epiq Bankruptcy Solutions, LLC (the “Voting Agent”), by 5:00 p.m., Eastern Time, on November 2, 2009 to seek approval of the Plan in chapter 11 reorganization cases (the “Reorganization Cases”) to be filed after the appropriate solicitation period has expired.

The Plan incorporates a comprehensive financial restructuring that will significantly reduce the Debtors’ outstanding debt. The Plan is the product of negotiations over several months among the Debtors and certain of their creditors, including (i) the holders of at least two-thirds (2/3) of the outstanding principal amount of the revolving and term notes due under that certain Credit Agreement, dated as of September 30, 2005, by and among Holdings II, Panolam, the lenders party thereto, and Credit Suisse, Cayman Islands Branch, as administrative agent and collateral agent (as amended or otherwise modified from time to time, the “Credit Agreement”) and (ii) the holders of 66% of the outstanding principal amount of the 10¾% Senior Subordinated Notes due 2013 (the “Senior Subordinated Notes”), issued pursuant to that certain indenture, dated as of September 30, 2005 (the “10 3/4% Indenture”), with Panolam as issuer, certain of the other Debtors as guarantors named thereto, and Wells Fargo Bank, National Association, as trustee, who have agreed to vote to accept the Plan.

A restructuring pursuant to the proposed Plan would enable the Debtors to reduce the amount of debt by approximately $151 million (or approximately 44%), eliminate approximately $16 million in annual cash interest payments to the holders of Senior Subordinated Notes Claims, and free up additional cash that can be reinvested in their businesses.(1)

(1) Savings are calculated as a gross amount of Senior Subordinated Notes less $3.5 million of fees paid to the Senior Lenders and Senior Subordinated Noteholders (both as defined in the Plan).

The Debtors do not have the resources to service all of their existing debt obligations. The proposed financial restructuring in the Plan will reduce the Debtors’ leverage and position the Debtors to pursue future growth opportunities.

The Debtors are seeking your vote on the Plan prior to the commencement of the chapter 11 cases. By using this “joint prepackaged chapter 11 plan of reorganization” method, the Debtors anticipate that their day-to-day business operations will not be impacted, their chapter 11 cases will be significantly shortened, and the administration of their cases will be simplified and less costly. Please review the attached Disclosure Statement carefully for details about voting, recoveries, the proposed financial restructuring, the Debtors and their financial performance, and other relevant matters. The Debtors have established the following date for determining who is entitled to vote on the Plan (the “Record Date”) and the following deadline for their Voting Agent to receive votes (the “Voting Deadline”):

RECORD DATE: | September 25, 2009 |

| |

VOTING DEADLINE: | November 2, 2009, 5:00 p.m., Eastern Time |

| Sincerely, |

| |

| Panolam Holdings Co., et al. |

| |

| /s/ Robert J. Muller, Jr |

| Robert J. Muller, Jr. |

| Chairman, President and Chief Executive Officer |

THIS SOLICITATION (THE “SOLICITATION”) OF VOTES IS BEING CONDUCTED TO OBTAIN SUFFICIENT ACCEPTANCES OF THE PLAN BEFORE THE FILING OF VOLUNTARY REORGANIZATION CASES UNDER CHAPTER 11 OF THE BANKRUPTCY CODE. BECAUSE CHAPTER 11 CASES HAVE NOT YET BEEN COMMENCED, THIS DISCLOSURE STATEMENT HAS NOT BEEN APPROVED BY THE BANKRUPTCY COURT AS CONTAINING ADEQUATE INFORMATION WITHIN THE MEANING OF SECTION 1125(a) OF THE BANKRUPTCY CODE. FOLLOWING THE COMMENCEMENT OF THE CHAPTER 11 CASES, THE DEBTORS EACH EXPECT TO PROMPTLY SEEK ORDERS OF THE BANKRUPTCY COURT (i) APPROVING THIS DISCLOSURE STATEMENT AS CONTAINING ADEQUATE INFORMATION, (ii) APPROVING THE SOLICITATION OF VOTES AS BEING IN COMPLIANCE WITH SECTIONS 1125 AND 1126(b) OF THE BANKRUPTCY CODE, AND (iii) CONFIRMING THE PROPOSED PLAN OF REORGANIZATION (THE “PLAN”).

DISCLOSURE STATEMENT, DATED SEPTEMBER 30, 2009

Solicitation of Votes on the Joint

Prepackaged Plan of Reorganization of

PANOLAM HOLDINGS CO., ET AL.

from the holders of outstanding

SENIOR LENDER CREDIT AGREEMENT REVOLVER CLAIMS

SENIOR LENDER CREDIT AGREEMENT TERM CLAIMS

NOTEHOLDER CREDIT AGREEMENT CLAIMS

SENIOR SUBORDINATED NOTES CLAIMS

EQUITY INTERESTS IN PANOLAM HOLDINGS CO.

THE VOTING DEADLINE TO ACCEPT OR REJECT THE JOINT PREPACKAGED PLAN OF REORGANIZATION IS 5:00 P.M., EASTERN TIME, ON NOVEMBER 2, 2009, UNLESS EXTENDED BY PANOLAM HOLDINGS CO.

i

RECOMMENDATION BY THE DEBTORS

The Board of Directors of Panolam Holdings Co., the Board of Directors of Panolam Holdings II, Co., the Board of Directors of Panolam Industries International, Inc. (“Panolam”), and the Board of Directors or the sole member of each of Panolam’s wholly owned direct and indirect United States subsidiaries have unanimously approved the solicitation, the Plan, and the transactions contemplated thereby, and recommend that all creditors whose votes are being solicited submit ballots to accept the Plan. Holders of more than two-thirds (2/3) in outstanding principal amount of certain of the Classes of Claims entitled to vote on the Plan have already agreed to vote in favor of the Plan.

HOLDERS OF CLAIMS SHOULD NOT CONSTRUE THE CONTENTS OF THE DISCLOSURE STATEMENT (THIS “DISCLOSURE STATEMENT”) AS PROVIDING ANY LEGAL, BUSINESS, FINANCIAL, OR TAX ADVICE AND SHOULD CONSULT WITH THEIR OWN ADVISORS BEFORE CASTING A VOTE WITH RESPECT TO THE PLAN.

THE NEW CAPITAL STOCK AND NEW WARRANTS EXERCISABLE FOR SUCH NEW CAPITAL STOCK HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR SIMILAR STATE SECURITIES OR “BLUE SKY” LAWS. THE ISSUANCE OF SUCH SECURITIES UNDER THE PLAN IS BEING EFFECTED PURSUANT TO THE EXEMPTION UNDER SECTION 1145 OF THE BANKRUPTCY CODE. THIS SOLICITATION IS BEING MADE ONLY TO THOSE CREDITORS WHO ARE ACCREDITED INVESTORS AS DEFINED IN REGULATION D UNDER THE SECURITIES ACT.

THE NEW CAPITAL STOCK AND NEW WARRANTS EXERCISABLE FOR SUCH NEW CAPITAL STOCK TO BE ISSUED ON THE EFFECTIVE DATE HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION (THE “SEC”) OR BY ANY STATE SECURITIES COMMISSION OR SIMILAR PUBLIC, GOVERNMENTAL, OR REGULATORY AUTHORITY, AND NEITHER THE SEC NOR ANY SUCH AUTHORITY HAS PASSED UPON THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT OR UPON THE MERITS OF THE PLAN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

CERTAIN STATEMENTS CONTAINED IN THIS DISCLOSURE STATEMENT, INCLUDING PROJECTED FINANCIAL INFORMATION AND OTHER FORWARD-LOOKING STATEMENTS, ARE BASED ON ESTIMATES AND ASSUMPTIONS. THERE CAN BE NO ASSURANCE THAT SUCH STATEMENTS WILL BE REFLECTIVE OF ACTUAL OUTCOMES. FORWARD-LOOKING STATEMENTS ARE PROVIDED IN THIS DISCLOSURE STATEMENT PURSUANT TO THE SAFE HARBOR ESTABLISHED UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 AND SHOULD BE EVALUATED IN THE CONTEXT OF THE ESTIMATES, ASSUMPTIONS, UNCERTAINTIES, AND RISKS DESCRIBED HEREIN.

FURTHER, READERS ARE CAUTIONED THAT ANY FORWARD-LOOKING STATEMENTS HEREIN ARE BASED ON ASSUMPTIONS THAT ARE BELIEVED TO BE REASONABLE, BUT ARE SUBJECT TO A WIDE RANGE OF RISKS INCLUDING, BUT NOT LIMITED TO, RISKS ASSOCIATED WITH (I) FUTURE FINANCIAL

ii

RESULTS AND LIQUIDITY, INCLUDING THE ABILITY TO FINANCE OPERATIONS IN THE NORMAL COURSE, (II) VARIOUS FACTORS THAT MAY AFFECT THE VALUE OF THE NEW CAPITAL STOCK TO BE ISSUED UNDER THE PLAN, (III) THE RELATIONSHIPS WITH AND PAYMENT TERMS PROVIDED BY TRADE CREDITORS, (IV) ADDITIONAL FINANCING REQUIREMENTS POST-RESTRUCTURING, (V) FUTURE DISPOSITIONS AND ACQUISITIONS, (VI) THE EFFECT OF COMPETITIVE PRODUCTS, SERVICES OR PRICING BY COMPETITORS, (VII) CHANGES TO THE COSTS OF COMMODITIES AND RAW MATERIALS, (VIII) THE PROPOSED RESTRUCTURING AND COSTS ASSOCIATED THEREWITH, (IX) THE EFFECT OF CONDITIONS IN THE COMMERCIAL AND RESIDENTIAL LAMINATES INDUSTRY ON THE DEBTORS, (X) THE ABILITY TO OBTAIN RELIEF FROM THE BANKRUPTCY COURT TO FACILITATE THE SMOOTH OPERATION UNDER CHAPTER 11, (XI) THE CONFIRMATION AND CONSUMMATION OF THE PLAN, AND (XII) EACH OF THE OTHER RISKS IDENTIFIED IN THIS DISCLOSURE STATEMENT. DUE TO THESE UNCERTAINTIES, READERS CANNOT BE ASSURED THAT ANY FORWARD-LOOKING STATEMENTS WILL PROVE TO BE CORRECT. THE DEBTORS ARE UNDER NO OBLIGATION TO (AND EXPRESSLY DISCLAIM ANY OBLIGATION TO) UPDATE OR ALTER ANY FORWARD-LOOKING STATEMENTS WHETHER AS A RESULT OF NEW INFORMATION, FUTURE EVENTS, OR OTHERWISE, UNLESS INSTRUCTED TO DO SO BY THE BANKRUPTCY COURT.

HOLDERS OF PREPETITION TRADE CLAIMS, CUSTOMERS AND EMPLOYEES WILL NOT BE IMPAIRED BY THE PLAN, AND AS A RESULT THE RIGHT TO RECEIVE PAYMENT IN FULL ON ACCOUNT OF EXISTING OBLIGATIONS IS NOT ALTERED BY THE PLAN. DURING THE CHAPTER 11 CASES, THE DEBTORS INTEND TO OPERATE THEIR BUSINESSES IN THE ORDINARY COURSE AND WILL SEEK AUTHORIZATION FROM THE BANKRUPTCY COURT TO MAKE PAYMENT IN FULL ON A TIMELY BASIS TO ALL TRADE CREDITORS, CUSTOMERS AND EMPLOYEES OF ALL AMOUNTS DUE PRIOR TO AND DURING THE CHAPTER 11 CASES.

NO INDEPENDENT AUDITOR OR ACCOUNTANT HAS REVIEWED OR APPROVED THE FINANCIAL PROJECTIONS OR THE LIQUIDATION ANALYSIS HEREIN.

THE DEBTORS HAVE NOT AUTHORIZED ANY PERSON TO GIVE ANY INFORMATION OR ADVICE, OR TO MAKE ANY REPRESENTATION, IN CONNECTION WITH THE PLAN AND THIS DISCLOSURE STATEMENT.

THE STATEMENTS CONTAINED IN THIS DISCLOSURE STATEMENT ARE MADE AS OF THE DATE HEREOF UNLESS OTHERWISE SPECIFIED. THE TERMS OF THE PLAN GOVERN IN THE EVENT OF ANY INCONSISTENCY WITH THE SUMMARIES IN THIS DISCLOSURE STATEMENT.

THE INFORMATION IN THIS DISCLOSURE STATEMENT IS BEING PROVIDED SOLELY FOR PURPOSES OF VOTING TO ACCEPT OR REJECT THE PLAN OR OBJECTING TO CONFIRMATION. NOTHING IN THIS DISCLOSURE STATEMENT MAY BE USED BY ANY PARTY FOR ANY OTHER PURPOSE.

iii

ALL EXHIBITS TO THE DISCLOSURE STATEMENT ARE INCORPORATED INTO AND ARE A PART OF THIS DISCLOSURE STATEMENT AS IF SET FORTH IN FULL HEREIN.

INTERNAL REVENUE SERVICE CIRCULAR 230 NOTICE: TO ENSURE COMPLIANCE WITH INTERNAL REVENUE SERVICE CIRCULAR 230, HOLDERS OF CLAIMS AND PRECONFIRMATION EQUITY INTERESTS ARE HEREBY NOTIFIED THAT: (A) ANY DISCUSSION OF FEDERAL TAX ISSUES CONTAINED OR REFERRED TO IN THIS DISCLOSURE STATEMENT IS NOT INTENDED OR WRITTEN TO BE USED, AND CANNOT BE USED, BY HOLDERS OF CLAIMS OR PRECONFIRMATION EQUITY INTERESTS FOR THE PURPOSE OF AVOIDING PENALTIES THAT MAY BE IMPOSED ON THEM UNDER THE INTERNAL REVENUE CODE; (B) SUCH DISCUSSION IS WRITTEN IN CONNECTION WITH THE PROMOTION OR MARKETING BY THE DEBTORS OF THE TRANSACTIONS OR MATTERS ADDRESSED HEREIN; AND (C) HOLDERS OF CLAIMS AND PRECONFIRMATION EQUITY INTERESTS SHOULD SEEK ADVICE BASED ON THEIR PARTICULAR CIRCUMSTANCES FROM AN INDEPENDENT TAX ADVISOR.

iv

INTRODUCTION

IMPORTANT — PLEASE READ

Panolam Holdings Co. (“Holdings”), Panolam Holdings II, Co. (“Holdings II”) and Panolam Industries International, Inc. (“Panolam”), together with Panolam Industries, Inc., Pioneer Plastics Corporation, Nevamar Holding Corp., Nevamar Holdco LLC, and Nevamar Company LLC, (collectively, the “Panolam Subsidiary Debtors,” and, collectively with Holdings, Holdings II, and Panolam, the “Debtors”), submit this Disclosure Statement in connection with (i) the solicitation from eligible holders of acceptances (“Acceptances”) of the joint prepackaged plan of reorganization substantially in the form set forth in Exhibit “A” (the “Plan”) to be filed by the Debtors with the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”) and (ii) the hearing to consider confirmation of the Plan (the “Confirmation Hearing”), which will be scheduled by the Bankruptcy Court after the commencement of the chapter 11 cases. The date on which the Clerk of the Bankruptcy Court enters the order confirming the Plan pursuant to section 1129 of the Bankruptcy Code (the “Confirmation Order”) shall be the “Confirmation Date.” The date on which the Plan is consummated shall be the “Effective Date.”

This solicitation is being conducted at this time in order to obtain sufficient votes to enable the Plan to be confirmed by the Bankruptcy Court. Capitalized terms used in this Disclosure Statement but not defined herein have the meanings ascribed to them in the Plan. Please note that to the extent any inconsistencies exist between this Disclosure Statement and Plan, the Plan shall govern.

The Debtors are commencing this solicitation after extensive discussions over the past several months among the Debtors and certain of their major creditor groups. The discussions have resulted in (a) holders of more than two-thirds (2/3) in amount and half (1/2) in number of (i) the Senior Lender Credit Agreement Revolver Claims, (ii) the Senior Lender Credit Agreement Term Claims, and (iii) Noteholder Credit Agreement Claims and (b) holders of 66% of the Senior Subordinated Notes Claims (collectively, the “Consenting Holders”) agreeing to support the restructuring transactions and vote to accept the Plan through executing a Restructuring Support Agreement, dated as of September 25, 2009 (the “Restructuring Support Agreement”).

The Plan is premised upon the limited substantive consolidation of the Debtors for purposes of voting on, and distribution under, the Plan only. The Debtors propose procedural substantive consolidation to avoid the inefficiency of proposing, voting on, and making distributions in respect of entity-specific claims. Accordingly, on the Effective Date, all of the Debtors and their estates shall, for purposes of the Plan only, be deemed merged and (a) all assets and liabilities of the Debtors are treated for purposes of the Plan only as though they were merged, (b) all guarantees of Holdings II, Panolam and the Panolam Subsidiary Debtors of payment, performance or collection of obligations of any other Debtor shall be eliminated and cancelled, (c) all joint obligations, and all multiple Claims against the Debtors, shall be considered a single claim against the Debtors, and (d) any Claim filed in the Reorganization Cases shall be deemed filed against the consolidated Debtors and a single obligation of the consolidated Debtors on and after the Effective Date. Unless otherwise set forth in the Plan, such substantive consolidation shall not (other than for voting, treatment, and distribution purposes under the Plan) affect (i) the legal and corporate structures of the Debtors (including the corporate ownership of the Panolam Subsidiary Debtors), (ii) any intercompany claims or (iii) the substantive rights of any creditor. If any party in interest challenges the proposed limited substantive consolidation, the Debtors reserve the right to establish at the Confirmation Hearing the ability to confirm the Plan on an entity-by-entity basis.

WHO IS ENTITLED TO VOTE: Under the Bankruptcy Code, only holders of claims or interests in “impaired” classes are entitled to vote on the Plan (unless, for reasons discussed in more detail below, such holders are deemed to accept or reject the Plan). Under section 1124 of the Bankruptcy Code, a class of claims or interests is deemed to be “impaired” under the Plan unless (1) the Plan leaves unaltered the legal, equitable and contractual rights to which such claim or interest entitles the holder thereof or (2) notwithstanding any legal right to an accelerated payment of such claim or interest, the Plan cures all existing defaults (other than defaults resulting from the occurrence of events of bankruptcy) and reinstates the maturity of such claim or interest as it existed before the default.

Through this vote, the Debtors’ goal is to consummate a financial restructuring transaction that will significantly reduce the Debtors’ outstanding debt and put the Debtors in a stronger financial position for future growth and stability.

Pursuant to the Plan, and as discussed more fully below, on the Effective Date, Reorganized Panolam shall issue the following: (i) Amended and Restated Revolver Notes (as defined below), (ii) Amended and Restated Term Notes (as defined below) (together with the Amended and Restated Revolver Notes, the “Amended and Restated First Lien Notes”); and (iii) New Second Lien Notes (as defined below). Moreover, pursuant to the Plan, on the Effective Date, Reorganized Holdings shall issue the following: (i) one class of common stock of Reorganized Holdings (the “New Capital Stock”), 90% of which shall be contributed to Reorganized Panolam for distribution pursuant to the Plan; and (ii) warrants to purchase a number of shares of New Capital Stock equal to 2.5% of the number of outstanding shares of New Capital Stock as of the Effective Date at an exercise price of $0.01 per share (the “New Warrants”). The New Warrants shall only be exercisable upon a change of control of Reorganized Panolam.

The following table summarizes the treatment and estimated recovery for creditors and stockholders under the Plan. For a complete explanation, please refer to the discussion in Section IV below, entitled “THE PLAN” and the Plan itself:

Class | | Description | | Treatment | | Entitled

to Vote | | Estimated

Recovery(2) |

1 | | Priority Non-Tax Claims | | Unimpaired. Except to the extent that a holder of an Allowed Priority Non-Tax Claim against any of the Debtors agrees to a different treatment, each such holder shall receive, in full satisfaction of such Claim, Cash in an amount equal to such Claim, on or as soon as reasonably practicable after the latest of (i) the Effective Date, (ii) the date such Claim becomes Allowed, and (iii) the date for payment provided by any agreement or understanding between the applicable Debtor and the holder of such Claim. | | No (deemed to accept) | | 100% |

(2) Recovery based on mid-point valuation and illustrated prior to dilution of the New Capital Stock from the New Warrants and the Management Incentive Plan.

2

Class | | Description | | Treatment | | Entitled

to Vote | | Estimated

Recovery(2) |

2A | | Senior Lender Credit Agreement Revolver Claims | | Impaired. On the Effective Date or as soon thereafter as is reasonably practicable, each holder of an Allowed Senior Lender Credit Agreement Revolver Claim shall receive from Reorganized Panolam, as illustrated in the Amended and Restated Term Notes Distribution Analysis attached to the Plan as Exhibit “D,” (i) an amount of Cash equal to the Intercreditor Distribution Adjustment plus its pro rata share (based upon the amount of the Allowed Senior Lender Credit Agreement Revolver Claim held by such holder divided by the total amount of all Allowed Senior Lender Credit Agreement Claims) of the Excess Cash, (ii) its pro rata share of the Amended and Restated Revolver Notes, (iii) its pro rata share of the Amended and Restated Term Notes Distributable to Senior Lender Credit Agreement Revolver Claims, and (iv) its pro rata share of Cash sufficient to pay that portion of the Allowed Senior Lender Credit Agreement Revolver Claims set forth in Sections 4.2(a)(ii) and 4.2(a)(iii) of the Plan. | | Yes | | 100% |

2B | | Senior Lender Credit Agreement Term Claims | | Impaired. On the Effective Date or as soon thereafter as is reasonably practicable, each holder of an Allowed Senior Lender Credit Agreement Term Claim shall receive from Reorganized Panolam, as illustrated in the Amended and Restated Term Notes Distribution Analysis attached to the Plan as Exhibit “D,” (i)(a) its pro rata share (based upon the amount of the Allowed Senior Lender Credit Agreement Term Claim held by such holder divided by the total amount of all Allowed Senior Lender Credit Agreement Claims) of the Excess Cash minus (b) the Excess Cash Adjustment and minus (c) an amount of Cash equal to the Intercreditor Distribution Adjustment, (ii) its pro rata share of the Amended and Restated Term Notes Distributable to Senior Lender Credit Agreement Term Claims, and (iii) its pro rata share of Cash sufficient to pay that portion of the Allowed Senior Lender Credit Agreement Term Claims set forth in Sections 4.3(a)(ii) and 4.3(a)(iii) of the Plan. | | Yes | | 100% |

3 | | Noteholder Credit Agreement Claims | | Impaired. On the Effective Date or as soon thereafter as is reasonably practicable, each holder of an Allowed Noteholder Credit Agreement Claim shall receive from Reorganized Panolam (i) its pro rata share of the New Second Lien Term Notes and (ii) its pro rata share of Cash sufficient to pay that portion of the Allowed Senior Lender Credit Agreement Term Claims set forth in Sections 4.4(a)(ii) and 4.4(a)(iii) of the Plan. | | Yes | | 100% |

3

Class | | Description | | Treatment | | Entitled

to Vote | | Estimated

Recovery(2) |

4 | | Other Secured Claims | | Unimpaired. On the Effective Date or as soon thereafter as is reasonably practicable, except to the extent that a holder of an Allowed Other Secured Claim agrees to a different treatment, each Allowed Other Secured Claim shall be reinstated or rendered unimpaired in accordance with section 1124 of the Bankruptcy Code, notwithstanding any contractual provision or applicable non-bankruptcy law that entitles the holder of an Allowed Other Secured Claim to demand or receive payment of such Claim prior to its stated maturity from and after the occurrence of default. All Allowed Other Secured Claims that are not due and payable on or before the Effective Date shall, at the Debtors’ option, be paid (i) in the ordinary course of business in accordance with the course of practice between the Debtors and such holder with respect to such Claim, or (ii) by transfer of the Collateral to the holder of such Claim. | | No (deemed to accept) | | 100% |

5 | | Senior Subordinated Notes Claims | | Impaired. On the Effective Date or as soon thereafter as is reasonably practicable, each holder of an Allowed Senior Subordinated Notes Claim shall exchange with Reorganized Panolam all, and not less than all, of such holder’s Senior Subordinated Notes for such holder’s pro rata share (based upon the principal amount of Senior Subordinated Notes held by such holder) of ninety percent (90%) of the sum of (i) the number of shares of New Capital Stock outstanding on the Effective Date, including New Capital Stock issued to management pursuant to the Management Incentive Plan, plus (ii) the number of shares of New Capital Stock reserved for issuance under the Management Incentive Plan. | | Yes | | 49%(3) |

(3) Recovery based on mid-point valuation and illustrated prior to dilution of the New Capital Stock from the New Warrants and the Management Incentive Plan.

4

Class | | Description | | Treatment | | Entitled

to Vote | | Estimated

Recovery(2) |

6 | | General Unsecured Claims | | Unimpaired. Each holder of an Allowed General Unsecured Claim shall receive payment in full in Cash of the unpaid portion of such Allowed General Unsecured Claim on the latest of (i) the Effective Date (or as soon thereafter as is reasonably practicable), (ii) the date on which such Claim would be paid in the ordinary course of the Debtors’ business, or (iii) as otherwise agreed by the Debtors and the holder of such Claim; provided, however, that the Debtors may seek authority from the Bankruptcy Court to pay certain General Unsecured Claims in advance of the Effective Date in the ordinary course of business. The Debtors reserve their rights, however, to dispute the validity of any General Unsecured Claim, whether or not objected to prior to the Effective Date. | | No (deemed to accept) | | 100% |

7 | | Debtor Section 510(b) Claims | | Impaired. On the Effective Date, all Debtor Section 510(b) Claims shall be extinguished with no distribution; provided, however, that nothing in section 4.10 of the Plan shall affect or limit the rights or obligations set forth in section 8.5 thereof. | | No (deemed to reject) | | 0% |

8 | | Intercompany Claims | | Unimpaired. On or as soon as practicable after the Effective Date, all Intercompany Claims will either be reinstated to the extent determined to be appropriate by the Debtors or adjusted, continued or capitalized (but not paid in Cash), either directly or indirectly, in whole or in part; provided, however, that the Intercompany Claims held by any foreign non-Debtor subsidiary of Panolam may be paid in full in Cash. Any such transaction may be effected on or subsequent to the Effective Date without any further action by equityholders of Reorganized Holdings. | | No (deemed to accept) | | 100% |

9 | | Equity Interests in Holdings II, Panolam and Panolam Subsidiary Debtors | | Unimpaired. On the Effective Date and subject to Section 5.5 of the Plan, all of the Equity Interests of the Panolam Subsidiary Debtors shall continue to be owned by Panolam or Nevamar Holding Corp., as applicable. On the Effective Date, all of the Equity Interests of Panolam shall be cancelled and the Equity Interests of Reorganized Panolam shall be owned by Reorganized Holdings. On the Effective Date, all of the Equity Interests in Holdings II will be cancelled, unless Holdings II is merged into Holdings. | | No (deemed to accept) | | 100% |

5

Class | | Description | | Treatment | | Entitled

to Vote | | Estimated

Recovery(2) |

10 | | Equity Interests in Holdings | | Impaired. On the Effective Date, or as soon thereafter as is reasonably practicable, all existing Equity Interests in Holdings shall be cancelled, and each holder of an Allowed Equity Interest in Holdings shall be permitted, in full satisfaction of such Equity Interest, to exchange with Holdings all of its Allowed Equity Interests in Holdings for its pro rata share of New Warrants. | | Yes | | N/A |

WHERE TO FIND ADDITIONAL INFORMATION: For detailed historical and projected financial information and financial estimates, see Section VII below, entitled “FINANCIAL INFORMATION, PROJECTIONS, AND VALUATION ANALYSIS” and the following documents: (i) Panolam’s Form 10-K for the year ended December 31, 2008, filed with the SEC on March 31, 2009 (the “Panolam 10-K”), (ii) Panolam’s Form 10-Q for the period ended March 31, 2009, filed with the SEC on May 20, 2009, and (ii) Panolam’s Form 10-Q for the period ended June 30, 2009, filed with the SEC on August 10, 2009, each as annexed to this Disclosure Statement as Exhibits “B,” “C,” and “D,” respectively.

The Debtors’ legal advisors are Weil, Gotshal & Manges LLP and Richards, Layton & Finger, P.A. and their financial advisors are Perella Weinberg Partners LP. They can be contacted at:

Weil, Gotshal & Manges LLP 767 Fifth Avenue New York, NY 10153 (212) 310-8000 Attn: Gary T. Holtzer, Esq. and Weil, Gotshal & Manges LLP 200 Crescent Court, Suite 300 Dallas, TX 75201 (214) 746-7700 Attn: Stephen A. Youngman, Esq. | Perella Weinberg Partners LP 767 Fifth Avenue New York, NY 10153 (212) 287-3200 Attn: Adam Verost |

| |

— and — | |

| |

Richards, Layton & Finger, P.A. One Rodney Square P.O. Box 551 Wilmington, DE 19899 (302) 651-7700 Attn: Mark D. Collins, Esq. | |

6

Summary of Voting Procedures

To be counted, your vote (or the Master Ballot (as defined below) cast on your behalf)) must be received, pursuant to the following instructions, by the Debtors’ Voting Agent at the following address, before the Voting Deadline of 5 p.m. (Eastern Time) on November 2, 2009 (the “Voting Deadline”):

If by mail:

Panolam Ballot Processing Center

C/O Epiq Bankruptcy Solutions, LLC

FDR Station, P.O. Box 5014

New York, NY 10150-5014

If by personal delivery or overnight courier:

Panolam Ballot Processing Center

C/O Epiq Bankruptcy Solutions, LLC

757 Third Avenue, 3rd Floor

New York, NY 10017

Confirm by Telephone: (646) 282-2400

ONLY CERTAIN HOLDERS OF CLAIMS AND EQUITY INTERESTS AGAINST THE DEBTORS ARE ELIGIBLE TO VOTE ON THE PLAN, ATTACHED TO THIS DISCLOSURE STATEMENT AS EXHIBIT “A,” AND SUMMARIZED BELOW UNDER THE SECTION ENTITLED “THE PLAN.” IT IS IMPORTANT THAT THE HOLDERS OF CLAIMS IN CLASS 2A (SENIOR LENDER CREDIT AGREEMENT REVOLVER CLAIMS), CLASS 2B (SENIOR LENDER CREDIT AGREEMENT TERM CLAIMS), CLASS 3 (NOTEHOLDER CREDIT AGREEMENT CLAIMS), CLASS 5 (SENIOR SUBORDINATED NOTES CLAIMS) AND CLASS 10 (EQUITY INTERESTS IN HOLDINGS) EXERCISE THEIR RIGHTS TO VOTE TO ACCEPT OR REJECT THE PLAN.

PURSUANT TO THE RESTRUCTURING SUPPORT AGREEMENT, (a) HOLDERS OF MORE THAN TWO-THIRDS (2/3) IN AMOUNT AND MORE THAN HALF (1/2) IN NUMBER OF THE (I) SENIOR LENDER CREDIT AGREEMENT REVOLVER CLAIMS, (II) SENIOR LENDER CREDIT AGREEMENT TERM CLAIMS, AND (III) NOTEHOLDER CREDIT AGREEMENT CLAIMS, AND (b) HOLDERS OF 66% OF THE SENIOR SUBORDINATED NOTES CLAIMS INTEND TO VOTE IN FAVOR OF THE PLAN.

Please complete the information requested on the ballot, sign, date and indicate your vote on the ballot, and return your completed ballot in the enclosed pre-addressed postage-paid envelope so that it is actually received by the Voting Agent before the Voting Deadline.

If the return envelope provided with your ballot was addressed to your bank or brokerage firm, please allow sufficient time for that firm to process your vote before the Voting Deadline (5 p.m., Eastern Time, on November 2, 2009).

7

IF YOU ARE ENTITLED TO VOTE AND YOU HAVE RETURNED YOUR BALLOT BUT FAILED TO INDICATE ON THE BALLOT WHETHER YOU ACCEPT OR REJECT THE PLAN, SUCH BALLOT WILL NOT BE COUNTED.

* * *

For detailed voting instructions, see Section IX below, entitled “VOTING PROCEDURES AND REQUIREMENTS,” and the instructions on your ballot.

8

TABLE OF CONTENTS

| | | | | Page |

| | | | | |

I. | General Information | 1 |

| A. | Description of the Debtors | 1 |

| | 1. | Business | 1 |

| | 2. | Corporate History and Structure | 2 |

| | 3. | Selected Financial Information | 4 |

| B. | Prepetition Indebtedness and Capital Structure | 4 |

| | 1. | Equity | 4 |

| | 2. | Prepetition Indebtedness | 4 |

| | | (a) | The Term Loan and Revolving Loan | 4 |

| | | (b) | The Senior Subordinated Notes | 4 |

II. | Key Events Leading to the Decision to Commence the Voluntary Chapter 11 Reorganization Cases | 4 |

| A. | Industry-Specific Events | 4 |

| B. | Liquidity Constraints and Prepetition Negotiations | 5 |

| C. | Restructuring Negotiations | 6 |

| D. | The Financial Restructuring Transaction | 7 |

| | 1. | Restructuring Support Agreement | 7 |

| | 2. | New Financing | 8 |

| | | (a) | The Amended and Restated Credit Agreement | 8 |

| | | (b) | New Second Lien Credit Agreement | 9 |

| | 3. | Purpose of the Financial Restructuring | 17 |

| | 4. | Distributions in Connection with the Financial Restructuring | 17 |

| | | (a) | Distributions to Holders of Senior Lender Credit Agreement Revolver Claims | 18 |

| | | (b) | Distributions to Holders of Senior Lender Credit Agreement Term Claims | 18 |

| | | (c) | Noteholder Credit Agreement Claims | 18 |

III. | Anticipated Events During the Chapter 11 Cases | 19 |

| A. | Administration of the Plan | 19 |

| B. | Operational Issues After the Commencement Date | 19 |

| C. | Confirmation Hearing | 19 |

| D. | Timetable for the Chapter 11 Cases | 20 |

i

TABLE OF CONTENTS

(continued)

| | | | | Page |

| | | | | |

IV. | The Plan | 20 |

| A. | Classification and Treatment of Claims and Equity Interests Under the Plan | 20 |

| | 1. | Description of Unclassified Claims | 24 |

| | | (a) | Administrative Expense Claims | 24 |

| | | (b) | Professional Compensation and Reimbursement Claims | 25 |

| | | (c) | Priority Tax Claims | 25 |

| | 2. | Description of Classified Claims | 25 |

| | | (a) | Priority Non-Tax Claims (Class 1) | 25 |

| | | (b) | Senior Lender Credit Agreement Revolver Claims (Class 2A) | 26 |

| | | (c) | Senior Lender Credit Agreement Term Claims (Class 2B) | 26 |

| | | (d) | Noteholder Credit Agreement Claims (Class 3) | 27 |

| | | (e) | Other Secured Claims (Class 4) | 28 |

| | | (f) | Senior Subordinated Notes Claims (Class 5) | 28 |

| | | (g) | General Unsecured Claims (Class 6) | 29 |

| | | (h) | Debtor Section 510(b) Claims (Class 7) | 29 |

| | | (i) | Intercompany Claims (Class 8) | 29 |

| | | (j) | Equity Interests in Holdings II, Panolam and Panolam Subsidiary Debtors (Class 9) | 30 |

| | | (k) | Equity Interests in Holdings (Class 10) | 30 |

V. | Corporate Restructuring Transactions Under the Plan and Certain Securities Matters | 31 |

| A. | Corporate Action | 31 |

| | 1. | General | 31 |

| | 2. | Restated Certificate of Incorporation and Restated Bylaws of Reorganized Holdings and the Other Reorganized Debtors | 31 |

| | 3. | Boards of Directors of Reorganized Holdings and the Other Reorganized Debtors | 32 |

| | 4. | Officers of Reorganized Holdings and the Other Reorganized Debtors | 32 |

| B. | Authorization and Issuance of Plan Securities | 32 |

| | 1. | Distribution of Amended and Restated First Lien Notes and New Second Lien Term Notes | 32 |

| | 2. | Issuance of New Capital Stock and New Warrants | 33 |

ii

TABLE OF CONTENTS

(continued)

| | | | | Page |

| | | | | |

| C. | Merger/Dissolution/Consolidation | 33 |

| D. | Cancellation of Existing Securities and Agreements | 33 |

| E. | Surrender of Existing Securities | 34 |

| F. | Agreements with Existing Management | 34 |

| G. | Management Incentive Plan | 34 |

| H. | Emergence Bonus Plan | 34 |

| I. | Cancellation of Liens | 35 |

| J. | Compromise of Controversies | 35 |

| K. | Exemption from Securities Laws | 35 |

| L. | Exemptions from Transfer Taxes | 35 |

VI. | Other Aspects of the Plan | 36 |

| A. | Distributions | 36 |

| | 1. | Voting of Claims | 36 |

| | 2. | Cramdown and No Unfair Discrimination | 36 |

| | 3. | Timing and Conditions of Distributions | 36 |

| | | (a) | Distribution Record Date | 36 |

| | | (b) | Date of Distributions | 36 |

| | | (c) | Sources of Cash for Distribution | 36 |

| | | (d) | Disbursement Agent | 37 |

| | | (e) | Rights and Powers of Disbursement Agent | 37 |

| | | (f) | Expenses of the Disbursement Agent | 37 |

| | | (g) | Delivery of Distributions | 37 |

| | | (h) | Manner of Payment Under the Plan | 38 |

| | | (i) | No Fractional Shares of New Capital Stock or New Warrants | 39 |

| | | (j) | Setoffs and Recoupment | 39 |

| | | (k) | Distribution After Effective Date | 39 |

| | | (l) | Cash Distributions | 39 |

| | | (m) | Allocations of Principal Between Principal and Interest | 39 |

| | | (n) | No Postpetition Interest on Claims | 39 |

| | 4. | Procedures for Disputed Claims Under the Plan | 40 |

| | | (a) | Disputed Claims/Process | 40 |

iii

TABLE OF CONTENTS

(continued)

| | | | | Page |

| | | | | |

| | | (b) | Objections to Claims | 40 |

| | | (c) | Estimation of Claims | 40 |

| | | (d) | No Distributions Pending Allowance | 40 |

| | | (e) | Distribution after Allowance | 41 |

| | | (f) | Preservation of Claims and Rights to Settle Claims | 41 |

| B. | Treatment of Executory Contracts and Unexpired Leases | 41 |

| | 1. | Assumption and Rejection of Contracts and Leases | 41 |

| | 2. | Cure of Defaults | 42 |

| | 3. | Rejection Claims | 42 |

| | 4. | Survival of the Debtors’ Indemnification Obligations | 42 |

| | 5. | Survival of Other Employment Arrangements | 42 |

| | 6. | Insurance Policies | 43 |

| C. | Conditions Precedent to the Effective Date | 43 |

| | 1. | Conditions Precedent to Effective Date of the Plan | 43 |

| | | (a) | Confirmation Order | 43 |

| | | (b) | Execution and Delivery of Other Documents | 43 |

| | | (c) | Regulatory Approvals | 43 |

| | | (d) | Consents | 43 |

| | | (e) | Corporate Formalities | 43 |

| | | (f) | Minimum Excess Cash | 43 |

| | | (g) | Other Acts | 43 |

| | 2. | Waiver of Conditions Precedent | 43 |

| | 3. | Effect of Failure of Conditions | 43 |

| D. | Effect of Confirmation | 44 |

| | 1. | Vesting of Assets | 44 |

| | 2. | Binding Effect | 44 |

| | 3. | Discharge of the Debtors | 44 |

| | 4. | Exculpation | 45 |

| | 5. | Term of Injunctions or Stays | 45 |

| | 6. | Injunction Against Interference with the Plan | 45 |

| | 7. | Solicitation of the Plan | 45 |

iv

TABLE OF CONTENTS

(continued)

| | | | | Page |

| | | | | |

| | 8. | Waiver of Certain Claims | 46 |

| | 9. | Preservation of Claims | 46 |

| | 10. | Reservation of Rights | 46 |

| | 11. | Plan Supplement | 46 |

| E. | Releases | 46 |

| | 1. | Releases by Debtors | 46 |

| | 2. | Releases by Holders of Claims | 47 |

VII. | Financial Information, Projections, and Valuation Analysis | 47 |

| A. | Historical Financial Information | 47 |

| | | (a) | General | 47 |

| | | (b) | Selected Financial Data | 48 |

| | | (c) | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 48 |

| | | (d) | Recent Performance | 48 |

| B. | Projections | 48 |

| C. | Valuation | 48 |

VIII. | CERTAIN RISK FACTORS TO BE CONSIDERED | 48 |

| A. | Certain Bankruptcy Considerations | 49 |

| | 1. | Parties in Interest May Object to the Debtors’ Classification of Claims | 49 |

| | 2. | In Certain Instances, Any Chapter 11 Case May be Converted to a Case under Chapter 7 of the Bankruptcy Code | 49 |

| | 3. | The Bankruptcy Court May Not Confirm the Plan | 50 |

| | 4. | The Debtors May Fail to Meet All Conditions Precedent to Effectiveness of the Plan | 51 |

| | 5. | The Debtors May Be Unsuccessful in Obtaining First Day Orders to Authorize Payment to Key Creditors in the Ordinary Course of Business | 51 |

| | 6. | The Debtors Cannot Predict the Amount of Time Needed in Bankruptcy to Implement the Plan, and a Lengthy Bankruptcy Case Could Disrupt the Business, as well as Impair the Prospect for Reorganization on the Terms Contained in the Plan and Possibly Provide an Opportunity for Other Plans to be Proposed | 51 |

v

TABLE OF CONTENTS

(continued)

| | | | | Page |

| | | | | |

| B. | Risks to Recovery By Holders of Senior Lender Credit Agreement Claims, Noteholder Credit Agreement Claims, Senior Subordinated Notes Claims, and Equity Interests in Holdings | 52 |

| | 1. | Variances from Projections | 52 |

| | 2. | Holders of Senior Subordinated Notes Claims and Management’s Ownership of the Reorganized Debtors | 52 |

| | 3. | Unforeseen Events | 53 |

| C. | Risks Associated with the Debtors’ Business and the Industry | 53 |

| | 1. | Competitive Conditions | 53 |

| | 2. | Material Disruption of Debtors’ Facilities | 54 |

| | 3. | Increased Costs of Raw Materials and Purchased Energy | 54 |

IX. | Voting Procedures and Requirements | 55 |

| A. | Vote Required for Acceptance by a Class | 55 |

| B. | Classes Not Entitled to Vote | 56 |

| C. | Voting | 56 |

| D. | Beneficial Owners | 57 |

| E. | Nominees | 57 |

| | 1. | Pre-Validated Ballots | 58 |

| | 2. | Master Ballots | 58 |

| | 3. | Miscellaneous | 58 |

| | 4. | Fiduciaries And Other Representatives | 59 |

| | 5. | Agreements Upon Furnishing Ballots | 59 |

| | 6. | Change of Vote | 59 |

| F. | Waivers of Defects, Irregularities, etc | 59 |

| G. | Further Information, Additional Copies | 60 |

X. | Confirmation of the Plan | 60 |

| A. | Confirmation Hearing | 60 |

| B. | General Requirements of Section 1129 | 61 |

| C. | Best Interests Test | 61 |

| D. | Liquidation Analysis | 61 |

| E. | Feasibility | 61 |

| F. | Section 1129(b) | 62 |

vi

TABLE OF CONTENTS

(continued)

| | | | | Page |

| | | | | |

| | 1. | No Unfair Discrimination | 62 |

| | 2. | Fair and Equitable Test | 62 |

XI. | Alternatives to Confirmation and Consummation of the Plan | 62 |

| A. | Liquidation Under Chapter 7 | 62 |

| B. | Alternative Plan | 63 |

XII. | Certain United States Federal Income Tax Consequences of the Plan | 63 |

| A. | Consequences to the Debtors | 64 |

| | 1. | Cancellation of Debt | 65 |

| | 2. | Potential Limitations on NOL Carryforwards and Other Tax Attributes | 65 |

| | | (a) | Built In Gains and Losses | 66 |

| | | (b) | Special Bankruptcy Exception | 67 |

| | 3. | Alternative Minimum Tax | 67 |

| B. | Consequences to Holders of Certain Claims | 68 |

| | 1. | Consequences to Holders of Credit Agreement Claims | 68 |

| | | (a) | Fully Taxable Exchange | 69 |

| | | (b) | Potential Recapitalization Treatment | 69 |

| | 2. | Consequences to Holders of Senior Subordinated Notes Claims | 70 |

| | 3. | Character of Gain or Loss | 71 |

| | 4. | Payment of Accrued Interest | 72 |

| | 5. | Ownership and Disposition of New Term Notes and New Drawn Revolver | 72 |

| | | (a) | Stated Interest and Original Issue Discount | 72 |

| | | (b) | Acquisition Premium | 74 |

| | | (c) | Sale, Exchange or Other Disposition of the New Term Notes and New Drawn Revolver | 74 |

| | 6. | Ownership and Disposition of New Capital Stock | 75 |

| C. | Consequences to Holders of Equity Interests in Holdings | 75 |

| | 1. | Consequences of the Exchange to Holders of Equity Interests in Holdings | 75 |

| | | (a) | New Warrants Treated as Warrants | 75 |

| | | (b) | New Warrants Treated as Stock | 76 |

| | 2. | Ownership, Exercise, and Disposition of New Warrants | 77 |

vii

TABLE OF CONTENTS

(continued)

| | | | | Page |

| | | | | |

| D. | Information Reporting and Backup Withholding | 77 |

XIII. | Conclusion | 78 |

| | |

Exhibit A | Joint Prepackaged Plan of Reorganization | |

Exhibit B | Panolam’s Form 10-K for the year ended December 31, 2008, filed with the SEC on March 31, 2009 | |

Exhibit C | Panolam’s Form 10-Q for the period ended March 31, 2009, filed with the SEC on May 20, 2009 | |

Exhibit D | Panolam’s Form 10-Q for the period ended June 30, 2009, filed with the SEC on August 10, 2009 | |

Exhibit E | Restructuring Support Agreement | |

Exhibit F | Pro Form Financial Projections | |

Exhibit G | Reorganized Valuation Analysis | |

Exhibit H | Liquidation Analysis | |

Exhibit I | Hypothetical Distribution of Excess Cash and Hypothetical Recovery Analysis | |

viii

I.

GENERAL INFORMATION

A. Description of the Debtors

The Debtors, which are privately owned, operate their businesses through a group of affiliated entities. The Debtors in these Reorganization Cases are:

Panolam Holdings Co.

Panolam Holdings II Co.

Panolam Industries International, Inc.

Panolam Industries, Inc.

Pioneer Plastics Corporation

Nevamar Holding Corp.

Nevamar Holdco, LLC

Nevamar Company, LLC

1. Business

Panolam, together with the Panolam Subsidiary Debtors, is a leading designer, manufacturer and distributor of decorative laminates in the United States and Canada. Its products, which are marketed under the Panolam, Pluswood, Nevamar and Pionite brand names, are used in a wide variety of commercial and residential indoor surfacing applications, including kitchen and bath cabinets, furniture, store fixtures and displays, and other specialty applications. It also markets other decorative laminates including a fiber reinforced laminate product (“FRL”). In addition to decorative laminates, it manufactures and distributes industrial laminate products, including Conolite, a fiber reinforced product (“FRP”). It also produces and markets a selection of specialty resins for industrial uses, such as powdered paint, adhesives and melamine resins for decorative laminate production, custom treated and chemically prepared decorative overlay papers for the high pressure laminates (“HPL”) and thermally-fused melamine (“TFM”), industry, and a variety of other custom products such as bowling lanes and leather laminates.

Panolam is the only vertically integrated North American manufacturer of both HPL and TFM (with the exception of particle board production in the TFM business where it purchases approximately 50% of its needs), and it designs, manufactures and distributes its own products throughout its principal markets. Panolam manufactures and sells its products through its wholly owned subsidiaries Panolam Industries Ltd., a Canadian corporation and non-debtor subsidiary, Panolam Industries, Inc., Pioneer Plastics Corporation, Nevamar Holding Corp., Nevamar Holdco, LLC and Nevamar Company, LLC. For the year ended December 31, 2008, Panolam’s decorative laminates products comprised approximately 87% of net sales.

Panolam offers an array of decorative and industrial laminate products from premium to commodity grades at a broad range of prices. HPL, TFM, FRL, FRP, Leatherlam and Panolam’s engineered laminates are utilized as durable and economical look-alike substitutes for natural surfacing materials such as wood, stone, leather and ceramic tile. HPL is used in surfacing applications requiring greater surface wear and impact resistance than applications using TFM. FRL, a proprietary product, is used in surfacing applications requiring greater surface wear, impact resistance and fire prevention than applications using HPL. FRP is used in the building, trucking and recreational vehicle, or RV, markets. A typical customer or end user of decorative overlays might utilize HPL, TFM, FRL, FRP or Leatherlam for different surfaces of the same project. Panolam’s

TFM products consist of a standard palette of over 150 colors, patterns and wood grains. Panolam’s HPL products consist of a standard palette of approximately 500 colors, patterns and wood grains.

Panolam markets and distributes its decorative laminate products through a geographically diverse network of approximately 300 independently owned and operated distributors. For many of the distributors, Panolam is the exclusive supplier of HPL, TFM or other decorative laminates. Panolam’s ability to offer matching decorative laminate products is one of its core value propositions. Approximately 38% of Panolam’s sales for the twelve months ended December 31, 2008 were generated through 50 distributors that carry both of Panolam’s HPL and TFM brand product lines. In addition, Panolam sells to approximately 700 national and regional original equipment manufacturers, or OEMs, who buy proprietary designs and customized versions of its products directly.

Panolam integrates new product development with marketing, manufacturing and product engineering to meet the needs of its customers. Panolam has product engineering employees who work to enhance Panolam’s existing products and develop new product applications for Panolam’s growing base of customers who require custom solutions. The products are supported by a dedicated in-house sales force and customer service team.

Panolam does not depend on any single customer or a particular group of customers. No single customer individually accounted for more than 10% of Panolam’s 2008 or first six months of 2009 consolidated revenues. Panolam services a number of diverse, high quality accounts. Retail customers include CVS, Saks Fifth Avenue and Kohl’s. Furniture customers include Herman Miller, Kitchen Craft Cabinetry, Bush Industries and Steelcase. Panolam maintains strong relationships with other high quality accounts, including The Boeing Company, Brunswick Corporation, QubicaAMF Worldwide LLC and United Parcel Service of America, Inc.

Panolam relies on a combination of patent, trade name, trademark and copyright laws in the United States and other jurisdictions, as well as employee and third party non-disclosure agreements, license arrangements and domain name registrations, and on unpatented proprietary know-how and other trade secrets, to protect its products, components, processes and applications. Panolam’s registered trademarks include: Panolam, Pionite, Conolite, Resopreg, Leatherlam, Nevamar, Pluswood, FRL, Melcor II, DecoCor, Chemarmor and Meluminum.

As of September 1, 2009, Panolam had approximately 958 employees (242 salaried and 716 hourly). The approximately 197 hourly employees at Panolam’s Hampton, South Carolina, facility are represented by the Carpenters East Coast Industrial Council Local Union No. 3130 pursuant to a collective bargaining agreement which expires on October 1, 2014. The approximately 219 full time and regular part time production and maintenance employees at Panolam’s Auburn, Maine, facility are represented by the International Brotherhood of Teamsters, Local 340, and are in the process of negotiating a collective bargaining agreement.

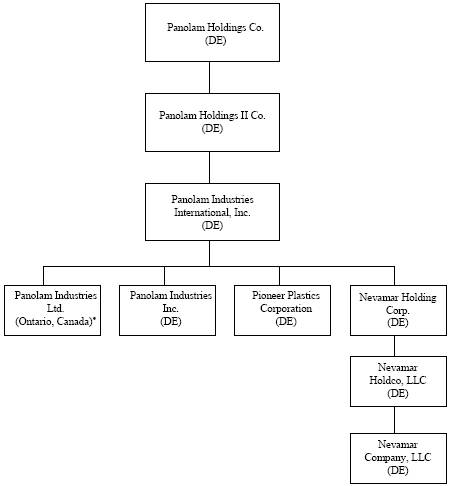

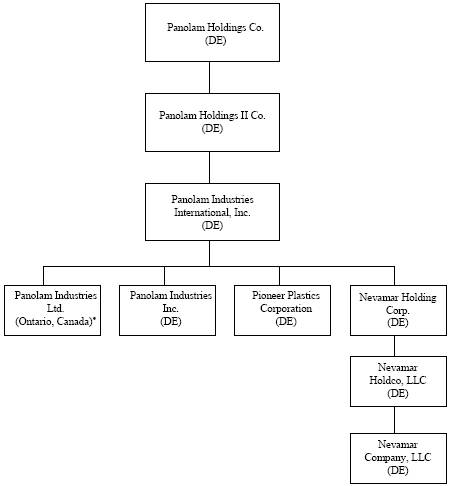

2. Corporate History and Structure

Holdings, a Delaware corporation, owns 100% of Holdings II, a Delaware corporation, which owns 100% of Panolam, a Delaware corporation. Panolam is the direct parent of Panolam Industries, Inc., Pioneer Plastics Corporation and Nevamar Holding Corp., each of which is a Delaware corporation, and Panolam Industries Ltd., a Canadian corporation and non-debtor subsidiary. Nevamar Holding Corp. owns 100% of Nevamar Holdco, LLC which, in turn, owns 100% of Nevamar Company, LLC, each of which is a Delaware limited liability company.

2

On September 30, 2005, through a series of mergers and related transactions, Holdings acquired the business formerly conducted by Panolam Industries Holdings, Inc. (which was controlled by affiliates of The Carlyle Group) for an aggregate cash consideration of $347.5 million, less funded debt at closing and certain expenses of the transaction. Debt financing for the leveraged buy-out was provided by (a) a $135 million term loan tranche and a $20 million revolving loan tranche, $2.5 million of which was drawn at the consummation of the transaction, under the Credit Agreement and (b) the issuance of $151 million in Senior Subordinated Notes.

Panolam acquired Nevamar Holdco, LLC and Nevamar Company, LLC on March 1, 2006. In connection with this acquisition, Panolam amended the Credit Agreement to increase the term loan tranche to $215 million and to increase the revolving loan tranche to $30 million.

The chart below summarizes Panolam’s current corporate structure:

* Panolam Industries Ltd. is a non-debtor subsidiary of Panolam.

3

3. Selected Financial Information

For the fiscal year ending December 31, 2008, Panolam, on a consolidated basis, generated $366.7 million in net sales. As of June 30, 2009, Panolam reported total assets of $398.7 million and total liabilities of $440.7 million, including approximately $344.0 million of long-term debt.

B. Prepetition Indebtedness and Capital Structure

1. Equity

The capital stock of Holdings is privately held by (a) Genstar Capital Partners IV, L.P., Stargen IV, L.P. and certain affiliates (collectively, “Genstar Capital”), which hold 48.38% of the Holdings capital stock, (b) Sterling Group Partners II, L.P., Sterling Group Partners II (Parallel), L.P. and certain affiliates (collectively, “Sterling Group”), which hold 48.38%, (c) Robert Muller, Jr., who holds 2.5%, and (d) other Panolam employees collectively hold the remaining 0.74%. Holdings holds all of the outstanding capital stock of Holdings II, which holds all of the outstanding capital stock of Panolam.

2. Prepetition Indebtedness

(a) The Term Loan and Revolving Loan

On September 30, 2005, Holdings II and Panolam entered into the Credit Agreement, together with the Administrative Agent and the lenders thereunder (the “Senior Lenders”). The Credit Agreement provides for (i) a term loan facility in the amount of $215 million (the “Term Loan”), and (ii) a revolving credit facility in the maximum aggregate amount of $30 million (the “Revolving Loan”). Obligations arising under the Credit Agreement are the direct obligation of Panolam, and are guaranteed by Holdings II and the Panolam Subsidiary Debtors. As of September 30, 2009, there was approximately $193.5 million outstanding under the Credit Agreement, consisting of (i) a term loan in the aggregate principal amount of $167.6 million and (ii) revolving credit loans in the aggregate outstanding principal amount of $25.9 million, and excluding (y) outstanding undrawn letters of credit in the aggregate amount of approximately $4.1 million, and (z) accrued and unpaid interest thereon.

(b) The Senior Subordinated Notes

On September 30, 2005, Panolam issued $151,000,000 of notes due October 1, 2013 under the 10 3/4% Indenture.

II.

KEY EVENTS LEADING TO THE DECISION TO COMMENCE THE VOLUNTARY

CHAPTER 11 REORGANIZATION CASES

A. Industry-Specific Events

In the United States, decorative laminate sales have historically correlated closely with commercial and residential construction activity. A significant portion of Panolam’s net sales is to companies that manufacture cabinetry, store fixtures and furniture for use by the construction industry and, in particular, the residential housing market and retail industry. Spending on new

4

construction and renovation in both the commercial and residential markets depends, in large part, upon the overall strength of business and consumer spending, which is linked to the availability of financing for construction activity, which is further linked to the overall health of the economy and the availability of financing (including for home buyers). Reductions in construction activity, generally, materially reduce the demand for decorative laminates and adversely affect Panolam’s business. The recent significant downturn in the construction industry has resulted in a material reduction in demand for decorative laminates which in turn has adversely affected Panolam’s business. As deterioration in the construction industry and these markets has continued, Panolam’s results of operations have suffered. Panolam is currently experiencing, among other things, (i) lower sales volume, (ii) higher product costs, (iii) reduced margins and (iv) increased pricing pressure from competitors. Initially, Panolam felt the effects of deteriorating conditions when demand for its thermally-fused melamine (TFM) products softened. As conditions have worsened, Panolam is now also experiencing lower demand for high pressure laminate (HPL) products. TFM and HPL are part of the decorative overlay segment, which historically has accounted for nearly 90% of Panolam’s revenues.

Much of the slowdown in demand for HPL and TFM products is due primarily to weaknesses in the commercial and residential markets, respectively. Over the past year, many residential homebuilders have reported decreases in new home orders, a trend that is exacerbated by the substantial nationwide inventory of homes on the housing market, a growing wave of residential home foreclosures and limited availability of financing for developers and home buyers alike, and it is difficult to predict how long these trends will continue. In response to these widespread and continuing adverse conditions, Panolam may be forced to lower prices, cut costs and improve spending efficiency in an effort to mitigate deterioration in its results of operations and financial condition. Further, the creditworthiness of its customers may deteriorate. Although to date the commercial construction sector has not experienced the same level of weakness as the residential sector, the slower economy and tighter lending conditions may cause commercial projects to be increasingly cancelled or deferred. Decreases in overall spending for new construction or renovation in any geographic region in which Panolam does a substantial amount of business has had a material adverse effect on its financial condition and results of operations and continued deterioration in the creditworthiness of its customers could have a material adverse impact on future revenue and liquidity.

B. Liquidity Constraints and Prepetition Negotiations

Panolam suffered a net loss for 2008 of approximately $121.7 million, which is principally attributable to impairment charges related to fixed assets, goodwill and other indefinite lived intangible assets and to insufficient revenue to cover its relatively high percentage of fixed costs, including the interest costs on its debt and depreciation expense. Panolam also had a stockholder’s deficit of $27.9 million as of December 31, 2008. During the fourth quarter of 2008, in light of the weakening economy and Panolam’s concerns about the troubled credit markets, Panolam borrowed the full amount available under the Revolving Loan.

Given liquidity constraints resulting from the current weakness in the commercial and residential markets, coupled with their debt servicing requirements, the Debtors began analyzing various restructuring scenarios and their potential impact on the value of the Company, as well as refinancing opportunities. To this end, in October 2008, the Debtors engaged Morpheus Capital Advisors and in March 2009 the Debtors engaged Weil, Gotshal & Manges LLP and Perella Weinberg Partners LP, who replaced Morpheus, to assist in analyzing restructuring scenarios and in negotiations with creditors and other groups affected by any

5

potential restructuring. Accordingly, the Debtors pursued negotiations with the Senior Lenders and the holders of Senior Subordinated Notes Claims regarding a financial restructuring of the Debtors.

On February 27, 2009, the Administrative Agent sent Panolam a notice of default under the Credit Agreement alleging that Panolam failed to comply with certain financial and reporting covenants set forth in the Credit Agreement. On March 31, 2009, Panolam entered into a forbearance agreement with the Senior Lenders (the “Forbearance Agreement”) pursuant to which the Senior Lenders agreed to forbear from exercising any rights and remedies under the Credit Agreement relating to the aforementioned defaults — including any right to accelerate Panolam’s payment obligations under the Credit Agreement — until the earlier of (a) June 30, 2009, (b) the occurrence of an event of default under the Forbearance Agreement, or (c) the fulfillment of all obligations under the Forbearance Agreement and the Credit Agreement and the termination of the Credit Agreement. The Forbearance Agreement, which expired by its terms on June 30, 2009, required Panolam to deliver to the Senior Lenders, on or before June 30, 2009, an excess cash flow payment related to the year ended December 31, 2008. Panolam did not make the excess cash flow payment and, furthermore, did not make the regularly-scheduled June interest payment on either the Term Loan or Revolving Loan, which non-payments constitute defaults under the Forbearance Agreement. On July 1, 2009, Panolam received a letter from the Administrative Agent notifying Panolam of its defaults under the Forbearance Agreement and that from and after such date the Senior Lenders again shall have the ability to accelerate all of the Panolam’s payment obligations under the Credit Agreement. As of the date of this Disclosure Statement, Panolam has not received an acceleration notice from the Administrative Agent.

The terms of the Forbearance Agreement prohibited Panolam from, among other things, paying the scheduled April 1, 2009 interest payment on the Senior Subordinated Notes. In addition, on March 30, 2009, the Administrative Agent issued Panolam a “blockage notice” directing Panolam not to make the April 1, 2009 interest payment on the Senior Subordinated Notes. By virtue of its non-payment of interest on the Senior Subordinated Notes, Panolam was in default under the 10 3/4% Indenture. Consequently, after the lapse of a 30-day grace period, the holders of Senior Subordinated Notes Claims were entitled to accelerate Panolam’s obligations under the Senior Subordinated Notes. Panolam did not cure the default within the requisite cure period and, as a result, on May 1, 2009, Panolam purportedly was in payment default under the 10 3/4% Indenture. The Indenture Trustee informed the holders of Senior Subordinated Notes Claims of the payment default and of the event of default by letters dated April 9, 2009 and May 7, 2009, respectively. Upon the occurrence of an event of default under the 10 3/4% Indenture, the Indenture Trustee or the holders of Senior Subordinated Notes Claims of at least 25% of principal amount of the Senior Subordinated Notes may declare the principal of, and accrued but unpaid interest on, all the Senior Subordinated Notes to be immediately due and payable. As of the date of this Disclosure Statement, Panolam has not received an acceleration notice from the holders of Senior Subordinated Notes Claims or the Indenture Trustee.

C. Restructuring Negotiations

Throughout the term of the Forbearance Agreement and thereafter, Panolam engaged both the Senior Lenders and the Ad Hoc Noteholder Group (as defined below) in discussions about a potential financial restructuring. In connection therewith, Panolam agreed to pay certain fees incurred by Sidley Austin LLP and Young Conway Stargatt & Taylor, as legal advisors and Conway Del Genio Gries & Co., LLC, as financial advisor to the Senior Lenders, and Akin Gump Strauss Hauer & Feld LLP and Ashby & Geddes, as legal advisors and Blackstone Advisory Services L.P., as financial advisor to the Ad Hoc Noteholder Group.

6

From March through September 2009, the Debtors held numerous meetings and conversations with the Administrative Agent, the Senior Lenders and the Ad Hoc Noteholder Group, as well as their financial and legal advisors. The Debtors have actively negotiated with both groups of creditors to create a consensus on the appropriate restructuring of the outstanding debt.

On June 30, 2009, Panolam announced that it had reached an agreement in principle with the holders of Senior Subordinated Notes Claims holding 66% in principal amount of the Senior Subordinated Notes, led by Apollo Capital Management, together with its Affiliates (“Apollo”) and Eaton Vance Management, together with its Affiliates (“Eaton Vance” and, together with Apollo, the “Ad Hoc Noteholder Group”), to pursue a restructuring that would significantly reduce Panolam’s outstanding debt.

On July 1, 2009, the Administrative Agent under the Credit Agreement sent to Panolam a notice of default under the Forbearance Agreement on behalf of the Senior Lenders. The notice stated that certain defaults under the Forbearance Agreement had occurred and were continuing, including failure to pay when due the interest payable and failure to deliver to the Administrative Agent (for the account and benefit of the Senior Lenders) when due the excess cash flow payment for fiscal year 2008.

On July 27, 2009, Panolam, the Ad Hoc Noteholder Group and the Senior Lenders holding approximately seventy-three percent (73%) of the aggregate principal amount of indebtedness under the Credit Agreement reached agreement in principal to pursue a restructuring on the terms and conditions set forth in the proposed Plan. A restructuring pursuant to the proposed Plan would enable the Debtors to reduce the amount of debt on the balance sheet by approximately $151 million (or approximately 44%), eliminate approximately $16 million in annual cash interest payments to the holders of Senior Subordinated Notes Claims and free up additional cash that can be reinvested in the businesses.(4)

On September 25, 2009, (a) holders of more than two-thirds (2/3) in amount and half (1/2) in number of the (i) Senior Lender Credit Agreement Revolver Claims, (ii) Senior Lender Credit Agreement Term Claims, and (iii) Noteholder Credit Agreement Claims and (b) holders of 66% of the Senior Subordinated Notes Claims entered into the Restructuring Support Agreement, pursuant to which they agreed to support the restructuring transactions reflected in, and vote in favor of, the Plan.

D. The Financial Restructuring Transaction

1. Restructuring Support Agreement

On September 25, 2009, the Debtors entered into the Restructuring Support Agreement, attached to this Disclosure Statement as Exhibit “E” with the Consenting Holders. Pursuant to the Restructuring Support Agreement, the Consenting Holders agreed to restructure and recapitalize the Revolving Loan, the Term Loan and the Senior Subordinated Notes (the “Financial Restructuring”). The Debtors agreed to implement the Financial Restructuring through the solicitation of votes for the Plan and the filing of chapter 11 cases and the Plan.

(4) Savings are calculated as a gross amount of Senior Subordinated Notes less $3.5 million of fees paid to the Senior Lenders and Senior Subordinated Noteholders (both as defined in the Plan).

7

The Plan sets forth the Debtors’ post-Effective Date capital structure and the distribution each class of the Debtors’ creditors is to receive under the Plan. Specifically, upon the Effective Date, among other things:

(a) the holders of Senior Subordinated Notes Claims will receive from Panolam 90% of the New Capital Stock;

(b) the holders of General Unsecured Claims will be unimpaired; and

(c) the holders of Equity Interests in Holdings will receive the New Warrants and Equity Interests in Holdings and Holdings II will be cancelled (unless Holdings II is merged into Holdings).

2. New Financing

In addition, Panolam is expected to enter into an amended and restated credit agreement, to be dated as of the Effective Date, by and among Reorganized Panolam, the other Reorganized Debtors (as guarantors), the holders of the Senior Lender Credit Agreement Claims, and the Administrative Agent (as amended or otherwise modified from time to time in accordance with the terms thereof, the “Amended and Restated Credit Agreement”) and a second lien credit agreement, to be dated as of the Effective Date, by and among Reorganized Panolam, the other Reorganized Debtors (as guarantors), the holders of Noteholder Credit Agreement Claims, and Apollo Laminates Agent, LLC (as amended or otherwise modified from time to time, the “New Second Lien Credit Agreement”), each of which shall be filed as part of the Plan Supplement (and be consistent with the terms set forth in the Plan Term Sheet).

(a) The Amended and Restated Credit Agreement

Pursuant to the Amended and Restated Credit Agreement, Reorganized Panolam will issue amended and restated revolver notes in the aggregate principal amount equal to the lesser of (i) $15 million or (ii) the sum of (a) $5.9 million, which will be drawn on the Effective Date, (b) an amount equal to Excess Cash distributed pursuant to Section 4.2(b)(i) of the Plan, and (c) approximately $4.1 million on account of outstanding and undrawn letters of credit, which shall survive confirmation and remain in place post-Effective Date (the “Amended and Restated Revolver Notes”). Of the issued amount of the Amended and Restated Revolver Notes, $5 million shall represent a letter of credit sub-limit. “Excess Cash” means the Debtors’ Cash on hand in excess of $10 million (and, for the avoidance of doubt, after payment of the Debtors’ restructuring costs, including, without limitation, legal, business advisor, and success fees), as described more fully in the Plan.

Put differently, under the Amended and Restated Credit Agreement, the Amended and Restated Revolver Notes could be issued in an aggregate principal amount up to $15 million (of which $5 million will be reserved for a letter of credit sub-facility); provided, however, that (as illustrated in Exhibit “D” to the Plan) the size of such facility will be reduced by approximately $174 for every $1,000 of Excess Cash less than approximately $28.9 million. Therefore, based on the Debtors’ current projected Excess Cash totaling $22.2 million, the revolving credit facility will be approximately $13.8 million as of the Effective Date, consisting of the sum of (i) $5.9 million, which will be drawn on the Effective Date, (ii) approximately $3.8 million in undrawn availability, and (iii) approximately $4.1 million on account of outstanding and undrawn letters of credit (which shall survive confirmation and remain in place post-Effective Date). The Amended and Restated Credit Agreement will include a letter of credit sub-limit of $5 million and, if the Amended and Restated

8

Revolver Notes are issued in the maximum amount of $15 million, a direct borrowing sub-limit of $10 million.

Pursuant to the Amended and Restated Credit Agreement, Reorganized Panolam will also issue amended and restated term notes (the “Amended and Restated Term Notes”). Based on the Debtors’ current projected Excess Cash totaling $22.2 million, such Amended and Restated Term Notes would be issued in an aggregate principal amount of $141.6 million. As a result of the possible variance in the amount of the Excess Cash distributions and other adjustments described in the Plan and illustrated in Exhibit “D” thereof, the principal amount of the Amended and Restated Notes could be decreased by approximately $1,174 per $1,000 of cash distributed in excess of the Debtors’ current projected cash balance of $22.2 million. Similarly, such principal amount shall be increased by approximately $1,174 per $1,000 of cash distributed below the Debtors current projected cash balance.

(b) New Second Lien Credit Agreement

Pursuant to the New Second Lien Credit Agreement, Reorganized Panolam shall issue new second lien term notes in the aggregate principal amount of $25 million.

In addition to the foregoing summary, parties-in-interest are advised to review Exhibit “D” of the Plan — which, provides illustrative calculations of the defined terms used in Sections 1.10 (Amended and Restated First Lien Notes), 1.11 (Amended and Restated Revolver Notes), 1.13 (Amended and Restated Term Notes Distributable to Senior Lender Credit Agreement Revolver Claims) , 1.14 (Amended and Restated Term Notes Distributable to Senior Lender Credit Agreement Term Claims), 1.51 (Intercreditor Distribution Adjustment), and 1.52 (Intercreditor Adjustment Percentage) of the Plan (and noted above) — for a greater understanding of Reorganized Panolam’s post-Effective Date capital structure.

The summary below describes the anticipated principal terms of the Amended and Restated Credit Agreement and the New Second Lien Credit Agreement. It does not purport to be a complete description of the terms and conditions thereof, certain terms and conditions of which have not yet been determined. Capitalized terms used in the summaries below but not otherwise defined herein shall have the meanings ascribed to such terms in the Amended and Restated Credit Agreement and the New Second Lien Credit Agreement, as applicable.

Amended and Restated Revolver Notes

Borrower | | Panolam. |

| | |

Administrative Agent | | Credit Suisse, Cayman Islands Branch. |

| | |

Fees | | See description of fees payable to holders of Senior Lender Credit Agreement Claims (as described in the discussion of the terms of the Amended and Restated Term Notes below). |

| | |

Maximum Availability under Letter of Credit | | Cap of $5 million. |

9

Facility | | |

| | |

Maximum Borrowings under Revolver Facility | | Equal to the amount of the Amended and Restated Revolver Notes less $5 million letter of credit facility. |

| | |

Maturity | | June 30, 2013. |

| | |

Interest Rate | | Eurodollar Rate Loan, bearing cash-pay interest at the sum of the Eurodollar Rate plus 6.00%, with a Eurodollar Rate floor of 2.50%. Default rate of 2.00% above the rate otherwise applicable, which would be applicable upon any event of default and payable on the then outstanding principal amount. |

| | |

Guarantees | | Fully and unconditionally guaranteed on a joint and several basis by each of the Panolam Subsidiary Debtors and Panolam’s post-Effective Date parent company. |

| | |

Collateral | | Consistent with the terms of the Amended and Restated Term Notes (as described below). |

| | |

Covenants | | Consistent with the terms of the Amended and Restated Term Notes (as described below). |

| | |

Unused Commitment Fee | | 1%. |

| | |

Voluntary Prepayment | | Voluntary prepayments will not reduce the commitment. |

Amended and Restated Term Notes

Borrower | | Panolam. |

| | |

Principal | | Variable amount depending on amount of Excess Cash distributed pursuant to the Plan. See Section 2(a) of this Disclosure Statement. |

| | |

Administrative Agent | | Credit Suisse, Cayman Islands Branch. |

| | |

Fees | | A restructuring fee of $1 million shall be payable to all holders of Senior Lender Credit Agreement Claims. One-time restructuring fee equal to $500,000 payable to the |

10

| | Administrative Agent on the Effective Date. Annual agency fee equal to $75,000 payable to the Administrative Agent on a quarterly basis. |

| | |

Maturity | | December 31, 2013. |

| | |

Amortization | | None in 2009 and the first two quarters of 2010. $500,000 per six months (first payment due December 31, 2010 for the six month period then ended). |

| | |

Interest Rate | | Eurodollar Rate Loan, bearing cash-pay interest at the sum of the Eurodollar Rate plus 6.00%, with a Eurodollar Rate floor of 2.50%. Default rate of 2.00% above the rate otherwise applicable, which would be applicable upon any event of default and payable on the then outstanding principal amount. |

| | |

Guarantees | | Fully and unconditionally guaranteed on a joint and several basis by each of the Panolam Subsidiary Debtors and Panolam’s post-Effective Date parent company. |

| | |

Collateral | | Substantially similar collateral as under the Credit Agreement plus cash, cash equivalents, deposit accounts and securities accounts, with exceptions for payroll accounts, employee benefits accounts and other accounts containing Trust Funds (with a provision for the release of trust funds in each case), all under terms to be set forth in the definitive documentation. For purposes of the foregoing, “Trust Funds” shall mean all funds held by the Company as a fiduciary, all taxes required to be collected or withheld (including, without limitation, federal and state withholding taxes), other funds and taxes for which the Company or its directors, officers or employees may have criminal or personal liability, and accrued and unpaid employee compensation. |

| | |

Financial Covenants | | Minimum cash interest coverage ratio and maximum first lien leverage ratio will be set based on a 20% cushion to management’s long-term business plan as set forth in the Panolam Chart of Provisions attached to the Plan Term Sheet. First financial covenant test will occur at the end of the second fiscal quarter of 2010. Maximum consolidated capital expenditures covenant will be revised based on a 10% cushion to the business plan as set forth in the Panolam Chart of Provisions. Definitions used in the financial covenants shall be acceptable to the holders of Senior Lender Credit Agreement Claims and Panolam. |

11

Voluntary Prepayment | | Voluntary prepayment will be permitted at any time without premium or penalty. All voluntary prepayments to be applied as directed by Panolam. |

| | |