EXHIBIT 99.2

MLP Investor Conference March 1, 2005

FORWARD-LOOKING STATEMENTS

Statements in this presentation which are not statements of historical fact are forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on current factual information and certain assumptions which management believes to be reasonable at this time. The Partnership’s actual current and future results, however, are dependent upon numerous factors outside the control of the Partnership. These factors, and other applicable risks and uncertainties that could cause actual results to differ materially from projected results, are described more fully in the Partnership’s public periodic and other reports filed with the Securities and Exchange Commission. Except as required by applicable securities laws, the Partnership undertakes no obligation to update any forward-looking statements at any time in the future.

Alliance Resource Partners, L.P.

3 2005 MLP Investor Conference

Focused On Primary Objective

Sustainable, capital efficient growth in distributable cash flow that will enable growth in distributions to ARLP unitholders

4 2005 MLP Investor Conference

ARLP Investment Highlights

Diversified asset base, both geographically and in types of coal produced Efficient, low cost operator Strong long-term market outlook for coal Proven track record of growth Attractive growth prospects looking forward Demonstrated market performance

5 2005 MLP Investor Conference

Diversified & Efficient Operator

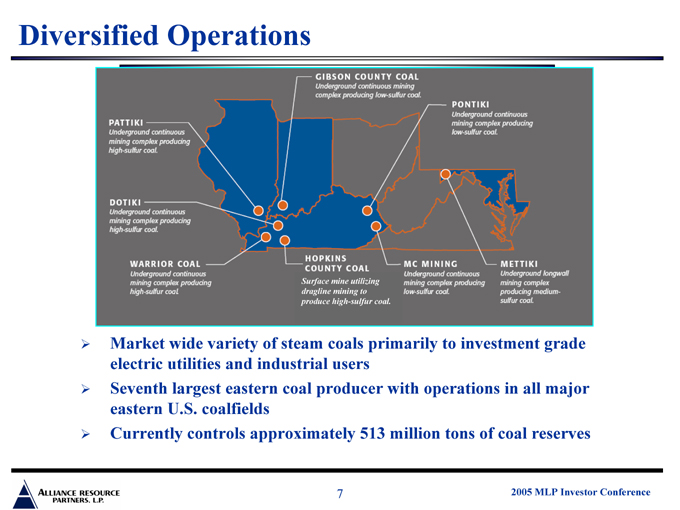

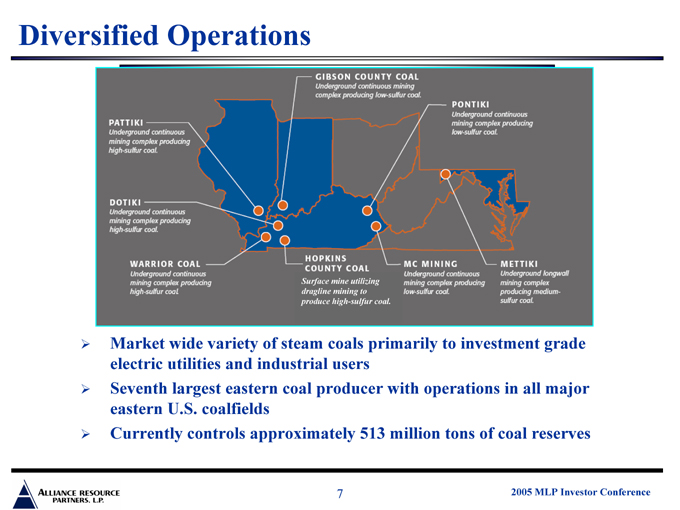

Diversified Operations

Market wide variety of steam coals primarily to investment grade electric utilities and industrial users Seventh largest eastern coal producer with operations in all major eastern U.S. coalfields Currently controls approximately 513 million tons of coal reserves

GIBSON COUNTY COAL

Underground continuous mining complex producing low-slfur coal.

PONTIKI

Underground continuous mining complex producing low-sulfur coal.

PATTIKI

Underground continuous mining complex producing high sulfur coal.

DOTIKI

Underground continuous mining complex producing high-sulfur coal.

WARRIOR COAL

Underground continuous mining complex producing high-sulfur coal.

HOPKINS COUNTY COAL

Surface mine utilizing dragline mining to produce high-sulfur coal.

MC MINING

Underground continuous mining complex producing low-sulfur coal.

METTIKI

Underground longwall mining complex producing medium-sulfur coal.

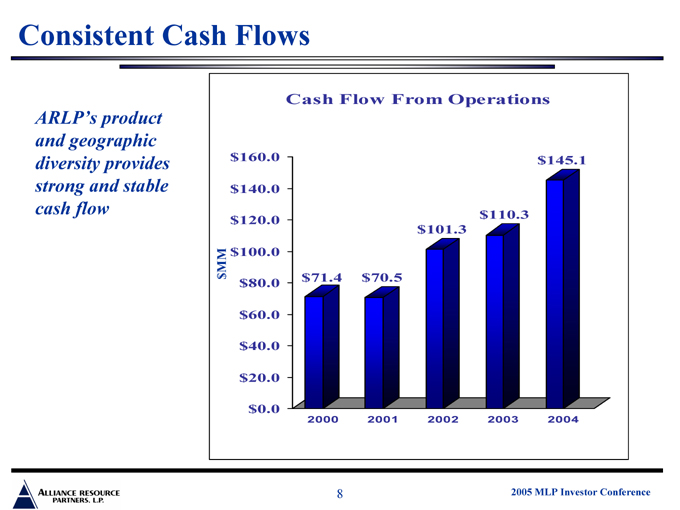

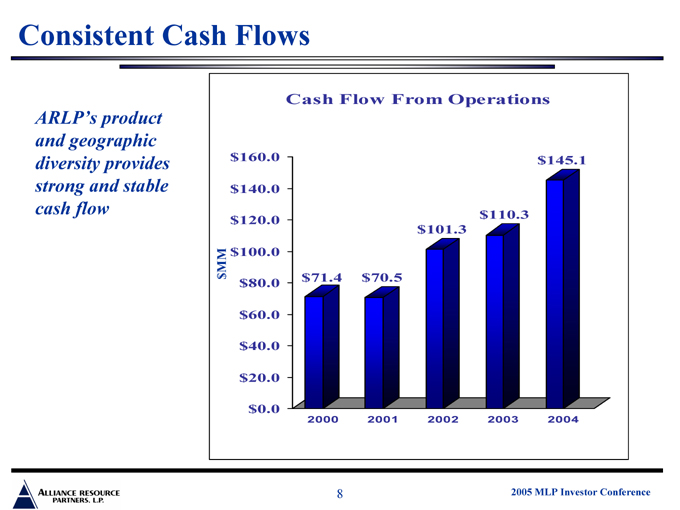

Consistent Cash Flows

ARLP’s product and geographic diversity provides strong and stable cash flow

Cash Flow From Operations $MM $160.0 $140.0 $120.0 $100.0 $80.0 $60.0 $40.0 $20.0 $0.0 $71.4 $70.5 $101.3 $110.3 $145.1

2000 2001 2002 2003 2004

8

2005 MLP Investor Conference

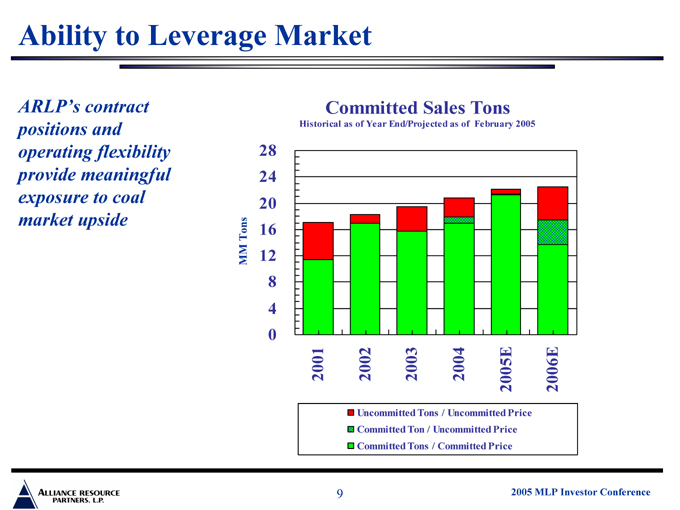

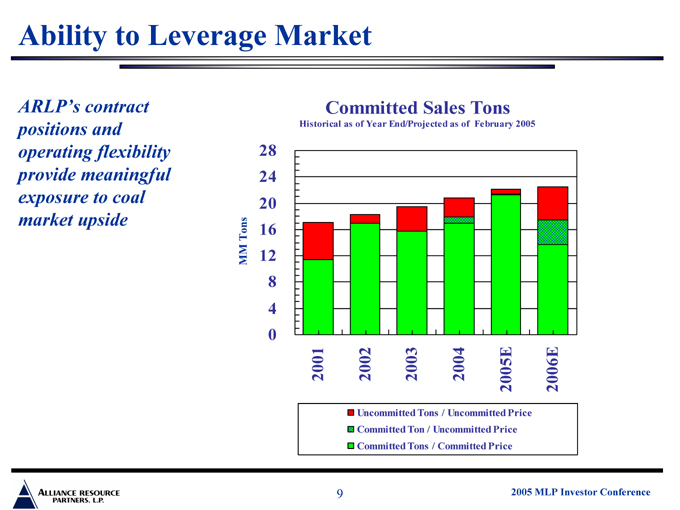

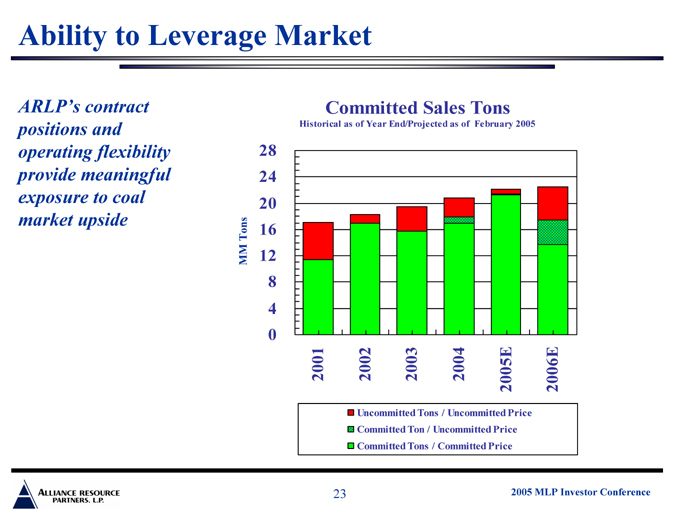

Ability to Leverage Market

ARLP’s contract positions and operating flexibility provide meaningful exposure to coal market upside

Committed Sales Tons

Historical as of Year End/Projected as of February 2005

MM Tons

28 24 20 16 12 8 4 0

2001 2002 2003 2004

2005E 2006E

Uncommitted Tons / Uncommitted Price Committed Ton / Uncommitted Price Committed Tons / Committed Price

9

2005 MLP Investor Conference

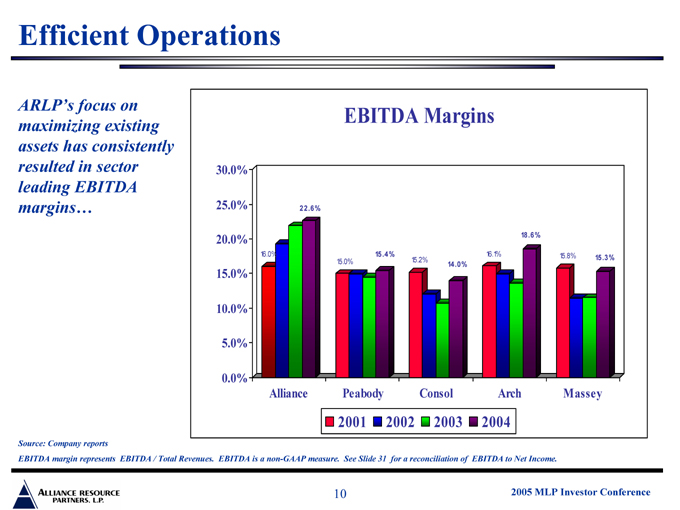

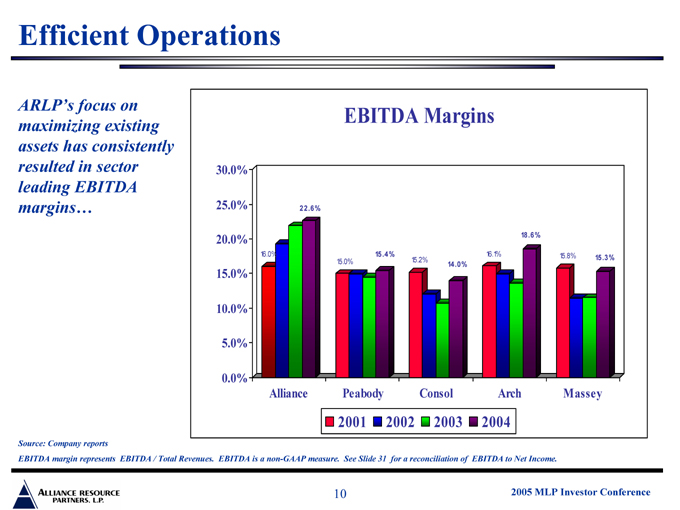

Efficient Operations

ARLP’s focus on maximizing existing assets has consistently resulted in sector leading EBITDA margins…

EBITDA Margins

30.0% 25.0% 20.0% 15.0% 10.0% 5.0% 0.0%

Alliance Peabody Consol Arch Massey

16.0%

22.6%

15.0%

15.4%

15.2%

14.0%

16.1%

18.6%

15.8%

15.3%

Source: Company reports

EBITDA margin represents EBITDA / Total Revenues. EBITDA is a non-GAAP measure. See Slide 31 for a reconciliation of EBITDA to Net Income.

10

2005 MLP Investor Conference

Coal Market Outlook

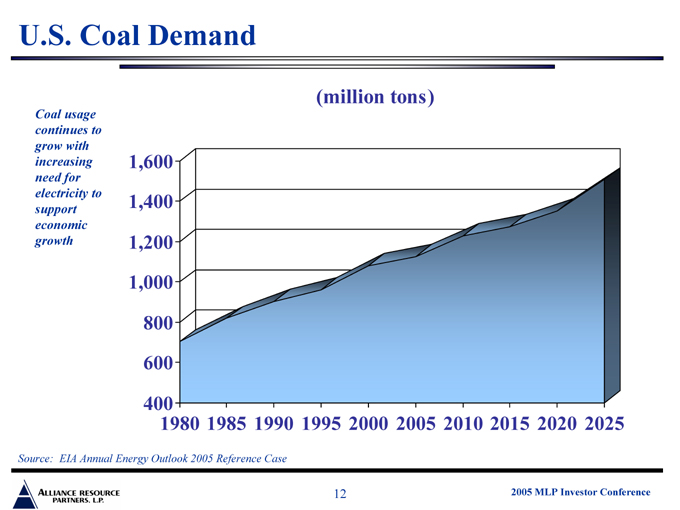

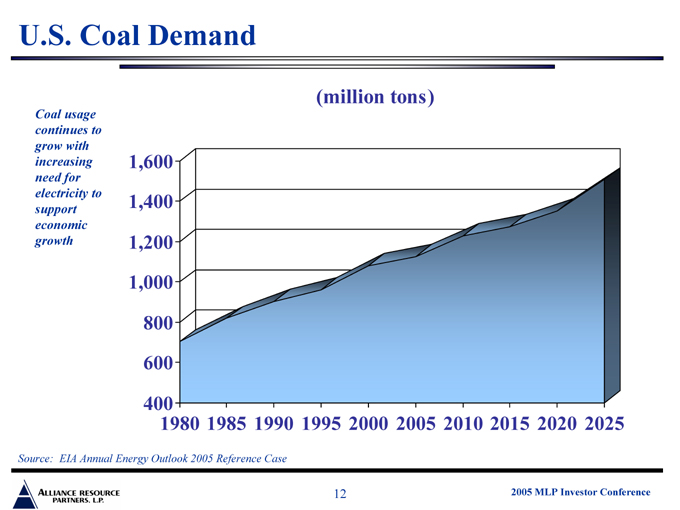

U.S. Coal Demand

Coal usage continues to grow with increasing need for electricity to support economic growth

(million tons)

1,600 1,400

1,200 1,000

800 600

400

1980 1985 1990 1995 2000 2005 2010 2015 2020 2025

Source: EIA Annual Energy Outlook 2005 Reference Case

12

2005 MLP Investor Conference

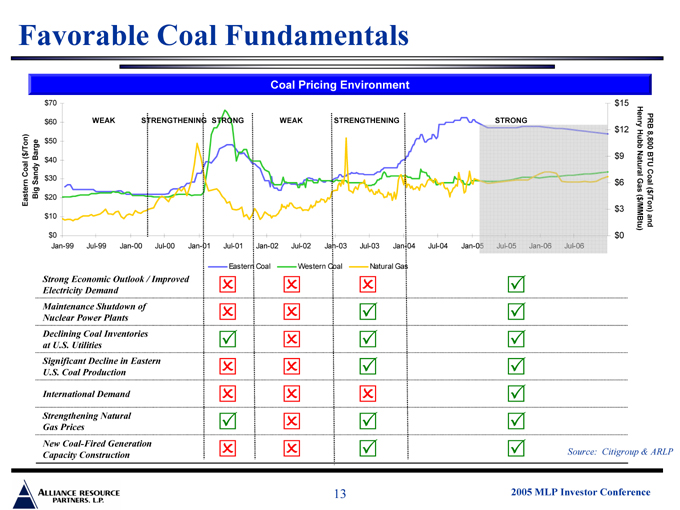

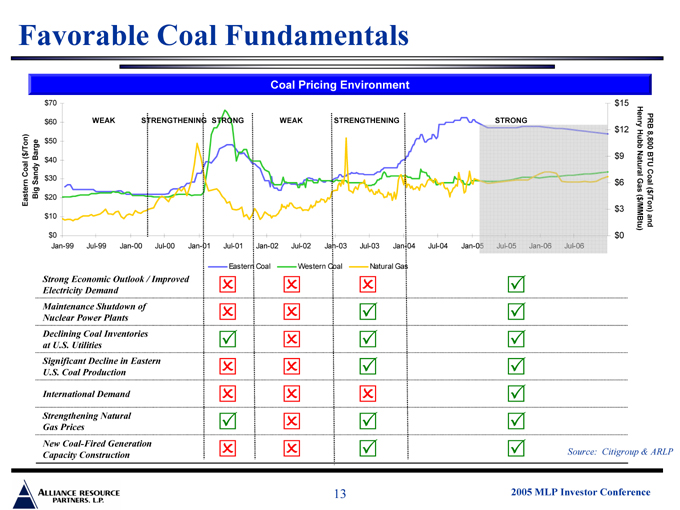

Favorable Coal Fundamentals

Coal Pricing Environment

Eastern Coal ($/Ton) Big Sandy Barge $70 $60 $50 $40 $30 $20 $10 $0

WEAK

STRENGTHENING

STRONG

WEAK

STRENGTHENING

STRONG

Jan-99 Jul-99 Jan-00 Jul-00 Jan-01 Jul-01 Jan-02 Jul-02 Jan-03 Jul-03 Jan-04 Jul-04 Jan-05 Jul-05 Jan-06 Jul-06 $15 $12 $9 $6 $3 $0

PRB 8,800 BTU Coal ($/Ton) and Henry Hubb Natural Gas ($/MMBtu)

Eastern Coal

Western Coal

Natural Gas

Strong Economic Outlook / Improved Electricity Demand

Maintenance Shutdown of Nuclear Power Plants

Declining Coal Inventories at U.S. Utilities

Significant Decline in Eastern U.S. Coal Production

International Demand

Strengthening Natural Gas Prices

New Coal-Fired Generation Capacity Construction

Source: Citigroup & ARLP

13

2005 MLP Investor Conference

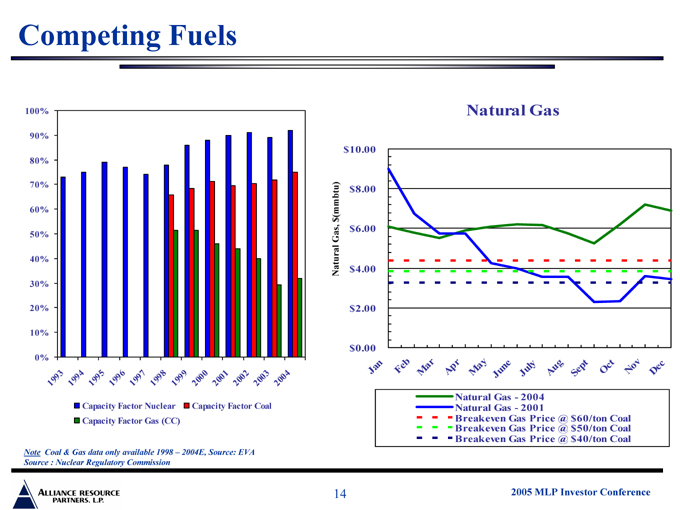

Competing Fuels

100%

90%

80%

70%

60% 50% 40%

30%

20%

10%

0%

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

Capacity Factor Nuclear

Capacity Factor Coal

Capacity Factor Gas (CC)

Natural Gas, $(mmbtu) $10.00 $8.00 $6.00

$4.00 $2.00 $0.00

Natural Gas

Jan

Feb

Mar

Apr

May June

July

Aug

Sept

Oct

Nov

Dec

Note Coal & Gas data only available 1998 – 2004E, Source: EVA Source : Nuclear Regulatory Commission

Natural Gas—2004 Natural Gas—2001

Breakeven Gas Price @ $60/ton Coal Breakeven Gas Price @ $50/ton Coal Breakeven Gas Price @ $40/ton Coal

14

2005 MLP Investor Conference

Proven Track Record of Growth

Four Consecutive Years of Record Results

Production Revenues EBITDA Net Income

2005 MLP Investor Conference

16

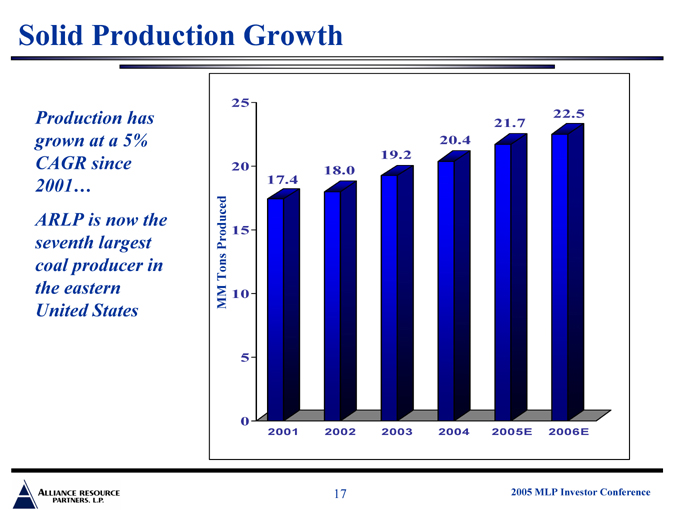

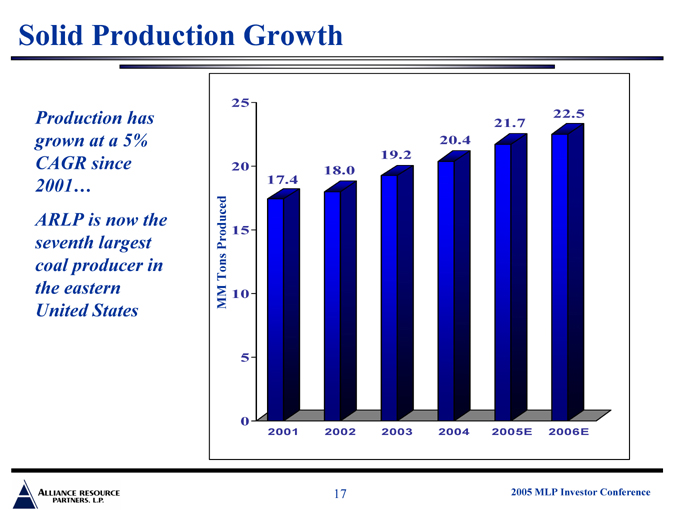

Solid Production Growth

Production has grown at a 5% CAGR since 2001… ARLP is now the seventh largest coal producer in the eastern United States

MM Tons Produced

25

20

15

10

5

0

17.4

18.0

19.2

20.4

21.7

22.5

2001 2002 2003 2004 2005E 2006E

2005 MLP Investor Conference

17

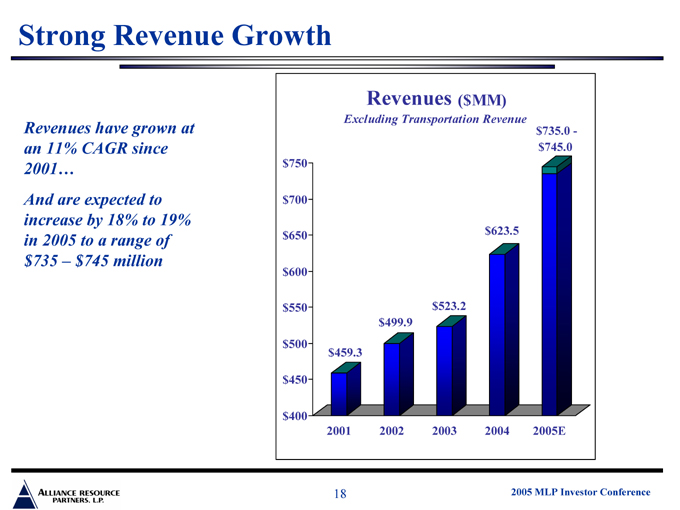

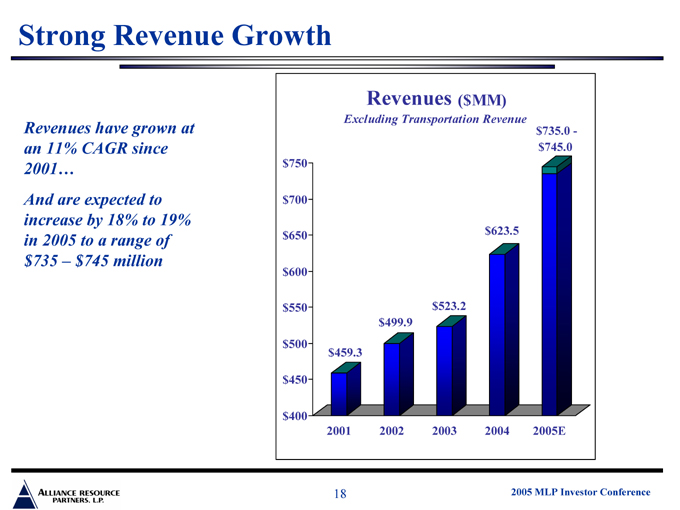

Strong Revenue Growth

Revenues have grown at an 11% CAGR since 2001… And are expected to increase by 18% to 19% in 2005 to a range of $735 – $745 million $750 $700 $650 $600 $550 $500 $450 $400

Revenues ($MM)

Excluding Transportation Revenue $459.3 $499.9 $523.2 $623.5 $735.0 - $745.0

2001 2002 2003 2004 2005E

2005 MLP Investor Conference

18

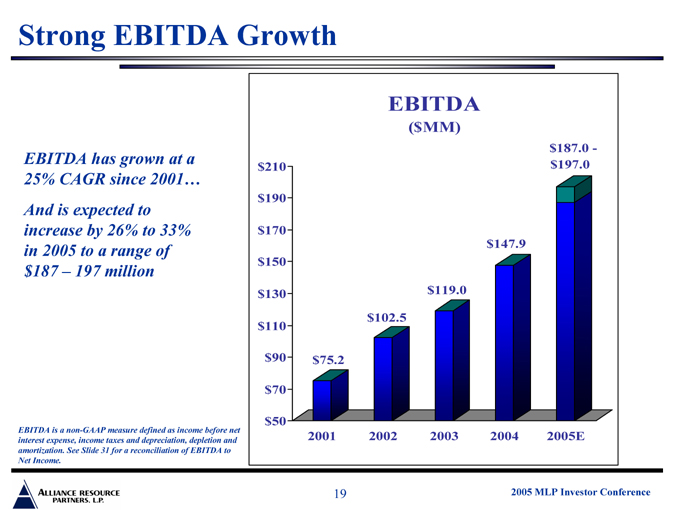

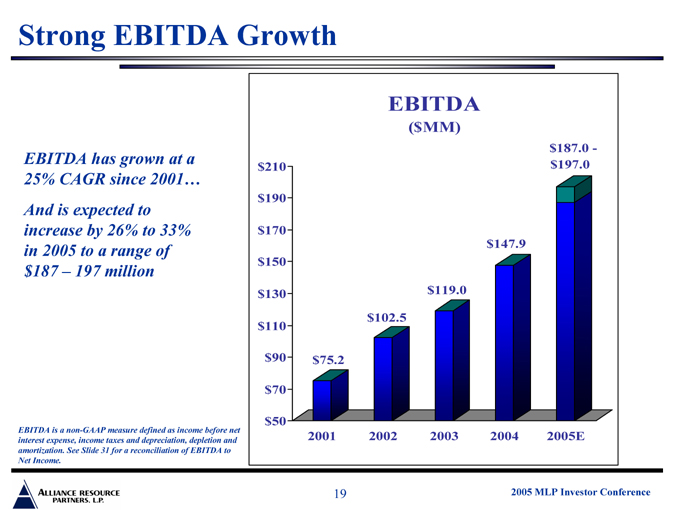

Strong EBITDA Growth

EBITDA has grown at a 25% CAGR since 2001… And is expected to increase by 26% to 33% in 2005 to a range of $187 – 197 million

EBITDA is a non-GAAP measure defined as income before net interest expense, income taxes and depreciation, depletion and amortization. See Slide 31 for a reconciliation of EBITDA to Net Income.

$210 $190 $170 $150 $130 $110 $90 $70 $50

EBITDA

($ MM) $75.2 $102.5 $119.0 $147.9 $187.0 - $197.0

2001 2002 2003 2004 2005E

2005 MLP Investor Conference

19

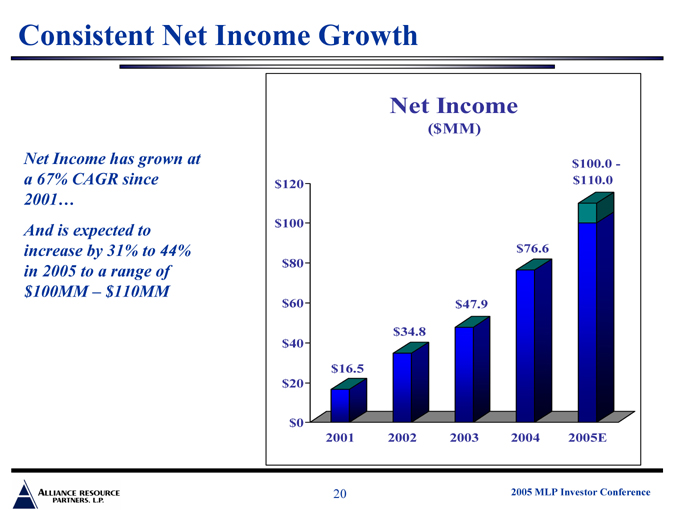

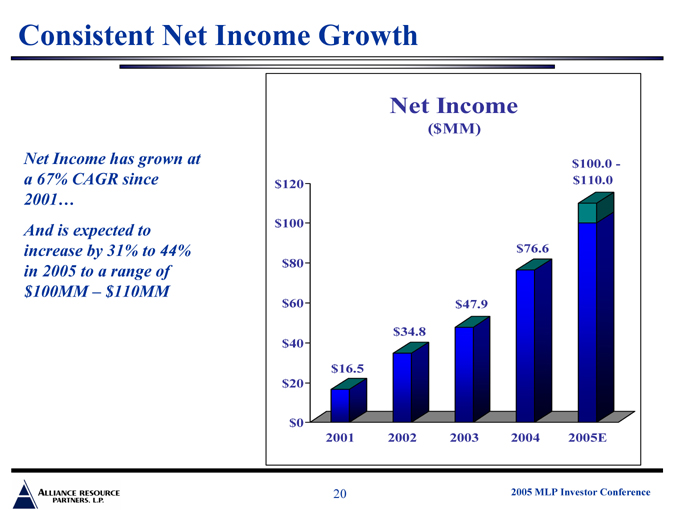

Consistent Net Income Growth

Net Income has grown at a 67% CAGR since 2001… And is expected to increase by 31% to 44% in 2005 to a range of $100MM – $110MM

Net Income

($ MM) $120 $100 $80 $60 $40 $20 $0 $16.5 $34.8 $47.9 $76.6 $100.0 - $110.0

2001 2002 2003 2004 2005E

2005 MLP Investor Conference

20

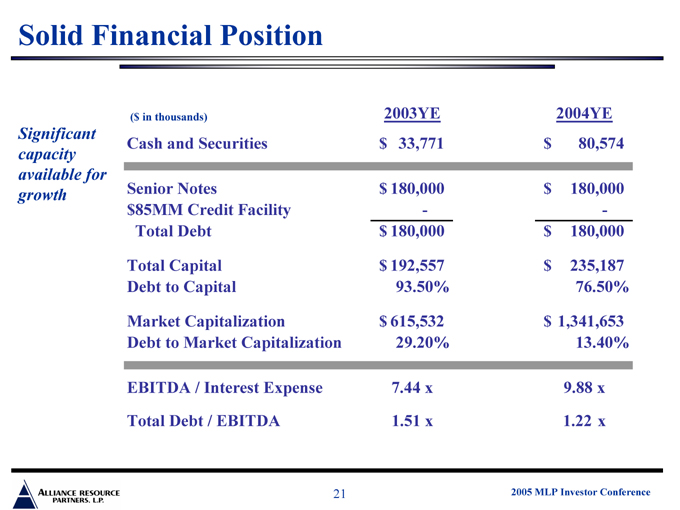

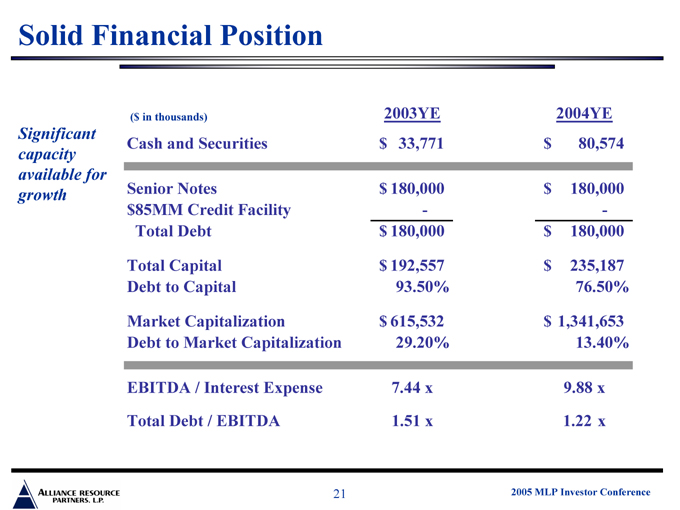

Solid Financial Position

Significant capacity available for growth

($ in thousands) 2003YE 2004YE

Cash and Securities $33,771 $80,574

Senior Notes $180,000 $180,000

$85MM Credit Facility - -

Total Debt $180,000 $180,000

Total Capital $192,557 $235,187

Debt to Capital 93.50% 76.50%

Market Capitalization $615,532 $1,341,653

Debt to Market Capitalization 29.20% 13.40%

EBITDA / Interest Expense 7.44 x 9.88 x

Total Debt / EBITDA 1.51 x 1.22 x

21

2005 MLP Investor Conference

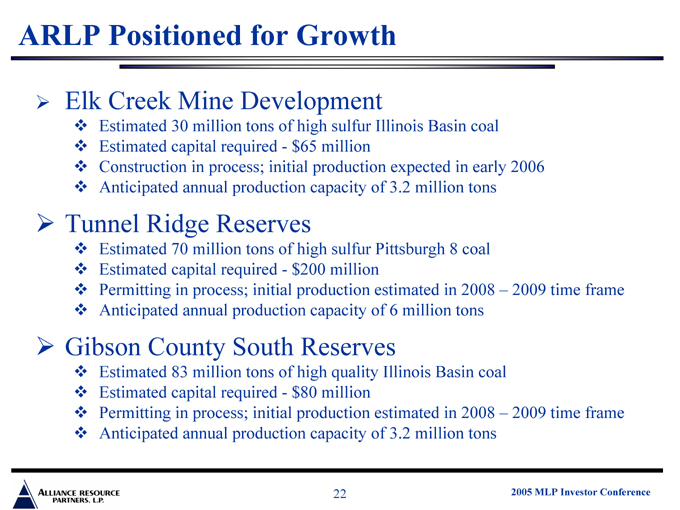

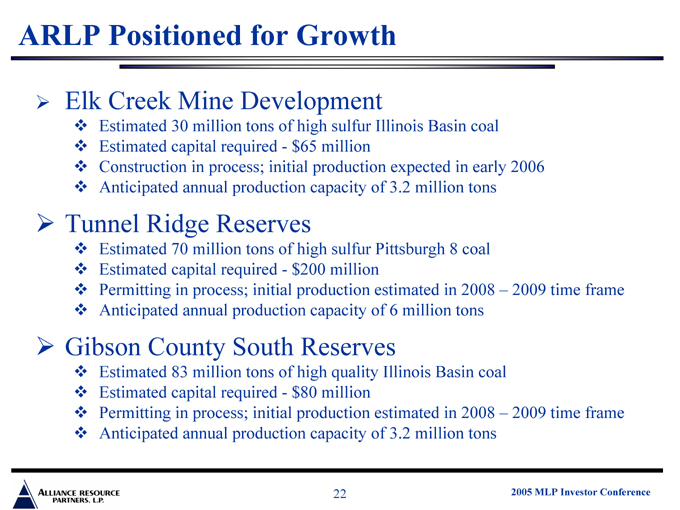

ARLP Positioned for Growth

Elk Creek Mine Development

Estimated 30 million tons of high sulfur Illinois Basin coal Estimated capital required - $65 million Construction in process; initial production expected in early 2006 Anticipated annual production capacity of 3.2 million tons

Tunnel Ridge Reserves

Estimated 70 million tons of high sulfur Pittsburgh 8 coal Estimated capital required - $200 million

Permitting in process; initial production estimated in 2008 – 2009 time frame Anticipated annual production capacity of 6 million tons

Gibson County South Reserves

Estimated 83 million tons of high quality Illinois Basin coal Estimated capital required - $80 million

Permitting in process; initial production estimated in 2008 – 2009 time frame Anticipated annual production capacity of 3.2 million tons

2005 MLP Investor Conference

22

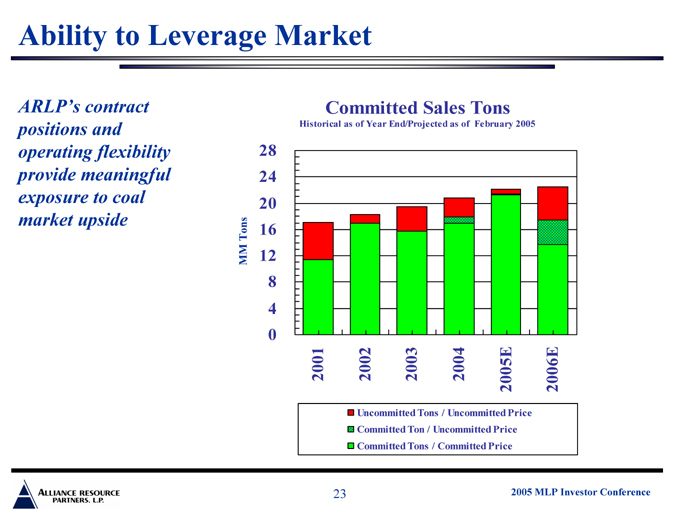

Ability to Leverage Market

ARLP’s contract positions and operating flexibility provide meaningful exposure to coal market upside

Committed Sales Tons

Historical as of Year End/Projected as of February 2005

28 24 20 16

MM Tons 12

8 4 0

2001 2002 2003 2004 2005E 2006E

Uncommitted Tons / Uncommitted Price Committed Ton / Uncommitted Price Committed Tons / Committed Price

2005 MLP Investor Conference

23

Demonstrated Market Performance

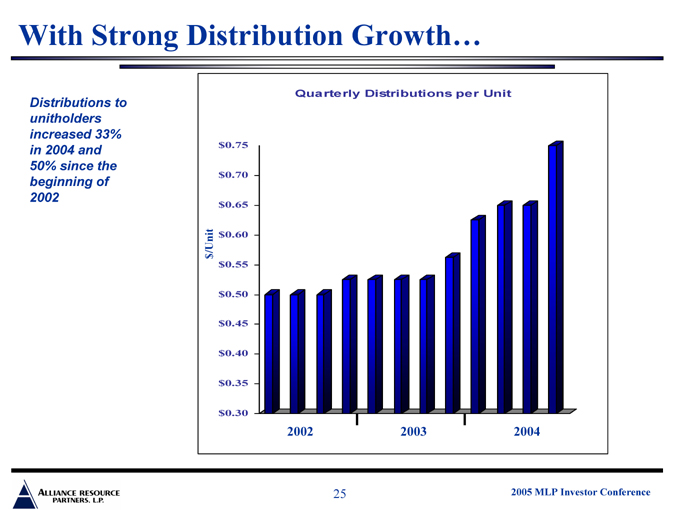

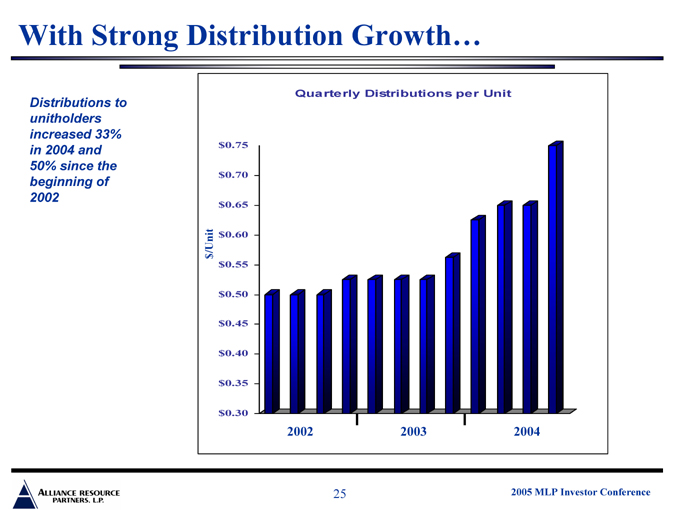

With Strong Distribution Growth…

Distributions to unitholders increased 33% in 2004 and 50% since the beginning of 2002

Quarterly Distributions per Unit $0.75 $0.70 $0.65

/Unit $0.60 $

$0.55 $0.50 $0.45 $0.40 $0.35 $0.30

2002 2003 2004

2005 MLP Investor Conference

25

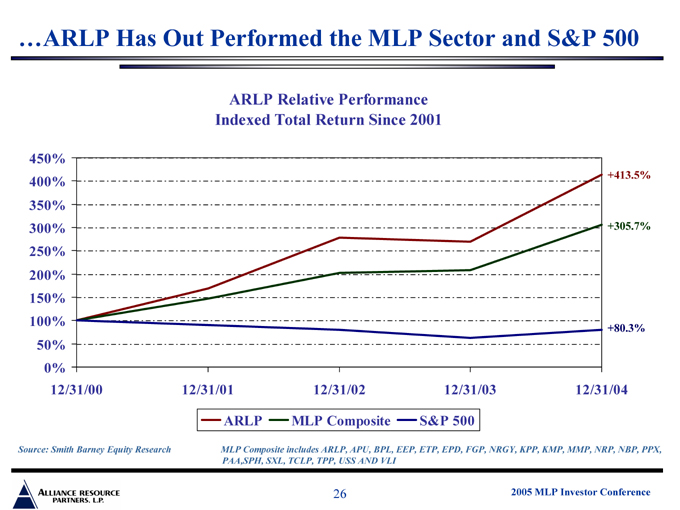

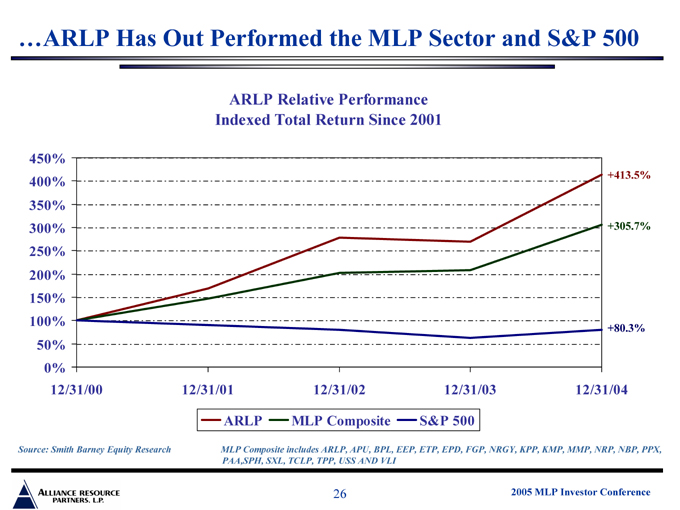

…ARLP Has Out Performed the MLP Sector and S&P 500

ARLP Relative Performance Indexed Total Return Since 2001

450% 400% 350% 300% 250% 200% 150% 100% 50% 0%

12/31/00 12/31/01 12/31/02 12/31/03 12/31/04

+413.5% +305.7% +80.3%

ARLP

MLP Composite

S&P 500

Source: Smith Barney Equity Research

MLP Composite includes ARLP, APU, BPL, EEP, ETP, EPD, FGP, NRGY, KPP, KMP, MMP, NRP, NBP, PPX, PAA,SPH, SXL, TCLP, TPP, USS AND VLI

2005 MLP Investor Conference

26

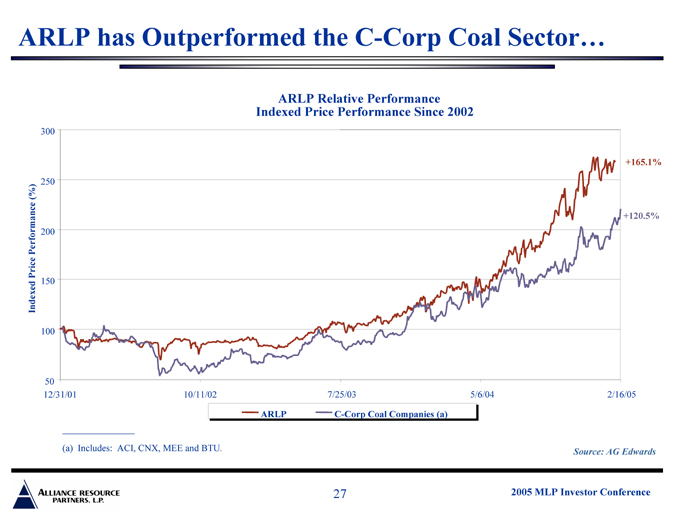

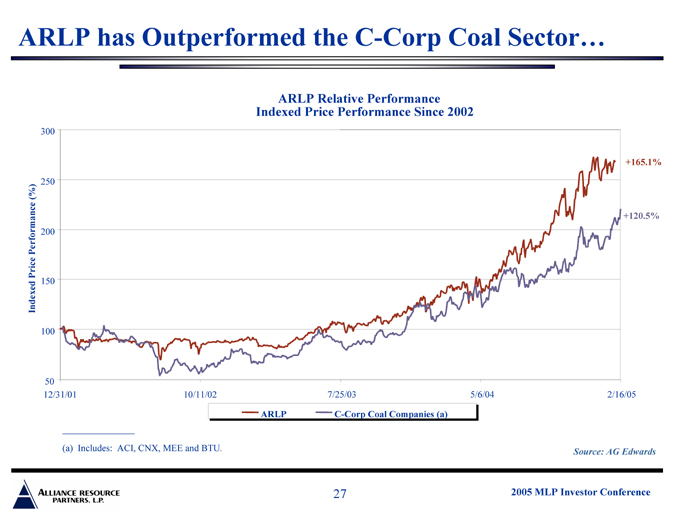

ARLP has Outperformed the C-Corp Coal Sector…

ARLP Relative Performance Indexed Price Performance Since 2002

Indexed Price Performance (%)

50 100 150 200 250 300

+165.1%

+120.5%

12/31/01 10/11/02 7/25/03 5/6/04 2/16/05

ARLP

C-Corp Coal Companies (a)

(a) Includes: ACI, CNX, MEE and BTU.

Source: AG Edwards

2005 MLP Investor Conference

27

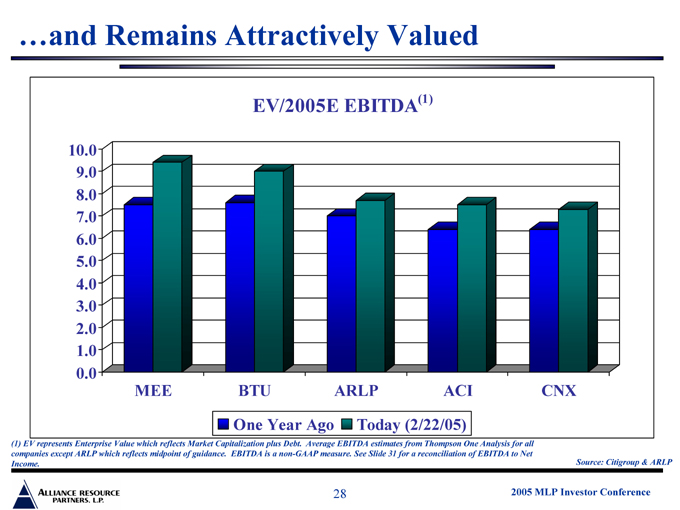

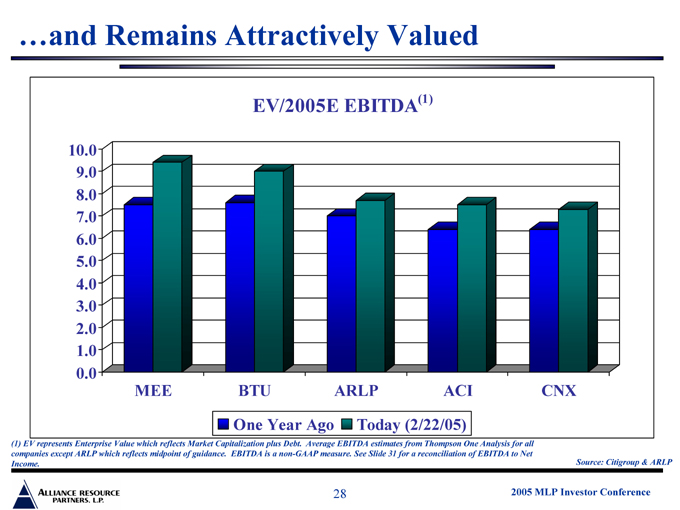

…and Remains Attractively Valued

EV/2005E EBITDA(1)

10.0 9.0 8.0 7.0 6.0 5.0 4.0 3.0 2.0 1.0 0.0

MEE BTU ARLP ACI CNX

One Year Ago

Today (2/22/05)

(1) EV represents Enterprise Value which reflects Market Capitalization plus Debt. Average EBITDA estimates from Thompson One Analysis for all companies except ARLP which reflects midpoint of guidance. EBITDA is a non-GAAP measure. See Slide 31 for a reconciliation of EBITDA to Net Income.

Source: Citigroup & ARLP

2005 MLP Investor Conference

28

Investment Highlights

ARLP Investment Highlights

Diversified asset base, both geographically and in types of coal produced Efficient, low cost operator Strong long-term market outlook for coal Proven track record of growth Attractive growth prospects looking forward Demonstrated market performance

2005 MLP Investor Conference

30

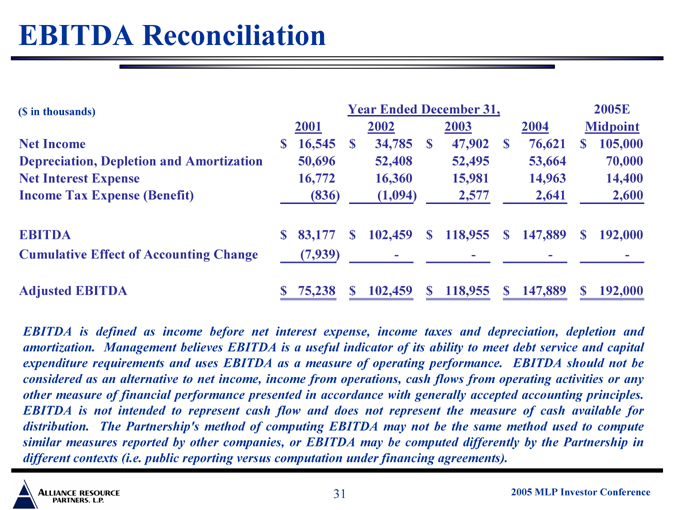

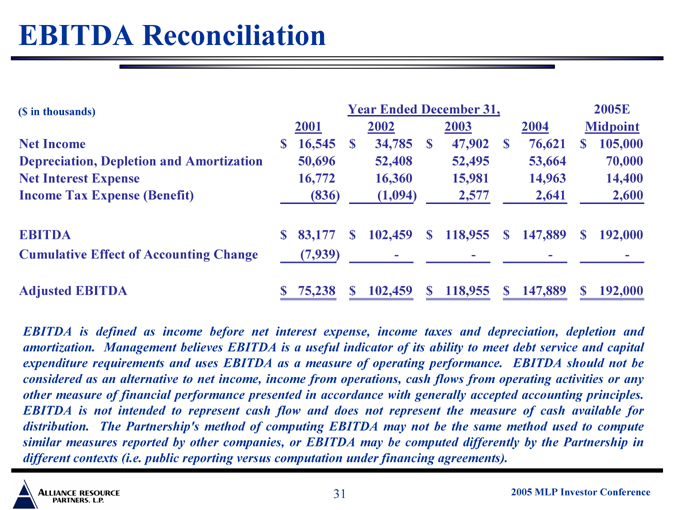

EBITDA Reconciliation

($ in thousands) Year Ended December 31, 2005E

2001 2002 2003 2004 Midpoint

Net Income $16,545 $34,785 $47,902 $76,621 $105,000

Depreciation, Depletion and Amortization 50,696 52,408 52,495 53,664 70,000

Net Interest Expense 16,772 16,360 15,981 14,963 14,400

Income Tax Expense (Benefit) (836) (1,094) 2,577 2,641 2,600

EBITDA $83,177 $102,459 $118,955 $147,889 $192,000

Cumulative Effect of Accounting Change (7,939) - - - -

Adjusted EBITDA $75,238 $102,459 $118,955 $147,889 $192,000

EBITDA is defined as income before net interest expense, income taxes and depreciation, depletion and amortization. Management believes EBITDA is a useful indicator of its ability to meet debt service and capital expenditure requirements and uses EBITDA as a measure of operating performance. EBITDA should not be considered as an alternative to net income, income from operations, cash flows from operating activities or any other measure of financial performance presented in accordance with generally accepted accounting principles. EBITDA is not intended to represent cash flow and does not represent the measure of cash available for distribution. The Partnership’s method of computing EBITDA may not be the same method used to compute similar measures reported by other companies, or EBITDA may be computed differently by the Partnership in different contexts (i.e. public reporting versus computation under financing agreements).

2005 MLP Investor Conference

31