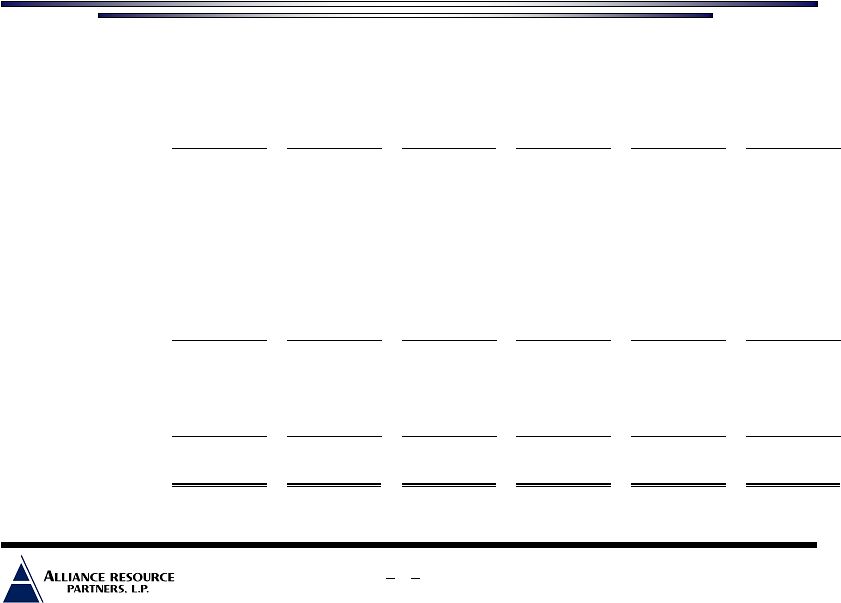

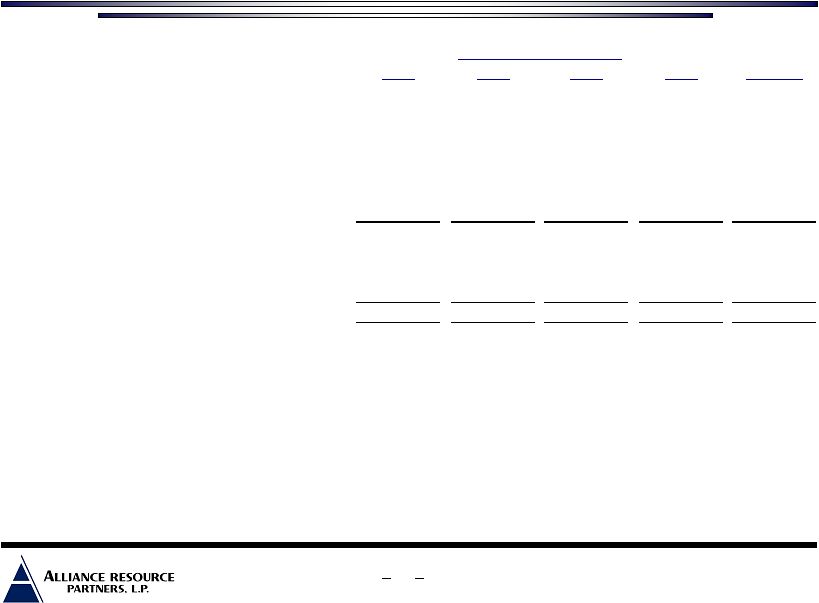

June 28, 2006 ARLP EBITDA Reconciliation EBITDA is defined as income before net interest expense, income taxes and depreciation, depletion and amortization. Management believes EBITDA is a useful indicator of its ability to meet debt service and capital expenditure requirements and uses EBITDA as a measure of operating performance. EBITDA should not be considered as an alternative to net income, income from operations, cash flows from operating activities or any other measure of financial performance presented in accordance with generally accepted accounting principles. EBITDA is not intended to represent cash flow and does not represent the measure of cash available for distribution. The Partnership's method of computing EBITDA may not be the same method used to compute similar measures reported by other companies, or EBITDA may be computed differently by the Partnership in different contexts (i.e. public reporting versus computation under financing agreements). ($ in thousands) Year Ended December 31, 2006E 2002 2003 2004 2005 Midpoint Cash flows provided by operating activities 101,306 $ 110,312 $ 145,055 $ 193,618 $ 250,000 $ Reclamation and mine closing (1,365) (1,341) (1,622) (1,918) (1,800) Coal inventory adjustment to market (48) (687) (488) (573) - Other 1,014 353 (255) (2,057) (1,000) Net effect of changes in operating assets and liabilities (13,714) (8,240) (12,405) 26,577 (5,700) Interest expense 16,360 15,981 14,963 11,816 10,700 Income taxes (1,094) 2,577 2,641 2,682 2,800 EBITDA 102,459 $ 118,955 $ 147,889 $ 230,145 $ 255,000 $ Depreciation, depletion and amortization (52,408) (52,495) (53,664) (55,637) (71,500) Interest expense (16,360) (15,981) (14,963) (11,816) (10,700) Income taxes 1,094 (2,577) (2,641) (2,682) (2,800) Net income 34,785 $ 47,902 $ 76,621 $ 160,010 $ 170,000 $ 12 |