- ARLP Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

CORRESP Filing

Alliance Resource Partners (ARLP) CORRESPCorrespondence with SEC

Filed: 14 Jul 23, 12:00am

July 14, 2023

Via EDGAR

Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, D.C. 20549

Attn: | Karl Hiller |

| Branch Chief |

| Office of Energy & Transportation |

|

|

Re: | Alliance Resource Partners, L.P. |

| Form 10-K for the Year Ended December 31, 2022 |

| Filed February 24, 2023 |

| File No. 000-26823 |

Ladies and Gentlemen:

This letter sets forth the responses of Alliance Resource Partners, L.P. (the “Partnership”) to the comments provided by the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) in its comment letter dated July 5, 2023 (the “Comment Letter”) with respect to the Form 10-K for the year ended December 31, 2022 filed by the Partnership on February 24, 2023 (the “Form 10-K”). We respectfully believe that our Technical Report Summary for the Tunnel Ridge Mine dated February 2023 (the “2023 Tunnel Ridge TRS”) contains all the information called for under Item 1302(e) and Item 601(b)(96)(iii)(B)(18) and (19) of Regulation S-K and is consistent with the information included in our Technical Report Summary for the Tunnel Ridge Mine dated July 2022 (the “2022 Tunnel Ridge TRS”) filed with our Form 10-K/A on August 26, 2022, as discussed in more detail below. We further included links to all the technical report summaries associated with our material operations in addition to the 2023 Tunnel Ridge TRS as exhibits to our Form 10-K to avoid confusion as to which reports were the most recent. Because the Staff’s comments require very limited changes to the substance of the 2023 Tunnel Ridge TRS, we propose to file an amended technical report summary including the changes discussed below as an exhibit to our Form 10-K for the year ended December 31, 2023. We are happy to discuss any concerns the Staff might have regarding that approach.

For your convenience, we have repeated each comment of the Staff exactly as given in the Comment Letter in bold and italics below and provided our response below each such comment.

Exhibits and Financial Statement Schedules

Exhibit 96.5, page 190

| 1. | We note that you have filed a Technical Report Summary for Tunnel Ridge Mine which has been updated to February 2023, to supersede the July 2022 version that you filed with the Form 10-K/A on August 26, 2022, which was necessary to address content deficiencies observed in earlier comments. However, the more recent version excludes content that was previously included or added in response to the earlier comments. |

Please coordinate with the persons at RESPEC who were involved in preparing the document to obtain and file an amended Technical Report Summary that includes all of the required content, including the details necessary to address the following points.

Response: We acknowledge the Staff’s comment and respectfully point out that the 2023 Tunnel Ridge TRS does not exclude content that was previously included or added in response to earlier comment from the Staff. As discussed below, the 2023 Tunnel Ridge TRS contains the same content as the 2022 Tunnel Ridge

1

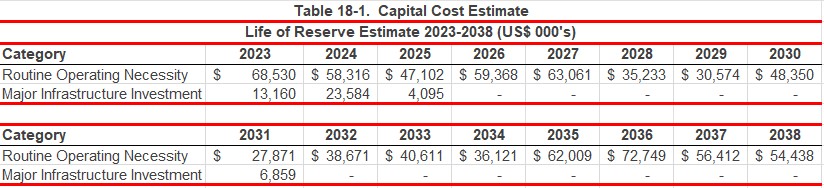

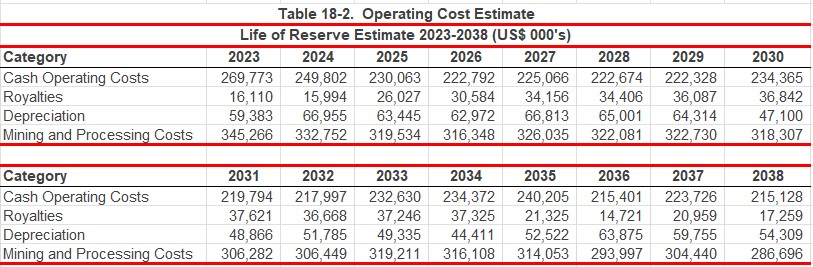

TRS except that certain tables in the 2022 Tunnel Ridge TRS, including Tables 13-1, 13-2, 18-1, 18-2 and 19-1, have been reformatted to a graphical format for ease of viewing similar to presentations seen in other registrant’s filings with the Commission. As discussed below, we will change Figures 18-1 and 18-2 back to the tabular format in accordance with Item 601(b)(96)(iii)(B)(18)(i) of Regulation S-K.

| ● | Section 2 should include the name and date of the Technical Report Summary that is being updated to comply with Item 601(b)(96)(iii)(B)(2)(v) of Regulation S-K, which appears to be the July 2022 report that updated the February 2022 report. |

Response: We acknowledge the Staff’s comment and have discussed it with RESPEC, our qualified engineering firm. To clarify that the 2023 Tunnel Ridge TRS is an update to the 2022 Tunnel Ridge TRS, RESPEC will update Section 2.2 Terms of Reference and Purpose to modify the following sentences:

“This TRS was prepared by RESPEC. A prior TRS was prepared in 2022 by RESPEC.”

to the following:

“This TRS for the Tunnel Ridge Mine was prepared by RESPEC and updates the TRS for the Tunnel Ridge Mine dated July 2022, which updated the TRS for the Tunnel Ridge Mine dated February 2022.”

| ● | Section 18 should include estimates of capital and operating costs, having major components set out in tabular form, to comply with Item 601(b)(96)(iii)(B)(18)(i) of Regulation S-K. |

. | Response: We acknowledge the Staff’s comment and have discussed it with RESPEC. We believe that the information contained in Figure 18-1 Capital Cost Estimate and Figure 18-2 Operating Costs Estimates is consistent with Item 1302(e)(12) and Item 601(b)(96)(iii)(B)(18)(i) of Regulation S-K. However, we acknowledge this information is not in a tabular format, and, therefore, RESPEC will modify the 2023 Tunnel Ridge TRS to replace Figures 18-1 and 18-2 with the following tables: |

2

| ● | Section 19.1 should include annual cash flow forecasts based on your annual production schedule for the life of the project, having line item details such as revenues, operating costs, capital expenditures, royalties, taxes, and any other items that must be considered in projecting after tax cash flows, to comply with Item 601(b)(96)(iii)(B)(19)(ii) of Regulation S-K. |

Response: We acknowledge the Staff’s comment and respectfully believe that Figure 19-1 Pre-Tax Cash-Flow Summary and Table 19-1 Sensitivity Analysis are responsive to Item 1302(e)(11) and Item 601(b)(96)(iii)(B)(19)(ii) of Regulation S-K. Figure 19-1 discloses our annual cash flow forecast based on our annual production schedule and includes revenues, cash operating costs, royalties, capital expenditures, working capital changes and cash flow. The annual cash flow forecast was made on a pre-tax basis because, as stated in Section 19.1 of the 2023 Tunnel Ridge TRS, our coal operation is held by a partnership for tax purposes, rather than taxed as a corporation, and hence is not subject to federal and state income taxes. Figure 19-1 contains the same information that was previously provided in Table 19-1 in the 2022 Tunnel Ridge TRS. We also believe that Table 19-1 in the 2023 Tunnel Ridge TRS is consistent with Table 19-2 in the 2022 Tunnel Ridge TRS.

We respectfully request that the Staff accept our response.

Please direct any questions or comments regarding the foregoing to the undersigned or to our counsel at Vinson & Elkins L.L.P., David Oelman at (713) 758-3708 or doelman@velaw.com.

| Very truly yours, | |

|

| |

| Alliance Resource Partners, L.P. | |

|

| |

|

| |

| By: | /s/ Cary P. Marshall |

Cary P. Marshall | ||

| Sr. Vice President and Chief Financial Officer | |

Cc: | Eb Davis |

| Alliance Resource Partners, L.P. |

|

|

| David P. Oelman |

| Vinson & Elkins L.L.P. |

3