Exhibit 99.2

Manulife Financial Corporation

Management’s Discussion and Analysis

For the year ended December 31, 2013

Caution regarding forward-looking statements

This document contains forward-looking statements within the meaning of the “safe harbour” provisions of Canadian provincial securities laws and the U.S. Private Securities Litigation Reform Act of 1995. The forward-looking statements in this document include, but are not limited to, statements with respect to our 2016 management objectives for core earnings and core ROE, our 2016 goal for pre-tax run rate savings related to our Efficiency and Effectiveness Program, and the potential impact of a new Canadian Actuarial Standards Board Standard related to economic reinvestment assumptions used in the valuation of policy liabilities. Theforward-looking statements in this document also relate to, among other things, our objectives, goals, strategies, intentions, plans, beliefs, expectations and estimates, and can generally be identified by the use of words such as “may”, “will”, “could”, “should”, “would”, “likely”, “suspect”, “outlook”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “plan”, “forecast”, “objective”, “seek”, “aim”, “continue”, “goal”, “restore”, “embark” and “endeavour” (or the negative thereof) and words and expressions of similar import, and include statements concerning possible or assumed future results. Although we believe that the expectations reflected in such forward-looking statements are reasonable, such statements involve risks and uncertainties, and undue reliance should not be placed on such statements and they should not be interpreted as confirming market or analysts’ expectations in any way. Certain material factors or assumptions are applied in making forward-looking statements, including in the case of our 2016 management objectives for core earnings and core ROE, the assumptions described under “Key Planning Assumptions and Uncertainties” in this document and actual results may differ materially from those expressed or implied in such statements. Important factors that could cause actual results to differ materially from expectations include but are not limited to: the factors identified in “Key Planning Assumptions and Uncertainties” in this document; general business and economic conditions (including but not limited to the performance, volatility and correlation of equity markets, interest rates, credit and swap spreads, currency rates, investment losses and defaults, market liquidity and creditworthiness of guarantors, reinsurers and counterparties); changes in laws and regulations; changes in accounting standards; our ability to execute strategic plans and changes to strategic plans; downgrades in our financial strength or credit ratings; our ability to maintain our reputation; impairments of goodwill or intangible assets or the establishment of provisions against future tax assets; the accuracy of estimates relating to morbidity, mortality and policyholder behaviour; the accuracy of other estimates used in applying accounting policies and actuarial methods; our ability to implement effective hedging strategies and unforeseen consequences arising from such strategies; our ability to source appropriate assets to back our long dated liabilities; level of competition and consolidation; our ability to market and distribute products through current and future distribution channels; unforeseen liabilities or asset impairments arising from acquisitions and dispositions of businesses; the realization of losses arising from the sale of investments classified as available-for-sale; our liquidity, including the availability of financing to satisfy existing financial liabilities on expected maturity dates when required; obligations to pledge additional collateral; the availability of letters of credit to provide capital management flexibility; accuracy of information received from counterparties and the ability of counterparties to meet their obligations; the availability, affordability and adequacy of reinsurance; legal and regulatory proceedings, including tax audits, tax litigation or similar proceedings; our ability to adapt products and services to the changing market; our ability to attract and retain key executives, employees and agents; the appropriate use and interpretation of complex models or deficiencies in models used; political, legal, operational and other risks associated with ournon-North American operations; acquisitions and our ability to complete acquisitions including the availability of equity and debt financing for this purpose; the disruption of or changes to key elements of the Company’s or public infrastructure systems; environmental concerns; and our ability to protect our intellectual property and exposure to claims of infringement. Additional information about material factors that could cause actual results to differ materially from expectations and about material factors or assumptions applied in making forward-looking statements may be found in the body of this document as well as under “Risk Management and Risk Factors” and “Critical Accounting and Actuarial Policies” in the Management’s Discussion and Analysis and in the “Risk Management” note to the consolidated financial statements as well as under “Risk Factors” in our most recent Annual Information Form and elsewhere in our filings with Canadian and U.S. securities regulators. We do not undertake to update any forward-looking statements, except as required by law.

| | | | |

| 1 | | Manulife Financial Corporation 2013 Management’s Discussion and Analysis | | |

2013 Manulife Financial Corporation

Management’s Discussion and Analysis

TABLE OF CONTENTS

| | | | |

| | Manulife Financial Corporation 2013 Management’s Discussion and Analysis | | 2 |

MANAGEMENT’S DISCUSSION AND ANALYSIS

This Management’s Discussion and Analysis (“MD&A”) is current as of February 26, 2014.

Overview

Manulife Financial is a leading Canada-based financial services company with principal operations in Asia, Canada and the United States. Manulife Financial’s vision is to be the most professional financial services organization in the world, providing strong, reliable, trustworthy and forward-thinking solutions for our clients’ most significant financial decisions. Our international network of more than 84,000 employees and agents offers our clients a broad range of financial protection and wealth management products and services. We offer personal and corporate products to millions of customers across our three operating divisions: Asia, Canada and the United States, each of which represents about one third of our overall business.

Funds under management1 by Manulife Financial and its subsidiaries were $599 billion as at December 31, 2013.

In this document, the terms “Company”, “Manulife Financial”, “Manulife” and “we” mean Manulife Financial Corporation (“MFC”) and its subsidiaries.

In 2013 we made significant progress towards our strategic priorities:

| n | | Developing our Asian opportunity to the fullest, |

| n | | Growing our wealth and asset management businesses in Asia, Canada, and the U.S., |

| n | | Continuing to build our balanced Canadian franchise, and |

| n | | Continuing to grow higher return on equity (“ROE”), lower risk U.S. businesses. |

Since 2010, we have enjoyed a positive progression in earnings and in 2013 our reportednet income attributed to shareholders was $3,130 million, an increase of $1,320 million compared with $1,810 million in 2012. The increase was driven by a $368 million increase in core earnings1 and $952 million of items excluded from core earnings, the two most significant items of which were a $592 million reduction in charges related to changes in actuarial methods and assumptions and a $350 million gain on the sale of our Taiwan insurance business.

In 2012 we introduced “core earnings” – a non-GAAP financial measure which management believes better reflects our underlying earnings capacity. Core earnings excludes investment-related experience in excess of $200 million per annum (the $200 million per annum to be included in core earnings compares with an average of over $320 million per annum reported from 2007 to 2011). It also excludes the mark-to-market accounting impact of equity markets and interest rates as well as a number of other items, outlined in the “Performance and Non-GAAP Measures” section below.

Core earnings in 2013 was $2,617 million compared with $2,249 million in 2012. The $368 million increase in core earnings was driven by higher fee income growth in our wealth management businesses, increased new business margins in our North American insurance businesses and lower amortization of deferred acquisition costs on our closed blocks of variable annuity business, partially offset by higher expenses. The increase in expenses related to higher legal and variable compensation accruals. While we reported overall policy experience losses in both years of about the same amount, there was significantly improved claims experience in the U.S. in 2013 offset by one-time gains reported in 2012 related to specific run-off accident and health reinsurance business settlements and the release of excess Property and Casualty Reinsurance provisions related to 2011 events. We also reported net favourable tax items in both periods of about equal amounts.

Asia Division continues to build a pan-Asian life insurance and wealth franchise that is well positioned to satisfy the protection and retirement needs of the fast growing customer base in the region. Our core strategy focuses on expanding our professional agency force and alternative channel distribution, growing our wealth and asset management businesses and investing in our brand across Asia. In 2013, we achieved record sales1 for wealth products, further expanded our network of bank partnerships and achieved solid growth in our professional agency force in several key markets. Our wealth sales in 2013 grew by 57 per cent over 20122, as new products and expanded distribution contributed to broad-based growth across most of our markets. Our 2013 insurance sales of US$1.0 billion were below our expectations and decreased 16 per cent compared with 2012. Sales in 2012 were higher primarily due to a run up in cancer product sales in Japan, prior to a tax change in April of last year and lower corporate product sales, a result of pricing actions in late 2012. We did see improved momentum in the fourth quarter of 2013 as both Hong Kong and Indonesia had record sales quarters and Japan sales grew by 18 per cent over the third quarter of 2013.

Canadian Division continued to build our diversified Canadian franchise. In 2013, we achieved record full year sales in Manulife Mutual Funds, strong Group Retirement Solutions sales and once again led the market in Group Benefits sales3. Manulife Bank responded to significant regulatory changes and ended the year with record net lending assets despite a slowdown in the residential mortgage market and an aggressive competitive environment. We continued to drive our desired shift in product mix in 2013,

| 1 | This item is a non-GAAP measure. See “Performance and Non-GAAP Measures” below. |

| 2 | Growth (declines) in sales, premiums and deposits and funds under management are stated on a constant currency basis. Constant currency basis is a non-GAAP measure. See “Performance and Non-GAAP Measures” below. |

| 3 | Based on quarterly sales survey by LIMRA, an insurance industry organization as at September 30, 2013. |

| | | | |

| 3 | | Manulife Financial Corporation 2013 Management’s Discussion and Analysis | | |

reducing the proportion of insurance and segregated fund sales with long-duration guarantee features. We expanded our distribution reach by welcoming new advisors, extending existing relationships and enhancing support to our distribution partners as well as through two strategic transactions in travel insurance and mortgage creditor life insurance. In 2013, we were the first company in Canada licensed by the Office of the Superintendent of Financial Institutions (“OSFI”) to administer the new federal Pooled Registered Pension Plans (“PRPPs”) which are expected to be available for sale in certain provinces in 2014.

U.S. Division continued to make substantive progress towards our strategic priority of growing higher ROE and lower risk businesses. Our focus is on building a leading company in the U.S. that helps Americans with their retirement, long-term care and estate planning needs. We are leveraging our trusted brand, diverse and broad distribution, and core business strength of product innovation to profitably grow our de-risked insurance and wealth management franchises. During 2013, we have executed an acquisition of Symetra Investment Services, increasing our affiliated advisor headcount by 15 per cent. We achieved record sales in our mutual fund business in 2013, benefiting from the significant investments made in distribution and the investment product line-up. Through product re-design, re-pricing and business re-positioning, we have reduced the equity and interest rate risk and earnings sensitivity of our product portfolio, while we continue to invest in the growth of fee-based products with lower capital requirements and higher return potential, including our 401(k), mutual fund and lower risk insurance products. We are seeing the desired impact of these actions on our sales mix and improved new business strain with a continued shift away from guaranteed, long-duration products in 2013. To improve operating efficiencies, we combined JH Life Insurance and JH Long-Term Care Insurance into a single business unit. In addition, at the end of 2013, we announced plans to file for state approvals of a long-term care in-force rate increase during 2014. In December 2013, shareholders of the John Hancock Variable Insurance Trust (“JHVIT”) Lifestyle Portfolios approved a change to the investment objectives of the JHVIT Lifestyle Portfolios to include a volatility management overlay. The managed volatility program is aimed at helping John Hancock contract owners and policyholders diversify risk, manage volatility of returns, and limit the magnitude of portfolio losses during periods of elevated volatility.

Investment Division continued to deliver strong investment-related gains in 2013 with the vast majority of those gains coming from excellent credit experience, fixed income and alternative long-duration asset investing and asset allocation activities that enhanced surplus liquidity and resulted in higher yields in the liability segments. The favourable credit experience reflects the strength of our underwriting combined with the benign economic environment. Attractive long corporate bond and alternative long-duration asset acquisitions enhanced our risk-adjusted returns. We continue to focus our acquisitions on high quality, good relative value assets.

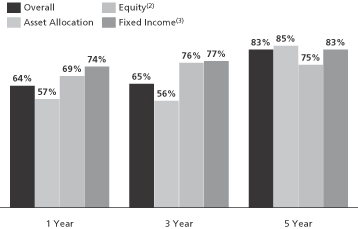

Manulife Asset Management (“MAM”) experienced significant growth in 2013 across its global franchise, with external assets under management increasing by 18 per cent to $242.8 billion. We made several strategic additions to our portfolio management teams in the fourth quarter including the purchase of MAAKL Holdings Berhad in Malaysia. Outstanding investment performance continues to differentiate MAM with all public asset classes outperforming their benchmarks on a 1, 3, and5-year basis.

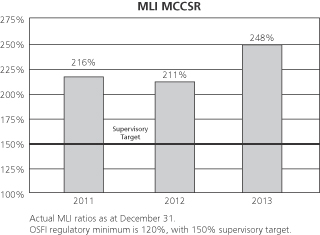

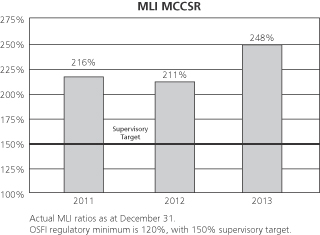

The Minimum Continuing Capital and Surplus Requirements (“MCCSR”) ratio for The Manufacturers Life Insurance Company (“MLI”) closed 2013 at 248 per cent, up 37 points from the 211 per cent reported at the end of 2012. This increase reflects the contribution from earnings, a reduction in capital requirements for variable annuity and segregated fund guarantees due to the strong equity markets, the sale of our Taiwan insurance business and net capital issuance as well as the 2013 MCCSR Guideline change that reduced capital required for lapse risk.

| | | | |

| | Manulife Financial Corporation 2013 Management’s Discussion and Analysis | | 4 |

Financial Performance

| | | | | | | | | | | | | | |

As at and for the years ended December 31, (C$ millions, unless otherwise stated) | | 2013 | | | restated(1) 2012 | | | 2011 | | | |

Net income attributed to shareholders | | $ | 3,130 | | | $ | 1,810 | | | $ | 129 | | | |

Preferred share dividends | | | (131 | ) | | | (112 | ) | | | (85 | ) | | |

Common shareholders’ net income | | $ | 2,999 | | | $ | 1,698 | | | $ | 44 | | | |

Reconciliation of core earnings to net income attributed to shareholders: | | | | | | | | | | | | | | |

Core earnings(2) | | $ | 2,617 | | | $ | 2,249 | | | $ | 2,169 | | | |

Investment-related experience in excess of amounts included in core earnings | | | 706 | | | | 949 | | | | 1,290 | | | |

Core earnings plus investment-related experience in excess of amounts included in core earnings | | $ | 3,323 | | | $ | 3,198 | | | $ | 3,459 | | | |

Other items to reconcile core earnings to net income attributed to shareholders: | | | | | | | | | | | | | | |

Direct impact of equity markets and interest rates and variable annuity guarantee liabilities that are dynamically hedged | | | (336 | ) | | | (582 | ) | | | (2,217 | ) | | |

Changes in actuarial methods and assumptions | | | (489 | ) | | | (1,081 | ) | | | (751 | ) | | |

Disposition of Taiwan insurance business(3) | | | 350 | | | | (50 | ) | | | – | | | |

Other items | | | 282 | | | | 325 | | | | (362 | ) | | |

Net income attributed to shareholders | | $ | 3,130 | | | $ | 1,810 | | | $ | 129 | | | |

Basic earnings per common share (C$) | | $ | 1.63 | | | $ | 0.94 | | | $ | 0.02 | | | |

Diluted earnings per common share (C$) | | $ | 1.62 | | | $ | 0.92 | | | $ | 0.02 | | | |

Diluted core earnings per common share (C$)(2) | | $ | 1.34 | | | $ | 1.15 | | | $ | 1.14 | | | |

Return on common shareholders’ equity (“ROE”) (%) | | | 12.8% | | | | 7.8% | | | | 0.2% | | | |

Core ROE (%) (2) | | | 10.6% | | | | 9.8% | | | | 9.1% | | | |

U.S. GAAP net (loss) income attributed to shareholders(2) | | $ | (648 | ) | | $ | 2,557 | | | $ | 3,674 | | | |

Sales(2) | | | | | | | | | | | | | | |

Insurance products(4) | | $ | 2,757 | | | $ | 3,279 | | | $ | 2,456 | | | |

Wealth products | | $ | 49,681 | | | $ | 35,940 | | | $ | 34,299 | | | |

Premiums and deposits(2) | | | | | | | | | | | | | | |

Insurance products | | $ | 24,549 | | | $ | 24,221 | | | $ | 22,278 | | | |

Wealth products | | $ | 63,701 | | | $ | 51,280 | | | $ | 43,783 | | | |

Funds under management (C$ billions)(2) | | $ | 599 | | | $ | 531 | | | $ | 500 | | | |

Capital (C$ billions)(2) | | $ | 33.5 | | | $ | 29.2 | | | $ | 29.0 | | | |

MLI’s MCCSR ratio | | | 248% | | | | 211% | | | | 216% | | | |

Sensitivities to equity markets and interest rates: | | | | | | | | | | | | | | |

% of underlying earnings sensitivity to equity market movements offset by hedges(5) | | | 64 to 82% | | | | 72 to 83% | | | | 59 to 70% | | | |

Earnings impact of a 1% parallel decline in interest rates(6) | | $ | (400 | ) | | $ | (400 | ) | | $ | (1,000 | ) | | |

| (1) | The 2012 results were restated to reflect the retrospective application of new International Financial Reporting Standards (“IFRS”) accounting standards effective January 1, 2013. For a detailed description of the change see note 2 to the 2013 Consolidated Financial Statements. The 2011 results were not required to be restated. |

| (2) | This item is a non-GAAP measure. For a discussion of our use of non-GAAP measures, see “Performance and Non-GAAP Measures” below. |

| (3) | This $50 million charge in 2012 represents closing adjustments to the 2011 disposition of our Life Retrocession business. |

| (4) | Insurance sales have been adjusted to exclude Taiwan for all periods. |

| (5) | The lower end of the range assumes that the change in value of the hedge assets does not completely offset the change in the dynamically hedged variable annuity guarantee liabilities, including the provisions for adverse deviation. The estimated amount that would not be completely offset assumes that provision for adverse deviation is not offset and that the hedge assets are based on the actual position at the period end. |

| (6) | The impact above excludes the impact of market value changes in available-for-sale (“AFS”) bonds. The AFS bonds provide a natural economic offset to the interest rate risk arising from our product liabilities, and if included would have reduced the impact by $600 million, $800 million and $800 million, respectively, for the years ended December 31, 2013, 2012 and 2011. |

Analysis of Net Income

In 2013, Manulife reported net income attributed to shareholders of $3,130 million (2012 – $1,810 million) and core earnings of $2,617 million (2012 – $2,249 million). Net income attributed to shareholders increased $1,320 million compared with 2012, of which $368 million was driven by higher core earnings and $952 million related to items excluded from core earnings.

The $368 million increase in core earnings was driven by growth in fee income due to growth in our wealth businesses, increased new business margins in our North American insurance businesses and lower amortization of deferred acquisition costs on our closed blocks of variable annuity business, partially offset by higher expenses. The increase in expenses related to higher legal and variable compensation accruals. While we reported overall policy experience losses in both years of about the same amount, there was significantly improved claims experience in the U.S. in 2013 offset by one-time gains reported in 2012 related to specific run-off accident and health reinsurance business settlements and the release of excess Property and Casualty Reinsurance provisions related to 2011 events. We also reported net favourable tax items in both periods of about equal amounts.

The net amount of items excluded from core earnings in 2013 was a gain of $513 million compared to a charge of $439 million in 2012. This $952 million change was driven by a $592 million reduction in charges related to changes in actuarial methods and assumptions (2013 – $489 million charge, 2012 – $1,081 million charge) and a $350 million gain on the sale of our Taiwan insurance business. While investment-related experience was strong in both years, the $706 million gain reported in 2013 (in excess of the $200

| | | | |

| 5 | | Manulife Financial Corporation 2013 Management’s Discussion and Analysis | | |

million of investment gains included in core earnings) was $243 million lower than in 2012. This decrease was offset by $246 million of lower charges related to the direct impact of equity markets and interest rates and variable annuity guarantee liabilities that are dynamically hedged. Other items excluded from core earnings netted to a gain of $282 million in 2013 and $275 million in 2012. The 2013 amount primarily related to policyholder approved changes to the investment objectives of separate accounts that support our Variable Annuity products in the U.S. and a reinsurance recapture transaction in Asia. The 2012 amount primarily related to in-force product changes, the recapture of a reinsurance treaty and tax items, partially offset by a $200 million goodwill impairment charge.

As noted above, investment-related experience totaled $906 million in 2013 and was $243 million lower than in 2012. The investment-related experience gains are a combination of reported investment experience as well as the impact of investing activities on the measurement of our policy liabilities. The investment-related experience in 2013 included: $516 million primarily related to the impact of investing activities (both fixed income and alternative long-duration assets) on the measurement of our policy liabilities; $228 million related to planned asset allocation activities that enhanced surplus liquidity and resulted in higher yielding assets in the respective liability segments; and $162 million due to favourable credit experience relative to our long-term assumptions. The investment-related experience in 2012 included: $1,117 million primarily related to the impact of investing activities (both fixed income and alternative long-duration assets) on the measurement of our policy liabilities; and $32 million due to favourable credit experience relative to our long-term assumptions (see “Financial Performance - Impact of Fair Value Accounting” below).

The table below reconciles 2013 core earnings of $2,617 million to the reported net income attributed to shareholders of $3,130 million.

| | | | | | | | | | | | | | |

For the years ended December 31, (C$ millions, unaudited) | | 2013 | | | restated(1) 2012 | | | 2011 | | | |

Core earnings(2) | | | | | | | | | | | | | | |

Asia Division(3) | | $ | 921 | | | $ | 963 | | | $ | 938 | | | |

Canadian Division(3) | | | 905 | | | | 835 | | | | 849 | | | |

U.S. Division(3) | | | 1,510 | | | | 1,085 | | | | 1,005 | | | |

Corporate and Other (excluding expected cost of macro hedges and core investment gains) | | | (506 | ) | | | (345 | ) | | | (415) | | | |

Expected cost of macro hedges(3),(4) | | | (413 | ) | | | (489 | ) | | | (408) | | | |

Investment-related experience in core earnings(5) | | | 200 | | | | 200 | | | | 200 | | | |

Total core earnings | | $ | 2,617 | | | $ | 2,249 | | | $ | 2,169 | | | |

Investment-related experience in excess of amounts included in core earnings(5) | | | 706 | | | | 949 | | | | 1,290 | | | |

Core earnings plus investment-related experience in excess of amounts included in core earnings | | $ | 3,323 | | | $ | 3,198 | | | $ | 3,459 | | | |

Changes in actuarial methods and assumptions(6) | | | (489 | ) | | | (1,081 | ) | | | (751) | | | |

Direct impact of equity markets and interest rates and variable annuity guarantee liabilities that are dynamically hedged(7) (see table below) | | | (336 | ) | | | (582 | ) | | | (2,217) | | | |

Disposition of Taiwan insurance business in 2013(8) | | | 350 | | | | (50 | ) | | | 303 | | | |

Impact of in-force product changes and recapture of reinsurance treaties(9) | | | 261 | | | | 260 | | | | – | | | |

Material and exceptional tax related items(10) | | | 47 | | | | 322 | | | | – | | | |

Goodwill impairment charge | | | – | | | | (200 | ) | | | (665) | | | |

Restructuring charge related to organizational design(11) | | | (26 | ) | | | (57 | ) | | | – | | | |

Net income attributed to shareholders | | $ | 3,130 | | | $ | 1,810 | | | $ | 129 | | | |

| (1) | The 2012 results were restated to reflect the retrospective application of new IFRS accounting standards effective January 1, 2013. For a detailed description of the change see note 2 to the 2013 Consolidated Financial Statements. The 2011 results were not required to be restated. |

| (2) | This item is a non-GAAP measure. See “Performance and Non-GAAP Measures” below. |

| (3) | The decrease in expected macro hedging cost in 2013 compared with 2012 was partially offset by an increase in dynamic hedging costs included in Asia, Canada and U.S. divisional core earnings. |

| (4) | The 2013 net loss from macro equity hedges was $1,851 million and consisted of a $413 million charge related to the estimated expected cost of the macro equity hedges relative to our long-term valuation assumptions and a charge of $1,438 million because actual markets outperformed our valuation assumptions. The latter amount is included in the direct impact of equity markets and interest rates (see table below). |

| (5) | As outlined under “Critical Accounting and Actuarial Policies” below, net insurance contract liabilities under IFRS for Canadian insurers are determined using the Canadian Asset Liability Method (“CALM”). Under CALM, the measurement of policy liabilities includes estimates regarding future expected investment income on assets supporting the policies. Experience gains and losses are reported when current period activity differs from what was assumed in the policy liabilities at the beginning of the period. These gains and losses can relate to both the investment returns earned in the period, as well as to the change in our policy liabilities driven by the impact of current period investing activities on future expected investment income assumptions. |

| (6) | Of the $489 million charge for change in actuarial methods and assumptions in 2013, $252 million was reported in the third quarter as part of the comprehensive annual review of valuation assumptions. See “Review of Actuarial Methods and Assumptions” section below. |

| (7) | The direct impact of equity markets and interest rates is relative to our policy liability valuation assumptions and includes changes to interest rate assumptions, as well as experience gains and losses on derivatives associated with our macro equity hedges. We also include gains and losses on the sale of AFS debt securities as management may have the ability to partially offset the direct impacts of changes in interest rates reported in the liability segments. See table below for components of this item. |

| (8) | The 2011 gain of $303 million relates to the sale of our Life Retrocession business and the $50 million charge in 2012 represents closing adjustments to that disposition. |

| (9) | The 2013 gain of $261 million includes the impact on the measurement of policy liabilities of policyholder-approved changes to the investment objectives of separate accounts that support our Variable Annuity products in the U.S. and a reinsurance recapture transaction in Asia. The $260 million gain in 2012 largely relates to a recapture of a reinsurance treaty and in-force segregated funds product changes in Canada. |

| (10) | The 2013 tax item primarily reflects the impact on our deferred tax asset position of Canadian provincial tax rate changes. Included in the 2012 tax items are $264 million of material and exceptional U.S. tax items and $58 million for changes to tax rates in Japan. |

| (11) | The restructuring charge is related to severance, pension and consulting costs for the Company’s Organizational Design Project, which was completed in the second quarter of 2013. |

| | | | |

| | Manulife Financial Corporation 2013 Management’s Discussion and Analysis | | 6 |

The net loss related to the direct impact of equity markets and interest rates and variable annuity guarantee liabilities that are dynamically hedged in the table above is attributable to:

| | | | | | | | | | | | | | |

For the years ended December 31, C$ millions, unaudited | | 2013 | | | 2012 | | | 2011 | | | |

Variable annuity guarantee liabilities that are dynamically hedged(1) | | $ | 392 | | | $ | 176 | | | $ | (1,153 | ) | | |

Variable annuity guarantee liabilities that are not dynamically hedged | | | 1,293 | | | | 1,078 | | | | (1,092 | ) | | |

General fund equity investments supporting policy liabilities and on fee income(2) | | | 211 | | | | 108 | | | | (214 | ) | | |

Macro equity hedges relative to expected costs(3) | | | (1,438 | ) | | | (511 | ) | | | 636 | | | |

Direct impact of equity markets and variable annuity guarantees that are dynamically hedged(4) | | $ | 458 | | | $ | 851 | | | $ | (1,823 | ) | | |

Fixed income reinvestment rates assumed in the valuation of policy liabilities(5) | | | (276 | ) | | | (740 | ) | | | (281 | ) | | |

Sale of AFS bonds and derivative positions in the Corporate and Other segment | | | (262 | ) | | | (16 | ) | | | 324 | | | |

Charges due to lower fixed income URR assumptions used in the valuation of policy liabilities(6) | | | (256 | ) | | | (677 | ) | | | (437 | ) | | |

Direct impact of equity markets and interest rates and variable annuity guarantees that are dynamically hedged | | $ | (336 | ) | | $ | (582 | ) | | $ | (2,217 | ) | | |

Direct impact of equity markets and interest rates | | $ | (728 | ) | | $ | (758 | ) | | $ | (1,064 | ) | | |

| (1) | Our variable annuity guarantee dynamic hedging strategy is not designed to completely offset the sensitivity of policy liabilities to all risks associated with the guarantees embedded in these products. The gain in 2013 was primarily due to our equity fund results outperforming indices and a gain on the release of provision for adverse deviation associated with more favourable equity markets. See: “Risk Management and Risk Factors” below. |

| (2) | The impact on general fund equity investments supporting policy liabilities and on fee income includes the capitalized impact on fees for variable universal life policies. |

| (3) | As described in the previous table, we incurred a charge of $1,438 million in 2013 because actual markets outperformed our valuation assumptions. |

| (4) | In 2013, gross equity exposure gains of $4,357 million were partially offset by gross equity hedging charges of $1,438 million from macro hedge experience and charges of $2,461 million from dynamic hedging experience which resulted in a gain of $458 million. |

| (5) | The charge in 2013 for fixed income reinvestment assumptions was driven by the increase in swap spreads and the decrease in corporate spreads, partially offset by the increase in risk free rates. |

| (6) | Beginning with the first quarter of 2013 for North America and the third quarter of 2013 for Japan, the URR impact was calculated on a quarterly basis, whereas in 2012, it was calculated on an annual basis in the second quarter. |

Earnings per Common Share and Return on Common Shareholders’ Equity

Net income per common share for 2013 was $1.63, compared to $0.94 in 2012. Return on common shareholders’ equity for 2013 was 12.8 per cent, compared to 7.8 per cent for 2012.

Sales

Insurance sales of $2.8 billion in 2013 declined by 13 per cent compared with 2012. In Asia, insurance sales declined 16 per cent due to lower sales in Japan as a result of tax and product changes, partially offset by growth in most territories. In Canada, insurance sales declined 14 per cent driven by normal variability in our Group Benefits business. John Hancock Life sales declined six per cent reflecting our actions to reposition our new business mix to products with increased margins and more favourable risk profiles.

Recordwealth sales of $49.7 billion in 2013, increased 37 per cent compared to 2012. Record wealth sales in Asia increased 57 per cent driven by new fund launches and strong pension sales following the launch of Hong Kong’s Mandatory Provident Fund’s (“MPF”) new Employee Choice Arrangement. In Canada, wealth sales rose 21 per cent due to continued strong mutual fund sales and higher pension sales. U.S. Division wealth sales rose 39 per cent driven by strong mutual fund sales, partly offset by a decline in pension and annuity sales.

Premiums and Deposits

Total Company premiums and deposits4 for insurance products increased to $24.5 billion in 2013, an increase5 of two per cent over 2012 which included a two per cent increase in Asia and Canada and a three per cent increase in the U.S.

Total Company premiums and deposits for wealth products increased to $63.7 billion in 2013, an increase of 24 per cent over 2012. The increase was 54 per cent in Asia, 36 per cent in Canada and 31 per cent in the U.S. The strong total Company result was partly offset by lower Manulife Asset Management institutional deposits, a business line where variability is expected.

Funds under Management

Funds under management4 as at December 31, 2013 were a record $599 billion, an increase of $68 billion, or eight per cent, compared with December 31, 2012. The increase was largely attributable to growth in our asset management business and favourable equity markets, partially offset by the mark-to-market impact of the increase in interest rates on fixed income investments.

| 4 | This item is a non-GAAP measure. See “Performance and Non-GAAP Measures” below. |

| 5 | Sales, premiums and deposits and funds under management growth (decline) in rates are quoted on a constant currency basis. Constant currency basis is a non-GAAP measure. See “Performance and Non-GAAP Measures” below. |

| | | | |

| 7 | | Manulife Financial Corporation 2013 Management’s Discussion and Analysis | | |

Funds under management

| | | | | | | | | | | | | | |

As at December 31, (C$ millions) | | 2013 | | | restated(1) 2012 | | | 2011 | | | |

General fund | | $ | 232,709 | | | $ | 227,932 | | | $ | 226,520 | | | |

Segregated funds net assets(2) | | | 239,871 | | | | 209,197 | | | | 195,933 | | | |

Mutual funds, institutional advisory accounts and other(2),(3) | | | 126,353 | | | | 94,029 | | | | 77,199 | | | |

Total funds under management | | $ | 598,933 | | | $ | 531,158 | | | $ | 499,652 | | | |

| (1) | The 2012 results were restated to reflect the retrospective application of new IFRS accounting standards effective January 1, 2013. For a detailed description of the change see note 2 of the Consolidated Financial Statements. The 2011 results were not required to be restated. |

| (2) | Segregated fund assets, mutual fund assets and other funds are not available to satisfy the liabilities of the Company’s general fund. |

| (3) | Other funds represent pension funds, pooled funds, endowment funds and other institutional funds managed by the Company on behalf of others. |

Capital

Total capital6 was $33.5 billion as at December 31, 2013 compared to $29.2 billion as at December 31, 2012, an increase of $4.3 billion. The increase included net earnings of $3.1 billion, the $1 billion impact from favourable currency movements on translation of foreign operations and net capital issued of $0.7 billion, partially offset by cash dividends of $0.8 billion over the period.

Impact of Fair Value Accounting

Fair value accounting policies affect the measurement of both our assets and our liabilities. The difference between the reported amounts of our assets and liabilities determined as of the balance sheet date in accordance with the applicable mark-to-market accounting principles is reported as investment-related experience, the direct impact of equity markets and interest rates and variable annuity guarantees that are dynamically hedged, each of which impacts net income (see “Analysis of Net Income” above).

We reported $17.6 billion of net realized and unrealized losses reported in investment income in 2013. These amounts were driven by the mark-to-market impact of the increase in interest rates on our bond and fixed income derivative holdings and the increase in equity markets on our equity futures in our macro and dynamic hedging program, as well as other items.

As outlined under “Critical Accounting and Actuarial Policies” below, net insurance contract liabilities under IFRS are determined using the Canadian Asset Liability Method (“CALM”), as required by the Canadian Institute of Actuaries. The measurement of policy liabilities includes the estimated value of future policyholder benefits and settlement obligations to be paid over the term remaining on in-force policies, including the costs of servicing the policies, reduced by the future expected policy revenues and future expected investment income on assets supporting the policies. Investment returns are projected using the current asset portfolios and projected reinvestment strategies. Experience gains and losses are reported when current period activity differs from what was assumed in the policy liabilities at the beginning of the period. We classify gains and losses by assumption type. For example, current period investing activities that increase (decrease) the future expected investment income on assets supporting the policies will result in an investment-related experience gain (loss).

Public Equity Risk and Interest Rate Risk Reduction Plans

At December 31, 2013 between 64 per cent and 82 per cent of our underlying earnings sensitivity to a 10 per cent decline in equity markets was offset by hedges and the impact of a 100 basis point decline in interest rates on our earnings was $400 million. See “Risk Management and Risk Factors” below.

Fourth Quarter Financial Highlights

| | | | | | | | | | | | | | |

For the quarters ended December 31, (C$ millions, except per share amounts) | | 2013 | | | restated(1)

2012 | | | 2011 | | | |

Net income (loss) attributed to shareholders | | $ | 1,297 | | | $ | 1,077 | | | $ | (69 | ) | | |

Core earnings(2)(see table below for reconciliation) | | $ | 685 | | | $ | 554 | | | $ | 373 | | | |

Diluted earnings (loss) per common share (C$) | | $ | 0.68 | | | $ | 0.57 | | | $ | (0.05 | ) | | |

Diluted core earnings per common share (C$)(2) | | $ | 0.35 | | | $ | 0.28 | | | $ | 0.19 | | | |

Return on common shareholders’ equity (annualized) | | | 20.2% | | | | 19.2% | | | | (1.6)% | | | |

Sales(2) | | | | | | | | | | | | | | |

Insurance products(3) | | $ | 617 | | | $ | 922 | | | $ | 619 | | | |

Wealth products | | $ | 12,241 | | | $ | 10,439 | | | $ | 8,141 | | | |

Premiums and deposits(2) Insurance products | | $ | 6,169 | | | $ | 6,629 | | | $ | 5,749 | | | |

Wealth products | | $ | 15,367 | | | $ | 17,499 | | | $ | 10,168 | | | |

| (1) | The 2012 results were restated to reflect the retrospective application of new IFRS accounting standards effective January 1, 2013. For a detailed description of the change see note 2 to the 2013 Consolidated Financial Statements. The 2011 results were not required to be restated. |

| (2) | This item is a non-GAAP measure. See “Performance and Non-GAAP Measures” below. |

| (3) | Insurance sales have been adjusted to exclude Taiwan for all periods. |

Net Income Attributed to Shareholders

Manulife reported fourth quarter 2013 net income attributed to shareholders of $1,297 million and core earnings of $685 million. Net income attributed to shareholders increased $220 million compared with the fourth quarter of 2012, of which $131 million was driven by higher core earnings and $89 million related to other items.

| 6 | This item is a non-GAAP measure. See “Performance and Non-GAAP Measures” below. |

| | | | |

| | Manulife Financial Corporation 2013 Management’s Discussion and Analysis | | 8 |

The $131 million increase in core earnings was driven by increased new business margins in North America, higher fee income due to growth in our asset management businesses, lower hedging costs and net modestly favourable currency impacts, partially offset by higher legal and variable compensation accruals. Core earnings in the fourth quarter of both 2013 and 2012 included favourable policy related experience and favourable tax related items.

Items excluded from core earnings in the fourth quarter of 2013 netted to a gain of $612 million and included $215 million of favourable investment-related experience (in excess of the $50 million included in core earnings), a $350 million gain on the sale of our Taiwan insurance business, and $261 million related to policyholder approved changes to the investment objectives of separate accounts that support our Variable Annuity products in the U.S., as well as a reinsurance recapture transaction in Asia. These items were partially offset by an $81 million net charge related to the direct impact of equity markets and interest rates and variable annuity guarantee liabilities that are dynamically hedged, and $133 million related to changes in actuarial methods and assumptions of which $69 million resulted from our review of our modeling of future tax cash flows for our U.S. Variable Annuity business and the remainder from other modeling refinements. Items excluded from core earnings in the fourth quarter of 2012 netted to a gain of $523 million.

Analysis of Net Income

The table below reconciles the fourth quarter 2013 core earnings of $685 million to the reported net income attributed to shareholders of $1,297 million.

| | | | | | | | | | |

| (C$ millions, unaudited) | | 4Q 2013 | | | restated(1)

4Q 2012 | | | |

Core earnings(2) | | | | | | | | | | |

Asia Division(3) | | $ | 227 | | | $ | 180 | | | |

Canadian Division(3) | | | 233 | | | | 233 | | | |

U.S. Division(3) | | | 366 | | | | 293 | | | |

Corporate and Other (excluding expected cost of macro hedges and core investment gains) | | | (138 | ) | | | (62 | ) | | |

Expected cost of macro hedges(3),(4) | | | (53 | ) | | | (140 | ) | | |

Investment-related experience in core earnings(5) | | | 50 | | | | 50 | | | |

Core earnings | | $ | 685 | | | $ | 554 | | | |

Investment-related experience in excess of amounts included in core earnings(5) | | | 215 | | | | 321 | | | |

Core earnings plus investment-related experience in excess of amounts included in core earnings | | $ | 900 | | | $ | 875 | | | |

Other items to reconcile core earnings to net income attributed to shareholders: | | | | | | | | | | |

(Charges) gains on direct impact of equity markets and interest rates and variable annuity guarantee liabilities that are dynamically hedged (see table below)(5),(6) | | | (81 | ) | | | 82 | | | |

Changes in actuarial methods and assumptions(7) | | | (133 | ) | | | (87 | ) | | |

Disposition of Taiwan insurance business | | | 350 | | | | – | | | |

Impact of in-force product changes and recapture of a reinsurance treaty(8) | | | 261 | | | | – | | | |

Restructuring charge related to organizational design | | | – | | | | (57 | ) | | |

Material and exceptional tax related items | | | – | | | | 264 | | | |

Net income attributed to shareholders | | $ | 1,297 | | | $ | 1,077 | | | |

| (1) | The 2012 results were restated to reflect the retrospective application of new IFRS accounting standards effective January 1, 2013. For a detailed description of the change see note 2 to the 2013 Consolidated Financial Statements. |

| (2) | This is a non-GAAP measure. See “Performance and Non-GAAP Measures” below. |

| (3) | The fourth quarter 2013 decrease in the expected cost of macro hedges compared with the fourth quarter 2012 was partially offset by increases in dynamic hedging costs included in core earnings across all divisions. |

| (4) | The fourth quarter 2013 net loss from macro equity hedges was $285 million and consisted of a $53 million charge related to the estimated expected cost of the macro equity hedges relative to our long-term valuation assumptions and a charge of $232 million because actual markets outperformed our valuation assumptions. This latter amount is included in the direct impact of equity markets and interest rates. |

| (5) | As outlined under “Critical Accounting and Actuarial Policies” below, net insurance contract liabilities under IFRS for Canadian insurers are determined using CALM. Under CALM, the measurement of policy liabilities includes estimates regarding future expected investment income on assets supporting the policies. Experience gains and losses are reported when current period activity differs from what was assumed in the policy liabilities at the beginning of the period. These gains and losses can relate to both the investment returns earned in the period, as well as to the change in our policy liabilities driven by the impact of current period investing activities on future expected investment income assumptions. |

| (6) | The direct impact of equity markets and interest rates is relative to our policy liability valuation assumptions and includes changes to interest rate assumptions, including a quarterly URR update for North America, starting in the first quarter of 2013, and for Japan, starting in the third quarter of 2013, as well as experience gains and losses on derivatives associated with our macro equity hedges. We also include gains and losses on the sale of available-for-sale (“AFS”) bonds and derivative positions in the surplus segment. See table below for components of this item. |

| (7) | The fourth quarter 2013 charge of $133 million was primarily attributable to the impact of method and modeling refinements of which $69 million resulted from our review of our modeling of future tax cash flows for our U.S. Variable Annuity business and the remainder from other modeling refinements. |

| (8) | The fourth quarter 2013 gain of $261 million included $193 million related to policyholder approved changes to the investment objectives of separate accounts that support our Variable Annuity products in the U.S. and $68 million related to a recapture of a reinsurance treaty in Asia. |

| | | | |

| 9 | | Manulife Financial Corporation 2013 Management’s Discussion and Analysis | | |

The gain (charge) related to the direct impact of equity markets and interest rates and variable annuity guarantee liabilities that are dynamically hedged in the table above is attributable to:

| | | | | | | | | | |

| (C$ millions, unaudited) | | 4Q 2013 | | | 4Q 2012 | | | |

Variable annuity guarantee liabilities that are dynamically hedged(1) | | $ | 101 | | | $ | 100 | | | |

Variable annuity guarantee liabilities that are not dynamically hedged | | | 155 | | | | 556 | | | |

General fund equity investments supporting policy liabilities and on fee income(2) | | | 81 | | | | 48 | | | |

Macro equity hedges relative to expected costs(3) | | | (232 | ) | | | (292 | ) | | |

Direct impact of equity markets and variable annuity guarantees that are dynamically hedged(4) | | $ | 105 | | | $ | 412 | | | |

Fixed income reinvestment rates assumed in the valuation of policy liabilities(5) | | | (105 | ) | | | (290 | ) | | |

Sale of AFS bonds and derivative positions in the Corporate and Other segment | | | (55 | ) | | | (40 | ) | | |

Charges due to lower fixed income URR assumptions used in the valuation of policy liabilities(6) | | | (26 | ) | | | – | | | |

Direct impact of equity markets and interest rates and variable annuity guarantees that are dynamically hedged | | $ | (81 | ) | | $ | 82 | | | |

Direct impact of equity markets and interest rates | | $ | (182 | ) | | $ | (18 | ) | | |

| (1) | Our variable annuity guarantee dynamic hedging strategy is not designed to completely offset the sensitivity of policy liabilities to all risks associated with the guarantees embedded in these products. The gain in the fourth quarter of 2013 was primarily due to our equity fund results outperforming indices, and a gain on the release of provision for adverse deviation associated with more favourable equity markets. See “Risk Management and Risk Factors” below. |

| (2) | The impact on general fund equity investments supporting policy liabilities and on fee income includes the capitalized impact on fees for variable universal life policies. |

| (3) | As described in the previous table, we incurred a charge of $232 million because actual markets outperformed our valuation assumptions. |

| (4) | In the fourth quarter of 2013, gross equity exposure gains of $1,017 million were partially offset by gross equity hedging charges of $232 million from macro hedge experience and charges of $680 million from dynamic hedging experience which resulted in a gain of $105 million. |

| (5) | The charge in the fourth quarter of 2013 for fixed income reinvestment assumptions was driven by a decrease in corporate spreads in North America. |

| (6) | Beginning with the first quarter of 2013 for North America and the third quarter of 2013 for Japan, the URR impact was calculated on a quarterly basis, whereas in 2012, it was calculated on an annual basis in the second quarter. |

Sales7

Insurance sales of $617 million in the fourth quarter of 2013 decreased 32 per cent8 compared with the fourth quarter of 2012. While we reported record quarterly sales in Hong Kong and Indonesia, overall sales were lower due to the high level of sales in Japan in fourth quarter 2012 in advance of product changes and normal variability of sales in Canadian Group Benefits. As a result, sales in Asia and Canada declined five per cent and 59 per cent, respectively. In the U.S., insurance sales decreased 21 per cent reflecting our actions to increase margins.

Wealth sales exceeded $12 billion in the fourth quarter of 2013, an increase of 15 per cent compared with the fourth quarter of 2012. In Asia, fourth quarter wealth sales exceeded US$1.5 billion, a decline of 18 per cent from a fourth quarter of 2012 that benefited from a successful fund launch in Japan and the start of Hong Kong MPF’s Employee Choice Arrangement. Fourth quarter Canadian and U.S. wealth sales reported year-over-year growth of 24 per cent and 22 per cent, respectively, driven by continued strong mutual fund sales and also included a 79 per cent increase in Canadian Group Retirement Solutions sales.

| 7 | This is a non-GAAP measure. See “Performance and Non-GAAP Measures” below. |

| 8 | Growth (declines) in sales, premiums and deposits and funds under management are stated on a constant currency basis. Constant currency basis is a non-GAAP measure. See “Performance and Non-GAAP Measures” below. |

| | | | |

| | Manulife Financial Corporation 2013 Management’s Discussion and Analysis | | 10 |

Performance by Division

Asia Division

Manulife Financial has a demonstrated business expertise in Asia dating back more than 100 years. Since issuing our first Asian policy in Shanghai in 1897, we have pursued strong, sustained growth and remained a leading provider of financial protection and wealth management products in Asia. We are relentlessly focused on helping our Asian customers prepare for their futures, and that focus drives our growth strategy and underpins our commitment to the region. We are diversified across Asia, including some of the world’s largest and fastest-growing economies, with operations in Hong Kong, Japan, Indonesia, the Philippines, Singapore, China, Taiwan, Vietnam, Malaysia, Thailand, Macau and Cambodia. We now have more than 57,000 contracted agents selling our products and have expanded our distribution capabilities to include more than 100 bank partnerships and more than 500 dealers, independent agents and brokers.

In 2013, Asia Division contributed 19 per cent of total premiums and deposits and, as at December 31, 2013, accounted for 13 per cent of the Company’s funds under management.

Financial Performance

Asia Division’s net income attributed to shareholders was US$2,451 million in 2013 compared to US$1,979 million for 2012. The increase was driven by the gain on the sale of our Taiwan insurance business and higher earnings from the direct impact of equity markets and interest rates and other investment-related items, partially offset by a decrease in core earnings, primarily related to changes in currency rates.

Core earnings of US$893 million decreased by US$70 million primarily related to changes in currency rates. On a currency neutral basis, the favourable impact on core earnings from the growth in in-force business was more than offset by higher dynamic hedging costs and the high new business margins reported in the first half of 2012 in Japan in advance of tax changes. Sales of these high margin products significantly declined following the tax changes.

On a Canadian dollar basis, the net income attributed to shareholders for 2013 was $2,519 million compared to $1,969 million reported a year earlier.

The table below reconciles core earnings to net income (loss) attributed to shareholders for Asia Division for 2013, 2012 and 2011.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the years ended December 31, | | Canadian $ | | | | | US $ | |

| ($ millions) | | 2013 | | | 2012 | | | 2011 | | | | | 2013 | | | 2012 | | | 2011 | |

Core earnings(1) | | $ | 921 | | | $ | 963 | | | $ | 938 | | | | | $ | 893 | | | $ | 963 | | | $ | 950 | |

Items to reconcile core earnings to net income attributed to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | | | |

Direct impact of equity markets and interest rates and variable annuity guarantee liabilities that are dynamically hedged(2) | | | 1,164 | | | | 911 | | | | (1,190 | ) | | | | | 1,142 | | | | 920 | | | | (1,217 | ) |

Investment-related experience related to fixed income trading, market value increases in excess of expected alternative assets investment returns, asset mix changes and credit experience | | | 16 | | | | 55 | | | | 204 | | | | | | 18 | | | | 56 | | | | 205 | |

Favourable impact of enacted tax rate changes | | | – | | | | 40 | | | | – | | | | | | – | | | | 40 | | | | – | |

Disposition of Taiwan insurance business | | | 350 | | | | – | | | | – | | | | | | 334 | | | | – | | | | – | |

Impact of recapture of a reinsurance treaty | | | 68 | | | | – | | | | – | | | | | | 64 | | | | – | | | | – | |

Net income (loss) attributed to shareholders | | $ | 2,519 | | | $ | 1,969 | | | $ | (48 | ) | | | | $ | 2,451 | | | $ | 1,979 | | | $ | (62 | ) |

| (1) | This item is non-GAAP measure. See “Performance and Non-GAAP Measure” below. |

| (2) | The direct impact of equity markets and interest rates is relative to our policy liability valuation assumptions and includes changes to interest rate assumptions. The net gain of C$1,192 million in 2013 (2012 – net gain of C$906 million) consisted of a C$1,057 million gain (2012 – C$946 million gain) related to variable annuities that are not dynamically hedged, a C$60 million gain (2012 – C$70 million gain) on general fund equity investments supporting policy liabilities and on fee income and a C$75 million gain (2012 – C$110 million loss) related to fixed income reinvestment rates assumed in the valuation of policy liabilities and a C$28 million charge (2012 –C$5 million gain) related to variable annuity guarantee liabilities that are dynamically hedged. The amount of variable annuity guaranteed value that was dynamically hedged at the end of 2013 was 49 per cent (2012 – 14 per cent). Our variable annuity guarantee dynamic hedging strategy is not designed to completely offset the sensitivity of policy liabilities to all risks associated with the guarantees embedded in these products. |

Sales

Asia Division’s insurance salesin 2013 were US$1.0 billion, a decrease of 16 per cent compared with 2012. Sales in Japan of US$400 million were 36 per cent lower in 2013 than the prior year due to the run up in sales of cancer products prior to a tax change in April of last year and lower corporate product sales, a result of pricing actions in late 2012. Indonesia sales of US$120 million increased 18 per cent from 2012, driven by improved agency productivity and by sales generated by Bank Danamon which continue to meet our expectations set when we entered the exclusive relationship. Sales in Hong Kong of US$256 million were in line with 2012 as the favourable impact of 12 per cent more professional agents during 2013 was offset by the higher sales in 2012 related to announced pricing actions. Asia Other insurance sales (Asia excluding Japan, Hong Kong, Indonesia and Taiwan) of US$244 million were five per cent higher than 2012 primarily driven by an expanded agency force in Vietnam.

| | | | |

| 11 | | Manulife Financial Corporation 2013 Management’s Discussion and Analysis | | |

Asia Division’s wealth salesin 2013 were a record US$8.3 billion, an increase of 57 per cent compared with 2012. Japan sales of US$1.9 billion increased 33 per cent from 2012, driven by higher sales of the Strategic Income Fund during the first half of 2013, along with new fund launches in the second half of the year. Indonesia sales of US$974 million were in line with last year. A significant rise in Indonesian interest rates, a drop in the local equity market and depreciation of the Rupiah in the second half of 2013 caused many investors to delay investment decisions. Hong Kong sales of US$1.1 billion increased 44 per cent from 2012, primarily driven by continued momentum in Pension sales following the launch of the Mandatory Provident Fund’s new Employee Choice Arrangement late last year. Asia Other wealth sales (Asia excluding Japan, Hong Kong and Indonesia) reached a record level of US$4.3 billion, almost double 2012 sales, driven by new fund launches in China, higher mutual fund sales in Taiwan and strong single premium unit-linked product sales in the Philippines in the first half of the year.

Sales

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

For the years ended December 31, ($ millions) | | Canadian $ | | | | | US $ | | | |

| | | 2013 | | | | 2012 | | | | 2011 | | | | | | 2013 | | | | 2012 | | | | 2011 | | | |

Insurance products(1) | | $ | 1,052 | | | $ | 1,370 | | | $ | 1,179 | | | | | $ | 1,020 | | | $ | 1,370 | | | $ | 1,193 | | | |

Wealth products | | | 8,536 | | | | 5,690 | | | | 4,131 | | | | | | 8,319 | | | | 5,698 | | | | 4,186 | | | |

| (1) | All periods have been restated to exclude insurance product sales from Taiwan. |

Premiums and Deposits

Premiums and deposits in 2013 were US$16.1 billion, up 29 per cent over 2012 on a constant currency basis.

Insurance premiums and deposits increased by two per cent to US$6.2 billion in 2013 driven by in-force business growth partly offset by a 2012 one-time initial reinsurance premium, the exceptionally high level of cancer product sales prior to tax changes in the first half of 2012 and strong corporate product sales prior to pricing actions in the fourth quarter of 2012 in Japan.

Wealth premiums and deposits increased by 54 per cent to US$9.9 billion, for the same reasons as noted in the wealth sales section above.

Premiums and Deposits

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

For the years ended December 31, ($ millions) | | Canadian $ | | | | | US $ | | | |

| | | 2013 | | | | 2012 | | | | 2011 | | | | | | 2013 | | | | 2012 | | | | 2011 | | | |

Insurance products | | $ | 6,337 | | | $ | 6,650 | | | $ | 5,311 | | | | | $ | 6,154 | | | $ | 6,655 | | | $ | 5,365 | | | |

Wealth products | | | 10,167 | | | | 6,811 | | | | 4,992 | | | | | | 9,908 | | | | 6,822 | | | | 5,057 | | | |

Total premiums and deposits | | $ | 16,504 | | | $ | 13,461 | | | $ | 10,303 | | | | | $ | 16,062 | | | $ | 13,477 | | | $ | 10,422 | | | |

Funds under Management

Asia Division funds under management as at December 31, 2013 were US$72.0 billion, an increase of one per cent on a constant currency basis, compared with December 31, 2012. Net policyholder cash flows of US$4.8 billion and favourable investment returns in the past year were mostly offset by the negative impact of a weaker Japanese Yen compared to the U.S. dollar and the sale of our Taiwan insurance business.

Funds under Management

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As at December 31, | | Canadian $ | | | | | US $ | | | |

($ millions) | | | 2013 | | | | 2012 | | | | 2011 | | | | | | 2013 | | | | 2012 | | | | 2011 | | | |

General funds | | $ | 34,756 | | | $ | 37,798 | | | $ | 34,757 | | | | | $ | 32,680 | | | $ | 38,002 | | | $ | 34,172 | | | |

Segregated funds | | | 23,568 | | | | 23,435 | | | | 23,524 | | | | | | 22,160 | | | | 23,558 | | | | 23,130 | | | |

Mutual and other funds | | | 18,254 | | | | 16,480 | | | | 13,109 | | | | | | 17,164 | | | | 16,563 | | | | 12,889 | | | |

Total funds under management | | $ | 76,578 | | | $ | 77,713 | | | $ | 71,390 | | | | | $ | 72,004 | | | $ | 78,123 | | | $ | 70,191 | | | |

Strategic Direction

Asia Division continues to build a premier pan-Asian insurance and wealth franchise that is well positioned to meet the evolving protection, savings and retirement needs of the customers in the region. Our core strategy focuses on expanding our professional agency force and alternative channel distribution, building and expanding our portfolio of products in wealth and protection, as well as investing in our brand across Asia. We remain committed to grow our wealth and asset management businesses to leverage our asset management capabilities.

In 2013, we further expanded our network of bank partnerships, highlighted by our exclusive agreement with Alliance Bank in Malaysia, achieved solid growth in our professional agency force in key markets and strengthened our brand awareness in Asia through various brand building campaigns and activities. We also acquired a 100 per cent interest in MAAKL Mutual Bhd, lifting our asset management franchise in Malaysia to a Top 10 market position9.

| 9 | Based on pro-forma Lipper rankings of all private unit trust funds in Malaysia as at December 31, 2013. |

| | | | |

| | Manulife Financial Corporation 2013 Management’s Discussion and Analysis | | 12 |

In Hong Kong, we continue to execute our growth strategy based on diversified product offerings and broadened distribution capabilities. Our professional agency force now exceeds 6,200, and we signed up two new brokerage partners to distribute our insurance products. We successfully executed on the new Employee Choice Arrangement within the Mandatory Provident Fund business, and improved our market share from 17.0% to 17.7%10. We also launched a suite of new protection products, including a medical product targeting the high net-worth segment and three new critical illness products. On the technology side, we continue to make progress in rolling out our mobile point of sales platform, which enables our advisors to perform financial planning analysis and complete an insurance application electronically.

In Japan, we focused on growing the number of captive agents, maintaining our strong momentum in the corporate market and continuing the build out of the retail business in the independent agent channel. Our mutual fund business grew significantly with a series of new fund launches and expansion of the distributor network. We are well placed to take advantage of the new Nippon Individual Savings Account program to further grow our mutual fund business in 2014.

In Indonesia, we continued to expand our distribution network and product mix. In 2013, we achieved double digit insurance sales growth over the prior year despite a challenging economic environment in the second half of the year. Growth in our professional agency force was relatively flat, as we shifted our strategy to focus on enhancing productivity and professionalism. Our partnership with Bank Danamon that began in July 2012 delivered strong results, consistent with our expectations. We plan to launch a series of new products in 2014 to cater to the growing protection and investment needs of the middle class. We also launched a series of branding campaigns in 2013 to further our brand awareness in the market.

In the Other Asia territories, we continued investing to expand and diversify our distribution channels, as well as develop our wealth and asset management businesses. We achieved a record number of agents in 2013 in the Philippines, Vietnam and Thailand. We also significantly grew our wealth sales through our bank partners in the Philippines, Malaysia and Thailand. In China, Manulife Sinochem is now licensed in 51 cities (2012 – 50 cities) within 14 provinces and municipalities, one of the broadest geographic footprints among foreign joint venture insurance companies. Our focus in China has shifted to enhancing the productivity and professionalism of our agency force. We have also recently expanded into bancassurance and direct distribution channels, and we are exploring ways to capitalize on potential pension and mutual fund distribution opportunities in China.

| 10 | The calculation of market share is based on the Aggregate Net Asset Values of all Mandatory Provident Fund Schemes (including assets transferred from Occupational Retirement Schemes) as at September 30, 2013, as published in the Statistical Digest by the Mandatory Provident Fund Schemes Authority. |

| | | | |

| 13 | | Manulife Financial Corporation 2013 Management’s Discussion and Analysis | | |

Canadian Division

Serving one in five Canadians, Canadian Division is one of the leading financial services organizations in Canada. We offer a broad portfolio of protection, estate planning, investment and banking solutions through a diversified independent distribution network, supported by a team of more than 8,700 employees.

Our Individual Insurance business offers a broad portfolio of insurance products, including universal, whole and term life, as well as living benefits insurance, designed to meet protection, estate and retirement planning needs for middle- and upper-income customers. Manulife Investments offers a range of investment products and services that span the investor spectrum, from those just starting to build their financial portfolio to individuals and families with complex retirement and estate planning needs, while Manulife Private Wealth provides personalized investment management, private banking and estate solutions to affluent clients. Manulife Bank helps Canadians with flexible debt and cash flow management solutions as part of their financial plan. We provide group life, health, disability and retirement solutions to Canadian employers; more than 19,000 Canadian businesses and organizations entrust their employee benefit programs to Manulife’s Group Benefits. Life, health and specialty products, such as travel insurance, are also offered through alternative distribution channels, including sponsor groups and associations, as well as direct-to-customer marketing.

In 2013, Canadian Division contributed 24 per cent of the Company’s total premiums and deposits and, as at December 31, 2013, accounted for 24 per cent of the Company’s funds under management.

Financial Performance

Canadian Division’s net income attributed to shareholders was $828 million in 2013 compared with $1,169 million in 2012. The decline was primarily related to the favourable impacts in 2012 of a major reinsurance transaction and reserve releases due to segregated funds product changes, as well as the unfavourable direct impact of interest rates on the valuation of policy liabilities in 2013.

Core earnings were $905 million in 2013 compared with $835 million in 2012. The $70 million increase in core earnings was driven by growth of in-force business, including higher fee income on higher assets under management; higher new business margins, due to price increases and higher interest rates; and improvements in operational efficiency. These increases were partially offset by unfavourable policyholder experience and a lower release of tax provisions related to the closure of prior years’ tax filings.

The table below reconciles core earnings to the net income attributed to shareholders for Canadian Division for 2013, 2012 and 2011.

| | | | | | | | | | | | | | | | | | |

For the years ended December 31, (C$ millions) | | 2013 | | | | | 2012 | | | | | 2011 | | | |

Core earnings(1),(2) | | $ | 905 | | | | | $ | 835 | | | | | $ | 849 | | | |

Items to reconcile core earnings to net income attributed to shareholders: | | | | | | | | | | | | | | | | | | |

Impact of recapture of a reinsurance treaty and in-force product changes(3) | | | – | | | | | | 259 | | | | | | – | | | |

Direct impact of equity markets and interest rates and variable annuity guarantee liabilities that are dynamically hedged(4) | | | (40 | ) | | | | | 85 | | | | | | (266 | ) | | |

Investment gains related to fixed income trading, market value increases in excess of expected alternative assets investment returns, asset mix changes and credit experience | | | (34 | ) | | | | | (10 | ) | | | | | 344 | | | |

Impact of change in marginal tax rate(5) | | | (3 | ) | | | | | – | | | | | | – | | | |

Net income attributed to shareholders | | $ | 828 | | | | | $ | 1,169 | | | | | $ | 927 | | | |

| (1) | The Company moved the reporting of its International Group Program business unit from the U.S. Division to the Canadian Division in 2012. Prior period results have been restated to reflect this change. |

| (2) | Core earnings is a non-GAAP measure. See “Performance and Non-GAAP Measures” below. |

| (3) | The $259 million gain in 2012 included $137 million related to the recapture of a reinsurance treaty and $122 million related to in-force segregated funds product changes. |

| (4) | The direct impact of equity markets and interest rates is relative to our policy liability valuation assumptions and includes changes to interest rate assumptions. The loss of $40 million in 2013 (2012 – $85 million gain) consisted of a $28 million gain (2012 – nil) on general fund equity investments supporting policy liabilities, a $187 million loss (2012 – $31 million gain) related to fixed income reinvestment rates assumed in the valuation of policy liabilities, a $12 million gain (2012 – $4 million gain) related to unhedged variable annuities and a $107 million gain (2012 – $50 million gain) related to variable annuity guarantee liabilities that are dynamically hedged. The amount of variable annuity guaranteed value that was dynamically hedged at the end of 2013 was 92 per cent (2012 – 86 per cent). Our variable annuity guarantee dynamic hedging strategy is not designed to completely offset the sensitivity of policy liabilities to all risks associated with the guarantees embedded in these products. |

| (5) | Impact of enacted or substantially enacted income tax rate changes. |

Sales

Sales of wealth products in 2013 were a record $12.1 billion, an increase of $2.1 billion or 21 per cent from 2012 levels driven by record mutual fund deposits and strong sales in Group Retirement Solutions (“GRS”). Manulife Bank’s new loan volumes declined modestly from 2012 reflecting an industry-wide slowdown in the retail mortgage market and a highly competitive environment. Sales of segregated funds11 and Individual Insurance continued to reflect the impact of our deliberate product re-positioning away from long duration guarantees.

| 11 | Segregated fund products include guarantees. These products are also referred to as variable annuities. |

| | | | |

| | Manulife Financial Corporation 2013 Management’s Discussion and Analysis | | 14 |

Gross mutual fund deposits of $6.6 billion were 60 per cent higher than 2012 levels. The sales success reflects our expanded distribution reach and strong fund performance, leveraging our global asset management expertise across a diverse global platform. GRS ranked second12 in the Canadian group retirement industry for the first three quarters of 2013 and had sales of $1.4 billion in 2013, 25 per cent higher than 2012 levels. Manulife Bank achieved record net lending assets of $19 billion at December 31, 2013, up nine per cent from 2012 due to continued favourable retention and new lending volumes of $4.1 billion for the year. Fixed product sales of $379 million increased 25 per cent compared with 2012, while segregated fund sales of $1.5 billion were 28 per cent lower than in 2012.

Insurance sales for 2013 were $1.1 billion, 14 per cent lower than our record 2012 sales. Sales in both 2013 and 2012 included significant one-time single premium sales. Excluding these single premium sales, insurance sales decreased eight per cent from 2012. Group Benefits led the market in sales12 for the first three quarters of 2013. Sales in Individual Insurance declined by one per cent as we continued to reduce exposure to long-term guarantees.

Sales

For the years ended December 31,

| | | | | | | | | | | | |

| (C$ millions) | | 2013 | | | 2012 | | | 2011 | |

Insurance products | | $ | 1,125 | | | $ | 1,310 | | | $ | 658 | |

Wealth products | | | 12,133 | | | | 10,057 | | | | 10,784 | |

Premiums and Deposits

Canadian Division premiums and deposits of $21.2 billion in 2013 grew 17 per cent from $18.1 billion in 2012. The increase was driven by record mutual fund deposits and growth in our group retirement business driven by sales and deposits from a growingin-force block of plan participants.

Premiums and Deposits

For the years ended December 31,

| | | | | | | | | | | | |

| (C$ millions) | | 2013 | | | 2012 | | | 2011 | |

Insurance products | | $ | 10,552 | | | $ | 10,310 | | | $ | 9,603 | |

Wealth products | | | 10,620 | | | | 7,809 | | | | 8,213 | |

Total premiums and deposits | | $ | 21,172 | | | $ | 18,119 | | | $ | 17,816 | |

Funds under Management

Funds under management of $145.2 billion as at December 31, 2013 grew by $12.0 billion or nine per cent from $133.2 billion at December 31, 2012 driven by business growth in our wealth management business.

Funds under Management

As at December 31,

| | | | | | | | | | | | |

| (C$ millions) | | 2013 | | | 2012 | | | 2011 | |

General fund | | $ | 80,611 | | | $ | 79,961 | | | $ | 73,926 | |

Segregated funds | | | 51,681 | | | | 44,701 | | | | 40,826 | |

Mutual and other funds | | | 27,560 | | | | 20,675 | | | | 17,708 | |

Less mutual funds held by segregated funds | | | (14,641 | ) | | | (12,138 | ) | | | (10,333 | ) |

Total funds under management | | $ | 145,211 | | | $ | 133,199 | | | $ | 122,127 | |

Strategic Direction

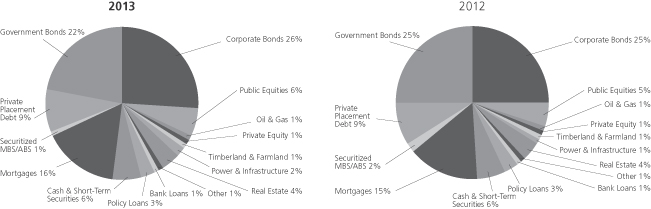

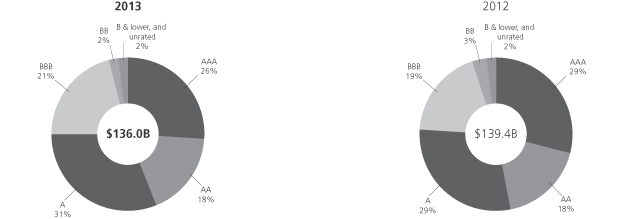

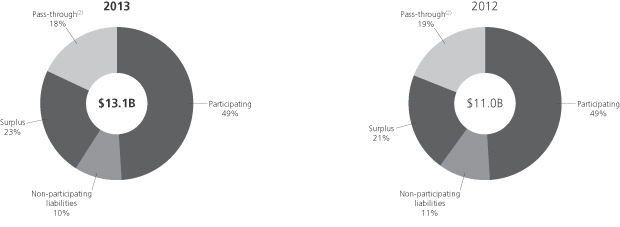

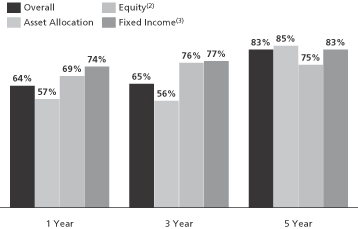

Our strategic aspiration is to be the trusted partner for broad-based integrated financial solutions in Canada. We have realigned our organization to facilitate a more unified approach to enhancing our customer focus in everything we do. We will continue to leverage our historic core competencies of product innovation, distribution excellence and service quality to meet our customers’ needs in the manner suited to them. We have built a large customer base and strong market positions in our core businesses. Through disciplined, risk-appropriate growth, we aim to achieve scale in our less mature businesses and maintain or improve market share in our core businesses in order to deliver high quality sustainable earnings and shareholder value.