BOARDCOMPENSATION

(4) As of February 28, 2019, ournon-employee directors had DSUs and unvested RSAs representing the right to receive the following number of shares of common stock: Mr. Abbasi—31,823, Dr. Albrecht—15,392, Ms. Begley—1,710, Dr. Gupta—46,284, Ms. Hammonds—1,710, Mr. Kaiser—8,900, Mr. Murai—2,389 and Mr. Zollar—2,448.

(5) During Fiscal 2019, Mr. Abbasi was eligible to receive $110,000 in cash compensation and an annual RSA valued at $250,000. Mr. Abbasi elected to receive DSUs in lieu of his cash compensation and annual RSA. The stock awards total in the table includes $372 of value realized as a result of issuing grants rounded up to the nearest whole share.

(6) During Fiscal 2019, Dr. Albrecht received $107,500 in cash compensation and an annual RSA valued at $250,000. Dr. Albrecht elected to receive DSUs in lieu of his annual RSA. The stock awards total in the table includes $36 of value realized as a result of issuing a grant rounded up to the nearest whole share.

(7) During Fiscal 2019, Ms. Begley received $87,500 in cash compensation and an annual RSA valued at $250,000. The stock awards total in the table includes $36 of value realized as a result of issuing a grant rounded up to the nearest whole share.

(8) During Fiscal 2019, Dr. Gupta received $135,000 in cash compensation and an annual RSA valued at $250,000. Dr. Gupta elected to receive DSUs in lieu of his annual RSA. The stock awards total in the table includes $36 of value realized as a result of issuing a grant rounded up to the nearest whole share.

(9) During Fiscal 2019, Ms. Hammonds received $82,500 in cash compensation and an annual RSA valued at $250,000. The stock awards total in the table includes $36 of value realized as a result of issuing a grant rounded up to the nearest whole share.

(10) During Fiscal 2019, Mr. Kaiser received $75,000 in cash compensation and an annual RSA valued at $250,000. The stock awards total in the table includes $36 of value realized as a result of issuing a grant rounded up to the nearest whole share.

(11) During Fiscal 2019, Mr. Livingstone received $45,951 in cash compensation. Mr. Livingstone retired as a director in Fiscal 2019. He received cash compensation for his service up to his retirement date, but did not receive an annual RSA award.

(12) During Fiscal 2019, Mr. Murai received $24,783 in cash compensation and an initial RSA valued at $300,000. The stock awards total in the table includes $58 of value realized as a result of issuing a grant rounded up to the nearest whole share.

(13) During Fiscal 2019, Mr. Zollar was eligible to receive $56,517 in cash compensation and an initial RSA valued at $300,000. For part of Fiscal 2019, Mr. Zollar elected to receive DSUs in lieu of his cash compensation (DSUs received for $20,000 in cash compensation). Mr. Zollar also received a prorated annual RSA valued at $41,667. The stock awards total in the table includes $138 of value realized as a result of issuing grants rounded up to the nearest whole share.

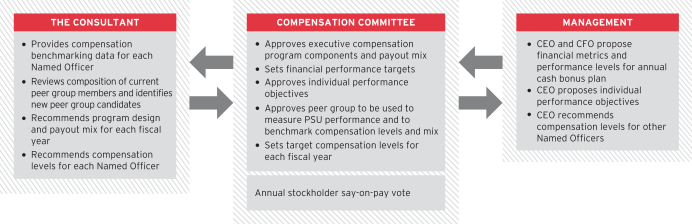

PROCESS FOR SETTING DIRECTOR COMPENSATION

The Compensation Committee reviews ournon-employee director compensation program annually and works with the Consultant to design and update the Director Compensation Plan to keep our compensation levels competitive so that the Company may attract and retain directors with the combination of attributes, experience and skills needed for the Board to operate effectively. In making decisions regardingnon-employee director compensation, the Compensation Committee considers data provided by the Consultant aboutnon-employee director compensation at the companies in our compensation peer group (the composition of our compensation peer group is described in “Executive Compensation-Compensation Discussion and Analysis-Process for Determining Named Officers’ Compensation-Compensation Peer Group”).

INDEMNIFICATION

Each director has entered into an indemnification agreement with the Company. The indemnification agreements are on substantially the same terms as the indemnification agreements that the Company has entered into with the Named Officers, as described in the section entitled “Executive Compensation—Employment and Indemnification Arrangements with Named Officers—Indemnification.”

DIRECTOR STOCK OWNERSHIP REQUIREMENTS

We have a Stock Ownership Policy that applies to our non-employee directors. During Fiscal 2019 this Stock Ownership Policy was amended to set the stock ownership level for each non-employee director at 2,500 shares, an ownership level based on a multiple of the cash retainer for service as a Board member in place at the beginning of Fiscal 2019. The ownership levels were adjusted to account for the almost 90% increase in Red Hat’s stock price since the levels were previously set. As of the end of Fiscal 2019, each of our non-employee directors was in compliance with the Stock Ownership Policy. Our Stock Ownership Policy is described in the section entitled “Executive Compensation—Compensation Discussion and Analysis—Compensation Policies and Practices—Stock Ownership Requirements.”

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The Compensation Committee is composed entirely of independent directors, as was the case at all times during Fiscal 2019. At the beginning of Fiscal 2019, Mr. Abbasi, Dr. Gupta, Ms. Hammonds and Mr. Livingstone were members of the Compensation Committee. Mr. Livingstone did not stand for re-election at the 2018 Annual Meeting and left the committee when his term ended in August 2018. In February 2019, Mr. Murai joined the Compensation Committee. No member of the Compensation Committee (i) was during Fiscal 2019 or is currently an employee of the Company, (ii) has ever been an officer of the Company, (iii) is or was a participant in a “related person” transaction as described in the section entitled “Key Governance Policies—Policies and Procedures for Related Person Transactions—Related Person Transactions for Fiscal 2019” or (iv) is an executive officer of another entity, at which one of our executive officers serves on the compensation committee or the board of directors. None of our executive officers serves as a member of the board of directors or on the compensation committee, or other committee serving an equivalent function, of any entity that has one or more executive officers who serve as members of our Board or our Compensation Committee.

| | | | | | |

| | | |

| | 19 |

Financial Expertise. Assists us in understanding, advising on and overseeing our capital structure, financing and investing activities and our financial reporting and internal controls

Financial Expertise. Assists us in understanding, advising on and overseeing our capital structure, financing and investing activities and our financial reporting and internal controls Global Expertise. Brings us business and cultural perspectives that relate to many significant aspects of our global business

Global Expertise. Brings us business and cultural perspectives that relate to many significant aspects of our global business IT Industry Expertise. Helps us to analyze our research and development efforts, competing technologies, the various products and processes that we develop and the market segments in which we compete

IT Industry Expertise. Helps us to analyze our research and development efforts, competing technologies, the various products and processes that we develop and the market segments in which we compete Public Company Board Experience. Offers us advice and insights with regard to the dynamics and operation of a board of directors, the relations of a board with senior management, and oversight of a changing mix of strategic, operational and compliance-related matters

Public Company Board Experience. Offers us advice and insights with regard to the dynamics and operation of a board of directors, the relations of a board with senior management, and oversight of a changing mix of strategic, operational and compliance-related matters Senior Leadership Experience. Provides us with insight and guidance and brings us an understanding of organizations, processes, strategy, risk management and methods to drive change and growth

Senior Leadership Experience. Provides us with insight and guidance and brings us an understanding of organizations, processes, strategy, risk management and methods to drive change and growth Technology and Innovation Experience. Supports us in our efforts to develop new ideas and products

Technology and Innovation Experience. Supports us in our efforts to develop new ideas and products

THE BOARD OF DIRECTORS

THE BOARD OF DIRECTORS

IF VOTING BY MAIL, SIGN, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE.

IF VOTING BY MAIL, SIGN, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE.