UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

InterMune, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

INTERMUNE, INC.

3280 Bayshore Boulevard

Brisbane, California 94005

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 10, 2011

To the Stockholders of InterMune, Inc.:

Notice is hereby given that the Annual Meeting of Stockholders (“Annual Meeting”) ofINTERMUNE, INC., a Delaware corporation (the “Company”), will be held on Tuesday, May 10, 2011, at 10:00 a.m. local time, at 3280 Bayshore Boulevard, Brisbane, California for the following purposes:

1. To elect two directors to hold office until the 2014 annual meeting of stockholders or until their successors are elected;

2. To ratify the selection, by the Audit and Compliance Committee of the Board of Directors, of Ernst & Young LLP as the independent registered public accounting firm of the Company for the year ending December 31, 2011;

3. To approve an amendment to the Company’s Amended and Restated 2000 Equity Incentive Plan to increase the aggregate number of shares of common stock authorized for issuance under the plan by 1,950,000 shares;

4. To hold an advisory vote on executive compensation;

5. To hold an advisory vote on the frequency of an advisory vote on executive compensation; and

6. To transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

The Board of Directors has fixed the close of business on March 31, 2011, as the record date for the determination of stockholders entitled to notice of and to vote at this Annual Meeting and at any adjournment or postponement thereof.

|

By Order of the Board of Directors |

|

/s/ Robin Steele |

Robin Steele |

Secretary |

Brisbane, California

April 13, 2011

All stockholders are cordially invited to attend the meeting in person. Whether or not you expect to attend the meeting, please complete, date, sign and return the enclosed proxy card as promptly as possible in order to ensure your representation at the meeting. A return envelope (which is postage prepaid if mailed in the United States) is enclosed for that purpose. Alternatively, you may vote your shares on the Internet or by telephone by following the instructions in the proxy statement. If your shares are held in an account at a brokerage firm, bank or other nominee, you may be able to vote on the Internet or by telephone by following the instructions provided with your voting form. Even if you have already voted your proxy, you may still vote in person if you attend the meeting. Please note, however, that if your shares are held in an account at a brokerage firm by a broker, bank or other nominee, and you wish to vote at the meeting, you must obtain a proxy card issued in your name from the record holder.

INTERMUNE, INC.

3280 Bayshore Boulevard

Brisbane, California 94005

PROXY STATEMENT

PRELIMINARY COPIES FILED PURSUANT TO RULE 14a-6(a)

FOR THE 2011 ANNUAL MEETING OF STOCKHOLDERS

MAY 10, 2011

QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING

Why am I receiving these materials?

We sent you this proxy statement and the enclosed proxy card because the Board of Directors (the “Board”) of InterMune, Inc. (sometimes referred to as the “Company,” “InterMune,” “we,” “our,” or “us”) is soliciting your proxy to vote at the 2011 Annual Meeting of Stockholders (the “Annual Meeting”). You are invited to attend the Annual Meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card, or follow the instructions below to submit your proxy over the telephone or on the Internet.

The Company intends to mail this proxy statement and accompanying proxy card on or about April 13, 2011 to all stockholders of record entitled to vote at the Annual Meeting.

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on March 31, 2011 will be entitled to vote at the Annual Meeting. At the close of business on the record date, there were 59,022,626 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If, at the close of business on March 31, 2011, your shares were registered directly in your name with InterMune’s transfer agent, BNY Mellon Shareowner Services, then you are a stockholder of record. As a stockholder of record, you may vote in person at the meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to fill out and return the enclosed proxy card or vote by proxy over the telephone or on the Internet as instructed below to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker, Bank or Other Agent

If, at the close of business on March 31, 2011, your shares were held in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy card from your broker or other agent.

On what am I voting?

You are being asked to vote on five (5) proposals, as follows:

| | • | | To elect two directors to hold office until the 2014 annual meeting of stockholders or until their successors are elected; |

1

| | • | | To ratify the selection, by the Audit and Compliance Committee of the Board, of Ernst & Young LLP as the independent registered public accounting firm of the Company for the year ending December 31, 2011; |

| | • | | To approve an amendment of the Company’s Amended and Restated 2000 Equity Incentive Plan to increase the aggregate number of shares of common stock authorized for issuance under the plan by 1,950,000 shares; |

| | • | | To approve, on a non-binding, advisory basis, the executive compensation disclosed in this proxy statement; and |

| | • | | To recommend, on a non-binding advisory basis, the frequency of an advisory vote on executive compensation. |

In addition, you are entitled to vote on any other matters that are properly brought before the Annual Meeting.

How do I vote?

You may either vote “For” the nominees to the Board or withhold your vote for the nominees. For Proposal 2, the ratification of the selection of Ernst & Young as the independent registered public accounting firm of the Company for the year ending December 31, 2011; Proposal 3, the amendment to the Company’s Amended and Restated 2000 Equity Incentive Plan; and Proposal 4, the non-binding advisory vote on executive compensation, you may vote “For” or “Against” or abstain from voting. With respect to Proposal 5, the non-binding advisory vote on the frequency of an advisory vote on executive compensation, you may vote for every one year, two years or three years.

For information on how votes are counted for each of the proposals, please see “How many votes are needed to approve each proposal?” below.

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the Annual Meeting, vote by proxy using the enclosed proxy card, vote by proxy over the telephone or vote by proxy on the Internet. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote in person if you have already voted by proxy.

| | • | | To vote in person, please come to the Annual Meeting and we will give you a ballot when you arrive. |

| | • | | To vote using the proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct. |

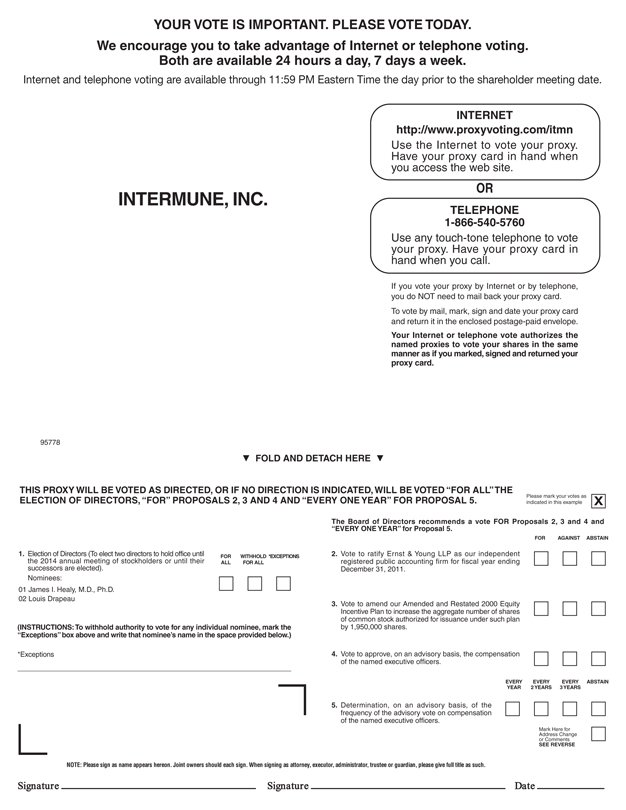

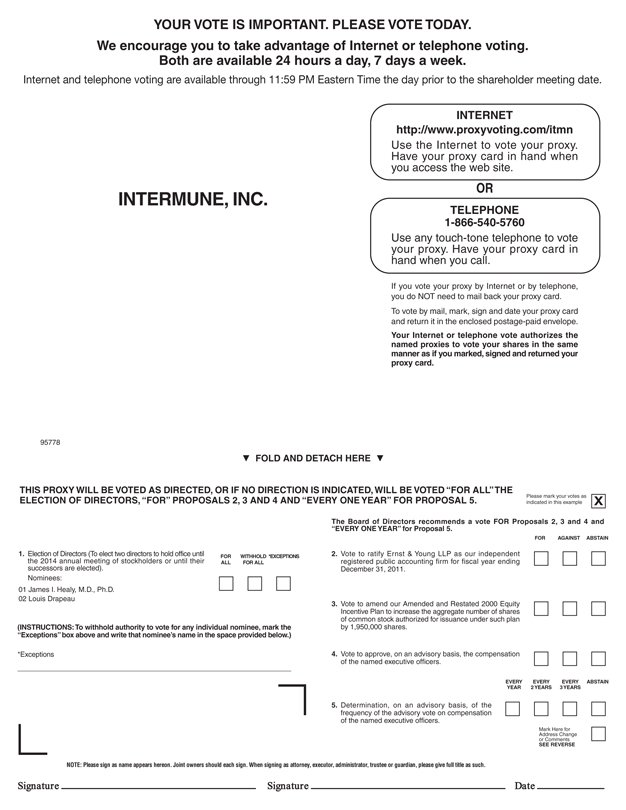

| | • | | To vote over the telephone, dial toll-free 1-866-540-5760 using a touch-tone phone and follow the recorded instructions. Please have your proxy card in hand when you call. Your vote must be received by 11:59 p.m., Eastern Time on May 9, 2011 to be counted. |

| | • | | To vote on the Internet, go to http://www.proxyvoting.com/itmn to complete an electronic proxy card. Please have your proxy card in hand when you log on. Your vote must be received by 11:59 p.m., Eastern Time on May 9, 2011 to be counted. |

Beneficial Owner: Shares Registered in the Name of Broker, Bank or Other Agent

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than from the Company. Simply complete and mail the proxy card to ensure that your vote is counted.

2

Alternatively, you may vote by telephone or over the Internet as instructed by your broker, bank or other agent. To vote in person at the Annual Meeting, you must obtain a valid proxy card from your broker, bank or other agent. Follow the instructions from your broker, bank or other agent included with these proxy materials, or contact your broker, bank or other agent to request a proxy card.

We provide Internet proxy voting to allow you to vote your shares on-line, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of the close of business on March 31, 2011.

What if I return a proxy card but do not make specific choices?

If we receive a signed and dated proxy card and the proxy card does not specify how your shares are to be voted, your shares will be voted “For” the election of each of the two nominees for director; “For” Proposals 2, 3 and 4 and EVERY ONE YEAR regarding the frequency, on an advisory basis, of a vote on executive compensation. If any other matter is properly presented at the meeting, your proxy (one of the individuals named on your proxy card) will vote your shares using his or her best judgment. The Board currently knows of no other business that will be presented for consideration.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the outstanding shares are present at the Annual Meeting. On the record date, there were 59,022,626 shares outstanding and entitled to vote. Thus, the holders of 29,511,314 shares must be present at the Annual Meeting to have a quorum. Your shares will be counted as present at the meeting if you:

| | • | | are present and entitled to vote in person at the meeting; or |

| | • | | have properly submitted a proxy card or voting instruction card, or voted by telephone or over the Internet. |

Abstentions and broker non-votes (as described below) will be counted towards the quorum requirement. If there is no quorum, either the chairman of the meeting or the holders of a majority of shares present at the meeting in person or represented by proxy may adjourn the 2011 Annual Meeting to another date.

How many votes are needed to approve each proposal?

| | • | | Proposal 1 — Election of Directors. The two nominees receiving the most “For” votes (among votes properly cast in person or by proxy) will be elected. Broker non-votes will have no effect. |

| | • | | Proposal 2 — Ratification of the Selection, by the Audit and Compliance Committee of the Board, of Ernst & Young LLP as the Independent Registered Public Accounting Firm of the Company For The Year Ending December 31, 2011. This proposal must receive a “For” vote from the majority of shares present and entitled to vote either in person or by proxy at the Annual Meeting to be approved. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will have no effect. |

| | • | | Proposal 3 — Amendment to the Company’s Amended and Restated 2000 Equity Incentive Plan. This proposal must receive a “For” vote from the majority of shares present and entitled to vote either in person or by proxy at the Annual Meeting to be approved. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will have no effect. |

3

| | • | | Proposal 4 — Advisory Vote on Executive Compensation. This proposal is advisory and not binding on the Company. Shares present and not voted, whether by broker non-vote, abstention or otherwise, will have no effect on this advisory vote. The affirmative vote of the holders of a majority in voting power of the shares present and entitled to vote either in person or by proxy at the Annual Meeting is required for the approval of the advisory vote on the compensation of our named executive officers. |

| | • | | Proposal 5 — Advisory Vote on the Frequency of an Advisory Vote on Executive Compensation. This proposal is advisory and not binding on the Company. Shares present and not voted, whether by broker non-vote, abstention or otherwise, will have no effect on this advisory vote. The affirmative vote of the holders of a majority in voting power of the shares present and entitled to vote either in person or by proxy at the Annual Meeting is required for the approval of the vote regarding the frequency of an advisory vote on the compensation of our named executive officers. With respect to this proposal, if none of the frequency alternatives (one year, two years or three years) receives a majority vote, we will consider the frequency that receives the highest number of votes by stockholders to be the frequency that has been selected by our stockholders. However, because this vote is advisory and not binding on us or our Board in any way, our Board may decide that it is in our and our stockholders’ best interests to hold an advisory vote on executive compensation more or less frequently than the option approved by our stockholders. |

What are “broker non-votes”?

Broker non-votes occur when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed “non-routine.” Generally, if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker or nominee holding the shares. If the beneficial owner does not provide voting instructions, the broker or nominee can still vote the shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. In the event that a broker, bank, custodian, nominee or other record holder of InterMune common stock indicates on a proxy that it does not have discretionary authority to vote certain shares on a particular proposal, then those shares will be treated as broker non-votes with respect to that proposal. Accordingly, if you own shares through a nominee, such as a broker or bank, please be sure to instruct your nominee how to vote to ensure that your vote is counted on each of the proposals.

Which ballot measures are considered "routine" or "non-routine?"

The ratification of the selection, by the Audit and Compliance Committee of the Board, of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2011 (Proposal 2) is considered routine under applicable rules. A broker or other nominee may generally vote on routine matters, and therefore no broker non-votes are expected to exist in connection with Proposal 2. The election of directors (Proposal 1), the amendment to the Company’s Amended and Restated 2000 Equity Incentive Plan (Proposal 3), the advisory vote on executive compensation (Proposal 4) and the advisory vote on the frequency of the advisory vote on executive compensation (Proposal 5) are matters considered non-routine under applicable rules. A broker or other nominee cannot vote without instructions on non-routine matters, and therefore there may be broker non-votes on Proposals 1, 3, 4, and 5.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. Please complete, sign and return each proxy card to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the Annual Meeting. You may revoke your proxy in any one of four ways:

| | • | | You may submit another properly completed proxy card with a later date; |

4

| | • | | You may submit another proxy by telephone or the Internet after you have already provided an earlier proxy; |

| | • | | You may send a written notice that you are revoking your proxy to InterMune’s Corporate Secretary at 3280 Bayshore Boulevard, Brisbane, California 94005; or |

| | • | | You may attend the Annual Meeting and vote in person. Simply attending the meeting will not, by itself, revoke your proxy. |

How are votes counted?

Votes will be counted by the Inspector of Election appointed for the Annual Meeting, who will separately count “For” and (with respect to proposals other than the election of directors) “Against” votes, abstentions and broker non-votes. In addition, with respect to the election of directors, the Inspector of Election will count the number of “withheld” votes received for the nominees. If your shares are held by your broker as your nominee (that is, in “street name”), you will need to obtain a proxy form from the institution that holds your shares and follow the instructions included on that form regarding how to instruct your broker to vote your shares. If you do not give instructions to your broker, your broker can vote your shares with respect to “discretionary” items, but not with respect to “non-discretionary” items. See “What are “broker non-votes?”and “Which ballot measures are considered “routine” and “non-routine”?” above for more information regarding discretionary and “non-discretionary” matters.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these mailed proxy materials, our directors and employees and BNY Mellon Shareowner Services may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies, but BNY Mellon Shareowner Services will be paid its customary fee of approximately $8,000 plus out-of-pocket expenses if it solicits proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be published in the Company’s current report on Form 8-K on or before May 16, 2011. If final voting results are not available to us in time to file a Current Report on Form 8-K by May 16, 2011, we intend to file a Current Report on Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Current Report on Form 8-K to publish the final results.

When are stockholder proposals due for the 2012 annual meeting of stockholders?

To be considered for inclusion in the Company’s 2012 proxy statement, your proposal must be submitted in writing to InterMune’s Corporate Secretary at 3280 Bayshore Boulevard, Brisbane, California 94005 by December 15, 2011, unless the date of the 2012 annual meeting of stockholders is more than 30 days before or after May 10, 2012, in which case the deadline is a reasonable time before the Company begins to print and send its proxy materials. If you wish to submit a proposal for the 2012 annual meeting of stockholders that is not to be included in the Company’s 2012 proxy statement or to nominate a director for election at the meeting, you must give timely notice to InterMune’s Corporate Secretary. To be timely, the notice must be delivered to the address listed above between January 11, 2012 and February 10, 2012, unless the date of the 2012 annual meeting of stockholders is more than 30 days before or more than 60 days after May 10, 2012, in which case the notice must be delivered no later than the 90th day prior to the 2012 annual meeting or, if later, the 10th day following the day on which public disclosure of the date of the 2012 annual meeting of stockholders was first made. You are also advised to review our Amended and Restated Bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations, as summarized below.

5

The Amended and Restated Bylaws were adopted by InterMune on March 22, 2010 which, among other things, included modifications to (i) existing provisions providing for advance notice of stockholder proposals and director nominations (other than proposals properly made in accordance with Rule 14a-8 (“Rule 14a-8”) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) to expand the disclosure stockholders must provide regarding themselves when submitting proposals and nominations for consideration; (ii) require stockholders nominating directors to disclose the same information about proposed director nominees that would be required if the director nominee were submitting a proposal, and require the director nominees to complete a questionnaire and representation and agreement with respect to their background, any voting commitments or compensation arrangements and their commitment to abide by the Company’s policies and guidelines; (iii) require stockholders to update the disclosures described above as of the record date for the meeting of stockholders and as of the date that is ten business days prior to the date of the meeting or any adjournment or postponement thereof; and (iv) clarify that the requirements set forth in the Amended and Restated Bylaws apply to all stockholder proposals and director nominees, other than stockholder proposals made pursuant to Rule 14a-8.

PROPOSAL 1

ELECTION OF DIRECTORS

The Company’s Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws provide that the Board shall be divided into three classes, with each class having a three-year term. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board to fill a vacancy (including a vacancy created by an increase in the number of directors) shall serve for the remainder of the full term of the class of directors in which the vacancy occurred and until such director’s successor is elected and qualified.

The Board currently consists of six directors, divided into the three following classes:

| | • | | Class I directors: David S. Kabakoff, Ph.D. and Daniel G. Welch; whose terms will expire at the annual meeting of stockholders to be held in 2013; |

| | • | | Class II directors: James I. Healy M.D., Ph.D. and Louis Drapeau; whose terms will expire at the Annual Meeting; and |

| | • | | Class III directors: Lars G. Ekman, M.D., Ph.D. and Jonathan S. Leff; whose terms will expire at the annual meeting of stockholders to be held in 2012. |

At each annual meeting of stockholders, the successors to directors whose terms will then expire will be elected to serve from the time of election and qualification until the third subsequent annual meeting of stockholders.

There are two nominees for two Class II positions: Dr. Healy and Mr. Drapeau, each of whom is currently a director. Dr. Healy and Mr. Drapeau each have been nominated for and have elected to stand for reelection. Each director to be elected will hold office from the date of their election by the stockholders until the third subsequent annual meeting of stockholders or until his successor is elected and has been qualified, or until such director’s earlier death, resignation or removal.

Pursuant to the Company’s Amended and Restated Certificate of Incorporation, the number of directors has been fixed at seven by a resolution of the Board. The Board currently consists of six directors leaving one vacancy which the Board may fill at any time. While there could be a total of three Class II directors, there are only two nominees. Proxies cannot be voted for a greater number of persons than the number of nominees named.

6

The Company does not have a policy regarding directors’ attendance at the annual meetings of stockholders. Five of the Company’s six directors who were members of the Board at the time attended the 2010 annual meeting of stockholders.

Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the two nominees named below. In the event that any nominee should be unavailable for election as a result of an unexpected occurrence, such shares will be voted for the election of such substitute nominee as the Board may propose. Each person nominated for election has agreed to serve if elected, and management has no reason to believe that any nominee will be unable to serve. Directors are elected by a plurality of the votes present in person or represented by proxy and entitled to vote at the meeting.

The following table sets forth, for the Class II nominees and our other current directors who will continue in office after the Annual Meeting, information with respect to their ages and position/office held with the Company:

| | | | | | | | | | |

Name | | Age | | | Position/Office Held With the Company | | Director Since | |

Class I Directors whose terms expire at the 2013 Annual Meeting of Stockholders | | | | |

David S. Kabakoff, Ph.D.(1)(3) | | | 63 | | | Director | | | 2005 | |

Daniel G. Welch | | | 53 | | | Chairman, Chief Executive Officer and President | | | 2003 | |

| |

Class II Directors for election at the Annual Meeting of Stockholders | | | | |

Louis Drapeau(1)(2) | | | 67 | | | Director | | | 2007 | |

James I. Healy, M.D, Ph.D.(1)(3) | | | 46 | | | Director | | | 1999 | |

| |

Class III Directors whose terms expire at the 2012 Annual Meeting of Stockholders | | | | |

Lars G. Ekman, M.D., Ph.D.(2)(3) | | | 61 | | | Lead Independent Director | | | 2006 | |

Jonathan S. Leff(2) | | | 42 | | | Director | | | 2000 | |

| (1) | Member of the Audit and Compliance Committee of the Board. |

| (2) | Member of the Compensation and Governance and Nominating Committee of the Board. |

| (3) | Member of the Science Committee of the Board. |

Set forth below is biographical information for each nominee and each person whose term of office as a director will continue after the Annual Meeting.

Nominees for Election to a Three-Year Term Expiring at the 2014 Annual Meeting of Stockholders

LOUIS DRAPEAU has served as a member of the Board since September 2007. He currently serves as Vice President and Chief Financial Officer of InSite Vision Incorporated. From November 2008 to December 2010, he also served as Chief Executive Officer of InSite Vision. Prior to joining InSite Vision in October 2007, Mr. Drapeau served as Senior Vice President, Finance and Chief Financial Officer for Nektar Therapeutics from January 2006 to August 2007. From August 2002 to August 2005, he held the position of Senior Vice President and Chief Financial Officer at BioMarin Pharmaceutical Inc., a biotechnology company. Mr. Drapeau also served as Acting Chief Executive Officer of BioMarin from August 2004 to May 2005. Mr. Drapeau spent more than 30 years with public accounting firm Arthur Andersen, including 19 years as an Audit Partner in Arthur Andersen’s Northern California Audit and Business Consulting practice and 12 years as managing partner. From 2006 to 2008, Mr. Drapeau served on the board of directors of Inflazyme Pharmaceuticals, a biotechnology company whose stock is traded on the Toronto stock exchange. He currently serves on the boards of directors of Bio-Rad Laboratories and Bionovo, Inc. since 2007 and 2008, respectively. Mr. Drapeau holds a B.S. in Mechanical Engineering and an M.B.A. both from Stanford University. The Board believes that Mr. Drapeau operational experience and financial expertise in the health care sector contributes valuable insight to the Board. The Board also believes that Mr. Drapeau’s extensive experience with Arthur Andersen qualifies him as a “financial expert,” for purposes of the Audit and Compliance Committee and makes him a strong Chairman of the Audit and Compliance Committee.

7

JAMES I. HEALY, M.D., PH.D. has served as a member of the Board since April 1999 and served as the Chairman of the Board from October 1999 through January 2000. Dr. Healy joined Sofinnova Ventures in June 2000 as a General Partner and Managing Director. From January 1998 through March 2000, Dr. Healy was employed at Sanderling Ventures and served as a consultant to Ista Pharmaceuticals. From 1990 to 1997, Dr. Healy was employed by the Howard Hughes Medical Institute and Stanford University. Dr. Healy has served on the board of directors of the following public companies: from 2001 to 2006, on the board of directors of Cotherix, Inc. (acquired by Actelion); from 2001 through 2008, on the board of directors of Novacea, Inc (merged with Trancept Pharmaceuticals Inc); and from 2006 through 2010, on the board of directors of Movetis NV (sold to Shire Holdings Luxembourg S.a.r.l). Dr. Healy currently serves on the board of directors of each of Anthera Pharmaceuticals, Inc., since 2006, and Amarin Corporation, since 2008. Dr. Healy also currently serves on the board of directors of several private companies. Dr. Healy holds a B.A. in Molecular Biology and a B.A. in Scandinavian Studies, both from the University of California at Berkeley, where he graduated with Distinction in General Scholarship, Honors, and received a Departmental Citation. Dr. Healy holds an M.D. and a Ph.D. in immunology from Stanford University School of Medicine, where he was supported by the Medical Scientist Training Program, was a Beckman Scholar and received a bursary award from the Novartis Foundation. The Board believes that Dr. Healy’s knowledge of medicine, together with his extensive experience as a venture capitalist and role as a board member for a number of emerging biotechnology companies, provide the Board with valuable insight into a broad range of issues related to the Company’s business activities.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE

IN FAVOR OF THE NAMED NOMINEES.

Directors Continuing in Office Until the 2012 Annual Meeting of Stockholders

LARS G. EKMAN, M.D., PH.D.has served as Lead Independent Director of the Board since May 2008 and has been a member of the Board since September 2006. Dr. Ekman has served as Chairman and Chief Executive Officer of Cebix Incorporated, a biotechnology company, since May 2008. Until transitioning his role to serve solely as a director of Elan Corporation in December 2007, Dr. Ekman served as President of Research and Development of Elan which he joined in 2001 as Executive Vice President and President of Global Research and Development. From 1997 to 2001 he was Executive Vice President, Research and Development at Schwartz Pharma AG. From 1984 to 1997, Dr. Ekman was employed in a variety of senior scientific and clinical functions at Pharmacia (now Pfizer). Dr. Ekman currently serves on the board of directors of ARYx Therapeutics, Elan Corporation and Amarin Corporation since 2003, 2005 and 2008, respectively. Dr. Ekman also currently serves on the board of directors of a private company. Dr. Ekman holds an M.D. and a Ph.D. in Experimental Biology both from the University of Gothenburg, Sweden. The Board believes that Dr. Ekman brings global experience and proven leadership in the pharmaceutical industry to the Board based on the extensive knowledge of the research, development and commercialization of pharmaceutical products in a variety of therapeutic areas that he gained as a former senior executive at several global pharmaceutical companies. The Board believes that this experience enables Dr. Ekman to provide the Board with invaluable insight into a broad range of issues that impact the Company’s business and makes him a strong Chairman of the Science Committee of the Board and strong Lead Independent Director of the Board.

JONATHAN S. LEFFhas served as a member of the Board since January 2000. Mr. Leff joined Warburg Pincus LLC, a global private equity investment firm, in 1996 and is currently a Managing Director responsible for the firm’s investment efforts in biotechnology and pharmaceuticals. Mr. Leff served on the board of directors of Sunesis Pharmaceuticals from 1999 to 2006, on the board of directors of Transkaryotic Therapies from 2000 to 2005, on the board of directors of Neurogen Inc. from 2001 to 2008, on the board of directors of ZymoGenetics, Inc. from 2002 to 2010 and on the board of directors of Altus Pharmaceuticals from 2004 to 2008. Mr. Leff currently serves on the boards of directors of Allos Therapeutics, Inc., Inspire Pharmaceuticals, Inc., Protox Therapeutics Inc. and Talon Therapeutics, Inc., since 2005, 2007, 2010 and 2010, respectively. Mr. Leff also serves on the boards of directors of several private companies. Mr. Leff holds an A.B. in Government from Harvard University and an M.B.A. from Stanford University. The Board believes that

8

Mr. Leff’s extensive experience investing in and serving on the boards of directors of public biotechnology and pharmaceutical companies has provided Mr. Leff with substantial expertise in corporate governance and executive compensation, making him a strong Chairman of the Compensation and Governance and Nominating Committee of the Board.

Directors Continuing in Office Until the 2013 Annual Meeting of Stockholders

DAVID S. KABAKOFF, PH.D.has served as a member of the Board since November 2005. Dr. Kabakoff serves as Executive Partner at Sofinnova Ventures, with whom he has been employed since May 2007. Dr. Kabakoff has also served as President and Chief Executive Officer of Strategy Advisors, LLC, a consulting company, since August 2000. Dr. Kabakoff also served as the founder, Chairman and Chief Executive Officer of Salmedix, Inc., a biotechnology company, from January 2001 to June 2005, when it was acquired by Cephalon, Inc.,. From May 1996 to August 2000, Dr. Kabakoff served in senior executive positions at Dura Pharmaceuticals Inc., a specialty pharmaceuticals company that was acquired by Elan Pharmaceuticals. From 2005 to 2009, Dr. Kabakoff served on the board of directors of Avalon Pharmaceuticals, Inc. Dr. Kabakoff currently serves as Chairman of the Board of Directors of Trius Therapeutics, since 2007. Dr. Kabakoff also serves on the boards of directors of several private companies. Dr. Kabakoff holds a B.A. in Chemistry from Case Western Reserve University and a Ph.D. in Chemistry from Yale University. The Board believes that Dr. Kabakoff brings strategic insight and leadership and a wealth of experience in the biotechnology industry to the Board.

DANIEL G. WELCH has served as the Chairman, Chief Executive Officer and President of the Company and a member of the Board since May 2008 and as the President and Chief Executive Officer of the Company and a member of the Board since September 2003. From March 2003 to September 2003, Mr. Welch served as a consultant to Warburg Pincus LLC, a global private equity investment firm. From August 2002 to January 2003, Mr. Welch served as Chairman and Chief Executive Officer of Triangle Pharmaceuticals, Inc., a pharmaceutical company. From October 2000 to June 2002, Mr. Welch served as President of the pharmaceutical division of Elan Corporation, PLC. From September 1987 to August 2000, Mr. Welch served in various senior management roles at Sanofi-Synthelabo and its predecessor companies, Sanofi and Sterling Winthrop, including Vice President of worldwide marketing and Chief Operating Officer of the U.S. business. From November 1980 to September 1987, Mr. Welch was with American Critical Care, a division of American Hospital Supply. Mr. Welch currently serves on the board of directors of Seattle Genetics, since 2007, and also serves on the board of directors of a private company. Mr. Welch holds a B.S. in Marketing from the University of Miami and an M.B.A. from the University of North Carolina. The Board believes that Mr. Welch is a strong operating executive with operational and strategic expertise in the global pharmaceutical market, whose experience contributes valuable insight to the Board.

Director Qualifications and Diversity

The Compensation and Governance and Nominating Committee is responsible for identifying, evaluating, and recommending to the Board, individuals qualified to be directors of the Company. As set forth in further detail below in the description of the Board’s committees, the Compensation and Governance and Nominating Committee takes into consideration a number of relevant factors for Board membership including, but not limited to, diversity, age, skills, experience and understanding of the Company’s business and business environment. We do not have a formal diversity policy for selecting Board members. However, we believe it is important that our Board members collectively bring the experiences and skills appropriate to effectively carry out the Board’s responsibilities both as our business exists today and as we plan to develop an organization capable of successfully conducting research, development and commercialization of our products. We therefore seek as members of our Board individuals with a variety of perspectives and the expertise and ability to provide advice and oversight in one or more of these areas: accounting controls, business strategy, risk management, strategic partnering, financial engineering, science and medicine, health care system, legal and regulatory compliance and

9

compensation and retention practices. Finally, Board members should display the personal attributes necessary to be an effective director: unquestioned integrity, sound judgment, independence in fact and mindset, ability to operate collaboratively, and commitment to the Company, its stockholders, and other constituencies.

Board Leadership Structure

Mr. Welch, the Company’s Chief Executive Officer and President, also serves as the Chairman of the Board. This leadership structure has been in place since 2008, in connection with the departure of two former members of the Board, William R. Ringo and Michael Smith. At the same time that Mr. Welch was appointed Chairman, the Board also appointed Dr. Ekman as the Company’s Lead Independent Director. Dr. Ekman conducts an executive session with the independent directors on a quarterly basis. This approach is commonly used by other public companies in the United States and the Board believes it has been effective for Intermune as well. The Company has a single leader, and the Company’s Chairman and Chief Executive Officer is seen by customers, business partners, investors and others as providing strong leadership for the Company in the communities we serve and in our industry. The Board believes that combining the roles of Chairman of the Board and Chief Executive Officer has fostered a constructive and cooperative relationship between the Board and management and resulted in open and effective communications between the Board and management. The Board also believes that its regular sessions with the Lead Independent Director afford the Board the opportunity to discuss matters independent of Mr. Welch if desired, and given its current size and the constructive working relationships of its members, the Board believes that changing the existing structure at this time would not improve the performance of the Board. The directors bring a broad range of leadership experience to the boardroom and regularly contribute to the thoughtful discussions involved in overseeing the affairs of the Company. All directors are well engaged in their responsibilities, express their views and are open to the opinions expressed by other directors.

Independence of the Board of Directors

The listing requirements of the Nasdaq Global Select Market (“Nasdaq”), require that a majority of the members of a listed company’s board of directors must qualify as “independent,” as affirmatively determined by the board of directors. The Board consults with the Company’s counsel to ensure that the Board’s determinations as to independence are consistent with all relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent listing standards of the Nasdaq, as in effect from time to time.

Consistent with these considerations, after review of all relevant transactions or relationships between each director, or any of his family members, and the Company, its senior management and its independent registered public accounting firm, the Board affirmatively has determined that all of the Company’s directors are independent directors within the meaning of the applicable Nasdaq listing standards, except for Mr. Welch, the Company’s current Chairman, Chief Executive Officer and President due to his employment with the Company.

Information Regarding the Board of Directors and its Committees

In March 2004, the Board approved the amended Corporate Governance Guidelines and Code of Director Conduct and Ethics with the aim to ensure that the Board will have the necessary authority and practices in place to review and evaluate the Company’s business operations as needed, to make decisions that are independent of the Company’s management and to ensure honest and ethical conduct by the members of the Board. The guidelines are also intended to align the interests of directors and management with those of the Company’s stockholders. The Corporate Governance Guidelines and Code of Director Conduct and Ethics sets forth the practices the Board must follow with respect to Board composition and selection, Board meetings and involvement of senior management, chief executive officer succession planning and selection, Board compensation, committee composition, self-assessment, interaction with outside parties, orientation and continuing education and ethical conduct. The Corporate Governance Guidelines and Code of Director Conduct and Ethics may be viewed on our Internet website athttp://www.intermune.com/pdf/governance_guidelines.pdf.

10

During 2010, the Board met twelve times, including by telephone conference, and acted by unanimous written consent six times. No director attended fewer than 80% of the aggregate of the total number of meetings of the Board (held during the period for which he was a director) and the total number of meetings held by all committees of the Board on which he served (during the period that he served as a committee member) in 2010.

Currently, the Board has an Audit and Compliance Committee, a Compensation and Governance and Nominating Committee and a Science Committee.

Audit and Compliance Committee

The Audit and Compliance Committee of the Board oversees the Company’s corporate accounting and financial reporting processes, the systems of internal accounting and financial controls and audits of financial statements, the quality and integrity of financial statements and reports, the qualifications, independence and performance of the firms engaged as independent outside auditors, corporate compliance, including development, implementation, administration and enforcement of the Company’s compliance programs and reviewing the Company’s compliance with its policies and all applicable laws. For this purpose, the Audit and Compliance Committee performs several functions. Among other things, the Audit and Compliance Committee:

| | • | | appoints, compensates, retains and oversees the independent registered public accounting firm; |

| | • | | determines and approves engagements of the auditors, including the scope of the audit and any non-audit services, the compensation to be paid to the auditors and monitors auditor partner rotation and potential conflicts of interest; |

| | • | | reviews and discusses with the independent registered public accounting firm and management, as appropriate, the Company’s critical accounting policies, financial statements, the results of the annual audit, the quarterly results and earnings press releases; |

| | • | | reviews financial risk management programs, internal control letters, any material conflicts or disagreements between management and the auditors and internal controls over financial reporting; |

| | • | | directs management to enforce the Company’s Code of Business Conduct and Ethics and provides for prompt communication of violations of the Code of Business Conduct and Ethics to the Audit and Compliance Committee; |

| | • | | oversees and directs management to ensure compliance as required by the Office of Inspector General of the U.S. Department of Health and Human Services; |

| | • | | oversees management’s preparation of the Company’s annual proxy report, including the Audit and Compliance Committee report; |

| | • | | oversees the establishment of procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters and the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters; and |

| | • | | ensures the confidential receipt, retention and consideration of any report of evidence of a material violation by the Company or any officer, director, employee or agent of the Company by attorneys appearing and practicing before the SEC. |

The Audit and Compliance Committee is currently composed of Mr. Drapeau, Dr. Healy and Dr. Kabakoff. The Board annually reviews the applicable Nasdaq listing standards for Audit and Compliance Committee members and has determined that all members of the Company’s Audit and Compliance Committee are independent, as currently defined in Rule 5605(a)(2) of the Nasdaq Listing Rules. Mr. Drapeau is currently the Chairman of the Audit and Compliance Committee. The Board has determined that Mr. Drapeau qualifies as an “audit committee financial expert,” as defined in applicable SEC rules. In March 2008, the Board approved the

11

Charter of the Audit and Compliance Committee of the Board, which charter was last amended by the Board in December 2010. The amended charter can be found on our corporate website athttp://www.intermune.com/pdf/Charter_of_the_Audit_and_Compliance_Committee.pdf. In 2010, the Audit and Compliance Committee met seven times. (Please see “Audit and Compliance Committee Report” below.)

Compensation and Governance and Nominating Committee

The Compensation and Governance and Nominating Committee of the Board approves the type and level of compensation for officers and employees of the Company, administers the Company’s stock plans, performs such other functions regarding compensation as the Board may delegate, develops and implements policies and procedures and oversees corporate governance matters, including the evaluation of Board performance and processes, and recommends qualified candidates for Board membership to the Board for nomination to the Board and election by the stockholders. The Compensation and Governance and Nominating Committee approves all compensation, including equity grants, for the Company’s vice presidents and above, and all equity grants to non-vice president employees and consultants for greater than or equal to 20,000 shares of common stock.

For Board membership, the Compensation and Governance and Nominating Committee takes into consideration applicable laws and regulations (including the Nasdaq listing standards), diversity, age, skills, experience, integrity, ability to make independent analytical inquires, understanding of the Company’s business and business environment, willingness to devote adequate time and effort to Board responsibilities and other relevant factors.

The Compensation and Governance and Nominating Committee reviews candidates for director in the context of the current composition, skills and expertise of the Board, the operating requirements of the Company and the interests of stockholders. In the case of new director candidates, the Compensation and Governance and Nominating Committee determines whether the nominee must be independent for Nasdaq purposes, which determination is based upon applicable Nasdaq listing standards and applicable SEC rules and regulations. The Compensation and Governance and Nominating Committee then uses its network of contacts to compile a list of potential candidates, but may also engage, if it deems appropriate, a professional search firm. The Compensation and Governance and Nominating Committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the functions and needs of the Board. The Compensation and Governance and Nominating Committee meets to discuss and consider such candidates’ qualifications. All members of the Compensation and Governance and Nominating Committee and the Chairman, Chief Executive Officer and President then interview candidates that the Compensation and Governance and Nominating Committee believes have the requisite background, before recommending a nominee to the Board, which votes to elect the nominees.

The Compensation and Governance and Nominating Committee will consider director candidates recommended by stockholders. Though the committee has not established a formal policy with regard to consideration of director candidates recommended by stockholders, in March 2010 the Board adopted the Amended and Restated Bylaws which, among other things, included modifications to (i) existing provisions providing for advance notice of stockholder nominations to expand the disclosure stockholders must provide regarding themselves when submitting nominations for consideration; (ii) require stockholders nominating directors to disclose the same information about proposed director nominees that would be required if the director nominee were submitting a proposal, and require the director nominees to complete a questionnaire and representation and agreement with respect to their background, any voting commitments or compensation arrangements and their commitment to abide by the Company’s policies and guidelines; (iii) require stockholders to update the disclosures described above as of the record date for the meeting of stockholders and as of the date that is ten business days prior to the date of the meeting or any adjournment or postponement thereof; and (iv) clarify that the requirements set forth in the Amended and Restated Bylaws apply to all stockholder director nominees. The Board believes that such rigorous procedures set forth in the Amended and Restated Bylaws is currently sufficient and the establishment of a formal policy is not necessary. To date, the Compensation and Governance and Nominating Committee has not received a director nominee from any stockholder. Stockholders

12

who wish to recommend individuals for consideration by the Corporate Governance and Nominating Committee to become nominees for election to the Board may do so by delivering a written recommendation by certified mail only, c/o the Chairman or Secretary, at the following address: InterMune, Inc., 3280 Bayshore Boulevard, Brisbane, California 94005 no sooner than 120 days and no later than 90 days prior to the anniversary date of the Company’s last annual meeting of stockholders. Submissions must include the full name of the proposed nominee, a description of the proposed nominee’s business experience for at least the previous five years, complete biographical information, a description of the proposed nominee’s qualifications as a director and a representation that the nominating stockholder is a beneficial or record owner of the Company’s stock. Any such submission must be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a director if elected. The Compensation and Governance and Nominating Committee will evaluate any director candidates that are properly recommended by stockholders in the same manner as it evaluates all other director candidates, as described above.

In March 2008, the Board approved the Charter of the Compensation and Governance and Nominating Committee of the Board of Directors, which can be found on our corporate website athttp://www.intermune.com/pdf/Charter_of_the_Compensation_and_Governance_and_Nominating_Committee.pdf.The Board has authorized a subcommittee comprised of the Company’s Chief Executive Officer, Senior Vice President of Human Resources and General Counsel to make normative (i.e., consistent with a matrix pre-approved by the Compensation and Governance and Nominating Committee) new hire equity grants of less than 20,000 shares of common stock to non-executive committee employees and consultants. (Please see “Compensation and Governance and Nominating Committee Report” below.) The Compensation and Governance and Nominating Committee is currently composed of Dr. Ekman and Messrs. Leff and Drapeau, and Mr. Leff is currently the Chairman of the committee. Each of Dr. Ekman and Messrs. Drapeau and Leff are considered to be independent currently defined in Rule 5605(a)(2) of the Nasdaq Listing Rules. In 2010, the Compensation and Governance and Nominating Committee met two times.

Science Committee

In March 2007, the Board created a Science Committee. In July 2007, the Board approved the Science Committee charter, which will be posted on our corporate website athttp://www.intermune.com/pdf/charter_science_committee.pdf. The Science Committee is composed of Drs. Ekman, Healy and Kabakoff, and Dr. Ekman is currently the Chairman of the committee.

Stockholder Communications with the Board of Directors

The Board provides a procedure for stockholders to send written communications to the Board or any of the directors. Stockholders may send written communications to the Board or any of the directors by certified mail only, c/o the Chairman or Secretary, InterMune, Inc., 3280 Bayshore Boulevard, Brisbane, California 94005. All such written communications will be compiled by the Chairman or Secretary of the Company and submitted to the Board or the individual directors, as the case may be, within a reasonable period.

Code of Business Conduct and Ethics

The Board has approved a Code of Business Conduct and Ethics, as amended (the “Code”) applicable to all of our employees, including our Chief Executive Officer, Chief Financial Officer and Controller, and to the members of the Board. The purpose of the Code is to deter wrongdoing and to promote, among other things:

| | • | | honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; |

| | • | | full, fair, accurate, timely and understandable disclosure in reports and documents that we file with, or submit to, the SEC and in other public communications that we make; |

| | • | | compliance with applicable governmental laws, rules and regulations; |

13

| | • | | the prompt internal reporting of violations of the Code to an appropriate person or persons identified in the Code; |

| | • | | the prompt public disclosure of any waivers under the Code granted to any of our executive officers, including our Chief Executive Officer, Chief Financial Officer and Controller; and |

| | • | | accountability for adherence to the Code. |

The Code is available on our corporate website athttp://www.intermune.com/pdf/Code_of_Conduct_01OCT07.pdf. If the Company grants any waiver from a provision of the Code with respect to any Company officer at the level of Vice President or above, the Company will promptly disclose in a Current Report filed with the SEC on Form 8-K the nature of the waiver along with the reasons for the waiver.

Risk Oversight

Our Board oversees an enterprise-wide approach to risk management, designed to support the achievement of organizational objectives, including strategic objectives, to improve long-term organizational performance and enhance stockholder value. A fundamental part of risk management is not only understanding the risks a Company faces and what steps management is taking to manage those risks, but also understanding what level of risk is appropriate for the Company. The involvement of the full Board in setting the Company’s business strategy is a key part of its assessment of management’s appetite for risk and also a determination of what constitutes an appropriate level of risk for the Company. The full Board participates in a regular and ongoing assessment of enterprise risk management in consultation with the Company’s senior management including the Chief Executive Officer, the Chief Financial Officer, the General Counsel and the Chief Compliance Officer. In this process, risk is assessed throughout the business, focusing on three primary areas of risk: financial risk, legal compliance risk and operational strategic risk.

While the Board has the ultimate oversight responsibility for the risk management process, various committees of the Board also have responsibility for risk management. In particular, the Audit and Compliance Committee focuses on financial and compliance risks including internal controls. The Audit and Compliance Committee, receives an annual risk assessment report from the Company’s external auditors, assists the Board in fulfilling its oversight responsibility with respect to regulatory, healthcare compliance and public policy issues that affect the Company and works closely with the Company’s legal and regulatory groups. In addition, the Compensation and Governance and Nominating Committee considers risks related to succession planning, the attraction and retention of talent and risks relating to the design of compensation programs and arrangements. The Compensation and Governance and Nominating Committee also reviews compensation and benefits plans affecting employees in addition to those applicable to executive officers. The full Board considers strategic risks and opportunities and regularly receives detailed reports from both the Audit and Compliance Committee and the Compensation and Governance and Nominating Committee regarding risk oversight in their areas of responsibility. The risk oversight functions of the Board and its committees described above do not necessarily have any material effect on the Company’s leadership structure.

14

2010 AUDIT AND COMPLIANCE COMMITTEE REPORT(1)

The Audit and Compliance Committee, currently composed of Mr. Drapeau (Chairman), Dr. Healy and Dr. Kabakoff, oversees the Company’s financial reporting process on behalf of the Board as well legal and compliance matters relating to the Company’s operations . The Audit and Compliance Committee meets with the independent registered public accounting firm, Ernst & Young LLP, with and without management present, to discuss the results of Ernst & Young LLP’s examinations and evaluation of the Company’s internal controls and the overall quality of the Company’s financial reporting. In addition, the Audit and Compliance Committee meets with the Company’s Chief Compliance Officer and General Counsel to discuss their respective examination and evaluation of legal and compliance matters relating to the Company’s operations.

The members of the Audit and Compliance Committee are appointed by and serve at the discretion of the Board. The Audit and Compliance Committee held seven meetings during 2010.

The Company’s management team has the primary responsibility for the financial statements and the reporting process, including the system of internal controls and disclosure controls and procedures. In fulfilling its oversight responsibilities, the Audit and Compliance Committee reviewed the audited financial statements in the Annual Report on Form 10-K with management and the unaudited financial statements in the Quarterly Reports on Form 10-Q, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements. The Company’s Chief Compliance Officer and General Counsel have the primary responsibility for managing compliance and legal matters relating to the Company’s operations, including conducting employee compliance training, interfacing with governmental agencies in connection with various types of inquiries and managing litigation.

The Audit and Compliance Committee, among other things, is responsible for reviewing, approving and managing the engagement of the independent registered public accounting firm, including the scope, extent and procedures of the annual audit and compensation to be paid, and all other matters the Audit and Compliance Committee deems appropriate, including the auditors’ accountability to the Board and the Audit and Compliance Committee. The Audit and Compliance Committee reviewed with the independent registered public accounting firm, who are responsible for expressing an opinion on the conformity of those audited financial statements with generally accepted accounting principles, their judgments as to the quality, not just the acceptability, of the Company’s accounting principles and such other matters as are required to be discussed with the Audit and Compliance Committee under generally accepted auditing standards and those matters required to be discussed by SAS 61, as amended and as adopted by the Public Company Accounting Oversight Board (PCAOB) in Rule 3200T, which addresses communications between the Company’s independent registered public accounting firm and the Audit and Compliance Committee.

In addition, the Audit and Compliance Committee discussed with the independent registered public accounting firm its independence from management and the Company, including the matters and disclosures received in the written disclosures and the letter from the independent registered public accounting firm required by PCAOB Ethics and Independence Rule 3526, Communications with Audit Committees Concerning Independence, and has considered the compatibility of non-audit services with the auditors’ independence. The Audit and Compliance Committee also discussed with the Company’s independent registered public accounting firm the overall scope and plans for their audits and the Audit and Compliance Committee reviewed and made non-material changes to the Audit and Compliance Committee’s charter. The Audit and Compliance Committee also receives regular updates from the Company’s Chief Compliance Officer and General Counsel on compliance and legal matters facing the Company.

In reliance on the reviews and discussions referred to above, the Audit and Compliance Committee recommended to the Board (and the Board approved) that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2010 for filing with the SEC. The Audit and Compliance Committee has also retained Ernst & Young LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2011.

15

Oversight of Assessment of Internal Control Over Financial Reporting

During 2010, management documented, tested and evaluated the Company’s internal control over financial reporting pursuant to the requirements of the Sarbanes-Oxley Act of 2002. The Audit and Compliance Committee was kept apprised of the Company’s progress by management and the independent registered public accounting firm at committee meetings. At the conclusion of the assessments, management and Ernst & Young LLP each provided the Audit and Compliance Committee with its respective report on the effectiveness of the Company’s internal control over financial reporting. The Audit and Compliance Committee reviewed management’s and the independent registered public accounting firm’s evaluations that were included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2010. Management did not identify any material weaknesses in the Company’s internal controls over financial reporting and concluded that the Company’s internal controls were effective as of December 31, 2010.

|

| AUDIT AND COMPLIANCE COMMITTEE |

|

| Louis Drapeau — Chairman |

| James I. Healy, M.D., Ph.D. |

| David S. Kabakoff, Ph.D. |

| (1) | The material in this report is not “soliciting material,” is not deemed “filed” with the SEC and is not to be incorporated by reference in any filing of the Company under the Securities Act or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing. |

PROPOSAL 2

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit and Compliance Committee has selected Ernst & Young LLP as the Company’s independent registered public accounting firm to serve as the Company’s independent auditors for the year ending December 31, 2011 and has further directed management to submit the Audit and Compliance Committee’s selection of independent registered public accounting firm for ratification by the stockholders at the Annual Meeting. Ernst & Young LLP has audited the Company’s financial statements since January 2000. Representatives of Ernst & Young LLP are expected to be present at the Annual Meeting, will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions. In the event the stockholders do not ratify such appointment, the Board will reconsider its selection.

AUDITOR’S FEES

Audit Fees. The aggregate fees billed by Ernst & Young LLP for the audit of the Company’s financial statements, review of the Company’s interim financial statements, review of SEC registration statements, issuance of comfort letters and consents for the year ended December 31, 2010 were $910,824 and for the year ended December 31, 2009 were $1,068,173.

Audit-Related Fees. Ernst & Young LLP did not provide any audit-related services to the Company during 2010 or 2009.

16

Tax Fees. The aggregate fees billed by Ernst & Young LLP in relation to the preparation and review of the Company’s income tax returns and for general tax advice provided for the year ended December 31, 2010 and for the year ended December 31, 2009 were as follows:

| | | | | | | | |

| | | 2010 | | | 2009 | |

Assistance with State and Federal income tax returns preparation | | $ | 6,794 | | | $ | 75,750 | |

All Other Fees. Ernst & Young LLP did not provide any other services to the Company during 2010 or 2009.

Pursuant to the Audit and Compliance Committee’s charter, the Audit and Compliance Committee reviews, and prior to initiation of services, authorizes all non-audit services provided to the Company by the independent registered public accounting firm, and considers the possible effect of such services on the independence of such auditors. The Audit and Compliance Committee by prior resolution may pre-approve non-audit services. The Audit and Compliance Committee has determined that the non-audit services provided by Ernst & Young LLP in 2010 were compatible with maintaining the auditors’ independence. The Audit and Compliance Committee pre-authorizes all audit and non-audit services conducted by Ernst & Young LLP. Ernst & Young LLP may not perform any non-audit services except as pre-authorized by the Audit and Compliance Committee or its Chairman. The Audit and Compliance Committee has not pre-authorized the Company to engage Ernst & Young LLP to perform any non-audit services for 2011.

Stockholder ratification of the Audit and Compliance Committee’s selection of Ernst & Young LLP as the Company’s independent registered public accounting firm is not required by the Company’s Amended and Restated Bylaws or otherwise. However, the Board is submitting the selection of Ernst & Young LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit and Compliance Committee and the Board will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit and Compliance Committee may engage different independent registered public accounting firms at any time during the year if it determines that such a change would be in the best interests of the Company and its stockholders.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF PROPOSAL 2

PROPOSAL 3

APPROVAL OF AN AMENDMENT TO THE INTERMUNE, INC.

AMENDED AND RESTATED 2000 EQUITY INCENTIVE PLAN TO INCREASE

THE NUMBER OF SHARES AUTHORIZED FOR ISSUANCE

In January 2000, the Board adopted, and the stockholders subsequently approved, the Company’s Amended and Restated 2000 Equity Incentive Plan (the “Incentive Plan”). In June 2002, the stockholders approved an amendment of the Incentive Plan to increase the aggregate number of shares reserved for issuance under the Incentive Plan by 2,500,000 shares. As a result of this amendment, as of December 31, 2002, there were an aggregate of 6,278,226 shares reserved for issuance under the Incentive Plan. In March 2003, the Board amended the Incentive Plan, subject to stockholder approval, to add 1,300,000 shares of common stock to the share reserve to increase the aggregate number of shares authorized for issuance under the Incentive Plan from 6,278,226 shares to 7,578,226 shares. However, the Company’s stockholders did not approve this amendment at the Company’s 2003 annual meeting of stockholders, and the increase was not implemented. In March 2004, the Board adopted an amendment to the Incentive Plan that added 1,000,000 shares of common increase to the share reserve to increase the aggregate number of shares authorized for issuance under the Incentive Plan from 6,278,226 shares to 7,278,226 shares and the stockholders approved this amendment at the Company’s 2004 annual meeting of stockholders. In May 2007, the stockholders approved an amendment of the Incentive Plan,

17

among other things, to increase the aggregate number of shares reserved for issuance under the Incentive Plan by an additional 1,500,000 shares bringing the aggregate number of shares authorized for issuance under the Incentive Plan to 8,778,226. Finally, in May 2009, the stockholders approved an amendment of the Incentive Plan to increase the aggregate number of shares reserved for issuance under the Incentive Plan by an additional 2,000,000 shares bringing the aggregate number of shares authorized for issuance under the Incentive Plan to 10,778,226.

As of March 31, 2011, options (net of canceled or expired options) covering 4,260,215 shares had been granted under the Incentive Plan, and only 1,284,317 shares of the Company’s common stock (plus any shares that might in the future be returned to the Incentive Plan as a result of cancellations or expirations of options) remained available for future grant under the Incentive Plan. In March 2011, the Board adopted the amendment of the Incentive Plan, subject to stockholder approval, which would include the following change to the Incentive Plan:

| | • | | Increases the number of shares authorized for issuance under the Incentive Plan by 1,950,000 shares, from 10,778,226 to 12,728,226 shares. |

The Board adopted the amendment to the Incentive Plan to provide the Company with more flexibility in granting equity incentives to current and new employees and to ensure that the Company can continue to grant equity incentives at levels determined appropriate by the Board. Specifically, the addition of these new shares as provided in the amendment, when added to shares currently available under the Incentive Plan, will support our 2011-2012 annual equity grant cycle and allow for expected recruitment and retention grants we may require during fiscal year 2011. The text of the proposed amendment to the Incentive Plan is attached to this proxy statement asAppendix A. The essential features of the Incentive Plan are summarized below. The Incentive Plan is currently our sole plan for providing equity based incentive compensation to our employees. We provide equity compensation to our directors through a separate plan, the Amended and Restated 2000 Non-Employee Directors' Stock Option Plan, as amended (the “Directors Plan”). We are not seeking to add additional shares to the Directors Plan at this time.

During the last fiscal year, under the Incentive Plan, the Company granted to all current executive officers as a group, options to purchase 1,030,000 shares of common stock at exercise prices ranging from $8.73 to $12.77 per share and 419,000 shares of common stock with a market value on the date of grant ranging from $8.73 to $14.21, and to all employees (excluding executive officers) as a group, options to purchase 1,077,839 shares at exercise prices ranging from $8.73 to $45.51 per share and 200,677 shares of common stock with a market value on the date of grant ranging from $8.73 to $13.41.

During the last fiscal year, no options or other awards were granted under the Incentive Plan to any directors, except for Mr. Welch who was an executive officer on the date of the grant and except for Dr. Ekman who received options to purchase 15,000 shares of common stock in September 2010. (For information regarding stock option grants to non-employee directors under the Company’s 2000 Non-Employee Directors’ Stock Option Plan, see “Executive Compensation — Compensation of Directors.” For information regarding stock option grants to certain executive officers of the Company, see “Executive Compensation — Stock Option Grants and Exercises.”)

SUMMARY OF INCENTIVE PLAN

The essential features of the Incentive Plan, as it is proposed to be modified, are summarized below. The following description of the Incentive Plan is a summary only and stockholders are encouraged to read the full text of the Incentive Plan, which is filed with the Company’s Registration Statement on Form S-8 (No. 333-162141) filed with the SEC on September 25, 2009, and the proposed amendment, a copy of which is attached asAppendix A to this proxy statement.

18

General

The Incentive Plan provides for the grant of incentive stock options, non-statutory stock options, stock bonuses and restricted stock purchase awards (collectively “awards”). Incentive stock options granted under the Incentive Plan are intended to qualify as “incentive stock options” within the meaning of Section 422 of the Internal Revenue Code of 1986, as amended (the “IRC”). Non-statutory stock options granted under the Incentive Plan are not intended to qualify as incentive stock options under the IRC. (See “Federal Income Tax Information” for a discussion of the tax treatment of awards.)

Purpose