FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

Securities Exchange Act of 1934

For the month of February 2011

SANTANDER UK PLC

(Translation of registrant's name into English)

2 Triton Square, Regent’s

Place, London NW1 3AN, England

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F . . . .X. . . . Form 40-F . . . . . . . .

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes . . . . . . . No . . .X. . . .

Santander delivers 6th year of double digit profit growth

London, 3rd February 2011

This statement provides a summary of the unaudited business and financial trends for the year ended 31 December 2010. Unless otherwise stated, references to Santander UK and other general statements refer to the trading1 results and business flow analysis of Santander UK plc (“Santander U.K”) compared to the same period in 2009.

The results of Banco Santander, S.A. ("Banco Santander") for the year ended 31 December 2010 are also released today and can be found on www.santander.com. The results of Santander UK, on a Group basis, are included within Banco Santander’s financial statements.

“Santander UK delivered a strong performance in 2010, with a good flow of new business and a healthy uplift in profit despite a challenging operating environment.

The move to a single brand, offering a range of best-buy products, was supported by prudent lending and controlled costs. This allowed us to continue our strong support for the UK economy, where we wrote almost 1 in 5 mortgages and increased lending to small and medium-sized enterprises (SMEs) by 26%.

We enter 2011 with confidence. We are working towards completing the acquisition of 318 RBS branches, a key step in fulfilling our ambition to be a full-service commercial bank as we complement our strong retail offering with an increased presence for SMEs. This is an important part of Santander UK’s strategy and a vital sector for the growth of the economy. Our aim is to increase our lending to UK businesses and create new jobs as we open more business centres to serve them."

Ana Botín, Chief Executive Officer, Santander UK

Key Highlights

Santander UK delivering solid business growth and strong profits:

| ■ | double digit growth in trading profit before tax, with a stronger performance on a statutory basis; |

| ■ | trading income up c.4%, including the impact of more stringent regulatory liquidity requirements in the second half of the year; |

| ■ | flat costs resulting in a trading cost-to-income ratio of around 40%, almost 2 percentage points better than 2009 and maintaining Santander UK’s strong position relative to UK peers 2; |

| ■ | more than 10% reduction in impairment charges compared to the previous year largely due to improved arrears performance across the portfolio, especially in mortgages; and |

| ■ | improved the commercial funding position compared to December 2009, with growth in commercial deposits of 7% exceeding growth in commercial assets of 3%, resulting in an improvement in the loan to deposit ratio 3 to 122% from 126% in 2009. |

Becoming a full-service commercial bank:

| ■ | awarded “Best Bank in the UK” by Euromoney for the third year in succession and won “Bank of the Year” from The Banker for the second year running; |

| ■ | launched the latest stage of our Loyalty strategy in January 2011 which further extended eligibility for the market-leading Santander Zero Current Account to customers who hold £10,000 or more in savings with Santander. This now makes the Zero account an option for around 70 per cent of the UK’s adult population; |

Investor Relations

2 Triton Square, Regent’s Place, London NW1 3AN

| ■ | strong new business volumes in 2010 across the range of loyalty products including the Santander Zero current account, the Loyalty Tracker Bond and the Zero Credit Card. Eligible customers who hold one of our core products benefited from no fees on overdrafts, free worldwide ATM withdrawals, waived mortgage booking fees and market leading rates; |

| ■ | lending to SMEs grew by 26%, increasing the momentum of previous quarters and maintaining our support for this important sector of the UK economy; |

| ■ | for the second successive year we opened over 1 million new bank accounts; |

| ■ | competitive levels of new business written in our core markets with £24.2bn of gross mortgage lending and net deposit inflows of £9.6bn; |

| ■ | expanded our agency network by around 50% through the addition of a number of former Halifax agencies which were successfully rebranded and opened for business by the end of 2010; and |

| ■ | following agreement in August 2010, preparation for the integration of 318 RBS branches and 40 Corporate Business Centres has begun. |

Progress in improving customer service:

| ■ | to support our ongoing growth and improve customer service, the creation of 600 UK based customer-facing roles was announced in July and a further 400 in September. Recruitment is well under way with over 740 new employees deployed in our UK branches and call centres, with the remaining 260 expected to be in place by the end of March 2011; |

| ■ | customer satisfaction has improved over the twelve months to December 2010 as measured by our monthly internal survey of 20,000 customers; |

| ■ | complaints handling has been a key focus for improvement and we now typically resolve around 80% of complaints within 48 hours, with the volume of complaints reportable to the FSA reduced by around 20% in the second half of 2010; and |

| ■ | the latest figures from the Financial Ombudsman Service (FOS) confirm that uphold rates in favour of those customers who choose to escalate their complaints to FOS remains well below the industry average. |

Successful integration of A&L:

| ■ | all Alliance & Leicester (A&L) personal customers have migrated onto Santander’s core banking system Partenon, allowing them to transact at any of our c.1,400 outlets; |

| ■ | the rebranding of A&L branches was completed as planned in 2010; and |

| ■ | we remain on track to deliver and exceed the targeted cost savings of £180m by the end of 2011, announced at the time of the A&L acquisition. |

Investor Relations

2 Triton Square, Regent’s Place, London NW1 3AN

Financial results

Full year trading profit before tax was up over 10% compared to last year, with good results across all business units and a stronger result on a statutory basis.

Trading income

Trading income grew by c.4% largely driven by growth in net interest income, in part offset by lower fees.

Balanced growth in customer loans and deposits and a successful margin management strategy has led to higher net interest income. Higher lending margins were partly offset with the increased cost of deposit acquisition. In addition, higher costs of market funding and liquidity balances in response to new regulatory requirements, especially in the second half, have partly offset the healthy underlying new business activity. This has resulted in some pressure on the commercial banking margin with further impacts expected in 2011.

Successful campaigns in Retail Banking to attract new deposits and a 9% growth in personal bank account balances supported growth in mortgage lending. SVR balances have increased, driving income higher, although this successful retention strategy does have an offset in the relative cost of new customer deposits and market funding.

In Corporate Banking, growth in the SME lending book of 26% has driven increased revenue, while in Global Banking & Markets growth in customer transactions resulted in a strong fourth quarter of 2010 and led to robust growth in income despite more favourable conditions in 2009.

As seen throughout the sector, lower fees across the Retail Banking product range continue to restrict non-interest income growth. Better mortgage retention and the reduction of the unsecured book both contributed to the fall, while the continued shift in the sales mix of the investment range towards managed funds rather than structured products resulted in the substitution of upfront fees with ongoing future income streams.

Trading expenses

Operating expenses were marginally lower than last year as a result of the successful and ongoing cost management strategy. Within this framework the synergy benefits realised from the A&L integration have been re-invested to fund growth initiatives across the bank, including the ongoing recruitment in Retail operations to support business growth and improve customer service.

Trading provisions

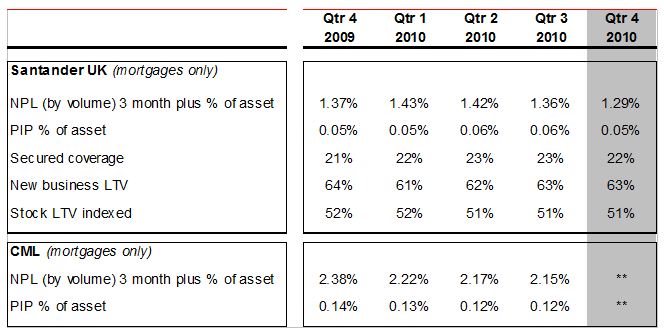

Trading provisions reduced by more than 10% compared to last year supported by improving mortgage and unsecured loan related charges stemming from reductions in arrears levels, more than offsetting an increase in charges in relation to the growing corporate book. Secured coverage improved to 22% with the mortgage non-performing loans ratio lower than December 2009.

The stock of properties in possession increased slightly to 873 cases from 820 in 2009, but still represents only 0.05% of the book, and continues to remain well below the industry average4. The mortgage non-performing loan ratio decreased for the third consecutive quarter to 1.29% from 1.37% a year ago. The level of arrears cases remained lower than expected, as did the average losses on repossessed properties following positive house price inflation in the first half of 2010. A strong focus on collections strategy, low interest rates and the relative stability of the UK economy continue to support the improving arrears position and the low volume of properties in possession.

Investor Relations

2 Triton Square, Regent’s Place, London NW1 3AN

Despite lower provisions charges, strong coverage continues to be maintained across the mortgage and UPL portfolios. High credit quality combined with stable new business and stock LTV helped to ensure that the business maintains its resilience against adverse economic conditions. Coverage of the unsecured portfolio remains above 100%.

The key ratios in the table below demonstrate the performance seen in the year:

** CML December 2010 data not available at time of reporting

Other profit and loss items

In August 2010 we announced a planned restructure to transfer to Santander UK the ownership of certain UK-related Group businesses. During the fourth quarter of 2010 Santander UK completed the acquisition of the UK operations of Santander Cards, Santander Consumer Finance and the remaining interest in Santander Private Banking. The loan books of these businesses amounted to around £6bn but given the timing of the transfer the impact on the full year financial performance was not material.

The statutory profit after tax for 2010 incorporates non-trading adjustments including reorganisation and other costs, hedging volatility and other one-off adjustments and charges. In 2010, the level of these was slightly lower than in 2009.

Balance sheet strength

Santander UK remains a UK focused institution with c.95% of the balance sheet UK-related and around 85% of customer loans made up of residential mortgages to UK customers.

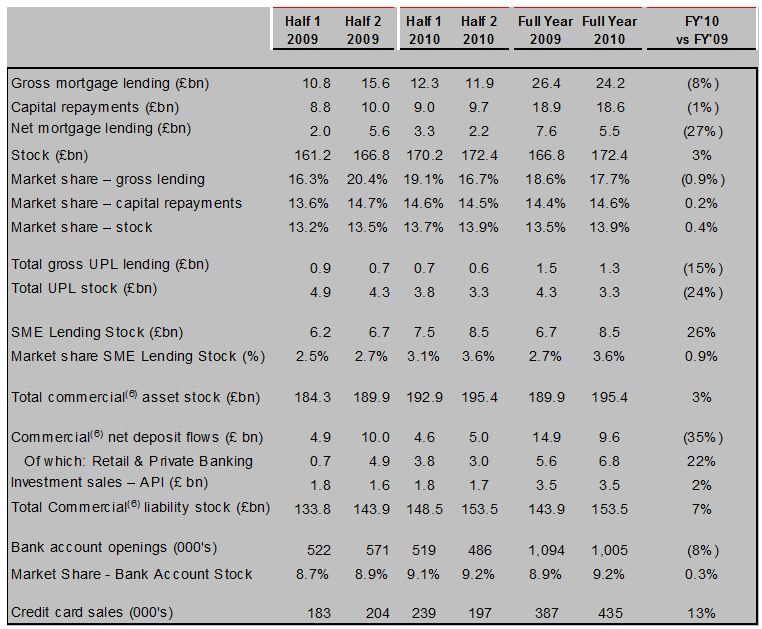

Commercial funding jaws of 4% resulted from balanced growth in customer loans and deposits (commercial asset stock grew 3% to £195.4bn and commercial liability stock grew 7% to £153.5bn). The commercial loan to deposit ratio improved to 122% from 126% in 2009.

In 2010 Santander raised almost £21bn of medium-term funding at attractive rates. This issuance represents c.7% 5 of total assets.

Deleveraging of non-core assets continued in 2010 with Corporate run-down balances 21% lower to £4.3bn and the Treasury Portfolio 46% lower at £5.1bn with further reductions planned for early 2011.

Investor Relations

2 Triton Square, Regent’s Place, London NW1 3AN

During the year, the holdings of high quality liquid assets increased significantly from £14bn to over £41bn in response to higher regulatory liquidity requirements. Liquid assets now make up around 15% of total assets 5 compared to 5% at December 2008.

Business flows

The key metrics in the table below highlight the performance achieved in the year:

| ■ | gross lending of £24.2bn with an estimated gross lending market share of around 18%, 4 percentage points above our stock share of c.14%. New lending continues to focus on affordability for low risk customers. The LTV of new lending and mortgage stock was 63% and 51% respectively, broadly unchanged since last year; |

| ■ | lending to the UK SME market continues to grow via our 25 regional business centres. Lending stock of £8.5bn was 26% higher than 2009 and equates to an estimated market share of 3.6% 7; |

| ■ | total gross UPL lending decreased by 15% to £1.3bn as a result of the bank’s ongoing focus of restricting unsecured lending to high quality customer segments. The de-leveraging of the UPL book has resulted in a 24% reduction in asset to £3.3bn; |

Investor Relations

2 Triton Square, Regent’s Place, London NW1 3AN

| ■ | net commercial deposit inflows of £9.6bn achieved through a strong performance across all business units despite the adverse impact of higher regulatory liquidity costs. Retail and Private Banking deposits were up 22%, while Corporate deposits, although lower than 2009, benefited from an improvement in quality and term; |

| ■ | investment sales increased by 2% to £3.5bn in a decreasing market in 2010; |

| ■ | more than 1 million bank accounts opened in the each of the last 2 years, including c.194,000 Zero Current Accounts in 2010. Strong bank account balance growth of around 9% was a result of not only the larger stock of accounts but also a focus on increasing the quality and primacy of openings; and |

| ■ | credit card sales of 435,000 grew by 13% with a continued focus on existing customers. |

| | 1 | Trading profit before tax is management’s preferred profit measure when assessing the performance of the business and is the internal measure of segment profit required to be disclosed under IFRS 8. It is calculated by adjusting statutory profit before tax for reorganisation and other costs, hedging and other variances, run-down and non-growth portfolio, profit on disposal of subsidiaries, goodwill on acquisition of associates and capital and other charges. In Q4 2010 Santander UK acquired Santander Consumer Finance, Santander Cards and the remaining interest of Santander Private Banking as part of the previously announced restructure of group companies. Given the timing of these transfers, the impact on the full year financials was not material, and excluded from this Trading Statement. |

| | 2 | For our internal review we compare to the PFS segments of The Royal Bank of Scotland Group, Lloyds Banking Group and Barclays Plc based on 2010 Interim Results. |

| | 3 | Includes Equity but not the capital injection received in August 2010. If included the loan to deposit ratio would be c.119%. |

| | 4 | Based on latest market data from the Council of Mortgages Lenders. |

| | 5 | Excluding derivatives and self funding (repos or reverse repos). |

| | 6 | Includes Retail and Corporate. |

| | 7 | Market share on an asset basis of SME businesses with turnover up to £150m. |

Investor Relations

2 Triton Square, Regent’s Place, London NW1 3AN

Santander UK plc & Banco Santander, S.A.

Santander UK plc (“Santander UK”) is a subsidiary of Banco Santander, S.A. (“Santander”) (SAN.MC, STD.N). Santander is a retail and commercial bank, based in Spain, with a presence in 10 main markets. At the close of June 2010, Santander was the largest bank in the euro zone by market capitalisation and, at the end of 2009, fourth in the world by profit. Founded in 1857, Santander had EUR 1,365 billion in managed funds. Santander has more than 95 million customers 14,082 branches – more than any other international bank – and over 178,000 employees. It is the largest financial group in Spain and Latin America, with leading positions in the United Kingdom and Portugal and a broad presence in Europe through its Santander Consumer Finance arm.

Santander has a standard listing of its ordinary shares on the London Stock Exchange and Santander UK continues to have its preference shares listed on the London Stock Exchange. Nothing in this press release constitutes or should be construed as constituting a profit forecast.

Disclaimer

Santander UK and Santander both caution that this press release may contain forward-looking statements. Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended, contain a safe harbour for forward-looking statements on which we rely in making such statements in documents filed with the U.S. Securities and Exchange Commission. Such forward-looking statements are found in various places throughout this press release. Words such as “believes”, “anticipates”, “expects”, “intends”, “aims” and “plans” and other similar expressions are intended to identify forward looking statements, but they are not the exclusive means of identifying such statements. Forward-looking statement s include, without limitation, statements concerning our future business development and economic performance. These forward looking statements are based on management’s current expectations, estimates and projections and both Santander UK and Santander caution that these statements are not guarantees of future performance. We also caution readers that a number of important factors could cause actual results to differ materially from the plans, objectives, expectations, estimates and intentions expressed in such forward-looking statements. Factors that may affect the Santander UK’s operations are described under ‘Risk Factors’ in Santander UK’s Annual Report and Accounts on Form 20-F for 2009. A more detailed cautionary statement is also given on page 5 of Santander UK’s Annual Report and Accounts on Form 20-F for 2009. When relying on forward-looking statements to make decisions with respect to Santander UK or Santander, investors and others sh ould carefully consider the foregoing factors and other uncertainties and events. Such forward-looking statements speak only as of the date on which they are made, and we do not undertake any obligation to update or revise any of them, whether as a result of new information, future events or otherwise. Statements as to historical performance, historical share price or financial accretion are not intended to mean that future performance, future share price or future earnings (including earnings per share) for any period will necessarily match or exceed those of any prior year.

This announcement is not a form of statutory accounts.

Contacts | | |

| Anthony Frost | (Head of UK Corporate Communications) | 020 7756 5536 |

| Jonathan Burgess | (Head of FMI, Planning & Investor Relations) | 020 7756 4182 |

| Israel Santos | (Head of Investor Relations) | 020 7756 4275 |

For more information contact: ir@santander.co.uk

Investor Relations

2 Triton Square, Regent’s Place, London NW1 3AN

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | SANTANDER UK PLC |

| | |

| Dated: 3 February 2011 | By / s / Jessica Petrie |