- Company Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

-

Shorts

-

PREM14A Filing

Xerox PREM14APreliminary proxy related to merger

Filed: 15 Mar 19, 5:31pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☒ | Soliciting Material under §240.14a-12 | |

XEROX CORPORATION

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☒ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

$861,754 | |||

| (2) | Form, Schedule or Registration Statement No.:

333-230342 | |||

| (3) | Filing Party:

Xerox Holdings Corporation | |||

| (4) | Date Filed:

March 15, 2019 | |||

The information in this preliminary joint proxy statement/prospectus is not complete and may be changed. These securities may not be issued until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary joint proxy statement/prospectus is not an offer to sell, nor does it seek an offer to buy, these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION

DATED MARCH 15, 2019

|

| Xerox Corporation |

JOINT PROXY STATEMENT/PROSPECTUS

YOUR VOTE IS VERY IMPORTANT

Dear Shareholders:

You are cordially invited to attend the 2019 Annual Meeting of Shareholders of Xerox Corporation (Xerox), to be held at 9:00 a.m. on Tuesday, May 21, 2019, at 301 Merritt 7 in Norwalk, Connecticut. We look forward to meeting our shareholders who are able to attend.

At the Annual Meeting, you will be asked to consider and vote upon proposals to: (i) adopt the merger agreement pursuant to which we will implement a holding company reorganization; (ii) elect seven directors to our board of directors; (iii) ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2019; (iv) approve, on an advisory basis, the 2018 compensation of our named executive officers; (v) authorize the amendment of the Xerox restated certificate of incorporation to implement a majority voting standard for certain corporate actions; and (vi) authorize the adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes to approve the foregoing proposals, in each case as described in the accompanying joint proxy statement/prospectus.

This year, we are asking you to approve a proposal to implement a holding company structure for Xerox. We regularly evaluate a range of possible strategic growth opportunities for our company. We believe implementation of a holding company structure will provide us with more flexibility to develop and realize these possibilities. By providing optionality for future innovation, investment and growth opportunities to exist either within or separate from current Xerox businesses, we believe that the holding company reorganization is an important step in reestablishing Xerox as a technology powerhouse with a robust portfolio of hardware, software, solutions and services, while preserving our existing customer, partner, vendor and supplier relationships. The holding company structure is intended to provide us with optionality to potentially acquire and incubate future businesses through subsidiaries that can operate on a global scale, with the flexibility to finance and structure each new opportunity in a manner that we believe will create value, while also maintaining — and continuing investment in — the existing Xerox product and technology platforms. We have carefully considered the holding company reorganization and believe it is advisable, fair to and in the best interests of our shareholders.

If the holding company reorganization is completed, your existing shares of Xerox common stock will be automatically converted, on aone-for-one basis, into shares of common stock of Xerox Holdings Corporation (Holdings), the new holding company. As a result, you will hold the same number of shares of Holdings common stock as you held of Xerox common stock immediately before the holding company reorganization. We expect the common stock of Holdings to trade on the New York Stock Exchange under Xerox’s current trading symbol, “XRX.”

Additionally, as a result of our shareholder engagement efforts and our commitment to corporate governance, we are asking you to approve a proposal to amend the Xerox restated certificate of incorporation to implement a majority voting standard for certain corporate actions which currently require a supermajority vote. We recognize that many shareholders believe that a majority voting requirement will provide shareholders with a greater voice in expressing their views on matters impacting Xerox.

Confident in the future direction and strategy of the Company, directors Greg Brown and Sara Martinez Tucker have decided not to stand for reelection to the Board. We thank them for their many significant contributions over the years.

Our Board unanimously recommends that you vote “FOR” the adoption of the merger agreement, “FOR” all nominees for director, “FOR” ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2019, “FOR” thenon-binding executive compensation proposal, “FOR” the majority voting standard proposal, and “FOR” the adjournment proposal.

Your vote is important — no matter how many or how few shares you may own. Whether or not you plan to attend the Annual Meeting, please vote your shares as soon as possible. You may vote via the Internet, by telephone or by signing, dating and mailing the enclosed proxy card. Specific instructions for shareholders of record who wish to use Internet or telephone voting procedures are included in the enclosed joint proxy statement/prospectus. Any shareholder attending the Annual Meeting may vote in person even if a proxy has been returned.

The accompanying notice of meeting and this joint proxy statement/prospectus provide specific information about the Annual Meeting and explain the various proposals. Please read these materials carefully.In particular, you should consider the discussion ofrisk factors beginning on page [●] before voting on the proposal to adopt the merger agreement pursuant to which we will implement the holding company reorganization.

Thank you for your continued support of Xerox.

For the Board of Directors,

| Keith Cozza | Giovanni (“John”) Visentin | |

| Chairman of the Board | Vice Chairman and Chief Executive Officer |

Neither the Securities and Exchange Commission, or SEC, nor any state securities regulatory agency has approved or disapproved of the securities to be issued under this joint proxy statement/prospectus or passed upon the adequacy or accuracy of the disclosure in this joint proxy statement/prospectus. Any representation to the contrary is a criminal offense.

The accompanying joint proxy statement/prospectus is dated [●], 2019 and is first being mailed to shareholders on or about [●], 2019.

Notice of 2019 Annual Meeting of Shareholders

You are cordially invited to attend the 2019 Annual Meeting of Shareholders of Xerox Corporation to be held at 9:00 a.m. on Tuesday, May 21, 2019, at 301 Merritt 7 in Norwalk, Connecticut. Your Board of Directors and management look forward to greeting those shareholders who are able to attend.

Shareholders will be asked to:

| 1. | Adopt the Agreement and Plan of Merger, dated as of March 15, 2019, by and among Xerox Corporation, Xerox Holdings Corporation and Xerox Merger Sub, Inc.; |

| 2. | Elect each of the seven directors named in this joint proxy statement/prospectus; |

| 3. | Ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2019; |

| 4. | Approve, on an advisory basis, the 2018 compensation of our named executive officers; |

| 5. | Authorize the amendment of the Xerox restated certificate of incorporation to implement a majority voting standard for certain corporate actions; and |

| 6. | Approve the proposal to authorize the adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes to approve the foregoing proposals at the time of the Annual Meeting. |

Shareholders will also be asked to consider such other business as may properly come before the Annual Meeting.

Voting:

You are eligible to vote if you were a shareholder of record at the close of business on March 25, 2019.

Ensure that your shares are represented at the meeting by voting in one of several ways:

| Go to the website listed on your proxy card to voteVIA THE INTERNET. | |

| Call the telephone number specified on your proxy card to voteBY TELEPHONE. | |

| Sign, date and return the enclosed proxy card in the postage-paid envelope provided to voteBY MAIL.

| |

|

Attend the meeting to voteIN PERSON(please see pages [●] and [●] of the proxy statement for additional information regarding admission to the Annual Meeting and how to vote your shares). | |

Please submit your proxy as soon as possible to ensure that your shares are represented, even if you plan to attend the Annual Meeting. Voting now will not limit your right to change your vote or to attend the Annual Meeting. | ||

If you have any questions or require assistance in voting your shares, you should call Harkins Kovler, LLC, Xerox’s proxy solicitor for the Annual Meeting, toll-free at (844)218-8384 (from the U.S. and Canada) or at (212)468-5380) (from other locations) (Banks and Brokerage firms may call collect at (212)468-5380).

By order of the Board of Directors,

Douglas H. Marshall

Corporate Secretary

Norwalk, Connecticut

[●], 2019

ADDITIONAL INFORMATION

This document constitutes a proxy statement of Xerox with respect to the solicitation of proxies for the Annual Meeting described within, and a prospectus of Holdings for the shares of Holdings common stock to be issued pursuant to the merger agreement. As permitted under the rules of the SEC, this joint proxy statement/prospectus incorporates important business and financial information about us that is contained in documents filed with the SEC that are not included in or delivered with this joint proxy statement/prospectus. You may obtain copies of these documents, without charge, from the web site maintained by the SEC at www.sec.gov, as well as other sources. See “Where You Can Find More Information” beginning on page [●].

You may also obtain copies of these documents, at no cost, by contacting Xerox at the following address or telephone number:

Xerox Corporation

201 Merritt 7

Norwalk, CT 06851-1056

(203)968-3000

or Harkins Kovler, LLC (“Harkins Kovler”), our proxy solicitor, at the following address or telephone numbers:

Harkins Kovler

3 Columbus Circle, 15th Floor

New York, NY 10019

(844)218-8384 or (212)468-5380

(Banks and Brokerage firms may call collect at (212)468-5380)

To receive timely delivery of requested documents in advance of the Annual Meeting, we should receive your request no later than [●], 2019.

We have not authorized any person to provide any information or to make any representation other than the information contained or incorporated by reference in this joint proxy statement/prospectus, and if any person provides any of this information or makes any representation of this kind, that information or representation must not be relied upon as having been authorized by us. If you receive any other information, you should not rely on it.

This joint proxy statement/prospectus is dated [●], 2019. You should not assume the information contained in this joint proxy statement/prospectus is accurate as of any date other than this date, and neither the mailing of this joint proxy statement/prospectus to shareholders nor the issuance of Holdings common stock pursuant to the merger agreement implies that information is accurate as of any other date. Our business, financial condition, results of operations and prospects may have changed since those dates.

i

IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING

The following are some of the questions that you may have about this joint proxy statement/prospectus and the answers to those questions. The information in this section does not provide all of the information that may be important to you with respect to this joint proxy statement/prospectus. Therefore, we encourage you to read the entire joint proxy statement/prospectus for more information about these topics.

The Annual Meeting

The 2019 Annual Meeting of Shareholders (“Annual Meeting”) of Xerox Corporation (“Xerox” or the “Company”), will be held beginning at 9:00 a.m. at 301 Merritt 7 in Norwalk, Connecticut, on Tuesday, May 21, 2019.

What is the purpose of the Annual Meeting?

At the Annual Meeting, shareholders will consider and vote on the following matters:

| 1. | Adoption of the Agreement and Plan of Merger, dated as of March 15, 2019, by and among Xerox Corporation, Xerox Holdings Corporation and Xerox Merger Sub, Inc.; |

| 2. | Election of each of the seven directors named in this joint proxy statement/prospectus; |

| 3. | Ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2019; |

| 4. | Approval, on an advisory basis, of the 2018 compensation of our named executive officers; |

| 5. | Authorization of the amendment of the Xerox restated certificate of incorporation to implement a majority voting standard for certain corporate actions; and |

| 6. | Approval of the proposal to authorize the adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes to approve the foregoing proposals at the time of the Annual Meeting. |

Shareholders will also be asked to consider any other business that may properly come before the Annual Meeting. In addition, our management will report on the holding company reorganization and Xerox’s performance during fiscal 2018 and respond to questions from shareholders.

Who is entitled to vote?

Owners of our common stock, par value $1.00, as of the close of business on March 25, 2019 (the “Record Date”), are entitled to vote at the Annual Meeting. The shares owned include shares you held on that date (1) directly in your name as the shareholder of record and/or (2) in the name of a broker, bank or other holder of record where the shares were held for you as the beneficial owner. Each share of common stock is entitled to one vote on each matter to be voted on. As of the Record Date, there were [●] shares of our common stock outstanding and entitled to vote. There are no other outstanding securities of the Company entitled to vote on the proposals at the Annual Meeting.

What is the difference between holding shares as a shareholder of record and as a beneficial owner?

If your shares are registered directly in your name with our transfer agent, Computershare, you are considered, with respect to those shares, a “shareholder of record.” In this case, this joint proxy statement/prospectus, the notice of Annual Meeting and the proxy card have been sent directly to you by us.

If your shares are held in a stock brokerage account or by a bank or other holder of record, you are considered the “beneficial owner” of shares held in “street name.” As a result, this joint proxy statement/prospectus, the notice of Annual Meeting and the proxy card have been forwarded to you by your broker, bank or other holder of record who is considered, with respect to those shares, the shareholder of record. As the beneficial owner, you have the right to direct your broker, bank or other holder of record on how to vote your shares by using the voting instruction card included in the mailing or by following their instructions for voting by telephone or on the Internet.

1

How do I vote?

Registered shareholderscan vote in any one of four ways:

BY INTERNET

|

BY TELEPHONE

| |

If you have Internet access, you may vote your shares by following the “Vote by Internet” instructions included on the enclosed proxy card. If you vote via the Internet, donot return your proxy card.

| If you received written materials, you may vote your shares by following the “Vote by Telephone” instructions on the enclosed proxy card. If you vote by telephone, donot return your proxy card.

| |

BY MAIL

|

IN PERSON

| |

If you received written materials, you may vote by completing and signing the proxy card enclosed with this joint proxy statement/prospectus and promptly mailing it in the enclosed postage-prepaid envelope. The shares you own will be voted according to your instructions on the proxy card you mail. If you sign and return your proxy card but do not indicate your voting instructions on one or more of the matters listed, the shares you own will be voted by the named proxies in accordance with the recommendations of our Board.

|

We will distribute written ballots to any shareholder of record or authorized representative of a shareholder of record who wants to vote in person at the Annual Meeting instead of by proxy. If you submit a proxy or voting instructions via the Internet, telephone or mail, you donot need to vote at the Annual Meeting. Voting in person will revoke any proxy previously given. |

If you use your proxy to vote by Internet, telephone or mail, you authorize each of the three directors, whose names are listed on the proxy card accompanying this joint proxy statement/prospectus, to act as your proxies to represent you and vote your shares as you direct.

Beneficial ownerswill receive enclosed with this joint proxy statement/prospectus, voting instructions from the bank, broker or other holder of record where the shares are held that must be followed in order for their shares to be voted. Beneficial owners should follow the instructions from their bank, broker or other holder of record in order for their shares to be voted. If you hold your shares through a broker, bank or nominee, you must obtain a “legal proxy” from your broker, bank or nominee to vote in person at the Annual Meeting.

What is a proxy?

It is your legal designation of another person to vote on matters transacted at the Annual Meeting based upon the stock you own. That other person is called a proxy. If you designate someone as your proxy in a written document, that document is also called a proxy or a proxy card.

May I change or revoke my vote after I return my proxy card?

Yes. You may change or revoke your proxy at any time before it is exercised at the Annual Meeting by submitting a later dated proxy card, by a later telephone or online vote, by notifying the Secretary of the Company in writing that you have revoked your proxy or by attending the Annual Meeting and either giving notice of revocation or voting in person.

If your shares are held in ��street name” (i.e., held of record by a broker, bank or other holder of record) and you wish to revoke a proxy, you should contact your bank, broker or other holder of record and follow its procedures for changing your voting instructions. You also may vote in person at the Annual Meeting if you obtain a legal proxy from your bank or broker.

How does the Board recommend that I vote?

The Board recommends that you vote:

| • | “FOR” the adoption of the Agreement and Plan of Merger, dated as of March 15, 2019, by and among Xerox Corporation, Xerox Holdings Corporation and Xerox Merger Sub, Inc.; |

2

| • | “FOR”the election of each of the seven directors named in this joint proxy statement/prospectus; |

| • | “FOR”the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2019; |

| • | “FOR”the approval, on an advisory basis, of the 2018 compensation of our named executive officers; |

| • | “FOR” the authorization of the amendment of the Xerox restated certificate of incorporation to implement a majority voting standard for certain corporate actions; and |

| • | “FOR”the approval of the proposal to authorize the adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes to approve the foregoing proposals at the time of the Annual Meeting. |

How will my proxy be voted?

If you properly complete, sign and return your proxy card, your shares will be voted as you specify. However, if you are a registered shareholder and you sign and return your proxy card but do not specify a vote with respect to the proposals, your proxy will follow the Board’s recommendations.

How can I attend the Annual Meeting?

Registered shareholders may be admitted to the Annual Meeting upon providing picture identification. If you own shares in street name, please bring your most recent brokerage statement, along with government-issued picture identification, to the Annual Meeting. We will use your brokerage statement to verify your ownership of common stock and admit you to the Annual Meeting.

All shareholders of record on the Record Date may attend. In order to be admitted to the Annual Meeting, please obtain an admission ticket in advance and bring a form of personal photo identification, such as a driver’s license.

To obtain an admission ticket:

If you are a registered shareholder:

| • | If you vote via the Internet or by telephone, you will be asked if you would like to receive an admission ticket. |

| • | If you vote by proxy card, please mark the appropriate box on the proxy card and an admission ticket will be sent to you. |

If you are a beneficial owner:

| • | Please request an admission ticket in advance by calling Shareholder Services at (203)849-2315 or by mailing a written request, along with proof of your ownership of Xerox common stock as of the Record Date, to Xerox Corporation, Shareholder Services, 201 Merritt 7, Norwalk, CT 06851-1056. All calls and written requests for admission tickets must be received no later than the close of business on May 10, 2019. |

You can find directions to the meeting online atwww.edocumentview.com/XRX. If you have any further questions regarding admission or directions to the Annual Meeting, please call Shareholder Services at(203) 849-2315.

How many shares are required to be present to hold the Annual Meeting?

A quorum is necessary to hold a valid meeting of shareholders. The presence at the Annual Meeting, in person or by proxy, of holders representing a majority of the shares of our common stock outstanding on the Record Date will constitute a quorum. If a quorum is not present at the Annual Meeting, the shareholders of Xerox will not be able to take action on any of the proposals at the Annual Meeting; provided that the Annual Meeting may be adjourned as described below.

As of the Record Date, there were [●] shares of our common stock outstanding. If you vote — including by Internet, telephone or proxy card — your shares will be counted towards the quorum for the Annual Meeting. Brokernon-votes and abstentions are counted as present for the purpose of determining a quorum.

3

If there is no quorum, the shareholders present may adjourn the Annual Meeting to another time and place, and it shall not be necessary to give any notice of such adjourned meeting if the time and place to which the Annual Meeting is adjourned are announced at the Annual Meeting. At the adjourned meeting, any business may be transacted that might have been transacted on the original date of the Annual Meeting. If after the adjournment, the Board fixes a new record date for the adjourned meeting, a notice of the adjourned meeting shall be given to each shareholder on the new record date entitled to notice under the restatedby-laws of Xerox. If Proposal 6 is approved, the Annual Meeting may also be adjourned to solicit additional proxies if there are not sufficient votes to approve Proposals 1, 2, 3, 4 or 5 at the Annual Meeting.

How many votes are required to approve each proposal?

Holding Company Reorganization. Under the Business Corporation Law of the State of New York (the “BCL”), the affirmative vote of at leasttwo-thirds of the outstanding shares entitled to vote thereon will be required for the approval of the proposal to adopt the merger agreement pursuant to which we will implement the holding company reorganization.

Amendment of the Restated Certificate of Incorporation. Under the BCL, the affirmative vote of at leasttwo-thirds of the outstanding shares entitled to vote thereon will be required for the approval of the amendment of the restated certificate of incorporation to implement a majority voting standard for certain corporate actions.

Election of Directors. Under the restatedby-laws of Xerox, directors are elected by majority vote, meaning that in an uncontested director election, the votes cast “for” the nominee’s election must exceed the votes cast “against” the nominee’s election, with abstentions and brokernon-votes not counting as votes “for” or “against.” The restatedby-laws of Xerox require that any incumbent nominee for director who receives a greater number of votes cast “against” his or her election than “for” his or her election shall tender his or her resignation promptly after such election. The independent directors will then evaluate and determine, based on the relevant facts and circumstances, whether to accept or reject the resignation. The Board’s explanation of its decision will be promptly disclosed on a Form8-K filed with the Securities and Exchange Commission (the “SEC”).

Other Items. The affirmative vote of a majority of the votes cast in favor of or against such action at the Annual Meeting will be required for approval of the following proposals.

| • | Ratification of PwC as our independent auditor; |

| • | Approval, on an advisory basis, of the 2018 compensation of our named executive officers; and |

| • | Approval of the adjournment proposal. |

Abstentions, failures to vote and brokernon-votes are not considered votes cast and therefore have no effect on the outcome of the vote on the proposals (provided that a quorum is present), with the exception of the proposals to approve the holding company reorganization and to approve the amendment of the Xerox restated certificate of incorporation. For these proposals, abstentions will have the effect of a vote “against” a proposal, and brokernon-votes will have no effect (provided that a quorum is present).

If you hold your Xerox shares through a bank, broker, or other holder of record, such intermediary may not be able to vote your shares. For additional information, see below underWhat is a brokernon-vote and how will it affect voting?

Although the advisory vote isnon-binding, the Board values the opinions of shareholders and will consider the outcome of the vote on this proposal when making future decisions regarding named executive officer compensation.

At present, the Board does not intend to present any other matters at this meeting and knows of no matters other than these to be presented for shareholder action at the Annual Meeting. If any other matters properly come before the Annual Meeting, the persons named in the accompanying proxy card intend to vote the proxies in accordance with their best judgment and in their discretion to the extent permitted by Rule14a-4(c) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

4

What is a brokernon-vote and how will it affect the voting?

A brokernon-vote occurs when a broker, bank or other holder of record, in nominee name or otherwise submits a proxy for the Annual Meeting, but does not vote on a particular proposal because it has not received voting instructions from the beneficial owner and it does not otherwise have discretion to vote the uninstructed shares. Under the NYSE rules that govern brokers who are voting with respect to shares held in street name, brokers only have the discretion to vote those shares for which it has not received voting instructions on “routine” matters, but not on“non-routine” matters. Routine matters to be presented at the Annual Meeting include the ratification of the selection of independent public accountants. Thenon-routine matters to be presented at the Annual Meeting include the approval of the holding company reorganization, the election of directors, the advisory vote on executive compensation, amendment of the Xerox restated certificate of incorporation, and the adjournment proposal.

If you do not instruct your broker on how to vote your shares with respect to thesenon-routine matters, your broker will not be able to cast a vote on these proposals. Accordingly, we urge you to give instructions to your bank or broker or other holder of record as to how you wish your shares to be voted so you may vote on these important matters.

Who will count the vote? Is my vote confidential?

A representative of Computershare will act as Inspector of Elections, supervise the voting, decide the validity of proxies and receive and tabulate proxies. As a matter of policy, we keep confidential all shareholder meeting proxies, ballots and voting tabulations that identify individual shareholders. In addition, the vote of any shareholder is not disclosed except as may be necessary to meet legal requirements.

When will the voting results be disclosed?

We will publicly disclose voting results of the Annual Meeting within four business days after the Annual Meeting in a Current Report on Form8-K.

How are proxies solicited?

In addition to the solicitation of proxies by mail, we also request brokerage houses, nominees, custodians and fiduciaries to forward soliciting material to the beneficial owners of stock held of record and reimburse such person for the cost of forwarding the material. We have engaged Harkins Kovler to handle the distribution of soliciting material to, and the collection of proxies from, such entities. We will pay Harkins Kovler a fee of $20,000.00, plus reimbursement ofout-of-pocket expenses, for this service. We bear the cost of all proxy solicitation.

What are the deadlines and requirements for shareholder submission of proposals, director nominations and other business for the 2020 Annual Meeting of Shareholders?

We expect to hold our 2020 Annual Meeting of Shareholders during the second half of May 2020 and to file and mail our Proxy Statement for that meeting during the first half of April 2020. Under SEC proxy rules, if a shareholder wants us to include a proposal in our Proxy Statement and proxy card for the 2020 Annual Meeting of Shareholders, the proposal must be received by us no later than December 13, 2019. All submissions are reviewed by the Corporate Governance Committee.

Any shareholder wishing to make a nomination for director or wishing to introduce any business at the 2020 Annual Meeting of Shareholders (other than a proposal submitted for inclusion in the Company’s proxy materials) must provide the Company advance notice of such nominee or business which must be received by the Company no earlier than November 13, 2019 and no later than December 13, 2019. Any such notice must comply with requirements set forth in the restatedby-laws of Xerox. Nominations for director must be accompanied by a written consent of the nominee consenting to being named as a nominee and serving as a director if elected. Proposals and other items of business should be directed to Xerox Corporation, 201 Merritt 7, Norwalk, CT 06851-1056, Attention: Corporate Secretary.

5

How can I contact the Board?

Under our Corporate Governance Guidelines, shareholders and other interested parties may contact thenon-management members of the Board by contacting the Chairman of the Corporate Governance Committee using the “Contact the Board” link posted on our Company’s website atwww.xerox.com/governance.

What if multiple shareholders have the same address?

Where multiple shareholders reside in the same household, we will deliver a single copy of the proxy materials, along with separate proxy cards to multiple shareholders who reside in the same household unless we have received contrary instructions. If you share a household with another registered shareholder and would like to receive separate copies of our proxy materials, you may request a change in delivery preferences. For registered shareholders, you may contact our transfer agent at(800)-828-6396 or write them at Computershare, P.O. Box 30170, College Station, TX 77842-3170. For beneficial owners, you may call the bank, broker or other nominee where your shares are held in street name or call (800)542-1061.

How may I get copies of the proxy materials?

Copies of the 2018 Annual Report and 2019 joint proxy statement/prospectus have been distributed to shareholders. Additional paper copies of these documents are available at no cost upon request made to Xerox Corporation, 201 Merritt 7, Norwalk, CT 06851-1056, Attention: Corporate Secretary, or by contacting Harkins Kovler, our proxy solicitor, by mail at 3 Columbus Circle, 15th Floor, New York, NY 10019, or by telephonetoll-free at (844)218-8384 (from the U.S. and Canada) or at (212)468-5380 (from other locations) (Banks and Brokerage firms may call collect at (212)468-5380). You may request paper copies of the materials until one year after the date of the Annual Meeting.

The 2018 Annual Report and joint proxy statement/prospectus are also available on the Company’s website atwww.xerox.com/investor orwww.edocumentview.com/XRX.

Registered shareholders can also elect to receive future distributions of our proxy statements, annual reports to shareholders and proxy cards by electronic delivery atwww.computershare.com/investor. Beneficial owners can sign up for electronic delivery athttp://enroll.icsdelivery.com/xrx or by checking the information provided in the proxy materials mailed to you by your bank or broker regarding the availability of this service. Opting to receive future proxy materials electronically by email will provide the Company cost savings relating to printing and postage and reduce the environmental impact of delivering documents to you.

Is there a list of shareholders entitled to vote at the Annual Meeting?

A list of registered shareholders entitled to vote at the Annual Meeting will be available at the Annual Meeting and for ten days prior to the Annual Meeting at our offices located at Xerox Corporation, 201 Merritt 7, Norwalk, CT 06851-1056.

6

QUESTIONS AND ANSWERS ABOUT THE HOLDING COMPANY REORGANIZATION PROPOSAL

The following questions and answers are intended to address briefly certain questions regarding the proposal to adopt the merger agreement pursuant to which we will implement the holding company reorganization. These questions and answers do not address all questions that may be important to you as a Xerox shareholder. Please refer to “Proposal 1 — Approval of The Holding Company Reorganization” and the more detailed information contained elsewhere in this joint proxy statement/prospectus and the documents incorporated by reference into this joint proxy statement/prospectus, which you should read carefully.

What is the holding company reorganization proposal?

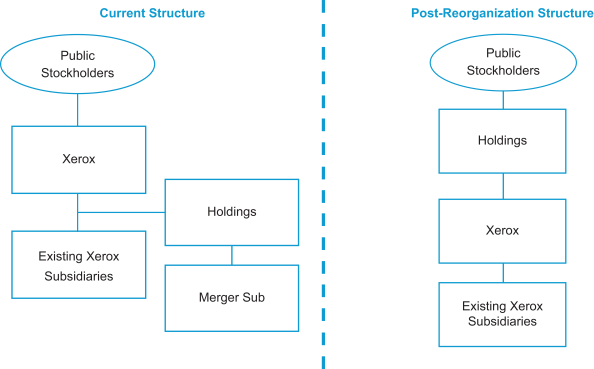

We are asking you to approve a proposal to adopt the merger agreement pursuant to which we will implement the holding company reorganization. If the holding company reorganization is completed, Xerox will become a direct, wholly-owned subsidiary of Holdings, a New York corporation. As a result, current common shareholders of Xerox will become common shareholders of Holdings, and will hold the same number of common shares of Holdings as they held of Xerox immediately prior to theholding company reorganization. A copy of the merger agreement is attached as Annex A to this joint proxy statement/prospectus. Upon completion of the holding company reorganization, the forms of restated certificate of incorporation andby-laws of Holdings attached to this joint proxy statement/prospectus as Annex B and Annex C, respectively, will take effect. You are encouraged to read the merger agreement and forms of restated certificate of incorporation andby-laws of Holdings carefully.

Why is Xerox proposing the holding company reorganization?

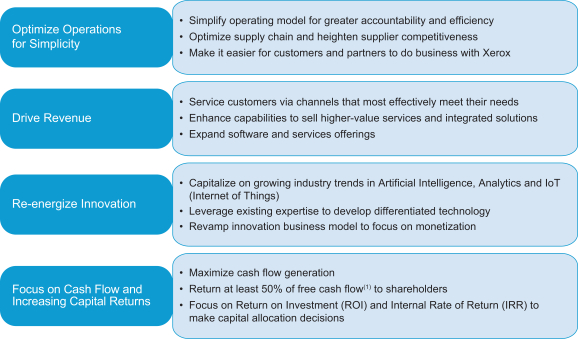

We regularly evaluate a range of possible strategic growth opportunities. We believe implementation of a holding company structure will provide us with flexibility to develop and realize these possibilities. By providing optionality for future innovation, investment and growth opportunities to exist either within or separate from current Xerox businesses, we believe that the holding company reorganization is an important step in reestablishing Xerox as a technology powerhouse with a robust portfolio of hardware, software, solutions and services, while preserving our existing customer, partner, vendor and supplier relationships. The holding company structure is intended to provide us with optionality to potentially acquire and incubate future businesses through subsidiaries that can operate on a global scale, with the flexibility to finance and structure each new opportunity in a manner that we believe will create value, while also maintaining — and continuing investment in — the existing Xerox product and technology platforms.

Will the management or the business of the company change as a result of the holding company reorganization?

No. The management and business of our company will remain the same immediately following the holding company reorganization. We expect that the directors and executive officers of Xerox will also serve in the same capacities for Holdings, including their capacities as members of board committees. Immediately following the holding company reorganization, we expect Holdings to adopt Corporate Governance Guidelines, a Code of Business Conduct, a Code of Business Conduct and Ethics for Members of the Board, and a Finance Code of Conduct substantially the same in all material respects as the corresponding guidelines and codes of Xerox.

What will happen to my Xerox common stock?

If the holding company reorganization is completed, each share of common stock of Xerox will convert into one share of common stock of Holdings. As a result, you will become a shareholder of Holdings and will hold the same number of shares of Holdings common stock that you hold of Xerox common stock immediately prior to the holding company reorganization. We expect that Holdings common stock will be listed on the New York Stock Exchange under the symbol “XRX,” the same ticker symbol currently used for Xerox common stock. We do not expect to list Holdings common stock on the Chicago Stock Exchange, and, in connection with the holding company reorganization, intend to delist Xerox’s common stock from the Chicago Stock Exchange.

7

What will happen to the issued and outstanding shares of Xerox Series B Preferred Stock?

If the holding company reorganization is completed, each share of Xerox Series B convertible perpetual preferred stock (“Series B Preferred Stock”) will be exchanged for one share of Holdings Series A convertible perpetual voting preferred stock (“Series A Preferred Stock”). As a result, the holder of the Xerox Series B Preferred Stock will hold the same number of shares of Holdings Series A Preferred Stock that he held of Xerox Series B Preferred Stock immediately prior to the holding company reorganization. Upon completion of the holding company reorganization, all outstanding shares of the Xerox Series B Preferred Stock will be held by Holdings. The holder of the Xerox Series B Preferred Stock has consented to the terms of the holding company reorganization, notwithstanding any provisions of the Xerox restated certificate of incorporation.

Each share of Holdings Series A Preferred Stock will have the same designations, rights, powers and preferences, and the same qualifications, limitations and restrictions as the existing shares of Xerox Series B Preferred Stock, with the addition of certain voting rights to ensure the treatment of the holding company reorganization as a “reorganization” for U.S. federal income tax purposes. The Holdings Series A Preferred Stock will vote together with the Holdings common stock, as a single class, on all matters submitted to the shareholders of Holdings, but the Holdings Series A Preferred Stock will only be entitled to one vote for every ten shares of Holdings common stock into which the Holdings Series A Preferred Stock is convertible. For more information, see “Proposal 1 — Approval of The Holding Company Reorganization — Comparative Rights of Xerox and Holdings Shareholders.”

Will my rights as a common shareholder of Holdings be different from my rights as a common shareholder of Xerox?

Assuming that the proposed amendment to the Xerox restated certificate of incorporation (Proposal 5) is authorized by shareholders and becomes effective prior to completion of the holding company reorganization, the rights of shareholders of Holdings after giving effect to the holding company reorganization will be substantially similar in all material respects to the current rights of Xerox shareholders, subject to nominal dilution of voting rights as a result of the voting provisions of the Holdings Series A Preferred Stock. The Holdings Series A Preferred Stock will vote together with the Holdings common stock, as a single class, on all matters submitted to the shareholders of Holdings, but the Holdings Series A Preferred Stock will only be entitled to one vote for every ten shares of Holdings common stock into which the Holdings Series A Preferred Stock is convertible. Based on 180,000 shares of Xerox Series B Preferred Stock outstanding, which will be exchanged for 180,000 shares of Holdings Series A Preferred Stock as a result of the merger yielding voting rights of 674,157 votes as of [●], 2019, the voting rights of Xerox common shareholders will be diluted by approximately 0.29% upon completion of the holding company reorganization (based on [●] shares of Xerox common stock outstanding on the Record Date).

If the proposed amendment to the Xerox restated certificate of incorporation (Proposal 5) is not authorized by shareholders or does not become effective prior to completion of the holding company reorganization, the rights of common shareholders of Holdings after giving effect to the holding company reorganization will be substantially similar in all material respects to the current rights of Xerox common shareholders, subject to nominal dilution of voting rights as described above and except that the voting rights of holders of Holdings common stock will be different from the voting rights of holders of Xerox common stock in that the voting requirement to approve the following corporate actions will be at least a majority of the outstanding shares entitled to vote thereon (as compared totwo-thirds of the outstanding shares entitled to vote thereon):

| • | Adoption of a plan of merger or consolidation; |

| • | Authorization of a sale, lease, exchange or other dispositions of all or substantially all the assets of the corporation; |

| • | Adoption of a plan for the exchange of shares; and |

| • | Authorization of dissolution of the corporation. |

The forms of restated certificate of incorporation andby-laws of Holdings that will be effective upon completion of the holding company reorganization are attached to this joint proxy statement/prospectus as Annex B and Annex C, respectively. See “Proposal 1 — Approval of The Holding Company Reorganization — Comparative Rights of Xerox and Holdings Shareholders.”

8

Will the CUSIP number for my common stock change as a result of the holding company reorganization?

Yes. Following the holding company reorganization, the CUSIP number for your shares of Holdings common stock will be [●].

Will I have to turn in my Xerox common stock certificate(s)?

No. We will not require you to exchange your Xerox common stock certificates as a result of the holding company reorganization. After the holding company reorganization, each certificate currently representing your shares of Xerox common stock will be deemed for all purposes to evidence the same number of shares of Holdings common stock.

How will the holding company reorganization be treated for accounting purposes?

For accounting purposes, the holding company reorganization will be treated as a transaction between entities under common control, resulting in no change in the carrying amount of Xerox’s existing assets or liabilities. Accordingly, the financial position and results of operations of Xerox will be included in the consolidated financial statements of Holdings on the same basis as currently presented.

Will the holding company reorganization affect my U.S. federal income taxes?

The holding company reorganization is intended to be atax-free transaction under U.S. federal income tax laws. We expect that you will not recognize any gain or loss for federal income tax purposes upon your receipt of Holdings common stock in exchange for your shares of Xerox common stock in the holding company reorganization. The tax consequences to you will depend on your own situation. We urge you to consult your own tax advisors concerning the specific tax consequences of the holding company reorganization to you, including any foreign, state, or local tax consequences. For more information, see “Proposal 1 — Approval of The Holding Company Reorganization — Material U.S. Federal Income Tax Consequences.”

What vote is required to approve the holding company reorganization?

Approval of the holding company reorganization proposal requires the affirmative vote oftwo-thirds of all outstanding shares of Xerox common stock entitled to vote on the proposal. As a result, abstentions and the failure to submit a proxy vote or to vote in person on this proposal at the Annual Meeting will have the same effect as a vote “Against” the proposal. Brokernon-votes will have no effect (provided that a quorum is present).

If approved by shareholders, when will the holding company reorganization occur?

The holding company reorganization will be completed when we file a certificate of merger with the Department of State of the State of New York. We currently plan to complete the holding company reorganization promptly following satisfaction of conditions to the holding company reorganization, including shareholder approval, or at such later time as the Company determines. However, we may choose not to complete the holding company reorganization, even if the Xerox shareholders approve the holding company reorganization proposal. See “Risk Factors — Even with shareholder approval, the holding company reorganization may not be completed.”

Do I have dissenters’ (or appraisal) rights in connection with the holding company reorganization?

No. Holders of Xerox common stock do not have dissenters’ rights under New York law as a result of the holding company reorganization even if the holding company reorganization is approved by our shareholders.

9

Who do I contact if I have questions about the holding company reorganization proposal?

If you have questions about the holding company reorganization, or if you need assistance in submitting your proxy or voting your shares or need additional copies of this joint proxy statement/prospectus or the enclosed proxy card, you should contact Harkins Kovler, our proxy solicitor, by mail at 3 Columbus Circle, 15th Floor, New York, NY 10019, or by telephone toll-free at (844)218-8384 (from the U.S. and Canada) or at(212) 468-5380 (from other locations) (Banks and Brokerage firms may call collect at (212)468-5380). If your shares are held in a stock brokerage account or by a bank or other nominee, you should contact your broker, bank or other nominee for additional information.

10

SUMMARY OF THE HOLDING COMPANY REORGANIZATION PROPOSAL

This section highlights key aspects of the proposal to adopt the merger agreement pursuant to which we will implement the holding company reorganization, that are described in greater detail elsewhere in this joint proxy statement/prospectus. It does not contain all of the information that may be important to you. To better understand the holding company reorganization proposal, and for a more complete description of the legal terms of the merger agreement, you should read this entire document carefully, including the Annexes, and the additional documents to which we refer you. You can find information with respect to these additional documents in “Where You Can Find More Information.”

Parties Involved in the Holding Company Reorganization

| • | Xerox Corporation. Xerox is a print technology and intelligent work solutions leader focused on helping people communicate and work better. We apply our expertise in imaging and printing, data analytics, and the development of secure and automated solutions to help our customers improve productivity and increase client satisfaction. Xerox is a New York corporation and Xerox common stock, par value $1.00, trades on the New York Stock Exchange and the Chicago Stock Exchange under the symbol “XRX.” Additional information about Xerox is contained in our public filings, which are incorporated by reference herein. See “Where You Can Find More Information.” |

| • | Xerox Holdings Corporation. Holdings is a New York corporation that is a wholly owned subsidiary of Xerox and was formed in order to effect the holding company reorganization. Prior to the holding company reorganization, Holdings will have no assets or operations other than those incident to its formation. After the holding company reorganization, Xerox will be a wholly owned subsidiary of Holdings, and the current common shareholders of Xerox will become common shareholders of Holdings. |

| • | Xerox Merger Sub, Inc. Merger Sub is a New York corporation that is a wholly owned subsidiary of Holdings and was formed in order to effect the holding company reorganization. Prior to the holding company reorganization, Merger Sub will have no assets or operations other than those incident to its formation. In connection with the holding company reorganization, Merger Sub will merge with and into Xerox and will cease to exist following the merger. |

The principal executive offices of Xerox, Holdings and Merger Sub are located at 201 Merritt 7, Norwalk, Connecticut 06851-1056. Their telephone number is (203)968-3000. The management and business of Xerox will remain the same immediately following the holding company reorganization.

The Holding Company Reorganization

We are asking you to approve a proposal to adopt the merger agreement pursuant to which we will implement the holding company reorganization. If the holding company reorganization is completed, Xerox will become a direct, wholly-owned subsidiary of Holdings, a New York corporation. As a result, current common shareholders of Xerox will become common shareholders of Holdings, and will hold the same number of common shares of Holdings as they held of Xerox immediately prior to theholding company reorganization. A copy of the merger agreement is attached as Annex A to this joint proxy statement/prospectus. Upon completion of the holding company reorganization, the forms of restated certificate of incorporation andby-laws of Holdings attached to this joint proxy statement/prospectus as Annex B and Annex C, respectively, will take effect. You are encouraged to read the merger agreement and forms of restated certificate of incorporation andby-laws of Holdings carefully.

Treatment of Xerox Common Stock in the Holding Company Reorganization

If the holding company reorganization is completed, each share of common stock of Xerox will convert into one share of common stock of Holdings. As a result, you will become a shareholder of Holdings and will hold the same number of shares of Holdings common stock that you hold of Xerox common stock immediately prior to the holding company reorganization. We expect that Holdings common stock will be listed on the NYSE under the symbol “XRX,” the same ticker symbol currently used for Xerox common stock. We do not expect to list Holdings common stock on the Chicago Stock Exchange, and, in connection the holding company reorganization, intend to delist Xerox’s common stock from the Chicago Stock Exchange.

11

Treatment of Xerox Series B Preferred Stock in the Holding Company Reorganization

If the holding company reorganization is completed, each share of Xerox Series B Preferred Stock will be exchanged for one share of Holdings Series A Preferred Stock. As a result, the holder of the Xerox Series B Preferred Stock will hold the same number of shares of Holdings Series A Preferred Stock that he held of Xerox Series B Preferred Stock immediately prior to the holding company reorganization. Upon completion of the holding company reorganization, all outstanding shares of the Xerox Series B Preferred Stock will be held by Holdings. The holder of the Xerox Series B Preferred Stock has consented to the terms of the holding company reorganization, notwithstanding any provisions of the Xerox restated certificate of incorporation.

Each share of Holdings Series A Preferred Stock will have the same designations, rights, powers and preferences, and the same qualifications, limitations and restrictions as the existing shares of Xerox Series B Preferred Stock, with the addition of certain voting rights to ensure the treatment of the holding company reorganization as a “reorganization” for U.S. federal income tax purposes. The Holdings Series A Preferred Stock will vote together with the Holdings common stock, as a single class, on all matters submitted to the shareholders of Holdings, but the Holdings Series A Preferred Stock will only be entitled to one vote for every ten shares of Holdings common stock into which the Holdings Series A Preferred Stock is convertible. For more information, see “Proposal 1 — Approval of The Holding Company Reorganization — Comparative Rights of Xerox and Holdings Shareholders.”

Treatment of Xerox Stock Plans and Outstanding Equity Awards

Pursuant to the terms of the merger agreement, at the effective time, Xerox will transfer to Holdings, Holdings will assume sponsorship of, and Holdings will agree to perform all obligations under, the June 30, 2017 Amendment and Restatement of the Xerox Corporation 2004 Performance Incentive Plan (the “Performance Incentive Plan”) and the 2013 Amendment and Restatement of the Xerox Corporation 2004 Equity Compensation Plan forNon-Employee Directors (the “Directors Plan,” and together with the Performance Incentive Plan, the “Xerox Stock Plans”) and each outstanding award granted under the Xerox Stock Plans. Accordingly, Holdings will assume each of the Xerox Stock Plans and all unexercised and unexpired options to purchase Xerox common stock (each, a “Stock Option”) and each right to acquire or vest in a share of Xerox common stock, including restricted stock unit awards, performance share awards and deferred stock units (each, a “Stock Right” and together with the Stock Options, the “Awards��) that are outstanding under the Xerox Stock Plans at the effective time. At the effective time, the reserve of Xerox common stock under each Xerox Stock Plan, whether allocated to outstanding equity awards under such Xerox Stock Plans or unallocated at that time, will automatically be converted on aone-share-for-one-share basis into shares of Holdings common stock, and the terms and conditions that are in effect immediately prior to the effective time under each outstanding Award assumed by Holdings will continue in full force and effect after the effective time, including, without limitation, the vesting schedule and applicable issuance dates, the per share exercise price, the expiration date and other applicable termination provisions, except that the shares of common stock issuable under each such Award will be shares of Holdings common stock.

As of the Record Date, the following Awards were outstanding under the Xerox Stock Plans: [●] stock options to purchase [●] shares of Xerox common stock, [●] performance shares, [●] restricted stock units and [●] shares of restricted stock.

Issuances of Holdings Common Stock Under the Xerox Stock Plans

The adoption of the merger agreement by the shareholders of Xerox will also constitute approval, without further shareholder action, of any amendments to the Xerox Stock Plans necessary, appropriate or advisable to authorize (i) the assumption by Holdings of the Xerox Stock Plans (including the existing share reserves), and the outstanding Awards under such plans, (ii) the issuance of existing Awards and future Awards of Holdings common stock in lieu of Xerox common stock under each of the Xerox Stock Plans, and (iii) Holdings’ ability to issue Awards under the Xerox Stock Plans to the eligible employees of Holdings and any of its subsidiaries, including any subsidiary formed or acquired after the effective time.

12

Recommendation of the Xerox Board of Directors and Reasons for the Holding Company Reorganization

The Xerox Board unanimously recommends that the shareholders of Xerox vote “FOR” the proposal to adopt the merger agreement pursuant to which we will implement the holding company reorganization. For a description of the reasons considered by the Xerox Board in deciding to recommend the approval of the proposal to adopt the merger agreement pursuant to which we will implement the holding company reorganization, see “Proposal 1 — Approval of The Holding Company Reorganization — Recommendation of the Xerox Board of Directors and Reasons for the Holding Company Reorganization.”

Conditions to Completion of the Holding Company Reorganization

We will complete the holding company reorganization only if each of the following conditions is satisfied (or, to the extent not prohibited by law, waived by Xerox):

| • | adoption of the merger agreement bytwo-thirds of the votes of all outstanding Xerox shares entitled to vote thereon; |

| • | absence of any law, order or pending legal proceeding that would prevent completion of the holding company reorganization; |

| • | receipt of approval from the United Kingdom Financial Conduct Authority in accordance with Part XII of the United Kingdom Financial Services and Markets Act 2000; |

| • | effectiveness of the registration statement, of which this joint proxy statement/prospectus forms a part, relating to the shares of Holdings common stock to be issued in the holding company reorganization and absence of any stop order suspending such effectiveness; and |

| • | receipt of approval for listing on NYSE of shares of Holdings common stock to be issued in the holding company reorganization, subject to official notice of issuance. |

See “Risk Factors — Even with shareholder approval, the holding company reorganization may not be completed.”

Regulatory Approvals

As noted above, the holding company reorganization is conditioned on, among other things, (i) receipt of approval of the holding company reorganization by the Financial Conduct Authority of the United Kingdom (“FCA”), (ii) the effectiveness of the registration statement, of which this joint proxy statement/prospectus forms a part, and (iii) the receipt of approval for listing on NYSE of shares of Holdings common stock to be issued in the holding company reorganization, subject to official notice of issuance. For more information relating to the required FCA approval, see “Proposal 1 — Approval of The Holding Company Reorganization — Merger Agreement. In addition, to complete the holding company reorganization, we must file a certificate of merger with the New York State Department of State in accordance with the New York Business Corporation Law.

We are not aware of any other federal, state, local or foreign regulatory requirements that must be complied with or approvals that must be obtained in connection with the holding company reorganization.

Termination of the Holding Company Reorganization

At the discretion of the Xerox Board of Directors, we may determine not to proceed with the holding company reorganization at any time, even after approval by Xerox shareholders. See “Risk Factors — Even with shareholder approval, the holding company reorganization may not be completed.”

Material U.S. Federal Income Tax Consequences

The holding company reorganization is intended to be atax-free transaction under U.S. federal income tax laws. We expect that Xerox common shareholders will not recognize any gain or loss for U.S. federal income tax purposes upon receipt of Holdings common stock in exchange for shares of Xerox common stock. However, the tax consequences to you will depend on your own situation. You are urged to consult your own tax advisors concerning the specific tax consequences of the holding company reorganization to you, including any state, local or foreign tax consequences. See “Proposal 1 — Approval of The Holding Company Reorganization — Material U.S. Federal Income Tax Consequences.”

13

Security Ownership of Directors and Executive Officers

As of March 25, 2019, the Record Date for the Annual Meeting, our directors and executive officers beneficially owned [●] shares of Xerox common stock, representing approximately [●]% of the issued and outstanding shares of common stock as calculated pursuant to Rule13d-3 of the Securities Exchange Act of 1934, as amended. Each director and executive officer has advised us that they each plan to vote all of their respective shares of common stock in favor of the proposals to be presented at the Annual Meeting, including the proposal to adopt the merger agreement pursuant to which we will implement the holding company reorganization.

As of the Record Date, Carl C. Icahn beneficially owned [●] shares of Xerox common stock, representing approximately [●]% of the issued and outstanding shares of common stock as calculated pursuant toRule 13d-3 of the Securities Exchange Act of 1934, as amended, based solely on the Schedule 13D/A filed with the SEC on February 25, 2019. Mr. Icahn has advised us that he intends to vote all of his shares of common stock in favor of the proposals to be presented at the Annual Meeting, including the proposal to adopt the merger agreement pursuant to which we will implement the holding company reorganization.

As of the Record Date, Darwin A. Deason beneficially owned [●] shares of Xerox common stock, representing approximately [●]% of the issued and outstanding shares of common stock calculated pursuant to Rule13d-3 of the Securities Exchange Act of 1934, as amended (including 6,741,572 shares of common stock issuable upon the conversion of 180,000 shares of Xerox Series B Preferred Stock), based solely on the Schedule 13D/A filed with the SEC on May 15, 2018. Mr. Deason has advised us that he intends to vote all of his shares of common stock in favor of the proposals to be presented at the Annual Meeting, including the proposal to adopt the merger agreement pursuant to which we will implement the holding company reorganization.

The affirmative vote of the holders oftwo-thirds of the outstanding shares of Xerox common stock entitled to vote on the proposal is required to approve the holding company reorganization.

Risk Factors

Before voting on the holding company reorganization, you should carefully consider all of the information contained in or incorporated by reference into this joint proxy statement/prospectus and especially consider the factors discussed in “Risks Factors” beginning on page [●] as well as the additional risk factors incorporated by reference herein that relate to Xerox’s business.

Dissenters’ Rights

Holders of Xerox common stock do not have dissenters’ rights under New York law as a result of the holding company reorganization even if the holding company reorganization is approved by our shareholders.

Markets and Market Prices

Holdings common stock is not currently traded on any stock exchange. Following the holding company reorganization, we expect Holdings common stock to trade on the NYSE under Xerox’s current trading symbol, “XRX.” We do not expect to list Holdings common stock on the Chicago Stock Exchange, and, in connection with the holding company reorganization, intend to delist Xerox’s common stock from the Chicago Stock Exchange.

On March 6, 2019, the last trading day before the announcement of the holding company reorganization proposal, the closing price per share of Xerox’s common stock was $30.85. On [●], 2019 the most recent trading day for which prices were available prior to the mailing of this joint proxy statement/prospectus, the closing price per share of Xerox’s common stock was $[●].

14

Comparative Rights of Holders of Holdings Common Stock and Xerox Common Stock

Assuming that the proposed amendment to the Xerox restated certificate of incorporation (Proposal 5) is authorized by shareholders and becomes effective prior to completion of the holding company reorganization, the rights of shareholders of Holdings after giving effect to the holding company reorganization will be substantially similar in all material respects to the current rights of Xerox shareholders, subject to nominal dilution of voting rights as a result of the voting provisions of the Holdings Series A Preferred Stock. The Holdings Series A Preferred Stock will vote together with the Holdings common stock, as a single class, on all matters submitted to the shareholders of Holdings, but the Holdings Series A Preferred Stock will only be entitled to one vote for every ten shares of Holdings common stock into which the Holdings Series A Preferred Stock is convertible. Based on 180,000 shares of Xerox Series B Preferred Stock outstanding, which will be exchanged for 180,000 shares of Holdings Series A Preferred Stock as a result of the merger yielding voting rights of 674,157 votes as of the Record Date, the voting rights of Xerox common shareholders will be diluted by approximately 0.29% upon completion of the holding company reorganization (based on [●] shares of Xerox common stock outstanding on the Record Date).

If the proposed amendment to the Xerox restated certificate of incorporation (Proposal 5) is not authorized by shareholders or does not become effective prior to completion of the holding company reorganization, the rights of common shareholders of Holdings after giving effect to the holding company reorganization will be substantially similar in all material respects to the current rights of Xerox common shareholders, subject to nominal dilution of voting rights as described above and except that the voting rights of holders of Holdings common stock will be different from the voting rights of holders of Xerox common stock in that the voting requirement to approve the following corporate actions will be at least a majority of the outstanding shares entitled to vote thereon (as compared totwo-thirds of the outstanding shares entitled to vote thereon):

| • | Adoption of a plan of merger or consolidation; |

| • | Authorization of a sale, lease, exchange or other dispositions of all or substantially all the assets of the corporation; |

| • | Adoption of a plan for the exchange of shares; and |

| • | Authorization of dissolution of the corporation. |

The forms of restated certificate of incorporation andby-laws of Holdings that will be effective upon completion of the holding company reorganization are attached to this joint proxy statement/prospectus as Annex B and Annex C, respectively. See “Proposal 1 — Approval of The Holding Company Reorganization — Comparative Rights of Xerox and Holdings Shareholders.”

15

Selected Historical Consolidated Financial Information

| (in millions, exceptper-share data) | 2018 | 2017 | 2016 | 2015 | 2014 | |||||||||||||||

Per-Share Data | ||||||||||||||||||||

Income from continuing operations | ||||||||||||||||||||

Basic | $1.40 | $0.70 | $2.36 | $3.00 | $3.42 | |||||||||||||||

Diluted | 1.38 | 0.70 | 2.33 | 2.97 | 3.37 | |||||||||||||||

Net Income (Loss) Attributable to Xerox | ||||||||||||||||||||

Basic | 1.40 | 0.71 | (1.95 | ) | 1.59 | 3.37 | ||||||||||||||

Diluted | 1.38 | 0.71 | (1.93 | ) | 1.58 | 3.32 | ||||||||||||||

Common stock dividends declared | 1.00 | 1.00 | 1.24 | 1.12 | 1.00 | |||||||||||||||

Operations | ||||||||||||||||||||

Revenues | $9,830 | $10,265 | $10,771 | $11,465 | $12,679 | |||||||||||||||

Sales | 3,972 | 4,073 | 4,319 | 4,674 | 5,214 | |||||||||||||||

Services, maintenance and rentals | 5,590 | 5,898 | 6,127 | 6,445 | 7,078 | |||||||||||||||

Financing | 268 | 294 | 325 | 346 | 387 | |||||||||||||||

Income from continuing operations | 374 | 204 | 633 | 840 | 1,034 | |||||||||||||||

Income from continuing operations — Xerox | 361 | 192 | 622 | 822 | 1,011 | |||||||||||||||

Net income (loss) | 374 | 207 | (460 | ) | 466 | 1,018 | ||||||||||||||

Net income (loss) — Xerox | 361 | 195 | (471 | ) | 448 | 995 | ||||||||||||||

Financial Position (1) | ||||||||||||||||||||

Working capital | $1,444 | $2,489 | $2,338 | $1,431 | $2,798 | |||||||||||||||

Total Assets | 14,874 | 15,946 | 18,051 | 25,442 | 27,576 | |||||||||||||||

Consolidated Capitalization (1) | ||||||||||||||||||||

Short-term debt and current portion of long-term debt | $961 | $282 | $1,011 | $985 | $1,427 | |||||||||||||||

Long-term debt | 4,269 | 5,235 | 5,305 | 6,382 | 6,314 | |||||||||||||||

Total Debt (2) | 5,230 | 5,517 | 6,316 | 7,367 | 7,741 | |||||||||||||||

Convertible preferred stock | 214 | 214 | 214 | 349 | 349 | |||||||||||||||

Xerox shareholders’ equity | 5,005 | 5,256 | 4,709 | 8,975 | 10,596 | |||||||||||||||

Noncontrolling interests | 34 | 37 | 38 | 43 | 75 | |||||||||||||||

Total Consolidated Capitalization | $10,483 | $11,024 | $11,277 | $16,734 | $18,761 | |||||||||||||||

Selected Data and Ratios | ||||||||||||||||||||

Common shareholders of record atyear-end | 26,742 | 28,752 | 31,803 | 33,843 | 35,307 | |||||||||||||||

Book value per common share (3) | $21.80 | $20.64 | $18.57 | $35.45 | $37.95 | |||||||||||||||

Year-end common stock market price (3) | $19.76 | $29.15 | $23.00 | $42.52 | $55.44 | |||||||||||||||

| (1) | Balance sheet amounts at December 31, 2016 exclude Conduent Incorporated (Conduent) balances as a result of the separation and distribution of Conduent on December 31, 2016 while balance sheet amounts prior to December 31, 2016 include amounts for Conduent. Refer to Note 5 — Divestitures in our Consolidated Financial Statements for additional information in our Annual Report on Form10-K for the year ended December 31, 2018, which is incorporated by reference herein. |

| (2) | Includes capital lease obligations. |

| (3) | Per share prices and computations for 2015 and 2014 are on apre-separation basis. Refer to Note 5 —Divestitures in our Consolidated Financial Statements for further information in our Annual Report onForm 10-K for the year ended December 31, 2018, which is incorporated by reference herein. |

16

Prior to the holding company reorganization, Holdings will have no assets, liabilities, or operations other than those incident to its formation. For this reason, we have not provided financial statements of Holdings. In addition, we have not included pro forma financial comparative per share information concerning Xerox that gives effect to the holding company reorganization because, immediately after the completion of the holding company reorganization, the consolidated financial statements of Holdings will be substantially the same as Xerox’s financial statements immediately prior to the holding company reorganization. For more information regarding the documents incorporated by reference into this joint proxy statement/prospectus, including Xerox’s financial information, please see the section entitled “Where You Can Find More Information.”

17

In considering whether to vote in favor of the proposal to adopt the merger agreement pursuant to which we will implement the holding company reorganization, you should consider all of the information we have included in this joint proxy statement/prospectus, including its annexes, and all of the information in the documents we have incorporated by reference. Specifically, you should review the risk factors described in our Annual Report on Form10-K for the year ended December 31, 2018, as filed with the SEC and incorporated herein by reference. Please see the section entitled “Where You Can Find More Information.”

We may not obtain the expected benefits of the holding company reorganization.

We believe that the holding company reorganization will provide us with future benefits. These expected benefits are not guaranteed and may not be obtained if market conditions or other circumstances prevent us from taking advantage of the investment, financing and structuring flexibility we expect to gain as a result of the holding company reorganization. In other words, we may incur the costs of the holding company reorganization without receiving the benefits. Moreover, the holding company structure resulting from the holding company reorganization may be unsuccessful in insulating the liabilities of our subsidiaries from each other or from Holdings. We, or our future subsidiaries, may be liable for one another’s liabilities, especially if we do not observe the requisite corporate formalities or adequately capitalize Holdings or its subsidiaries.

The holding company reorganization may result in substantial direct and indirect costs whether completed or not.

The holding company reorganization may result in substantial direct costs, which are expected to consist primarily of attorneys’ fees, accountants’ fees, filing fees, financial printing expenses and mailing costs. A significant portion of these costs will be incurred prior to the Annual Meeting. The holding company reorganization may also result in substantial indirect costs by diverting the attention of our management and employees from our business and increasing administrative costs and expenses on a going forward basis. These administrative costs and expenses will include keeping separate records and, in some cases, making separate regulatory filings for each of Xerox and Holdings.

As a holding company, Holdings will be dependent on the operations and funds of its subsidiaries.

Once the holding company reorganization is complete, Holdings will be a holding company with no business operations of its own. Upon completion, its only significant assets will be the outstanding stock in Xerox. As a result, Holdings will rely on payments from its subsidiaries to meet its obligations.

We currently expect that a significant portion of the cash flows of Xerox, which will become a wholly owned subsidiary of Holdings upon the completion of the holding company reorganization, will be used by it in its operations, including to service Xerox’s current as well as any future debt obligations. In addition, in the future, subsidiaries may be restricted in their ability to pay cash dividends or to make other distributions to Holdings, which may limit the payment of cash dividends or other distributions, if any, to the holders of Holdings stock. Future debt obligations of Holdings, in addition to statutory restrictions, may limit the ability of Holdings and its subsidiaries to pay dividends.

Our business relationships may be subject to disruption due to uncertainty resulting from the holding company reorganization, which could have a material adverse effect on our business, financial condition and operating results.

Customers, distributors, suppliers, vendors and other parties with whom we do business may perceive uncertainty and may attempt to negotiate changes in existing business relationships in relation to the holding company reorganization. This could disrupt our business and could have an adverse effect on our financial condition and operating results, including an adverse effect on our ability to realize the expected benefits of the holding company reorganization.

18

Even with shareholder approval, the holding company reorganization may not be completed.