UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-09373

Oppenheimer Senior Floating Rate Fund

(Exact name of registrant as specified in charter)

6803 South Tucson Way, Centennial, Colorado 80112-3924

(Address of principal executive offices) (Zip code)

Arthur S. Gabinet

OFI Global Asset Management, Inc.

Two World Financial Center, New York, New York 10281-1008

(Name and address of agent for service)

Registrant’s telephone number, including area code: (303) 768-3200

Date of fiscal year end: July 31

Date of reporting period: 7/31/2014

| Item 1. | Reports to Stockholders. |

Table of Contents

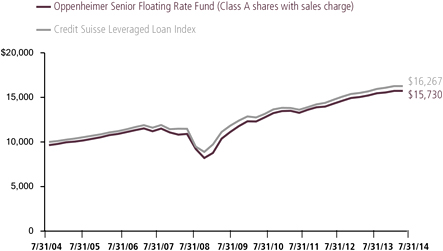

Class A Shares

AVERAGE ANNUAL TOTAL RETURNS AT 7/31/14

| | | | | | | | |

| | | Class A Shares of the Fund | | | | |

| | | Without Sales Charge | | With Sales Charge | | | | Credit Suisse Leveraged Loan Index |

1-Year | | 4.62% | | 0.96% | | | | 4.95% |

5-Year | | 8.69 | | 7.92 | | | | 7.90 |

10-Year | | 5.00 | | 4.63 | | | | 4.99 |

Performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Fund returns include changes in share price, reinvested distributions, and a 3.50% maximum applicable sales charge except where “without sales charge” is indicated. Current performance may be lower or higher than the performance quoted. Returns do not consider capital gains or income taxes on an individual’s investment. For performance data current to the most recent month-end, visit oppenheimerfunds.com or call 1.800.CALL OPP (225.5677).

2 OPPENHEIMER SENIOR FLOATING RATE FUND

Fund Performance Discussion

The Fund’s Class A shares (without sales charge) produced a total return of 4.62% during the 12-month reporting period ended July 31, 2014, modestly lagging its current benchmark, the Credit Suisse Leveraged Loan Index, which returned 4.95%. Bank loan yields declined modestly over the reporting period, mainly due to moderating long-term interest rates and changing supply-and-demand dynamics in 2014.

MARKET OVERVIEW

The reporting period began in the wake of market turmoil after the Federal Reserve (the “Fed”) signaled an earlier-than-expected shift away from its massive quantitative easing program. However, fixed-income markets began to stabilize by the start of the reporting period, when it became clearer that the Fed’s plans did not necessarily portend an imminent increase in short-term interest rates. In addition, economic data at the time showed a relatively mild increase in economic activity.

Although the U.S. economy strengthened in the fall, investors grew concerned when a 16-day government shutdown prompted the Fed to refrain from starting the quantitative easing tapering process. Investors responded positively to the delay, sparking a rally among longer-term bonds. However, stronger economic data over the final months of 2013—including a sharp dip in the unemployment rate to 6.7% by year end—derailed the bond market rally, and in December the Fed implemented the first in a series of gradual reductions of its bond

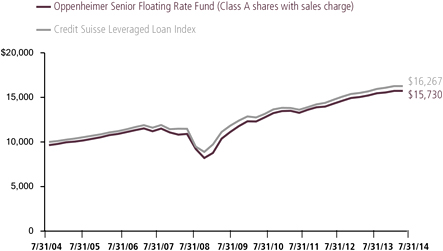

COMPARISON OF CHANGE IN VALUE OF $10,000 HYPOTHETICAL INVESTMENTS IN:

3 OPPENHEIMER SENIOR FLOATING RATE FUND

purchasing program. The resulting selling pressure sent yields of 10-year U.S. Treasury securities above 3% for the first time in two years.

Investor sentiment shifted again during January 2014 amid fears that political and economic instability in the world’s emerging markets might dampen the U.S. recovery. Economic activity also was constrained by harsh winter weather over much of the United States. Despite ongoing strength in U.S. labor markets, U.S. GDP contracted at a surprising 2.1% annualized rate over the first quarter of 2014. Long-term interest rates fell and bonds generally rallied.

Still, investors remained optimistic amid expectations that economic activity would bounce back in warmer weather. Indeed, the unemployment rate fell to 6.3% in April, and manufacturing activity, personal incomes, and home sales continued to grow. It later was estimated that U.S. GDP rebounded at a 4.2% annualized rate during the second quarter.

The economy continued to exhibit signs of renewed strength in June and July, with more than 200,000 jobs created each month. After dipping to 6.1% in June, the unemployment rate ticked higher to 6.2% in July, and inflation began to accelerate. The Fed implemented further reductions in its bond purchasing program, putting the quantitative easing program on track for elimination in the fall.

Despite accelerating economic growth, yields of 10-year U.S. Treasury securities remained low over the first seven months of 2014, in part due to robust demand for a relatively limited supply of newly issued securities. Short-term bond yields remained steady, as the Fed reiterated that short-term rates would remain at current levels at least through year-end. In addition to interest-rate trends, the leveraged loans market was influenced by capital flows. Over much of the reporting period, the market attracted assets from investors seeking more competitive yields than were available from most developed-market sovereign bonds, including German bunds and U.S. Treasury securities. Later in the reporting period, the leveraged loan market experienced net outflows when investors sought opportunities in other areas.

FUND REVIEW

In this environment, the Fund produced higher-than-average results in most of the industry groups represented in the Credit Suisse Leveraged Loan Index. However, shortfalls in the consumer products and gaming sectors caused the Fund to lag its benchmark for the reporting period overall. Producers of consumer products generally sat out the economic recovery as wage growth remained anemic for most workers. Within gaming, the Fund’s exposure to a troubled casino and hotel company detracted from performance.

Our note selection strategy achieved particularly strong results in the media, utilities and forest products sectors. Within

4 OPPENHEIMER SENIOR FLOATING RATE FUND

media, one of the Fund’s broadcasting holdings had converted some of its debt to equity securities when emerging from bankruptcy, and the security advanced along with the company’s prospects. Performance in the utilities sector was bolstered by a five-month opportunistic investment in a company undergoing bankruptcy. While held, the market value of the loan increased and we sold our position. The Fund benefited from its exposure to forest products, as it held higher-yielding names in the sector.

STRATEGY & OUTLOOK

Despite the anticipated end of the Fed’s quantitative easing program this fall, we currently expect the U.S. economic recovery to gain momentum over the remainder of

2014. Stronger economic growth and renewed inflationary pressures could produce higher long-term interest rates. In addition, many analysts expect the Fed to begin laying the groundwork for short-term rate hikes in 2015. Rising interest rates typically hurt prices of fixed-rate bonds, but historically have been beneficial to floating-rate loans.

Therefore, we have maintained a constructive investment approach, in which we conduct extensive research into company and market fundamentals to identify attractive relative values among leveraged loans. We recently have reduced exposure to loans that reached less compelling valuations, enabling us to focus more intently on areas that we regard as better opportunities.

5 OPPENHEIMER SENIOR FLOATING RATE FUND

Top Holdings and Allocations

| | |

TOP TEN CORPORATE LOAN INDUSTRIES |

Media | | 11.0% |

Commercial Services & Supplies | | 9.8 |

Health Care Equipment & Supplies | | 6.8 |

Hotels, Restaurants & Leisure | | 6.4 |

Energy Equipment & Services | | 4.3 |

Chemicals | | 4.2 |

Health Care Providers & Services | | 3.6 |

Diversified Telecommunication Services | | 3.2 |

Diversified Consumer Services | | 3.0 |

Industrial Conglomerates | | 2.7 |

Portfolio holdings and allocations are subject to change. Percentages are as of July 31, 2014, and are based on net assets.

| | |

CREDIT RATING BREAKDOWN | | NRSRO

ONLY

TOTAL |

AAA | | 3.5% |

BBB | | 1.0 |

BB | | 25.1 |

B | | 62.5 |

CCC | | 5.7 |

D | | 0.1 |

Unrated | | 2.1 |

Total | | 100.0% |

The percentages above are based on the market value of the Fund’s securities as of July 31, 2014, and are subject to change. Except for securities labeled “Unrated” and except for certain securities issued or guaranteed by a foreign sovereign, all securities have been rated by at least one Nationally Recognized Statistical Rating Organization (“NRSRO”), such as Standard & Poor’s (“S&P”). For securities rated only by an NRSRO other than S&P, OppenheimerFunds, Inc. (the “Sub-Adviser”) converts that rating to the equivalent S&P rating. If two or more NRSROs have assigned a rating to a security, the highest S&P equivalent rating is used. Unrated securities issued or guaranteed by a foreign sovereign are assigned a credit rating equal to the highest NRSRO rating assigned to that foreign sovereign. For securities not rated by an NRSRO, the Sub-Adviser uses its own credit analysis to assign ratings in categories similar to those of S&P. The use of similar categories is not an indication that the Sub-Adviser’s credit analysis process is consistent or comparable with any NRSRO’s process were that NRSRO to rate the same security. Fund assets invested in Oppenheimer Institutional Money Market Fund are assigned that fund’s S&P rating, which is currently AAA. For the purposes of this table, “investment-grade” securities are securities rated within the NRSROs’ four highest rating categories (AAA, AA, A and BBB). Unrated securities do not necessarily indicate low credit quality, and may or may not be the equivalent of investment-grade. Please consult the Fund’s prospectus and Statement of Additional Information for further information.

6 OPPENHEIMER SENIOR FLOATING RATE FUND

Share Class Performance

AVERAGE ANNUAL TOTAL RETURNS WITHOUT SALES CHARGE AS OF 7/31/14

| | | | | | | | | | | | | | | | | | |

| | | Inception Date | | | 1-Year | | | 5-Year | | | 10-Year | | | |

Class A (OOSAX) | | | 9/8/99 | | | | 4.62% | | | | 8.69% | | | | 5.00% | | | |

Class B (OOSBX) | | | 9/8/99 | | | | 3.93% | | | | 8.02% | | | | 4.65% | | | |

Class C (OOSCX) | | | 9/8/99 | | | | 3.77% | | | | 8.10% | | | | 4.46% | | | |

Class I (OOSIX) | | | 10/26/12 | | | | 4.72% | | | | 5.75% | * | | | N/A | | | |

Class R (OOSNX) | | | 10/26/12 | | | | 4.22% | | | | 5.13% | * | | | N/A | | | |

Class Y (OOSYX) | | | 11/28/05 | | | | 4.88% | | | | 9.00% | | | | 5.14% | * | | |

AVERAGE ANNUAL TOTAL RETURNS WITH SALES CHARGE AS OF 7/31/14

| | | | | | | | | | | | | | | | | | |

| | | Inception Date | | | 1-Year | | | 5-Year | | | 10-Year | | | |

Class A (OOSAX) | | | 9/8/99 | | | | 0.96% | | | | 7.92% | | | | 4.63% | | | |

Class B (OOSBX) | | | 9/8/99 | | | | 0.93% | | | | 7.88% | | | | 4.65% | | | |

Class C (OOSCX) | | | 9/8/99 | | | | 2.77% | | | | 8.10% | | | | 4.46% | | | |

Class I (OOSIX) | | | 10/26/12 | | | | 4.72% | | | | 5.75% | * | | | N/A | | | |

Class R (OOSNX) | | | 10/26/12 | | | | 3.22% | | | | 5.13% | * | | | N/A | | | |

Class Y (OOSYX) | | | 11/28/05 | | | | 4.88% | | | | 9.00% | | | | 5.14% | * | | |

*Shows performance since inception.

STANDARDIZED YIELDS

| | | | |

For the 30 Days Ended 7/31/14 | | | | |

Class A | | 3.88% | | |

Class B | | 3.50 | | |

Class C | | 3.26 | | |

Class I | | 4.33 | | |

Class R | | 3.76 | | |

Class Y | | 4.26 | | |

Performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Returns do not consider capital gains or income taxes on an individual’s investment. For performance data current to the most recent month-end, visit oppenheimerfunds.com or call 1.800.CALL OPP (225.5677). Fund returns include changes in share price, reinvested distributions, and the applicable sales charge: for Class A shares, the current maximum initial sales charge of 3.50%; for Class B shares, the contingent deferred sales charge (“CDSC”) of 3% (1-year) and 1% (5-year); and for Class C shares, the 1% CDSC charge for the 1-year period. Prior to 7/1/14, Class R shares were named Class N shares. Beginning 7/1/14, new purchases of Class R shares will no longer be subject to a CDSC upon redemption (any CDSC will remain in effect for purchases prior to 7/1/14.) There is no sales charge for Class I and Y shares.

7 OPPENHEIMER SENIOR FLOATING RATE FUND

Standardized yield is based on net investment income for the 30-day period ended 7/31/14 and the maximum offering price at the end of the period (including the maximum sales charge) for Class A shares and the net asset value for Class B, Class C, Class I, Class R and Class Y shares. Each result is compounded semiannually and then annualized. Falling share prices will tend to artificially raise yields.

The Fund’s performance is compared to the performance of the Credit Suisse Leveraged Loan Index, a composite index of U.S. dollar denominated senior loan returns representing an unleveraged investment in senior loans that is broadly based across the spectrum of senior floating rate loans and includes reinvestment of income (to represent real assets). The Index is unmanaged and cannot be purchased directly by investors. While index comparisons may be useful to provide a benchmark for the Fund’s performance, it must be noted that the Fund’s investments are not limited to the investments comprising the Index. Index performance includes reinvestment of income, but does not reflect transaction costs, fees, expenses or taxes. Index performance is shown for illustrative purposes only as a benchmark for the Fund’s performance, and does not predict or depict performance of the Fund. The Fund’s performance reflects the effects of the Fund’s business and operating expenses.

The Fund’s investment strategy and focus can change over time. The mention of specific fund holdings does not constitute a recommendation by OppenheimerFunds, Inc. or its affiliates.

Before investing in any of the Oppenheimer funds, investors should carefully consider a fund’s investment objectives, risks, charges and expenses. Fund prospectuses and summary prospectuses contain this and other information about the funds, and may be obtained by asking your financial advisor, visiting oppenheimerfunds.com, or calling 1.800.CALL OPP (225.5677). Read prospectuses and summary prospectuses carefully before investing.

Shares of Oppenheimer funds are not deposits or obligations of any bank, are not guaranteed by any bank, are not insured by the FDIC or any other agency, and involve investment risks, including the possible loss of the principal amount invested.

8 OPPENHEIMER SENIOR FLOATING RATE FUND

Fund Expenses

Fund Expenses. As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments, contingent deferred sales charges on redemptions; and (2) ongoing costs, including management fees; distribution and service fees; and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000.00 invested at the beginning of the period and held for the entire 6-month period ended July 31, 2014.

Actual Expenses. The first section of the table provides information about actual account values and actual expenses. You may use the information in this section for the class of shares you hold, together with the amount you invested, to estimate the expense that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600.00 account value divided by $1,000.00 = 8.60), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio for each class of shares, and an assumed rate of return of 5% per year for each class before expenses, which is not the actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front-end or contingent deferred sales charges (loads). Therefore, the “hypothetical” section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

9 OPPENHEIMER SENIOR FLOATING RATE FUND

| | | | | | | | | | | | | | | | | | |

| Actual | | Beginning Account Value February 1, 2014 | | Ending Account Value July 31, 2014 | | Expenses Paid During

6 Months Ended

July 31, 2014 |

Class A | | $ | 1,000.00 | | | | | $ | 1,017.10 | | | | | $ | 5.21 | | | |

Class B | | | 1,000.00 | | | | | | 1,014.60 | | | | | | 7.72 | | | |

Class C | | | 1,000.00 | | | | | | 1,012.20 | | | | | | 8.92 | | | |

Class I | | | 1,000.00 | | | | | | 1,017.40 | | | | | | 3.71 | | | |

Class R | | | 1,000.00 | | | | | | 1,015.80 | | | | | | 6.52 | | | |

Class Y | | | 1,000.00 | | | | | | 1,018.30 | | | | | | 4.01 | | | |

| | | | | | |

| Hypothetical | | | | | | | | | | | | | | | | | | |

(5% return before expenses) | | | | | | | | | | | | | | | | | | |

Class A | | | 1,000.00 | | | | | | 1,019.64 | | | | | | 5.22 | | | |

Class B | | | 1,000.00 | | | | | | 1,017.16 | | | | | | 7.73 | | | |

Class C | | | 1,000.00 | | | | | | 1,015.97 | | | | | | 8.94 | | | |

Class I | | | 1,000.00 | | | | | | 1,021.12 | | | | | | 3.72 | | | |

Class R | | | 1,000.00 | | | | | | 1,018.35 | | | | | | 6.53 | | | |

Class Y | | | 1,000.00 | | | | | | 1,020.83 | | | | | | 4.02 | | | |

Expenses are equal to the Fund’s annualized expense ratio for that class, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). Those annualized expense ratios, excluding indirect expenses from affiliated funds, based on the 6-month period ended July 31, 2014 are as follows:

| | | | | | |

| Class | | Expense Ratios | | | |

Class A | | | 1.04 | % | | |

Class B | | | 1.54 | | | |

Class C | | | 1.78 | | | |

Class I | | | 0.74 | | | |

Class R | | | 1.30 | | | |

Class Y | | | 0.80 | | | |

The expense ratios reflect voluntary and/or contractual waivers and/or reimbursements of expenses by the Fund’s Manager. Some of these undertakings may be modified or terminated at any time, as indicated in the Fund’s prospectus. The “Financial Highlights” tables in the Fund’s financial statements, included in this report, also show the gross expense ratios, without such waivers or reimbursements and reduction to custodian expenses, if applicable.

10 OPPENHEIMER SENIOR FLOATING RATE FUND

| | |

| |

| STATEMENT OF INVESTMENTS July 31, 2014 | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| |

Corporate Loans—98.6% | | | | | | | | |

| |

Consumer Discretionary—31.2% | | | | | | | | |

| |

Auto Components—2.4% | | | | | | | | |

| |

Affinia Group, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B2, 4.75%, 4/25/201 | | $ | 40,036,132 | | | $ | 40,236,312 | |

| |

Breed Technologies, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.75%, 5/10/181 | | | 41,293,662 | | | | 41,474,322 | |

| |

Cap-Con Automotive Technologies Ltd., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 6.00%, 11/15/181 | | | 29,232,344 | | | | 29,341,965 | |

| |

Cooper Standard, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.00%, 3/26/211 | | | 32,345,000 | | | | 32,304,569 | |

| |

FleetPride, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, 5.25%, 11/19/191 | | | 33,556,586 | | | | 33,315,415 | |

| |

Goodyear Tire & Rubber Co. (The), Sr. Sec. Credit Facilities 2nd Lien Term Loan, 4.75%, 4/30/191 | | | 99,715,000 | | | | 100,587,506 | |

| |

Metaldyne LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.25%, 12/18/181 | | | 50,782,976 | | | | 51,058,067 | |

| |

Remy International, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.25%, 3/5/201 | | | 31,509,471 | | | | 31,548,858 | |

| |

TI Group Automotive Systems LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.25%, 7/1/211 | | | 59,210,000 | | | | 59,339,552 | |

| |

Tower Automotive Holdings, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.00%, 4/23/201 | | | 51,406,961 | | | | 51,246,314 | |

| |

Transtar Holding Co., Sr. Sec. Credit Facilities 1st Lien Term Loan, 5.75%, 10/9/181 | | | 33,550,305 | | | | 33,676,119 | |

| | | | | | | | |

| | | | | | | 504,128,999 | |

| | | | | | | | |

| |

Automobiles—0.7% | | | | | | | | |

| |

Chrysler LLC, Sr. Sec. Credit Facilities Term Loan, Tranche B1, 5.333%, 8/3/491,2 | | | 52,763,842 | | | | 158,292 | |

| |

Federal-Mogul Holdings Corp., Sr. Sec. Credit Facilities 1st Lien Term Loan: | | | | | | | | |

Tranche B, 4.00%, 4/3/181 | | | 41,400,000 | | | | 41,392,589 | |

Tranche C, 4.75%, 4/3/211 | | | 93,000,000 | | | | 93,069,750 | |

| | | | | | | | |

| | | | | | | 134,620,631 | |

| | | | | | | | |

| |

Distributors—1.4% | | | | | | | | |

| |

99 Cents Only Stores, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B2, 4.50%, 1/11/191 | | | 50,375,866 | | | | 50,701,193 | |

| |

BJ’s Wholesale Club, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.50%, 9/26/191 | | | 66,232,519 | | | | 66,196,290 | |

| |

BJ’s Wholesale Club, Inc., Sr. Sec. Credit Facilities 2nd Lien Term Loan, 8.50%, 3/26/201 | | | 38,534,030 | | | | 39,148,185 | |

| |

Capital Automotive LP, Sr. Sec. Credit Facilities 1st Lien Term Loan, 4.00%, 4/10/191 | | | 16,189,203 | | | | 16,258,590 | |

| |

Capital Automotive LP, Sr. Sec. Credit Facilities 2nd Lien Term Loan, 6.00%, 4/30/201 | | | 31,020,835 | | | | 31,809,291 | |

| |

Container Store, Inc. (The), Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.25%, 4/6/191 | | | 28,783,563 | | | | 28,702,250 | |

| |

Leslie’s Poolmart, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.25%, 10/16/191 | | | 49,181,338 | | | | 49,196,732 | |

| | | | | | | | |

| | | | | | | 282,012,531 | |

11 OPPENHEIMER SENIOR FLOATING RATE FUND

|

|

| STATEMENT OF INVESTMENTS Continued |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| |

Diversified Consumer Services—3.0% | | | | | | | | |

| |

4L Technologies, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 5.50%, 5/8/201 | | $ | 57,320,000 | | | $ | 57,158,816 | |

| |

Affinion Group, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 6.75%, 4/30/181 | | | 57,984,487 | | | | 57,591,874 | |

| |

Affinion Group, Inc., Sr. Sec. Credit Facilities 2nd Lien Term Loan, 8.50%, 10/31/181 | | | 31,300,668 | | | | 30,909,409 | |

| |

Interactive Data Corp., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.75%, 4/23/211 | | | 92,690,000 | | | | 93,182,462 | |

| |

IQOR US, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 6.00%, 4/1/211 | | | 56,584,762 | | | | 54,462,833 | |

| |

IQOR US, Inc., Sr. Sec. Credit Facilities 2nd Lien Term Loan, 9.75%, 4/1/221 | | | 15,770,000 | | | | 15,020,925 | |

| |

Knowledge Universe Education LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 5.25%, 3/12/211 | | | 24,937,500 | | | | 25,124,531 | |

| |

Koosharem LLC, Sr. Sec. Credit Facilities 1st Lien Exit Term Loan, 7.50%, 5/15/201 | | | 27,845,000 | | | | 28,077,033 | |

| |

Laureate Education, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, 5.00%, 6/15/181 | | | 110,630,891 | | | | 107,588,541 | |

| |

Nord Anglia Education Finance, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.50%, 3/31/211 | | | 46,205,000 | | | | 46,291,635 | |

| |

Sedgwick, Inc., Sr. Sec. Credit Facilities 2nd Lien Term Loan, 6.75%, 2/28/221 | | | 45,023,869 | | | | 45,035,125 | |

| |

ServiceMaster Co. LLC (The), Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.25%, 6/16/211 | | | 45,000,000 | | | | 44,781,750 | |

| |

TransFirst Holdings, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, 4.00%, 12/27/171 | | | 12,741,281 | | | | 12,745,269 | |

| |

TransFirst Holdings, Inc., Sr. Sec. Credit Facilities 2nd Lien Term Loan, 7.50%, 6/27/181 | | | 12,020,000 | | | | 12,120,163 | |

| | | | | | | | |

| | | | | | | 630,090,366 | |

| | | | | | | | |

| |

Hotels, Restaurants & Leisure—6.4% | | | | | | | | |

| |

Allflex Holdings III, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.25%, 7/17/201 | | | 38,211,250 | | | | 38,230,356 | |

| |

Amaya BV, Sr. Sec. Credit Facilities 2nd Lien Term Loan, 5.00%, 7/29/211 | | | 106,040,000 | | | | 105,095,608 | |

| |

Amaya BV, Sr. Sec. Credit Facilities 2nd Lien Term Loan, 8.00%, 7/29/221 | | | 46,215,000 | | | | 46,811,959 | |

| |

American Casino & Entertainment Properties, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.50%, 7/3/191 | | | 19,800,000 | | | | 19,899,000 | |

| |

American Seafoods Group LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, 4.50%-5.50%, 3/18/181 | | | 16,469,457 | | | | 16,236,134 | |

| |

AMF Bowling Centers, Inc., Sr. Sec. Credit Facilities 1st Lien Exit Term Loan, 8.75%, 6/29/181 | | | 38,494,104 | | | | 39,263,986 | |

| |

ARG IH Corp., Sr. Sec. Credit Facilities 1st Lien Term Loan, 5.00%-6.25%, 11/15/201 | | | 21,850,200 | | | | 21,977,477 | |

| |

Caesars Entertainment Operating Co., Inc., Extended Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B5, 4.448%, 1/28/181 | | | 24,230,949 | | | | 22,379,559 | |

| |

Caesars Entertainment Operating Co., Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan: | | | | | | | | |

Tranche B4, 9.50%, 10/31/161 | | | 18,391,854 | | | | 18,434,008 | |

Tranche B5B, 6.50%, 1/28/181 | | | 242,773 | | | | 224,223 | |

Tranche B6, 5.448%, 1/28/181 | | | 55,714,572 | | | | 52,023,482 | |

12 OPPENHEIMER SENIOR FLOATING RATE FUND

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| |

Hotels, Restaurants & Leisure (Continued) | | | | | | | | |

| |

Caesars Entertainment Operating Co., Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan: (Continued) | | | | | | | | |

Tranche B7, 9.75%, 3/1/171 | | $ | 40,120,000 | | | $ | 39,450,156 | |

| |

Caesars Entertainment Resort Properties LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 7.00%, 10/11/201 | | | 156,022,384 | | | | 156,631,807 | |

| |

Caesars Growth Properties Holdings LLC/Caesars Growth Properties Finance, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, 6.25%, 5/10/211 | | | 88,491,000 | | | | 88,297,470 | |

| |

CCM Merger, Inc./MotorCity Casino, Sr. Sec. Credit Facilities 1st Lien Term Loan, 5.00%, 3/1/171 | | | 45,740,925 | | | | 45,798,101 | |

| |

CEC Entertainment, Inc., Sr. Sec. Credit Facilities Term Loan, Tranche B, 4.25%, 2/14/211 | | | 46,214,175 | | | | 45,925,336 | |

| |

Corner Investment Co. LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, 11.00%, 11/2/191 | | | 13,395,000 | | | | 13,763,363 | |

| |

Dave & Buster’s, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.50%, 7/23/201 | | | 42,425,000 | | | | 42,550,960 | |

| |

Del Monte Foods Co., Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, 4.25%-5.50%, 2/18/211 | | | 44,237,700 | | | | 43,968,115 | |

| |

Del Monte Pacific Ltd., Sr. Sec. Credit Facilities 2nd Lien Term Loan, 8.25%, 8/18/211 | | | 8,565,000 | | | | 8,375,859 | |

| |

Equinox Holdings, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.25%, 1/31/201 | | | 26,456,608 | | | | 26,555,820 | |

| |

Focus Brands, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.25%, 2/21/181 | | | 27,779,748 | | | | 27,826,056 | |

| |

Golden Nugget, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 5.50%, 11/21/191 | | | 25,816,186 | | | | 26,380,915 | |

| |

Golden Nugget, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Delayed Draw, Tranche B, 5.50%, 11/21/191 | | | 9,297,174 | | | | 9,500,550 | |

| |

Great Wolf Resorts, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, 4.25%, 8/6/201 | | | 29,700,000 | | | | 29,764,984 | |

| |

Jacobs Entertainment, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, 5.25%, 10/29/181 | | | 16,955,512 | | | | 17,040,290 | |

| |

La Quinta Intermediate Holdings LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.00%, 4/14/211 | | | 36,552,381 | | | | 36,632,358 | |

| |

Landry’s, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.00%, 4/24/181 | | | 48,870,617 | | | | 49,041,665 | |

| |

Oceania Cruises, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 5.25%, 7/2/201 | | | 24,705,850 | | | | 24,922,026 | |

| |

Peninsula Gaming LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.25%, 11/20/171 | | | 33,636,942 | | | | 33,715,585 | |

| |

Peppermill Casinos, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, 7.25%, 11/9/181 | | | 20,975,841 | | | | 21,474,017 | |

| |

Pinnacle Operating Corp., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.75%, 11/15/181 | | | 27,978,643 | | | | 27,978,643 | |

| |

Revel Entertainment, Inc., Sr. Sec. Credit Facilities 2nd Lien Exit Term Loan, 14.50%, 5/20/181,2,3 | | | 36,421,136 | | | | 11,836,869 | |

| |

Town Sports International LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.50%, 11/2/201 | | | 34,063,825 | | | | 30,998,081 | |

| |

US Foods, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.50%, 3/31/191 | | | 89,377,433 | | | | 89,433,294 | |

| | | | | | | | |

| | | | | | | 1,328,438,112 | |

13 OPPENHEIMER SENIOR FLOATING RATE FUND

|

|

| STATEMENT OF INVESTMENTS Continued |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| |

Household Durables—1.8% | | | | | | | | |

| |

Britax US Holdings, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.50%, 10/15/201 | | $ | 26,554,337 | | | $ | 25,110,445 | |

| |

KIK Custom Products, Sr. Sec. Credit Facilities 1st Lien Term Loan, 5.50%, 4/29/191 | | | 61,809,725 | | | | 61,912,762 | |

| |

KIK Custom Products, Sr. Sec. Credit Facilities 2nd Lien Term Loan, 9.50%, 10/29/191 | | | 23,595,000 | | | | 23,939,086 | |

| |

Party City Holdings, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.00%, 7/27/191 | | | 59,643,136 | | | | 59,296,968 | |

| |

Renfro Corp., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 5.75%, 1/30/191 | | | 15,020,059 | | | | 15,062,311 | |

| |

Revlon Consumer Products Corp., Sr. Sec. Credit Facilities 1st Lien Term Loan, 4.00%, 10/8/191 | | | 59,942,428 | | | | 60,101,635 | |

| |

SRAM Corp., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.00%, 4/10/201 | | | 65,830,360 | | | | 65,405,227 | |

| |

Sun Products Corp. (The), Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 5.50%, 3/23/201 | | | 42,187,153 | | | | 40,921,539 | |

| |

Wilton Brands, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 7.50%, 8/30/181 | | | 30,289,961 | | | | 29,078,363 | |

| | | | | | | | |

| | | | | | | 380,828,336 | |

| | | | | | | | |

| |

Internet & Catalog Retail—0.2% | | | | | | | | |

| |

CWGS Group LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, 5.75%-6.75%, 2/20/201 | | | 36,695,179 | | | | 37,062,131 | |

| | | | | | | | |

| |

Leisure Products—1.3% | | | | | | | | |

| |

Boyd Gaming Corp., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.00%, 8/14/201 | | | 48,388,889 | | | | 48,496,748 | |

| |

Four Seasons Holdings, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, 3.50%, 6/29/201 | | | 17,865,000 | | | | 17,800,793 | |

| |

Four Seasons Holdings, Inc., Sr. Sec. Credit Facilities 2nd Lien Term Loan, 6.25%, 12/28/201 | | | 10,000,000 | | | | 10,112,500 | |

| |

Hilton Worldwide, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, 3.50%-3.75%, 10/26/201 | | | 47,615,921 | | | | 47,454,742 | |

| |

Intrawest Corp., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 5.50%, 12/9/201 | | | 33,282,750 | | | | 33,948,405 | |

| |

Pinnacle Entertainment, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B2, 3.75%, 8/13/201 | | | 24,750,771 | | | | 24,830,592 | |

| |

Playa Resorts Holding BV, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.00%, 8/9/191 | | | 21,839,975 | | | | 21,860,461 | |

| |

Station Casinos LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.25%, 3/2/201 | | | 69,275,426 | | | | 69,362,020 | |

| |

Stockbridge/SBE Holdings LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 13.00%, 5/2/171 | | | 4,035,000 | | | | 4,519,200 | |

| | | | | | | | |

| | | | | | | 278,385,461 | |

| | | | | | | | |

| |

Media—11.0% | | | | | | | | |

| |

Alpha Media Group, Inc., Sr. Sec. Credit Facilities Term Loan, Tranche B, 3.05%, 7/15/161,2,3,4 | | | 27,992,767 | | | | 2,799 | |

| |

Altice Financing SA, Sr. Sec. Credit Facilities 1st Lien Term Loan, Delayed Draw, 5.50%, 7/2/191 | | | 62,836,673 | | | | 64,387,985 | |

14 OPPENHEIMER SENIOR FLOATING RATE FUND

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| |

Media (Continued) | | | | | | | | |

| |

Catalina Marketing, Sr. Sec. Credit Facilities 1st Lien Term Loan, 4.50%, 4/1/211 | | $ | 87,242,959 | | | $ | 87,461,066 | |

| |

Catalina Marketing, Sr. Sec. Credit Facilities 2nd Lien Term Loan, 7.75%, 4/11/221 | | | 27,945,000 | | | | 27,875,138 | |

| |

Cinram International, Inc., Sr. Sec. Credit Facilities 2nd Lien Term Loan, 0.432%, 8/3/491,2,3 | | | 577,191 | | | | 2,889 | |

| |

Clear Channel Communications, Inc., Extended Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche D, 6.90%, 1/30/191 | | | 102,361,554 | | | | 100,751,509 | |

| |

Clear Channel Communications, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan: | | | | | | | | |

Tranche B, 3.80%, 1/29/161 | | | 55,711,458 | | | | 55,300,474 | |

Tranche E, 7.65%, 7/30/191 | | | 50,751,807 | | | | 50,779,010 | |

| |

Cumulus Media Holdings, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.25%, 12/18/201 | | | 32,365,643 | | | | 32,472,579 | |

| |

Delta 2 LUX Sarl, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.50%, 4/30/191 | | | 81,155,324 | | | | 81,358,212 | |

| |

Deluxe Entertainment Services, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 6.50%, 2/26/201 | | | 36,326,531 | | | | 36,371,939 | |

| |

Emerald Expositions Holding, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.75%, 6/17/201 | | | 9,250,000 | | | | 9,250,000 | |

| |

Extreme Reach, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 6.75%, 1/24/201 | | | 27,765,413 | | | | 28,147,187 | |

| |

Extreme Reach, Inc., Sr. Sec. Credit Facilities 2nd Lien Term Loan, 10.50%, 1/22/211 | | | 13,915,000 | | | | 14,158,513 | |

| |

Getty Images, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.75%, 10/18/191 | | | 79,936,325 | | | | 77,293,950 | |

| |

Gray Television, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, 3.75%, 6/10/211 | | | 36,840,000 | | | | 36,903,328 | |

| |

Harland Clarke Holdings Corp., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B4, 6.00%, 8/4/191 | | | 47,240,323 | | | | 48,114,269 | |

| |

Hoyts Cinemas Group, Sr. Sec. Credit Facilities 2nd Lien Term Loan, 8.25%, 11/30/201 | | | 9,250,000 | | | | 9,481,250 | |

| |

IMG Worldwide, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 5.25%, 5/6/211 | | | 92,820,000 | | | | 92,394,606 | |

| |

IMG Worldwide, Inc., Sr. Sec. Credit Facilities 2nd Lien Term Loan, 8.25%, 5/6/221 | | | 25,520,000 | | | | 25,392,400 | |

| |

Intelsat Jackson Holdings SA, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B2, 3.75%, 6/30/191 | | | 168,601,201 | | | | 168,601,201 | |

| |

Internet Brands, Sr. Sec. Credit Facilities 1st Lien Term Loan, 5.00%, 6/30/211 | | | 35,780,784 | | | | 35,875,818 | |

| |

Internet Brands, Sr. Sec. Credit Facilities 1st Lien Term Loan, Delayed Draw, 0.00%-5.00%, 6/25/211 | | | 3,889,216 | | | | 3,899,545 | |

| |

ION Media Networks, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 5.00%, 12/17/201 | | | 15,676,225 | | | | 15,759,513 | |

| |

Liberty Cablevision of Puerto Rico LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, 6.00%, 12/24/211 | | | 38,415,000 | | | | 38,619,099 | |

| |

Liberty Cablevision of Puerto Rico LLC, Sr. Sec. Credit Facilities 2nd Lien Term Loan, 10.00%, 6/26/231 | | | 8,070,000 | | | | 8,081,346 | |

| |

Lions Gate Entertainment Corp., Sr. Sec. Credit Facilities 2nd Lien Term Loan, 5.00%, 7/19/201 | | | 32,500,000 | | | | 33,037,875 | |

| |

Media General, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Delayed Draw, Tranche B, 4.25%, 7/30/201 | | | 84,102,316 | | | | 84,535,443 | |

15 OPPENHEIMER SENIOR FLOATING RATE FUND

|

|

| STATEMENT OF INVESTMENTS Continued |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| |

Media (Continued) | | | | | | | | |

| |

Mediacom Broadband LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche G, 4.00%, 1/20/201 | | $ | 9,874,372 | | | $ | 9,880,464 | |

| |

Mediacom Illinois LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, Delayed Draw, 3.75%, 6/18/211 | | | 27,665,000 | | | | 27,641,955 | |

| |

Mergermarket USA, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, 4.50%, 2/4/211 | | | 29,261,663 | | | | 28,877,603 | |

| |

Mergermarket USA, Inc., Sr. Sec. Credit Facilities 2nd Lien Term Loan, 7.50%, 2/4/221 | | | 9,975,000 | | | | 9,825,375 | |

| |

Merrill Corp., Sr. Sec. Credit Facilities 1st Lien Term Loan, 5.75%, 3/8/181 | | | 33,136,730 | | | | 33,689,020 | |

| |

NEP/NCP Holdco, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.25%, 1/22/201 | | | 64,655,495 | | | | 64,716,142 | |

| |

Penton Media, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, 5.50%, 10/3/191 | | | 40,136,700 | | | | 40,554,804 | |

| |

Radio One, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 7.50%, 3/31/161 | | | 35,662,701 | | | | 36,197,642 | |

| |

Rovi Solutions Corp., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 3.75%, 6/6/211 | | | 51,730,000 | | | | 51,665,338 | |

| |

Salem Communications Corp., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.50%, 3/13/201 | | | 27,127,987 | | | | 27,144,617 | |

| |

Sensus USA, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 8.00%, 2/28/191 | | | 15,244,524 | | | | 15,454,136 | |

| |

SuperMedia, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, 11.60%, 12/30/161 | | | 13,770,000 | | | | 11,936,869 | |

| |

Tech Finance & Co. SCA, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 5.50%, 7/11/201 | | | 40,250,125 | | | | 40,635,842 | |

| |

Tribune Co., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.00%, 12/27/201 | | | 93,978,000 | | | | 94,024,519 | |

| |

TWCC Holding Corp., Sr. Sec. Credit Facilities 2nd Lien Term Loan, 7.00%, 6/26/201 | | | 53,481,154 | | | | 52,712,362 | |

| |

Univision Communications, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan: | | | | | | | | |

Tranche C2, 4.00%, 3/1/201 | | | 47,775,250 | | | | 47,524,430 | |

Tranche C4, 4.00%, 3/1/201 | | | 86,024,689 | | | | 85,594,565 | |

| |

US Finco, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.00%, 5/29/201 | | | 25,791,480 | | | | 25,751,194 | |

| |

Virgin Media Investment Holdings, Sr. Sec. Credit Facilities 1st Lien Term Loan, 3.50%, 6/8/201 | | | 13,000,000 | | | | 12,897,417 | |

| |

WaveDivision Holdings LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.00%, 10/12/191 | | | 43,598,593 | | | | 43,634,911 | |

| |

Wide Open West Finance LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.75%, 4/1/191 | | | 157,430,170 | | | | 158,155,766 | |

| |

Yankee Cable Acquisition LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.50%, 3/1/201 | | | 61,190,844 | | | | 61,506,344 | |

| |

YP LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 8.00%, 6/4/181 | | | 25,413,594 | | | | 25,620,079 | |

| | | | | | | | |

| | | | | | | 2,271,950,337 | |

| | | | | | | | |

| |

Multiline Retail—1.2% | | | | | | | | |

| |

Hudson Bay Co., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.75%, 11/4/201 | | | 42,337,250 | | | | 42,734,162 | |

16 OPPENHEIMER SENIOR FLOATING RATE FUND

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| |

Multiline Retail (Continued) | | | | | | | | |

| |

J.C. Penny Corp., Sr. Sec. Credit Facilities 1st Lien Term Loan, 6.00%, 5/22/181 | | $ | 62,079,154 | | | $ | 62,788,656 | |

| |

J.C. Penny Corp., Sr. Sec. Credit Facilities 1st Lien Term Loan, 5.00%, 6/14/191 | | | 13,770,000 | | | | 13,850,830 | |

| |

Neiman Marcus Group, Inc., Sr. Sec. Credit Facilities Term Loan, 4.25%, 10/25/201 | | | 122,574,862 | | | | 122,168,895 | |

| | | | | | | | |

| | | | | | | 241,542,543 | |

| | | | | | | | |

| |

Specialty Retail—1.6% | | | | | | | | |

| |

Anchor Hocking LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, 8.50%, 5/21/201,3 | | | 24,146,534 | | | | 17,958,985 | |

| |

Breed Technologies, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, 4.75%, 7/23/211 | | | 32,085,000 | | | | 32,105,053 | |

| |

Burlington Coat Factory Warehouse Corp., Sr. Sec. Credit Facilities 1st Lien Term Loan: | | | | | | | | |

Tranche B2, 4.25%, 2/23/171 | | | 59,710,661 | | | | 59,897,257 | |

Tranche B3, 4.25%, 7/24/211 | | | 91,805,000 | | | | 91,805,000 | |

| |

Harbor Freight Tools USA, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.75%, 7/26/191 | | | 91,803,006 | | | | 92,342,348 | |

| |

National Vision, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.00%, 3/5/211 | | | 32,398,800 | | | | 32,169,319 | |

| |

National Vision, Sr. Sec. Credit Facilities 2nd Lien Term Loan, 6.75%, 3/11/221 | | | 11,565,000 | | | | 11,456,578 | |

| | | | | | | | |

| | | | | | | 337,734,540 | |

| | | | | | | | |

| |

Textiles, Apparel & Luxury Goods—0.2% | | | | | | | | |

| |

Vogue International LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 5.25%, 2/14/201 | | | 36,992,288 | | | | 37,177,249 | |

| | | | | | | | |

| |

Consumer Staples—3.2% | | | | | | | | |

| |

Food & Staples Retailing—1.5% | | | | | | | | |

| |

Albertsons LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B2, 4.75%, 3/21/191 | | | 74,804,068 | | | | 75,278,026 | |

| |

Fairway Group Acquisition, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 5.00%, 8/17/181 | | | 31,438,131 | | | | 31,143,399 | |

| |

New Albertsons, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.75%, 6/25/211 | | | 68,925,000 | | | | 69,217,587 | |

| |

Rite Aid Corp., Sr. Sec. Credit Facilities 2nd Lien Term Loan, Tranche 6, 5.75%, 8/21/201 | | | 36,533,334 | | | | 37,300,534 | |

| |

Smart & Final, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.75%, 11/15/191 | | | 70,386,354 | | | | 70,540,359 | |

| |

Supervalu, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, 4.50%, 3/21/191 | | | 32,587,195 | | | | 32,589,444 | |

| | | | | | | | |

| | | | | | | 316,069,349 | |

| | | | | | | | |

| |

Food Products—1.5% | | | | | | | | |

| |

AdvancePierre Foods, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 5.75%, 7/10/171 | | | 45,570,320 | | | | 45,722,206 | |

| |

AdvancePierre Foods, Inc., Sr. Sec. Credit Facilities 2nd Lien Term Loan, 9.50%, 10/10/171 | | | 4,110,000 | | | | 4,002,112 | |

| |

CSM Bakery Solutions LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 5.00%, 7/3/201 | | | 7,860,000 | | | | 7,830,525 | |

17 OPPENHEIMER SENIOR FLOATING RATE FUND

|

|

| STATEMENT OF INVESTMENTS Continued |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| |

Food Products (Continued) | | | | | | | | |

| |

Dole Food Co., Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, 4.50%-5.75%, 11/1/181 | | $ | 55,119,350 | | | $ | 55,165,044 | |

| |

H.J. Heinz Co., Sr. Sec. Credit Facilities 1st Lien Term Loan, 3.50%, 6/5/201 | | | 39,600,000 | | | | 39,649,500 | |

| |

Hostess Brands, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 6.75%, 4/9/201 | | | 36,534,487 | | | | 37,767,526 | |

| |

JBS USA LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan: | | | | | | | | |

Tranche B, 3.75%, 5/25/181 | | | 14,645,614 | | | | 14,572,386 | |

Tranche B, 3.75%, 9/18/201 | | | 29,775,000 | | | | 29,672,276 | |

| |

Mill US Acquisition LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.75%, 7/3/201 | | | 34,793,550 | | | | 34,779,041 | |

| |

Mill US Acquisition LLC, Sr. Sec. Credit Facilities 2nd Lien Term Loan, 8.50%, 7/5/211 | | | 13,840,000 | | | | 13,909,200 | |

| |

Performance Food Group, Inc., Sr. Sec. Credit Facilities 2nd Lien Term Loan, 6.25%, 11/14/191 | | | 28,593,956 | | | | 28,862,024 | |

| | | | | | | | |

| | | | | | | 311,931,840 | |

| | | | | | | | |

| |

Household Products—0.2% | | | | | | | | |

| |

PFS Holding Corp., Sr. Sec. Credit Facilities 1st Lien Term Loan, 4.50%, 1/29/211 | | | 26,623,275 | | | | 25,558,344 | |

| |

PFS Holding Corp., Sr. Sec. Credit Facilities 2nd Lien Term Loan, 8.25%, 1/28/221 | | | 16,695,000 | | | | 15,442,875 | |

| | | | | | | | |

| | | | | | | 41,001,219 | |

| | | | | | | | |

| |

Energy—5.3% | | | | | | | | |

| |

Energy Equipment & Services—4.3% | | | | | | | | |

| |

American Energy-Marcellus LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, 5.25%, 6/20/201 | | | 27,545,000 | | | | 27,579,431 | |

| |

Ameriforge Group, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, 5.00%, 12/19/191 | | | 21,605,158 | | | | 21,740,190 | |

| |

Ameriforge Group, Inc., Sr. Sec. Credit Facilities 2nd Lien Term Loan, 8.75%, 12/21/201 | | | 22,710,000 | | | | 23,277,750 | |

| |

BBTS Borrower LP, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 8.75%, 6/4/191 | | | 18,468,403 | | | | 18,655,969 | |

| |

CITGO Petroleum Corp., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.50%, 7/23/211 | | | 18,445,000 | | | | 18,560,281 | |

| |

Drillships Financing Holding, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B1, 6.00%, 3/31/211 | | | 111,250,410 | | | | 112,362,915 | |

| |

Fieldwood Energy LLC, Sr. Sec. Credit Facilities 2nd Lien Term Loan, 8.375%, 9/30/201 | | | 54,592,942 | | | | 56,008,974 | |

| |

HGIM, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 5.50%, 6/18/201 | | | 49,828,462 | | | | 49,672,749 | |

| |

Larchmount Resources LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, 8.25%, 8/7/191 | | | 24,750,000 | | | | 25,306,875 | |

| |

McDermott Finance LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 5.25%, 4/16/191 | | | 27,605,000 | | | | 27,915,556 | |

| |

Offshore Group Investment Ltd., Sr. Sec. Credit Facilities 1st Lien Term Loan: | | | | | | | | |

Tranche B, 5.00%, 10/25/171 | | | 32,713,147 | | | | 32,624,559 | |

Tranche B, 5.75%, 3/28/191 | | | 32,429,500 | | | | 32,341,681 | |

| |

Pacific Drilling SA, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.50%, 6/3/181 | | | 23,220,450 | | | | 23,307,527 | |

18 OPPENHEIMER SENIOR FLOATING RATE FUND

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| |

Energy Equipment & Services (Continued) | | | | | | | | |

| |

ProPetro Services, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 7.25%, 9/30/191 | | $ | 103,728,625 | | | $ | 104,506,590 | |

| |

Quicksilver Resources, Inc., Sr. Sec. Credit Facilities 2nd Lien Term Loan, 7.00%, 6/21/191 | | | 52,050,000 | | | | 50,380,080 | |

| |

Sabine Oil & Gas LLC, Sr. Sec. Credit Facilities 2nd Lien Term Loan, 8.75%, 12/31/181 | | | 38,730,000 | | | | 39,383,569 | |

| |

Seadrill Operating LP, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.00%, 2/12/211 | | | 134,244,215 | | | | 132,912,244 | |

| |

Sheridan Investment Partners I LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B2, 4.25%, 10/1/191 | | | 47,293,640 | | | | 47,485,794 | |

| |

Sheridan Production Partners I-A LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B2, 4.25%, 10/1/191 | | | 6,266,795 | | | | 6,282,462 | |

| |

Sheridan Production Partners I-M LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B2, 4.25%, 10/1/191 | | | 3,827,795 | | | | 3,837,364 | |

| |

Templar Energy, Sr. Sec. Credit Facilities 2nd Lien Term Loan, 8.00%, 11/25/201 | | | 46,780,000 | | | | 46,429,150 | |

| | | | | | | | |

| | | | | | | 900,571,710 | |

| | | | | | | | |

| |

Oil, Gas & Consumable Fuels—1.0% | | | | | | | | |

| |

Blackbrush, Sr. Sec. Credit Facilities 2nd Lien Term Loan, 7.50%, 7/21/211 | | | 25,245,000 | | | | 25,434,338 | |

| |

Samson Investment Co., Sr. Sec. Credit Facilities 2nd Lien Term Loan, 5.00%, 9/25/181 | | | 92,620,000 | | | | 92,520,804 | |

| |

Sheridan Investment Partners II LLC, Sr. Sec. Credit Facilities 1st Lien REV Term Loan, 4.25%, 12/11/201 | | | 34,831,657 | | | | 34,846,182 | |

| |

Sheridan Investment Partners II-A LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B2, 4.25%, 12/11/201 | | | 4,845,336 | | | | 4,847,356 | |

| |

Sheridan Production Partners II-M LLC, Sr. Sec. Credit Facilities 1st Lien REV Term Loan, Tranche B2, 4.25%, 12/11/201 | | | 1,807,045 | | | | 1,807,798 | |

| |

Southcross Energy Partners LP, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 6.00%, 7/30/211 | | | 4,590,000 | | | | 4,615,764 | |

| |

Southcross Holdings LP, Sr. Sec. Credit Facilities 1st Lien Term Loan, 5.25%, 7/29/211 | | | 32,130,000 | | | | 32,330,009 | |

| | | | | | | | |

| | | | | | | 196,402,251 | |

| | | | | | | | |

| |

Financials—3.0% | | | | | | | | |

| |

Capital Markets—0.7% | | | | | | | | |

| |

Nuveen Investments, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.155%, 5/13/171 | | | 104,633,121 | | | | 104,756,693 | |

| |

Nuveen Investments, Inc., Sr. Sec. Credit Facilities 2nd Lien Term Loan, 6.50%, 2/28/191 | | | 38,535,000 | | | | 38,647,406 | |

| | | | | | | | |

| | | | | | | 143,404,099 | |

| | | | | | | | |

| |

Commercial Banks—0.2% | | | | | | | | |

| |

Hub International Ltd., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.75%, 10/2/201 | | | 42,807,500 | | | | 42,962,677 | |

| | | | | | | | |

| |

Consumer Finance—0.4% | | | | | | | | |

| |

Fly Leasing Ltd., Sr. Sec. Credit Facilities 1st Lien Term Loan, 4.50%, 8/9/191 | | | 43,004,090 | | | | 43,380,377 | |

19 OPPENHEIMER SENIOR FLOATING RATE FUND

|

|

| STATEMENT OF INVESTMENTS Continued |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| |

Consumer Finance (Continued) | | | | | | | | |

| |

Grosvenor Capital Management Holdings LLP, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 3.75%, 1/4/211 | | $ | 31,412,150 | | | $ | 31,264,921 | |

| | | | | | | | |

| | | | | | | 74,645,298 | |

| | | | | | | | |

| |

Diversified Financial Services—0.6% | | | | | | | | |

| |

Altisource Solutions Sarl, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.50%, 12/9/201 | | | 37,991,651 | | | | 37,991,651 | |

| |

Guggenheim Partners Investment Management, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.25%, 7/22/201 | | | 39,662,812 | | | | 39,687,601 | |

| |

RCS Capital, Sr. Sec. Credit Facilities 1st Lien Term Loan, 6.50%, 4/29/191 | | | 49,790,000 | | | | 50,692,444 | |

| | | | | | | | |

| | | | | | | 128,371,696 | |

| | | | | | | | |

| |

Insurance—0.9% | | | | | | | | |

| |

Aqgen Liberty Management I, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, 6.50%, 7/1/191 | | | 105,383,650 | | | | 105,251,920 | |

| |

National Financial Partners Corp., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.50%, 7/1/201 | | | 88,194,379 | | | | 88,693,581 | |

| | | | | | | | |

| | | | | | | 193,945,501 | |

| | | | | | | | |

| |

Real Estate Management & Development—0.2% | | | | | | | | |

| |

Realogy Group LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 3.75%, 3/5/201 | | | 43,230,268 | | | | 43,297,837 | |

| | | | | | | | |

| |

Health Care—11.9% | | | | | | | | |

| |

Biotechnology—0.1% | | | | | | | | |

| |

eResearch Technology, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 6.00%, 5/2/181 | | | 20,979,870 | | | | 21,058,545 | |

| | | | | | | | |

| |

Health Care Equipment & Supplies—6.8% | | | | | | | | |

| |

Accellent. Inc., Sr. Sec. Credit Facilities 2nd Lien Term Loan, 4.50%, 3/12/211 | | | 37,077,075 | | | | 37,044,633 | |

| |

Akorn, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.50%, 4/16/211 | | | 50,595,000 | | | | 50,784,731 | |

| |

Alliance Healthcare Services, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, 4.25%, 6/3/191 | | | 46,237,804 | | | | 46,266,702 | |

| |

Alvogen Pharma US, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 7.00%, 5/23/181 | | | 24,458,539 | | | | 24,917,136 | |

| |

Carestream Health, Inc., Sr. Sec. Credit Facilities Term Loan, 5.00%, 6/7/191 | | | 40,830,090 | | | | 40,943,107 | |

| |

Connolly Corp., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 5.00%, 5/9/211 | | | 46,185,000 | | | | 46,560,253 | |

| |

ConvaTec Ltd., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 5.00%, 12/22/161 | | | 56,832,372 | | | | 56,938,933 | |

| |

Covis Pharmaceuticals Holdings, Sr. Sec. Credit Facilities 1st Lien Term Loan, 6.00%, 4/4/191 | | | 29,667,278 | | | | 29,704,362 | |

| |

DJO Finance LLC/DJO Finance Corp., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.25%, 9/15/171 | | | 63,089,374 | | | | 63,312,836 | |

| |

Drumm Investors LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, 6.75%, 5/4/181 | | | 51,192,878 | | | | 51,304,888 | |

| |

Envision Pharmaceutical Services, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 5.75%, 11/4/201 | | | 42,369,825 | | | | 42,846,486 | |

20 OPPENHEIMER SENIOR FLOATING RATE FUND

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| |

Health Care Equipment & Supplies (Continued) | | | | | | | | |

| |

Envision Pharmaceutical Services, Inc., Sr. Sec. Credit Facilities 2nd Lien Term Loan, 9.75%, 11/4/211 | | $ | 5,000,000 | | | $ | 5,078,125 | |

| |

Generic Drug Holdings, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 5.00%, 8/16/201 | | | 25,157,629 | | | | 25,291,292 | |

| |

HCR ManorCare, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, 5.00%, 4/6/181 | | | 48,858,783 | | | | 47,087,652 | |

| |

Healthport, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, 5.25%, 10/4/191 | | | 18,905,000 | | | | 19,023,156 | |

| |

Healthport, Inc., Sr. Sec. Credit Facilities 2nd Lien Term Loan, 9.25%, 10/5/201 | | | 6,700,000 | | | | 6,775,375 | |

| |

IASIS Healthcare LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B2, 4.50%, 5/3/181 | | | 48,554,827 | | | | 48,729,333 | |

| |

Kinetic Concepts, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche E1, 4.00%, 5/4/181 | | | 59,270,541 | | | | 59,333,842 | |

| |

LHP Hospital Group, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 9.00%, 7/3/181 | | | 30,535,830 | | | | 29,238,057 | |

| |

LifeCare Holdings LLC, Sr. Sec. Credit Facilities 1st Lien Exit Term Loan, Tranche A, 6.50%, 11/30/181 | | | 45,277,650 | | | | 44,711,679 | |

| |

Medpace, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.75%, 3/31/211 | | | 21,133,774 | | | | 21,239,442 | |

| |

MHP Acquisition Holdings LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.00%, 3/31/211 | | | 48,636,364 | | | | 48,479,317 | |

| |

National Mentor, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.75%, 1/31/211 | | | 34,698,038 | | | | 34,857,059 | |

| |

New Trident Holdcorp, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 6.50%, 7/31/191 | | | 35,074,950 | | | | 35,140,715 | |

| |

Opal Acquisition, Inc., Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 5.00%, 11/27/201 | | | 80,985,793 | | | | 81,218,627 | |

| |

Ortho-Clinical Diagnostics, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.75%, 6/30/211 | | | 69,265,000 | | | | 69,337,174 | |

| |

P2 Lower Acquisition LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, 5.50%, 10/22/201 | | | 33,343,256 | | | | 33,468,293 | |

| |

PRA Holdings, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, 5.00%, 9/23/201 | | | 81,762,150 | | | | 81,557,745 | |

| |

Quintiles Transnational Co., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B3, 3.75%, 6/8/181 | | | 62,250,220 | | | | 62,289,127 | |

| |

Sage Products Holdings III LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.25%, 12/13/191 | | | 30,846,164 | | | | 30,904,001 | |

| |

Salix Pharmaceuticals Ltd., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.25%, 1/2/201 | | | 46,297,875 | | | | 46,565,523 | |

| |

United Surgical Partners, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.75%, 4/3/191 | | | 19,931,156 | | | | 19,993,441 | |

| |

US Renal Care, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B2, 4.25%, 7/3/191 | | | 51,820,144 | | | | 51,771,588 | |

| |

US Renal Care, Inc., Sr. Sec. Credit Facilities 2nd Lien Term Loan, Tranche B1, 8.50%, 7/3/201 | | | 5,188,000 | | | | 5,239,880 | |

| | | | | | | | |

| | | | | | | 1,397,954,510 | |

| | | | | | | | |

| |

Health Care Providers & Services—3.6% | | | | | | | | |

| |

American Renal Holdings, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Delayed Draw, Tranche B, 4.50%, 8/20/191 | | | 42,277,399 | | | | 42,242,182 | |

21 OPPENHEIMER SENIOR FLOATING RATE FUND

|

|

| STATEMENT OF INVESTMENTS Continued |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| |

Health Care Providers & Services (Continued) | | | | | | | | |

| |

Ardent Medical Services, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 6.75%, 7/2/181 | | $ | 40,691,446 | | | $ | 40,882,207 | |

| |

Ardent Medical Services, Inc., Sr. Sec. Credit Facilities 2nd Lien Term Loan, 11.00%, 1/2/191 | | | 1,785,714 | | | | 1,796,130 | |

| |

CHS/Community Health Systems, Inc., Sr. Sec. Credit Facilities Term Loan, 4.25%, 1/27/211 | | | 57,222,450 | | | | 57,437,034 | |

| |

CRC Health, Sr. Sec. Credit Facilities 1st Lien Term Loan, 5.25%, 3/26/211 | | | 36,872,588 | | | | 37,183,718 | |

| |

DaVita HealthCare Partners, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 3.50%, 6/4/211 | | | 45,890,000 | | | | 45,877,701 | |

| |

Envision Healthcare Intermedia, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.00%, 5/25/181 | | | 44,020,736 | | | | 44,094,119 | |

| |

Genesis Healthcare Corp., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 10.00%, 12/4/171 | | | 25,018,160 | | | | 25,560,228 | |

| |

Gentiva Health Services, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 6.50%, 10/18/191 | | | 28,800,275 | | | | 28,867,610 | |

| |

Ikaria, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 5.00%, 2/11/211 | | | 43,600,000 | | | | 43,891,946 | |

| |

Ikaria, Inc., Sr. Sec. Credit Facilities 2nd Lien Term Loan, Tranche B, 8.75%, 2/14/221 | | | 6,490,000 | | | | 6,598,708 | |

| |

inVentiv Health, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan: | | | | | | | | |

Tranche B, 7.75%, 8/4/161 | | | 19,281,949 | | | | 19,354,256 | |

Tranche B4, 7.75%, 5/15/181 | | | 2,905,238 | | | | 2,912,501 | |

| |

Kindred Healthcare, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.00%, 4/9/211 | | | 75,850,356 | | | | 75,779,284 | |

| |

Millennium Laboratories LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 5.25%, 4/14/211 | | | 115,100,000 | | | | 115,482,708 | |

| |

Steward Health Care System LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, 6.75%, 4/10/201 | | | 22,522,500 | | | | 22,381,734 | |

| |

STHI Holding Corp., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.50%, 5/9/211 | | | 9,180,000 | | | | 9,151,313 | |

| |

Surgery Center Holdings LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, 6.00%, 4/11/191 | | | 35,103,605 | | | | 35,147,484 | |

| |

Surgery Center Holdings LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, 5.25%, 7/22/211 | | | 64,260,000 | | | | 64,500,975 | |

| |

Surgery Center Holdings LLC, Sr. Sec. Credit Facilities 2nd Lien Term Loan, 9.75%, 4/11/201 | | | 19,595,000 | | | | 19,619,494 | |

| |

Surgery Center Holdings LLC, Sr. Sec. Credit Facilities 2nd Lien Term Loan, 8.50%, 7/22/221 | | | 4,590,000 | | | | 4,572,788 | |

| | | | | | | | |

| | | | | | | 743,334,120 | |

| | | | | | | | |

| |

Health Care Technology—0.1% | | | | | | | | |

| |

Vitera Healthcare Solutions LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, 6.00%, 11/4/201 | | | 26,153,585 | | | | 26,186,277 | |

| | | | | | | | |

| |

Life Sciences Tools & Services—0.3% | | | | | | | | |

| |

JLL/Delta Dutch Newco BV, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.25%, 3/11/211 | | | 52,110,000 | | | | 51,784,313 | |

| | | | | | | | |

| |

Pharmaceuticals—1.0% | | | | | | | | |

| |

Catalent Pharma Solutions, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, 6.50%, 12/31/171 | | | 7,664,791 | | | | 7,712,696 | |

22 OPPENHEIMER SENIOR FLOATING RATE FUND

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| |

Pharmaceuticals (Continued) | | | | | | | | |

| |

Catalent Pharma Solutions, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.50%, 5/7/211 | | $ | 30,000,000 | | | $ | 30,161,730 | |

| |

Par Pharmaceutical, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B2, 4.00%, 9/30/191 | | | 107,393,234 | | | | 107,335,672 | |

| |

Valeant Pharmaceuticals International, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.50%, 8/5/201 | | | 69,367,281 | | | | 69,497,344 | |

| | | | | | | | |

| | | | | | | 214,707,442 | |

| | | | | | | | |

| |

Industrials—21.7% | | | | | | | | |

| |

Aerospace & Defense—1.2% | | | | | | | | |

| |

AM General LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 10.25%, 3/22/181 | | | 24,886,421 | | | | 23,393,236 | |

| |

Doncasters Group Ltd., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.50%, 4/9/201 | | | 59,061,381 | | | | 59,252,090 | |

| |

Doncasters Group Ltd., Sr. Sec. Credit Facilities 2nd Lien Term Loan, 9.50%, 10/9/201 | | | 7,062,069 | | | | 7,190,069 | |

| |

IAP Worldwide Services, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 10.139%, 12/31/151,2 | | | 30,286,585 | | | | 8,783,110 | |

| |

IAP Worldwide Services, Inc., Sr. Sec. Credit Facilities 2nd Lien Term Loan, 10.589%, 6/30/161,2 | | | 10,182,637 | | | | 208,744 | |

| |

Landmark Aviation FBO Canada, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 5.75%, 10/25/191 | | | 23,500,000 | | | | 23,562,416 | |

| |

LM US Member LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.75%, 10/25/191 | | | 35,068,603 | | | | 35,161,745 | |

| |

Sequa Corp., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 5.25%, 6/19/171 | | | 28,740,915 | | | | 28,435,543 | |

| |

TurboCombustor Technology, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 5.50%, 12/2/201 | | | 22,641,225 | | | | 22,825,185 | |

| |

WP CPP Holdings LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, 4.75%, 12/28/191 | | | 49,141,238 | | | | 49,427,878 | |

| | | | | | | | |

| | | | | | | 258,240,016 | |

| | | | | | | | |

| |

Air Freight & Couriers—0.2% | | | | | | | | |

| |

US Airways, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B1, 3.50%, 5/23/191 | | | 38,907,000 | | | | 38,761,099 | |

| | | | | | | | |

| |

Airlines—0.6% | | | | | | | | |

| |

American Airlines, Inc., Sr. Sec. Credit Facilities 1st Lien Exit Term Loan, Tranche B, 3.75%, 6/27/191 | | | 120,045,899 | | | | 120,335,330 | |

| | | | | | | | |

| |

Building Products—0.2% | | | | | | | | |

| |

ABC Supply Co., Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 3.50%, 4/16/201 | | | 17,431,700 | | | | 17,354,077 | |

| |

Wilsonart International Holdings, Sr. Sec. Credit Facilities 1st Lien Term Loan, 4.00%, 10/31/191 | | | 30,265,934 | | | | 30,067,329 | |

| | | | | | | | |

| | | | | | | 47,421,406 | |

| | | | | | | | |

| |

Commercial Services & Supplies—9.8% | | | | | | | | |

| |

AlixPartners LLP, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B2, 4.00%, 7/10/201 | | | 37,562,500 | | | | 37,585,977 | |

| |

AlixPartners LLP, Sr. Sec. Credit Facilities 2nd Lien Term Loan, 9.00%, 7/10/211 | | | 13,600,000 | | | | 13,821,000 | |

| |

23 OPPENHEIMER SENIOR FLOATING RATE FUND

|

|

| STATEMENT OF INVESTMENTS Continued |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| |

Commercial Services & Supplies (Continued) | | | | | | | | |

| |

Allied Security Holdings LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.25%, 2/12/211 | | $ | 30,703,376 | | | $ | 30,607,428 | |

| |

Allied Security Holdings LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, Delayed Draw, Tranche B, 3.25%, 2/12/211 | | | 10,920,727 | | | | 10,886,600 | |

| |

Allied Security Holdings LLC, Sr. Sec. Credit Facilities 2nd Lien Term Loan, Tranche B, 8.00%, 8/12/211 | | | 25,262,123 | | | | 25,209,502 | |

| |

Allied Security Holdings LLC, Sr. Sec. Credit Facilities 2nd Lien Term Loan, Delayed Draw, Tranche B, 7.00%, 8/12/211 | | | 7,615,068 | | | | 7,599,206 | |

| |

Allied Security Holdings LLC, Sr. Sec. Credit Facilities 2nd Lien Term Loan, Delyed Draw, Tranche B, 8.00%, 8/12/211 | | | 1,917,808 | | | | 1,913,813 | |

| |

Ascend Learning LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, 6.00%-7.25%, 7/26/191 | | | 16,153,825 | | | | 16,340,612 | |

| |

Asurion LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan: | | | | | | | | |

Tranche B1, 5.00%, 5/24/191 | | | 58,155,035 | | | | 58,485,646 | |

Tranche B2, 4.25%, 7/8/201 | | | 54,895,500 | | | | 54,809,753 | |

| |

Asurion LLC, Sr. Sec. Credit Facilities 2nd Lien Term Loan, 8.50%, 3/3/211 | | | 51,560,000 | | | | 53,300,150 | |

| |

Audio Visual Services Corp., Sr. Sec. Credit Facilities 1st Lien Term Loan, 4.50%, 1/22/211 | | | 46,264,050 | | | | 46,336,361 | |

| |

Brand Energy & Infrastructure Services, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.75%, 11/26/201 | | | 85,235,437 | | | | 85,402,839 | |

| |

Brock Holdings III, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 6.00%, 3/16/171 | | | 13,338,245 | | | | 13,384,009 | |

| |

Brock Holdings III, Inc., Sr. Sec. Credit Facilities 2nd Lien Term Loan, 10.00%, 3/16/181 | | | 14,670,000 | | | | 14,850,324 | |

| |

Ceridian Corp., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.405%, 8/14/151 | | | 71,864,374 | | | | 72,056,899 | |

| |

CEVA Group plc, Sr. Sec. Credit Facilities 1st Lien Term Loan, 6.50%, 3/14/211 | | | 10,058,498 | | | | 9,865,183 | |

| |

CEVA Group plc, Sr. Sec. Credit Facilities 1st Lien Term Loan, 6.50%, 3/19/211 | | | 12,404,871 | | | | 12,161,946 | |

| |

CEVA Logistics U.S. Holdings, Inc., Sr. Sec. Credit Facilities Term Loan, 6.50%, 3/14/211 | | | 14,593,966 | | | | 14,313,484 | |

| |

Crossmark Holdings, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, 4.50%, 12/20/191 | | | 36,929,693 | | | | 36,791,207 | |

| |

Crossmark Holdings, Inc., Sr. Sec. Credit Facilities 2nd Lien Term Loan, 8.75%, 12/21/201 | | | 15,000,000 | | | | 14,974,995 | |

| |

EWT Holdings III Corp., Sr. Sec. Credit Facilities 1st Lien Term Loan, 4.75%, 1/15/211 | | | 46,158,793 | | | | 46,187,642 | |

| |

EWT Holdings III Corp., Sr. Sec. Credit Facilities 2nd Lien Term Loan, 8.50%, 1/15/221 | | | 9,315,000 | | | | 9,367,397 | |

| |

Expert Global Solutions, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 8.50%, 4/3/181 | | | 32,371,488 | | | | 32,366,438 | |

| |

First Data Corp., Extended Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche C1, 4.154%, 3/23/181 | | | 74,010,797 | | | | 74,163,852 | |

| |

First Data Corp., Sr. Sec. Credit Facilities 1st Lien Term Loan: | | | | | | | | |

Tranche B, 4.154%, 9/24/181 | | | 27,204,695 | | | | 27,261,362 | |

Tranche B, 4.155%, 3/24/211 | | | 58,835,094 | | | | 58,866,630 | |

| |

Garda World Security Co., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.00%, 11/6/201 | | | 22,635,960 | | | | 22,607,665 | |

24 OPPENHEIMER SENIOR FLOATING RATE FUND

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| |

Commercial Services & Supplies (Continued) | | | | | | | | |

| |

Garda World Security Co., Sr. Sec. Credit Facilities 1st Lien Term Loan, Delayed Draw, Tranche B, 4.00%, 11/6/201 | | $ | 5,790,594 | | | $ | 5,783,356 | |

| |

GCA Services Group, Inc., Sr. Credit Facilities 1st Lien Term Loan, 4.25%-5.50%, 11/1/191 | | | 17,464,633 | | | | 17,486,464 | |

| |

GCA Services Group, Inc., Sr. Sec. Credit Facilities 2nd Lien Term Loan, Tranche B, 9.25%, 11/1/201 | | | 10,516,000 | | | | 10,669,355 | |

| |

IG Investments Holdings LLC, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 5.25%, 10/31/191 | | | 52,692,087 | | | | 53,054,345 | |

| |

Information Resources, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.75%, 9/30/201 | | | 23,611,575 | | | | 23,705,030 | |

| |

Inmar, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.25%, 1/27/211 | | | 27,830,000 | | | | 27,551,700 | |

| |

Inmar, Inc., Sr. Sec. Credit Facilities 2nd Lien Term Loan, Tranche B, 8.00%, 1/27/221 | | | 9,275,000 | | | | 9,251,812 | |

| |

iPayment, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 6.75%, 5/8/171 | | | 31,520,000 | | | | 31,201,396 | |

| |

JHCI Acquisition, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 7.00%, 7/11/191 | | | 26,862,248 | | | | 27,198,026 | |

| |

JHCI Acquisition, Inc., Sr. Sec. Credit Facilities 2nd Lien Term Loan, 11.00%, 7/11/201 | | | 11,000,000 | | | | 11,137,500 | |

| |

Language Line LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 6.25%, 6/20/161 | | | 49,566,770 | | | | 49,684,491 | |

| |

Language Line LLC, Sr. Sec. Credit Facilities 2nd Lien Term Loan, 10.50%, 12/20/161 | | | 18,060,000 | | | | 18,001,305 | |

| |

Livingston International, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B1, 5.00%, 4/18/191 | | | 29,997,000 | | | | 30,059,484 | |

| |

Livingston International, Inc., Sr. Sec. Credit Facilities 2nd Lien Term Loan, 9.00%, 4/17/201 | | | 14,900,330 | | | | 15,044,685 | |

| |

Neff Rental LLC, Sr. Sec. Credit Facilities 2nd Lien Term Loan, 7.25%, 5/21/211 | | | 41,360,000 | | | | 41,230,750 | |

| |

New Breed Logistics, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 6.00%, 10/1/191 | | | 23,560,003 | | | | 23,692,528 | |

| |

Novitex Acquisition LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, 7.50%, 7/1/201 | | | 27,540,000 | | | | 27,402,300 | |

| |

Novitex Acquisition LLC, Sr. Sec. Credit Facilities 2nd Lien Term Loan, 11.75%, 7/1/211 | | | 12,850,000 | | | | 12,817,875 | |

| |

OPE USIC Holdings, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, 4.00%, 7/10/201 | | | 47,025,000 | | | | 46,495,969 | |

| |

Orbitz Worldwide, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, 4.50%, 4/10/211 | | | 35,676,219 | | | | 35,869,477 | |

| |

Osmose Holdings, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.75%, 11/26/181 | | | 23,384,080 | | | | 23,403,956 | |

| |

Ozburn-Hessey Holding Co. LLC, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 6.75%, 5/23/191 | | | 26,827,488 | | | | 26,911,323 | |

| |

Protection One, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.25%, 3/21/191 | | | 50,204,190 | | | | 50,235,567 | |

| |

Sabre, Inc., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 4.25%, 2/19/191 | | | 86,464,970 | | | | 86,347,896 | |

| |

Sabre, Inc., Sr. Sec. Credit Facilities Incremental 1st Lien Term Loan, Tranche B2, 4.50%, 2/19/191 | | | 33,199,125 | | | | 33,257,921 | |

| |

25 OPPENHEIMER SENIOR FLOATING RATE FUND

|

|

| STATEMENT OF INVESTMENTS Continued |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| |

Commercial Services & Supplies (Continued) | | | | | | | | |

| |

Ship Midco Ltd., Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche C, 4.75%, 11/29/191 | | $ | 33,205,000 | | | $ | 33,443,677 | |

| |

Sourcehov, Sr. Sec. Credit Facilities 1st Lien Term Loan, Tranche B, 5.25%, 4/30/181 | | | 35,169,750 | | | | 35,492,151 | |

| |