Registration Statement No. 333-___________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CHINA YONGXIN PHARMACEUTICALS INC.

(Exact name of registrant as specified in its charter)

| Delaware | 5912 | 20-1661391 | ||

(State or Other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

927 Canada Court

City of Industry, California 91748

(626) 581-9098

(Address, including zip code, and telephone lumber, including area code, of registrant’s principal executive offices)

Yongxin Liu, Chief Executive Officer

927 Canada Court

City of Industry, California 91748

(626) 581-9098

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Nimish Patel, Esq. Edgar Park, Esq. Dominador Tolentino, Esq. Richardson & Patel LLP 10900 Wilshire Boulevard, Suite 500 Los Angeles, California 90024 | Gregory Sichenzia, Esq. Thomas A. Rose, Esq. Sichenzia Ross Friedman Ference LLP 61 Broadway, 32nd Floor New York, NY 10006 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o | Accelerated filer o | Non-accelerated filer o | Smaller reporting company x |

| (Do not check if smaller reporting company) |

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Amount to be Registered | Proposed Maximum Aggregate Offering Price (1) | Amount of Registration Fee | |||||||

| Common stock, $0.001 par value per share (2) | $ | 23,000,000 | $ | 1,639.90 | ||||||

| Shares of Common Stock underlying Underwriter’s Common Stock Purchase Warrant (3) (4) | $ | $ | — | |||||||

| Total | $ | 1,639.90 | ||||||||

| (1) | Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(o) of the Securities Act. |

| (2) | Includes [ ] shares of common stock which may be issued pursuant to the exercise of a 45-day option granted by the registrant to the underwriters to cover over-allotments, if any. |

| (3) | No registration fee required pursuant to Rule 457(g) under the Securities Act of 1933. |

| (4) | Pursuant to Rule 416 under the Securities Act of 1933, this registration statement shall be deemed to cover the additional securities (i) to be offered or issued in connection with any provision of any securities purported to be registered hereby to be offered pursuant to terms which provide for a change in the amount of securities being offered or issued to prevent dilution resulting from stock splits, stock dividends, or similar transactions and (ii) of the same class as the securities covered by this registration statement issued or issuable prior to completion of the distribution of the securities covered by this registration statement as a result of a split of, or a stock dividend on, the registered securities. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a) may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS | Subject to Completion | ______, 2010 |

Common Stock

CHINA YONGXIN PHARMACEUTICALS INC.

| This is a firm commitment public offering of [________] shares of our common stock. |

Our common stock is quoted on the OTC Bulletin Board under the symbol “CYXND” and it will revert back to “CYXN” on or around June 24, 2010. On June 1, 2010, the last reported market price of our common stock was $5.75 per share.

We intend to apply for listing of our common stock on The NASDAQ Capital Market under the symbol “CYXN”, which listing we expect to occur immediately prior to the date of this prospectus. No assurance can be given that our application will be approved. If the application is not approved, we will not complete this offering and the shares of our common stock will continue to be traded on the OTC Bulletin Board.

Investing in our common stock and warrants involves a high degree of risk. Please read our “Risk Factors” beginning on page 16.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined whether this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Per Share | Total | |||||||

| Public offering price | $ | $ | ||||||

| Underwriting discounts and commissions (1) | $ | $ | ||||||

| Proceeds, before expenses, to us (2) | $ | $ | ||||||

| (1) | Does not include a non-accountable expense allowance equal to 1% of the gross proceeds of this offering payable to Rodman & Renshaw, LLC, as lead underwriter. Non-accountable expenses are estimated to be $_______. See “Underwriting” for a description of compensation payable to the underwriter. |

| (2) | We estimate that the total expenses of this offering will be approximately $_______, consisting of $_______ for the underwriter’s non-accountable expense allowance (equal to 1% of the gross proceeds) and $_______ for legal, accounting, printing costs and various fees associated with the registration and listing of our shares. |

We have granted a 45-day option to Rodman & Renshaw, LLC, as lead underwriter, to purchase up to [_____] additional shares of common stock (15% of the shares sold) solely to cover over-allotments, if any. The shares issuable upon exercise of the underwriter over-allotment option are identical to those offered by this prospectus and have been registered under the registration statement of which this prospectus forms a part.

3

In connection with this offering, we have also agreed to sell to Rodman & Renshaw, LLC a warrant to purchase up to 5% of the shares sold in this offering (excluding the over-allotment option). If Rodman & Renshaw, LLC exercises this warrant, each share of common stock may be purchased at $ per share (125% of the price of the shares sold in the offering).

We are offering the shares of common stock on a firm commitment basis. The underwriters expect to deliver our shares to purchasers in the offering on or about ______, 2010.

Rodman & Renshaw, LLC

The date of this prospectus is _________________, 2010

4

|

Corporate Offices (1) |

|

Distribution center (2) |

| (1) | China Yongxin Pharmaceuticals, Inc.’s (“China Yongxin”) main corporate offices in China located at Changchun City, Jilin Province, P.R. China. |

| (2) | The Company’s national distribution center is also located at Changchun City, Jilin Province, P.R. China. |

5

Retail Drugstores (3)

| (3) | Images of some of the Company’s various retail drugstores located in Jilin Province, P.R. China. |

6

TABLE OF CONTENTS

| Prospectus Summary | 8 | |

| Summary Financial Information | 14 | |

| The Offering | 15 | |

| Risk Factors | 16 | |

| Forward Looking Statements | 30 | |

| Use of Proceeds | 31 | |

| Market for Common Equity and Related Stockholder Matters | 31 | |

| Dividend Policy | 32 | |

| Determination of Offering Price | 32 | |

| Capitalization | 33 | |

| Dilution | 33 | |

| Management’s Discussion and Analysis of Financial Condition and Results of Operations | 34 | |

| Business | 41 | |

| Legal Proceedings | 50 | |

| Description of Property | 50 | |

| Management | 50 | |

| Executive Compensation | 53 | |

| Security Ownership of Certain Beneficial Owners and Management | 55 | |

| Certain Relationships and Related Transactions | 57 | |

| Description of Securities | 57 | |

| Underwriting and Plan of Distribution | 58 | |

| Legal Matters | 66 | |

| Experts | 66 | |

| Where You Can Find More Information | 66 | |

| Disclosure of Commission Position of Indemnification for Securities Act Liabilities | 66 | |

| Changes in and Disagreements with Accountants on Accounting and Financial Disclosures | 70 | |

| Index to Financial Statements | F-1 |

You should rely only on the information contained or incorporated by reference to this prospectus in deciding whether to purchase our common stock. We have not authorized anyone to provide you with information different from that contained or incorporated by reference to this prospectus. Under no circumstances should the delivery to you of this prospectus or any sale made pursuant to this prospectus create any implication that the information contained in this prospectus is correct as of any time after the date of this prospectus. To the extent that any facts or events arising after the date of this prospectus, individually or in the aggregate, represent a fundamental change in the information presented in this prospectus, this prospectus will be updated to the extent required by law.

We obtained statistical data, market data, and other industry data and forecasts used throughout this prospectus from market research, publicly available information, and industry publications. Industry publications generally state that they obtain their information from sources that they believe to be reliable, but they do not guarantee the accuracy and completeness of the information. Nevertheless, we are responsible for the accuracy and completeness of the historical information presented in this prospectus, as of the date of this prospectus.

7

PROSPECTUS SUMMARY

This summary contains basic information about us and this offering. The reader should read the entire prospectus carefully, especially the risks of investing in our common stock discussed under “Risk Factors” beginning on page 16. Some of the statements contained in this prospectus, including statements under “Prospectus Summary” and “Risk Factors” as well as those noted in the documents incorporated herein by reference, are forward-looking statements and may involve a number of risks and uncertainties. We note that our actual results and future events may differ significantly based upon a number of factors. The reader should not put undue reliance on the forward-looking statements in this document, which speak only as of the date on the cover of this prospectus.

References to “we,” “our,” “us,” the “Company,” or “China Yongxin” refer to China Yongxin Pharmaceuticals Inc., a Delaware corporation, and its consolidated subsidiaries.

Overview

China Yongxin is a wholesale distributor of pharmaceuticals and health-related products, and the third largest drugstore chain in Jilin province in the northeastern region of the People’s Republic of China (“PRC” or “China”). In 2009, we were a leader in the sales and distribution of over-the-counter Chinese traditional and Western medicines, prescription pharmaceuticals, natural health products including herbal and nutritional supplements, health foods, personal care products, cosmetics and medical equipment through retail operations in northeastern China. According to the PRC National Bureau of Statistics, Jilin province had a total population of approximately 27.34 million people as of the end of 2008. We currently operate 50 stores in high-traffic residential districts. We enjoy strong brand name recognition in Jilin province, which we believe results from our many locations in high-traffic areas, our quality of service and our reputation. We believe that our customer service orientation, close contact with local community, competitive price format, and broad product offerings provide a convenient and value-oriented shopping experience for our customers and has allowed us to build customer loyalty.

Our PRC operations began retail operations in 2004, and in 2005, we gained franchise rights from one of the world's largest drug chains for Jilin province. The Company has rapidly grown and it currently has a retail chain of 100 drugstore outlets as well as the wholesale distribution operations in Northeastern China. Our corporate headquarters are located in City of Industry, California and the Company’s distribution operations are based in Changchun City, Jilin Province, China. Substantially all of our employees are located in China. As of June 1, 2010, we had approximately 673 full time employees, with 143 employees with pharmaceutical education and/or training, and 17 licensed pharmacists working at our retail drugstores.

Industry Background

In 2004, the Chinese government initiated regulation towards separation of drug prescription and dispensation. Since then, the number of retail pharmacies in China has grown significantly. According to Business Monitor International, an independent research firm, in 2003, 25.35% of all drug sales in China were made by retail pharmacies, whereas sales through hospitals were 62.13%. In 2007, the percentage of drug sales through retail pharmacies increased to 26.83%, whereas drug sales through hospitals declined to 54.12%. Over time, we believe that a continuation of this trend will occur and more and more prescription drugs will be sold via retail drugstores versus state-run hospitals because of the immediate accessibility that retail storefront drugstores provide to consumers. The retail drugstore segment is highly fragmented consisting of several chains and a large number of single-location businesses. According to Snapshot International Ltd., China had approximately 391,500 non-hospital drugstores in 2008, up from 239,800 in 2004. According to Business Monitor International, in 2007, the amounts spent in China on prescription drugs (including patented drugs and generics) was USD$22.42 billion while over-the-counter drugs accounted for USD$7.07 billion and traditional Chinese medicine accounted for USD$21 billion. We believe that by providing our customers with convenient and professional pharmacy services through our wholesale and retail drugstore businesses, we will be able to take advantage of rising disposable income among Chinese residents, which, in turn, has fueled a growing demand in China for the Products (as defined below) we sell.

Our Business

Our business operates in two segments: the wholesale distribution of pharmaceuticals and other health-related products and, the operation of retail drugstores. The following table reflects the revenue contribution percentage from each of our business operations for the years ended December 31, 2009, 2008 and 2007, respectively:

| For the Years Ended December 31, | ||||||||||||

| 2009 | 2008 | 2007 | ||||||||||

| Wholesale Distribution Operations | 70.08 | % | 81.6 | % | 84 | % | ||||||

| Retail Drugstore Operations | 29.2 | % | 18.4 | % | 16 | % | ||||||

| Total Revenues | 100 | % | 100 | % | 100 | % | ||||||

8

The Products We Sell

The products we sell include over-the-counter Chinese traditional and Western medicines, prescription pharmaceuticals, natural health products including herbal and nutritional supplements, health foods, personal care products, cosmetics and medical equipment (sometimes collectively referred to hereinafter as our “Products”). We also utilize our extensive retail network as a channel for our pharmacists to provide affordable, quality, health and wellness services such as providing pharmaceutical advice and nutritional information to our customers.

Competitive Strengths

We believe that by leveraging the following strengths, we can effectively compete and enhance our market position:

| 1. | Management team with extensive industry experience. Our management team is comprised of 11 members with an average age of 43. Ninety percent (90%) of our management team holds at least a bachelor’s degree and 5 members hold a master’s degree. Most of our management has more than 10 years of experience working in the pharmaceutical industry. We also have 90 pharmacists, accounting for 13% of all employees. |

| 2. | Scalability, reputation, and a wide distribution and retail network. We are the largest drug distributor in Jilin province and the third largest chain drugstore retailer in Jilin province with an established reputation of providing convenient access to pharmaceutical and health-related products via our wholesale and retail distribution. |

| 3. | Unique industry position in drug distribution in Jilin province. We are the only “Pilot Pharmaceutical Logistics Enterprise” in Jilin province certified by the Jilin Food and Drug Administration and we are one of the essential drug distributors of Jilin province certified by the Jilin Health Department. |

| 4. | Use of modern information technology. We use computerized information management systems, such as Enterprise Resource Planning (“ERP”), third party logistics platform, Warehouse Management System (“WMS”), Automatic Control Selection (“WCS”) and a Technology Management System (“TMS”), to unify our management of drug distribution, operation of retail outlets and warehouses, and delivery of goods and billing. Our IT system can process real-time online orders, product storage, billing and search for storage information, order status and delivery status. |

| 5. | Strong financial performance and cash flow generation. We have enjoyed strong historical financial performance and steady cash flow. Our bank credit is rated A+ by local banks in Jilin province. We have been honored as an “AAA Rate Good Standing Enterprise” by the Provincial Business Association. |

Notwithstanding our competitive strengths, we expect to face certain risks and uncertainties, including but not limited to:

| Ÿ | our ability to identify market trends and to find and introduce new products in response to those trends; |

| Ÿ | changes in economic conditions in China that may affect spending on the Products we sell; |

| Ÿ | our ability to respond to competitive market conditions; and |

| Ÿ | uncertainties with respect to the PRC legal and regulatory environments. |

For a full discussion of the risks associated with this offering, please see the discussion titled “Risk Factors” starting on page 16.

Key Business Strategies

We are implementing the following key business strategies to further improve our position as a leading pharmaceutical and healthcare distributor and retailer in Northeastern China:

9

Strengthening existing and developing new distribution channels

To make full use of our advantages in our distribution channels, business network, information management and logistics, we seek to enhance and develop exclusive distributor agreements with drug suppliers and develop distribution business with hospitals, communities and health centers. We plan to establish and acquire seven drug distribution entities within eight cities in Jilin province and one drug distribution entity in each of Heilongjiang province and Liaoning province. Our goal is to become the largest Good Supply Practice (“GSP”) standardized drug distributor in Northeastern China.

Improving and Expanding our Retail Pharmacies

We strive to provide a convenient and value-oriented shopping experience by maintaining improved in-stock conditions, more convenient operating hours, faster customer prescription fulfillment and enhanced accessibility and interaction between our customers and pharmacists. We are responding to market demand and adopting a diversified operation mode in order to improve our profitability and competitive strength while staying in contact with our customers and local community. We intend to grow our market share in the pharmaceutical market by opening new stores, increasing comparable store sales and strategic acquisitions. Based in the city of Changchun, we plan to acquire and establish retail outlets in the cities of Baishan and Tianjin. We also plan to have approximately 300 retail drugstore outlets within the next three years.

With our existing distribution and logistics business, we are expanding our network centered in Jilin province. Our goal is to become the largest chain drug store operator in Northeastern China and a top 20 drug retail company in China by December 2012.

10

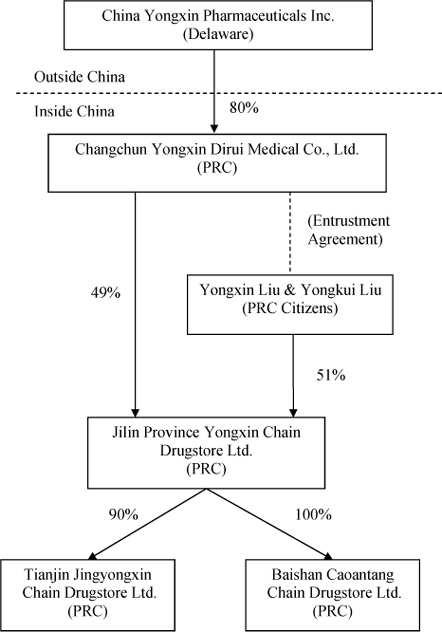

Corporate Structure and History

The Company was originally incorporated in Delaware on February 18, 1999 under the name of FreePCSQuote. On December 21, 2006, Changchun Yongxin Dirui Medical Co., Ltd, a Chinese corporation ("Yongxin") and all of the shareholders of Yongxin entered into a reverse acquisition transaction with the Company. On April 12, 2008, we entered into a second amended acquisition agreement with Yongxin, effective November 16, 2007, in which the Company acquired 80% of the equity interest of Yongxin, and the Company issued an aggregate of 21,000,000 shares (pre-Reverse Split) of newly issued common stock and 5,000,000 shares of Series A Convertible Preferred Stock to the original Yongxin shareholders and/or their designees (the “Reverse Acquisition Transaction”). For accounting purposes, this Reverse Acquistion Transaction was accounted for under GAAP as a reverse acquisition, since the original stockholders of Yongxin became the owners of a majority of the issued and outstanding shares of common stock of the Company, and the directors and executive officers of Yongxin became the directors and executive officers of the Company. As a result of the Reverse Acquisition Transaction, the following PRC companies became our operating businesses:

11

| 1. | Yongxin, through which we operate our wholesale pharmaceuticals distribution business and in which the Company owns an 80% equity ownership interest; |

| 2. | Jilin Province Yongxin Chain Drugstore Ltd. (“Yongxin Drugstore”), through which we operate 42 pharmacy retail drugstores and which we control through Yongxin’s equity ownership interest in Yongxin Drugstore, and through an Entrustment Agreement described more fully below by and between Yongxin, on the one hand, and Yongxin Liu (our CEO and Chairman) and Yongkui Liu (a Company Vice President and former director), on the other hand; |

| 3. | Tianjin Jingyongxin Chain Drugstore Ltd. (“Jingyongxin Drugstore”), through which we operate 26 pharmacy retail drugstores and in which Yongxin Drugstore owns a 90% equity ownership interest; and |

| 4. | Baishan Caoantang Chain Drugstore Ltd. (“Caoantang Drugstore”), through which we operate 32 pharmacy retail drugstores and in which Yongxin Drugstore owns 100% of the equity ownership interest. |

May 2010 Restructuring

As described above, we collectively own and control 100 retail pharmacy outlets, through our ownership of Yongxin Drugstore and its affiliated entities, Jingyongxin Drugstore and Caoantang Drugstore. Yongxin previously owned a direct 100% equity interest in Yongxin Drugstore as a record owner of all of its outstanding share capital. PRC laws and regulations limit foreign ownership of in excess of 49% of the outstanding share capital of PRC entities that operate more than 30 drugstores in China that sell a variety of branded pharmaceutical products sourced from different suppliers.

In May 2010, in an effort to comply with PRC regulatory requirements regarding foreign ownership of drugstores in the PRC, and in contemplation of future growth of our Company, we conducted a restructuring of Yongxin’s ownership and control of Yongxin Drugstore (the “Restructuring”) in which we changed the method by which we own Yongxin Drugstore. Specifically, we instituted a “variable interest entity” (“VIE”) structure under which Yongxin is a record holder of 49% of the outstanding share capital of Yongxin Drugstore, and Mr. Yongxin Liu (our CEO and Chairman of the Company’s Board of Directors) and Mr. Yongkui Liu (a Company Vice President and former Company director), each of whom are PRC citizens (collectively, the “PRC Holders”), serve as nominee record holders of the remaining 51% of the share capital of Yongxin Drugstore. In order to retain the Company’s rights and authority to control, operate and manage Yongxin Drugstore and to continue to receive all of the economic benefits of Yongxin Drugstore’s business operations, concurrent with the equity transfers, Yongxin and the PRC Holders also entered into an Entrustment Agreement dated May 17, 2010 (the “Entrustment Agreement”), which effectively grants Yongxin beneficial ownership of the interest attributable to the 51% interest, including but not limited to, the right to exclusively control, operate and manage Yongxin Drugstore, and all of the profits, income, distributions, dividends, compensation, payments, assets property, or other economic benefits from Yongxin Drugstore that the PRC Holders now hold or receive or otherwise become entitled to receive in the future by virtue of their 51% record ownership of Yongxin Drugstore’s share capital. As a result of the rights conferred to Yongxin under the Entrustment Agreement, the Company is considered the primary beneficiary of Yongxin Drugstore and Yongxin Drugstore is deemed our variable interest entity (“VIE”). Further, we consolidate 100% of Yongxin Drugstore’s results of operations, assets and liabilities in our financial statements.

Chinese laws and regulations concerning the validity of the contractual arrangements such as the Entrustment Agreement are uncertain, as many of these laws and regulations are relatively new and may be subject to change. Official interpretation and enforcement by the Chinese government involves substantial uncertainty. Additionally, the Entrustment Agreement may not be as effective in providing control over Yongxin Drugstore as direct majority equity interest ownership under the current PRC laws and regulations. Due to such uncertainty, the Entrustment Agreement includes a further assurances provision that allows us to take any additional steps in the future permissible under the then-applicable law to ensure the Company’s complete control over, and the realization of the entirety of all rights and benefits of ownership of Yongxin Drugstore and its assets and business operations, including but not limited to direct ownership of selected assets.

Reverse Stock Split

Effective on May 24, 2010, the Company effectuated a reverse stock split with a ratio of 1-for-12, whereby each twelve (12) issued and outstanding shares of the common stock of the Company, par value $0.001 per share (“Common Stock”) was combined into one (1) share of Common Stock (the “Reverse Split”), pursuant to the Certificate of Amendment of the Certificate of Incorporation that the Company filed with the State of Delaware’s Secretary of State (“Certificate of Amendment”). Effective May 26, 2010 (“Effective Date”), the Company’s Common Stock commenced trading under a new OTC Bulletin Board trading symbol, “CYXND,” the new trading symbol assigned by Financial Industry Regulatory Authority (“FINRA”) in connection with the approval of the Reverse Split. The Company’s trading symbol will revert to “CYXN” within 20 business days of the Effective Date. The Company’s Common Stock, on a split-adjusted basis, has a new CUSIP number of 16946Y 207.

Throughout this prospectus, each instance which refers to a number of shares of our common stock, refers to the number of shares of common stock after giving effect to the Reverse Split, unless otherwise indicated. The term “pre-Reverse Split” as used in this prospectus means a number of shares of common stock issued or outstanding prior to May 24, 2010 without giving effect to the Reverse Split. References to a number of shares of common stock in our historical financial statements for the three month period ending March 31, 2010, and for the years ending December 31, 2009 and 2008, are reported on a pre-Reverse Split basis.

12

IMPORTANT DISCLOSURES REGARDING OUR CORPORATE STRUCTURE

The Company owns eighty percent (80%) of the outstanding equity interest of Yongxin, a corporate entity organized and existing under the laws of the PRC, which is a holding company for the other subsidiaries of the Company. Yongxin Liu and Yongkui Liu, who are brothers, individually own 11% and 9% of Yongxin, respectively. On May 13, 2007, Yongxin Liu, Yongkui Liu and the Company entered into an Equity Cooperative Joint Venture Contract dated May 13, 2007, pursuant to which Yongxin became an 80% subsidiary and a “joint venture” under PRC law. At the time of formation, the parties sought to form a joint venture as opposed to a wholly foreign owned entity (or WFOE), due to certain PRC laws which made it advantageous for the Company, a pharmaceutical business, to be constituted and classified as a joint venture. Yongxin was granted a business license by the Administration for Industry and Commerce of Changchun City on September 14, 2007, which recognized and deemed it to be an equity joint venture, with 80% foreign ownership and 20% domestic (PRC) ownership. Yongxin also received recognition from, and was registered as an equity joint venture, by the Jilin Branch of the State Administration of Foreign Exchange (SAFE) on September 20, 2007. Yongxin received certification from China’s Ministry of Commerce (“MOFCOM”) pursuant to the PRC’s Regulation for Mergers with and Acquisitions of Domestic Enterprises by Foreign Investors and other relevant laws on September 8, 2006.

As a result of the corporate structure described above, we note several important implications:

| · | The Company may not be able to exercise absolute control over Yongxin, because it is not a 100% equityholder of Yongxin. The minority shareholders, Yongxin Liu and Yongkui Liu, may hold certain minority rights under PRC corporate law and pursuant to the equity joint venture agreement, with respect to the control and governance of Yongxin. Specifically, Yongxin Liu and Yongkui Liu have the right to jointly appoint a director and the Company has the right to appoint two directors. Also, under the equity joint venture agreement, Yongxin Liu has a contractual right to appoint the General Manager of Yongxin. |

| · | Since Yongxin Liu is also the Chief Executive Officer and Chairman of the Company and Yongkui Liu is also the Vice President and former Chief Financial Officer and director of the Company, this may give rise to a conflict of interest with the Company and the Company’s stockholders. While the Company is not aware of any present situation which involves a conflict of interest, in the future, a conflict of interest may arise from the fact that Yongxin Liu and Yongkui Liu are executive officers of the Company, and are also minority equityholders of Yongxin. If there should ever be a divergence of interest of the minority equityholders on the one hand, and the Company on the other hand, Yongxin Liu and Yongkui Liu would have incentives to act to protect their minority interests in Yongxin vis-à-vis the majority controlling interest of the Company. |

| · | Although the Company consolidates the financial results of Yongxin and its subsidiaries for financial reporting purposes, the Company will not receive 100% of the economic benefit of the income and assets of Yongxin, and in most cases the Company will receive only 80% of such economic benefit. For example, if Yongxin were to distribute accumulated earnings or assets, 20% of such distributed assets would be paid to the minority equity holders, and 80% would be paid to the Company. |

| · | For financial reporting purposes, the Company accounts for the 20% interest as a non-controlling interest, which has the effect of lowering reported earnings per share (as compared to a scenario in which the Company owned 100% of Yongxin). |

Please also review our risk factors for a discussion of these and other factors for your consideration.

Corporate Information

Our corporate headquarters are located in the City of Industry, California in the United States at 927 Canada Court, City of Industry, CA 91748, and our telephone number is (626) 581-9098.

We are a reporting company under Section 13 of the Securities Exchange Act of 1934, as amended. Our shares of common stock are currently quoted on the OTC Bulletin Board with the symbol that was changed to “CYXND” on May 26, 2010 due to our recent 1-for-12 reverse stock split. Our trading symbol will revert back to “CYXN” on or around June 24, 2010. We are also applying for the listing of our common stock on The NASDAQ Capital Market.

13

SUMMARY FINANCIAL INFORMATION

In the table below we provide you with historical consolidated financial data for the fiscal years ended December 31, 2009 and 2008, derived from our audited consolidated financial statements included elsewhere in this prospectus. Historical results are not necessarily indicative of the results that may be expected for any future period. When you read this historical selected financial data, it is important that you read along with it the appropriate historical consolidated financial statements and related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus.

Three Months Ended March 31, | Year Ended December 31, | |||||||||||||||

| 2010 | 2009 | 2009 | 2008 | |||||||||||||

| (Unaudited) | ||||||||||||||||

| Statements of Operations Data: | ||||||||||||||||

| Revenue | $ | 10,679,465 | $ | 9,184,993 | $ | 47,589,280 | $ | 59,116,534 | ||||||||

| Cost of Goods Sold | 8,276,360 | 6,954,270 | 31,271,463 | 47,226,275 | ||||||||||||

| Gross Profit | 2,403,104 | 2,230,723 | 16,317,817 | 11,890,259 | ||||||||||||

| Total Operating Expenses | 1,641,953 | 1,158,654 | 7,118,442 | 6,021,513 | ||||||||||||

| Operating Income | 761,150 | 1,072,069 | 9,199,376 | 5,868,745 | ||||||||||||

| Total Non-operating Expense | 158,273 | 69,893 | 150,170 | 531,368 | ||||||||||||

| Income Before Income Taxes | 919,424 | 1,141,963 | 9,349,545 | 6,400,113 | ||||||||||||

| Income Tax Provision | 290,816 | 204,765 | 2,594,483 | 1,009,643 | ||||||||||||

| Net Income | 2,350,980 | 388,391 | 5,124,989 | 4,066,139 | ||||||||||||

| Earnings Per Share (1): | ||||||||||||||||

| Basic | 0.48 | 0.12 | 1.80 | 1.56 | ||||||||||||

| Diluted | 0.48 | 0.12 | 1.80 | 1.56 | ||||||||||||

| Weighted average shares outstanding (1): | ||||||||||||||||

| Basic | 4,749,818 | 2,586,821 | 2,770,067 | 2,595,902 | ||||||||||||

| Diluted | 4,968,017 | 2,586,821 | 2,770,067 | 2,595,902 | ||||||||||||

(1) The effect of the 1-for-12 reverse stock split on May 24, 2010 has been applied retroactively.

March 31, 2010 | December 31, 2009 | |||||||

| (Unaudited) | ||||||||

| Balance Sheet Data: | ||||||||

| Cash and Cash Equivalents | $ | 1,995,674 | $ | 1,805,271 | ||||

| Working Capital | $ | 33,385,173 | $ | 32,014,966 | ||||

| Total Assets | $ | 42,819,765 | $ | 41,755,662 | ||||

| Total Liabilities | $ | 13,689,527 | $ | 16,518,000 | ||||

| Total Shareholders’ Equity | $ | 29,130,238 | $ | 25,237,662 | ||||

14

THE OFFERING

| Common stock offered by us | _________ shares at $____ per share | |

| Number of shares outstanding before this offering | 5,295,047 shares as of June 1, 2010 | |

| Number of shares outstanding after this offering | _________ shares | |

| Use of Proceeds | We intend to use the net proceeds of this offering for acquisitions, marketing, working capital and general corporate purposes. We will not receive any of the proceeds from the sale of shares of our common stock by the selling shareholders. See “Use of Proceeds” beginning on page 31. | |

| OTC Bulletin Board symbol for our common stock | CYXND | |

| Proposed NASDAQ Capital Market listing symbol for our common stock | CYXN | |

| Risk Factors | The securities offered by this prospectus are speculative and involve a high degree of risk and investors purchasing securities should not purchase the securities unless they can afford the loss of their entire investment. See “Risk Factors” beginning on page 16. | |

| Underwriter representative’s common stock purchase warrant | In connection with this offering, we have also agreed to sell to Rodman & Renshaw, LLC a common stock purchase warrant to purchase up to 5% ( shares) of the shares of common stock sold. If this warrant is exercised, each share may be purchased by Rodman & Renshaw, LLC at $ per share (125% of the price of the shares sold in the offering.) |

15

RISK FACTORS

The reader should carefully consider the risks described below together with all of the other information included in this prospectus. The statements contained in or incorporated into this prospectus that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and an investor in our securities may lose all or part of their investment.

RISKS RELATED TO OUR BUSINESS

THE PURCHASE OF MANY OF OUR PRODUCTS IS DISCRETIONARY, AND MAY BE PARTICULARLY AFFECTED BY ADVERSE TRENDS IN THE GENERAL ECONOMY; THEREFORE CHALLENGING ECONOMIC CONDITIONS MAY MAKE IT MORE DIFFICULT FOR US TO GENERATE REVENUE.

Our business is affected by global, national and local economic conditions since many of the Products we sell are discretionary and we depend, to a significant extent, upon a number of factors relating to discretionary consumer spending in China. These factors include economic conditions and perceptions of such conditions by consumers, employment rates, the level of consumers' disposable income, business conditions, interest rates, consumer debt levels, availability of credit and levels of taxation in regional and local markets in China where we sell such products. There can be no assurance that consumer spending on the Products we sell, will not be adversely affected by changes in general economic conditions in China and globally.

THE SUCCESS OF OUR BUSINESS DEPENDS ON OUR ABILITY TO MARKET AND ADVERTISE THE PRODUCTS WE SELL EFFECTIVELY.

Our ability to establish effective marketing and advertising campaigns is key to our success. Our advertisements promote our corporate image, our merchandise and the pricing of such products. If we are unable to increase awareness of our retail brand and our products, we may not be able to attract new customers. Our marketing activities may not be successful in promoting the Products we sell or pricing strategies or in retaining and increasing our customer base. We cannot assure you that our marketing programs will be adequate to support our future growth, which may result in a material adverse effect on our results of operations.

WE MAY NOT BE ABLE TO OBTAIN, OR TIMELY OBTAIN, ALL OF THE LICENSES REQUIRED TO OPERATE OUR BUSINESS, OR WE MAY FAIL TO MAINTAIN THE LICENSES WE CURRENTLY HOLD. THIS COULD SUBJECT US TO FINES AND OTHER PENALTIES, WHICH MAY HAVE A MATERIAL ADVERSE EFFECT ON OUR BUSINESS, FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

We are required to hold a variety of permits and licenses to operate our business in China. We may not possess all of the permits and licenses required for all of our business activities. In addition, there may be circumstances under which an approval, permit or license granted by a governmental agency is subject to change without substantial advance notice, and it is possible that we could fail to obtain an approval, permit or license that is required to expand our business as we intend. If we fail to obtain on a timely basis or to maintain such permits or licenses or renewals are granted with onerous conditions, we could be subject to fines and other penalties and be limited in the number or the quality of the products that we would be able to offer. As a result, our business, financial condition and results of operations could be materially and adversely affected.

WE MAY BE UNABLE TO IDENTIFY AND RESPOND EFFECTIVELY TO SHIFTING CUSTOMER PREFERENCES, AND WE MAY FAIL TO OPTIMIZE OUR PRODUCT OFFERINGS AND INVENTORY POSITION.

Consumer preferences in the drugstore industry change rapidly and are difficult to predict. The success of our business depends on our ability to predict accurately and respond to future changes in consumer preferences, carry the inventory demanded by customers, deliver the appropriate quality of products, price products correctly and implement effective purchasing procedures. We must optimize our product selection and inventory positions based on consumer preferences and sales trends. If we fail to anticipate, identify or react appropriately to changes in consumer preferences and adapt our product selection to these changing preferences, we could experience excess inventories, higher than normal markdowns or an inability to sell the Products we sell, which, in turn, could significantly reduce our revenue and have a material adverse effect on our business, financial condition and results of operations.

16

IF WE FAIL TO MAINTAIN OPTIMAL INVENTORY LEVELS, OUR INVENTORY HOLDING COSTS COULD INCREASE OR CAUSE US TO LOSE SALES, EITHER OF WHICH COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR BUSINESS, FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

While we must maintain sufficient inventory levels to operate our business successfully and meet our customers' demands, we must be careful to avoid amassing excess inventory. Changing consumer demands, manufacturer backorders and uncertainty surrounding new product launches expose us to increased inventory risks. Demand for products can change rapidly and unexpectedly, including the time between when the product is ordered from the supplier to the time it is offered for sale. We carry a wide variety of products and must maintain sufficient inventory levels of the Products we sell. We may be unable to sell certain products in the event that consumer demand changes. Our inventory holding costs will increase if we carry excess inventory. However, if we do not have a sufficient inventory of a product to fulfill customer orders, we may lose orders or customers, which may adversely affect our business, financial condition and results of operations. We cannot assure you that we can accurately predict consumer demand and events and avoid over-stocking or under-stocking products.

IF WE ARE UNABLE TO MANAGE THE DISTRIBUTION OF OUR PRODUCTS AT OUR LOGISTICS CENTER, WE MAY BE UNABLE TO MEET CUSTOMER DEMAND.

Substantially all of the Products we sell are distributed to our stores and our wholesale customers through our "Logistics Center" located in our "Logistics Plaza" in Changchun, PRC. The efficient operation and management of this facility is essential in order for us to meet customer demands. Our business would suffer if we do not successfully operate this distribution facility or if the operation of this facility was disrupted for any reason, including disruptions caused by natural disasters. Our failure to manage this facility properly could result in higher distribution costs, excess or insufficient inventory, or an inability to fulfill customer orders, each of which could result in a material adverse effect on our results of operations.

DUE TO THE GEOGRAPHIC CONCENTRATION OF OUR SALES IN THE NORTHEAST REGION OF CHINA, OUR RESULTS OF OPERATIONS AND FINANCIAL CONDITION ARE SUBJECT TO FLUCTUATIONS IN REGIONAL ECONOMIC CONDITIONS.

A significant percentage of our total sales are made in the northeast region of China, particularly in Jilin province. For the years ended December 31, 2009, 2008 and 2007, approximately 86%, 85% and 80% of revenues, respectively, were generated from this area. Our concentration of sales in this area heightens our exposure to adverse developments related to competition, as well as economic and demographic changes in this region. Our geographic concentration might result in a material adverse effect on our business, financial condition or results of operations in the future.

WE HAVE OUTSTANDING SHORT-TERM RELATED PARTY BORROWINGS AND WE MAY NOT BE ABLE TO OBTAIN EXTENSIONS WHEN THEY MATURE.

Our short term related party loans as of March 31, 2010 and December 31, 2009 were $0 and $184,662, respectively. The short term loans made to us by our officers are interest free, due on demand and unsecured. Generally, these short-term related party loans mature in one year or less and contain no specific renewal terms. However, in China it is customary practice for borrowers to negotiate roll-overs or renewals of short-term borrowings on an on-going basis shortly before they mature. Although we have renewed our short-term borrowings in the past, we cannot assure you that we will be able to renew these loans in the future as they mature. If we are unable to obtain renewals of these loans or sufficient alternative funding on reasonable terms from banks or other parties, we will have to repay these borrowings with the cash on our balance sheet or cash generated by our future operations, if any. We cannot assure you that our business will generate sufficient cash flow from operations to repay these borrowings.

IF ALL OR A SIGNIFICANT PORTION OF OUR CUSTOMERS WITH ACCOUNTS RECEIVABLES FAIL TO PAY ALL OR PART OF THE TRADE RECEIVABLES OR DELAY THE REPAYMENT, OUR NET INCOME WILL DECREASE AND OUR PROFITABILITY WILL BE ADVERSELY AFFECTED.

We had accounts receivables, net of allowance for doubtful accounts, of approximately $12,564,016 as of March 31, 2010. The standard credit period for most of our clients is six (6) months. There is no assurance that our accounts receivables will be fully repaid on a timely basis. If all or a significant portion of our customers with accounts receivables fail to pay all or part of the accounts receivables or delay the payment due to us for whatever reason, our net profit will decrease and our profitability will be adversely affected.

CERTAIN DISRUPTIONS IN SUPPLY OF AND CHANGES IN THE COMPETITIVE ENVIRONMENT FOR OUR PRODUCTS MAY ADVERSELY AFFECT OUR PROFITABILITY.

We carry a broad range of merchandise in our stores, including the Products we sell. A significant disruption in the supply of these products could decrease inventory levels and sales, and materially adversely affect our business and financial results. Shortages of products or interruptions in transportation systems, labor strikes, work stoppages, war, acts of terrorism or other interruptions or difficulties in the employment of labor or transportation in the markets in which we purchase products may adversely affect our ability to maintain sufficient inventories of our products to meet consumer demand. If we were to experience a significant or prolonged shortage of products from any of our suppliers and could not procure the products from other sources, we would be unable to meet customer demand, which, in turn, would adversely affect our sales, margins and customer relations.

17

ADVERSE WEATHER CONDITIONS, NATURAL DIASATERS, PESTILENCES AND OTHER NATURAL CONDITIONS CAN AFFECT THE RAW MATERIAL COSTS OF CERTAIN MEDICATIONS, WHICH CAN ADVERSELY AFFECT OUR OPERATIONSA ND OUR RESULTS OF OPERATIONS.

The ingredients and raw materials that are used in certain medications are vulnerable to adverse weather conditions and natural disasters, such as floods, droughts, frosts, earthquakes and pestilences. Adverse weather conditions may be impacted by global warming and other factors. Adverse weather conditions and natural disasters can reduce crop size and crop quality, which in turn could reduce our supplies of raw materials, lower recoveries of usable raw materials, increase the prices of our raw materials, increase our cost of storing raw materials if harvests are accelerated and processing capacity is unavailable. For example, certain raw herbal ingredients for seasonal and herbal medications are supplied by our suppliers in the southwest region of China. In 2009, the southwest region in China experienced a severe drought. This has resulted in higher prices for fiscal 2010. If drought conditions continue in the southwest region of China, our supplies of raw materials may be reduced and the price we pay for raw materials in future years may increase further, which could adversely affect our results of operations. Our competitors may be affected differently by weather conditions and natural disasters depending on the location of their supplies or operations. If our supplies of raw materials are reduced, we may not be able to find enough supplemental supply sources on favorable terms, if at all, which could impact our ability to supply product to our customers and adversely affect our business, financial condition and results of operations.

OUR OPERATIONS WOULD BE MATERIALLY ADVERSELY AFFECTED IF THIRD-PARTY CARRIERS WERE UNABLE TO TRANSPORT OUR PRODUCTS ON A TIMELY BASIS.

All of our products are shipped through third party carriers. If a strike or other event prevented or disrupted these carriers from transporting our products, other carriers may be unavailable or may not have the capacity to deliver our products to our customers and to our retail stores. If adequate third party sources to ship our products were unavailable at any time, our business would be materially adversely affected.

THE MARKET FOR OUR PRODUCTS AND SERVICES IS VERY COMPETITIVE AND, IF WE CANNOT EFFECTIVELY COMPETE, OUR BUSINESS WILL BE HARMED.

The industries in which we operate are highly fragmented and very competitive. We compete with local drugstores and with large foreign multinational companies that offer products that are similar to ours. Some of these competitors have larger local or regional customer bases, more locations, more brand equity, and substantially greater financial, marketing and other resources than we have. As a result, our competitors may be in a stronger position to respond quickly to potential acquisitions and other market opportunities, new or emerging technologies and changes in customer tastes. We cannot assure you that we will be able to maintain or increase our market share against the emergence of these or other sources of competition. Failure to maintain and enhance our competitive position could materially adversely affect our business and prospects.

WE MAY NOT BE SUCCESSFUL IN COMPETING WITH OTHER WHOLESALERS AND DISTRIBUTORS OF PHARMACEUTICAL PRODUCTS IN THE TENDER PROCESSES FOR THE PURCHASE OF MEDICINES BY STATE-OWNED AND STATE-CONTROLLED HOSPITALS.

Our wholesale business sells various pharmaceutical products to hospitals owned and controlled by government authorities in the PRC. Government owned hospitals purchase pharmaceutical products by using collective tender processes. During a collective tender process, a hospital establishes a committee of recognized pharmaceutical experts, which assesses bids submitted by pharmaceutical manufacturers. The hospitals may only purchase pharmaceuticals that win in collective tender processes. The collective tender process for pharmaceuticals with the same chemical composition must be conducted at least annually, and pharmaceuticals that have won in the collective tender processes previously must participate and win in the collective tender processes in the following period before hospitals may make new purchases. If we are unable to win purchase contracts through the collective tender processes in which we decide to participate, we will lose market share to our competitors, and our sales and profitability will be adversely affected.

18

COUNTERFEIT PRODUCTS SOLD IN CHINA COULD NEGATIVELY IMPACT OUR REVENUES, BRAND REPUTATION, BUSINESS AND RESULTS OF OPERATIONS.

The Products we sell are also subject to competition from counterfeit products, which are pharmaceuticals manufactured without proper licenses or approvals and are fraudulently mislabeled with respect to their content and/or manufacturer. Counterfeit products are generally sold at lower prices than authentic products due to their low production costs, and in some cases are very similar in appearance to authentic products. Counterfeit pharmaceuticals may or may not have the same chemical content as their authentic counterparts. Although the PRC government has recently been increasingly active in policing counterfeit products, including counterfeit pharmaceuticals, there is a lack of effective counterfeit product regulation control and enforcement systems in China. The proliferation of counterfeit products has grown in recent years and may continue to grow in the future. Despite our implementation of quality controls, we cannot assure you that we would not be distributing or selling counterfeit products inadvertently. Any accidental sale or distribution of counterfeit products can subject our company to fines, administrative penalties, litigation and negative publicity, which could negatively impact our revenues, brand reputation, business and results of operations. Moreover, the continued proliferation of counterfeit products and other products in recent years may reinforce the negative image of retailers among consumers in the PRC. The continued proliferation of counterfeit products in the PRC could have a material adverse effect on our business, financial condition, and results of operation.

THE RETAIL PRICES OF SOME OF OUR PRODUCTS ARE SUBJECT TO PRICE CONTROLS BY THE PRC GOVERNMENT, WHICH MAY AFFECT BOTH OUR REVENUES AND NET INCOME.

The laws of the PRC permit the PRC government to fix and adjust prices of certain pharmaceutical products, including many of those listed in the Insurance Catalogue. Through these price controls, the government can fix retail prices and set retail price ceiling for certain of the pharmaceutical products we sell. Additionally, the PRC government may periodically adjust the retail prices of these products downward in order to make pharmaceuticals more affordable to the general Chinese population. While our sales of pharmaceutical products are not affected by the price controls because we currently sell such products at prices below the price control level, we cannot guarantee that our sales of these products will not be affected in the future, as price controls may be increased or may affect additional products. To the extent that we are subject to price controls, our revenue, gross profit, gross margin and net income will be affected because the revenue we derive from our sales will be limited and we may have limited ability to control our costs. Further, if price controls affect both our revenue and costs, our ability to be profitable and the extent of our profitability will be effectively subject to determination by the applicable regulatory authorities in the PRC. Any future price controls or price reductions may reduce our revenue and profitability and have a material adverse effect on our financial condition and results of operations.

IF WE DO NOT COMPLY WITH PRC LAWS AND REGULATIONS APPLICABLE TO THE SALE OF PHARMACEUTICALS UNDER THE PRC NATIONAL MEDICAL INSURANCE PROGRAM, WE MAY BE SUBJECT TO FINES AND OTHER PENALTIES.

Persons eligible to participate in the PRC National Medical Insurance Program can buy pharmaceuticals that have been included in the Insurance Catalogue using a medical insurance card in an authorized pharmacy. The applicable PRC government social security bureau then reimburses the pharmacy. PRC law also forbids pharmacies from selling goods other than pre-approved pharmaceuticals when purchases are made with medical insurance cards. While we have established procedures to prevent our drugstores from selling unauthorized goods to customers who make purchases with medical insurance cards, we cannot assure you that these procedures will be properly followed at all times in all of our stores. Violations of this prohibition by any of our drugstores may result in the revocation of such drugstore’s status as an authorized pharmacy. Additionally, we could be subject to other fines or other penalties, and to negative publicity, which could damage our company's reputation and have a material adverse effect on our results of operations.

THE REQUIRED CERTIFICATES, PERMITS, AND LICENSES RELATED TO OUR OPERATIONS ARE SUBJECT TO GOVERNMENTAL CONTROL AND RENEWAL AND FAILURE TO OBTAIN RENEWAL WILL CAUSE ALL OR PART OF OUR OPERATIONS TO BE TERMINATED.

We are subject to various PRC laws and regulations pertaining to our wholesale and retail operations. We have attained certificates, permits, and licenses required for the operation of a pharmaceutical distributor and retailer. We cannot assure you that we will have all necessary permits, certificates and authorizations for the operation of our business at all times. Additionally, our certifications, permits and authorizations are subject to periodic renewal by the relevant government authorities. We intend to apply for renewal of these certificates, permits and authorizations prior to their expiration. During the renewal process, we will be re-evaluated by the appropriate governmental authorities and must comply with the then prevailing standards and regulations which may change from time to time. In the event that we are not able to renew the certificates, permits and licenses, all or part of our operations may be terminated. Furthermore, if escalating compliance costs associated with governmental standards and regulations restrict or prohibit any part of our operations, it may adversely affect our operations and profitability.

19

IF WE BECOME SUBJECT TO PRODUCT LIABILITY CLAIMS, PERSONAL INJURY CLAIMS OR DEFECTIVE PRODUCTS OUR BUSINESS MAY BE HARMED.

Our pharmacies are exposed to risks inherent in the packaging and distribution of pharmaceutical and other healthcare products, such as with respect to improper filling of prescriptions, labeling of prescriptions, adequacy of warnings, and the unintentional distribution of counterfeit drugs. Furthermore, the applicable laws, rules and regulations require our in-store pharmacists to offer counseling, without additional charge, to our customers about medication, dosage, delivery systems, common side effects and other information the in-store pharmacists deem significant. Our in-store pharmacists may also have a duty to warn customers regarding any potential negative effects of a prescription drug if the warning could reduce or negate these effects and we may be liable for claims arising from advice given by our in-store pharmacists. Further, we may sell products which inadvertently have an adverse effect on the health of individuals. Product liability claims may be asserted against us with respect to any of the products we sell and as a retailer, we are required to pay for damages for any successful product liability claim against us, although we may have the right under applicable PRC laws, rules and regulations to recover from the relevant manufacturer for compensation we paid to our customers in connection with a product liability claim. Any product liability claim, product recall, adverse side effects caused by improper use of the products we sell or manufacturing defects may result in adverse publicity regarding us and the products we sell, which would harm our reputation. If we are found liable for product liability claims, we could be required to pay substantial monetary damages. Furthermore, even if we successfully defend ourselves against this type of claim, we could be required to spend significant management, financial and other resources, which could disrupt our business, and our reputation as well as our brand name may also suffer. We, like many other similar companies in the PRC, do not carry product liability insurance. As a result, any imposition of product liability could materially harm our business, financial condition and results of operations. In addition, we do not have any business interruption insurance due to the limited coverage of any business interruption insurance in the PRC, and as a result, any business disruption or natural disaster could severely disrupt our business and operations and significantly decrease our revenue and profitability.

WE RELY ON TRADE SECRET PROTECTIONS THROUGH CONFIDENTIALITY AGREEMENTS WITH OUR EMPLOYEES, CUSTOMERS AND OTHER PARTIES; THE BREACH OF SUCH AGREEMENTS COULD ADVERSELY AFFECT OUR BUSINESS ANDS RESULTS OF OPERATIONS.

We rely on trade secrets, which we seek to protect, in part, through confidentiality and non-disclosure agreements with our employees, customers and other parties. There can be no assurance that these agreements will not be breached, that we would have adequate remedies for any such breach or that our trade secrets will not otherwise become known to or independently developed by competitors. To the extent that consultants, key employees or other third parties apply technological information independently developed by them or by others to our proposed projects, disputes may arise as to the proprietary rights to such information that may not be resolved in our favor. We may be involved from time to time in litigation to determine the enforceability, scope and validity of our proprietary rights. Any such litigation could result in substantial cost and diversion of effort by our management and technical personnel.

THE FAILURE TO MANAGE GROWTH EFFECTIVELY COULD HAVE AN ADVERSE EFFECT ON OUR EMPLOYEE EFFICIENCY, PRODUCT QUALITY, WORKING CAPITAL LEVELS, AND RESULTS OF OPERATIONS.

Any significant growth in the market for our products or our entry into new markets may require an expansion of our employee base for managerial, operational, financial, and other purposes. As of March 31, 2010, we had approximately 673 full time employees. During any growth, we may face problems related to our operational and financial systems and controls, including quality control and delivery and service capacities. We would also need to continue to expand, train and manage our employee base. Continued future growth will impose significant added responsibilities upon the members of management to identify, recruit, maintain, integrate, and motivate new employees.

Aside from increased difficulties in the management of human resources, we may also encounter working capital issues, as we will need increased liquidity to finance the purchase of raw materials and supplies, development of new products, and the hiring of additional employees. For effective growth management, we will be required to continue improving our operations, management, and financial systems and controls. Our failure to manage growth effectively may lead to operational and financial inefficiencies that will have a negative effect on our profitability. We cannot assure investors that we will be able to timely and effectively meet that demand and maintain the quality standards required by our existing and potential customers.

WE ARE DEPENDENT ON CERTAIN KEY PERSONNEL AND LOSS OF THESE KEY PERSONNEL COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR BUSINESS, FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

Our success is, to a certain extent, attributable to the management, sales and marketing, and operational and technical expertise of certain key personnel. Each of the named executive officers, including Mr. Yongxin Liu, our Chief Executive Officer and Chairman and Mr. Ning Liu, our President and Chief Operating Officer, perform key functions in the operation of our business. The loss of these employees could have a material adverse effect upon our business, financial condition, and results of operations. We do not maintain key-man insurance for members of our management team because it is not a customary practice in China. If we lose the services of any senior management, we may not be able to locate suitable or qualified replacements, and may incur additional expenses to recruit and train new personnel, which could severely disrupt our business and prospects.

20

WE ARE DEPENDENT ON A TRAINED WORKFORCE AND ANY INABILITY TO RETAIN OR EFFECTIVELY RECRUIT SUCH EMPLOYEES, INCLUDING IN-STORE PHARMACISTS FOR OUR STORES, COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR BUSINESS, FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

We must attract, recruit and retain a sizeable workforce of qualified and trained staff, including in-store pharmacists, in order to operate our retail drugstores. Applicable PRC regulations require at least one qualified pharmacist to be stationed in each drugstore to instruct or advise customers on prescription medications. A nationwide shortage of pharmacists has occurred in the past few years due to increasing demand within the drugstore industry as well as demand from other businesses in the healthcare industry. We face competition for personnel from other drugstore chains, supermarkets, retail chains, and pharmaceutical companies. We cannot assure you that we will be able to attract, hire and retain sufficient numbers of in-store pharmacists and other skilled employees that are necessary to continue to develop and grow our business.

Our ability to implement effectively our business strategy and expand our operations will depend upon, among other factors, the successful recruitment and retention of additional highly skilled and experienced pharmacists, managers and other technical and marketing personnel. There is significant competition for technologically qualified personnel in our business and we may not be successful in recruiting or retaining sufficient qualified personnel consistent with our current and future operational needs.

OUR FINANCIAL RESULTS MAY FLUCTUATE BECAUSE OF MANY FACTORS AND, AS A RESULT, INVESTORS SHOULD NOT RELY ON OUR HISTORICAL FINANCIAL DATA AS INDICATIVE OF FUTURE RESULTS.

Fluctuations in operating results or the failure of operating results to meet the expectations of public market analysts and investors may negatively impact the market price of our securities. Operating results may fluctuate in the future due to a variety of factors that could affect revenues or expenses in any particular quarter. Fluctuations in operating results could cause the value of our securities to decline. Investors should not rely on comparisons of results of operations as an indication of future performance. As a result of the factors listed below, it is possible that in future periods results of operations may be below the expectations of public market analysts and investors. This could cause the market price of our securities to decline. Factors that may affect our quarterly results include:

| · | vulnerability of our business to a general economic downturn in China; |

| · | fluctuation and unpredictability of the prices of the Products we sell; |

| · | seasonality of our business; |

| · | changes in the laws of the PRC that affect our operations; |

| · | competition from other retailers and wholesalers; and |

| · | our ability to obtain necessary government certifications and/or licenses to conduct our business. |

OUR STRATEGY TO ACQUIRE COMPANIES MAY RESULT IN UNSUITABLE ACQUISITIONS OR FAILURE TO SUCCESSFULLY INTEGRATE ACQUIRED COMPANIES, WHICH COULD LEAD TO REDUCED PROFITABILITY.

We may embark on a growth strategy through acquisitions of companies or operations that complement existing product lines, customers or other capabilities. We may be unsuccessful in identifying suitable acquisition candidates, or may be unable to consummate a desired acquisition. To the extent any future acquisitions are completed, we may be unsuccessful in integrating acquired companies or their operations, or if integration is more difficult than anticipated, we may experience disruptions that could have a material adverse impact on future profitability. Some of the risks that may affect our ability to integrate, or realize any anticipated benefits from, acquisitions include:

| · | unexpected losses of key employees or customer of the acquired company; |

| · | difficulties integrating the acquired company's standards, processes, procedures and controls; |

| · | difficulties coordinating new product and process development; |

| · | difficulties hiring additional management and other critical personnel; |

| · | difficulties increasing the scope, geographic diversity and complexity of our operations; |

21

| · | difficulties consolidating facilities, transferring processes and know-how; |

| · | difficulties reducing costs of the acquired company's business; |

| · | diversion of management's attention from our management; and |

| · | adverse impacts on retaining existing business relationships with customers. |

RISKS RELATED TO CONDUCTING BUSINESS IN CHINA

SUBSTANTIALLY ALL OF OUR ASSETS ARE LOCATED IN THE PEOPLE’S REPULIC OF CHINA (“PRC” OR “CHINA”) AND SUBSTANTIALLY ALL OF OUR REVENUES ARE DERIVED FROM OUR OPERATIONS IN THE PRC; CHANGES IN THE POLITICAL AND ECONOMIC POLICIES OF THE PRC GOVERNMENT COULD HAVE A SIGNIFICANT IMPACT UPON THE BUSINESS WE MAY BE ABLE TO CONDUCT IN THE PRC AND ACCORDINGLY ON OURS RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

Our business operations may be adversely affected by the current and future political environment in the PRC. The Chinese government exerts substantial influence and control over the manner in which we must conduct our business activities. Our ability to operate in the PRC may be adversely affected by changes in Chinese laws and regulations, including those relating to retail and wholesale distribution of the products we sell, prescription drug regulations, the national health policy and related regulations, taxation, import and export tariffs, raw materials, environmental regulations, land use rights, property and other matters. Under the current government leadership, the government of the PRC has been pursuing economic reform policies that encourage private economic activity and greater economic decentralization. There is no assurance, however, that the government of the PRC will continue to pursue these policies, or that it will not significantly alter these policies from time to time without notice.

OUR OPERATIONS ARE SUBJECT TO PRC LAWS AND REGULATIONS THAT ARE SOMETIMES VAGUE AND UNCERTAIN. ANY CHANGES IN SUCH PRC LAWS AND REGULATIONS, OR THE INTERPRETATIONS THEREOF, MAY HAVE A MATERIAL AND ADVERSE EFFECT ON OUR BUSINESS.

The PRC's legal system is a civil law system based on written statutes. Unlike the common law system prevalent in the United States, decided legal cases have little value as precedent in the PRC. There are substantial uncertainties regarding the interpretation and application of PRC laws and regulations, including but not limited to, the laws and regulations governing our business, or the enforcement and performance of our arrangements with customers in the event of the imposition of statutory liens, death, bankruptcy or criminal proceedings. The Chinese government has been developing a comprehensive system of commercial laws, and considerable progress has been made in introducing laws and regulations dealing with economic matters such as foreign investment, corporate organization and governance, commerce, taxation and trade. However, because these laws and regulations are relatively new, and because of the limited volume of published cases and judicial interpretation and their lack of authority as precedents, interpretation and enforcement of these laws and regulations involve significant uncertainties. New laws and regulations that affect existing and proposed future businesses may also be applied retroactively.

Our principal operating subsidiary, Yongxin, is regarded as a foreign invested enterprise (“FIE”) under PRC laws, and as a result is required to comply with PRC laws and regulations, including laws and regulations specifically governing the activities and conduct of foreign invested enterprises. We cannot predict what effect the interpretation of existing or new PRC laws or regulations may have on our businesses. If the relevant authorities find us in violation of PRC laws or regulations, they would have broad discretion in dealing with such a violation, including, without limitation:

| · | levying fines; |

| · | revoking our business license, other licenses or authorities; |

| · | requiring that we restructure our ownership or operations; and |

| · | requiring that we discontinue any portion or all of our business. |

22

NEW LABOR LAWS IN THE PRC MAY ADVERSLY AFFECT OUR RESULTS OF OPERATIONS.

On January 1, 2008, the PRC government promulgated the Labor Contract Law of the PRC, or the New Labor Contract Law. The New Labor Contract Law imposes greater liabilities on employers and significantly impacts the cost of an employer’s decision to reduce its workforce. Further, it may require certain terminations to be based upon seniority and not merit. In the event we decide to significantly change or decrease our workforce, the New Labor Contract Law could adversely affect our ability to enact such changes in a manner that is most advantageous to our business or in a timely and cost effective manner, thus materially and adversely affecting our financial condition and results of operations.

THE SCOPE OF OUR BUSINESS LICENSE IN THE PRC IS LIMITED, AND WE MAY NOT EXPAND OR CONTINUE OUR BUSINESS WITHOUT GOVERNMENT APPROVAL AND RENEWAL, RESPECTIVELY.

Our principal operating subsidiary, Yongxin, is a FIE located in the PRC. An FIE can only conduct business within its approved business scope, which is designated in its business license. Our license permits us to design, manufacture, sell and market pharmaceutical products throughout the PRC. Any amendment to the scope of our business requires further application and government approval. In order for us to expand our business beyond the scope of our license, it will be required to enter into negotiations with the government authorities to obtain the approval that would be required to expand the scope of our business. We cannot assure investors that Yongxin will be able to obtain the necessary government approval for any change or expansion of its business.

OUR BUSINESS IS SUBJECT TO A VARIETY OF ENVIRONMENTAL LAWS AND REGULATIONS. OUR FAILURE TO COMPLY WITH ENVIRONMENTAL LAWS AND REGULATIONS MAY HAVE A MATERIAL ADVERSE EFFECT ON OUR BUSINESS AND RESULTS OF OPERATIONS.

We are subject to various environmental laws and regulations that require us to obtain environmental permits and are subject to registration and inspection by the PRC’s State Food and Drug Administration. We have a provincial license issued by the Business Administration Bureau, Jilin Province. Although we are currently compliant with all provisions of our registrations and licenses, we cannot assure you that at all times we will be in compliance with environmental laws and regulations or our environmental permits or that we will not be required to expend significant funds to comply with, or discharge liabilities arising under, environmental laws, regulations and permits. Additionally, we cannot guarantee you that our licenses and registrations will be renewed. Any non-renewal of any of our required permits and licenses could result in the curtailment or termination of our business operations.

PRC REGULATIONS RELATING TO ACQUISITIONS OF PRC COMPANIES BY FOREIGN ENTITIES MAY CREATE REGULATORY UNCERTAINTIES THAT COULD RESTRICT OR LIMIT OUR ABILITY TO OPERATE, INCLUDING OUR ABILITY TO PAY DIVIDENDS.

On August 8, 2006, the PRC Ministry of Commerce ("MOFCOM"), joined by the State-owned Assets Supervision and Administration Commission of the State Council, the State Administration of Taxation, the State Administration for Industry and Commerce, the PRC Securities Regulatory Commission and SAFE, released a substantially amended version of the Provisions for Foreign Investors to Merge with or Acquire Domestic Enterprises (the "Revised M&A Regulations"), which took effect September 8, 2006. These new rules significantly revised the PRC's regulatory framework governing onshore-to-offshore restructurings and foreign acquisitions of domestic enterprises. These new rules signify greater PRC government attention to cross-border merger, acquisition and other investment activities, by confirming MOFCOM as a key regulator for issues related to mergers and acquisitions in the PRC and requiring MOFCOM approval of a broad range of merger, acquisition and investment transactions. Further, the new rules establish reporting requirements for acquisition of control by foreigners of companies in key industries, and reinforce the ability of the Chinese government to monitor and prohibit foreign control transactions in key industries.

23