UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09689

Wells Fargo Master Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

C. David Messman

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: Registrant is making a filing for 3 of its series, Wells Fargo Advantage Diversified Fixed Income Portfolio, Wells Fargo Advantage Diversified Stock Portfolio, and Wells Fargo Advantage Short-Term Investment Portfolio. Each series has a February 28 fiscal year end.

Date of reporting period: August 31, 2014

| ITEM 1. | REPORT TO STOCKHOLDERS |

Wells Fargo Advantage

Dow Jones Target Date FundsSM

Semi-Annual Report

August 31, 2014

| n | | Wells Fargo Advantage Dow Jones Target Today FundSM |

| n | | Wells Fargo Advantage Dow Jones Target 2010 FundSM |

| n | | Wells Fargo Advantage Dow Jones Target 2015 FundSM |

| n | | Wells Fargo Advantage Dow Jones Target 2020 FundSM |

| n | | Wells Fargo Advantage Dow Jones Target 2025 FundSM |

| n | | Wells Fargo Advantage Dow Jones Target 2030 FundSM |

| n | | Wells Fargo Advantage Dow Jones Target 2035 FundSM |

| n | | Wells Fargo Advantage Dow Jones Target 2040 FundSM |

| n | | Wells Fargo Advantage Dow Jones Target 2045 FundSM |

| n | | Wells Fargo Advantage Dow Jones Target 2050 FundSM |

| n | | Wells Fargo Advantage Dow Jones Target 2055 FundSM |

Reduce clutter. Save trees.

Sign up for electronic delivery of prospectuses and shareholder reports at wellsfargo.com/advantagedelivery

Contents

Dow Jones® and Dow Jones Target Date IndexesSM are service marks of Dow Jones Trademark Holdings LLC (Dow Jones); have been licensed to CME Group Index Services LLC (CME Indexes); and have been sublicensed for use for certain purposes by Global Index Advisors, Inc., and Wells Fargo Funds Management, LLC. The Wells Fargo Advantage Dow Jones Target Date FundsSM, based on the Dow Jones Target Date Indexes, are not sponsored, endorsed, sold, or promoted by Dow Jones, CME Indexes, or their respective affiliates, and none of them makes any representation regarding the advisability of investing in such product(s).

The views expressed and any forward-looking statements are as of August 31, 2014, unless otherwise noted, and are those of the Fund managers and/or Wells Fargo Funds Management, LLC. Discussions of individual securities, or the markets generally, or any Wells Fargo Advantage Fund are not intended as individual recommendations. Future events or results may vary significantly from those expressed in any forward-looking statements; the views expressed are subject to change at any time in response to changing circumstances in the market. Wells Fargo Funds Management, LLC and the Fund disclaim any obligation to publicly update or revise any views expressed or forward-looking statements.

NOT FDIC INSURED ¡ NO BANK GUARANTEE ¡ MAY LOSE VALUE

| | | | |

| 2 | | Wells Fargo Advantage Dow Jones Target Date Funds | | Letter to shareholders (unaudited) |

Karla M. Rabusch

President

Wells Fargo Advantage Funds

Improving U.S. economic data contributed to a strong domestic stock market.

Emerging markets rallied on a combination of improved economic data in China and an investor-friendly election in India.

Dear Valued Shareholder:

We are pleased to offer you this semi-annual report for the Wells Fargo Advantage Dow Jones Target Date Funds for the six-month period that ended August 31, 2014. The three main asset classes underlying our target date funds had the following results: Equity performance was strong in the U.S. and in emerging markets, but European stock markets lagged; fixed-income results were solid because interest rates generally declined, which supported bond prices; and short-term investment returns remained low as a result of the ultra-low short-term interest-rate environment.

Major central banks continued to provide stimulus.

Throughout the reporting period, the Federal Open Market Committee (FOMC)—the U.S. Federal Reserve’s monetary policymaking body—kept its key interest rate near zero. Beginning in January 2014, the FOMC began to reduce (or taper) its bond-buying program by $10 billion per month. Although some anticipated this action would lead to higher interest rates, instead interest rates followed a downward trend for the remainder of the period, despite short-term volatility. European markets continued to benefit from the European Central Bank’s (ECB’s) actions. In June 2014, the ECB announced a variety of measures aimed at encouraging lending, including cutting its key rate to a then-historic low of 0.15% and imposing a negative interest rate on bank deposits held at the central bank.

Returns by asset class were generally favorable.

Improving U.S. economic data contributed to a strong domestic stock market. The unemployment rate continued its slow improvement, declining from 6.7% in March 2014 to 6.1% in August 2014. Although investors received a negative surprise when gross domestic product (GDP) growth for the first quarter of 2014 declined by 2.1% on an annualized basis, several commentators suggested that harsh winter weather may have dampened economic activity. Economic growth did accelerate in the second quarter of 2014, with an annualized GDP growth rate of 4.2%. U.S. equities, as measured by the Russell 3000® Index1, gained 7.68% for the reporting period.

The European Union’s economic data continued to show sluggish growth, with GDP rising by 0.3% in the first quarter of 2014 compared with the previous quarter, and by 0.2% in the second quarter. (European growth rates are not annualized.) Partly as a result, European stocks lagged, contributing to a modest 1.24% gain for the MSCI EAFE Index (Net)2, which measures developed international markets excluding the U.S. Emerging markets rallied on a combination of improved economic data in China and an investor-friendly election in India. The MSCI Emerging Markets Index (Net)3, which measures emerging markets equity performance, gained 14.52%.

| 1. | The Russell 3000® Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market. You cannot invest directly in an index. |

| 2. | The Morgan Stanley Capital International Europe, Australasia, and Far East (MSCI EAFE) Index (Net) is an unmanaged group of securities widely regarded by investors to be representations of the stock markets of Europe, Australasia, and the Far East. Calculations for EAFE use net dividends, which reflect the deduction of withholding taxes. You cannot invest directly in an index. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. |

| 3. | The Morgan Stanley Capital International (MSCI) Emerging Markets Index is a free float-adjusted market-capitalization-weighted index designed to measure the equity market performance in the global emerging markets. The index is currently composed of 21 emerging markets country indexes. You cannot invest directly in an index. |

| | | | | | |

| Letter to shareholders (unaudited) | | Wells Fargo Advantage Dow Jones Target Date Funds | | | 3 | |

On the bond front, 10-year U.S. Treasury bond yields declined, ending the period at a yield of 2.35%. Lower interest rates aided bond prices, and the Barclays U.S. Aggregate Bond Index4 returned 2.74% during the period.

Our target date funds provided exposure to the broader market.

Our target date series is passively managed across nine equity and four fixed-income asset allocations. The target date represents the year in which investors may likely begin withdrawing assets. The funds gradually seek to reduce market risk as the target date approaches and after it arrives by decreasing equity exposure and increasing fixed-income exposure. The principal value is not guaranteed at any time, including at the target date.

Don’t let short-term uncertainty derail long-term investment goals.

Periods of uncertainty can present challenges, but experience has taught us that maintaining long-term investment goals can be an effective way to plan for the future. To help you create a sound strategy based on your personal goals and risk tolerance, Wells Fargo Advantage Funds offers more than 100 mutual funds and other investments spanning a wide range of asset classes and investment styles. Although diversification cannot guarantee an investment profit or prevent losses, we believe it can be an effective way to manage investment risk and potentially smooth out overall portfolio performance. We encourage investors to know their investments and to understand that appropriate levels of risk-taking may unlock opportunities.

Thank you for choosing to invest with Wells Fargo Advantage Funds. We appreciate your confidence in us and remain committed to helping you meet your financial needs. For current information about your fund investments, contact your investment professional, visit our website at wellsfargoadvantagefunds.com, or call us directly at 1-800-222-8222. We are available 24 hours a day, 7 days a week.

Sincerely,

Karla M. Rabusch

President

Wells Fargo Advantage Funds

| 4. | The Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid ARM passthroughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index. |

| | | | |

| 4 | | Wells Fargo Advantage Dow Jones Target Date Funds | | Performance highlights (unaudited) |

Wells Fargo Advantage Dow Jones Target Date Funds1

Investment objective

Each Fund’s objective is to approximate, before fees and expenses, the total return of the appropriate Dow Jones Global Target Date Index as specified in the following table:

| | |

Wells Fargo Advantage Dow

Jones Target Date Funds | | Corresponding Dow Jones

Global Target Date Index |

| Target Today Fund | | Dow Jones Global Target Today Index |

| Target 2010 Fund | | Dow Jones Global Target 2010 Index |

| Target 2015 Fund | | Dow Jones Global Target 2015 Index |

| Target 2020 Fund | | Dow Jones Global Target 2020 Index |

| Target 2025 Fund | | Dow Jones Global Target 2025 Index |

| Target 2030 Fund | | Dow Jones Global Target 2030 Index |

| Target 2035 Fund | | Dow Jones Global Target 2035 Index |

| Target 2040 Fund | | Dow Jones Global Target 2040 Index |

| Target 2045 Fund | | Dow Jones Global Target 2045 Index |

| Target 2050 Fund | | Dow Jones Global Target 2050 Index |

| Target 2055 Fund | | Dow Jones Global Target 2055 Index |

Adviser

Wells Fargo Funds Management, LLC

Subadviser

Global Index Advisors, Inc.

Portfolio managers

Rodney H. Alldredge

James P. Lauder

Paul T. Torregrosa, Ph.D.

The target date represents the year in which investors may likely begin withdrawing assets. The Funds gradually seek to reduce market risk as the target date approaches and after it arrives by decreasing equity exposure and increasing fixed income exposure. The principal value is not guaranteed at any time, including at the target date.

Stock values fluctuate in response to the activities of individual companies and general market and economic conditions. Bond values fluctuate in response to the financial condition of individual issuers, general market and economic conditions, and changes in interest rates. In general, when interest rates rise, bond values fall and investors may lose principal value. The use of derivatives may reduce returns and/or increase volatility. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). These Funds are exposed to foreign investment risk, mortgage- and asset-backed securities risk, smaller-company investment risk, and allocation methodology risk (risk that the allocation methodology of the Dow Jones Target Date Index, whose total returns the Funds seek to approximate, before fees and expenses, will not meet an investor’s goals). Consult the prospectus for additional information on these and other risks.

Please see footnotes on pages 17-18.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Advantage Dow Jones Target Date Funds | | | 5 | |

Target Today Fund

Average annual total returns2 (%) as of August 31, 2014

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios3 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | 10 year | | | 1 year | | | 5 year | | | 10 year | | | Gross | | | Net4 | |

| Class A (STWRX) | | 3-1-1994 | | | 0.57 | | | | 3.40 | | | | 3.71 | | | | 6.73 | | | | 4.62 | | | | 4.33 | | | | 1.01 | | | | 0.81 | |

| Class B (WFOKX)* | | 8-1-1998 | | | 0.97 | | | | 3.50 | | | | 3.79 | | | | 5.97 | | | | 3.84 | | | | 3.79 | | | | 1.76 | | | | 1.56 | |

| Class C (WFODX) | | 12-1-1998 | | | 4.95 | | | | 3.84 | | | | 3.54 | | | | 5.95 | | | | 3.84 | | | | 3.54 | | | | 1.76 | | | | 1.56 | |

| Class R (WFRRX) | | 6-28-2013 | | | – | | | | – | | | | – | | | | 6.48 | | | | 4.51 | | | | 4.27 | | | | 1.26 | | | | 1.06 | |

| Class R4 (WOTRX) | | 11-30-2012 | | | – | | | | – | | | | – | | | | 7.05 | | | | 5.11 | | | | 4.84 | | | | 0.68 | | | | 0.45 | |

| Class R6 (WOTDX) | | 6-30-2004 | | | – | | | | – | | | | – | | | | 7.28 | | | | 5.15 | | | | 4.87 | | | | 0.53 | | | | 0.30 | |

| Administrator Class (WFLOX) | | 11-8-1999 | | | – | | | | – | | | | – | | | | 6.91 | | | | 4.79 | | | | 4.57 | | | | 0.85 | | | | 0.65 | |

| Investor Class (WFBTX) | | 1-31-2007 | | | – | | | | – | | | | – | | | | 6.64 | | | | 4.70 | | | | 4.50 | | | | 1.07 | | | | 0.86 | |

| Dow Jones Global Target Today Index5 | | – | | | – | | | | – | | | | – | | | | 7.59 | | | | 5.62 | | | | 5.31 | | | | – | | | | – | |

| Russell 3000® Index6 | | – | | | – | | | | – | | | | – | | | | 24.74 | | | | 17.22 | | | | 8.83 | | | | – | | | | – | |

| Barclays U.S. Aggregate Bond Index7 | | – | | | – | | | | – | | | | – | | | | 5.66 | | | | 4.48 | | | | 4.72 | | | | – | | | | – | |

| * | | Class B shares are closed to investment, except in connection with the reinvestment of any distributions and permitted exchanges. |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted and assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargoadvantagefunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class B shares, the maximum contingent deferred sales charge is 5.00%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including a contingent deferred sales charge assumes the sales charge for the corresponding time period. Class R, Class R4, Class R6, Administrator Class, and Investor Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Please see footnotes on pages 17-18.

| | | | |

| 6 | | Wells Fargo Advantage Dow Jones Target Date Funds | | Performance highlights (unaudited) |

Target 2010 Fund

Average annual total returns8 (%) as of August 31, 2014

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios3 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | 10 year | | | 1 year | | | 5 year | | | 10 year | | | Gross | | | Net4 | |

| Class A (STNRX) | | 3-1-1994 | | | 1.53 | | | | 4.22 | | | | 4.00 | | | | 7.70 | | | | 5.47 | | | | 4.61 | | | | 1.01 | | | | 0.83 | |

| Class B (SPTBX)* | | 3-1-1997 | | | 1.91 | | | | 4.35 | | | | 4.07 | | | | 6.91 | | | | 4.68 | | | | 4.07 | | | | 1.76 | | | | 1.58 | |

| Class C (WFOCX) | | 12-1-1998 | | | 5.91 | | | | 4.68 | | | | 3.84 | | | | 6.91 | | | | 4.68 | | | | 3.84 | | | | 1.76 | | | | 1.58 | |

| Class R (WFARX) | | 6-28-2013 | | | – | | | | – | | | | – | | | | 7.48 | | | | 5.34 | | | | 4.55 | | | | 1.26 | | | | 1.08 | |

| Class R4 (WFORX) | | 11-30-2012 | | | – | | | | – | | | | – | | | | 8.13 | | | | 5.95 | | | | 5.12 | | | | 0.68 | | | | 0.47 | |

| Class R6 (WFOAX) | | 6-30-2004 | | | – | | | | – | | | | – | | | | 8.28 | | | | 6.00 | | | | 5.15 | | | | 0.53 | | | | 0.32 | |

| Administrator Class (WFLGX) | | 11-8-1999 | | | – | | | | – | | | | – | | | | 7.92 | | | | 5.64 | | | | 4.86 | | | | 0.85 | | | | 0.67 | |

| Investor Class (WFCTX) | | 1-31-2007 | | | – | | | | – | | | | – | | | | 7.66 | | | | 5.54 | | | | 4.79 | | | | 1.07 | | | | 0.88 | |

| Dow Jones Global Target 2010 Index5 | | – | | | – | | | | – | | | | – | | | | 8.63 | | | | 6.49 | | | | 5.84 | | | | – | | | | – | |

| Russell 3000® Index6 | | – | | | – | | | | – | | | | – | | | | 24.74 | | | | 17.22 | | | | 8.83 | | | | – | | | | – | |

| Barclays U.S. Aggregate Bond Index7 | | – | | | – | | | | – | | | | – | | | | 5.66 | | | | 4.48 | | | | 4.72 | | | | – | | | | – | |

| * | | Class B shares are closed to investment, except in connection with the reinvestment of any distributions and permitted exchanges. |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted and assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargoadvantagefunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class B shares, the maximum contingent deferred sales charge is 5.00%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including a contingent deferred sales charge assumes the sales charge for the corresponding time period. Class R, Class R4, Class R6, Administrator Class, and Investor Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Please see footnotes on pages 17-18.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Advantage Dow Jones Target Date Funds | | | 7 | |

Target 2015 Fund

Average annual total returns9 (%) as of August 31, 2014

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios3 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | Since inception | | | 1 year | | | 5 year | | | Since inception | | | Gross | | | Net4 | |

| Class A (WFACX) | | 11-30-2012 | | | 2.68 | | | | 5.34 | | | | 3.05 | | | | 8.93 | | | | 6.59 | | | | 3.91 | | | | 1.01 | | | | 0.84 | |

| Class R (WFBRX) | | 6-28-2013 | | | – | | | | – | | | | – | | | | 8.70 | | | | 6.35 | | | | 3.69 | | | | 1.26 | | | | 1.09 | |

| Class R4 (WFSRX) | | 11-30-2012 | | | – | | | | – | | | | – | | | | 9.32 | | | | 6.98 | | | | 4.22 | | | | 0.68 | | | | 0.48 | |

| Class R6 (WFSCX) | | 6-29-2007 | | | – | | | | – | | | | – | | | | 9.50 | | | | 7.00 | | | | 4.24 | | | | 0.53 | | | | 0.33 | |

| Administrator Class (WFFFX) | | 6-29-2007 | | | – | | | | – | | | | – | | | | 9.10 | | | | 6.66 | | | | 3.94 | | | | 0.85 | | | | 0.68 | |

| Investor Class (WFQEX) | | 6-29-2007 | | | – | | | | – | | | | – | | | | 8.93 | | | | 6.55 | | | | 3.87 | | | | 1.07 | | | | 0.89 | |

| Dow Jones Global Target 2015 Index5 | | – | | | – | | | | – | | | | – | | | | 9.92 | | | | 7.52 | | | | 4.74 | * | | | – | | | | – | |

| Russell 3000® Index6 | | – | | | – | | | | – | | | | – | | | | 24.74 | | | | 17.22 | | | | 6.63 | * | | | – | | | | – | |

| Barclays U.S. Aggregate Bond Index7 | | – | | | – | | | | – | | | | – | | | | 5.66 | | | | 4.48 | | | | 5.34 | * | | | – | | | | – | |

| * | | Based on the inception date of the oldest class. |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted and assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargoadvantagefunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. Class R, Class R4, Class R6, Administrator Class, and Investor Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Please see footnotes on pages 17-18.

| | | | |

| 8 | | Wells Fargo Advantage Dow Jones Target Date Funds | | Performance highlights (unaudited) |

Target 2020 Fund

Average annual total returns2 (%) as of August 31, 2014

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios3 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | 10 year | | | 1 year | | | 5 year | | | 10 year | | | Gross | | | Net4 | |

| Class A (STTRX) | | 3-1-1994 | | | 4.67 | | | | 6.56 | | | | 4.90 | | | | 11.04 | | | | 7.82 | | | | 5.53 | | | | 0.98 | | | | 0.86 | |

| Class B (STPBX)* | | 3-1-1997 | | | 5.24 | | | | 6.70 | | | | 4.98 | | | | 10.24 | | | | 7.00 | | | | 4.98 | | | | 1.73 | | | | 1.61 | |

| Class C (WFLAX) | | 12-1-1998 | | | 9.19 | | | | 7.03 | | | | 4.74 | | | | 10.19 | | | | 7.03 | | | | 4.74 | | | | 1.73 | | | | 1.61 | |

| Class R (WFURX) | | 6-28-2013 | | | – | | | | – | | | | – | | | | 10.80 | | | | 7.70 | | | | 5.47 | | | | 1.23 | | | | 1.11 | |

| Class R4 (WFLRX) | | 11-30-2012 | | | – | | | | – | | | | – | | | | 11.39 | | | | 8.34 | | | | 6.06 | | | | 0.65 | | | | 0.50 | |

| Class R6 (WFOBX) | | 6-30-2004 | | | – | | | | – | | | | – | | | | 11.61 | | | | 8.38 | | | | 6.09 | | | | 0.50 | | | | 0.35 | |

| Administrator Class (WFLPX) | | 11-8-1999 | | | – | | | | – | | | | – | | | | 11.22 | | | | 8.00 | | | | 5.78 | | | | 0.82 | | | | 0.70 | |

| Investor Class (WFDTX) | | 1-31-2007 | | | – | | | | – | | | | – | | | | 10.98 | | | | 7.91 | | | | 5.72 | | | | 1.04 | | | | 0.91 | |

| Dow Jones Global Target 2020 Index5 | | – | | | – | | | | – | | | | – | | | | 11.99 | | | | 8.85 | | | | 7.03 | | | | – | | | | – | |

| Russell 3000® Index6 | | – | | | – | | | | – | | | | – | | | | 24.74 | | | | 17.22 | | | | 8.83 | | | | – | | | | – | |

| Barclays U.S. Aggregate Bond Index7 | | – | | | – | | | | – | | | | – | | | | 5.66 | | | | 4.48 | | | | 4.72 | | | | – | | | | – | |

| * | | Class B shares are closed to investment, except in connection with the reinvestment of any distributions and permitted exchanges. |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted and assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargoadvantagefunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class B shares, the maximum contingent deferred sales charge is 5.00%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including a contingent deferred sales charge assumes the sales charge for the corresponding time period. Class R, Class R4, Class R6, Administrator Class, and Investor Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Please see footnotes on pages 17-18.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Advantage Dow Jones Target Date Funds | | | 9 | |

Target 2025 Fund

Average annual total returns10 (%) as of August 31, 2014

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios3 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | Since

inception | | | 1 year | | | 5 year | | | Since

inception | | | Gross | | | Net4 | |

| Class A (WFAYX) | | 11-30-2012 | | | 6.76 | | | | 8.09 | | | | 3.26 | | | | 13.22 | | | | 9.37 | | | | 4.12 | | | | 0.98 | | | | 0.86 | |

| Class R (WFHRX) | | 6-28-2013 | | | – | | | | – | | | | – | | | | 12.90 | | | | 9.11 | | | | 3.90 | | | | 1.23 | | | | 1.11 | |

| Class R4 (WFGRX) | | 11-30-2012 | | | – | | | | – | | | | – | | | | 13.65 | | | | 9.77 | | | | 4.44 | | | | 0.65 | | | | 0.50 | |

| Class R6 (WFTYX) | | 6-29-2007 | | | – | | | | – | | | | – | | | | 13.71 | | | | 9.80 | | | | 4.46 | | | | 0.50 | | | | 0.35 | |

| Administrator Class (WFTRX) | | 6-29-2007 | | | – | | | | – | | | | – | | | | 13.29 | | | | 9.43 | | | | 4.16 | | | | 0.82 | | | | 0.70 | |

| Investor Class (WFGYX) | | 6-29-2007 | | | – | | | | – | | | | – | | | | 13.14 | | | | 9.33 | | | | 4.09 | | | | 1.04 | | | | 0.91 | |

| Dow Jones Global Target 2025 Index5 | | – | | | – | | | | – | | | | – | | | | 14.12 | | | | 10.28 | | | | 4.86 | * | | | – | | | | – | |

| Russell 3000® Index6 | | – | | | – | | | | – | | | | – | | | | 24.74 | | | | 17.22 | | | | 6.63 | * | | | – | | | | – | |

| Barclays U.S. Aggregate Bond Index7 | | – | | | – | | | | – | | | | – | | | | 5.66 | | | | 4.48 | | | | 5.34 | * | | | – | | | | – | |

| * | | Based on the inception date of the oldest class. |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted and assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargoadvantagefunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. Class R, Class R4, Class R6, Administrator Class, and Investor Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Please see footnotes on pages 17-18.

| | | | |

| 10 | | Wells Fargo Advantage Dow Jones Target Date Funds | | Performance highlights (unaudited) |

Target 2030 Fund

Average annual total returns2(%) as of August 31, 2014

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios3 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | 10 year | | | 1 year | | | 5 year | | | 10 year | | | Gross | | | Net4 | |

| Class A (STHRX) | | 3-1-1994 | | | 8.52 | | | | 9.24 | | | | 5.81 | | | | 15.17 | | | | 10.55 | | | | 6.44 | | | | 0.98 | | | | 0.87 | |

| Class B (SGPBX)* | | 3-1-1997 | | | 9.34 | | | | 9.44 | | | | 5.88 | | | | 14.34 | | | | 9.72 | | | | 5.88 | | | | 1.73 | | | | 1.62 | |

| Class C (WFDMX) | | 12-1-1998 | | | 13.32 | | | | 9.72 | | | | 5.65 | | | | 14.32 | | | | 9.72 | | | | 5.65 | | | | 1.73 | | | | 1.62 | |

| Class R (WFJRX) | | 6-28-2013 | | | – | | | | – | | | | – | | | | 14.91 | | | | 10.43 | | | | 6.38 | | | | 1.23 | | | | 1.12 | |

| Class R4 (WTHRX) | | 11-30-2012 | | | – | | | | – | | | | – | | | | 15.59 | | | | 11.08 | | | | 6.98 | | | | 0.65 | | | | 0.51 | |

| Class R6 (WFOOX) | | 6-30-2004 | | | – | | | | – | | | | – | | | | 15.77 | | | | 11.12 | | | | 6.99 | | | | 0.50 | | | | 0.36 | |

| Administrator Class (WFLIX) | | 11-8-1999 | | | – | | | | – | | | | – | | | | 15.37 | | | | 10.73 | | | | 6.70 | | | | 0.82 | | | | 0.71 | |

| Investor Class (WFETX) | | 1-31-2007 | | | – | | | | – | | | | – | | | | 15.12 | | | | 10.62 | | | | 6.62 | | | | 1.04 | | | | 0.92 | |

| Dow Jones Global Target 2030 Index5 | | – | | | – | | | | – | | | | – | | | | 16.18 | | | | 11.57 | | | | 8.27 | | | | – | | | | – | |

| Russell 3000® Index6 | | – | | | – | | | | – | | | | – | | | | 24.74 | | | | 17.22 | | | | 8.83 | | | | – | | | | – | |

| Barclays U.S. Aggregate Bond Index7 | | – | | | – | | | | – | | | | – | | | | 5.66 | | | | 4.48 | | | | 4.72 | | | | – | | | | – | |

| * | | Class B shares are closed to investment, except in connection with the reinvestment of any distributions and permitted exchanges. |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted and assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargoadvantagefunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class B shares, the maximum contingent deferred sales charge is 5.00%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including a contingent deferred sales charge assumes the sales charge for the corresponding time period. Class R, Class R4, Class R6, Administrator Class, and Investor Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Please see footnotes on pages 17-18.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Advantage Dow Jones Target Date Funds | | | 11 | |

Target 2035 Fund

Average annual total returns10 (%) as of August 31, 2014

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios3 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | Since inception | | | 1 year | | | 5 year | | | Since inception | | | Gross | | | Net4 | |

| Class A (WFQBX) | | 11-30-2012 | | | 10.28 | | | | 10.47 | | | | 3.64 | | | | 17.02 | | | | 11.77 | | | | 4.50 | | | | 1.01 | | | | 0.88 | |

| Class R (WFKRX) | | 6-28-2013 | | | – | | | | – | | | | – | | | | 16.73 | | | | 11.41 | | | | 4.22 | | | | 1.26 | | | | 1.13 | |

| Class R4 (WTTRX) | | 11-30-2012 | | | – | | | | – | | | | – | | | | 17.38 | | | | 12.15 | | | | 4.81 | | | | 0.68 | | | | 0.52 | |

| Class R6 (WFQRX) | | 6-29-2007 | | | – | | | | – | | | | – | | | | 17.55 | | | | 12.20 | | | | 4.84 | | | | 0.53 | | | | 0.37 | |

| Administrator Class (WFQWX) | | 6-29-2007 | | | – | | | | – | | | | – | | | | 17.10 | | | | 11.73 | | | | 4.48 | | | | 0.85 | | | | 0.72 | |

| Investor Class (WFQTX) | | 6-29-2007 | | | – | | | | – | | | | – | | | | 16.84 | | | | 11.62 | | | | 4.40 | | | | 1.07 | | | | 0.93 | |

| Dow Jones Global Target 2035 Index5 | | – | | | – | | | | – | | | | – | | | | 17.99 | | | | 12.63 | | | | 5.12 | * | | | – | | | | – | |

| Russell 3000® Index6 | | – | | | – | | | | – | | | | – | | | | 24.74 | | | | 17.22 | | | | 6.63 | * | | | – | | | | – | |

| Barclays U.S. Aggregate Bond Index7 | | – | | | – | | | | – | | | | – | | | | 5.66 | | | | 4.48 | | | | 5.34 | * | | | – | | | | – | |

| * | | Based on the inception date of the oldest class. |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted and assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargoadvantagefunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. Class R, Class R4, Class R6, Administrator Class, and Investor Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Please see footnotes on pages 17-18.

| | | | |

| 12 | | Wells Fargo Advantage Dow Jones Target Date Funds | | Performance highlights (unaudited) |

Target 2040 Fund

Average annual total returns2 (%) as of August 31, 2014

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | Excluding sales charge | | | Expense ratios3 (%) |

| | | Inception date | | 1 year | | 5 year | | 10 year | | 1 year | | | 5 year | | | 10 year | | | Gross | | Net4 |

| Class A (STFRX) | | 3-1-1994 | | 11.53 | | 11.05 | | 6.62 | | | 18.32 | | | | 12.37 | | | | 7.25 | | | 0.99 | | 0.88 |

| Class B (SLPBX)* | | 3-1-1997 | | 12.40 | | 11.23 | | 6.68 | | | 17.40 | | | | 11.49 | | | | 6.68 | | | 1.74 | | 1.63 |

| Class C (WFOFX) | | 7-1-1998 | | 16.49 | | 11.52 | | 6.45 | | | 17.49 | | | | 11.52 | | | | 6.45 | | | 1.74 | | 1.63 |

| Class R (WFMRX) | | 6-28-2013 | | – | | – | | – | | | 18.05 | | | | 12.23 | | | | 7.19 | | | 1.24 | | 1.13 |

| Class R4 (WTFRX) | | 11-30-2012 | | – | | – | | – | | | 18.73 | | | | 12.87 | | | | 7.78 | | | 0.66 | | 0.52 |

| Class R6 (WFOSX) | | 6-30-2004 | | – | | – | | – | | | 18.90 | | | | 12.92 | | | | 7.80 | | | 0.51 | | 0.37 |

| Administrator Class (WFLWX) | | 11-8-1999 | | – | | – | | – | | | 18.54 | | | | 12.55 | | | | 7.50 | | | 0.83 | | 0.72 |

| Investor Class (WFFTX) | | 1-31-2007 | | – | | – | | – | | | 18.28 | | | | 12.44 | | | | 7.43 | | | 1.05 | | 0.93 |

| Dow Jones Global Target 2040 Index5 | | – | | – | | – | | – | | | 19.36 | | | | 13.37 | | | | 8.94 | | | – | | – |

| Russell 3000® Index6 | | – | | – | | – | | – | | | 24.74 | | | | 17.22 | | | | 8.83 | | | – | | – |

| Barclays U.S. Aggregate Bond Index7 | | – | | – | | – | | – | | | 5.66 | | | | 4.48 | | | | 4.72 | | | – | | – |

| * | | Class B shares are closed to investment, except in connection with the reinvestment of any distributions and permitted exchanges. |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted and assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargoadvantagefunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class B shares, the maximum contingent deferred sales charge is 5.00%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including a contingent deferred sales charge assumes the sales charge for the corresponding time period. Class R, Class R4, Class R6, Administrator Class, and Investor Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Please see footnotes on pages 17-18.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Advantage Dow Jones Target Date Funds | | | 13 | |

Target 2045 Fund

Average annual total returns10 (%) as of August 31, 2014

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | Excluding sales charge | | | Expense ratios3 (%) |

| | | Inception date | | 1 year | | 5 year | | Since inception | | 1 year | | | 5 year | | | Since inception | | | Gross | | Net4 |

| Class A (WFQVX) | | 11-30-2012 | | 12.23 | | 11.46 | | 4.08 | | | 19.11 | | | | 12.79 | | | | 4.95 | | | 1.04 | | 0.88 |

| Class R (WFNRX) | | 6-28-2013 | | – | | – | | – | | | 18.76 | | | | 12.50 | | | | 4.68 | | | 1.29 | | 1.13 |

| Class R4 (WFFRX) | | 11-30-2012 | | – | | – | | – | | | 19.54 | | | | 13.21 | | | | 5.28 | | | 0.71 | | 0.52 |

| Class R6 (WFQPX) | | 6-29-2007 | | – | | – | | – | | | 19.75 | | | | 13.22 | | | | 5.29 | | | 0.56 | | 0.37 |

| Administrator Class (WFQYX) | | 6-29-2007 | | – | | – | | – | | | 19.24 | | | | 12.81 | | | | 4.98 | | | 0.88 | | 0.72 |

| Investor Class (WFQSX) | | 6-29-2007 | | – | | – | | – | | | 19.06 | | | | 12.71 | | | | 4.86 | | | 1.10 | | 0.93 |

| Dow Jones Global Target 2045 Index5 | | – | | – | | – | | – | | | 20.12 | | | | 13.72 | | | | 5.52 | * | | – | | – |

| Russell 3000® Index6 | | – | | – | | – | | – | | | 24.74 | | | | 17.22 | | | | 6.63 | * | | – | | – |

| Barclays U.S. Aggregate Bond Index7 | | – | | – | | – | | – | | | 5.66 | | | | 4.48 | | | | 5.34 | * | | – | | – |

| * | | Based on the inception date of the oldest class. |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted and assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargoadvantagefunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. Class R, Class R4, Class R6, Administrator Class, and Investor Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Please see footnotes on pages 17-18.

| | | | |

| 14 | | Wells Fargo Advantage Dow Jones Target Date Funds | | Performance highlights (unaudited) |

Target 2050 Fund

Average annual total returns11 (%) as of August 31, 2014

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios3 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | Since

inception | | | 1 year | | | 5 year | | | Since

inception | | | Gross | | | Net4 | |

| Class A (WFQAX) | | 11-30-2012 | | | 12.35 | | | | 11.54 | | | | 4.08 | | | | 19.23 | | | | 12.86 | | | | 4.95 | | | | 1.01 | | | | 0.88 | |

| Class C (WFQCX) | | 11-30-2012 | | | 17.38 | | | | 12.03 | | | | 4.17 | | | | 18.38 | | | | 12.03 | | | | 4.17 | | | | 1.76 | | | | 1.63 | |

| Class R (WFWRX) | | 6-28-2013 | | | – | | | | – | | | | – | | | | 18.96 | | | | 12.60 | | | | 4.69 | | | | 1.26 | | | | 1.13 | |

| Class R4 (WQFRX) | | 11-30-2012 | | | – | | | | – | | | | – | | | | 19.69 | | | | 13.27 | | | | 5.27 | | | | 0.68 | | | | 0.52 | |

| Class R6 (WFQFX) | | 6-29-2007 | | | – | | | | – | | | | – | | | | 19.87 | | | | 13.32 | | | | 5.31 | | | | 0.53 | | | | 0.37 | |

| Administrator Class (WFQDX) | | 6-29-2007 | | | – | | | | – | | | | – | | | | 19.41 | | | | 12.92 | | | | 4.97 | | | | 0.85 | | | | 0.72 | |

| Investor Class (WFQGX) | | 6-29-2007 | | | – | | | | – | | | | – | | | | 19.22 | | | | 12.82 | | | | 4.88 | | | | 1.07 | | | | 0.93 | |

| Dow Jones Global Target 2050 Index5 | | – | | | – | | | | – | | | | – | | | | 20.26 | | | | 13.77 | | | | 5.55 | * | | | – | | | | – | |

| Russell 3000® Index6 | | – | | | – | | | | – | | | | – | | | | 24.74 | | | | 17.22 | | | | 6.63 | * | | | – | | | | – | |

| Barclays U.S. Aggregate Bond Index7 | | – | | | – | | | | – | | | | – | | | | 5.66 | | | | 4.48 | | | | 5.34 | * | | | – | | | | – | |

| * | | Based on the inception date of the oldest class. |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted and assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargoadvantagefunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including a contingent deferred sales charge assumes the sales charge for the corresponding time period. Class R, Class R4, Class R6, Administrator Class, and Investor Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Please see footnotes on pages 17-18.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Advantage Dow Jones Target Date Funds | | | 15 | |

Target 2055 Fund

Average annual total returns10 (%) as of August 31, 2014

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios3 (%) | |

| | | Inception date | | 1 year | | | Since

inception | | | 1 year | | | Since

inception | | | Gross | | | Net4 | |

| Class A (WFQZX) | | 11-30-2012 | | | 12.42 | | | | 8.56 | | | | 19.24 | | | | 10.61 | | | | 1.21 | | | | 0.88 | |

| Class R (WFYRX) | | 6-28-2013 | | | – | | | | – | | | | 18.94 | | | | 10.14 | | | | 1.46 | | | | 1.13 | |

| Class R4 (WFVRX) | | 11-30-2012 | | | – | | | | – | | | | 19.63 | | | | 11.00 | | | | 0.88 | | | | 0.52 | |

| Class R6 (WFQUX) | | 6-30-2011 | | | – | | | | – | | | | 19.84 | | | | 11.06 | | | | 0.73 | | | | 0.37 | |

| Administrator Class (WFLHX) | | 6-30-2011 | | | – | | | | – | | | | 19.36 | | | | 10.68 | | | | 1.05 | | | | 0.72 | |

| Investor Class (WFQHX) | | 6-30-2011 | | | – | | | | – | | | | 19.23 | | | | 10.58 | | | | 1.27 | | | | 0.93 | |

| Dow Jones Global Target 2055 Index5 | | – | | | – | | | | – | | | | 20.26 | | | | 11.28 | * | | | – | | | | – | |

| Russell 3000® Index6 | | – | | | – | | | | – | | | | 24.74 | | | | 16.28 | * | | | – | | | | – | |

| Barclays U.S. Aggregate Bond Index7 | | – | | | – | | | | – | | | | 5.66 | | | | 3.74 | * | | | – | | | | – | |

| * | | Based on the inception date of the oldest class. |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargoadvantagefunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. Class R, Class R4, Class R6, Administrator Class, and Investor Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Please see footnotes on pages 17-18.

| | | | |

| 16 | | Wells Fargo Advantage Dow Jones Target Date Funds | | Performance highlights (unaudited) |

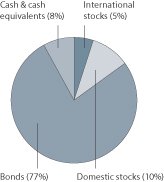

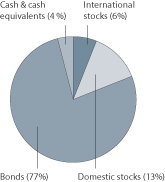

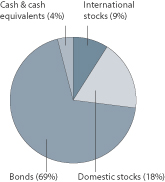

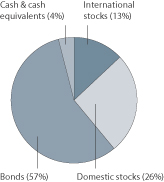

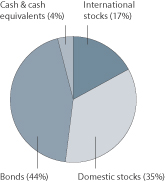

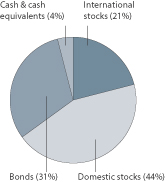

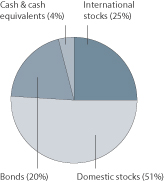

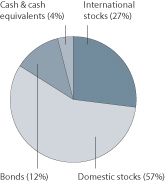

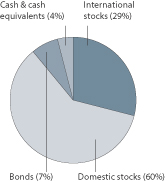

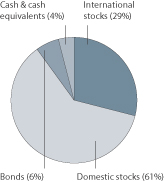

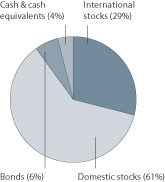

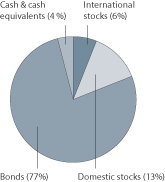

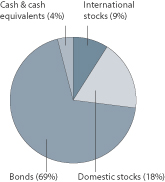

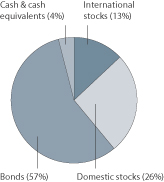

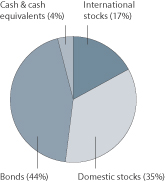

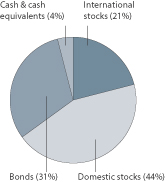

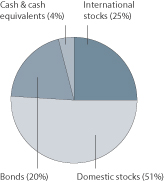

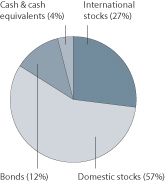

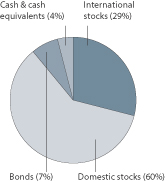

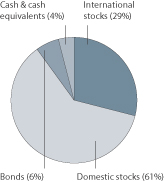

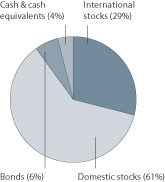

Portfolio allocation12 as of August 31, 2014

| | | | |

| Target Today Fund | | Target 2010 Fund | | Target 2015 Fund |

| | | |

| |  | |  |

| | | | |

| Target 2020 Fund | | Target 2025 Fund | | Target 2030 Fund |

| | | |

| |  | |  |

| | | | |

| Target 2035 Fund | | Target 2040 Fund | | Target 2045 Fund |

| | | |

| |  | |  |

Please see footnotes on pages 17-18.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Advantage Dow Jones Target Date Funds | | | 17 | |

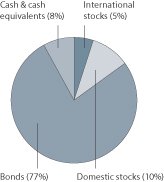

Portfolio allocation12 as of August 31, 2014 (continued)

| | |

| Target 2050 Fund | | Target 2055 Fund |

| | |

| |  |

| 1. | The Funds are gateway funds that invest in various affiliated master portfolios which in turn invest in a combination of equity, fixed income, and money market securities using an asset allocation strategy designed to replicate, before fees and expenses, the total return of the Dow Jones Global Target Date Indexes that have the same target year as the Funds. References to the investment activities of the Funds are intended to refer to the investment activities of the underlying affiliated master portfolios in which the Funds invest. |

| 2. | Historical performance shown for Class R shares prior to their inception reflects the performance of the Class A shares and has been adjusted to reflect the higher expenses applicable to Class R shares. Historical performance shown for Class R4 shares prior to their inception reflects the performance of Class R6 shares and includes the expenses applicable to Class R6. Effective June 1, 2013, Institutional Class was renamed Class R6 and modified to assume the features and attributes of Class R6. Historical performance shown for Class R6 shares from inception through May 31, 2013, reflects Institutional Class performance and expenses. Historical performance shown for Investor Class shares prior to their inception reflects the performance of Administrator Class shares and has been adjusted to reflect the higher expenses applicable to Investor Class shares (except during those periods in which expenses of the Investor Class would have been lower than those of Administrator Class no such adjustment is reflected). |

| 3. | Reflects the expense ratios as stated in the most recent prospectuses. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report. |

| 4. | The Adviser has committed through June 30, 2015, to waive fees and/or reimburse expenses to the extent necessary to cap the Fund’s Total Annual Fund Operating Expenses After Fee Waiver, excluding certain expenses, at the amounts shown. After this time, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses, and extraordinary expenses are excluded from the cap. Fees from the underlying affiliated master portfolios are included in the cap. Without this cap, the Fund’s returns would have been lower. |

| 5. | The Dow Jones Global Target Date Indexes (each an “index” or collectively the “indexes”) are a series of indexes designed as benchmarks for multi-asset class portfolios with risk profiles that became more conservative over time. The index weightings among the major asset classes are adjusted monthly based on a published set of index rules. The indexes with longer time horizons have higher allocations to equity securities, while the indexes with shorter time horizons replace some of their stock allocations with allocations to fixed income securities and money market instruments. You cannot invest directly in an index. |

| 6. | The Russell 3000® Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market. You cannot invest directly in an index. |

| 7. | The Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass throughs), ABS, and CMBS. You cannot invest directly in an index. |

| 8. | Historical performance shown for Class R shares prior to their inception reflects the performance of Class A shares and has been adjusted to reflect the higher expenses applicable to Class R shares. Historical performance shown for Class R4 shares prior to their inception reflects the performance of Class R6 shares, and has been adjusted to reflect the higher expenses applicable to Class R6 shares at that time. If these expenses had not been included, returns would be higher. Effective June 1, 2013, Institutional Class was renamed Class R6 and modified to assume the features and attributes of Class R6. Historical performance shown for Class R6 shares from inception through May 31, 2013, reflects Institutional Class performance and expenses. Historical performance shown for Investor Class shares prior to their inception reflects the performance of Administrator Class shares and has been adjusted to reflect the higher expenses applicable to Investor Class shares (except during those periods in which expenses of Investor Class would have been lower than those of Administrator Class no such adjustment is reflected). |

| | | | |

| 18 | | Wells Fargo Advantage Dow Jones Target Date Funds | | Performance highlights (unaudited) |

| 9. | Historical performance shown for Class A shares prior to their inception reflects the performance of Class R6 shares and has been adjusted to reflect the higher expenses applicable to Class A shares. Historical performance shown for Class R shares prior to their inception reflects the performance of Investor Class shares and has been adjusted to reflect the higher expenses applicable to Class R shares. Historical performance shown for Class R4 shares prior to their inception reflects the performance of Class R6 shares, and has been adjusted to reflect the higher expenses applicable to Class R6 shares at that time. If these expenses had not been included, returns would be higher. Effective June 1, 2013, Institutional Class was renamed Class R6 and modified to assume the features and attributes of Class R6. Historical performance shown for Class R6 shares from inception through May 31, 2013, reflects Institutional Class performance and expenses. |

| 10. | Historical performance shown for Class A shares prior to their inception reflects the performance of Class R6 shares and has been adjusted to reflect the higher expenses applicable to Class A shares. Historical performance shown for Class R shares prior to their inception reflects the performance of Investor Class shares and has been adjusted to reflect the higher expenses applicable to Class R shares. Historical performance shown for Class R4 shares prior to their inception reflects the performance of Class R6 shares and includes the expenses applicable to Class R6. Effective June 1, 2013, Institutional Class was renamed Class R6 and modified to assume the features and attributes of Class R6. Historical performance shown for Class R6 shares from inception through May 31, 2013, reflects Institutional Class performance and expenses. |

| 11. | Historical performance shown for Class A and Class C shares prior to their inception reflects the performance of Class R6 shares and has been adjusted to reflect the higher expenses applicable to Class A and Class C shares. Historical performance shown for Class R shares prior to their inception reflects the performance of Investor Class shares and has been adjusted to reflect the higher expenses applicable to Class R shares. Historical performance shown for Class R4 shares prior to their inception reflects the performance of Class R6 shares and includes the expenses applicable to Class R6. Effective June 1, 2013, Institutional Class was renamed Class R6 and modified to assume the features and attributes of Class R6. Historical performance shown for Class R6 shares from inception through May 31, 2013, reflects Institutional Class performance and expenses. |

| 12. | Each chart represents the composite of the portfolio allocations of the affiliated master portfolios in which the Fund invests and is calculated based on the total investments of the affiliated master portfolios. Portfolio holdings are subject to change and may have changed since the date specified. See the Portfolio of investments or Summary portfolio of investments of each affiliated master portfolio which is also included in this report. |

| | | | | | |

| Fund expenses (unaudited) | | Wells Fargo Advantage Dow Jones Target Date Funds | | | 19 | |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and contingent deferred sales charges (if any) on redemptions and (2) ongoing costs, including management fees, distribution (12b-1) and/or shareholder service fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period from March 1, 2014 to August 31, 2014.

Actual expenses

The “Actual” line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the “Actual” line under the heading entitled “Expenses paid during period” for your applicable class of shares to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The “Hypothetical” line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) and contingent deferred sales charges. Therefore, the “Hypothetical” line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| Target Today Fund | | Beginning

account value

3-1-2014 | | | Ending

account value

8-31-2014 | | | Expenses

paid during

the period¹ | | | Net annualized

expense ratio | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,023.21 | | | $ | 4.13 | | | | 0.81 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.12 | | | $ | 4.13 | | | | 0.81 | % |

Class B | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,019.43 | | | $ | 7.94 | | | | 1.56 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,017.34 | | | $ | 7.93 | | | | 1.56 | % |

Class C | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,019.19 | | | $ | 7.94 | | | | 1.56 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,017.34 | | | $ | 7.93 | | | | 1.56 | % |

Class R | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,021.81 | | | $ | 5.40 | | | | 1.06 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.86 | | | $ | 5.40 | | | | 1.06 | % |

Class R4 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,024.34 | | | $ | 2.30 | | | | 0.45 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.94 | | | $ | 2.29 | | | | 0.45 | % |

Class R6 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,025.61 | | | $ | 1.53 | | | | 0.30 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.69 | | | $ | 1.53 | | | | 0.30 | % |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,023.98 | | | $ | 3.32 | | | | 0.65 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.93 | | | $ | 3.31 | | | | 0.65 | % |

Investor Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,022.67 | | | $ | 4.38 | | | | 0.86 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.87 | | | $ | 4.38 | | | | 0.86 | % |

| | | | |

| 20 | | Wells Fargo Advantage Dow Jones Target Date Funds | | Fund expenses (unaudited) |

| | | | | | | | | | | | | | | | |

| Target 2010 Fund | | Beginning

account value

3-1-2014 | | | Ending

account value

8-31-2014 | | | Expenses

paid during

the period¹ | | | Net annualized

expense ratio | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,025.23 | | | $ | 4.24 | | | | 0.83 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.02 | | | $ | 4.23 | | | | 0.83 | % |

Class B | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,021.98 | | | $ | 8.05 | | | | 1.58 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,017.24 | | | $ | 8.03 | | | | 1.58 | % |

Class C | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,021.85 | | | $ | 8.05 | | | | 1.58 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,017.24 | | | $ | 8.03 | | | | 1.58 | % |

Class R | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,024.86 | | | $ | 5.51 | | | | 1.08 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.76 | | | $ | 5.50 | | | | 1.08 | % |

Class R4 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,027.25 | | | $ | 2.40 | | | | 0.47 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.84 | | | $ | 2.40 | | | | 0.47 | % |

Class R6 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,028.35 | | | $ | 1.64 | | | | 0.32 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.59 | | | $ | 1.63 | | | | 0.32 | % |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,026.07 | | | $ | 3.42 | | | | 0.67 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.83 | | | $ | 3.41 | | | | 0.67 | % |

Investor Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,025.73 | | | $ | 4.49 | | | | 0.88 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.77 | | | $ | 4.48 | | | | 0.88 | % |

| Target 2015 Fund | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,028.40 | | | $ | 4.29 | | | | 0.84 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.97 | | | $ | 4.28 | | | | 0.84 | % |

Class R | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,027.70 | | | $ | 5.57 | | | | 1.09 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.71 | | | $ | 5.55 | | | | 1.09 | % |

Class R4 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,030.83 | | | $ | 2.46 | | | | 0.48 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.79 | | | $ | 2.45 | | | | 0.48 | % |

Class R6 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,031.56 | | | $ | 1.69 | | | | 0.33 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.54 | | | $ | 1.68 | | | | 0.33 | % |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,029.54 | | | $ | 3.48 | | | | 0.68 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.78 | | | $ | 3.47 | | | | 0.68 | % |

Investor Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,028.52 | | | $ | 4.55 | | | | 0.89 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.72 | | | $ | 4.53 | | | | 0.89 | % |

| | | | | | |

| Fund expenses (unaudited) | | Wells Fargo Advantage Dow Jones Target Date Funds | | | 21 | |

| | | | | | | | | | | | | | | | |

| Target 2020 Fund | | Beginning

account value

3-1-2014 | | | Ending

account value

8-31-2014 | | | Expenses

paid during

the period¹ | | | Net annualized

expense ratio | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,033.73 | | | $ | 4.41 | | | | 0.86 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.87 | | | $ | 4.38 | | | | 0.86 | % |

Class B | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,029.86 | | | $ | 8.24 | | | | 1.61 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,017.09 | | | $ | 8.19 | | | | 1.61 | % |

Class C | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,029.91 | | | $ | 8.24 | | | | 1.61 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,017.09 | | | $ | 8.19 | | | | 1.61 | % |

Class R | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,033.00 | | | $ | 5.69 | | | | 1.11 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.61 | | | $ | 5.65 | | | | 1.11 | % |

Class R4 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,035.64 | | | $ | 2.57 | | | | 0.50 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.68 | | | $ | 2.55 | | | | 0.50 | % |

Class R6 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,036.32 | | | $ | 1.80 | | | | 0.35 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.44 | | | $ | 1.79 | | | | 0.35 | % |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,034.81 | | | $ | 3.59 | | | | 0.70 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.68 | | | $ | 3.57 | | | | 0.70 | % |

Investor Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,033.95 | | | $ | 4.67 | | | | 0.91 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.62 | | | $ | 4.63 | | | | 0.91 | % |

| Target 2025 Fund | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,038.87 | | | $ | 4.42 | | | | 0.86 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.87 | | | $ | 4.38 | | | | 0.86 | % |

Class R | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,038.24 | | | $ | 5.70 | | | | 1.11 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.61 | | | $ | 5.65 | | | | 1.11 | % |

Class R4 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,041.14 | | | $ | 2.57 | | | | 0.50 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.68 | | | $ | 2.55 | | | | 0.50 | % |

Class R6 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,041.88 | | | $ | 1.80 | | | | 0.35 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.44 | | | $ | 1.79 | | | | 0.35 | % |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,039.18 | | | $ | 3.60 | | | | 0.70 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.68 | | | $ | 3.57 | | | | 0.70 | % |

Investor Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,038.25 | | | $ | 4.68 | | | | 0.91 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.62 | | | $ | 4.63 | | | | 0.91 | % |

| | | | |

| 22 | | Wells Fargo Advantage Dow Jones Target Date Funds | | Fund expenses (unaudited) |

| | | | | | | | | | | | | | | | |

| Target 2030 Fund | | Beginning

account value

3-1-2014 | | | Ending

account value

8-31-2014 | | | Expenses

paid during

the period¹ | | | Net annualized

expense ratio | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,043.61 | | | $ | 4.48 | | | | 0.87 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.82 | | | $ | 4.43 | | | | 0.87 | % |

Class B | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,039.90 | | | $ | 8.33 | | | | 1.62 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,017.04 | | | $ | 8.24 | | | | 1.62 | % |

Class C | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,039.75 | | | $ | 8.33 | | | | 1.62 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,017.04 | | | $ | 8.24 | | | | 1.62 | % |

Class R | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,042.26 | | | $ | 5.77 | | | | 1.12 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.56 | | | $ | 5.70 | | | | 1.12 | % |

Class R4 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,045.42 | | | $ | 2.63 | | | | 0.51 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.63 | | | $ | 2.60 | | | | 0.51 | % |

Class R6 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,046.75 | | | $ | 1.86 | | | | 0.36 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.39 | | | $ | 1.84 | | | | 0.36 | % |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,044.52 | | | $ | 3.66 | | | | 0.71 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.63 | | | $ | 3.62 | | | | 0.71 | % |

Investor Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,043.75 | | | $ | 4.74 | | | | 0.92 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.57 | | | $ | 4.69 | | | | 0.92 | % |

| Target 2035 Fund | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,048.06 | | | $ | 4.54 | | | | 0.88 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.77 | | | $ | 4.48 | | | | 0.88 | % |

Class R | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,046.34 | | | $ | 5.83 | | | | 1.13 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.51 | | | $ | 5.75 | | | | 1.13 | % |

Class R4 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,049.48 | | | $ | 2.69 | | | | 0.52 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.58 | | | $ | 2.65 | | | | 0.52 | % |

Class R6 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,050.17 | | | $ | 1.91 | | | | 0.37 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.34 | | | $ | 1.89 | | | | 0.37 | % |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,048.39 | | | $ | 3.72 | | | | 0.72 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.58 | | | $ | 3.67 | | | | 0.72 | % |

Investor Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,047.22 | | | $ | 4.80 | | | | 0.93 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.52 | | | $ | 4.74 | | | | 0.93 | % |

| | | | | | |

| Fund expenses (unaudited) | | Wells Fargo Advantage Dow Jones Target Date Funds | | | 23 | |

| | | | | | | | | | | | | | | | |

| Target 2040 Fund | | Beginning

account value

3-1-2014 | | | Ending

account value

8-31-2014 | | | Expenses

paid during

the period¹ | | | Net annualized

expense ratio | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,051.58 | | | $ | 4.55 | | | | 0.88 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.77 | | | $ | 4.48 | | | | 0.88 | % |

Class B | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,047.25 | | | $ | 8.41 | | | | 1.63 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,016.99 | | | $ | 8.29 | | | | 1.63 | % |

Class C | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,047.24 | | | $ | 8.41 | | | | 1.63 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,016.99 | | | $ | 8.29 | | | | 1.63 | % |

Class R | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,049.57 | | | $ | 5.84 | | | | 1.13 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.51 | | | $ | 5.75 | | | | 1.13 | % |

Class R4 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,052.79 | | | $ | 2.69 | | | | 0.52 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.58 | | | $ | 2.65 | | | | 0.52 | % |

Class R6 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,054.01 | | | $ | 1.92 | | | | 0.37 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.34 | | | $ | 1.89 | | | | 0.37 | % |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,051.95 | | | $ | 3.72 | | | | 0.72 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.58 | | | $ | 3.67 | | | | 0.72 | % |

Investor Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,051.18 | | | $ | 4.81 | | | | 0.93 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.52 | | | $ | 4.74 | | | | 0.93 | % |

| Target 2045 Fund | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,053.59 | | | $ | 4.56 | | | | 0.88 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.77 | | | $ | 4.48 | | | | 0.88 | % |

Class R | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,051.71 | | | $ | 5.84 | | | | 1.13 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.51 | | | $ | 5.75 | | | | 1.13 | % |

Class R4 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,055.65 | | | $ | 2.69 | | | | 0.52 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.58 | | | $ | 2.65 | | | | 0.52 | % |

Class R6 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,056.43 | | | $ | 1.92 | | | | 0.37 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.34 | | | $ | 1.89 | | | | 0.37 | % |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,053.59 | | | $ | 3.73 | | | | 0.72 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.58 | | | $ | 3.67 | | | | 0.72 | % |

Investor Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,052.39 | | | $ | 4.81 | | | | 0.93 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.52 | | | $ | 4.74 | | | | 0.93 | % |

| | | | |

| 24 | | Wells Fargo Advantage Dow Jones Target Date Funds | | Fund expenses (unaudited) |

| | | | | | | | | | | | | | | | |

| Target 2050 Fund | | Beginning

account value

3-1-2014 | | | Ending

account value

8-31-2014 | | | Expenses

paid during

the period¹ | | | Net annualized

expense ratio | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,053.70 | | | $ | 4.56 | | | | 0.88 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.77 | | | $ | 4.48 | | | | 0.88 | % |

Class C | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,050.34 | | | $ | 8.42 | | | | 1.63 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,016.99 | | | $ | 8.29 | | | | 1.63 | % |

Class R | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,052.25 | | | $ | 5.85 | | | | 1.13 | % |