SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

eUniverse, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box)

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1. | Title of each class of securities to which transaction applies: |

| 2. | Aggregate number of securities to which transaction applies: |

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4. | Proposed maximum aggregate value of transaction: |

| 5. | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 6. | Amount Previously Paid: |

| 7. | Form, Schedule or Registration Statement No.: |

| 8. | Filing Party: |

| 9. | Date Filed: |

6060 Center Drive, Suite 300

Los Angeles, California 90045

Dear Stockholder:

You are cordially invited to attend the annual meeting of eUniverse, Inc. stockholders on January 29, 2004, at 10:00 a.m. PST, at the Company’s offices located at 6060 Center Drive, Suite 300, Los Angeles, California 90045.

The details of the business to be conducted at the meeting are given in the attached Notice of Annual Meeting and Proxy Statement.

Stockholders are urged to exercise their right to vote and are reminded that shares cannot be voted unless the signed proxy card is returned or other arrangements are made to have the shares represented at the annual meeting. Your vote is important. I urge you to vote your shares as soon as possible.

Sincerely, |

|

Brett C. Brewer President and Principal Executive Officer |

Los Angeles, California

December 30, 2003

Your Vote is Important

In order to assure your representation at our annual meeting of stockholders, you are requested to complete, sign and date the enclosed proxy as promptly as possible and return it in the enclosed envelope.

eUniverse, Inc.

Notice of 2003 Annual Meeting of Stockholders

Dear Stockholder:

The fiscal year 2003 eUniverse, Inc. annual meeting of stockholders will be held on January 29, 2004, at 10:00 a.m. PST, at the Company’s offices located at 6060 Center Drive, Suite 300, Los Angeles, California 90045. We intend to vote on the following matters at the meeting:

1. To elect four directors to serve until the next annual meeting of stockholders.

2. To approve the issuance of a warrant to VantagePoint if we draw down on a $4 million loan commitment and the modification of the terms of an existing note due to VantagePoint, including the preferred stock issuable on exercise or conversion and the conversion of the preferred stock into common stock at the applicable conversion rate.

3. To approve amendments to the Series A and Series B Certificates of Designation.

4. To ratify the appointment of Moss Adams LLP as the Company’s independent auditors for fiscal year 2004.

5. To consider and act upon such other matters that may properly be brought before the meeting or any adjournment or postponement.

These items are more fully described in the Proxy Statement accompanying this Notice.

Stockholders of record at the close of business on December 1, 2003, the record date fixed by the Board of Directors, are entitled to receive notice of, attend and vote at the annual meeting. No business other than the proposals described in this Notice is expected to be considered at the annual stockholder meeting.

By Order of the Board of Directors, |

|

Christopher S. Lipp Secretary, Senior Vice President and General Counsel |

Los Angeles, California

December 30, 2003

PROXY STATEMENT

FOR

2003 ANNUAL MEETING OF STOCKHOLDERS

This proxy statement is furnished to stockholders of eUniverse, Inc., a Delaware corporation (the “Company”, “we” or “our”), in connection with the solicitation of proxies by the Board of Directors of the Company (the “Board”) to be voted at the 2003 annual meeting of stockholders and at any adjournment thereof. The annual meeting is being held for the purposes set forth in the accompanying Notice of 2003 Annual Meeting of Stockholders. This proxy statement and the accompanying proxy card and Notice of 2003 Annual Meeting are being provided to stockholders beginning on or about December 30, 2003.

The Company is headquartered at 6060 Center Drive, Suite 300, Los Angeles, California 90045.

Voting Securities

Description of Capital Stock

Our authorized capital stock consists of 250,000,000 shares of common stock, $0.001 par value, and 40,000,000 shares of preferred stock, $0.10 par value, of which 10,000,000 shares are designated as Series A 6% Convertible Preferred Stock (“Series A”), $0.10 par value, 4,098,335 shares are designated as Series B Convertible Preferred Stock (“Series B”), $0.10 par value and 20,000,000 are designated as Series C Convertible Preferred stock (“Series C”), $0.10 par value. As of December 1, 2003, the record date for determining stockholders entitled to vote at our annual stockholder meeting, our issued and outstanding capital stock consisted of 28,745,469 shares of common stock, 275,250 shares of Series A preferred stock, 1,923,077 shares of Series B preferred stock and 5,333,333 shares of Series C preferred stock.

Common Stock

Common stockholders are entitled to one vote per share on all matters to be voted upon by the common stockholders.

Preferred Stock

Preferred stockholders are entitled to vote, on an as-converted basis, on all matters to be voted upon by common stockholders. The current conversion rate for the Series A preferred stock is one-for-one plus 6% accretion from April 14, 1999, the current conversion rate for the Series B preferred stock is one-for-one and the current conversion rate for the Series C preferred stock is one-for-one. Accordingly, each holder of Series A preferred stock as of December 1, 2003 is entitled to 1.278 votes per share of Series A preferred stock held, each holder of Series B preferred stock as of December 1, 2003 is entitled to one vote per share of Series B preferred stock held and each holder of Series C preferred stock as of December 1, 2003 is entitled to one vote per share of Series C preferred stock held. The Series A preferred stockholders are entitled to cast 351,770 votes at our annual stockholders meeting, the Series B preferred stockholders are entitled to cast 1,923,077 votes at our annual stockholders meeting and the Series C preferred stockholders are entitled to cast 5,333,333 votes at our annual stockholders meeting. In total, our common and preferred stockholders are entitled to cast 36,353,649 votes at our annual stockholders meeting.

Proposal 1 – To Elect Four Directors to Serve Until the Next Annual Meeting of Stockholders.

Nominees for Election of Directors

The Board proposes the election of Brett Brewer, Daniel Mosher, Lawrence Moreau and Bradley Ward as Company directors, each for a term of office that runs until the 2004 annual stockholders meeting and until his successor has been elected and has qualified. Each of the nominees has served continuously on the Board since the date indicated in the table below. The Board knows of no reason why any nominee may be unable to serve as a director. If any nominee is unable to serve, the shares represented by all valid proxies may be voted for the election of such other person as the Board may recommend.

Pursuant to the Certificate of Designation of Series B Preferred Stock, 550 Digital Media Ventures Inc. (“550 DMV”), an indirect subsidiary of Sony Corporation of America, the majority holder of our Series B preferred stock, has the exclusive right, voting separately as a single class, to elect two directors in the event the Board consists of six to eight members. 550 DMV has notified the Company that it intends to elect Jeffrey Edell to the Board and leave one Series B Board seat vacant at this time. 550 DMV can fill this Board seat at any time. Pursuant to the Certificate of Designation of Series C Preferred Stock, affiliates of VantagePoint Venture Partners, the sole holders of our Series C preferred stock, have the exclusive right, voting separately as a single class, to elect two directors. VantagePoint has notified the Company that it intends to elect David Carlick and Andrew Sheehan to the Board. If the additional 550 DMV Board seat is filled, the preferred stockholders will have four Board seats out of the eight total Board seats.

Company Directors are elected by a plurality of the votes cast at the annual meeting. Plurality means that the four nominees who receive the largest number of votes cast “FOR” are elected as directors. You may not cast your votes for more than four nominees. Votes withheld and broker non-votes will be counted in determining the presence of a quorum but will not be counted in determining the outcome of the election.

Recommendation of the Board:

The Board recommends a vote “FOR” the election of Directors Brett Brewer, Daniel Mosher, Lawrence Moreau and Bradley Ward.

2

The names and ages of the nominees, their principal occupations or employment during the past five years and other data regarding them, based on information received from the respective nominees, are set forth below:

Name | Age | Principal Occupation | Director Since | |||

| Directors nominated by the Board: | ||||||

Brett Brewer | 31 | President, eUniverse, Inc. | August 29, 2000 | |||

Daniel Mosher | 30 | Director, Corporate Development, Verisign, Inc. | April 17, 2000 | |||

Lawrence Moreau | 60 | Chairman, Stone Mountain Financial Systems, Inc. | May 27, 2003 | |||

Bradley Ward | 35 | President and Chief Executive Officer, The Game Tree | October 16, 2003 | |||

| Directors expected to be elected by the Series B and Series C stockholders: | ||||||

Jeffrey Edell | 46 | President and Chief Executive Officer, Showorks Entertainment Group, Inc. | October 14, 2003 | |||

David Carlick | 53 | Managing Director, VantagePoint Venture Partners | October 31, 2003 | |||

Andrew Sheehan | 46 | Managing Director, VantagePoint Venture Partners | October 31, 2003 | |||

Brett Brewer has served as President and a Director since August 29, 2000. He joined the Company in April 1999 and was named Vice President of its e-Commerce Division in December 1999 and named President of CD Universe, Inc., a subsidiary of eUniverse, in July 2000. Prior to joining eUniverse, Mr. Brewer helped run the Southern California Retail Sales Division of CB Richard Ellis between October 1996 and December 1998. Mr. Brewer received a B.A. degree in business/economics from the University of California at Los Angeles.

Daniel Mosher has served as a Director since December 8, 1999. Mr. Mosher is currently a member of eUniverse’s Audit and Nominating Committees. He is employed as Director of Strategic Development of Verisign, Inc. where he oversees the company’s acquisitions, investments and strategic alliances. Prior to that, Mr. Mosher was employed by Webvan Group, Inc. from May 1999 to May 2001, most recently as Director, Business Development. From January 1998 to May 1999, Mr. Mosher served in the Mergers and Acquisitions Department of Morgan Stanley Dean Witter Technology Group, an investment banking firm. From February 1996 to January 1998, he held several positions in the Corporate Finance Group of Arthur Andersen, focused on technology private placements. Mr. Mosher holds a B.S. degree in business administration from the University of California at Berkeley.

Lawrence Moreau has served as a Director since May 22, 2003. Mr. Moreau is currently a member of the eUniverse’s Audit and Nominating Committees. Mr. Moreau is the Chairman of Stone Mountain Financial Systems, Inc., a private company providing online payment solutions primarily to Internet related retail merchants. Previously, Mr. Moreau founded and served as Chief Executive Officer of Moreau and Company, Inc., a financial consulting firm, and Moreau Capital Corporation, a National Association of Securities Dealers registered investment-banking firm, which specialized in private and public securities offerings. Prior to founding Moreau Capital, Mr. Moreau was a financial principal and on the Board of Directors of H. J. Meyers & Company, a New York Stock Exchange investment banking firm. Previous to his investment-banking career, Mr. Moreau was a Vice President and Special Assistant to the President of Pacific Enterprises, a multi-billion dollar diversified holding company. Prior to joining Pacific Enterprises, Mr. Moreau worked for Touche Ross & Co. (now Deloitte & Touche) for eleven years planning and managing audits of companies in a wide variety of industries. Prior to beginning his professional career, Mr. Moreau served as a commissioned officer in the United States Army during the Vietnam War. Mr. Moreau holds a B.A. in Accounting and a Master’s Degree in Accounting Science from the University of Illinois, Champaign/Urbana. Mr. Moreau was licensed as a Financial Principal and an Operations Principal with the NASD. Mr. Moreau was also an Associate Member of the NYSE

3

and a member of the Securities and Exchange Commission practice section of the American Institute of Certified Public Accountants. For seven years, Mr. Moreau was a member of the Board of Directors of the Los Angeles Venture Capital Association and served as its Chairman for two years. He is a Certified Public Accountant.

Jeffrey Edell has served as a Director since October 14, 2003 and as Chairman of the Board since November 14, 2003. Mr. Edell is currently a member of eUniverse’s Compensation and Audit Committees. Mr. Edell was employed as President and Chief Executive Officer and a director of Soundelux Entertainment Group, Inc., a provider of entertainment content and technologies, from 1995 until 2002. From 1999 to 2002, he was a Director of IVC Industries, Inc. (public ‘IVC’), a manufacturer of vitamins and supplements. Mr. Edell was also the founder, in 1984, of eLabor, Inc., a developer of time and attendance software, where he served as the Chairman and Chief Executive Officer until 1991 and a Director to 2003. From 1995 to 1999, Mr. Edell was the President and Executive Producer of Hastings/Edell Productions, Inc., an independent film company, and from 1992 to 1995, he was a partner at DF & Co. (subsequently Century Business Services, Inc.), an accounting and tax services firm. Mr. Edell became a Certified Public Accountant while at KPMG and he holds a B.S. degree in Commerce from the McIntire School At the University of Virginia. Ernst & Young and NASDAQ named him Entertainment Entrepreneur of the Year 2000. He is a member of the Young Presidents Organization, the Academy of Motion Picture Arts & Sciences and the Academy of Television Arts & Sciences.

Bradley Ward has served as a Director since October 16, 2003. Mr. Ward is currently a member of eUniverse’s Compensation Committee. Mr. Ward is President and Chief Executive Officer of The Game Tree, a publisher of games and game-related intellectual property, which he co-founded in 2002. From January 2001 to January 2003, he served as the Vice President of Licensing/Corporate Development of PopCap Games, Inc., a leading publisher of mass-market entertainment whose licensees include MSN, Yahoo, AOL, Real Networks and eUniverse. Previously, Mr. Ward was a business consultant from 1996 to 2001, providing interactive and operational strategies to various companies and startups. In addition, he served from January 2000 through June 2000 as the Vice President of Internet Operations for ETM Entertainment Network, a global provider of live event and movie ticketing services. Also, Mr. Ward was the Strategic Development Director at Cendant Interactive (later Havas Interactive) between 1998 and 1999, then the world’s largest publisher of entertainment and edutainment software, where he was responsible for the online gaming units. Mr. Ward holds several technical certifications and was an adjunct professor from 1998 to 2000 at Seattle’s City University, where he taught upper-level technical classes.

David Carlick has served as a Director since October 31, 2003. Mr. Carlick is currently a member of eUniverse’s Nominating Committee. Mr. Carlick has served in various positions at VantagePoint Venture Partners, a venture capital firm, from October 1997, and he is presently a Managing Director with that firm. From April to September 1997, Mr. Carlick was President, Media Operations for PowerAgent, a start-up company involved in opt-in marketing and consumer privacy. Prior thereto, Mr. Carlick held positions leading to Executive Vice President at Poppe Tyson, an advertising agency and interactive marketing firm and subsidiary of BJK&E Worldwide (Bozell) from April 1993 until March 1997. In 1996, while at Poppe Tyson, Mr. Carlick co-founded DoubleClick, which provides on-line marketing services, and poppe.com, the agency’s interactive operation. Mr. Carlick was a founding director of International Network Services (INSS) which was sold in 1999 to Lucent, and Internet Profiles, the first Internet measurement company. Mr. Carlick is presently a member of the board of directors of, SatMetrix Systems and Touchpoint, Inc., privately-held companies, and Ask Jeeves, a publicly-held company.

Andrew Sheehan has served as a Director since October 31, 2003. Mr. Sheehan is currently a member of eUniverse’s Compensation Committee. Mr. Sheehan joined VantagePoint Venture Partners, a venture capital firm, in November 2002, and he is presently a Managing Director with that firm. From April 1998 to October 2002, Mr. Sheehan was a Managing Member of the General Partner of ABS Capital Partners, a private equity firm. Mr. Sheehan is a member of the board of directors of BakBone Software, Inc., a storage management software company, and he serves on the boards of several publicly-held companies. Mr. Sheehan holds a B.A. from Dartmouth College and an M.B.A. from The Wharton School of Business.

4

Information Relating to Directors, Nominees and Executive Officers

Board of Directors Meetings and Board Committees

The Board held five meetings during the year ended March 31, 2003 (“fiscal year 2003”). All members of the Board during fiscal year 2003 attended all Board meetings held during the period that he was a director. In addition, all members of the Board during fiscal year 2003 attended all Board committee meetings on which he served held during the period that he served on the committee. The standing committees of the Board in fiscal year 2003 were the Audit, Compensation and Executive Committees. The Board dissolved the Executive Committee on August 9, 2002. The Board established a Nominating and Corporate Governance Committee on September 19, 2003. Information about the Audit, Compensation and Nominating and Corporate Governance Committees is as follows:

Name of Committee and Members | Functions of the Committees | Number of Meetings in Fiscal Year 2003 | ||

Audit | ||||

Daniel Mosher (1) Thomas Gewecke (2) Lawrence Moreau* (3) Jeffrey Lapin (4) Jeffrey Edell (5) | Oversees our financial reporting process and internal controls. See the Audit Committee’s Charter attached as Appendix C to this Proxy. | 7 | ||

Compensation | ||||

Brad Greenspan (6) Daniel Mosher (1) Brett Brewer (7) Thomas Gewecke (2) Jeffrey Edell (5) Bradley Ward (8) Andrew Sheehan (8) | Administers eUniverse’s 1999 Stock Awards Plan and reviews and recommends to the Board the compensation and benefits of Company officers and other senior executives. | 1 | ||

Nominating and Corporate Governance | ||||

Daniel Mosher (1) Lawrence Moreau (3) David Carlick (9) | Reviews and recommends nominees for the Board and reviews and recommends corporate governance policies and procedures. | N/A | ||

During fiscal year 2003, the Board acted by written consent on one occasion, the Compensation Committee acted by written consent on ten occasions and the Executive Committee acted by written consent on five occasions.

| * | Chairman |

| (1) | Re-elected to the Audit and Compensation Committees on October 23, 2002 and elected to the Nominating and Corporate Governance Committee on September 19, 2003. Resigned from the Compensation Committee on November 14, 2003. |

| (2) | Resigned from the Board and Audit and Compensation Committees on October 7, 2003. |

| (3) | Elected to the Audit Committee on May 27, 2003 and the Nominating and Corporate Governance Committee on September 19, 2003. |

| (4) | Resigned from the Board and Audit Committee on May 8, 2003. |

| (5) | Elected to the Audit and Compensation Committees on November 14, 2003. |

| (6) | Resigned from the Compensation Committee on November 14, 2003 and resigned from the Board on December 11, 2003. |

| (7) | Resigned from the Compensation Committee on November 14, 2003. |

| (8) | Elected to the Compensation Committee on November 14, 2003. |

| (9) | Elected to the Nominating Committee on November 14, 2003. |

5

Director Compensation in Fiscal Year 2003

Compensation of the Company’s Directors is determined by resolution of the Board in accordance with the Company’s Bylaws. Directors of eUniverse who are also Company employees or officers do not receive any compensation specifically related to their activities as directors. Directors are reimbursed for their expenses incurred in connection with their attendance at Board and Board committee meetings.

On April 17, 2000, Daniel Mosher, for his first year of service as a non-employee director, received an option to purchase 63,750 shares of the Company’s common stock at the market price on the date of grant, which vested on December 8, 2000, one year after the date that he became a director, and expires ten years after the date of grant (or sooner in the event Mr. Mosher’s relationship with the Company terminates). In July 2002, Mr. Mosher was paid $51,000 for cancellation of this option in connection with the Company’s cancellation of approximately 900,000 total options held by various Company stock option holders. On January 22, 2001, for his second year of service as a non-employee director, Mr. Mosher received an option to purchase 25,000 shares of the Company’s common stock at the market price on the date of grant, which vested on January 22, 2002 and expires ten years after the date of grant (or sooner in the event Mr. Mosher’s relationship with the Company terminates). On October 23, 2002, Mr. Mosher, for his continued service as a non-employee director, received an option to purchase 37,500 shares of the Company’s common stock at the market price on the date of grant, a portion of which vested on the date of the grant with the remainder to vest on the date of the Company’s next annual meeting of stockholders, and which option expires ten years after the date of grant (or sooner in the event Mr. Mosher’s relationship with the Company terminates). On June 25, 2003, the Company’s Board agreed, in recognition of Mr. Mosher’s service on the Audit Committee and the recently increased demands of such service, to pay Mr. Mosher $5,000 per month for the months June to October 2003.

On December 3, 2001, Thomas Gewecke, for his first year of service as a non-employee director, received an option to purchase 25,000 shares of the Company’s common stock at the market price on the date of grant, which vested on October 23, 2002. On October 23, 2002, Mr. Gewecke, for his second year of service as a non-employee director, received an option to purchase 25,000 shares of the Company’s common stock at the market price on the date of grant, which vests on the date of the Company’s next annual meeting of stockholders. The option expired due to Mr. Gewecke’s resignation from the Board.

Lawrence Moreau receives as compensation for his service on the Board and as Chairman of the Audit Committee of the Board, $9,250 per month.

On October 23, 2002, Jeffrey Lapin, for his first year of service as a non-employee director, received an option to purchase 33,333 shares of the Company’s common stock at the market price on the date of grant, 8,333 of which vested on grant and the remainder of which vested on the date of the Company’s next annual meeting of stockholders. This option expired due to Mr. Lapin’s resignation from the Board.

Independence of Directors and Audit Committee Financial Experts

The Board has determined that Daniel Mosher, Thomas Gewecke and Lawrence Moreau are independent directors, as independence is defined by the National Association of Securities Dealers’ listing standards in effect at the time of determination. The Board intends to make a determination in the near future regarding the independence of all non-management directors under the revised standards applicable to companies listed on The NASDAQ SmallCap Market and the standards adopted by the Securities and Exchange Commission. In addition, the Board has determined that Lawrence Moreau is an “Audit Committee financial expert” under rules adopted by the Securities and Exchange Commission.

Compensation Committee Interlocks and Insider Participation

No member of the Board or the Compensation Committee serves as a member of the board of directors or compensation committee of any entity that has one or more of the Company’s executive officers serving on such other company’s board of directors or compensation committee. During fiscal year 2003, the members of the

6

Compensation Committee were Brad Greenspan, Brett Brewer, Daniel Mosher and Thomas Gewecke. Mr. Greenspan was the Company’s Chief Executive Officer until October 30, 2003. Mr. Brewer is the Company’s President.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information as of December 1, 2003 with respect to the beneficial ownership of the Company’s voting securities by the following individuals or groups: (a) each person who is known by us to own beneficially more than 5% of the Company’s common stock, including our preferred stock on an as-converted basis, (b) each director and nominee, (c) each Named Executive Officer (as defined below under the caption Executive Compensation), and (d) all Named Executive Officers and directors as a group. Except as noted below, the address for each person listed in the table below is 6060 Center Drive, Suite 300, Los Angeles, CA 90045.

Name of Beneficial Owner | Shares Beneficially Owned (1) | Percentage Beneficially Owned (2) | ||||

Brett Brewer | 1,166,245 | (3) | 3.0 | % | ||

Thomas Flahie | — | — | ||||

Adam Goldenberg | 805,558 | (4) | 2.1 | % | ||

Christopher Lipp | 194,703 | (5) | * | |||

Brad Greenspan | 8,223,218 | (6) | 21.3 | % | ||

Daniel Mosher | 65,000 | (7) | * | |||

Lawrence Moreau | — | — | ||||

Jeffrey Edell | — | — | ||||

Bradley Ward | — | — | ||||

David Carlick | — | (8) | — | |||

Andrew Sheehan | — | (8) | — | |||

550 Digital Media Ventures, Inc. | 4,834,686 | (9) | 12.5 | % | ||

VantagePoint Venture Partners and Affiliates | 10,133,333 | (10) | 26.2 | % | ||

Directors and executive officers as a group | 10,454,724 | (11) | 27.0 | % |

| * | less than 1% |

| (1) | Unless otherwise noted, all of the shares shown are held by individuals or entities possessing sole voting and investment power with respect to the shares. Shares not outstanding but deemed beneficially owned by virtue of the right of a person to acquire them within 60 days, whether by the exercise of options or warrants or the conversion of shares of preferred stock into shares of common stock, are deemed outstanding in determining the number of shares beneficially owned by the person or group. We are treating our preferred stock and common stock as one class of voting securities because the holders of our preferred stock have the right to vote their shares with the common stock on an as-converted basis. |

| (2) | The Percentage Beneficially Owned is calculated by dividing the Number of Shares Beneficially Owned by the total outstanding shares of common stock and preferred stock on an as-converted basis including shares beneficially owned by the person with respect to whom the percentage is calculated. |

| (3) | Includes 979,167 shares represented by options exercisable within 60 days. |

| (4) | Includes 716,667 shares represented by options exercisable within 60 days. |

| (5) | Includes 191,667 shares represented by options exercisable within 60 days. |

| (6) | Includes 400,000 shares represented by options exercisable within 60 days. Mr. Greenspan’s address is 264 S. La Cienega, Suite 1218 Beverly Hills, CA 90211. |

| (7) | Includes 62,500 shares represented by options exercisable within 60 days. |

| (8) | Does not include any shares owned by VantagePoint Venture Partners of which Mr. Carlick and Mr. Sheehan are Managing Directors because they disclaim beneficial ownership. |

| (9) | Includes 3,366,154 shares of common stock and 1,468,532 shares of Series B preferred stock on an as-converted basis. Also includes 3,050,000 common shares and 1,295,455 Series B preferred shares which are subject to an option granted to VantagePoint. 550 Digital Media’s address is 550 Madison Avenue, New York, NY 10022. |

7

| (10) | Includes shares represented by an option to purchase 3,050,000 common shares and 1,295,455 Series B preferred shares from 550 Digital Media Ventures. VantagePoint’s address is 1001 Bay Hill Drive #300, San Bruno, CA 94066. |

| (11) | Includes 2,350,001 shares represented by options exercisable within 60 days. |

The number of shares to be issued upon exercise of outstanding options and warrants, and the number of shares remaining available for future issuance under the Company’s equity compensation plans at December 1, 2003 were as follows (in thousands, except per share data):

Plan Category | Number of securities to be issued upon outstanding warrants and | Weighted - average exercise of outstanding options, warrants and rights | Number of securities remaining available for issuance under equity plans (excluding securities reflected in column (a)) | ||||

| (a) | (b) | (c) | |||||

Equity compensation plan approved by stock holders (1) | 4,794,789 | $ | 2.68 | 3,344,085 | |||

Equity compensation plan not approved by stock holders (2) | 108,181 | $ | 2.66 | — | |||

Total | 4,902,970 | 3,344,085 | |||||

| (1) | The Company has reserved an aggregate of 9,000,000 shares of common stock for issuance under the Company’s 1999 Stock Award Plan. |

| (2) | The Company granted warrants to purchase common stock in connection with professional services at exercise prices ranging from $1.75 to $5.03 and with terms ranging from 1 to 4 years. |

Compensation Committee Report on Executive Compensation

General

The Compensation Committee of the Board makes decisions as to certain compensation of our executive officers.

Compensation Policies

Our philosophy is to tightly link executive compensation to corporate performance and returns to stockholders. A significant portion of executive compensation is dependent upon the Company’s success in meeting one or more specified goals and to the potential appreciation of the eUniverse common stock. Thus, a significant portion of an executive’s compensation is at risk. The goals of the compensation program are to attract and retain exceptional executive talent, to motivate these executives to achieve the Company’s business goals, to link executive and stockholders interests through equity-based plans, and to recognize individual contributions as well as overall business results.

Each year the Compensation Committee conducts a review of the Company’s executive compensation program. This review often includes data supplied by independent third party compensation consultants and is used to realign the Company’s compensation programs to other comparable rapidly growing companies in the technology space. The key elements of our executive compensation are generally base salary, bonus, stock options and benefits. The Compensation Committee’s policies with respect to each of the elements are discussed below. While the elements of compensation are considered separately, the Compensation Committee also takes into account the complete compensation package provided by eUniverse to the individual executive.

8

Base salaries for executive officers are determined by evaluating the responsibilities of the position and the experience of the individual, and by reference to the competitive marketplace for pertinent executive talent, including a comparison to base salaries for comparable positions at companies of similar size, complexity and within the same sector. Base salary adjustments are determined annually by evaluating the financial performance and, where appropriate, certain non-financial performance measures, of eUniverse, and the performance of each executive officer.

The Company’s executive officers are generally eligible for annual and other cash bonuses. At the beginning of each fiscal year, the Compensation Committee establishes both quarterly and annual individual and corporate performance objectives. For fiscal year 2003, the targets were based upon achieving certain profitability goals. A target amount payable was also established for each executive officer eligible for a particular bonus. The Compensation Committee also considers individual non-financial performance measures in determining bonuses. For fiscal year 2003, the bonus structure was modified to enable an executive officer to achieve a higher bonus than the targeted amount should the performance goals be exceeded by a certain percentage.

The purpose of the eUniverse stock awards plan is to provide an additional incentive to Company employees to work to maximize stockholder value. To this end, the Compensation Committee grants to key executives stock options under the Company’s 1999 Stock Awards Plan (the “1999 Plan”) which generally vest over a three-year period following the date of grant as follows: 33 1/3% on the first anniversary; and 1/8 each quarter thereafter. During the fourth quarter of fiscal year 2003, the stock vesting period was revised to four years from the date of grant with 25% vesting on the first anniversary and 1/12 each quarter thereafter. Options under the 1999 Plan are generally granted at the current market price, have a term of ten years from the date of grant and vested options may be exercised at any time during such term.

The benefits available to executive officers are the same as those afforded to all full-time employees, including medical, dental, death, disability coverage and a 401(k) plan.

Chief Executive Officer Compensation

The Board determined the components of Mr. Greenspan’s fiscal year 2003 compensation as follows:

Mr. Greenspan’s base salary of $185,000 was increased to $215,000 as of January 2, 2003 to reflect changes in market conditions and complexities in the business and for performance for the previous twelve-month period. Additionally, Mr. Greenspan was awarded a $42,500 bonus for fiscal year 2003 for achieving certain operating objectives, primarily relating to revenue growth and profitability during the first two quarters of the fiscal year. As of June 16, 2003, Mr. Greenspan voluntarily decided to cut his salary by 20% to $172,000, as a reflection of the Company’s restated quarterly financial results and lower than anticipated fiscal year 2003 results. In addition, Mr. Greenspan repaid the $42,500 bonus to the Company by tendering 17,782 shares of Company common stock.

On July 12, 2002, in connection with the Company’s cancellation of approximately 900,000 options, the Company paid $55,000 to Mr. Greenspan in exchange for the cancellation of 340,000 options. Mr. Greenspan was not awarded any stock options during fiscal year 2003.

Employment Agreements

The Company has no employment agreements with any of its officers or directors.

Other Executive Officer Compensation

The compensation plans of most of our other executive officers, including the persons listed in the Summary Compensation Table below, provide for a base salary, bonus, option grants under the 1999 Plan, and access to our standard employee benefit plans.

9

Submitted by the Compensation Committee of the Board:

Brad D. Greenspan

Daniel L. Mosher

Brett C. Brewer

Thomas Gewecke

Executive Compensation

The table below summarizes the compensation paid or awarded during the last three fiscal years to our Chief Executive Officer and our four other most highly compensated executive officers. These executives are referred to as the Named Executive Officers elsewhere in this Proxy Statement.

SUMMARY COMPENSATION TABLE

(in thousands)

NAME AND PRINCIPAL POSITION | LONG–TERM COMPENSATION | ALL OTHER ($)(10) | |||||||||||||

| AWARDS | |||||||||||||||

| ANNUAL COMPENSATION | |||||||||||||||

FISCAL YEAR | SALARY ($) | BONUS ($) | OTHER ANNUAL COMPENSATION ($) | SECURITIES UNDERLYING OPTIONS # | |||||||||||

Brad D. Greenspan Chairman of the Board and Chief Executive Officer | 2003 2002 2001 |

| 192 178 100 | 43 95 — | (1)

| 55 — 50 | (2)

(3) | — 800 — | 6 — — | ||||||

Brett C. Brewer President and Director | 2003 2002 2001 |

| 174 132 105 | 33 99 — | (1)

| 55 — — | (4)

| — 500 750 | 10 1 — | ||||||

Joseph L. Varraveto Executive Vice President and Chief Financial Officer | 2003 2002 2001 |

(5) | 181 160 38 | 30 60 — |

| — — — |

| 60 50 350 | 12 2 — | ||||||

Adam Goldenberg Chief Operating Officer | 2003 2002 2001 |

(6) | 156 124 96 | 132 109 — | (1)

| 62 — — | (7)

| — 675 175 | 13 3 — | ||||||

Christopher S. Lipp Senior Vice President and General Counsel and Secretary | 2003 2002 2001 |

(9) | 151 135 91 | 18 38 — | (1)

| 60 — — | (8)

| — 150 150 | 12 12 2 | ||||||

| (1) | Brad Greenspan, Brett Brewer and Christopher Lipp, entered into agreements with the Company in August 2003 to repay the bonuses they received during fiscal year 2003 amounting to $42,500, $33,000 and $18,125, respectively. Under the agreements, repayment of the bonuses could be made in cash, Company common stock or a combination thereof. The value of the common stock is determined based on the average closing price of the common stock for the ten trading-day period ending on the 30th day after trading in the Company’s common stock resumes. By October 14, 2003, the 30th day after trading resumed, Brad Greenspan had tendered 17,782 shares of common stock, Brett Brewer had tendered 8,922 shares of common stock and had paid $11,677 in cash and Christopher Lipp had paid $18,125 in cash to repay the bonuses. Adam Goldenberg repaid the portion of the $132,000 bonus he received during fiscal year 2003 which would not have been paid based upon the restated fiscal year 2003 financial statements. By October 14, 2003, Adam Goldenberg had paid $106,320 in cash. |

| (2) | On July 12, 2002, in connection with the Company’s cancellation of approximately 900,000 total options, the Company paid $55,000 to Mr. Greenspan in exchange for the cancellation of 340,000 options. |

10

| (3) | Represents consulting fees paid to Mr. Greenspan prior to his appointment as Chief Executive Officer of eUniverse on August 29, 2000. |

| (4) | On July 12, 2002, in connection with the Company’s cancellation of approximately 900,000 total options, the Company paid $55,000 to Mr. Brewer in exchange for the cancellation of 75,000 options. |

| (5) | Mr. Varraveto was appointed as Executive Vice President and Chief Financial Officer of eUniverse on January 2, 2001. Mr. Varraveto resigned effective as of August 19, 2003. |

| (6) | Mr. Goldenberg was appointed Chief Operating Officer in October 2001. |

| (7) | On July 12, 2002, in connection with the Company’s cancellation of approximately 900,000 total options, the Company paid $62,334 to Mr. Goldenberg in exchange for the cancellation of 85,000 options. |

| (8) | On July 12, 2002, in connection with the Company’s cancellation of approximately 900,000 total options, the Company paid $60,000 to Mr. Lipp in exchange for the cancellation of 100,000 options. |

| (9) | Mr. Lipp was appointed Secretary on March 30, 2001, was promoted to General Counsel on May 1, 2001, and promoted to Senior Vice President, General Counsel on October 26, 2001. |

| (10) | These are non-accountable automobile allowance payments. |

As of the date of this Proxy Statement, our current executive officers are:

Name | Age | Position | Executive Officer Since | |||

Brett Brewer | 31 | President | August 29, 2000 | |||

Thomas Flahie | 46 | Chief Financial Officer | August 25, 2003 | |||

Adam Goldenberg | 22 | Chief Operating Officer | October 26, 2001 | |||

Christopher Lipp | 32 | Secretary, Senior Vice President and General Counsel | March 30, 2001 | |||

For Brett Brewer’s biography, please see Nominees for Election of Directors in this Proxy Statement. The biographical descriptions of our other current executive officers are as follows:

Thomas Flahie has served as Chief Financial Officer since August 25, 2003 and as a Director and President of the Company’s subsidiary Download Solutions, Limited. He was the Chief Financial Officer of eLabor, Inc. from June 2000 to March 2003 and the Senior Vice President of Finance and Administration of Balance Bar Company from February 1998 to March 2000. Mr. Flahie was a director of Bariatrix Products International Incorporated, a company in which Balance Bar Company had an investment, from May 1999 to March 2000. From December 1978 to February 1998, he held various positions with Andersen Worldwide, an international accounting and consulting firm. He was a partner with Andersen Worldwide for the last seven years. Mr. Flahie is a Certified Public Accountant and he received his BS in Business Administration from the University of Arizona.

Adam Goldenberg has served as Chief Operating Officer since October 26, 2001. In 1997, Mr. Goldenberg founded Gamer’s Alliance, Inc., an online entertainment portal, and served as its President before and after it was acquired by eUniverse in April 1999. Mr. Goldenberg served as Vice President, Strategic Planning of eUniverse from April 1999 to October 2001.

Christopher Lipp has served as Senior Vice President and General Counsel since October 26, 2001, Vice President, General Counsel since May 1, 2001, Secretary since March 30, 2001 and Vice President, Business and Legal Affairs since January 11, 2000. Prior to joining eUniverse, Mr. Lipp was employed as an attorney in the Intellectual Property Group of Pillsbury Madison & Sutro LLP in Los Angeles, California. He has been a member of the California State Bar since 1997. Mr. Lipp received his J.D. from the University of Southern California Law School and a B.A. degree in government and sociology from Georgetown University.

11

The following table summarizes the option grants to the Named Executive Officers in the last fiscal year:

Option Grants in Last Fiscal Year

Name | Number of Securities Underlying Options Granted | % of Total Options Granted to Employees in Fiscal Year | Exercise Price $/Share | Expiration Date | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Options Term | |||||||||||

| 5% | 10% | |||||||||||||||

Brad Greenspan | — | — | $ | — | — | $ | — | $ | — | |||||||

Brett Brewer | — | — | — | — | — | — | ||||||||||

Joseph Varraveto | 60,000 | 10 | % | 5.10 | July 9, 2012 | 192,442 | 487,685 | |||||||||

Adam Goldenberg | — | — | — | — | — | — | ||||||||||

Christopher Lipp | — | — | — | — | — | — | ||||||||||

One-third of the options vest and are exercisable one year from the date of grant. Thereafter, one-eighth of the remaining options vest and are exercisable each three months thereafter until all optioned shares are vested.

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-end Option Values

Name | Number of shares acquired exercise | Value Realized | Number of securities underlying unexercised options/SAR’s at fiscal year-end | Value of unexercised in-the-money options/SAR’s at fiscal year-end | |||||||||||

| Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||||||

Brad D. Greenspan | — | $ | — | 666,667 | 113,333 | $ | 1,560,001 | $ | 311,999 | ||||||

Brett C. Brewer | — | — | 916,667 | 333,333 | 2,363,751 | 936,249 | |||||||||

Joseph L. Varraveto | — | — | 262,500 | 197,500 | 752,792 | 395,708 | |||||||||

Adam Goldenberg | — | — | 510,417 | 339,583 | 1,478,751 | 939,249 | |||||||||

Christopher S. Lipp | 87,500 | 289,198 | 112,500 | 100,000 | 263,250 | 280,875 | |||||||||

Certain Relationships and Related Transactions

In March 2003, Sony Music Entertainment (“Sony”), its 550 Digital Media Ventures affiliate, and the Company agreed to modify certain terms of Sony’s preferred stock investment in and 550 Digital Media Venture’s convertible note due from the Company. Under the terms of the amendment, the maturity date of the 550 Digital Media Ventures’ $2,290,000 loan to the Company was extended until March 31, 2005, and we agreed not to exercise our right, triggered by the Company’s achievement of certain earnings before interest, taxes, depreciation and amortization milestones, to convert Sony’s Series B preferred stock into common stock. The Company also agreed to make available to Sony limited marketing and advertising services to promote Sony Music recording artist releases or other products and services of Sony or its affiliates. Finally, the agreement provided for subordination of 550 Digital Media Venture’s security interest in our assets to a $10 million working capital line of credit. The 550 Digital Media Ventures note was originally issued in September 2000 in connection with a marketing agreement between the Company and two Internet publishing affiliates of Sony. The loan was amended and restated in connection with Sony’s October 2001 investment in the Company.

Pursuant to the Certificate of Designation of Series B preferred stock, 550 Digital Media Ventures, as the majority holder of our Series B preferred stock, has the exclusive right, voting separately as a single class, to elect two directors in the event the Board consists of six to eight members. 550 Digital Media Ventures has notified the Company that it intends to elect Jeffrey Edell to the Board and leave one Series B Board seat vacant at this time. 550 Digital Media Ventures can fill this Board seat at any time.

12

On October 31, 2003, VantagePoint invested $8 million in our Company by purchasing 5,333,333 shares of a new series of convertible preferred stock, designated Series C convertible preferred stock. VantagePoint will receive an additional 426,667 shares of Series C preferred stock as dividends during the year ended October 31, 2004. The Company allocated 20 million shares of authorized preferred stock for the Series C preferred stock and has reserved shares of common stock for conversion of the Series C preferred stock into common stock. In addition, on July 15, 2003, 550 Digital Media Ventures and VantagePoint entered into an option agreement pursuant to which VantagePoint may purchase up to 3,050,000 shares of our common stock and 1,750,000 shares of our Series B preferred stock owned by 550 Digital Media Ventures until January 16, 2004. On October 31, 2003, the option term was extended to April 16, 2004 and VantagePoint agreed to partially exercise its option and purchase 454,545 shares of our Series B preferred stock from 550 Digital Media Ventures for $500,000. 550 Digital Media Ventures also agreed to release the Company from any claims that it may have, other than claims relating to the outstanding $1,790,000 convertible secured promissory note held by 550 Digital Media Ventures, including the related security interest, and any current advertising arrangements with the Company. In connection with the transaction, 550 Digital Media Ventures waived its anti-dilution protection, preemptive rights and rights of first refusal. 550 Digital Media Ventures agreed to vote in favor of VantagePoint’s investment and loan transactions at any Company stockholder meeting or by written consent and not sell any of its Company stockholdings until such transactions are completed.

As consideration for the option, 550 Digital Media Ventures sold to VantagePoint a $500,000 convertible promissory note due from the Company. In anticipation of the preferred stock investment, on July 15, 2003, VantagePoint loaned $2 million to the Company. VantagePoint and the Company agreed to terminate the $500,000 convertible promissory note and issue to VantagePoint a new $2.5 million promissory note. The $2.5 million note bears interest at 8% and is collateralized by a security interest in all of the Company’s assets. The Company and VantagePoint also agreed that in the event that VantagePoint does not exercise the option within 120 days of its grant, VantagePoint may transfer the option to the Company in exchange for a warrant to purchase 200,000 shares of the Company’s Series B preferred stock at $2.50 per share expiring three years from the date of issuance. This term has now expired and VantagePoint may not transfer the option to the Company.

On October 31, 2003, VantagePoint agreed to make available to the Company or give a bank guarantee for a bank to make available to the Company, a $4 million one-year senior secured bridge loan for certain proposed new business ventures. The bridge loan would bear interest at the prime rate and be secured by a security interest in all of our assets that is senior to the $2.5 million note from VantagePoint and the $1,790,000 note with 550 Digital Media Ventures. The senior secured bridge loan will be available to the Company to be drawn down until February 28, 2004. If the Company draws upon the senior secured bridge loan, for each $1 million in loan proceeds we receive the Company will issue a warrant to purchase 250,000 shares of Series C preferred stock at $2.00 per share expiring five years from the date of issuance. In addition, as of October 31, 2003, the Company amended the terms of the $2.5 million note due to VantagePoint to change the due date to February 8, 2004 (ten days after the annual stockholder’s meeting) and agreed to seek stockholder approval to permit VantagePoint to convert the note to a prospective series of Company preferred stock, which will be designated Series C-1 preferred stock, at the rate of one share for each $2.00 of principal. If the stockholders approve the addition of the conversion feature to the note, the maturity date of the note will be October 31, 2004.

In connection with the VantagePoint transactions, the Company entered into a management rights agreement pursuant to which VantagePoint is entitled to consult with and advise the Company’s management on significant business issues, inspect the Company’s books and records and appoint a representative to attend all meetings of the Board as a non-voting observer.

As part of the transaction, VantagePoint appointed Andrew Sheehan and David Carlick to the Company’s Board. The Company entered into indemnification agreements with Mr. Sheehan and Mr. Carlick that grant the new directors more extensive indemnity rights than provided under the Delaware General Corporate Law.

13

Accounting Restatement

On August 22, 2003, the Company restated its previously reported quarterly financial results for the first three quarters of the year ended March 31, 2003 because of accounting errors it had previously identified in the Company’s financial statements. As a result of the discovery of the accounting errors, management and the Audit Committee initiated an internal review of its accounting records and its accounting policies and procedures. In an effort to identify the extent of the accounting errors, and to identify any deficiencies in the Company’s system of internal controls that gave rise to the errors, management significantly expanded its accounting and finance staff and retained an outside accounting firm to assist in the process. The Company’s Board also directed the Audit Committee to explore the facts and circumstances giving rise to the restatement as well as to evaluate the Company’s accounting practices, policies and procedures. During management’s and the Audit Committee reviews of the Company’s accounting records and procedures, and during the audit of the Company’s financial statements for fiscal year 2003, a variety of deficiencies in internal controls were identified. We believe such deficiencies were attributable to the following broad factors: insufficient supervision and oversight of the Company’s accounting systems and personnel; a poorly designed, non-integrated accounting system; the rapid growth in our business operations during fiscal year 2003; difficulties in absorbing and integrating the acquisition of a sizable e-commerce company, ResponseBase, during the third and fourth quarters of fiscal year 2003; the loss of critical personnel; and, limited human resources in the accounting and financial reporting function. Further information about the nature of the restatement adjustments is presented in “Business-Recent Events-Restatement” and “Item 14-Controls and Procedures” in the Company’s Annual Report on Form 10-K for the Year Ended March 31, 2003.

In response to the Company’s restatement announcement on May 6, 2003, NASDAQ halted trading of the Company’s common stock. On June 13, 2003, the Company received a NASDAQ Staff Determination stating that its common stock was subject to delisting from The NASDAQ SmallCap Market due to the NASDAQ Staff’s inability to assess the Company’s current financial position and the Company’s ability to sustain compliance with NASDAQ’s continued listing requirements. On July 2, 2003, the Company received notice of an additional listing deficiency from NASDAQ indicating that the Company was not in compliance with the filing requirement for continued listing due to the Company’s failure to timely file its Annual Report on Form 10-K for the Year Ended March 31, 2003. The Company filed its Annual Report on Form 10-K for the Year Ended March 31, 2003 on August 22, 2003. The Company appealed the NASDAQ Staff’s determination to delist the Company’s securities to a Listing Qualifications Hearings Panel (the “Panel”). On July 31, 2003, the Company presented to the Panel its plan for providing current financial information to the market place and regaining compliance with Securities and Exchange Commission and NASDAQ reporting requirements. The Panel decided to delist the Company’s securities from The NASDAQ SmallCap Market on September 2, 2003. The Company’s common stock has been trading on what is commonly called the “pink sheets” since September 2, 2003. The Company appealed the Panel’s decision and the Panel is currently investigating if public interest concerns currently exist and if the Company is in compliance with current listing standards. A number of market makers have informed the Company that they have or intend to apply to the OTC Bulletin Board to make a market in the Company’s common stock. On October 21, 2003, the National Association of Security Dealers (“NASD”) informed one market maker that the NASD needs additional information in order to determine if they will permit the market maker to make a market for the Company’s common stock on the OTC Bulletin Board.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended (Section 16(a)) requires eUniverse’s executive officers, directors, and persons who own more than 10% of a registered class of eUniverse’s equity securities (10% Stockholders) to file reports of ownership on a Form 3 and changes in ownership on a Form 4 or a Form 5 with the SEC.

Based solely on its review of the copies of such forms received by eUniverse, or written representations from certain reporting persons, eUniverse believes that during fiscal year 2003 its executive officers, directors

14

and 10% Stockholders complied with all applicable Section 16(a) filing requirements, except that a Form 4 required to be filed by Joseph Varraveto (who was an executive officer of eUniverse during fiscal year 2003) and the Form 5’s required to be filed by Thomas Gewecke and Jeffrey Lapin (each of whom was a director of eUniverse during fiscal year 2003) were inadvertently filed late.

Performance Graph

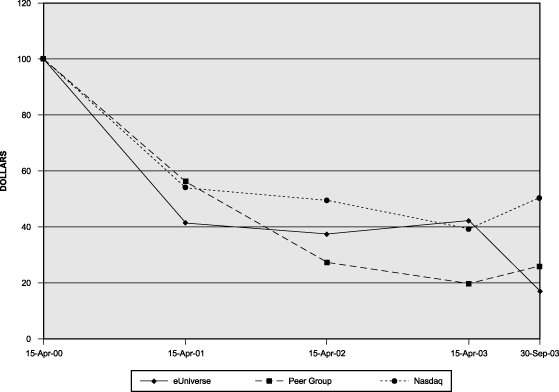

The following graph compares the yearly percentage change in the cumulative total stockholder return on the Company’s common stock to the cumulative total return of the NASDAQ Composite Index and a peer group of Internet stocks for the period April 15, 2000 to September 30, 2003. The peer group selected by Company consists of AOL Time Warner, Inc., CNET Networks, Inc., Valueclick, Inc., Doubleclick, Inc. and Yahoo, Inc. In the proxy statement for the 2002 annual meeting of stockholders, the Company included Overture Services, Inc. in the peer group. Overture Services, Inc. was acquired by Yahoo, Inc. in October 2003 and we substituted Valueclick, Inc. in its place. The graph assumes that the value of the investment in the Company’s common stock and the comparison index was $100 on April 15, 2000 and assumes the reinvestment of dividends. The Company has never declared a dividend on its common stock. The stock price performance depicted in the graph below is not necessarily indicative of future price performance.

The Company’s common stock began trading on The NASDAQ SmallCap Market on April 15, 2000 under the symbol EUNI. From April 1999 to March 2000 the Company’s common stock was traded on the OTC Bulletin Board. NASDAQ delisted the Company’s common stock from The NASDAQ SmallCap Market on September 2, 2003. The Company’s common stock has been trading on what is commonly called the “pink sheets” since September 2, 2003 under the symbol EUNI.PK.

15

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee (the “Nominating Committee”) is responsible for determining the slate of director nominees for consideration by the Company’s Board, identifying and nominating candidates to fill Board vacancies occurring between annual stockholder meetings, and reviewing, evaluating, and recommending changes to the Company’s corporate governance guidelines. The Nominating Committee expects to periodically review the compensation paid to non-employee directors, including Board and committee chairs, and meeting fees, if any, and make recommendations to the Board for any changes. The Nominating Committee also expects to regularly review the charters of Board committees and, after consultation with the respective committee chairs, make recommendations, if necessary, about changes to the charters. The Nominating Committee will also consider stockholder recommendations for candidates for the Board. The name of any recommended candidate for director, together with a brief biographical sketch, a document indicating the candidate’s willingness to serve, if elected, and evidence of the nominated person’s ownership of Company stock should be sent to the attention of the Office of the Secretary as further discussed below in Stockholder Proposals and Communications with Directors.

The Nominating Committee is responsible for and has determined the qualifications of director nominees by considering the Company’s needs for business and other experience relevant to the issues impacting the Company. The Nominating Committee also considers the qualifications of director candidates put forth by stockholders. No candidates were recommended by stockholders. The Nominating Committee reviewed the performance and effectiveness of each existing member of the Board, their qualifications, including capability to serve, conflicts of interest, and other relevant factors. The Nominating Committee has not retained any third party to assist in the review process.

The Nominating Committee has recommended to the Board that the Board nominate Brett Brewer, Daniel Mosher, Lawrence Moreau and Bradley Ward as Company directors, each for a term of office that runs until the 2004 annual stockholders meeting and until his successor has been elected and has qualified. Brad Greenspan, the Company’s former Chairman and Chief Executive Officer, has formally notified the Company that he plans to nominate a slate of directors to be voted upon at the stockholder’s meeting in opposition to the slate of directors nominated by the Board. See the section of this proxy statement entitled “Stockholder Action” for more information. In the event that Mr. Greenspan proceeds to take actions in connection with his plan, the Company will promptly file supplemental proxy materials with the SEC to inform our stockholders of Mr. Greenspan’s actions and the Company’s reactions to them.

Proposal 2 – To Approve the Issuance of a Warrant to VantagePoint if We Draw Down on a $4 Million Loan Commitment and the Modification of the Terms of an Existing Note Due to VantagePoint, including the Preferred Stock Issuable on Exercise or Conversion and the Conversion of the Preferred Stock into Common Stock at the Applicable Conversion Rate.

On October 31, 2003, VantagePoint invested $8 million in our Company by purchasing 5,333,333 shares of a new series of convertible preferred stock, designated Series C convertible preferred stock. VantagePoint will receive an additional 426,667 shares of Series C preferred stock as dividends during the year ended October 31, 2004. The Company allocated 20 million shares of authorized preferred stock for the Series C preferred stock and has reserved shares of common stock for conversion of the Series C preferred stock into common stock. In addition, on July 15, 2003, 550 Digital Media Ventures and VantagePoint entered into an option agreement pursuant to which VantagePoint may purchase up to 3,050,000 shares of our common stock and 1,750,000 shares of our Series B preferred stock owned by 550 Digital Media Ventures until January 16, 2004. On October 31, 2003, the option term was extended to April 16, 2004 and VantagePoint agreed to partially exercise its option and purchase 454,545 shares of our Series B preferred stock from 550 Digital Media Ventures for $500,000. 550 Digital Media Ventures also agreed to release the Company from any claims that it may have, other than claims

16

relating to the outstanding $1,790,000 convertible secured promissory note held by 550 Digital Media Ventures, including the related security interest, and any current advertising arrangements with the Company. In connection with the transaction, 550 Digital Media Ventures waived its anti-dilution protection, preemptive rights and rights of first refusal. 550 Digital Media Ventures agreed to vote in favor of VantagePoint’s investment and loan transactions at any Company stockholder meeting or by written consent and not sell any of its Company stockholdings until such transactions are completed.

As consideration for the option, 550 Digital Media Ventures sold to VantagePoint a $500,000 convertible promissory note due from the Company. In anticipation of the preferred stock investment, on July 15, 2003, VantagePoint loaned $2 million to the Company. VantagePoint and the Company agreed to terminate the $500,000 convertible promissory note and issue to VantagePoint a new $2.5 million promissory note. The $2.5 million note bears interest at 8% and is collateralized by a security interest in all of the Company’s assets. The Company and VantagePoint also agreed that in the event that VantagePoint does not exercise the option within 120 days of its grant, VantagePoint may transfer the option to the Company in exchange for a warrant to purchase 200,000 shares of the Company’s Series B preferred stock at $2.50 per share expiring three years from the date of issuance. This term has now expired and VantagePoint may not transfer the option to the Company.

On October 31, 2003, VantagePoint agreed to make available to the Company or give a bank guarantee for a bank to make available to the Company, a $4 million one-year senior secured bridge loan for certain proposed new business ventures. The bridge loan would bear interest at the prime rate and be secured by a security interest in all of our assets that is senior to the $2.5 million note from VantagePoint and the $1,790,000 note with 550 Digital Media Ventures. The senior secured bridge loan will be available to the Company to be drawn down until February 28, 2004. If the Company draws upon the senior secured bridge loan, for each $1 million in loan proceeds we receive the Company will issue a warrant to purchase 250,000 shares of Series C preferred stock at $2.00 per share expiring five years from the date of issuance (the “Bridge Warrant”). In addition, as of October 31, 2003, the Company amended the terms of the $2.5 million note due to VantagePoint to change the due date to February 8, 2004 (ten days after the annual stockholder’s meeting) and agreed to seek stockholder approval to permit VantagePoint to convert the note to a prospective series of Company preferred stock, which will be designated Series C-1 preferred stock, at the rate of one share for each $2.00 of principal. If the stockholders approve the addition of the conversion feature to the note, the maturity date of the note will be October 31, 2004.

In connection with the VantagePoint transactions, the Company entered into a management rights agreement pursuant to which VantagePoint is entitled to consult with and advise the Company’s management on significant business issues, inspect the Company’s books and records and appoint a representative to attend all meetings of the Board as a non-voting observer.

As part of the transaction, VantagePoint appointed Andrew Sheehan and David Carlick to the Company’s Board. The Company entered into indemnification agreements with Mr. Sheehan and Mr. Carlick that grant the new directors more extensive indemnity rights than provided under the Delaware General Corporate Law.

The net proceeds, if any, from the exercise of the Bridge Warrant are expected to be used to fund working capital and general corporate purposes, and could result in the issuance of 1,000,000 additional shares of Series C preferred stock, a 2.8% increase in the number of outstanding shares. If the $2.5 million convertible secured promissory note payable to VantagePoint is converted to Series C-1 preferred stock, the current portion of long-term debt would be reduced by $2.5 million, stockholders’ equity would be increase by $2.5 million and 1,250,000 shares of Series C-1 preferred stock would be issued. This would represent a 3.4% increase in the number of outstanding shares. The Company’s cash and cash equivalents at September 30, 2003 were $2.0 million and the Company raised approximately $10.5 million in proceeds from private placements of preferred and common stock subsequent to September 30, 2003.

The NASDAQ Marketplace Rules require listed companies to obtain stockholder approval prior to issuing 20% or more of their common stock or voting power. In the aggregate, the VantagePoint transactions could result in

17

the issuance of additional securities that are greater than 20% of the Company’s outstanding common stock, on an as-converted basis. Although the Company was delisted from The NASDAQ SmallCap Market, we have appealed the NASDAQ Listing Qualifications Hearings Panel’s decision and are seeking reinstatement on The NASDAQ SmallCap Market. As such, the Company is determined to comply with all NASDAQ rules and regulations. Therefore, we are seeking to obtain stockholder approval for the issuance to VantagePoint of the shares of Series C and C-1 preferred stock underlying the amended and restated $2.5 million convertible secured promissory note and the Bridge Warrant, including the preferred stock issuable on exercise or conversion and the conversion of the preferred stock into common stock at the applicable conversion rate. The Bridge Warrant and the amended and restated $2.5 million convertible secured promissory note are attached as Appendix A and D, respectively.

Recommendation of the Board:

The Board recommends a vote “FOR” the approval of (1) the issuance to VantagePoint of up to 1,000,000 shares of eUniverse, Inc. Series C preferred stock issuable upon the exercise of the warrant issued as consideration for the $4 million bridge loan to the Company and (2) the issuance of the shares of Series C-1 preferred stock issuable upon the conversion of the amended and restated $2.5 million convertible secured promissory note payable to VantagePoint that are convertible into common stock at the applicable conversion rate.

The following is a summary of the terms of the new Series C preferred stock. Please refer to the Series C Certificate of Designation attached as Appendix B for the full terms of this preferred stock. The Series C-1 Certification of Designation is substantially the same as the Series C Certificate of Designation. The Series C and C-1 are treated as a single class of stock with the same rights and preferences, except that the Series C-1 Certificate of Designation provides for a liquidation preference and initial conversion rate of $2.00 per share instead of $1.50 per share.

Series C preferred stockholders are entitled to vote with the common stockholders, Series A preferred stockholders and Series B preferred stockholders as a single class on an as-converted basis on all matters voted on by stockholders, except for matters directly affecting the rights of each series of preferred stock which may only be voted upon by stockholders of the affected series. The current conversion rate for the Series A preferred stock is one-for-one plus 6% accretion from April 14, 1999, the current conversion rate for the Series B preferred stock is one-for-one and the current conversion rate for the Series C preferred stock is one-for-one.

Series C stockholders will receive stock dividends, accruing on a daily basis from November 1, 2003 to October 31, 2004, at an annual rate of 8%. Series C stock dividends will be distributed quarterly on March 31, June 30, September 30, and December 31 of each year. If and when declared by the Board, the Series C stockholders will also receive common stock dividends based on the current Series C preferred stock conversion ratio at that time.

The Series C preferred stock has registration rights and anti-dilution protection. In the event the Company proposes to issue or sell capital stock (other than certain excluded stock), Series C stockholders have the right to purchase their pro rata share of the offering.

Series C stockholders have the right to convert any or all of their Series C preferred stock into common stock at any time. Each share of Series C preferred stock will be converted to shares of common stock at an initial conversion price of $1.50, subject to any adjustment to account for any increase or decrease in the number of outstanding shares of common stock by a stock split, stock dividend, or other similar event. The conversion price per share of Series C preferred stock may be adjusted downward in the event we acquire or issue any shares of common stock (other than an issuance of common stock as a stock split, stock dividend or other similar event), options to purchase or rights to subscribe for common stock, securities by their terms that are convertible into or exchangeable for common stock or options to purchase or rights to subscribe for convertible or exchangeable securities (other than certain excluded stock), without consideration or for consideration per share less than the

18

then-current conversion price (initially $1.50 per share). All shares of Series C preferred stock will automatically convert into common stock upon the written consent of holders of more than 50% of the issued and outstanding shares of Series C preferred stock.

For distributions of assets upon liquidation, dissolution or winding up of the Company, our preferred stockholders will receive a liquidation preference equal to the aggregate original issue price of their preferred stock plus accrued and unpaid stock and cash dividends, and thereafter will participate pro rata with the common stockholders on an as-converted basis. In the event that the full liquidation preference cannot be paid, the Series C preferred stockholders are entitled to receive the Series C preference amount plus the unpaid stock and cash dividends, prior and in preference to any other class of stock that has been designated as junior in rank to the Series C preferred stock. The Series C preferred stock ranks senior to the Series B preferred stock which ranks senior to the Series A preferred stock.

Series C stockholders have the exclusive right, voting separately as a single class, to elect two members to the Board as long as 51% or more of the originally issued shares of Series C preferred stock remains outstanding. A director that is designated by the Series C preferred stockholders may only be removed by the written consent or affirmative vote of at least a majority of the shares held by the Series C stockholders. If for any reason a director that is designated by the Series C preferred stockholders resigns or is otherwise removed from the Board, then his or her replacement will be a person elected by the Series C stockholders.

So long as 51% or more of the original issue of Series C preferred stock remains outstanding, the Company will not, without the written consent or affirmative vote of at least two-thirds of the shares held by Series C preferred stockholders, (1) amend, alter, waive or repeal, whether by merger, consolidation, combination, reclassification or otherwise, the Company’s Certificate of Incorporation, including the Series C Certificate of Designation, or the Company’s Bylaws or any provisions thereof including the adoption of a new provision, (2) increase the size of the Board beyond nine members, or (3) authorize or issue any class, series or shares of preferred stock or any other class of capital stock ranking either as to payment of dividends, distributions or as to distributions of assets upon liquidation prior to or on parity with the Series C preferred stock. The vote of at least two-thirds of the outstanding shares of Series C preferred stock, voting separately as one class, is necessary to adopt any alteration, amendment or repeal of any provision of these protective provisions, in addition to any other stockholder vote required by law.

The Series C Certificate of Designation also provides that so long as VantagePoint owns at least 2,666,667 shares of Series C preferred stock or common stock, as adjusted for any stock split, combination, reorganization, reclassification, stock dividend, stock distribution or similar event, the Company will not, without the written consent or affirmative vote of at least two-thirds of the Board (1) enter into an agreement to, or consummate, a reorganization, merger, change of control or consolidation of the Company or sale or other disposition of all or substantially all of the Company’s assets, (2) enter into transactions which result in or require the Company to issue shares of its capital stock in excess of 5% in any one transaction, or 12.5% in the aggregate, in a series of transactions, of the Company’s issued and outstanding shares of capital stock, (3) enter into transactions which result in or require the Company to pay, whether in cash, stock or a combination thereof, in excess of 5% in any one transaction, or 12.5% in the aggregate, in a series of transactions, of the Company’s current market capitalization, (4) increase or decrease the number of authorized shares of capital stock, (5) directly or indirectly declare or pay any dividend or make any other distribution, or directly or indirectly purchase, redeem, repurchase or otherwise acquire any shares of capital stock of the Company or any of its subsidiaries, whether in cash or property or in obligations of the Company or any Company subsidiary, other than repurchases pursuant to an employee’s employment or incentive agreement, or upon an employee’s termination and at a price not to exceed such employee’s cost, or (6) increase or decrease the size of the Board, provided that in no event shall the total number of members of the Board of Directors exceed nine.

19

Proposal 3. To Approve Amendments to the Series A and Series B Certificates of Designation.

As part of the VantagePoint transactions that are discussed in Proposal 2, we obtained the consent of the Series A and Series B stockholders to amend the Series A and Series B Certificates of Designation as described below. The consent of the Company’s stockholders is generally required under Delaware law to formally amend the Certificates of Designation which form a part of the Company’s Certificate of Incorporation.

The Series A stockholders consented to delete Section 12 from the Series A Certificate of Designation. Section 12 reads as follows:

“Section 12. Event of Default.

(a)Holder’s Option to Demand Prepayment. Upon the occurrence of an Event of Default (as herein defined), each Holder shall have the right to elect at any time and from time to time prior to the cure by Company of such Event of Default to have all or any portion of such Holder’s then outstanding Series A Preferred Stock prepaid by the Company for an amount equal to the Holder Demand Prepayment Amount (as defined below).