Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 |

|

| Filed by the registrant [X] |

| Filed by a party other than the registrant [ ] |

|

|

| Check the appropriate box: |

| [ ] | Preliminary proxy statement | [ ] | Confidential, For Use of the Commission |

| [X] | Definitive proxy statement | | Only (as permitted by Rule 14a-6(e)(2)) |

| [ ] | Definitive additional materials |

| [ ] | Soliciting material pursuant to Rule 14a-11(c) or Rule 14a-12 |

|

EVERTRUST FINANCIAL GROUP, INC.

|

| (Name of Registrant as Specified in Its Charter) |

|

EVERTRUST FINANCIAL GROUP, INC.

|

| (Name of Person(s) Filing Proxy Statement) |

|

| Payment of filing fee (Check the appropriate box): |

| [X] | No fee required. |

| [ ] | $500 per each party to the controversy pursuant to Exchange Act Rule 14a-6(i)(3). |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

|

| (1) | Title of each class of securities to which transaction applies: |

N/A

|

| (2) | Aggregate number of securities to which transactions applies: |

N/A

|

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule |

| 0-11: |

N/A

|

| (4) | Proposed maximum aggregate value of transaction: |

N/A |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11 (a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

|

| (1) | Amount previously paid: |

N/A

|

| (2) | Form, schedule or registration statement no.: |

N/A

|

| (3) | Filing party: |

N/A

|

| (4) | Date filed: |

N/A

|

|

<PAGE> June 19, 2003

Dear Fellow Stockholder:

You are cordially invited to attend the annual meeting of stockholders of EverTrust Financial Group, Inc. ("Company"). The meeting will be held at the Everett Golf & Country Club located at 1500 52nd Street in Everett, Washington, on Thursday, July 24, 2003 at 7:00 p.m., local time.

The Notice of Annual Meeting of Stockholders and Proxy Statement appearing on the following pages describes the formal business to be transacted at the meeting. Please take a moment to read this material. When you have finished, please mark, sign, date and return your proxy card in the enclosed envelope.

If you have any questions about this material or what to expect at our annual meeting, I would like to extend an invitation to contact our director of investor relations, Brad Ogura (425/258-0380 or e-mail Ogura@EverTrustFinancial.com).

Your vote is important. Whether or not you attend this meeting in person, and regardless of the number of shares you own, it is important that your shares are represented at this meeting. To make sure your shares are represented, please mark, sign, date and return your proxy card as soon as possible. This will allow us to avoid the expense of a follow-up mailing. If you attend the meeting, you may vote in person even if you have previously mailed a proxy card.

On behalf of the board of directors and officers of EverTrust Financial Group, Inc., we look forward to seeing you at our annual meeting and providing you with an update on our operations.

Sincerely,

/s/Michael B. Hansen

Michael B. Hansen

President and Chief Executive Officer

<PAGE>

EVERTRUST FINANCIAL GROUP, INC.

2707 COLBY AVENUE, SUITE 600

EVERETT, WASHINGTON 98201

(425) 258-3645

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JULY 24, 2003

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of EverTrust Financial Group, Inc. ("Company") will be held at the Everett Golf & Country Club located at 1500 52nd Street in Everett, Washington, on Thursday, July 24, 2003, at 7:00 p.m., local time, for the following purposes:

| | (1) | To elect five directors of the Company;

|

| | (2) | To approve the appointment of Deloitte and Touche LLP as the Company's independent auditors for the fiscal year ending March 31, 2004; and

|

| | (3) | To consider and act upon such other matters as may properly come before the meeting or any adjournments thereof.

|

| | NOTE: | The Board of Directors is not aware of any other business to come before the meeting. |

Any action may be taken on the foregoing proposals at the meeting on the date specified above or on any date or dates to which, by original or later adjournment, the meeting may be adjourned. Stockholders of record at the close of business on May 30, 2003 are entitled to notice of and to vote at the meeting and any adjournments or postponements thereof.

You are requested to complete and sign the enclosed form of proxy, which is solicited by the Board of Directors, and to mail it promptly in the enclosed envelope. The proxy will not be used if you attend the meeting and vote in person.

BY ORDER OF THE BOARD OF DIRECTORS

/s/Lorelei Christenson

LORELEI CHRISTENSON

CORPORATE SECRETARY

Everett, Washington

June 19, 2003

IMPORTANT: THE PROMPT RETURN OF PROXIES WILL SAVE THE COMPANY THE EXPENSE OF FURTHER REQUESTS FOR PROXIES IN ORDER TO ENSURE A QUORUM. A SELF-ADDRESSED ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE. NO POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES.

<PAGE>

PROXY STATEMENT

OF

EVERTRUST FINANCIAL GROUP, INC.

2707 COLBY AVENUE, SUITE 600

EVERETT, WASHINGTON 98201

(425) 258-3645

ANNUAL MEETING OF STOCKHOLDERS

JULY 25, 2002

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of EverTrust Financial Group, Inc. ("Company") to be used at the Annual Meeting of Stockholders of the Company ("Meeting"). The Company is the holding company for EverTrust Bank ("Bank"). The Meeting will be held at the Everett Golf & Country Club located at 1500 52nd Street in Everett, Washington, on Thursday, July 24, 2003, at 7:00 p.m., local time. This Proxy Statement and the enclosed proxy card are being first mailed to stockholders on or about June 19, 2003.

VOTING AND PROXY PROCEDURE

Stockholders Entitled to Vote. Stockholders of record as of the close of business on May 30, 2003 ("Voting Record Date") are entitled to one vote for each share of common stock ("Common Stock") of the Company then held. At the close of the Voting Record Date, the Company had 4,838,279 shares of Common Stock issued and outstanding.

If you want to vote your shares of Company Common Stock held in street name (if you are a beneficial owner of Company Common Stock held by a broker, bank or other nominee) in person at the Meeting, you will need a written proxy in your name from the broker, bank or other nominee who holds your shares.

Quorum. The presence, in person or by proxy, of at least a majority of the total number of outstanding shares of Common Stock entitled to vote is necessary to constitute a quorum at the Meeting. Abstentions and broker non-votes will be counted as shares present and entitled to vote at the Meeting for purposes of determining the existence of a quorum.

Proxies; Proxy Revocation Procedures. The Board of Directors solicits proxies so that each stockholder has the opportunity to vote on the proposals to be considered at the Meeting. When a proxy card is returned properly signed and dated, the shares represented thereby will be voted in accordance with the instructions on the proxy card. Where a proxy card is signed and dated but no instructions are indicated, proxies will be voted FOR the nominees for directors set forth belowand FOR the approval of the appointment of independent auditors. If a stockholder of record attends the Meeting, he or she may vote by ballot.

Stockholders who execute proxies retain the right to revoke them at any time. Proxies may be revoked by written notice delivered in person or mailed to the Corporate Secretary of the Company or by filing a later dated and signed proxy prior to a vote being taken on a proposal at the Meeting. Attendance at the Meeting will not automatically revoke a proxy, but a stockholder in attendance may request a ballot and vote in person, thereby revoking a prior granted proxy.

If your Company Common Stock is held in street name, you will receive instructions from your broker, bank or other nominee that you must follow in order to have your shares voted. Your broker or bank may allow you to deliver your voting instructions via the telephone or the Internet. Please see the instruction form that accompanies this proxy statement. If you wish to change your voting instructions after you have returned your voting instruction form to your broker or bank, you must contact your broker or bank.

<PAGE>

Participants in the EverTrust Financial Group, Inc. ESOP.If a stockholder is a participant in the EverTrust Financial Group, Inc. Employee Stock Ownership Plan ("ESOP"), the proxy card represents a voting instruction to the trustee of the ESOP as to the number of shares in the participant's plan account. Each participant in the ESOP may direct the trustees as to the manner in which shares of Common Stock allocated to the participant's plan account are to be voted. Unallocated shares of Common Stock held by the ESOP and allocated shares for which no voting instructions are received will be voted by the trustees in the same proportion as shares for which the trustees have received voting instructions.

Voting.The directors to be elected at the Meeting will be elected by a plurality of the votes cast by stockholders present in person or by proxy and entitled to vote. Pursuant to the Company's Articles of Incorporation, stockholders are not permitted to cumulate their votes for the election of directors. Votes may be cast for or withheld from each nominee. Votes that are withheld and broker non-votes will have no effect on the outcome of the election because directors will be elected by a plurality of the votes cast.

With respect to the other proposal to be voted upon at the Meeting, stockholders may vote for or against the proposal or may abstain from voting. Approval of the appointment of independent auditors will require the affirmative vote of a majority of the outstanding shares of Common Stock present in person or by proxy at the Meeting and entitled to vote. Abstentions will be counted and will have the same effect as a vote against the proposal; broker non-votes will be disregarded and will have no effect on the outcome of this proposal.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Persons and groups who beneficially own in excess of 5% of the Company's Common Stock are required to file certain reports with the Securities and Exchange Commission ("SEC"), and provide a copy to the Company, disclosing such ownership pursuant to the Securities Exchange Act of 1934, as amended ("Exchange Act"). Based on such reports, the following table sets forth, as of the close of business on the Voting Record Date, certain information as to those persons who were beneficial owners of more than 5% of the outstanding shares of Common Stock. Management knows of no persons other than those set forth below who beneficially owned more than 5% of the outstanding shares of Common Stock as of the close of business on the Voting Record Date. The following table also sets forth, as of the close of business on the Voting Record Date, certain information as to shares of Common Stock beneficially owned by the Company's directors and "named executive officers" and by all directors and executive officers as a group.

| Number of Shares | Percent of Shares |

Name

| Beneficially Owned (1)

| Outstanding

|

| | |

| Beneficial Owners of More Than 5% | | |

| | |

| Private Capital Management, Inc. | 244,500 | 5.06% |

| 8889 Pelican Bay Boulevard - 5 | | |

| Naples, FL 34108-7512 | | |

| | | |

| Directors | | |

| | | |

| Margaret B. Bavasi | 44,351 | 0.92 |

| Thomas R. Collins | 53,124 | 1.10 |

| Thomas J. Gaffney | 45,274 | 0.94 |

| R. Michael Kight | 45,532 | 0.94 |

| Robert A. Leach, Jr. | 39,571 | 0.82 |

| | |

(table continued on following page) 2 <PAGE> |

| Number of Shares | Percent of Shares |

Name

| Beneficially Owned (1)

| Outstanding

|

| |

| Directors(continued) | | |

| | | |

| Louis H. Mills | 10,000 | 0.21% |

| George S. Newland | 46,810 | 0.97 |

| William J. Rucker | 56,082 | 1.16 |

| Robert G. Wolfe | 1,000 | 0.02 |

| | | |

| Named Executive Officers(2) | | |

| | | |

| Michael B. Hansen(3)(4) | 226,109 | 4.68 |

| Michael R. Deller (3) | 95,596 | 1.98 |

| Kirk A. Bottles | 6,098 | 0.13 |

| Robert L. Nall (5) | 30,984 | 0.64 |

| Lorelei Christenson (6) | 88,575 | 1.83 |

| All Executive Officers and | | |

| Directors as a Group (14 persons) | 789,103(7) | 16.32 |

______________

| (1) | In accordance with Rule 13d-3 under the Exchange Act, a person is deemed to be the beneficial owner, for purposes of this table, of any shares of Common Stock if he or she has voting and/or investment power with respect to such security. The table includes shares owned by spouses, other immediate family members in trust, shares held in retirement accounts or funds for the benefit of the named individuals, and other forms of ownership, over which shares the persons named in the table may possess voting and/or investment power. Shares held in accounts under the Company's ESOP, as to which the holders have voting power but not investment power, are included as follows: Mr. Hansen, 7,224 shares; Mr. Deller, 5,733 shares; Ms. Christenson, 3,955 shares; and Mr. Nall, 3,537 shares; all executive officers and directors as a group, 20,449 shares. Shares of restricted stock awarded under the Company's 2000 Management Recognition Plan ("MRP"), as to which the holders have voting power but not investment power, are included as follows: Mrs. Bavasi, 5,550 shares; Mr. Collins, 5,550 shares; Mr. Gaffney, 6,025 shares; Mr. Kight, 6,512 shares; Mr. Leach, 5,550 shares; Mr. Newland, 6,025 shares; Mr. Rucker, 6,512 shares; Mr. Hansen, 33,069 shares; Mr. Deller, 14,378 shares; Ms. Christenson, 18,691 shares; and Mr. Nall, 5,750 shares; all executive officers and directors as a group, 113,612 shares. The amounts shown also include the following number of shares which the indicated individuals have the right to acquire within 60 days of the Voting Record Date through the exercise of stock options granted pursuant to the Company's 2000 Stock Option Plan: Mrs. Bavasi, 18,419 shares; Mr. Collins, 19,249 shares; Mr. Gaffney, 19,249 shares; Mr. Kight, 19,249 shares; Mr. Leach, 19,249 shares; Mr. Newland, 19,249 shares; Mr. Rucker, 19,249 shares; Mr. Hansen, 107,835 shares; Mr. Deller, 43,683 shares; Mr. Nall, 175 shares; Mr. Bottles, 6,000 shares; and Ms. Christenson, 26,959 shares; all executive officers and directors as a group, 318,562 shares. |

| (2) | SEC regulations define the term "named executive officers" to include all individuals serving as chief executive officer during the most recently completed fiscal year, regardless of compensation level, and the four most highly compensated executive officers, other than the chief executive officer, whose total annual salary and bonus for the last completed fiscal year exceeded $100,000. Messrs. Hansen, Deller, Bottles, Nall and Ms. Christenson were the Company's "named executive officers" for the fiscal year ended March 31, 2003. |

| (3) | Messrs. Hansen and Deller are also directors of the Company. |

| (4) | Includes 3,100 shares owned by Mr. Hansen's spouse's individual retirement account ("IRA"). |

| (5) | Includes 254 shares owned by Mr. Nall's spouse's IRA. |

| (6) | Includes 5,000 shares owned by Ms. Christenson's spouse's IRA. |

| (7) | Includes an approximation of the number of shares in the participant's ESOP account. |

3

<PAGE>

PROPOSAL I -- ELECTION OF DIRECTORS

The Company's Board of Directors consists of eleven members. In accordance with the Company's Articles of Incorporation, the Board is divided into three classes with three-year staggered terms, with approximately one-third of the directors elected each year.

At the December 16, 2002 meeting of the Board of Directors, the Board determined to increase the size of the Board from nine to ten members and appointed Louis H. Mills as a Director of the Company and to stand for election at this year's Meeting. Subsequently, at the March 24, 2003 meeting of the Board of Directors, the Board determined to increase the size of the Board from ten to eleven members and appointed Robert G. Wolfe as a Director of the Company and to stand for election at this year's Meeting.

The Board of Directors, at the recommendation of the Nominating Committee, has nominated for election as directorsMargaret B. Bavasi, R. Michael Kight and Thomas J. Gaffney, each to serve for a three-year term; Louis H. Mills to serve for a two-year term; and Robert G. Wolfe to serve for a term of one year, or until their respective successors have been elected and qualified. Each of the nominees for election as director are current members of the Board of Directors of the Company and the Bank.

It is intended that the proxies solicited by the Board of Directors will be voted for the election of the nominees named in the following table. If any nominee is unable to serve, the shares represented by all valid proxies will be voted for the election of such substitute as the Board of Directors may recommend or the Board of Directors may adopt a resolution to amend the Bylaws and reduce the size of the Board. At this time the Board of Directors knows of no reason why any nominee might be unavailable to serve.

The Board of Directors recommends a vote "FOR" the election ofMs. Bavasi and Messrs. Kight, Gaffney, Mills and Wolfe.

The following table sets forth certain information regarding the nominees for election at the Meeting, as well as information regarding those directors continuing in office after the Meeting.

| | Year First Elected or | Term to |

Name

| Age(1)

| Appointed Director(2)

| Expire

|

| |

| BOARD NOMINEES |

|

| Margaret B. Bavasi | 48 | 1996 | 2006(3) |

| R. Michael Kight | 64 | 1974 | 2006(3) |

| Thomas J. Gaffney | 55 | 1984 | 2006(3) |

| Louis H. Mills | 47 | 2002 | 2005(3) |

| Robert G. Wolfe | 46 | 2003 | 2004(3) |

|

DIRECTORS CONTINUING IN OFFICE |

|

| Michael B. Hansen | 61 | 1981 | 2004 |

| George S. Newland | 63 | 1985 | 2004 |

| William J. Rucker | 63 | 1976 | 2004 |

| Michael R. Deller | 52 | 1999 | 2005 |

| Robert A. Leach, Jr. | 53 | 1997 | 2005 |

| Thomas R. Collins | 60 | 1994 | 2005 |

______________

| (1) | As of March 31, 2003. |

| (2) | Except for Directors Mills and Wolfe, includes prior service on the Board of Directors of the Bank and the Company's predecessor, Mutual Bancshares. |

| (3) | Assuming the individual is elected. |

4

<PAGE>

The present principal occupation and other business experience during the last five years of each nominee for election and each director continuing in office is set forth below:

Margaret B. Bavasi is Principal of Bavasi Sports Partners, LLP, and the former-owner of the Everett AquaSox Baseball Club, a minor league baseball club. She served as the Club's Vice President from 1984 to 1999.

R. Michael Kight is an attorney and a Partner in the law firm of Newton-Kight, LLP, which he joined 36 years ago. The firm serves as general counsel to the Bank.

Thomas J. Gaffney is a Partner of the Everett office of Moss Adams, LLP, a certified public accounting firm, with which he has been associated for 34 years.

Louis H. Mills is the former managing partner (retired) of the Seattle, Washington office of Moss Adams, LLP, a certified public accounting firm, a firm he was associated with for over 20 years.

Robert G. Wolfe is a general partner of Northwest Venture Associates, an investment services firm, and a part owner and managing member of Phillips Real Estate Services, a residential management company. Both companies are based in Seattle, Washington.

Michael B. Hansen is Chairman of the Board, President and Chief Executive Officer of the Company and Chief Executive Officer of EverTrust Bank. Mr. Hansen has been employed by the Bank for 24 years.

George S. Newland is the President and owner of Newland Construction Co., Inc., a general contracting company specializing in commercial, industrial and institutional projects in the greater Northwest area. Mr. Newland has over 40 years of experience in the construction area.

William J. Rucker is the Chief Executive Officer and owner of H&L Sporting Goods/Soccer West, a retail and institutional sporting goods business.

Michael R. Deller is Executive Vice President of the Company and President and Chief Operating Officer of EverTrust Bank. Prior to his appointment as President of EverTrust Bank in April 2000, he had served as Executive Vice President and Chief Operating Officer since 1997. From 1994 to 1997, Mr. Deller was the Executive Director of the Port of Everett. Mr. Deller is the brother-in-law of director Thomas R. Collins.

Robert A. Leach, Jr. is an investment executive and senior vice president of Ragen Mackenzie, Inc., a financial services company. Mr. Leach has worked in the financial services industry for 21 years.

Thomas R. Collins is an attorney and Senior Partner in the Anderson Hunter Law Firm, PS, which firm he has been associated with for 34 years. Mr. Collins is the brother-in-law of Michael R. Deller, the President and Chief Operating Officer of the Bank.

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

Committees of the Company

The Board of Directors of the Company conducts its business through meetings of the Board and through its committees. During the fiscal year ended March 31, 2003, the Board of Directors of the Company held 13 meetings. No director of the Company attended fewer than 75% of the total meetings of the Board and committees on which such person served during this period.

The Company's Board of Directors has established Audit, Nominating and Compensation Committees.

5

<PAGE>

The Audit Committee, consisting of Directors Gaffney (Chairman), Rucker, Mills and Wolfe, receives and reviews all reports prepared by the Company's external and internal auditors. The Audit Committee met 13 times during the fiscal year ended March 31, 2003.

The Nominating Committee, consisting of Directors Newland (Chairman), Kight, Wolfe and Leach, makes recommendations to the Board for the annual selection of management's nominees for election as directors of the Company. The Nominating Committee met twice during the fiscal year ended March 31, 2003.

The Executive Committee, which serves as the Company's Compensation Committee and is comprised of Directors Rucker (Chairman), Bavasi, Mills and Gaffney, makes recommendations to the full Board of Directors concerning employee compensation. The committee also oversees the Stock Option Plan, Management Recognition Plan and the Employee Stock Ownership Plan. The Compensation Committee meets as needed and met five times during the fiscal year ended March 31, 2003.

Committees of EverTrust Bank

The Bank's Board of Directors meets monthly and has special meetings as needed. During the year ended March 31, 2003, the Board of Directors met 15 times. No director attended fewer than 75% of the total meetings of the board and committees on which such board members served during this period.

The Executive Committee of the Bank, which serves as the Bank's Compensation Committee, is comprised of Directors Rucker (Chairman), Bavasi, Mills and Gaffney, sets board policies and reviews the performance and salary of the Bank's Chief Executive Officer. In fiscal 2003, this Committee met once.

The Loan Review Committee of the Bank, comprised of Directors Kight (Chairman), Bavasi, Collins, Newland and Leach, meets at least monthly. This Committee monitors the Bank's lending practices and policies. In fiscal 2003, this Committee met 23 times.

The Audit and Budget Committee of the Bank, comprised of Directors Gaffney (Chairman), Rucker, Mills and Wolfe, meets monthly. This Committee reviews internal auditing functions and establishes policies to assure full disclosure of the Bank's financial condition. This Committee also oversees the results of the examinations of the Federal Deposit Insurance Corporation and the Washington Division of Banks. In fiscal 2003, this Committee met 13 times.

The Investment Committee of the Bank, comprised of Directors Leach (Chairman), Kight, Rucker and Newland, meets quarterly. This Committee reviews the liquidity investments of the Bank. In fiscal 2003, this Committee met four times.

The Nominating Committee of the Bank, comprised of Directors Newland (Chairman), Kight, Wolfe and Leach, meets as necessary. This Committee reviews and investigates potential board members when there is a vacancy on the board. In fiscal 2003, this Committee met twice.

DIRECTORS' COMPENSATION

All non-officer directors receive an annual retainer of $10,000 paid quarterly in increments of $2,500. Also, all non-officer directors, other than the Vice Chairman of the Board, receive a fee of $550 per board meeting attended and $220 per committee meeting attended. The Vice Chairman of the Board receives a fee of $660 per board meeting attended and the chairman of each committee receives $275 per committee meeting attended. Total fees paid to directors during the year ended March 31, 2003 were $179,585, including amounts deferred as described below.

6

<PAGE>

Directors participate in a Company sponsored voluntary deferred compensation program that is also available to a select group of management and/or highly compensated employees. Under the plan, a director is permitted to defer all or a specified portion of the compensation paid to them. Deferral amounts are credited to a director's Deferred Compensation Account and credited with earnings as of the last day of each calendar quarter in accordance with such benchmark investment measures as specified in the plan. During the year ended March 31, 2003, $41,315 of directors compensation was deferred (net of distributions) under the plan.

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table shows the compensation, including amounts deferred to future periods by the officers, paid to the Company's Chief Executive Officer and named executive officers, whose salary and bonus exceeded $100,000, during the fiscal year ended March 31, 2003.

| | | | Long-term Compensation | |

| | Annual Compensation(1)

| Awards

| |

| | | | Other | Restricted | Number | All |

| Name and | | | | Annual | Stock | of | Other |

Position

| Year

| Salary

| Bonus

| Compensation(4)(5)

| Awards(6)

| Options(7)

| Compensation(8)

|

|

| Michael B. Hansen | 2003 | $226,935 | $ 59,000(2) | -- | $ -- | -- | $27,637 |

| Chairman of the Board, | 2002 | 208,200 | 35,394 | -- | -- | -- | 25,450 |

| President and Chief Executive | 2001 | 208,200 | 30,000 | -- | 997,255 | 179,725 | 29,693 |

| Officer of the Company, and | | | | | | | |

| Chief Executive Officer of | | | | | | | |

| the Bank | | | | | | | |

| |

| Michael R. Deller | 2003 | 165,000 | 40,000(2) | -- | -- | -- | 22,819 |

| Executive Vice President of | 2002 | 150,000 | 25,500 | -- | -- | -- | 24,806 |

| the Company and President | 2001 | 150,000 | 22,500 | -- | 433,587 | 89,863 | 25,251 |

| and Chief Operating Officer | | | | | | | |

| of the Bank | | | | | | | |

| |

| Kirk A. Bottles | 2003 | 120,000 | 24,000(2) | -- | -- | -- | 648 |

| Executive Vice President of | 2002 | 10,000(3) | | -- | -- | 30,000 | -- |

| Private and Business Banking | | | | | | | |

| of the Bank | | | | | | | |

| | | | | | | | |

| Robert L. Nall | 2003 | 106,827 | 51,940(2) | -- | -- | -- | 14,912 |

| Senior Vice President and Chief | 2002 | 98,006 | 44,749 | -- | -- | -- | 19,232 |

| Lending Officer of the Bank | 2001 | 89,997 | 22,000 | -- | 173,435 | 26,959 | 15,949 |

| | | | | | | | |

| Lorelei Christenson |

| Senior Vice President and | 2002 | 101,000 | 17,170 | -- | -- | -- | 22,669 |

| Corporate Secretary of the | 2001 | 101,000 | 15,000 | -- | 563,669 | 44,931 | 17,415 |

| Company; Senior Vice | | | | | | | |

| President and Corporate | | | | | | | |

| Secretary of the Bank and | | | | | | | |

| Mutual Bancshares Capital, Inc. | | | | | | | |

__________________

| (1) | Salary and bonus information does not exclude amounts deferred under a nonqualified deferred compensation plan. |

(footnotes continue on following page)

8

<PAGE>

| (2) | Paid in May 2003 for fiscal year ending March 31, 2003. |

| (3) | Mr. Bottles joined the Company on March 1, 2002. Salary reflected represents the amount paid during the fiscal year. |

| (4) | The aggregate amount of perquisites and other personal benefits was less than 10% of the total annual salary and bonus reported. |

| (5) | Amounts reported are earnings credited to the non-qualified deferred compensation programs in excess of 120% of the applicable federal rate. |

| (6) | Pursuant to the MRP, 82,674, 35,945, 14,378 and 46,729 shares of restricted Common Stock were awarded to Messrs. Hansen, Deller, Nall and Ms. Christenson, respectively, on October 1, 2000, the award date. The value of the restricted stock awards on the award date are reflected in the year 2001. Dividends are paid on such awards if and when declared and paid by the Company on the Common Stock. The awards vest pro rata over a five-year period with three 20% installments having vested on October 1, 2000, 2001 and 2002, respectively. At March 31, 2003, the value of the unvested restricted stock awards were: Mr. Hansen, $792,348; Mr. Deller, $344,497; Mr. Nall, $137,799; and Ms. Christenson, $447,851. |

| (7) | Options granted pursuant to the Stock Option Plan on October 1, 2000, the grant date. Options are subject to pro rata vesting over a five year period with three 20% installments having vested on October 1, 2000, 2001 and 2002, respectively. Includes 41,450 incentive stock options for Mr. Deller, 26,959 incentive options for Mr. Nall, and 30,000 incentive options granted to Mr. Bottles on March 1, 2002. Mr. Bottles' options are subject to pro rata vesting over a five year period beginning on October 1, 2002. |

| (8) | Amounts for fiscal year 2003 reflect: for Mr. Hansen, 401(k) contribution of $7,673, payment of term life insurance premium of $720, and ESOP contribution of $19,244; for Mr. Deller, 401(k) contribution of $6,611, payment of term life insurance premium of $720, and ESOP contribution of $15,488; for Mr. Bottles, payment of term life insurance premium of $648; for Mr. Nall, 401(k) contributions of $4,283, payment of term life insurance premium of $578 and ESOP contribution of $10,051; and for Ms. Christenson, 401(k) contribution of $4,426, payment of term life insurance premium of $596, and ESOP contribution of $10,358. |

Option Grant Table. No options were granted to the Chief Executive Officer and named executive officers during the calendar year ended March 31, 2003.

Option Exercise/Value Table. The following information is presented for the Chief Executive Officer and the named executive officers.

| | | Number of | |

| | | Securities Underlying | Value of Unexercised |

| | | Unexercised Options | In-the-Money Options |

| Shares

Acquired on | Value | at Fiscal Year End(#)

| at Fiscal Year End($)(1)

|

Name

| Exercise (#)

| Realized($)

| Exercisable

| Unexercisable

| Exercisable

| Unexercisable

|

| | | | | | |

| Michael B. Hansen | -- | -- | 107,835 | 71,890 | $1,282,967 | $855,311 |

| Michael R. Deller | 10,235 | 103,338 | 43,683 | 35,945 | 519,716 | 427,658 |

| Kirk A. Bottles | -- | -- | 6,000 | 24,000 | 40,560 | 162,240 |

| Robert L. Nall | 16,000 | 175,000 | 175 | 10,784 | 2,087 | 128,298 |

| Lorelei Christenson | -- | -- | 26,959 | 17,972 | 320,740 | 213,827 |

______________

| (1) | Value of unexercised in-the-money stock options equals the market value of shares covered by in-the-money options on March 31, 2003 less the option exercise price. Options are in-the-money if the market value of shares covered by the options is greater than the exercise price. |

Employment Agreements for Executive Officers. The Company and the Bank (collectively, the "Employers") have entered into three-year employment agreements ("Employment Agreements") with Messrs. Hansen, Deller, Bottles and Nall (individually, the "Executive"). Under the Employment Agreements, the current salary level for Mr. Hansen is $226,935, which amount is paid by the Company, and for Messrs. Deller, Bottles and Nall $165,000,

8

<PAGE>

$120,000 and $106,827, respectively, which amounts are paid by the Bank, and which may be increased at the discretion of the Board of Directors or an authorized committee of the Board. On each anniversary of the initial date of the Employment Agreements, the term of each agreement may be extended for an additional year at the discretion of the Board. The agreements are terminable by the Employers at any time, by the Executive if he is assigned duties inconsistent with his initial position, duties, responsibilities and status, or upon the occurrence of certain events specified by federal regulations. In the event that an Executive's employment is terminated without cause or upon the Executive's voluntary termination following the occurrence of an event described in the preceding sentence, the Employers would be required to honor the terms of the agreement through the expiration of the current term, including payment of then current cash compensation and continuation of employee benefits.

The Employment Agreements provide for severance payments and other benefits if the Executive is involuntarily terminated because of a change in control of the Employers. The agreements authorize severance payments on a similar basis if the Executive voluntarily terminates his employment following a change in control because he is assigned duties inconsistent with his position, duties, responsibilities and status immediately prior to such change in control. The agreements define the term "change in control" as having occurred when, among other things, a person other than the Company purchases shares of Common Stock under a tender or exchange offer for the shares; any person, as such term is used in Sections 13(d) and 14(d)(2) of the Exchange Act, is or becomes the beneficial owner, directly or indirectly, of securities of the Company representing 25% or more of the combined voting power of the Company's then outstanding securities; the membership of the Board of Directors changes as the result of a contested election; or stockholders of the Company approve a merger, consolidation, sale or disposition of all or substantially all of the Company's assets, or a plan of partial or complete liquidation.

The maximum value of the severance benefits under the Employment Agreements is 2.99 times the Executive's average annual compensation during the five-year period prior to the effective date of the change in control (the "base amount"). The Employment Agreements provide that the value of the maximum benefit may be distributed, at the Executive's election, in the form of a lump sum cash payment equal to 2.99 times the Executive's base amount, or a combination of a cash payment and continued coverage under the Employer's health, life and disability programs for a 36-month period following the change in control, the total value of which does not exceed 2.99 times the Executive's base amount. Assuming that a change in control had occurred at March 31, 2003 and that Messrs. Hansen, Deller, Bottles and Nall each elected to receive a lump sum cash payment, they would be entitled to a payment of approximately $678,536, $493,350, $358,800 and $319,413, respectively. Section 280G of the Internal Revenue Code, as amended ("Code"), provides that severance payments that equal or exceed three times the individual's base amount are deemed to be "excess parachute payments" if they are conditioned upon a change in control. Individuals receiving parachute payments in excess of 2.99 times of their base amount are subject to a 20% excise tax on the amount of such excess payments. If excess parachute payments are made, the Employers would not be entitled to deduct the amount of such excess payments. The Employment Agreements provide that severance and other payments that are subject to a change in control will be reduced as much as necessary to ensure that no amounts payable to the Executive will be considered excess parachute payments.

The Employment Agreements restrict each Executive's right to compete against the Bank for a period of one year from the date of termination of the agreement if the Executive voluntarily terminates employment except in the event of a change in control.

AUDIT COMMITTEE MATTERS

Audit Committee Charter. The Audit Committee operates pursuant to a Charter approved by the Company's Board of Directors. The Audit Committee reports to the Board of Directors and is responsible for overseeing and monitoring financial accounting and reporting, the system of internal controls established by management and the audit process of the Company. The Audit Committee Charter sets out the responsibilities, authority and specific duties of the Audit Committee. The Charter specifies, among other things, the structure and membership requirements of the

9

<PAGE>

Audit Committee, as well as the relationship of the Audit Committee to the independent accountants, the internal audit department, and management of the Company.

Report of the Audit Committee. The Audit Committee reports as follows with respect to the Company's audited financial statements for the year ended March 31, 2003:

The Audit Committee has completed its initial review and discussion of the Company's 2003 audited financial statements with management;

The Audit Committee has discussed with the independent auditors (Deloitte & Touche LLP) the matters required to be discussed by Statement on Auditing Standards ("SAS") No. 61,Communication with Audit Committees, as amended by SAS No. 90,Audit Committee Communications, including matters related to the conduct of the audit of the Company's financial statements;

The Audit Committee has received written disclosures, as required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committee, indicating all relationships, if any, between the independent auditor and its related entities and the Company and its related entities which, in the auditors' professional judgment, reasonably may be thought to bear on the auditors' independence, and the letter from the independent auditors confirming that, in its professional judgment, it is independent from the Company and its related entities, and has discussed with the auditors the auditors' independence from the Company; and

The Audit Committee has, based on its initial review and discussions with management of the Company's 2003 audited financial statements and discussions with the independent auditors, recommended to the Board of Directors that the Company's audited financial statements for the year ended March 31, 2003 be included in the Company's Annual Report on Form 10-K.

Audit Committee: Thomas J. Gaffney, Chairman

William J. Rucker

Louis H. Mills

Robert G. Wolfe

Independence and Other Matters. Each member of the Audit Committee is "independent," as defined, in the case of the Company, under The Nasdaq Stock Market Rules. The Audit Committee members, as well as the Nominating Committee members and the Executive/Compensation Committee members, do not have any relationship to the Company that may interfere with the exercise of their independence from management and the Company. None of these committee members are current officers or employees of the Company or its affiliates.

COMPENSATION COMMITTEE MATTERS

Notwithstanding anything to the contrary set forth in any of the Company's previous filings under the Securities Act of 1933, as amended, or the Exchange Act that might incorporate future filings, including this Proxy Statement, in whole or in part, the following Report of the Compensation Committee and Performance Graph shall not be incorporated by reference into any such filings.

Report of the Compensation Committee. Under rules established by the SEC, the Company is required to provide certain data and information in regard to the compensation and benefits provided to the Company's Chief Executive Officer and other named executive officers. The disclosure requirements for the Chief Executive Officer and named executive officers include the use of tables and a report explaining the rationale and considerations that led to the fundamental executive compensation decisions affecting those individuals. The Company's Executive Committee,

10

<PAGE>

which serves as its Compensation Committee, is responsible for establishing and monitoring compensation policies of the Company. Performance of the Chief Executive Officer is evaluated and salary is set by the Compensation Committee of the Bank.

General. The Bank's Compensation Committee's duties are to recommend and administer policies that govern executive compensation. The Committee evaluates individual executive performance, compensation policies and salaries. The Committee is responsible for evaluating the performance of the Chief Executive Officer of the Bank while the Chief Executive Officer of the Bank evaluates the performance of other senior officers of the Bank and makes recommendations to the Committee regarding compensation levels. The Committee has final authority to set compensation levels.

Compensation Policies. The executive compensation policies of the Bank are designed to establish an appropriate relationship between executive pay and the Company's and the Bank's annual performance, to reflect the attainment of short- and long-term financial performance goals and to enhance the ability of the Company and the Bank to attract and retain qualified executive officers. The principles underlying the executive compensation policies include the following:

To attract and retain key executives who are vital to the long-term success of the Company and the Bank and are of the highest caliber;

To provide levels of compensation competitive with those offered throughout the financial industry and consistent with the Company's and the Bank's level of performance;

To motivate executives to enhance long-term stockholder value by building their equity interest in the Company; and

To integrate the compensation program with the Company's and the Bank's annual and long-term strategic planning and performance measurement processes.

The Committees consider a variety of subjective and objective factors in determining the compensation package for individual executives including: (1) the performance of the Company and the Bank as a whole with emphasis on annual performance factors and long-term objectives; (2) the responsibilities assigned to each executive; and (3) the performance of each executive of assigned responsibilities as measured by the progress of the Company and the Bank during the year.

Base Salary. The Company's current compensation plan involves a combination of salary, cash bonuses to reward short-term performance, and voluntary participation in the deferred compensation plan. The salary levels of executive officers are designed to be competitive within the banking and financial services industries. In setting competitive salary levels, the Compensation Committees continually evaluate current salary levels by surveying similar institutions in Washington, Oregon and the United States. The Committee's peer group analysis focuses on asset size, nature of ownership, type of operation and other common factors. Specifically, the Committees annually review the Northwest Financial Industry Salary Survey prepared by Milliman & Robertson, Inc., Actuaries and Consultants, covering 107 institutions and combining the studies of the Washington Bankers Association, Washington Financial League, Puget Sound Banking Industry and Seattle Mortgage Banking Industry, and the SNL Executive Compensation Review.

Bonus Program. A short-term incentive bonus plan is in effect for the officers of the Bank which is designed to compensate for performance. The plan is designed to provide for bonuses of up to 50% of salary for the chief executive officer, up to 40% of salary for executive vice presidents, up to 35% of salary for senior vice presidents and certain other officers. In certain circumstances, bonuses may be payable at higher levels based on exceptional performance in excess of established targets. The performance bonus is based primarily on quantifiable data such as return on assets, return on equity and level of operating expenses. Subjective evaluation of performance is limited.

11

<PAGE>

Deferred Compensation. The Company sponsors a voluntary deferred compensation plan for directors and a select group of management and/or highly compensated employees. An eligible employee is permitted to defer all or a specified portion of his compensation. Deferral amounts are credited to a participant's Deferred Compensation Account on a payroll deduction basis and credited with earnings on the last calendar day of each quarter in accordance with the benchmark investment measures selected by the participant as specified in the plan.

Compensation of the Chief Executive Officer. During the calendar year ended March 31, 2003, the base salary of Michael B. Hansen, Chairman of the Board, President and Chief Executive Officer of the Company, and Chief Executive Officer of the Bank, was $226,935. In addition, he was credited with a bonus of $59,000; retirement plan contributions of $7,673; ESOP contributions of $19,244; and term life insurance premiums of $720. This resulted in total compensation of $313,572, which represents a 17% increase from the twelve month period ended March 31, 2002. The Committee believes that Mr. Hansen's compensation is appropriate based on the Company's overall compensation policy, on the basis of the Committee's consideration of peer group data, and the financial performance of the Company during the fiscal year. Mr. Hansen did not participate in the Committee's consideration of his compensation level for the fiscal year.

Compensation Committee: William J. Rucker, Chairman

Margaret B. Bavasi

Thomas J. Gaffney

Louis H. Mills

Compensation Committee Interlocks and Insider Participation. There are no interlocks or insider participation.

12

<PAGE>

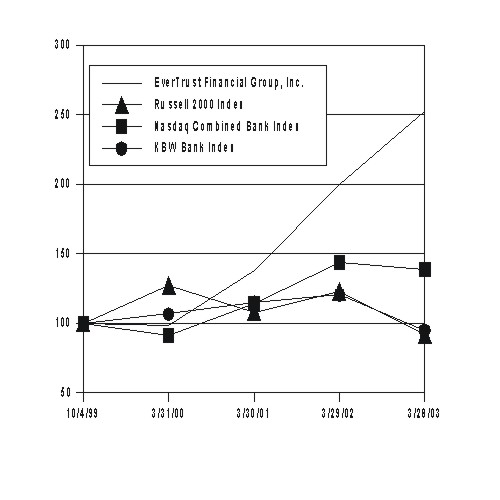

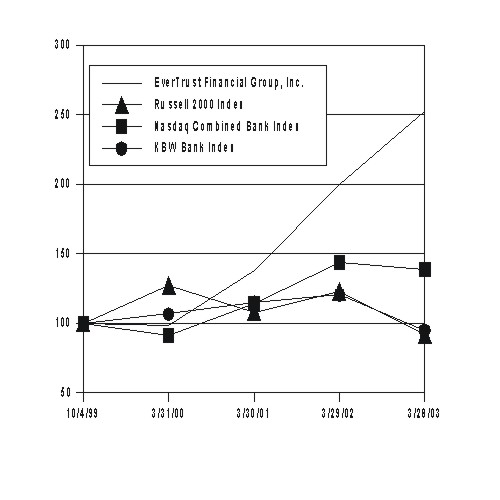

Performance Graph. The following graph compares the cumulative total return on the Company's Common Stock with the cumulative total return on the Russell 2000 Index, Nasdaq Combined Bank Index, and the KBW Bank Index, a peer group index. The graph assumes that the value of the investment was 100 on October 4, 1999, the initial day of trading, and that all dividends were reinvested. The closing price of the Company's Common Stock on the initial day of trading was $10.938 per share and the initial offering price for the Company's Common Stock was $10.00 per share.

| Period Ending

|

| 10/4/1999

| 3/31/2000

| 3/30/2001

| 3/29/2002

| 3/28/2003

|

| EverTrust Financial Group, Inc. | 100.00 | 98.63 | 137.65 | 200.15 | 252.30 |

| Russell 2000 Index | 100.00 | 127.11 | 107.99 | 122.79 | 91.90 |

| Nasdaq Combined Bank Index | 100.00 | 90.85 | 114.02 | 143.55 | 138.81 |

| KBW Bank Index | 100.00 | 106.64 | 115.08 | 120.37 | 94.85 |

COMPLIANCE WITH SECTION 16(a) OF THE EXCHANGE ACT

Section 16(a) of the Exchange Act requires the Company's executive officers and directors, and persons who own more than 10% of any registered class of the Company's equity securities, to file reports of ownership and changes

13

<PAGE>

in ownership with the SEC. Executive officers, directors and greater than 10% stockholders are required by regulation to furnish the Company with copies of all Section 16(a) forms they file.

Based solely on its review of the copies of such forms it has received and written representations provided to the Company by the above referenced persons, the Company believes that during the fiscal year ended March 31, 2003 all filing requirements applicable to its reporting officers, directors and greater than 10% stockholders were properly and timely complied with, exceptfor the filing of a Form 4, Statement of Change in Beneficial Ownership of Securities, by Mr. Dale A. Lyski, Senior Vice President of the Bank's Business Banking Group, and Mr. John E. Thoresen, a former executive officer of the Company's subsidiary, Mutual Bancshares Capital, Inc. Mr. Lyski inadvertently failed to file a Form 4, Statement of Change in Beneficial Ownership of Securities, on February 17, 2002 for a transaction on February 13, 2002. The Form 4 was subsequently filed on February 19, 2002. Mr. Thoresen inadvertently failed to file a Form 4, Statement of Change in Beneficial Ownership of Securities, on January 17, 2003 for a transaction on January 15, 2003. The Form 4 was subsequently filed on January 28, 2003.

TRANSACTIONS WITH MANAGEMENT

Current law requires that all loans or extensions of credit to executive officers and directors must be made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other persons (unless the loan or extension of credit is made under a benefit program generally available to all other employees and does not give preference to any insider over any other employee) and does not involve more than the normal risk of repayment or present other unfavorable features. Loans to all directors and executive officers and their associates totaled approximately $3.0 million at March 31, 2003. Such loans (i) were made in the ordinary course of business, (ii) were made on substantially the same terms and conditions, including interest rates and collateral, as those prevailing at the time for comparable transactions with the Bank's other customers or under the established Employee Home Loan Policy, and (iii) did not involve more than the normal risk of collectibility or present other unfavorable features when made.

PROPOSAL II -- APPROVAL OF APPOINTMENT OF INDEPENDENT AUDITORS

Deloitte & Touche LLP served as the Company's independent auditors for the calendar year ended March 31, 2003. The Board of Directors has appointed Deloitte & Touche LLP as independent auditors for the fiscal year ending March 31, 2004, subject to approval by stockholders. A representative of Deloitte & Touche LLP will be present at the Meeting to respond to stockholders' questions and will have the opportunity to make a statement if he or she so desires.

Audit Fees

The aggregate fees billed to the Company by Deloitte & Touche LLP for professional services rendered for the audit of the Company's financial statements for fiscal 2003 and the reviews of the financial statements included in the Company's Forms 10-Q for that year, including travel expenses, were $124,525.

Financial Information Systems Design and Implementation Fees

Deloitte & Touche LLP performed no financial information system design or implementation work for the Company during the fiscal year ended March 31, 2003.

All Other Fees

Other than audit fees, the aggregate fees billed to the Company by Deloitte & Touche LLP for fiscal 2003, none of which were financial information systems design and implementation fees, were $41,070. The Audit Committee of

14

<PAGE>

the Board of Directors determined that the services performed by Deloitte & Touche LLP other than audit services are not incompatible with Deloitte & Touche LLP maintaining its independence.

If the ratification of the appointment of the auditors is not approved by a majority of the votes cast by shareholders at the Meeting, other independent public accountants will be considered by the Board of Directors.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE "FOR" THE APPROVAL OF THE APPOINTMENT OF DELOITTE & TOUCHE LLP AS INDEPENDENT AUDITORS OF THE COMPANY FOR THE FISCAL YEAR ENDING MARCH 31, 2004.

OTHER MATTERS

The Board of Directors is not aware of any business to come before the Meeting other than those matters described above in this Proxy Statement. However, if any other matters should properly come before the Meeting, it is intended that proxies in the accompanying form will be voted in respect thereof in accordance with the judgment of the person or persons voting the proxies.

MISCELLANEOUS

The cost of solicitation of proxies will be borne by the Company. The Company will reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending proxy material to the beneficial owners of the Company's Common Stock. In addition to solicitations by mail, directors, officers and regular employees of the Company may solicit proxies personally or by telephone without additional compensation. The Company has retained MacKenzie Partners, Inc., to assist in soliciting proxies for a fee not to exceed $5,500, including reimbursable expenses.

The Company's Annual Report to Stockholders, which includes the Company's Annual Report on Form 10-K as filed with the SEC, has been mailed to stockholders as of the close of business on the Voting Record Date. Any stockholder who has not received a copy of such Annual Report may obtain a copy by writing to the Corporate Secretary of the Company. The Annual Report is not to be treated as part of the proxy solicitation material or as having been incorporated herein by reference.

STOCKHOLDER PROPOSALS

In order to be eligible for inclusion in the Company's proxy solicitation materials for next year's Annual Meeting of Stockholders, any stockholder proposal to take action at such meeting must be received at the Company's main office at 2707 Colby Avenue, Suite 600, Everett, Washington, no later than February 19, 2004. Any such proposals shall be subject to the requirements of the proxy solicitation rules adopted under the Exchange Act.

The Company's Articles of Incorporation generally provide that stockholders will have the opportunity to nominate directors of the Company if such nominations are made in writing and are delivered to the Corporate Secretary of the Company not less than 30 days nor more than 60 days before the annual meeting of stockholders; provided, however, if less than 31 days' notice is given, such notice shall be delivered to the Corporate Secretary of the Company no later than the close of the tenth day following the date on which notice of the meeting was mailed to stockholders. The notice must set forth (i) the name, age, business address and, if known, residence address of each nominee for election as a director, (ii) the principal occupation or employment of each nominee, (iii) the number of shares of stock of the Company which are beneficially owned by each such nominee, (iv) such other information as would be required to be included in a proxy statement soliciting proxies for the election of the proposed nominee pursuant to the Exchange Act, including, without limitation, such person's written consent to being named in the proxy statement as a nominee

15

<PAGE>

and to serving as a director, if elected, and (v) as to the stockholder giving such notice (a) his or her name and address as they appear on the Company's books and (b) the class and number of shares of the Company which are beneficially owned by such stockholder.

BY ORDER OF THE BOARD OF DIRECTORS

/s/Lorelei Christenson

LORELEI CHRISTENSON

CORPORATE SECRETARY

Everett, Washington

June 19, 2003

16

<PAGE>

REVOCABLE PROXY

EVERTRUST FINANCIAL GROUP, INC.

ANNUAL MEETING OF STOCKHOLDERS

JULY 24, 2003

The undersigned hereby appoints the official Proxy Committee of the Board of Directors of EverTrust Financial Group, Inc. ("Company") with full powers of substitution, as attorneys and proxies for the undersigned, to vote all shares of common stock of the Company which the undersigned is entitled to vote at the Annual Meeting of Stockholders ("Meeting"), to be held at the Everett Golf & Country Club located at 1500 52nd Street in Everett, Washington, on Thursday, July 24, 2003, at 7:00 p.m., local time, and at any and all adjournments thereof, as indicated.

| | | VOTE |

| | | FOR

| WITHHELD

|

| | | |

| 1. | The election as director of the nominees | [ ] | [ ] |

| | listed below (except as marked to the | | |

| contrary below). | | |

| | | | |

| | Margaret B. Bavasi (for a three year term) | | |

| R. Michael Kight (for a three year term) | | |

| Thomas J. Gaffney (for a three year term) | | |

| Louis H. Mills (for a two year term) | | |

| Robert G. Wolfe (for a one year term) | | |

| | | | |

| INSTRUCTIONS: To withhold your vote | | |

| for any individual nominee, write the | | |

| nominee's name on the line below. | | |

| | _______________________________ | | |

| | | | |

| | FOR

| AGAINST

| ABSTAIN

|

| | | | |

| 2. | The approval of the appointment of Deloitte & | [ ] | [ ] | [ ] |

| | Touche LLP as independent auditors for the | | | |

| fiscal year ending March 31, 2004. | | | |

| | | | | |

| 3. | In their discretion, upon such other matters | | | |

| as may properly come before the meeting. | | | |

| | | | | |

| The Board of Directors recommends a vote "FOR" the above proposals. |

THIS PROXY WILL BE VOTED AS DIRECTED, BUT IF NO INSTRUCTIONS ARE SPECIFIED, THIS PROXY WILL BE VOTED FOR THE PROPOSITIONS STATED. IF ANY OTHER BUSINESS IS PRESENTED AT SUCH MEETING, THIS PROXY WILL BE VOTED BY THOSE NAMED IN THIS PROXY IN THEIR BEST JUDGMENT. AT THE PRESENT TIME, THE BOARD OF DIRECTORS KNOWS OF NO OTHER BUSINESS TO BE PRESENTED AT THE MEETING.

<PAGE>

THIS PROXY IS SOLICITED BY THE BOARD OF DIRECTORS

Should the undersigned be present and elect to vote at the Meeting or at any adjournment thereof and after notification to the Corporate Secretary of the Company at the Meeting of the stockholder's decision to terminate this proxy, then the power of said attorneys and proxies shall be deemed terminated and of no further force and effect.

The undersigned acknowledges receipt from the Company prior to the execution of this proxy of the Notice of Annual Meeting of Stockholders, a Proxy Statement for the Annual Meeting of Stockholders, and the Annual Report on Form 10-K for the year ended March 31, 2003.

| Dated:_______________, 2003 |

| |

| |

|

| _____________________________ | ________________________________ |

| PRINT NAME OF STOCKHOLDER | PRINT NAME OF STOCKHOLDER |

|

| |

|

| _________________________ | ________________________________ |

| SIGNATURE OF STOCKHOLDER | SIGNATURE OF STOCKHOLDER |

|

Please sign exactly as your name appears on this proxy card. When signing as attorney, executor, administrator, trustee or guardian, please give your full title. If shares are held jointly, each holder should sign.

PLEASE COMPLETE, DATE, SIGN AND MAIL THIS PROXY PROMPTLY IN THE ENCLOSED POSTAGE-PREPAID ENVELOPE.