Filed by TiVo Inc. Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934 Subject Companies: TiVo Inc. (Commission File No. 000-27141) Rovi Corporation (Commission File No. 000-53413), and Titan Technologies Corporation (Commission File No. 000-53413) The following is a presentation made by TiVo Inc.’s interim Chief Executive Officer Naveen Chopra at the Jeffries Technology Conference on May 11, 2016.

Jefferies Technology Conference May 11, 2016

Safe Harbor Statement Please review our SEC filings, including forms 10-Q and 10-K Forward-Looking Statements This presentation contains "forward-looking" statements as that term is defined in the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements regarding the proposed acquisition of TiVo Inc., the integration of TiVo’s IP assets into Rovi’s products and solutions offerings, enhanced global reach, anticipated combined company revenue, synergies and financial results, future product offerings and expected transaction timing. A number of factors could cause Rovi’s and TiVo’s actual results to differ from anticipated results expressed in such forward-looking statements. Such factors include, among others, 1) uncertainties as to the timing of the consummation of the transaction and the ability of each party to consummate the transaction; 2) uncertainty as to the actual premium that will be realized by TiVo stockholders in connection with the proposed transaction; 3) failure to realize the anticipated benefits of the proposed transaction, including as a result of delay in completing the transaction or integrating the businesses of Rovi and TiVo; 4) uncertainty as to the long-term value of the combined companies’ common stock; 5) unpredictability and severity of natural disasters; 6) adequacy of Rovi’s or TiVo’s risk management and loss limitation methods; 7) the resolution of intellectual property claims; 8) seasonal trends that impact consumer electronics sales; 9) the combined companies’ ability to implement their business strategy; 10) adequacy of Rovi’s, TiVo’s or the combined companies’ loss reserves; 11) retention of key executives by Rovi and TiVo; 12) intense competition from a number of sources; 13) potential loss of business from one or more major licensees; 14) general economic and market conditions; 15) the integration of businesses the combined companies may acquire or new business ventures the combined companies may start; 16) evolving legal, regulatory and tax regimes; 17) the expected amount and timing of cost savings and operating synergies; 18) failure to receive the approval of the stockholders of either Rovi or TiVo; 19) litigation related to the transaction; 20) unexpected costs, charges or expenses resulting from the transaction; and 21) other developments in the DVR and advanced television solutions market, as well as management’s response to any of the aforementioned factors. The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included herein and elsewhere, including the Risk Factors included in Rovi’s Annual Report on Form 10-K for the period ended December 31, 2015, Rovi’s Quarterly Report on Form 10-Q for the period ended March 31, 2016, TiVo’s Annual Report on Form 10-K for the period ended January 31, 2016, and other securities filings which are on file with the Securities and Exchange Commission (available at www.sec.gov). Neither company assumes any obligation to update any forward-looking statements except as required by law. No Offer or Solicitation The information in this communication is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities or the solicitation of any vote or approval in any jurisdiction pursuant to or in connection with the proposed transactions or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

Additional Information Additional Information about the Proposed Transaction and Where to Find It This communication is not a solicitation of a proxy from any stockholder of Rovi, Titan Technologies Corporation or TiVo. In connection with the Agreement and Plan of Merger among Rovi, TiVo, Titan Technologies Corporation (“Parent”), Nova Acquisition Sub, Inc. and Titan Acquisition Sub, Inc., Rovi, TiVo and Parent intend to file relevant materials with the SEC, including a Registration Statement on Form S-4 filed by Parent that will contain a joint proxy statement/prospectus. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED TRANSACTION WHEN IT BECOMES AVAILABLE BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION ABOUT ROVI, TIVO, PARENT AND THE PROPOSED TRANSACTION. Stockholders may obtain a free copy of the joint proxy statement/prospectus (when it becomes available), as well as any other documents filed by Rovi, Parent and TiVo with the Securities and Exchange Commission, at the Securities and Exchange Commission’s Web site at http://www.sec.gov. Stockholders may also obtain a free copy of the joint proxy statement/prospectus and the filings with the SEC that will be incorporated by reference in the joint proxy statement/prospectus from Rovi by directing a request to Rovi Investor Relations at 818-565-5200 and from TiVo by directing a request to MacKenzie Partners, Inc., 105 Madison Avenue, New York, New York, 10016, (212) 929-5500, proxy@mackenziepartners.com. Participants in the Solicitation Rovi, Parent, TiVo and their respective directors and executive officers and other members of their management and employees may be deemed, under Securities and Exchange Commission rules, to be participants in the solicitation of proxies in connection with the proposed transaction. Information regarding Rovi’s directors and officers can be found in its proxy statement filed with the Securities and Exchange Commission on March 10, 2016 and information regarding TiVo’s directors and officers can be found in its proxy statement filed with the Securities and Exchange Commission on June 1, 2015. Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests in the transaction, by security holdings or otherwise, will be contained in the Form S-4 and the joint proxy statement/prospectus that Parent will file with the Securities and Exchange Commission when it becomes available. Stockholders may obtain a free copy of these documents as described in the preceding paragraph.

Rovi’s Non-GAAP EPS is defined as diluted earnings per share from continuing operations, adding back non-cash items such as equity- based compensation, amortization of intangibles, amortization or write-off of note issuance costs, non-cash interest expense recorded on convertible debt under Accounting Standards Codification (“ASC”) 470-20 (formerly known as FSP APB 14-1), mark-to-market fair value adjustments for interest rate swaps; as well as items which impact comparability that are required to be recorded under GAAP, but that the Company believes are not indicative of its core operating results such as changes in the fair value of contingent consideration, gains from the release of Sonic payroll tax withholding liabilities related to a stock option review, transaction, transition and integration costs, contested proxy election costs, restructuring and asset impairment (benefit) charges, payments to note holders and for expenses in connection with the early redemption or modification of debt, gains on sale of strategic investments and discrete income and franchise tax items, including changes in reserves. Adjusted EBITDA is defined as operating income excluding depreciation, amortization of intangible assets, restructuring and asset impairment charges, equity-based compensation, retention earn-outs payable to former shareholders of businesses acquired and changes in contingent consideration, contested proxy election costs, changes in franchise tax reserves and transaction, transition and integration expenses. Rovi’s Non-GAAP Information

Use and Limitations of Non-GAAP Information Rovi’s management has evaluated and made operating decisions about its business operations primarily based upon Adjusted EBITDA and Non-GAAP EPS. Management uses Adjusted EBITDA and Non-GAAP EPS as measures as they exclude items management does not consider to be “core costs” or “core proceeds” when making business decisions. Therefore, management presents these Non-GAAP financial measures along with GAAP measures. For each such Non-GAAP financial measure, the adjustment provides management with information about the Rovi's underlying operating performance that enables a more meaningful comparison of its financial results in different reporting periods. For example, since Rovi does not acquire businesses on a predictable cycle, management excludes amortization of intangibles from acquisitions, transaction costs and transition and integration costs in order to make more consistent and meaningful evaluations of Rovi's operating expenses. Management also excludes the effect of restructuring and asset impairment (benefit) charges, expenses in connection with the early redemption or modification of debt and gains on sale of strategic investments. Management excludes the impact of equity-based compensation to help it compare current period operating expenses against the operating expenses for prior periods and to eliminate the effects of this non-cash item, which, because it is based upon estimates on the grant dates, may bear little resemblance to the actual values realized upon the future exercise, expiration, termination or forfeiture of the equity-based compensation, and which, as it relates to stock options and stock purchase plan shares, is required for GAAP purposes to be estimated under valuation models, including the Black-Scholes model used by Rovi Corporation. Management excludes non-cash interest expense recorded on convertible debt under ASC 470-20 and mark-to- market fair value adjustments for interest rate swaps as they are non-cash items and not considered “core costs” or meaningful when management evaluates Rovi's operating expenses. Management excludes discrete tax items, including changes in tax reserves, so that its Non-GAAP income tax expense and franchise tax expense reflect the current year cash taxes it accrues and pays.

Use and Limitations of Non-GAAP Information (Cont.) Management is using these Non-GAAP measures to help it make budgeting decisions, including decisions that affect operating expenses and operating margin. Further, Non-GAAP financial information helps management track actual performance relative to financial targets. Making Non-GAAP financial information available to investors, in addition to GAAP financial information, may also help investors compare Rovi's performance with the performance of other companies in our industry, which may use similar financial measures to supplement their GAAP financial information. Management recognizes that the use of Non-GAAP measures has limitations, including the fact that management must exercise judgment in determining which types of charges should be excluded from the Non-GAAP financial information. Because other companies, including companies similar to Rovi, may calculate their non-GAAP financial measures differently than Rovi calculates its Non-GAAP measures, these Non-GAAP measures may have limited usefulness in comparing companies. Management believes, however, that providing Non-GAAP financial information, in addition to GAAP financial information, facilitates consistent comparison of Rovi's financial performance over time. Rovi provides Non-GAAP financial information to the investment community, not as an alternative, but as an important supplement to GAAP financial information; to enable investors to evaluate Rovi's core operating performance in the same way that management does.

TiVo’s Non-GAAP Information TiVo's "EBITDA" means income before interest income and expense, provision for income taxes and depreciation and amortization. TiVo's "Adjusted EBITDA" is EBITDA adjusted for acquisition related charges for retention earn-outs payable to former shareholders of the business we acquired and changes in fair value of acquired business' performance related earn- outs, transition and restructuring charges, stock-based compensation, litigation expenses associated with litigation matters (whether or not initiated by us) which have the potential to result in revenue generation and litigation proceeds attributable to past damage awards, but includes litigation proceeds recognized as technology licensing revenue. EBITDA and Adjusted EBITDA are not measures of financial performance under generally accepted accounting principles, which we refer to as GAAP. We have presented EBITDA and Adjusted EBITDA solely as supplemental disclosure because we believe they allow for a more complete analysis of our results of operations and we believe that EBITDA and Adjusted EBITDA are useful to investors because EBITDA and Adjusted EBITDA are commonly used to analyze companies on the basis of operating performance. In addition, because of the variety of equity awards used by companies, the varying methodologies for determining stock-based compensation expense, and the subjective assumptions involved in those determinations, we believe excluding stock-based compensation enhances the ability of management and investors to evaluate our operating performance over multiple periods. Management does not use EBITDA or Adjusted EBITDA as a measure of liquidity because, among other things, they do not exclude the impact of deferred revenue from IP settlements nor the impact of deferred revenues associated with the amortization of product lifetime subscriptions. We do not use stock-based compensation expense in our internal measures. A limitation associated with these non-GAAP measures is that they do not include any stock-based compensation expense related to hiring, retaining, and incentivizing the Company's workforce. EBITDA and Adjusted EBITDA are not intended to represent, and should not be considered more meaningful than, or as an alternative to, measures of operating performance as determined in accordance with GAAP.

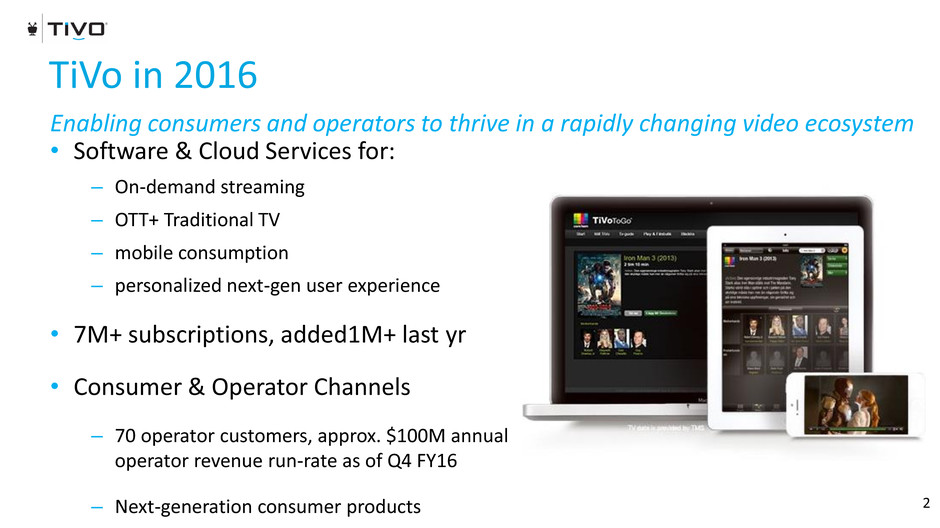

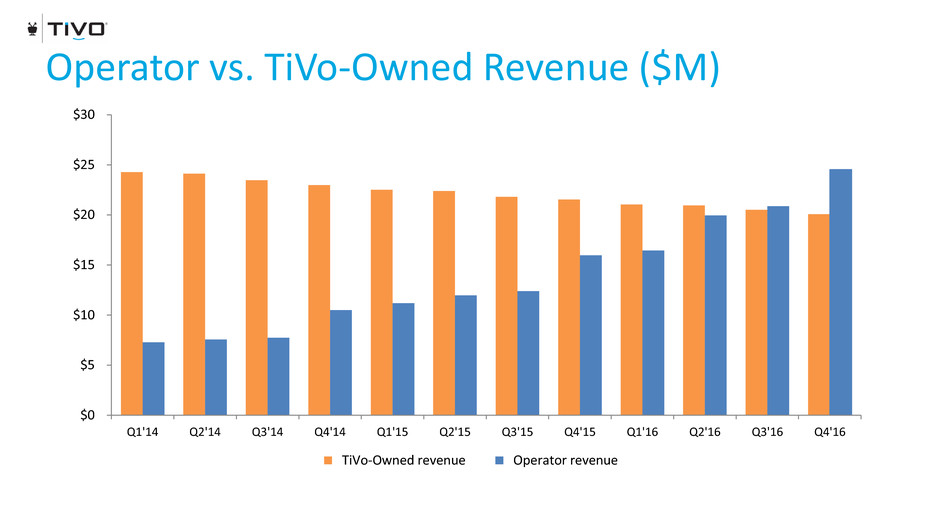

TiVo in 2016 2 • Software & Cloud Services for: – On-demand streaming – OTT+ Traditional TV – mobile consumption – personalized next-gen user experience • 7M+ subscriptions, added1M+ last yr • Consumer & Operator Channels – 70 operator customers, approx. $100M annual operator revenue run-rate as of Q4 FY16 – Next-generation consumer products Enabling consumers and operators to thrive in a rapidly changing video ecosystem

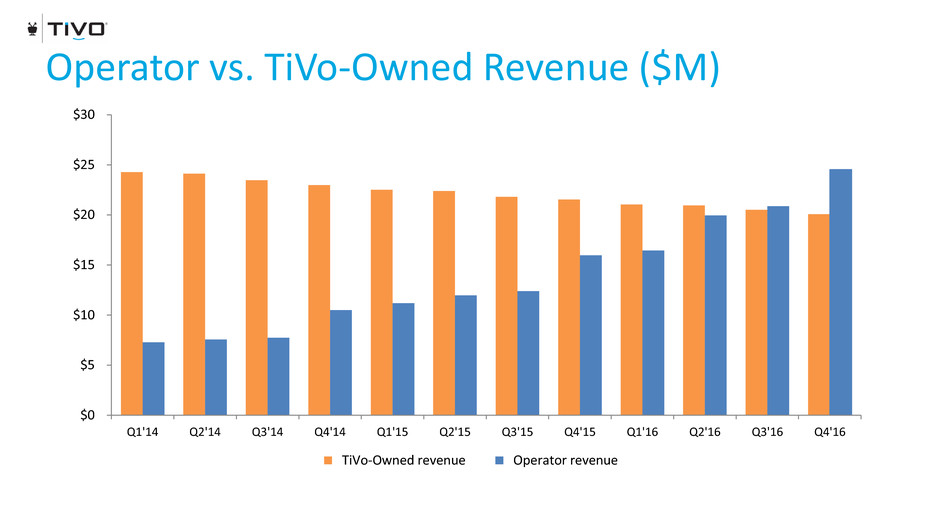

$0 $5 $10 $15 $20 $25 $30 Q1'14 Q2'14 Q3'14 Q4'14 Q1'15 Q2'15 Q3'15 Q4'15 Q1'16 Q2'16 Q3'16 Q4'16 TiVo-Owned revenue Operator revenue Operator vs. TiVo-Owned Revenue ($M)

• Leading user interface • OTT content integrated with traditional linear television • Seamless Multi-screen experience • Ability to integrate with virtually any infrastructure • Consumer offering drives innovation • A smarter way to access ongoing Innovation Demonstrated Improvements in Churn, ARPU, NPS Why TiVo 11

TiVo’s Operator Clients 12 “TiVo is the best connected TV certainly in the U.K. and I would argue in the world. It is produced by connected TV experts. It's all they do, that's why we've partnered with them.” — Neil Berkett, Former CEO, Virgin Media 5

TiVo+Rovi: Rationale • Creates largest entertainment software provider • Nearly 500 operator customers • Significant financial scale -- 2016 Pro forma revenue of $780M to $830M & ~40% Adjusted EBITDA margins (1) (2) (3) • Revenue diversity • Increased R&D capacity • $100M+ synergy opportunity • Non-GAAP EPS Accretive 12 months after close 13 (1) Represents a combination of licensing revenues and past damages awards from Rovi and TiVo, recognized as a contra expense (2) On a pro forma basis, based upon the midpoint of estimates and post the impact of purchase accounting adjustments, but before any benefit from synergies (3) See definition of Non-GAAP information for Rovi and TiVo in the Appendix