Term Sheet

JAG Media Holdings, Inc. (OTCBB: JAGH)

and

CardioGenics Inc.

Acquisition of CardioGenics Inc. by CardioGenics ExchangeCo, Inc., A To Be Created Wholly Owned Subsidiary of CardioGenics CallCo, Inc., a To Be Created Wholly-Owned Subsidiary of JAG Media Holdings, Inc.

| 1. | Target: | CardioGenics Inc., a corporation organized under the laws of the Province of Ontario Canada, having a principal place of business at 6295 Northam Drive, Unit 8, Missisauga, Ontario L4V 1W8 Canada (“CardioGenics”). A summary of CardioGenics and its business is attached as Annex 1 to this Term Sheet. |

| | | |

| 2. | ISSUER: | JAG Media Holdings, Inc., a Nevada corporation (OTCBB: JAGH) having a principal place of business at 6865 SW 18th Street, Suite B13, Boca Raton, FL 33433 (“JAG Media”). |

| | | |

| 3. | Y.A. Global: | YA Global Master SPV Ltd., having offices at 101 Hudson Street, Suite 3700, Jersey City, NJ 07302 (“YA Global”). |

| | | |

| 4. | Common Stock: | The Common Stock of JAG Media, par value $0.00001 per share, or any security into which such Common Stock is hereafter reclassified. |

| | | |

| 5. | CardioGenics | |

| | Shares: | All of the issued and outstanding shares of capital stock of CardioGenics. |

| | | |

| 6. | Closing: | The closing of the transactions contemplated by this term sheet, which shall take place in the offices of Fasken Martineau Dumoulin LLP, 66 Wellington Street West, Suite 4200, Toronto Dominion Bank Tower, Toronto, Ontario M5K 1N6, Canada, on the Closing Date. |

| | | |

| 7. | Closing Date: | The date on which the Closing occurs, which date shall be April 30, 2009 or such other date as may be mutually agreed upon by the parties. |

| | | |

| 8. | CardioGenics | |

| | Stockholders: | The holders of the CardioGenics Shares. |

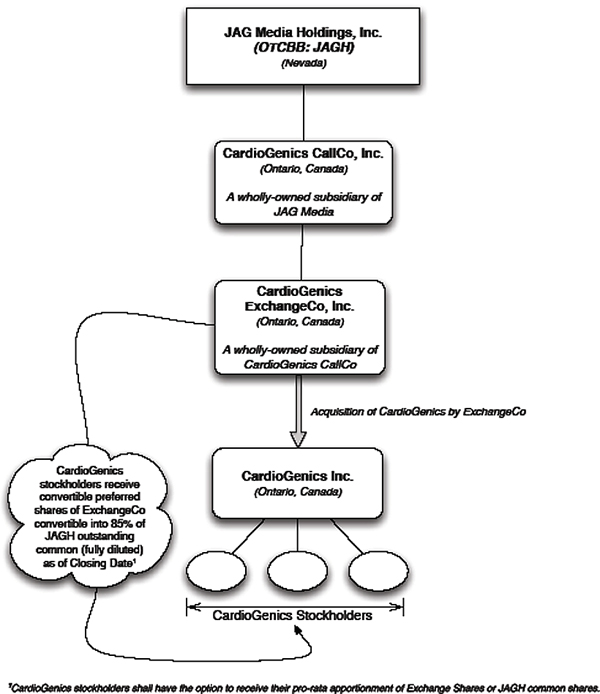

| 9. | Deal Structure: | At the Closing CardioGenics ExchangeCo, Inc. (“ExchangeCo”), a wholly-owned Ontario subsidiary of CardioGenics CallCo, Inc. (“CallCo”), a wholly-owned Ontario subsidiary of JAG Media, shall acquire CardioGenics (the “Acquisition”). In consideration of the acquisition of CardioGenics by ExchangeCo, the CardioGenics Stockholders shall be issued at the Closing, in exchange for all of the CardioGenics Shares, a number of convertible preferred ExchangeCo shares (the “ExchangeCo Shares”), which, upon conversion, shall result in the issuance to the ExchangeCo stockholders of a number of shares of Common Stock, which upon such issuance shall equal eighty-five percent (85%) of JAG Media’s outstanding Common Stock (on a fully diluted basis) as of the Closing Date, assuming (for purposes of this calculation) that the shares of Common Stock resulting from the conversion of the ExchangeCo Shares were issued at the Closing. The CardioGenics Stockholders shall have the option to receive their pro-rata number of ExchangeCo Shares or, in lieu thereof, may elect to receive directly their pro-rata number of Common Stock shares. The shares of Common Stock to be received by stockholders of CardioGenics at the Closing may not be registered for sale with the U.S. Securities and Exchange Commission and would, therefore, be subject to the rights and restrictions of Rule 144. Shares of Common Stock issued to ExchangeCo stockholders upon conversion of their ExchangeCo Shares after the Closing may not be registered for sale with the U.S. Securities and Exchange Commission prior to six (6) months following the Closing and would, therefore, be subject to the rights and restrictions of Rule 144 prior to any such registration. CallCo and ExchangeCo shall be established as subsidiaries of JAG Media prior to the Closing. A diagram of the acquisition structure is attached as Annex 2 to this term sheet. Capitalization summaries for JAG Media and CardioGenics are set forth in Annex 3 to this term sheet. |

| | | |

| 10. | Acquisition | |

| | Agreement & | |

| | Other Documents: | The respective parties shall make good faith efforts to negotiate and execute an acquisition agreement, standby equity distribution agreement with Y.A. Global (as defined in paragraph 14 below) (“SEDA”) and such other documents as may be necessary or desirable in connection with the transactions contemplated by this term sheet. The execution of the acquisition agreement shall be subject to (a) JAG Media and YA Global entering into the SEDA and (b) CardioGenics receiving commitments for not less than $1,500,000 in financing (“Required Funding”). The Closing shall be subject to (x) each party completing a due diligence review, the results of which are satisfactory in all respects to each party; (y) JAG Media’s common stock continuing to be quoted on the OTC Bulletin Board as of the Closing Date and (z) the entering into of definitive agreements among the parties, including, without limitation, a mutually acceptable definitive acquisition agreement between CardioGenics and ExchangeCo and other related agreements. |

| 11. | Audited | |

| | Financials: | No later than April 10, 2009, CardioGenics shall furnish JAG Media with audited financial statements covering its two (2) most recent fiscal years, which financial statements shall be prepared in accordance with U.S. GAAP. Upon receipt of such audited financials from CardioGenics, JAG Media shall cause its accountants and auditors to prepare pro forma financials for the combined companies for the last two (2) fiscal years, which shall be included in the Current Report on Form 8-K to be filed on or about the Closing Date as set forth in paragraph 15 below. |

| | | |

| 12. | Board of | |

| | Directors & | |

| | | JAG Media’s Board of Directors shall be increased from three (3) to four (4) members and at the Closing JAG Media’s current directors shall resign and four (4) CardioGenics nominees shall be appointed to the Board. In connection with the resignation of such board members, JAG Media, with the assistance of CardioGenics, shall file and begin mailing to the JAG Media stockholders, promptly after the execution of the acquisition agreement and at least ten (10) days prior to the Closing, an 14f-1 Information Statement containing such information as may be required regarding the change in the majority of the directors of JAG Media. Further, at the Closing, Thomas J. Mazzarisi and Stephen J. Schoepfer shall also resign from all executive positions held by them with JAG Media or any of its subsidiaries and shall be replaced by executives appointed by the CardioGenics appointed directors. |

| 13. | Corporate | |

| | Approvals: | JAG Media and CardioGenics shall obtain all appropriate and necessary corporate and stockholder approvals for the transactions contemplated hereby and shall deliver officer certificates to such effect at Closing. |

| | | |

| 14. | Standby Equity | |

| | Distribution | |

| | Agreement: | (a) Prior to the execution of the acquisition agreement, JAG Media and YA Global shall enter into the SEDA pursuant to which YA Global shall commit to purchase up to $5,000,000 of Common Stock of the post-closing company over the course of 36-months after the date that the registration statement for the shares of Common Stock to be issued pursuant to the SEDA is first declared effective. |

| | | |

| | | (b) The post-closing company shall have the right, but not the obligation, to sell Common Stock to YA Global under the SEDA by delivering “Advance Notices” to YA Global not more frequently than weekly and for not more than $250,000 per week. The per share price for the issuance of Common Stock in connection with any Advance Notice shall be equal to 95% of the lowest Volume Weighted Average Price (“VWAP”) per share of the post-closing company’s Common Stock during the five (5) consecutive trading days commencing on the trading day immediately following the date on which YA Global received the Advance Notice. |

| | | |

| | | (c) The post-closing company shall file with the U.S. Securities and Exchange Commission (“SEC”), not prior to the tenth (10th) trading day following the “Commencement Date,” an applicable registration statement, which shall register for resale the shares of Common Stock to be issued in connection with the SEDA. “Commencement Date” shall mean the date that the following conditions have been satisfied or waived by YA Global: (i) YA Global shall have completed due diligence on CardioGenics, including, without limitation, its business and its public disclosure filed with the SEC; (ii) YA Global shall have conducted background investigations into the management and directors of CardioGenics, the results of which are satisfactory to YA Global; and (iii) JAG Media shall have completed the Acquisition. |

| | | |

| | | (d) The post-closing company shall issue to YA Global restricted shares of the Issuer’s common stock in an amount equal to $250,000 as a commitment fee (“Commitment Fee”). The shares representing the Commitment Fee shall be: (i) payable 10 trading days after the Commencement Date and (ii) shall be issued at a price equal to the average VWAP of the Common Stock over the ten (10) trading days following the effectiveness of the Closing. |

| 15. | 8-K: | JAG Media and CardioGenics shall cooperate in the preparation of a Current Report on Form 8-K, which shall be filed with the SEC on or about the Closing Date. Such 8-K shall contain required information regarding CardioGenics, JAG Media and the acquisition, including, without limitation, pro forma financials for the combined companies for the last two (2) fiscal years. |

| | | |

| 16. | Transition: | At the Closing, Messers. Mazzarisi & Schoepfer shall enter into consulting agreements with the post-closing company pursuant to which they will provide certain consulting services to assist the post-closing company in connection with certain transition matters, including the continued operation of JAG Media’s pre-acquisition business. The consulting agreements shall be on terms and conditions to be agreed upon by the parties. |

| | | |

| 17. | Post-Closing | |

| | Information | |

| | Statement: | Immediately following the Closing, if necessary in order to change the post-closing company’s name, the post-closing company shall prepare, distribute to the JAG Media Stockholders and file with the SEC an information statement changing the company’s name from “JAG Media Holdings, Inc.” to “CardioGenics Holdings, Inc” and including such other matters as the post-closing company may deem appropriate. |

| | | |

| 18. | Cooperation: | Each party, will make available to the other party for review their respective financial statements, books, records, corporate documents and other information as the other party may reasonably request, and each party shall have the opportunity to meet with attorneys, accountants and key personnel of the other party to discuss the financial and business conditions of the respective parties and to make whatever future independent investigation deemed necessary and prudent. The parties agree to cooperate with each other in complying with these requests and providing such materials as the other parties may request. CardioGenics shall also assist JAG Media, and provide such information and documentation regarding the CardioGenics business as may be necessary, in connection with any filings to be made by JAG Media with the SEC, including, without limitation, one or more Form 8-K’s relating to the transaction to be filed on or about the Closing Date. |

| 19. | Expenses: | JAG Media and CardioGenics shall be solely responsible to pay their own expenses (including, without limitation, legal and accounting expenses) incurred in preparing and negotiating the acquisition agreement and related documents, whether or not the transactions contemplated hereby are consummated. |

Dated: March 12, 2009

| JAG MEDIA HOLDINGS, INC. | | CARDIOGENICS INC. | |

| | | | | | |

| | | | | | |

| | | | | | |

| By: | /s/ Thomas J. Mazzarisi | | By: | /s/ Yahia Gawad | |

| | Name: Thomas J. Mazzarisi | | | Name: Yahia Gawad | |

| | Title: Chairman & CEO | | | Title: Chief Executive Officer | |

| | | | | | |

| | | | | | |

| | | | PRINCIPAL STOCKHOLDER: | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | /s/ Yahia Gawad | |

| | | | Yahia Gawad | |

ANNEX 1

CARDIOGENICS BUSINESS SUMMARY

CardioGenics Inc. (“CardioGenics”) was incorporated under the Ontario Business Corporations Act on November 20th, 1997 by Dr. Yahia Gawad to develop technology and products targeting the immunoassay segment of the In Vitro Diagnostic (IVD) testing market. CardioGenics has developed the QL Care Analyzer (“QLCA”), a proprietary point of care immuno-analyzer and a series of tests for cardiovascular diagnostics. To date, CardioGenics has invested approximately $4.0 million in product development. The full scope of CardioGenics’ technology and all aspects of chemical entrapment in bioassays are covered under CardioGenics patents.

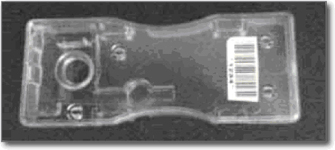

The QLCA operates through a pre-loaded disposable test cartridge, which uses a core technology that delivers medical-lab quality test results at the point of care. Unlike many other point of care and lab-based diagnostic equipment CardioGenics’ disposable cartridge will allow tests to be run using whole blood in lieu of blood plasma, thereby simplifying and expediting the test procedure.

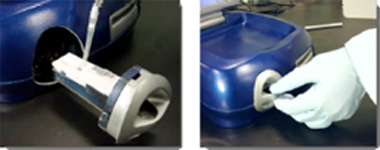

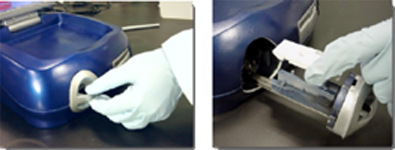

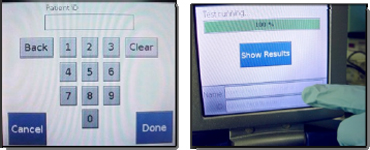

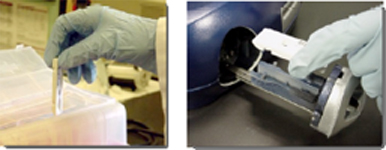

CardioGenics’ first four immunoassay tests will identify proteins occurring during cardiovascular diseases. The QLCA is small, self-contained, completely automated and the operator does not require specialized training. Testing can be completed in 15 minutes using the pre-loaded test cartridge and a few drops of whole blood. A typical test sequence is depicted below.

| Ü | Operator initiates the QL Care® analyzer by opening the flip top and tapping the graphical touch screen |

| Ü | Operator adds a drop of patient’s blood to the cartridge and closes the door, initiating the test |

| Ü | Operator opens the cartridge door and inserts our proprietary cartridge containing all reagents for the test |

| Ü | QL Care® analyzer automatically identifies the test from the cartridge barcode, loads the corresponding software and runs the test |

| Ü | 15 minutes later, the test results are displayed on the monitor, stored in the analyzer, forwarded to a network or printed on the internal printer |

| Ü | The cartridge is removed and disposed; the QL Care® analyzer is ready for the next test |

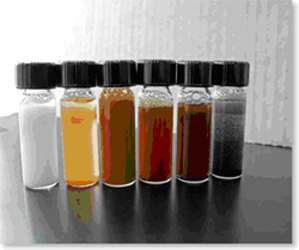

As part of the development of its core proprietary technology, CardioGenics has also developed a proprietary method for silver coating paramagnetic microspheres (a fundamental platform component of immunoassay equipment) (“Beads”) to improve instrument sensitivity to light.

CardioGenics plans to submit the QLCA and its first cardiovascular diagnostic test (Troponin I) for United States Food and Drug Administration (“FDA”) approval within 12-14 months from the closing of the acquisition. The Beads are market ready.

ANNEX 2

ACQUISITION STRUCTURE

ANNEX 3

CAPITALIZATION SUMMARIES

JAG MEDIA HOLDINGS, INC.

A Nevada Corporation

Common Shares Authorized: 500,000,000

Preferred Shares Authorized: 50,000,000

Par Value: $0.0001

| Common Shares Outstanding: | | | 63,503,004 | 1 |

| | | | | |

| Preferred Shares Outstanding: | | None | |

| | | | | |

| Options Outstanding/Issuable: | | | 2,750,000 | |

| | | | | |

| Warrants Outstanding: | | | 8,250,000 | |

| | | | | |

| Convertible Debt Outstanding: | | None | |

| | | | | |

| Outstanding Shares (fully diluted) | | | 74,503,004 | |

1Includes all CL A Common, Ser 1 CL B Common and Common J shares, which are convertible into JAG Media Common Shares.

CARDIOGENICS, INC.

An Ontario Canada Corporation

COMMON SHARES AUTHORIZED: Unlimited

PREFERRED SHARES AUTHORIZED: None

| Common Shares Outstanding: | | | 12,730,045 | |

| | | | | |

| Preferred Shares Outstanding: | | None | |

| | | | | |

| Options Outstanding: | | | 460,953 | |

| | | | | |

| Warrants Outstanding: | | | 1,609,908 | |

| | | | | |

| Common Shares Issuable Upon | | | | |

| Conversion of Debt Instruments: | | | 2,523,000 | |

| | | | | |

| Outstanding Shares (fully diluted) | | | 17,323,906 | |