UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [_]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[_] CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE

14A-6(E)(2)

[X] Definitive Proxy Statement

[_] Definitive Additional Materials

[_] Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12

VENTIV HEALTH, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[_] Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

[_] Fee paid previously with preliminary materials.

[_] Checkbox if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

May 17, 2006

Dear Fellow Stockholder:

You are cordially invited to attend the 2006 Annual Meeting of Stockholders of Ventiv Health, Inc. (the "Company"), which will be held at 1180 Avenue of the Americas, 10th Floor (Times Square Conference Room), New York, NY 10036, on June 14, 2006 at 9:00 a.m., EST.

Enclosed are the Notice of Annual Meeting, the Proxy Statement and the Company’s 2006 Annual Report. The Proxy Statement describes the business to be conducted at the Annual Meeting and provides other information concerning the Company of which you should be aware when you vote your shares.

Admission to the Annual Meeting will be by ticket only. If you are a registered stockholder planning to attend the meeting, please check the appropriate box on the proxy card and retain the bottom portion of the card as your admission ticket.

If you are unable to attend the Annual Meeting in person, you may listen to the proceedings through the Internet. To listen to the live webcast, please log on at www.inventivhealth.com in the "Investor Relations" section of the website. The webcast will begin at 9:00 a.m., EST, and will remain on the Company's website for one year. The webcast will permit stockholders to listen to the Annual Meeting but will not provide for the ability to vote or present any stockholder proposals.

Whether or not you attend the Annual Meeting, it is important that your shares be represented and voted at the meeting. As a stockholder of record, you can vote your shares by signing, dating and mailing the proxy card in the enclosed envelope. If you decide to attend the Annual Meeting and vote in person, you may then withdraw your proxy.

On behalf of the Board of Directors and the employees of Ventiv Health, Inc., I would like to express my appreciation for your continued interest in the affairs of the Company.

Sincerely,

Eran Broshy

Chief Executive Officer

VENTIV HEALTH, INC.

200 Cottontail Lane

Vantage Court North

Somerset, New Jersey 08873

NOTICE OF 2006 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 14, 2006

May 17, 2006

To Our Stockholders:

You are cordially invited to attend the 2006 Annual Meeting of Stockholders of Ventiv Health, Inc. (the "Company") to be held at 1180 Avenue of the Americas, 10th Floor (Times Square Conference Room), New York, NY 10036, on June 14, 2006 at 9:00 a.m., EST, for the following purposes:

| 1. | To elect eight (8) directors of the Company; |

| 2. | To approve an amendment to the Company’s Certificate of Incorporation changing the name of the Company to inVentiv Health, Inc. |

| 3. | To approve the Company’s 2006 Long-Term Incentive Plan; |

| 4. | To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for 2006; and |

| 5. | To transact such other business as may properly come before the meeting. |

Only stockholders of record at the close of business on May 5, 2006 will be entitled to notice of, and to vote at, the meeting.

YOUR VOTE IS VERY IMPORTANT. WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING, PLEASE FILL IN, SIGN, DATE AND MAIL THE ENCLOSED PROXY AS PROMPTLY AS POSSIBLE.

IF YOU DO NOT PLAN TO ATTEND THE ANNUAL MEETING, PLEASE MARK THE APPROPRIATE BOX ON YOUR PROXY CARD. AN ADMISSION CARD IS INCLUDED IF YOU ARE A STOCKHOLDER OF RECORD. IF YOUR SHARES ARE HELD IN STREET NAME, AN ADMISSION CARD IN THE FORM OF A LEGAL PROXY WILL BE SENT TO YOU BY YOUR BROKER. IF YOU DO NOT RECEIVE THE LEGAL PROXY IN TIME, YOU WILL BE ADMITTED TO THE ANNUAL MEETING BY SHOWING YOUR MOST RECENT BROKERAGE STATEMENT VERIFYING YOUR OWNERSHIP OF COMMON STOCK AS OF THE RECORD DATE.

By Order of the Board of Directors,

John R. Emery

John R. Emery Secretary

TABLE OF CONTENTS

| | PAGE |

| | 1 |

| | 3 |

| | | | 3 |

| | | | 4 |

| | | | | 4 |

| | | | | 5 |

| | | | | 5 |

| | | | | | 5 |

| | | | | | 5 |

| | | | | | 5 |

| | | | 6 |

| | 7 |

| | 8 |

| | 8 |

| | | | 8 |

| | | | 9 |

| | | | 10 |

| | | | 10 |

| | | | 10 |

| | | | 12 |

| | | | 13 |

| | | | 13 |

| | | | 14 |

| | 15 |

| | | | 15 |

| | | | 15 |

| | | | 16 |

| | | | 20 |

| | 21 |

| | 21 |

| | |

| | |

VENTIV HEALTH, INC.

200 Cottontail Lane

Vantage Court North

Somerset, New Jersey 08873

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 14, 2006

GENERAL INFORMATION

General

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Ventiv Health, Inc. (the “Company”) for use at the 2006 Annual Meeting of Stockholders to be held at 1180 Avenue of the Americas, 10th Floor (Times Square Conference Room), New York, NY 10036, on June 14, 2006 at 9:00 a.m., EST. The proposals to be acted upon are set forth in the accompanying Notice of Annual Meeting. Each proposal is described in more detail in this Proxy Statement.

This Proxy Statement and the enclosed proxy are first being mailed to the Company's stockholders on or about May 17, 2006. The Company is mailing its Annual Report to Stockholders for the year ended December 31, 2005, along with this Proxy Statement and the enclosed proxy. The 2005 Annual Report to Stockholders does not form any part of the materials for the solicitation of proxies.

Record Date, Share Ownership and Voting

Stockholders of record at the close of business on May 5, 2006 (the “Record Date”) are entitled to notice of and to vote at the Annual Meeting and at any adjournment(s) thereof. At the Record Date, 29,157,678 shares of our Common Stock, par value $0.001 per share (“Common Stock”), were issued and outstanding. Each stockholder of record will be entitled to one vote for each share of Common Stock held of record as of the Record Date.

Stockholders of record as of the Record Date may vote in person at the Annual Meeting or by proxy using the enclosed proxy card. Stockholders are requested to complete, date, sign and promptly return the accompanying form of proxy in the enclosed envelope whether or not they plan to attend the Annual Meeting to ensure that all votes are counted. As stated above, stockholders who have voted by proxy may still attend the Annual Meeting and vote in person.

If instructions are not given, proxies will be voted "FOR" election of each nominee for director named herein and each of the other proposals described herein. A properly executed proxy marked "WITHHELD" with respect to the election of one or more directors will not be voted with respect to the director or directors indicated. As a consequence of New York Stock Exchange (“NYSE”) regulations described below, shares held through a broker or other nominee that is a member organization of the NYSE will only be voted on Proposal 3 (approval of the Company’s 2006 Long-Term Incentive Plan) if the beneficial owner has provided specific voting instructions to the broker or other nominee holding such shares to vote such shares on that proposal.

Discretionary authority is provided in the proxy as to any matters not specifically referred to therein. Except for the matters discussed in this Proxy Statement and reflected in the proxy, management is not aware of any other matters which are likely to be brought before the Annual Meeting. If any such matters properly come before the Annual Meeting, however, the persons named in the proxy are fully authorized to vote thereon in accordance with their judgment and discretion.

Under our by-laws, directors are elected by plurality, which means that the eight persons for whom the highest numbers of votes are cast will be elected as directors. Proposal 2 (approval of amendment of the Company’s certificate of incorporation changing name to inVentiv Health, Inc.) is subject to approval by a majority of the outstanding shares of the Company's common stock. Proposals 3 (approval of 2006 Long-Term Incentive Plan) and 4 (ratification of appointment of independent registered public accounting firm) are subject to approval by a majority of the votes cast with respect to the particular matter.

Quorum; Abstentions; Broker Non-Votes

Our Bylaws provide that stockholders holding a majority of the shares of Common Stock issued and outstanding and entitled to vote on the Record Date shall constitute a quorum at meetings of stockholders. Votes will be counted by the inspector of election appointed for the Annual Meeting, who will separately count “For” and (with respect to proposals other than the election of directors) “Against” votes, abstentions and broker non-votes. A “broker non-vote” occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that proposal and has not received instructions with respect to that proposal from the beneficial owner. Broker non-votes and abstentions are not counted toward votes cast and therefore have no effect on any proposal, but will be counted for purposes of determining the presence or absence of a quorum for the transaction of business.

The NYSE has issued regulations prohibiting brokers or other nominees that are NYSE member organizations from voting in favor of proposals relating to equity compensation plans unless they receive specific instructions from the beneficial owner of the shares to vote in that manner.

Revocability of Proxies

A stockholder who has given a proxy pursuant to this solicitation may revoke it at any time prior to its exercise at the Annual Meeting by (1) giving written notice of revocation to the Secretary of the Company, (2) properly submitting to the Company a duly executed proxy bearing a later date or (3) voting in person at the Annual Meeting. All written notices of revocation or other communications with respect to revocation of proxies should be addressed as follows: Ventiv Health, Inc., 200 Cottontail Lane, Vantage Court North, Somerset, NJ, 08873, Attention: Corporate Secretary.

Costs of Proxy Solicitation; Means of Solicitation

The Company will pay the cost of all proxy solicitations. The Company has engaged The Altman Group to render proxy solicitation services at a cost of $7,000 plus out of pocket expenses and customary fees relating to the solicitation and receipt of proxies. Furthermore, officers and other employees of the Company and its subsidiaries may solicit proxies. In addition to the solicitation of proxies by mail, proxies may be solicited by personal interview, telephone, telecopy and telegram. Officers and employees of the Company will not receive compensation for proxy solicitation services, which will be performed in addition to their regular duties.

The Company has made arrangements with brokerage firms, banks, nominees and other fiduciaries to forward proxy solicitation material for shares held of record by them to the beneficial owners of such shares. The Company will reimburse such persons for their reasonable out-of-pocket expenses in forwarding such material.

The Board of Directors (the “Board”) has nominated the following eight incumbent directors for election to the Board: Eran Broshy, A. Clayton Perfall, Donald Conklin, John R. Harris, Per G.H. Lofberg, Mark E. Jennings, Terrell G. Herring and R. Blane Walter. Daniel M. Snyder, our Chairman and the ninth member of the Board, has determined to retire from the Board at the end of his current term; however, Mr. Snyder will assume the role of Chairman Emeritus upon his retirement. Eran Broshy is expected to assume the role of Chairman of the Board following the Company's 2006 annual shareholder meeting and will retain his current position as Chief Executive Officer of the Company.

If elected, each of the following nominees will serve for a one-year term expiring at the 2007 Annual Meeting or at the earlier of his resignation or removal. Certain additional information regarding each of the nominees, as of the Record Date, is set forth below.

Name and present position with the Company | Biography |

| Eran Broshy, | |

| Director, Chief Executive Officer | Mr. Broshy, 47, has served as the chief executive officer and a director of the Company since it became a publicly-traded entity in September 1999, and has led the Company’s successful growth and expansion. Mr. Broshy brings over 20 years pharmaceutical and health care industry experience to the Company. Prior to joining the Company, Mr. Broshy spent 14 years with The Boston Consulting Group, a leading strategy consulting firm, serving from 1993 to 1998 as the partner responsible for the firm’s North American healthcare practice. From 1998 to 1999, Mr. Broshy served as president and chief executive officer of Coelacanth Corporation, a privately-held biotechnology company. Mr. Broshy is also a member of the Board of Directors of Neurogen Corporation. |

| A. Clayton Perfall, | |

| Director | Mr. Perfall, 47, has been a director of the Company since the Company's separation from Snyder Communications, Inc. in September 1999. He currently serves as chief executive officer of AHL Services, Inc. a sales and marketing execution company serving primarily the automotive, retail, consumer products and financial services industries. Prior to taking this position in October 2001, Mr. Perfall served as chief executive officer of Convergence Holdings, Corp. Prior to taking this position in January 2001, Mr. Perfall served as the chief financial officer and a director of Snyder Communications, Inc. from 1996 to September 2000. Prior to joining Snyder Communications, Inc., Mr. Perfall spent fifteen years with Arthur Andersen LLP. |

| Donald R. Conklin, | |

| Director | Mr. Conklin, 69, has been a director of the Company since September 1999. Prior to joining the Company's Board, Mr. Conklin worked for 39 years with Schering-Plough Corporation. He was president of the Worldwide Pharmaceutical Operations for nine years and concluded his career as chairman of the Health Care Products division for three years. Mr. Conklin is a member of the Board of Directors of Alfacell, Inc. |

| John R. Harris, | |

| Director | Mr. Harris, 57, has been a director of the Company since May 2000. Mr. Harris previously spent 25 years with Electronic Data Systems, during which he held a variety of executive leadership positions including group executive and president of EDS's four strategic business units serving the telecommunications and media industries and later served as corporate vice president, marketing & strategy. Since leaving EDS in 1999, Mr. Harris has served as chairman and chief executive officer of Ztango, Inc., as chief executive officer and president of Exolink, as chief executive officer and president of Delinea Corporation, and most recently as chief executive officer of Seven Worldwide Inc., a digital content management company. Mr. Harris is a member of the Board of Directors of PTEK Holdings, Inc. |

| Per G.H. Lofberg, | |

| Director | Mr. Lofberg, 58, has been a director of the Company since February 2005. Mr. Lofberg brings over 30 years pharmaceutical and health care industry experience to the Company. He is currently president and chief executive officer of Merck Capital Ventures, LLC, a position that he has held since 2000. From 1993-2000, Mr. Lofberg was chairman of Merck-Medco Managed Care, LLC, a wholly-owned subsidiary of Merck & Co., Inc. and the country’s largest provider of prescription drug benefit management services. Under his leadership, Merck-Medco grew from $3 billion to $23 billion in revenues. Mr. Lofberg joined Merck-Medco in 1988 as senior executive vice president, a member of the office of the president and a director. Before Merck-Medco, Mr. Lofberg was a partner at The Boston Consulting Group and oversaw the firm’s worldwide health care practice. |

Name and present position with the Company | Biography |

| Mark E. Jennings, | |

| Director | Mr. Jennings, 43, has been a director of the Company since February 2005. Mr. Jennings is the managing partner and co-founder of Generation Partners, a $325 million private investment firm focused on providing growth capital to companies primarily in the business and information services, communications and healthcare sectors. Prior to founding Generation in 1995, Mr. Jennings was a partner of Centre Partners, a private investment firm affiliated with Lazard Frères & Co. Mr. Jennings began his career at Goldman Sachs & Co. where he advised companies in the areas of financial strategy, public offerings, mergers & acquisitions and leveraged buyouts. Through Generation and predecessor firms, he has invested in more than 50 companies and has served as a director on 20 boards. Mr. Jennings is also the chairman of the Board of Trustees of Post University, Inc., a 115 year-old regionally-accredited University and is on the Board of Directors of the Spiritual Cinema Circle, a mult-faith organization dedicated to fitness that inspire, heal and transform. |

| Terrell G. Herring, | |

| Director, President and Chief Executive Officer, inVentiv Commercial | Mr. Herring, 42, has been a director of the Company since October 2005. Mr. Herring has served as the president and chief executive officer of the Company's inVentiv Commercial division since October 2005. Since joining the Company in November 1999, Mr. Herring has held the positions of national business director, vice president and general manager, U. S. Sales, president and COO, Ventiv Pharma Services and president and COO, inVentiv Commerical. He has more than 18 years experience in pharmaceutical sales. Before joining Ventiv, Mr. Herring was the senior national sales director at Noven Pharmaceuticals where he focused on transdermal delivery and women's health marketing. He began his career at Ciba-Geigy Pharmaceuticals and Solvay Pharmaceuticals where he held various sales management, training, development, marketing, and operations positions. |

| R. Blane Walter, | |

| Director, President and Chief Executive Officer, inVentiv Communications | Mr. Walter, 35, has been a director of the Company since October 2005. Mr. Walter has served as the president and chief executive officer of the Company's inVentiv Communications division since the acquisition of inChord Communications, Inc. (“inChord”) in October 2005. Mr. Walter joined inChord (then known as Gerbig, Snell/Weisheimer & Associates) as an account manager in 1994. In 1996, he became a partner and later purchased the company in 2000. Under his direction as chairman and chief executive officer, inChord became the largest privately-held healthcare communication company in the world, with affiliates throughout the world. Prior to inChord, Mr. Walter worked as a financial analyst in New York City for Smith Barney in mergers and acquisitions. |

Director Independence and Executive Sessions of Independent Directors. The Board of Directors has determined that six of its nine incumbent directors satisfy the director independence criteria adopted by the National Association of Securities Dealers, Inc. (the "NASD"). Daniel M. Synder, A. Clayton Perfall, Donald Conklin, John R. Harris, Per G.H. Lofberg and Mark E. Jennings were determined to be “independent” within the meaning of NASD Rule 4200(a)(15). Eran Broshy, who is the chief executive officer of the Company, and Terrell G. Herring and R. Blane Walter, who are executive officers of the Company, were not deemed independent. The Board has determined that its independent members will meet in executive session no less than two times per year in conjunction with regularly scheduled Board meetings.

Communicating with the Board of Directors. The Board provides a process for stockholders to send communications to the Board or any individual director. Stockholders may send written communications to the Board or any director c/o Ventiv Health, Inc., 200 Cottontail Lane, Vantage Court North, Somerset, New Jersey 08873.

Director Attendance at Annual Meetings. The Company has adopted a policy that strongly encourages, but does not require, directors to attend each Annual Meeting, subject to exigent or unforeseeable circumstances that may prevent such attendance. Six directors attended the Company’s 2005 Annual Meeting.

Code of Business Conduct and Ethics. The Board has adopted a Code of Business Conduct and Ethics that applies to all officers, directors and employees. The code can be accessed in the "Investor Relations—Corporate Governance" section of the Company’s website at www.inventivhealth.com. The purpose of the Code of Business Conduct and Ethics is to deter wrongdoing and to promote honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; full, fair, accurate, timely and understandable disclosure in periodic reports required to be filed by the Company; and compliance with all applicable rules and regulations that apply to the Company and its officers and directors.

The Board of Directors held seven meetings or teleconference calls during 2005. No director attended fewer than 75% of the aggregate of the total of Board and Committee meetings during the past year.

The Audit Committee is comprised of Messrs. Perfall (Chairman), Conklin and Harris. The Audit Committee oversees the accounting and financial reporting processes of the Company, as well as the audits of the financial statements of the Company. See “Report of Audit Committee” below. The Audit Committee charter can be accessed in the "Investor Relations—Corporate Governance" section of the Company’s website at www.inventivhealth.com. The Board has determined that all members of the Audit Committee are independent directors, and otherwise satisfy the requirements for service on the Audit Committee, under the rules of the Securities and Exchange Commission (the “SEC”) and the NASD. The Board has determined that Mr. Perfall qualifies as an “audit committee financial expert” as defined by the rules of the SEC. The Audit Committee held seven meetings in 2005.

The Compensation Committee is comprised of Messrs. Lofberg (Chairman) and Conklin. The Compensation Committee administers the Company’s benefit plans, reviews and administers all compensation arrangements for executive officers and establishes and reviews general policies relating to the compensation and benefits of the Company’s officers and employees. See “Compensation Committee Report on Executive Compensation” below. The Compensation Committee charter can be accessed in the "Investor Relations—Corporate Governance" section of the Company’s website at www.inventivhealth.com. The Board has determined that each member of the Compensation Committee is an independent director under the rules of the NASD. The Compensation Committee held six meetings in 2005.

The Nominating and Corporate Governance Committee is comprised of Messrs. Conklin (Chairman), Harris and Jennings. The responsibilities of the Nominating and Corporate Governance Committee include identifying and recommending to the Board appropriate director nominee candidates and providing oversight with respect to corporate governance matters. The Nominating and Corporate Governance Committee charter can be accessed in the "Investor Relations—Corporate Governance" section of the Company’s website at www.inventivhealth.com. The Board has determined that each member of the Nominating and Corporate Governance Committee is an independent director under the rules of the NASD. The Nominating and Corporate Governance held two meetings in 2005.

Board Criteria and Director Nomination Procedures. The Nominating and Corporate Governance Committee believes that candidates for director should have certain minimum qualifications, including being able to read and understand basic financial statements; having expertise and experience in an area pertinent to the Company’s business; having the time to provide and being effective in provide advice and guidance to the Company based on that expertise and experience, free of any recurrent conflict of interest; having reputations, both personal and professional, consistent with the image and reputation of the Company; and being of the highest ethical character. No candidate may be selected if the election of such candidate as part of a slate to be recommended to the Board would cause the Board of Directors to consist of less than a majority of directors who are “independent” under the rules of the NASD. In addition, at least one director willing to chair the Audit Committee should have the knowledge, credentials and experience sufficient to satisfy the definition of an “audit committee financial expert” as defined in the rules of the SEC. The Nominating and Corporate Governance Committee believes that one or more directors should have a substantial background in marketing services, contract sales or related fields. These guidelines may be supplemented or varied by the Committee as appropriate. The Board of Directors may also establish or recommend criteria for the election of nominees.

The Nominating and Corporate Governance Committee’s process for identifying and evaluating nominees is as follows:

In determining whether to recommend an incumbent director for renomination in connection with a stockholder meeting, the Committee will review such director’s overall service to the Company during the term of his or her service, including the number of meetings attended, level of participation, quality of performance, and any circumstances that have presented or are expected to present a conflict of interest on the part of the director with the Company. In general, other than in cases of death or disability or pending or actual resignation or removal, no specific effort will be initiated to fill the position of an incumbent director unless and until such time as the full Board of Directors, upon recommendation of the Committee, has determined that such director will not be renominated.

New candidates for the Board of Directors will be considered by the Nominating Committee when the need to add a new Board Member or to fill a vacancy is identified. In addition, the Committee will on a regular basis consider appropriate potential candidates for nomination as Board members. The Committee will consider the criteria describe above and all other factors it considers relevant in selecting nominees. When a determination has been made that the Committee should recommend a nominee for election by the stockholders or to fill a vacancy, the Chairman of the Committee will initiate a search, seeking input from other members of the Committee, other Board members and senior management, and may, with the concurrence of the Committee, hire a search firm to assist in identifying candidates. The Committee generally will examine biographical and other written information regarding candidates and discuss the candidates and select from the candidates presented those it wishes to interview. When the interviews have been concluded, the Committee will make a recommendation to the Board for each open position.

The Nominating and Corporate Governance Committee will consider written proposals from stockholders for nominees for director. All bona fide shareholder-recommended candidates will be considered on the same basis as other candidates. Any such nominations should be submitted to the Chairman of the Nominating and Corporate Governance Committee, c/o Ventiv Health, Inc., 200 Cottontail Lane, Vantage Court North, Somerset, New Jersey 08873, and should include the following: (a) all information relating to such nominee that is required to be disclosed pursuant to Regulation 14A under the Securities Exchange Act of 1934 (including such person's written consent to being named in the proxy statement as a nominee and to serving as director if elected); (b) whether the candidate qualifies as “independent” under NASD rules and for service on the Audit Committee under SEC rules; (c) the name and address of the recommending shareholder, as they appear on the Corporation’s books, and of any beneficial owner on whose behalf the recommendation is made; (d) the class and number of shares of the Company that are beneficially owned and held of record by such shareholder and any such beneficial owner; (e) information regarding whether the recommending shareholder, beneficial owner or candidate or their affiliates have any plans or proposals for the Company; and (f) whether the recommending shareholder, beneficial owner or candidate seeks to use the nomination to redress personal claims or grievances against the Company or to further personal interests or special interests not shared by shareholders at large.

Two of the nominees for the Board of Directors, Mr. Herring and Mr. Walter, are incumbent directors who were appointed to the Board of Directors to fill vacancies that arose subsequent to the 2005 Annual Meeting of Stockholders as a result of increases in the size of the Board of Directors. Both of these candidates are key executive officers of the Company and were recommended by our chief executive officer. The Company did not retain a search firm for the purpose of identifying director candidates with respect to these vacancies, although it has engaged search firms in the past to identify director candidates.

All non-management directors receive compensation of $35,000 per year plus $1,000 for attendance at each Board of Directors or Board Committee meeting, other than telephonic meetings. In addition, Board Committee Chairpersons receive additional annual compensation in the following amounts: Daniel M. Snyder (Chairman of the Board) - $15,000, A. Clayton Perfall (Chairman of the Audit Committee) - $25,000, and Per G.H. Lofberg (Chairman of the Compensation Committee, who cannot receive equity compensation pursuant to his current employment agreement with Merck Capital Ventures, LLC, his principal employer) - $90,000. Eran Broshy, Terrell G. Herring and R. Blane Walter are not additionally compensated for attending Board meetings.

Option and restricted stock award grants for non-management directors are determined by the Compensation Committee from time to time. No options were granted to directors during 2005. Non-management members of the Board of Directors received the following restricted stock awards during 2005:

| | Date | Number of Restricted Stock Awards |

| | | |

| Daniel M. Snyder | June 2005 | 20,000 |

| | | |

| A. Clayton Perfall | June 2005 | 20,000 |

| | | |

| Donald Conklin | June 2005 | 20,000 |

| | | |

| John R. Harris | June 2005 | 20,000 |

| | | |

| Mark E. Jennings | June 2005(1) | 20,000 |

(1) On June 15, 2005, Mr. Jennings agreed to surrender for cancellation the 25,000 options granted to Mr. Jennings on February 9, 2005.

Non-management directors’ 2005 restricted stock awards vest at a rate of 25% per year on the anniversary of the grant date.

The following table sets forth certain information, to our knowledge, as of the Record Date (except as otherwise noted), with respect to the beneficial ownership of the Common Stock by (i) each person known to us to be the beneficial owner of more than 5% of the outstanding Common Stock, (ii) each director and nominee for director, (iii) each of our executive officers named in the Summary Compensation Table under "Executive Compensation," and (iv) all of our directors and executive officers as a group.

Beneficial ownership is determined under the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. Except as indicated in the footnotes to this table and pursuant to applicable community property laws, the persons named in the table below have sole voting and investment power with respect to all shares of Common Stock beneficially owned. The number of shares beneficially owned by each person or group as of the Record Date includes shares of Common Stock that such person or group had the right to acquire on or within 60 days after the Record Date, including, but not limited to, upon the exercise of options. References to options in the footnotes of the table below include only options to purchase shares that were exercisable on or within 60 days after the Record Date.

Name and Address of Beneficial Owner (1) | Number of Shares and Nature of Beneficial Ownership | Percent of Class (2) |

| | | |

| Daniel M. Snyder (3)(4) | 1,320,001 | 4.5% |

| A. Clayton Perfall (5) | 120,000 | * |

| Don Conklin (6) | 100,000 | * |

| John R. Harris | 20,000 | * |

| Mark E. Jennings (7) | 30,000 | * |

| Per G.H. Lofberg | -- | -- |

| Eran Broshy (8) | 503,012 | 1.7% |

| John R. Emery (9) | 78,056 | * |

| Terrell G. Herring (10) | 46,310 | * |

| R. Blane Walter | 416,180 | 1.4% |

| All directors and executive officers as a group (10 persons) | 2,633,559 | 9.0% |

| (1) | Except as noted, the address for each such beneficial owner is c/o inVentiv Health, Inc., 200 Cottontail Lane, Vantage Court North, Somerset, New Jersey 08873 |

| (2) | Percentage ownership is calculated by dividing the number of shares beneficially owned by each person or group listed in the table by the sum of the 29,157,678 shares of Common Stock outstanding on the Record Date plus the number of shares of Common Stock that such person or group had the right to acquire on or within 60 days after the Record Date. |

| (3) | Includes 300,000 shares of Common Stock issuable upon exercise of options. The address for Daniel M. Snyder is 21300 Redskin Park Drive, Ashburn, Virginia 20147. |

| (4) | Mr. Snyder holds interests in three private investment companies ("Private Funds") to which shares of our capital stock or our predecessor, Snyder Communications, Inc., were contributed in exchange for interests in the Private Funds. Under certain circumstances (principally at the discretion of the Private Funds), Mr. Snyder may receive shares of Common Stock held by the Private Funds in satisfaction of redemption rights. No such shares have been included in Mr. Snyder's beneficial ownership of Common Stock set forth in the above table. |

| (5) | Includes 100,000 shares of Common Stock issuable upon exercise of options. |

| (6) | Includes 70,000 shares of Common Stock issuable upon exercise of options. |

| (7) | Includes 10,000 shares purchased in the open market prior to election to the Board of Directors. |

| (8) | Includes 421,438 shares of Common Stock issuable upon exercise of options. In addition, Mr. Broshy holds an interest in a Private Fund to which shares of our common stock were contributed in exchange for such interest. Under certain circumstances, Mr. Broshy may receive shares of common stock held by the Private Fund in satisfaction of redemption rights. No such shares have been included in Mr. Broshy's beneficial ownership of common stock set forth in the above table. |

| (9) | Includes 70,000 shares of Common Stock issuable upon exercise of options. |

| (10) | Includes 13,750 shares of Common Stock issuable upon exercise of options. |

For additional information concerning the Company’s equity compensation plans, see Proposal No. 3.

Section 16(a) of the Securities Exchange Act of 1934 requires our executive officers and directors, and persons who beneficially own more than ten percent (10%) of a registered class of our equity securities, to file reports of ownership and changes in ownership with the Securities and Exchange Commission and the Nasdaq National Market System. In addition, under Section 16(a), trusts for which a reporting person is a trustee and a beneficiary (or for which a member of his immediate family is a beneficiary) may have a separate reporting obligation with regard to ownership of our Common Stock and other equity securities. Such reporting persons are required by rules of the Securities and Exchange Commission to furnish us with copies of all Section 16(a) reports they file. Based upon a review of the copies of such forms furnished to us and written representations from and communications with our executive officers, directors and greater than ten percent (10%) beneficial stockholders, we believe that during 2005, all transactions were timely reported except as set forth below. To our knowledge, all forms relating to transactions during 2005 have been timely filed.

CONCERNING EXECUTIVE OFFICERS

The following table sets forth certain information concerning our current executive officers:

Name | Age | Positions with Company |

| Eran Broshy | 47 | Chief Executive Officer and Director |

| John R. Emery | 49 | Chief Financial Officer and Secretary |

| Terrell G. Herring | 42 | President and Chief Executive Officer, inVentiv Commercial, and Director |

| R. Blane Walter | 35 | President and Chief Executive Officer, inVentiv Communications, and Director |

Eran Broshy - please refer to the section entitled “Board of Directors” for a discussion of Mr. Broshy.

John R. Emery - Mr. Emery has served as the chief financial officer of the Company since August 2001. Prior to that time, Mr. Emery was chief financial officer of MedQuist Inc. During his tenure at MedQuist, revenues increased nearly five-fold and market capitalization increased from approximately $200 million to $1.5 billion. During this period MedQuist also completed a $230 million acquisition of its largest competitor, acquired 20 smaller competitors and sold a 65% equity stake in the company to Philips Electronics for $1.2 billion. Prior to joining MedQuist, Mr. Emery held the positions of chief financial officer and senior vice president of operations at Integra LifeSciences Corporation.

Terrell G. Herring - please refer to the section entitled “Board of Directors” for a discussion of Mr. Herring.

R. Blane Walter - please refer to the section entitled “Board of Directors” for a discussion of Mr. Walter.

The following Summary Compensation Table sets forth the compensation earned for each of the last three completed fiscal years by (i) the person who served as our chief executive officer during the last completed fiscal year and (ii) each of our officers other than our chief executive officer who was serving as an executive officer at the end of the last completed fiscal year.

SUMMARY COMPENSATION TABLE

| | Annual Compensation | Long-Term Compensation Awards | |

Name and Principal Position(s) | Year | Salary | Bonus (1) | Restricted Stock Award(s)($) (2) | Securities Underlying Options | All Other Compensation (3) |

Eran Broshy Chief Executive Officer Ventiv Health, Inc. | 2005 | $535,137 | $600,000 (4), (5) | -- | -- | $3,500 |

| 2004 | $519,841 | $919,841 | -- | 200,000 | $3,250 |

| 2003 | $504,587 | $600,000 | -- | 55,000 | $3,000 |

| | | | | | | |

John R. Emery Chief Financial Officer Ventiv Health, Inc. | 2005 | $ 308,827 | $277,945 (5) | $50,006 | -- | -- |

| 2004 | $300,000 | $370,000 | -- | 100,000 | -- |

| 2003 | $291,779 | $229,103 | -- | 15,000 | -- |

| | | | | | | |

Terrell G. Herring President and Chief Executive Officer inVentiv Commercial | 2005 | $345,000 | $345,000 (5) | $102,480 | -- | $4,235 |

| 2004 | $304,615 | $429,615 | $175,009 | 150,000 | $2,939 |

| 2003 | $291,187 | $410,098 | $84,500 | 20,000 | $3,000 |

| | | | | | | |

R. Blane Walter (6) President and Chief Executive Officer inVentiv Communications | 2005 | $104,192 | $14,565 | -- | -- | -- |

| | | | | | |

| | | | | | |

| (1) | Bonuses to executive officers (including any discretionary component thereof) are disclosed for the year with respect to which they are awarded whether paid in that year or in a subsequent year. |

| (2) | In January 2005, the Company granted Mr. Emery 2,431 shares of restricted Common Stock, one-third of which vested on January 1, 2006 and two-thirds will vest on January 1, 2007. The restricted stock agreements for these grants prohibit Mr. Emery from transferring any of his restricted shares during the vesting period. |

In December 2003, the Company granted Mr. Herring 10,000 shares of restricted Common Stock, which are fully vested. In December 2004, the Company granted Mr. Herring 10,122 shares of restricted Common Stock, one-third of which vested on January 1, 2006 and two-thirds will vest on January 1, 2007. In March 2005, the Company granted Mr. Herring 4,000 shares of restricted Common Stock, which vest equally on the first three anniversaries of the date of grant. The restricted stock agreements for these grants prohibit Mr. Herring from transferring any of his restricted shares during the respective vesting periods.

Dividends will be paid on shares of restricted stock granted to the Company’s executive officers if dividends are paid on the Company’s capital stock. The Company has never paid dividends and has no plan to do so in the foreseeable future.

As of December 31, 2005 Mr. Herring held a total of 14,122 shares of restricted (unvested) stock having a value of $277,489 and Mr. Emery held a total of 2,431 shares of restricted (unvested) stock having a value of $50,006. No other named executive officer held unvested shares of restricted stock as of December 31, 2005.

| (3) | Represents matching contributions made by us under our 401(k) savings plan and, with respect to Mr. Herring, $785 in premiums paid to purchase life insurance for his benefit. |

| (4) | Of the bonus of $600,000 awarded to Mr. Broshy to date with respect to 2005, Mr. Broshy elected to defer approximately $450,000 in accordance with the Ventiv Health, Inc. Deferred Compensation Plan (the "NQDC Plan"). Of the total bonus of $919,841 awarded to Mr. Broshy with respect to 2004, Mr. Broshy elected to defer approximately $389,881 in accordance with the NQDC Plan. |

| (5) | Does not include discretionary bonuses, if any, that may be awarded after the date of this report with respect to 2005. |

| (6) | Mr. Walter joined the Company in October 2005, a subsequent to of the acquisition of inChord. Prior to joining the Company, Mr. Walter served as the Chief Executive Officer of inChord. Pursuant to Mr. Walter’s employment agreement, he is entitled to receive an annual salary of $387,000. |

There were no options granted in 2005 to the executive officers.

The following table sets forth information with respect to options exercised during fiscal 2005 to the individuals named in the Summary Compensation Table pursuant to the Company’s 1999 Stock Incentive Plan.

Name | Shares Acquired on Exercise | Value Realized ($) | Number of Securities Underlying Unexercised Options/SARs at Fiscal Year End Exercisable/Unexercisable | Value of Unexercised in-the-money Options/SARs Fiscal Year End Exercisable/ Unexercisable |

| Eran Broshy | 400,000 | $7,960,317 | 421,438/57,500 | $5,828,653 / $1,076,550 |

| John R. Emery | 103,750 | 1,734,014 | 70,000/77,500 | $536,900/ $1,534,750 |

| Terrell G. Herring | 85,750 | 1,387,587 | --/156,250 | $--/ $1,746,513 |

ON EXECUTIVE COMPENSATION

The information contained in this report shall not be deemed to be “soliciting material” or “filed” or incorporated by reference in future filings with the SEC, or subject to the liabilities of Section 18 of the Securities Exchange Act of 1934, except to the extent that we specifically incorporate it by reference into a document filed under the Securities Act of 1933 or the Securities Exchange Act of 1934.

The basic responsibilities of the Compensation Committee are to review the performance of Company management in achieving corporate goals and objectives and to assure that senior executives of the Company are compensated effectively in a manner consistent with the strategy of the Company, competitive practice, and the requirements of the appropriate regulatory bodies. Toward that end, the Compensation Committee oversees, reviews and administers all compensation, equity and employee benefit plans and programs.

In an effort to enhance corporate governance and clarify the role of the Compensation Committee with respect to carrying out the foregoing responsibilities, the Board of Directors has adopted a Compensation Committee Charter. The Charter provides that the Compensation Committee must consist of at least two directors who are “non-employee directors” within the meaning of Rule 16b-3 issued by the Securities and Exchange Commission, “outside directors” within the meaning of Section 162(m) of the Internal Revenue Code, as amended, and “independent” within the meaning of applicable NASDAQ rules and interpretations.

Executive Officer Compensation

The Committee seeks to establish competitive levels of cash and long-term incentive compensation and to structure an overall compensation package that recognizes and rewards executive officers for current year performance, motivates executive officers to achieve specified performance targets on an annual basis and align the interests of executive officers with the long-term interests of the Company's stockholders.

During 2005, the Committee received support and input from a compensation consultant, Frederic W. Cook & Co., Inc., in determining its approach to executive officer compensation for 2005 and beyond. The Committee reviewed, among other things, analyses of cash compensation, long-term incentive compensation and total compensation for the Company’s executive officers and for executive officers at a peer group of companies in order to assess whether compensation was being maintained at competitive levels and was appropriately structured to achieve retention objectives and alignment with stockholder interests. In conducting this review, the Committee sought to establish executive compensation at approximately the 25th percentile of peer group compensation. In conjunction with its review, the Committee engaged in an iterative process with the Chief Executive Officer to consider and refine various proposals responsive to the analytical findings of the Company’s compensation consultant.

Cash Compensation. All of the Company's executive officers have employment agreements that establish a base salary, subject to such increases as may be approved by the Company. See "Executive Compensation--Executive Employment Contracts." In determining whether to increase each officer’s base salary with respect to 2006, the Committee considered the position, level and scope of responsibility of the officer and the performance of the Company during 2005, as well as cost-of-living benchmarks.

Annual Bonus. Cash bonuses are awarded annually to the Company’s executive officers pursuant to a cash bonus plan (the “Cash Bonus Plan”). The Cash Bonus Plan establishes a bonus range of 0 to 100% of base salary for the Company’s executive officers and provides for the payment of a target bonus at the midpoint of this range based 70% on the achievement of budgeted EBIT targets, which are determined annually by the Board of Directors, and a 30% discretionary component based on individual performance. The Cash Bonus Plan provides for bonus payments in excess of the bonus range at the discretion of the Committee, which historically the Committee has based on substantial performance achievement beyond budgeted financial targets.

A portion of the bonuses under the Cash Bonus Plan for 2005 was awarded and paid during 2005. It is anticipated that additional bonus compensation with respect to 2005 may be awarded in mid-2006 in recognition of the fact that budgeted financial targets were substantially exceeded for 2005. The form and amount of this additional bonus compensation has not been determined as of the date of this report. The Compensation Committee's practice is to finalize bonus determinations after completion of the Company's year-end audit.

Equity-Based Incentive Awards. The goal of the Company’s long-term, equity-based incentive awards is to align the interests of executive officers with shareholders and to provide each executive officer with a significant incentive to manage the Company from the perspective of an owner with an equity stake in the business. The Committee determines the size of the long-term, equity-based incentives according to each executive’s position within the Company and sets a level it considers appropriate to create a meaningful opportunity for reward predicated on increasing shareholder value. In addition, the Committee takes into account an individual’s performance history, his or her potential for future responsibility and promotion, and competitive total compensation targets for the individual’s position and level of contribution. The relative weight given to each of these factors varies among individuals at the Committee’s discretion.

During 2005, the Committee determined to modify its practice of making long-term, equity-based incentive awards to executives on an ad hoc basis and instead to award annual grants, which are anticipated to occur in the first quarter of each calendar year. These grants, which commenced during the first quarter of 2006, are considered to be a component of compensation for the year in which they are granted. The Committee believes such an approach will provide it with a greater opportunity to optimize the value of such awards to the Company. The Committee’s philosophy is that incentive awards should be structured to maintain an appropriate retention incentive for executive officers and an alliance with shareholders interests.

The Committee granted 4,000 shares of restricted stock to Terrell Herring with respect to the Company's 2005 fiscal year. The Committee did not grant any other restricted stock, options or equity-based awards to executive officers with respect to 2005 performance. Mr. Herring's 2005 grant vests in periodic installments over a three-year period, contingent upon his continued employment with the Company.

Compensation of the Chief Executive Officer

Mr. Broshy’s overall compensation for 2005 was determined in a manner consistent with that described above for other executive officers of the Company. All deliberations concerning Mr. Broshy’s compensation were conducted by the Committee without Mr. Broshy’s participation.

For 2005, Mr. Broshy’s base salary was $535,436, reflecting an increase of 3% over 2004. In February 2006, Mr. Broshy was awarded a $600,000 bonus for 2005 under the Cash Bonus Plan. It is anticipated that additional bonus compensation with respect to 2005 may be awarded to Mr. Broshy in mid-2006, consistent with other executive officers.

The factors considered by the Compensation Committee in determining Mr. Broshy’s base salary and bonus payment for 2005 were the strong growth in the Company’s profitability from continuing operations in 2005 compared to the prior year and compared to the Board-approved budget for 2005, the successful execution of the Company’s acquisition program and the integration of acquired operations, the increase in the Company’s market capitalization and visibility in the investment community and Mr. Broshy’s continuing leadership and establishment and implementation of strategic direction for the Company.

Deductibility of Compensation

Under Section 162(m) of the Internal Revenue Code and regulations adopted thereunder by the Internal Revenue Service, publicly held companies may be precluded from deducting certain compensation paid to its chief executive officer or any of its four other most highly compensated executive officer in excess of $1.0 million in a year. The regulations exclude from this limit performance-based compensation and stock options provided certain requirements, including stockholder approval, are satisfied. While the Committee designs certain components of executive compensation to preserve income tax deductibility, it believes that it is not in the stockholders’ interest to restrict the Committee’s discretion and flexibility in developing appropriate compensation programs and establishing compensation levels and the Committee has approved and may in the future approve compensation that is not fully deductible. Restricted stock grants that are subject to time-based vesting will not qualify for exclusion and may result in the payment in future years of compensation that is not deductible for federal income tax purposes under Section 162(m). The NQDC Plan permits executive officers to defer amounts that would otherwise be non-deductible for federal income tax purposes under Section 162(m). The Company believes that all compensation paid to the Company’s executive officers during 2005 will be deductible for federal income tax purposes.

Submitted by the Compensation Committee of the Board of Directors

Donald Conklin

Per G.H. Lofberg (Chairman)

The Company has entered into employment agreements with each of the named officers below and on such terms and conditions as are described.

Eran Broshy. The Company entered into a new employment agreement with Eran Broshy on May 9, 2006. Mr. Broshy is entitled to an annual base salary of $560,000. He is also eligible for an annual bonus award, with the target bonus being 50% of annual base salary, based on performance measures established by the Board. Any bonus award is discretionary. Mr. Broshy is also eligible to receive discretionary grants of options and restricted stock. Mr. Broshy has been awarded a bonus of $600,000 with respect to 2005 and may become eligible for an additional bonus award with respect to 2005 subsequent to the date of this proxy statement. Mr. Broshy was not granted any options or shares of restricted stock with respect to 2005.

In the event of Mr. Broshy's termination without cause or for good reason or for disability, he is entitled to receive a lump sum payment equal to two times the sum of his base salary and the average of his awarded bonus for the three years prior to termination; continuation of health and life insurance benefits for a period of one year; and acceleration of vesting of all options and restricted stock awards, which will generally remain exercisable for the period permitted by Section 409A of the Internal Revenue Code, but not for more than two years after termination. Upon a "change in control" of the Company, Mr. Broshy is entitled to receive a lump sum payment equal to two times the sum of his base salary and the average of his awarded bonus for the three years prior to termination and acceleration of vesting of all options and restricted stock awards, which options will generally remain exercisable for the period permitted by Section 409A of the Internal Revenue Code, but not for more than two years after the change in control. In addition, in the event of Mr. Broshy's termination without cause or for good reason within 13 months after a "change in control", he is entitled to receive a lump sum payment equal to the sum of his base salary and the average of his awarded bonus for the three years prior to termination and continuation of health and life insurance benefits for a period of three years. Any termination by Mr. Broshy during the 30 days following the first anniversary of a "change in control" will be deemed to be a termination for good reason. In the event of Mr. Broshy's death during the term of his employment, his estate is entitled to acceleration of vesting of all options and restricted stock awards, which options will generally remain exercisable for the period permitted by Section 409A of the Internal Revenue Code, but not for more than two years after his death. The Company has agreed to maintain $2.5 million of term life insurance for the benefit of Mr. Broshy.

John R. Emery. Ventiv Health, Inc. entered into an employment agreement with John R. Emery on August 13, 2001, which was amended as of January 1, 2004. Mr. Emery was entitled to an initial annual base salary of $270,000; his base salary currently in effect in 2006 is $318,270, as compared to $308,827 for 2005 and $300,000 for 2004. He is also eligible for an annual bonus award of up to 100% of annual base salary, with the target bonus being 50% of annual base salary, based on certain performance measures. Any bonus determination, either within or outside of Mr. Emery’s contractual range, is discretionary. During 2005, Mr. Emery was awarded a bonus of $277,945 and was granted 2,341 shares of restricted stock, one-third of which vested on January 1, 2006 and two-thirds will vest on January 1, 2007.

In the event of Mr. Emery's termination without cause, he is entitled to receive his base salary until the earlier of twenty-six (26) weeks after his termination or the date he gains new employment. The agreement provides that upon a "change in control" of Ventiv, the vesting of stock options will accelerate so that Mr. Emery’s options would be fully vested in the event that Mr. Emery is terminated without cause within six months following the change in control. For purposes of his employment agreement, "change in control" means any sale, transfer or other disposition of all or substantially all of our assets or the consummation of a merger or consolidation which results in our stockholders immediately prior to such transaction owning, in the aggregate, less than a majority of the surviving entity. Mr. Emery’s agreement also provides that in the event of a change in control, Mr. Emery will be eligible for payments of up to one year of base salary in lieu of severance or any other payments, in the event that Mr. Emery has appropriately fulfilled his obligations to facilitate such change in control for a period of up to one year following such change in control.

Terrell G. Herring. Mr. Herring’s employment agreement executed in April 2002 entitles him to an initial annual base salary of $230,000; his base salary currently in effect in 2006 is $360,500, as compared to $345,000 for 2005 and $304,615 for 2004. He is also eligible for an annual bonus of up to 100% of base salary, with the target bonus being 50% of annual base salary, based on certain performance measures. Any bonus determination, either within or outside of Mr. Herring’s contractual range, is discretionary, except that Mr. Herring has been guaranteed a minimum $100,000 bonus payout with respect to 2006 contingent upon continued employment. During 2005, Mr. Herring was awarded a bonus of $345,000 and in March 2005 Mr. Herring was granted 4,000 shares of restricted stock, which vest equally on the first three anniversaries of the date of grant..

In the event of Mr. Herring's termination without cause or his resignation for good reason, he is entitled to receive a lump sum payment equal to 52 weeks' base salary and continuation of his base salary until the earlier of 26 weeks after his termination or the date he gains new employment. The agreement provides that upon a "change in control" of Ventiv, Mr. Herring may become entitled to an additional payment equal to 18 months' base salary, subject to his having satisfactorily performed his employment duties and having used his best efforts to facilitate the "change in control", if Mr. Herring is either terminated without cause within two months prior to the "change in control" or is employed on the date of the "change in control", provided that if he is so employed but his employment terminates prior to the six month anniversary of the "change in control" for any reason other than a

termination without cause by us, the additional payment will be equal to 9 months' base salary. The agreement further provides that upon a "change in control" of Ventiv, the vesting of stock options will accelerate so that Mr. Herring’s options would be fully vested in the event that Mr. Herring is terminated without cause within six months following the change in control. For purposes of his employment agreement, "change in control" means any sale, transfer or other disposition of all or substantially all of our assets or the consummation of a merger or consolidation which results in our stockholders immediately prior to such transaction owning, in the aggregate, less than a majority of the surviving entity.

The Company has agreed to provide Mr. Herring with life insurance in a minimum amount of $1 million.

R. Blane Walter. Mr. Walter's employment agreement was executed on September 6, 2005, became effective on October 5, 2005 upon the closing of the inChord acquisition and continues through December 31, 2007. Mr. Walter was entitled to an initial annual base salary of $387,000, subject to such increases as may be approved by our Board or the Compensation Committee. Prior to the termination date, Mr. Walter’s employment may be terminated by the Employer only (i) for cause, (ii) in the event that inChord fails to achieve certain specified performance measures or (iii) a contractually stipulated settlement of certain obligations under the inChord acquisition agreement occurs simultaneously with the termination.

The employment agreements described above for Messrs. Broshy, Emery and Herring contain non-competition commitments during the term of employment and for a period of 12 months after termination of employment. The employment agreement described above for Mr. Walter contains a non-competition commitment ending on October 5, 2010. Additionally, each employment agreement contains a non-solicitation provision and provides for assignment by the employee to his employer of any work products developed by him during the term of his employment.

The members of the Compensation Committee for the 2005 fiscal year, effective February 2005, were Per Lofberg and Donald Conklin. No member of the Compensation Committee was at any time during the 2005 fiscal year or at any other time an officer or employee of Ventiv, and no member had any relationship with Ventiv requiring disclosure under Item 404 of Regulation S-K. None of our executive officers has served on the board of directors or compensation committee of any other entity that has or has had one or more executive officers who served as a member of the Board of Directors or the Compensation Committee during the 2005 fiscal year.

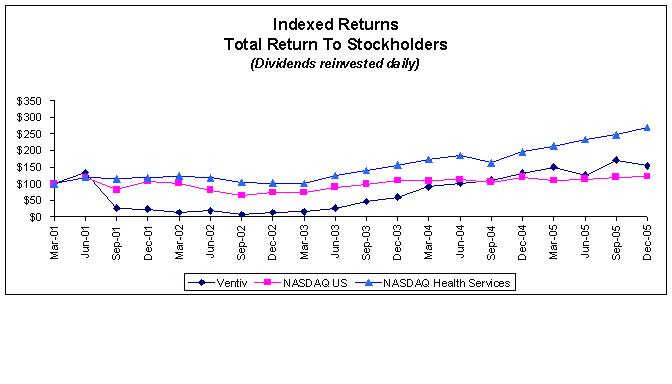

SEC rules require proxy statements to contain a performance graph comparing the performance of the Company's Common Stock against a broad market index and against either a published industry or line-of-business index or a group of peer issuers. The following graph compares the cumulative total return on a $100 investment in the Company's Common Stock against the cumulative total return on a similar investment in (i) the Total Return Index for The Nasdaq Stock Market (US) and (ii) Nasdaq Health Services Stocks. The graph assumes that all investments were made on December 31, 2000 and are held through the year ended December 31, 2005 and that all dividends are reinvested on a daily basis.

Ventiv Health vs. The Nasdaq Stock Market (US) vs. Nasdaq Health Services

(Dividends reinvested daily)

| | Mar-01 | Dec-01 | Dec-02 | Dec-03 | Dec-04 | Dec-05 |

| Ventiv Health, Inc | 100.00 | 23.80 | 13.21 | 59.51 | 132.16 | 153.63 |

| The Nasdaq Stock Market (US) | 100.00 | 106.36 | 73.53 | 109.94 | 119.65 | 122.18 |

| Nasdaq Health Services Stocks | 100.00 | 117.76 | 101.47 | 155.17 | 195.55 | 268.84 |

Returns for the Company's Common Stock depicted in the graph are not necessarily indicative of future performance. The above graph shall not have been deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933 or under the Securities Exchange Act of 1934, except to the extent the Company specifically incorporates this information by reference, and shall not otherwise be deemed filed under such Acts.

The Audit Committee oversees the Company's financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process, including the system of internal controls. The independent registered public accounting firm are responsible for performing an independent audit of the Company's consolidated financial statements in accordance with generally accepted accounting principles and issuing a report thereon. The Committee reviews and oversees these processes, including oversight of (i) the integrity of the Company's financial statements, (ii) the Company's independent registered public accounting firm' qualifications and independence, (iii) the performance of the Company's independent registered public accounting firm and the Company's internal audit function and (iv) the Company's compliance with legal and regulatory requirements.

In this context, the Committee met and held discussions with management and the independent registered public accounting firm. Management represented to the Committee that the Company's consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States, and the Committee reviewed and discussed the consolidated financial statements with management and the independent registered public accounting firm. The Committee also discussed with the independent registered public accounting firm the matters required to be discussed by Statement on Auditing Standards No. 61 (Codification of Statements on Auditing Standards, AU 380), as amended.

In addition, the Committee discussed with the independent registered public accounting firm the auditors' independence from the Company and its management, and the independent registered public accounting firm provided to the Committee the written disclosures and letter required from the independent registered public accounting firm by the Independence Standards Board Standard No. 1 (Independence Discussions With Audit Committees).

The Committee approved the engagement of Deloitte & Touche LLP as independent registered public accounting firm for the Company for its 2005 fiscal year. The Committee discussed with the Company's independent registered public accounting firm the overall scope and plans for their respective audits. The Committee met with the independent registered public accounting firm to discuss the results of their examinations, the evaluations of the Company's internal controls, and the overall quality of the Company's financial reporting.

Based on the reviews and discussions referred to above, the Committee recommended to the Board of Directors, and the Board has approved, that the audited financial statements be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2005 for filing with the SEC.

Submitted by the Audit Committee of the Board of Directors

Donald Conklin

John R. Harris

A. Clayton Perfall (Chairman)

The information contained in the foregoing report shall not be deemed to be "soliciting material" or to be "filed" with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that the Company specifically incorporates it by reference in such filing.

Nominees for Election as Directors

The Certificate of Incorporation and Bylaws of the Company provide that directors shall be elected at each annual meeting of the Company's stockholders. The number of directors constituting the full Board of Directors currently is fixed at nine (9) directors and will be reduced to eight (8) directors effective as of the date of the Annual Meeting.

Eight (8) nominees are named in this Proxy Statement. If elected, each of the directors will serve for a one-year term expiring at the 2007 Annual Meeting or at the earlier of his resignation or removal. The Board of Directors has nominated eight (8) incumbent directors for election to the Board: Eran Broshy, A. Clayton Perfall, Donald Conklin, John R. Harris, Per G.H. Lofberg, Mark E. Jennings, Terrell G. Herring and R. Blane Walter. Proxies may not be voted for a greater number of persons than the number of nominees named.

Approval of the election of each of the nominees as directors of the Company requires the affirmative vote of a plurality of the votes cast at the Annual Meeting. The persons named in the enclosed form of proxy have advised that, unless contrary instructions are received, they intend to vote "FOR" the eight (8) nominees named by the Board of Directors.

The Board of Directors expects that all of the nominees will be available for election as a director. However, if by reason of an unexpected occurrence one or more of the nominees is not available for election, the persons named in the form of proxy have advised that they will vote for such substitute nominees as the Board of Directors of the Company may propose.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE STOCKHOLDERS OF THE COMPANY VOTE "FOR" THE ELECTION OF EACH OF THE NOMINEES TO SERVE AS DIRECTORS OF THE COMPANY FOR THE TERM INDICATED.

INCORPORATION CHANGING NAME TO INVENTIV HEALTH, INC.

The Company seeks stockholder approval to amend its certificate of incorporation to change its name from Ventiv Health, Inc. to inVentiv Health, Inc. The proposed name change is part of a re-branding initiative that began when the Company acquired inChord Communications, Inc. in October 2005. The primary reason for the re-branding initiative is to better reflect the Company’s significantly broadened capabilities and industry leadership position.

Ventiv Health, Inc. today is composed of three operating divisions, each of which operates under the “inVentiv” brand: inVentiv Clinical, which provides clients a variety of essential services to help navigate through the clinical development and regulatory approval process, including clinical staffing, statistical analysis, data management and clinical monitoring; inVentiv Communications, which provides clients a complete portfolio of integrated advertising and communications, branding, interactive, medical education, contract marketing and patient adherence services to effectively deliver their messages to specific target audiences; and inVentiv Commercial, which provides clients with complete support to launch and maintain their products in the market, including sales and marketing teams, planning and analytics, data collection and management, patient assistance, sample management and regulatory compliance, among other integrated services.

The Company's operating businesses have changed substantially since it became a public entity in 1999. The Company continues to build upon its foundation as the leading provider of outsourced sales teams and market analytics while expanding the range of services it provides to its pharmaceutical clients, both through service line extensions and the acquisition of synergistic businesses. The Company’s acquisitions, in particular of Smith Hanley and inChord, firmly established the Company’s position as a full-service provider of clinical development, communications and commercialization services. Changing the Company’s name to inVentiv Health, Inc. will better reflect the Company’s significantly broader services platform and enhanced market positioning, and will align the Company’s corporate identity with its three operating divisions. The Company has already begun to use “inVentiv Health” as part of its corporate re-branding initiative pending approval of the formal name change. The Company has decided to retain the symbol "VTIV" for its stock exchange listing.

A copy of the proposed amendment to the certificate of incorporation is attached as Exhibit A to this proxy statement.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE STOCKHOLDERS OF THE COMPANY VOTE "FOR" THE APPROVAL OF THE AMENDMENT OF THE COMPANY’S CERTIFICATE OF INCORPORATION TO CHANGE ITS NAME TO inVentiv Health, Inc.

General

On April 25, 2006, the Board of Directors approved the inVentiv Health, Inc. 2006 Long-Term Incentive Plan (the "Incentive Plan"), subject to approval by the Company's stockholders. The Incentive Plan is intended to replace the Company's 1999 Stock Incentive Plan (the "Prior Plan"), which was established in conjunction with the commencement of public trading of the Common Stock. If the Incentive Plan is approved by the Company's stockholders, no further grants will be made under the Prior Plan.

Without approval of the Incentive Plan, there remained as of March 31, 2006 only approximately 700,000 shares to be issued under the 1999 Stock Incentive Plan, which the Company believes is insufficient to (i) provide the appropriate long-term incentive awards to continue retaining its key executives and managers and (ii) provide adequate long-term incentives for potential future acquisitions. We are concerned that the inability to make sufficient equity based compensation awards will materially adversely impact our ability to accomplish these goals.

To address these concerns, the Board of Directors has approved the Incentive Plan, subject to shareholder approval, in order to provide the Company with flexibility in recruiting and motivating and rewarding key employees with long-term incentives. The Board of Directors has limited the total aggregate number of shares available for grant under the Incentive Plan to the sum of 2,100,000 and the number of shares of Common Stock available for issuance under the Prior Plan, or approximately 10% of our total outstanding shares. In the event that the Incentive Plan is approved by the Company's shareholders and the Board of Directors would like to increase the number of shares available for issuance under the terms of the Incentive Plan in the future, the Company would seek shareholder approval for any such increase. The Board of Directors believes that equity compensation under the Incentive Plan will be important to the Company's ability to achieve superior performance in the future.

Description of the Plan

The following description summarizes the principal features of the Incentive Plan, but is qualified in its entirety by reference to the full text of the Incentive Plan as set forth on Appendix B to this Proxy Statement.

Purpose. The purpose of the Incentive Plan is to assist the Company and its subsidiaries in attracting and retaining selected individuals to serve as directors, employees, consultants and advisors. The Board of Directors believes that such individuals will contribute to the Company’s success in achieving its long-term objectives, which will inure to the benefit of all stockholders of the Company, through the incentives inherent in the awards granted under the Incentive Plan.

Eligibility. All directors, employees, consultants and advisors of the Company and its subsidiaries are eligible to receive awards under the Incentive Plan. The Compensation Committee has historically granted options under the Prior Plan to executive officers and other key employees and members of our board of directors to create a more performance-oriented culture and to further align the interests of management and the Company's stockholders. As of the Record Date, there were six non-management directors and four executive officers eligible to participate in the Incentive Plan. In addition, all employees who are not executive officers (approximately 4,200 people) will be eligible to participate in the plan.

Administration. The Incentive Plan will be administered by the Compensation Committee of the Board of Directors. The Compensation Committee has the authority to interpret and construe all provisions of the Incentive Plan and to make all decisions and determinations relating to the operation of the Incentive Plan, including the authority and discretion to: (i) select the individuals to receive stock option grants or other awards; (ii) determine the time or times when stock option grants or other awards will be granted and will vest; and (iii) establish the terms and conditions upon which awards may be exercised.

Duration. The Incentive Plan will be effective on the date it is approved by the shareholders of the Company and continue until the tenth anniversary of such approval date. If shareholder approval is not obtained, the Incentive Plan will be null and void.

Shares Subject to Plan. Upon shareholder approval, the maximum number of shares of Common Stock available for issuance under the Incentive Plan will be the sum of 2,100,000 and the number of remaining shares of Common Stock available for issuance under the Prior Plan as of the date of such approval. For purposes of determining the amount of the remaining availability under the Prior Plan, awards, forfeitures and expirations under the Prior Plan after March 31, 2006 will be evaluated using the principles described in the next paragraph.