Exhibit 99.2

Alaska Communications:Investor Presentation August 2013

Safe Harbor Statement Other Placeholder: Forward-Looking Statements We have included in this presentation certain "forward-looking statements," as that term is defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on management's beliefs as well as on a number of assumptions concerning future events made using information currently available to management. You are cautioned not to put undue reliance on such forward-looking statements, which are not a guarantee of performance and are subject to a number of risks, uncertainties and other factors, many of which are outside Alaska Communications' control. For further information regarding risks and uncertainties associated with ACS' business, please refer to the Alaska Communications’ SEC filings, including, but not limited to, our annual report on Form 10-K for the fiscal year ended December 31, 2012, quarterly reports on Form 10-Q filed subsequently, and other filings with the SEC, included under headings such as “Risk factors” and “Management’s discussion and analysis of financial condition and results of operations.”

Business Updates as of July 2013

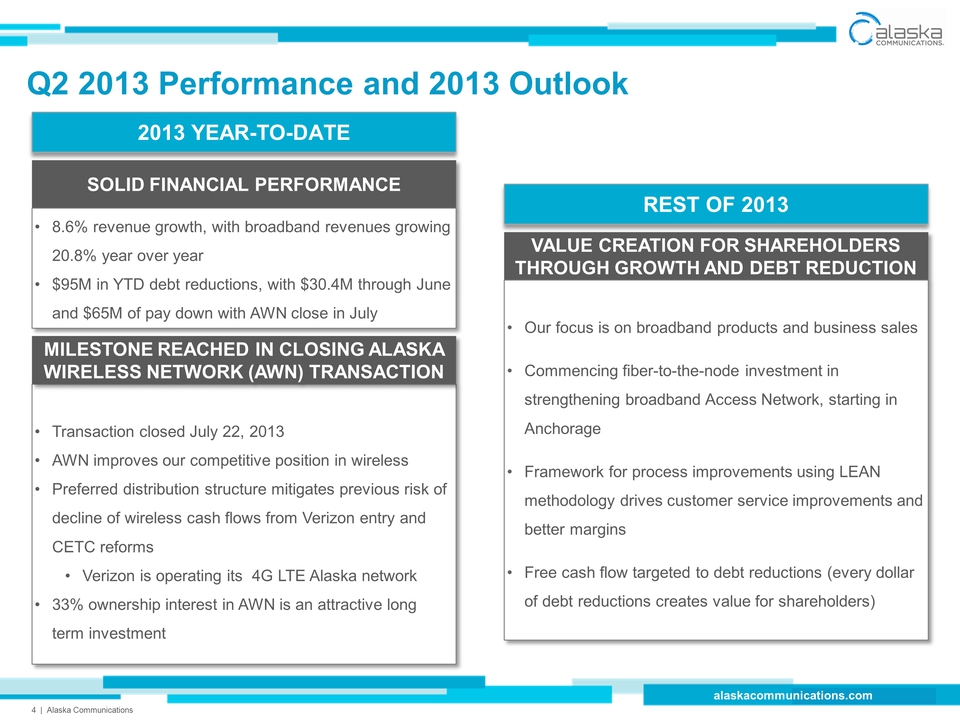

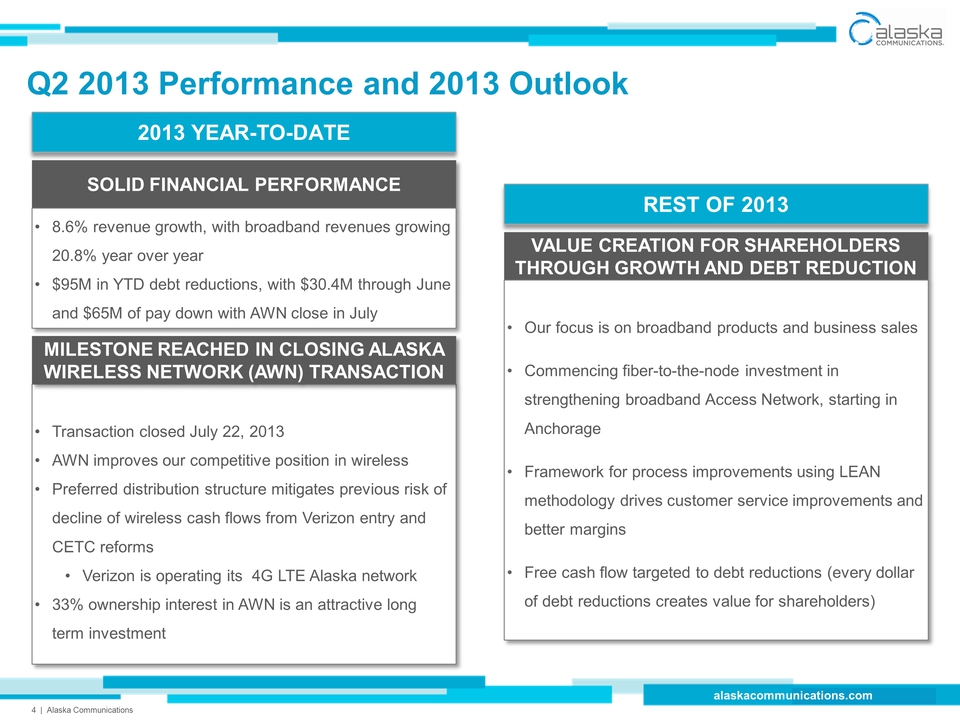

Value creation for shareholders through growth and debt reduction Title: Q2 2013 Performance and 2013 Outlook Our focus is on broadband products and business salesCommencing fiber-to-the-node investment in strengthening broadband Access Network, starting in AnchorageFramework for process improvements using LEAN methodology drives customer service improvements and better marginsFree cash flow targeted to debt reductions (every dollar of debt reductions creates value for shareholders) Transaction closed July 22, 2013AWN improves our competitive position in wirelessPreferred distribution structure mitigates previous risk of decline of wireless cash flows from Verizon entry and CETC reformsVerizon is operating its 4G LTE Alaska network33% ownership interest in AWN is an attractive long term investment 2013 YEAR-TO-DATE REST OF 2013 SOLID FINANCIAL PERFORMANCE 8.6% revenue growth, with broadband revenues growing 20.8% year over year$95M in YTD debt reductions, with $30.4M through June and $65M of pay down with AWN close in July Milestone reached in closing Alaska Wireless Network (AWN) transaction

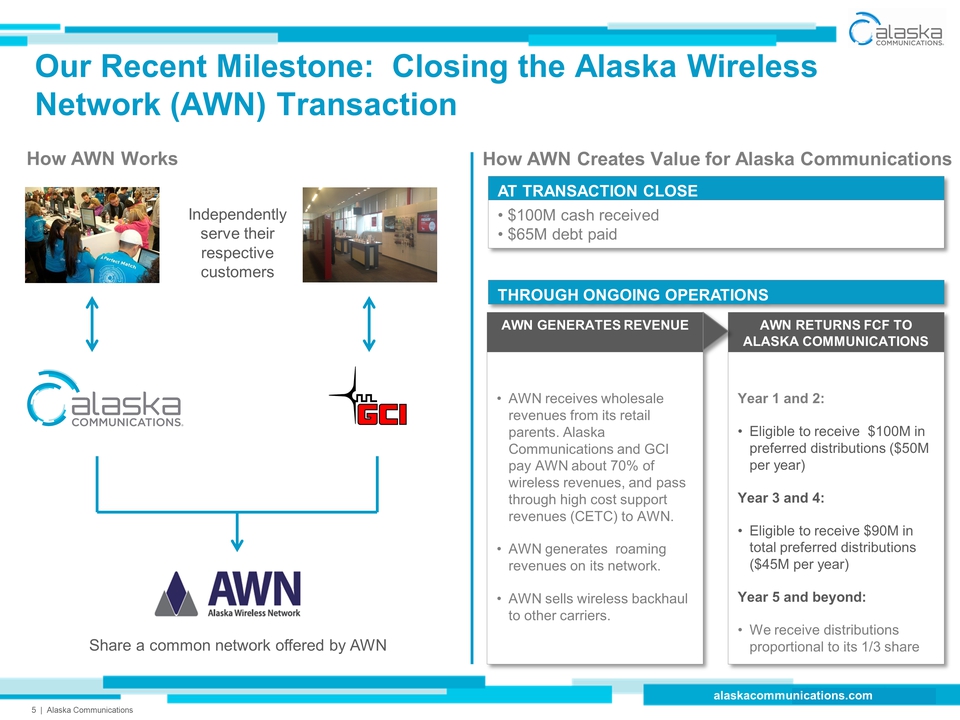

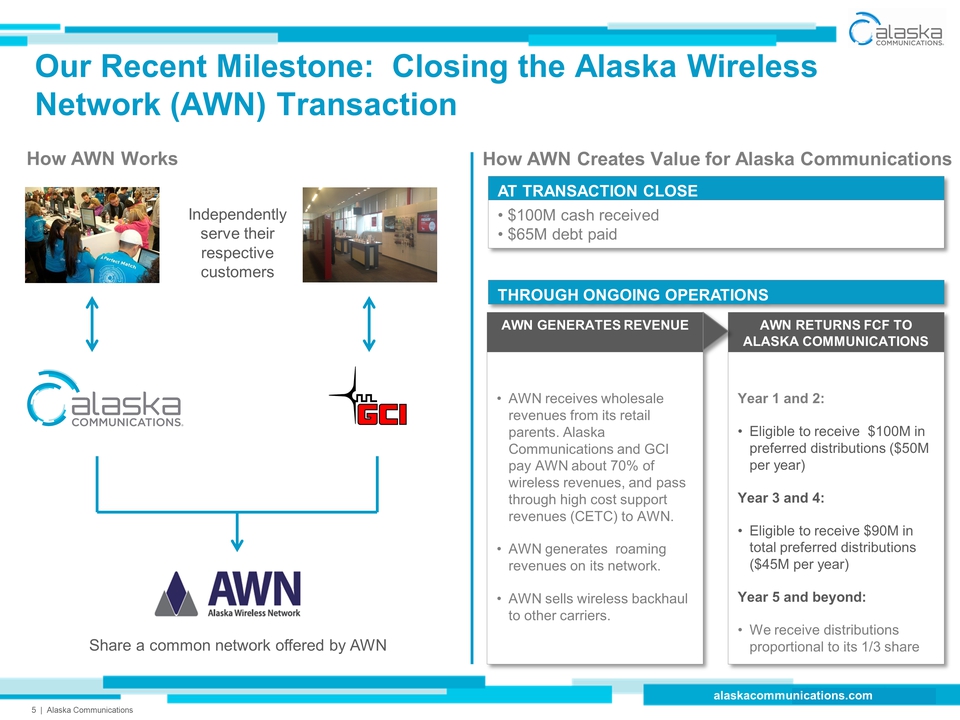

AWN RETURNS FCF TO ALASKA COMMUNICATIONS AWN GENERATES REVENUE AT TRANSACTION CLOSE AWN receives wholesale revenues from its retail parents. Alaska Communications and GCI pay AWN about 70% of wireless revenues, and pass through high cost support revenues (CETC) to AWN.AWN generates roaming revenues on its network.AWN sells wireless backhaul to other carriers. Title: Our Recent Milestone: Closing the Alaska Wireless Network (AWN) Transaction $100M cash received $65M debt paid How AWN Works Independently serve their respective customers How AWN Creates Value for Alaska Communications Share a common network offered by AWN Year 1 and 2:Eligible to receive $100M in preferred distributions ($50M per year)Year 3 and 4:Eligible to receive $90M in total preferred distributions ($45M per year)Year 5 and beyond:We receive distributions proportional to its 1/3 share THROUGH ONGOING OPERATIONS

Alaska Communications:Strategy for Value Creation

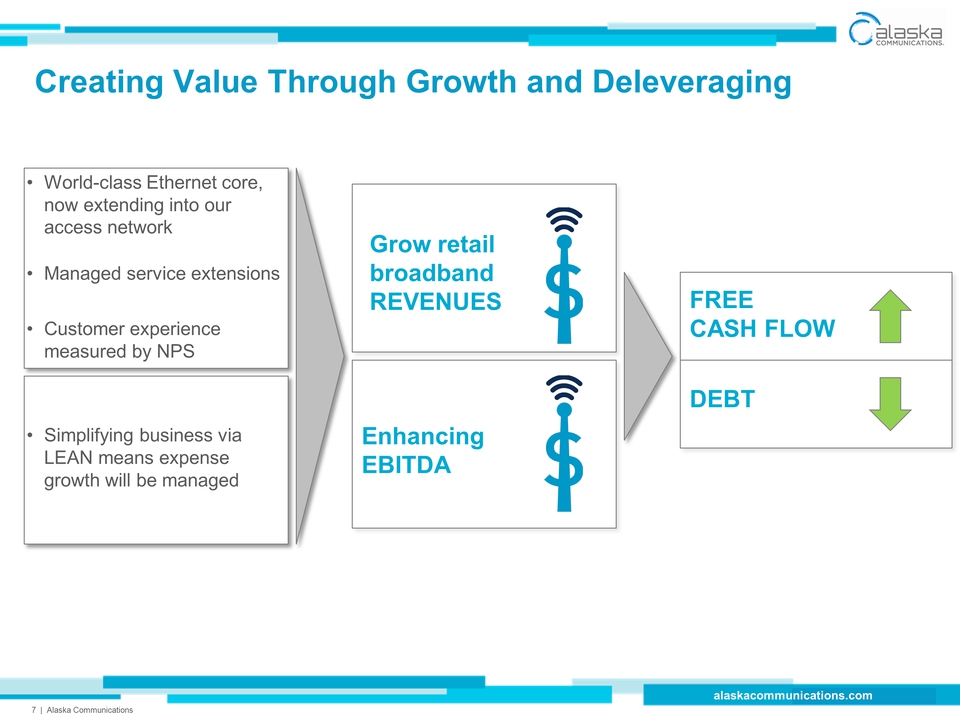

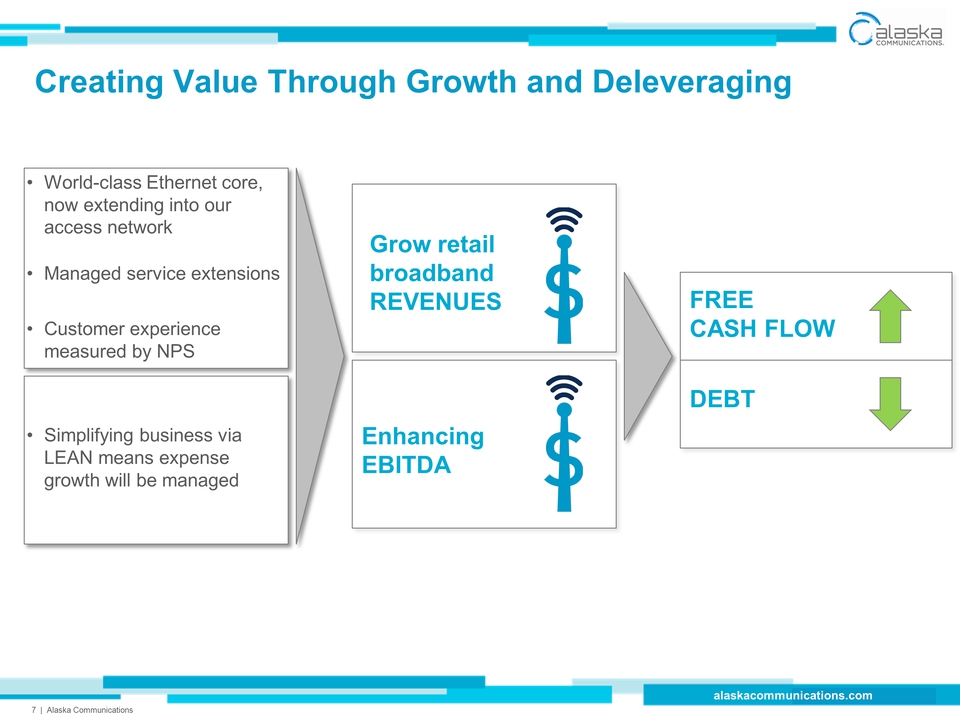

Creating Value Through Growth and Deleveraging World-class Ethernet core, now extending into our access networkManaged service extensionsCustomer experience measured by NPS Simplifying business via LEAN means expense growth will be managed (Gp:) Grow retail broadband revenues (Gp:) EnhancingEBITDA (Gp:) FREECASH FLOW (Gp:) DEBT

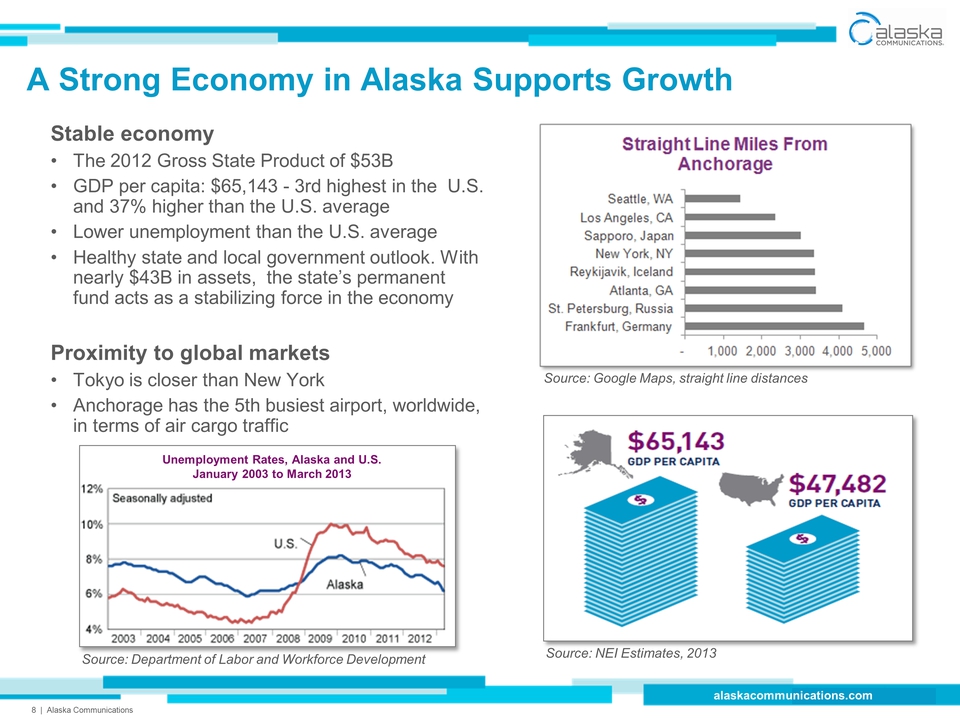

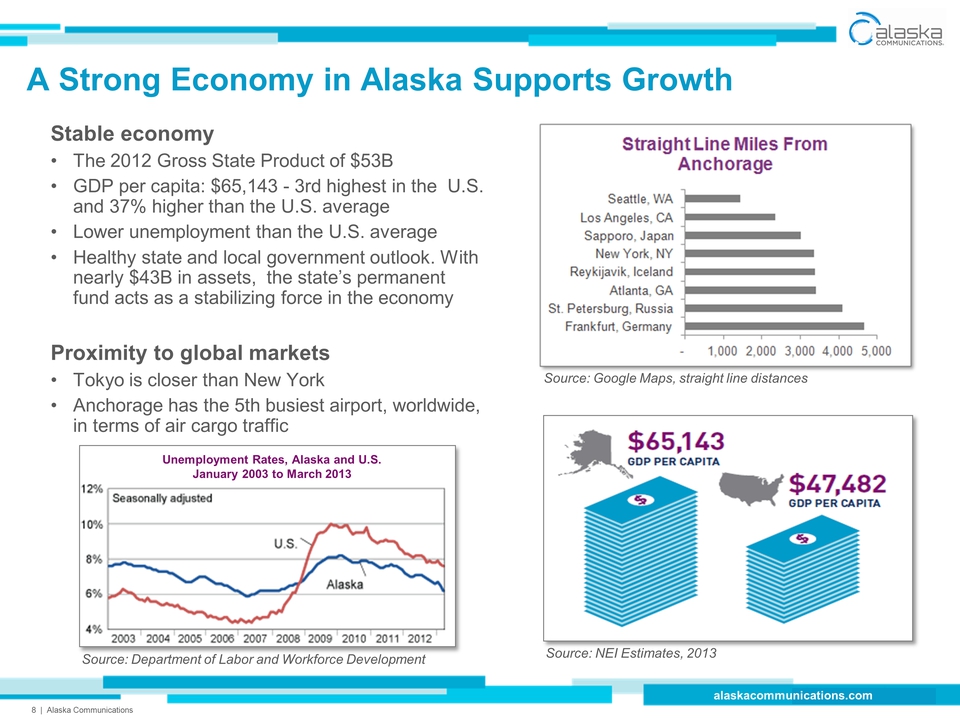

A Strong Economy in Alaska Supports Growth Other Placeholder: Stable economyThe 2012 Gross State Product of $53BGDP per capita: $65,143 - 3rd highest in the U.S. and 37% higher than the U.S. averageLower unemployment than the U.S. averageHealthy state and local government outlook. With nearly $43B in assets, the state’s permanent fund acts as a stabilizing force in the economyProximity to global marketsTokyo is closer than New York Anchorage has the 5th busiest airport, worldwide, in terms of air cargo traffic (Gp:) Unemployment Rates, Alaska and U.S. January 2003 to March 2013 Source: Google Maps, straight line distances Source: NEI Estimates, 2013 Source: Department of Labor and Workforce Development

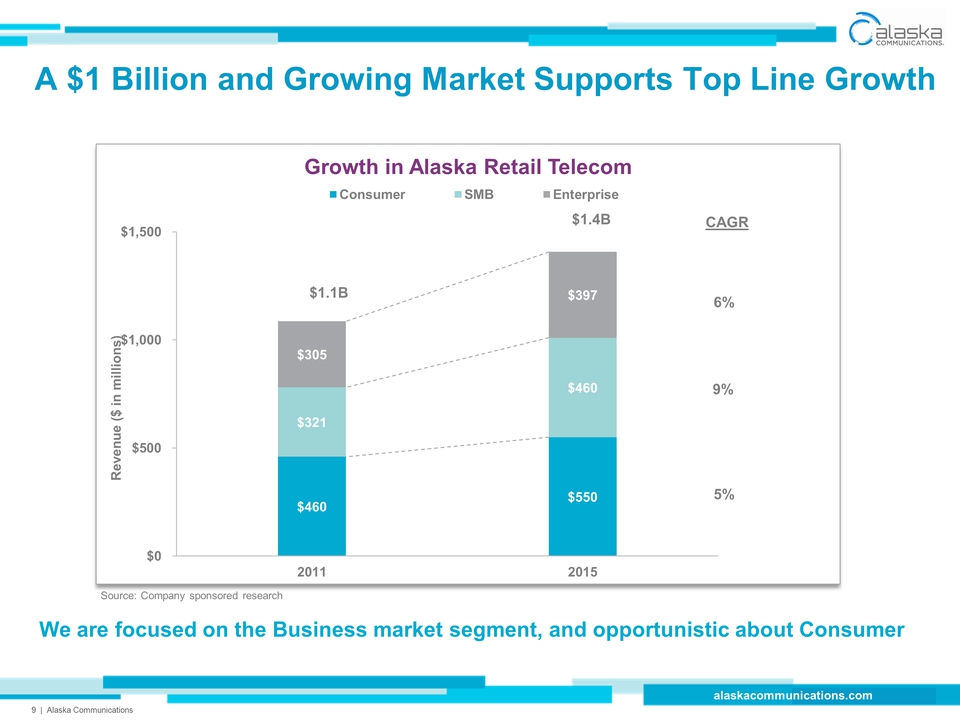

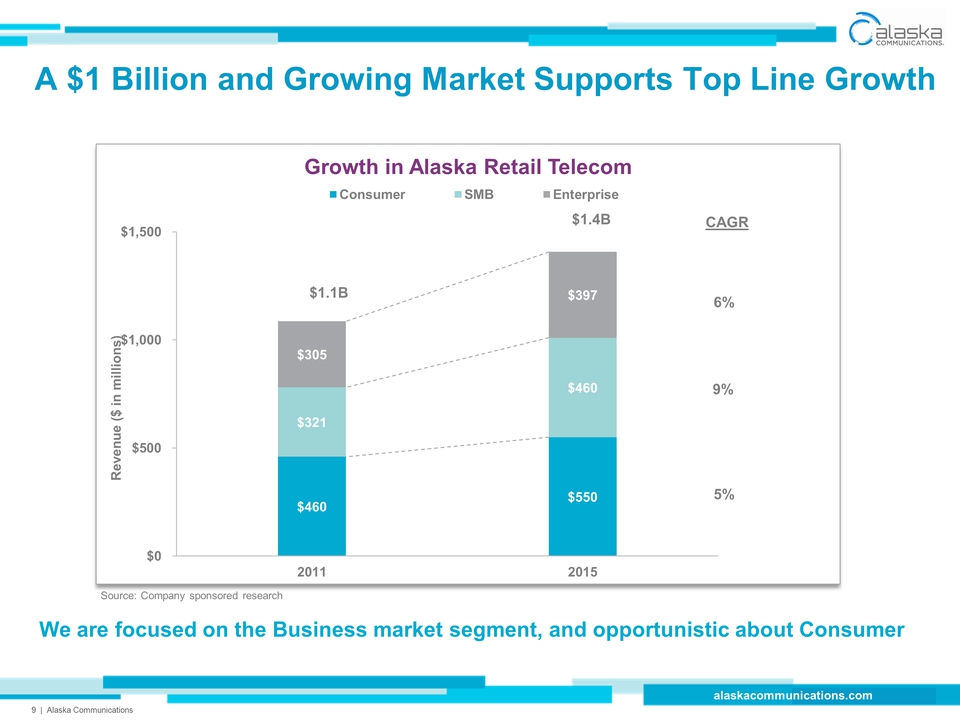

A $1 Billion and Growing Market Supports Top Line Growth We are focused on the Business market segment, and opportunistic about Consumer 6% 9% 5% CAGR Source: Company sponsored research

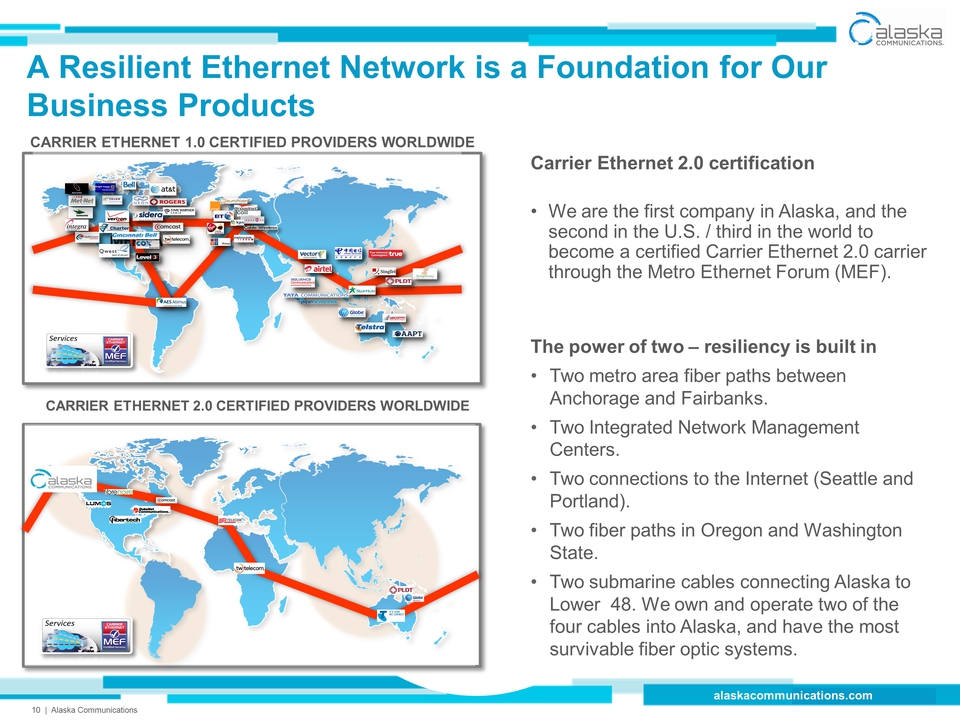

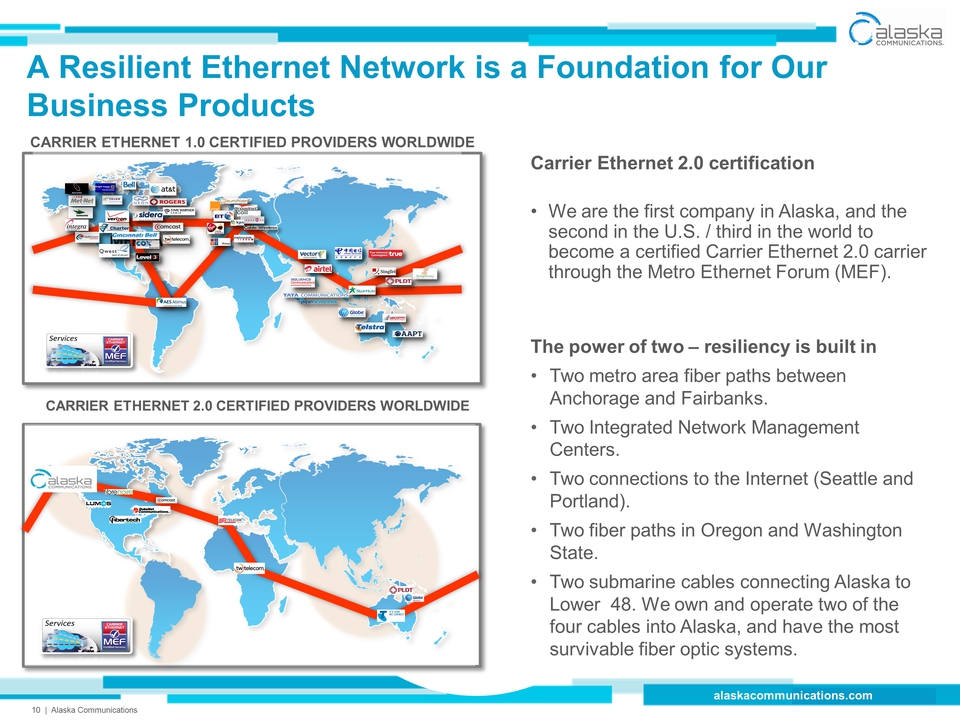

Title: A Resilient Ethernet Network is a Foundation for Our Business Products (Gp:) MERICA (Gp:) CARRIER ETHERNET 1.0 CERTIFIED PROVIDERS WORLDWIDE CARRIER ETHERNET 2.0 CERTIFIED PROVIDERS WORLDWIDE Carrier Ethernet 2.0 certification We are the first company in Alaska, and the second in the U.S. / third in the world to become a certified Carrier Ethernet 2.0 carrier through the Metro Ethernet Forum (MEF).The power of two – resiliency is built inTwo metro area fiber paths between Anchorage and Fairbanks.Two Integrated Network Management Centers.Two connections to the Internet (Seattle and Portland).Two fiber paths in Oregon and Washington State.Two submarine cables connecting Alaska to Lower 48. We own and operate two of the four cables into Alaska, and have the most survivable fiber optic systems.

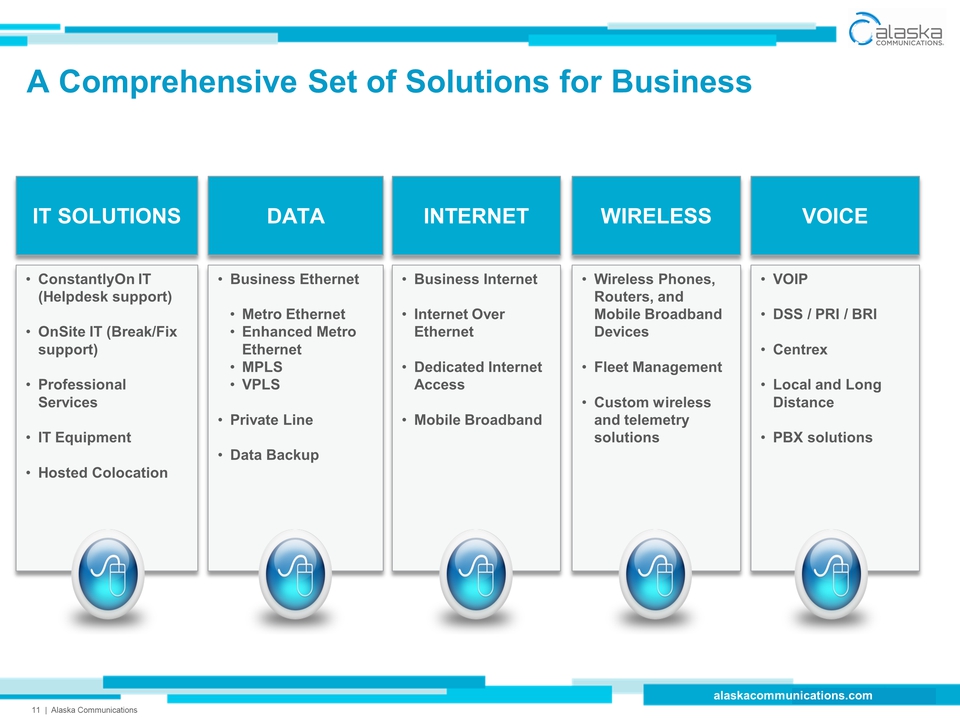

Title: A Comprehensive Set of Solutions for Business (Gp:) ConstantlyOn IT (Helpdesk support)OnSite IT (Break/Fix support)Professional ServicesIT EquipmentHosted Colocation (Gp:) IT SOLUTIONS (Gp:) DATA (Gp:) Business EthernetMetro EthernetEnhanced Metro EthernetMPLSVPLSPrivate Line Data Backup (Gp:) WIRELESS (Gp:) Wireless Phones, Routers, and Mobile Broadband DevicesFleet ManagementCustom wireless and telemetry solutions (Gp:) INTERNET (Gp:) Business InternetInternet Over EthernetDedicated Internet AccessMobile Broadband (Gp:) VOICE (Gp:) VOIPDSS / PRI / BRICentrexLocal and Long DistancePBX solutions

Title: Consumer Products Allow us to Target Specific Segments (Gp:) WIRELESS (Gp:) Mobile VoiceMobile Broadband DataPostpaid, Prepaid, Lifeline (Gp:) INTERNET (Gp:) Dedicated Home InternetMobile Broadband (Gp:) VOICE (Gp:) LocalLong DistanceInternational

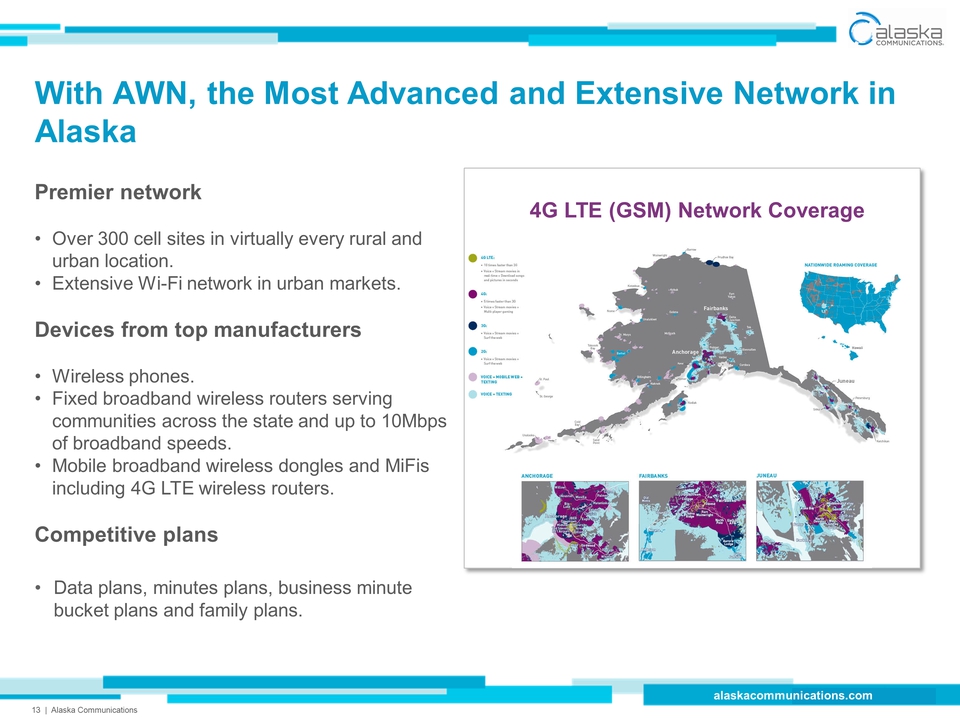

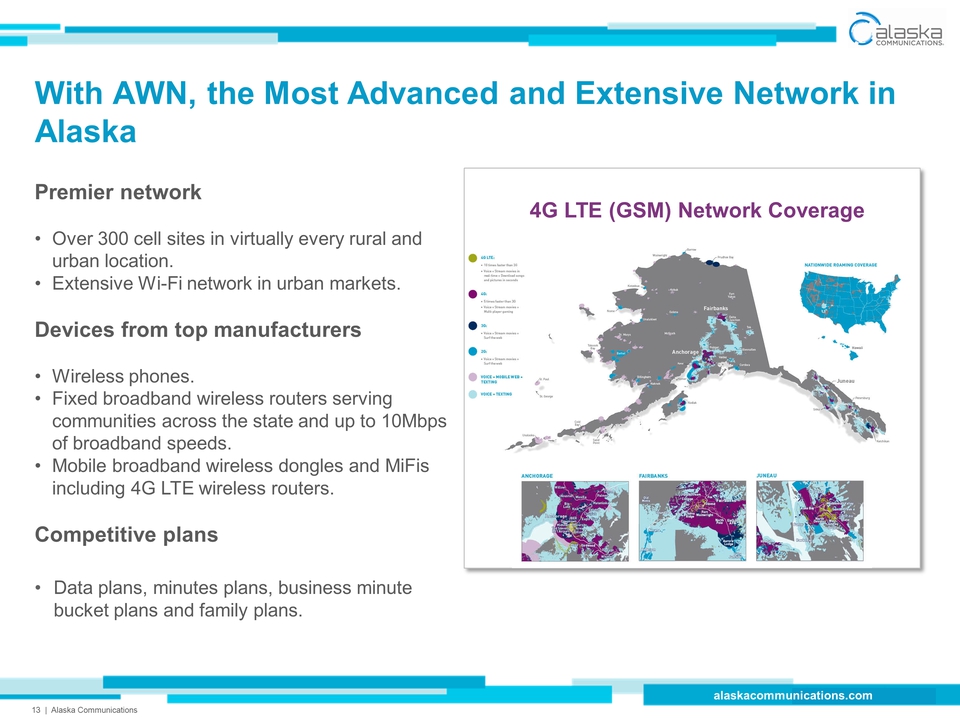

Title: With AWN, the Most Advanced and Extensive Network in Alaska 4G LTE (GSM) Network Coverage Premier networkOver 300 cell sites in virtually every rural and urban location.Extensive Wi-Fi network in urban markets.Devices from top manufacturersWireless phones.Fixed broadband wireless routers serving communities across the state and up to 10Mbps of broadband speeds.Mobile broadband wireless dongles and MiFis including 4G LTE wireless routers.Competitive plansData plans, minutes plans, business minute bucket plans and family plans.

Title: Process Improvement and Customer Service Focus Provide Differentiation and a Strong Operating Model Body: Process Improvements through LEAN Other Placeholder: A front line driven approach to process improvementFocus on eliminating wasteSmall, incremental improvements add up over timeSimplifies how we do business while improving customer experienceRate of expense growth will be lower than rate of revenue growth Body: Customer Service measured byNet Promoter Score (NPS) Other Placeholder: Retaining our existing customers is as or more important compared to gaining new customersSatisfied customers who are our “promoters” are the best way to gain market shareNPS is a proven methodology for companies that grow revenues by providing exceptional service Empowering and investing in our people is at the heart of both programs.

Q2 2013 Results andPost-AWN Financial Guidance

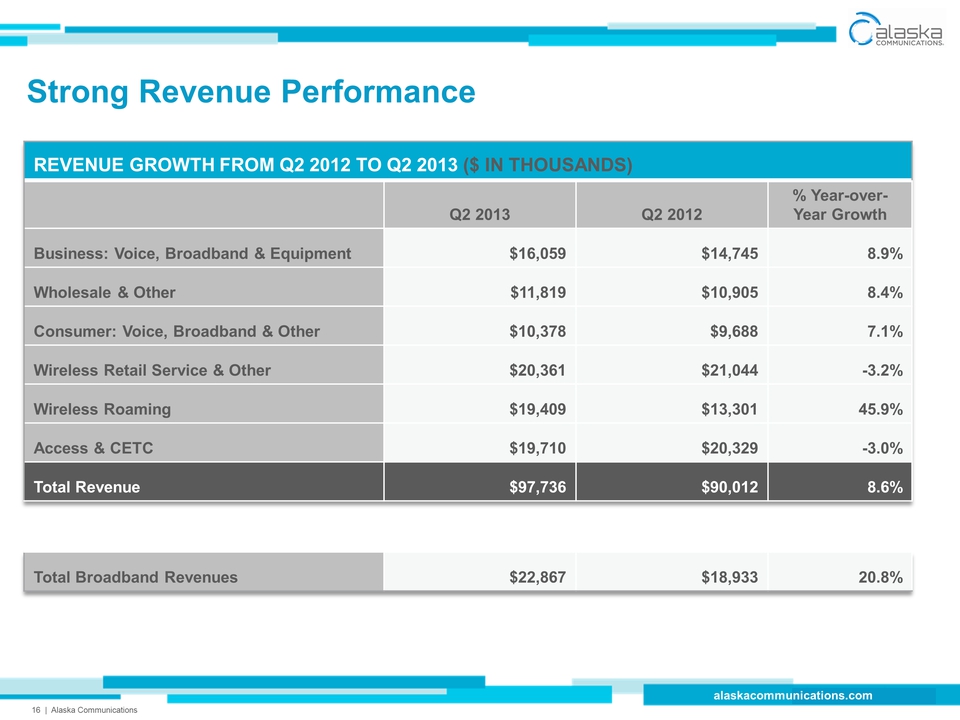

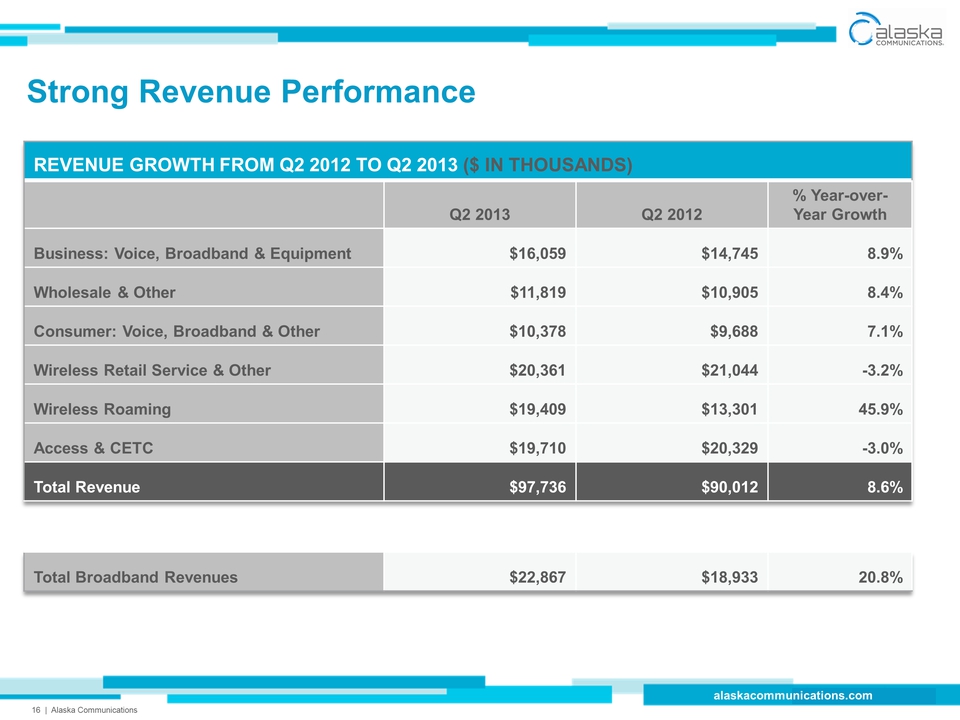

Title: Strong Revenue Performance

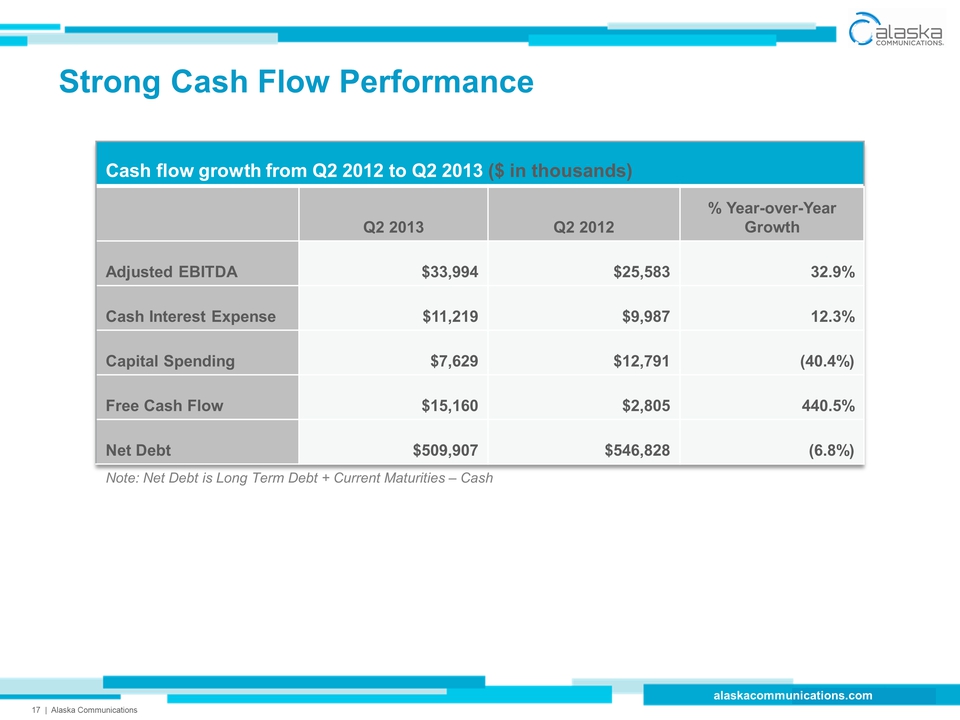

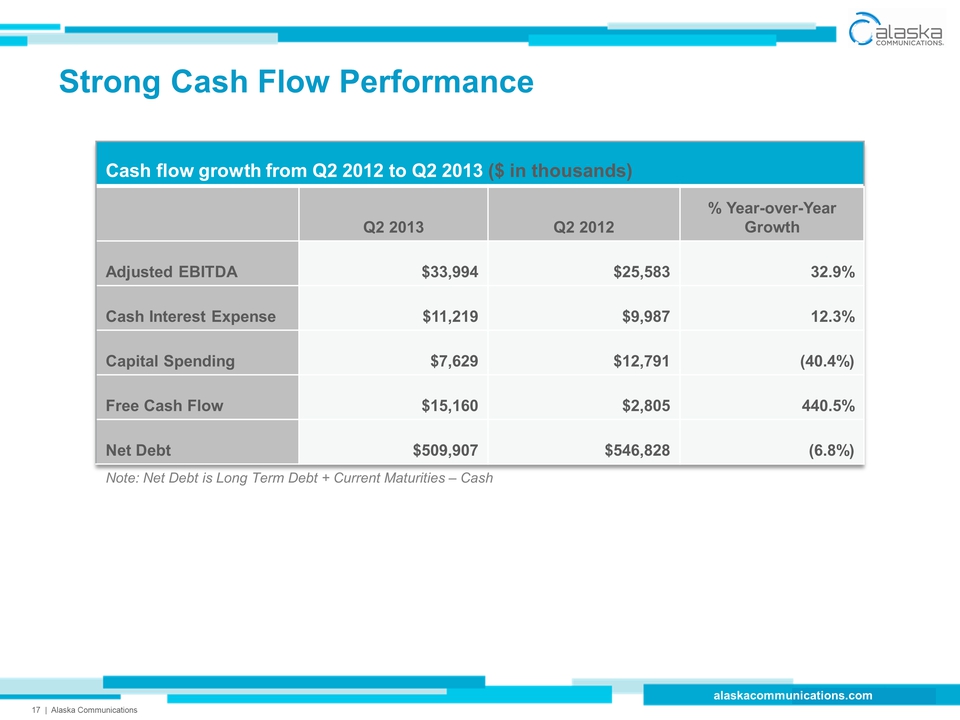

Title: Strong Cash Flow Performance Note: Net Debt is Long Term Debt + Current Maturities – Cash

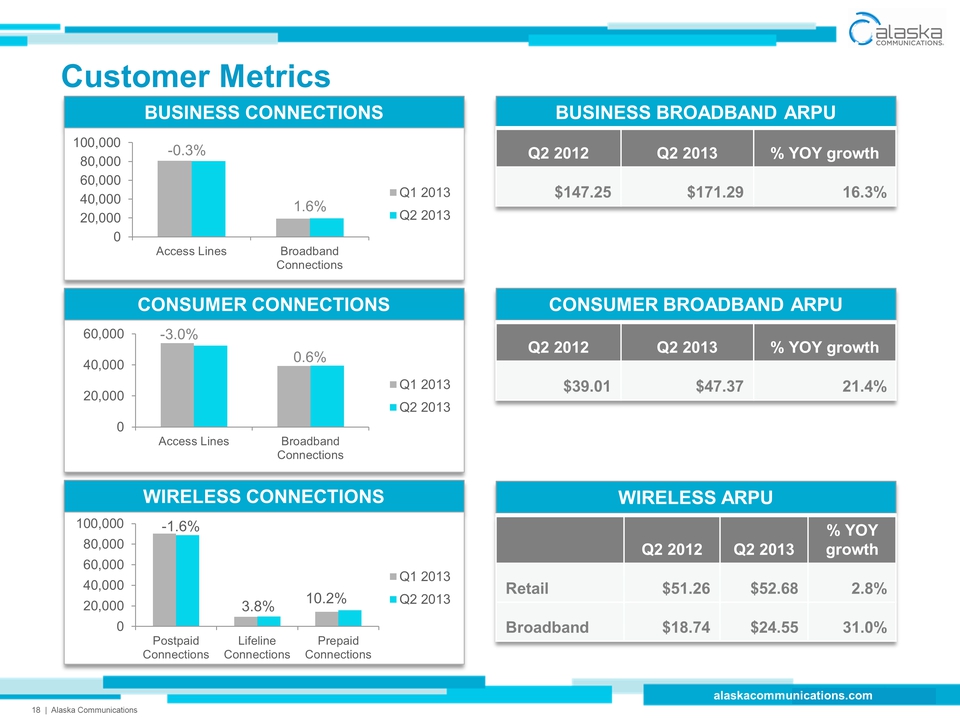

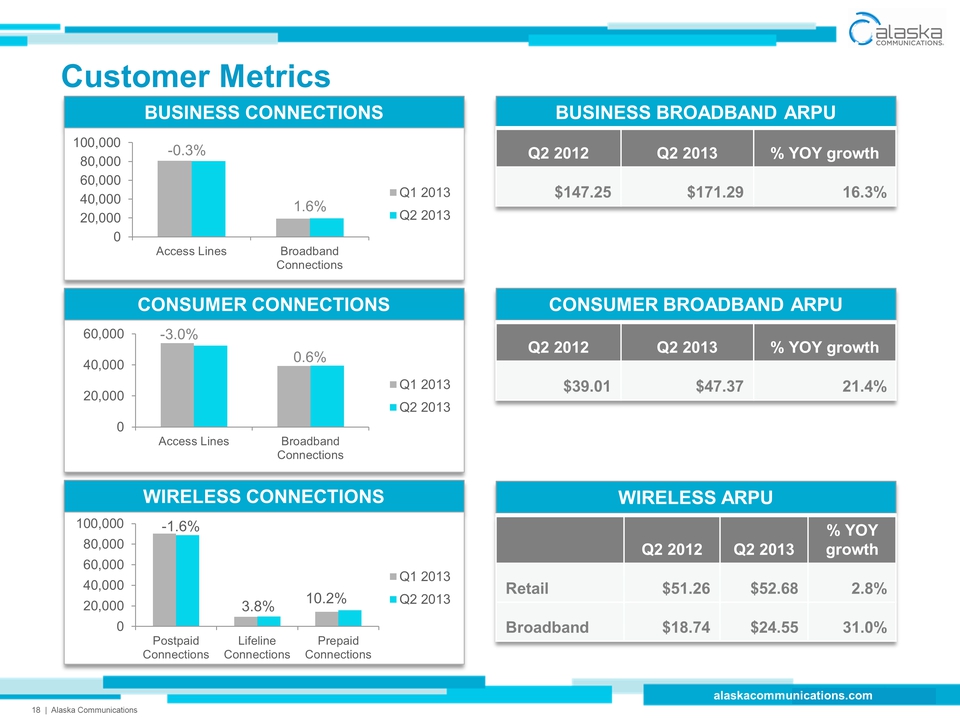

CONSUMER BROADBAND ARPU BUSINESS BROADBAND ARPU WIRELESS CONNECTIONS CONSUMER CONNECTIONS BUSINESS CONNECTIONS Title: Customer Metrics -1.6% 3.8% 10.2% WIRELESS ARPU

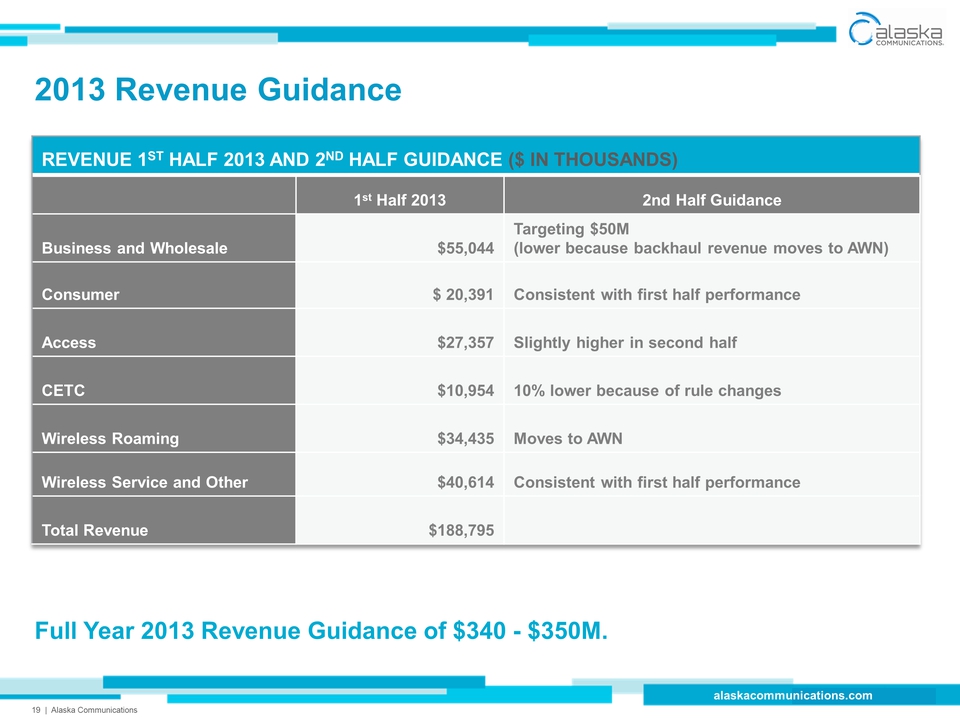

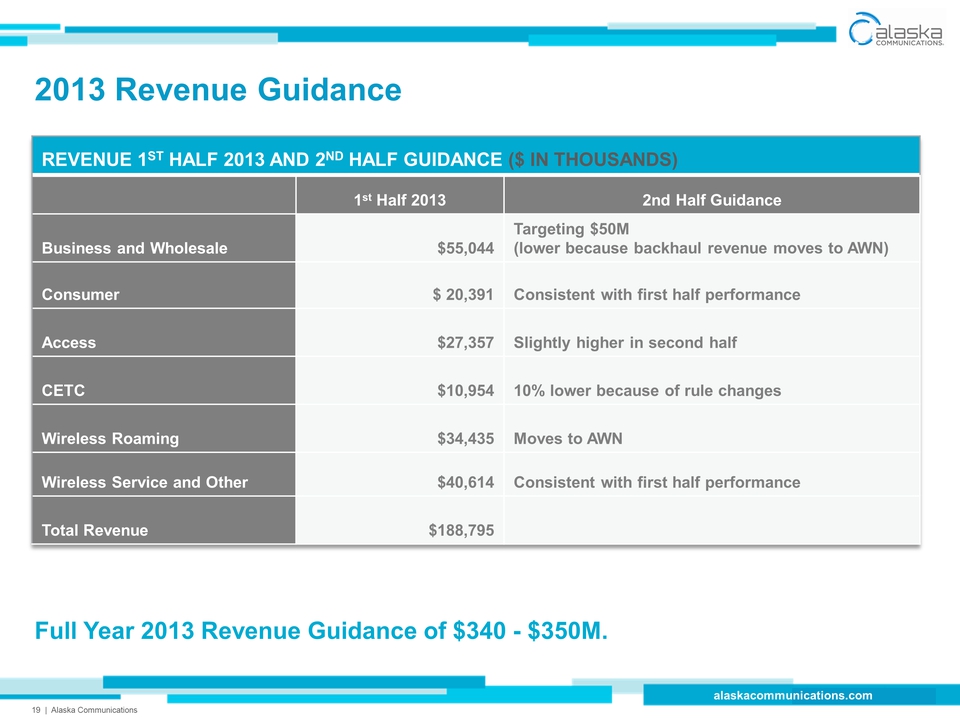

Title: 2013 Revenue Guidance Full Year 2013 Revenue Guidance of $340 - $350M.

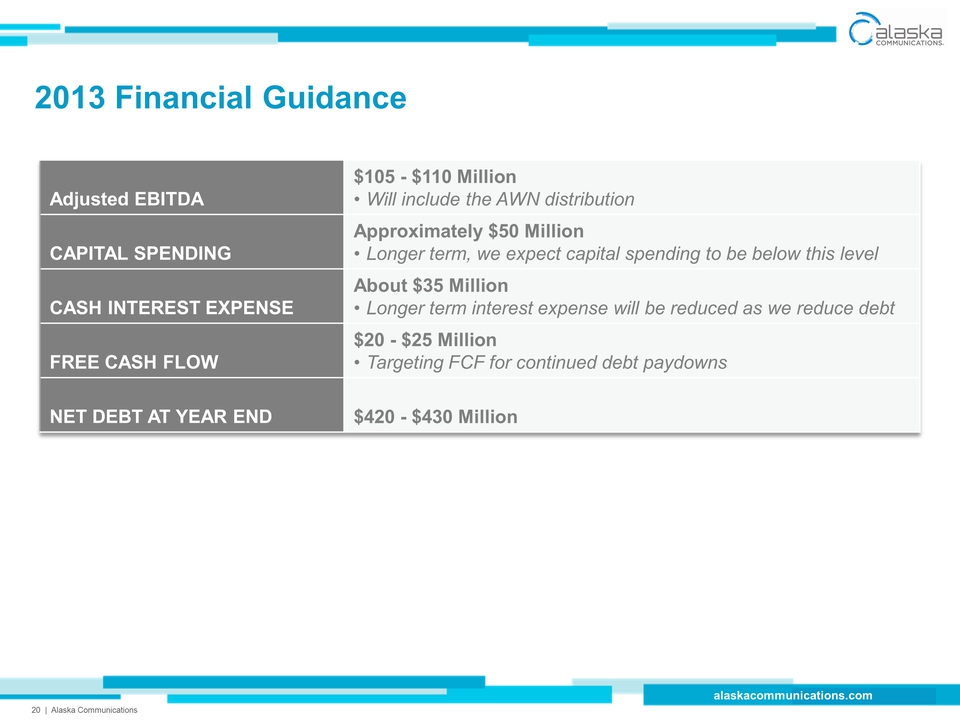

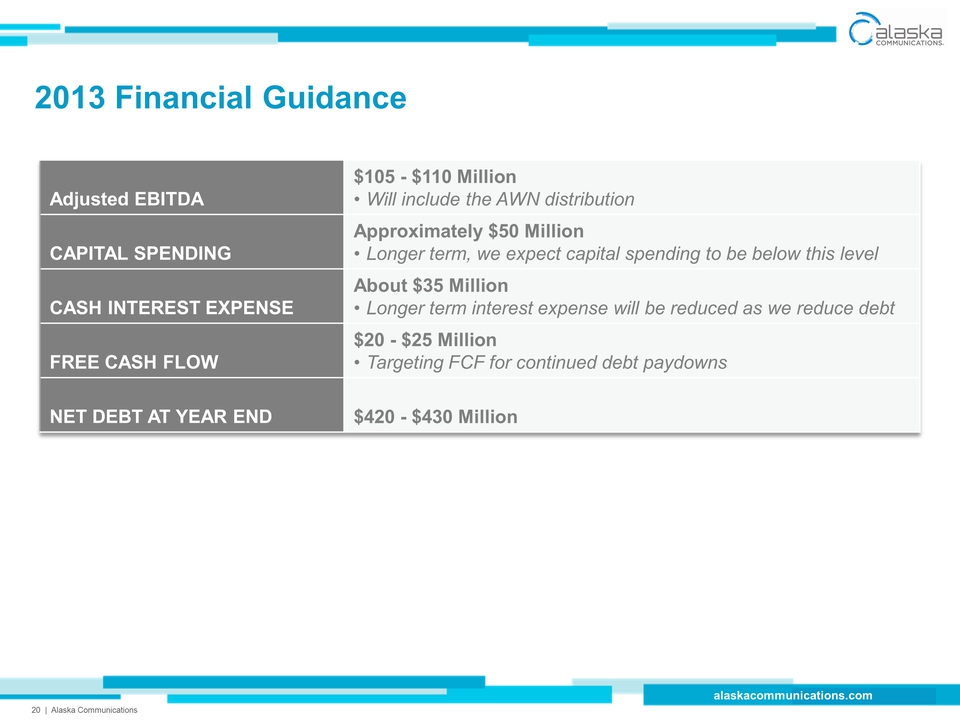

Title: 2013 Financial Guidance

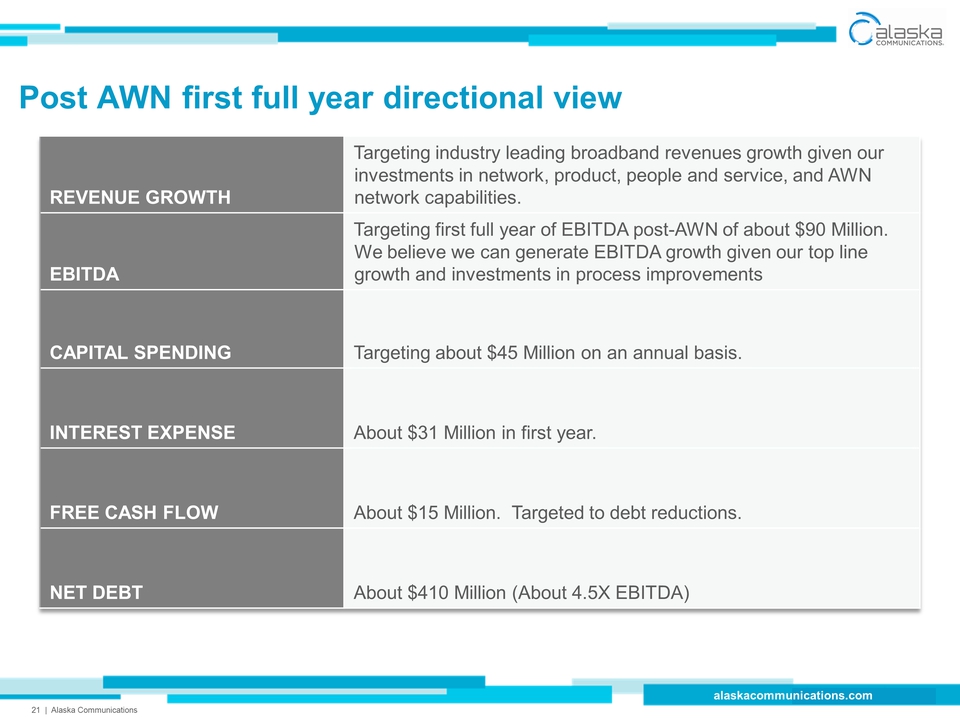

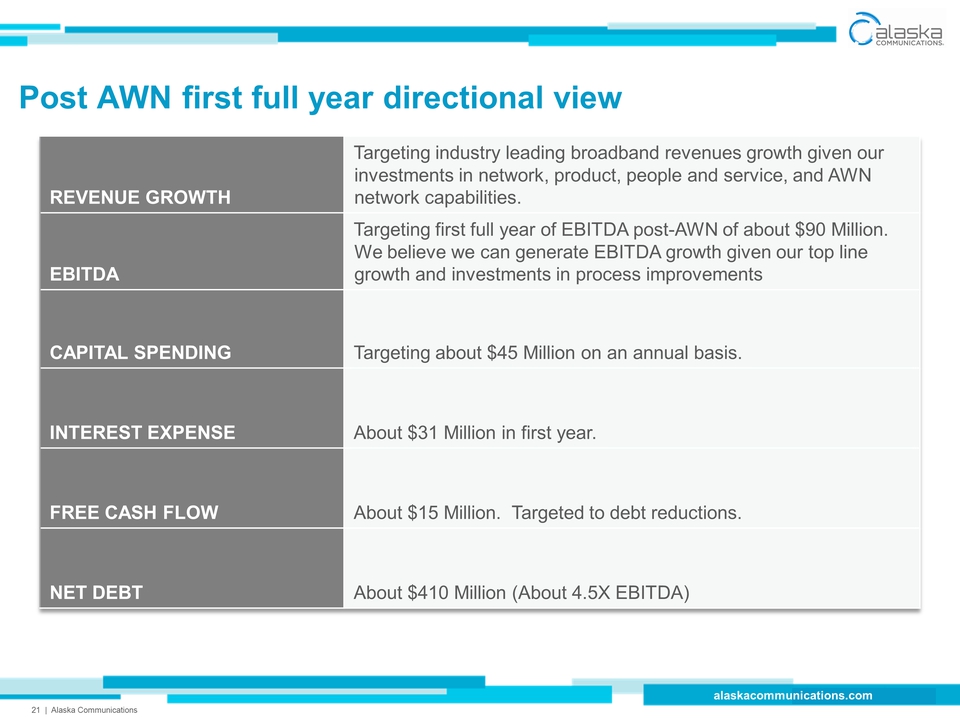

Title: Post AWN first full year directional view

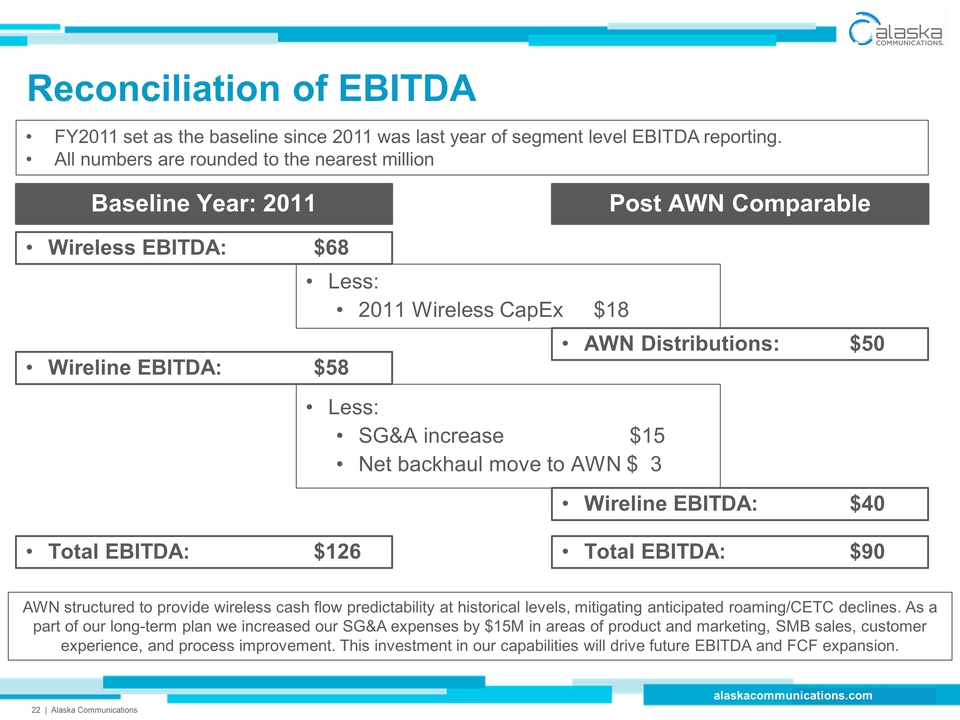

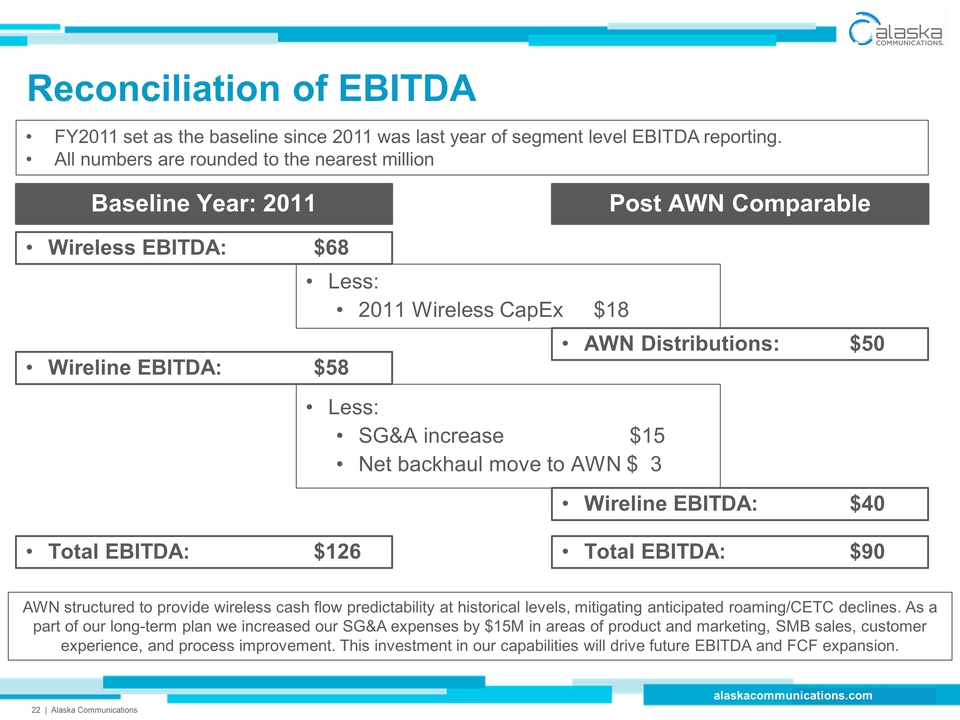

Title: Reconciliation of EBITDA FY2011 set as the baseline since 2011 was last year of segment level EBITDA reporting.All numbers are rounded to the nearest million Baseline Year: 2011 Post AWN Comparable AWN Distributions: $50 Wireline EBITDA: $58 Less: SG&A increase $15Net backhaul move to AWN $ 3 Wireline EBITDA: $40 Wireless EBITDA: $68 Less:2011 Wireless CapEx $18 Total EBITDA: $126 Total EBITDA: $90 AWN structured to provide wireless cash flow predictability at historical levels, mitigating anticipated roaming/CETC declines. As a part of our long-term plan we increased our SG&A expenses by $15M in areas of product and marketing, SMB sales, customer experience, and process improvement. This investment in our capabilities will drive future EBITDA and FCF expansion.

In Summary: A Plan to Create Value, and a Track Record to Support the Plan

Title: Creating Long-Term Shareholder Value (Gp:) Broadband growth: FY2012 11.9% vs FY2011; 1H2013 20.8% vs. 1H 2012Fiber-to-the-Node investments supplements world-class Ethernet coreCustomer experience focus via Net Promoter Score (NPS) (Gp:) RESULTS: RESULTS: $95.4M in total debt reductions YTD through July 2013$30.4M through cash flow from operations and $65M from AWN close Predictable cash flows from AWNBroadband revenue growth combined with LEAN process improvement will drive broadband margin expansion RESULTS: (Gp:) FREECASH FLOW (Gp:) DEBT (Gp:) Grow retail broadband revenues (Gp:) EnhancingEBITDA

Appendix

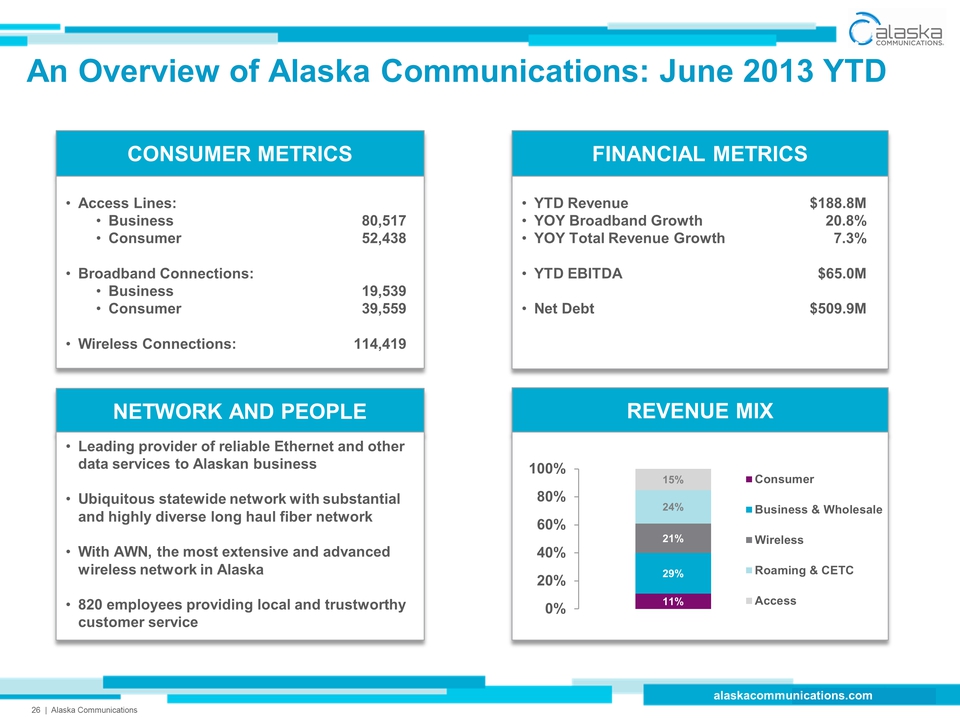

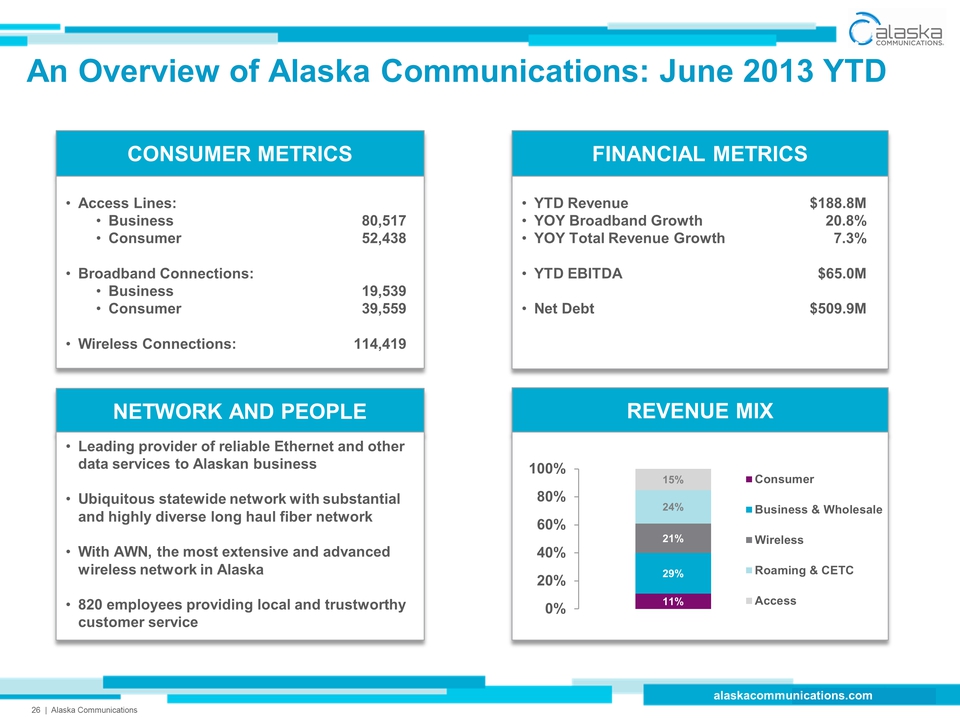

REVENUE MIX NETWORK AND PEOPLE FINANCIAL METRICS CONSUMER METRICS Title: An Overview of Alaska Communications: June 2013 YTD Access Lines:Business 80,517Consumer 52,438Broadband Connections:Business 19,539Consumer 39,559Wireless Connections: 114,419 YTD Revenue $188.8MYOY Broadband Growth 20.8%YOY Total Revenue Growth 7.3%YTD EBITDA $65.0MNet Debt $509.9M Leading provider of reliable Ethernet and other data services to Alaskan businessUbiquitous statewide network with substantial and highly diverse long haul fiber networkWith AWN, the most extensive and advanced wireless network in Alaska820 employees providing local and trustworthy customer service

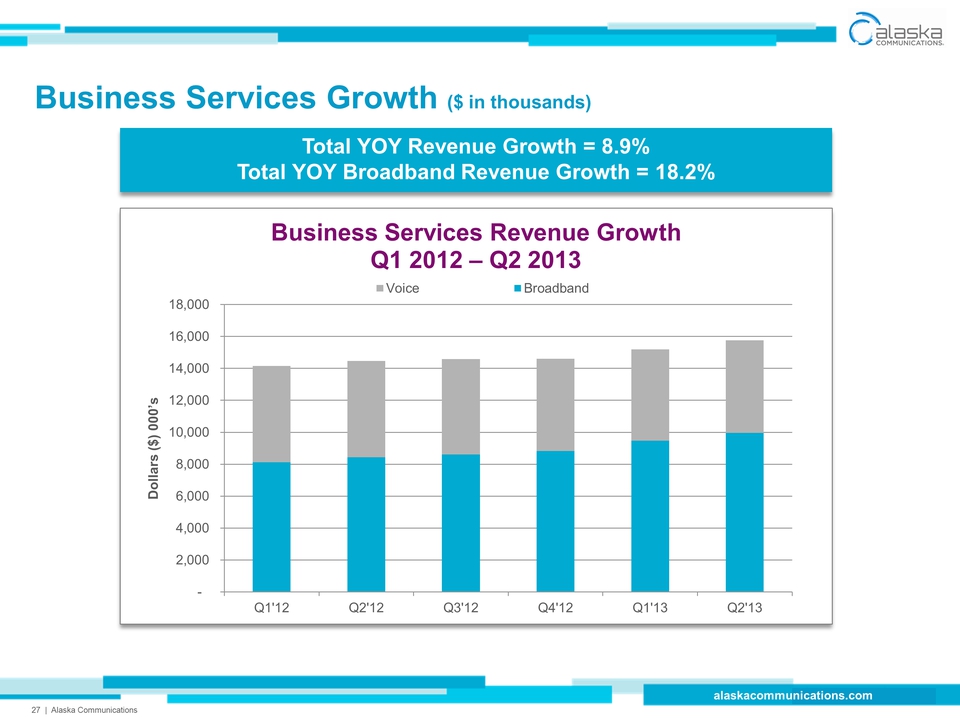

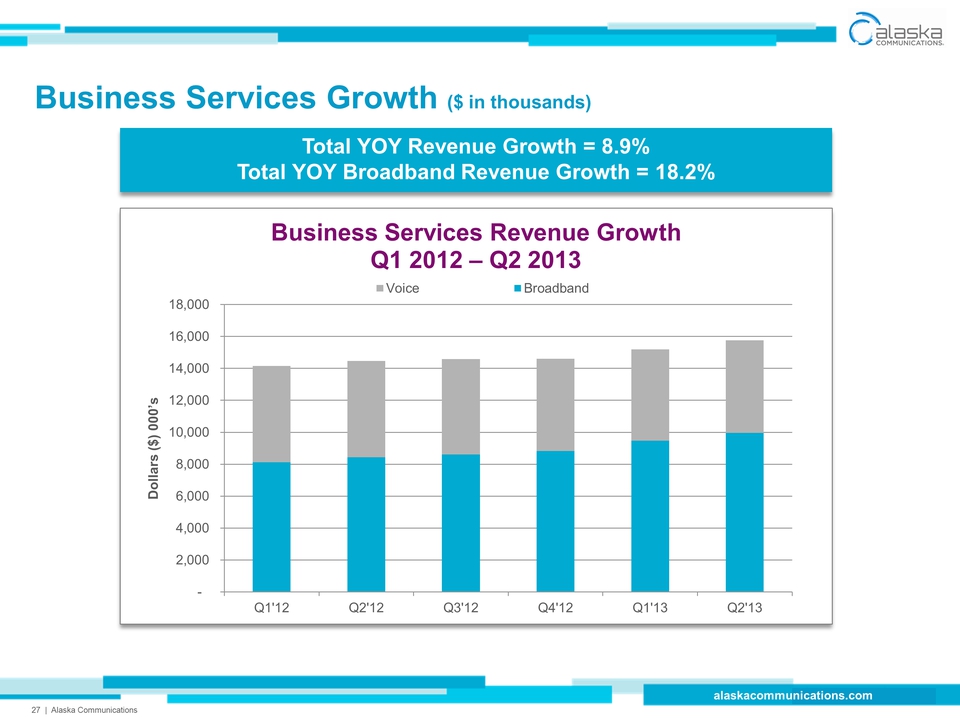

Title: Business Services Growth ($ in thousands) Total YOY Revenue Growth = 8.9%Total YOY Broadband Revenue Growth = 18.2%

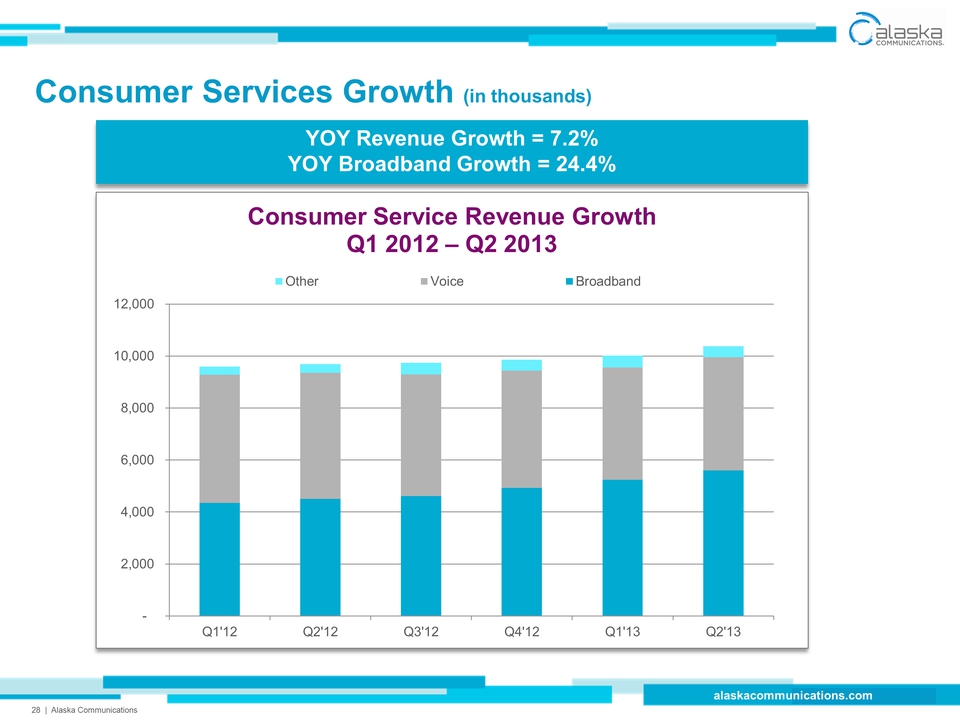

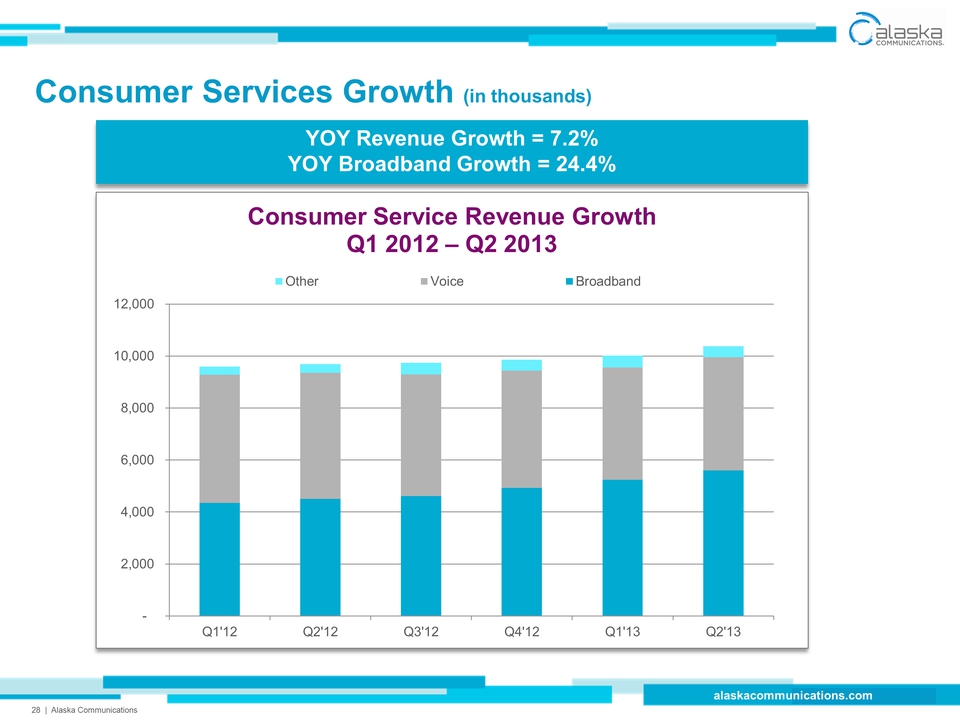

Title: Consumer Services Growth (in thousands) YOY Revenue Growth = 7.2%YOY Broadband Growth = 24.4%