Exhibit 99.2

4th Quarter & Full-Year Earnings Results March 2014 Alaska Communications

Participants Anand Vadapalli: President and Chief Executive Officer Wayne Graham: Chief Financial Officer Leonard Steinberg: General Counsel Laurie Butcher: Vice President of Finance 2 | Alaska Communications alaskacommunications.com

Safe Harbor Statement Forward-Looking Statements We have included in this presentation certain "forward-looking statements," as that term is defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on management's beliefs as well as on a number of assumptions concerning future events made using information currently available to management. You are cautioned not to put undue reliance on such forward-looking statements, which are not a guarantee of performance and are subject to a number of risks, uncertainties and other factors, many of which are outside Alaska Communications' control. For further information regarding risks and uncertainties associated with Alaska Communications' business, please refer to the Alaska Communications’ SEC filings, including, but not limited to, our annual report on Form 10-K for the fiscal year ended December 31, 2012, quarterly reports on Form 10-Q filed subsequently, and other filings with the SEC, included under headings such as “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” 3 | Alaska Communications alaskacommunications.com

2013 Highlights and Strategic Overview Anand Vadapalli: President and Chief Executive Officer 4 | Alaska Communications alaskacommunications.com

How We Create Value For Our Shareholders Growing Broadband Revenues Growing EBITDA Reducing Debt 5 | Alaska Communications alaskacommunications.com

2013 Accomplishments AWN transaction was closed in July 2013 Strong broadband revenue growth Focus on high margin business and wholesale segment TekMate acquisition in January 2014 further strengthens our position with business customers Access network upgrade program enabling new addressable market Cost structure re-alignment commences for new wireless operating model 6 | Alaska Communications alaskacommunications.com

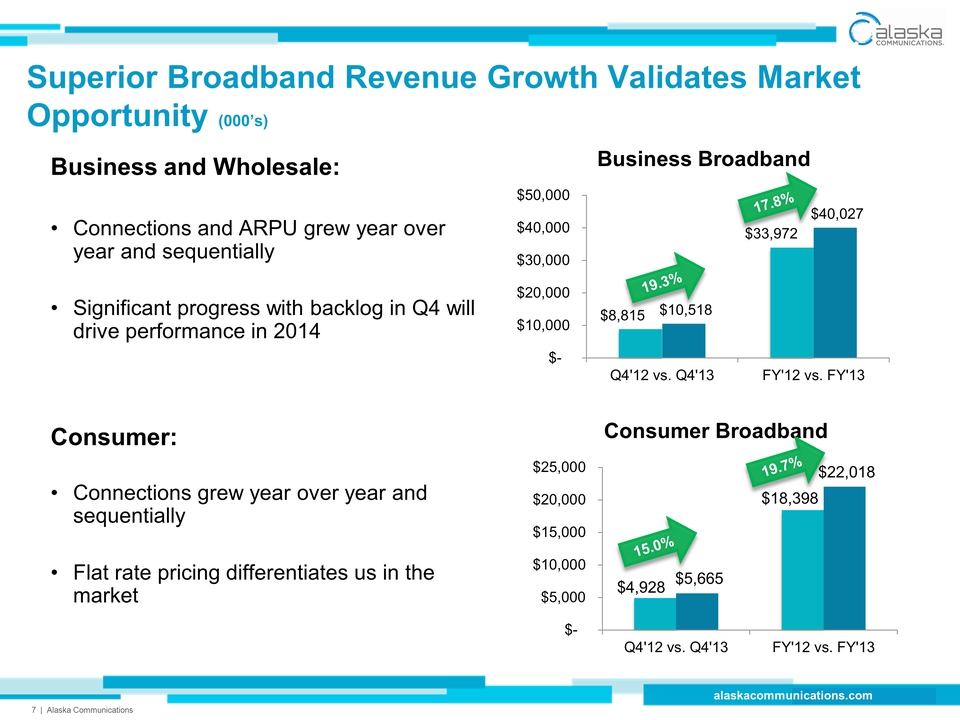

Superior Broadband Revenue Growth Validates Market Opportunity (000’s) Business and Wholesale: Connections and ARPU grew year over year and sequentially Significant progress with backlog in Q4 will drive performance in 2014 Consumer: Connections grew year over year and sequentially Flat rate pricing differentiates us in the market Business Broadband $8,815 $10,518 $33,972 $40,027 19.3% 17.8% $- $10,000 $20,000 $30,000 $40,000 $50,000 Q4'12 vs. Q4'13 FY'12 vs. FY'13 Consumer Broadband $4,928 $5,665 $18,398 $22,018 15.0% 19.7% $- $5,000 $10,000 $15,000 $20,000 $25,000 Q4'12 vs. Q4'13 FY'12 vs. FY'13 7 | Alaska Communications alaskacommunications.com

Growing the Business Market Segment is Our Top Priority Our highly reliable network has always been a differentiator for our customers. We offer managed services to further extend our value proposition. TekMate is the leading IT services firm in Alaska, and has a complementary customer base. We have recently added key leadership in sales and managed services to accelerate our growth. Business and Wholesale Drive Growth (2013*) Business and Wholesale 68% Consumer 27% TekMate (PF) 5% * Includes 100% of TekMate unaudited results for 2013 8 | Alaska Communications alaskacommunications.com

Access Network Upgrade Program Will Drive Further Growth We have completed access network upgrades including fiber to the business, fiber to the node and existing node upgrades. Our first programmatic investment to upgrade our broadband access network totaling approximately $10 million. This program gives us capabilities to serve over 5,000 businesses and over 7,500 consumers with speeds ranging from 25 Mbps to GigE. We have begun selling into this network and believe it is a significant revenue opportunity for us in 2014. 9 | Alaska Communications alaskacommunications.com

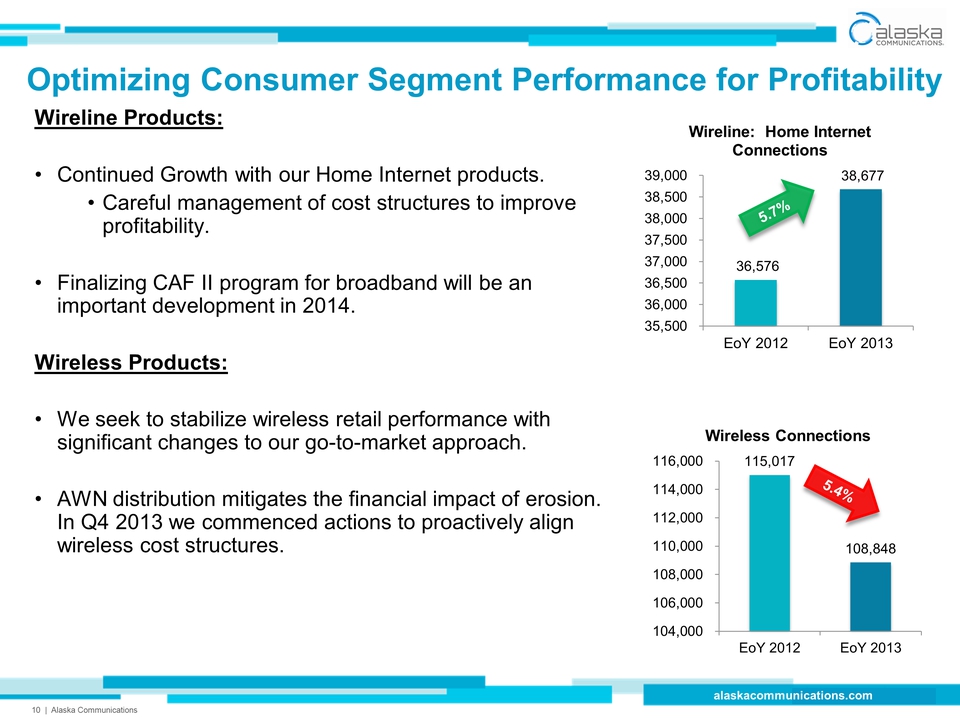

Optimizing Consumer Segment Performance for Profitability Wireline Products: Continued Growth with our Home Internet products. Careful management of cost structures to improve profitability. Finalizing CAF II program for broadband will be an important development in 2014. Wireless Products: We seek to stabilize wireless retail performance with significant changes to our go-to-market approach. AWN distribution mitigates the financial impact of erosion. In Q4 2013 we commenced actions to proactively align wireless cost structures. Wireline: Home Internet Connections 36,576 38,677 5.7% 35,500 36,000 36,500 37,000 37,500 38,000 38,500 39,000 EoY 2012 EoY 2013 Wireless Connections 115,017 108,848 5.4% 104,000 106,000 108,000 110,000 112,000 114,000 116,000 EoY 2012 EoY 2013 10 | Alaska Communications alaskacommunications.com

Priorities for 2014 Business Double Down on Business: Leverage our network capabilities Accelerate offerings in managed services Consumer Manage for financial performance: Improve margins through continuous alignment of cost structures Continue flat rate Home Internet products Work with FCC on CAF II program that supports broadband deployment in Alaska Leverage FTTx Monetize recent investments: Fiber to the node Managed services and TekMate 11 | Alaska Communications alaskacommunications.com

Review of Fourth Quarter Results and 2014 Guidance Wayne Graham, Chief Financial Officer Source: NEI Estimates, 2013 12 | Alaska Communications alaskacommunications.com

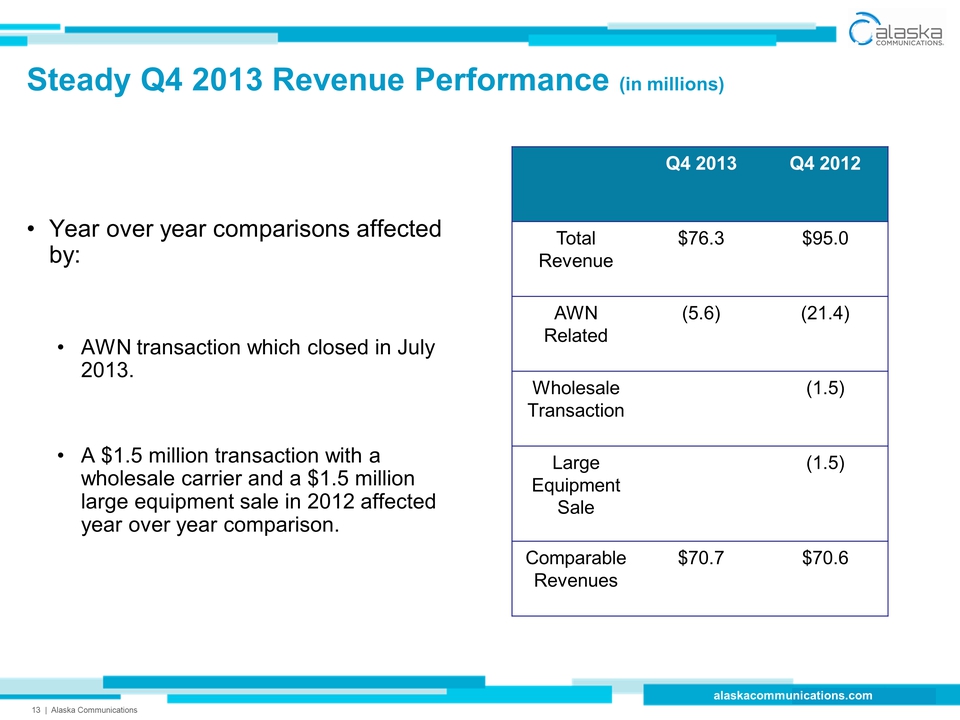

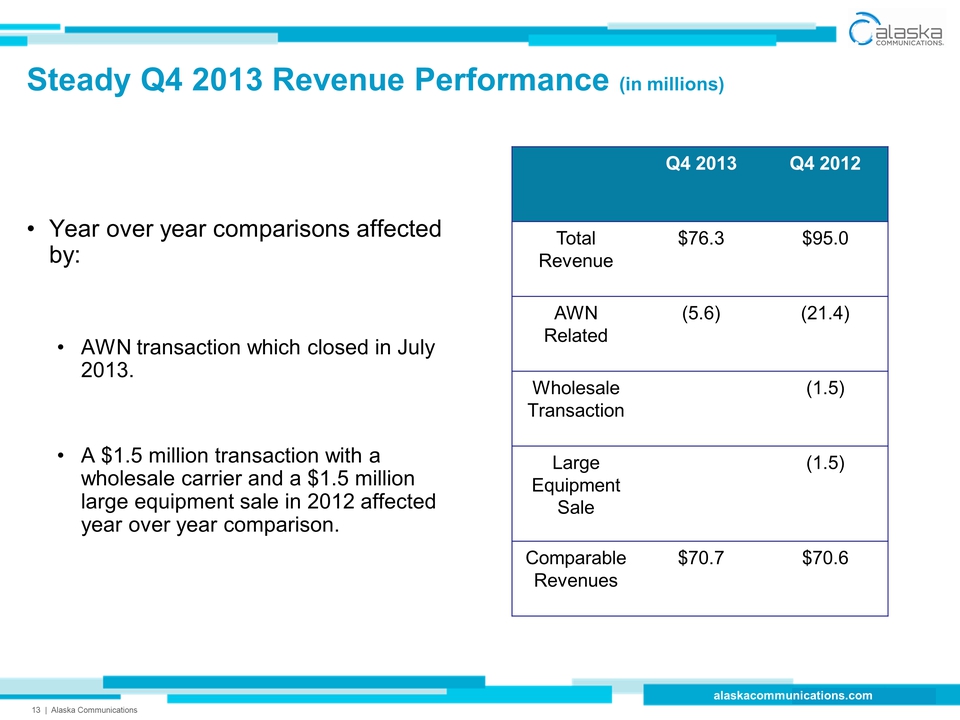

Steady Q4 2013 Revenue Performance (in millions) Year over year comparisons affected by: AWN transaction which closed in July 2013. A $1.5 million transaction with a wholesale carrier and a $1.5 million large equipment sale in 2012 affected year over year comparison. Q4 2013 Q4 2012 Total Revenue $76.3 $95.0 AWN Related (5.6) (21.4) Wholesale Transaction (1.5) Large Equipment Sale (1.5) Comparable Revenues $70.7 $70.6 13 | Alaska Communications alaskacommunications.com

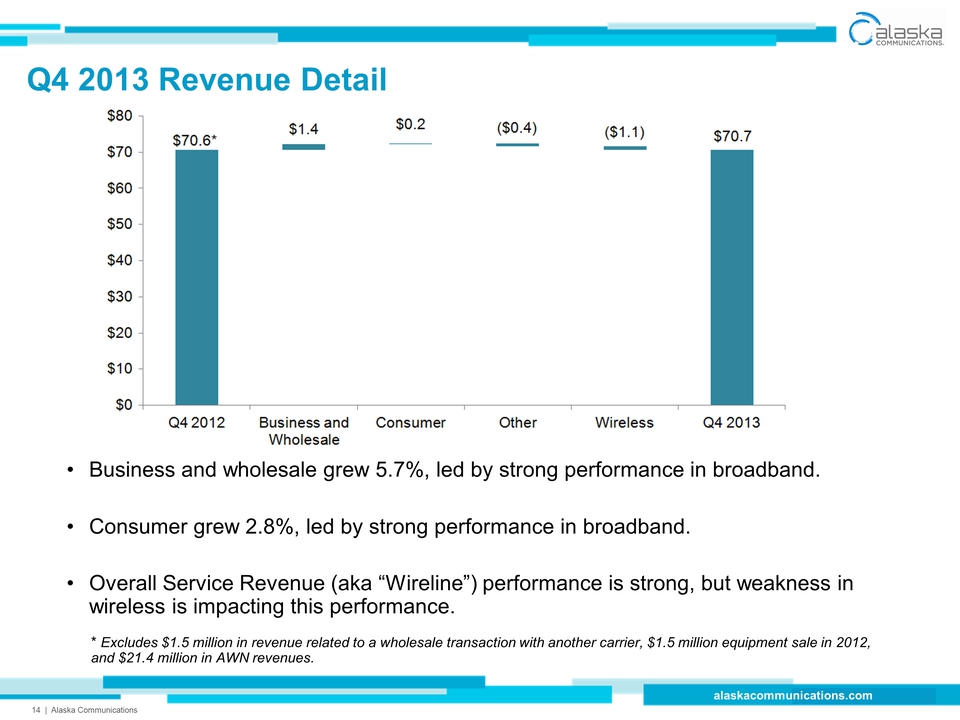

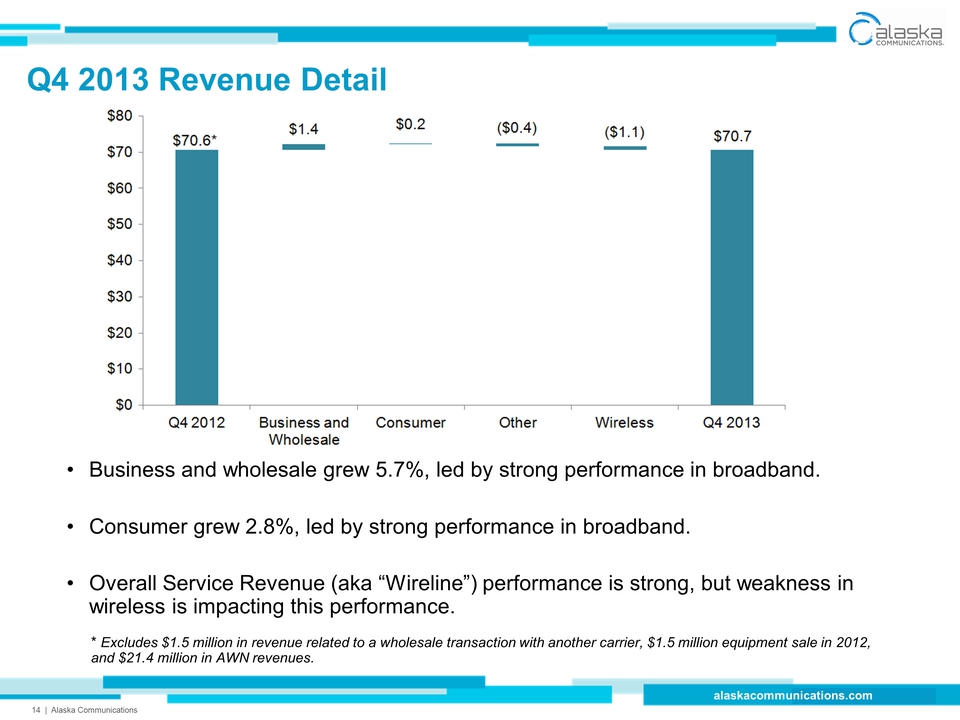

Q4 2013 Revenue Detail $70.6* $1.4 $0.2 ($0.4) ($1.1) $70.7 $0 $10 $20 $30 $40 $50 $60 $70 $80 Q4 2012 Business and Wholesale Consumer Other Wireless Q4 2013 Business and wholesale grew 5.7%, led by strong performance in broadband. Consumer grew 2.8%, led by strong performance in broadband. Overall Service Revenue (aka “Wireline”) performance is strong, but weakness in wireless is impacting this performance. * Excludes $1.5 million in revenue related to a wholesale transaction with another carrier, $1.5 million equipment sale in 2012, and $21.4 million in AWN revenues. 14 | Alaska Communications alaskacommunications.com

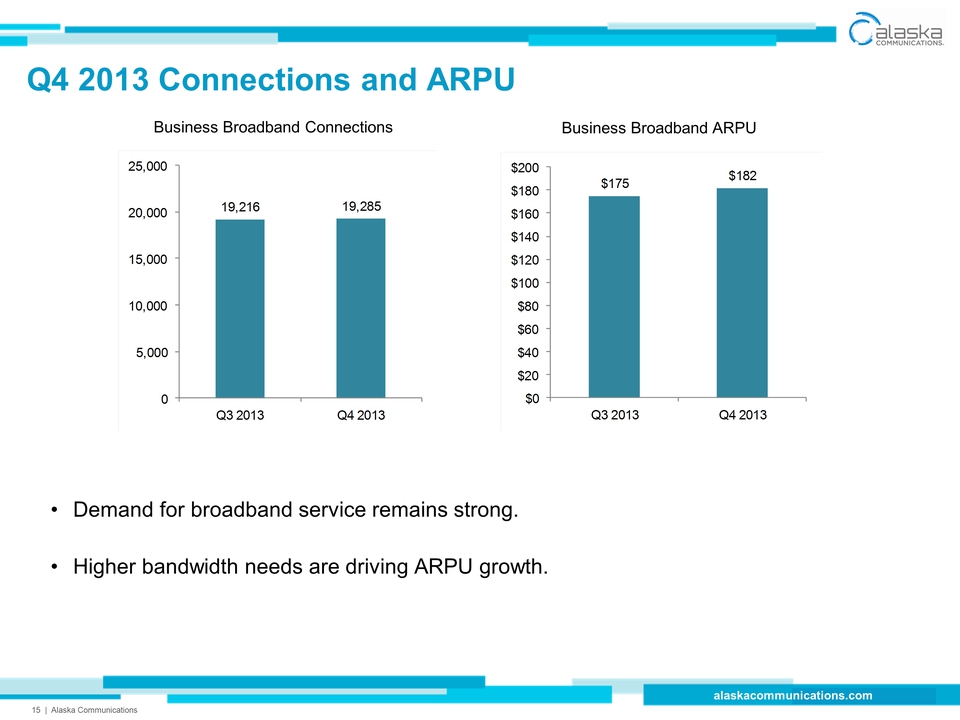

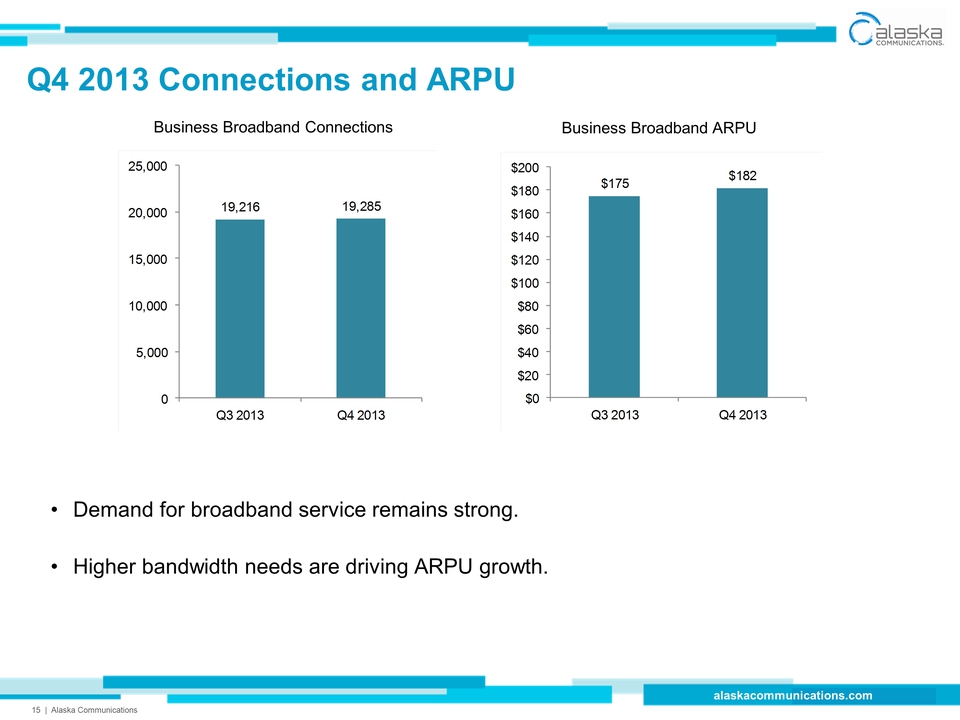

Q4 2013 Connections and ARPU Business Broadband Connections Business Broadband ARPU 19,216 19,285 0 5,000 10,000 15,000 20,000 25,000 Q3 2013 Q4 2013 $175 $182 $0 $20 $40 $60 $80 $100 $120 $140 $160 $180 $200 Q3 2013 Q4 2013 Demand for broadband service remains strong. Higher bandwidth needs are driving ARPU growth. 15 | Alaska Communications alaskacommunications.com

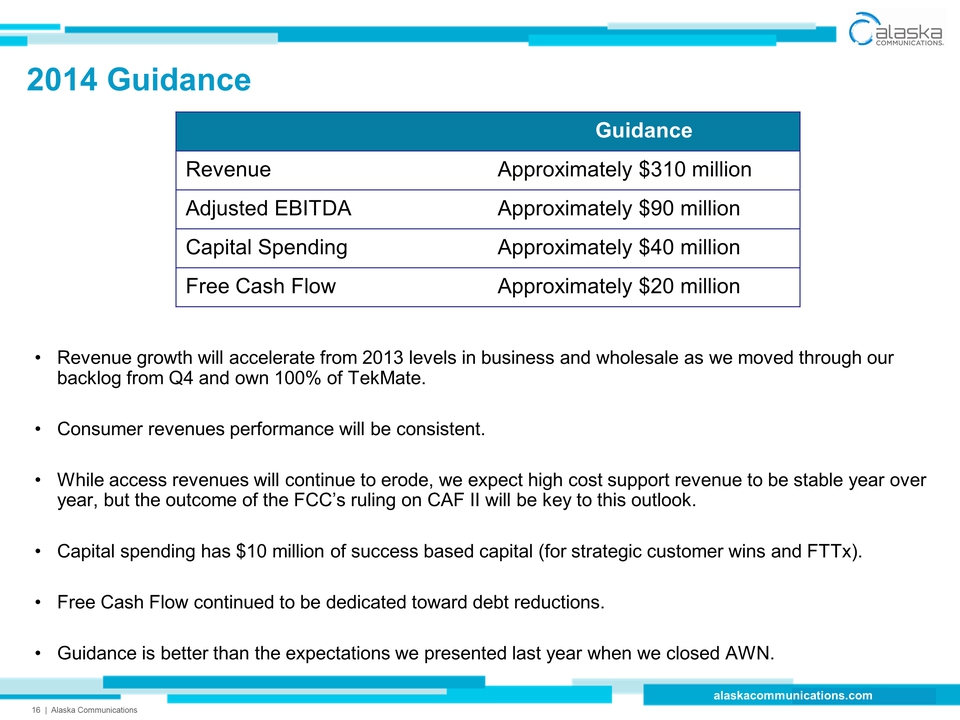

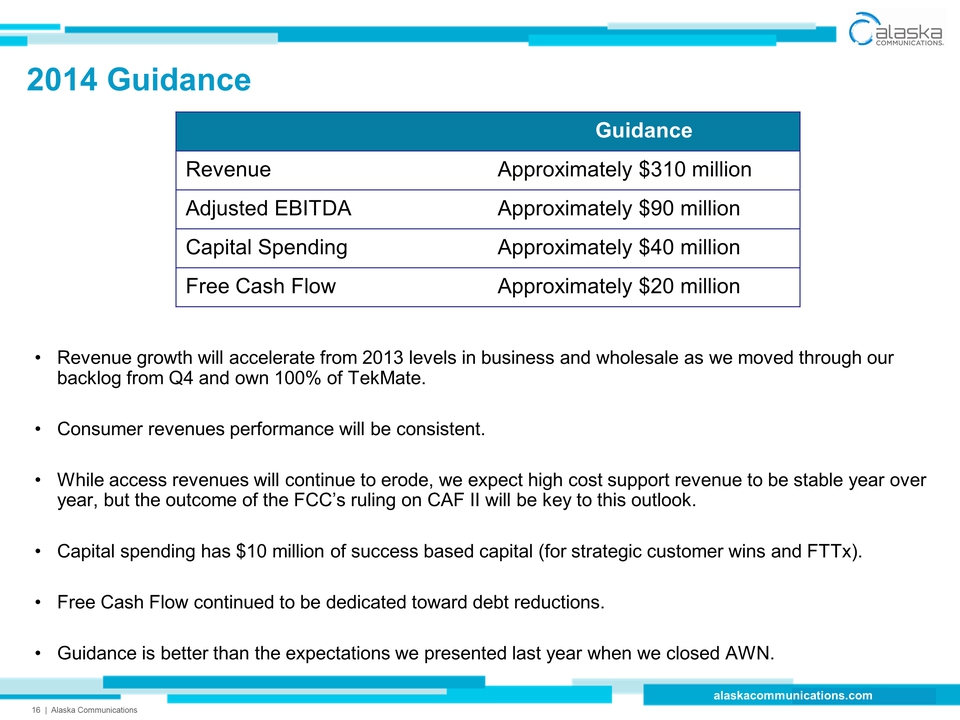

2014 Guidance Guidance Revenue Approximately $310 million Adjusted EBITDA Approximately $90 million Capital Spending Approximately $40 million Free Cash Flow Approximately $20 million Revenue growth will accelerate from 2013 levels in business and wholesale as we moved through our backlog from Q4 and own 100% of TekMate. Consumer revenues performance will be consistent. While access revenues will continue to erode, we expect high cost support revenue to be stable year over year, but the outcome of the FCC’s ruling on CAF II will be key to this outlook. Capital spending has $10 million of success based capital (for strategic customer wins and FTTx). Free Cash Flow continued to be dedicated toward debt reductions. Guidance is better than the expectations we presented last year when we closed AWN. 16 | Alaska Communications alaskacommunications.com

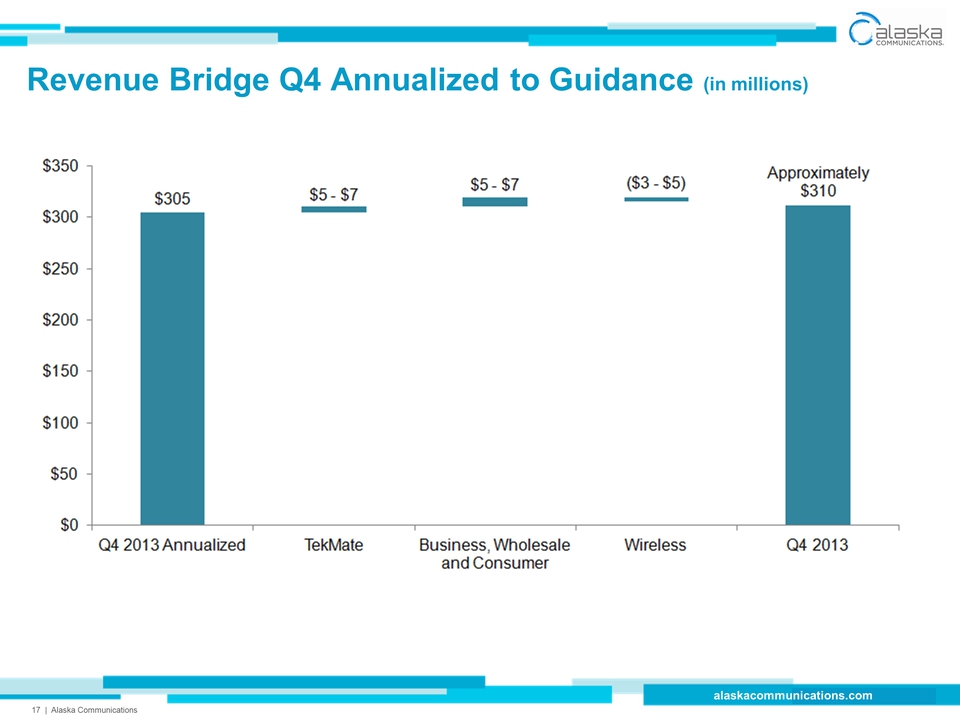

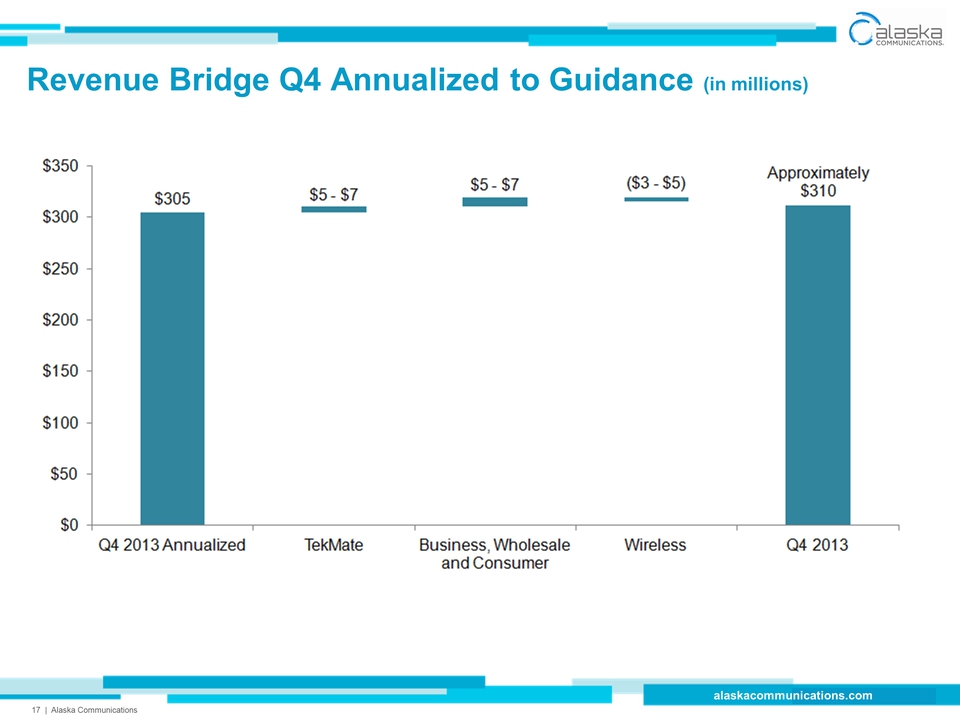

Revenue Bridge Q4 Annualized to Guidance (in millions) $305 $5-$7 $5-$7 ($3-$5) Approximately $310 $0 $50 $100 $150 $200 $250 $300 $350 Q4 2013 Annualized TekMate Business, Wholesale and Consumer Wireless Q4 2013 17 | Alaska Communications alaskacommunications.com

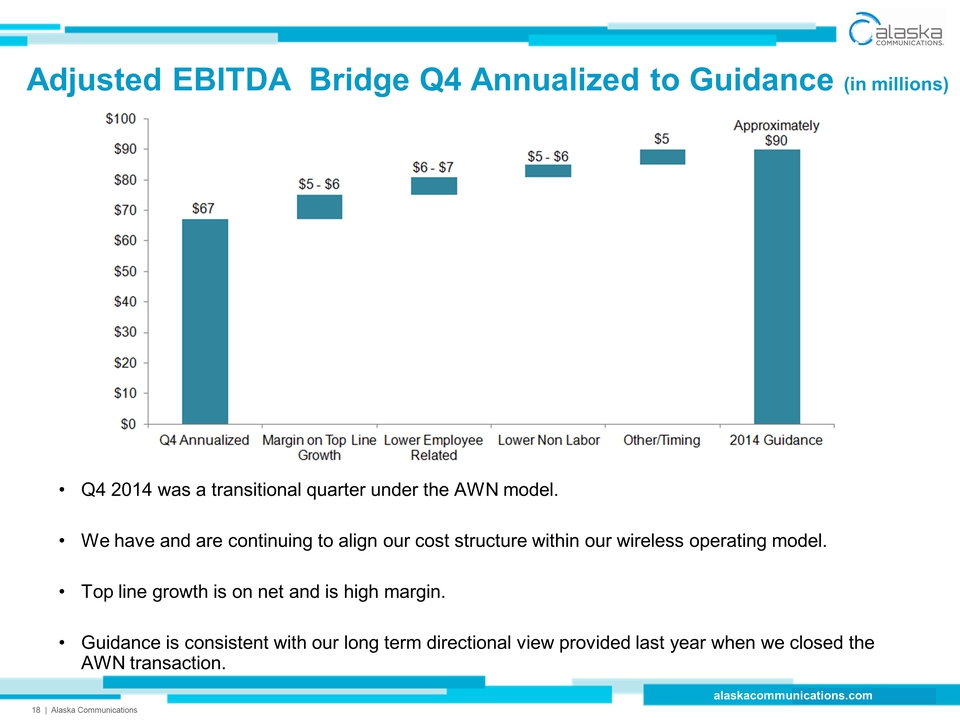

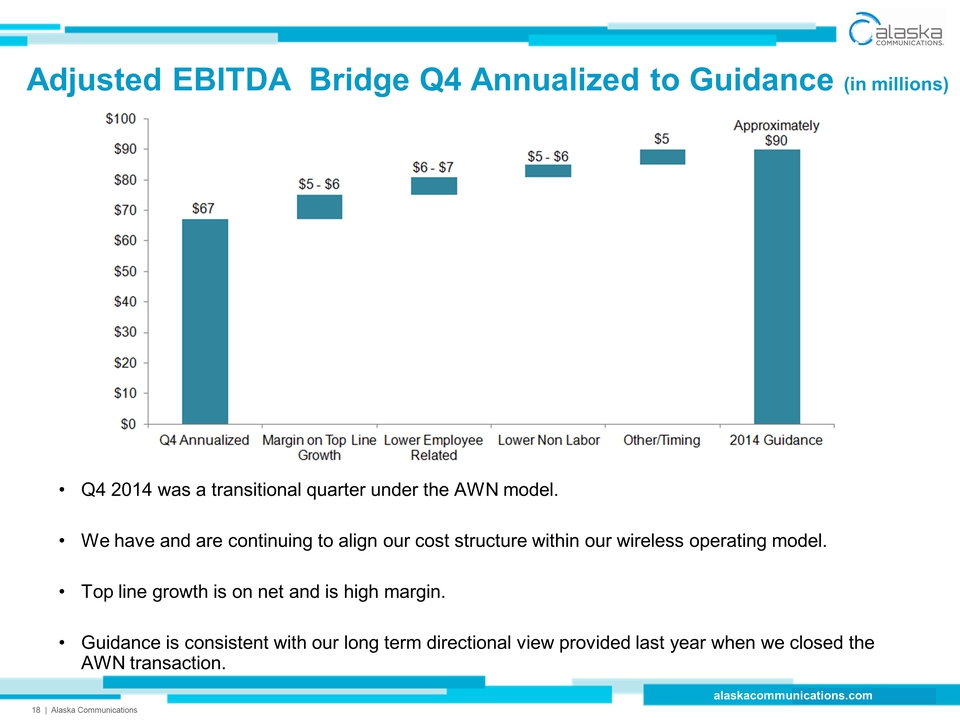

Adjusted EBITDA Bridge Q4 Annualized to Guidance (in millions) $67 $5-$6 $6-$7 $5-$6 $5 Approximately $90 $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 $100 Q4 Annualized Margin on Top Line Growth Lower Employee Related Lower Non Labor Other/Timing 2014 Guidance Q4 2014 was a transitional quarter under the AWN model. We have and are continuing to align our cost structure within our wireless operating model. Top line growth is on net and is high margin. Guidance is consistent with our long term directional view provided last year when we closed the AWN transaction. 18 | Alaska Communications alaskacommunications.com

In Closing, We Deliver Value By Doing What We Say … Grow retail broadband REVENUES RESULTS: Superior broadband growth validates market opportunity. Fiber-to-the-Node and Managed Services will accelerate future growth. Enhancing EBITDA RESULTS: Predictable cash flows from AWN and alignment of our cost structures. Our 2014 EBITDA will provide the baseline from which to measure long-term EBITDA growth. FREE CASH FLOW RESULTS: Over $100 million in debt reductions. Free cash flow dedicated to continued balance sheet strengthening. DEBT 19 | Alaska Communications alaskacommunications.com

4th Quarter & Full-Year Earnings Results March 2014 Alaska Communications