June 17, 2014

Mr. Larry Spirgel

Assistant Director

U.S. Securities and Exchange Commission

Division of Corporation Finance

100 F Street N.E.

Washington, D.C. 20549

| | RE: | Oral comments from the Staff in a conference call May 12, 2014 |

| | | As clarified in an e-mail dated June 3, 2014 |

Dear Mr. Spirgel:

Set forth below are Alaska Communications Systems Group, Inc.’s (“we”, “us”, “our”, the “Company” or “ACS”) responses to the oral comments from the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”), on May 12, 2014, as clarified in an e-mail dated June 3, 2014.

For ease of reference, the text of the Staff’s comments is set forth below in bold italics followed by the Company’s responses.

With respect the contributed capacity, please also explain why ACS agreed to a 20 year term, particularly considering all of the uncertainty related to scope of the arrangement.

The twenty year term was the outcome of the negotiations between GCI and ACS regarding the formation of AWN, and the desire of the owners to provide bandwidth (“contributed capacity”) that would allow AWN to connect its cell sites to its switches, to the public switched and IP networks, rather than AWN having to spend the capital to do this on its own. AWN is an entity that is designed to operate into perpetuity, however, the network elements associated with contributed capacity have a more limited life. Twenty years was the agreed upon term that balanced the perpetual period with the life of the network elements.

It remains unclear why an estimate based on some allocation of the value of the network assets presents a more reliable valuation of a non-exclusive right to capacity over a finite period than an estimate based on the market value of other rights of use (IRUs), adjusted for scale or by some other means, to make more comparable. Please explain in more detail why the network capacity contribution was not estimated based on IRUs (indefeasible right of use), or some similar market based approached. Clarify whether a market or income based approach was also performed for comparison.

Mr. Larry Spirgel

U.S. Securities and Exchange Commission

| RE: | Oral comments from the Staff in a conference call held May 12, 2014 |

| | As clarified in an e-mail dated June 3, 2014 |

Page 2 of 8

Working with a nationally known valuation expert/appraiser with over 25 years of experience in telecom valuation both nationally and in the state of Alaska, the management teams at ACS and GCI and both companies’ independent registered accountants, did consider multiple valuation methods. We began our analysis with the market approach as we presumed, given the fair value hierarchy prescribed in ASC Topic 820, it would be the preferred method to value the non-exclusive right for AWN to receive capacity from our network (contributed capacity). However, after performing an analysis of the inputs required, and comparing that against available market information, we determined we did not have adequate or comparable information to perform a market approach for the reasons listed below:

| | 1. | GCI and ACS, as facility based carriers are the only two providers of various capacity service arrangements to third parties in Alaska, including but not limited to Indefeasible Right to Use (“IRU”) arrangements. In our opinion, because there are a limited number of competitors, we do not have sufficient market related data points available from which to extrapolate a reasonable estimate of fair value for the contributed capacity. Further, for the limited market data points that we do have, the breadth and scope of this contributed capacity arrangement is far more complex than any of our historic or existing service or IRU arrangements. The nature of the arrangements we have entered in to in the past is limited to a number of point to point capacity service agreements, typically providing capacity over one type of infrastructure, covering much shorter timeframes and distances, and one IRU agreement. |

| | 2. | The contributed capacity is unlike any other capacity for which we have comparable data. Typically a capacity type transaction such as an IRU is a discrete point to point circuit for a fixed period of time over a specific fiber line. For instance, if AT&T required a unit of bandwidth from ACS for capacity from Anchorage to Seattle, we would enter into an IRU arrangement for that point to point arrangement. Comparing this to the AWN capacity agreement, AWN has been granted capacity from GCI and ACS to service approximately 500 cellular sites, and infrastructure over multiple network types, each of which uses different technology. |

| | 3. | Further, if we were to assume that an IRU transaction is a valid proxy for the contributed capacity in the AWN transaction, the sample size for Alaska IRU transactions is very limited. We’ve entered into one of these transactions in the past three years. Further, our experience has been that wireless carriers in Alaska, (AT&T and Verizon) do not enter into IRU type arrangements but rather establish short term service arrangements from the carrier’s cell site to the carriers switch location. We believe they do this as it provides them the flexibility to negotiate perhaps a better rate with the same or other carriers as capacity demand increases over time. It also allows for the potential to build their own facility at some point in time, something AWN has not contemplated. |

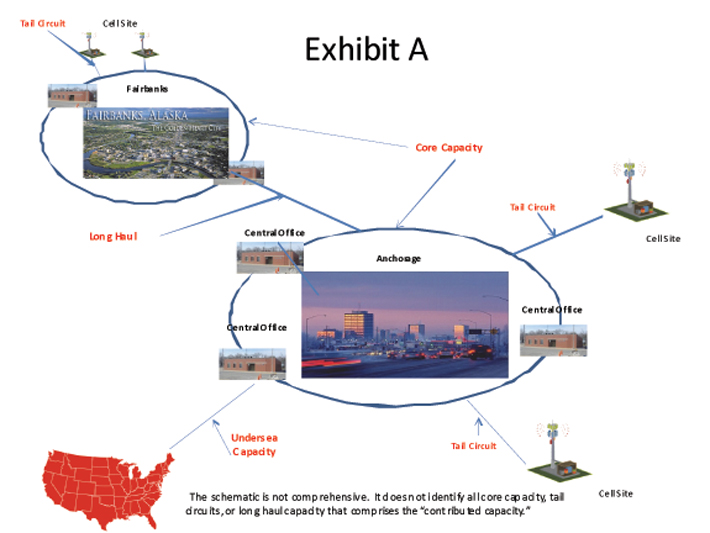

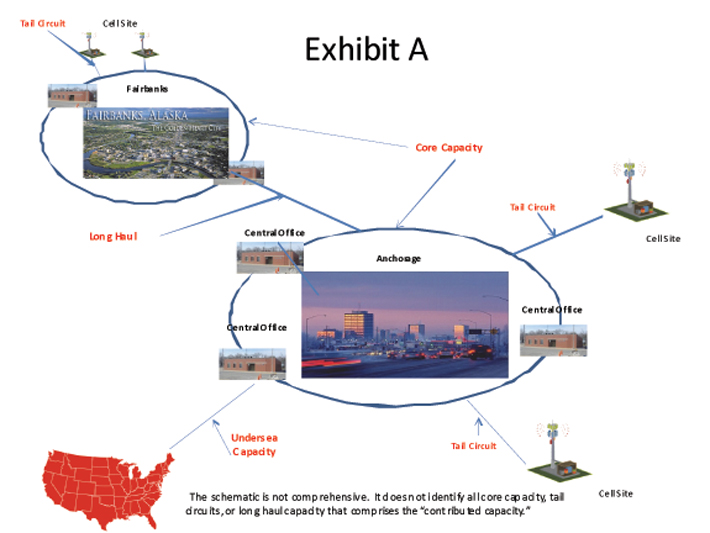

| | 4. | The capacity contribution from ACS represents a series of disaggregated elements of bandwidth very different than is provided to other carriers. The capacity covers Core (capacity that AWN shares with ACS and GCI that is used in urban markets for ACS and GCI’s consolidated networks), Long Haul (capacity between urban markets), Undersea capacity (capacity between Anchorage and the lower 48) and Tail circuits (capacity between cell sites and switches). These elements allow AWN to connect from cell sites, into ring architectures in urban markets, into the switches to the public switched and IP networks all the way to the contiguous lower 48 states. There are no comparable market based transactions for this type of capacity in Alaska. Further, the agreement is for 20 years while our existing service agreements with AT&T and Verizon are normally for much shorter durations. Additionally, even if we could extrapolate our limited data points, we have no reliable market data to scale individual point A to point B agreements to the size and scope of what we have contributed to AWN. We believe any scaling factors selected would be highly speculative and arbitrary as there are no examples from which we could derive this scaling factor, and the outcomes would be unreliable. (See Exhibit A for a schematic of the contributed capacity) |

Mr. Larry Spirgel

U.S. Securities and Exchange Commission

| RE: | Oral comments from the Staff in a conference call held May 12, 2014 |

| | As clarified in an e-mail dated June 3, 2014 |

Page 3 of 8

| | 5. | We independently shared this market information with the valuation expert to assess these data points and they reviewed data points elsewhere in Alaska and the lower 48. They responded with the following summary: |

We reviewed all IRU and service agreements provided by both parties. We identified approximately 8 undersea fiber transactions, some of which were inter-related (i.e. optional and conditional provisions). We reviewed these for comparability and none were found to be comparable to the subject RTUs. The statistic of one standard deviation on the mean was determined to be more than 50% and the minimum to maximum range was several orders of magnitude. A handful of terrestrial IRU and service agreements were also reviewed and no comps were identified as comparable. Several monthly recurring backhaul service agreements with AT&T and Verizon for both GCI and ACS were also reviewed. These circuits were analyzed on a present value basis and produced significantly varying value indications dependent on renewal terms and discount rate assumptions which were considered too speculative. Additionally, these service agreements addressed “bulk” connection of cell sites with varying capacity and there was no identification to indicate price differences by capacity or routes.

Following an extensive process, in the opinion of the expert, these collective data points were neither sufficient nor comparable to the contributed capacity to perform a supportable market valuation.

After ruling out a market approach we next considered an income approach. As we noted in our March 11, 2013 letter to the Office of the Chief Accountant of the Division of Corporation Finance, certain relevant information to prepare pro-forma financial statements was not available and there was no reasonable way to disaggregate the components of many of the significant revenue streams associated with specific assets contributed by ACS to AWN, as part of our wholesale business, nor could we take it one step further to identify just those revenue streams associated with the assets underlying the network capacity contribution. Without the ability to identify cash flows related to these assets it was not reasonable to develop an income model without using a series of assumptions that were completely speculative and without transaction based support. We used an income model to determine the estimated fair value of AWN as well as our interest in AWN. However that model does not bifurcate cash flows between the underlying assets that are used to produce those cash flows such as the contributed cell sites, the contributed spectrum or contributed capacity. Without the ability to identify cash flows for the assets underlying the capacity agreement, both ACS and GCI management as well as our respective auditors and our valuation expert agreed that an income approach could not reasonably be performed.

After considering the market and income approaches, we believed the cost approach was the most appropriate and representative valuation approach. It assigned valuation as if the capacity were contributed using cost factors that reflect the cost of technology, construction and operating costs and cost of capital, that carriers such as GCI and ACS would factor into pricing for that capacity, and which were validated by the independent valuation expert.

Mr. Larry Spirgel

U.S. Securities and Exchange Commission

| RE: | Oral comments from the Staff in a conference call held May 12, 2014 |

| | As clarified in an e-mail dated June 3, 2014 |

Page 4 of 8

The following are excerpts from our valuation expert in their report favoring the use of the cost based approach:

| | 1. | By using the cost approach, the appraisers have maintained a consistent approach among the above 4 network RTU (Right to use contributed capacity) components – otherwise if market comps were available to one category, consistency would be sacrificed among the other categories. Furthermore, there are no market comps for certain of these facilities contributed as a “future capacity.” These future capacities are to be provided as and if required by AWN and are considered an intangible asset. There is no additional cost to AWN for these future rights as the consideration is imbedded in the overall transaction. The appraisers have researched whether GCI and/or ACS had any comparable intangible asset sales/acquisitions and determined based on management discussions that there were none. Therefore, no market data was available as the futures RTUs are unique to AWN. |

| | 2. | It is the appraisers understanding that in particular in the Alaska market, the several IRU agreements that were reviewed for comparability were initiated between the mid 2000’s through 2013, with most of the activity in the earlier years. As is typical of the industry, these transactions are negotiated and often have “quid-pro-quo” arrangements. These include options for additional capacity at later dates, protection or back-up services, route diversity, cable landing station services, terrestrial circuit termination arrangements, dark and/or lit fiber provisions, roaming agreements, among others. |

| | 3. | Additionally, the appraisers note that typical industries IRUs have specified circuit availability (performance) criteria, whereas the AWN Transmission Service Agreement does not. Furthermore, the appraisers observed that there are differences in the amount of payment upfront relative to future options and monthly O&M payments. These factors make any comparability to the subject RTUs speculative at best. |

| | 4. | The undersea and long haul facilities (LH), the only facilities for which limited market data was available for review by the appraisers are typically large capacity (say 10Gbps) fiber circuits which are costly to construct and have various remaining useful lives (RULs). Any market data would not accurately reflect the RUL differences among the subject RTUs as the only appropriate measure would be to compare rates on a comparable data rate (i.e. 10Gbps). |

| | 5. | An advantage to the cost approach is the maintenance of the historical and/or replacement cost elements for future transactions such as circuit sales or retirements. The market approach would not support this. |

| | 6. | The appraisers discussed with GCI marketing and engineering, the elements that go into pricing capacity services. In general cost is a major consideration, in particular as holdover or historical rate regulation practices are still considered so that an adequate rate of return is realized. The appraisers note that in large sections of Alaska, there is limited competition and thus, availability of market comps upon which to base pricing. Of AWN’s wireless competitors, AT&T does not own any material LH facilities and Verizon has just started building its network and does own Alaskan LH facilities. The other two national players, Sprint and T-Mobile, do not directly serve Alaska. |

| | 7. | The pricing of LH facilities such as the undersea fiber facilities, reflects the underlying costs at the time of construction. This in turn was significantly influenced by the industry capacity to build undersea facilities and the availability of cable laying ships. It is the appraisers understanding that of the few available undersea IRU sales by the parties, their pricing reflected the constraints of the industry to build such facilities at that time and thus do not reflect the FMV at the time of the AWN closing. The Appraiser’s use of a current vendor quote to replace the undersea facilities provides a more accurate measure of FMV at the valuation date. This was another consideration in the appraiser’s decision to use the cost approach. |

Mr. Larry Spirgel

U.S. Securities and Exchange Commission

| RE: | Oral comments from the Staff in a conference call held May 12, 2014 |

| | As clarified in an e-mail dated June 3, 2014 |

Page 5 of 8

Please explain how the network capacity arrangement with AWN differs from the most comparable historical IRU and circuit arrangements considered. Particularly discuss your consideration of any arrangements with ATT or Verizon to the extent they use your capacity to support their wireless networks.

As described above, the network capacity arrangement with AWN differs significantly from historical IRU and circuit arrangements both in:

| | • | | Breadth and scope: the AWN capacity arrangement covers Core, Long Haul, Undersea and Tail circuits, while IRU and circuit arrangements typically cover single components of capacity; and, |

| | • | | Duration: the AWN capacity arrangement is for 20 years, while typical circuit arrangements are for 3 – 5 years. |

We have not entered into any IRU arrangements with Verizon. Verizon’s practice is to contract the use of a certain amount of bandwidth from Verizon’s cell sites to their central switch location in Anchorage. From Anchorage, Verizon enters into a separate service arrangement for capacity to the lower 48. These are 3-5 year service arrangements and do not have the same characteristics as an IRU. In an IRU arrangement, there is a “dedicated facility” or amount of bandwidth that is provided to a customer over the life of that facility.

AT&T also follows the same practice as Verizon utilizing service arrangements for capacity between their cell sites and a central switch in Anchorage. We have entered into one IRU agreement with AT&T in the past three years, and we believe GCI had entered into an IRU arrangement prior to 2013. As discussed earlier, our existing agreements are very different than our arrangement with AWN, therefore we believe relying on these limited data points of non-comparable existing transactions would lead to erroneous valuation conclusions.

How are these types of arrangements (IRUs) generally valued within the industry?

We discussed this with our valuation expert given their more broad industry experience. They have said that,“Industry practice for valuing IRU’s is to select the best indicator of value from the cost, market and income approaches based on the facts and circumstances involved with the subject property. The market approach is usually the appropriate method to use when there are sufficient sales of comparable circuit IRUs, which is clearly not the case with AWNs RTUs. As mentioned earlier, there a host of items to consider when comparing IRU and if adjustments for comparability could be made, it is the appraiser’s opinion that they would be highly speculative. The cost approach is often used as the data is typically available from historical cost records and/or vendor quotes.”

Please confirm how the assets underlying the arrangement are tested for impairment. How is fair value determined?

The testing for impairment and fair value of the underlying assets to the capacity arrangement is done at the asset group level. The FASB ASC 360,Impairment or Disposal of Long-Lived Assets(“ASC 360”)

Mr. Larry Spirgel

U.S. Securities and Exchange Commission

| RE: | Oral comments from the Staff in a conference call held May 12, 2014 |

| | As clarified in an e-mail dated June 3, 2014 |

Page 6 of 8

defines an asset group as the “lowest level for which identifiable cash flows are largely independent of the cash flows of other assets and liabilities.” Based on that definition ACS has determined that we have one asset group as we have no identifiable cash flows for any lower subset of our assets.

We have also determined we have one reporting unit so our evaluation of asset impairment can be tied to our evaluation of goodwill impairment. We test Goodwill impairment annually in October or more frequently as triggering circumstances arise. The AWN transaction was considered one of those triggers and an impairment analysis was performed at the transaction date and again in October of 2013 in accordance with ASC 350,Intangibles – Goodwill and Other (“ASC 350”). We used the qualitative approach allowed by ASC 350. Our qualitative analysis did not determine that it was more-likely-than-not that the fair value of our reporting unit was less than its carrying value therefore further valuation of fair value was not necessary. Additionally, our qualitative assessment did not indicate any long-lived asset impairment under ASC 360.

Tell us why an income based approach was not used to value the arrangement. How do you expect results from an income based valuation methodology would differ? Particularly considering Verizon’s entry into the market.

As we noted in our March 11, 2013 letter to the Office of the Chief Accountant of the Division of Corporation Finance, certain relevant information to prepare pro-forma financial statements was not available and there was no reasonable way to disaggregate the components of many of the significant revenue streams associated with specific assets contributed to AWN, as part of our wholesale business, nor could we take it one step further to identify just those associated with the assets underlying the network capacity contribution. Without the ability to identify cash flows related to these assets, which have never been historically tracked at this level, it was not reasonable to develop an income model without using a series of assumptions that were completely speculative and without transaction based support.

We used an income model, which included the consideration of Verizon entering the market, to determine the estimated fair value of AWN as well as our interest in AWN. However, that model did not bifurcate cash flows between the underlying assets that are used to produce those cash flows such as the contributed cell sites, the contributed spectrum or contributed capacity. We did however consider the results of the asset valuations performed under the cost approach to their relative weighting in our overall investment value calculated under the income approach and found that allocation to be reasonable.

Mr. Larry Spirgel

U.S. Securities and Exchange Commission

| RE: | Oral comments from the Staff in a conference call held May 12, 2014 |

| | As clarified in an e-mail dated June 3, 2014 |

Page 7 of 8

If you have any questions regarding our responses or would like to discuss any of our views further, please contact me at 907-564-3314. In addition, we respectfully request that the Staff provide any additional comments you may have to my attention at wayne.graham@acsalaska.com.

Sincerely,

/s/ Wayne Graham

Wayne Graham

Chief Financial Officer

Alaska Communications Systems Group, Inc.

| cc: | Leonard Steinberg, Senior Vice President, Legal, Regulatory & Government Affairs of the Company. |

Mr. Larry Spirgel

U.S. Securities and Exchange Commission

| RE: | Oral comments from the Staff in a conference call held May 12, 2014 |

| | As clarified in an e-mail dated June 3, 2014 |

Page 8 of 8