QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

Ness Technologies, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

Dear Stockholders:

It is our pleasure to invite you to the 2005 Annual Meeting of Stockholders of Ness Technologies. We will hold the meeting on Friday, June 3, 2005, at 10:00 a.m. local time, at the offices of Warburg Pincus, 466 Lexington Avenue, 10th Floor, New York, NY 10017.

Details regarding admission to the meeting and the business to be conducted are more fully described in the accompanying Notice of Annual Meeting and Proxy Statement.

We hope you will be able to attend the Annual Meeting. Whether or not you expect to attend, please vote your shares by completing, signing and dating the proxy card or voting instruction card and returning it in the prepaid envelope; or voting in person at the meeting.

Thank you for your ongoing support of and continued interest in Ness Technologies.

Sincerely,

| |  |

Aharon Fogel

Chairman of the Board | | Raviv Zoller

President and Chief Executive Officer |

NESS TECHNOLOGIES, INC. AND SUBSIDIARIES

INDEX

| Notice of Annual Meeting of Stockholders | | 1 |

Questions and Answers about the Proxy Materials and the Annual Meeting |

|

3 |

Corporate Governance Principles and Board Matters |

|

8 |

| | Board Independence | | 8 |

| | Board Structure and Committee Composition | | 8 |

| | Board Committees | | 9 |

| | Compensation Committee Interlocks and Insider Participation | | 10 |

| | Stockholder Communications with the Board | | 10 |

| | Director Compensation | | 11 |

| | Director Nominations | | 12 |

Proposals To Be Voted On |

|

14 |

| | Proposal No. 1: Election of Directors | | 14 |

| | Proposal No. 2: Ratification of Independent Registered Public Accounting Firm | | 16 |

Security Ownership of Certain Beneficial Owners and Management |

|

17 |

| | Beneficial Ownership Table | | 17 |

| | Section 16(a) Beneficial Ownership Reporting Compliance | | 19 |

Certain Relationships and Related Transactions |

|

20 |

Management |

|

24 |

Executive Compensation |

|

27 |

| | Summary Compensation Table | | 27 |

| | Option Grants in Last Fiscal Year | | 27 |

| | Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values | | 28 |

| | Equity Compensation Plan Information | | 28 |

| | Employment Arrangements, Termination of Employment Arrangements and Change in Control Arrangements | | 28 |

| | Report of the Stock Option and Compensation Committee of the Board of Directors on Executive Compensation | | 31 |

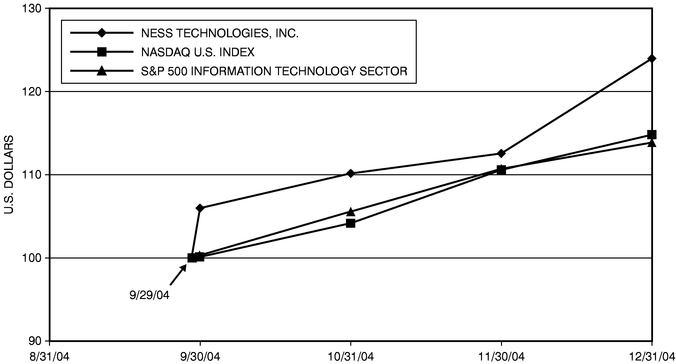

Stock Performance Graph |

|

34 |

Principal Accountant Fees and Services |

|

35 |

Report of the Audit Committee of the Board of Directors |

|

36 |

Other Matters |

|

36 |

Appendix A: Audit Committee Charter |

|

A-1 |

Appendix B: Stock Option and Compensation Committee Charter |

|

B-1 |

Appendix C: Nominating and Governance Committee Charter |

|

C-1 |

Ness Technologies, Inc.

Ness Tower

Atidim High-Tech Industrial Park, Building 4

Tel Aviv 61580, Israel

Notice of Annual Meeting of Stockholders

| Time and Date | | 10:00 a.m., local time, on Friday, June 3, 2005 |

| Place | | The offices of Warburg Pincus, 466 Lexington Avenue, 10th Floor, New York, NY 10017 |

| Items of Business | | 1. | | To elect directors |

| | | 2. | | To ratify the appointment of our independent registered public accounting firm for the year ending December 31, 2005 |

| | | 3. | | To consider such other business as may properly come before the meeting |

| Adjournments and Postponements | | Any action on the items of business described above may be considered at the annual meeting at the time and on the date specified above or at any time and date to which the annual meeting may be properly adjourned or postponed. |

| Record Date | | You are entitled to vote only if you were a stockholder of Ness Technologies as of the close of business on April 20, 2005. |

| Meeting Admission | | You are entitled to attend the annual meeting only if you were a stockholder of Ness Technologies as of the close of business on April 20, 2005 or hold a valid proxy for the annual meeting. You should be prepared to present photo identification for admittance. In addition, if you are a stockholder of record, your ownership will be verified against the list of stockholders of record on the record date prior to being admitted to the meeting. If you are not a stockholder of record but hold shares through a broker, trustee or nominee (i.e., in street name), you should provide proof of beneficial ownership as of the record date, such as your most recent account statement prior to April 20, 2005, a copy of the voting instruction card provided by your broker, trustee or nominee, or similar evidence of ownership. If you do not provide photo identification or comply with the other procedures outlined above, you will not be admitted to the annual meeting. |

| | | The annual meeting will begin promptly at 10:00 a.m., local time. You should allow adequate time for the check-in procedures. |

| Voting | | Your vote is very important. Whether or not you plan to attend the annual meeting, we encourage you to read this proxy statement and submit your proxy or voting instructions as soon as possible. You may submit your proxy or voting instructions for the annual meeting by completing, signing, dating and returning your proxy or voting instruction card in the pre-addressed envelope provided. For specific instructions on how to vote your shares, please refer to the section entitled "Questions and Answers about the Proxy Materials and the Annual Meeting" on page 3 of this proxy statement and the instructions on the proxy or voting instruction card. |

| | | By order of the Board of Directors, |

|

|

|

| | | Ilan Rotem

General Counsel and Secretary |

This notice of annual meeting, proxy statement and form of proxy are being distributed on or about April 22, 2005.

PROXY STATEMENT

In this Proxy Statement, we use the terms "Ness," "we," "our," "us" and "the Company" to refer to Ness Technologies, Inc. and its subsidiaries.

Questions and Answers about the Proxy Materials and the Annual Meeting

- Q:

- Why did I receive this proxy statement?

- A:

- The board of directors is soliciting your proxy to vote at the annual meeting because you were a stockholder at the close of business on April 20, 2005, the record date, and are entitled to vote at the meeting.

This proxy statement and 2004 annual report, along with either a proxy card or a voting instruction card, are being mailed to stockholders beginning April 22, 2005. The proxy statement summarizes the information you need to know to vote at the annual meeting. You do not need to attend the annual meeting to vote your shares.

- Q:

- What information is contained in this proxy statement?

- A:

- The information in this proxy statement relates to the proposals to be voted on at the annual meeting, the voting process, our board and board committees, the compensation of directors and the five most highly paid executive officers for fiscal 2004, and certain other required information.

- Q:

- What should I do if I receive more than one set of voting materials?

- A:

- You may receive more than one set of voting materials, including multiple copies of this proxy statement and multiple proxy cards or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you may receive a separate voting instruction card for each brokerage account in which you hold shares. If you are a stockholder of record and your shares are registered in more than one name, you will receive more than one proxy card. Please complete, sign, date and return each proxy card and voting instruction card that you receive.

- Q:

- How may I obtain an additional set of proxy materials?

- A:

- All stockholders also may write to us at our principal executive offices to request an additional copy of these materials. The address is:

- Q:

- What is the difference between holding shares as a stockholder of record and as a beneficial owner?

- A:

- If your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, you are considered, with respect to those shares, the "stockholder of record." The proxy statement, annual report and proxy card have been sent directly to you by Ness.

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the "beneficial owner" of shares held in street name. The proxy statement and annual report have been forwarded to you by your broker, bank or nominee who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker, bank or nominee how to vote your shares by using the voting instruction card included in the mailing or by following their instructions for voting by telephone or the Internet, if they offer that alternative. Since a beneficial owner is not the stockholder of record, you may not vote these shares in person at the meeting unless you obtain a "legal proxy" from the broker, trustee or nominee that holds your

3

shares, giving you the right to vote the shares at the meeting.

- Q:

- What am I voting on?

- A:

- You are voting on the following proposals:

- •

- To elect directors

- •

- To ratify the appointment of our independent registered public accounting firm for the year ending December 31, 2005

- •

- To consider such other business as may properly come before the meeting

The board recommends a vote FOR each of the nominees to the board of directors and FOR the ratification of the appointment of Kost Forer Gabbay & Kasierer, a member of Ernst & Young Global, as our independent registered public accounting firm for 2005.

- Q:

- What is the voting requirement to elect the directors and to approve each of the proposals?

- A:

- In the election of directors, each director receiving a plurality of affirmative votes will be elected. You may withhold votes from any or all nominees. Except for the votes that stockholders of record withhold from any or all nominees, the persons named in the proxy card will vote such proxy FOR the nominees as directors of Ness.

All other proposals require the affirmative "FOR" vote of a majority of those shares present in person or represented by proxy and entitled to vote on those proposals at the annual meeting. Thus, abstentions will not affect the outcome of any matter being voted on at the meeting. If you hold shares beneficially in street name and do not provide your broker with voting instructions, your shares may constitute "broker non-votes." Generally, broker non-votes occur on a matter when a broker is not permitted to vote on that matter without instructions from the beneficial owner and instructions are not given. In tabulating the voting result for any particular proposal, shares that constitute broker non-votes are not considered entitled to vote on that proposal. Thus, broker non-votes will not affect the outcome of any matter being voted on at the meeting, assuming that a quorum is obtained.

- Q:

- What happens if a nominee for director is unable to serve as a director?

- A:

- If any of the nominees becomes unavailable for election, which we do not expect, votes will be cast for such substitute nominee or nominees as may be designated by the board of directors, unless the board of directors reduces the number of directors.

- Q:

- How many votes do I have?

- A:

- You are entitled to one vote for each share of common stock that you hold.

- Q:

- Is cumulative voting permitted for the election of directors?

- A:

- We do not use cumulative voting for the election of our board of directors members.

- Q:

- How do I vote?

- A:

- You may vote using any of the following methods:

- •

- Proxy card or voting instruction card. Be sure to complete, sign and date the card and return it in the prepaid envelope. If you are a stockholder of record and you return your signed proxy card but do not indicate your voting preferences, the persons named in the proxy card will vote FOR the election of directors and the ratification of the appointment of Kost Forer Gabbay & Kasierer, a member of Ernst & Young Global, as our independent registered public accounting firm for 2005.

- •

- By telephone or the Internet, if you are a beneficial owner of shares and your broker, bank or nominee offers that alternative.

- •

- In person at the annual meeting. All stockholders may vote in person at the annual meeting. You may also be

4

represented by another person at the meeting by executing a proper proxy designating that person. If you are a beneficial owner of shares, you must obtain a legal proxy from your broker, bank or nominee and present it to the inspectors of election with your ballot when you vote at the meeting.

- Q:

- What can I do if I change my mind after I vote my shares?

- A:

- If you are a stockholder of record, you may revoke your proxy at any time before it is voted at the annual meeting by:

- •

- sending written notice of revocation to the Secretary of Ness;

- •

- submitting a new, proper proxy by paper ballot after the date of the revoked proxy; or

- •

- attending the annual meeting and voting in person.

If you are a beneficial owner of shares, you may submit new voting instructions by contacting your broker, bank or nominee. You may also vote in person at the annual meeting if you obtain a legal proxy as described in the answer to the previous question. Attendance at the annual meeting will not, by itself, revoke a proxy.

- Q:

- What happens if additional matters are presented at the annual meeting?

- A:

- Other than the two items of business described in this proxy statement, we are not aware of any other business to be acted upon at the annual meeting. If you grant a proxy, the persons named as proxy holders, Mr. Zoller and Mr. Rotem, will have the discretion to vote your shares on any additional matters properly presented for a vote at the meeting. If for any reason any of our nominees is not available as a candidate for director, the persons named as proxy holders will vote your proxy for such other candidate or candidates as may be nominated by the board.

- Q:

- How many shares must be present or represented to conduct business at the annual meeting?

- A:

- A quorum will be present if at least a majority of the outstanding shares of our common stock entitled to vote is represented at the annual meeting, either in person or by proxy. Both abstentions and broker non-votes (described above) are counted for the purpose of determining the presence of a quorum.

- Q:

- How can I attend the annual meeting?

- A:

- You are entitled to attend the annual meeting only if you were a Ness stockholder or joint holder as of the close of business on April 20, 2005 or you hold a valid proxy for the annual meeting. You should be prepared to present photo identification for admittance. In addition, if you are a stockholder of record, your name will be verified against the list of stockholders of record on the record date prior to your being admitted to the annual meeting. If you are not a stockholder of record but hold shares through a broker, trustee or nominee (i.e., in street name), you should provide proof of beneficial ownership on the record date, such as your most recent account statement prior to April 20, 2005, a copy of the voting instruction card provided by your broker, trustee or nominee, or other similar evidence of ownership. If you do not provide photo identification or comply with the other procedures outlined above, you will not be admitted to the annual meeting.

The meeting will begin promptly at 10:00 a.m., local time. You should allow adequate time for the check-in procedures.

- Q:

- How can I vote my shares in person at the annual meeting?

- A:

- Shares held in your name as the stockholder of record may be voted in person at the annual meeting. Shares held beneficially in street name may be voted in person at the annual meeting only if you obtain a legal proxy from the broker, trustee or nominee that holds your shares

5

giving you the right to vote the shares. Even if you plan to attend the annual meeting, we recommend that you also submit your proxy or voting instructions as described below so that your vote will be counted if you later decide not to attend the meeting.

- Q:

- What is the deadline for voting my shares?

- A:

- If you hold shares as the stockholder of record, your vote by proxy must be received before the polls close at the annual meeting.

If you hold shares beneficially in street name with a broker, trustee or nominee, please follow the voting instructions provided by your broker, trustee or nominee. You may vote your shares in person at the annual meeting, only if at the annual meeting you provide a legal proxy obtained from your broker, trustee or nominee.

- Q:

- Is my vote confidential?

- A:

- Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within Ness or to third parties, except: (1) as necessary to meet applicable legal requirements, (2) to allow for the tabulation of votes and certification of the vote, and (3) to facilitate a successful proxy solicitation. Occasionally, stockholders provide on their proxy card written comments, which are then forwarded to our management.

- Q:

- How are votes counted?

- A:

- In the election of directors, you may vote "FOR" all or some of the nominees or your vote may be "WITHHELD" with respect to one or more of the nominees.

For the other items of business, you may vote "FOR," "AGAINST" or "ABSTAIN." If you elect to "ABSTAIN," the abstention will have no effect on the outcome of the vote of such proposal. If you provide specific instructions with regard to certain items, your shares will be voted as you instruct on such items. If you sign your proxy card or voting instruction card without giving specific instructions, your shares will be voted in accordance with the recommendations of the board ("FOR" all of our nominees to the board, "FOR" ratification of our independent registered public accounting firm, and in the discretion of the proxy holders, Mr. Zoller and Mr. Rotem, on any other matters that properly come before the meeting).

- Q:

- Where can I find the voting results of the annual meeting?

- A:

- We intend to announce preliminary voting results at the annual meeting and publish final results in our quarterly report on Form 10-Q for the second quarter of fiscal 2005.

- Q:

- When are the stockholder proposals due for the 2006 annual meeting?

- A:

- In order to be considered for inclusion in next year's proxy statement, stockholder proposals must be submitted in writing to:

Ilan Rotem, Secretary and General Counsel

Ness Technologies

Ness Tower

Atidim High-Tech Industrial Park, Building 4

Tel Aviv 61580, Israel

and received at this address by December 23, 2005.

- Q:

- Are there any stockholders who own more than 5 percent of Ness' shares?

- A:

- According to filings made with the Securities and Exchange Commission on or before February 14, 2005, five entities each own over 5 percent of our outstanding common stock. See "Security Ownership of Certain Beneficial Owners and Management" on page 17 for more information.

- Q:

- Who will bear the cost of soliciting votes for the annual meeting?

- A:

- Ness Technologies is making this solicitation and will pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials and

6

soliciting votes. In addition to the mailing of these proxy materials, the solicitation of proxies or votes may be made in person, by telephone or by electronic communication by our directors, officers and employees, who will not receive any additional compensation for such solicitation activities. Upon request, we will also reimburse brokerage houses and other custodians, nominees and fiduciaries for forwarding proxy and solicitation materials to stockholders.

- Q:

- How can I obtain your corporate governance information?

- A:

- Our home page iswww.ness.com. You may also go directly toinvestor.ness.com for the following information which is available in print to any stockholder who requests it:

- •

- Amended and Restated Certificate of Incorporation of Ness Technologies

- •

- Amended and Restated By-Laws of Ness Technologies

- •

- Our board committee charters: Audit Committee, Nominating and Governance Committee, and Stock Option and Compensation Committee

- •

- Board committee composition

- •

- Our Code of Business Conduct and Ethics—our values and standards

- •

- Stockholder Communications with the Board

- Q:

- How may I obtain your Annual Report on Form 10-K and other financial information?

- A:

- A copy of our 2004 Form 10-K is enclosed.

Stockholders may request another free copy of the 2004 Form 10-K and other financial information from:

Investor Relations

Ness Technologies

Ness Tower

Atidim High-Tech Industrial Park, Building 4

Tel Aviv 61580, Israel

+972 (3) 766-6800

Alternatively, current and prospective investors can access the Form 10-K and other financial information on our Investor Relations web site at investor.ness.com.

We will also furnish any exhibit to the 2004 Form 10-K if specifically requested.

- Q:

- What if I have questions for your transfer agent?

- A:

- Please contact our transfer agent, at the telephone number or address listed below, with questions concerning stock certificates, transfer of ownership or other matters pertaining to your stock account.

- Q:

- Who can help answer my questions?

- A:

- If you have any questions about the annual meeting or how to vote or revoke your proxy, you should contact us at:

7

Corporate Governance Principles and Board Matters

Board Independence

The board of directors has determined that to be considered independent, an outside director may not have a direct or indirect material relationship with Ness. A material relationship is one which impairs or inhibits, or has the potential to impair or inhibit, a director's exercise of critical and disinterested judgment on behalf of Ness and its stockholders. In determining whether a material relationship exists, the board considers, for example, the sales or charitable contributions between Ness Technologies and an entity with which a director is affiliated (as an executive officer, partner or substantial stockholder) and whether a director is a former employee of ours. The board consults with our counsel to ensure that the board's determinations are consistent with all relevant securities and other laws and regulations regarding the definition of "independent director," including but not limited to those set forth in pertinent listing standards of the NASDAQ National Market as in effect from time to time. The Nominating and Governance Committee reviews the board's approach to determining director independence periodically and recommends changes as appropriate for consideration and approval by the full board.

Consistent with these considerations, the board has reviewed all relationships between Ness and the members of the board and affirmatively has determined that all directors are independent directors except Mr. Zoller, Mr. Fogel, Mr. Lavi and Mr. Srivastava because they are either currently, or have within in the last three years, been employed by or received compensation in excess of $60,000 from Ness.

Board Structure and Committee Composition

As of the date of this proxy statement, our board has eight directors and the following three standing committees: Audit Committee, Nominating and Governance Committee, Stock Option and Compensation Committee. In addition, the board from time to time establishes special purpose committees.

The committee membership and meetings during the last fiscal year and the function of each of the committees are described below. Each of the committees operates under a written charter adopted by the board. All of the committee charters are available on our web site at investor.ness.com under the heading "Corporate Governance Highlights" and copies are appended to this proxy statement.

|

| | Audit Committee

| | Nominating and

Governance Committee

| | Stock Option and

Compensation Committee

|

|---|

|

|

|

|

|

|

|

|

| Dr. Satyam C. Cherukuri | | Chairman | | | | |

|

| Mr. Aharon Fogel | | | | | | |

|

| Dr. Henry Kressel | | Member | | Member | | Chairman |

|

| Mr. Hagai Lavi | | | | | | |

|

| Mr. Rajeev Srivastava | | | | | | |

|

| Mr. Dan S. Suesskind | | Member, Financial Expert | | Member | | |

|

| Mr. Morris Wolfson | | | | Chairman | | Member |

|

| Mr. Raviv Zoller | | | | | | |

|

During 2004, the board held five meetings. Each director attended at least 75% of all board and applicable committee meetings, except Mr. Suesskind, who attended two of three board or committee meetings in 2004 following his appointment as a director. From time to time, the members of the board of directors and committees thereof also acted by unanimous written consent pursuant to the laws of the State of Delaware.

8

Each director is elected annually to serve until the next annual meeting or until his or her successor is elected. Mr. Lavi has chosen not to seek re-election. Ness intends to appoint an additional independent director prior to the one year anniversary of our public listing, which was September 29, 2004; at this time no candidate has been identified.

Board Committees

Our board of directors has three standing committees to assist it with its responsibilities. These committees are described below.

TheAudit Committee, which is comprised solely of directors who satisfy the NASDAQ National Market and U.S. Securities and Exchange Commission ("SEC") audit committee membership requirements or an exemption therefrom, is governed by a board-approved charter that contains, among other things, the committee's membership requirements and responsibilities. The Audit Committee oversees our accounting, financial reporting process, internal controls and audits, and consults with management, the internal auditors and the independent registered public accounting firm (the independent auditors) on, among other items, matters related to the annual audit, the published financial statements and the accounting principles applied. As part of its duties, the Audit Committee appoints, evaluates and retains our independent auditors. It maintains direct responsibility for the compensation, termination and oversight of our independent auditors and evaluates the independent auditors' qualifications, performance and independence. The committee also monitors compliance with our policies on ethical business practices and reports on these items to the board. The Audit Committee has established policies and procedures for the pre-approval of all services provided by the independent auditors. Further, the Audit Committee has established procedures for the receipt, retention and treatment, on a confidential basis, of complaints received by Ness, which are described under "Stockholder Communications with the Board" on page 10 of this proxy statement. The Audit Committee's Report is included on page 36 of this proxy statement and the committee's charter is available on our web site and in print to any stockholder who requests it. A copy of the charter is appended to this proxy statement. Our Audit Committee is comprised of Dr. Cherukuri, Mr. Suesskind and Dr. Kressel, and Dr. Cherukuri is the chairman of the committee. Dr. Kressel is serving on the Audit Committee pursuant to an exemption from the independence requirements of SEC Rule 10A-3 afforded to newly-public companies. We intend to appoint to our board and the Audit Committee an independent director who satisfies the heightened definition of "independent" under Rule 10A-3 prior to September 29, 2005, the one year anniversary of our initial public offering, at which time Dr. Kressel will resign from the Audit Committee.

Financial Expert on Audit Committee: The board has determined that Mr. Suesskind, who currently is the chief financial officer of Teva Pharmaceutical Industries Limited, is the Audit Committee financial expert, as defined under the Securities Exchange Act of 1934, as amended. The board made a qualitative assessment of Mr. Suesskind's level of knowledge and experience based on a number of factors, including his formal education and experience as chief financial officer of Teva for twenty-seven years.

TheStock Option and Compensation Committee, which is comprised solely of independent directors, determines all compensation for our chief executive officer; reviews and approves corporate goals relevant to the compensation of our chief executive officer and evaluates our chief executive officer's performance in light of those goals and objectives; reviews and approves objectives relevant to other executive officer compensation; reviews and approves the compensation of other executive officers in accordance with those objectives; administers our stock option plans; approves severance arrangements and other applicable agreements for executive officers; and consults generally with management on matters concerning executive compensation and on pension, savings and welfare benefit plans where board or stockholder action is contemplated with respect to the adoption of or amendments to such plans. The committee makes recommendations on organization, succession, the

9

election of officers, consultantships and similar matters where board approval is required. The committee's annual report on executive compensation is included on page 31 of this proxy statement and the committee's charter is available on our web site and in print to any stockholder who requests it. A copy of the charter is appended to this proxy statement. Our Stock Option and Compensation Committee is comprised of Dr. Kressel and Mr. Wolfson, and Dr. Kressel is the chairman of the committee.

TheNominating and Governance Committee, which is comprised solely of independent directors, considers and makes recommendations on matters related to the practices, policies and procedures of the board and takes a leadership role in shaping the corporate governance of Ness. As part of its duties, the committee assesses the size, structure and composition of the board and board committees, coordinates evaluation of board performance and reviews board compensation. The committee also acts as a screening and nominating committee for candidates considered for election to the board. In this capacity it concerns itself with the composition of the board with respect to depth of experience, balance of professional interests, required expertise and other factors. The committee evaluates prospective nominees identified on its own initiative or referred to it by other board members, management, stockholders or external sources and all self-nominated candidates. The committee uses the same criteria for evaluating candidates nominated by stockholders and self-nominated candidates as it does for those proposed by other board members, management and search companies. The committee's charter is available on our web site and in print to any stockholder who requests it. A copy of the charter is appended to this proxy statement. Our Nominating and Governance Committee is comprised of Mr. Wolfson, Dr. Kressel and Mr. Suesskind, and Mr. Wolfson is the chairman of the committee.

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics applying to our directors, officers and employees. The code is available on our web site,www.ness.com.

The code is reasonably designed to deter wrongdoing and promote (i) honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships, (ii) full, fair, accurate, timely and understandable disclosure in reports and documents filed with, or submitted to, the SEC and in other public communications made by us, (iii) compliance with applicable governmental laws, rules and regulations, (iv) the prompt internal reporting of violations of the code to appropriate persons identified in the code, and (v) accountability for adherence to the Code. Amendments to the code and any grant of a waiver from a provision of the code requiring disclosure under applicable SEC rules will be disclosed on our web site atinvestor.ness.com.

Compensation Committee Interlocks and Insider Participation

Our stock option and compensation committee consists of Dr. Kressel and Mr. Wolfson. Prior to our initial public offering, our executive committee, which previously handled executive compensation matters, consisted of Dr. Kressel, Mr. Wolfson and Mr. Fogel. Except as set forth in "Certain Relationships and Related Transactions" on page 20 and "Director Compensation" on page 11, none of such directors was a party to any transaction with Ness which requires disclosure under Item 402(j) of Regulation S-K.

Stockholder Communications with the Board

Stockholders who wish to do so may communicate directly with the board, or specified individual directors, according to the procedures described below.

In addition, the Audit Committee has established procedures for the receipt, retention and confidential treatment of complaints received by Ness regarding accounting, internal accounting

10

controls or auditing matters. In addition, we have established procedures for confidential, anonymous submissions by employees with respect to such matters.

We will forward all communications from security holders and interested parties to the full board, to non-management directors, to an individual director or to the chairperson of the board committee that is most closely related to the subject matter of the communication, except for the following types of communications:

- •

- communications that advocate that we engage in illegal activity;

- •

- communications that, under community standards, contain offensive or abusive content;

- •

- communications that have no relevance to our business or operations; and

- •

- mass mailings, solicitations and advertisements.

The corporate secretary and general counsel will determine when a communication is not to be forwarded.

Our acceptance and forwarding of communications to the directors does not imply that the directors owe or assume any fiduciary duties to persons submitting the communications.

Write to the Ness Board

Contact the Ness Audit Committee

Employees and stockholders may raise a question or concern to the Audit Committee regarding accounting, internal accounting controls or auditing matters by writing to:

Chairman, Audit Committee

c/o Corporate Secretary

Ness Technologies

Ness Tower

Atidim High-Tech Industrial Park, Building 4

Tel Aviv 61580, Israel

Director Compensation

We entered into an agreement with Mr. Fogel, our chairman of the board, on August 1, 1999 and an amendment to such agreement as of May 31, 2001. The current term expires on July 31, 2005 and is automatically extended for successive one-year periods, unless terminated by either party by providing written notice at least three months prior to the expiration of the then existing term. Mr. Fogel is required to devote at least 50% of his time and efforts to the performance of his duties for us. Mr. Fogel's annual base compensation is currently $152,311, and he is eligible to receive an annual bonus, subject to board approval, of up to 40% of the bonus awarded to our chief executive officer. According to the agreement, Mr. Fogel also received options to purchase 366,262 shares of our common stock at an exercise price of $0.58 per share (for 86,316 shares) and $8.47 (for 279,946). We may terminate Mr. Fogel for cause, as defined in the agreement, immediately or for any other reason upon six months prior written notice. In the event of termination for cause, Mr. Fogel will be entitled to his base salary through the termination date. However, if the agreement is terminated for any other reason by either party, Mr. Fogel will be entitled to receive his base salary and all amounts deposited in

11

his favor in any pension funds, including payments made for severance pay. The agreement also contains customary confidentiality, non-competition and non-solicitation provisions. The non-competition and non-solicitation provisions apply during the term of the agreement and for one year thereafter. In addition, effective January 1, 2004, Mr. Fogel was granted options to purchase 71,930 shares of our common stock at an exercise price of $11.82 per share. These options vest and become exercisable in three equal installments on each of the first three anniversaries of the grant and expire on December 31, 2010, subject to acceleration upon a change of control, as defined in the 2003 Israeli Share Option Plan, if Mr. Fogel's agreement is terminated or Mr. Fogel resigns due to a reduction in his title or duties within six months of the change of control.

Each of our independent directors receives options to purchase 15,000 shares of our common stock upon election to our board of directors and $10,000 annually. In addition, independent directors will receive $5,000 annually for service on our Audit Committee, and $400 for each committee meeting they attend as members of our Stock Option and Compensation Committee or our Nominating and Governance Committee. Other members of our board of directors do not receive any compensation for serving as directors or members of committees. All members of our board of directors are eligible for reimbursement for their reasonable expenses incurred in connection with attendance at meetings of the board of directors and its committees.

Director Nominations

The Nominating and Governance Committee evaluated and recommended director nominees for the election of directors at the annual meeting. In fulfilling its responsibilities, this committee considered the following factors:

- •

- the appropriate size of the board of directors and its committees;

- •

- our needs with respect to the particular talents and experience of our directors;

- •

- the knowledge, skills and experience of nominees, including experience in the information technology industry, the nonprofit sector, business, finance, administration or public service, in light of prevailing business conditions and the knowledge, skills and experience already possessed by other members of the board of directors;

- •

- experience with accounting rules and practices;

- •

- applicable regulatory and securities exchange/association requirements;

- •

- appreciation of the relationship of our business to the changing needs of society; and

- •

- a balance between the benefit of continuity and the desire for a fresh perspective provided by new members.

The Nominating and Governance Committee's goal is to assemble a board of directors that brings to us a variety of perspectives and skills derived from high quality business and professional experience. In doing so, the committee also considers candidates with appropriate non-business backgrounds.

Other than the foregoing factors, there are no stated minimum criteria for director nominees. However, the Nominating and Governance Committee may also consider such other factors as it may deem to be in the best interests of Ness and its stockholders. The committee does, however, recognize that, under applicable regulatory requirements, at least one member of the board must, and believes that it is preferable that more than one member of the board should, meet the criteria for an "audit committee financial expert" as defined by SEC rules, and that at least a majority of the members of the board must meet the definition of "independent director" under Nasdaq listing standards. The committee also believes it appropriate for certain key members of our management to participate as members of the board.

The Nominating and Governance Committee identifies nominees by first evaluating the current members of the board willing to continue in service. Current members of the board with skills and

12

experience that are relevant to our business and who are willing to continue in service are considered for re-nomination, thereby balancing the value of continuity of service by existing members of the board with that of obtaining a new perspective. If any member of the board up for re-election at an upcoming annual meeting of stockholders does not wish to continue in service, the committee identifies the desired skills and experience of a new nominee in light of the criteria above. Current members of the Nominating and Governance Committee and board of directors will be polled for suggestions as to individuals meeting the criteria of the committee. Research may also be performed to identify qualified individuals. If the committee believes that the board requires additional candidates for nomination, it may explore alternative sources for identifying additional candidates. Alternative sources may include engaging, as appropriate, a third party search firm to assist in identifying qualified candidates.

The Nominating and Governance Committee will evaluate any recommendation for director nominee proposed by a stockholder. Any recommendation for director nominee submitted by a qualifying stockholder must be received by us no earlier than 120 days and not later than 90 days prior to the anniversary of the date proxy statements were mailed to stockholders in connection with the prior year's annual meeting of stockholders. Any stockholder recommendation for director nominee must be submitted to our Secretary in writing at Ness Tower, Atidim High-Tech Industrial Park, Building 4, Tel Aviv 61580, Israel and must contain the following information:

- •

- the name and address of the stockholder who intends to make the recommendation;

- •

- a representation by the stockholder that he/she is a stockholder of record at the time of the recommendation and will be entitled to vote at the stockholders annual meeting for which the recommendation is being made;

- •

- the candidate's name, age, contact information and current principal occupation or employment;

- •

- a description of the candidate's qualifications and business experience during, at a minimum, the last five years, including his/her principal occupation and employment and the name and principal business of any corporation or other organization in which the candidate was employed;

- •

- such other information regarding each candidate proposed by such stockholder as would have been required to be included in a proxy statement filed pursuant to the proxy rules of the Securities and Exchange Commission had each candidate been nominated, or intended to be nominated, by the board;

- •

- a description of all arrangements or understandings between the stockholder and each candidate and any other person or persons (naming such person or persons) pursuant to which the recommendation or recommendations are to be made by the stockholder;

- •

- the candidate's resume;

- •

- three (3) references; and

- •

- the consent of each candidate to serve as a director of Ness if so elected.

The Nominating and Governance Committee will evaluate recommendations for director nominees submitted by directors, management or qualifying stockholders in the same manner, using the criteria stated above.

All directors and director nominees will submit a completed form of directors' and officers' questionnaire as part of the Nominating and Corporate Governance process. The process may also include interviews and additional background and reference checks for non-incumbent nominees, at the discretion of the committee.

All the director nominees named in this proxy statement met the board's criteria for membership and were recommended by the Nominating and Governance Committee for election by stockholders at this annual meeting.

13

Proposals To Be Voted On

Proposal No. 1: Election of Directors

There are seven nominees for election to our board of directors this year. All of the nominees except Satyam C. Cherukuri, Dan S. Suesskind and Raviv Zoller have served as directors since 1999. Dr. Cherukuri, Mr. Suesskind and Mr. Zoller became directors upon completion of our initial public offering, which closed in October 2004. Information regarding the business experience of each nominee is provided below. Each director is elected annually to serve until the next annual meeting or until his or her successor is elected. Mr. Lavi has chosen not to seek re-election. Ness intends to appoint an additional independent director prior to the one year anniversary of our public listing, which was September 29, 2004; at this time no candidate has been identified. There are no family relationships among our executive officers and directors.

If you sign your proxy or voting instruction card but do not give instructions with respect to voting for directors, your shares will be voted for the seven persons recommended by the board. If you wish to give specific instructions with respect to voting for directors, you may do so by indicating your instructions on your proxy or voting instruction card.

All of the nominees have indicated to Ness that they will be available to serve as directors. In the event that any of the nominees becomes unavailable, votes will be cast for such substitute nominee or nominees as may be designated by the board, unless the board reduces the number of directors.

Our board recommends a vote FOR the election to the board of each of the following nominees.

Vote Required

Each director receiving a plurality of affirmative votes will be elected. You may withhold votes from any or all nominees. Except for the votes that stockholders of record withhold from any or all nominees, the persons named in the proxy card will vote such proxy FOR the nominees as directors of Ness.

Nominees

Aharon Fogel

Director since 1999

Age 58 | | Aharon Fogel has served as our chairman of the board of directors since 1999. Since December 2000, he has served as the chairman of the board of Migdal Insurance Company Ltd., Israel's largest insurance company. Mr. Fogel served as general partner of Jerusalem Venture Partners, an Israeli venture capital fund, from 1996 to 1999. Mr. Fogel has held a number of senior positions, including Director General of the Israel Ministry of Finance, Chairman of Leumi & Co. Investment Bank, Chairman of the Hadassah Medical Center, and Director of the Economic & Control Division of Clal Israel Ltd. He holds a B.A. in Economics and Statistics from the Hebrew University of Jerusalem. |

Raviv Zoller

Director since 2004

Age 41 |

|

Raviv Zoller has served as our president and chief executive officer since June 2001 and has served as a member of our board since October 4, 2004. From October 1999 to May 2001, Mr. Zoller served as our chief financial officer. From 1994 to 1998, he served as founding partner of Apex-Mutavim, an Israeli investment banking firm. From 1991 to 1999, Mr. Zoller was a partner in Zoller, Radiano and Co., an Israeli CPA firm. Mr. Zoller holds a B.A. in economics and a B.A. in accounting from Tel Aviv University, where he also completed studies for a masters degree in economics while serving as a faculty member. Mr. Zoller is a certified public accountant licensed in Israel. |

| | | |

14

Rajeev Srivastava

Director since 2003

Age 41 |

|

Rajeev Srivastava has served as president of Ness Global Services since the effective date of our acquisition of Apar Holding Corp. in June 2003 and has served as a member of our board since August 2003. From June 1996 to June 2003, Mr. Srivastava served as chief executive officer of Apar, which he co-founded. From September 1992 to May 1996, Mr. Srivastava worked at Mastech Corporation (now iGate) and served as Director — Global Resources and as head of Mastech's Asia Pacific operations based out of Singapore. From June 1988 to August 1992, Mr. Srivastava served as an IT consultant with Tata Consultancy Services. Mr. Srivastava holds an engineering graduate degree and a masters degree in Management Studies from the University of Bombay. |

Dr. Henry Kressel

Director since 1999

Age 71 |

|

Dr. Henry Kressel has served as a member of our board since 1999. He joined Warburg Pincus in 1983 and has been a partner and managing director of Warburg Pincus since 1984. Prior to that, he was staff vice president of the RCA Corporation, where he was responsible for research and development of electronic devices and systems. Dr. Kressel is a graduate of Yeshiva College, Harvard University and holds an M.B.A. from the Wharton School of Business and a PhD in engineering from the University of Pennsylvania. He is an elected member of the National Academy of Engineering and has served in advisory capacities to the National Science Foundation and the United States Air Force. He serves on the boards of directors of several privately-held high-technology companies. |

Morris Wolfson

Director since 1999

Age 44 |

|

Morris Wolfson is the founder of our company and has served as a member of our board since our inception in 1999. Mr. Wolfson is a private investor and entrepreneur since 1983, with investments in a variety of companies and investment vehicles. He is a member of the Wolfson family, the principals of the Wolfson Group, which together with other Wolfson family entities has historically owned and developed commercial real estate development and ownership and actively invests in a diverse array of investments and investment vehicles, including a substantial portfolio of hedge funds and private equity funds. |

Dr. Satyam C. Cherukuri

Director since 2004

Age 48 |

|

Dr. Satyam C. Cherukuri has served as a member of our board since October 4, 2004. Since June 2002, Dr. Cherukuri has served as president and chief executive officer of Sarnoff Corporation, a manufacturer of electronic, biomedical and IT products and services. From November 2001 to June 2002, Dr. Cherukuri served as the chief operating officer of Sarnoff Corporation and from 1998 to 2001 he served as managing director of Sarnoff's life sciences and systems unit. Dr. Cherukuri joined Sarnoff Corporation in 1989 as a researcher and prior to that worked as a researcher at Olin Corporation, a materials producer and Siemens AG. Dr. Cherukuri received a B.Tech. in Ceramic Engineering from Banaras Hindu University in India and an M.S. in Glass Science and Ph.D. in Ceramics from Alfred University. |

| | | |

15

Dan S. Suesskind

Director since 2004

Age 61 |

|

Dan S. Suesskind has served as a member of our board since October 4, 2004. Mr. Suesskind has worked in various capacities for Teva Pharmaceutical Industries Limited, a publicly traded company, since 1976 and has been its chief financial officer since 1978. From 1970 until 1976, he was a consultant and securities analyst with International Consultants Ltd. He received his B.A. in Economics and Political Science from the Hebrew University in 1965 and an M.B.A. from the University of Massachusetts in 1969. Mr. Suesskind is currently on the board of directors of Migdal Insurance Company Ltd, a member of the Investment Advisory Committees of the Jerusalem Foundation and the Israel academy of science and humanities, and a member of the Board of Trustees of the Hebrew University. |

Proposal No. 2: Ratification of Independent Registered Public Accounting Firm

The Audit Committee, comprised of independent members of the board, has appointed Kost Forer Gabbay & Kasierer, a member of Ernst & Young Global, as the independent registered public accounting firm (the independent auditors) for Ness Technologies for the year 2005, subject to ratification by the holders of our common stock. In taking this action, the Audit Committee considered carefully Kost Forer Gabbay & Kasierer's performance for us in that capacity since its retention in 1999, its independence with respect to the services to be performed and its general reputation for adherence to professional auditing standards. Representatives of Kost Forer Gabbay & Kasierer do not intend to be present at the annual meeting.

During fiscal 2004, Kost Forer Gabbay & Kasierer served as our independent registered public accounting firm and also provided certain tax and other audit-related services. See "Principal Accountant Fees and Services" on page 35.

As the members of the Audit Committee value stockholders' views on our independent auditors, there will be presented at the annual meeting a proposal for the ratification of the appointment of Kost Forer Gabbay & Kasierer. Stockholder ratification of the selection of Kost Forer Gabbay & Kasierer as our independent auditors is not required by our by-laws or otherwise. However, the board is submitting the selection of Kost Forer Gabbay & Kasierer to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee will reconsider whether to retain the firm. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of different independent auditors at any time during the year if it determines that such a change would be in the best interests Ness and its stockholders.

The Audit Committee of the board of directors recommends a vote FOR this proposal.

Vote Required

Ratification of the appointment of Kost Forer Gabbay & Kasierer as our independent registered public accounting firm for fiscal 2005 requires the affirmative vote of a majority of the shares of our common stock present in person or represented by proxy and entitled to be voted at the meeting.

16

Security Ownership of Certain Beneficial Owners and Management

Beneficial Ownership Table

The following table sets forth certain information regarding the beneficial ownership of our common stock by:

- •

- each of our directors,

- •

- each of our named executive officers,

- •

- all of our directors and executive officers as a group, and

- •

- each person, or group of affiliated persons, known to us to beneficially own 5% or more of our outstanding common stock as reflected either in such person's filings with the SEC or otherwise provided to us.

Beneficial ownership of shares is determined in accordance with the rules of the SEC and generally includes any shares over which a person exercises sole or shared voting or investment power. The table includes the number of shares underlying options that are exercisable within 60 days of April 20, 2005. Common stock subject to these options is deemed to be outstanding for the purpose of computing the ownership percentage of the person holding these options, but is not deemed to be outstanding for the purpose of computing the ownership percentage of any other person. As of April 20, 2005, 34,532,770 shares of common stock were issued and outstanding.

Unless otherwise indicated, the address for all of the named executive officers, directors and stockholders named below is c/o Ness Technologies, Inc., Ness Tower, Atidim High-Tech Industrial Park, Building 4, Tel Aviv 61580, Israel. Except as otherwise indicated, the beneficial owners named in the table below have sole voting and investment power with respect to all shares of capital stock held by them.

| | Shares of Common Stock Beneficially Owned

|

|---|

Name

|

|---|

| | Number

| | Percentage

|

|---|

| Warburg Pincus(1) | | 6,816,828 | (2) | 19.7 |

| Nesstech LLC(3) | | 5,357,586 | | 15.5 |

| Entities affiliated with Raj Rajaratnam | | 1,808,114 | (4) | 5.2 |

| AXA Financial, Inc. | | 1,770,080 | (5) | 5.1 |

| JLF Asset Management, LLC | | 1,737,379 | (6) | 5.0 |

| Aharon Fogel(7) | | 390,238 | | 1.1 |

| Raviv Zoller(7) | | 505,581 | | 1.4 |

| Rajeev Srivastava(8) | | 770,730 | | 2.2 |

| Tuvia Feldman(7) | | 159,012 | | * |

| Yoram Michaelis(7) | | 164,437 | | * |

| Ivan Hruska(7) | | 38,826 | | * |

| Shachar Efal | | 117,708 | | * |

| Henry Kressel(9) | | 6,816,828 | (2) | 19.7 |

| Morris Wolfson | | 5,381,562 | (10) | 15.6 |

| Hagai Lavi(11) | | 1,184,447 | | 3.4 |

| Satyam C. Cherukuri | | — | | — |

| Dan S. Suesskind | | — | | — |

| All directors and executive officers as a group (18 persons) (12) | | 16,329,954 | | 44.7 |

- *

- Represents less than 1%

17

- (1)

- Warburg Pincus Partners, LLC, a New York limited liability company, or WPP, is the sole general partner of each of Warburg, Pincus Equity Partners, L.P., a Delaware limited partnership and certain affiliated funds, or WPEP, Warburg, Pincus Ventures International, L.P., a Bermuda limited partnership, or WPVI, and Warburg, Pincus Ventures L.P., a Delaware limited partnership, or WPV. Each of WPEP, WPVI and WPV are managed by Warburg Pincus LLC, a New York limited liability company, or WP LLC. Due to the respective relationship among the Warburg Pincus funds that are the record holders of our stock, each of WPEP, WPV, WPVI, WPP and WP LLC may be deemed to have shared beneficial ownership of these shares although each entity disclaims beneficial ownership of the shares of common stock owned of record by any other Warburg Pincus entity. The address of each of the Warburg Pincus entities is 466 Lexington Avenue, New York, New York 10017.

- (2)

- Consists of (i) 3,018,105 shares of common stock held by WPEP, (ii) 3,410,928 shares of common stock held by WPVI and (iii) 387,795 shares of common stock held by WPV.

- (3)

- Nesstech LLC is a New York limited liability company. Mr. Morris Wolfson is the sole manager of Nesstech LLC. As the sole manager, Mr. Wolfson has sole voting and investment power over, and therefore may be deemed to be the beneficial owner of, the shares of common stock held by Nesstech LLC. Mr. Wolfson disclaims beneficial ownership of the shares of common stock held by Nesstech LLC except to the extent of his equity interest therein. The address of Nesstech LLC is One State Street Plaza, New York, New York 10004. Nesstech LLC has granted an option to Lea Atad to purchase 130,673 shares of common stock.

- (4)

- Based solely upon a Schedule 13G filed with the Commission on February 23, 2005. Of the shares of our common stock being reported as beneficially owned: (i) 1,808,114 shares may be deemed to be beneficially owned by Raj Rajaratnam; Galleon Management, L.L.C.; and Galleon Management, L.P.; (ii) 347,608 shares are held by Galleon Advisors, L.L.C.; (iii) 322,608 are held by Galleon Captains Partners, L.P.; (iv) 1,237,106 are held by Galleon Captains Offshore, Ltd.; (v) 2,650 are held by Galleon Communications Partners, L.P.; (vi) 12,350 shares are held by Galleon Communications Offshore, Ltd.; (vii) 22,350 are held by Galleon Technology Partners II, L.P.; (viii) 82,650 are held by Galleon Technology Offshore, Ltd.; and (ix) 22,350 are held by Galleon Buccaneers Offshore, Ltd. Pursuant to the partnership agreements of Galleon Captains Partners, L.P., Galleon Technology Partners II, L.P. and Galleon Communications Partners, L.P., Galleon Management, L.P. and Galleon Advisors, L.L.C. share all investment and voting power with respect to the securities held by Galleon Captains Partners, L.P., Galleon Technology Partners II, L.P. and Galleon Communications Partners, L.P., and pursuant to an investment management agreement, Galleon Management, L.P. has all investment and voting power with respect to the securities held by Galleon Captains Offshore, Ltd., Galleon Technology Offshore, Ltd., Galleon Communications Offshore, Ltd. and Galleon Buccaneers Offshore, Ltd. Raj Rajaratnam, as the managing member of Galleon Management, L.L.C., controls Galleon Management, L.L.C., which, as the general partner of Galleon Management, L.P., controls Galleon Management, L.P. Raj Rajaratnam, as the managing member of Galleon Advisors, L.L.C., also controls Galleon Advisors, L.L.C. The shares reported herein by Raj Rajaratnam, Galleon Management, L.P., Galleon Management, L.L.C., and Galleon Advisors, L.L.C. may be deemed to be beneficially owned as a result of the purchase of such shares by Galleon Captains Partners, L.P., Galleon Captains Offshore, Ltd., Galleon Technology Partners II, L.P., Galleon Technology Offshore, Ltd., Galleon Communications Partners, L.P., Galleon Communications Offshore, Ltd., and Galleon Buccaneers Offshore, Ltd., as the case may be. Each of Raj Rajaratnam, Galleon Management, L.P., Galleon Management, L.L.C., and Galleon Advisors, L.L.C. disclaims any beneficial ownership of the shares reported herein, except to the extent of any pecuniary interest therein. The address for these entities is 135 East 57th Street, 16th Floor, New York, New York 10022.

18

- (5)

- Based solely upon a Schedule 13G filed with the Commission on February 14, 2005, AXA Financial, Inc. is the beneficial owner of 1,770,080 shares of common stock by virtue of its status as the parent company of Alliance Capital Management L.P. and AXA Equitable Life Insurance Company. Alliance Capital Management L.P. holds sole voting power over 1,258,500 shares of common stock and sole dispositive power over 1,440,550 shares of common stock. AXA Equitable Life Insurance Company holds sole voting and sole dispositive power over 329,530 shares of common stock. The address of AXA Financial, Inc. is 1290 Avenue of the Americas, New York, New York 10104.

- (6)

- Based solely upon a Schedule 13G filed with the Commission on January 14, 2005, JLF Asset Management, LLC is the beneficial owner of 1,737,379 shares of common stock. The address for JLF Asset Management, LLC is 2775 Via de la Valle, Suite 204, Del Mar, California 92014.

- (7)

- Consists of shares of common stock issuable upon exercise of stock options that are currently exercisable or exercisable within 60 days of April 20, 2005.

- (8)

- Includes 13,487 shares of common stock issuable upon exercise of stock options that are currently exercisable or exercisable within 60 days of April 20, 2005.

- (9)

- Dr. Kressel is a general partner of the parent company of WPP and a managing director and member of WP LLC. All shares indicated as owned by Dr. Kressel are included because of his affiliation with the Warburg Pincus entities. Dr. Kressel does not own any shares individually and disclaims beneficial ownership of all shares owned by the Warburg Pincus entities. The address of Dr. Kressel is c/o Warburg Pincus, 466 Lexington Avenue, New York, New York 10017.

- (10)

- Consists of (i) 5,357,586 shares of common stock held by Nesstech LLC, a New York limited liability company of which Mr. Wolfson is the sole manager, (ii) 11,988 shares of common stock held by the Chana Sasha Foundation, of which Mr. Wolfson is president, and (iii) 11,988 shares of common stock held by Morris Wolfson Family LP, a family limited partnership of which Arielle Wolfson, Mr. Wolfson's wife, is the general partner. Mr. Wolfson disclaims beneficial ownership of these shares except to the extent of his equity interest therein. The address of such entities is One State Street Plaza, New York, New York 10004.

- (11)

- Consists of (i) 8,392 shares of common stock issuable upon exercise of stock options that are currently exercisable or exercisable within 60 days of April 20, 2005 and (ii) 1,176,055 shares of common stock held of record by GLY High-Tech Investments Inc. Mr. Lavi and his wife are the sole stockholders of GLY, and Mr. Lavi has sole voting and investment power over, and therefore may be deemed to be the beneficial owner of, shares of common stock held by GLY. The address of GLY is c/o Tulchinsky Stern & Co., 22 Kanfei Nesharim Street, Jerusalem, Israel.

- (12)

- Includes 2,241,442 shares of common stock issuable upon exercise of stock options that are currently exercisable or exercisable within 60 days of April 20, 2005.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires our officers and directors, and persons who own more than 10% of a registered class of our equity securities, to file reports of ownership and changes in ownership of such securities with the Securities and Exchange Commission and the Nasdaq National Market. Officers, directors and greater than 10% beneficial owners are required by applicable regulations to furnish us with copies of all Section 16(a) forms they file.

Based solely upon a review of the copies of the forms furnished to us, we believe that all filing requirements applicable to our officers and directors were complied with during the 2004 fiscal year.

19

Certain Relationships and Related Transactions

Stock Ownership in Acquired Companies

APP Stock Purchase Agreement. On August 30, 2002, we entered into a stock purchase agreement with the stockholders of APP Group CEE B.V. pursuant to which we purchased all of the outstanding stock of APP in exchange for 906,086 shares of our common stock. We also issued options to purchase an aggregate of 164,582 shares of common stock in exchange for options previously issued by APP to its employees and directors. Warburg, Pincus Ventures, L.P. and Warburg, Pincus Ventures International, L.P. received 361,384 and 362,384 shares of our common stock, respectively, upon the closing of the transaction in exchange for all of the outstanding shares of common stock of APP held by them. These Warburg Pincus entities owned approximately 78% of APP prior to the transaction. Immediately prior to the closing of that transaction, Warburg, Pincus Ventures International, L.P. owned approximately 10.0% of our outstanding common stock on an as-converted basis and all Warburg Pincus entities collectively owned approximately 20.0% of our outstanding common stock on an as-converted basis. Warburg, Pincus Ventures, L.P. did not own any of our stock. These two Warburg Pincus entities made their initial investment in, and together became a majority stockholder of, APP in October 1997.

Pursuant to the terms of the stock purchase agreement, our subsidiary, Ness Technologies B.V., guaranteed the payment of the $2.0 million owed by APP to these Warburg Pincus entities. The $2.0 million represented the outstanding balance of $4.0 million of indebtedness originally issued by APP to these entities in August 2000. In consideration for our granting the guarantee, the lender reduced the annual interest rate to 2.95% and extended the maturity date. As amended, one-half of the principal amount and any accrued and unpaid interest was due on September 30, 2004, and such payment was made, and the remaining principal amount and any accrued and unpaid interest is due on September 30, 2005.

Negotiations of the terms of this transaction on our behalf were conducted by Raviv Zoller, our president and chief executive officer. In determining the purchase price of APP, Mr. Zoller and his counterpart at APP considered our revenues relative to those of APP for the six-month period prior to commencing negotiations and adjusted for the companies' growth expectations, non-recurring expenses, net debt and the potential cost savings that we might achieve as a combined company. Our board of directors conducted a detailed analysis of the value of APP to our business at that time. Given our board's collective financial sophistication and its understanding of our business and financial condition and the business and financial condition of APP, and considering the private nature of both companies at the time of the transaction, our board did not deem it necessary to receive a fairness opinion from an independent third party. Our board, including all disinterested directors, unanimously approved the transaction. Dr. Kressel, who is affiliated with the Warburg entities, did not participate in any of the negotiations of the terms of the transaction.

Apar Merger Agreement. On May 12, 2003, we entered into a merger agreement pursuant to which we acquired Apar Holding Corp., the parent of Apar InfoTech, resulting in Apar becoming our wholly-owned subsidiary. Upon the closing of the merger, we issued 6,221,712 shares of our common stock and assumed options previously issued by Apar to its employees and directors to purchase an aggregate of 540,121 shares of our common stock, based on the exchange rate set forth in the merger agreement. Five Warburg Pincus entities received shares of our common stock upon the closing of the merger, and each of these entities was one of our stockholders prior to the merger, as set forth in the table below. These Warburg Pincus entities owned approximately 53% of the outstanding common stock of Apar prior to the closing of the merger. These five Warburg Pincus entities made their initial investment in

20

Apar in March 2000. The aggregate amount invested by these entities in Apar was approximately $34.7 million.

| |

| | Ness Common Stock Received in Merger

| |

|

|---|

Entity

| | Percentage Ownership of

Ness Prior to the Merger

| | Number of Shares

| | Percentage

| | Percentage Ownership

of Ness Following

the Merger

|

|---|

| Warburg, Pincus Equity Partners, L.P. | | 8.5 % | | 1,868,819 | | 12.0 | % | 14.6 % |

| Warburg, Pincus Ventures International, L.P. | | 11.3 | | 1,977,585 | | 12.7 | | 17.1 |

| Warburg, Pincus Netherlands Equity Partners I, C.V. | | 0.3 | | 59,327 | | 0.4 | | 0.5 |

| Warburg, Pincus Netherlands Equity Partners II, C.V. | | 0.2 | | 39,551 | | 0.3 | | 0.3 |

| Warburg, Pincus Netherlands Equity Partners III, C.V. | | 0.04 | | 9,887 | | 0.1 | | 0.08 |

Pursuant to the terms of the merger agreement, we agreed to issue additional shares of our common stock to the stockholders of Apar to the extent necessary to preserve their ownership percentages in us prior to the exchange of shares of our common stock for the remaining shares of common stock of Ness U.S.A. that we do not own. Effective March 2, 2005, we issued to these stockholders an aggregate of 89,305 shares of our common stock pursuant to this agreement as a result of the closing of our exchange offer for the remaining shares of Ness U.S.A. that we did not own.

Negotiations of the terms of this transaction on our behalf were conducted by Raviv Zoller, our president and chief executive officer. In determining the merger consideration, Mr. Zoller and his counterpart at Apar considered our revenues and operating income relative to those of Apar for the six months prior to commencing negotiations, adjusted for the companies' growth expectations, non-recurring revenues and expenses and net debt. Mr. Zoller also considered the potential cost savings that we might achieve as a combined company. Our board of directors conducted a detailed analysis of the value of Apar to our business at that time. Given our board's collective financial sophistication and its understanding of our business and the business of Apar, and considering the private nature of both companies at the time of the transaction, our board did not deem it necessary to receive a fairness opinion from an independent third party. Our board, including all disinterested directors, unanimously approved the transaction. Dr. Kressel did not participate in any of the negotiations of the terms of the transaction.

Warburg Pincus, and all of its related entities, is a private equity fund that seeks to raise money from limited partners, identify investments in privately held companies (in most cases) and attempt to increase the value of these investments. Although Warburg Pincus exercised some control over these investments by virtue of having board representation, rights inherent in preferred stock, rights contained in stockholders agreements and other similar rights typically afforded large investors, Warburg Pincus's investments in APP and Apar were passive equity interests.

Consulting Agreement

On July 1, 2003, we entered into an agreement with GLY—Technological Horizons Ltd., or GLY Horizons, a company owned by Mr. Hagai Lavi, one of our directors, and his wife, pursuant to which Mr. Lavi provides us with consulting services. The services cover instruction and assistance with respect to sales and marketing activities, lectures and training for executives and employees, and participation in sales and special projects teams. The initial term of the agreement expired on December 31, 2004 and is automatically extended for successive one-year periods, unless terminated by either party by providing written notice at least three months prior to expiration of the then existing term. The annual

21

fees payable to GLY Horizons are $247,200 and GLY Horizons may be eligible to receive an annual bonus of up to $150,000 based on GLY Horizons reaching certain annual goals set by our chief executive officer. The bonus criteria may change from year to year. For 2004, the bonus criteria were the completion of training and mentoring by Mr. Lavi of our Israeli sales personnel in our sales and marketing methodology, and a 50% increase in backlog for our Israeli subsidiaries as a result of their sales activities. GLY Horizons earned an $84,000 bonus for 2004.

Stockholders Agreement

The Warburg Pincus stockholders, Nesstech LLC and certain of its affiliates, GLY, Velston Pte. Ltd., or Velston, and other principal stockholders were parties to a stockholders agreement with us. The stockholders agreement provided, among other things, for the rights of these stockholders to designate members of our board and certain cross-purchase and sale rights in respect of our common stock and our Class B and Class C preferred stock owned by these stockholders. The stockholders agreement terminated upon the consummation of our initial public offering.

Registration Rights Agreements

The holders of 12,899,212 shares of our common stock have the right to require us to register these shares with the SEC pursuant to the terms of certain registration rights agreements.

Registration Rights Agreements. GLY and certain of the affiliates of Nesstech LLC are parties to a registration rights agreement with us, dated March 26, 1999, and Velston is a party to a registration rights agreement with us, dated May 13, 1999. The Warburg Pincus stockholders, Nesstech LLC, GLY and certain other common stockholders are parties to a second amended and restated registration rights agreement with us, dated June 30, 2003, as amended. Under these agreements, holders of shares having registration rights can demand that we file a registration statement or request to have their shares included in a registration statement that we file for our own account or for the account of other stockholders.