SCHEDULE 14A INFORMATION

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

¨ | | Preliminary Proxy Statement |

¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

¨ | | Definitive Additional Materials |

¨ | | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 |

INTERTRUST TECHNOLOGIES CORPORATION

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

¨ | | Fee paid previously with preliminary materials. |

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

Notes:

INTERTRUST TECHNOLOGIES CORPORATION

4800 Patrick Henry Drive

Santa Clara, California 95054

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held December 18, 2002

The Annual Meeting of Stockholders (the “Annual Meeting”) of InterTrust Technologies Corporation (the “Company”) will be held at the Westin Santa Clara, 5101 Great America Parkway, Santa Clara, California, on Wednesday, December 18, 2002, at 9:00 a.m. for the following purposes:

1. To elect eight directors of the Board of Directors to serve until the next Annual Meeting or until their successors have been duly elected and qualified;

2. To ratify the appointment of Ernst & Young LLP as the Company’s independent auditors for the fiscal year ending December 31, 2002; and

3. To transact such other business as may properly come before the meeting or any adjournments or postponements thereof.

The foregoing items of business are more fully described in the attached Proxy Statement.

Only stockholders of record at the close of business on November 13, 2002 are entitled to notice of, and to vote at, the Annual Meeting and at any adjournments or postponements thereof. A list of such stockholders will be available for inspection at the Company’s headquarters located at 4800 Patrick Henry Drive, Santa Clara, California, during ordinary business hours for the ten-day period prior to the Annual Meeting, and will be present at the meeting as well.

BY ORDER OF THE BOARD OF DIRECTORS, Victor Shear Chairman of the Board |

Santa Clara, California

November 15, 2002

|

|

IMPORTANT |

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE COMPLETE, SIGN, DATE AND PROMPTLY RETURN THE ACCOMPANYING PROXY IN THE ENCLOSED POSTAGE-PAID ENVELOPE. YOU MAY REVOKE YOUR PROXY AT ANY TIME PRIOR TO THE ANNUAL MEETING. IF YOU DECIDE TO ATTEND THE ANNUAL MEETING AND WISH TO CHANGE YOUR PROXY VOTE, YOU MAY DO SO AUTOMATICALLY BY VOTING IN PERSON AT THE MEETING. |

|

INTERTRUST TECHNOLOGIES CORPORATION

4800 Patrick Henry Drive

Santa Clara, California 95054

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

To be held December 18, 2002

These proxy materials are furnished in connection with the solicitation of proxies by the Board of Directors of InterTrust Technologies Corporation, a Delaware corporation (the “Company”), for the Annual Meeting of Stockholders (the “Annual Meeting”) to be held at the Westin Santa Clara, 5101 Great America Parkway, Santa Clara, California, on Wednesday, December 18, 2002, at 9:00 a.m., and at any adjournment or postponement of the Annual Meeting. These proxy materials were first mailed to stockholders on or about November 15, 2002.

PURPOSE OF MEETING

The specific proposals to be considered and acted upon at the Annual Meeting are summarized in the accompanying Notice of Annual Meeting of Stockholders. Each proposal is described in more detail in this Proxy Statement.

VOTING RIGHTS AND SOLICITATION OF PROXIES

The Company’s common stock is the only type of security entitled to vote at the Annual Meeting. On November 13, 2002, the record date for determination of stockholders entitled to vote at the Annual Meeting, there were 98,230,035 shares of common stock outstanding. Each stockholder of record on November 13, 2002 is entitled to one vote for each share of common stock held by such stockholder on November 13, 2002. All votes will be tabulated by the inspector of election appointed for the meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes.

Quorum Required

The Company’s bylaws provide that the holders of a majority of the Company’s common stock issued and outstanding and entitled to vote at the Annual Meeting, present in person or represented by proxy, shall constitute a quorum for the transaction of business at the Annual Meeting. Abstentions and broker non-votes will be counted as present for the purpose of determining the presence of a quorum.

Votes Required

Proposal 1. Directors are elected by a plurality of the affirmative votes cast by those shares present in person, or represented by proxy, and entitled to vote at the Annual Meeting. The eight nominees for director receiving the highest number of affirmative votes will be elected. Abstentions and broker non-votes will not be counted toward a nominee’s total.

Proposal 2. Ratification of the appointment of Ernst & Young LLP as the Company’s independent auditors for the fiscal year ending December 31, 2002 requires the affirmative vote of a majority of those shares present in person, or represented by proxy, and cast either affirmatively or negatively at the Annual Meeting. Abstentions and broker non-votes will not be counted as having been voted on the proposal.

1

Proxies

Whether or not you are able to attend the Company’s Annual Meeting, you are urged to complete and return the enclosed proxy, which is solicited by the Company’s Board of Directors and which will be voted as you direct on your proxy when properly completed. In the event no directions are specified, such proxies will be voted FOR the Nominees of the Board of Directors (as set forth in Proposal 1), FOR Proposal 2 and in the discretion of the proxy holders as to other matters that may properly come before the Annual Meeting. You may also revoke or change your proxy at any time before the Annual Meeting. To do this, send a written notice of revocation or another signed proxy with a later date to the Secretary of the Company at the Company’s principal executive offices before the beginning of the Annual Meeting. You may also automatically revoke your proxy by attending the Annual Meeting and voting in person. All shares represented by a valid proxy received prior to the Annual Meeting will be voted.

Solicitation of Proxies

The Company will bear the entire cost of solicitation, including the preparation, assembly, printing, and mailing of this Proxy Statement, the proxy, and any additional soliciting material furnished to stockholders. Copies of solicitation material will be furnished to brokerage houses, fiduciaries, and custodians holding shares in their names that are beneficially owned by others so that they may forward this solicitation material to such beneficial owners. In addition, the Company may reimburse such persons for their costs of forwarding the solicitation material to such beneficial owners. The original solicitation of proxies by mail may be supplemented by solicitation by telephone, telegram, or other means by directors, officers, employees, or at the Company’s request, MacKenzie Partners, Inc., a professional proxy solicitation firm. No additional compensation will be paid to directors, officers or employees for such services, but MacKenzie Partners, Inc. will be paid its customary fee, estimated to be about $5,000, if it renders solicitation services.

2

PROPOSAL 1

ELECTION OF DIRECTORS

The directors who are being nominated for reelection to the Board of Directors (the “Nominees”), their ages as of October 1, 2002, their positions and offices held with the Company as of October 1, 2002, and certain biographical information are set forth below. The proxy holders intend to vote all proxies received by them in the accompanying form FOR the Nominees listed below unless otherwise instructed. In the event any Nominee is unable or declines to serve as a director at the time of the Annual Meeting the proxies will be voted for any nominee who may be designated by the present Board of Directors to fill the vacancy. As of the date of this Proxy Statement, the Board of Directors is not aware of any Nominee who is unable or will decline to serve as a director. The eight nominees receiving the highest number of affirmative votes of the shares entitled to vote at the Annual Meeting will be elected directors of the Company to serve until the next Annual Meeting or until their successors have been duly elected and qualified.

Nominees

| | Age

| | Positions and Offices Held With Company

|

| Victor Shear(4) | | 55 | | Chairman of the Board |

| David Lockwood | | 42 | | Executive Vice Chairman, Chief Executive Officer, President, and Director |

| David C. Chance(3) | | 45 | | Director |

| Satish K. Gupta(1)(2)(4) | | 57 | | Director |

| Curt Hessler | | 58 | | Director |

| Lester Hochberg(1)(2)(3)(4) | | 65 | | Director |

| Timo Ruikka | | 46 | | Director |

| Robert Walker(1)(2)(3)(4) | | 52 | | Director |

| (1) | | Member of Compensation Committee. |

| (2) | | Member of Audit Committee. |

| (3) | | Member of Special Committee. |

| (4) | | Member of Nominating Committee. |

Victor Shear has served as chairman of the board of the Company since its inception in January 1990 and chief executive officer of the Company from inception to March 2002. Before founding InterTrust, Mr. Shear co-founded Personal Library Software, Inc., a text and document database company, in June 1986. Mr. Shear served as chairman, president and chief executive officer of Data Scientific Corporation, a software developer of scientific workstations, from May 1982 to February 1985. Mr. Shear received a B.A. in sociology from Brandeis University.

David Lockwood has served as chief executive officer of the Company since March 2002, as president since November 2001, executive vice chairman of InterTrust since September 2001 and as a director since October 2000. Before joining InterTrust, from January 2000 to October 2001, Mr. Lockwood was the managing partner of Reuters Greenhouse Fund, a venture capital firm. Prior to joining Reuters Greenhouse Fund, Mr. Lockwood spent 10 years at Goldman, Sachs & Co., most recently as a managing director. Mr. Lockwood currently serves on the board of directors of Forbes.com. Mr. Lockwood previously served on the boards of directors of Epoch, Logicworx, @themoment, Aurigin Systems, Moreover and Zeroknowledge, and was the chairman of the board of Venture One. Mr. Lockwood received a B.A. from Miami University and an M.B.A. from the University of Chicago.

David C. Chance has served as a director of InterTrust since October 1999. Mr. Chance also served as executive vice chairman of InterTrust from October 1999 to October 2001. Before joining InterTrust, from January 1994 to January 1998, Mr. Chance was deputy managing director of BskyB Group Ltd., a leading United

3

Kingdom pay-television and media company, and continued to serve as a consultant and non-executive director until August 1999. In addition, Mr. Chance is a non-executive director of Modern Times Group, the primary pay-television operator in Scandinavia, and Sunderland football club. Mr. Chance received a B.S. in psychology, a B.A. in industrial relations, and an M.B.A. from the University of North Carolina at Chapel Hill.

Satish K. Gupta has served as a director of InterTrust since February 1993. Mr. Gupta is currently a senior vice president of Cradle Technologies, a semiconductor company. Mr. Gupta was the president and chief executive officer of Cradle Technologies from July 1998 until October 2002. From May 1994 to June 1998, Mr. Gupta was vice president of corporate marketing and business development of Cirrus Logic, a semiconductor company, and from June 1991 to May 1994, he was vice president of strategic marketing and advanced development of Media Vision, a multi-media peripherals company. Mr. Gupta received a B.E. in electrical engineering in India from Birla Institute of Technology and Science, an S.M. in electrical engineering from Massachusetts Institute of Technology, and an M.S. in engineering and economic systems from Stanford University.

Curt Hessler has served as a director of InterTrust since October 2002. Mr. Hessler has held a variety of senior positions at major corporations including Vice Chairman and Chief Financial Officer of Unisys from 1985 to 1991 and Executive Vice President of the Times-Mirror Group from 1991 to 1995. Mr. Hessler has also held several government positions including Assistant Secretary of the Treasury for Economic Policy from 1980 to 1981. Mr. Hessler received a B.A. from Harvard, a Masters degree in economics from the University of California at Berkeley, a J.D. from Yale Law School, and is also a Rhodes Scholar.

Lester Hochberg has served as director of InterTrust since January 2002. Mr. Hochberg has served as director and president of RR Capital Partners, an investment company, since June 1998 and as director and president of Bercap Corporation, a financial advisory company, since 1985. Mr. Hochberg was Chairman of Gibson’s, a chain of retail stores, from February 1992 to September 1998. Mr. Hochberg received a B.S. in economics from Brooklyn College and a J.D. from Harvard Law School.

Timo Ruikka has served as a director of InterTrust since March 2001. Mr. Ruikka has been a vice president of industry initiatives of Nokia Corporation, an electronics and communications network equipment company, since July 2001. From April 1999 to July 2001, Mr. Ruikka served as a vice president of Nokia, Inc., the United States subsidiary of Nokia Corporation. From January 1998 to March 1999, Mr. Ruikka served as vice president and senior vice president of Nokia Corporation. Mr. Ruikka has an L.L.M. degree from Turku University in Finland. Mr. Ruikka was nominated by Nokia Corporation to serve as a director of InterTrust in connection with an investment by Nokia Finance International B.V. in InterTrust.

Robert R. Walker has served as director of InterTrust since January 2002. Mr. Walker was executive vice president and chief financial officer of Agilent Technologies, a publicly traded electronic equipment manufacturing company, from March 1999 to December 2001. Prior to joining Agilent Technologies, Mr. Walker held positions including vice president, chief information officer and group controller at Hewlett-Packard Company, an electronic equipment manufacturing company, from June 1975 to February 1999. Mr. Walker is also a member of the Executive Committee of Financial Executives International. Mr. Walker received a B.S. in Electrical Engineering and a M.B.A. in finance from Cornell University.

Board of Directors Meetings and Committees

During the fiscal year ended December 31, 2001, the Board of Directors held fifteen meetings and never acted by written consent in lieu of a meeting. Other than Mr. Hessler who was recently elected to the Board in October 2002 for the 2001 fiscal year, each of the directors during the term of their tenure attended or participated in at least 75% of the aggregate of (i) the total number of meetings of the Board of Directors and (ii) the total number of meetings held by all committees of the Board of Directors on which each such director served. The Board of Directors currently has standing audit, compensation and nominating committees.

4

The Nominating Committee was created in May 2002 to oversee the process of determining the appropriate size of the Board of Directors, and managing the process of selecting potential candidates for the Board of Directors. The current members of the Nominating Committee are Messrs. Shear, Gupta, Hochberg, and Walker. The Nominating Committee does not currently consider nominees recommended by the stockholders.

The Special Committee was formed in March 2002 to have oversight and management over the analysis and pursuit of potential strategic alternatives that the Company might consider. The analysis and pursuit of strategic alternatives could include negotiations with third parties regarding potential strategic combinations, patent license agreements or other transactions. The Special Committee also oversees and manages the Company’s work with Allen and Company, a financial advisor hired by the Board. The current members of the Special Committee are Messrs. Hochberg, Chance and Walker.

The Audit Committee was created on July 22, 1999 and became effective on the effective date of the Company’s initial public offering of its securities, October 26, 1999. As discussed further in the Report of the Audit Committee and in the Audit Committee Charter attached as Appendix A, the Audit Committee reviews, acts on and reports to the Board of Directors with respect to various auditing and accounting matters, including the selection of the Company’s independent auditors, the scope of the annual audits, fees to be paid to the Company’s independent auditors, the performance of the Company’s independent auditors and the accounting practices of the Company. During the fiscal year ended December 31, 2001, the members of the Audit Committee were Messrs. Gupta, Patrick Jones, who resigned as a director in June of 2002, and David Lockwood. Currently, the members of the Audit Committee are Messrs. Gupta, Hochberg, and Walker. Mr. Lockwood resigned as a member of the Audit Committee in October 2001 when he became an executive of the Company and no longer qualified as an independent member of the Audit Committee under the listing standards of the Nasdaq National Market. Mr. Walker was added to the Audit Committee in January 2002. Mr. Hochberg was added to the Audit Committee in June 2002 to replace Mr. Jones. Until October 2001, when Mr. Lockwood became executive vice chairman of InterTrust, each of the members of the Audit Committee during the fiscal year ended December 31, 2001 was independent as defined under the listing standards of the Nasdaq National Market. The current members of the Audit Committee meet such independence standards. During the fiscal year ended December 31, 2001, the Audit Committee of the Board of Directors held four meetings.

The Compensation Committee was created on July 22, 1999 and became effective on the effective date of the Company’s initial public offering of its securities, October 26, 1999. The Compensation Committee reviews the performance of the executive officers of the Company, establishes compensation programs for the officers, and reviews the compensation programs for other key employees, including salary and cash bonus levels and option grants under the 1995 Stock Plan, 1999 Equity Incentive Plan, 2000 Supplemental Option Plan, and 1999 Employee Stock Purchase Plan. The members of the Compensation Committee during the fiscal year ended December 31, 2001 were Messrs. Gupta and Fredrickson. Mr. Jones joined the Compensation Committee in January 2002 following the resignation of Mr. Fredrickson. Current members of the Compensation Committee are Messrs. Gupta, Hochberg, and Walker. Mr. Hochberg joined the Compensation Committee following the resignation of Mr. Jones in June 2002. Mr. Walker joined the Compensation Committee in July 2002. During the fiscal year ended December 31, 2001, the Compensation Committee of the Board of Directors held one meeting, and acted by written consent in lieu of a meeting on fourteen occasions.

Compensation of Directors

Except for grants of stock options, directors of the Company did not receive compensation for services provided as a director during the last fiscal year ended December 31, 2001. The Company also did not pay compensation for committee participation or special assignments of the Board of Directors during the last fiscal year ended December 31, 2001. Beginning in April 2002, each non-employee director on the Audit Committee, Compensation Committee, and the Special Committee received a payment of $1,000 per meeting from the Company. In addition, the Board of Directors has approved a compensation plan for non-employee directors of the Company consisting of the following payments which in the aggregate may not exceed $50,000 per year for

5

any individual director: (i) an annual payment of $25,000 (which payment will be pro-rated so that non-employee directors receive a payment of $6,805.56 for the fiscal year ending December 31, 2002); (ii) a $1,000 per day payment for attendance of Board meetings in person; and (iii) a $500 per day payment for attendance of Board meetings by telephone.

Non-employee directors are eligible to receive options under the Company’s 1999 Non-Employee Directors Option Plan (“Directors Plan”). Each individual who first joins the Company’s Board of Directors as a non-employee director after the effective date of the Company’s initial public offering will receive at that time a fully vested option for 30,000 shares of the Company’s common stock. In addition, at each of the Company’s annual stockholders’ meetings, each non-employee director who will continue to be a director after that meeting will automatically be granted at that meeting a fully vested option for 10,000 shares of the Company’s common stock. However, any non-employee director who receives an option for 30,000 shares under this Directors Plan will first become eligible to receive the annual option for 10,000 shares at the annual meeting that occurs during the calendar year following the year in which he received the option for 30,000 shares.

Non-employee directors are also eligible to receive options and be issued shares of common stock under the Company’s 1999 Equity Incentive Plan. Directors who are also employees of the Company are eligible to receive options and be issued shares of common stock under the Company’s 1999 Equity Incentive Plan and are also eligible to participate in the Company’s 1999 Employee Stock Purchase Plan.

In May 2001, the Company granted to each of Messrs. Fredrickson and Gupta an option to purchase 40,000 shares of common stock at an exercise price of $2.10 per share; in June 2001, the Company granted to each of Messrs. Fredrickson, Gupta, and Lockwood an option to purchase 25,000 shares of common stock at an exercise price of $1.10 per share; and in November 2001, the Company granted an option to purchase 10,000 shares of common stock at an exercise price of $1.07 per share. In March 2001, the Company granted an option to purchase 30,000 shares of common stock at an exercise price of $3.75 per share to Mr. Ruikka. In June 2001, the Company granted Mr. Jones an option to purchase 30,000 shares of common stock at an exercise price of $1.10 per share, and in July 2001, the Company granted Mr. Jones an option to purchase 10,000 shares of common stock at an exercise price of $1.23 per share to Mr. Jones. In January 2002, the Company granted an option to purchase 30,000 shares of common stock at an exercise price of $1.50 to each of Messrs. Hochberg and Walker. In March 2002, we granted options to purchase 50,000 shares of our common stock to Mr. Chance at exercise prices of $1.26. In June 2002, the Company granted an option to purchase 30,000 shares of common stock at an exercise price of $2.12 to each of Messrs. Chance, Gupta, Hochberg, Jones, Ruikka and Walker.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE NOMINEES LISTED HEREIN.

6

PROPOSAL 2

RATIFICATION OF INDEPENDENT AUDITORS

The Company is asking the stockholders to ratify the appointment of Ernst & Young LLP as the Company’s independent auditors for the fiscal year ending December 31, 2002. The affirmative vote of the holders of a majority of shares present or represented by proxy and voting at the Annual Meeting will be required to ratify the appointment of Ernst & Young LLP.

In the event the stockholders fail to ratify the appointment, the Board of Directors will reconsider its selection. Even if the appointment is ratified, the Board of Directors, in its discretion, may direct the appointment of a different independent accounting firm at any time during the year if the Board of Directors feels that such a change would be in the Company’s and its stockholders’ best interests.

Ernst & Young LLP has audited the Company’s financial statements since 1994. Its representatives are expected to be present at the Annual Meeting, will have the opportunity to make a statement if they desire to do so, and will be available to respond to appropriate questions.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS RECOMMENDS A VOTE“FOR” PROPOSAL 2.

7

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of September 30, 2002, certain information with respect to shares beneficially owned by (i) each person who is known by the Company to be the beneficial owner of more than five percent of the Company’s outstanding shares of common stock, (ii) each of the Company’s directors and the executive officers named in Executive Compensation and Related Information and (iii) all current directors and executive officers as a group. Beneficial ownership has been determined in accordance with Rule 13d-3 under the Exchange Act. Under this rule, certain shares may be deemed to be beneficially owned by more than one person (if, for example, persons share the power to vote or the power to dispose of the shares). In addition, shares are deemed to be beneficially owned by a person if the person has the right to acquire shares (for example, upon exercise of an option or warrant) within sixty days of the date as of which the information is provided. In computing the percentage ownership of any person, the amount of shares is deemed to include the amount of shares beneficially owned by such person (and only such person) by reason of such acquisition rights. As a result, the percentage of outstanding shares of any person as shown in the following table does not necessarily reflect the person’s actual voting power at any particular date.

| | | Shares Beneficially Owned(1)(2)

| |

Name of Beneficial Owner

| | Number of Shares

| | Percentage of Total

| |

| Victor Shear | | 15,103,096 | | 15.4 | % |

| David Lockwood(3) | | 5,042,732 | | 5.1 | % |

| DMG Advisors LLC(#) | | 4,952,623 | | 5.0 | % |

| David C. Chance(4) | | 764,121 | | * | |

| Edmund Fish(5) | | 622,395 | | * | |

| Patrick Nguyen(6) | | 575,030 | | * | |

| Satish Gupta(7) | | 470,000 | | * | |

| David Maher(8) | | 302,789 | | * | |

| Greg Wood(9) | | 284,061 | | * | |

| Lester Hochberg(10) | | 74,521 | | * | |

| Robert R. Walker(11) | | 60,000 | | * | |

| Timo Ruikka(12) | | 60,000 | | * | |

| David Ludvigson | | — | | * | |

| Mark Ashida | | — | | * | |

| Patrick S. Jones | | — | | * | |

| All current directors and executive officers as a group (12 persons)(13) | | 23,537,600 | | 23.0 | % |

| (1) | | Percentage ownership is based on 98,230,035 shares of common stock outstanding on September 30, 2002. |

| (2) | | Shares of common stock subject to options currently exercisable or exercisable within 60 days of September 30, 2002 are deemed outstanding for purposes of computing the percentage ownership of the person holding such options but are not deemed outstanding for computing the percentage ownership of any other person. Except pursuant to applicable community property laws or as indicated in the footnotes to this table, each stockholder identified in the table possesses sole voting and investment power with respect to all shares of common stock shown as beneficially owned by such stockholder. Unless otherwise indicated, the address of each of the individuals listed in the table is c/o InterTrust Technologies Corporation, 4800 Patrick Henry Drive, Santa Clara, CA 95054. |

| (3) | | Includes 850,832 shares subject to options that are exercisable within 60 days of September 30, 2002. |

| (4) | | Includes 764,121 shares subject to options that are exercisable within 60 days of September 30, 2002. |

| (5) | | Includes 313,957 shares subject to options that are exercisable within 60 days of September 30, 2002. |

8

| (6) | | Includes 509,995 shares subject to options that are exercisable within 60 days of September 30, 2002. |

| (7) | | Includes 315,000 shares subject to options that are exercisable within 60 days of September 30, 2002. |

| (8) | | Includes 299,039 shares subject to options that are exercisable within 60 days of September 30, 2002. |

| (9) | | Includes 269,061 shares subject to options that are exercisable within 60 days of September 30, 2002. |

| (10) | | Includes 69,121 shares subject to options that are exercisable within 60 days of September 30, 2002. |

| (11) | | Includes 60,000 shares subject to options that are exercisable within 60 days of September 30, 2002. |

| (12) | | Includes 60,000 shares subject to options that are exercisable within 60 days of September 30, 2002. |

| (13) | | Includes 3,922,619 shares subject to options that are exercisable within 60 days of September 30, 2002. |

| (#) | | Based on Form 13(g) filed with the SEC on August 2, 2002. |

9

COMPENSATION COMMITTEE REPORT

The Compensation Committee of the Company’s Board of Directors (the “Compensation Committee” or the “Committee”) was formed on July 22, 1999. The charter for the Committee provides that it has the exclusive authority to establish the level of base salary payable to the chief executive officer (“CEO”) and certain other executive officers of the Company and to administer the Company’s 1999 Equity Incentive Plan and 1999 Employee Stock Purchase Plan. In addition, the Committee has the responsibility for approving the individual bonus programs to be in effect for the CEO and certain other executive officers and key employees each fiscal year.

For the 2001 fiscal year, the process utilized by the Compensation Committee in determining executive officer compensation levels was based on a number of factors, including reference to similar positions in other high-technology companies. In the case of the key executive officers, the Compensation Committee also reviewed the inputs from the CEO. In these cases, the final decisions regarding compensation were made independently by the committee.

General Compensation Policy. The Compensation Committee’s fundamental policy is to offer the Company’s executive officers competitive compensation opportunities based upon overall Company performance, their individual contribution to the financial success of the Company and their personal performance. It is the Compensation Committee’s objective to have a substantial portion of each officer’s compensation contingent upon the Company’s performance, as well as upon his or her own level of performance. Accordingly, each executive officer’s compensation package consists of: (i) base salary, (ii) discretionary cash bonus and (iii) long-term stock-based incentive awards.

Base Salary. The base salary for each executive officer is set on the basis of general market levels and personal performance. Each individual’s base pay is established to achieve an appropriate total compensation package, including other cash incentives and long-term incentives.

Annual Cash Bonuses. Each executive officer is eligible for a cash bonus at the discretion of the Compensation Committee. The Compensation Committee considers performance targets established at the start of the fiscal year and personal objectives established for each executive. Actual bonuses paid reflect an individual’s accomplishment of both corporate and functional objectives.

Long-Term Incentive Compensation. During fiscal 2001, the Compensation Committee, in its discretion, made option grants to the Company’s Named Executive Officers and certain executive officers as performance bonuses and for retention purposes. The Compensation Committee also made initial option grants to David Lockwood in connection with his employment commencement in September 2001 and subsequent assumption of the President position in November 2001. Mr. Lockwood was also appointed as chief executive officer in March 2002. Generally, a significant grant is made in the year that an officer commences employment. Thereafter, option grants may be made at varying times and in varying amounts in the discretion of the Compensation Committee. Generally, the size of each grant is set at a level that the Compensation Committee deems appropriate to create a meaningful opportunity for stock ownership based upon the individual’s position with the Company, the individual’s potential for future responsibility and promotion, the individual’s performance in the recent period and the number of unvested options held by the individual at the time of the new grant. The relative weight given to each of these factors will vary from individual to individual at the Compensation Committee’s discretion.

Each grant allows the officer to acquire shares of the Company’s common stock at a fixed price per share (the market price on the grant date) over a specified period of time. The option vests in periodic installments over a two to four year period, contingent upon the executive officer’s continued employment with the Company. The vesting schedule and the number of shares granted are established to ensure a meaningful incentive in each year following the year of grant. Accordingly, the option will provide a return to the executive officer only if he or she

10

remains in the Company’s employ, and then only if the market price of the Company’s common stock appreciates over the option term.

CEO Compensation. The annual base salary for Mr. Shear, the Company’s Chief Executive Officer until March 2002, was not increased by the Compensation Committee during fiscal 2001, and Mr. Shear was not granted any options or given any bonus during fiscal 2001.

Tax Limitation. Under the Federal tax laws, a publicly held company such as the Company will not be allowed a federal income tax deduction for compensation paid to certain executive officers to the extent that compensation exceeds $1 million per officer in any year. To qualify for an exemption from the $1 million deduction limitation, the stockholders were asked to approve a limitation under the Company’s 1999 Equity Incentive Plan on the maximum number of shares of common stock for which any one participant may be granted stock options per fiscal year. Because this limitation was adopted, any compensation deemed paid to an executive officer when he exercises an outstanding option under the 1999 Equity Incentive Plan with an exercise price equal to the fair market value of the option shares on the grant date will qualify as performance-based compensation that will not be subject to the $1 million limitation. Since it is not expected that the cash compensation to be paid to the Company’s executive officers for the 2001 fiscal year will exceed the $1 million limit per officer, the Compensation Committee will defer any decision on whether to limit the dollar amount of all other compensation payable to the Company’s executive officers to the $1 million cap.

Compensation Committee

Robert Walker

Lester Hochberg

Satish K. Gupta

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The Compensation Committee of the Company’s Board of Directors was created on July 22, 1999 and became effective on the effective date of the Company’s initial public offering of its securities, October 26, 1999. The current members of the Compensation Committee are Messrs. Hochberg, Walker and Gupta. The members of the Compensation Committee during the 2001 fiscal year were Messrs. Gupta and Fredrickson. Neither of these individuals was at any time during 2001, or at any other time, an officer or employee of the Company. No executive officer of the Company serves as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of the Company’s Board of Directors or Compensation Committee.

11

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The Audit Committee serves as the representative of the Board of Directors for general oversight of the Company’s financial accounting and reporting process, system of internal control, audit process, and process for monitoring compliance with laws and regulations and the Company’s Standards of Business Conduct. The Audit Committee annually recommends to the Board of Directors the appointment of a firm of independent auditors to audit the financial statements of the Company. A more detailed description of the functions of the Audit Committee can be found in the Company’s Audit Committee Charter, attached to this proxy statement as Appendix A.

The Audit Committee was organized in July 1999. The Audit Committee for the last fiscal year consisted of Messrs. Gupta, Lockwood and Jones. The Audit Committee held four meetings during the last fiscal year. In addition, the Audit Committee met once in 2002 to discuss the audit for the last fiscal year. Audit Committee meetings are held outside and apart from the Board meetings.

The Company’s management has primary responsibility for preparing the Company’s financial statements and financial reporting process. The Company’s independent auditors, Ernst & Young LLP, are responsible for expressing an opinion on the conformity of the Company’s audited financial statements to generally accepted accounting principles. The Audit Committee has general oversight responsibility with respect to the Company’s financial reporting, and reviews the results and scope of the audit and other services provided by the Company’s independent auditors.

In this context, the Audit Committee hereby reports as follows:

| | • | The then-current members of the Audit Committee reviewed and discussed the audited financial statements with the Company’s management and the independent auditors. |

| | • | The then-current members of the Audit Committee discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61 (Codification of Statements on Auditing Standard, AU 380). |

| | • | The then-current members of the Audit Committee discussed with the independent auditors the auditor’s independence from the Company and its management. The Audit Committee has received the written disclosures and the letter from the independent auditors required by Independence Standards Board Standard No. 1 (Independence Standards Board Standards No. 1, Independence Discussions with Audit Committees) and has discussed with the independent auditors the independent auditors’ independence. |

Audit Fees

Fees for the fiscal year 2001 audit and the review of Forms 10-Q were $197,000 of which an aggregate amount of $79,000 had been billed through December 31, 2001.

Financial Information Systems Design and Implementation Fees

There were no fees billed for financial information systems design and implementation rendered by Ernst & Young LLP for the fiscal year ended December 31, 2001.

All Other Fees

Aggregate fees billed for all other services rendered by Ernst & Young LLP for the fiscal year ended December 31, 2000 were $87,400.00. These fees related to accounting and tax consultations, as well as tax compliance services.

12

Based on the review and discussions referred to in paragraphs (1) through (3) above, the Audit Committee recommended to the Board of Directors, and the Board of Directors has approved, that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2001, for filing with the Securities and Exchange Commission. The Audit Committee and the Board of Directors have also recommended, subject to stockholder approval, the selection of Ernst & Young LLP, as the Company’s independent auditors.

Until October 2001, when Mr. Lockwood became executive vice chairman of InterTrust, each of the members of the Audit Committee was independent as defined under the listing standards of the Nasdaq National Market. The current members of the Audit Committee meet such independence standards.

Submitted by the current members of the Audit Committee:

Satish K. Gupta

Lester Hochberg

Robert Walker

13

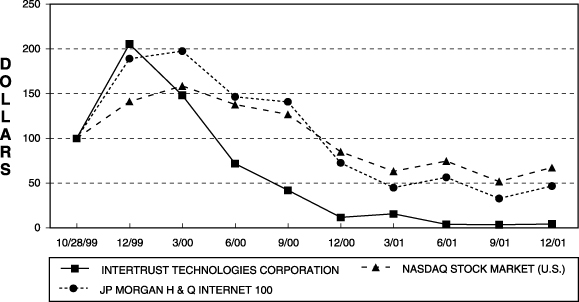

STOCK PERFORMANCE GRAPH

The graph set forth below compares the cumulative total stockholder return on the Company’s common stock between October 27, 1999 (the date the Company’s common stock commenced public trading) and December 31, 2001 with the cumulative total return of (i) the CRSP Total Return Index for the Nasdaq Stock Market (U.S. Companies) (the “Nasdaq Stock Market-U.S. Index”) and (ii) the J.P. Morgan H&Q Internet 100 Index (the “Internet Index”) over the same period. This graph assumes the investment of $100.00 on October 27, 1999, in the Company’s common stock, the Nasdaq Stock Market-U.S. Index and the Internet Index and assumes the reinvestment of dividends, if any.

The comparisons shown in the graph below are based upon historical data. The Company cautions that the stock price performance shown in the graph below is not indicative of, nor intended to forecast, the potential future performance of the Company’s common stock.

COMPARISON OF 26 MONTH CUMULATIVE TOTAL RETURN*

AMONG INTERTRUST TECHNOLOGIES CORPORATION,

THE NASDAQ STOCK MARKET (U.S.) INDEX AND THE JP MORGAN H&Q INTERNET 100 INDEX

The Company effected its initial public offering of common stock on October 26, 1999 at a price of $9.00 per share. The graph above, however, commences with the closing price of $27.188 per share on October 27, 1999—the date the Company’s common stock commenced public trading.

Notwithstanding anything to the contrary set forth in any of the Company’s previous or future filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate this Proxy Statement or future filings made by the Company under those statutes, the Compensation Committee Report and Stock Performance Graph shall not be deemed filed with the Securities and Exchange Commission and shall not be deemed incorporated by reference into any of those prior filings or into any future filings made by the Company under those statutes.

14

EXECUTIVE COMPENSATION AND RELATED INFORMATION

Compensation of Executive Officers

The following table presents information about compensation paid by the Company in 2001 for services by Victor Shear, the Company’s chief executive officer at December 31, 2001, David Lockwood, the Company’s current chief executive officer, and the Company’s four other highest-paid executive officers who were officers as of the end of fiscal year 2001, and one officer who ceased employment during the year (collectively the “Named Executive Officers”) whose total salary and bonus for the fiscal year exceeded $100,000:

Summary Compensation Table

| | | | | Annual Compensation

| | | Long-Term Compensation Awards

| |

Name and Principal Position

| | Year

| | Salary ($)

| | | Bonus ($)

| | Other Annual Compensation ($)

| | | Number of Securities Underlying Options (#)

| | All Other Compensation ($)

| |

Victor Shear Chairman of the Board, resigned as Chief Executive Officer in March 2002 | | 2001 2000 1999 | | $ | 280,000 249,375 175,000 | | | | — — — | | $ | 63,404 59,530 38,528 | (1) (2) (3) | | — — — | | | — — — | |

|

David Lockwood Vice Chairman of the Board, Chief Executive Officer and President | | 2001 2000 1999 | | | 53,333 — — | (4) | | | — — — | | | — — — | | | 2,625,000 30,000 — | | | — — — | |

|

Greg Wood Chief Financial Officer | | 2001 2000 1999 | | | 240,000 35,455 — | (5) | | | — — — | | | — — — | | | 75,000 360,000 — | | | — — — | |

|

Patrick Nguyen Executive Vice President | | 2001 2000 1999 | | | 233,600 183,650 162,400 | | | | — — — | | | — — — | | | 200,000 80,000 40,000 | | | — — — | |

|

David Ludvigson(6) Former President | | 2001 2000 1999 | | | 250,352 110,349 — | | | $ | 50,000 — — | | | — — — | | | 400,000 1,000,000 — | | $ | 75,249 — — | (7) |

|

Edmund J. Fish(8) Former Director, Executive Vice President and President MetaTrust Utility | | 2001 2000 1999 | | | 240,000 222,500 180,000 | | | | — — 200,000 | | | — — — | | | 300,000 125,000 — | | | — — — | |

|

Mark Ashida(9) Former Chief Operating Officer | | 2001 2000 1999 | | | 258,750 13,636 — | | | | — — — | | | — — — | | | 350,000 300,000 — | | | — — — | |

| (1) | | Represents $50,689 in rental and related payments, and $12,715 in leased car payments. |

| (2) | | Represents $47,895 in rental payments and $11,635 in leased car payments. |

| (3) | | Represents $24,568 in rental payments and $13,960 in leased car payments. |

| (4) | | Mr. Lockwood commenced employment with the Company in September, 2001 and became the Company’s Chief Executive Officer in March 2002. |

| (5) | | Mr. Wood commenced employment with the Company in November 2000. |

| (6) | | Mr. Ludvigson commenced employment with the Company in August 2000 and resigned his position as President in October 2001. |

| (7) | | Represents forgiveness of loan in the principal amount of $70,000 and interest of $5,249. $61,383 was forgiven as a severance benefit, and $13,866 was forgiven under the terms of the original employee loan agreement. |

| (8) | | Mr. Fish resigned his positions as Director, Executive Vice President and President of the MetaTrust Utility in May 2002. |

| (9) | | Mr. Ashida commenced employment with the Company in December 2000 and resigned his position as Chief Operating Officer in May 2002. |

15

Option Grants in Last Fiscal Year

The following table contains information concerning the stock option grants made to each of the Named Executive Officers in 2001. No stock appreciation rights were granted to these individuals during such year.

| | | Individual Grants(1)

| | | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term ($)(4)

|

Name

| | Number of Securities Underlying Options Granted (#)

| | | % of Total Options Granted to Employees in Fiscal Year(2)

| | | Exercise Price per Share ($/sh)(3)

| | Expiration Date

| | | 5%

| | 10%

|

| Victor Shear | | — | | | — | | | | — | | — | | | | — | | | — |

|

| David Lockwood | | 25,000 1,500,000 1,100,000 | | | 0.2 17.0 12.5 | % | | $ | 1.10 1.07 1.18 | | 6/21/11 9/24/11 10/31/11 | | | $ | 17,295 1,009,376 816,305 | | | |

|

| Edmund J. Fish | | 125,000 175,000 | (5) (5) | | 1.4 2.0 | | | | 3.75 1.10 | | 3/5/11 6/21/11 | | | | 294,794 121,062 | | $ | 747,067 306,795 |

|

| Greg Wood | | 75,000 | (5) | | 0.8 | | | | 1.10 | | 6/21/11 | | | | 51,884 | | | 131,483 |

|

| Mark Ashida | | 150,000 200,000 | (5) (5) | | 1.7 2.3 | | | | 3.29 1.10 | | 5/1/11 6/21/11 | | | | 310,359 138,356 | | | 786,512 350,623 |

|

| Patrick Nguyen | | 100,000 100,000 | (5) | | 1.1 1.1 | | | | 3.75 1.10 | | 3/5/11 9/11/11 | | | | 235,835 69,178 | | | 597,653 175,312 |

|

| David Ludvigson | | 200,000 200,000 | (5) | | 2.3 2.3 | | | | 3.75 1.10 | | 3/5/11 6/21/11 | (6) (7) | | | 471,671 138,356 | | | 1,195,307 350,623 |

| (1) | | The plan administrator has the discretionary authority to re-price the options through the cancellation of those options and the grant of replacement options with an exercise price based on the fair market value of the option shares on the re-grant date. The options have a maximum term of 10 years measured from the option grant date, subject to earlier termination in the event of the optionee’s cessation of service with the Company. Under each of the options, the option shares will vest upon acquisition of the Company by merger or asset sale, unless the acquiring entity or its parent corporation assumes the outstanding options or substitutes comparable options. |

| (2) | | Based on a total of 8,819,149 option shares granted to the Company’s employees and directors during 2001. |

| (3) | | The exercise price was equal to the fair market value of the Company’s Common Stock, based on the closing price of the Common Stock on the Nasdaq Stock Market, on the date of grant. The exercise price may be paid in cash, in shares of the Company’s Common Stock valued at fair market value on the exercise date or to the extent permitted by applicable law, through a cashless exercise procedure involving a same-day sale of the purchased shares or through a margin loan procedure involving a loan secured by the purchased shares with the proceeds of the loan used to pay the Company the exercise price for the purchased shares. The Company may also finance the option exercise by lending the optionee sufficient funds, to the extent permitted by applicable law, to pay the exercise price for the purchased shares, together with any federal and state income tax liability incurred by the optionee in connection with such exercise. |

| (4) | | The potential realizable value is calculated based on the ten-year term of the option at the time of grant. Stock price appreciation of 5% and 10% is assumed according to rules promulgated by the Securities and Exchange Commission and does not represent the Company’s prediction of the Company’s stock price performance. The potential realizable value at 5% and 10% appreciation is calculated by assuming that the exercise price on the date of grant appreciates at the indicated rate for the entire term of the option and that the option is exercised at the exercise price and sold on the last day of its term at the appreciated price. |

| (5) | | The option becomes exercisable in a series of equal monthly installments over a period of 48 months from the vesting commencement date. |

| (6) | | The option terminated on October 31, 2001. |

| (7) | | The options became fully vested and exercisable on October 31, 2001 and terminated on October 31, 2002 based on the terms of the Severance and Release Agreement dated October 31, 2001. |

16

Aggregate Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The table below presents for the Company’s Named Executive Officers the number and value of shares underlying unexercised options that were held by these Named Executive Officers as of December 31, 2001. No options or stock appreciation rights were exercised by these Named Executive Officers in 2001, and no stock appreciation rights were outstanding at the end of that year.

The figures in the value of unexercised in-the-money options at fiscal year-end column are based on the fair market value of the Company’s common stock at the end of 2001, less the exercise price payable for these shares. The fair market value for the Company’s common stock at the end of 2001 was $1.23 per share.

| | | Number of Securities Underlying Unexercised Options at Fiscal Year-End

| | Value of Unexercised In-the-Money Options at Fiscal Year-End

|

Name

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

| Victor Shear | | — | | — | | | — | | | — |

| David Lockwood | | 171,666 | | 2,483,334 | | $ | 19,395 | | $ | 278,864 |

| Edmund J. Fish | | 251,459 | | 343,543 | | | 63,002 | | | 19,906 |

| Greg Wood | | 106,875 | | 328,125 | | | 1,219 | | | 8,531 |

| Mark Ashida | | 121,875 | | 528,125 | | | 3,250 | | | 22,750 |

| Patrick Nguyen | | 314,999 | | 298,335 | | | 37,113 | | | 24,288 |

| David Ludvigson | | 520,831 | | — | | | 26,000 | | | — |

Employment Agreements, Change of Control Arrangements and Severance Agreements

In September 2002, the Compensation Committee granted Messrs. Nguyen and Wood a severance benefit equal to 100% of their respective gross annual salaries if they are terminated by a successor entity for reasons other than certain misconduct within one year following a corporate transaction.

In September 2001, the Company entered into an employment agreement with David Lockwood to serve as Executive Vice Chairman. The agreement provides for a base salary of $200,000 per year. In connection with his employment in September 2001, Mr. Lockwood received an option to acquire 1,500,000 shares at an exercise price of $1.07 per share. In the event of a change of control of the company, vesting will accelerate on 50% of such then unvested shares, unless consideration to the Company exceeds $5.00 per share in which case 100% of the then unvested shares will vest. Upon assumption of the additional role of President, in November 2001, Mr. Lockwood received an option to acquire an additional 1,100,000 shares at an exercise price of $1.18 per share. The November 2001 options will vest 100% in the event of a change of control.

Edmund Fish, the Company’s former President of the MetaTrust Utility, signed a Severance Agreement dated May 2, 2002 (the “Severance Agreement”) with the Company. In consideration for Mr. Fish’s agreement to comply with certain terms of his employment, confidentiality and invention assignment agreements with the Company, as well as other commitments set forth in the Severance Agreement, including a release of all claims against the Company, the Severance Agreement provided for the following severance benefits: (a) extension of the period to exercise his options from 90 days following his termination of employment to May 3, 2003; and (b) forgiveness of the remaining balance due of $105,989 under the promissory note executed by Mr. Fish in July 31, 2001.

Mr. Ashida, the Company’s former Chief Operating Officer, signed a Severance and Release Agreement dated May 15, 2002 (the “Severance Agreement”) with the Company. In consideration for Mr. Ashida’s agreement to comply with the terms of his employment, confidentiality and invention assignment agreements with the Company, as well as other commitments set forth in the Severance Agreement, including his release of all claims against the Company, the Severance Agreement provided for the following Severance benefits: (a) a payment equal to half of Mr. Ashida’s gross annual salary; (b) payment of Mr. Ashida’s COBRA health

17

insurance costs until July 13, 2003; and (c) forgiveness of the remaining balances due of $16,701 and $104,179 under two promissory notes dated July 1, 2001 and October 9, 2001, respectively.

Mr. Wood has an employment agreement with the Company that provides the following severance benefits: if Mr. Wood is terminated by the Company for reasons other than certain misconduct, in consideration for compliance with the Company’s confidentiality agreement and a release of claims against the Company, he will receive a cash severance payment equal to three months of base salary and an additional six months of vesting acceleration with respect to his initial option grant from the Company. In addition, if Mr. Wood is terminated by the Company for reasons other than cause in connection with an extraordinary corporate transaction, he will receive additional vesting acceleration with respect to his initial option grant from the Company, as if he provided 48 months of service with the Company.

Upon a corporate transaction of the Company, 100% of the then unvested shares of the Company’s common stock subject to the following options granted to certain Named Executive Officers will become vested: (a) June 22, 2001 options granted toMr. Wood for 75,000 shares of the Company’s common stock; (b) September 12, 2001 options granted to Mr. Lockwood for 400,000 shares of the Company’s common stock, and Messrs. Nguyen and Wood each for 300,000 shares of the Company’s common stock.

David Ludvigson, the Company’s former President, signed a Severance and Release Agreement dated October 31, 2001 (the “Severance Agreement”) with the Company. In consideration for Mr. Ludvigson’s agreement to comply with certain terms of his employment agreement with the Company and the Company’s confidentiality and invention agreement and his release of all claims against the Company, the Severance Agreement provided for the following severance benefits: (a) 100% vesting acceleration of his option to purchase 200,000 shares of the Company’s common stock granted on June 22, 2001 at an exercise price per share of $1.10; (b) extension of the term of this option to October 31, 2002; and (c) forgiveness of the remaining balance due of $61,383, under a promissory note executed by Mr. Ludvigson on August 14, 2000.

18

RELATED PARTY TRANSACTIONS

Since January 1, 2001, there has not been, nor is there currently proposed, any transaction or series of similar transactions to which the Company or any of its subsidiaries was or is to be a party in which the amount involved exceeded or will exceed $60,000 and in which any director, executive officer, holder of more than 5% of the common stock of the Company or any member of the immediate family of any of the foregoing persons had or will have a direct or indirect material interest other than (i) compensation agreements and other arrangements, which are described where required in Employment Contracts and Change in Control Arrangements and (ii) the transactions described below.

Options to Purchase Common Stock. In March 2001, we granted an option to purchase 100,000 shares of our common stock to Talal Shamoon, one of our executive officers, an option to purchase 80,000 shares of our common stock to Mark Scadina, one of our executive officers, an option to purchase 100,000 shares of our common stock to Patrick Nguyen, one of our executive officers, an option to purchase 65,000 shares of our common stock to David Maher, one of our executive officers, an option to purchase 125,000 shares of our common stock to Edmund Fish, one of our executive officers and one of our directors, and an option to purchase 200,000 shares of our common stock to David Ludvigson, a former executive officer, each at an exercise price of $3.75 per share. In May 2001, we granted an option to purchase 150,000 shares of our common stock to Mark Ashida, one of our executive officers, at an exercise price of $3.29 per share. In June 2001, we granted an option to purchase 75,000 shares of our common stock to Greg Wood, one of our executive officers, an option to purchase 150,000 shares of our common stock to Mr. Shamoon, an option to purchase 200,000 shares to Mr. Ludvigson, an option to purchase 175,000 shares of our common stock to Mr. Fish, an option to purchase 200,000 shares of our common stock to Mr. Ashida, and an option to purchase 100,000 shares of our common stock to Mr. Nguyen each at an exercise price of $1.10 per share. In September 2001, we granted an option to purchase 1,500,000 shares of our common stock to David Lockwood, one of our executive officers and one of our directors, at an exercise price of $1.07 per share. In November 2001, we granted an option to purchase 1,100,000 shares of our common stock to Mr. Lockwood at an exercise price of $1.18 per share. In January 2002, we granted an option to purchase 300,000 shares of our common stock to Mr. Shamoon, an option to purchase 275,000 shares of our common stock to Mr. Scadina, an option to purchase 300,000 shares of our common stock to Mr. Nguyen, an option to purchase 300,000 shares of our common stock to Mr. Maher, an option to purchase 300,000 shares of our common stock to Mr. Fish, an option to purchase 300,000 shares of our common stock to Mr. Wood, an option to purchase 400,000 shares of our common stock to Mr. Lockwood, and an option to purchase 300,000 shares of our common stock to Mr. Ashida at an exercise price of $1.22 per share.

Loan and Forgiveness of Loan of Executive Officer. In August 2000, our Compensation Committee agreed to forgive a $70,000 loan of David Ludvigson our former president. The loan was forgiven as follows: $12,000 in principal plus interest earned of $1,866 on January 1, 2001 according to the original loan document; and $58,000 in principal plus $3,383 in interest on October 31, 2001 as a provision of the Severance and Release agreement.

In March 2002, our Compensation Committee agreed to assume two loans to Mark Ashida during 2001, our former Chief Operating Officer, totaling $200,000. The first loan was a full-recourse, unsecured promissory note for $100,000 accruing interest at 7%, and is forgivable at $50,000 in January 2002 and $8,333 per month beginning in February 2002 as long as the officer is employed with the company (the “First Note”). The second note was a full-recourse unsecured promissory note for $100,000 accruing interest at 7%, and is forgivable at $50,000 on October 9, 2002 and on October 9, 2003 as long as the officer is employed with the company (the “Second Note”). The loans were forgiven as follows: $83,334 in principal plus interest earned of $4,374 on May 15, 2002 according to the First Note; $16,666 in principal plus interest earned of $35. pursuant to the First Note on May 15, 2002 as a provision of his Severance Agreement; $100,000 in principal plus interest earned of $4,179 under the Second Note on May 15, 2002 pursuant to the provisional of his Severance and Agreement.

19

In July 2001 we made a loan to Edmund Fish, another one of our executive officers. The loan is a full-recourse, unsecured promissory note for $100,000 accruing interest at 7%. The entire principal and accrued interest is due on July 30, 2004.

In May 2002, the Compensation Committee agreed to forgive a loan made to Edmund Fish, our former president of the MetaTrust Utility. The loan was forgiven as follows: $100,000 in principal plus interest earned of $5,489 as a provision of the Severance Agreement.

Loans to Directors. In December 2000, we loaned $100,000 to Bruce Fredrickson, a former non-employee director. The loans are in the form of a full-recourse note which accrues interest at the rate of 6.10% per year and was due in December 2001.

In January 2001, we sold 4,000,000 shares of common stock at $5.00 per share, fair market value, to Nokia Finance International B.V., a subsidiary of Nokia Corporation (“Nokia”), for total cash consideration of $20 million. In connection with its investment, Nokia agreed to license our DRM solutions and selected us as its preferred DRM technology. Additionally, per the agreement, we have appointed an executive officer of Nokia to our board of directors. During the fourth quarter of 2001 the two parties agreed to terminate the license, and we recognized $750,000 received from Nokia for the license as other income.

The Company’s Certificate of Incorporation limits the liability of its directors for monetary damages arising from a breach of their fiduciary duty as directors, except to the extent otherwise required by the Delaware General Corporation Law. Such limitation of liability does not affect the availability of equitable remedies such as injunctive relief or rescission.

The Company’s Bylaws provide that the Company shall indemnify its directors and officers to the fullest extent permitted by Delaware law, including in circumstances in which indemnification is otherwise discretionary under Delaware law. The Company has also entered into indemnification agreements with its officers and directors containing provisions that may require the Company, among other things, to indemnify such officers and directors against certain liabilities that may arise by reason of their status or service as directors or officers and to advance their expenses incurred as a result of any proceeding against them as to which they could be indemnified.

COMPLIANCE WITH SECTION 16(a) OF THE EXCHANGE ACT

The members of the Board of Directors, the executive officers of the Company and persons who hold more than ten percent (10%) of the Company’s outstanding common stock are subject to the reporting requirements of Section 16(a) of the Securities Exchange Act of 1934, as amended, which require them to file reports with respect to their ownership of the Company’s common stock and their transactions in such common stock. Based upon (i) the copies of Section 16(a) reports that the Company received from such persons for their 2001 fiscal year transactions in the common stock and their common stock holdings and (ii) the written representations received from one or more of such persons regarding their Section 16(a) reports for the 2001 fiscal year, the Company believes that all reporting requirements under Section 16(a) for such fiscal year were met in a timely manner by its executive officers, Board members and greater than ten percent (10%) stockholders, except that (i) Bruce Fredrickson, a former Director, filed a Form 4 in March 2002 disclosing eight transactions that took place in May 2001 and February 2001, (ii) David Lockwood filed a Form 4 in March 2002 disclosing two transactions that took place in November 2001 and September 2001, (iii) David Maher filed an amended Form 3 in March 2002 disclosing one transaction that took place in October 1999, (iv) Patrick Nguyen filed a Form 4 in March 2002 disclosing 1 transaction that took place in February 2001, and (v) Talal Shamoon filed an amended Form 3 in March 2002 disclosing one transaction that took place in October 1999.

20

FORM 10-K

THE COMPANY WILL MAIL WITHOUT CHARGE, UPON WRITTEN REQUEST, A COPY OF THE COMPANY’S ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 31, 2001, INCLUDING THE FINANCIAL STATEMENTS, SCHEDULE AND LIST OF EXHIBITS. REQUESTS SHOULD BE SENT TO INTERTRUST TECHNOLOGIES CORPORATION, 4800 PATRICK HENRY DRIVE, SANTA CLARA, CALIFORNIA 95054, ATTN: INVESTOR RELATIONS.

STOCKHOLDER PROPOSALS FOR 2003 ANNUAL MEETING

Proposals of stockholders intended to be presented at the 2003 Annual Meeting of Stockholders of the Company must be received by the Company at its offices at InterTrust Technologies Corporation, 4800 Patrick Henry Drive, Santa Clara, California 95054, Attn: General Counsel, not later than June 27, 2002 and satisfy the conditions established by the Securities and Exchange Commission for stockholder proposals to be included in the Company’s proxy statement for that meeting. Pursuant to new amendments to Rule 14a-4(c) of the Securities Exchange Act of 1934, as amended, if a stockholder who intends to present a proposal at the 2003 Annual Meeting of Stockholders does not notify the Company of such proposal on or prior to [September 10,] 2003, at its offices at 4800 Patrick Henry Drive, Santa Clara, California 95054, Attn: General Counsel, then management proxies would be allowed to use their discretionary voting authority to vote on the proposal when the proposal is raised at the annual meeting, even though there is no discussion of the proposal in the Company’s proxy statement for that meeting. The Company currently believes that the 2003 Annual Meeting of Stockholders will be held during the last week of November 2003.

21

OTHER MATTERS

The Board knows of no other matters to be presented for stockholder action at the Annual Meeting. However, if other matters do properly come before the Annual Meeting or any adjournments or postponements thereof, the Board intends that the persons named in the proxies will vote upon such matters in accordance with their best judgment.

BY ORDER OF THE BOARD OF DIRECTORS, Victor Shear Chairman of the Board |

Santa Clara, California

November 15, 2002

|

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE COMPLETE, SIGN, DATE AND PROMPTLY RETURN THE ACCOMPANYING PROXY IN THE ENCLOSED POSTAGE-PAID ENVELOPE. YOU MAY REVOKE YOUR PROXY AT ANY TIME PRIOR TO THE ANNUAL MEETING. IF YOU DECIDE TO ATTEND THE ANNUAL MEETING AND WISH TO CHANGE YOUR PROXY VOTE, YOU MAY DO SO AUTOMATICALLY BY VOTING IN PERSON AT THE MEETING. THANK YOU FOR YOUR ATTENTION TO THIS MATTER. YOUR PROMPT RESPONSE WILL GREATLY FACILITATE ARRANGEMENTS FOR THE ANNUAL MEETING. |

|

22

Appendix A

INTERTRUST TECHNOLOGIES CORPORATION

AUDIT COMMITTEE CHARTER

Statement of Policy

There shall be an Audit Committee, comprised of at least two independent directors reporting to and assisting the Board of Directors in the proper discharge of their statutory and fiduciary responsibilities.

Roles

The primary roles in the Committee shall be to:

| • | | Assist the Board of Directors in fulfilling its fiduciary responsibilities for the integrity of financial reporting and the adequacy of internal controls. |

| • | | Serve as focal point for communications among non-committee directors, Company’s management and the independent accountants. |

| • | | Function as an agent for the Board of Directors to help ensure the independence of the Company’s independent accountants, the integrity of management and the adequacy of disclosure to stockholders. |

| • | | The audit committee shall have the power to conduct or authorize investigations into any matters within the committee’s scope of responsibilities. The committee shall be empowered to retain independent counsel, accountants, or others to assist it in the conduct of any investigation. |

| • | | The committee will perform such other functions as assigned by law, the Company’s charter or bylaws, or Board of Directors. |

Responsibilities

| 1. | | Oversight of Financial Reporting Process: |

| | a. | | Ensure that management has established corporate ethical standards dealing with financial reporting integrity. |

| | b. | | Review with management and the independent accountants at the completion of annual examination: |

| | i. | | The Company’s annual financial statements and related footnotes. |

| | ii. | | The independent accountants’ audit of the financial statements and their report thereon. |

| | iii. | | Any significant changes required in the independent accountants’ audit plan. |

| | iv. | | Any serious difficulties or disagreements that arose between the auditors and management during the course of the audit. |

| | v. | | Other matters related to the conduct of the audit which are to be communicated to the committee under generally accepted auditing standards. |

| | c. | | Review Company’s interim financial information to stockholders and regulatory agencies. Pay particular attention to judgmental, high-risk, and sensitive areas in the financial statements. |

| | d. | | Review significant matters arising since previous audit reports. |

| | e. | | Review and discuss with management any threatened, pending or ongoing litigation which may result in a material financial impact to the Company. |

| | f. | | Review, in consultation with the independent accountants, the adequacy of the Company’s accounting principles, policies and practices. |

A-1

| | g. | | Review the impact of new accounting pronouncements or reporting practices relevant to the Company and other matters of interest. |

| | h. | | Review non-audit services performed by the independent accountants to consider what effect, if any, said activities could have on their independence. |

| | i. | | Review the scope and fees of audits and non-audit services of the independent accountants. |

| | j. | | Recommend to the Board of Directors the appointment of the independent accountants. |

| 2. | | Oversight of the Internal Controls: |

| | a. | | Evaluate the general procedures and practices of the Company to ensure the adequacy of internal controls, including the security surrounding assets and computerized information systems. |

| | b. | | Consider the findings and comments from the independent accountants on internal controls and review the status of prior period audit recommendations made by the independent accountants. |

| | c. | | Review the adequacy of the policies and practices related to: |

| | iii. | | Compliance with key regulatory issues. |

| 3. | | Committee Meetings and Reporting |

The Audit Committee shall hold such meetings periodically as the Committee deems necessary, but no less than two times annually. The Committee Chairman shall request that members of management and representatives of the independent accountants be present at the meetings of the Committee. Such meetings shall provide executive sessions with the independent accountants.

Semi-annually, the Committee shall report to the Board of Directors outlining its activities, future plans and any significant matters brought forth by the independent accountants.

A-2

1915-PS-01

PROXY | | INTERTRUST TECHNOLOGIES CORPORATION | | PROXY |

4800 Patrick Henry Drive

Santa Clara, California 95054

This Proxy is Solicited on Behalf of the Board of Directors of InterTrust Technologies Corporation for the Annual Meeting of Stockholders to be held December 18, 2002

The undersigned holder of Common Stock, par value $.001, of InterTrust Technologies Corporation (the “Company”) hereby appoints Victor Shear and David Lockwood, or either of them, proxies for the undersigned, each with full power of substitution, to represent and to vote as specified in this Proxy all Common Stock of the Company that the undersigned stockholder would be entitled to vote if personally present at the Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Wednesday, December 18, 2002, 9:00 a.m. local time, at the Westin Santa Clara, 5101 Great America Parkway, Santa Clara, California, and at any adjournments or postponements of the Annual Meeting. The undersigned stockholder hereby revokes any proxy or proxies heretofore executed for such matters.

This proxy, when properly executed, will be voted in the manner as directed herein by the undersigned stockholder. IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED FOR THE ELECTION OF THE DIRECTORS, AND FOR PROPOSAL 2, AND IN THE DISCRETION OF THE PROXIES AS TO ANY OTHER MATTERS THAT MAY PROPERLY COME BEFORE THE MEETING. The undersigned stockholder may revoke this proxy at any time before it is voted by delivering to the Corporate Secretary of the Company either a written revocation of the proxy or a duly executed proxy bearing a later date, or by appearing at the Annual Meeting and voting in person.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF THE DIRECTORS AND “FOR” PROPOSAL 2.

PLEASE MARK, SIGN, DATE AND RETURN THIS CARD PROMPTLY USING THE ENCLOSED RETURN ENVELOPE. If you receive more than one proxy card, please sign and return ALL cards in the enclosed envelope.

(CONTINUED AND TO BE SIGNED ON REVERSE SIDE)

(Reverse)

INTERTRUST TECHNOLOGIES CORPORATION

| x | | Please mark votes as in this example |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF THE DIRECTORS AND “FOR” PROPOSAL 2.

| 1. | | To elect the following directors to serve for a term ending upon the 2003 Annual Meeting of Stockholders or until their successors are elected and qualified: |

| | Nominees: | | Victor Shear, David Lockwood, David C. Chance, Satish K. Gupta, Curt Hessler, Lester Hochberg, Timo Ruikka, and Robert Walker. |

¨ For all nominees except as noted above.

| 2. | | To ratify the appointment of Ernst & Young LLP as the Company’s independent auditors for the fiscal year ending December 31, 2002. |

In their discretion, the proxies are authorized to vote upon such other business as may properly come before the Annual Meeting.

The undersigned acknowledges receipt of the accompanying Notice of Annual Meeting of Stockholders and Proxy Statement.

Signature: | | Signature (if held jointly): |

Date: , 2002

Please date and sign exactly as your name(s) is (are) shown on the share certificate(s) to which the Proxy applies. When shares are held by joint-tenants, both should sign. When signing as an executor, administrator, trustee, guardian, attorney-in fact or other fiduciary, please give full title as such. When signing as a corporation, please sign in full corporate name by President or other authorized officer. When signing as a partnership, please sign in partnership name by an authorized person.