Exhibit 99.2

Cleco Corporation

Berenson & Company and The Williams Capital Group Southeast Seminar March 23, 2005

David M. Eppler President & CEO

Forward-Looking Statements

This presentation contains forward-looking statements about future results and circumstances with respect to which there are many risks and uncertainties.

Although the company believes that expectations reflected in such forward-looking statements are based on reasonable assumptions, we can give no assurances that these expectations will prove to be correct or that other benefits anticipated in the forward-looking statements will be achieved. For a discussion of risk factors and other factors that may cause the company’s actual results to differ materially from those contemplated in its forward-looking statements, please refer to the company’s filings with the SEC.

2

Agenda

2004 accomplishments Strategic overview Cleco Power Cleco Midstream Cleco’s financials:

Stock performance Earnings Metrics

3

Cleco’s Story

Premier regional energy provider Experienced management team Leading Louisiana utility

Stable customer base RFP process under way

Long record of providing solid returns to shareholders

4

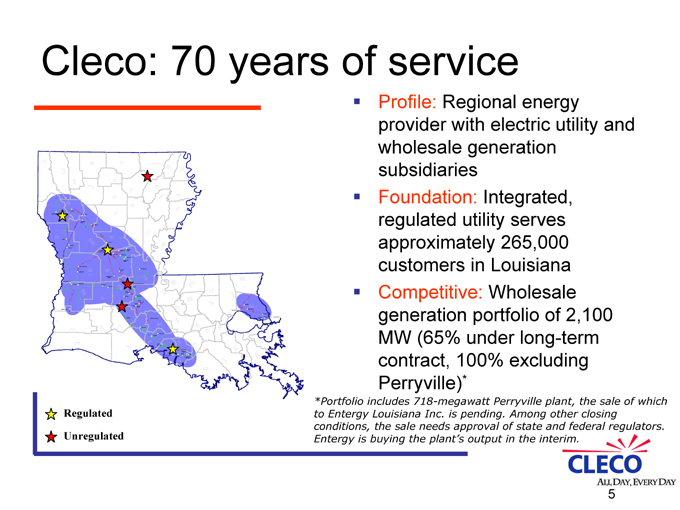

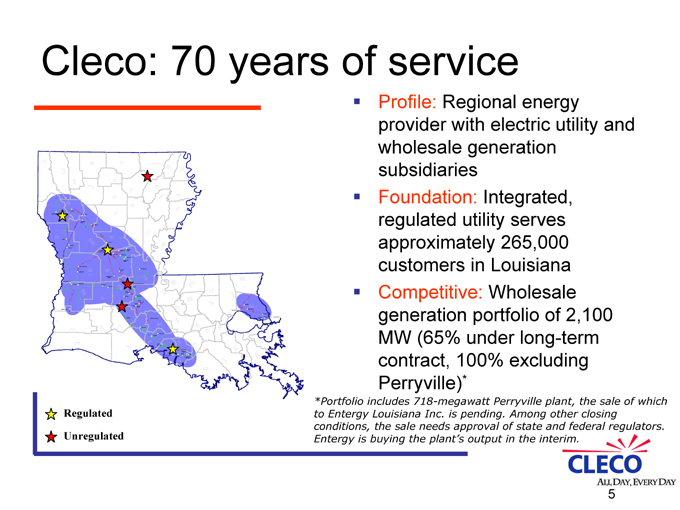

Cleco: 70 years of service

Profile: Regional energy provider with electric utility and wholesale generation subsidiaries

Foundation: Integrated, regulated utility serves approximately 265,000 customers in Louisiana

Competitive: Wholesale generation portfolio of 2,100 MW (65% under long-term contract, 100% excluding Perryville)*

Regulated

Unregulated

*Portfolio includes 718-megawatt Perryville plant, the sale of which to Entergy Louisiana Inc. is pending. Among other closing conditions, the sale needs approval of state and federal regulators.

Entergy is buying the plant’s output in the interim.

5

2004 Top Accomplishments

Strengthened balance sheet Improved liquidity Executed Perryville sale agreement Received third consecutive EEI award Ranked among top investor-owned utilities in customer satisfaction

6

Strategic Overview

Grow regulated utility

Secure cost-effective, diversified fuel supply Position utility among leaders in customer service, reliability Grow utility through economic development

Maximize earnings and cash flow from wholesale generation assets Maintain investment grade rating

7

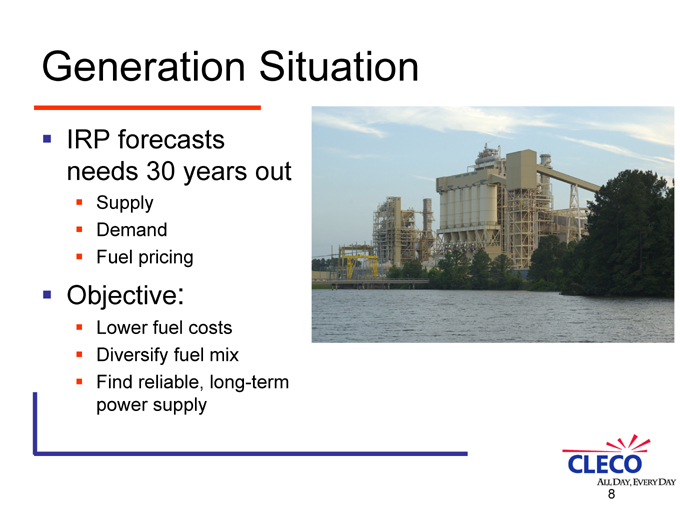

Generation Situation

IRP forecasts needs 30 years out

Supply Demand Fuel pricing

Objective:

Lower fuel costs Diversify fuel mix Find reliable, long-term power supply

8

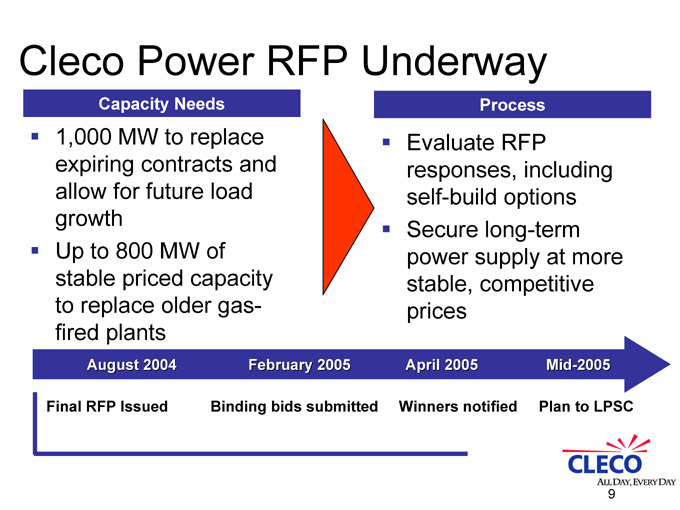

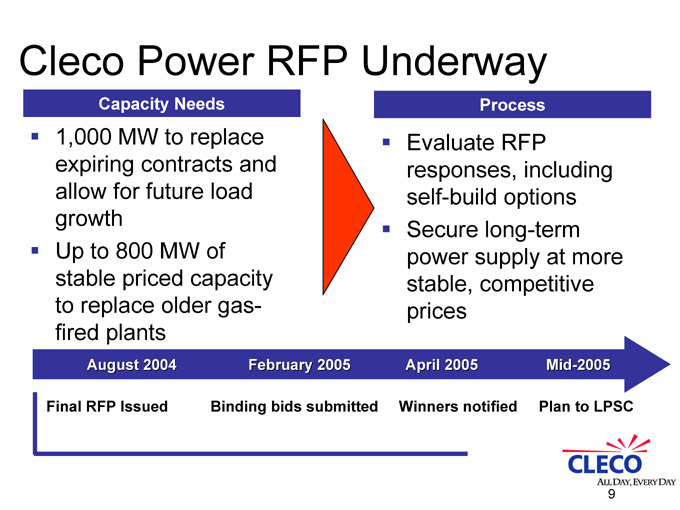

Cleco Power RFP Underway

Capacity Needs

1,000 MW to replace expiring contracts and allow for future load growth Up to 800 MW of stable priced capacity to replace older gas-fired plants

Process

Evaluate RFP responses, including self-build options Secure long-term power supply at more stable, competitive prices

August 2004

February 2005

April 2005

Mid-2005

Final RFP Issued

Binding bids submitted

Winners notified

Plan to LPSC

9

Strengthening Customer Bonds

Aligning organization to enhance community, customer relations Combining customer care and distribution functions Giving local managers more decision-making authority Empowering employees to address customer service issues Keeping centralized functions in key areas

10

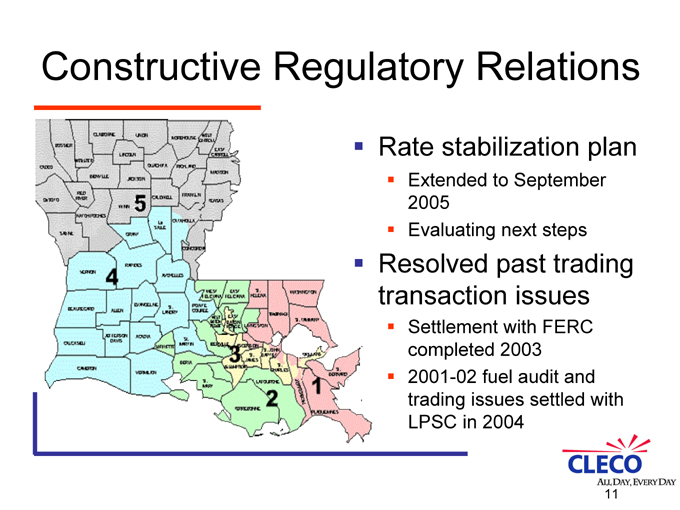

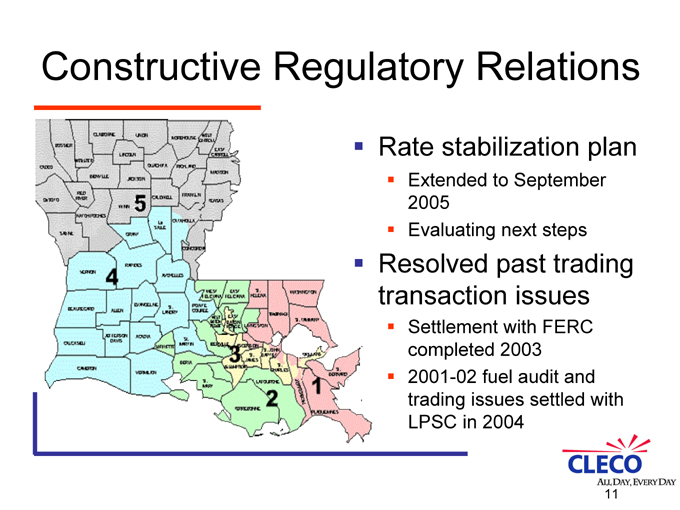

Constructive Regulatory Relations

Rate stabilization plan

Extended to September 2005 Evaluating next steps

Resolved past trading transaction issues

Settlement with FERC completed 2003 2001-02 fuel audit and trading issues settled with LPSC in 2004

11

Economic Success

Economic growth expected to be slow, steady Ranked by Site Selection magazine among Top 10 utilities in attracting capital investment on a per capita basis in 2003 Experiencing success $125 million Procter & Gamble expansion

3 Procter & Gamble vendors built new plants adjacent to expansion – total $52 million. $100 million Union Tank Car Co. plant

12

Midstream Operations

Maximizing cash flow and earnings from remaining assets Restructuring efforts

Sale of Cleco Energy

Monitoring counterparty risk

Williams

Improving credit picture

Calpine

Selling assets, contracts to meet debt obligations

13

Perryville Sale Pending

Sale to Entergy Louisiana Inc. pending LPSC and federal approvals

Concurrent Chapter 11 filing of Perryville subs FERC decided restructured deal not jurisdictional Entergy currently purchasing plant’s output

Mirant 2003 bankruptcy filing resulted in default on Perryville’s $133 million project bank loan Recognized $91 million after-tax impairment charge in 2003 Continue to pursue damages resulting from Mirant rejection of tolling agreement

14

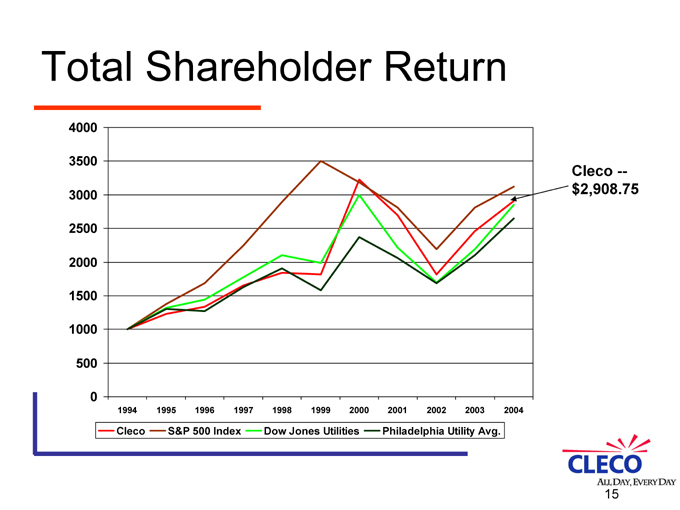

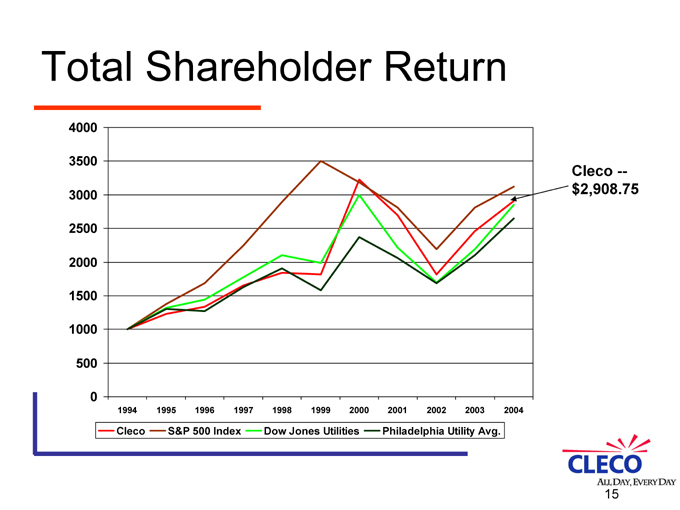

Total Shareholder Return

4000 3500 3000 2500 2000 1500 1000 500 0

1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004

Cleco

S&P 500 Index

Dow Jones Utilities

Philadelphia Utility Avg.

Cleco —$2,908.75

15

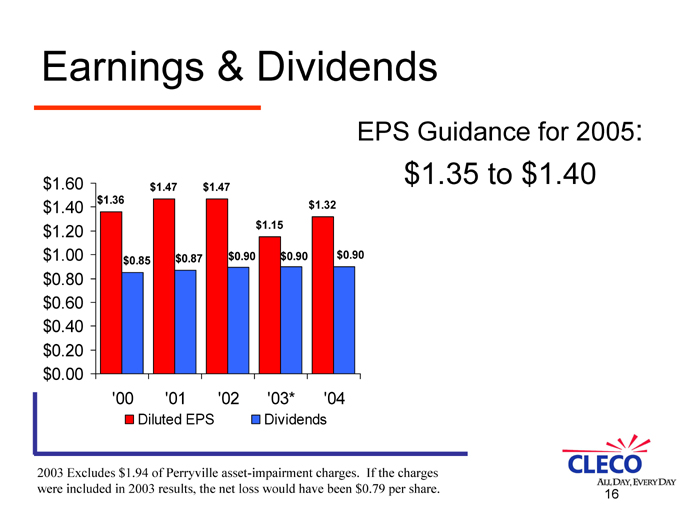

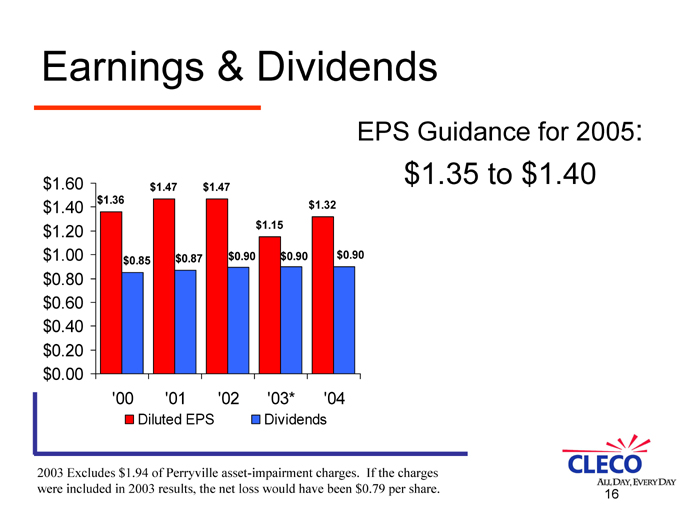

Earnings & Dividends $1.60 $1.40 $1.20 $1.00 $0.80 $0.60 $0.40 $0.20 $0.00

‘00 ‘01 ‘02 ‘03* ‘04

Diluted EPS

Dividends $1.36 $0.85 $1.47 $0.87 $1.47 $0.90 $1.15 $0.90 $1.32 $0.90

EPS Guidance for 2005: $1.35 to $1.40

2003 Excludes $1.94 of Perryville asset-impairment charges. If the charges were included in 2003 results, the net loss would have been $0.79 per share.

16

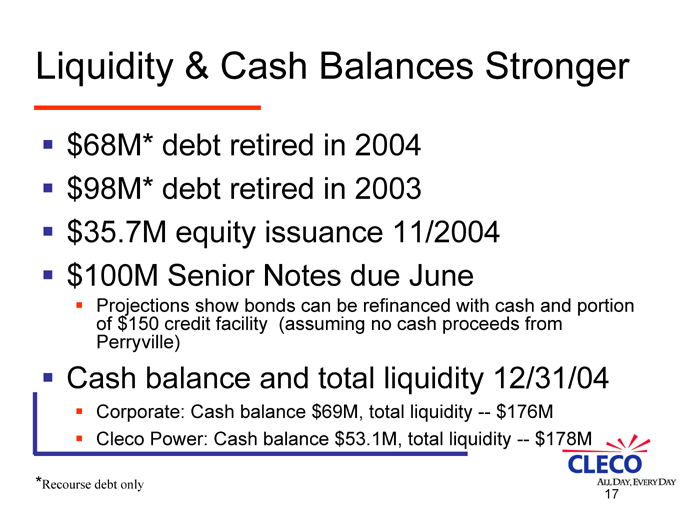

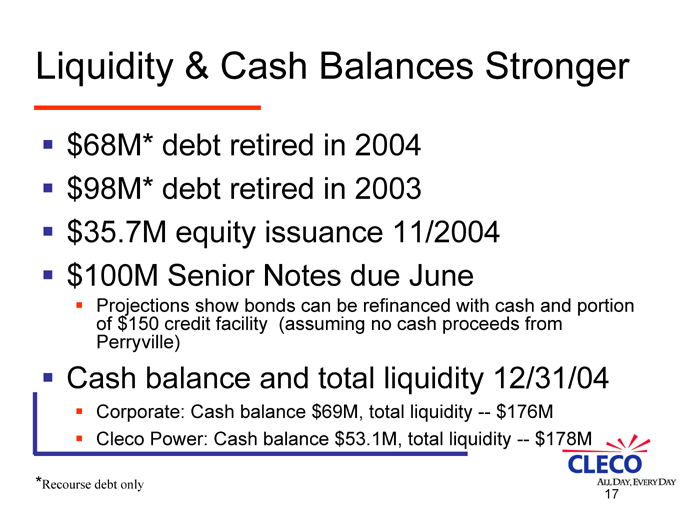

Liquidity & Cash Balances Stronger $68M* debt retired in 2004 $98M* debt retired in 2003 $35.7M equity issuance 11/2004 $100M Senior Notes due June

Projections show bonds can be refinanced with cash and portion of $150 credit facility (assuming no cash proceeds from Perryville)

Cash balance and total liquidity 12/31/04

Corporate: Cash balance $69M, total liquidity — $176M Cleco Power: Cash balance $53.1M, total liquidity — $178M

* Recourse debt only

17

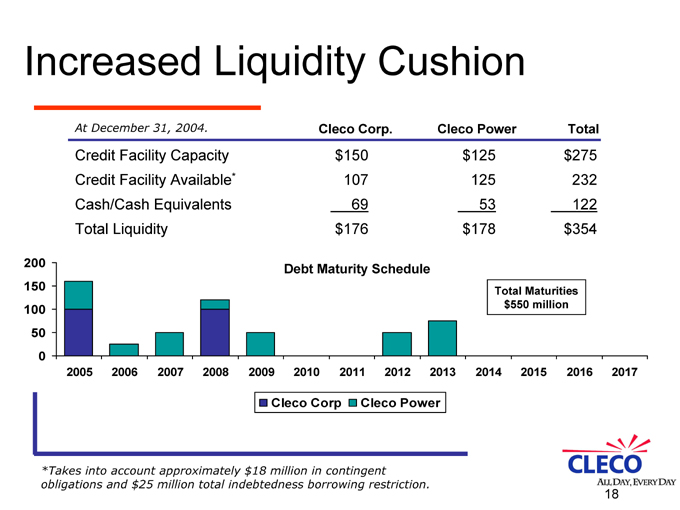

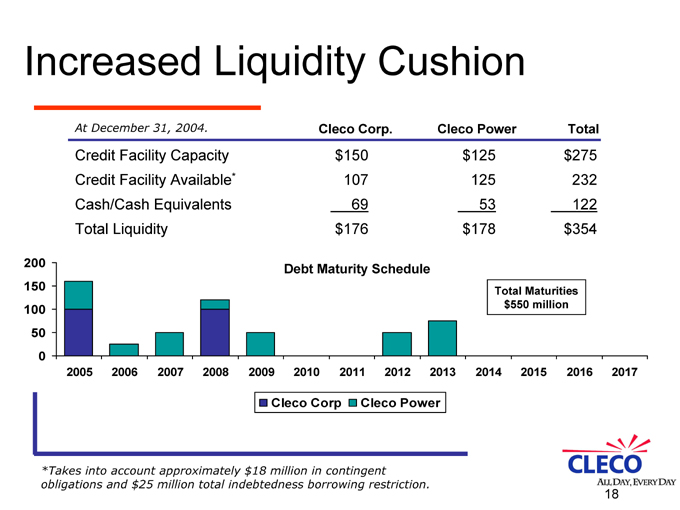

Increased Liquidity Cushion

At December 31, 2004. Cleco Corp. Cleco Power Total

Credit Facility Capacity $150 $125 $275

Credit Facility Available* 107 125 232

Cash/Cash Equivalents 69 53 122

Total Liquidity $176 $178 $354

200 150 100 50 0

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

Debt Maturity Schedule

Total Maturities $550 million

Cleco Corp

Cleco Power

*Takes into account approximately $18 million in contingent obligations and $25 million total indebtedness borrowing restriction.

18

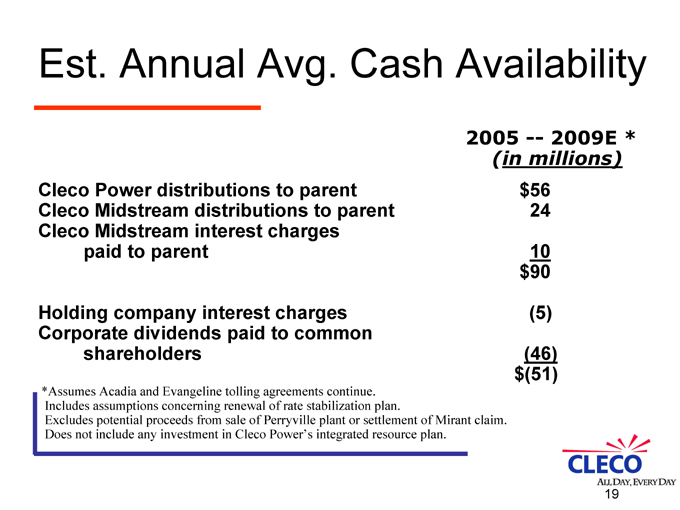

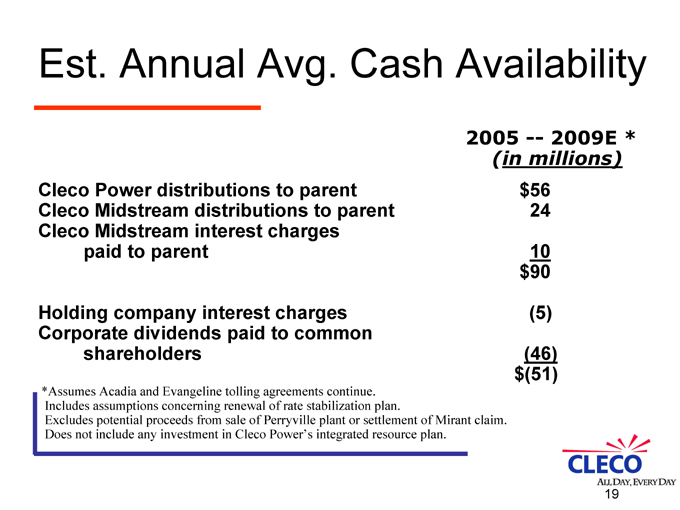

Est. Annual Avg. Cash Availability

2005 — 2009E *

(in millions)

Cleco Power distributions to parent $56

Cleco Midstream distributions to parent 24

Cleco Midstream interest charges paid to parent 10

$90

Holding company interest charges (5)

Corporate dividends paid to common shareholders (46)

$(51)

*Assumes Acadia and Evangeline tolling agreements continue. Includes assumptions concerning renewal of rate stabilization plan.

Excludes potential proceeds from sale of Perryville plant or settlement of Mirant claim. Does not include any investment in Cleco Power’s integrated resource plan.

19

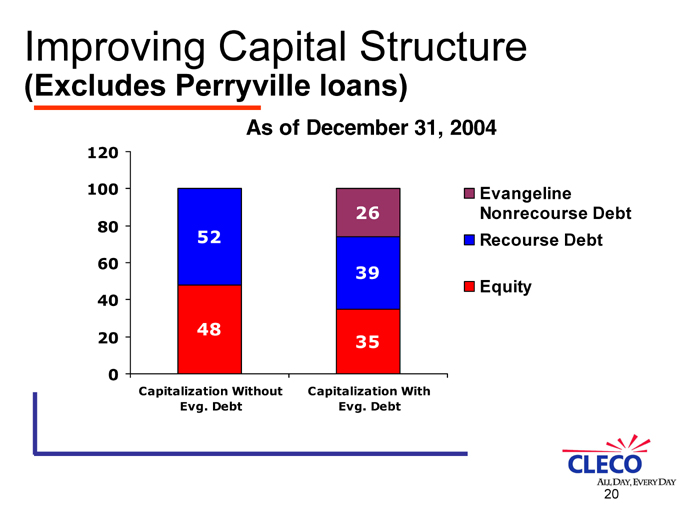

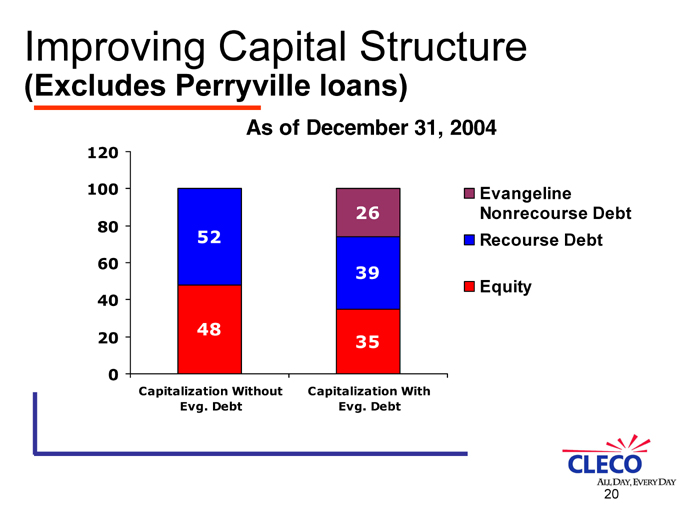

Improving Capital Structure

(Excludes Perryville loans)

As of December 31, 2004

120 100 80 60 40 20 0

Capitalization Without Evg. Debt

Capitalization With Evg. Debt

52

48

26

39

35

Evangeline Nonrecourse Debt

Recourse Debt

Equity

20

Preserving Shareholder Value

Strategy focused on utility

Historically stable regulatory environment Solid financial picture Proven leadership team Near-term challenges

Cleco Power RFP outcome/rate plan Completion of Perryville sale

Ongoing credit condition of Acadia and Evangeline counterparties Resolution of dispute between Acadia and Calpine Energy Services

21

All Day, EveryDay

22