AS FILED ELECTRONICALLY WITH THE SECURITIES AND EXCHANGE COMMISSION ON AUGUST 1, 2008

SECURITIES ACT FILE NO. 333–

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

| | | | |

| ¨ | | Pre-Effective Amendment No. | | |

| ¨ | | Post-Effective Amendment No. | | |

MANAGERS AMG FUNDS

(Exact Name of Registrant as Specified in Charter)

800 Connecticut Avenue, Norwalk, Connecticut 06854

(Address of Principal Executive Offices)

(800) 299-3500

(Registrant’s Telephone Number, Including Area Code)

Donald S. Rumery

Managers AMG Funds

800 Connecticut Avenue, Norwalk, Connecticut 06854

(Name and Address of Agent for Service)

Copy to: Daniel O. Hirsch, Esq.

Ropes & Gray LLP

One Metro Center

700 12th Street, NW, Suite 900

Washington, DC 20005

Title of Securities being Registered: shares of beneficial interest, $0.001 par value per share.

It is proposed that this filing will become effective on September 2, 2008, pursuant to Rule 488.

Approximate Date of Proposed Public Offering: As soon as practicable after this Registration Statement becomes effective.

No filing fee is required because an indefinite number of shares of the Registrant have previously been registered pursuant to Section 24(f) of the Investment Company Act of 1940, as amended.

| | | | |

| | NOTICE: PLEASE COMPLETE THE ENCLOSED PROXY BALLOT AND RETURN IT AS SOON AS POSSIBLE. | | |

BNY HAMILTON FUNDS, INC.

c/o The Bank of New York Mellon Corporation

One Wall Street

New York, New York 10286

BNY HAMILTON MULTI-CAP EQUITY FUND

BNY HAMILTON MUNICIPAL ENHANCED YIELD FUND

Meeting of Shareholders

To Be Held on October 15, 2008

Dear Valued Shareholder:

You are cordially invited to attend a special shareholder meeting of the BNY Hamilton Multi-Cap Equity Fund and the BNY Hamilton Municipal Enhanced Yield Fund (throughout this letter and the related proxy materials we refer to such funds as the “Existing Funds”), each a series of BNY Hamilton Funds, Inc. (“BNY Hamilton Funds”) to be held on October 15, 2008. I would like to provide you with additional background and ask for your vote on an important proposal affecting the Existing Funds.

BNY Hamilton Funds, a Maryland corporation and registered investment company advised by The Bank of New York Mellon Corporation (“BNY”), and Managers AMG Funds (“Managers AMG Funds”), a Massachusetts business trust and registered investment company advised by Managers Investment Group LLC (“Managers”), have each approved a proposed reorganization whereby each Existing Fund, each a series of BNY Hamilton Funds, would be reorganized into a new series of Managers AMG Funds (each a “Reorganization” and collectively the “Reorganizations”). The Reorganizations arise out of the Acquisition (defined below), and are expected to close on or about November 10, 2008, or sooner. The portfolios of the Existing Funds are managed by Gannett Welsh & Kotler, LLC (“GW&K”), a wholly-owned subsidiary of BNY, as subadvisor to the Existing Funds. Managers is an independently managed subsidiary of Affiliated Managers Group, Inc. (“AMG”). AMG and BNY have signed an agreement whereby AMG will acquire ownership of GW&K from BNY (the “Acquisition”). In connection with the Acquisition, a broad group of GW&K professionals will hold an equity interest in the firm and have entered into long-term employment agreements with the firm and AMG. As a result of the Acquisition, there will be a change in control of GW&K. GW&K, under its new ownership, will succeed to the registration of GW&K as an investment adviser. The Acquisition is scheduled to be consummated in October 2008, or sooner, subject to certain conditions.

In connection with the Acquisition, the Board of Directors of BNY Hamilton Funds, including a majority of the Directors who are not “interested persons” of BNY Hamilton Funds, as defined by the Investment Company Act of 1940, as amended (the “Independent Directors”), and the Board of Trustees of Managers AMG Funds formally approved the Reorganizations on July 24, 2008 and July 29, 2008, respectively. To carry out the Reorganizations, Managers AMG Funds is creating two new funds with substantially similar investment objectives, strategies and policies as the two Existing Funds. The

two funds are called the GW&K Multi-Cap Equity Fund and the GW&K Municipal Enhanced Yield Fund, and are part of the family of mutual funds advised by Managers (the “Managers Funds”). Throughout this letter and the related proxy materials we refer to the GW&K Multi-Cap Equity Fund and the GW&K Municipal Enhanced Yield Fund as the “New Funds.” We are seeking your approval of the Reorganizations to reorganize each Existing Fund into the corresponding New Fund. We expect that the Reorganizations will occur after the Acquisition. Because the consummation of the Acquisition will cause the Existing Funds’ subadvisory agreements with GW&K to terminate, shareholders of each Existing Fund are also being asked to approve proposed subadvisory agreements with GW&K. Approval of the proposed subadvisory agreements will continue the Existing Funds’ current subadvisory agreements with GW&K, which will allow each Existing Fund’s current management to continue uninterrupted between the closings of the Acquisition and the Reorganizations. Information regarding the Reorganizations and the proposed subadvisory agreements is contained in the enclosed proxy materials.

In each Reorganization, the Existing Fund will transfer all of its assets to the corresponding New Fund. In exchange for these assets, the New Fund will assume all of the liabilities of the Existing Fund and deliver to shareholders of the Existing Fund shares of the New Fund with a value equal to the value of the Existing Fund shares immediately prior to the Reorganization. Each Reorganization is expected to qualify as a tax-free transaction. Managers and GW&K have agreed that GW&K will pay the expenses of the Reorganizations, including proxy solicitation costs, so that shareholders of the BNY Hamilton Funds and Managers AMG Funds will not bear any of these costs.

BNY has indicated that it is not willing to continue to serve indefinitely as investment adviser to the Existing Funds following the Acquisition. A primary purpose of the Reorganizations is to bring the Existing Funds into the Managers Funds family in order to permit GW&K, which has managed each Existing Fund (or its predecessor) since such Fund’s inception and which will be affiliated with Managers after the Acquisition, to continue to provide day-to-day portfolio management services to shareholders of the New Funds. Pursuant to the Reorganizations, Managers will serve as the investment manager to each New Fund, and GW&K will serve as the subadvisor to each New Fund. As a result, the GW&K personnel involved in managing each New Fund’s portfolio will be the same personnel currently managing the corresponding Existing Fund’s portfolio. Oversight of the New Funds will be provided by the Board of Trustees of Managers AMG Funds, and, as the investment manager of each New Fund, Managers will provide investment oversight, administration, and shareholder services for the New Funds.

The Board of Directors of BNY Hamilton Funds has approved the Reorganizations and believes that approval of the Reorganizations is in the best interests of shareholders. Accordingly, your Board recommends that you vote in favor of the Reorganizations.

Please read the enclosed proxy materials and consider the information provided carefully. Your vote is very important to us. We encourage you to complete and mail your proxy ballot promptly. No postage is necessary if you mail it in the United States. If you have any questions about the proxy materials, the proposed Reorganizations or the proposed subadvisory agreements, please call your BNY Mellon wealth management account officer, other investment professional or the Existing Funds at 1-800-426-9363.

|

| Very truly yours, |

|

| |

Joseph F. Murphy President of BNY Hamilton Funds, Inc. |

2

BNY HAMILTON FUNDS, INC.

c/o The Bank of New York Mellon Corporation

One Wall Street

New York, New York 10286

QUESTIONS AND ANSWERS

YOUR VOTE IS IMPORTANT!

Q: What am I being asked to vote on?

A: As a shareholder of an Existing Fund, you are being asked to vote to approve the Reorganization of each Existing Fund into the corresponding New Fund, each a series of Managers AMG Funds, pursuant to an Agreement and Plan of Reorganization between BNY Hamilton Funds and Managers AMG Funds. In connection with the Reorganizations, each Existing Fund will transfer all of its assets to the corresponding New Fund, the New Fund will assume all of the liabilities of the Existing Fund, and you will receive shares of the New Fund (the “New Fund Shares”) with a value equal to the value of your shares of the Existing Fund immediately prior to the Reorganization. Upon completion of the Reorganization, you will become a shareholder of the New Fund.

Q: Has my Fund’s Board of Directors approved the Reorganizations?

A: Yes. The Board of Directors of BNY Hamilton Funds, including a majority of the Independent Directors, approved the Reorganization for each Existing Fund on July 24, 2008 and recommends that you vote to approve the Reorganizations.

Q: Why is the Board recommending the Reorganizations?

A: The Board of Directors of BNY Hamilton Funds, including a majority of the Independent Directors, has concluded that participation in each proposed Reorganization is in the best interests of the Existing Fund and its shareholders. In reaching this conclusion, the Board considered several factors, which are discussed in detail in these materials. These factors include that fact that BNY had advised the Board that following AMG’s Acquisition of GW&K, BNY is not willing to continue to serve indefinitely as the investment adviser to the Existing Funds. A primary purpose of the Reorganizations is to bring the Existing Funds into the Managers Funds family in order to permit GW&K, which has managed each Existing Fund (or its predecessor) since such Fund’s inception, to continue to provide day-to-day portfolio management services to shareholders of the New Funds. GW&K will serve as the subadvisor for the New Funds, allowing shareholders to continue to invest in a mutual fund advised by the same portfolio management personnel. Managers, an independently managed subsidiary of AMG, will assume the overall investment oversight, administration, and shareholder servicing responsibilities as the investment manager of the New Funds. Managers currently provides investment management and administration services to the Managers Funds family of funds, a complex of 32 other mutual funds, not including the New Funds. Managers has advised the Board of Directors of BNY Hamilton Funds that Managers is committed to providing shareholders with access to a complete array of investment products and state-of-the-art shareholder services. As a shareholder in a New Fund, you will have access to the Managers Funds family of funds with the ability to exchange into certain other Managers Funds. Because of expense cap arrangements in place for the New Funds for at least the next two years, as a shareholder in a New Fund your expenses will not increase above the current level of expenses of the corresponding Existing Fund. The Reorganizations are expected to be tax-free to Existing Fund shareholders for U.S. federal income tax purposes.

3

Q: Why am I being asked to approve subadvisory agreements?

A: GW&K currently serves as the subadvisor to the Existing Funds pursuant to subadvisory agreements with BNY. The closing of the Acquisition will result as a matter of law in an assignment of such subadvisory agreements and cause them to terminate. In order for the current subadvisory agreements to continue and for GW&K to continue to serve as subadvisor of the Existing Funds between the closing of the Acquisition and the closing of the Reorganizations under terms similar to those of the current subadvisory agreements, the Board of Directors of BNY Hamilton Funds, including a majority of the Independent Directors, has approved, and recommends that you approve, proposed subadvisory agreements with GW&K.

Q: How do the proposed subadvisory agreements differ from the current subadvisory agreements with GW&K?

A: The terms of the agreements, including fees payable to GW&K, are the same in all material respects, except for non-material conforming edits.

Q: Who will manage my Fund once the Reorganizations are completed?

A: Following the Reorganizations, Managers will serve as the investment manager of each New Fund and GW&K, the Existing Funds’ current subadvisor, will serve as each New Fund’s subadvisor. GW&K will continue to have day-to-day portfolio management responsibility as subadvisor for each New Fund, and each New Fund’s portfolio will be managed in the same manner and by the same personnel as the corresponding Existing Fund.

Q: Will the Fund expenses that I bear as a shareholder of a New Fund be higher than the expenses I currently bear as a shareholder of the corresponding Existing Fund?

A: No. It is anticipated that for at least the first two years after the Reorganizations take effect, because of contractual expense limitations that will be implemented by Managers, the expenses you will bear as a shareholder of a New Fund will be no higher than the expenses you currently bear as a shareholder of the corresponding Existing Fund. Each Existing Fund’s investment agreement currently contains a “breakpoint” that reduces the Existing Fund’s advisory fee when asset levels exceed $500 million. Existing Fund shareholders have never received the benefit of the breakpoint, however, because assets have never reached $500 million. Although the New Funds’ advisory fees do not contain breakpoints, the New Funds have agreed to further reduce advisory fees during the first two years of operation to the same extent as the Existing Funds would have done if assets exceed $500 million.

Q: Will I, or my Fund, need to pay fees or taxes as a result of the Reorganizations?

A: No. The Reorganizations will not trigger any sales commission or other fees for shareholders. Also, each Reorganization is expected to be a tax-free transaction for shareholders, the Existing Funds, and the New Funds for U.S. federal income tax purposes. Your cost basis in shares of an Existing Fund will carry over to shares of the corresponding New Fund upon the closing of the Reorganization.

4

Q: How do the investment objective and policies of the Existing Funds and the New Funds compare?

A: The investment objective and policies of each New Fund are substantially similar to those of the corresponding Existing Fund.

Q: What happens if shareholders of an Existing Fund do not approve the Reorganization?

A: In that event, the Existing Fund will not participate in the Reorganization. The Board of Directors of BNY Hamilton Funds will determine what further action, if any, is appropriate, which may include liquidation of the Existing Fund if BNY is no longer willing to serve as investment adviser to the Existing Funds or no suitable investment adviser can be found to replace BNY. There can be no assurance that another adviser or fund organization would agree to advise and support the Existing Fund if the Reorganization is not approved.

Q: What happens if shareholders of an Existing Fund do not approve the proposed subadvisory agreement?

A: In that event, GW&K will not be able to provide advisory services to the Existing Fund after the expiration of an interim 150-day subadvisory agreement in place for the period between the closing of the Acquisition and the closing of the Reorganization, should the Reorganization not have been completed by then. Also, GW&K will be limited in the fees it will receive for the services it performed under the interim agreement to the lesser of the costs GW&K incurred in performing such services or the compensation GW&K earned under the interim agreement plus interest on that amount. The proposed subadvisory agreement and interim agreement are discussed in greater detail in Section IV of this Proxy Statement/Prospectus.

Q: What happens if I do not wish to participate in the Reorganization of an Existing Fund, or what if I do not wish to own shares of the New Funds?

A: Assuming the Reorganization is approved by the shareholders, you may redeem your shares of an Existing Fund at any time before the last business day prior to the closing date of the Reorganization. After the closing date, you may also redeem your shares of a New Fund on any day in accordance with the procedures applicable to the New Fund. Such redemptions may be taxable to you.

Q: When will the Reorganizations occur?

A: The approval of the Reorganization and the proposed subadvisory agreement by each Existing Fund will require the affirmative vote of a majority of the outstanding shares of common stock of the Existing Fund entitled to vote. If approved, we expect the Reorganizations to be completed on or about November 10, 2008, or sooner, provided all of the other closing conditions have been satisfied.

Q: When will the Shareholder Meeting be held?

A: The Shareholder Meeting is scheduled to be held on October 15, 2008.

Q: How do I vote my shares?

A: You can vote your shares by telephone or through the Internet by following the instructions on the enclosed proxy card(s) or by completing and signing the enclosed proxy card(s) and mailing them in the enclosed postage paid envelope. If you have any questions regarding the proposals or how to vote your shares, please call your BNY Mellon wealth management account officer, other investment professional or the Existing Funds at 1-800-426-9363.

5

BNY Hamilton Multi-Cap Equity Fund

BNY Hamilton Municipal Enhanced Yield Fund

EACHA SERIESOF

BNY HAMILTON FUNDS, INC.

c/o The Bank of New York Mellon Corporation

One Wall Street

New York, New York 10286

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

SCHEDULED FOR OCTOBER 15, 2008

|

| This is the formal notice and agenda for the special shareholder meeting of the BNY Hamilton Multi-Cap Equity Fund and the BNY Hamilton Municipal Enhanced Yield Fund (the “Existing Funds”), each a series of BNY Hamilton Funds, Inc. (“BNY Hamilton Funds”). This notice tells the shareholders of the Existing Funds what proposals will be voted on and the time and place of the meeting. We refer in this notice (and the proxy materials included with the notice) to the GW&K Multi-Cap Equity Fund and the GW&K Municipal Enhanced Yield Fund as the “New Funds,” which are series of Managers AMG Funds (“Managers AMG Funds”). We refer to the Existing Funds and the New Funds together as the “Funds.” |

To the Shareholders of the BNY Hamilton Multi-Cap Equity Fund and the BNY Hamilton Municipal Enhanced Yield Fund:

A special meeting of shareholders of the Multi-Cap Equity Fund and the Municipal Enhanced Yield Fund will be held on October 15, 2008 at 11:00 a.m. (Eastern Time) at 200 Park Avenue, 8th Floor, New York, New York (the “Meeting”). At the Meeting, we will ask you to vote on:

1. A proposal to approve the reorganization of the BNY Hamilton Multi-Cap Equity Fund into the GW&K Multi-Cap Equity Fund in exchange for shares of the GW&K Multi-Cap Equity Fund. (To be voted on by the shareholders of the BNY Hamilton Multi-Cap Equity Fund only)

2. A proposal to approve the reorganization of the BNY Hamilton Municipal Enhanced Yield Fund into the GW&K Municipal Enhanced Yield Fund in exchange for shares of the GW&K Municipal Enhanced Yield Fund. (To be voted on by the shareholders of the BNY Hamilton Municipal Enhanced Yield Fund only)

(The transactions that are the subject of the foregoing proposals are referred to herein as the “Reorganizations,” each a “Reorganization.”)

3. A proposal to approve a subadvisory agreement between The Bank of New York Mellon Corporation (“BNY”) and Gannett Welsh & Kotler, LLC (“GW&K”) for the BNY Hamilton Multi-Cap Equity Fund. (To be voted on by the shareholders of the BNY Hamilton Multi-Cap Equity Fund only)

4. A proposal to approve a subadvisory agreement between BNY and GW&K for the BNY Hamilton Municipal Enhanced Yield Fund. (To be voted on by the shareholders of the BNY Hamilton Municipal Enhanced Yield Fund only)

5. Any other business that properly comes before the Meeting.

Only shareholders of record of the Existing Funds as of the close of business on August 25, 2008 are entitled to receive this notice and vote at the Meeting. Whether or not you expect to attend the Meeting, please complete and return the enclosed proxy ballot (voting instruction card).

|

| By Order of the Board of Directors of BNY Hamilton Funds, Inc. |

|

| |

| Jennifer English, Secretary |

| September 5, 2008 |

YOUR VOTE IS VERY IMPORTANT TO US REGARDLESS OF THE

NUMBER OF SHARES THAT YOU ARE ENTITLED TO VOTE.

2

Proxy Statement/Prospectus

September 2, 2008

BNY HAMILTON FUNDS, INC.

C/O THE BANK OF NEW YORK MELLON CORPORATION

ONE WALL STREET

NEW YORK, NEW YORK 10286

1-800-426-9363

MANAGERS AMG FUNDS

800 CONNECTICUT AVENUE

NORWALK, CONNECTICUT 06854

1-800-835-3879

WHAT IS THIS DOCUMENT AND WHY ARE YOU RECEIVING IT?

This document is both the proxy statement for the Existing Funds and a prospectus for the New Funds (the “Proxy Statement/Prospectus”). It contains the information that shareholders of the Existing Funds should know before voting on the approval of a proposed Agreement and Plan of Reorganization (the “Plan of Reorganization”) that provides for the Reorganization of each Existing Fund into the corresponding New Fund. Please retain this Proxy Statement/Prospectus for future reference. If shareholders of an Existing Fund do not approve the Reorganization, the Existing Fund will not participate in the Reorganization. In such event, the Board of Directors of BNY Hamilton Funds, Inc. (“BNY Hamilton Funds”) will consider what further action, if any, is appropriate, which may include liquidation of the Existing Fund if the Bank of New York Mellon Corporation (“BNY”) is no longer willing to serve as investment adviser to the Existing Funds or no suitable investment adviser can be found to replace BNY. There can be no assurance that another adviser or fund organization would agree to advise and support the Existing Funds if the Reorganizations are not approved. If the Reorganizations are approved, we expect the Reorganizations will be completed on or about November 10, 2008, or sooner, provided all of the other closing conditions have been satisfied.

Shareholders of each Existing Fund will also be asked to approve a proposed subadvisory agreement for each Existing Fund, which will continue the current subadvisory arrangements of the Existing Funds with Gannett Welsh & Kotler, LLC (“GW&K”) for the period between the closing of the Acquisition and the closing of the Reorganizations. Additional information regarding the Reorganizations and the proposed subadvisory agreements is contained in this Proxy Statement/Prospectus.

The Proxy Statement/Prospectus and the enclosed proxy card (the “Proxy Card”) are expected to be mailed to shareholders beginning on or about September 5, 2008.

HOW WILL THE REORGANIZATIONS WORK?

Each Reorganization of an Existing Fund will involve three steps:

| | (1) | the transfer of all of the assets of the Existing Fund to the corresponding New Fund in exchange for the assumption by the New Fund of all of the liabilities of the Existing Fund and the delivery to the Existing Fund of shares of the New Fund with a value equal to the value of the assets transferred by the Existing Fund, net of the applicable liabilities assumed by the New Fund (all as determined immediately prior to the transaction); |

| | (2) | the pro rata distribution of shares of the New Fund to the shareholders of record of the Existing Fund as of the effective date of the Reorganization in full redemption of all shares of the Existing Fund; and |

| | (3) | the liquidation and termination of the Existing Fund. |

As a result of the Reorganizations, shareholders of each Existing Fund will receive shares of the corresponding New Fund. The total value of the New Fund shares that you receive in the Reorganization will be the same as the total value of the shares of the Existing Fund that you held immediately before the Reorganization. A copy of the form of the Plan of Reorganization is attached to this document as Appendix A.

The New Funds will not commence operations until each Reorganization is completed. The Existing Funds are currently advised by BNY and subadvised by GW&K. Managers Investment Group LLC, which we refer to as “Managers,” serves as the investment manager to the New Funds. GW&K will serve as the subadvisor of the New Funds. If the Reorganizations are approved, shareholders of each Existing Fund will own shares of the corresponding New Fund, which is managed by Managers with GW&K as the subadvisor. Each New Fund will be advised in the same manner and by the same personnel as the corresponding Existing Fund because GW&K will continue to have day-to-day portfolio management responsibility as subadvisor for the New Fund.

| | | | |

| | The Securities and Exchange Commission has not approved or disapproved of these securities or passed upon the adequacy of this prospectus. Any representation to the contrary is a criminal offense. | | |

IS ADDITIONAL INFORMATION ABOUT THE FUNDS AVAILABLE?

Yes, additional information about the Existing Funds is available in the:

| | • | | Prospectuses for the Existing Funds; |

| | • | | Annual and Semi-Annual Reports to shareholders of the Existing Funds; and |

| | • | | Statement of Additional Information, or “SAI,” for the Existing Funds. |

These documents are on file with the Securities and Exchange Commission, which we refer to in the Proxy Statement/Prospectus as the “SEC.”

The effective prospectuses of the Existing Funds dated April 25, 2008 are incorporated by reference into this Proxy Statement/Prospectus (meaning such documents are legally considered to be part of this Proxy Statement/Prospectus).

The SAI relating to this Proxy Statement/Prospectus dated September 2, 2008 also is incorporated by reference and is legally considered to be part of this document.

The Existing Funds’ prospectuses, the most recent annual reports to shareholders of the Existing Funds, containing audited financial statements for the most recent fiscal year ended December 31, 2007, and the semi-annual reports to shareholders of the Existing Funds, containing unaudited financial statements for the six months ended June 30, 2008, have been previously mailed to shareholders.

2

Copies of all of the documents referred to above are available upon request without charge by writing to or calling:

BNY Hamilton Funds, Inc.

c/o The Bank of New York Mellon Corporation

One Wall Street

New York, New York 10286

1-800-426-9363

You also may view or obtain copies of these documents from the SEC:

| | |

| In Person: | | At the SEC’s Public Reference Room in Washington, D.C. Call 202-551-8090 for hours of operation. |

| |

| By Mail: | | Public Reference Section |

| | Securities and Exchange Commission |

| | 100 F Street, N.E. |

| | Washington, DC 20549-6009 |

| | (duplicating fee required) |

| |

| By Email: | | publicinfo@sec.gov |

| | (duplicating fee required) |

| |

| By Internet: | | www.sec.gov |

| |

| | www.managersinvest.com |

| |

| | www.bnyhamilton.com |

OTHER IMPORTANT THINGS TO NOTE:

| | • | | An investment in a New Fund is not a deposit in a bank and is not insured or guaranteed by the FDIC or any other government agency. |

| | • | | You may lose money by investing in a New Fund. |

3

TABLE OF CONTENTS

4

The Reorganizations

The Board of Directors of BNY Hamilton Funds, including a majority of the Directors who are not “interested persons” of BNY Hamilton Funds, as defined by the Investment Company Act of 1940, as amended (the “Independent Directors”), and the Board of Trustees of Managers AMG Funds approved the Reorganizations, and in connection with the Reorganizations, BNY agreed to use reasonable best efforts to obtain the approval of each Existing Fund’s shareholders for the reorganization of the Existing Fund (a series of BNY Hamilton Funds) into the corresponding New Fund (a series of Managers AMG Funds). BNY also agreed to cooperate to help prepare these proxy solicitation materials and other materials relating to the transactions contemplated under this Proxy Statement/Prospectus and process them through the SEC.

The Existing Funds called this special shareholders’ meeting to allow the shareholders of each Existing Fund to vote on the proposed Reorganization of the Existing Fund into the corresponding New Fund.

The Existing Funds are currently advised by BNY and subadvised by GW&K. Following the Reorganizations, the New Funds will be managed by Managers and subadvised by GW&K. GW&K will continue to have day-to-day portfolio management responsibility as the subadvisor for the New Funds, and the portfolios of each New Fund will be managed in the same manner and by the same personnel as the corresponding Existing Fund following the Reorganization.

As part of the Reorganizations, overall responsibility for investment management, administration, and shareholder servicing, currently being performed by BNY for the Existing Funds, will be assumed by Managers for the New Funds.

Proposed Subadvisory Agreements

Shareholders of each Existing Fund will also be asked to approve a proposed subadvisory agreement for each Existing Fund, which, in effect, will continue the current subadvisory agreement of the Existing Fund with GW&K until the closing of the Reorganizations. The terms of the proposed subadvisory agreements, including with respect to fees, are the same in all material respects as the current subadvisory agreements with GW&K, except for non-material conforming edits.

Under the Investment Company Act of 1940, as amended (the “1940 Act”) the closing of the Acquisition will be deemed a change in control of GW&K, which will result in an assignment of the current subadvisory agreements for the Existing Funds and cause their automatic termination. To ensure that portfolio management services for the Existing Funds can continue following the Acquisition and pending the completion of the Reorganizations, the Board of Directors of BNY Hamilton Funds, including a majority of the Independent Directors, has approved, and recommends that shareholders approve, proposed subadvisory agreements with GW&K. If the closing of the Acquisition, which is subject to regulatory and other approvals as described above, does not take place, the current subadvisory agreements will remain in effect.

To avoid a potential disruption of portfolio management services in the event of the closing of the Acquisition without such Existing Fund’s shareholders having approved a proposed subadvisory agreement, the Board of Directors of BNY Hamilton Funds, including a majority of the Independent Directors, has also approved, pursuant to Rule 15a-4 under the 1940 Act, interim subadvisory agreements

5

with GW&K for the Existing Funds. Rule 15a-4, in relevant part, permits the appointment of an investment adviser or subadvisor on an interim basis, without shareholder approval where such approval would otherwise be required, subject to certain conditions. The interim subadvisory agreements are the same as the proposed subadvisory agreements except for differences reflecting the requirements of Rule 15a-4. Thus, each interim subadvisory agreement will remain in effect for a period up to 150 days from the date of termination of the current subadvisory agreements, which will occur on the closing date of the Acquisition, and all compensation earned must be held in an interest-bearing escrow account pending shareholder approval of the proposed subadvisory agreements.

If shareholders do not approve the proposed subadvisory agreement for each Existing Fund, GW&K will not be able to provide advisory services to the Existing Fund after the expiration of the interim 150-day subadvisory agreement in place for the period between the closing of the Acquisition and the closing of the Reorganization, should the Reorganization not have been completed by then. Also, GW&K will be limited in the fees it will receive for the services it performed under the interim agreement to the lesser of the costs GW&K incurred in performing such services or the amount (including accrued interest) in the escrow account. Additional information regarding the proposed subadvisory agreements is included in Section IV of this Proxy Statement/Prospectus.

Federal Income Tax Consequences

The Reorganizations are not expected to result in the recognition of income, gain or loss for U.S. federal income tax purposes by the Existing Funds or their shareholders. As a condition to the closing of each Reorganization, the New Funds and the Existing Funds will receive an opinion of counsel to the effect that each Reorganization is expected to be treated as a tax-free transaction for U.S. federal income tax purposes, although this result is not free from doubt. See “The Reorganizations – Federal Income Tax Consequences.”

Investment Objective and Policies

The investment objective and policies of each New Fund are substantially similar to those of the corresponding Existing Fund, except as described below.

BNY Hamilton Multi-Cap Equity Fund – GW&K Multi-Cap Equity Fund

The investment objective of each of the GW&K Multi-Cap Equity Fund and the BNY Hamilton Multi-Cap Equity Fund is to provide investors with long-term capital appreciation; current income is a secondary consideration. Unlike the investment objective of the Existing Fund, the New Fund’s investment objective is not a fundamental policy and thus may be changed by the Managers AMG Funds’ Board of Trustees without shareholder approval.

Under normal circumstances, each Fund invests at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in equity securities. Each Fund will provide its shareholders with at least 60 days’ prior written notice of any change in this policy. Equity securities may include common stocks, preferred stocks, convertible securities, equity interests in foreign investment funds or trusts, depositary receipts and other equity investments.

Within limits, each Fund also may use certain derivatives (e.g., options, futures), which are investments whose value is determined by underlying securities, indices or reference rates. Although the Funds, under their 80% policies, may invest without limit in foreign securities, including emerging markets securities, the Funds have no present intention to do so.

6

Each Fund pursues flexible long-term investment policies in an attempt to emphasize companies with strong balance sheets and growth potential, i.e., companies GW&K believes are in industries or markets that are expanding or have business lines that demonstrate potential for growth in sales and earnings or cash flow. GW&K selects companies that it expects to have earnings and cash flow growth the same as, or greater than, that of comparable companies in similar industries.

GW&K uses a bottom-up stock selection approach, focusing on specific companies rather than the overall market level, industry sectors or particular economic trends. Each Fund intends to invest primarily in companies that GW&K believes are leaders in their respective industries (i.e., leaders in sales, earnings, services provided, etc.). Each Fund may invest in small-, medium- or large-capitalization companies. Each Fund may also purchase securities that GW&K believes are undervalued or attractively valued. GW&K assesses value using measures such as price-to-earnings and market price to book value ratios in comparison with similar measures for companies included in the Russell 3000® Index.

In addition to seeking capital appreciation, each Fund seeks to achieve current income by investing in securities with a history of paying dividends. Each Fund may also buy securities that do not have a history of paying dividends but are believed to offer prospects for capital growth or future income, based upon GW&K’s analysis of overall market conditions and the individual companies potential for growth or payment of dividends.

GW&K intends to assemble a portfolio of securities diversified as to companies and industries. GW&K expects that each economic sector within the Russell 3000® Index will be represented in each Fund’s portfolio. GW&K may consider increasing or reducing each Fund’s investment in a particular industry in view of the Fund’s goal of achieving industry diversification.

Various factors may lead GW&K to consider selling a particular security, such as a significant change in the relevant company’s senior management or its products, a deterioration in its fundamental characteristics, or if GW&K believes the security has become overvalued.

Each Fund may, from time to time, take a temporary defensive position that is inconsistent with its principal investment strategies. When GW&K believes a temporary defensive position is necessary, the Fund may invest any amount of its net assets in cash or cash equivalents. Taking a defensive position might prevent the Fund from achieving its investment objective.

BNY Hamilton Municipal Enhanced Yield Fund – GW&K Municipal Enhanced Yield Fund

The investment objective of each of the GW&K Municipal Enhanced Yield Fund and the BNY Hamilton Municipal Enhanced Yield Fund is to provide investors with a high level of current income that is exempt from federal income tax. Capital appreciation is also an objective, but is secondary to income. Each Fund’s investment objective is a fundamental policy and may not be changed without shareholder approval.

In pursuing its investment objective, each Fund under normal circumstances, invests at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in U.S. dollar-denominated fixed income securities that are exempt from federal income tax. This policy is fundamental and may not be changed without shareholder approval. In addition, up to 50% of each Fund’s net assets, plus the amount of any borrowings for investment purposes, may be invested in securities that are subject to the federal alternative minimum tax.

7

Each Fund may invest up to 35% of its total assets in unrated securities, and may invest up to 50% of its total assets in unrated securities and high yield securities. High yield securities (commonly known as “junk bonds”) are those securities that are rated below investment grade (i.e., rated below Baa3/BBB- by Moody’s Investors Service, Inc. (“Moody’s”), Standard & Poor’s (“S&P”), or another nationally recognized statistical rating organization, or unrated but determined by GW&K to be of comparable credit quality). However, GW&K normally expects that the average credit rating of each Fund’s portfolio will be Baa/BBB.

Each Fund typically invests in a diversified portfolio of municipal obligations. Municipal obligations are debt obligations issued by a state, territory, or possession of the United States or a political subdivision, public instrumentality, agency or other governmental unit of such a state, territory, or possession (e.g., county, city, town, village, district and authority). Municipal obligations in which each Fund may invest include: general obligation notes and bonds; revenue bonds; tax and revenue authorization notes; short-term municipal notes, such as tax anticipation notes; tax-exempt commercial paper; private activity bonds, such as industrial revenue bonds; bond anticipation notes; revenue anticipation notes; and participations in pools of municipal obligations. The interest on certain of these municipal obligations may be subject to federal income tax and/or the federal alternative minimum tax, subject to the investment limits described above.

Each Fund may invest in bonds of any maturity or duration and does not expect to target any specific range of maturity or duration. Each Fund’s average weighted portfolio maturity and duration will vary from time to time depending on GW&K’s views on the direction of interest rates.

GW&K uses a research-driven process based on knowledge of creditworthiness and market availability in selecting bonds. Although each Fund seeks to be diversified by geography and sector, each Fund may at times invest a significant portion of its assets in a particular state or region or in a particular sector due to market conditions. In particular, presently, a significant portion of the Baa/BBB municipal security universe is composed of hospital bonds. Accordingly, hospital bonds currently comprise a significant portion of the Existing Fund’s portfolio, and would continue to do so for the New Fund following the Reorganization.

Within limits, each Fund also may use certain derivatives (e.g., futures, options), which are investments whose value is determined by underlying securities, indices or reference rates.

As a temporary defensive measure, each Fund may invest more than 20% of its net assets, plus the amount of any borrowings for investment purposes, in taxable securities, such as money market instruments and debt securities issued or guaranteed by the U.S. government or its agencies. Under such circumstances, the Fund may not achieve its investment objective.

Principal Risk Factors

Although there are no material differences among the principal risk factors of the Funds, the principal risk factors of the New Funds are listed and described differently from those of the Existing Funds so that the disclosure will be similar to that of other funds in the Managers family of funds. Below is a discussion of the principal risk factors to which the Funds are subject.

Market risk. Each Fund’s principal risk factor is market risk. Market risk includes the risk that prices of securities held by the Existing Funds or New Funds may fall rapidly or unpredictably. The prices of securities will rise and fall due to changing economic, political, or market conditions or in response to events that affect particular industries or companies. The value of your investment could go

8

up or down depending on market conditions. Each of the Multi-Cap Equity Funds may invest in equity securities, including foreign securities. Equity securities generally have greater price volatility than fixed income securities. Since foreign securities trade on different markets, which have different supply and demand characteristics, their prices are not as closely linked to the U.S. markets. Foreign securities markets have their own market risks, and they may be more or less volatile than U.S. markets and may move in different directions.

Derivatives Risk. Derivatives include options, futures and forwards, which are financial contracts whose value depends on, or is derived from, the value of an underlying asset, interest rate or index. The use of derivatives will involve costs, the risk of mispricing or improper valuation, and may result in losses or have the effect of accelerating the recognition of gain. The use of derivatives may not succeed for various reasons, including unexpected changes in the value of the derivatives or the assets underlying them. With some derivatives, there is also the risk that the counterparty may fail to honor its contract terms, causing a loss for the Funds.

Leverage Risk. Borrowing, and some derivative investments, such as futures and forward commitment transactions, may magnify smaller adverse market movements into relatively larger losses for each Fund. There is no assurance that a Fund will leverage its portfolio or if it does, that the leveraging strategy will be successful.

Portfolio Turnover. With respect to the New Funds, GW&K may sell any security when it believes the sale is in a New Fund’s best interest. This may result in active and frequent trading of portfolio securities which can increase the portfolio turnover. Higher portfolio turnover may adversely affect a New Fund’s performance by increasing transaction costs and may increase your tax liability.

Principal Risk Factors of BNY Hamilton Multi-Cap Equity Fund and GW&K Multi-Cap Equity Fund:

Growth Stock Risk. Growth stocks may be more sensitive to changes in current or expected earnings than other types of stocks and tend to be more volatile than the market in general. Growth stocks may underperform value stocks during given periods.

Large-Capitalization Stock Risk. Large-capitalization companies tend to compete in mature product markets and do not typically experience the level of sustained growth of smaller companies and companies competing in less mature product markets. Also, large-capitalization companies may be unable to respond as quickly as smaller companies to competitive challenges or changes in business, product, financial, or other market conditions. For these and other reasons, each Fund may underperform other stock funds (such as funds that focus on small- and medium-capitalization companies) when stocks of large-capitalization companies are out of favor.

Small- And Mid-Capitalization Stock Risk. The stocks of small- and mid-capitalization companies involve more risk than the stocks of larger, more established companies because they often have greater price volatility, lower trading volume, and less liquidity. These companies tend to have smaller revenues, narrower product lines, less management depth and experience, smaller shares of their product or service markets, fewer financial resources, and less competitive strength than larger companies. Each Fund may underperform other stock funds (such as large-company stock funds) when stocks of small- and mid-capitalization companies are out of favor.

9

Value Stock Risk. Value stocks present the risk that a stock may decline or never reach what GW&K believes is its full market value, either because the market fails to recognize what GW&K considers to be the company’s true business value or because GW&K’s assessment of the company’s prospects is wrong. Companies that issue value securities may have experienced adverse business developments or may be subject to special risks that have caused their securities to be out of favor. Value stocks may underperform growth stocks during given periods.

Principal Risk Factors of BNY Hamilton Municipal Enhanced Yield Fund and GW&K Municipal Enhanced Yield Fund

Credit Risk. An issuer of bonds may not be able to meet interest or principal payments when the bonds come due. This risk of default for most debt securities is monitored by several nationally recognized statistical rating organizations such as Moody’s and S&P. Even if the likelihood of default is low, changes in the perception of a company’s financial health will affect the valuation of its debt securities. Bonds rated BBB/Baa, although investment grade, may have speculative characteristics because their issuers are more vulnerable to financial setbacks and economic pressures than issuers with higher ratings.

Geographic Concentration Risk. Funds that primarily purchase municipal bonds from particular cities, states or regions also bear investment risk from economic, political, or regulatory changes that could adversely affect municipal bond issuers in such cities, states or regions and therefore the value of each Fund’s investment portfolio.

High Yield Risk. Funds that invest in below-investment grade debt securities and unrated securities of similar credit quality (commonly known as “junk bonds” or “high yield securities”) may be subject to greater levels of interest rate, credit and liquidity risk than funds that do not invest in such securities. These securities are considered predominately speculative with respect to the issuer’s continuing ability to make principal and interest payments. These issuers may be involved in bankruptcy proceedings, reorganizations, or financial restructurings, and are not as strong financially as higher rated issuers. If the issuer of a security is in default with respect to interest or principal payments, each Fund may lose its entire investment. Below investment grade securities are more susceptible to sudden and significant price movements because they are generally more sensitive to adverse developments. Many below-investment grade securities are subject to legal or contractual restrictions that limit their resale at desired prices.

Inflation Risk. Inflation risk is the risk that the price of an asset, or income generated by an asset, will not keep up with the cost of living. Almost all financial assets have some inflation risk.

Interest Rate Risk. Changes in interest rates can impact bond prices. As interest rates rise, the fixed coupon payments (cash flows) of debt securities become less competitive with the market and thus the price of the securities will fall. The longer into the future that these cash flows are expected, the greater the effect on the price of the security. The longer the maturity or duration, the higher the interest rate risk. Duration is the weighted average time (typically quoted in years) to the receipt of cash flows (principal plus interest) for a bond or portfolio. It is used to evaluate such bond or portfolio’s interest rate sensitivity. For example, if interest rates rise by one percentage point, the share price of a fund with an average duration of five years would decline by about 5%. If rates decrease by a percentage point, the fund’s share price would rise by about 5%.

Liquidity Risk. Liquidity risk exists when particular investments are difficult to sell. Each Fund may not be able to sell these illiquid investments at the best prices. Investments in non-U.S. investments, restricted securities, securities having small market capitalization, and securities having substantial market and/or credit risk tend to involve greater liquidity risk.

10

Municipal Market Risk. Factors unique to the municipal bond market may negatively affect the value of each Fund’s investments in municipal bonds. These factors include political or legislative changes, and uncertainties related to the tax status of the securities and the rights of investors in the securities. Each Fund may invest in a group of municipal obligations that are related in such a way that an economic, business, or political development affecting one would also affect the others.

Prepayment Risk. Many bonds have call provisions which allow the debtors to pay them back before maturity. This is especially true with mortgage securities, which can be paid back any time. Typically debtors prepay their debt when it is to their advantage (when interest rates drop making a new loan at current rates more attractive), and thus likely to the disadvantage of bondholders. Prepayment risk will vary depending on the provisions of the security and current interest rates relative to the interest rate of the debt.

Reinvestment Risk. As debtors pay interest or return capital to investors, there is no guarantee that investors will be able to reinvest these payments and receive rates equal to or better than their original investment. If interest rates fall, the rate of return available to reinvested money will also fall. Purchasers of a 30-year, 8% coupon bond can be reasonably assured that they will receive an 8% return on their original capital, but unless they can reinvest all of the interest receipts at or above 8%, the total return over 30 years will be below 8%. The higher the coupon and prepayment risk, the higher the reinvestment risk. An investor who plans on spending (as opposed to reinvesting) the income generated by his portfolio is less likely to be concerned with reinvestment risk and more likely to be concerned with inflation and interest rate risk than is an investor who will be reinvesting all income.

Sector Risk. Companies that are in similar businesses may be similarly affected by particular economic or market events. As a result, each Fund’s performance could be more volatile than the performance of a fund that is more diversified across industries and sectors.

11

Comparison of Fees and Expenses

Each of the BNY Hamilton Multi-Cap Equity Fund and the GW&K Multi-Cap Equity Fund offers Class A shares, which are subject to a front-end sales charge, or “load,” in an amount depending on the size of the purchase. Sales charges apply to new purchases, however no sales charge will be applied to shares of the GW&K Multi-Cap Equity Fund received by shareholders in connection with the Reorganization. Each of the BNY Hamilton Municipal Enhanced Yield Fund and the GW&K Municipal Enhanced Yield Fund is a “no-load” fund, meaning there is no sales charge applied to purchases or sales of shares of these Funds. For all of the Funds, you will pay indirectly various other expenses because each Fund pays fees and other expenses that reduce the return on your investment.

The following table describes the fees and expenses that you may pay if you buy and hold shares of the Funds. Only pro forma information has been presented with respect to the New Funds because each New Fund will not commence operations until the applicable Reorganization is completed. The Reorganizations will not cause a shareholder to pay any additional fees.

| | | | | | | | | | | | |

| | | BNY

Hamilton

Multi-Cap

Equity

Fund

Class A

Shares | | | Pro Forma

– GW&K

Multi-Cap

Equity

Fund

Class A

Shares | | | BNY

Hamilton

Municipal

Enhanced

Yield Fund

Institutional

Shares | | | Pro Forma

–GW&K

Municipal

Enhanced

Yield Fund

Institutional

Shares | |

Shareholder Fees (fees paid directly from your investment) | | | | | | | | | | | | |

Maximum sales charge (load) imposed on purchases (as a percentage of the offering price) | | 5.25 | %(1) | | 5.25 | %(1) | | None | | | None | |

Maximum deferred sales charge (load) | | None | | | None | (2) | | None | | | None | |

Maximum sales charge (load) imposed on reinvested dividends and distributions | | None | | | None | | | None | | | None | |

Redemption fees | | None | | | None | | | None | | | None | |

Exchange fees | | None | | | None | | | None | | | None | |

Annual Operating Expenses | | | | | | | | | | | | |

Management Fees | | 0.75 | % | | 0.75 | % | | 0.50 | % | | 0.50 | % |

Distribution (12b-1) Fees | | 0.25 | % | | 0.25 | % | | None | | | None | |

Other Expenses | | 0.27 | % | | 0.40 | %(3) | | 1.26 | % | | 1.02 | %(3) |

Acquired Fund Fees and Expenses | | — | (4) | | — | (4) | | 0.01 | % | | 0.01 | % |

Total Annual Operating Expenses | | 1.27 | %(5) | | 1.40 | % | | 1.77 | %(7) | | 1.53 | % |

Fee Waiver and Reimbursement | | | | | (0.15 | %)(6) | | | | | (0.74 | %)(8) |

Net Annual Operating Expenses | | | | | 1.25 | % | | | | | 0.79 | % |

| (1) | The initial sales charge that applies to the sale of Class A shares of the BNY Hamilton Multi-Cap Equity Fund and Class A shares of the GW&K Multi-Cap Equity Fund varies according to the amount you invest, with a maximum of 5.25%. See Appendix C – Information Applicable to the New Funds/Shareholder Guide for more information. |

12

| (2) | Except with respect to redemptions or exchanges of Class A shares not subject to an initial sales charge. See Appendix C – Information Applicable to the New Funds/Shareholder Guide for more information. |

| (3) | Pro forma Other Expenses reflect annualized operating expenses that are expected to be incurred by each New Fund during the current fiscal year. |

| (4) | For the BNY Hamilton Multi-Cap Equity Fund and the GW&K Multi-Cap Equity Fund, an indirect expense of less than 0.01% incurred as a result of each Fund’s investment in underlying acquired funds is included under “Other Expenses.” |

| (5) | Since the Fund’s inception on October 7, 2002, BNY has voluntarily agreed to waive its fees and/or reimburse the BNY Hamilton Multi-Cap Equity Fund for certain of its expenses in order to limit the Fund’s Class A shares “Total Annual Operating Expenses” to 1.25% of average daily net assets allocable to Class A shares. The Total Annual Fund Operating Expenses listed above do not reflect the voluntary waiver and/or expense reimbursement. BNY has agreed to maintain the voluntary expense limitation until the closing of the Reorganizations. |

| (6) | Managers and GW&K have contractually agreed, through at least December 31, 2010, to limit “Net Annual Operating Expenses” of the GW&K Multi-Cap Equity Fund (exclusive of taxes, interest, brokerage commissions, acquired fund fees and expenses, and extraordinary items) to 1.25% of the average daily net assets of the Fund’s Class A shares. In general, for a period of up to 36 months from the time of any waiver or payment pursuant to the Fund’s contractual expense limitation, Managers and GW&K may recover from the GW&K Multi-Cap Equity Fund fees waived and expenses paid to the extent that such repayment would not cause the Fund’s Net Annual Fund Operating Expenses to exceed the contractual expense limitation amount. Acquired Fund Fees and Expenses are not subject to waiver and do not factor into the Fund’s contractual expense limitation. |

| (7) | Since the Fund’s inception on December 30, 2005, BNY has voluntarily agreed to waive its fees and/or reimburse the BNY Hamilton Municipal Enhanced Yield Fund for certain of its expenses in order to limit the Fund’s “Total Annual Operating Expenses” to 0.79% of the Fund’s average daily net assets allocable to Institutional Shares. The Total Annual Fund Operating Expenses listed above do not reflect the voluntary waiver and/or expense reimbursement. BNY has agreed to maintain the voluntary expense limitation until the closing of the Reorganizations. |

| (8) | Managers and GW&K have contractually agreed, through at least December 31, 2010, to limit “Net Annual Operating Expenses” of the GW&K Municipal Enhanced Yield Fund (exclusive of taxes, interest, brokerage costs, acquired fund fees and expenses, and extraordinary items) to 0.79% of average daily net assets of the Fund’s Institutional Shares. Acquired Fund Fees and Expenses are not subject to waiver and do not factor into the Fund’s contractual expense limitation. |

Example

These examples will help you compare the costs of investing in the Existing Funds and the New Funds to the cost of investing in other mutual funds. These examples make certain assumptions. They assume that you invest $10,000 as an initial investment in each Fund for the time periods indicated and then redeem all of your shares at the end of those periods. These examples also assume that your

13

investment in each Fund has a 5% total return each year and that each Fund has operating expenses described in the table above and such operating expenses remain the same each year.

| | | | | | | | | | | | |

FUND | | 1 YEAR | | 3 YEARS | | 5 YEARS | | 10 YEARS |

BNY Hamilton Multi-Cap Equity Fund – Class A Shares | | $ | 648 | | $ | 907 | | $ | 1,185 | | $ | 1,978 |

Pro Forma – GW&K Multi-Cap Equity Fund – Class A Shares (New Fund)1 | | $ | 646 | | $ | 914 | | $ | 1,220 | | $ | 2,089 |

BNY Hamilton Municipal Enhanced Yield Fund – Institutional Shares | | $ | 180 | | $ | 557 | | $ | 959 | | $ | 2,084 |

Pro Forma – GW&K Municipal Enhanced Yield Fund – Institutional Shares (New Fund)1 | | $ | 81 | | $ | 321 | | $ | 677 | | $ | 1,682 |

1 | The pro forma example for the New Funds reflects the impact of the GW&K Multi-Cap Equity Fund’s and GW&K Municipal Enhanced Yield Fund’s contractual expense limitations, through December 31, 2010, to limit net annual operating expenses to 1.25% and 0.79%, respectively (exclusive of taxes, interest, brokerage commissions, acquired fund fees and expenses, and extraordinary items). |

The purpose of these tables is to assist an investor in understanding the various types of costs and expenses that an investor in the New Funds will bear, whether directly or indirectly. The information in the previous tables should not be considered a representation of past or future expenses or rates of return. Actual expenses or returns may be greater or less than those shown and may change.

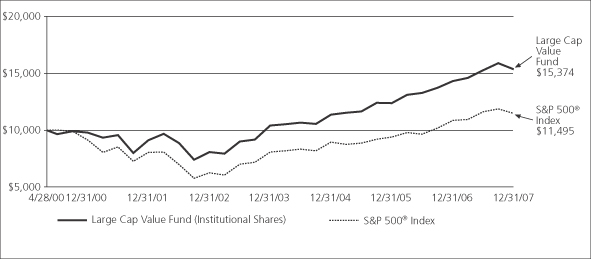

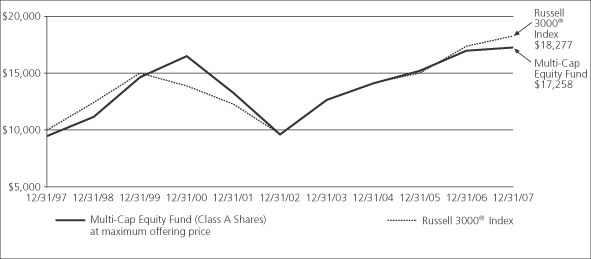

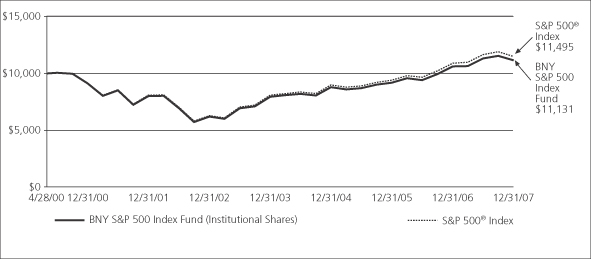

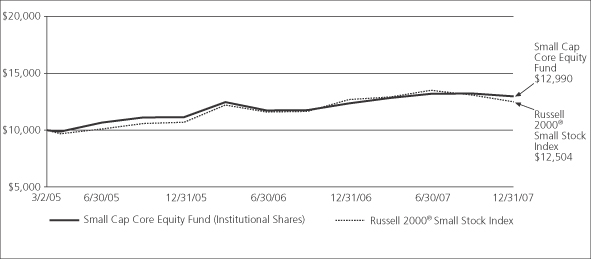

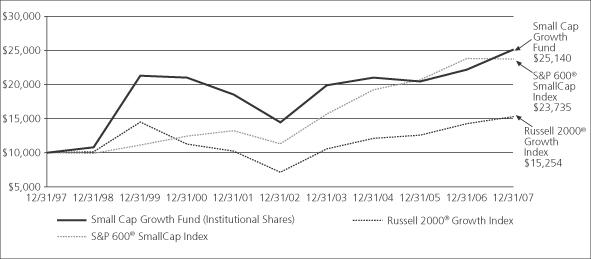

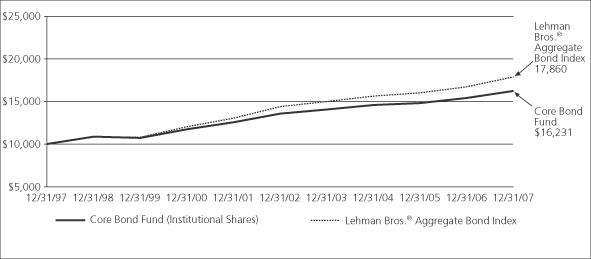

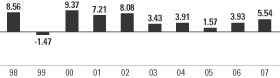

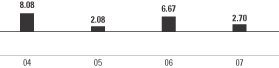

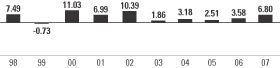

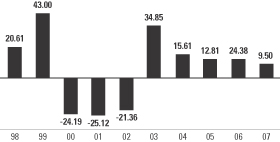

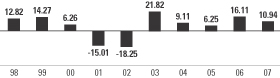

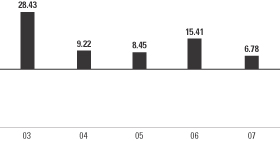

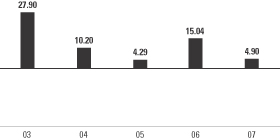

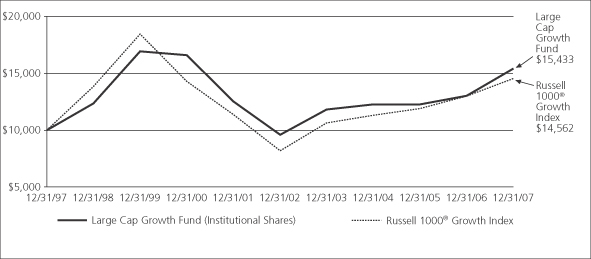

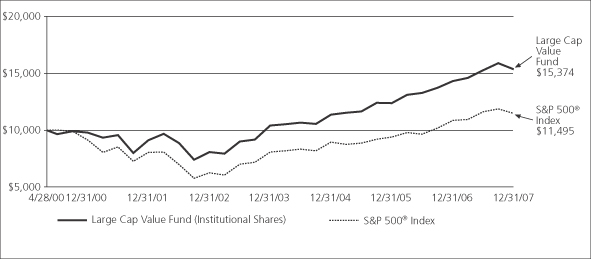

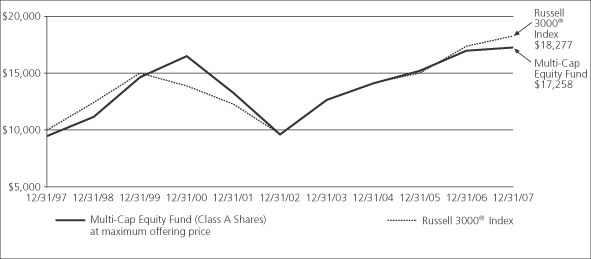

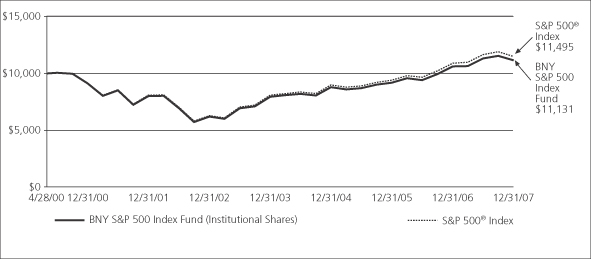

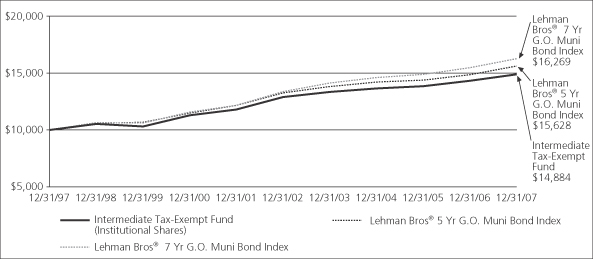

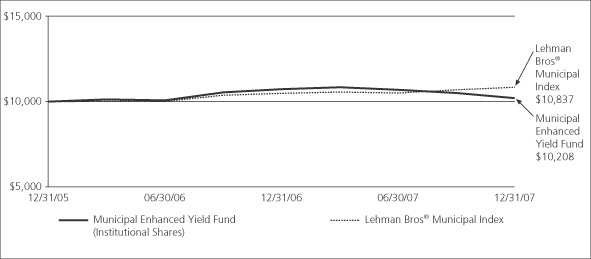

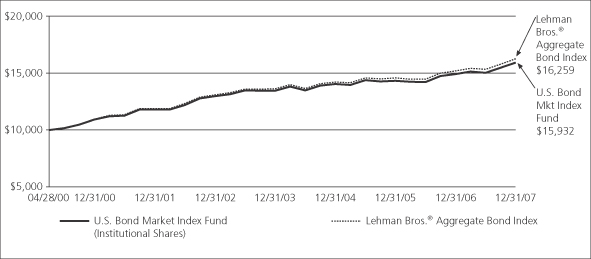

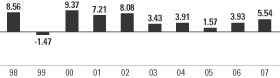

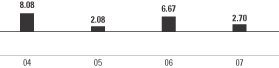

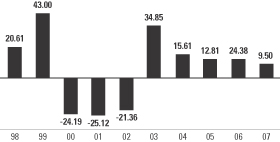

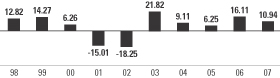

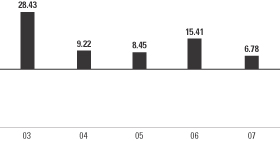

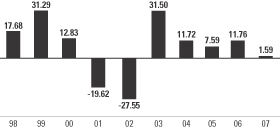

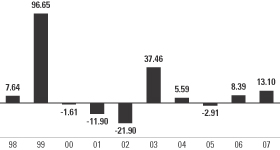

Performance

This section would normally include a bar chart and a table showing how each New Fund has performed and how its performance has varied from year to year. Because the New Funds have not commenced operations prior to the date of this Proxy Statement/Prospectus, the bar chart and table are not shown. Because the investment objectives and principal investment strategies of each New Fund will be substantially similar to that of the corresponding Existing Fund and the entity providing day-to-day advisory services to each New Fund will be the same as for the corresponding Existing Fund, the performance history of each Existing Fund is expected to carry over to the corresponding New Fund.

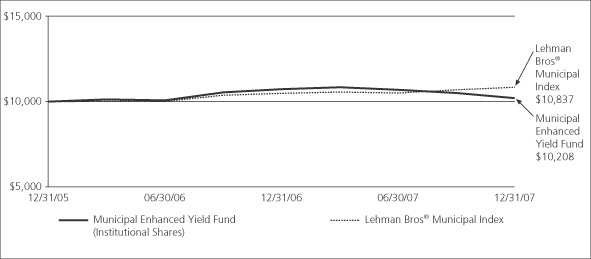

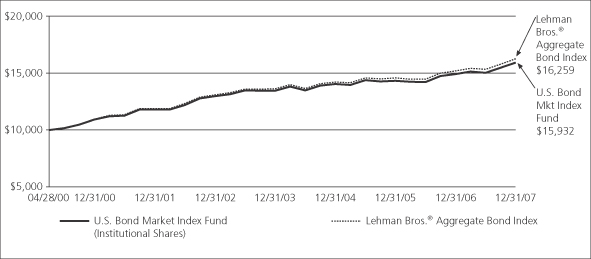

Performance information and financial highlights for each of the Existing Funds is available in each Existing Fund’s prospectus dated April 25, 2008, each of which is on file with the SEC and incorporated by reference into this Proxy Statement/Prospectus, and each of which has previously been provided to each Existing Fund’s shareholders. Of course, past performance does not predict future results.

Distribution and Purchase Procedures, Exchange Rights and Redemption Procedures

Purchase Procedures

The purchase procedures of the Existing Funds are substantially similar to those of the New Funds, in that shares of the New Funds may be purchased directly from the New Funds, as well as through retirement or savings plans or financial intermediaries, whereas shares of the Existing Funds may be purchased directly from the Existing Funds, as well as through retirement or savings plans or other financial intermediaries.

14

The BNY Hamilton Multi-Cap Equity Fund currently offers only Class A shares, which are subject to the following investment minimums:

| | | | | | | | | |

Account Type | | Minimum Initial

Investment | | Minimum Continuing

Investment | | Minimum Balance |

IRA | | $ | 250 | | $ | 25 | | | N/A |

Regular Account | | $ | 2,000 | | $ | 100 | | $ | 500 |

Automatic Investment Program | | $ | 500 | | $ | 50 | | | N/A |

The BNY Hamilton Municipal Enhanced Yield Fund currently offers only Institutional Class Shares. Such shares are available only to (1) institutions that invest over $1,000,000 or (2) investors who have specific asset management relationships with BNY. Any institution (including BNY and its affiliates) acting on behalf of customers having a qualified trust account, employee benefit account or other qualifying account at the institution is eligible to invest in the Institutional Shares of the Fund. The Fund may not be purchased by individual investors, either directly or through brokerage accounts. Notwithstanding the preceding restriction, any client (including any individual who is a client) of a registered investment adviser that has a selling arrangement with BNY Hamilton Distributors, Inc., and who invests $1,000,000 or more in the aggregate in Institutional Shares of all series of BNY Hamilton Funds is also eligible to invest in Institutional Shares through that registered investment adviser. In addition, shareholders who held, as of January 26, 2004, Institutional Shares of any series of BNY Hamilton Funds will be grandfathered for so long as they continue to hold Institutional Shares of a series of BNY Hamilton Funds and thus will not be required to meet these eligibility requirements in respect of additional purchases of the Institutional Shares of the BNY Hamilton Municipal Enhanced Yield Fund. Once an investor makes an initial investment in the Fund pursuant to the requirements described above, no minimum additional investment is required to purchase additional Institutional Shares of the Fund. If your account balance falls below $500 due to redemptions, rather than market movements, the Fund will give you 60 days to bring the balance back up. If you do not increase your balance, the Fund may close your account and send you the proceeds.

Shares of the Existing Funds are and shares of the New Funds will be available to individual investors (except as described above for Institutional Shares of the BNY Hamilton Enhanced Yield Fund), trusts, businesses and other organizations, education savings accounts, employer-sponsored retirement plans, individual-sponsored retirement plans, and other accounts. Unlike the BNY Hamilton Enhanced Yield Fund, Institutional Shares of the GW&K Municipal Enhanced Yield Fund will generally be available to individual investors.

The minimum initial investment to open an account with the GW&K Multi-Cap Equity Fund is $2,000 for regular accounts and $1,000 for individual retirement accounts, and subsequent investments must be at least $100. The minimum initial investment to open an account with the GW&K Municipal Enhanced Yield Fund is $2,500,000 for regular accounts and $50,000 for individual retirement accounts, and subsequent investments must be at least $1,000. Shareholders of the Existing Funds will not need to satisfy the minimum initial investment amounts of the New Funds in order to receive shares of the New Funds upon consummation of the Reorganizations.

15

Each Existing Fund may reject any purchase order (including an exchange from another BNY Hamilton Fund) from any investor the Fund believes has a history of market timing or other abusive trading or whose trading may be disruptive to the Existing Funds. The New Funds may also refuse a buy order for any reason, including the failure to submit a properly completed application, and each New Fund may also refuse an exchange request for any person or group if the Fund determines that the request could adversely affect the Fund, for example, if the person or group has engaged in excessive trading.

Redemption Procedures

The redemption procedures for the Existing Funds and the New Funds are substantially similar. Both the Existing Funds and New Funds allow shareholders to redeem shares from the respective Funds by mail, telephone, or bank wire. In addition, the New Funds allow shareholders to redeem their shares over the internet at www.managersinvest.com.

Both the Existing Funds and New Funds may redeem shares in a shareholder account if balances fall below a certain amount. The Existing Funds reserve the right to redeem shares in any account with a balance of less than $500, as noted above. The New Funds may redeem a shareholder’s account if its value falls below $500 with respect to Class A shares of the GW&K Multi-Cap Equity Fund, or falls below $50,000 with respect to Institutional Shares of the GW&K Municipal Enhanced Yield Fund, due to redemptions, but not until after a Fund gives 60 days’ notice and the opportunity to reestablish the account balance.

Both the Existing Funds and New Funds offer systematic redemption plans and may require a signature guarantee for redemptions. Under their systematic redemption plans, the Existing Funds require that the account have a share balance of $10,000 or more, and the New Funds require that redemptions be over $100. Unlike the Existing Funds, the New Funds do not require a minimum share balance for systematic redemptions. In addition, each of the Existing Funds requires a signature guarantee for redemptions over $50,000. For the New Funds, a shareholder must provide a signature guarantee for redemptions of $50,000 or more of Class A shares of the GW&K Multi-Cap Equity Fund or $250,000 or more of Institutional Shares of the GW&K Municipal Enhanced Yield Fund.

Exchange Rights

BNY Hamilton Funds allows shareholders of the Existing Funds to exchange their shares for shares of other series of BNY Hamilton Funds of the same class as the shares exchanged. In general, a shareholder of an Existing Fund must meet the minimum initial investment requirement of the class of shares of the BNY Hamilton Fund for which the shareholder is exchanging Existing Fund shares. As of September 18, 2008, it is expected that the BNY Hamilton Funds will consist only of the Existing Funds.

To enhance investment flexibility, Managers allows New Fund shareholders to exchange shares of the New Funds for the same class of shares of other funds managed by the Investment Manager or for shares of other funds managed by Managers that are not subject to a sales charge (load). Not all funds managed by Managers offer all classes of shares or are open to new investors. Shareholders may request an exchange in writing; by telephone (if elected on the application); by Internet; or through an investment adviser, bank, or investment professional. Normally, Managers will execute the entire exchange transaction in a single business day.

There is no fee associated with Managers’ exchange privilege; however, an exchange may result in tax consequences. In addition, Managers has implemented the following restrictions regarding exchanges:

| | • | | The value of the New Fund shares exchanged must meet the minimum purchase requirement of the fund for which you are exchanging them. |

16

| | • | | The exchange privilege is available only if both of the accounts involved in the transaction are registered in the same name with the same address and taxpayer identification number. |

In addition to the procedures described above, the New Funds may refuse a purchase order for any reason and will limit or refuse an exchange request if Managers believes that a shareholder is engaging in market timing activities that may harm a New Fund and its shareholders.

Distribution of the Funds

BNY Hamilton Distributors, LLC (“BNY Distributors”) serves as distributor of the Existing Funds. BNY Distributors, an indirect wholly-owned subsidiary of Foreside Financial Group LLC, is not affiliated with BNY or GW&K. Managers Distributors, Inc. (“MDI”), a wholly-owned subsidiary of Managers, serves as distributor of the New Funds. Managers or MDI may make direct or indirect payments to third parties in connection with the sale of New Fund shares or the servicing of shareholder accounts.

Pursuant to Rule 12b-1 under the 1940 Act, the Board of Directors of BNY Hamilton Funds have adopted a distribution plan (“12b-1 Plan”) with respect to Class A Shares of the BNY Hamilton Multi-Cap Equity Fund permitting the Class A Shares to reimburse BNY Distributors for distribution expenses incurred by BNY Distributors at a rate which shall not exceed 0.25% per annum of average daily net assets of the Class A Shares. The GW&K Multi-Cap Equity Fund has also adopted a 12b-1 Plan for Class A shares that allows the Fund to compensate MDI for selling and distributing the Fund’s Class A shares and for providing service to Class A shareholders, provided that fees paid to MDI may not exceed 0.25% annually of the average daily net assets of the Class A shares. Unlike the 12b-1 Plan for the BNY Hamilton Multi-Cap Equity Fund, the 12b-1 Plan for the corresponding New Fund (GW&K Multi-Cap Equity Fund) compensates the New Fund’s distributor, MDI, regardless of costs incurred by MDI.

Each New Fund may also participate in programs with national brokerage firms that limit a shareholder’s transaction fees, and Managers and/or GW&K may pay fees (out of their own funds and not as an expense of a New Fund) to these firms in return for shareholder servicing provided by these programs.

Additional Information Applicable to the Existing Funds and New Funds

Additional information regarding shareholder policies and procedures for the Existing Funds may be found in their respective Prospectuses, each dated April 25, 2008, which are on file with the SEC and are incorporated by reference into this Proxy Statement/Prospectus.

For a more detailed description of the shareholder policies and procedures of the New Funds, relating to the purchase, redemption, exchange, and distribution of New Fund shares, please see Appendix C – Information Applicable to the New Funds/Shareholder Guide.

17

II. THE REORGANIZATIONS

Description of the Reorganizations

On July 24, 2008, the Existing Funds’ Board of Directors, including a majority of the Independent Directors, voted to approve the Reorganizations, subject to approval by the shareholders of each Existing Fund. In each Reorganization, the Existing Fund will transfer its assets to the corresponding New Fund, which will assume all of the liabilities of the Existing Fund. Upon this transfer of assets and assumption of liabilities, each New Fund will issue shares of beneficial interest to the corresponding Existing Fund, which shares will be distributed to shareholders in liquidation of the Existing Fund. Any shares you own of an Existing Fund at the time of the Reorganization will be cancelled and you will receive shares in the corresponding New Fund having an aggregate value equal to the aggregate value of your shares of the Existing Fund. Each Reorganization is expected to be a tax-free transaction for U.S. federal income tax purposes, although this result is not free from doubt. If approved by shareholders, the Reorganizations are expected to occur on or about November 10, 2008, or sooner, provided all of the other closing conditions have been satisfied.

Reasons for the Reorganizations

Managers’ parent company, AMG, and BNY’s parent company, The Bank of New York Mellon Corporation, have signed an agreement whereby AMG will acquire ownership of GW&K from BNY (the “Acquisition”). In connection with the Acquisition, a broad group of GW&K professionals will hold an equity interest in the firm and have entered into long-term employment agreements with the firm and AMG. As a result of the Acquisition, there will be a change in control of GW&K. GW&K, under its new ownership, will succeed to the registration of GW&K as an investment adviser. The Acquisition is scheduled to be consummated in October 2008, or sooner, subject to certain conditions. BNY has indicated that it is not willing to continue to serve indefinitely as investment adviser to the Existing Funds following the Acquisition.

A primary purpose of the Reorganizations is to permit GW&K, which has managed each Existing Fund or its predecessor since inception and will be affiliated with Managers after the Acquisition, to continue to provide portfolio management services to shareholders of the New Funds. Pursuant to the Reorganizations, Managers will serve as the investment manager to the New Funds, and GW&K will continue to provide day-to-day portfolio management services as the subadvisor of the New Funds. Oversight of the New Funds will be provided by the Board of Trustees of Managers AMG Funds and, as investment manager, Managers will provide investment management, administration, and shareholder services for the New Funds. The Board of Directors of BNY Hamilton Funds, including a majority of the Independent Directors, and the Board of Trustees of Managers AMG Funds formally approved the Reorganizations on July 24, 2008 and July 29, 2008, respectively. In connection with the Reorganizations, BNY agreed to use reasonable efforts to obtain the approval of each Existing Fund’s shareholders for the reorganization of each Existing Fund, each a series of BNY Hamilton Funds, into the corresponding New Fund, each a series of Managers AMG Funds. BNY also agreed to cooperate to help prepare these proxy solicitation materials and other materials relating to the transactions contemplated under this Proxy Statement/Prospectus and process them through the SEC.

Headquartered in Norwalk, Connecticut, Managers was founded in 1983 to provide individual investors and smaller institutions with access to the same expertise, resources and techniques employed by major institutions and wealthy families. Managers serves as the investment manager to The Managers Funds family of funds, which includes Managers AMG Funds. Managers is an independently managed subsidiary of AMG. As of June 30, 2008, Managers had over $8.8 billion in assets under management. In approving the Reorganizations of the Existing Funds into the New Funds the Board of Directors of

18

BNY Hamilton Funds considered a number of factors, which are discussed under “Board Considerations of the Reorganizations” below. These factors include the opportunity for continuity of money management as a result of the Reorganizations, the distribution opportunities for the New Funds, the potential for economies of scale and lower costs if New Fund assets increase, the expense caps applicable to the New Funds, access to the Managers Funds family of funds, a fund family of 32 other mutual funds, not including the New Funds, and that Managers has advised the Board that Managers is committed to providing shareholders with a complete array of investment products and state-of-the-art shareholder services.

Terms of the Reorganizations

At the effective time of each Reorganization, each New Fund will acquire all of the assets and assume all of the liabilities of the corresponding Existing Fund in exchange for shares of the New Fund.