| | |

| | ANNUAL REPORT |

AMG Funds

December 31, 2016

AMG Renaissance Large Cap Growth Fund

Class N: MRLTX | Class I: MRLSX | Class Z: MRLIX

AMG Renaissance International Equity Fund

Class N: RIEIX | Class I: RIESX | Class Z: RIELX

| | | | |

| www.amgfunds.com | | | | | AR024-1216 |

|

| AMG Funds |

Annual Report—December 31, 2016 |

| | | | |

TABLE OF CONTENTS | | PAGE | |

LETTER TO SHAREHOLDERS | | | 2 | |

| |

ABOUT YOUR FUND’S EXPENSES | | | 3 | |

| |

PORTFOLIO MANAGER’S COMMENTS, FUND SNAPSHOTS, AND SCHEDULES OF PORTFOLIO INVESTMENTS | | | | |

| |

AMG Renaissance Large Cap Growth Fund | | | 4 | |

AMG Renaissance International Equity Fund | | | 9 | |

| |

NOTES TO SCHEDULES OF PORTFOLIO INVESTMENTS | | | 15 | |

| |

FINANCIAL STATEMENTS | | | | |

| |

Statement of Assets and Liabilities | | | 18 | |

Balance sheets, net asset value (NAV) per share computations and cumulative undistributed amounts | | | | |

| |

Statement of Operations | | | 20 | |

Detail of sources of income, expenses, and realized and unrealized gains (losses) during the fiscal year | | | | |

| |

Statements of Changes in Net Assets | | | 21 | |

Detail of changes in assets for the past two fiscal years | | | | |

| |

Financial Highlights | | | 22 | |

Historical net asset values per share, distributions, total returns, income and expense ratios, turnover ratios and net assets | | | | |

| |

Notes to Financial Statements | | | 26 | |

Accounting and distribution policies, details of agreements and transactions with Fund management and affiliates, and descriptions of certain investment risks | | | | |

| |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | | 33 | |

| |

TRUSTEES AND OFFICERS | | | 34 | |

Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of any series of the AMG Funds family of mutual funds. Such offering is made only by prospectus, which includes details as to offering price and other material information.

| | |

| | Letter to Shareholders |

DEAR SHAREHOLDER:

While the year got off to a rocky start, overall U.S. equity investors enjoyed strong positive returns for 2016. The S&P 500 Index, a widely-followed barometer of the U.S. equity market, returned 12.0% during the prior twelve months. Small cap investors were also rewarded with a return of 21.3% for the small cap Russell 2000® Index.

After the market’s initial stumble, investors had to balance a number of noteworthy events, including the U.K.’s planned exit from the European Union (“Brexit”), a contentious U.S. presidential election and the U.S. Federal Reserve’s second rate increase of 25 basis points to 0.50%-0.75%. Following the surprise election of Donald Trump as the 45th President of the United States, investors witnessed a rally in pro-cyclical sectors as the new administration’s plans for tax reform and increased fiscal spending drove anticipation of stronger future economic growth. Along with higher equity prices, long-term interest rates rose and the U.S. Dollar strengthened. Commodity prices collapsed, but then rebounded on indications of an increase in U.S. infrastructure spending and a small uptick in China’s third-quarter Gross Domestic Product (GDP). Oil prices also experienced volatility as they continued their fall from 2015, bottoming in February and subsequently recovering more than 100%. This recovery lent some much needed support to the beleaguered energy industry, which ended the year with the highest returns of any sector in the S&P 500 Index. In total, all sectors but the health care sector were positive for 2016; however, there was significant dispersion in performance across sectors. Energy, telecommunication services and financials returned 27%, 23% and 21%, respectively, while companies within the consumer staples, real estate and health care sectors returned 5%, 4% and (3)%, respectively. Internationally, stocks lagged their U.S. counterparts, returning 4.5%, as measured by the MSCI ACWI ex USA (in U.S. Dollar terms).

The Bloomberg Barclays U.S. Aggregate Bond Index, a broad U.S. bond market benchmark, returned 2.7% for the year ended December 31, 2016. Over the course of the year, interest rates and credit spreads gyrated at times, putting pressure on bond prices. While stocks finished strong, bond prices were less fortunate, as rising interest rates caused yields to rise and bond prices to fall. The 10-year U.S. Treasury note’s yield started the year at 2.24%, bottomed at 1.37% in July, and ended the year much higher at 2.45%. High yield, on the other hand, was very strong, as investor risk appetite improved and spreads tightened 470 basis points. The Bloomberg Barclays U.S. Corporate High Yield Bond Index ended the year with a healthy 17.1% return.

We are excited to announce as of October 1, 2016, the AMG Funds family of mutual funds fully integrated the former Aston Funds. AMG Funds and Aston Funds shareholders will now have access to the differentiated solutions of AMG Funds, which represents a single point of access to one of the largest line-ups of boutique managers and products in the world.

AMG Funds appreciates the privilege of providing investment tools to you and your clients. Our foremost goal at AMG Funds is to provide investment solutions that help our shareholders successfully reach their long-term investment goals. By partnering with AMG’s affiliated investment boutiques, AMG Funds provides access to a distinctive array of actively-managed return-oriented investment strategies. Additionally, we oversee and distribute a number of complementary open-architecture mutual funds subadvised by unaffiliated investment managers. We thank you for your continued confidence and investment in AMG Funds. You can rest assured that under all market conditions our team is focused on delivering excellent investment management services for your benefit.

Respectfully,

Jeffery Cerutti

President

AMG Funds

| | | | | | | | | | | | | | |

Average Annual Total Returns | | Periods ended December 31, 2016 | |

| | | 1 Year | | | 3 Years | | | 5 Years | |

Stocks: | | | | | | | | | | | | | | |

Large Caps | | (S&P 500 Index) | | | 11.96 | % | | | 8.87 | % | | | 14.66 | % |

Small Caps | | (Russell 2000® Index) | | | 21.31 | % | | | 6.74 | % | | | 14.46 | % |

International | | (MSCI All Country World ex-USA Index) | | | 4.50 | % | | | (1.78 | )% | | | 5.00 | % |

Bonds: | | | | | | | | | | | | | | |

Investment Grade | | (Bloomberg Barclays U.S. Aggregate Bond Index) | | | 2.65 | % | | | 3.03 | % | | | 2.23 | % |

High Yield | | (Bloomberg Barclays U.S. Corporate High Yield Index) | | | 17.13 | % | | | 4.66 | % | | | 7.36 | % |

Tax-exempt | | (Bloomberg Barclays Municipal Bond Index) | | | 0.25 | % | | | 4.14 | % | | | 3.28 | % |

Treasury Bills | | (BofA Merrill Lynch 6 month U.S. Treasury Bill) | | | 0.67 | % | | | 0.34 | % | | | 0.27 | % |

2

About Your Fund’s Expenses

As a shareholder of a Fund, you may incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on $1,000 invested at the beginning of the period and held for the entire period as indicated below.

ACTUAL EXPENSES

The first line of the following table provides information about the actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | | | | | | | | |

| | | Expense | | | Beginning | | | Ending | | | Expenses | |

| | | Ratio for | | | Account Value | | | Account Value | | | Paid During | |

| Six Months Ended December 31, 2016 | | the Period | | | 07/01/16 | | | 12/31/16 | | | the Period* | |

AMG Renaissance Large Cap Growth Fund | | | | | | | | | | | | | | | | |

Class N | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.16 | % | | $ | 1,000 | | | $ | 1,109 | | | $ | 6.15 | |

Hypothetical (5% return before expenses) | | | 1.16 | % | | $ | 1,000 | | | $ | 1,019 | | | $ | 5.89 | |

Class I | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 0.82 | % | | $ | 1,000 | | | $ | 1,110 | | | $ | 4.35 | |

Hypothetical (5% return before expenses) | | | 0.82 | % | | $ | 1,000 | | | $ | 1,021 | | | $ | 4.17 | |

Class Z | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 0.66 | % | | $ | 1,000 | | | $ | 1,112 | | | $ | 3.50 | |

Hypothetical (5% return before expenses) | | | 0.66 | % | | $ | 1,000 | | | $ | 1,022 | | | $ | 3.35 | |

AMG Renaissance International Equity Fund | | | | | | | | | | | | | | | | |

Class N | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.35 | % | | $ | 1,000 | | | $ | 1,026 | | | $ | 6.87 | |

Hypothetical (5% return before expenses) | | | 1.35 | % | | $ | 1,000 | | | $ | 1,018 | | | $ | 6.85 | |

Class I | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 0.97 | % | | $ | 1,000 | | | $ | 1,027 | | | $ | 4.94 | |

Hypothetical (5% return before expenses) | | | 0.97 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 4.93 | |

Class Z | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 0.85 | % | | $ | 1,000 | | | $ | 1,028 | | | $ | 4.33 | |

Hypothetical (5% return before expenses) | | | 0.85 | % | | $ | 1,000 | | | $ | 1,021 | | | $ | 4.32 | |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by 366. |

|

| AMG Renaissance Large Cap Growth Fund |

| Portfolio Manager’s Comments (unaudited) |

THE YEAR IN REVIEW

The AMG Renaissance Large Cap Growth Fund (Class I)1(the “Fund”) returned 9.1% for the year ending December 31, 2016, while its primary benchmark, the Russell 1000® Growth Index, rose 7.1%.

The surprising election of president-elect Donald Trump resulted in sharp reactions in the stock, bond and currency markets. After initially falling the night of the election, U.S. stocks gained steadily throughout November and December, led by financial and industrial issues. The S&P 500 posted a 1.7% loss for the fourth quarter pre-election, but gained 4.6% after the election. Trump’s victory raised expectations of a more pro-business political climate over the next four years, with a more restrained regulatory environment and lower corporate taxes contributing to higher corporate profits.

The U.S. Dollar also posted strong gains post-election, helped in part by declines in other currencies, most notably the Mexican Peso. Rising short-term interest rates also contributed to the Dollar’s strength, as the U.S. Federal Reserve (the Fed) raised their target for the fed funds rate to a range of 0.50% to 0.75% on December 14. The Fed also announced that they expect to raise rates another three times during 2017.

Bonds were the loser post-election, as prices on long-term Treasury bonds tumbled. The yield on 30-year U.S. Treasury bonds rose to 3.1% by the end of the quarter, the highest level since the quarter ending 6/30/15. Interest-rate increases by the Fed contributed to the negative sentiment on bonds but, even more significantly, inflation expectations have risen. President-elect Trump’s budget plans might result in increased federal budget deficits, at least in the short term, and rising energy prices are also contributing to higher inflation expectations.

Consumer confidence, as measured by the Conference Board, rose in December to its highest reading since 2001. A similar confidence survey by the University of Michigan showed the highest confidence reading in the past 13 years. Rising

optimism may provide a boost to the economy over the next few quarters, even before new government economic policies are initiated.

The recent post-election stock market rally was the strongest the U.S. has experienced over the past 100+ years. As to what followed other strong gains, the record is somewhat mixed. The average gain in the next calendar year after a post-election rally of 5% or more has been 11%. However, this average includes a gain of 30.0% (in 1925) as well as a loss of 8.7% (in 1901)2.

Market leadership within the stock market shifted dramatically following the election. While the energy, financial and materials sectors were poor performers for 2015 and 2016 leading up to the election, they were among the strongest sectors over the remainder of 2016. Conversely, the consumer staples and utilities sectors were among the strongest performing sectors through November 7, but then were significant underperformers through year-end. Rising expectations for economic growth contributed to the gains in more cyclically-sensitive sectors, such as energy, at the expense of traditionally defensive sectors such as utilities.

If economic growth does accelerate, companies with exposure to capital spending should potentially benefit. Historically, corporations have invested cash in excess of their actual operating cash flow in capital spending projects which, over time, contributes to rising productivity and stronger economic growth. However, since the financial crisis of 2008, many companies have underinvested in capital spending projects, preferring to use cash to buy back stock or pay out dividends. A return to a more traditional pattern of capital investment could be very beneficial to overall economic growth, and especially beneficial to companies involved in the capital spending sector, such as technology and industrial companies.

The S&P 500 P/E ratio rose to 21.0X by quarter-end, marking its highest level since quarter ending 9/30/093. The inverse of this measure, the E/P ratio or earnings yield, can be compared with the yield on bonds to provide a picture of the relative

valuation of stocks vs. bonds. As the earnings yield on stocks has declined, the yield on bonds has increased, with the result that the spread between these two yields has contracted to its lowest point since the financial crisis. Even so, this measure is still unusually high relative to longer-term history, suggesting that investors are still underpricing stocks, overpricing bonds, or perhaps a little of both.

For the year 2016, our selections in the technology sector, along with our over weighted position and selections in the industrial sector, made the most positive contribution to relative returns for the year. Notable performers over the period include Cummins 61%, Marriott 44% (sold during the period) and F5 Networks 49%. On the negative side, our selections in consumer staples and health care sectors detracted the most from our relative performance for the year. Notable underperformers include McKesson (28%), Gilead Sciences (28%) and Express Scripts (21%).

The new political environment we are about to experience is likely to be very different from the past, and a certain amount of uncertainty and volatility is to be expected. However, we are also encouraged by recently rising economic optimism and confident in the ability of American businesses to continue to compete and grow. We believe that the Fund is well positioned to take advantage of an improving economic landscape in the coming year. We continue to find good investment opportunity in stocks, particularly high-quality companies in the technology, consumer discretionary, health care and industrial sectors.

| 1 | Prior to October 1, 2016, the Fund’s Class I shares were known as Service Class shares. |

| 2 | Dow Jones Industrial Average, since inception in 1896 |

| 3 | Standard & Poors, FactSet |

This commentary reflects the viewpoint of the portfolio manager, The Renaissance Group LLC, as of December 31, 2016, and is not intended as a forecast or guarantee of future results and is subject to change without notice.

AMG Renaissance Large Cap Growth Fund

Portfolio Manager’s Comments (continued)

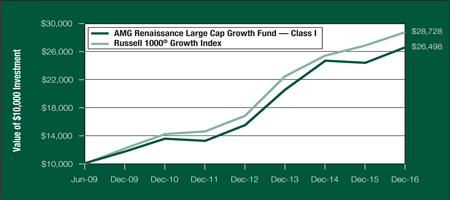

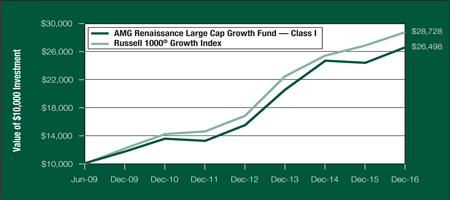

CUMULATIVE TOTAL RETURN PERFORMANCE

AMG Renaissance Large Cap Growth Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. The graph compares a hypothetical $10,000 investment made in AMG Renaissance Large Cap Growth Fund’s Class I (formerly Service Class) on June 3, 2009 (commencement of operations) to a $10,000 investment made in the Russell 1000® Growth Index for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the AMG Renaissance Large Cap Growth Fund and the Russell 1000® Growth Index for the same time periods ended December 31, 2016.

| | | | | | | | | | | | | | | | |

| | | One | | | Five | | | Since | | | Inception | |

| Average Annual Total Returns1 | | Year | | | Years | | | Inception | | | Date | |

AMG Renaissance Large Cap Growth Fund 2,3,4 | |

Class N5 | | | 8.81 | % | | | 15.02 | % | | | 13.38 | % | | | 06/03/09 | |

Class I5 | | | 9.12 | % | | | 15.41 | % | | | 13.72 | % | | | 06/03/09 | |

Class Z5 | | | 9.38 | % | | | 15.59 | % | | | 13.92 | % | | | 06/03/09 | |

Russell 1000® Growth Index6 | | | 7.08 | % | | | 14.50 | % | | | 14.94 | % | | | 06/03/09 | † |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges, and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call (800) 835-3879 or visit our website at www.amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

| † | The date reflects inception date of the Fund, not the index. |

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of December 31, 2016. All returns are in U.S. dollars ($). |

| 2 | From time to time, the Fund’s advisor has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. |

| 3 | The Fund invests in large-capitalization companies that may underperform other stock funds (such as funds that focus on small- and medium-capitalization companies) when stocks of large capitalization companies are out of favor. |

| 4 | The Fund invests in growth stocks, which may be more sensitive to market movements because their prices tend to reflect future investor expectations rather than just current profits. |

| 5 | Effective October 1, 2016, the Investor Class, Service Class and Institutional Class of AMG Renaissance Large Cap Growth Fund were renamed Class N, Class I and Class Z, respectively. |

| 6 | The Russell 1000® Growth Index is a market capitalization weighted index that measures the performance of those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values. Unlike the Fund, the Russell 1000® Growth Index is unmanaged, is not available for investment and does not incur expenses. |

The Russell 1000® Growth Index is a trademark of the London Stock Exchange Group companies.

Not FDIC insured, nor bank guaranteed. May lose value.

5

|

| AMG Renaissance Large Cap Growth Fund |

| Fund Snapshots (unaudited) |

| December 31, 2016 |

PORTFOLIO BREAKDOWN

| | | | | | | | |

Sector | | AMG Renaissance

Large Cap

Growth Fund* | | | Russell 1000®

Growth Index | |

Information Technology | | | 30.2 | % | | | 31.4 | % |

Consumer Discretionary | | | 20.7 | % | | | 20.8 | % |

Health Care | | | 18.2 | % | | | 16.1 | % |

Industrials | | | 16.6 | % | | | 11.1 | % |

Financials | | | 7.4 | % | | | 2.9 | % |

Consumer Staples | | | 3.2 | % | | | 9.5 | % |

Materials | | | 1.8 | % | | | 3.6 | % |

Real Estate | | | 0.0 | % | | | 2.7 | % |

Energy | | | 0.0 | % | | | 0.6 | % |

Telecommunication Services | | | 0.0 | % | | | 1.3 | % |

Other Assets and Liabilities | | | 1.9 | % | | | 0.0 | % |

| * | As a percentage of net assets. |

TOP TEN HOLDINGS

| | | | |

| | | % of | |

Security Name | | Net Assets | |

F5 Networks, Inc. | | | 2.2 | % |

Texas Instruments, Inc.** | | | 2.1 | |

The Boeing Co. | | | 2.1 | |

Cummins, Inc. | | | 2.1 | |

Darden Restaurants, Inc. | | | 2.1 | |

Juniper Networks, Inc. | | | 2.0 | |

Lam Research Corp. | | | 2.0 | |

Apple, Inc. | | | 2.0 | |

Western Digital Corp. | | | 2.0 | |

Microsoft Corp. | | | 2.0 | |

| | | | |

Top Ten as a Group | | | 20.6 | % |

| | | | |

| ** | Top Ten Holdings as of June 30, 2016. |

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

6

|

| AMG Renaissance Large Cap Growth Fund |

| Schedule of Portfolio Investments |

| December 31, 2016 |

| | | | | | | | |

| | | Shares | | | Value | |

Common Stocks—98.1% | | | | | | | | |

Consumer Discretionary—20.7% | | | | | |

AutoZone, Inc.* | | | 1,587 | | | $ | 1,253,397 | |

Carnival Corp. | | | 25,203 | | | | 1,312,068 | |

Darden Restaurants, Inc. | | | 20,313 | | | | 1,477,161 | |

Discovery Communications, Inc., Class A*, 1 | | | 46,692 | | | | 1,279,828 | |

Dollar General Corp. | | | 13,287 | | | | 984,168 | |

Foot Locker, Inc. | | | 18,237 | | | | 1,292,821 | |

The Home Depot, Inc. | | | 8,722 | | | | 1,169,446 | |

The Interpublic Group of Cos., Inc. | | | 50,675 | | | | 1,186,302 | |

Lowe’s Cos., Inc. | | | 14,528 | | | | 1,033,231 | |

O’Reilly Automotive, Inc.* | | | 4,613 | | | | 1,284,305 | |

Ross Stores, Inc. | | | 19,157 | | | | 1,256,699 | |

Scripps Networks Interactive, Inc., Class A | | | 18,160 | | | | 1,296,079 | |

Total Consumer Discretionary | | | | 14,825,505 | |

Consumer Staples—3.2% | | | | | |

CVS Health Corp. | | | 12,539 | | | | 989,452 | |

The Kroger Co. | | | 38,237 | | | | 1,319,559 | |

Total Consumer Staples | | | | | | | 2,309,011 | |

Financials—7.4% | | | | | | | | |

American Express Co. | | | 18,392 | | | | 1,362,479 | |

The Charles Schwab Corp. | | | 33,134 | | | | 1,307,799 | |

Prudential Financial, Inc. | | | 12,434 | | | | 1,293,882 | |

T. Rowe Price Group, Inc. | | | 17,702 | | | | 1,332,253 | |

Total Financials | | | | | | | 5,296,413 | |

Health Care—18.2% | | | | | | | | |

Aetna, Inc. | | | 10,568 | | | | 1,310,538 | |

Amgen, Inc. | | | 7,995 | | | | 1,168,949 | |

Anthem, Inc. | | | 8,749 | | | | 1,257,844 | |

Biogen, Inc.* | | | 4,562 | | | | 1,293,692 | |

Cardinal Health, Inc. | | | 15,324 | | | | 1,102,868 | |

Celgene Corp.* | | | 11,215 | | | | 1,298,136 | |

Cigna Corp. | | | 9,352 | | | | 1,247,463 | |

Express Scripts Holding Co.* | | | 15,758 | | | | 1,083,993 | |

Gilead Sciences, Inc. | | | 14,010 | | | | 1,003,256 | |

| | | | | | | | |

| | | Shares | | | Value | |

Hologic, Inc.* | | | 33,901 | | | $ | 1,360,108 | |

McKesson Corp. | | | 6,785 | | | | 952,953 | |

Total Health Care | | | | | | | 13,079,800 | |

Industrials—16.6% | | | | | | | | |

Alaska Air Group, Inc. | | | 14,583 | | | | 1,293,950 | |

The Boeing Co. | | | 9,605 | | | | 1,495,306 | |

Cummins, Inc. | | | 10,818 | | | | 1,478,496 | |

Illinois Tool Works, Inc. | | | 10,463 | | | | 1,281,299 | |

Masco Corp. | | | 36,225 | | | | 1,145,434 | |

Rockwell Automation, Inc. | | | 10,055 | | | | 1,351,392 | |

Southwest Airlines Co. | | | 26,674 | | | | 1,329,432 | |

Stanley Black & Decker, Inc. | | | 10,106 | | | | 1,159,057 | |

United Parcel Service, Inc., Class B | | | 11,758 | | | | 1,347,937 | |

Total Industrials | | | | | | | 11,882,303 | |

Information Technology—30.2% | | | | | |

Alphabet, Inc., Class A* | | | 1,635 | | | | 1,295,656 | |

Apple, Inc. | | | 12,451 | | | | 1,442,075 | |

Applied Materials, Inc. | | | 41,667 | | | | 1,344,594 | |

Citrix Systems, Inc.* | | | 14,231 | | | | 1,270,971 | |

Electronic Arts, Inc.* | | | 15,459 | | | | 1,217,551 | |

F5 Networks, Inc.* | | | 10,920 | | | | 1,580,342 | |

Facebook, Inc., Class A* | | | 10,778 | | | | 1,240,009 | |

Juniper Networks, Inc. | | | 51,914 | | | | 1,467,090 | |

Lam Research Corp. | | | 13,869 | | | | 1,466,369 | |

Microsoft Corp. | | | 22,519 | | | | 1,399,331 | |

Oracle Corp. | | | 31,675 | | | | 1,217,904 | |

Skyworks Solutions, Inc. | | | 18,077 | | | | 1,349,629 | |

Synopsys, Inc.* | | | 23,332 | | | | 1,373,322 | |

Texas Instruments, Inc. | | | 20,539 | | | | 1,498,731 | |

Total System Services, Inc. | | | 22,565 | | | | 1,106,362 | |

Western Digital Corp. | | | 20,893 | | | | 1,419,679 | |

Total Information Technology | | | | 21,689,615 | |

Materials—1.8% | | | | | | | | |

The Dow Chemical Co. | | | 22,669 | | | | 1,297,120 | |

Total Common Stocks

(cost $63,640,367) | | | | 70,379,767 | |

The accompanying notes are an integral part of these financial statements.

7

AMG Renaissance Large Cap Growth Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Short-Term Investments—1.3% | | | | | | | | |

Repurchase Agreements—0.7%2 | | | | | | | | |

Daiwa Capital Markets America, dated 12/30/16, due 01/03/17, 0.520% total to be received $488,082 (collateralized by various U.S. Government Agency Obligations, 0.000% - 6.500%, 03/02/17 - 02/01/49, totaling $497,815) | | $ | 488,054 | | | $ | 488,054 | |

| | |

| | | Shares | | | | |

Other Investment Companies—0.6%3 | |

Dreyfus Government Cash Management Fund, Institutional Class Shares, 0.45% | | | 418,561 | | | | 418,561 | |

Total Short-Term Investments

(cost $906,615) | | | | 906,615 | |

| | | | | | |

| | | | | Value | |

Total Investments—99.4%

(cost $64,546,982) | | $ | 71,286,382 | |

Other Assets, less Liabilities—0.6% | | | 422,138 | |

Net Assets—100.0% | | $ | 71,708,520 | |

The accompanying notes are an integral part of these financial statements.

8

AMG Renaissance International Equity Fund

Portfolio Manager’s Comments (unaudited)

The AMG Renaissance International Equity Fund (Class Z)1 (the “Fund”) returned (1.83)% for the year ended December 31, 2016, while its primary benchmark, the MSCI All Country World Index (“ACWI”) ex USA, returned 4.50%.

MARKET OVERVIEW

The Santa Claus/Trump rally enjoyed in the United States failed to find its way overseas during the fourth quarter. The positive momentum from the third quarter was fleeting for international equities, with many markets falling victim to the stronger U.S. Dollar and uncertainty surrounding president-elect Trump’s policies. The MSCI ACWI ex USA Index was up 4.9% in local currency terms, but lost 1.3% in U.S. Dollar terms as the Dollar rallied on hope for a stronger U.S. economy. The U.S. Federal Reserve’s decision to raise its interest rate in mid-December was as expected, although this solidified downward pressure on many foreign currencies, especially those in Emerging Markets, as central bankers in those countries have kept rates low in an effort to spur economic growth. Emerging Markets, which had been outperforming developed markets through September, sold off on fears of possible implementation of U.S. trade tariffs, with China and Mexico being the highest profile targets of the incoming U.S. President. Although the MSCI Emerging Market Index fell 4.2% during the quarter while the developed market MSCI EAFE Index lost 0.7%, Emerging Markets outperformed developed markets for the calendar year.

Another notable development during the quarter was the accelerating outperformance of value stocks relative to growth stocks. Value stocks have beaten growth issues since mid-2016, particularly in the fourth quarter when the MSCI ACWI ex USA Value Index added 2.3%, while the MSCI ex USA Growth Index sank (6.3)%. The last time value stocks outperformed growth stocks by such a wide margin was in 2009 and, prior to that, in 2000. The return disparity was most evident in the performance of the financial sector

(typically seen as a value play) which was one of the best-performing sectors in our benchmark.

The stronger U.S. Dollar was a consistent headwind for U.S. Dollar-based international investors throughout the year, but especially so after the U.S. election. Post-election through year-end, the Mexican Peso fell 12% and the Japanese Yen gave up 10% versus the Dollar, while the Brazilian Real fell 2.6%. For all of 2016, however, commodity-related currencies were generally stronger against the Dollar, with the Brazilian Real gaining 22% and the Russian Ruble up 20%2.

PERFORMANCE REVIEW

The energy sector was the best-performing sector in the benchmark, with crude oil (West Texas Intermediate) gaining 11% for the quarter. The Fund’s underweight to the sector was the largest detractor from relative performance during the period. A surprise decision by OPEC to reduce production along with additional cuts by non-OPEC members, including Russia, eased concerns about an oversupply of crude oil. While reduced supply from OPEC will help stabilize prices, OPEC’s historical lack of compliance towards their production quotas, along with increased production from U.S. fracking efforts, are reasons to remain cautious that oil prices will continue to rise. Although the Fund currently has no direct energy exposure, we are actively reviewing potential candidates in light of the changes in OPEC’s production.

Consumer discretionary holdings were most additive to Fund returns for the period because of favorable stock selection. With equity markets embracing more risk during the second half of the year, it was not surprising to see the more defensive consumer staples companies lag the overall market. Within the Fund, three of our four positions that were held during the year lost value. However, our benchmark relative underweight to this sector resulted in a positive allocation effect.

Information technology companies were some of the best-performing stocks through the third quarter of 2016, but investors rotated out of many of these firms during the last three months, resulting in a general weakness among our

technology shares. We still maintain an overweight to technology-related companies, as we believe long-term prospects for chips used in autos, smartphones and the Internet of Things will result in attractive investment returns.

The Fund’s performance for the period benefitted from stock selection in the financial sector. We enjoyed good stock performance from our developed market financials but this was partially undone by Emerging Market financials. We continue to look for attractive financial companies in our universe because the prospect of higher interest rates across the globe should give bank earnings a boost.

The Fund’s returns benefitted from stronger Emerging Market currencies but this was offset by weaker developed market currencies, most notably the British Pound, which sank 19% for the year. We maintained an overweighting to Emerging Markets in the portfolio, which detracted from overall performance, as these countries performed worse than developed countries. Investor flows into Emerging Market ETFs, which had been strong, weakened considerably in the fourth quarter. South Korea was our weakest Emerging Market country, followed by Taiwan, which was hurt due to the general downturn in technology-related shares. Among our developed market countries, Bermuda and Singapore contributed the most to relative returns, while France and Japan detracted the most. Our Japanese holdings, which account for our single largest country exposure, faced a stiff headwind as the Yen weakened 13% relative to the U.S. Dollar during the quarter.

OUTLOOK

One of the biggest questions facing international investors in 2017 is the possible enactment of trade tariffs by the Trump administration. Our belief is that Trump’s campaign rhetoric will be toned down considerably after he is in office. The stakes are certainly very large, as China, Mexico and Canada account for 47% of all imported goods and a similar level of all U.S. exports are sent to these three countries3. Any tariffs imposed on

9

AMG Renaissance International Equity Fund

Portfolio Manager’s Comments (continued)

these nations would likely result in retaliatory tariffs being imposed on U.S. companies, resulting in a no-win situation. Tariffs may be levied on particular items such as steel, but an all-out trade war with our long-time trading partners would benefit no one.

Another question facing U.S. investors is whether ongoing strength in the U.S. Dollar will continue to erode returns from foreign securities. Over the long term, returns from currencies are “mean reverting,” suggesting that currency prices will revert to their long-term averages over time. While strength in the U.S. Dollar may persist in the short term, currencies tend to move in multi-year cycles, and this rally may be getting long in the tooth. In the meantime, a positive effect of the U.S. Dollar strength is that foreign firms that sell to the U.S. will enjoy higher profits in local currency terms.

According to the International Monetary Fund, global economic growth is set to expand from 3.1% in 2016 to 3.4% in 2017. Along with this economic expansion will come higher company earnings, which should lead to higher equity valuations. Earnings per share for all companies in the MSCI ACWI ex USA Index are expected to grow

from $15.41 to $17.57 according to estimates from FactSet. This represents earnings growth of almost 14% compared to negative earnings growth the previous three years. Profit margins are also expected to widen, leading to higher overall Return on Equity, which should support higher valuations.

Another positive for equity markets in 2017 is the improvement in China’s economy. The country continues to move from an export-driven economy to one focused more on services, which should lead to a more sustainable and less volatile economy. Recent Purchasing Managers Index data shows a slow but steady rise in both the manufacturing and services components of the index. While the 10% plus year-over-year GDP growth from a decade ago is a fading memory, economists expect a more reasonable and manageable 6% to 7% GDP growth4.

The outlook for international equities is just as uncertain as it was at the beginning of 2016. As we enter 2017, we accept the fact that the financial and political landscape may continue to surprise us. In early 2016, few investors (including us) predicted a rally in crude prices, a vote in favor

of Brexit and Donald Trump winning the U.S. presidential election. Even so, our active management approach gives us the ability to position portfolios to take advantage of changes in the investment landscape and to capitalize on new information. This ability will likely be as important as ever in 2017, with uncertainty abounding. We believe that accelerating earnings growth, improving profitability and reasonable valuations in many foreign markets provide the framework for international equities to perform well in 2017.

This commentary reflects the viewpoint of the portfolio manager, The Renaissance Group LLC, as of December 31, 2016, and is not intended as a forecast or guarantee of future results and is subject to change without notice.

| 1 | Prior to October 1, 2016, the Fund’s Class Z shares were known as Institutional shares. |

10

AMG Renaissance International Equity Fund

Portfolio Manager’s Comments (continued)

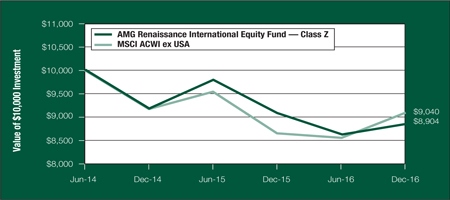

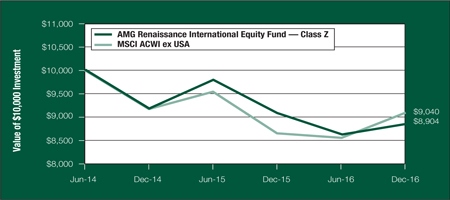

CUMULATIVE TOTAL RETURN PERFORMANCE

AMG Renaissance International Equity Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. The graph compares a hypothetical $10,000 investment made in AMG Renaissance International Equity Fund’s Class Z (formerly Institutional Class) on June 16, 2014 (commencement of operations) to a $10,000 investment made in the MSCI ACWI ex USA Index for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

The table below shows the total returns for the AMG Renaissance International Equity Fund and the MSCI ACWI ex USA Index for the same time periods ended December 31, 2016.

| | | | | | | | | | | | |

| Average Annual Total Returns1 | | One

Year | | | Since

Inception | | | Inception

Date | |

AMG Renaissance International Equity Fund 2,3,4,5,6 | | | | | | | | | | | | |

Class N7 | | | (2.37 | )% | | | (4.91 | )% | | | 06/16/14 | |

Class I7 | | | (2.02 | )% | | | (4.57 | )% | | | 06/16/14 | |

Class Z7 | | | (1.83 | )% | | | (4.46 | )% | | | 06/16/14 | |

MSCI ACWI ex USA8 | | | 4.50 | % | | | (3.89 | )% | | | 06/16/14 | † |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges, and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call (800) 835-3879 or visit our website at www.amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

| † | The date reflects inception date of the Fund, not the index. |

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of December 31, 2016. All returns are in U.S. dollars ($). |

| 2 | From time to time, the Fund’s advisor has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. |

| 3 | The Fund is subject to the risks associated with investments in emerging markets, such as erratic earnings patterns, economic and political instability, changing exchange controls, limitations on repatriation of foreign capital and changes in local governmental attitudes toward private investment, possibly leading to nationalization or confiscation of investor assets. |

| 4 | The Fund is subject to risks associated with investments in mid-capitalization companies such as greater price volatility, lower trading volume, and less liquidity than the stocks of larger, more established companies. |

| 5 | The Fund invests in growth stocks, which may be more sensitive to market movements because their prices tend to reflect future investor expectations rather than just current profits. |

| 6 | Investments in international securities are subject to certain risks of overseas investing including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. The Fund is subject to currency risk resulting from fluctuations in exchange rates that may affect the total loss or gain on a non-U.S. Dollar investment when converted back to U.S. Dollars. |

| 7 | Effective October 1, 2016, the Investor Class, Service Class and Institutional Class of AMG Renaissance International Equity Fund were renamed Class N, Class I and Class Z, respectively. |

| 8 | The MSCI All Country World Index (“ACWI”) ex USA is a free float-adjusted market-capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The index consists of 45 country indices comprising 22 developed and 23 emerging market country indices. Unlike the Fund, the Index is unmanaged, is not available for investment and does not incur expenses. All MSCI data is provided ‘as is.’ The products described herein are not sponsored or endorsed and have not been reviewed or passed on by MSCI. In no event shall MSCI, its affiliates, or any MSCI data provider have any liability of any kind in connection with the MSCI data or the products described herein. Copying or redistributing the MSCI data is strictly prohibited. |

Not FDIC insured, nor bank guaranteed. May lose value.

|

| AMG Renaissance International Equity Fund |

| Fund Snapshots (unaudited) |

| December 31, 2016 |

PORTFOLIO BREAKDOWN

| | | | | | | | |

Sector | | AMG Renaissance

International

Equity Fund* | | | MSCI ACWI

ex USA | |

Information Technology | | | 17.7 | % | | | 9.3 | % |

Consumer Discretionary | | | 17.4 | % | | | 11.4 | % |

Industrials | | | 15.0 | % | | | 11.6 | % |

Financials | | | 14.9 | % | | | 23.3 | % |

Telecommunication Services | | | 8.9 | % | | | 4.7 | % |

Materials | | | 7.2 | % | | | 8.0 | % |

Consumer Staples | | | 7.1 | % | | | 9.8 | % |

Health Care | | | 5.6 | % | | | 8.1 | % |

Real Estate | | | 3.3 | % | | | 3.3 | % |

Utilities | | | 1.8 | % | | | 3.2 | % |

Energy | | | 0.0 | % | | | 7.3 | % |

Other Assets and Liabilities | | | 1.1 | % | | | 0.0 | % |

TOP TEN HOLDINGS

| | | | |

Security Name | | %of

Net Assets | |

China Lodging Group, Ltd., Sponsored ADR | | | 2.2 | % |

Validus Holdings, Ltd. | | | 2.1 | |

Mitsubishi Electric Corp., ADR | | | 2.1 | |

DBS Group Holdings, Ltd., Sponsored ADR | | | 2.1 | |

Magna International, Inc. | | | 2.1 | |

Jazz Pharmaceuticals PLC | | | 2.0 | |

WH Group, Ltd., ADR | | | 2.0 | |

Bridgestone Corp., ADR | | | 2.0 | |

Pandora A/S, ADR | | | 2.0 | |

Infineon Technologies AG, ADR | | | 1.9 | |

| | | | |

Top Ten as a Group | | | 20.5 | % |

| | | | |

| * | As a percentage of net assets. |

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

12

|

| AMG Renaissance International Equity Fund |

| Schedule of Portfolio Investments |

| December 31, 2016 |

| | | | | | | | |

| | | Shares | | | Value | |

Common Stocks—98.9% | | | | | | | | |

Consumer Discretionary—17.4% | |

Bridgestone Corp., ADR (Japan) | | | 2,247 | | | $ | 40,558 | |

Carnival PLC, ADR (United States) | | | 733 | | | | 37,522 | |

China Lodging Group, Ltd., Sponsored ADR (China) | | | 868 | | | | 44,997 | |

Magna International, Inc. (Canada) | | | 990 | | | | 42,966 | |

Pandora A/S, ADR (Denmark)1 | | | 1,233 | | | | 40,122 | |

Persimmon PLC, ADR (United Kingdom) | | | 893 | | | | 38,931 | |

Renault, S.A., ADR (France) | | | 2,107 | | | | 37,568 | |

Tata Motors, Ltd., Sponsored ADR (India) | | | 1,017 | | | | 34,975 | |

Valeo, S.A., Sponsored ADR (France) | | | 1,381 | | | | 39,497 | |

Total Consumer Discretionary | | | | | | | 357,136 | |

Consumer Staples—7.1% | | | | | | | | |

Heineken N.V., Sponsored ADR (Netherlands) | | | 887 | | | | 33,183 | |

Koninklijke Ahold Delhaize NV, Sponsored ADR (Netherlands) | | | 1,698 | | | | 35,648 | |

Unilever PLC, Sponsored ADR (United Kingdom) | | | 865 | | | | 35,206 | |

WH Group, Ltd., ADR (Hong Kong) | | | 2,581 | | | | 41,361 | |

Total Consumer Staples | | | | | | | 145,398 | |

Financials—14.9% | | | | | | | | |

Allianz SE, Sponsored ADR (Germany) | | | 2,276 | | | | 37,508 | |

DBS Group Holdings, Ltd., Sponsored ADR (Singapore) | | | 900 | | | | 42,971 | |

Grupo Financiero Banorte SAB de CV, | | | | | | | | |

Sponsored ADR (Mexico) | | | 1,344 | | | | 33,412 | |

Kasikornbank PCL, ADR (Thailand) | | | 1,737 | | | | 34,219 | |

Manulife Financial Corp. (Canada) | | | 2,102 | | | | 37,458 | |

ORIX Corp., Sponsored ADR (Japan) | | | 482 | | | | 37,514 | |

Turkiye Garanti Bankasi A.S., ADR (Turkey) | | | 18,372 | | | | 38,397 | |

Validus Holdings, Ltd. (Bermuda) | | | 795 | | | | 43,733 | |

Total Financials | | | | | | | 305,212 | |

Health Care—5.6% | | | | | | | | |

ICON PLC (Ireland)* | | | 526 | | | | 39,555 | |

Jazz Pharmaceuticals PLC (Ireland)* | | | 381 | | | | 41,540 | |

Shire PLC,ADR (United States) | | | 202 | | | | 34,417 | |

Total Health Care | | | | | | | 115,512 | |

Industrials—15.0% | | | | | | | | |

AerCap Holdings N.V. (Ireland)* | | | 927 | | | | 38,572 | |

Canadian National Railway Co. (Canada) | | | 555 | | | | 37,407 | |

China Eastern Airlines Corp., Ltd., ADR (China)1 | | | 1,774 | | | | 39,649 | |

Controladora Vuela Cia de Aviacion SAB de CV, ADR (Mexico)* | | | 2,613 | | | | 39,300 | |

| | | | | | | | |

| | | Shares | | | Value | |

Mitsubishi Electric Corp., ADR (Japan) | | | 1,567 | | | $ | 43,516 | |

Ryanair Holdings PLC, Sponsored ADR (Ireland)* | | | 450 | | | | 37,467 | |

SMC Corp., Sponsored ADR (Japan) | | | 2,890 | | | | 34,073 | |

Vestas Wind Systems A/S, ADR (Denmark) | | | 1,727 | | | | 37,510 | |

Total Industrials | | | | | | | 307,494 | |

Information Technology—17.7% | |

AAC Technologies Holdings, Inc., ADR (China) | | | 395 | | | | 35,718 | |

Advanced Semiconductor Engineering, Inc., ADR (Taiwan) | | | 6,482 | | | | 32,669 | |

Capgemini, S.A., ADR (France) | | | 2,105 | | | | 35,396 | |

Check Point Software Technologies, Ltd. (Israel)* | | | 444 | | | | 37,500 | |

Infineon Technologies AG, ADR (Germany) | | | 2,317 | | | | 40,038 | |

Murata Manufacturing Co., Ltd., ADR (Japan)1 | | | 1,128 | | | | 37,630 | |

NetEase, Inc., ADR (China) | | | 160 | | | | 34,454 | |

NXP Semiconductors N.V. (Netherlands)* | | | 383 | | | | 37,538 | |

Taiwan Semiconductor Manufacturing Co., Ltd., Sponsored ADR (Taiwan) | | | 1,369 | | | | 39,359 | |

Wipro, Ltd., ADR (India)1 | | | 3,491 | | | | 33,793 | |

Total Information Technology | | | | | | | 364,095 | |

Materials—7.2% | | | | | | | | |

Akzo Nobel NV, Sponsored ADR (Netherlands) | | | 1,844 | | | | 38,171 | |

Arkema, S.A., Sponsored ADR (France) | | | 382 | | | | 37,321 | |

Linde AG, Sponsored ADR (Germany) | | | 2,314 | | | | 38,343 | |

Toray Industries, Inc., ADR (Japan) | | | 2,141 | | | | 34,470 | |

Total Materials | | | | | | | 148,305 | |

Real Estate—3.3% | | | | | | | | |

Colliers International Group, Inc. (Canada) | | | 923 | | | | 33,920 | |

Unibail-Rodamco SE, ADR (France) | | | 1,470 | | | | 34,942 | |

Total Real Estate | | | | | | | 68,862 | |

Telecommunication Services—8.9% | |

Bezeq The Israeli Telecommunication Corp., | | | | | | | | |

Ltd., ADR (Iceland) | | | 4,100 | | | | 38,991 | |

China Mobile, Ltd., Sponsored ADR (Hong Kong) | | | 637 | | | | 33,398 | |

KDDI Corp., ADR (Japan)1 | | | 2,991 | | | | 37,836 | |

Nippon Telegraph & Telephone Corp., ADR (Japan) | | | 832 | | | | 35,002 | |

SK Telecom Co., Ltd., Sponsored ADR (South Korea) | | | 1,782 | | | | 37,244 | |

Total Telecommunication Services | | | | | | | 182,471 | |

Utilities—1.8% | | | | | | | | |

Korea Electric Power Corp., Sponsored ADR (South Korea)* | | | 2,032 | | | | 37,551 | |

Total Common Stocks

(cost $1,987,412) | | | | | | | 2,032,036 | |

The accompanying notes are an integral part of these financial statements.

13

AMG Renaissance International Equity Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Short-Term Investments—2.9% | |

Repurchase Agreements—2.9%2 | |

Citigroup Global Markets, Inc., dated 12/30/16, due 01/03/17, 0.510% total to be received $59,999 (collateralized by various U.S. Government Agency Obligations, 0.125% - 1.750%, 04/15/20 - 01/15/28, totaling $61,196) | | $ | 59,996 | | | $ | 59,996 | |

Total Short-Term Investments

(cost $59,996) | | | | | | | 59,996 | |

| | | | |

| | | Value | |

Total Investments—101.8%

(cost $2,047,408) | | $ | 2,092,032 | |

Other Assets, less Liabilities—(1.8)% | | | (37,541 | ) |

Net Assets—100.0% | | $ | 2,054,491 | |

The accompanying notes are an integral part of these financial statements.

14

Notes to Schedules of Portfolio Investments

The following footnotes should be read in conjunction with each of the Schedules of Portfolio Investments previously presented in this report.

At December 31, 2016, the approximate cost of investments and the aggregate gross unrealized appreciation and depreciation for federal income tax were as follows:

| | | | | | | | | | | | | | | | |

| Fund | | Cost | | | Appreciation | | | Depreciation | | | Net | |

AMG Renaissance Large Cap Growth Fund | | $ | 64,577,155 | | | $ | 8,297,428 | | | $ | (1,588,201 | ) | | $ | 6,709,227 | |

AMG Renaissance International Equity Fund | | | 2,224,998 | | | | 144,484 | | | | (277,450 | ) | | | (132,966 | ) |

| * | Non-income producing security. |

| 1 | Some or all of these securities were out on loan to various brokers as of December 31, 2016, amounting to the following: |

| | | | | | | | |

| Fund | | Market Value | | | % of Net Assets | |

AMG Renaissance Large Cap Growth Fund | | $ | 473,288 | | | | 0.7 | % |

AMG Renaissance International Equity Fund | | | 58,323 | | | | 2.8 | % |

| 2 | Collateral received from brokers for securities lending was invested in these joint repurchase agreements. |

| 3 | Yield shown represents the December 31, 2016, seven-day average yield, which refers to the sum of the previous seven days’ dividends paid, expressed as an annual percentage. |

The accompanying notes are an integral part of these financial statements.

15

Notes to Schedules of Portfolio Investments (continued)

| | | | | | | | |

Country | | AMG Renaissance

International

Equity Fund† | | | MSCI ACWI

ex USA†† | |

Australia | | | 0.0 | % | | | 5.2 | % |

Austria | | | 0.0 | % | | | 0.1 | % |

Belgium | | | 0.0 | % | | | 0.8 | % |

Bermuda | | | 2.2 | % | | | 0.0 | % |

Brazil | | | 0.0 | % | | | 1.7 | % |

Canada | | | 7.5 | % | | | 7.1 | % |

Chile | | | 0.0 | % | | | 0.3 | % |

China | | | 7.6 | % | | | 6.0 | % |

Colombia | | | 0.0 | % | | | 0.1 | % |

Czech Republic | | | 0.0 | % | | | 0.0 | %# |

Denmark | | | 3.8 | % | | | 1.2 | % |

Egypt | | | 0.0 | % | | | 0.0 | %# |

Finland | | | 0.0 | % | | | 0.7 | % |

France | | | 9.1 | % | | | 7.2 | % |

Germany | | | 5.7 | % | | | 6.5 | % |

Greece | | | 0.0 | % | | | 0.1 | % |

Hong Kong | | | 3.7 | % | | | 2.3 | % |

Hungary | | | 0.0 | % | | | 0.1 | % |

Iceland | | | 1.9 | % | | | 0.0 | % |

India | | | 3.4 | % | | | 1.9 | % |

Indonesia | | | 0.0 | % | | | 0.6 | % |

Ireland | | | 7.7 | % | | | 0.3 | % |

Israel | | | 1.8 | % | | | 0.5 | % |

Italy | | | 0.0 | % | | | 1.5 | % |

Japan | | | 14.8 | % | | | 16.9 | % |

Malaysia | | | 0.0 | % | | | 0.6 | % |

Mexico | | | 3.6 | % | | | 0.8 | % |

Netherlands | | | 7.1 | % | | | 2.3 | % |

New Zealand | | | 0.0 | % | | | 0.1 | % |

| | | | | | | | |

Country | | AMG Renaissance

International

Equity Fund† | | | MSCI ACWI

ex USA†† | |

Norway | | | 0.0 | % | | | 0.5 | % |

Peru | | | 0.0 | % | | | 0.1 | % |

Philippines | | | 0.0 | % | | | 0.3 | % |

Poland | | | 0.0 | % | | | 0.3 | % |

Portugal | | | 0.0 | % | | | 0.1 | % |

Qatar | | | 0.0 | % | | | 0.2 | % |

Russia | | | 0.0 | % | | | 1.0 | % |

Singapore | | | 2.1 | % | | | 0.9 | % |

South Africa | | | 0.0 | % | | | 1.6 | % |

South Korea | | | 3.7 | % | | | 3.3 | % |

Spain | | | 0.0 | % | | | 2.2 | % |

Sweden | | | 0.0 | % | | | 2.0 | % |

Switzerland | | | 0.0 | % | | | 6.1 | % |

Taiwan | | | 3.5 | % | | | 2.8 | % |

Thailand | | | 1.7 | % | | | 0.5 | % |

Turkey | | | 1.9 | % | | | 0.2 | % |

United Arab Emirates | | | 0.0 | % | | | 0.2 | % |

United Kingdom | | | 3.7 | % | | | 12.8 | % |

United States | | | 3.5 | % | | | 0.0 | % |

| | | | | | | | |

| | | 100.0 | % | | | 100.0 | % |

| | | | | | | | |

| † | As a percentage of total long term investments as of December 31, 2016. |

The accompanying notes are an integral part of these financial statements.

16

Notes to Schedules of Portfolio Investments (continued)

The following table summarizes the inputs used to value the Funds’ investments by the fair value hierarchy levels as of December 31, 2016: (See Note 1(a) in the Notes to Financial Statements.)

| | | | | | | | | | | | | | | | |

| | | Quoted Prices in Active Markets

for Identical Investments | | | Significant Other

Observable Inputs | | | Significant

Unobservable Inputs | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

AMG Renaissance Large Cap Growth Fund | | | | | | | | | | | | | | | | |

Investments in Securities | | | | | | | | | | | | | | | | |

Common Stocks† | | | 70,379,767 | | | | — | | | | — | | | | 70,379,767 | |

Short-Term Investments | | | | | | | | | | | | | | | | |

Repurchase Agreements | | | — | | | $ | 488,054 | | | | — | | | | 488,054 | |

Other Investment Companies | | | 418,561 | | | | — | | | | — | | | | 418,561 | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities | | $ | 70,798,328 | | | $ | 488,054 | | | | — | | | $ | 71,286,382 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | Quoted Prices in Active Markets

for Identical Investments | | | Significant Other

Observable Inputs | | | Significant

Unobservable Inputs | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

AMG Renaissance International Equity Fund | | | | | | | | | | | | | | | | |

Investments in Securities | | | | | | | | | | | | | | | | |

Common Stocks† | | $ | 2,032,036 | | | | — | | | | — | | | $ | 2,032,036 | |

Short-Term Investments | | | | | | | | | | | | | | | | |

Repurchase Agreements | | | — | | | $ | 59,996 | | | | — | | | | 59,996 | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities | | $ | 2,032,036 | | | $ | 59,996 | | | | — | | | $ | 2,092,032 | |

| | | | | | | | | | | | | | | | |

| † | All common stocks held in the Fund are Level 1 securities. For a detailed breakout of the common stocks by major industry classification, please refer to the respective Schedules of Portfolio Investments. |

As of December 31, 2016, the Funds had no transfers between levels from the beginning of the reporting period.

INVESTMENTS DEFINITIONS AND ABBREVIATIONS:

ADR: ADR after the name of a holding stands for American Depositary Receipt, representing ownership of foreign securities on deposit with a domestic custodian bank. The value of an ADR security is determined or significantly influenced by trading on exchanges not located in the United States or Canada. Sponsored ADRs are initiated by the underlying foreign company.

PLC: Public Limited Company.

The accompanying notes are an integral part of these financial statements.

17

Statement of Assets and Liabilities

December 31, 2016

| | | | | | | | |

| | | AMG Renaissance

Large Cap

Growth Fund# | | | AMG Renaissance

International

Equity Fund# | |

Assets: | | | | | | | | |

Investments at value* (including securities on loan valued at $ 473,288 and $ 58,323, respectively) | | $ | 71,286,382 | | | $ | 2,092,032 | |

Receivable for Fund shares sold | | | 698,924 | | | | — | |

Receivable for investments sold | | | 639,216 | | | | 70,776 | |

Dividends and other receivables | | | 51,295 | | | | 1,517 | |

Receivable from affiliate | | | 22,436 | | | | 19,160 | |

Prepaid expenses | | | 21,974 | | | | 19,290 | |

Total assets | | | 72,720,227 | | | | 2,202,775 | |

Liabilities: | | | | | | | | |

Payable upon return of securities loaned | | | 488,054 | | | | 59,996 | |

Payable for Fund shares repurchased | | | 432,093 | | | | — | |

Payable to Custodian | | | — | | | | 51,193 | |

Accrued expenses: | | | | | | | | |

Investment advisory and management fees | | | 33,816 | | | | 710 | |

Administrative fees | | | 9,222 | | | | 266 | |

Shareholder servicing fees—Class I | | | 1,834 | | | | 48 | |

Shareholder servicing fees—Class N | | | 615 | | | | 85 | |

Distribution fees—Class N | | | 615 | | | | 85 | |

Professional fees | | | 24,730 | | | | 26,316 | |

Custodian fees | | | 3,187 | | | | 5,691 | |

Trustees fees and expenses | | | 35 | | | | — | |

Other | | | 17,506 | | | | 3,894 | |

Total liabilities | | | 1,011,707 | | | | 148,284 | |

Net Assets | | $ | 71,708,520 | | | $ | 2,054,491 | |

* Investments at cost | | $ | 64,546,982 | | | $ | 2,047,408 | |

| # | Effective October 1, 2016, the Funds’ share classes were renamed as described in Note 1 of the Notes to the Financial Statements. |

The accompanying notes are an integral part of these financial statements.

18

Statement of Assets and Liabilities (continued)

| | | | | | | | |

| | | AMG Renaissance

Large Cap

Growth Fund# | | | AMG Renaissance

International

Equity Fund# | |

Net Assets Represent: | | | | | | | | |

Paid-in capital | | $ | 64,213,917 | | | $ | 2,489,022 | |

Distributions in excess of net investment income | | | — | | | | (5,591 | ) |

Accumulated net realized gain (loss) from investments | | | 755,203 | | | | (473,564 | ) |

Net unrealized appreciation of investments | | | 6,739,400 | | | | 44,624 | |

Net Assets | | $ | 71,708,520 | | | $ | 2,054,491 | |

Class N: | | | | | | | | |

Net Assets | | $ | 3,068,845 | | | $ | 356,608 | |

Shares outstanding | | | 258,753 | | | | 42,109 | |

Net asset value, offering and redemption price per share | | $ | 11.86 | | | $ | 8.47 | |

Class I: | | | | | | | | |

Net Assets | | $ | 14,172,987 | | | $ | 179,028 | |

Shares outstanding | | | 1,186,614 | | | | 21,138 | |

Net asset value, offering and redemption price per share | | $ | 11.94 | | | $ | 8.47 | |

Class Z: | | | | | | | | |

Net Assets | | $ | 54,466,688 | | | $ | 1,518,855 | |

Shares outstanding | | | 4,611,708 | | | | 179,340 | |

Net asset value, offering and redemption price per share | | $ | 11.81 | | | $ | 8.47 | |

| # | Effective October 1, 2016, the Funds’ share classes were renamed as described in Note 1 of the Notes to the Financial Statements. |

The accompanying notes are an integral part of these financial statements.

19

Statement of Operations

For the year ended December 31, 2016

| | | | | | | | |

| | | AMG Renaissance

Large Cap Growth

Fund# | | | AMG Renaissance

International

Equity Fund# | |

Investment Income: | | | | | | | | |

Dividend income | | $ | 1,009,806 | | | $ | 66,321 | |

Securities lending income | | | 6,523 | | | | 6,679 | |

Interest income | | | 3,251 | | | | 98 | |

Foreign withholding tax | | | — | | | | (7,191 | ) |

Total investment income | | | 1,019,580 | | | | 65,907 | |

Expenses: | | | | | | | | |

Investment advisory and management fees | | | 362,938 | | | | 10,361 | |

Administrative fees | | | 147,286 | | | | 5,945 | |

Shareholder servicing fees—Class I | | | 23,027 | | | | 177 | |

Shareholder servicing fees—Class N | | | 5,834 | | | | 1,657 | |

Distribution fees—Class N | | | 5,834 | | | | 1,657 | |

Registration fees | | | 35,379 | | | | 35,751 | |

Professional fees | | | 32,181 | | | | 30,157 | |

Reports to shareholders | | | 20,538 | | | | 5,127 | |

Transfer agent | | | 10,031 | | | | 770 | |

Custodian | | | 5,159 | | | | 6,169 | |

Trustees fees and expenses | | | 4,969 | | | | 208 | |

Miscellaneous | | | 2,629 | | | | 1,946 | |

Total expenses before offsets | | | 655,805 | | | | 99,925 | |

Expense reimbursements | | | (185,526 | ) | | | (74,416 | ) |

Expense reductions | | | (3,292 | ) | | | (1,298 | ) |

Net expenses | | | 466,987 | | | | 24,211 | |

Net investment income | | | 552,593 | | | | 41,696 | |

Net Realized and Unrealized Gain (Loss): | | | | | | | | |

Net realized gain (loss) on investments | | | 1,749,376 | | | | (227,905 | ) |

Net change in unrealized appreciation (depreciation) of investments | | | 3,950,607 | | | | 93,548 | |

Net realized and unrealized gain (loss) | | | 5,699,983 | | | | (134,357 | ) |

Net increase (decrease) in net assets resulting from operations | | $ | 6,252,576 | | | $ | (92,661 | ) |

| # | Effective October 1, 2016, the Funds’ share classes were renamed as described in Note 1 of the Notes to the Financial Statements. |

The accompanying notes are an integral part of these financial statements.

20

Statements of Changes in Net Assets

For the years ended December 31,

| | | | | | | | | | | | | | | | |

| | | AMG Renaissance

Large Cap

Growth Fund# | | | AMG Renaissance

International

Equity Fund# | |

| | | 2016 | | | 2015 | | | 2016 | | | 2015 | |

Increase (Decrease) in Net Assets Resulting From Operations: | | | | | | | | | | | | | | | | |

Net investment income | | $ | 552,593 | | | $ | 278,475 | | | $ | 41,696 | | | $ | 31,520 | |

Net realized gain (loss) on investments | | | 1,749,376 | | | | 983,859 | | | | (227,905 | ) | | | (190,412 | ) |

Net change in unrealized appreciation (depreciation) of investments | | | 3,950,607 | | | | (2,228,379 | ) | | | 93,548 | | | | 104,965 | |

Net increase (decrease) in net assets resulting from operations | | | 6,252,576 | | | | (966,045 | ) | | | (92,661 | ) | | | (53,927 | ) |

Distributions to Shareholders: | | | | | | | | | | | | | | | | |

From net investment income: | | | | | | | | | | | | | | | | |

Class N | | | (12,054 | ) | | | — | | | | (7,871 | ) | | | (10,052 | ) |

Class I | | | (94,667 | ) | | | (63,670 | ) | | | (4,116 | ) | | | (1,852 | ) |

Class Z | | | (447,027 | ) | | | (216,729 | ) | | | (35,776 | ) | | | (21,950 | ) |

From net realized gain on investments: | | | | | | | | | | | | | | | | |

Class N | | | (41,286 | ) | | | (52,705 | ) | | | — | | | | — | |

Class I | | | (205,073 | ) | | | (362,066 | ) | | | — | | | | — | |

Class Z | | | (778,779 | ) | | | (916,813 | ) | | | — | | | | — | |

From paid-in capital: | | | | | | | | | | | | | | | | |

Class N | | | — | | | | — | | | | (3,077 | ) | | | — | |

Class I | | | — | | | | — | | | | (1,609 | ) | | | — | |

Class Z | | | — | | | | — | | | | (13,989 | ) | | | — | |

Total distributions to shareholders | | | (1,578,886 | ) | | | (1,611,983 | ) | | | (66,438 | ) | | | (33,854 | ) |

Capital Share Transactions:1 | | | | | | | | | | | | | | | | |

Net increase (decrease) from capital share transactions | | | 3,346,471 | | | | 36,500,463 | | | | (906,207 | ) | | | 1,078,835 | |

Total increase (decrease) in net assets | | | 8,020,161 | | | | 33,922,435 | | | | (1,065,306 | ) | | | 991,054 | |

Net Assets: | | | | | | | | | | | | | | | | |

Beginning of year | | | 63,688,359 | | | | 29,765,924 | | | | 3,119,797 | | | | 2,128,743 | |

End of year | | $ | 71,708,520 | | | $ | 63,688,359 | | | $ | 2,054,491 | | | $ | 3,119,797 | |

End of year distributions in excess of net investment income | | | — | | | | — | | | $ | (5,591 | ) | | $ | (176 | ) |

| | | | | | | | | | | | | | | | |

| # | Effective October 1, 2016, the Funds’ share classes were renamed as described in Note 1 of the Notes to the Financial Statements. |

| 1 | See Note 1(g) of the Notes to Financial Statements. |

The accompanying notes are an integral part of these financial statements.

21

AMG Renaissance Large Cap Growth Fund

Financial Highlights

For a share outstanding throughout each year

| | | | | | | | | | | | | | | | | | | | |

| | | For the years ended December 31, | |

| Class N | | 2016# | | | 2015 | | | 2014 | | | 2013 | | | 2012 | |

Net Asset Value, Beginning of Year | | $ | 11.10 | | | $ | 11.51 | | | $ | 11.80 | | | $ | 11.63 | | | $ | 10.77 | |

Income from Investment Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income1,2 | | | 0.04 | | | | 0.01 | | | | 0.03 | | | | 0.01 | | | | 0.01 | |

Net realized and unrealized gain (loss) on investments | | | 0.94 | | | | (0.18 | ) | | | 2.30 | | | | 3.95 | | | | 1.83 | |

Total income (loss) from investment operations | | | 0.98 | | | | (0.17 | ) | | | 2.33 | | | | 3.96 | | | | 1.84 | |

Less Distributions to Shareholders from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.05 | ) | | | — | | | | (0.03 | ) | | | (0.08 | ) | | | (0.01 | ) |

Net realized gain on investments | | | (0.17 | ) | | | (0.24 | ) | | | (2.59 | ) | | | (3.71 | ) | | | (0.97 | ) |

Total distributions to shareholders | | | (0.22 | ) | | | (0.24 | ) | | | (2.62 | ) | | | (3.79 | ) | | | (0.98 | ) |

Net Asset Value, End of Year | | $ | 11.86 | | | $ | 11.10 | | | $ | 11.51 | | | $ | 11.80 | | | $ | 11.63 | |

Total Return2 | | | 8.81 | % | | | (1.53 | )% | | | 19.59 | %4 | | | 34.17 | %4 | | | 17.10 | % |

Ratio of net expenses to average net assets (with offsets/reductions) | | | 1.15 | % | | | 1.14 | % | | | 1.14 | % | | | 1.17 | %5 | | | 1.15 | %6 |

Ratio of expenses to average net assets (with offsets) | | | 1.16 | % | | | 1.16 | % | | | 1.16 | % | | | 1.18 | %5 | | | 1.17 | %6 |

Ratio of total expenses to average net assets (without offsets/reductions)3 | | | 1.44 | % | | | 1.58 | % | | | 1.97 | % | | | 1.71 | %5 | | | 1.65 | %6 |

Ratio of net investment income to average net assets2 | | | 0.39 | % | | | 0.09 | % | | | 0.23 | % | | | 0.10 | %5 | | | 0.10 | %6 |

Portfolio turnover | | | 37 | % | | | 48 | % | | | 60 | % | | | 53 | % | | | 86 | % |

Net assets at end of year (000’s omitted) | | $ | 3,069 | | | $ | 2,533 | | | $ | 7,239 | | | $ | 984 | | | $ | 562 | |

| | | | | | | | | | | | | | | | | | | | |

| |

| | | For the years ended December 31, | |

| Class I | | 2016# | | | 2015 | | | 2014 | | | 2013 | | | 2012 | |

Net Asset Value, Beginning of Year | | $ | 11.17 | | | $ | 11.59 | | | $ | 11.87 | | | $ | 11.68 | | | $ | 10.83 | |

Income from Investment Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income1,2 | | | 0.08 | | | | 0.06 | | | | 0.07 | | | | 0.07 | | | | 0.05 | |

Net realized and unrealized gain (loss) on investments | | | 0.94 | | | | (0.20 | ) | | | 2.33 | | | | 3.97 | | | | 1.82 | |

Total income (loss) from investment operations | | | 1.02 | | | | (0.14 | ) | | | 2.40 | | | | 4.04 | | | | 1.87 | |

Less Distributions to Shareholders from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.08 | ) | | | (0.04 | ) | | | (0.05 | ) | | | (0.11 | ) | | | (0.05 | ) |

Net realized gain on investments | | | (0.17 | ) | | | (0.24 | ) | | | (2.63 | ) | | | (3.74 | ) | | | (0.97 | ) |

Total distributions to shareholders | | | (0.25 | ) | | | (0.28 | ) | | | (2.68 | ) | | | (3.85 | ) | | | (1.02 | ) |

Net Asset Value, End of Year | | $ | 11.94 | | | $ | 11.17 | | | $ | 11.59 | | | $ | 11.87 | | | $ | 11.68 | |

Total Return2 | | | 9.12 | % | | | (1.23 | )% | | | 20.08 | % | | | 34.75 | % | | | 17.42 | % |

Ratio of net expenses to average net assets (with offsets/reductions) | | | 0.81 | % | | | 0.80 | % | | | 0.75 | % | | | 0.77 | %5 | | | 0.82 | %6 |

Ratio of expenses to average net assets (with offsets) | | | 0.82 | % | | | 0.82 | % | | | 0.77 | % | | | 0.78 | %5 | | | 0.84 | %6 |

Ratio of total expenses to average net assets (without offsets/reductions)3 | | | 1.10 | % | | | 1.23 | % | | | 1.59 | % | | | 1.30 | %5 | | | 1.32 | %6 |

Ratio of net investment income to average net assets2 | | | 0.73 | % | | | 0.52 | % | | | 0.51 | % | | | 0.49 | %5 | | | 0.43 | %6 |

Portfolio turnover | | | 37 | % | | | 48 | % | | | 60 | % | | | 53 | % | | | 86 | % |

Net assets at end of year (000’s omitted) | | $ | 14,173 | | | $ | 17,189 | | | $ | 14,343 | | | $ | 11,336 | | | $ | 8,814 | |

| | | | | | | | | | | | | | | | | | | | |

22

AMG Renaissance Large Cap Growth Fund

Financial Highlights

For a share outstanding throughout each year

| | | | | | | | | | | | | | | | | | | | |

| | | For the years ended December 31, | |

| Class Z | | 2016# | | | 2015 | | | 2014 | | | 2013 | | | 2012 | |

Net Asset Value, Beginning of Year | | $ | 11.04 | | | $ | 11.45 | | | $ | 11.76 | | | $ | 11.58 | | | $ | 10.74 | |

Income from Investment Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income1,2 | | | 0.10 | | | | 0.09 | | | | 0.08 | | | | 0.08 | | | | 0.08 | |

Net realized and unrealized gain (loss) on investments | | | 0.94 | | | | (0.21 | ) | | | 2.31 | | | | 3.94 | | | | 1.81 | |

Total income (loss) from investment operations | | | 1.04 | | | | (0.12 | ) | | | 2.39 | | | | 4.02 | | | | 1.89 | |

Less Distributions to Shareholders from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.10 | ) | | | (0.05 | ) | | | (0.07 | ) | | | (0.13 | ) | | | (0.08 | ) |

Net realized gain on investments | | | (0.17 | ) | | | (0.24 | ) | | | (2.63 | ) | | | (3.71 | ) | | | (0.97 | ) |

Total distributions to shareholders | | | (0.27 | ) | | | (0.29 | ) | | | (2.70 | ) | | | (3.84 | ) | | | (1.05 | ) |

Net Asset Value, End of Year | | $ | 11.81 | | | $ | 11.04 | | | $ | 11.45 | | | $ | 11.76 | | | $ | 11.58 | |

Total Return2 | | | 9.38 | % | | | (1.06 | )% | | | 20.15 | % | | | 34.95 | % | | | 17.62 | % |

Ratio of net expenses to average net assets (with offsets/reductions) | | | 0.65 | % | | | 0.64 | % | | | 0.64 | % | | | 0.67 | %5 | | | 0.65 | %6 |

Ratio of expenses to average net assets (with offsets) | | | 0.66 | % | | | 0.66 | % | | | 0.66 | % | | | 0.68 | %5 | | | 0.67 | %6 |

Ratio of total expenses to average net assets (without offsets/reductions)3 | | | 0.94 | % | | | 1.07 | % | | | 1.51 | % | | | 1.16 | %5 | | | 1.15 | %6 |

Ratio of net investment income to average net assets2 | | | 0.89 | % | | | 0.76 | % | | | 0.63 | % | | | 0.58 | %5 | | | 0.64 | %6 |

Portfolio turnover | | | 37 | % | | | 48 | % | | | 60 | % | | | 53 | % | | | 86 | % |

Net assets at end of year (000’s omitted) | | $ | 54,467 | | | $ | 43,966 | | | $ | 8,184 | | | $ | 3,612 | | | $ | 15,674 | |

| | | | | | | | | | | | | | | | | | | | |

23

AMG Renaissance International Equity Fund

Financial Highlights

For a share outstanding throughout each period

| | | | | | | | | | | | |

| | | For the years ended

December 31, | | | For the period from June 16, 2014 through | |

| Class N | | 2016# | | | 2015 | | | December 31, 2014* | |

Net Asset Value, Beginning of Period | | $ | 8.90 | | | $ | 9.13 | | | $ | 10.00 | |

Income from Investment Operations: | | | | | | | | | | | | |

Net investment income1,2 | | | 0.12 | | | | 0.06 | 7 | | | 0.03 | |

Net realized and unrealized loss on investments | | | (0.33 | ) | | | (0.20 | ) | | | (0.87 | ) |

Total loss from investment operations | | | (0.21 | ) | | | (0.14 | ) | | | (0.84 | ) |

Less Distributions to Shareholders from: | | | | | | | | | | | | |

Net investment income | | | (0.16 | ) | | | (0.09 | ) | | | (0.03 | ) |

Paid-in capital | | | (0.06 | ) | | | — | | | | — | |

Total distributions to shareholders | | | (0.22 | ) | | | (0.09 | ) | | | (0.03 | ) |

Net Asset Value, End of Period | | $ | 8.47 | | | $ | 8.90 | | | $ | 9.13 | |

Total Return2 | | | (2.37 | )% | | | (1.56 | )%4 | | | (8.45 | )%4,8 |

Ratio of net expenses to average net assets (with offsets/reductions) | | | 1.30 | % | | | 1.29 | % | | | 1.12 | %9 |

Ratio of expenses to average net assets (with offsets) | | | 1.35 | % | | | 1.35 | % | | | 1.22 | %9 |

Ratio of total expenses to average net assets (without offsets/reductions)3 | | | 4.00 | % | | | 4.78 | % | | | 7.85 | %9 |

Ratio of net investment income to average net assets2 | | | 1.36 | % | | | 0.68 | % | | | 0.49 | %9 |

Portfolio turnover | | | 93 | % | | | 46 | % | | | 20 | %8 |

Net assets at end of period (000’s omitted) | | $ | 357 | | | $ | 1,010 | | | $ | 85 | |

| | | | | | | | | | | | |

| | |

| | | For the years ended

December 31, | | | For the period

from June 16, 2014 through | |

| Class I | | 2016# | | | 2015 | | | December 31, 2014* | |

Net Asset Value, Beginning of Period | | $ | 8.93 | | | $ | 9.12 | | | $ | 10.00 | |

Income from Investment Operations: | | | | | | | | | | | | |

Net investment income1,2 | | | 0.13 | | | | 0.11 | 7 | | | 0.05 | |

Net realized and unrealized loss on investments | | | (0.31 | ) | | | (0.21 | ) | | | (0.89 | ) |