[LOGO]

www.greenvillefirst.com

[LOGO]

Financial Services Conference

November 17th, 2005

During the course of this presentation, management may make projections and forward-looking statements regarding events or the future financial performance of Greenville First Bancshares, Inc. We wish to caution you that these forward-looking statements involve certain risks and uncertainties, including a variety of factors that may cause Greenville First's actual results to differ materially from the anticipated results expressed in these forward-looking statements. Investors are cautioned not to place undue reliance on these forward-looking statements and are advised to review the risk factors that may affect Greenville First's operating results in documents filed by Greenville First Bancshares, Inc. with the Securities and Exchange Commission, including the Form SB-2 Registration Statement, the Annual report on Form 10-KSB and other required filings. Greenville First assumes no duty to update the forward-looking statements made in this presentation.

[LOGO]

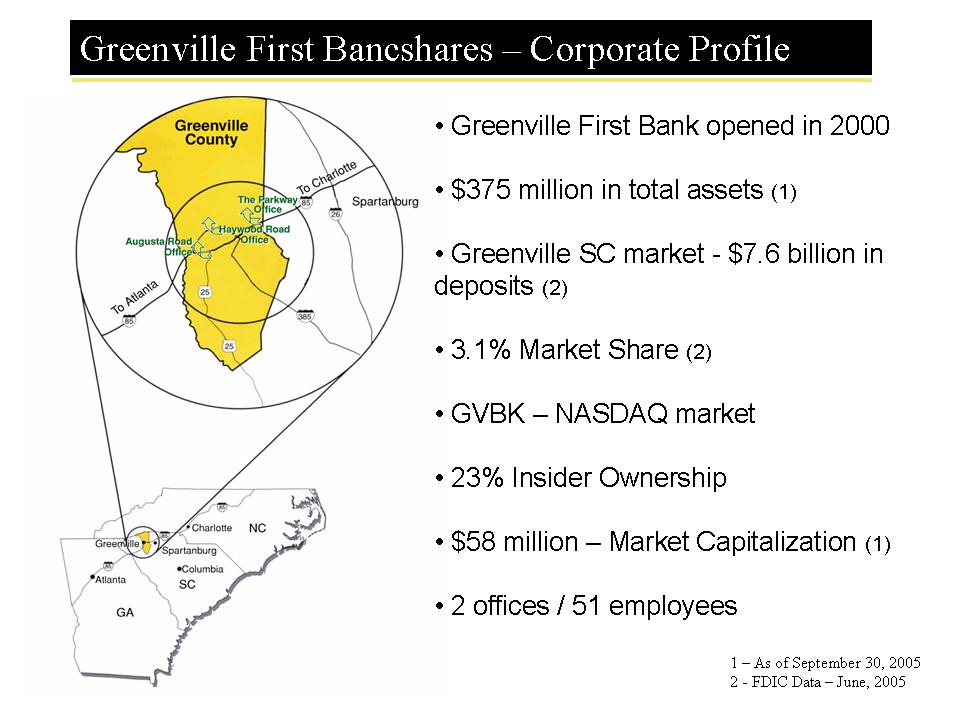

Greenville First Bancshares - Corporate Profile

[CHART]

• Greenville First Bank opened in 2000

• $375 million in total assets (1)

• Greenville SC market - $7.6 billion in Deposits (2)

• 3.1% Market Share (2)

• GVBK - NASDAQ market

• 23% Insider Ownership

• $58 million - Market Capitalization (1)

• 2 offices / 51 employees

Notes

(1) As of September 30, 2005

(2) FDIC Data - June, 2005

GVBK - Investment Profile

• Growth Story

• Performance Driven Leadership

• Unique Client FIRST Model

• Dynamic Greenville, SC Market

• Performance / Momentum

[LOGO]

GVBK - Growth Story

• Asset growth is 28% over September 2004

• 3rd quarter year-to-date earnings up 84% over same period in 2004

Total Assets (in millions)

[CHART]

Net Earnings (in thousands)

[CHART]

Notes:

(1) As of September 30, 2005

(2) Through September 30, 2005

[LOGO]

Corporate Strategy - Unique Model

Client FIRST

• Targeted Focus - Professional & Executive Market

• Relationship Team Structure - Personal Banker

- Drives growth

- Provides superior client service

- Produces sustainable efficiencies

• Highly Experienced Bank Team

- Zero employee turnover

[LOGO]

[CHART]

• SC's most populous county

• Largest deposit market in SC with over $7.6 billion in deposits

• Deposit growth averaging 9% annually over the past five years

• Diverse economy as market is home to over 240 international companies including BMW & Michelin

Notes:

Source - FDIC 2005

GVBK - Market Share Data

[CHART]

Notes:

Source - FDIC - June 2005

[LOGO]

• Efficiency ratio = 49.5% as of September 2005

• 50% increase in the number of people in the last year

Efficiency Ratio

[CHART]

[LOGO]

• Assets per employee = $8.5 million (1)

• Earnings per employee = $39.6 thousand (year to date) (1)

Assets per Employee

[CHART]

Earnings per Employee

[CHART]

Notes:

(1) Data as of June 30, 2005

Source - FDIC - June 2005

[LOGO]

• Market expansion

• Retail funding focus

- transaction account balances up 52% in 18 months

• Banker acquisition strategy- 3 key bankers acquired in the last year

• Capitalize on market / merger disruption

Summit National Bank

CCB

[LOGO]

• Experienced & Performance Oriented Leadership

• Unique Client FIRST Model

• Attractive Greenville, SC Market

• Growth Story

• Disciplined Credit Culture

• Momentum

[LOGO]