link to searchable text of slide shown above

link to searchable text of slide shown above

link to searchable text of slide shown above

link to searchable text of slide shown above

link to searchable text of slide shown above

link to searchable text of slide shown above

link to searchable text of slide shown above

link to searchable text of slide shown above

link to searchable text of slide shown above

link to searchable text of slide shown above

link to searchable text of slide shown above

link to searchable text of slide shown above

link to searchable text of slide shown above

link to searchable text of slide shown above

link to searchable text of slide shown above

link to searchable text of slide shown above

link to searchable text of slide shown above

link to searchable text of slide shown above

link to searchable text of slide shown above

Annual Shareholder's Meeting

May 17th, 2006

Forward-Looking Statements

During the course of this presentation, management may make projections and forward-looking statements regarding events or the future financial performance of Greenville First Bancshares, Inc. We wish to caution you that these forward-looking statements involve certain risks and uncertainties, including a variety of factors that may cause Greenville First's actual results to differ materially from the anticipated results expressed in these forward-looking statements. Investors are cautioned not to place undue reliance on these forward-looking statements and are advised to review the risk factors that may affect Greenville First's operating results in documents filed by Greenville First Bancshares, Inc. with the Securities and Exchange Commission, including the Form SB-2 Registration Statement, the Annual report on Form 10-K and other required filings. Greenville First assumes no duty to update the forward-looking statements made in this presentation.

[LOGO]

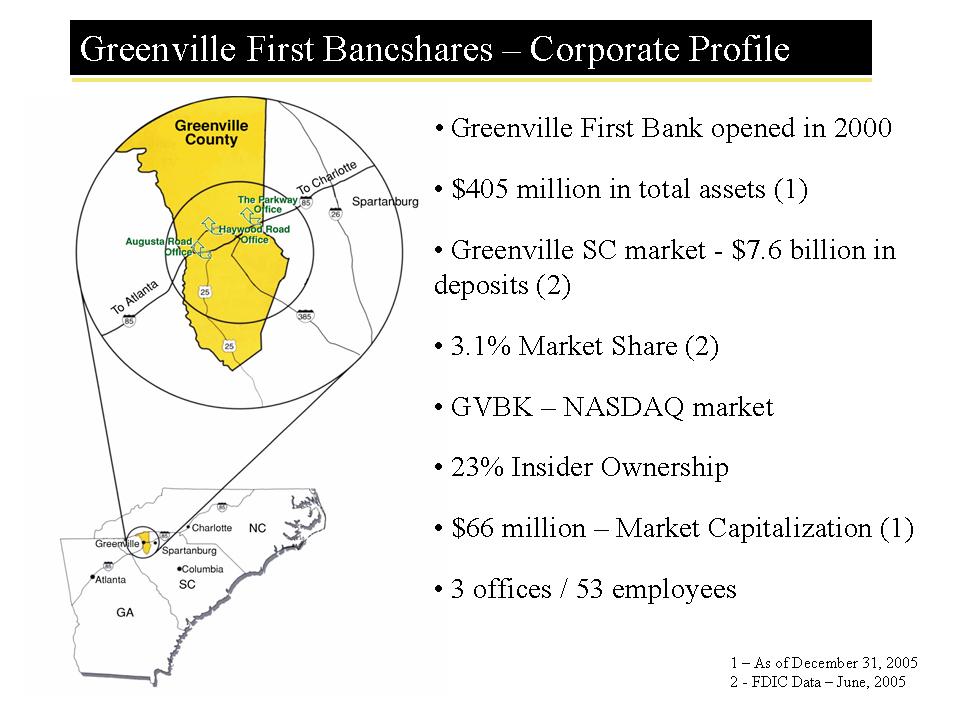

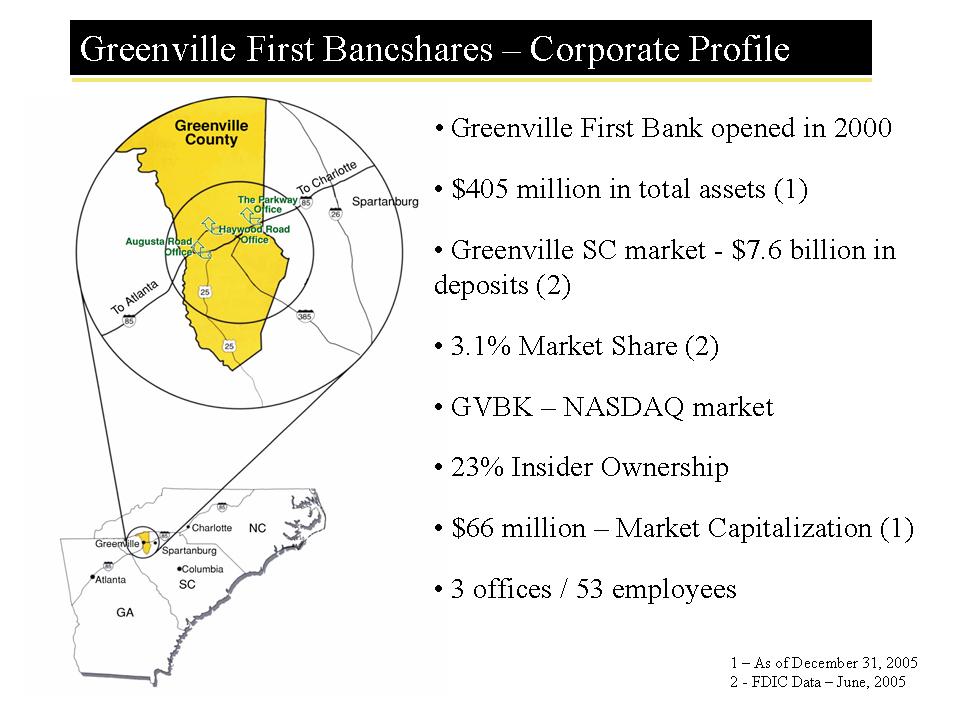

Greenville First Bancshares - Corporate Profile

[CHART]

• Greenville First Bank opened in 2000

• $405 million in total assets (1)

• Greenville SC market - $7.6 billion in deposits (2)

• 3.1% Market Share (2)

• GVBK - NASDAQ market

• 23% Insider Ownership

• $66 million - Market Capitalization (1)

• 3 offices / 53 employees

1 - As of December 31, 2005

2 - FDIC Data - June, 2005

• Solid asset & earnings growth

• Successful opening of our Parkway and Augusta Road offices

• Record retail deposit production

• Disciplined credit culture

• Improved efficiency

• Added 15 talented bankers to our team

• Stock price increased 26%

[LOGO]

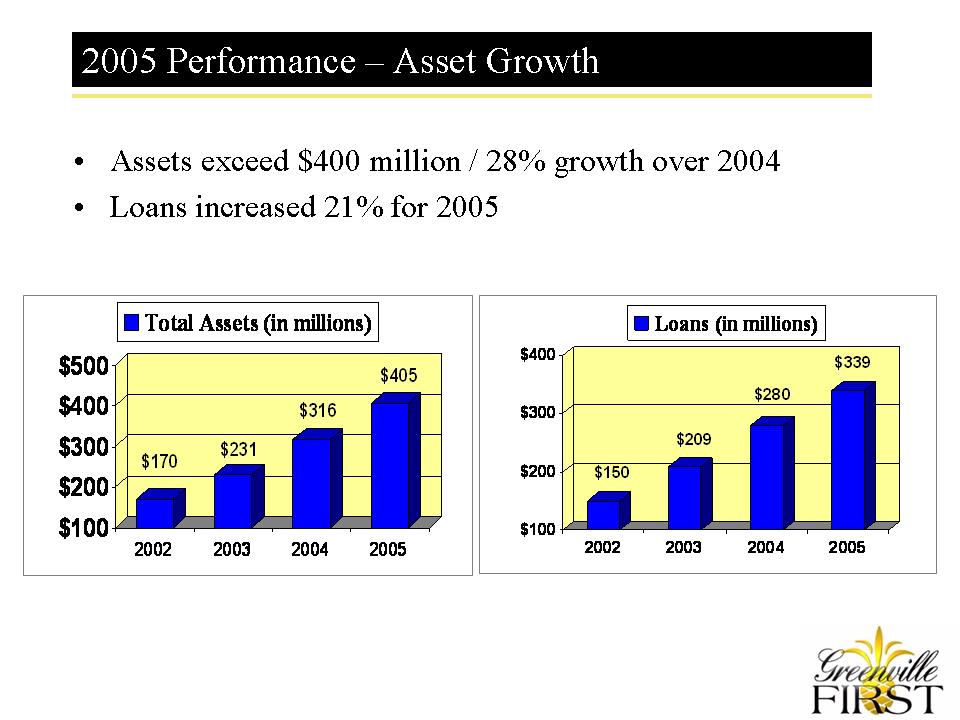

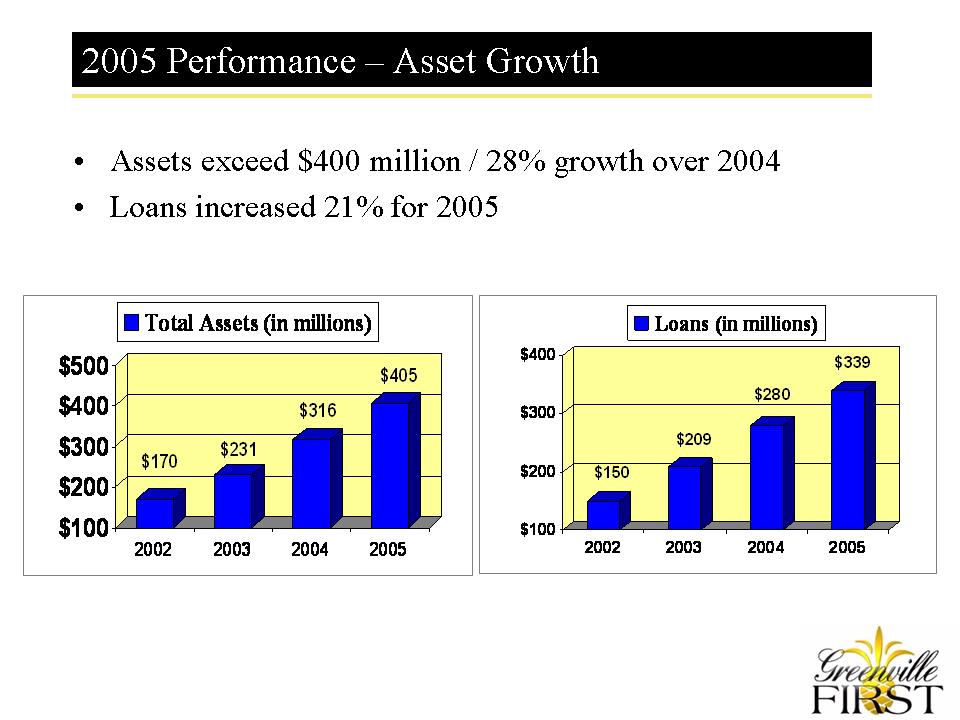

• Assets exceed $400 million / 28% growth over 2004

• Loans increased 21% for 2005

Total Assets (in millions)

[CHART]

Loans (in millions)

[CHART]

[LOGO]

• Net earnings increased 25% to $2.5 million and reflect 4th quarter charge related to move of corporate headquarters

• Operating earnings increased 71% to $3.4 million

Net Earnings (in thousands)

[CHART]

Net Operating Earnings (in thousands)

[CHART]

[LOGO]

• Parkway Office opened in March 2005

• Augusta Road Office opened in November 2005

[LOGO]

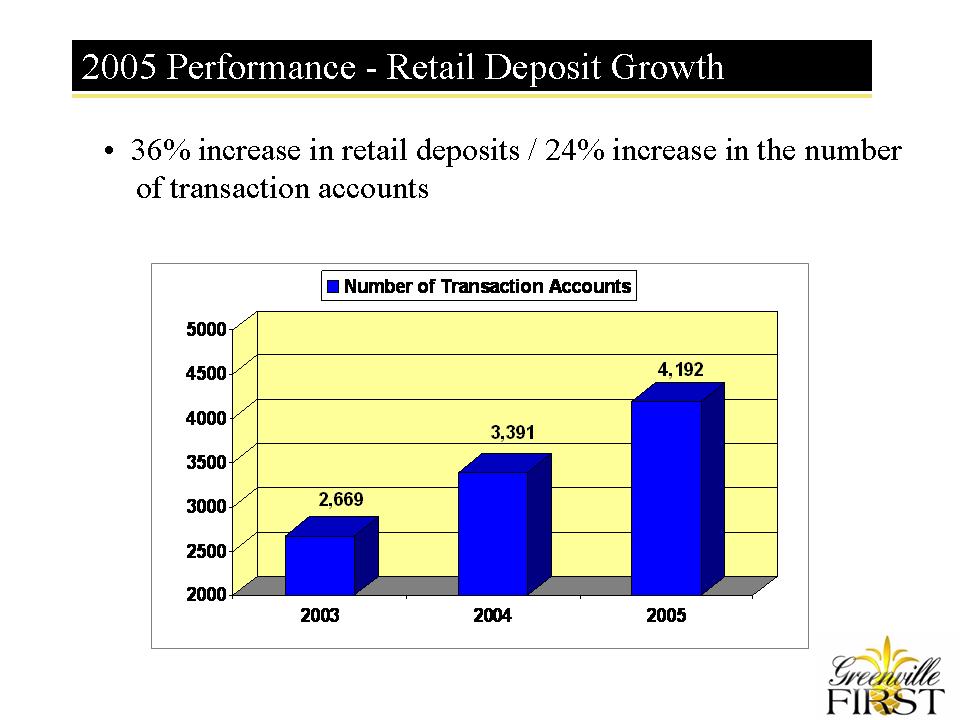

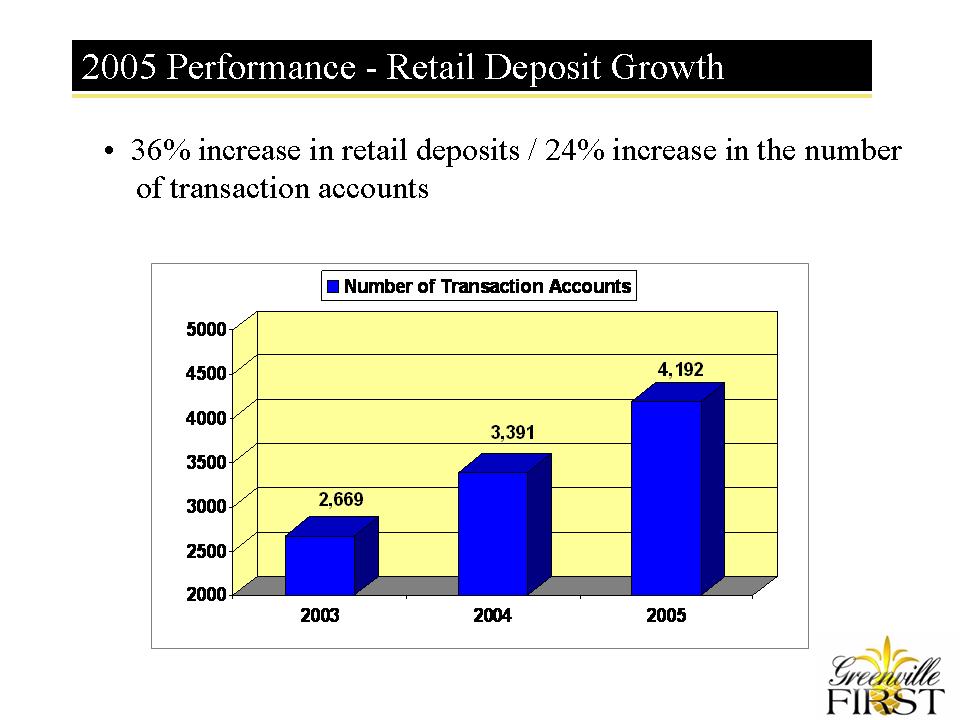

• 36% increase in retail deposits / 24% increase in the number of transaction accounts

Number of Transaction Accounts

[CHART]

[LOGO]

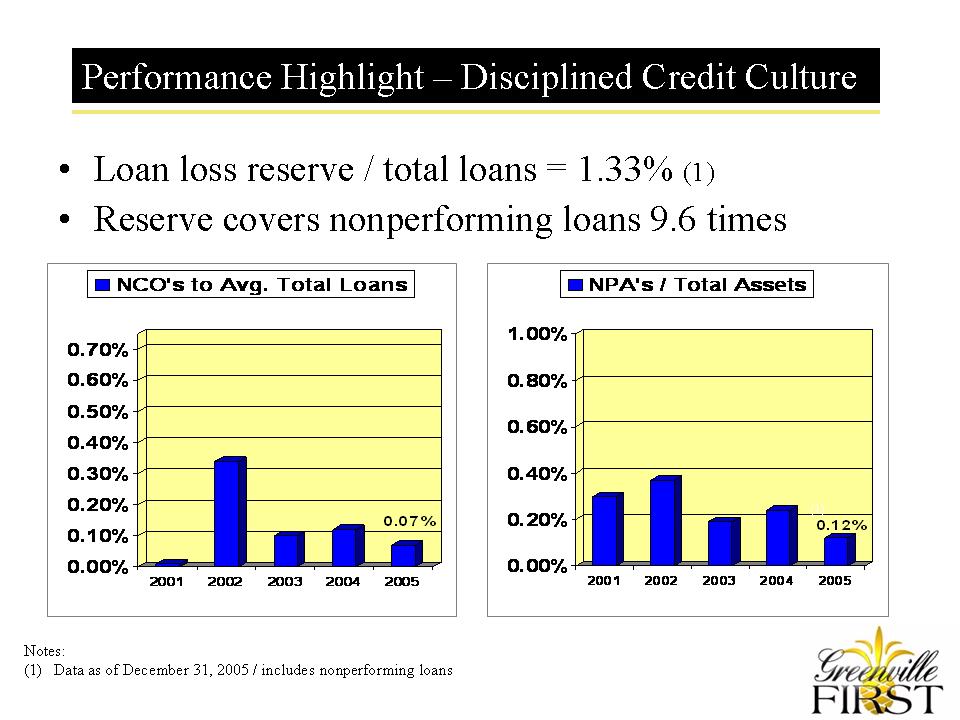

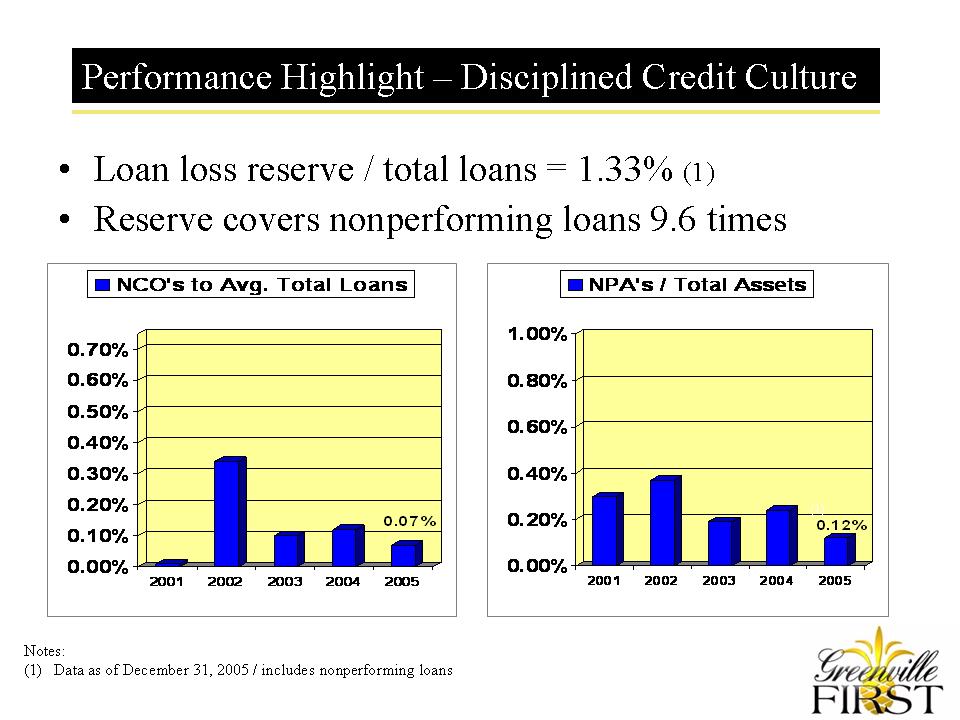

• Loan loss reserve / total loans = 1.33% (1)

• Reserve covers nonperforming loans 9.6 times

NCO's to Avg. Total Loans

[CHART]

NPA's /Total Assets

[CHART]

Notes:

(1) Data as of December 31, 2005 / includes nonperforming loans

[LOGO]

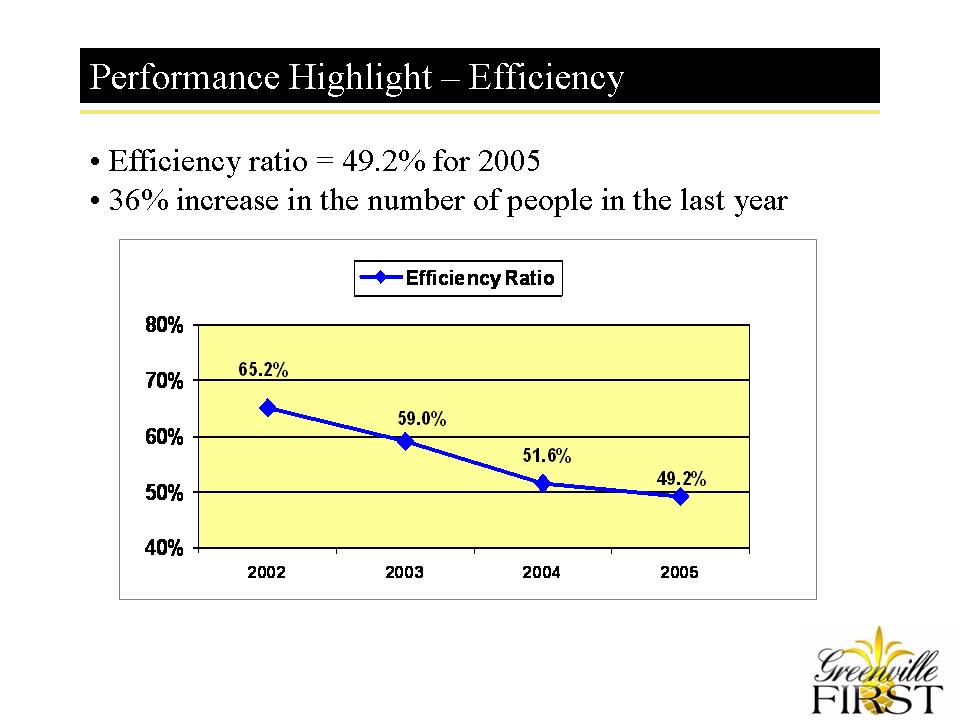

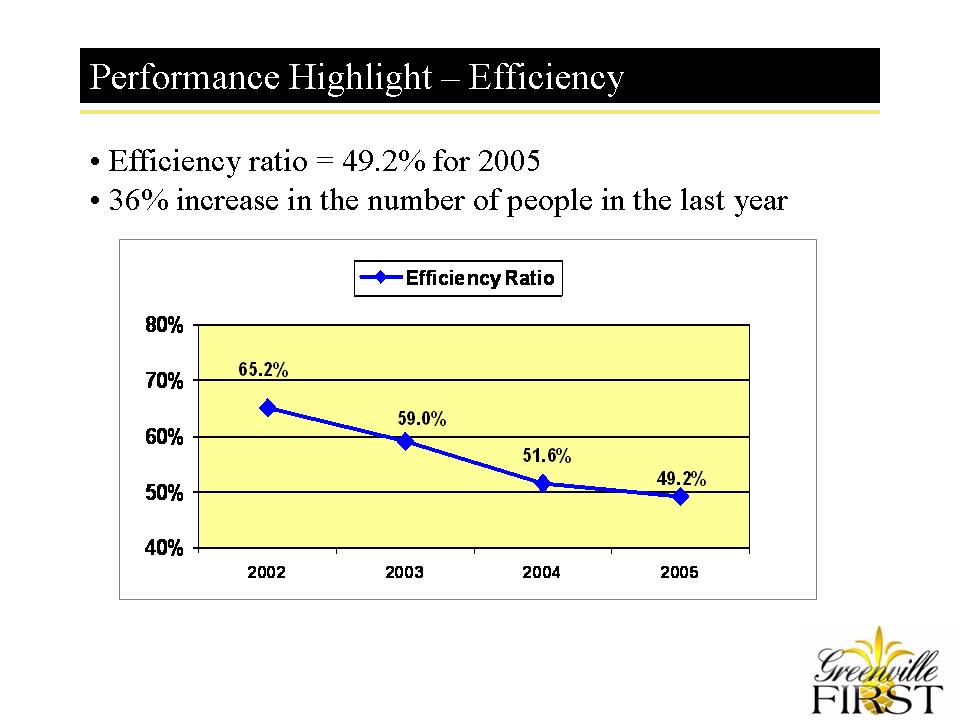

• Efficiency ratio = 49.2% for 2005

• 36% increase in the number of people in the last year

Efficiency Ratio

[CHART]

[LOGO]

Price History - GVBK (1/1/2005-12/31/2005)

[CHART]

[LOGO]

Greenville First Bancshares

Committed to the Future

[LOGO]

GVBK Market Capitalization ($ Millions)

[CHART]

[LOGO]

• Capitalize on our ClientFIRST model

• Invest in strategic infrastructure

- Verdae Headquarters, Woodruff Road Office

- Key Bankers

- Risk Management

• Grow assets to $600 million

• Grow earnings to $5 million

• Grow market share in excess of 5%

[LOGO]

• Assets increased to $417 million

• Strongest growth quarter in history for loans and deposits

Compared to first quarter 2005:

- Loans increased 23% to $364 million

- Retail deposits increased 52% to $206 million

- Transaction accounts increased 40% to $132 million

• Earnings increased 28% to $842 thousand

[LOGO]

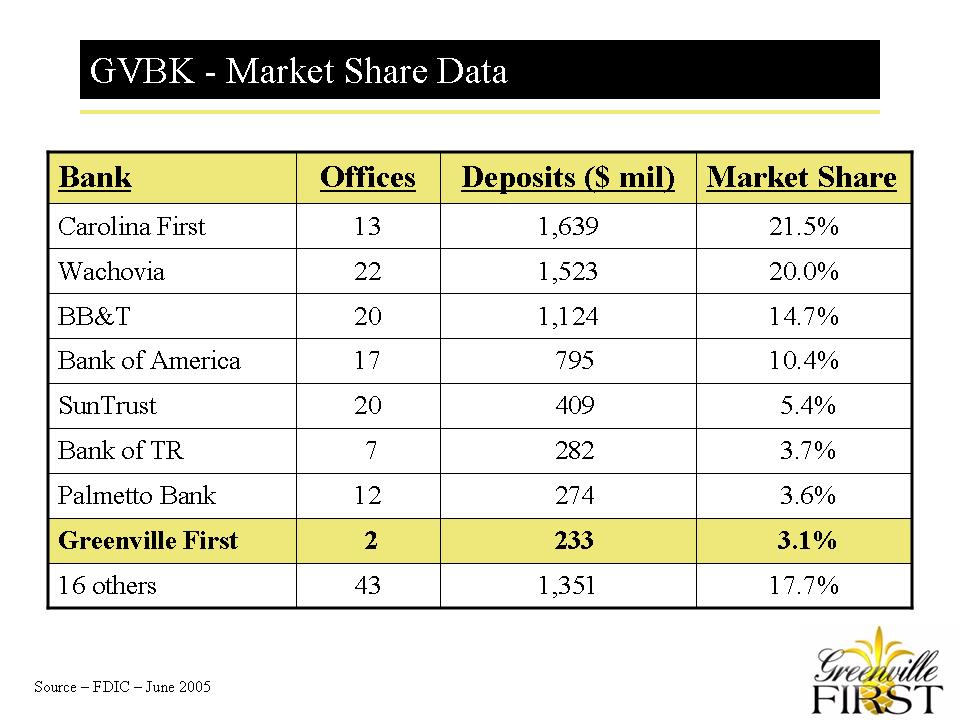

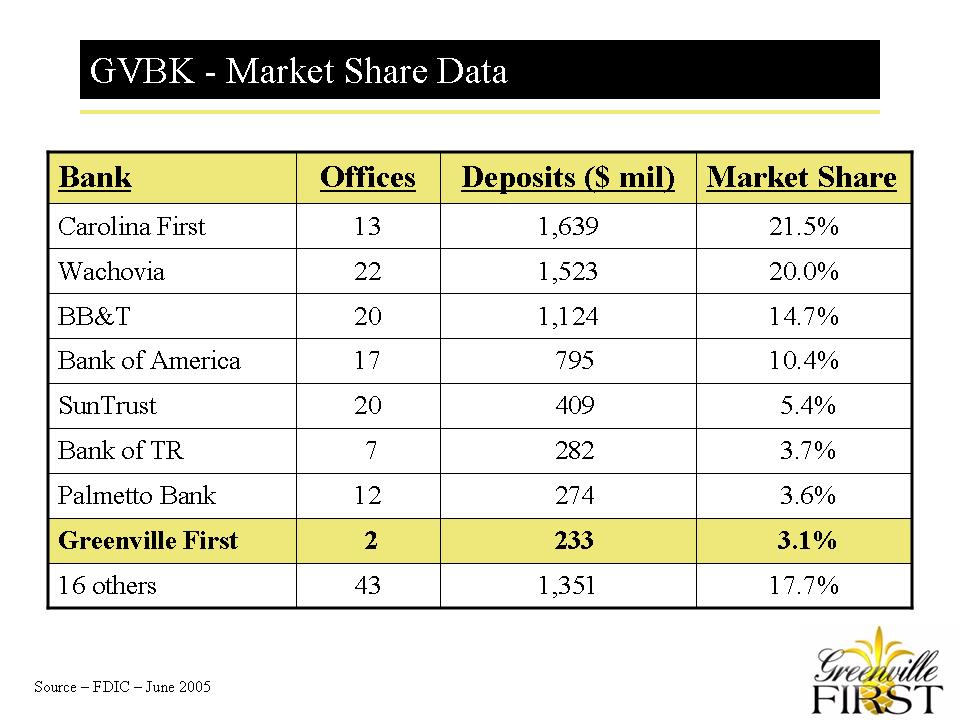

[CHART]

Source - FDIC - June 2005

[LOGO]

• Experienced & Performance Driven Leadership

• Unique ClientFIRST Model

• Dynamic Greenville, SC Market

• Growth Story / Winning Reputation

• Disciplined Credit & Risk Management Culture

• Momentum

[LOGO]

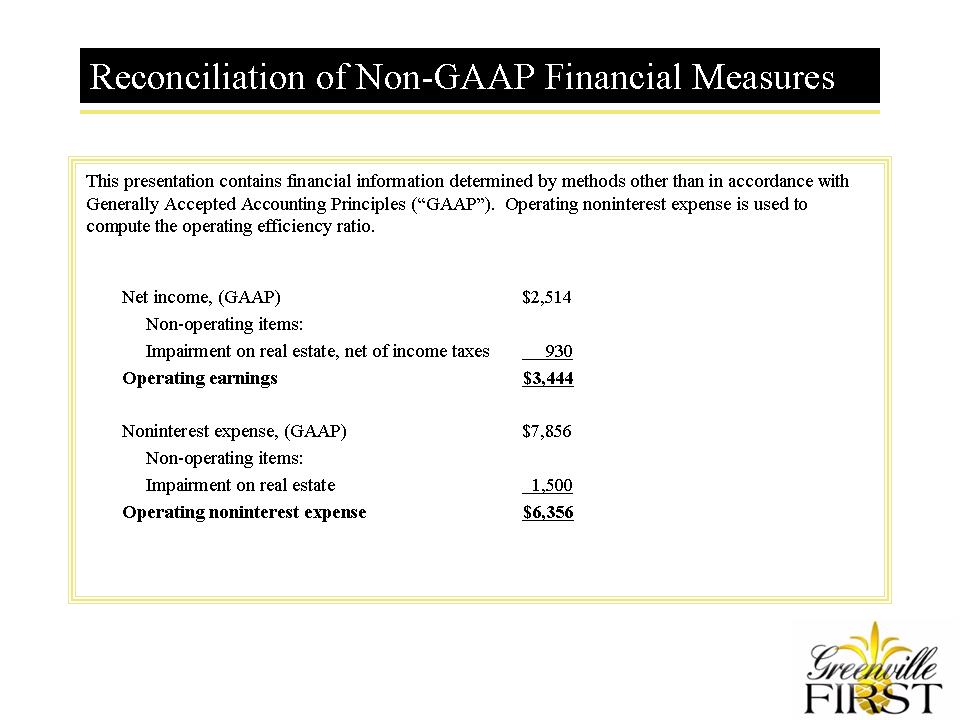

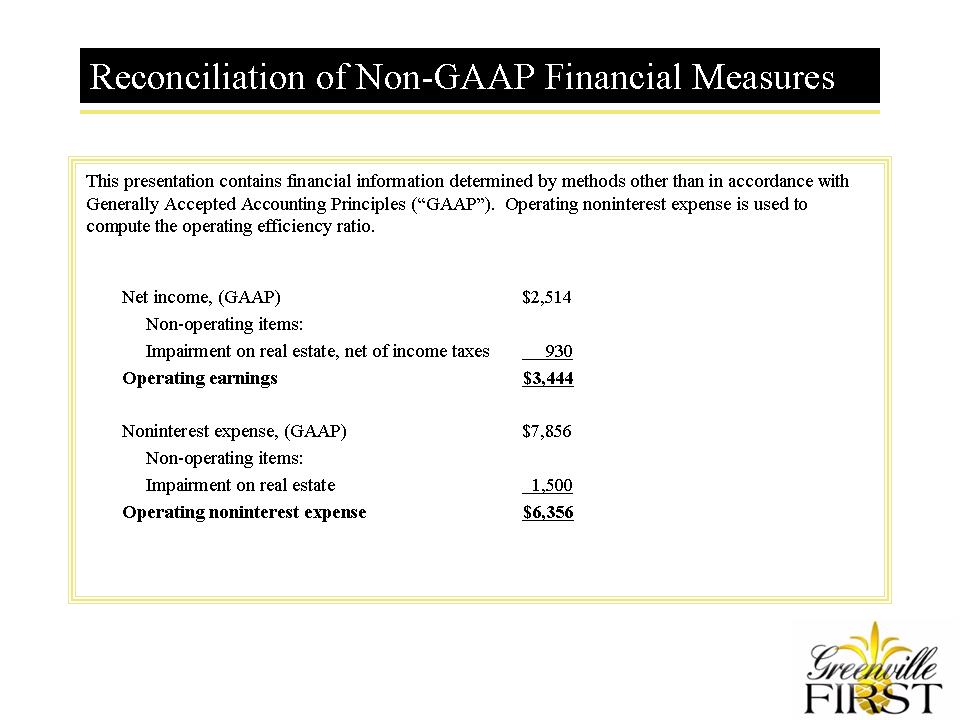

This presentation contains financial information determined by methods other than in accordance with Generally Accepted Accounting Principles ("GAAP"). Operating noninterest expense is used to compute the operating efficiency ratio.

Net income, (GAAP) $2,514

Non-operating items:

Impairment on real estate, net of income taxes 930

Operating earnings $3,444

Noninterest expense, (GAAP) $7,856

Non-operating items:

Impairment on real estate 1,500

Operating noninterest expense $6,356

[LOGO]

[LOGO]

GREENVILLE FIRST BANCSHARES, INC.

www.greenvillefirst.com

Thank You

For Your Continued Support