Exhibit 99.1

Southern First Bancshares, Inc. (SFST)

Annual Shareholders Meeting May 21st, 2013

Forward Looking Statements:

During the course of this presentation, management may make projections and forward-looking statements regarding events or the future financial performance of Southern First Bancshares, Inc. We wish to caution you that these forward-looking statements involve certain risks and uncertainties, including a variety of factors (including a downturn in the economy, greater than expected non-interest expenses, increased competition, fluctuations in interest rates, regulatory actions, excessive loan losses and other factors) that may cause Southern First’s actual results to differ materially from the anticipated results expressed or implied in these forward-looking statements. Therefore, we can give no assurance that the results contemplated in the forward-looking statements will be realized. Investors are cautioned not to place undue reliance on these forward-looking statements and are advised to review the risk factors that may affect Southern First’s operating results in documents filed by Southern First Bancshares, Inc. with the Securities and Exchange Commission, including the annual report on Form 10-K and other required filings. Southern First assumes no duty to update the forward-looking statements made in this presentation.

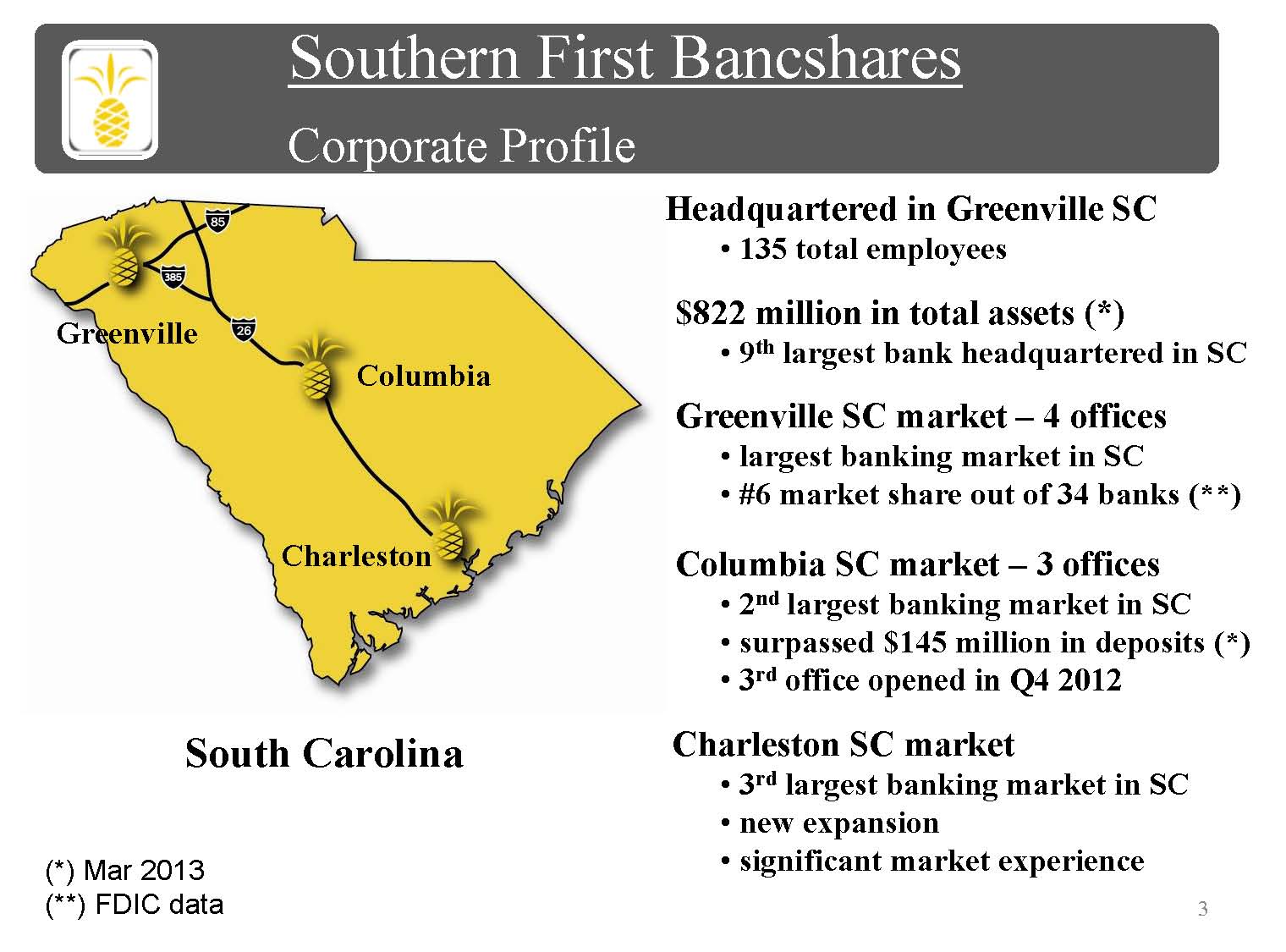

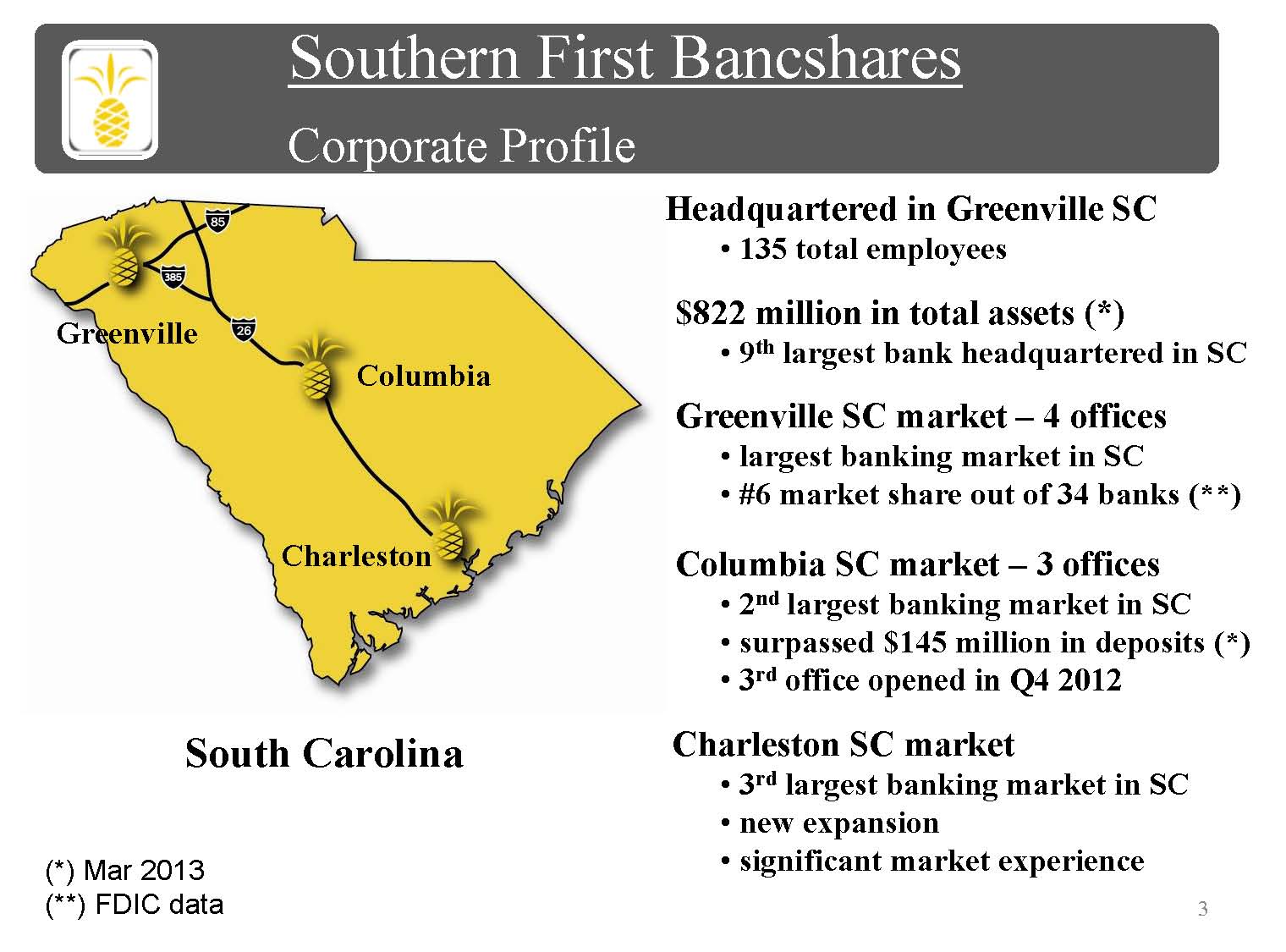

Southern First Bancshares

Corporate Profile

Headquartered in Greenville SC

•

135 total employees

$822 million in total assets (*)

•

9th largest bank headquartered in SC

Greenville SC market – 4 offices

•

largest banking market in SC

•

#6 market share out of 34 banks (**)

Columbia SC market – 3 offices

•

2nd largest banking market in SC

•

surpassed $145 million in deposits (*)

•

3rd office opened in Q4 2012

Charleston SC market

•

3rd largest banking market in SC

•

new expansion

•

significant market experience

(*) Mar 2013

(**) FDIC data

2012 Operating Highlights:

SFST valuation increased $11 million or 43%

Net income increased 85% to $3.9 million

Margin improved by 31 basis points to 3.61%

Loans increased by over $47 million

Noninterest income increased by 36%

Nonperforming assets improved to 1.24%

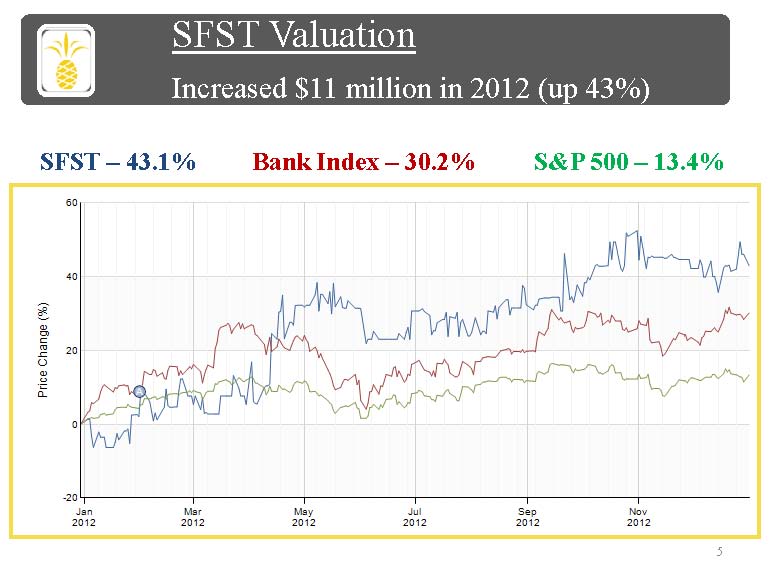

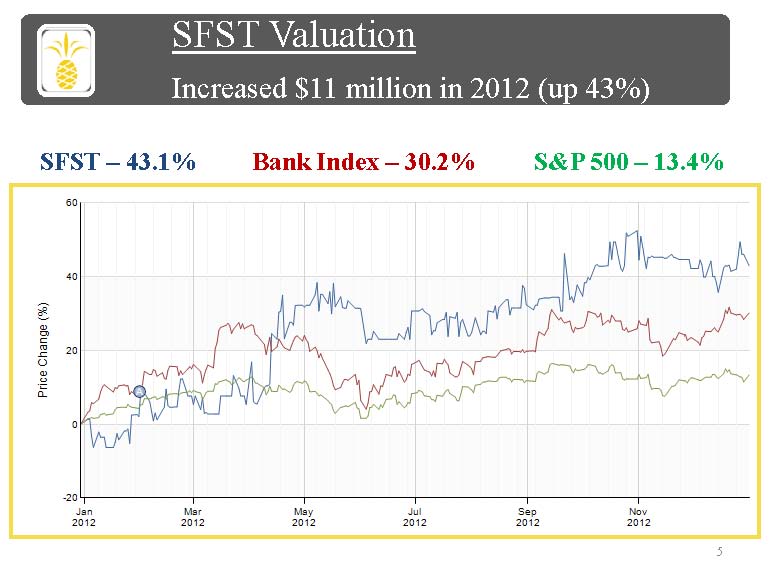

SFST Valuation

Increased $11 million in 2012 (up 43%)

SFST – 43.1%

Bank Index – 30.2%

S&P 500 – 13.4%

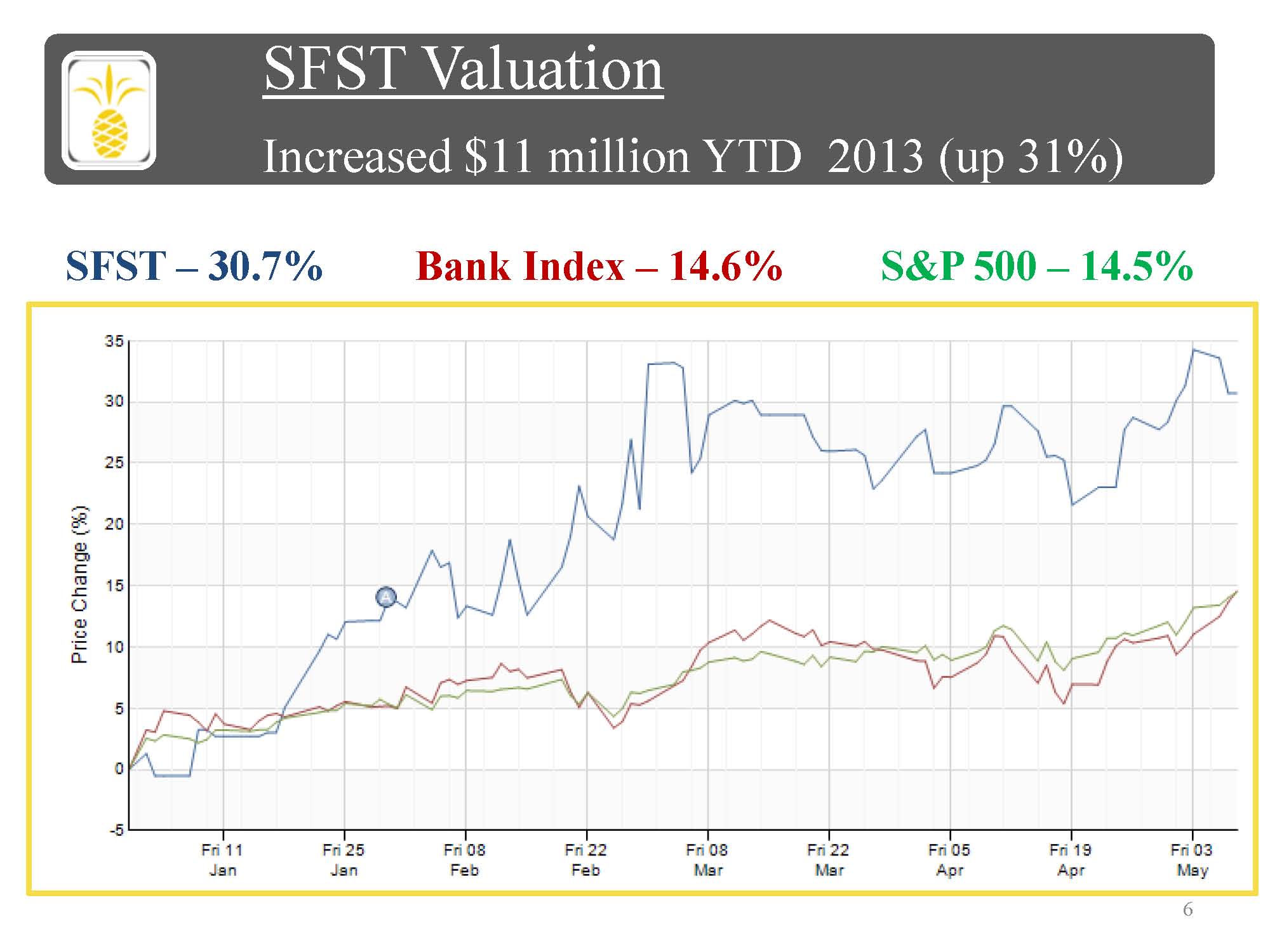

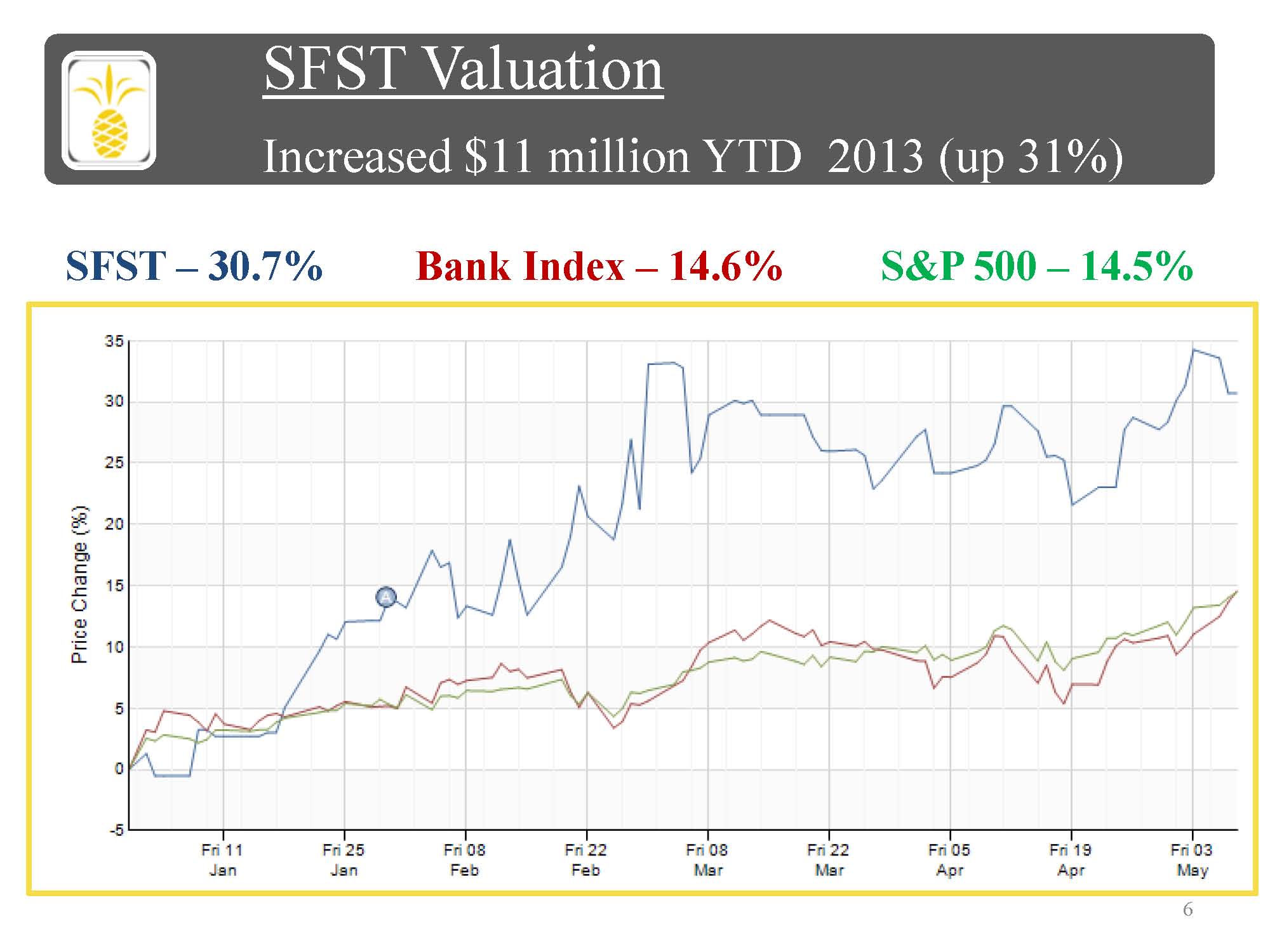

SFST Valuation

Increased $11 million YTD 2013 (up 31%)

SFST – 30.7%

Bank Index – 14.6%

S&P 500 – 14.5%

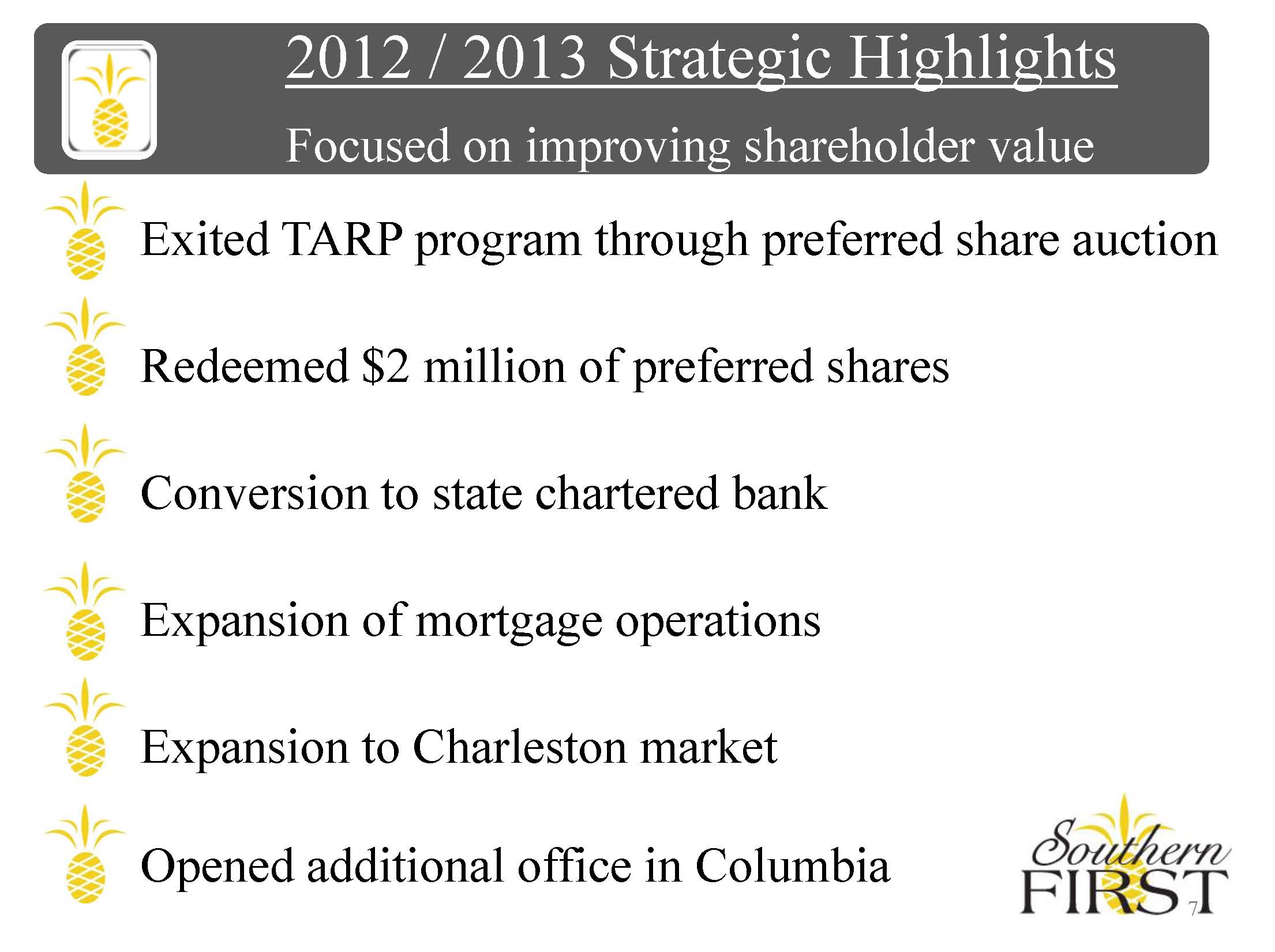

2012 / 2013 Strategic Highlights

Focused on improving shareholder value

Exited TARP program through preferred share auction

Redeemed $2 million of preferred shares

Conversion to state chartered bank

Expansion of mortgage operations

Expansion to Charleston market

Opened additional office in Columbia

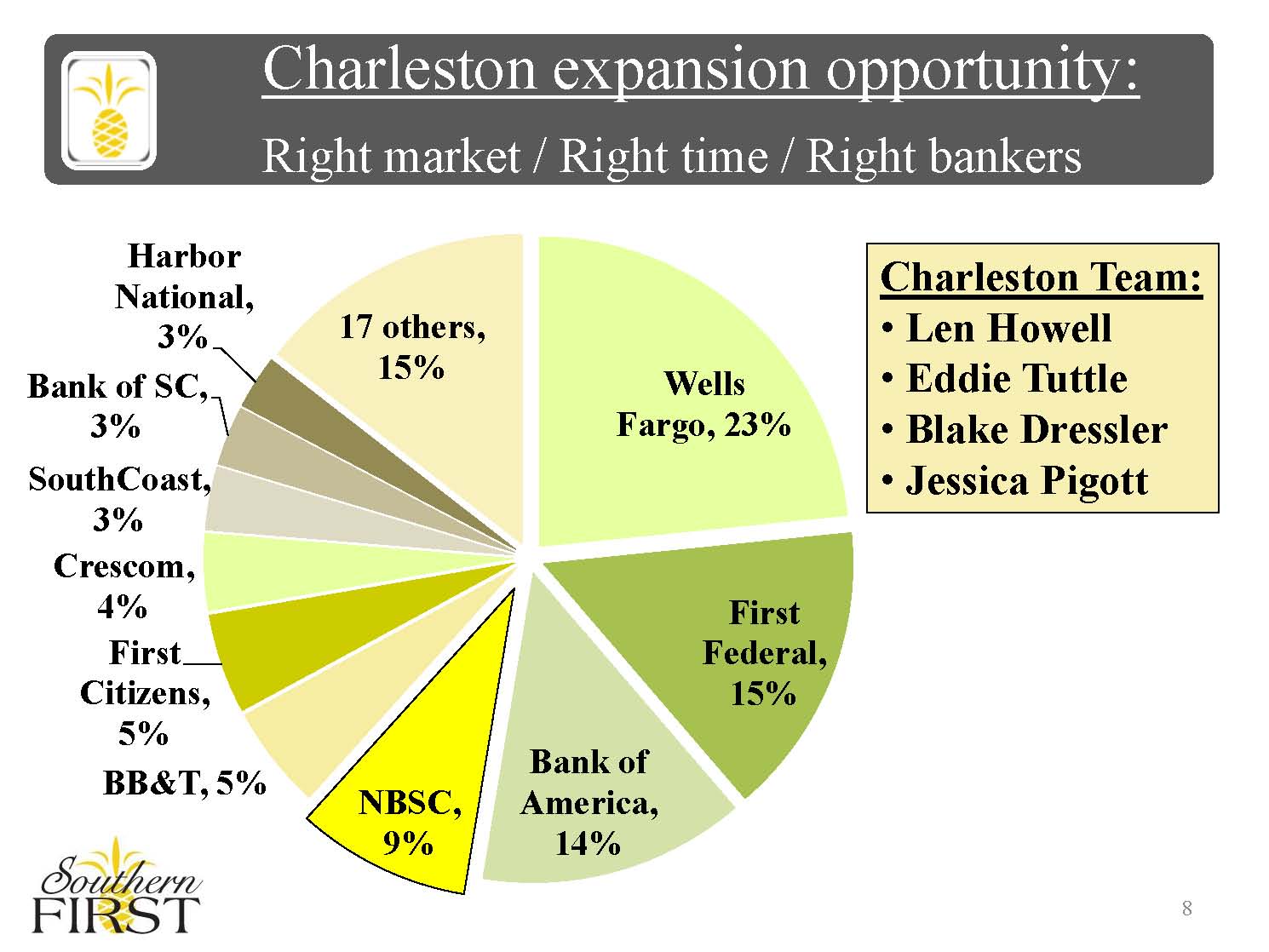

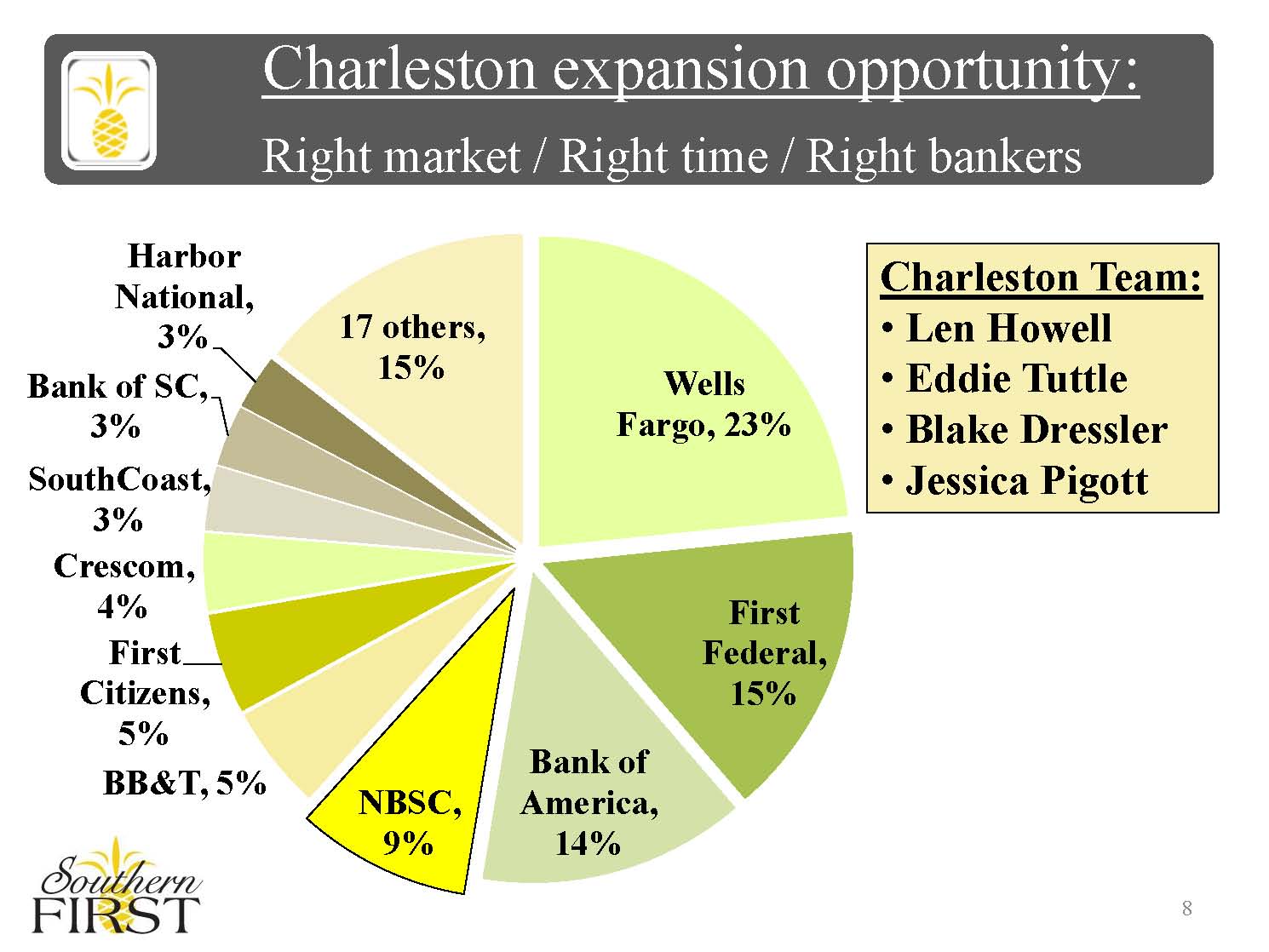

Charleston expansion opportunity:

Right market / Right time / Right bankers

Charleston Team:

•

Len Howell

•

Eddie Tuttle

•

Blake Dressler

•

Jessica Pigott

Southern First – Strategic Vision:

One Chance / One Step

•

Operating Initiatives:

•

Continue building earnings momentum

•

Capitalize on growth opportunities

•

Increase noninterest income

•

Reduce credit costs

•

Continue overhead efficiencies

•

Create world class client experiences

•

Invest in strategic talent and risk management infrastructure

Southern First – Strategic Vision:

One Chance / One Step

•

Strategic Initiatives:

•

Manage capital effectively

•

Preferred stock redemption plan

•

Recognize dilutive exposure

•

Monitor capital market options

•

Increase communication of the SFST story

•

Monitor strategic growth opportunities

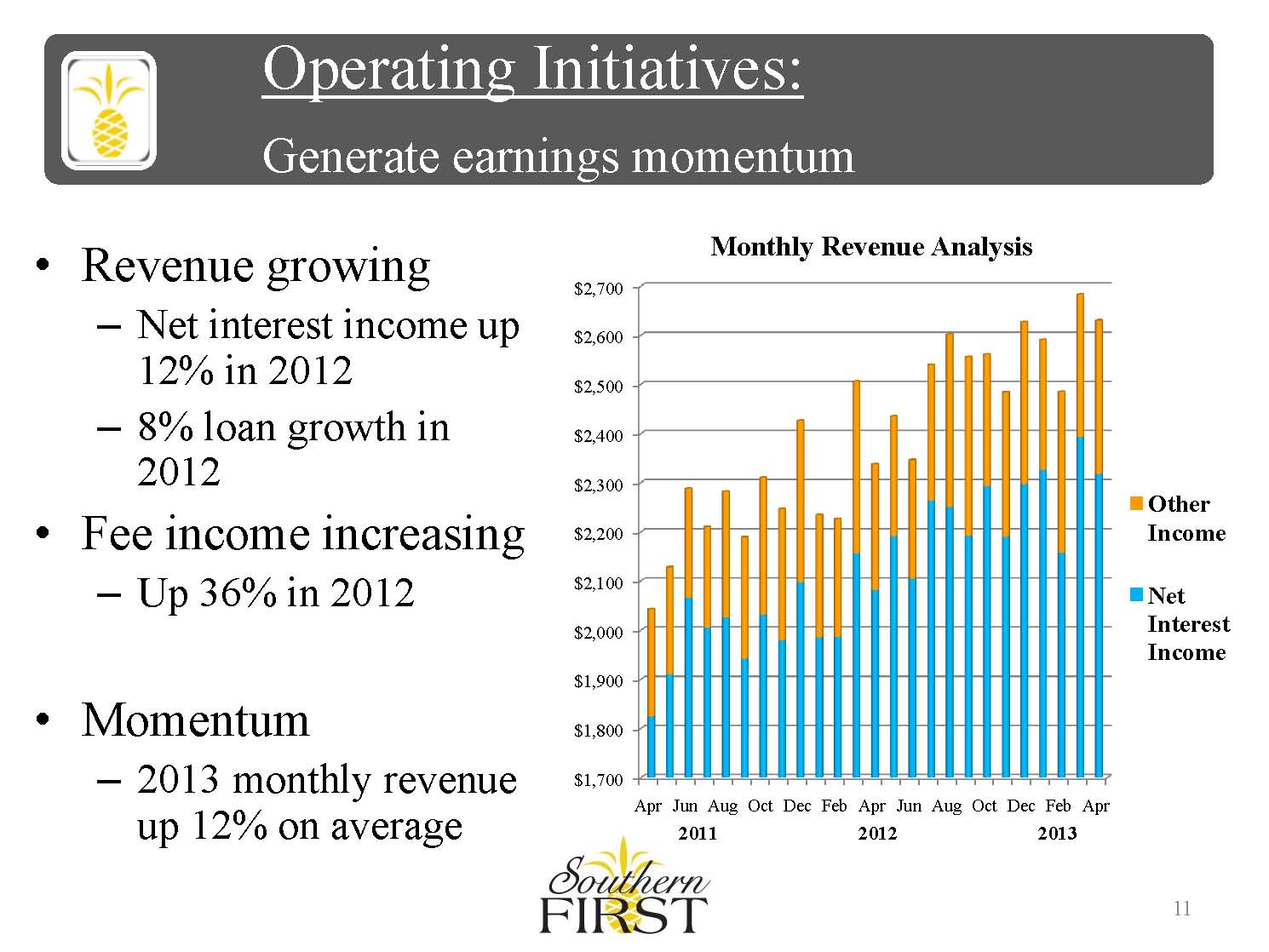

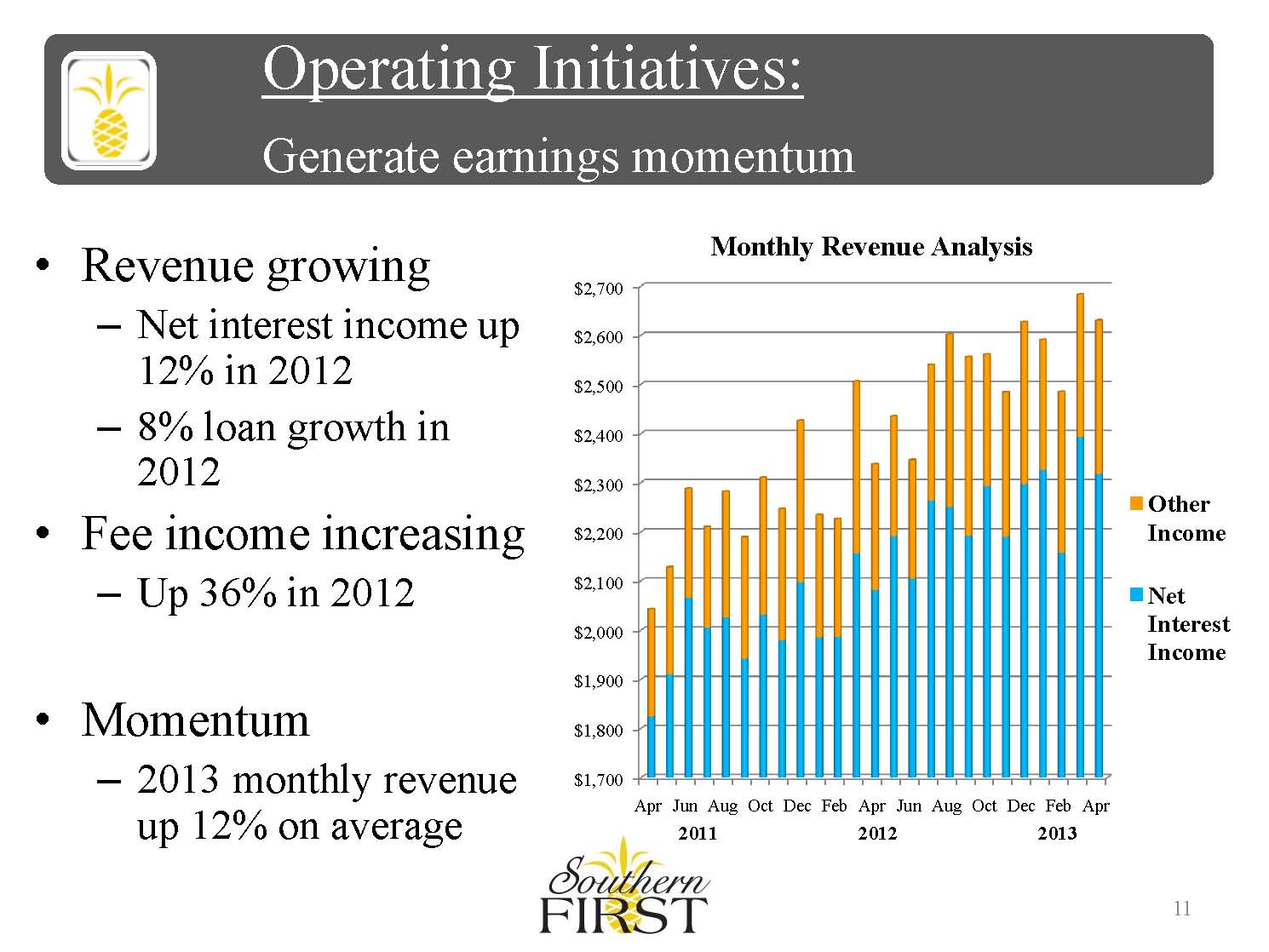

Operating Initiatives:

Generate earnings momentum

•

Revenue growing

–

Net interest income up 12% in 2012

–

8% loan growth in 2012

•

Fee income increasing

–

Up 36% in 2012

•

Momentum

–

2013 monthly revenue up 12% on average

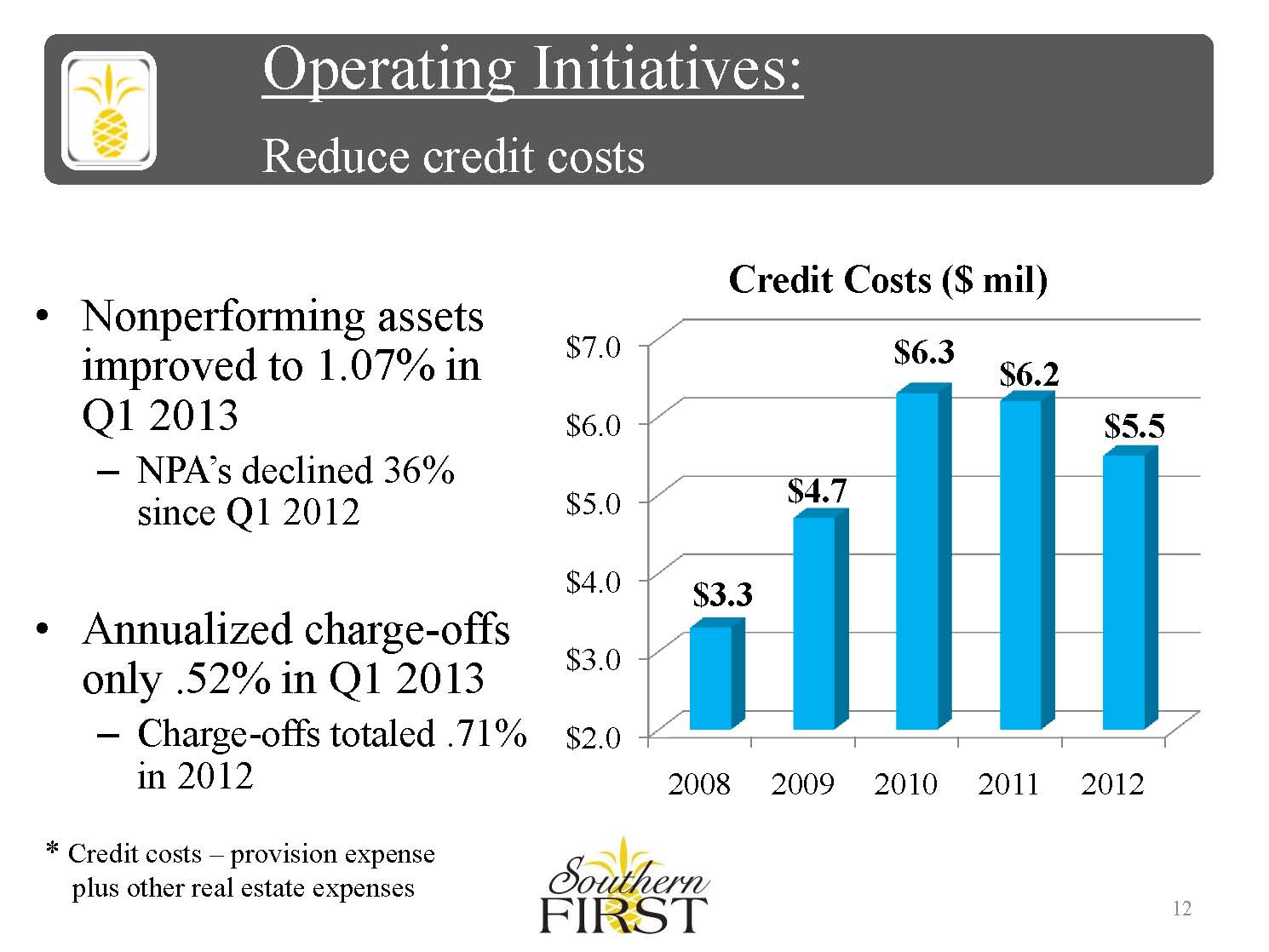

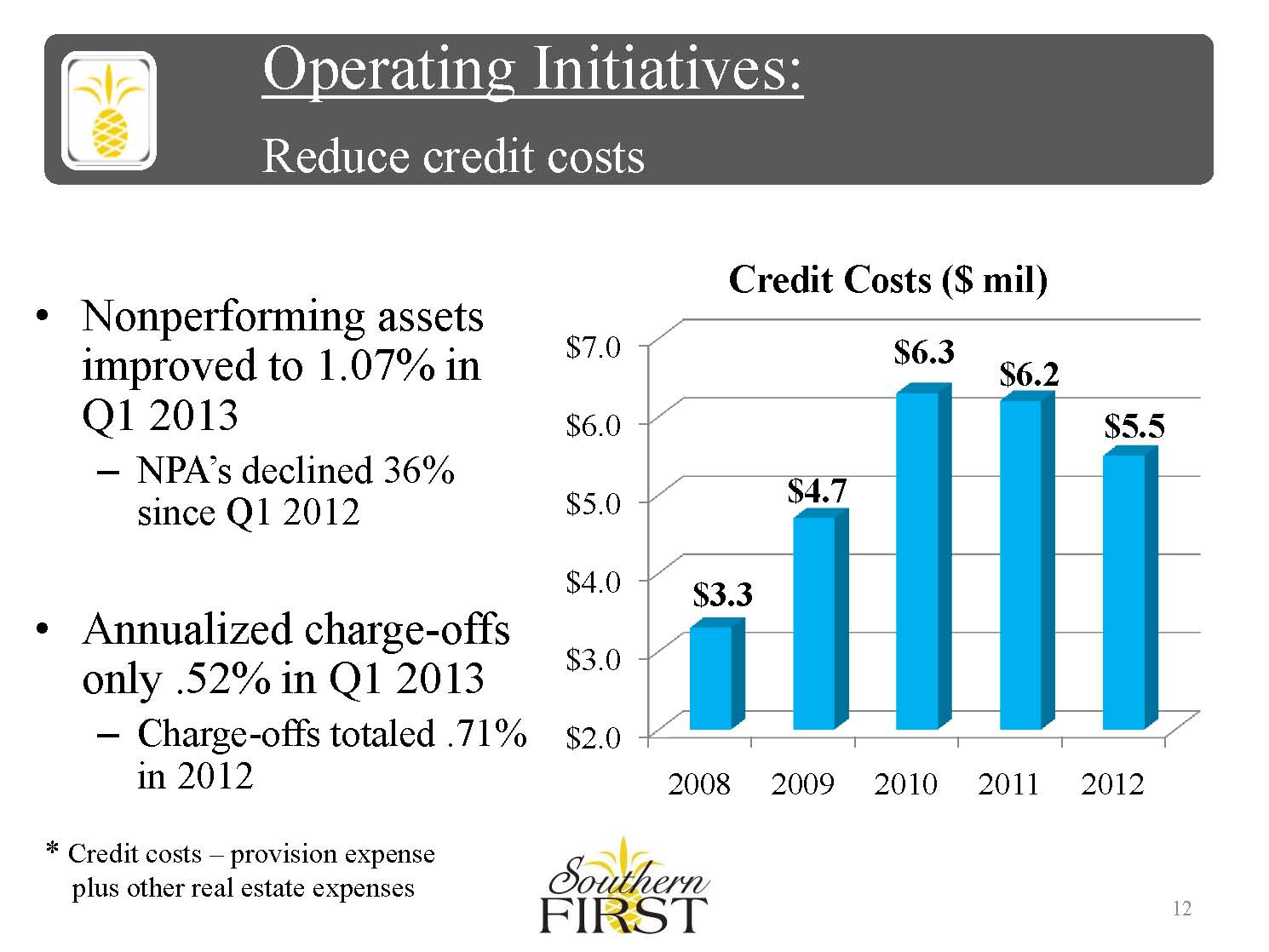

Operating Initiatives:

Reduce credit costs

•

Nonperforming assets improved to 1.07% in Q1 2013

–

NPA’s declined 36% since Q1 2012

•

Annualized charge-offs only .52% in Q1 2013

–

Charge-offs totaled .71% in 2012

*

Credit costs – provision expense plus other real estate expenses

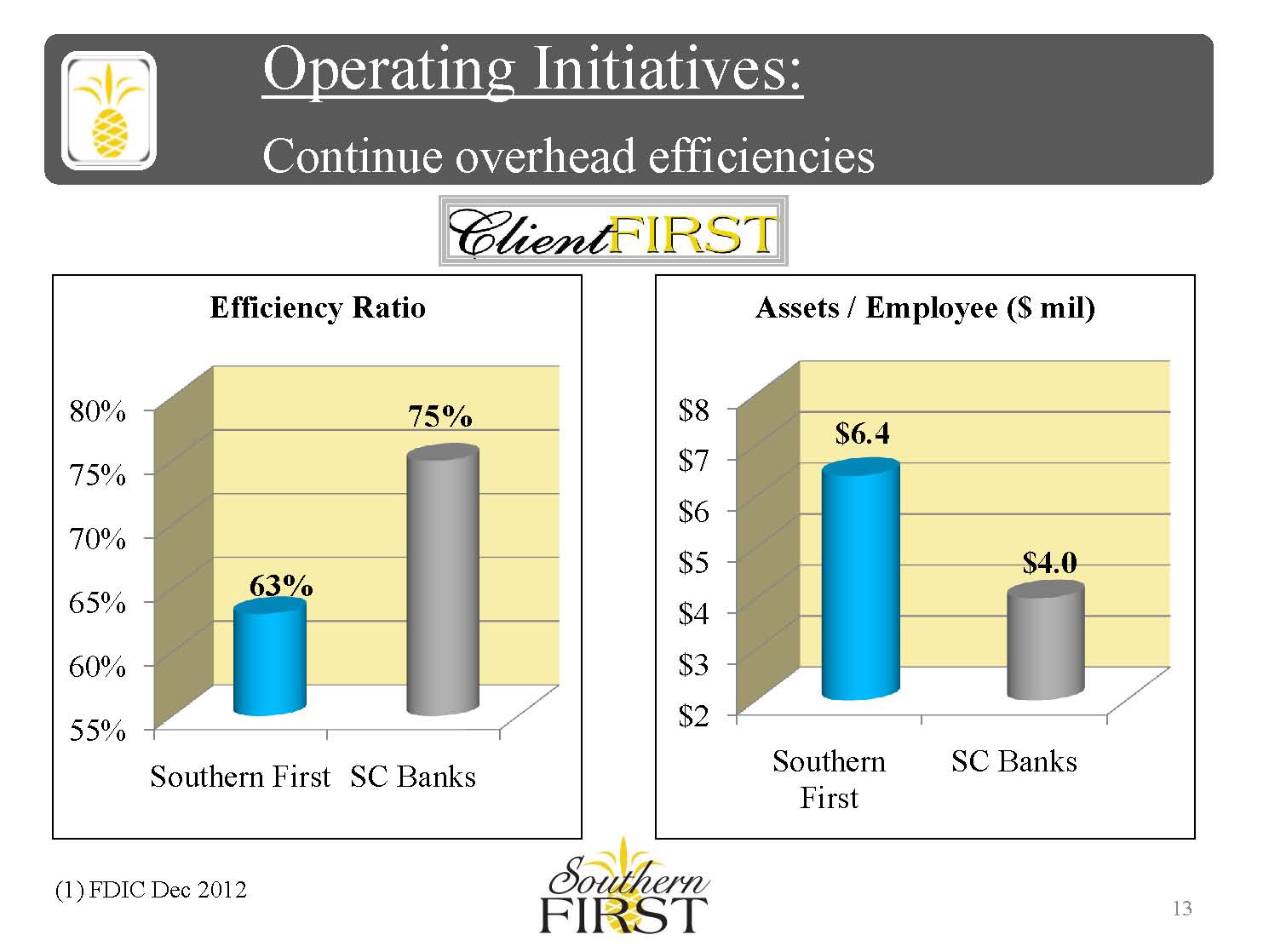

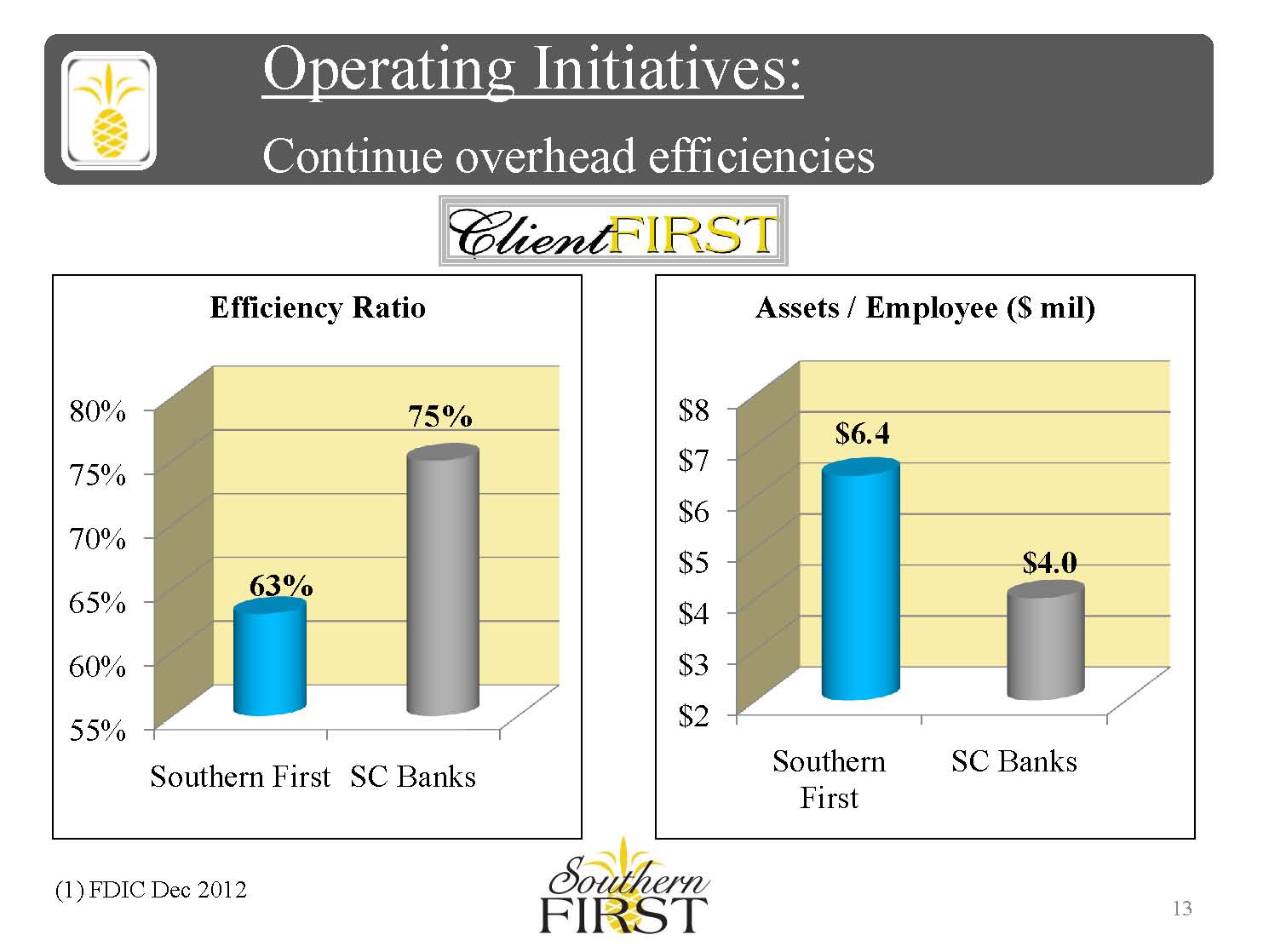

Operating Initiatives:

Continue overhead efficiencies

(1) FDIC Dec 2012

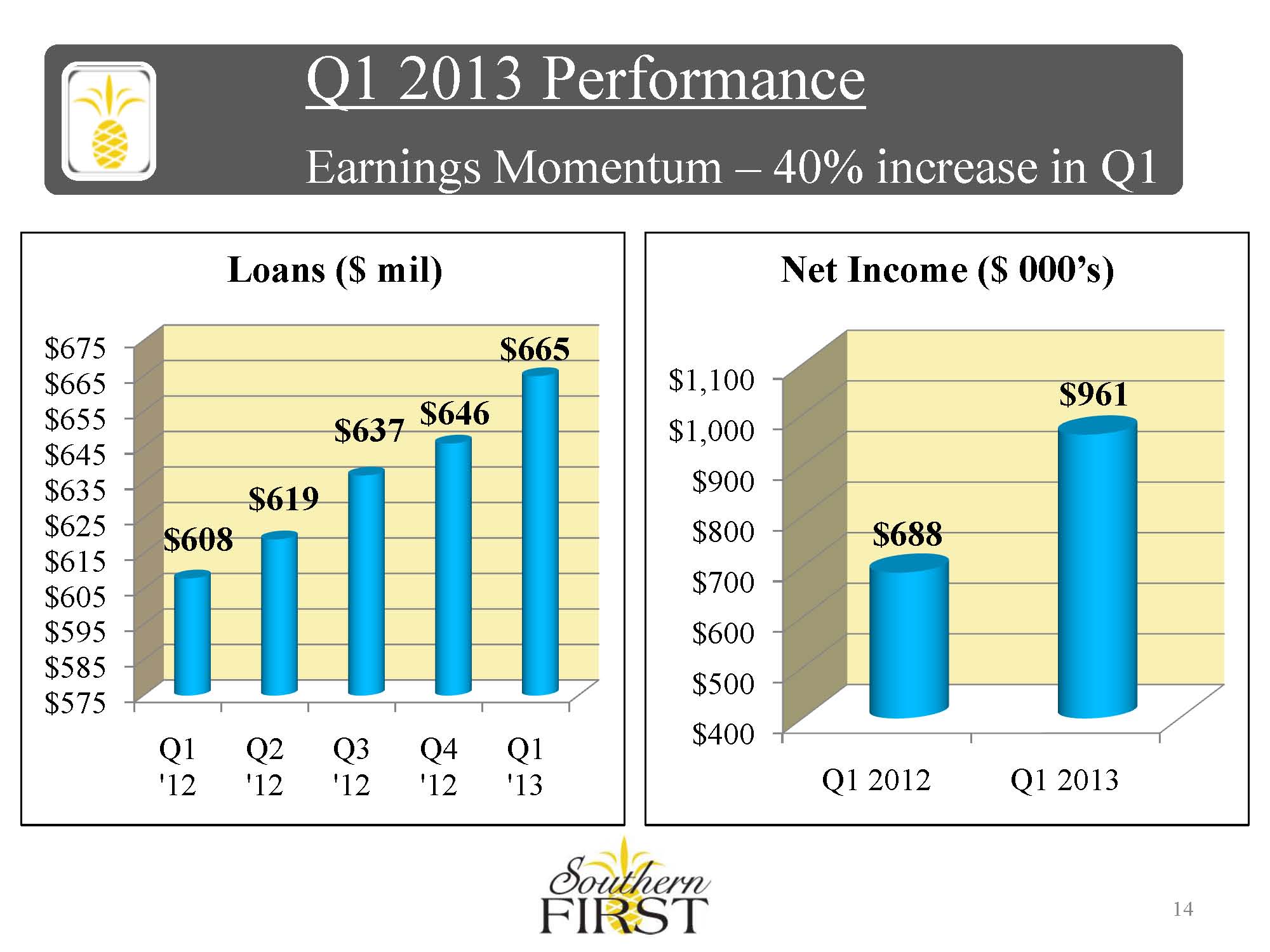

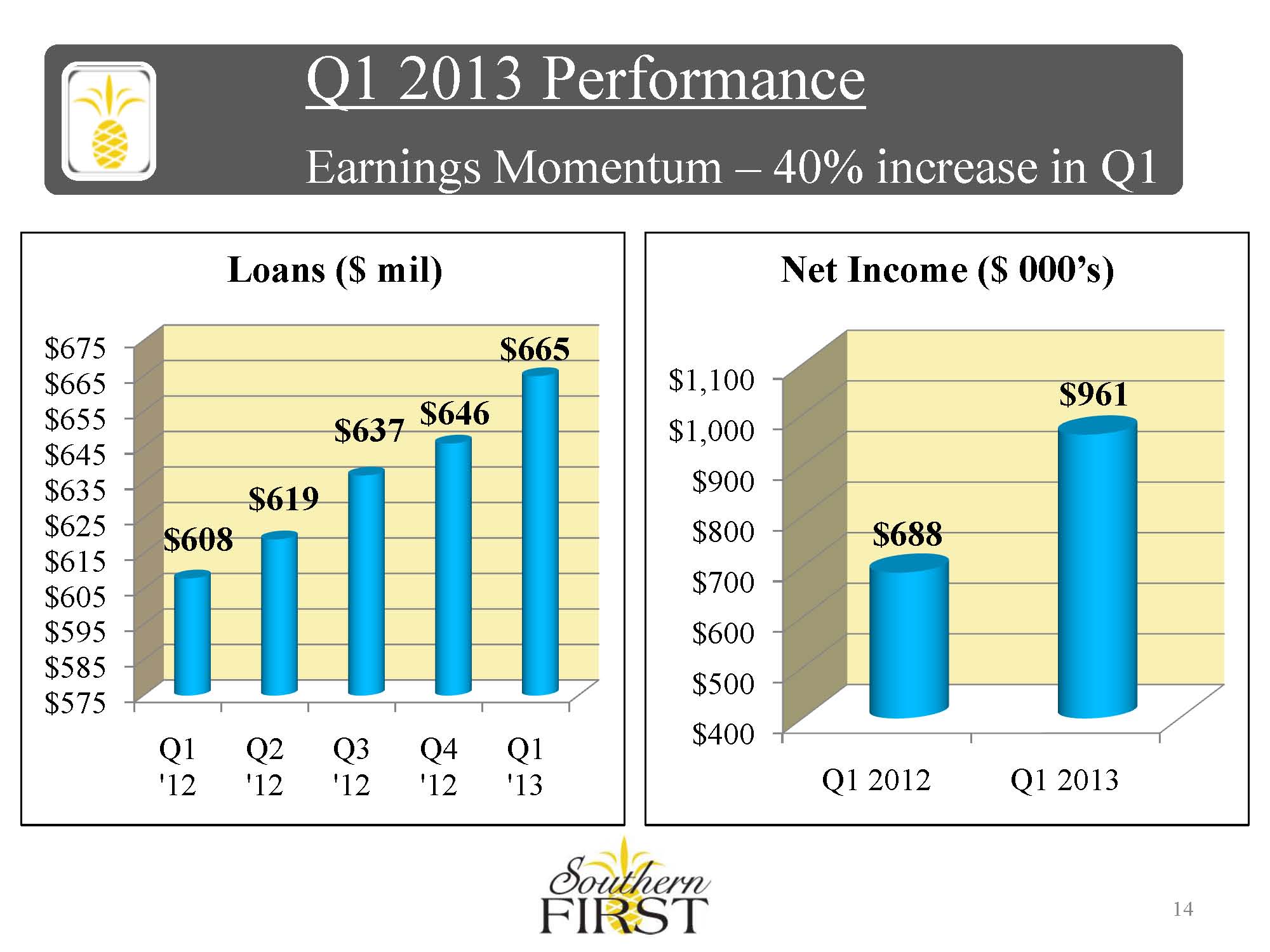

Q1 2013 Performance

Earnings Momentum – 40% increase in Q1

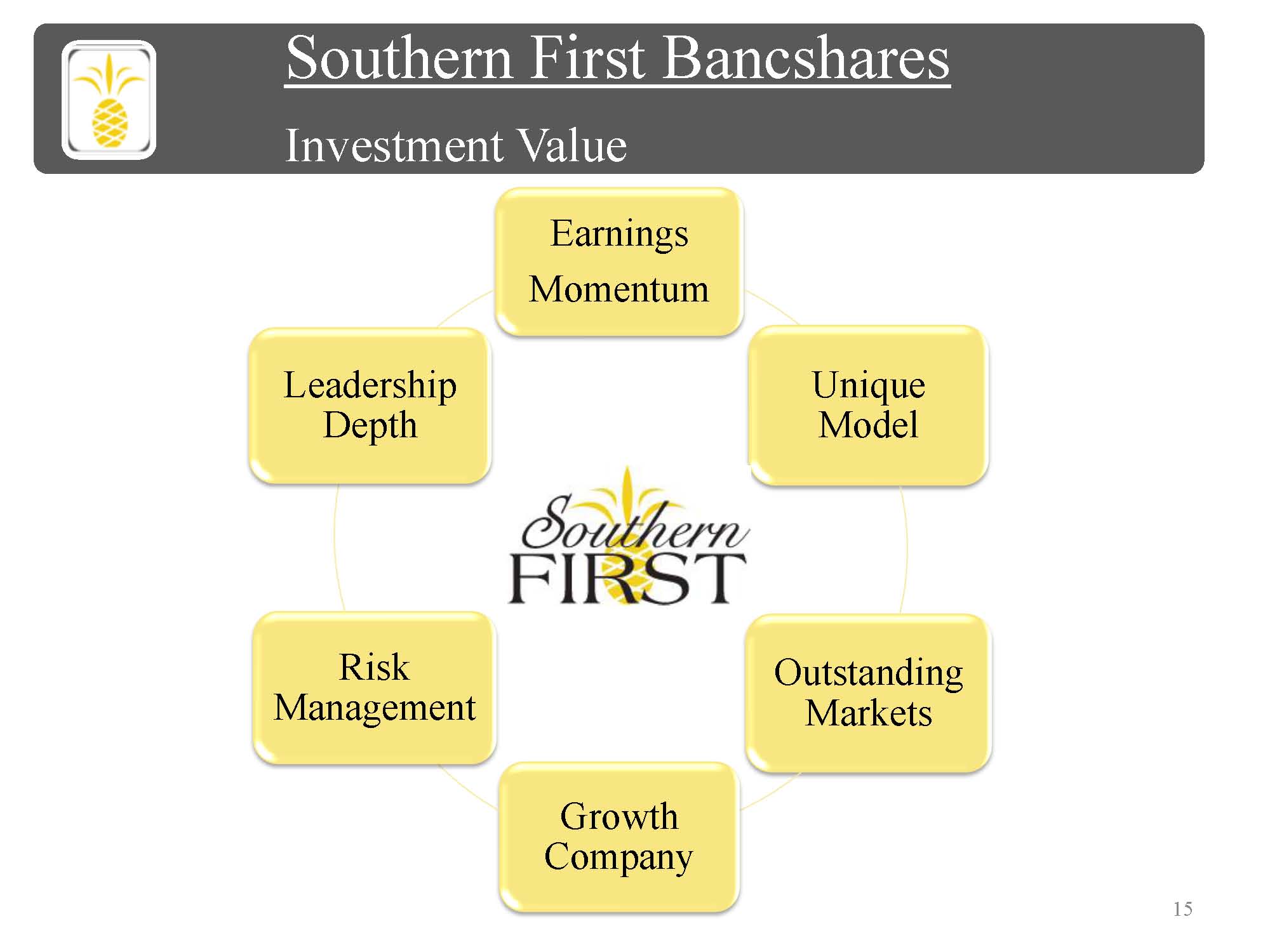

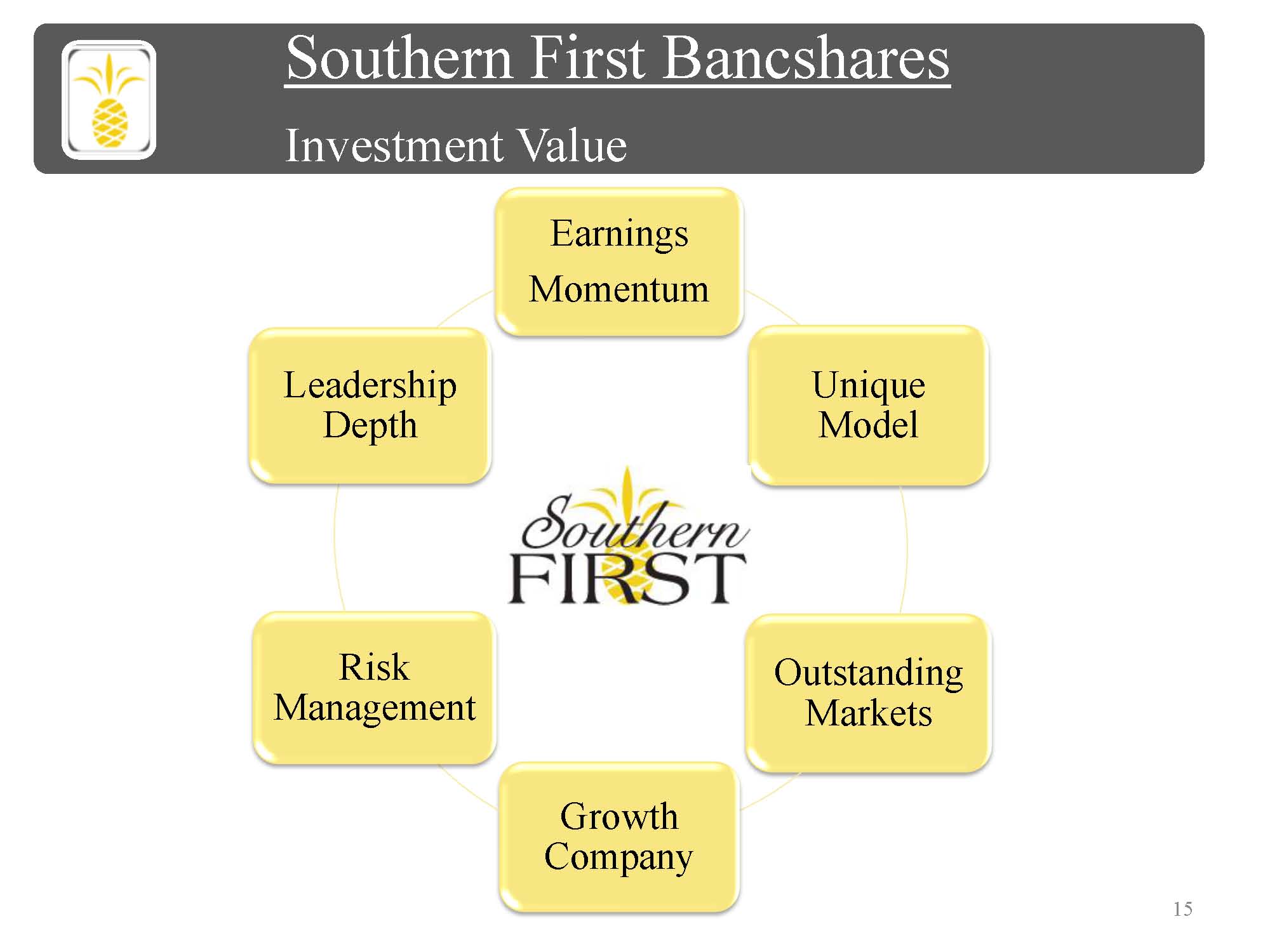

Southern First Bancshares

Investment Value

Earnings Momentum

Leadership Depth

Unique Model

Risk Management

Outstanding Markets

Growth Company

Southern First Bancshares

Focused on shareholder value

2013 Shareholder Meeting

Thank you for your continued support