Exhibit 99.1

1 Southern First Bancshares, Inc. Justin Strickland – President Mike Dowling – Chief Financial Officer KBW Community Bank Investor Conference July 30th, 2014

During the course of this presentation, management may make projections and forward-looking statements regarding events or the future financial performance of Southern First Bancshares, Inc. We wish to caution you that these forwardlooking statements involve certain risks and uncertainties, including a variety of factors (including a downturn in the economy, greater than expected non-interest expenses, increased competition, fluctuations in interest rates, regulatory actions, excessive loan losses and other factors) that may cause Southern First’s actual results to differ materially from the anticipated results expressed or implied in these forward-looking statements. Therefore, we can give no assurance that the results contemplated in the forward-looking statements will be realized. Investors are cautioned not to place undue reliance on these forward-looking statements and are advised to review the risk factors that may affect Southern First’s operating results in documents filed by Southern First Bancshares, Inc. with the Securities and Exchange Commission, including the annual report on Form 10-K and other required filings. Southern First assumes no duty to update the forward-looking statements made in this presentation. Forward Looking Statements: 2

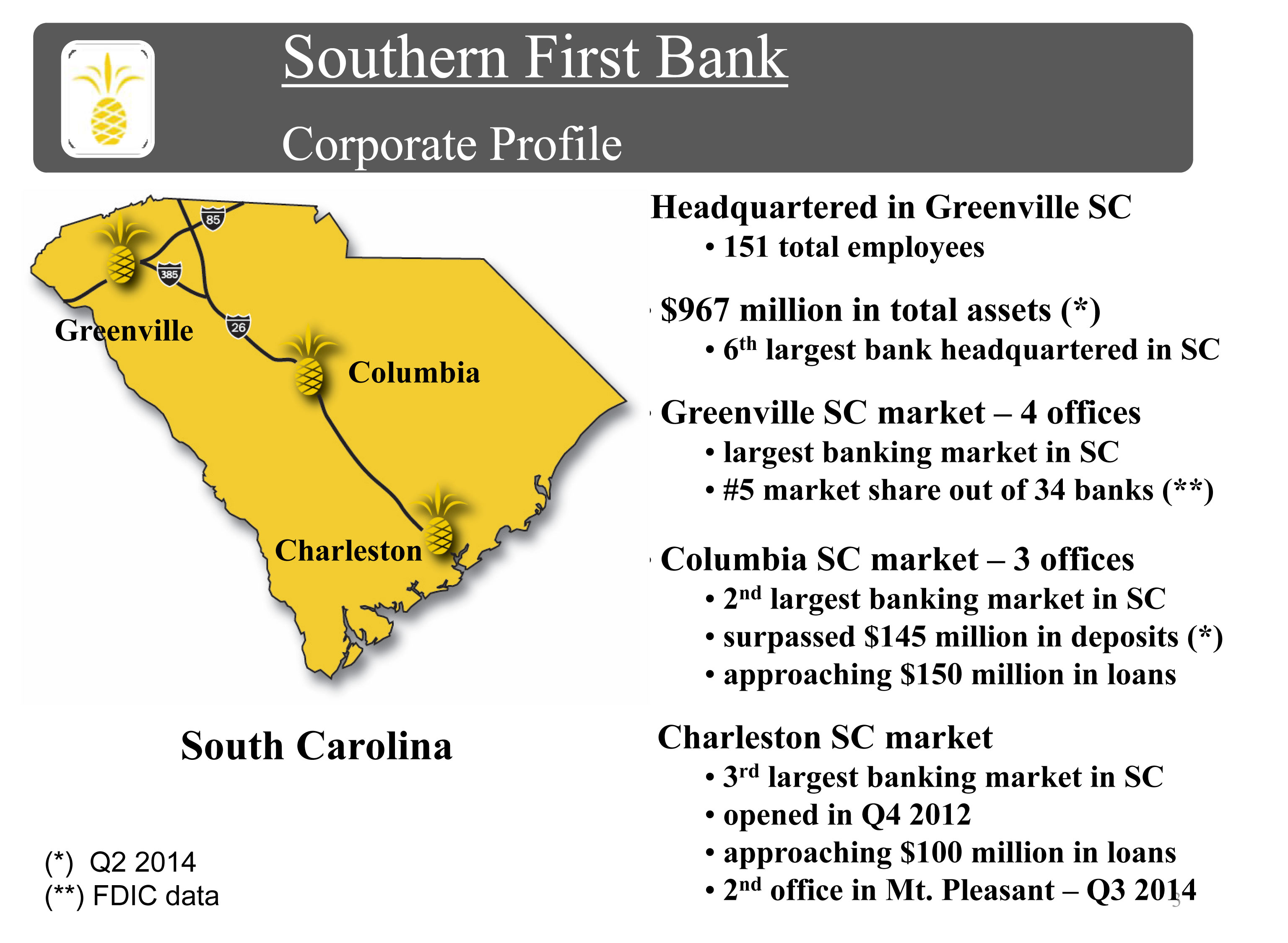

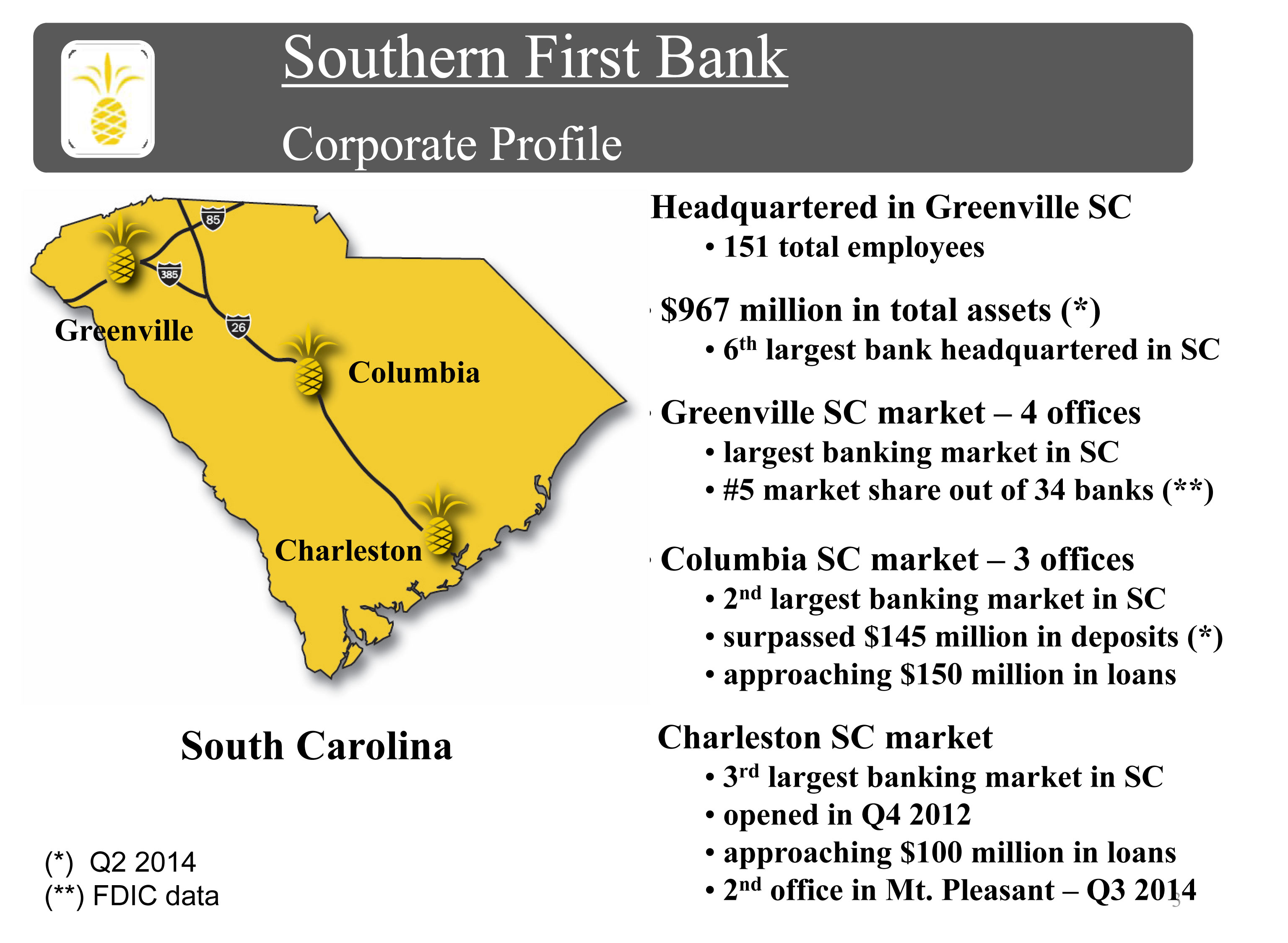

(*) Q2 2014 (**) FDIC data 3 Headquartered in Greenville SC • 151 total employees • $967 million in total assets (*) • 6th largest bank headquartered in SC • Greenville SC market – 4 offices • largest banking market in SC • #5 market share out of 34 banks (**) • Columbia SC market – 3 offices • 2nd largest banking market in SC • surpassed $145 million in deposits (*) • approaching $150 million in loans Charleston SC market • 3rd largest banking market in SC • opened in Q4 2012 • approaching $100 million in loans • 2nd office in Mt. Pleasant – Q3 2014 South Carolina Greenville Columbia Charleston Southern First Bank Corporate Profile/FONT>

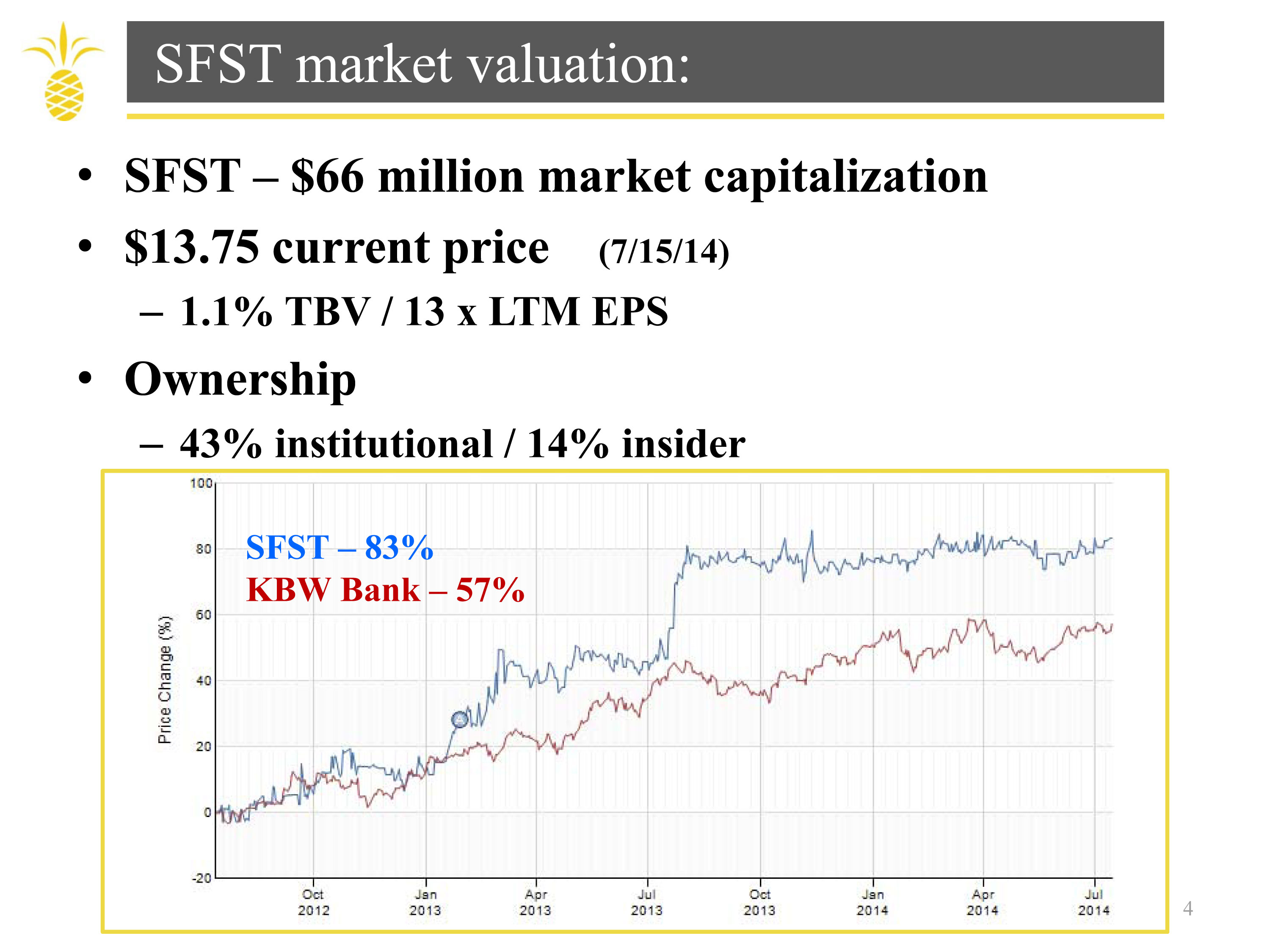

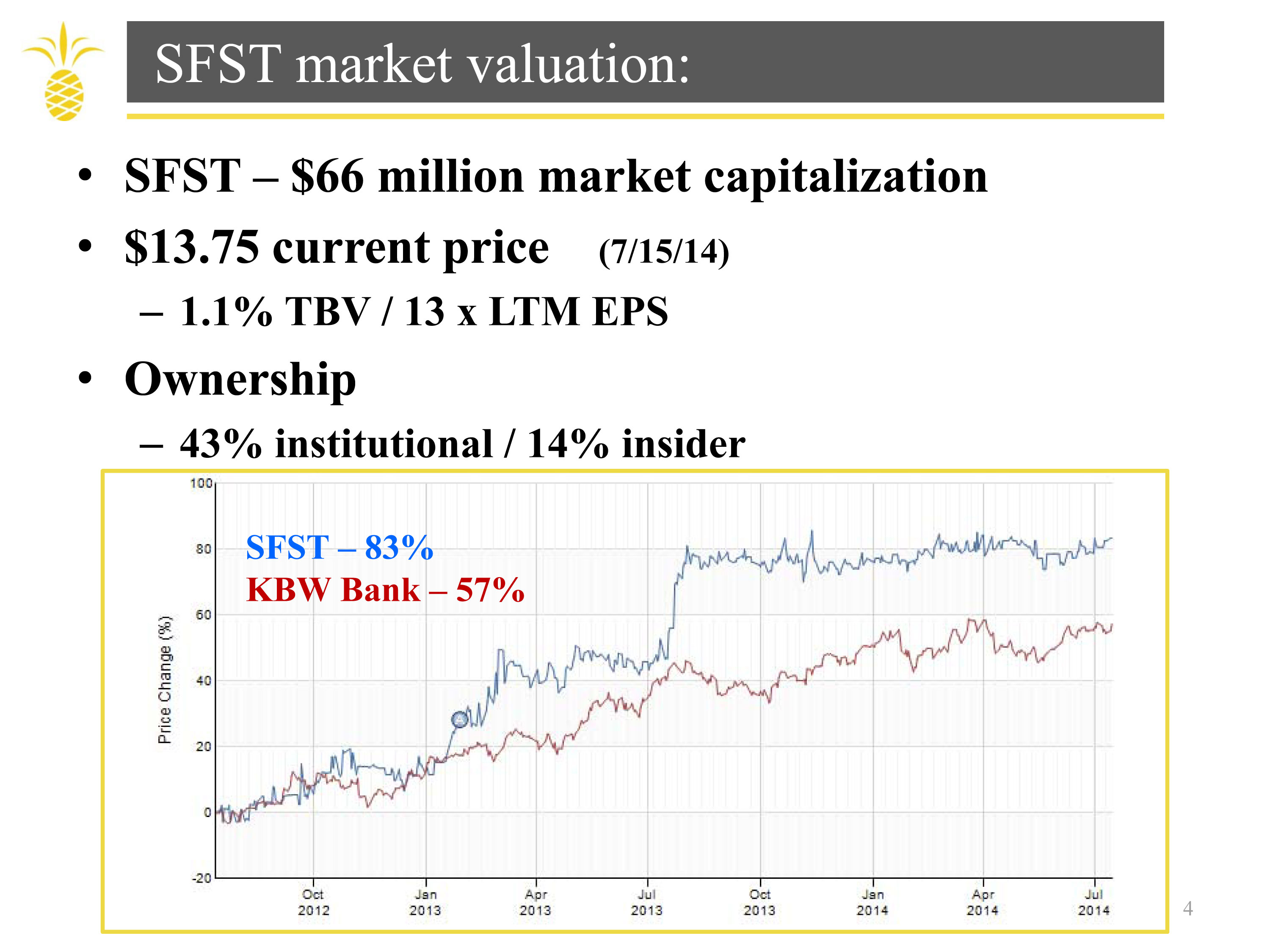

• SFST – $66 million market capitalization • $13.75 current price (7/15/14) – 1.1% TBV / 13 x LTM EPS • Ownership – 43% institutional / 14% insider 4 SFST market valuation: SFST – 83% KBW Bank – 57%>

SFST: Investment Profile 5 Growth / Performance Excellent earnings momentum / asset quality Model Proven organic growth / excellent efficiency Markets 3 largest SC markets / excellent demographics Leadership Market experience / performance driven

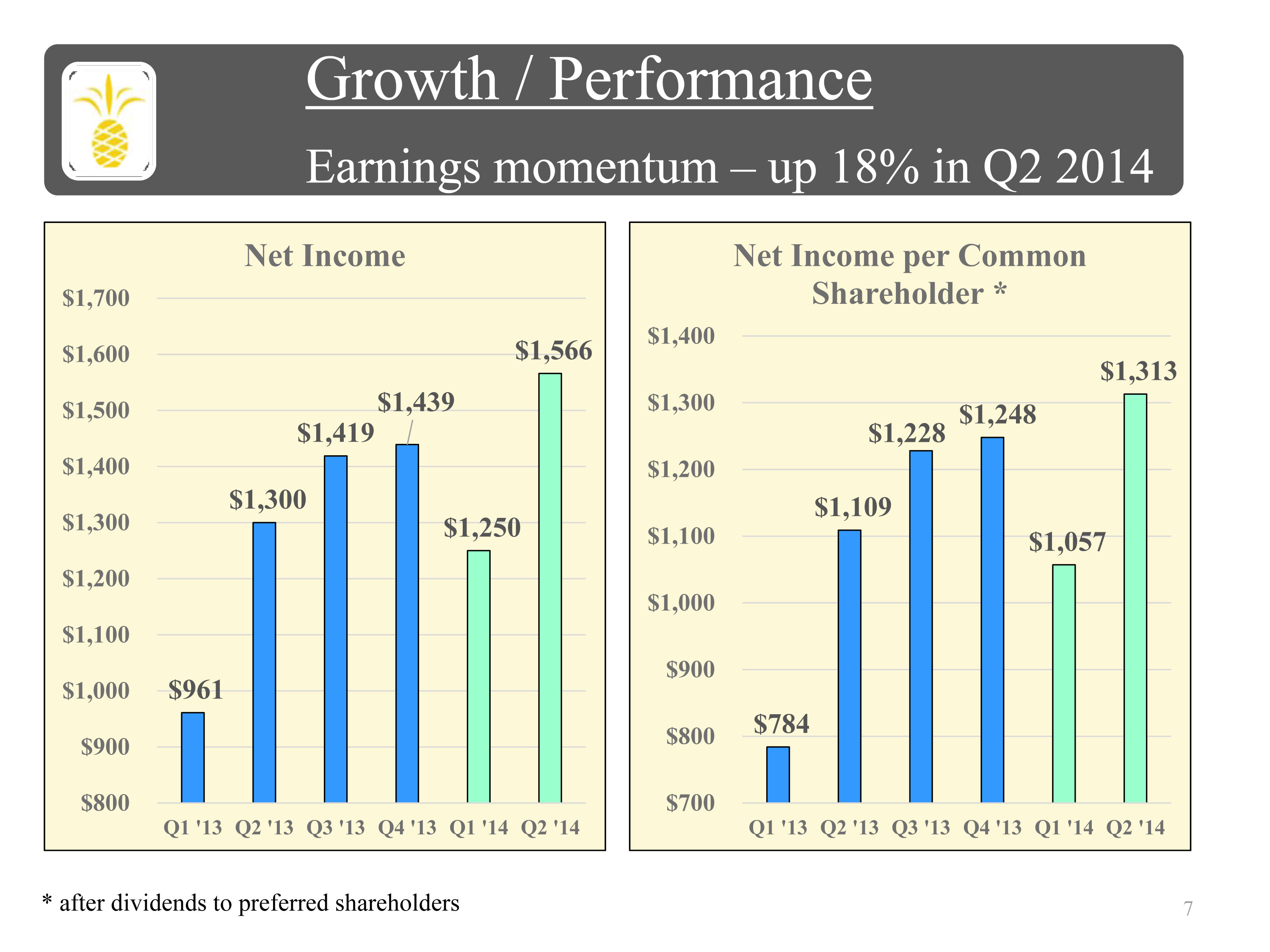

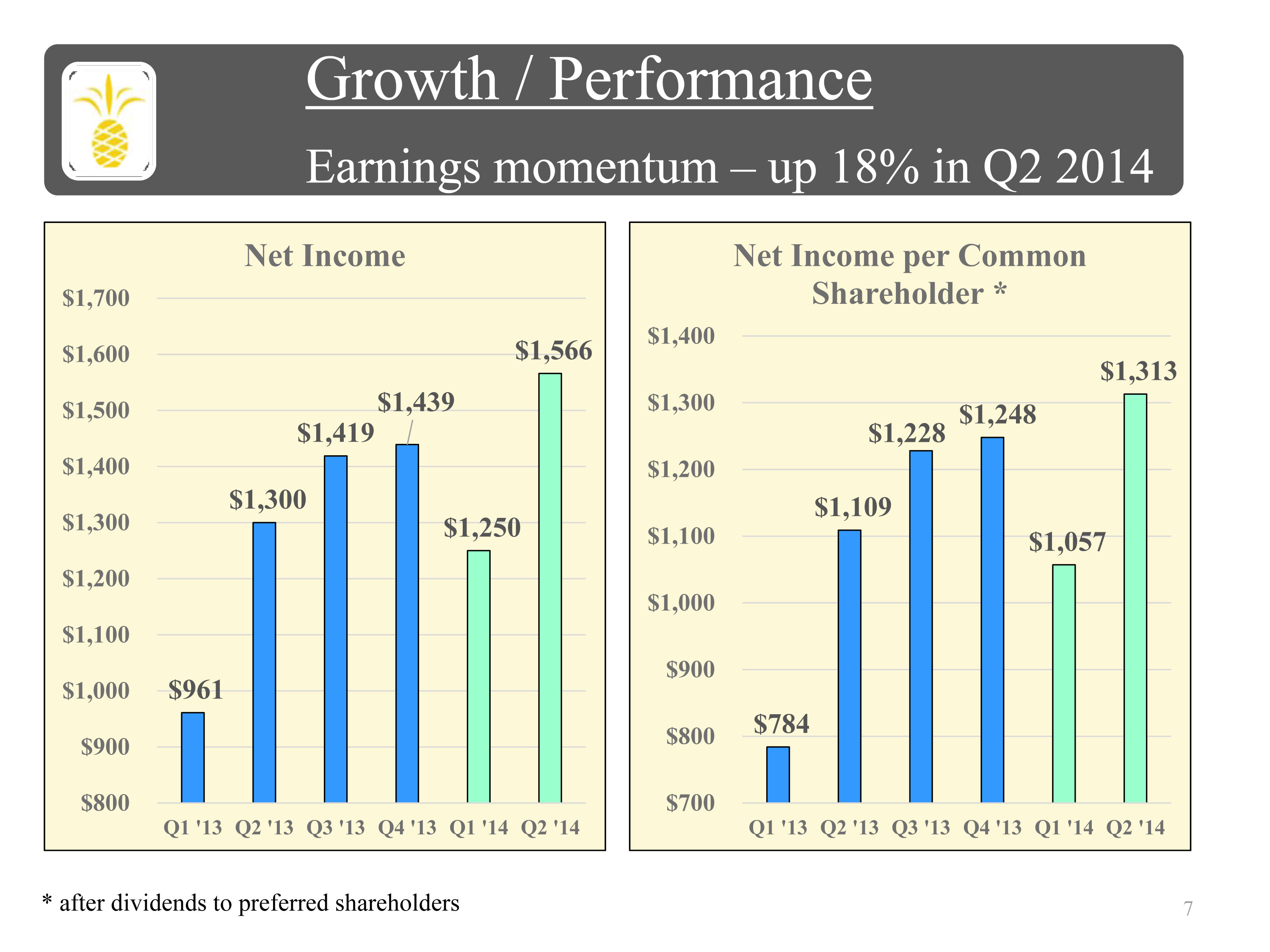

• Net income increased 18% to $1.3 million • Total assets increased 15% to $967 million • Loans increased 19% to $813 million • Core deposits increased 13% to $536 million • Top line revenue growth – Total revenue up 17% from Q2 2013 • Book value increased to $12.56 per share • NPA’s = 1.40% • Net charge-offs of .28% YTD annualized 6 Performance 2014 2nd quarter highlights:

$961 $1,300 $1,419 $1,439 $1,250 $1,566 $800 $900 $1,000 $1,100 $1,200 $1,300 $1,400 $1,500 $1,600 $1,700 Q1 '13 Q2 '13 Q3 '13 Q4 '13 Q1 '14 Q2 '14 Net Income 7 Growth / Performance Earnings momentum – up 18% in Q2 2014 $784 $1,109 $1,228 $1,248 $1,057 $1,313 $700 $800 $900 $1,000 $1,100 $1,200 $1,300 $1,400 Q1 '13 Q2 '13 Q3 '13 Q4 '13 Q1 '14 Q2 '14 Net Income per Common Shareholder * * after dividends to preferred shareholders

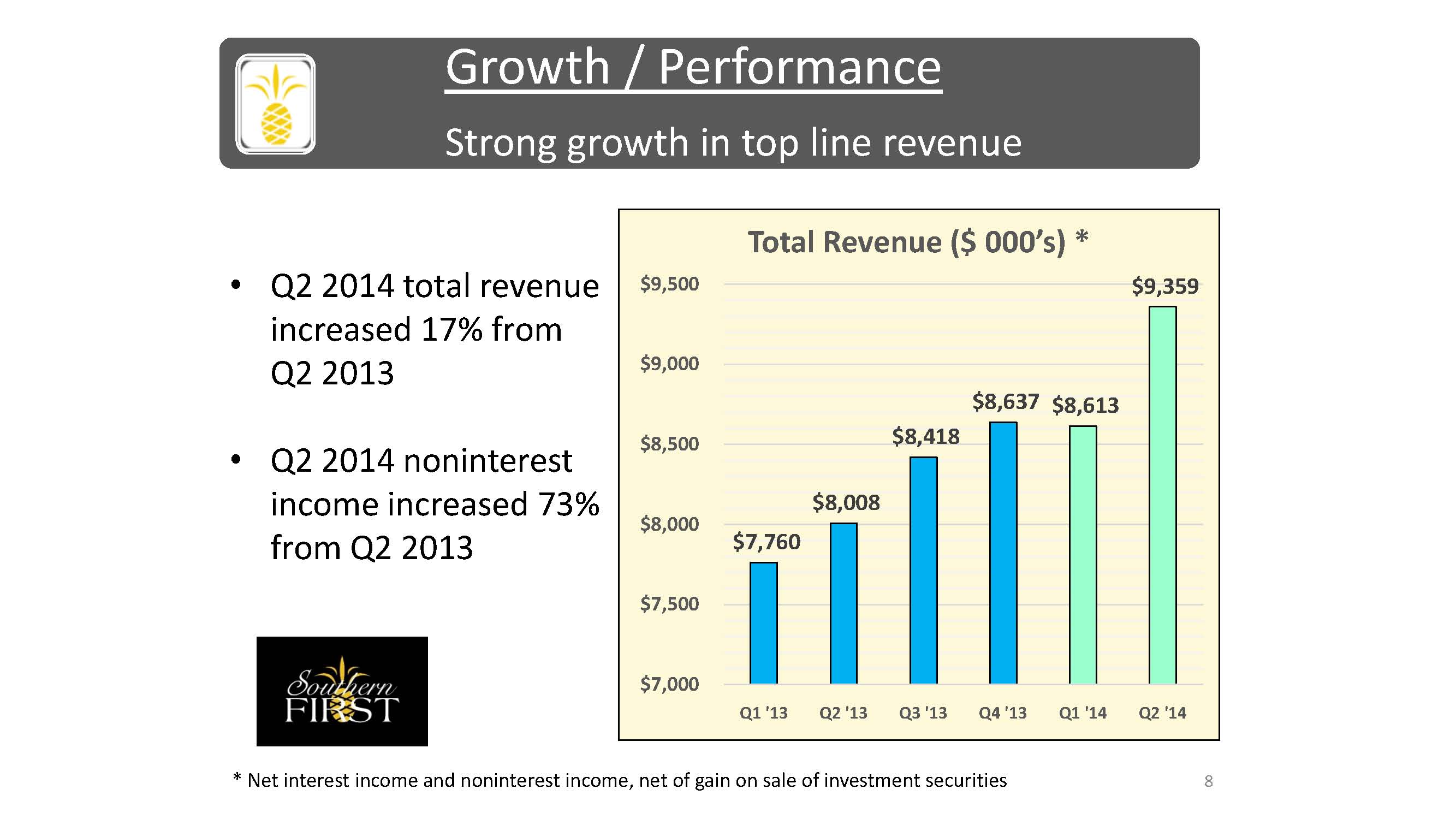

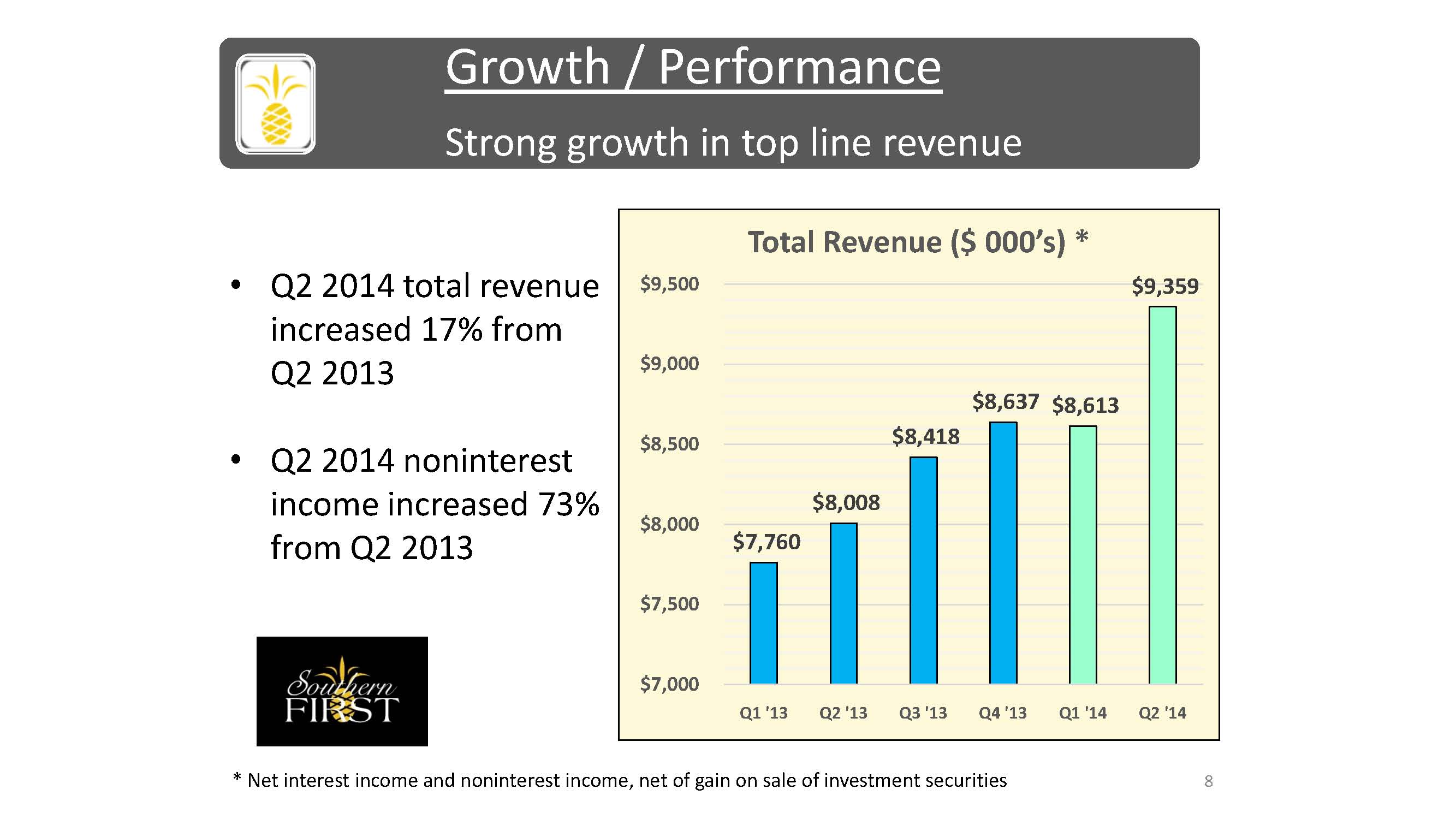

8 Growth / Performance Strong growth in top line revenue $7,760 $8,008 $8,418 $8,637 $8,613 $9,359 $7,000 $7,500 $8,000 $8,500 $9,000 $9,500 Q1 '13 Q2 '13 Q3 '13 Q4 '13 Q1 '14 Q2 '14 Total Revenue ($ 000’s) * • Q2 2014 total revenue increased 17% from Q2 2013 • Q2 2014 noninterest income increased 73% from Q2 2013 * Net interest income and noninterest income, net of gain on sale of investment securities

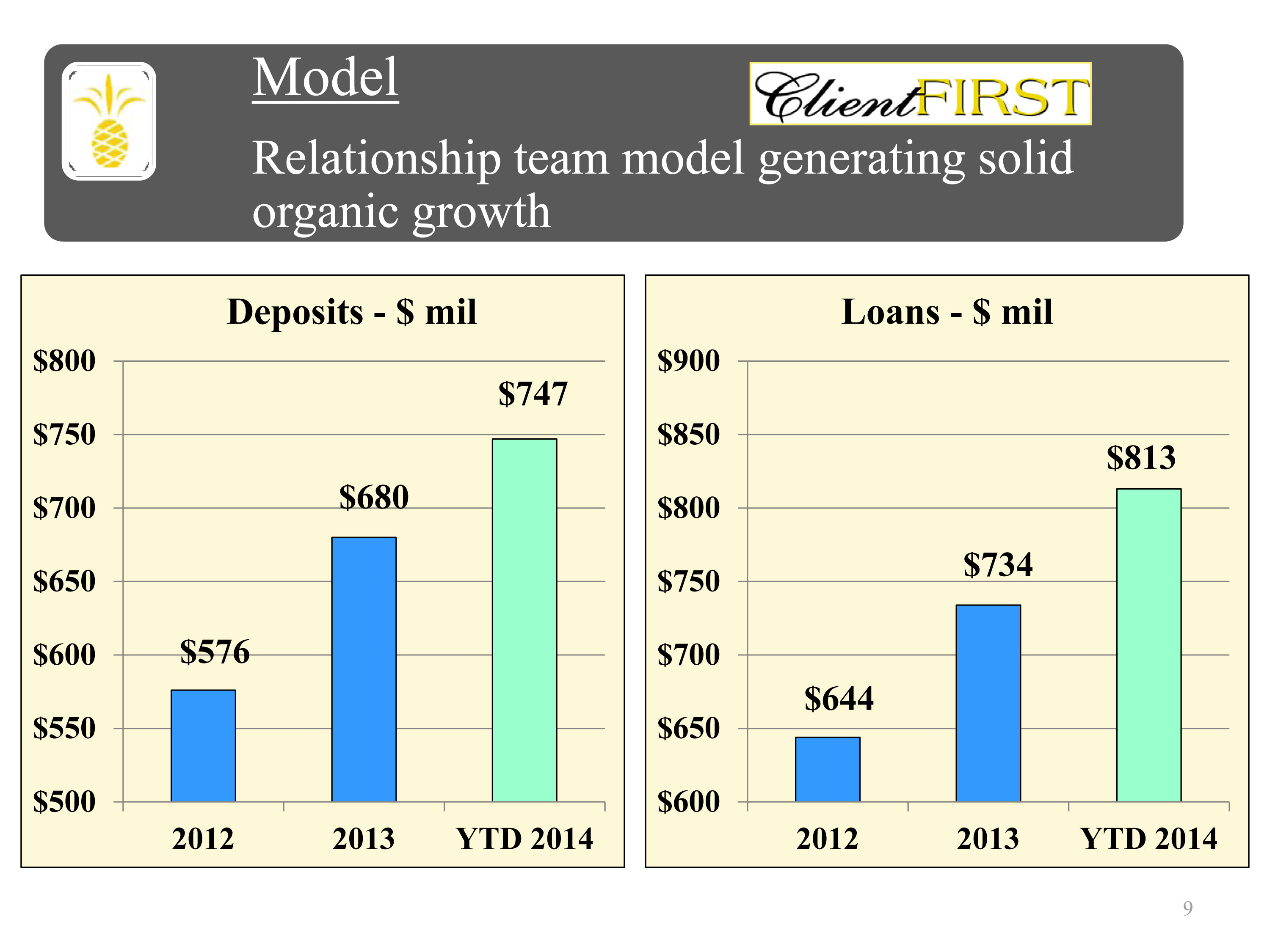

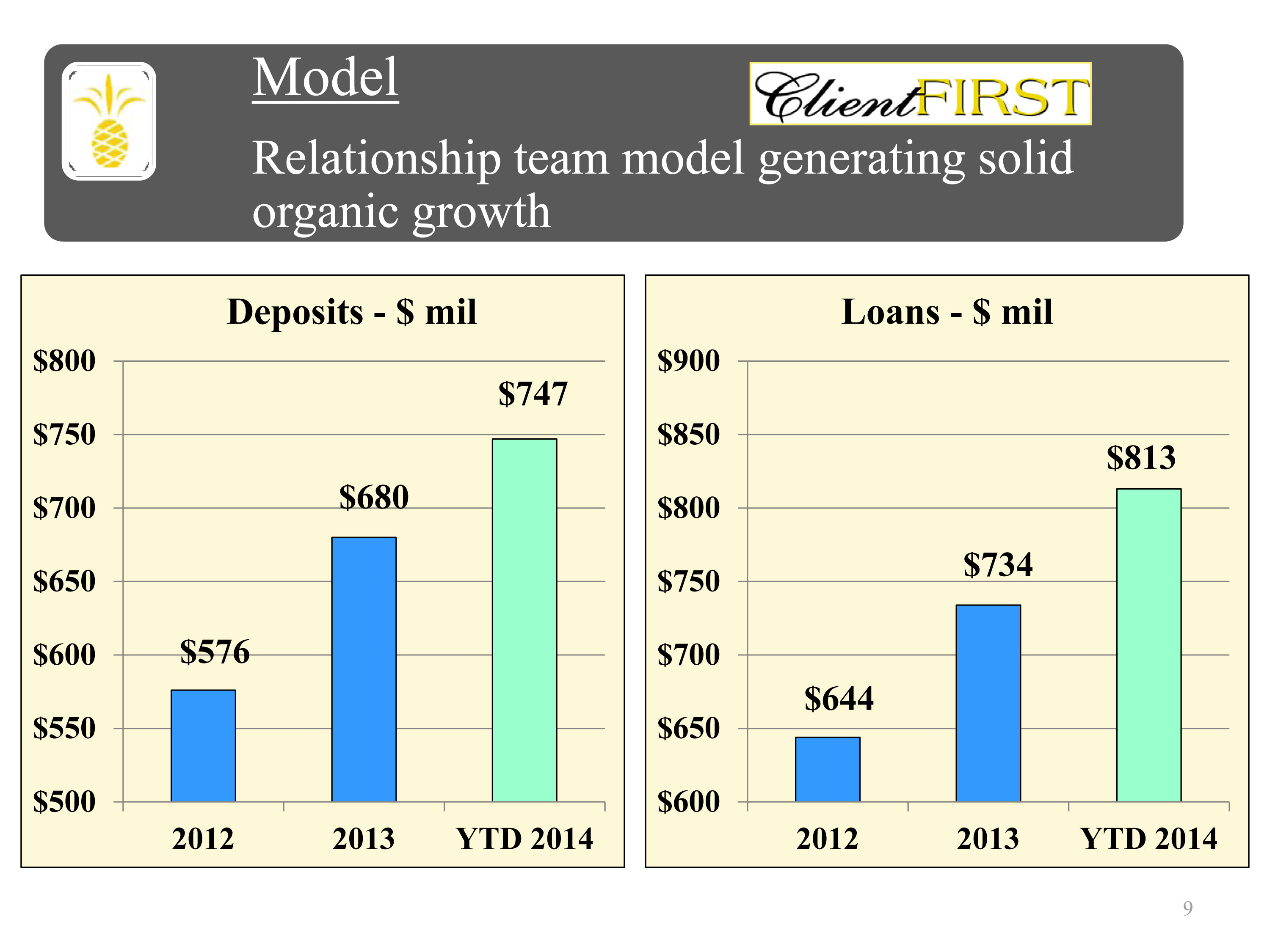

9 Model Relationship team model generating solid organic growth $644 $734 $813 $600 $650 $700 $750 $800 $850 $900 2012 2013 YTD 2014 Loans - $ mil $576 $680 $747 $500 $550 $600 $650 $700 $750 $800 2012 2013 YTD 2014 Deposits - $ mil

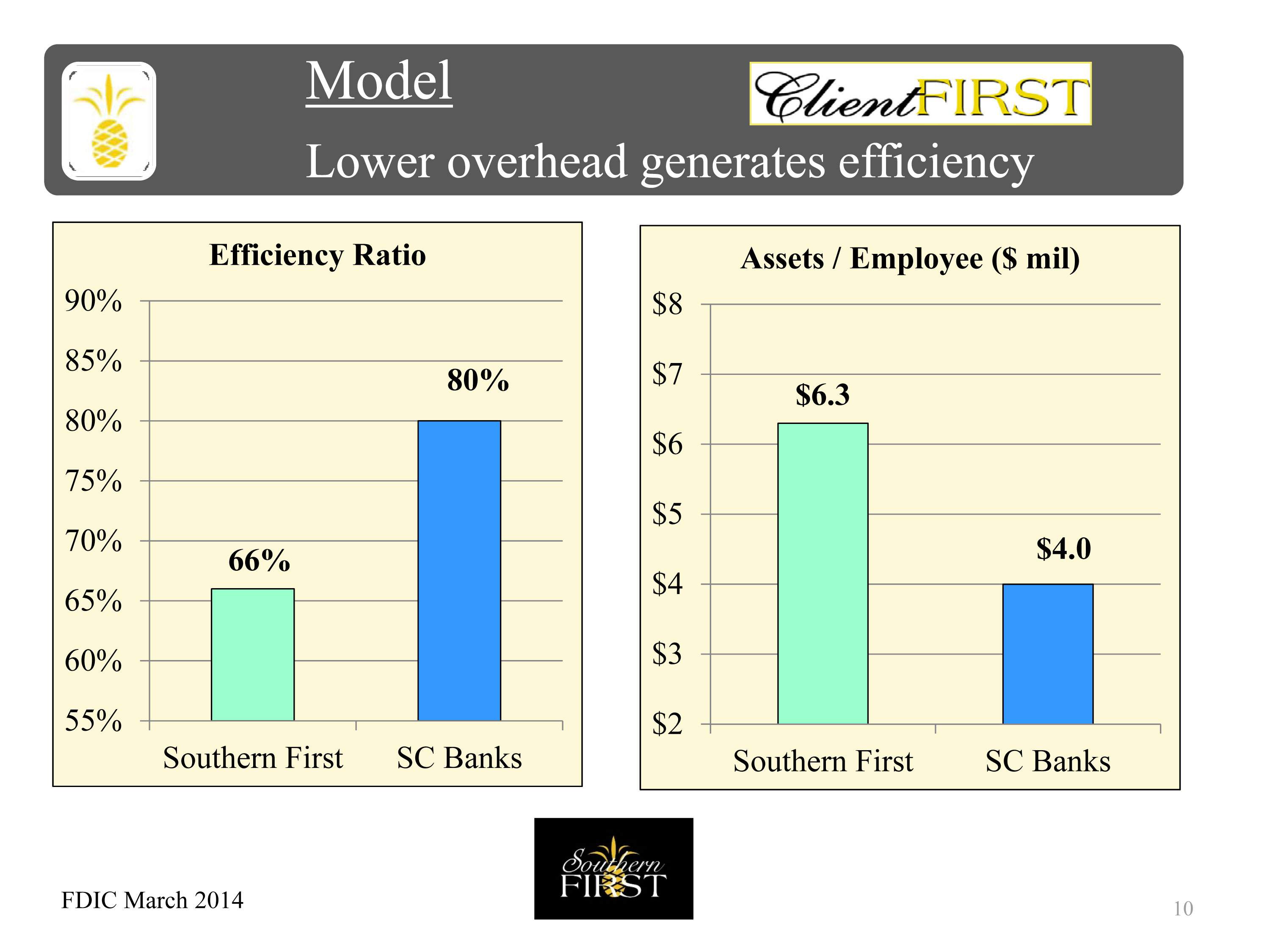

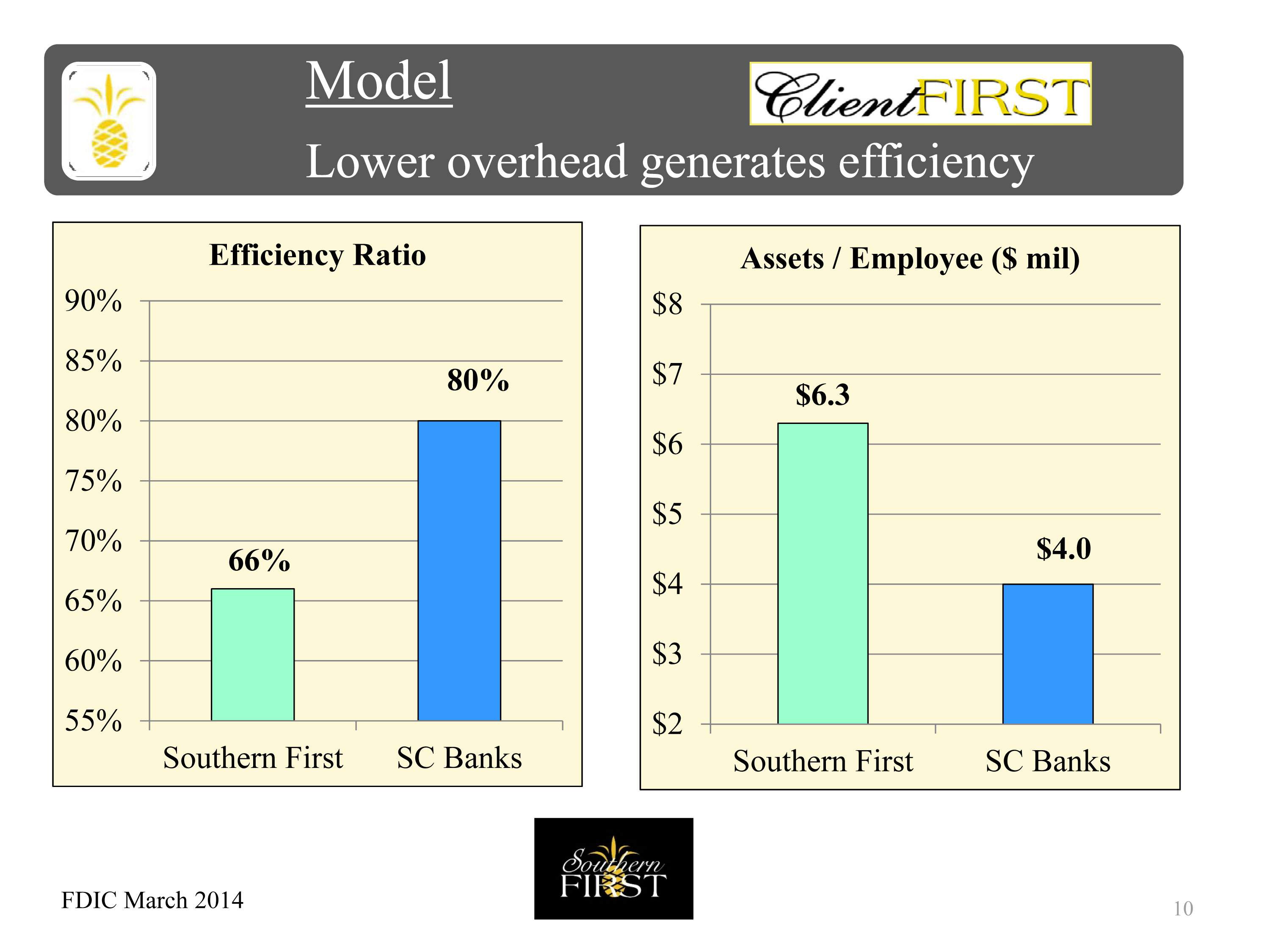

10 Model Lower overhead generates efficiency 66% 80% 55% 60% 65% 70% 75% 80% 85% 90% Southern First SC Banks Efficiency Ratio $6.3 $4.0 $2 $3 $4 $5 $6 $7 $8 Southern First SC Banks Assets / Employee ($ mil) FDIC March 2014

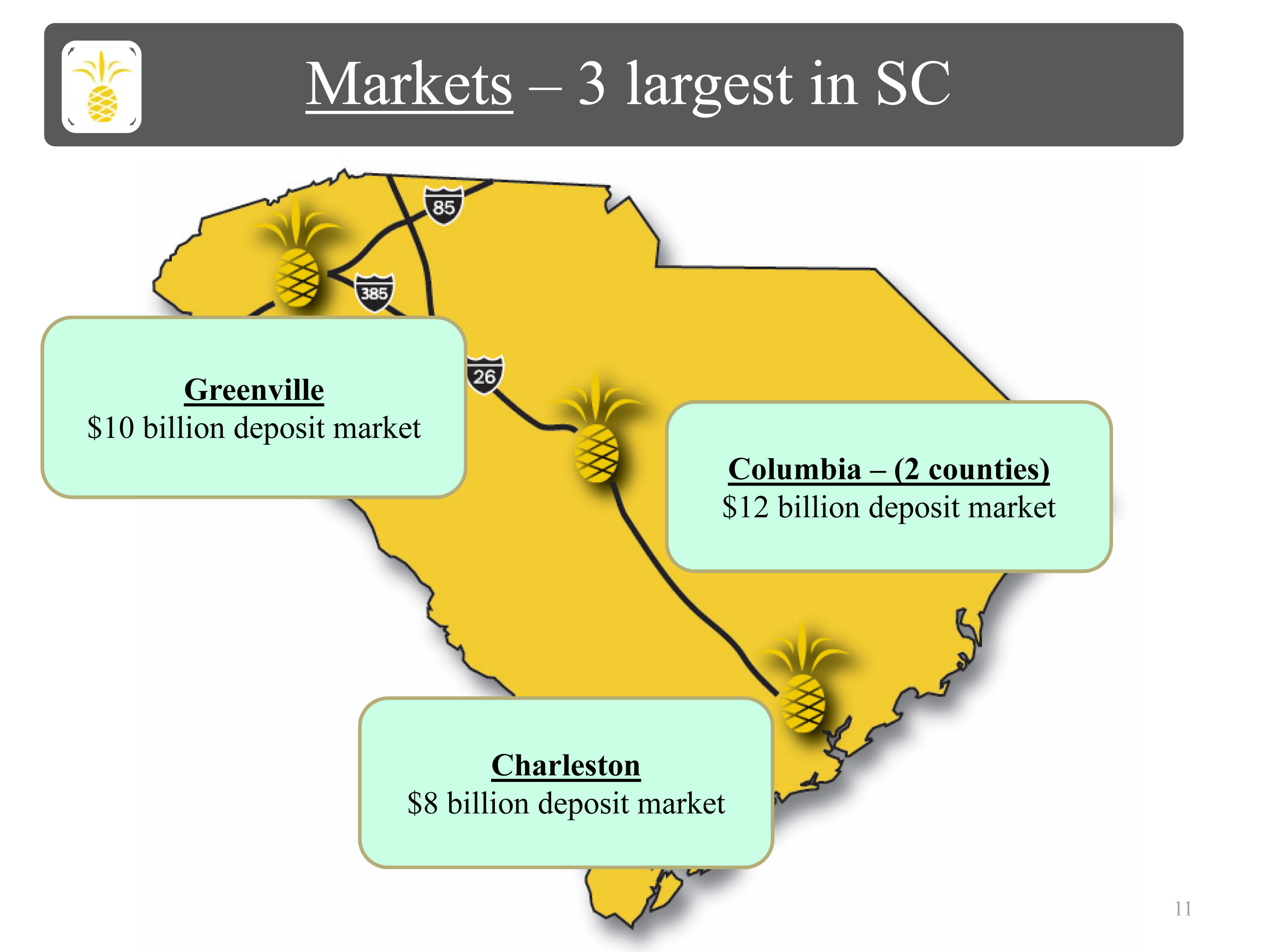

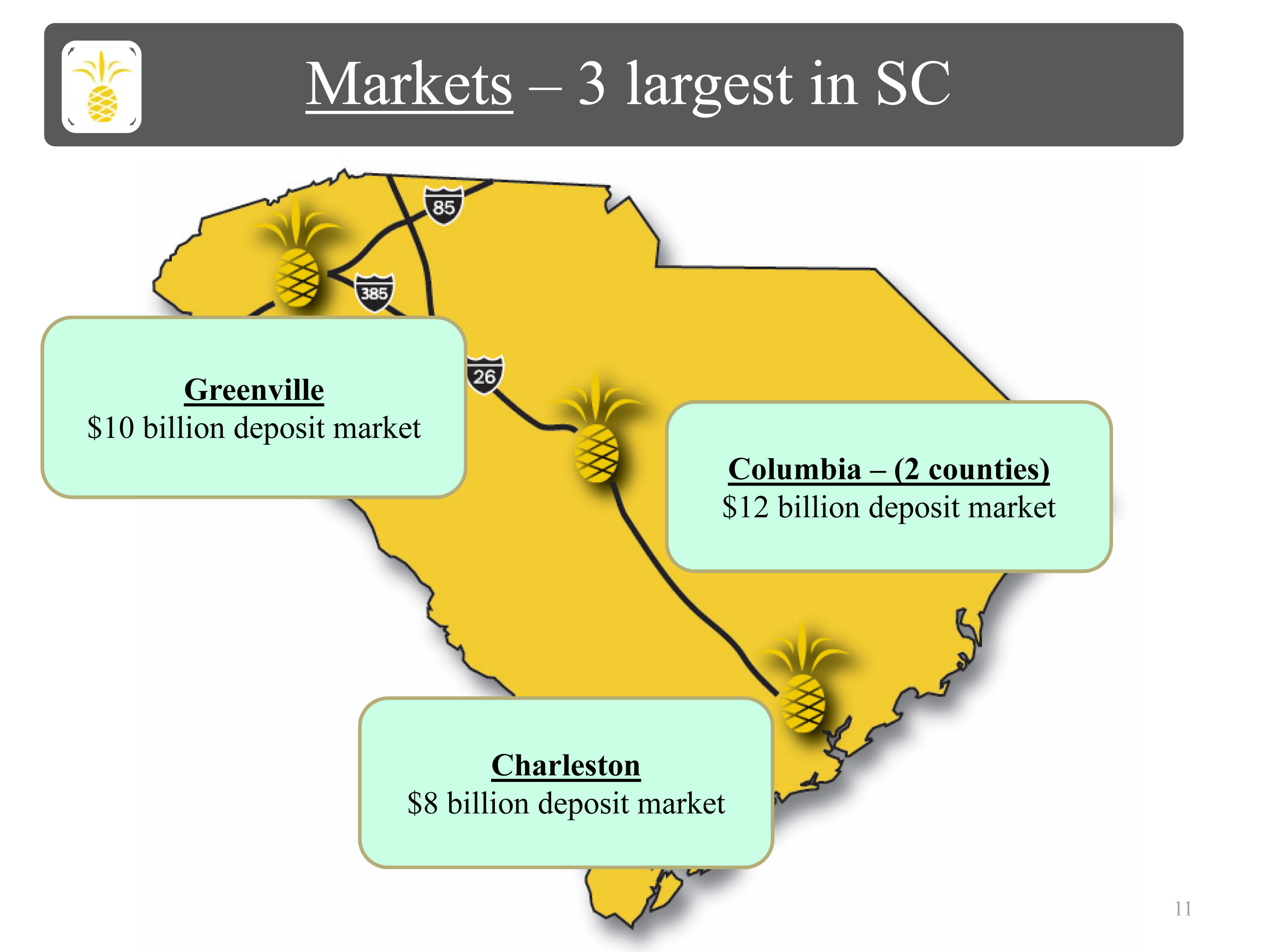

11 Greenville $10 billion deposit market Columbia – (2 counties) $12 billion deposit market Charleston $8 billion deposit market Markets – 3 largest in SC

• Extensive experience as relationship bankers • Significant market knowledge and reputation – Art Seaver – Greenville – Justin Strickland – Columbia – Len Howell - Charleston • Focused on performance and building value • Building a unique culture – attracting talent 12 Leadership Team:

13 Leadership Current executive focus Momentum - earnings Growth - market share / revenue Innovation – mobile / experience Capital - prudence Infrastructure - team / capabilities

14 South Carolina Greenville Columbia Charleston Southern First Bancshares SFST – growing shareholder value Growth / Performance Model Markets Leadership