Q2 2018 Operations Report Key Messages 2 Modeling Stats 3 Q2 Results 4 Outlook 6 Delaware Basin 12 STACK17 Eagle Ford 21 Rockies 22 Barnett Shale 23 Heavy Oil 24 NYSE: DVN devonenergy.com Exhibit 99.2

Q2 light-oil production exceeds high end of guidance Driven by strong well productivity in Delaware and STACK U.S. light-oil growth running ahead of original budget YTD No change to full-year capital spending budget Free cash flow positioned to rapidly expand Majority of U.S. oil has access to premium Gulf Coast pricing G&A and interest savings to reach ~$475 MM annually(1) Per-unit LOE on track to improve by ~10% by 1H 2019 Divestiture program accelerates value creation Ownership in EnLink Midstream monetized for 12x cash flow Expect to exceed $5 billion divestiture target around year end (pg. 10) Shareholder-friendly initiatives underway Recently increased share-repurchase program to $4 billion Consolidated debt has declined by ~40% YTD(1) Executing the 2020 Vision Focus on capital efficiency Portfolio simplification Improve financial strength Return cash to shareholders Maximize cash flow DEVON’S 2020 VISION (1) Includes the pro forma benefits related to the sale of EnLink Midstream in mid-July.

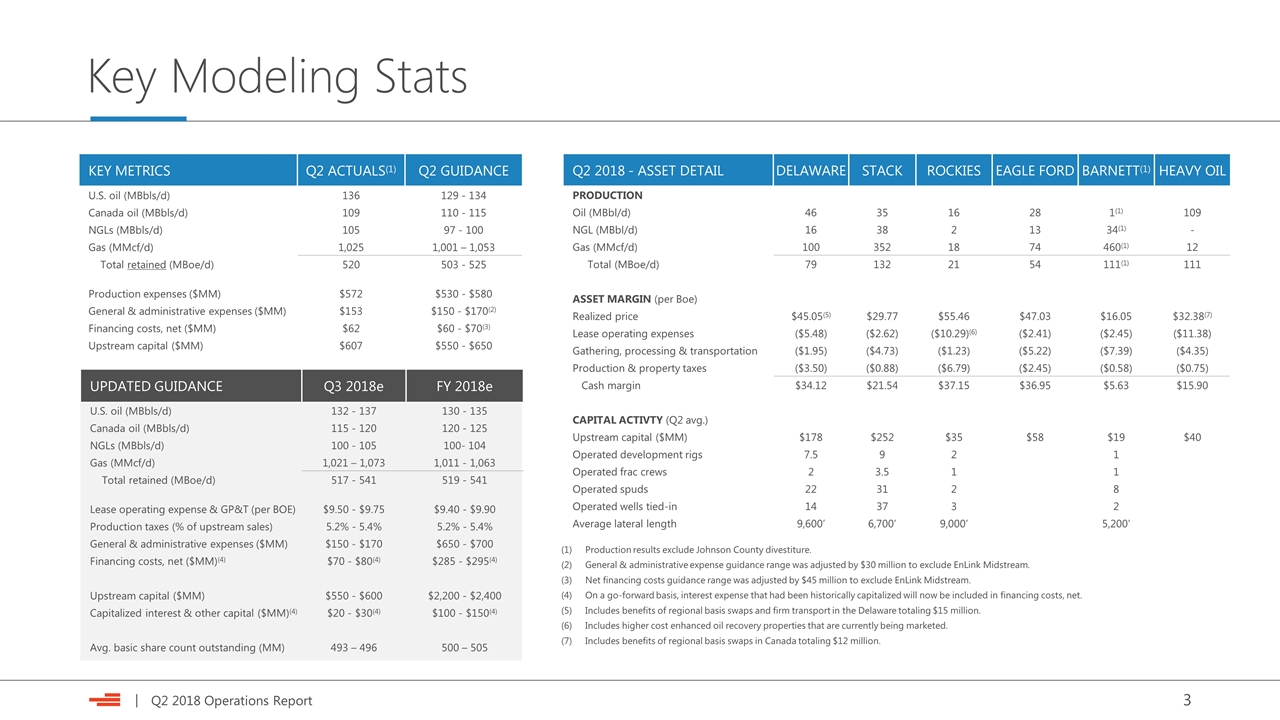

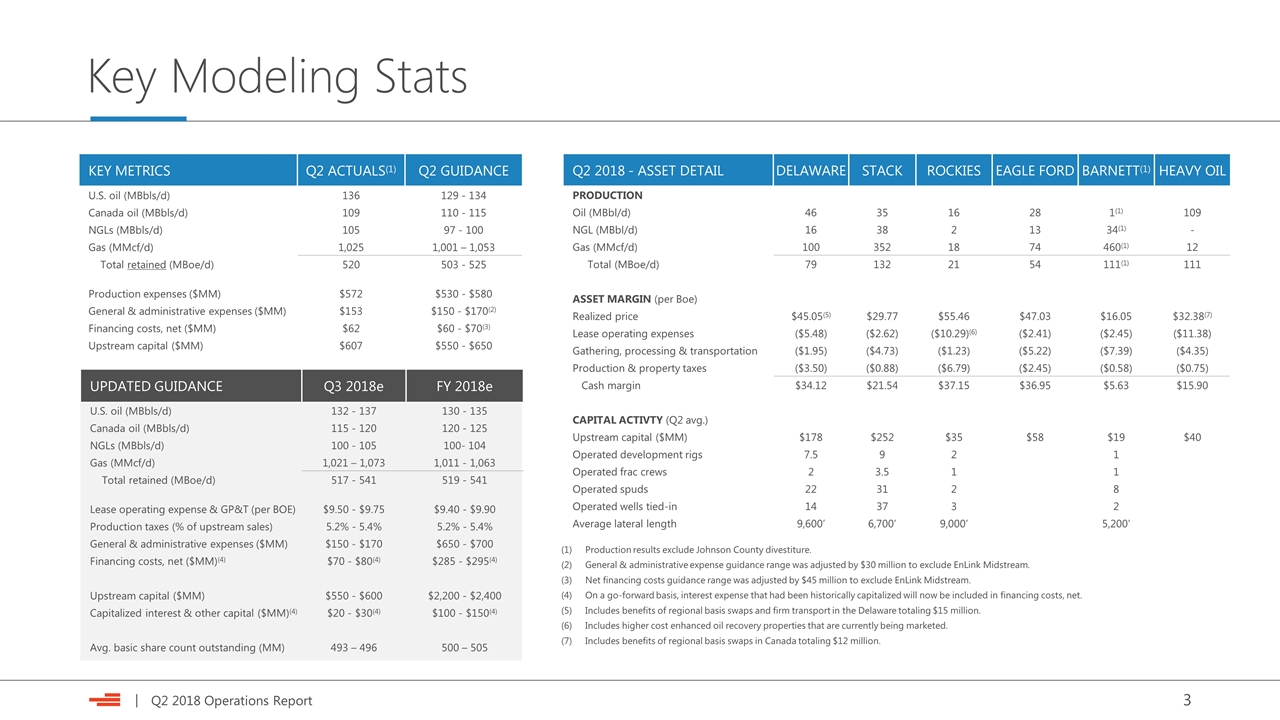

KEY METRICS Q2 ACTUALS(1) Q2 GUIDANCE U.S. oil (MBbls/d) 136 129 - 134 Canada oil (MBbls/d) 109 110 - 115 NGLs (MBbls/d) 105 97 - 100 Gas (MMcf/d) 1,025 1,001 – 1,053 Total retained (MBoe/d) 520 503 - 525 Production expenses ($MM) $572 $530 - $580 General & administrative expenses ($MM) $153 $150 - $170(2) Financing costs, net ($MM) $62 $60 - $70(3) Upstream capital ($MM) $607 $550 - $650 Q2 2018 - ASSET DETAIL DELAWARE STACK ROCKIES EAGLE FORD BARNETT(1) HEAVY OIL PRODUCTION Oil (MBbl/d) 46 35 16 28 1(1) 109 NGL (MBbl/d) 16 38 2 13 34(1) - Gas (MMcf/d) 100 352 18 74 460(1) 12 Total (MBoe/d) 79 132 21 54 111(1) 111 ASSET MARGIN (per Boe) Realized price $45.05(5) $29.77 $55.46 $47.03 $16.05 $32.38(7) Lease operating expenses ($5.48) ($2.62) ($10.29)(6) ($2.41) ($2.45) ($11.38) Gathering, processing & transportation ($1.95) ($4.73) ($1.23) ($5.22) ($7.39) ($4.35) Production & property taxes ($3.50) ($0.88) ($6.79) ($2.45) ($0.58) ($0.75) Cash margin $34.12 $21.54 $37.15 $36.95 $5.63 $15.90 CAPITAL ACTIVTY (Q2 avg.) Upstream capital ($MM) $178 $252 $35 $58 $19 $40 Operated development rigs 7.5 9 2 1 Operated frac crews 2 3.5 1 1 Operated spuds 22 31 2 8 Operated wells tied-in 14 37 3 2 Average lateral length 9,600’ 6,700’ 9,000’ 5,200’ UPDATED GUIDANCE Q3 2018e FY 2018e U.S. oil (MBbls/d) 132 - 137 130 - 135 Canada oil (MBbls/d) 115 - 120 120 - 125 NGLs (MBbls/d) 100 - 105 100- 104 Gas (MMcf/d) 1,021 – 1,073 1,011 - 1,063 Total retained (MBoe/d) 517 - 541 519 - 541 Lease operating expense & GP&T (per BOE) $9.50 - $9.75 $9.40 - $9.90 Production taxes (% of upstream sales) 5.2% - 5.4% 5.2% - 5.4% General & administrative expenses ($MM) $150 - $170 $650 - $700 Financing costs, net ($MM)(4) $70 - $80(4) $285 - $295(4) Upstream capital ($MM) $550 - $600 $2,200 - $2,400 Capitalized interest & other capital ($MM)(4) $20 - $30(4) $100 - $150(4) Avg. basic share count outstanding (MM) 493 – 496 500 – 505 Key Modeling Stats Production results exclude Johnson County divestiture. General & administrative expense guidance range was adjusted by $30 million to exclude EnLink Midstream. Net financing costs guidance range was adjusted by $45 million to exclude EnLink Midstream. On a go-forward basis, interest expense that had been historically capitalized will now be included in financing costs, net. Includes benefits of regional basis swaps and firm transport in the Delaware totaling $15 million. Includes higher cost enhanced oil recovery properties that are currently being marketed. Includes benefits of regional basis swaps in Canada totaling $12 million.

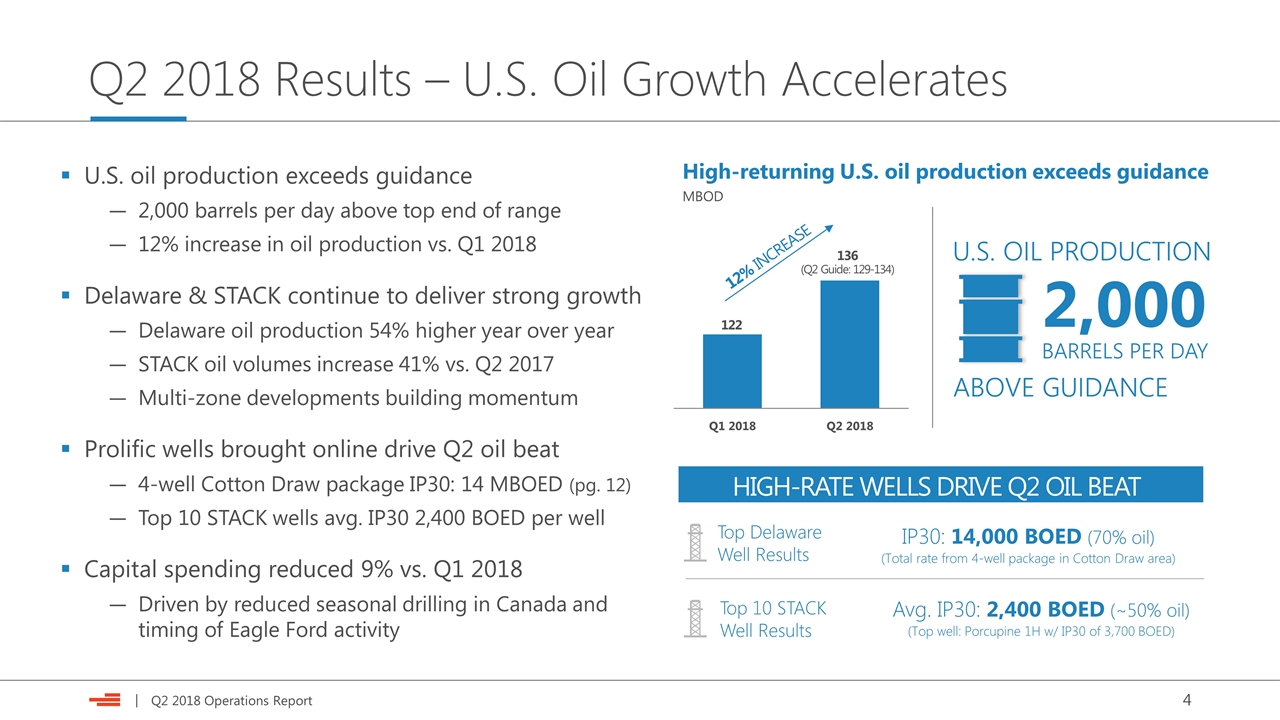

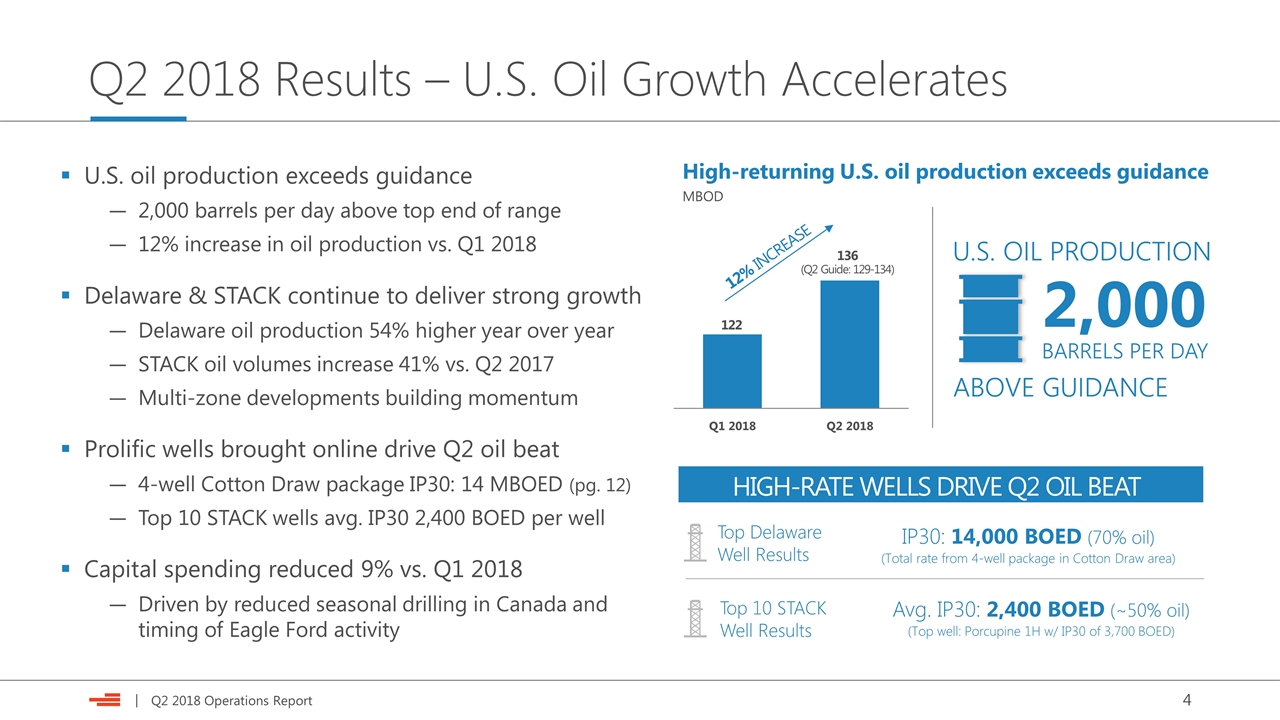

Q2 2018 Results – U.S. Oil Growth Accelerates U.S. oil production exceeds guidance 2,000 barrels per day above top end of range 12% increase in oil production vs. Q1 2018 Delaware & STACK continue to deliver strong growth Delaware oil production 54% higher year over year STACK oil volumes increase 41% vs. Q2 2017 Multi-zone developments building momentum Prolific wells brought online drive Q2 oil beat 4-well Cotton Draw package IP30: 14 MBOED (pg. 12) Top 10 STACK wells avg. IP30 2,400 BOED per well Capital spending reduced 9% vs. Q1 2018 Driven by reduced seasonal drilling in Canada and timing of Eagle Ford activity IP30: 14,000 BOED (70% oil) (Total rate from 4-well package in Cotton Draw area) Top Delaware Well Results Top 10 STACK Well Results HIGH-RATE WELLS DRIVE Q2 OIL BEAT Avg. IP30: 2,400 BOED (~50% oil) (Top well: Porcupine 1H w/ IP30 of 3,700 BOED) High-returning U.S. oil production exceeds guidance MBOD 136 (Q2 Guide: 129-134) 2,000 ABOVE GUIDANCE U.S. OIL PRODUCTION 122 BARRELS PER DAY

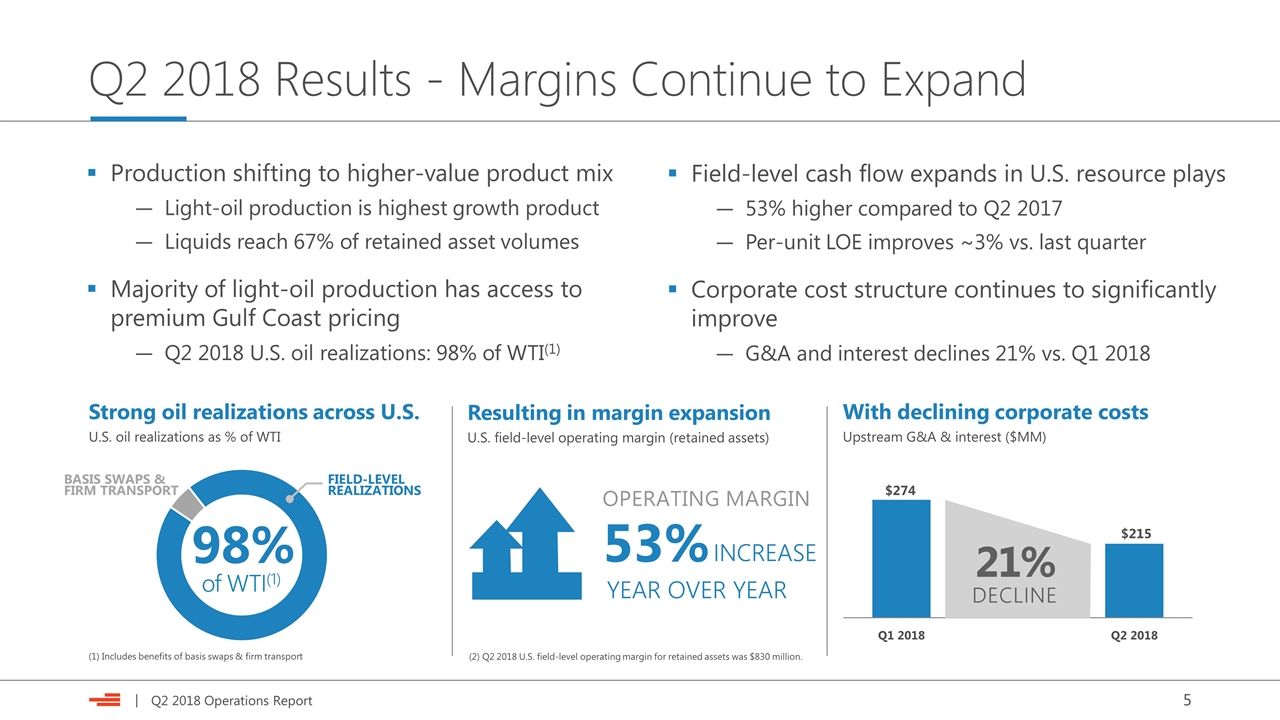

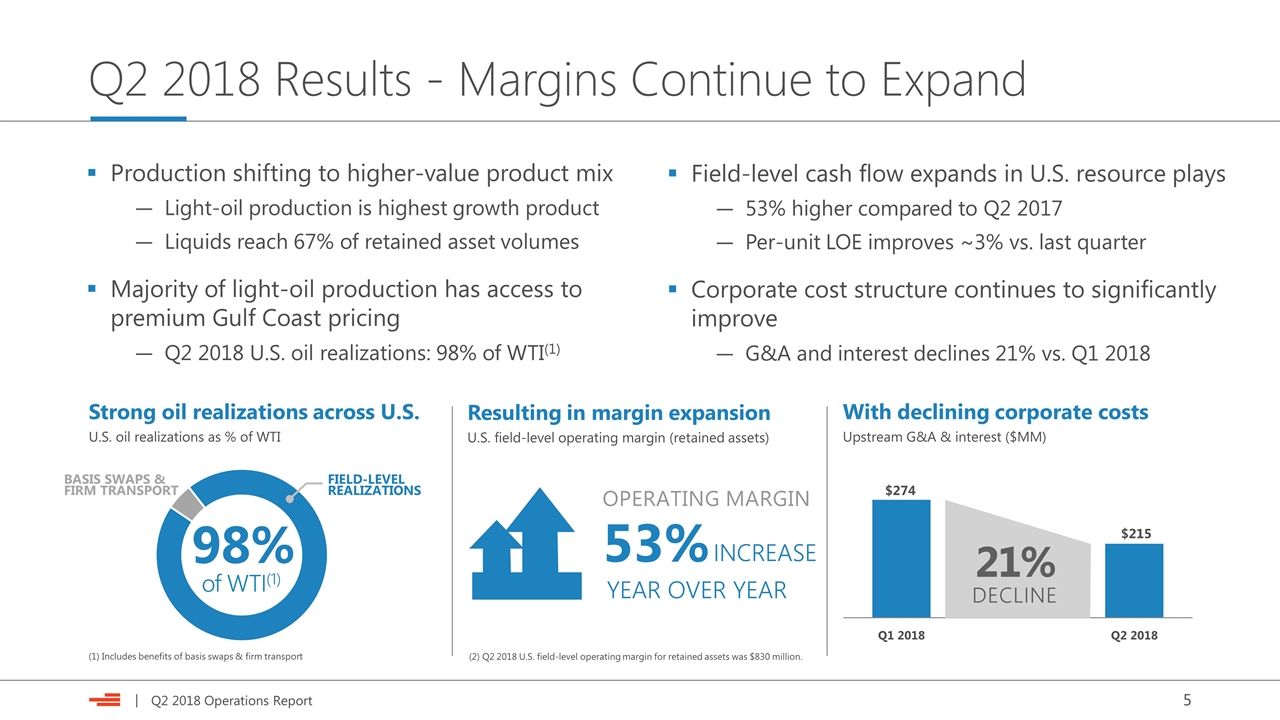

Q2 2018 Results - Margins Continue to Expand Production shifting to higher-value product mix Light-oil production is highest growth product Liquids reach 67% of retained asset volumes Majority of light-oil production has access to premium Gulf Coast pricing Q2 2018 U.S. oil realizations: 98% of WTI(1) Field-level cash flow expands in U.S. resource plays 53% higher compared to Q2 2017 Per-unit LOE improves ~3% vs. last quarter Corporate cost structure continues to significantly improve G&A and interest declines 21% vs. Q1 2018 With declining corporate costs Upstream G&A & interest ($MM) Resulting in margin expansion U.S. field-level operating margin (retained assets) Strong oil realizations across U.S. U.S. oil realizations as % of WTI 53% OPERATING MARGIN YEAR OVER YEAR DECLINE 21% INCREASE (2) Q2 2018 U.S. field-level operating margin for retained assets was $830 million. (1) Includes benefits of basis swaps & firm transport 98% of WTI(1) BASIS SWAPS & FIRM TRANSPORT FIELD-LEVEL REALIZATIONS

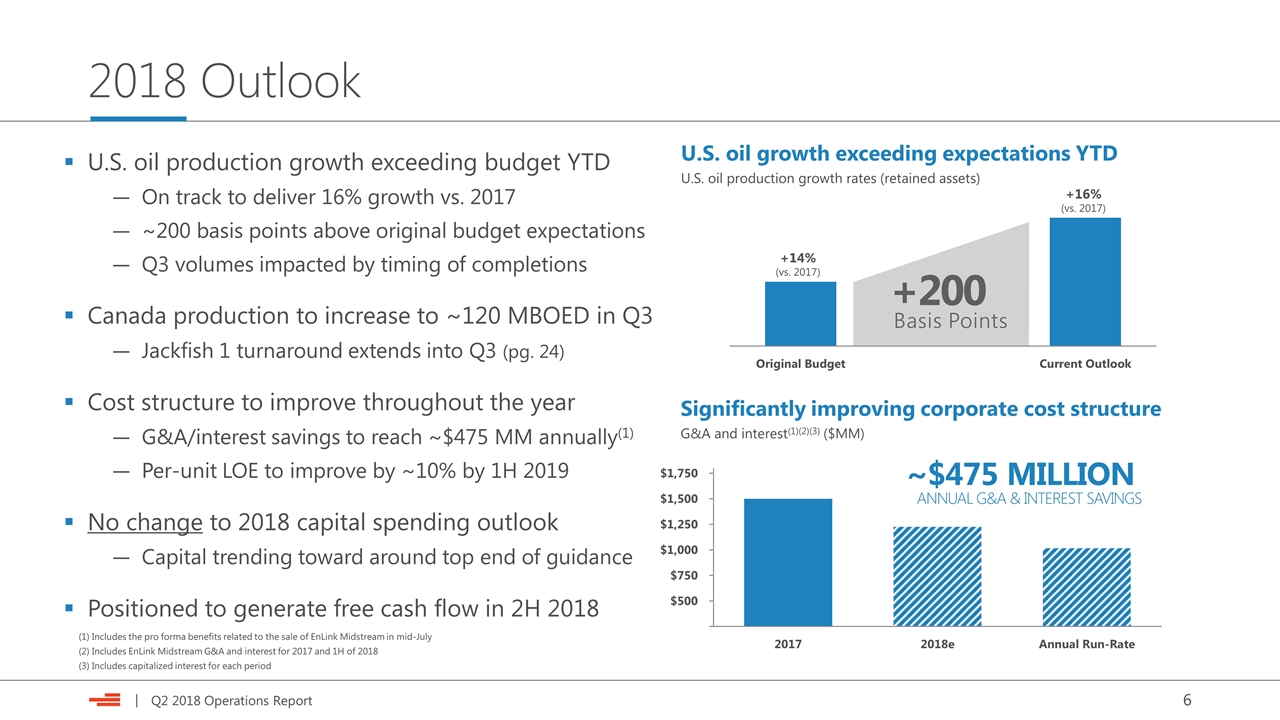

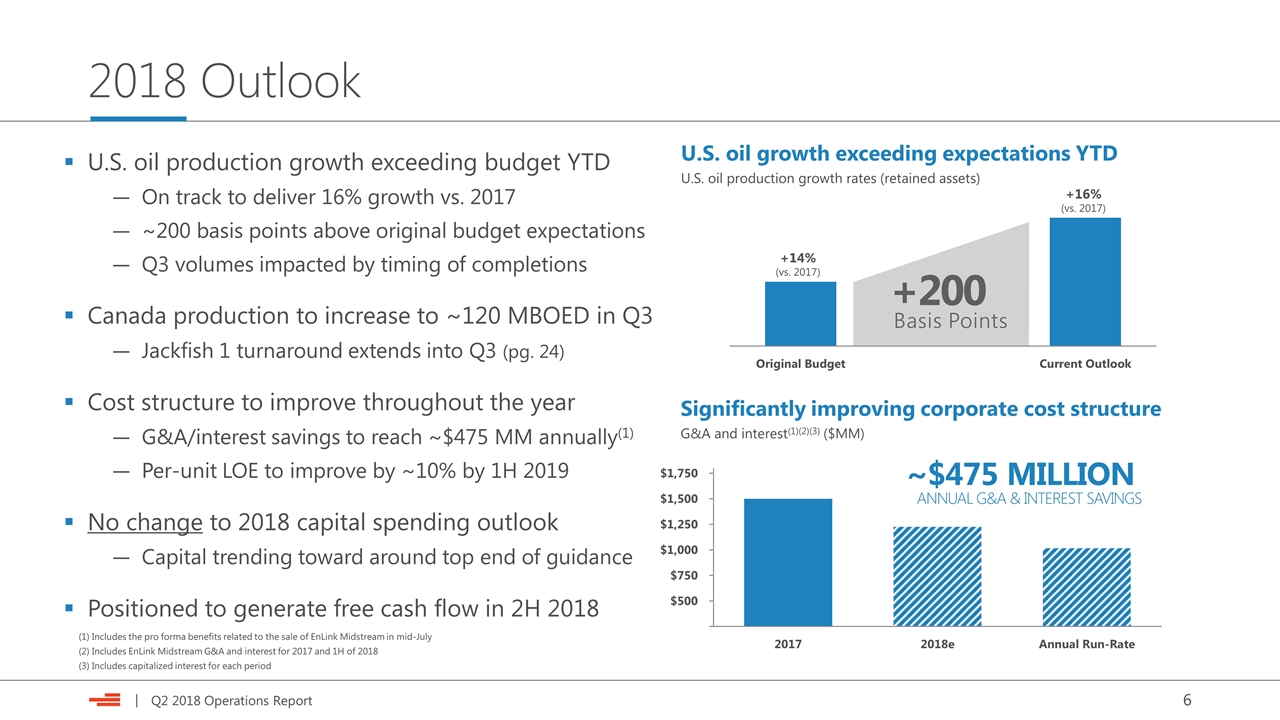

2018 Outlook U.S. oil production growth exceeding budget YTD On track to deliver 16% growth vs. 2017 ~200 basis points above original budget expectations Q3 volumes impacted by timing of completions Canada production to increase to ~120 MBOED in Q3 Jackfish 1 turnaround extends into Q3 (pg. 24) Cost structure to improve throughout the year G&A/interest savings to reach ~$475 MM annually(1) Per-unit LOE to improve by ~10% by 1H 2019 No change to 2018 capital spending outlook Capital trending toward around top end of guidance Positioned to generate free cash flow in 2H 2018 U.S. oil growth exceeding expectations YTD U.S. oil production growth rates (retained assets) Basis Points +200 ~$475 MILLION Significantly improving corporate cost structure G&A and interest(1)(2)(3) ($MM) (1) Includes the pro forma benefits related to the sale of EnLink Midstream in mid-July (2) Includes EnLink Midstream G&A and interest for 2017 and 1H of 2018 (3) Includes capitalized interest for each period

Supply Chain Strategy Effectively Mitigating Inflation Devon expects low-to-mid single-digit inflation (vs. 2017) No change to 2018 capital spending outlook Minimal inflation expected in 2H 2018 Development efficiencies offsetting cost pressures YTD Multi-year development plans allow for longer-term commitments at below-market rates Decoupling historically bundled services across supply chain Expanded vendor universe to achieve LOE and capital savings Vast majority of services and supplies secured through 2019 Innovative contracting strategy is delivering strong results 75% of rigs price protected at below market rates Long-term dedicated frac crews in Delaware & STACK at significant discounts to market rates Regional sand strategy delivering 30% savings SERVICES & SUPPLIES SECURED SERVICES & SUPPLIES SECURED

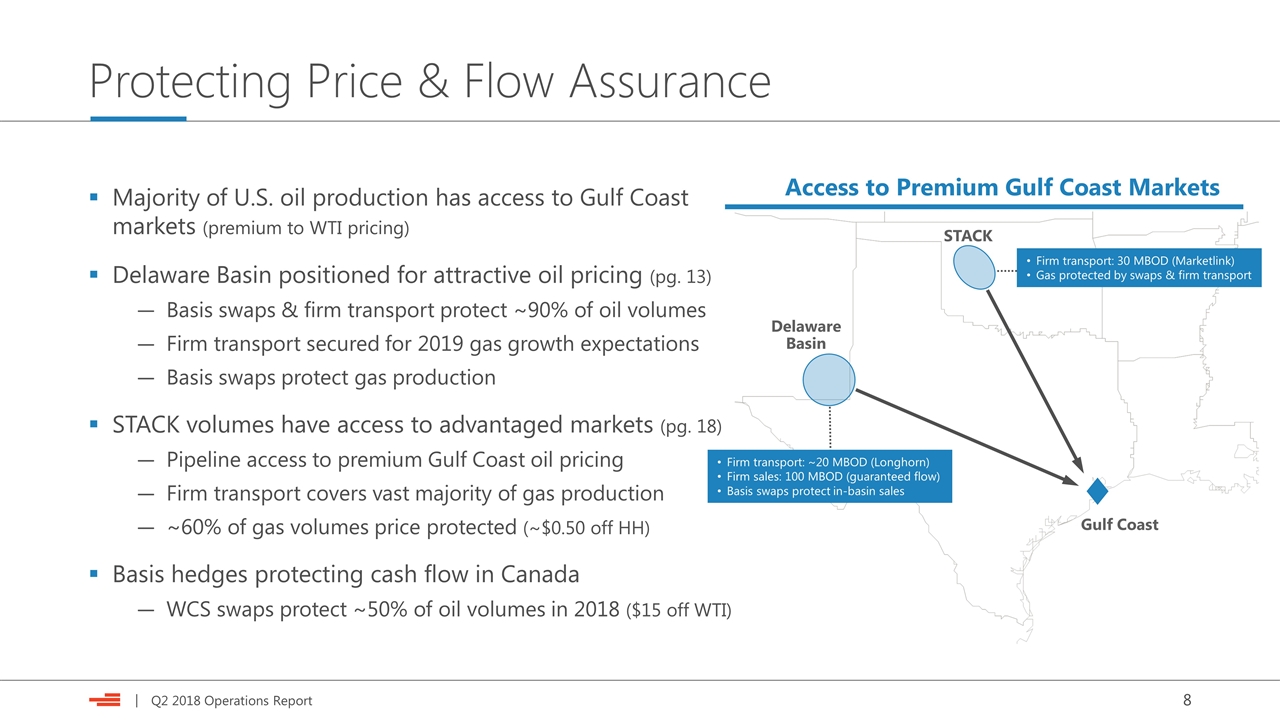

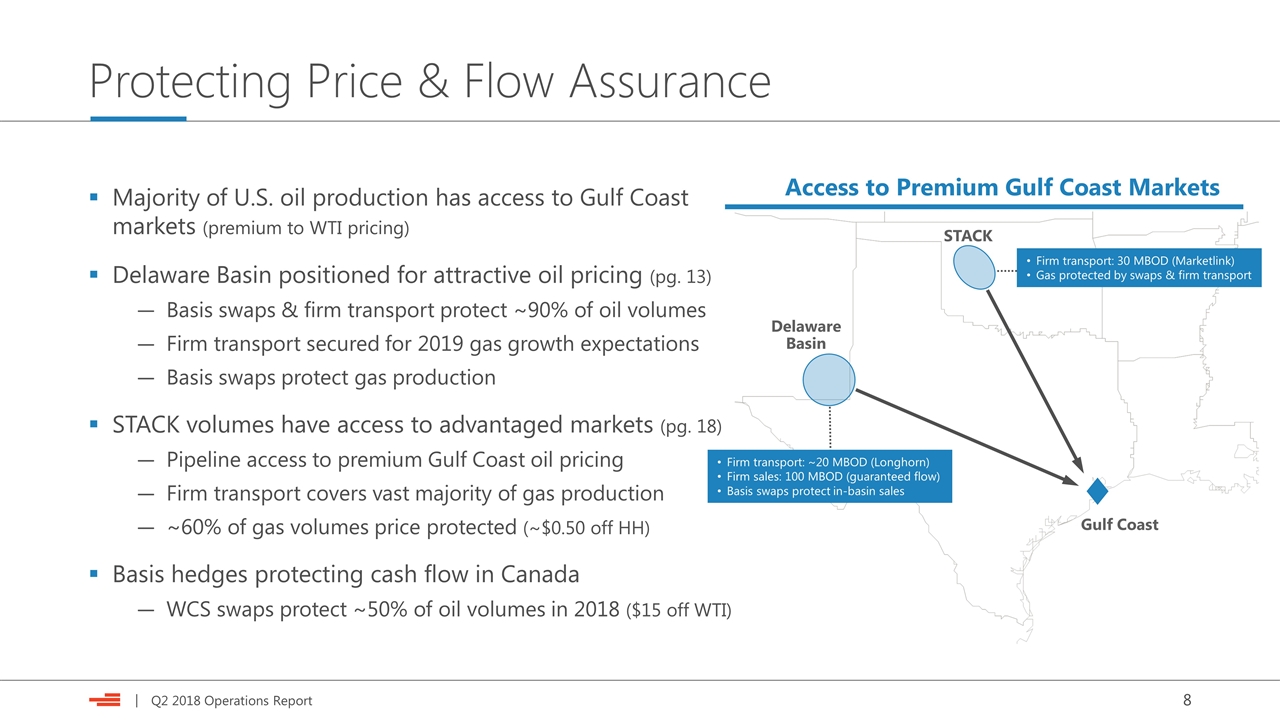

Protecting Price & Flow Assurance Majority of U.S. oil production has access to Gulf Coast markets (premium to WTI pricing) Delaware Basin positioned for attractive oil pricing (pg. 13) Basis swaps & firm transport protect ~90% of oil volumes Firm transport secured for 2019 gas growth expectations Basis swaps protect gas production STACK volumes have access to advantaged markets (pg. 18) Pipeline access to premium Gulf Coast oil pricing Firm transport covers vast majority of gas production ~60% of gas volumes price protected (~$0.50 off HH) Basis hedges protecting cash flow in Canada WCS swaps protect ~50% of oil volumes in 2018 ($15 off WTI) Gulf Coast Access to Premium Gulf Coast Markets Firm transport: 30 MBOD (Marketlink) Gas protected by swaps & firm transport STACK Delaware Basin Firm transport: ~20 MBOD (Longhorn) Firm sales: 100 MBOD (guaranteed flow) Basis swaps protect in-basin sales

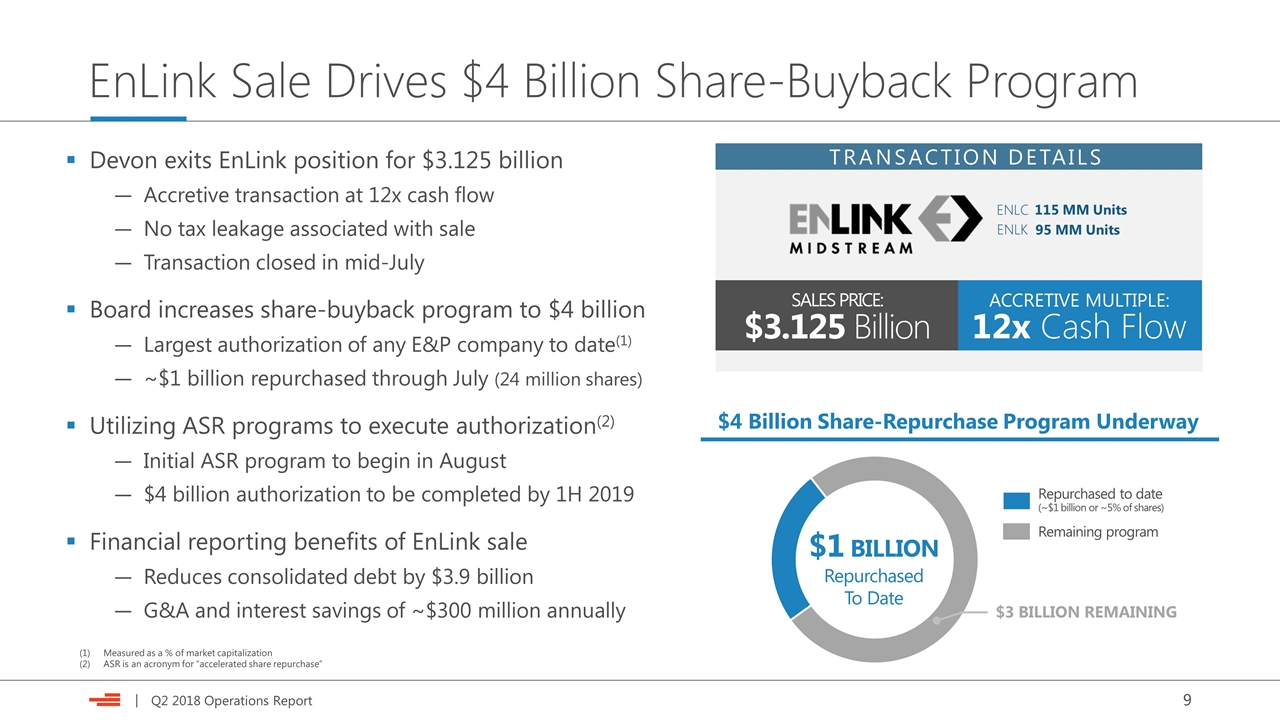

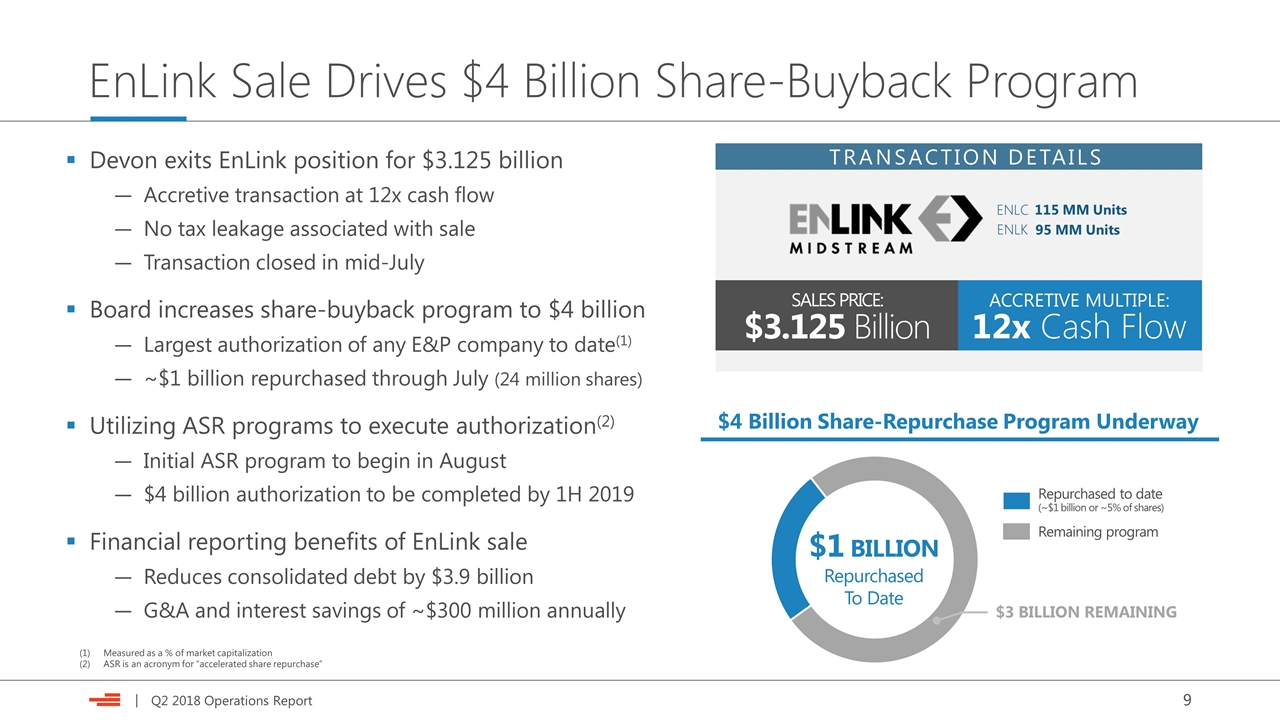

EnLink Sale Drives $4 Billion Share-Buyback Program SALES PRICE: $3.125 Billion ACCRETIVE MULTIPLE: 12x Cash Flow ENLC ENLK 115 MM Units 95 MM Units TRANSACTION DETAILS Devon exits EnLink position for $3.125 billion Accretive transaction at 12x cash flow No tax leakage associated with sale Transaction closed in mid-July Board increases share-buyback program to $4 billion Largest authorization of any E&P company to date(1) ~$1 billion repurchased through July (24 million shares) Utilizing ASR programs to execute authorization(2) Initial ASR program to begin in August $4 billion authorization to be completed by 1H 2019 Financial reporting benefits of EnLink sale Reduces consolidated debt by $3.9 billion G&A and interest savings of ~$300 million annually Measured as a % of market capitalization ASR is an acronym for “accelerated share repurchase” $4 Billion Share-Repurchase Program Underway $1 BILLION Repurchased To Date Repurchased to date (~$1 billion or ~5% of shares) Remaining program $3 BILLION REMAINING

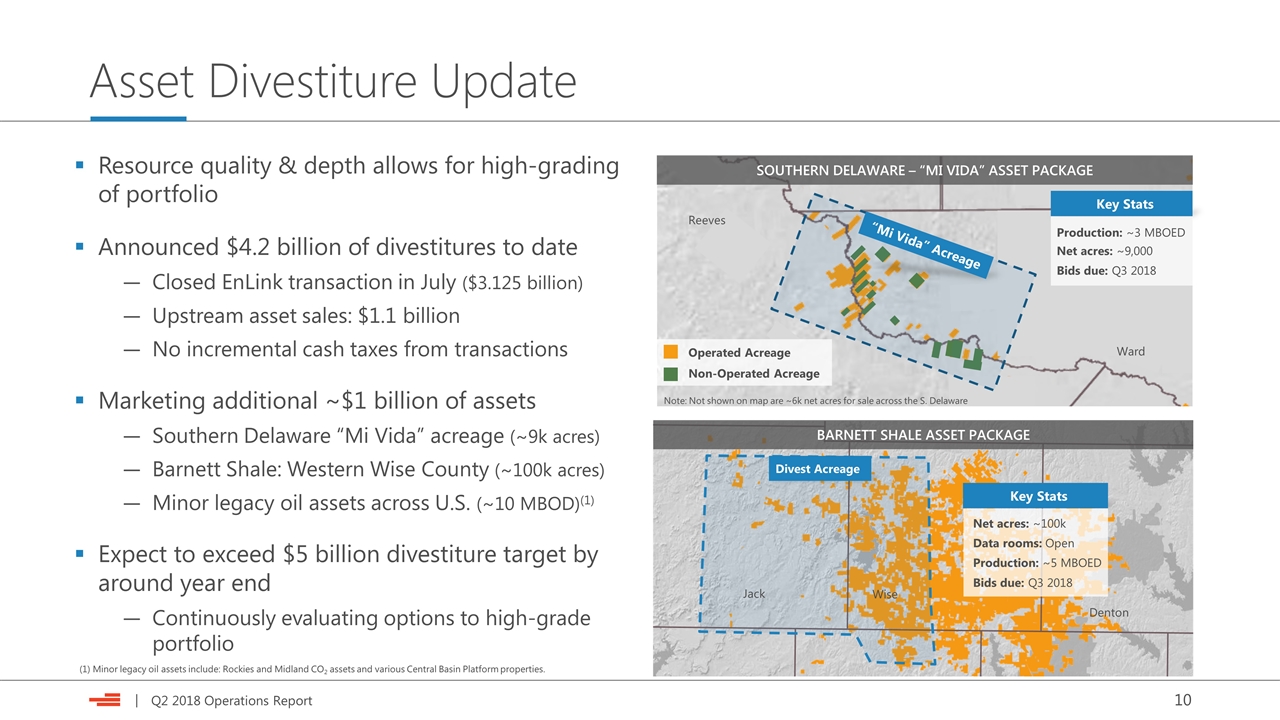

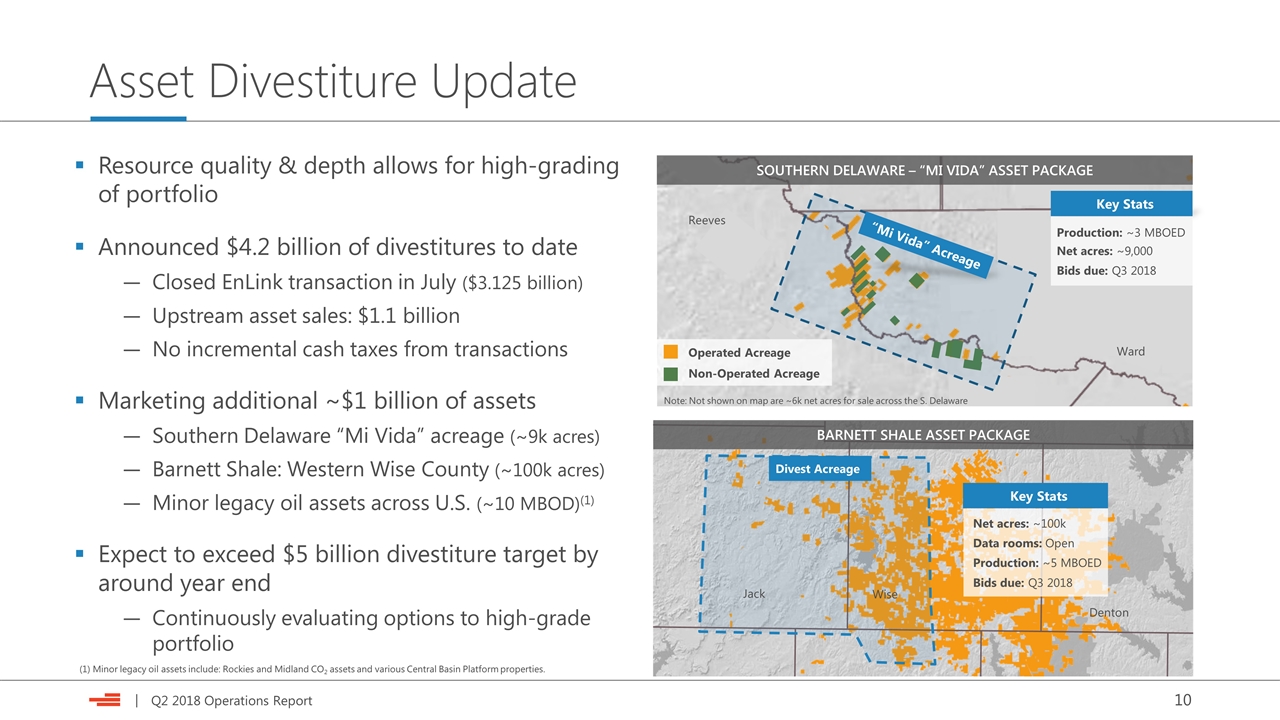

Resource quality & depth allows for high-grading of portfolio Announced $4.2 billion of divestitures to date Closed EnLink transaction in July ($3.125 billion) Upstream asset sales: $1.1 billion No incremental cash taxes from transactions Marketing additional ~$1 billion of assets Southern Delaware “Mi Vida” acreage (~9k acres) Barnett Shale: Western Wise County (~100k acres) Minor legacy oil assets across U.S. (~10 MBOD)(1) Expect to exceed $5 billion divestiture target by around year end Continuously evaluating options to high-grade portfolio Asset Divestiture Update Ward Reeves Key Stats Non-Operated Acreage Operated Acreage Production: ~3 MBOED Net acres: ~9,000 Bids due: Q3 2018 “Mi Vida” Acreage SOUTHERN DELAWARE – “MI VIDA” ASSET PACKAGE (1) Minor legacy oil assets include: Rockies and Midland CO2 assets and various Central Basin Platform properties. Note: Not shown on map are ~6k net acres for sale across the S. Delaware Divest Acreage BARNETT SHALE ASSET PACKAGE Key Stats Net acres: ~100k Data rooms: Open Production: ~5 MBOED Bids due: Q3 2018 Denton Wise Jack

2020 Vision: Next Steps Expand per-unit margins Maintain capital discipline Portfolio simplification Shareholder-friendly initiatives NEXT STEPS TO FURTHER OPTIMIZE RETURNS & CAPITAL-EFFICIENCY FOR SHAREHOLDERS Maintain strong pricing through basis swaps & firm transport Maintain discipline: no change to multi-year development plans Expect to exceed $5 billion divestiture target by around year end Retire ~$280 million of maturing debt by early next year Positioned to sustainably grow quarterly dividend rate Currently marketing ~$1 billion of non-core assets across the U.S. Execute on light-oil growth plans (mid-teens CAGR through 2020) Concentrate activity in economic core of Delaware & STACK Improve per-unit cash costs by ~10% by 1H 2019(1) Complete $4 billion share-repurchase program by 1H 2019 Generate free cash flow in 2H 2018(2) Continuously evaluating options to high-grade portfolio (1) Cash costs include LOE, G&A and interest expense. (2) Assumes $65 WTI & $2.75 Henry Hub pricing

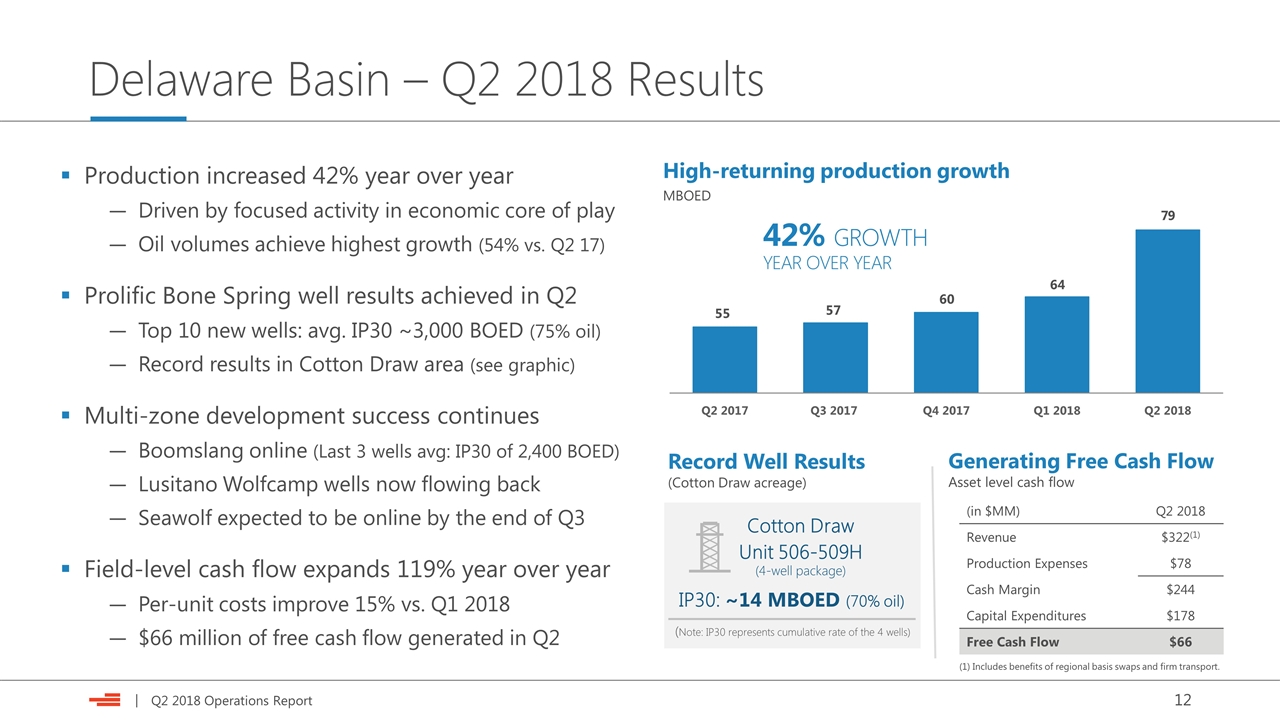

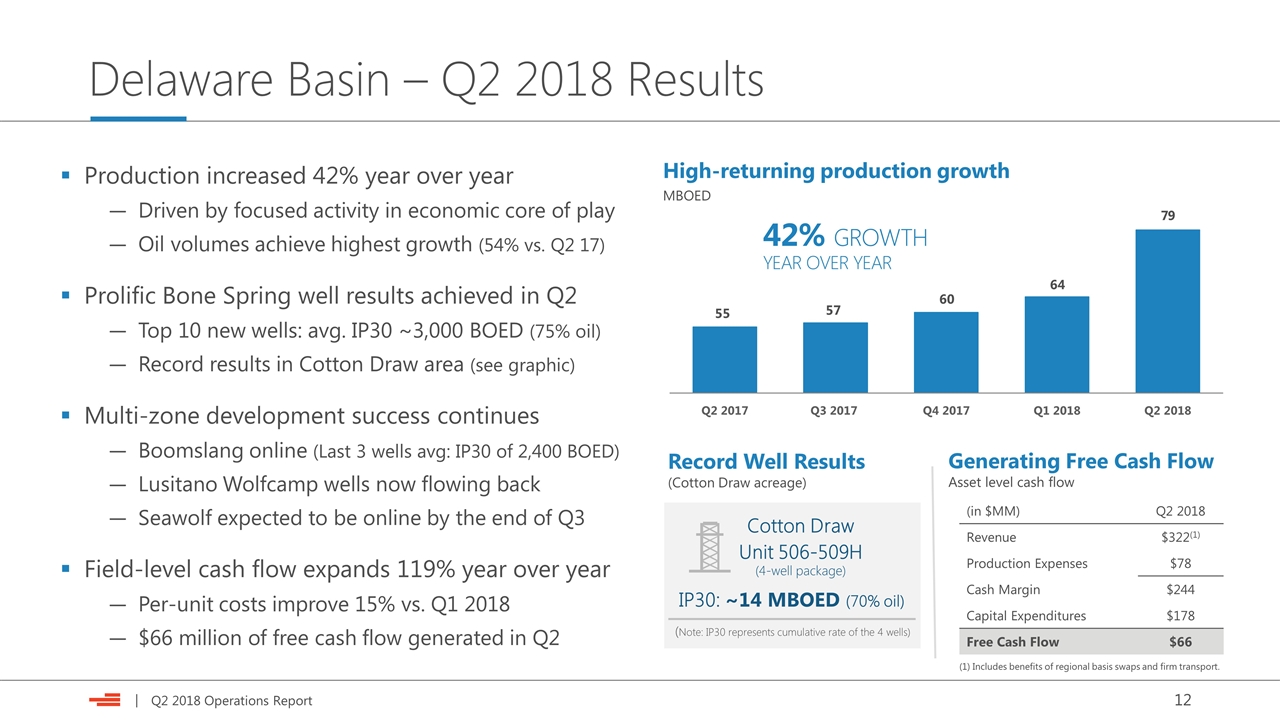

Delaware Basin – Q2 2018 Results Production increased 42% year over year Driven by focused activity in economic core of play Oil volumes achieve highest growth (54% vs. Q2 17) Prolific Bone Spring well results achieved in Q2 Top 10 new wells: avg. IP30 ~3,000 BOED (75% oil) Record results in Cotton Draw area (see graphic) Multi-zone development success continues Boomslang online (Last 3 wells avg: IP30 of 2,400 BOED) Lusitano Wolfcamp wells now flowing back Seawolf expected to be online by the end of Q3 Field-level cash flow expands 119% year over year Per-unit costs improve 15% vs. Q1 2018 $66 million of free cash flow generated in Q2 42% GROWTH YEAR OVER YEAR High-returning production growth MBOED Record Well Results (Cotton Draw acreage) Generating Free Cash Flow Asset level cash flow (in $MM) Q2 2018 Revenue $322(1) Production Expenses $78 Cash Margin $244 Capital Expenditures $178 Free Cash Flow $66 (1) Includes benefits of regional basis swaps and firm transport. Cotton Draw Unit 506-509H (4-well package) IP30: ~14 MBOED (70% oil) (Note: IP30 represents cumulative rate of the 4 wells)

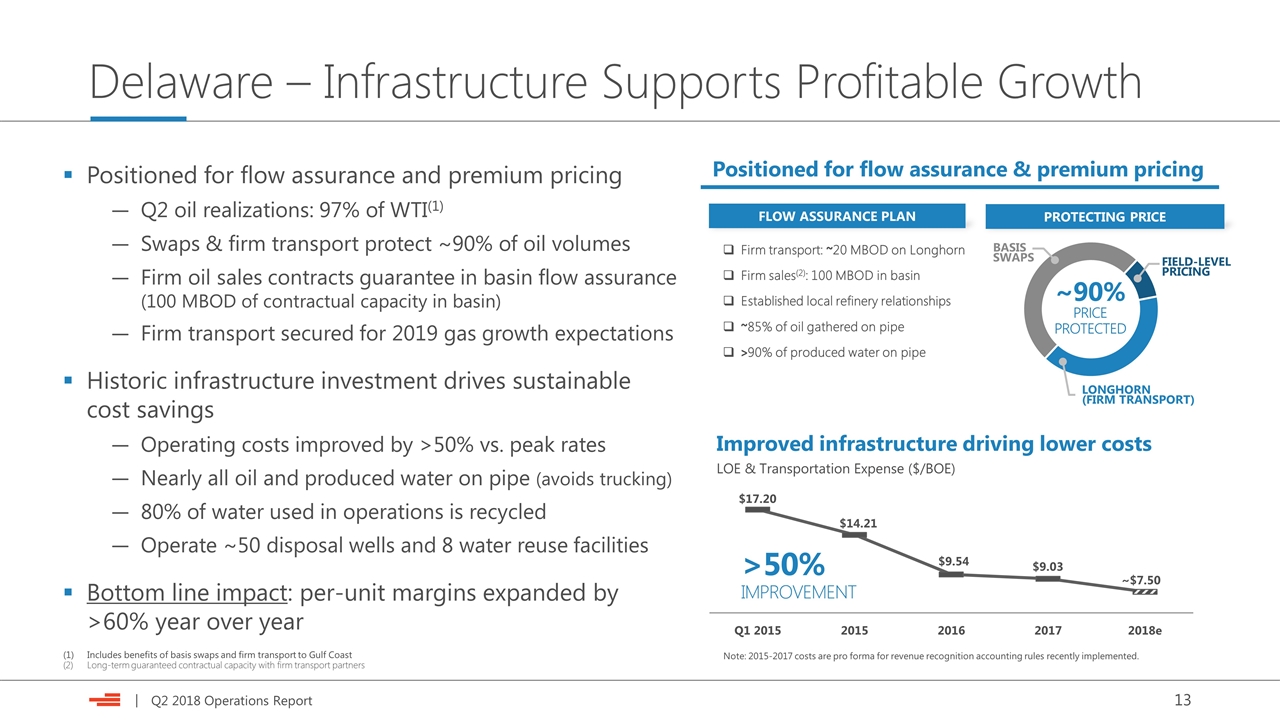

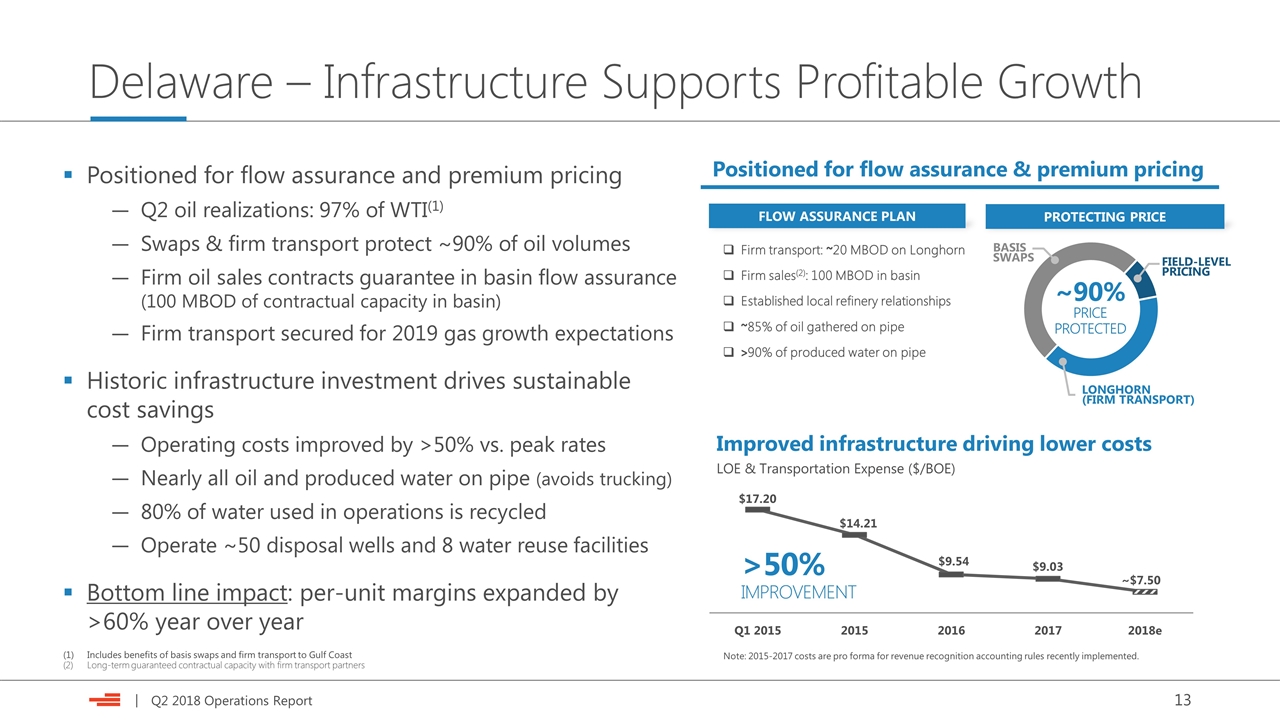

Delaware – Infrastructure Supports Profitable Growth Positioned for flow assurance and premium pricing Q2 oil realizations: 97% of WTI(1) Swaps & firm transport protect ~90% of oil volumes Firm oil sales contracts guarantee in basin flow assurance (100 MBOD of contractual capacity in basin) Firm transport secured for 2019 gas growth expectations Historic infrastructure investment drives sustainable cost savings Operating costs improved by >50% vs. peak rates Nearly all oil and produced water on pipe (avoids trucking) 80% of water used in operations is recycled Operate ~50 disposal wells and 8 water reuse facilities Bottom line impact: per-unit margins expanded by >60% year over year Note: 2015-2017 costs are pro forma for revenue recognition accounting rules recently implemented. >50% IMPROVEMENT Firm transport: ~20 MBOD on Longhorn Firm sales(2): 100 MBOD in basin Established local refinery relationships ~85% of oil gathered on pipe >90% of produced water on pipe Improved infrastructure driving lower costs LOE & Transportation Expense ($/BOE) FLOW ASSURANCE PLAN Positioned for flow assurance & premium pricing Includes benefits of basis swaps and firm transport to Gulf Coast Long-term guaranteed contractual capacity with firm transport partners PROTECTING PRICE ~90% PRICE PROTECTED BASIS SWAPS FIELD-LEVEL PRICING LONGHORN (FIRM TRANSPORT)

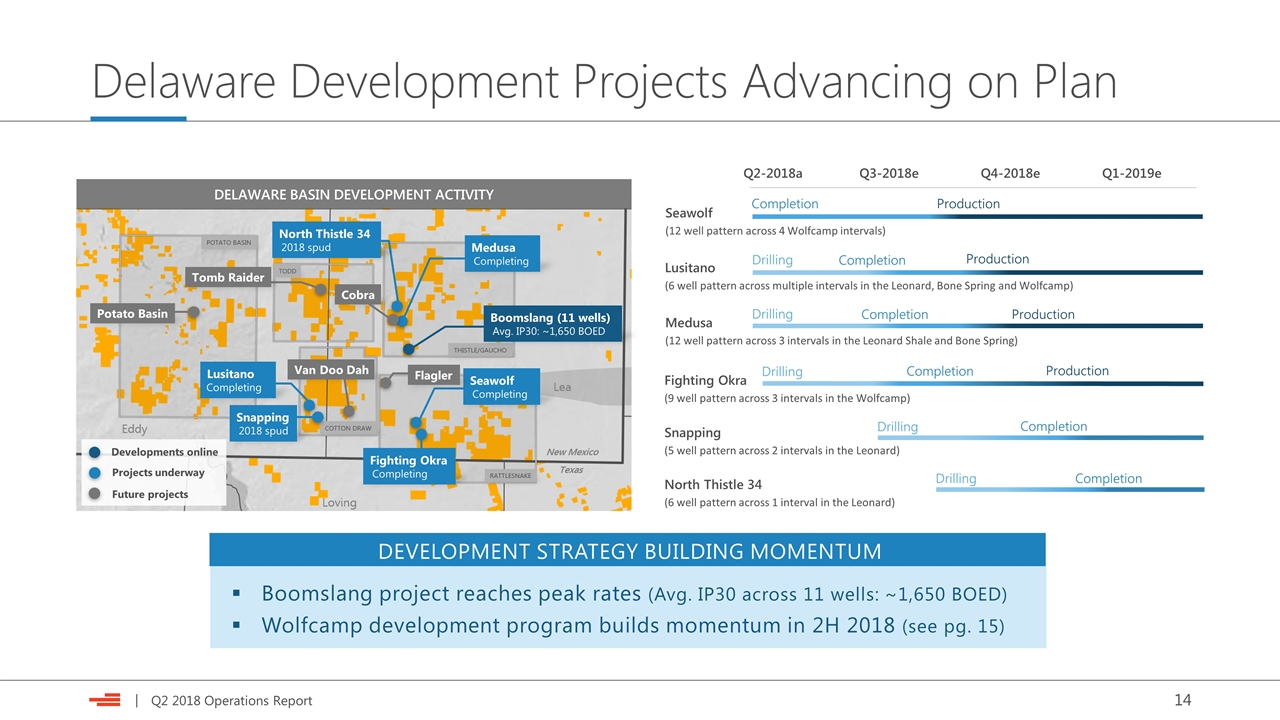

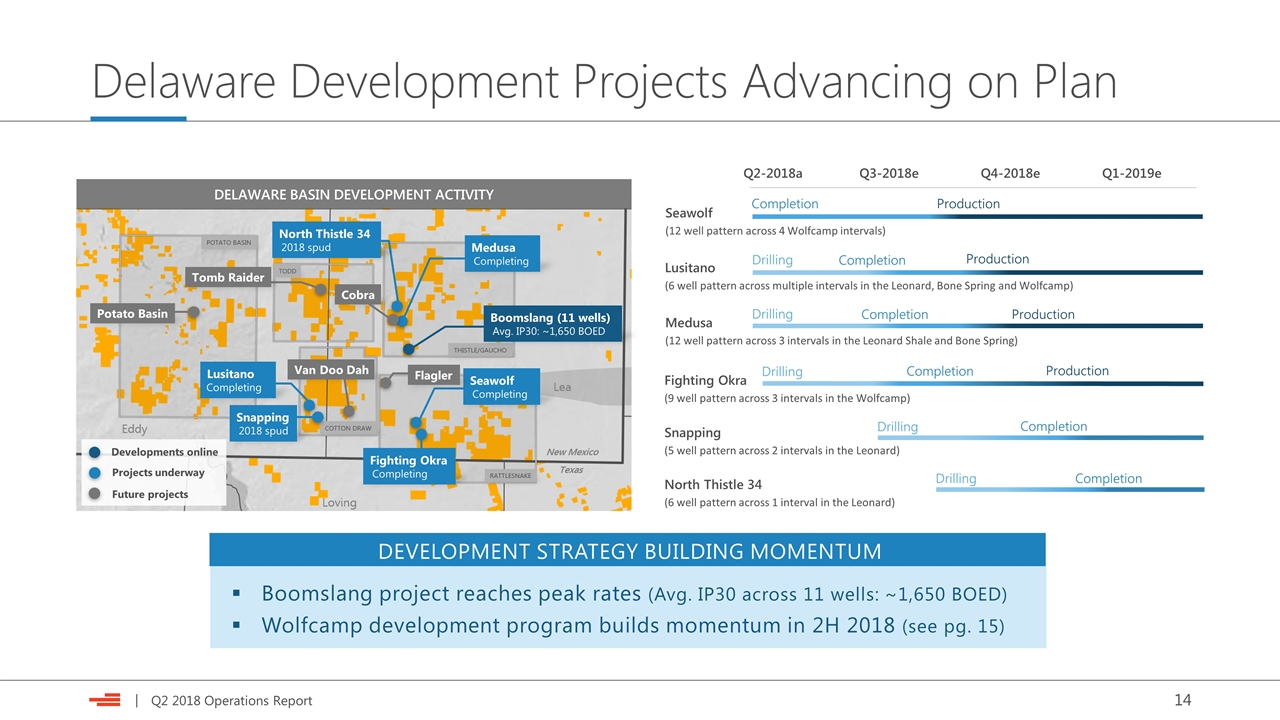

DEVELOPMENT STRATEGY BUILDING MOMENTUM Delaware Development Projects Advancing on Plan Boomslang project reaches peak rates (Avg. IP30 across 11 wells: ~1,650 BOED) Wolfcamp development program builds momentum in 2H 2018 (see pg. 15) Q2-2018a Q3-2018e Q4-2018e Q1-2019e Completion Production Completion Production Completion Fighting Okra (9 well pattern across 3 intervals in the Wolfcamp) Production Seawolf (12 well pattern across 4 Wolfcamp intervals) Lusitano (6 well pattern across multiple intervals in the Leonard, Bone Spring and Wolfcamp) Completion Medusa (12 well pattern across 3 intervals in the Leonard Shale and Bone Spring) Production Snapping (5 well pattern across 2 intervals in the Leonard) Drilling Completion North Thistle 34 (6 well pattern across 1 interval in the Leonard) Drilling Completion Drilling Drilling Drilling DELAWARE BASIN DEVELOPMENT ACTIVITY Developments online Projects underway Seawolf Completing Fighting Okra Completing Van Doo Dah Potato Basin Tomb Raider Cobra Flagler Lusitano Completing Boomslang (11 wells) Avg. IP30: ~1,650 BOED Medusa Completing North Thistle 34 2018 spud Future projects Snapping 2018 spud

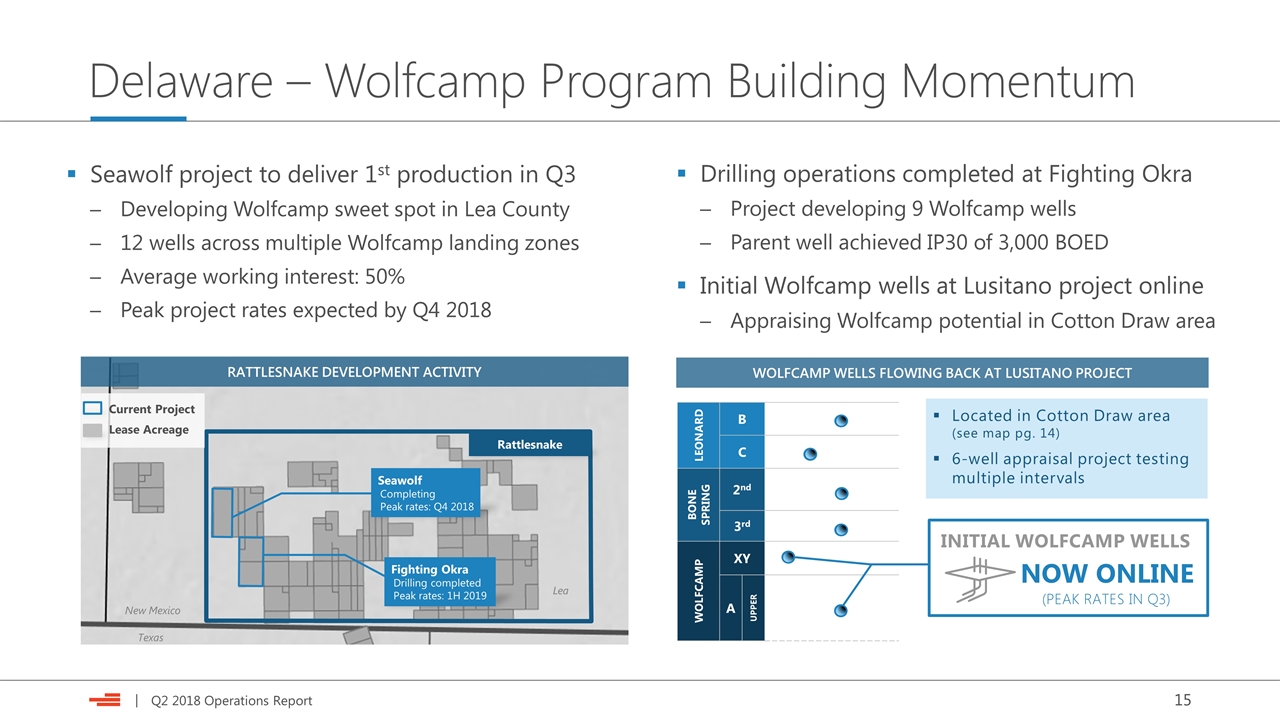

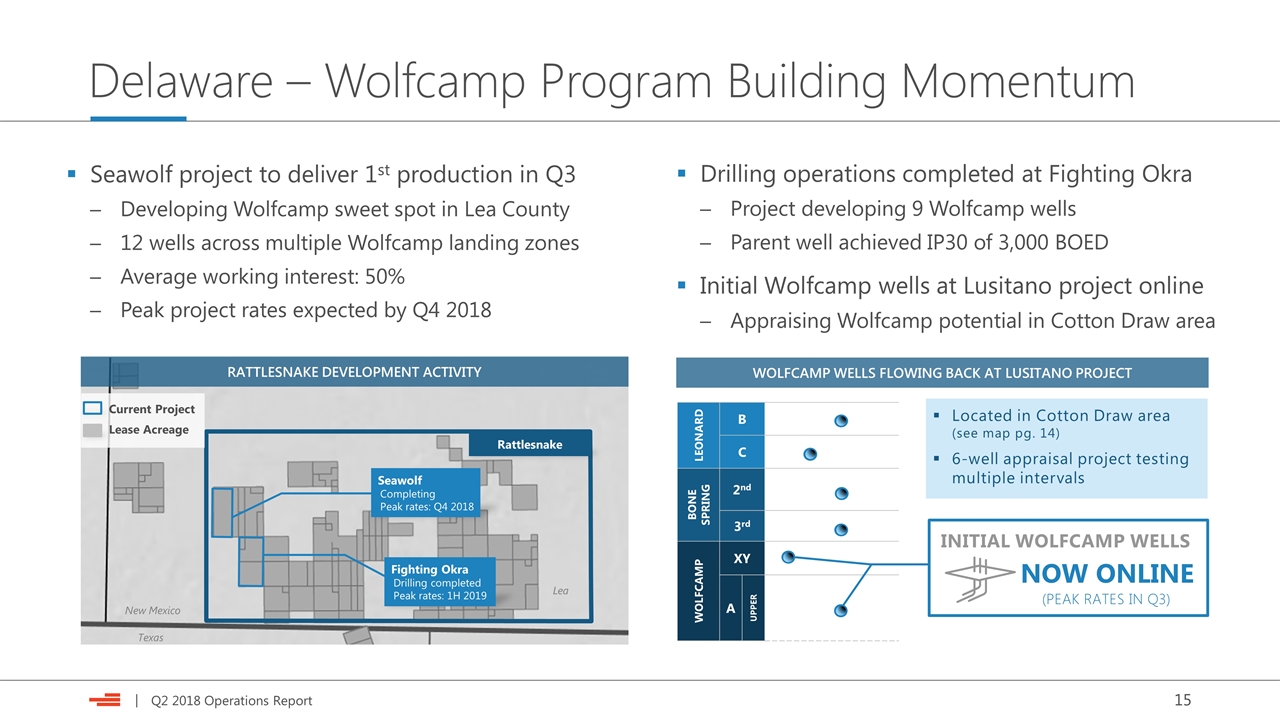

Delaware – Wolfcamp Program Building Momentum Seawolf project to deliver 1st production in Q3 Developing Wolfcamp sweet spot in Lea County 12 wells across multiple Wolfcamp landing zones Average working interest: 50% Peak project rates expected by Q4 2018 Drilling operations completed at Fighting Okra Project developing 9 Wolfcamp wells Parent well achieved IP30 of 3,000 BOED Initial Wolfcamp wells at Lusitano project online Appraising Wolfcamp potential in Cotton Draw area RATTLESNAKE DEVELOPMENT ACTIVITY Rattlesnake Fighting Okra Drilling completed Peak rates: 1H 2019 New Mexico Texas Lea Current Project Lease Acreage Seawolf Completing Peak rates: Q4 2018 LEONARD B C BONE SPRING 2nd 3rd WOLFCAMP XY A UPPER Located in Cotton Draw area (see map pg. 14) 6-well appraisal project testing multiple intervals WOLFCAMP WELLS FLOWING BACK AT LUSITANO PROJECT INITIAL WOLFCAMP WELLS NOW ONLINE (PEAK RATES IN Q3)

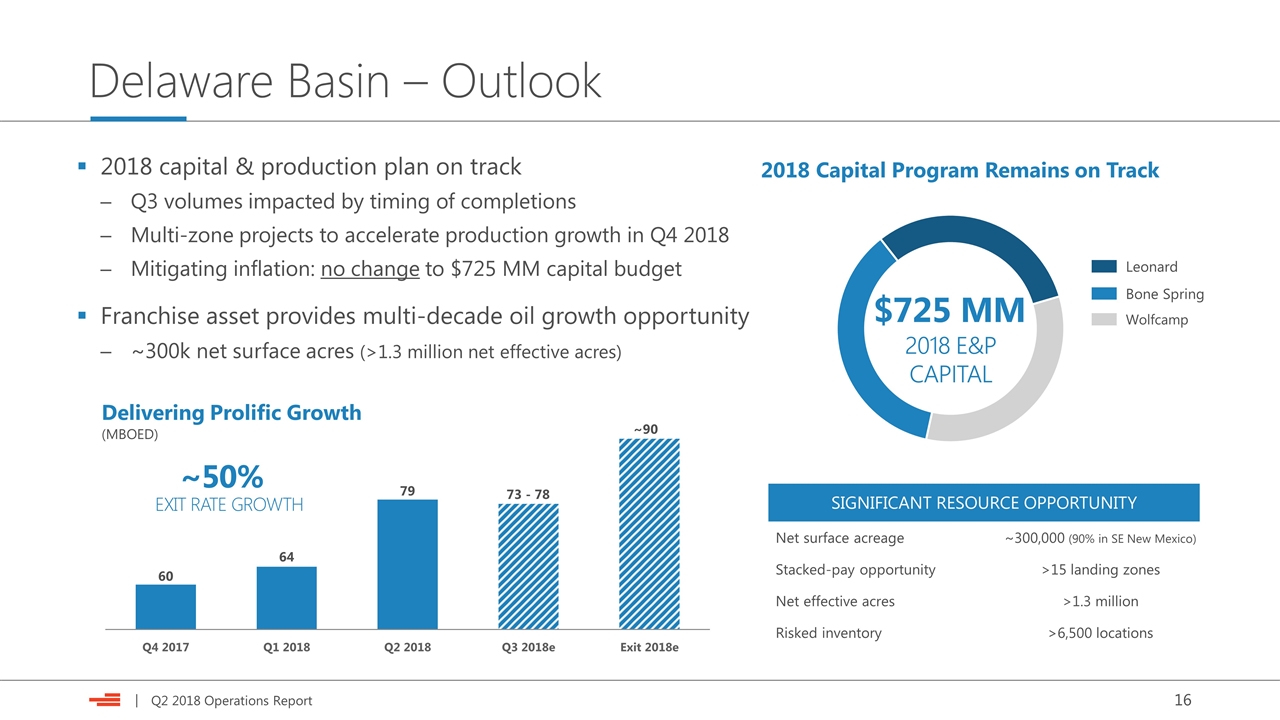

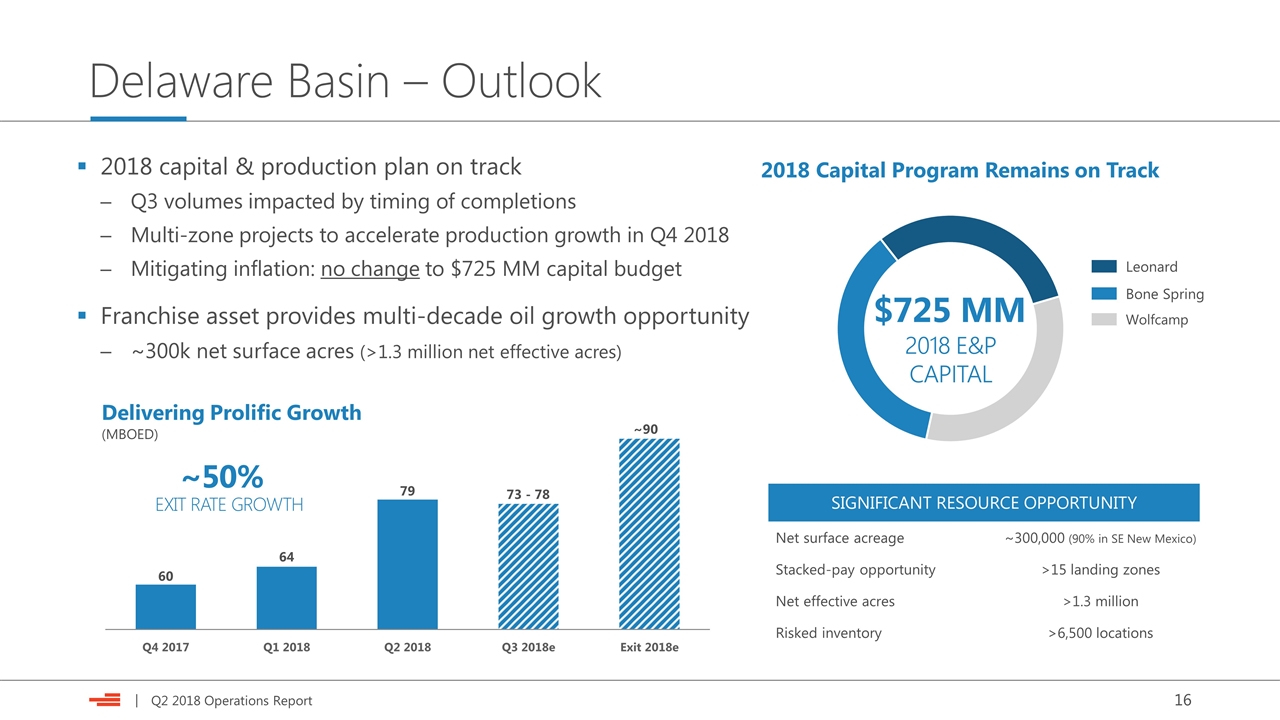

Delaware Basin – Outlook 2018 capital & production plan on track Q3 volumes impacted by timing of completions Multi-zone projects to accelerate production growth in Q4 2018 Mitigating inflation: no change to $725 MM capital budget Franchise asset provides multi-decade oil growth opportunity ~300k net surface acres (>1.3 million net effective acres) SIGNIFICANT RESOURCE OPPORTUNITY Net surface acreage ~300,000 (90% in SE New Mexico) Stacked-pay opportunity >15 landing zones Net effective acres >1.3 million Risked inventory >6,500 locations 2018 Capital Program Remains on Track Leonard Bone Spring Wolfcamp $725 MM 2018 E&P CAPITAL Delivering Prolific Growth (MBOED) ~50% EXIT RATE GROWTH 73 - 78

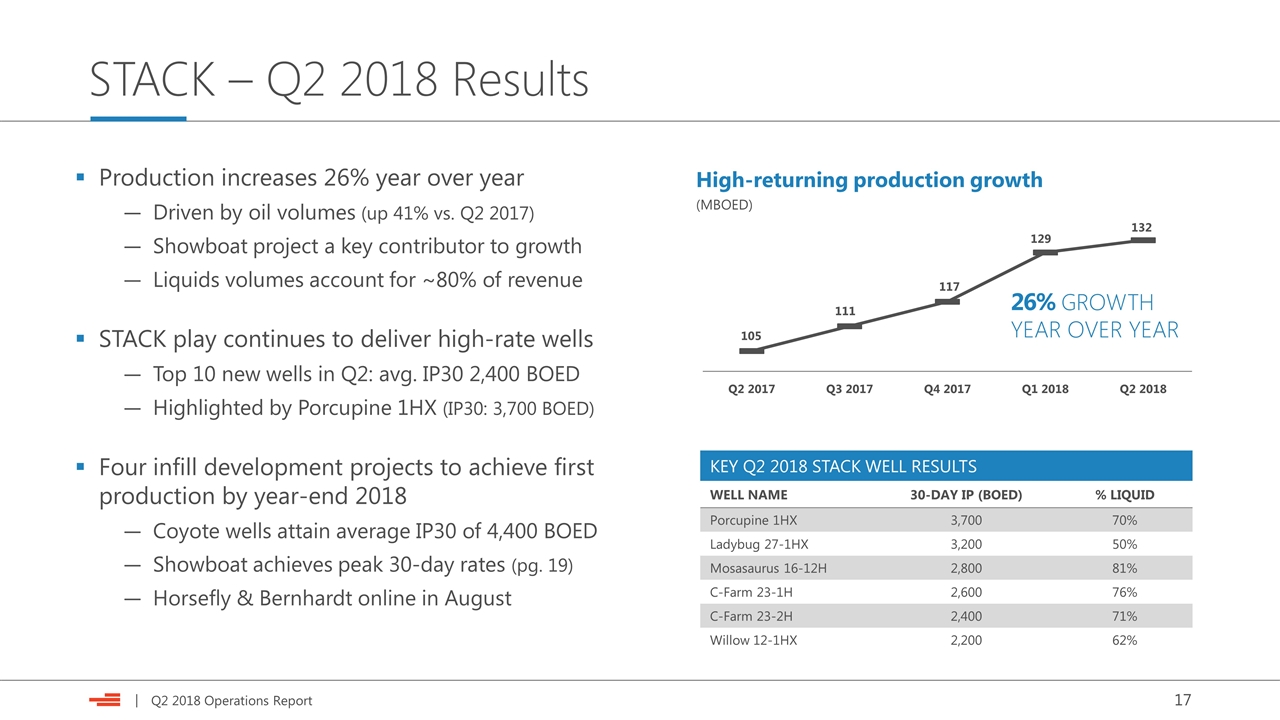

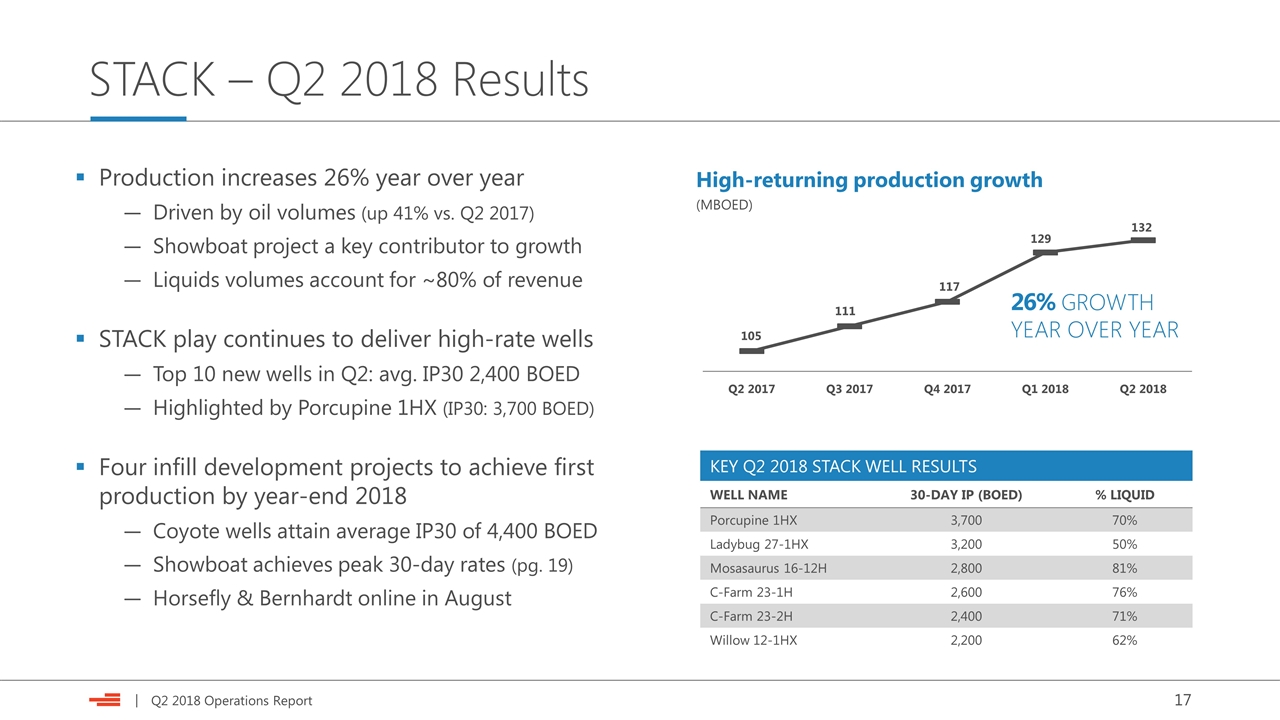

STACK – Q2 2018 Results Production increases 26% year over year Driven by oil volumes (up 41% vs. Q2 2017) Showboat project a key contributor to growth Liquids volumes account for ~80% of revenue STACK play continues to deliver high-rate wells Top 10 new wells in Q2: avg. IP30 2,400 BOED Highlighted by Porcupine 1HX (IP30: 3,700 BOED) Four infill development projects to achieve first production by year-end 2018 Coyote wells attain average IP30 of 4,400 BOED Showboat achieves peak 30-day rates (pg. 19) Horsefly & Bernhardt online in August High-returning production growth (MBOED) 117 132 105 111 26% GROWTH YEAR OVER YEAR KEY Q2 2018 STACK WELL RESULTS WELL NAME 30-DAY IP (BOED) % LIQUID Porcupine 1HX 3,700 70% Ladybug 27-1HX 3,200 50% Mosasaurus 16-12H 2,800 81% C-Farm 23-1H 2,600 76% C-Farm 23-2H 2,400 71% Willow 12-1HX 2,200 62%

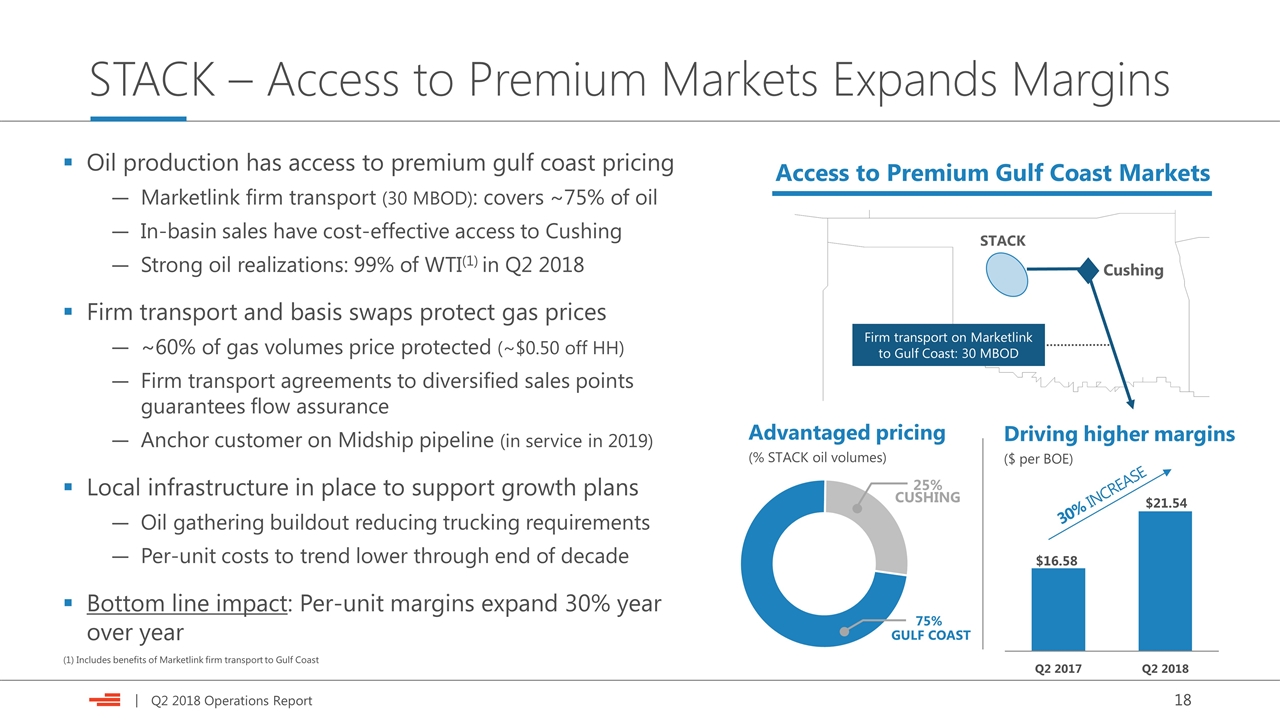

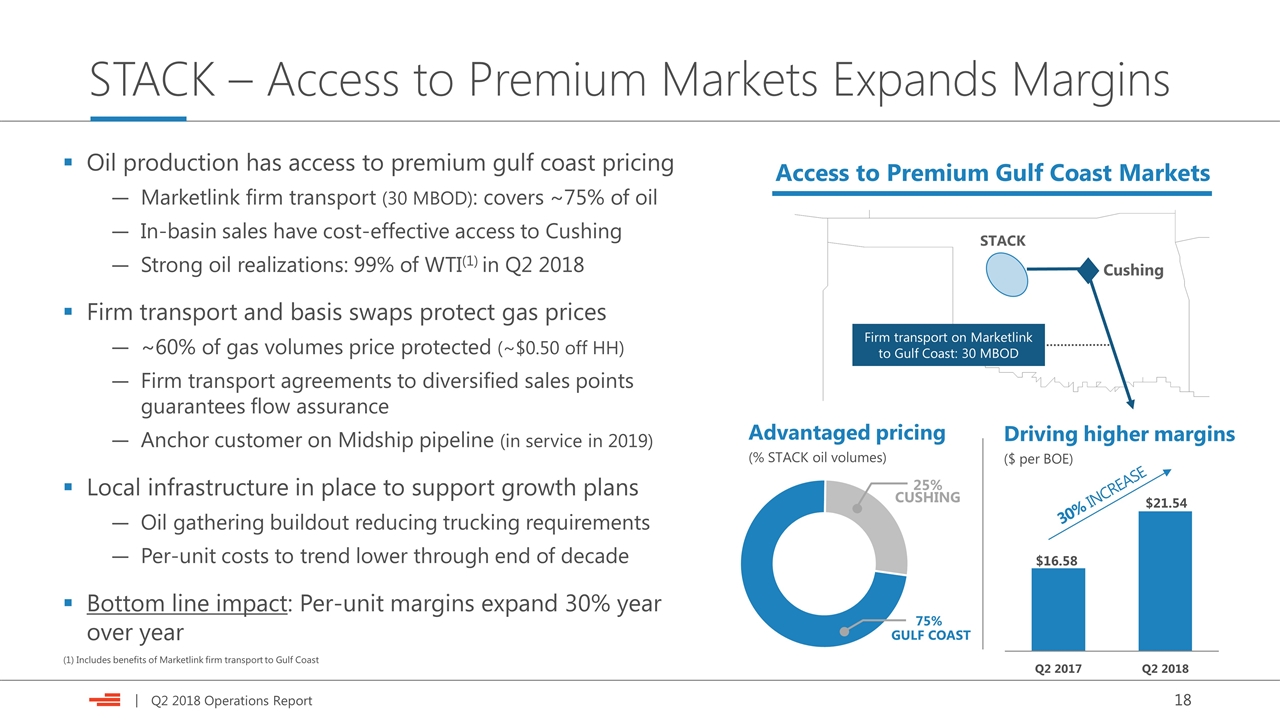

STACK – Access to Premium Markets Expands Margins (1) Includes benefits of Marketlink firm transport to Gulf Coast Oil production has access to premium gulf coast pricing Marketlink firm transport (30 MBOD): covers ~75% of oil In-basin sales have cost-effective access to Cushing Strong oil realizations: 99% of WTI(1) in Q2 2018 Firm transport and basis swaps protect gas prices ~60% of gas volumes price protected (~$0.50 off HH) Firm transport agreements to diversified sales points guarantees flow assurance Anchor customer on Midship pipeline (in service in 2019) Local infrastructure in place to support growth plans Oil gathering buildout reducing trucking requirements Per-unit costs to trend lower through end of decade Bottom line impact: Per-unit margins expand 30% year over year Access to Premium Gulf Coast Markets Firm transport on Marketlink to Gulf Coast: 30 MBOD STACK Cushing $16.58 $21.54 Driving higher margins ($ per BOE) Advantaged pricing (% STACK oil volumes) 75% GULF COAST 25% CUSHING

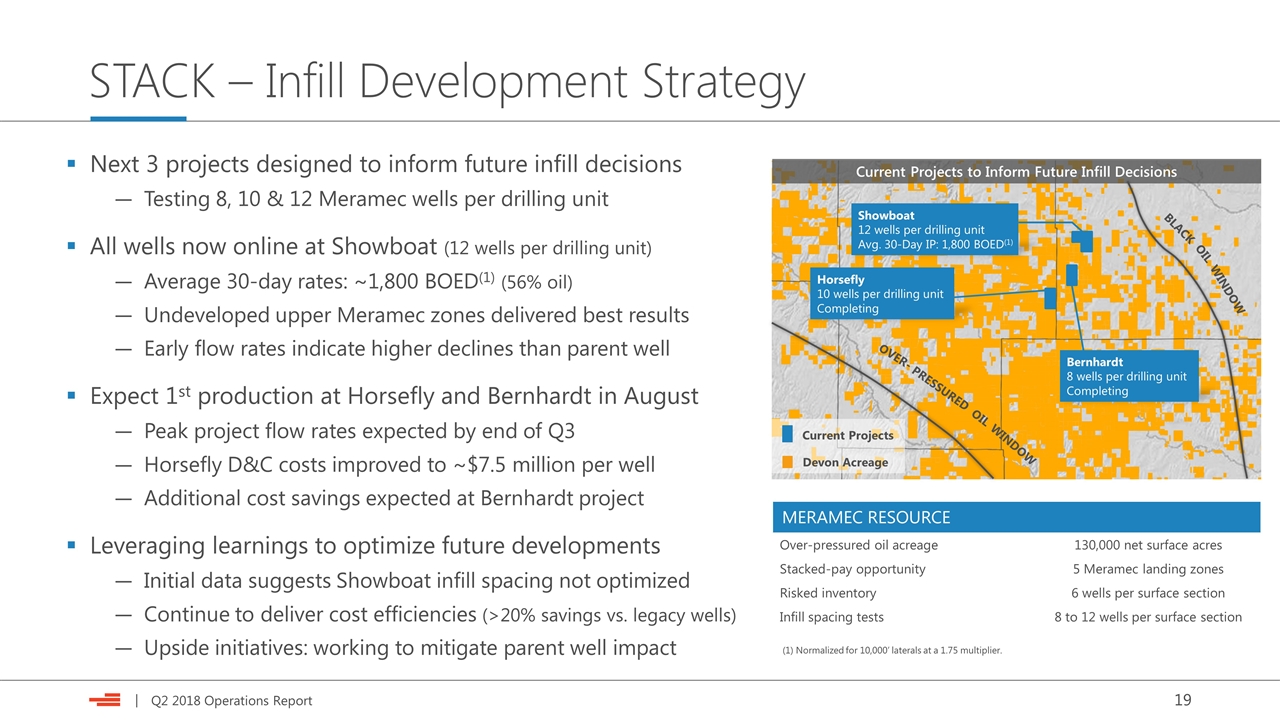

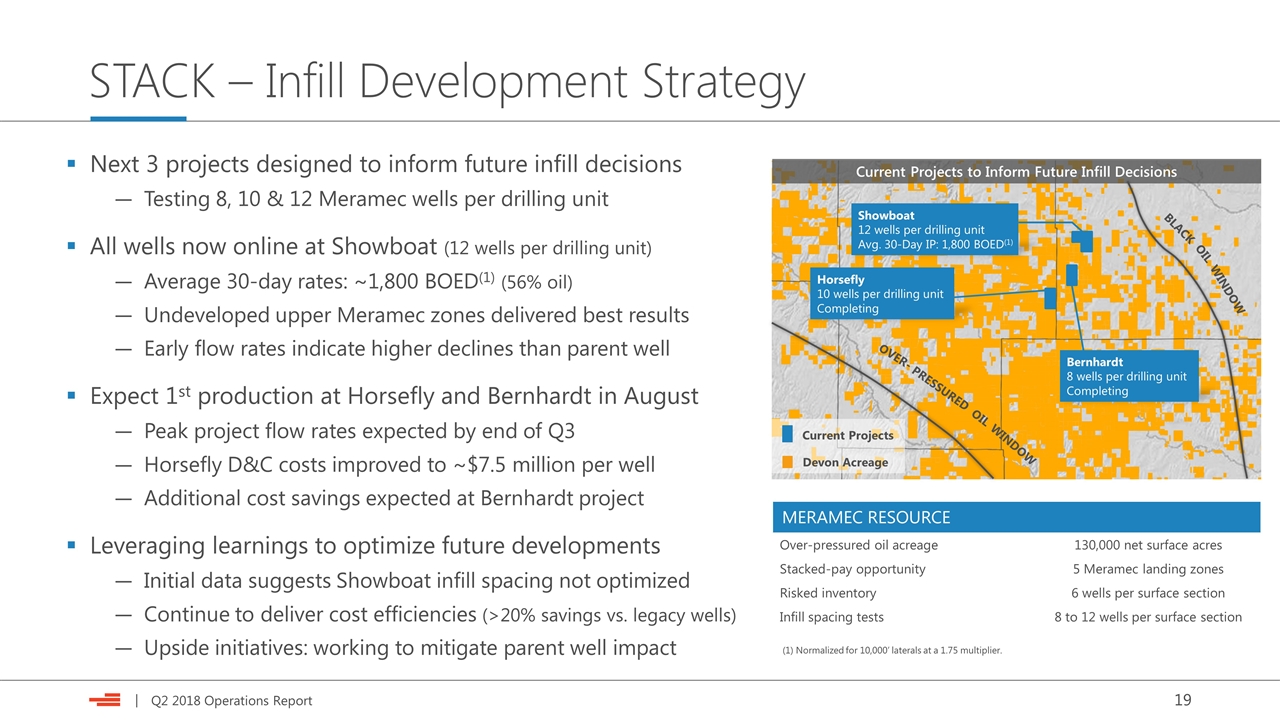

STACK – Infill Development Strategy Next 3 projects designed to inform future infill decisions Testing 8, 10 & 12 Meramec wells per drilling unit All wells now online at Showboat (12 wells per drilling unit) Average 30-day rates: ~1,800 BOED(1) (56% oil) Undeveloped upper Meramec zones delivered best results Early flow rates indicate higher declines than parent well Expect 1st production at Horsefly and Bernhardt in August Peak project flow rates expected by end of Q3 Horsefly D&C costs improved to ~$7.5 million per well Additional cost savings expected at Bernhardt project Leveraging learnings to optimize future developments Initial data suggests Showboat infill spacing not optimized Continue to deliver cost efficiencies (>20% savings vs. legacy wells) Upside initiatives: working to mitigate parent well impact Devon Acreage Current Projects Current Projects to Inform Future Infill Decisions MERAMEC RESOURCE Over-pressured oil acreage 130,000 net surface acres Stacked-pay opportunity 5 Meramec landing zones Risked inventory 6 wells per surface section Infill spacing tests 8 to 12 wells per surface section (1) Normalized for 10,000’ laterals at a 1.75 multiplier. Horsefly 10 wells per drilling unit Completing Showboat 12 wells per drilling unit Avg. 30-Day IP: 1,800 BOED(1) Bernhardt 8 wells per drilling unit Completing OVER- PRESSURED OIL WINDOW BLACK OIL WINDOW

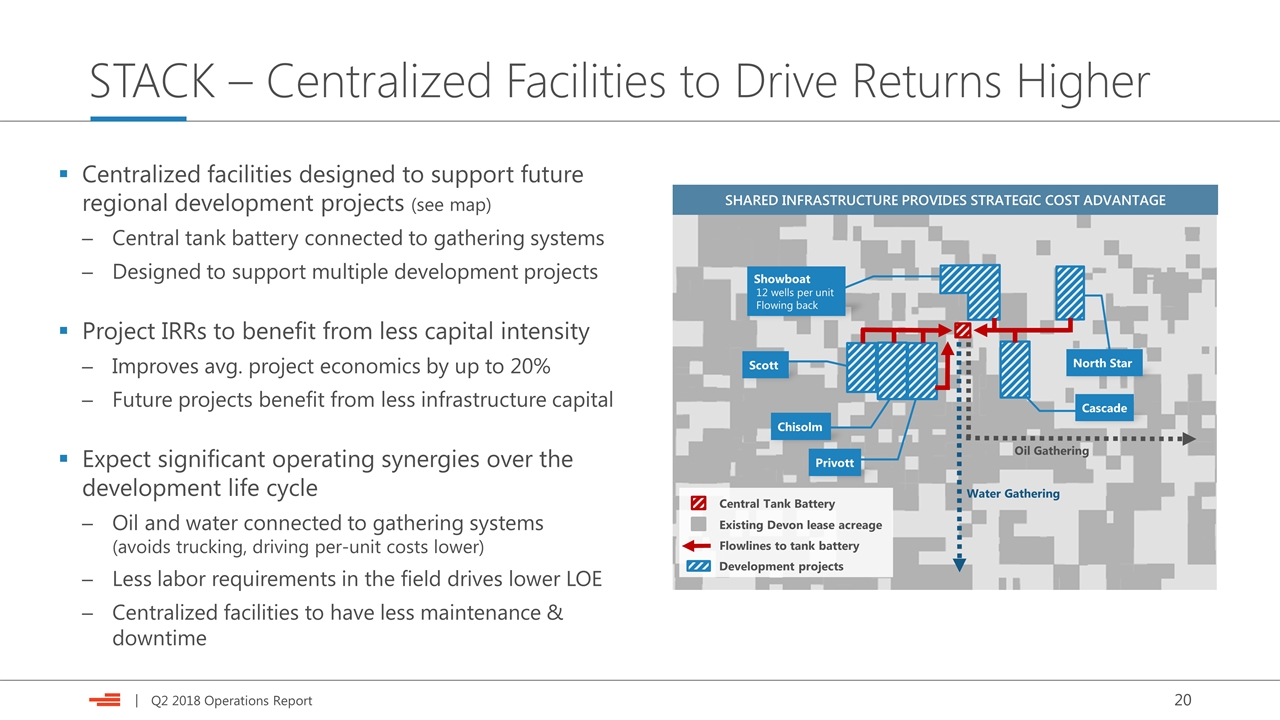

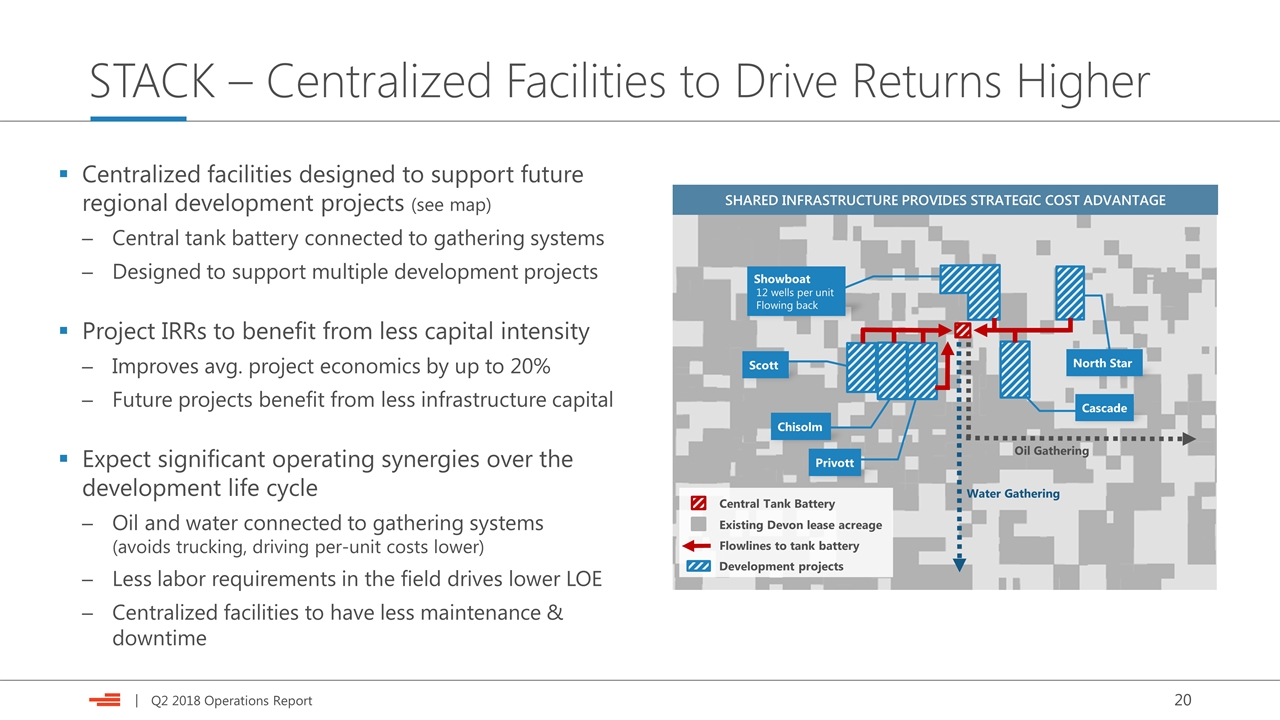

STACK – Centralized Facilities to Drive Returns Higher Centralized facilities designed to support future regional development projects (see map) Central tank battery connected to gathering systems Designed to support multiple development projects Project IRRs to benefit from less capital intensity Improves avg. project economics by up to 20% Future projects benefit from less infrastructure capital Expect significant operating synergies over the development life cycle Oil and water connected to gathering systems (avoids trucking, driving per-unit costs lower) Less labor requirements in the field drives lower LOE Centralized facilities to have less maintenance & downtime SHARED INFRASTRUCTURE PROVIDES STRATEGIC COST ADVANTAGE Showboat 12 wells per unit Flowing back North Star Central Tank Battery Cascade Privott Chisolm Scott Flowlines to tank battery Development projects Existing Devon lease acreage Oil Gathering Water Gathering

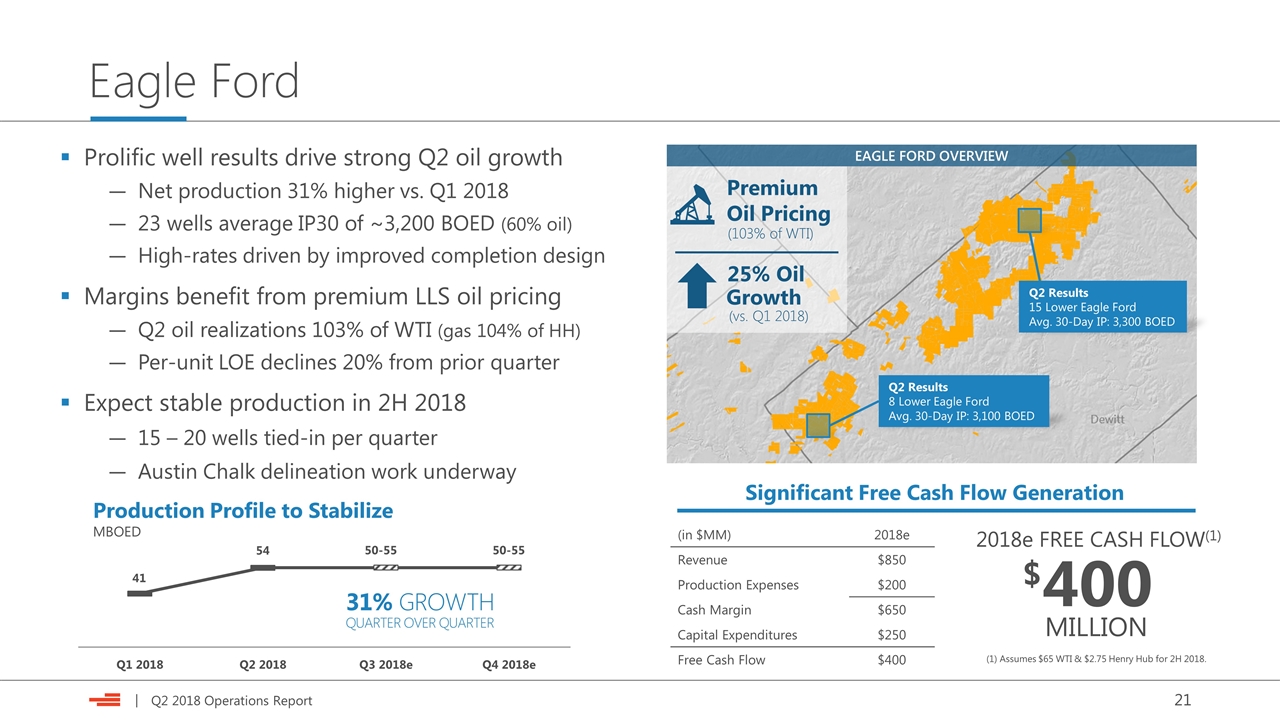

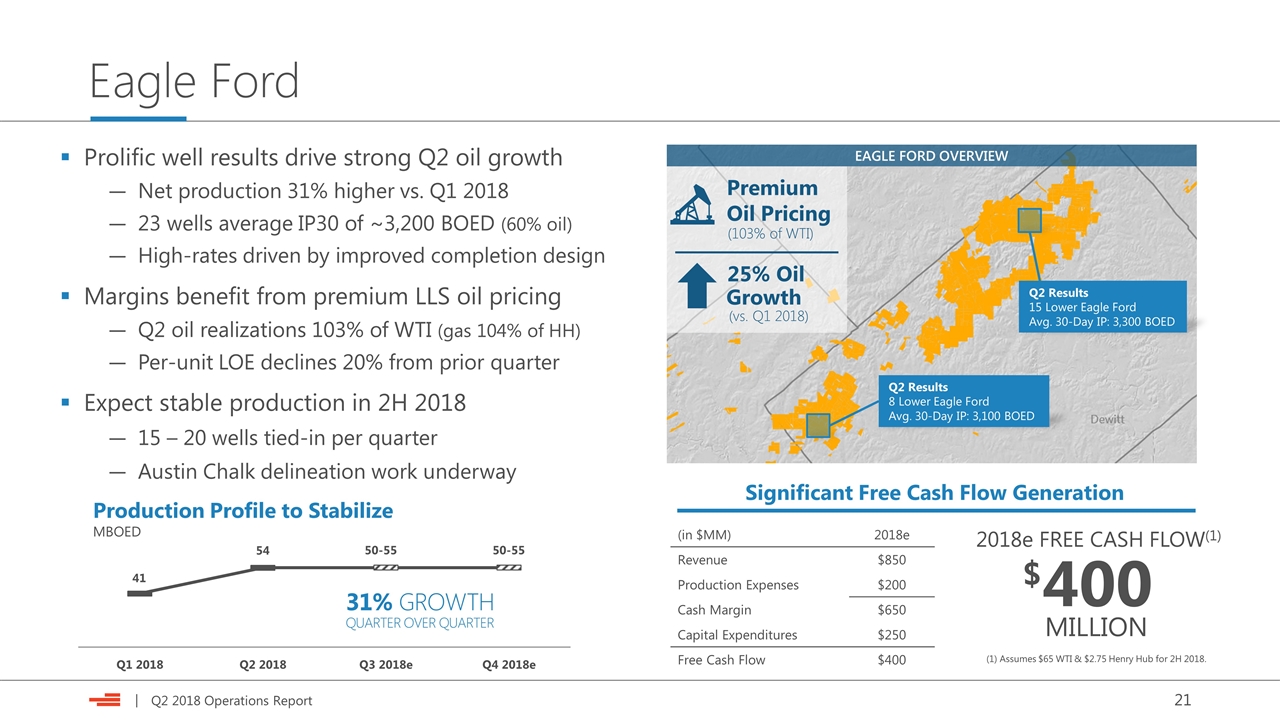

MILLION Eagle Ford Q2 Results 8 Lower Eagle Ford Avg. 30-Day IP: 3,100 BOED Q2 Results 15 Lower Eagle Ford Avg. 30-Day IP: 3,300 BOED EAGLE FORD OVERVIEW 25% Oil Prolific well results drive strong Q2 oil growth Net production 31% higher vs. Q1 2018 23 wells average IP30 of ~3,200 BOED (60% oil) High-rates driven by improved completion design Margins benefit from premium LLS oil pricing Q2 oil realizations 103% of WTI (gas 104% of HH) Per-unit LOE declines 20% from prior quarter Expect stable production in 2H 2018 15 – 20 wells tied-in per quarter Austin Chalk delineation work underway (vs. Q1 2018) Premium Oil Pricing (103% of WTI) Growth Production Profile to Stabilize MBOED (in $MM) 2018e Revenue $850 Production Expenses $200 Cash Margin $650 Capital Expenditures $250 Free Cash Flow $400 31% GROWTH QUARTER OVER QUARTER $ 400 Significant Free Cash Flow Generation (1) Assumes $65 WTI & $2.75 Henry Hub for 2H 2018. 2018e FREE CASH FLOW(1)

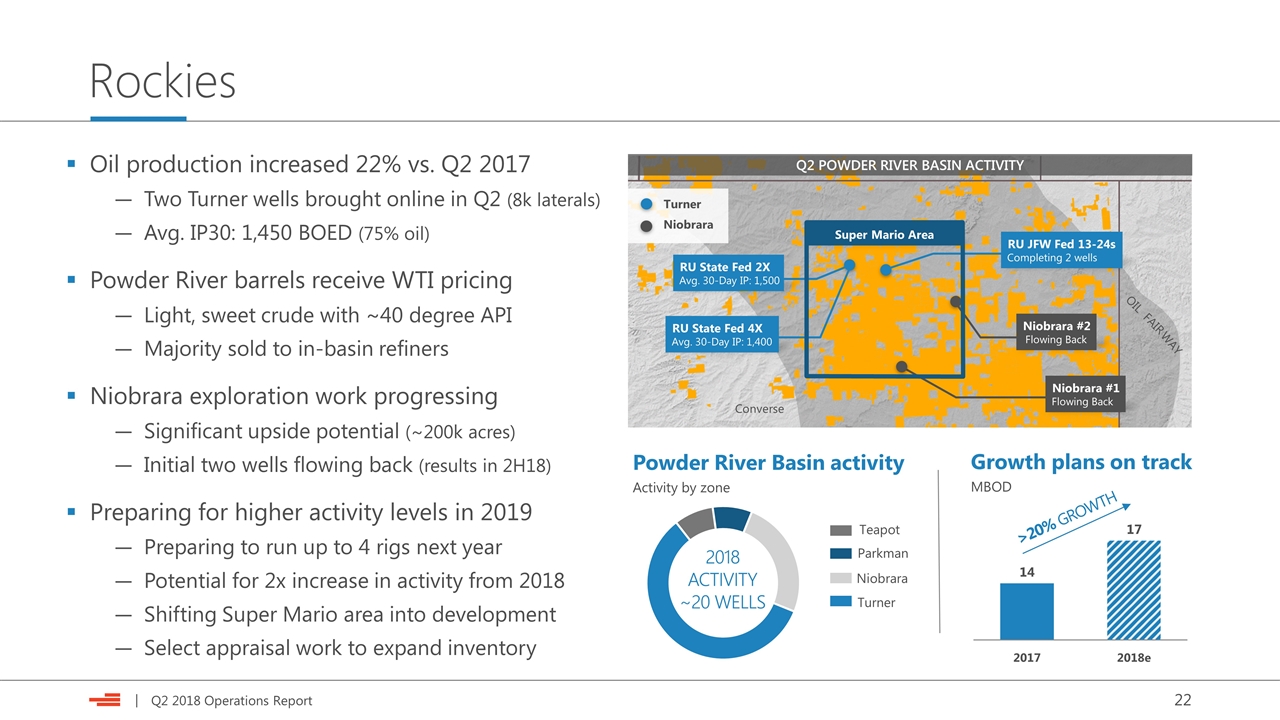

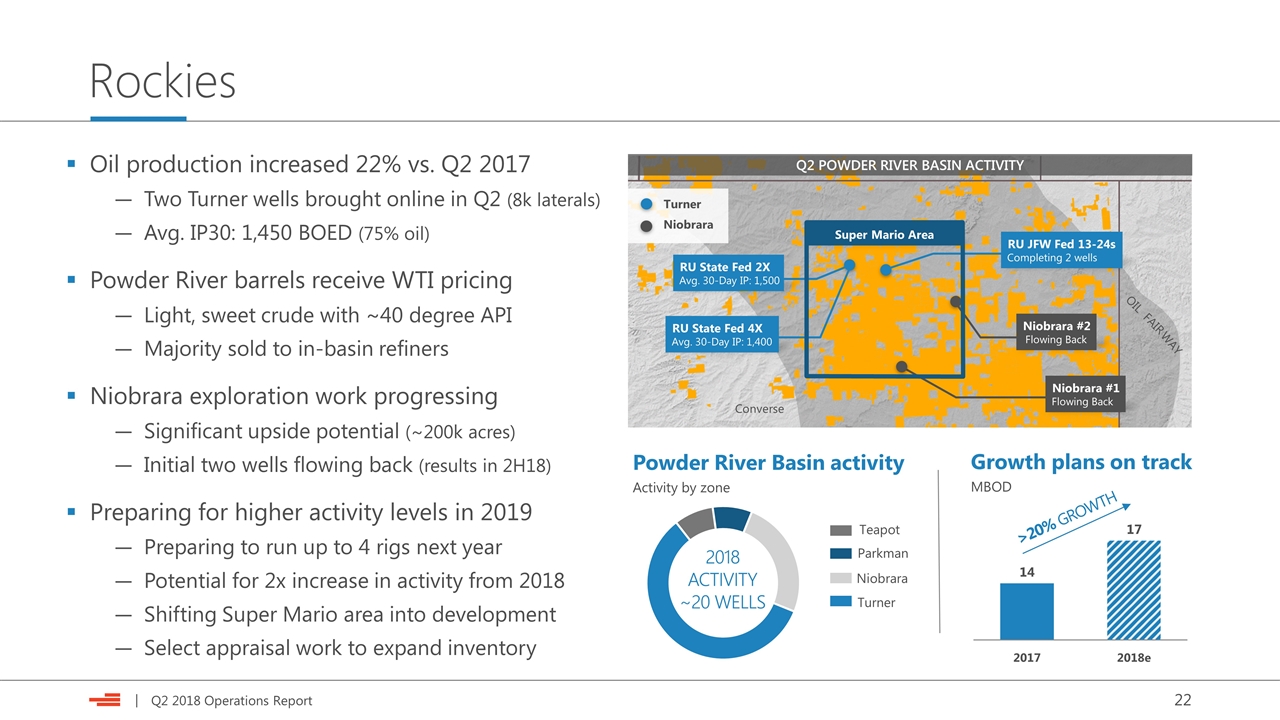

Rockies Parkman Turner Niobrara 2018 ACTIVITY ~20 WELLS 14 17 Growth plans on track MBOD Teapot Powder River Basin activity Activity by zone Oil production increased 22% vs. Q2 2017 Two Turner wells brought online in Q2 (8k laterals) Avg. IP30: 1,450 BOED (75% oil) Powder River barrels receive WTI pricing Light, sweet crude with ~40 degree API Majority sold to in-basin refiners Niobrara exploration work progressing Significant upside potential (~200k acres) Initial two wells flowing back (results in 2H18) Preparing for higher activity levels in 2019 Preparing to run up to 4 rigs next year Potential for 2x increase in activity from 2018 Shifting Super Mario area into development Select appraisal work to expand inventory Q2 POWDER RIVER BASIN ACTIVITY Super Mario Area RU JFW Fed 13-24s Completing 2 wells Niobrara #1 Flowing Back Turner Niobrara OIL Converse FAIR WAY RU State Fed 4X Avg. 30-Day IP: 1,400 Niobrara #2 Flowing Back RU State Fed 2X Avg. 30-Day IP: 1,500

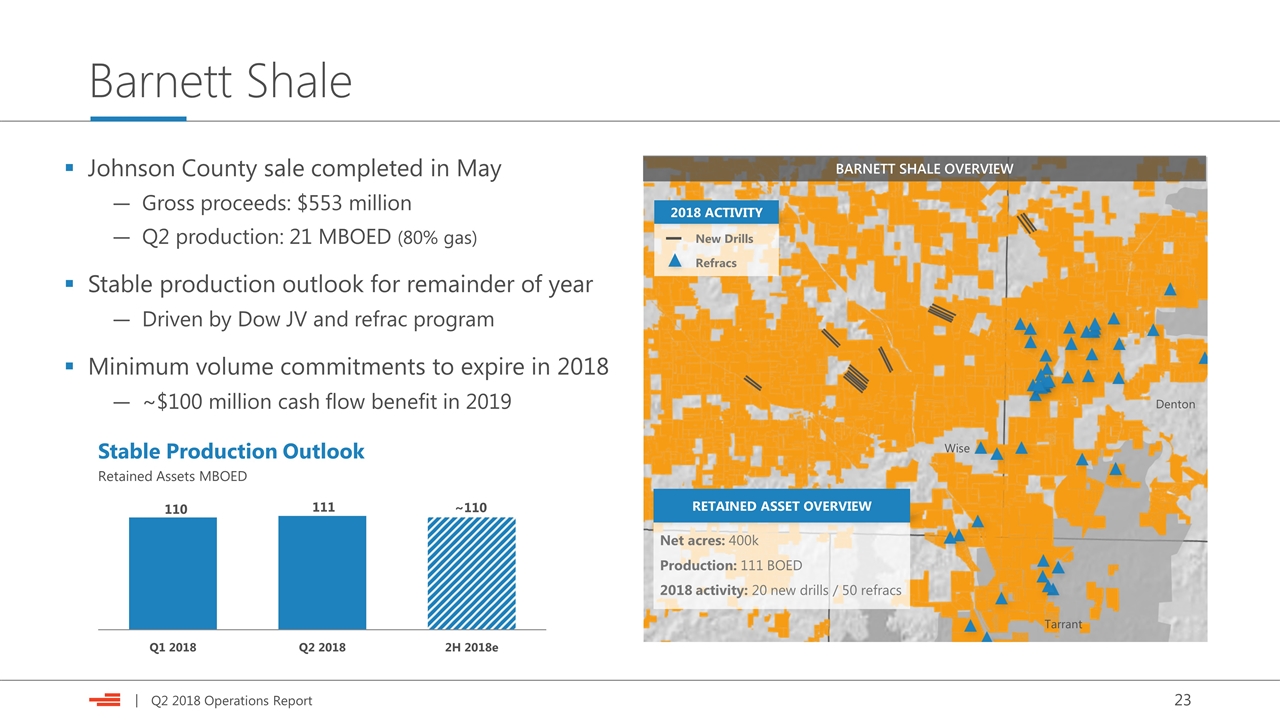

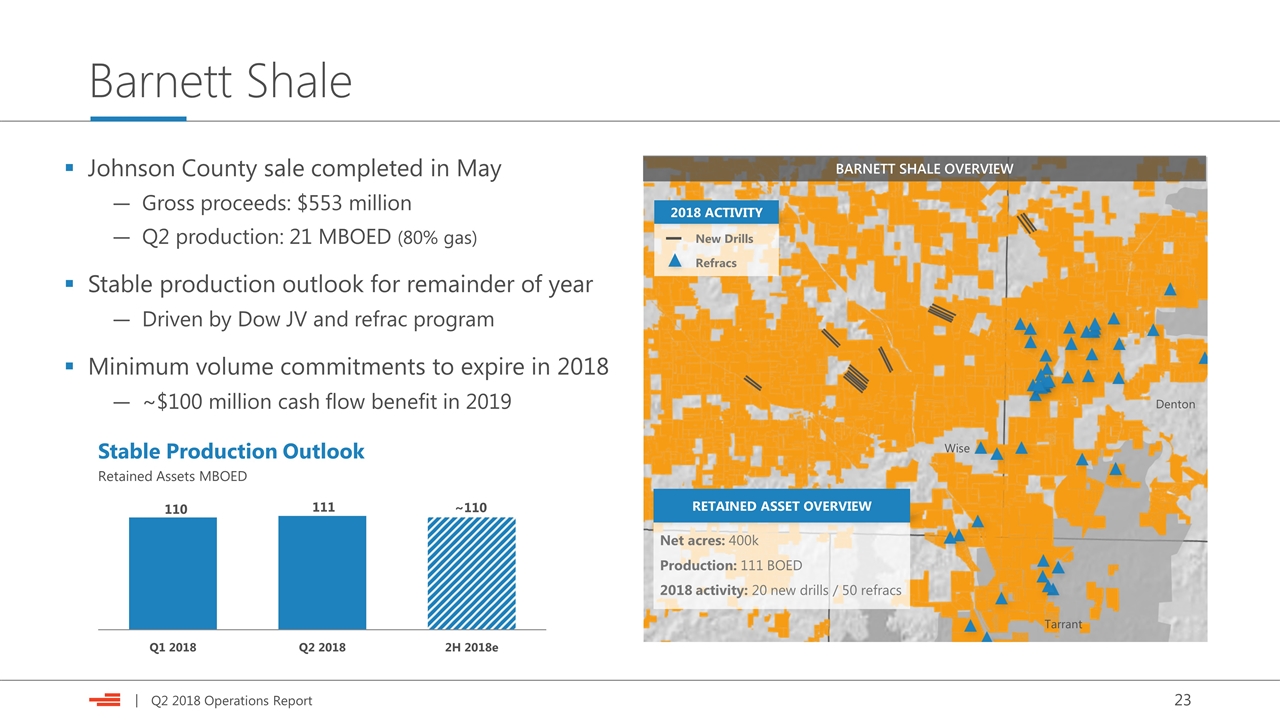

Barnett Shale Johnson County sale completed in May Gross proceeds: $553 million Q2 production: 21 MBOED (80% gas) Stable production outlook for remainder of year Driven by Dow JV and refrac program Minimum volume commitments to expire in 2018 ~$100 million cash flow benefit in 2019 BARNETT SHALE OVERVIEW New Drills RETAINED ASSET OVERVIEW Net acres: 400k Production: 111 BOED 2018 activity: 20 new drills / 50 refracs Denton Refracs Wise Tarrant 2018 ACTIVITY Stable Production Outlook Retained Assets MBOED

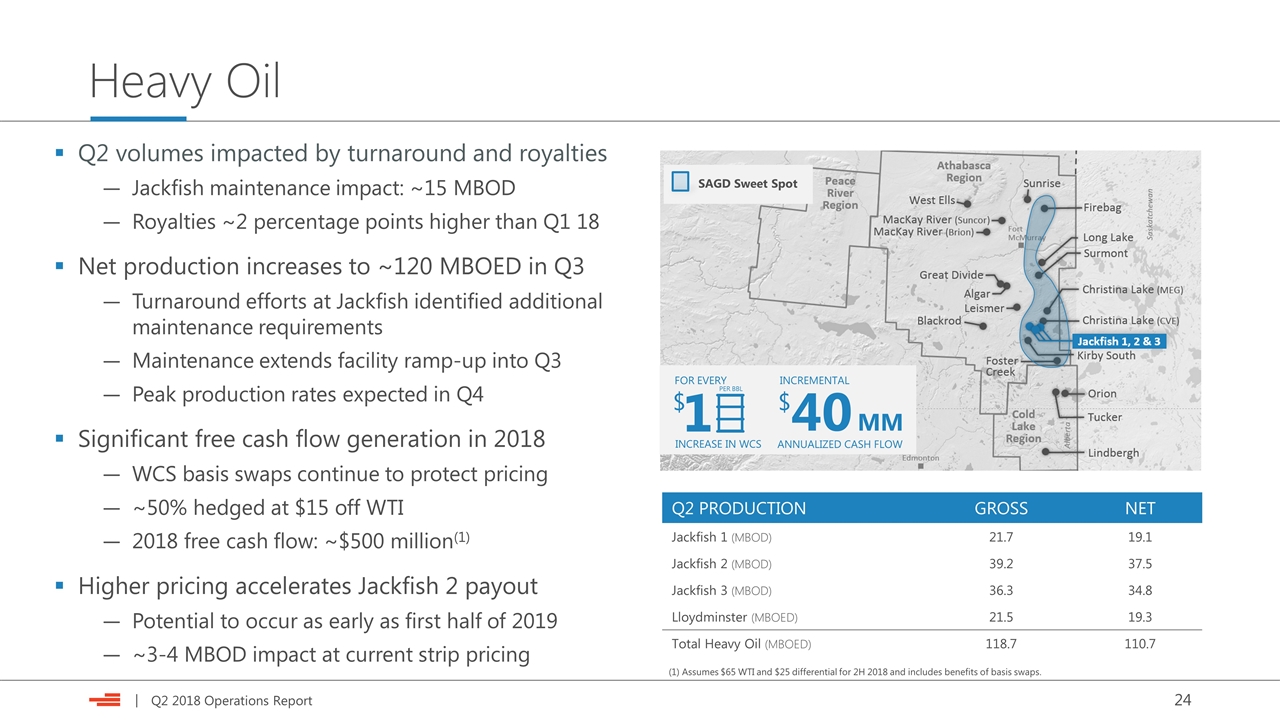

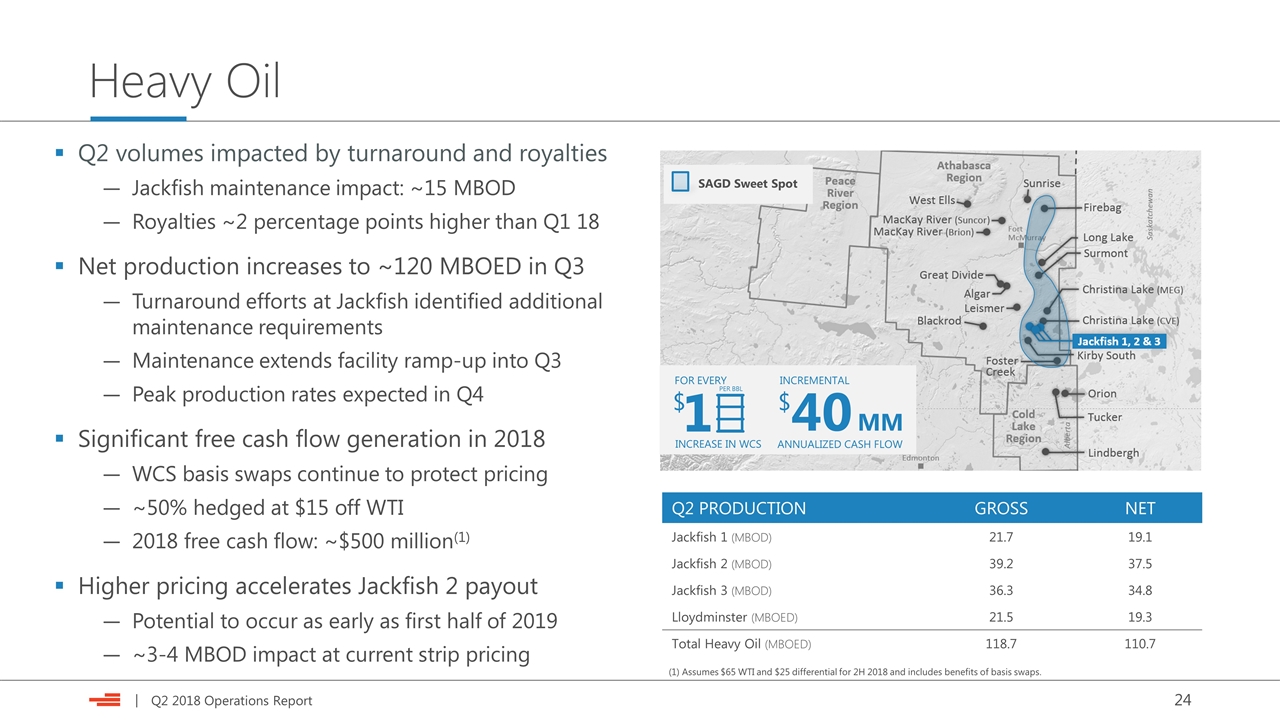

Heavy Oil Q2 PRODUCTION GROSS NET Jackfish 1 (MBOD) 21.7 19.1 Jackfish 2 (MBOD) 39.2 37.5 Jackfish 3 (MBOD) 36.3 34.8 Lloydminster (MBOED) 21.5 19.3 Total Heavy Oil (MBOED) 118.7 110.7 SAGD Sweet Spot (1) Assumes $65 WTI and $25 differential for 2H 2018 and includes benefits of basis swaps. Q2 volumes impacted by turnaround and royalties Jackfish maintenance impact: ~15 MBOD Royalties ~2 percentage points higher than Q1 18 Net production increases to ~120 MBOED in Q3 Turnaround efforts at Jackfish identified additional maintenance requirements Maintenance extends facility ramp-up into Q3 Peak production rates expected in Q4 Significant free cash flow generation in 2018 WCS basis swaps continue to protect pricing ~50% hedged at $15 off WTI 2018 free cash flow: ~$500 million(1) Higher pricing accelerates Jackfish 2 payout Potential to occur as early as first half of 2019 ~3-4 MBOD impact at current strip pricing 1 $ INCREASE IN WCS PER BBL FOR EVERY INCREMENTAL 40 MM $ ANNUALIZED CASH FLOW

Investor Contacts & Notices Investor Relations Contacts Scott CoodyChris Carr VP, Investor RelationsSupervisor, Investor Relations 405-552-4735405-228-2496 Email: investor.relations@dvn.com Forward-Looking Statements This presentation includes "forward-looking statements" as defined by the Securities and Exchange Commission (the “SEC”). Such statements include those concerning strategic plans, expectations and objectives for future operations, and are often identified by use of the words “expects,” “believes,” “will,” “would,” “could,” “forecasts,” “projections,” “estimates,” “plans,” “expectations,” “targets,” “opportunities,” “potential,” “anticipates,” “outlook” and other similar terminology. All statements, other than statements of historical facts, included in this presentation that address activities, events or developments that the Company expects, believes or anticipates will or may occur in the future are forward-looking statements. Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of the Company. Statements regarding our business and operations are subject to all of the risks and uncertainties normally incident to the exploration for and development and production of oil and gas. These risks include, but are not limited to: the volatility of oil, gas and NGL prices; uncertainties inherent in estimating oil, gas and NGL reserves; the extent to which we are successful in acquiring and discovering Investor Notices additional reserves; the uncertainties, costs and risks involved in oil and gas operations; regulatory restrictions, compliance costs and other risks relating to governmental regulation, including with respect to environmental matters; risks related to our hedging activities; counterparty credit risks; risks relating to our indebtedness; cyberattack risks; our limited control over third parties who operate our oil and gas properties; midstream capacity constraints and potential interruptions in production; the extent to which insurance covers any losses we may experience; competition for leases, materials, people and capital; our ability to successfully complete mergers, acquisitions and divestitures; and any of the other risks and uncertainties identified in our Form 10-K and our other filings with the SEC. Investors are cautioned that any such statements are not guarantees of future performance and that actual results or developments may differ materially from those projected in the forward-looking statements. The forward-looking statements in this presentation are made as of the date of this presentation, even if subsequently made available by Devon on its website or otherwise. Devon does not undertake any obligation to update the forward-looking statements as a result of new information, future events or otherwise. Use of Non-GAAP Information This presentation may include non-GAAP financial measures. Such non-GAAP measures are not alternatives to GAAP measures, and you should not consider these non-GAAP measures in isolation or as a substitute for analysis of our results as reported under GAAP. For additional disclosure regarding such non-GAAP measures, including reconciliations to their most directly comparable GAAP measure, please refer to Devon’s second-quarter 2018 earnings release at www.devonenergy.com. Cautionary Note to Investors The SEC permits oil and gas companies, in their filings with the SEC, to disclose only proved, probable and possible reserves that meet the SEC's definitions for such terms, and price and cost sensitivities for such reserves, and prohibits disclosure of resources that do not constitute such reserves. This presentation may contain certain terms, such as resource potential, potential locations, risked and unrisked locations, estimated ultimate recovery (EUR), exploration target size and other similar terms. These estimates are by their nature more speculative than estimates of proved, probable and possible reserves and accordingly are subject to substantially greater risk of being actually realized. The SEC guidelines strictly prohibit us from including these estimates in filings with the SEC. Investors are urged to consider closely the disclosure in our Form 10-K, available at www.devonenergy.com. You can also obtain this form from the SEC by calling 1-800-SEC-0330 or from the SEC’s website at www.sec.gov.