Q3 2018 Operations Report Key Messages 2 Outlook 3 Modeling Stats 7 Q3 Results 8 Delaware Basin 11 STACK15 Rockies 18 Eagle Ford & Barnett Shale 19 Heavy Oil 20 NYSE: DVN devonenergy.com Exhibit 99.2

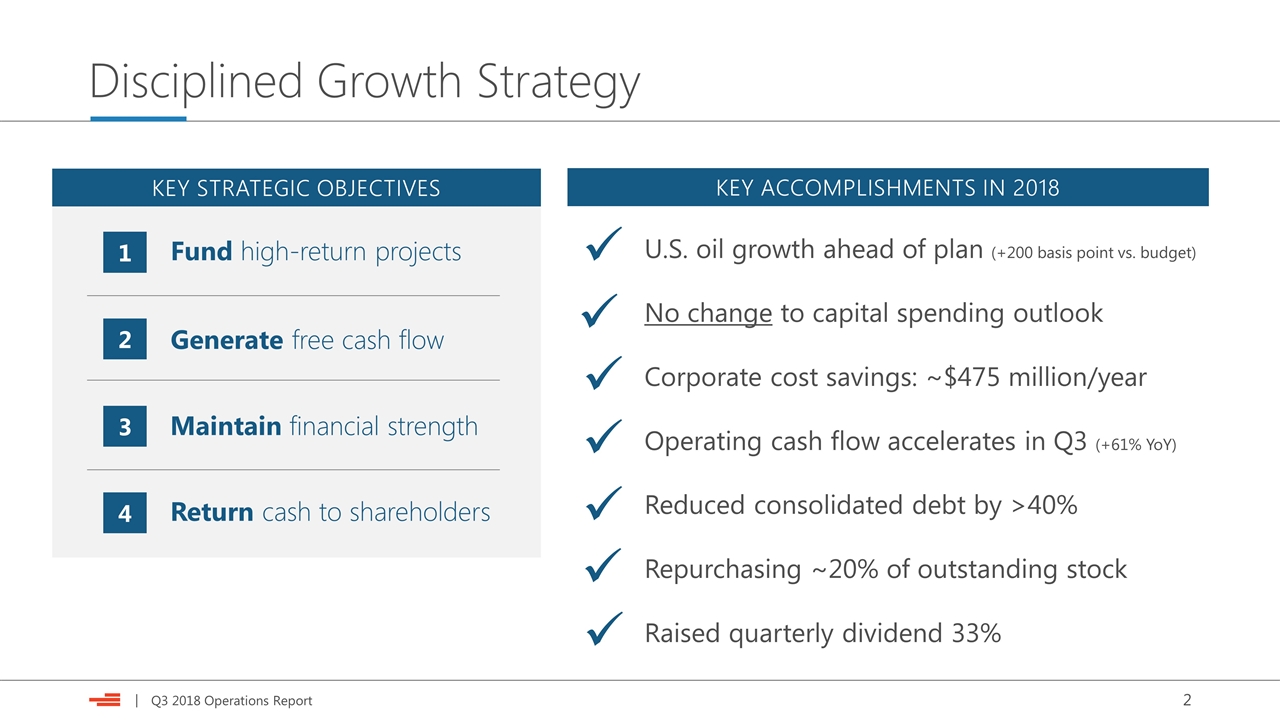

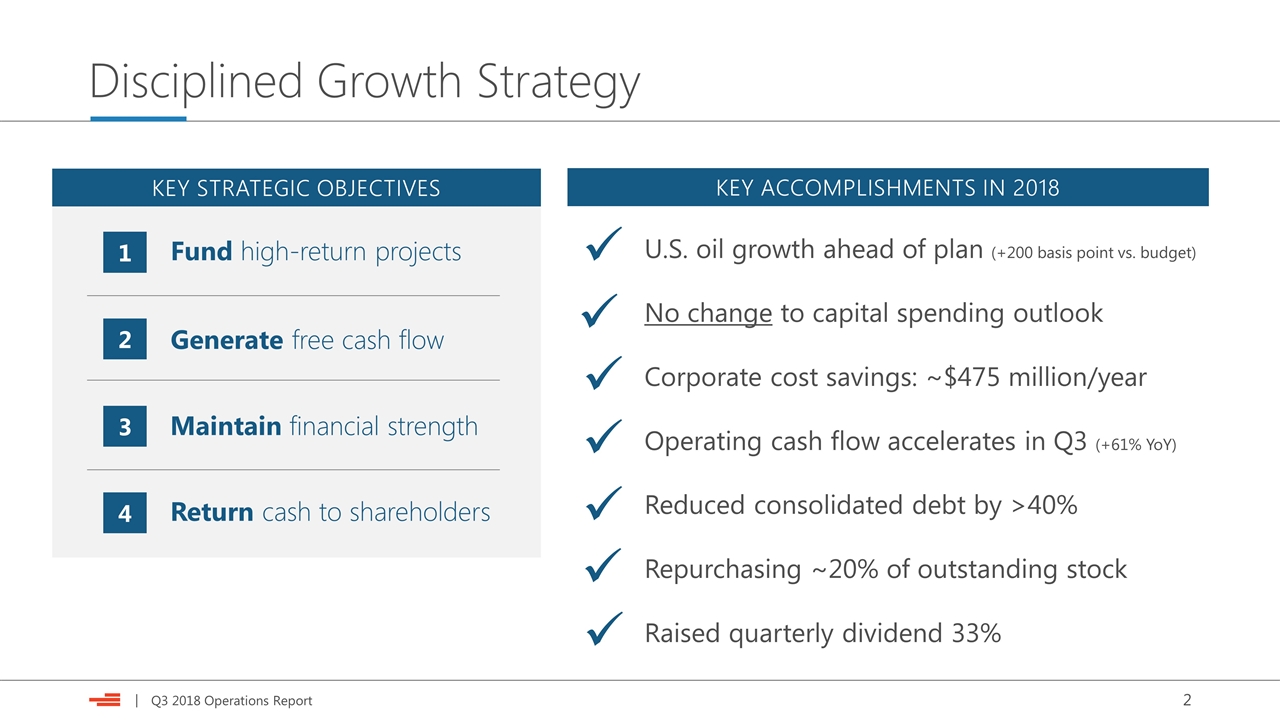

Disciplined Growth Strategy U.S. oil growth ahead of plan (+200 basis point vs. budget) No change to capital spending outlook Corporate cost savings: ~$475 million/year Operating cash flow accelerates in Q3 (+61% YoY) Reduced consolidated debt by >40% Repurchasing ~20% of outstanding stock Raised quarterly dividend 33% KEY ACCOMPLISHMENTS IN 2018 ü ü ü ü ü ü KEY STRATEGIC OBJECTIVES Fund high-return projects Maintain financial strength Return cash to shareholders Generate free cash flow 1 2 3 4 ü

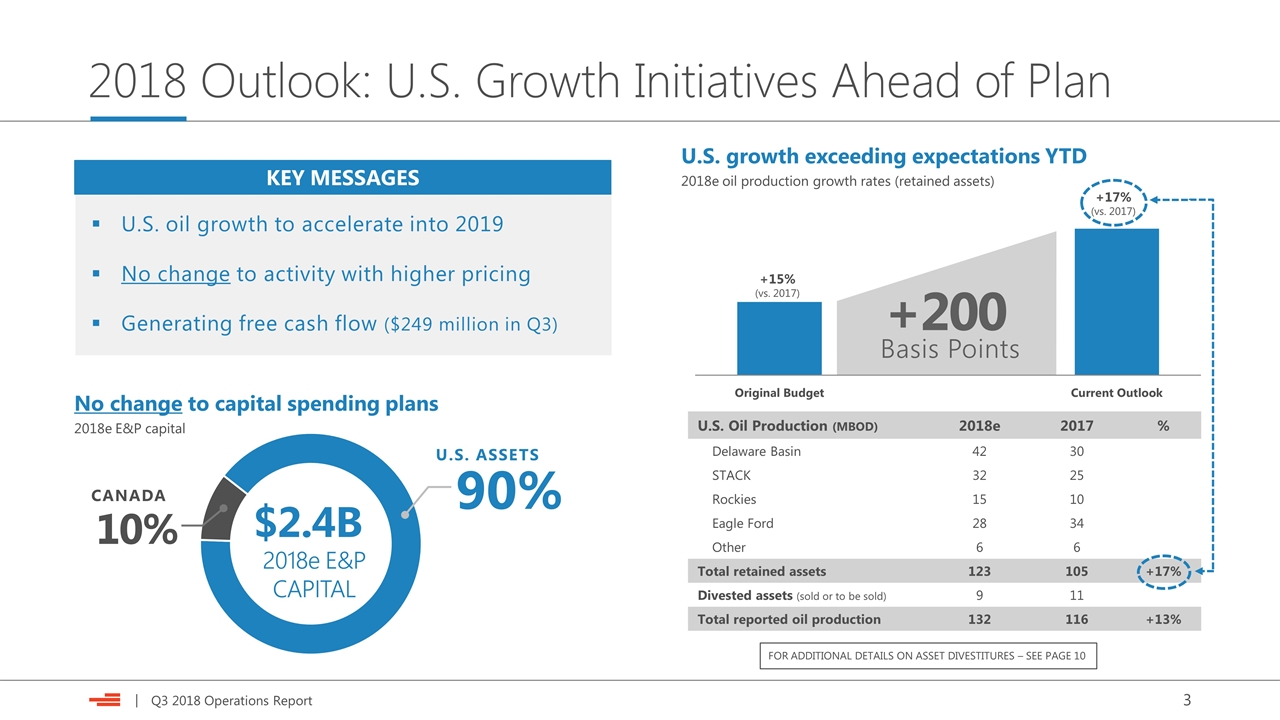

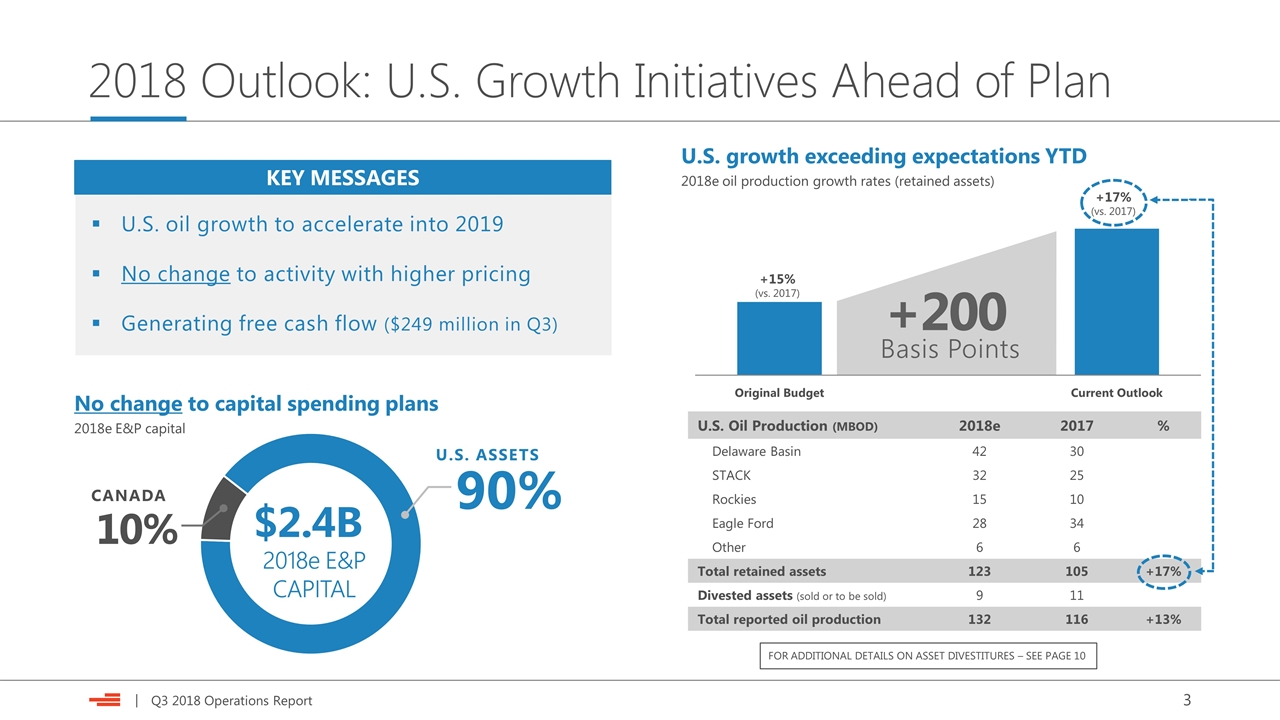

2018 Outlook: U.S. Growth Initiatives Ahead of Plan U.S. growth exceeding expectations YTD 2018e oil production growth rates (retained assets) U.S. Oil Production (MBOD) 2018e 2017 % Delaware Basin 42 30 STACK 32 25 Rockies 15 10 Eagle Ford 28 34 Other 6 6 Total retained assets 123 105 +17% Divested assets (sold or to be sold) 9 11 Total reported oil production 132 116 +13% Basis Points +200 FOR ADDITIONAL DETAILS ON ASSET DIVESTITURES – SEE PAGE 10 No change to capital spending plans 2018e E&P capital $2.4B 10% 90% U.S. ASSETS 2018e E&P CAPITAL CANADA KEY MESSAGES U.S. oil growth to accelerate into 2019 No change to activity with higher pricing Generating free cash flow ($249 million in Q3)

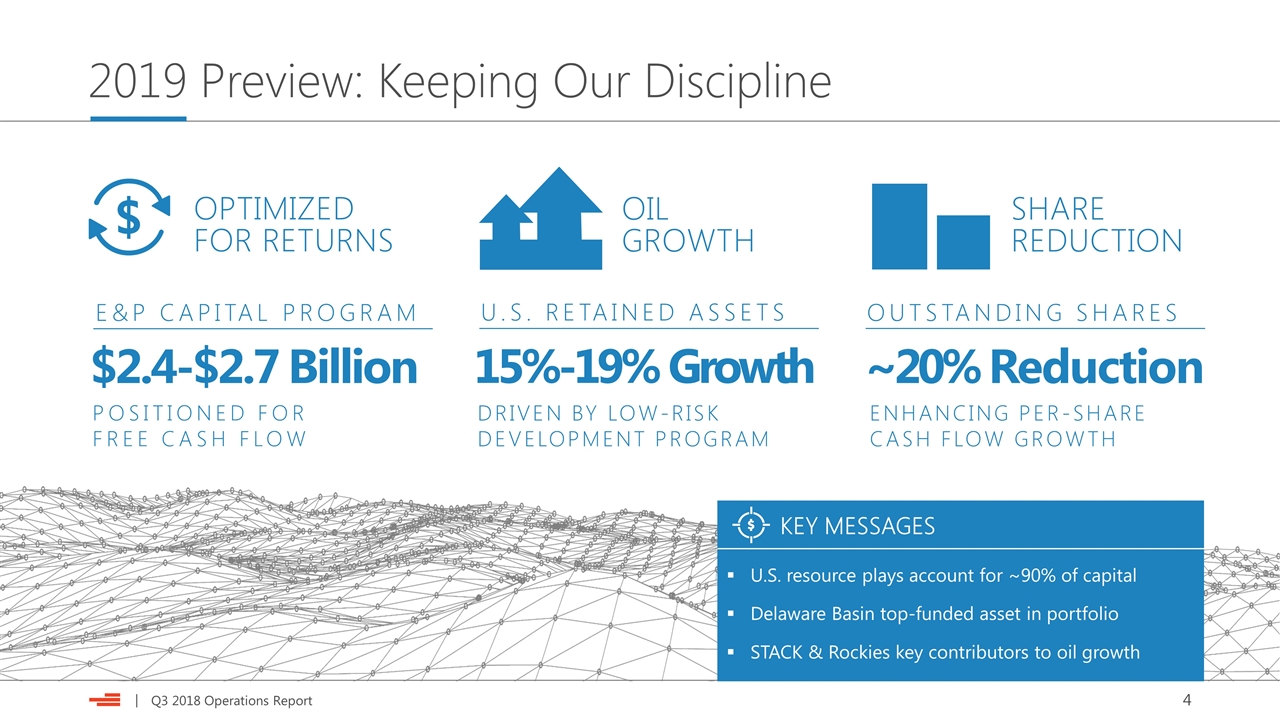

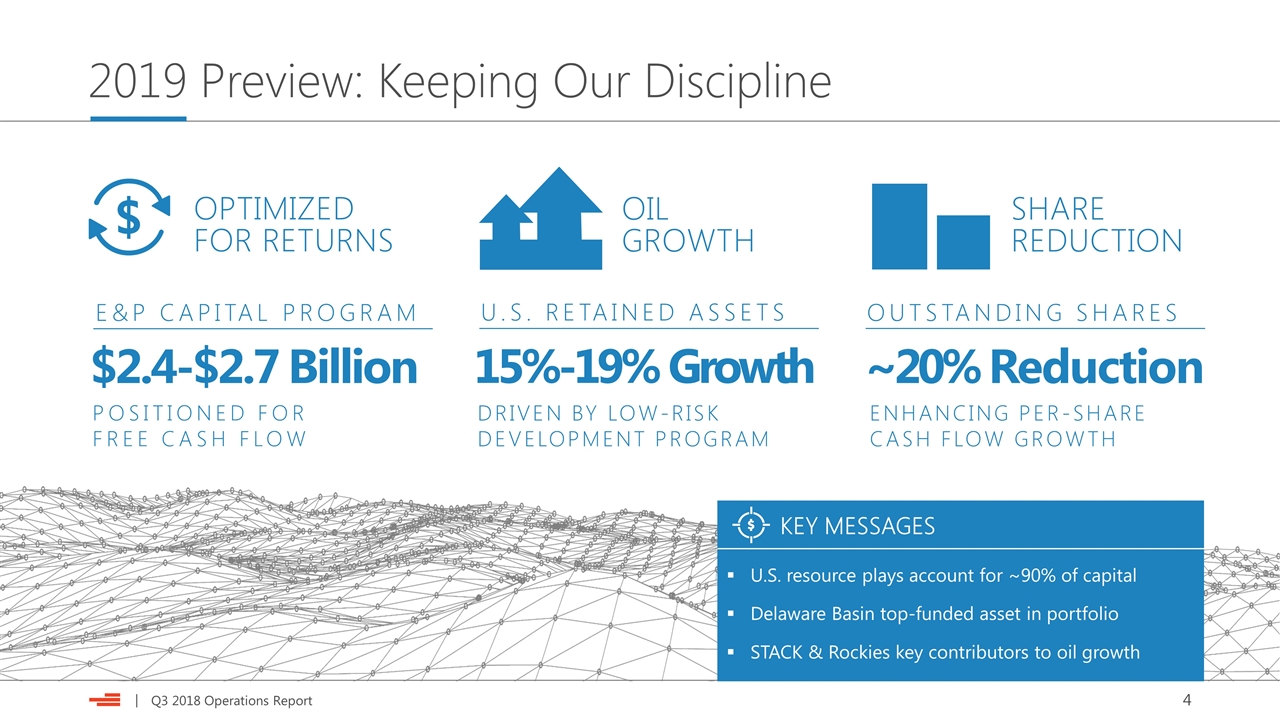

OUTSTANDING SHARES U.S. RETAINED ASSETS E&P CAPITAL PROGRAM 2019 Preview: Keeping Our Discipline 15%-19% Growth $2.4-$2.7 Billion OPTIMIZED FOR RETURNS POSITIONED FOR FREE CASH FLOW ~20% Reduction DRIVEN BY LOW-RISK DEVELOPMENT PROGRAM OIL GROWTH SHARE REDUCTION $ ENHANCING PER-SHARE CASH FLOW GROWTH KEY MESSAGES U.S. resource plays account for ~90% of capital Delaware Basin top-funded asset in portfolio STACK & Rockies key contributors to oil growth

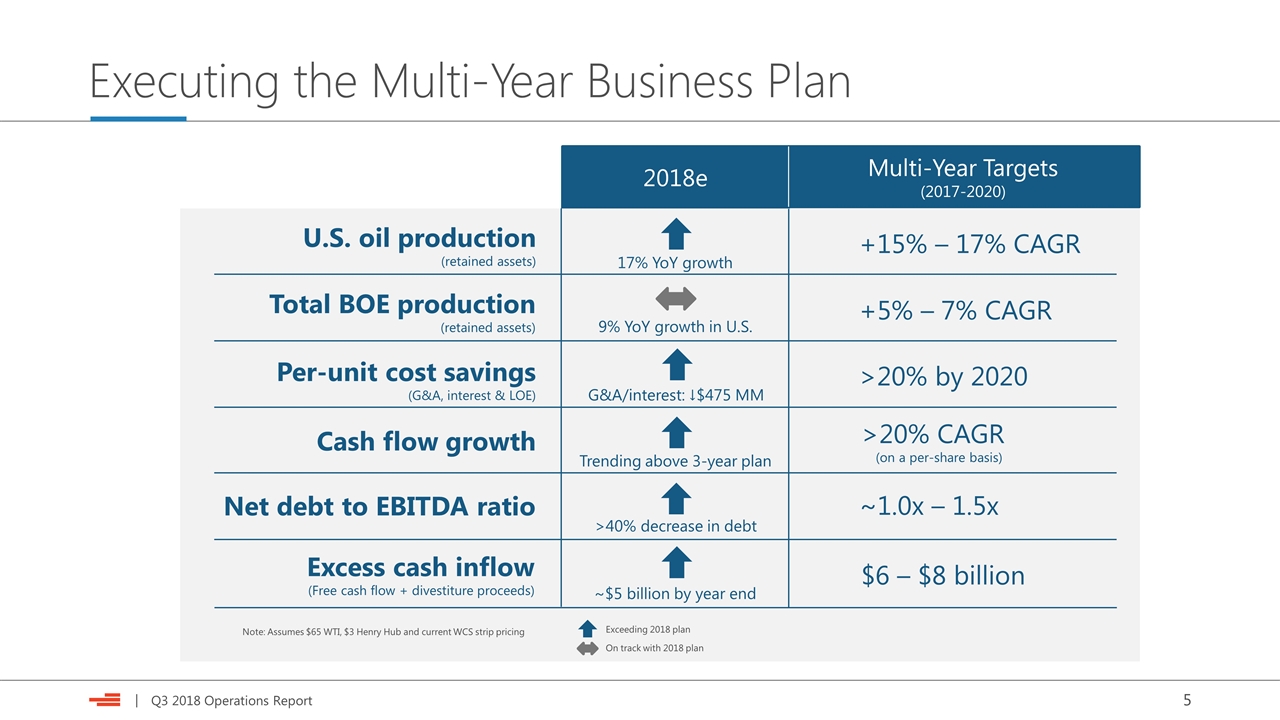

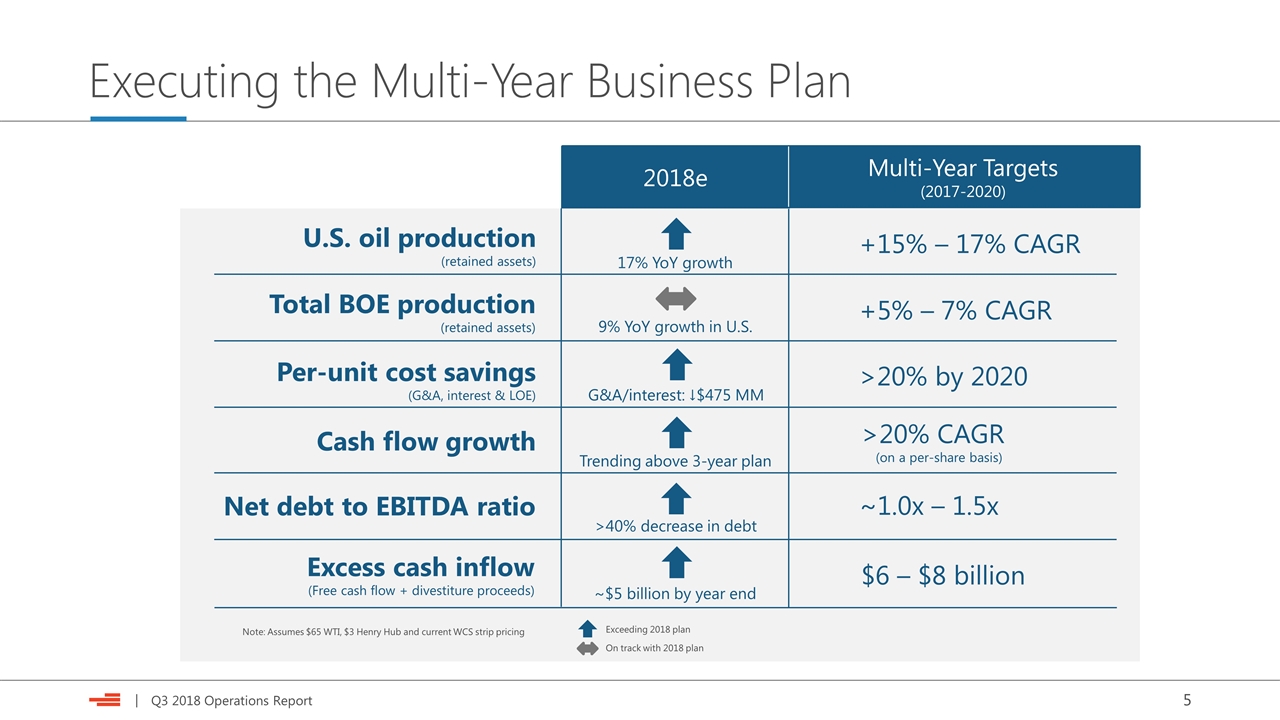

2018e Executing the Multi-Year Business Plan +15% – 17% CAGR Multi-Year Targets (2017-2020) 17% YoY growth 9% YoY growth in U.S. G&A/interest: ↓$475 MM Trending above 3-year plan ~$5 billion by year end >40% decrease in debt Note: Assumes $65 WTI, $3 Henry Hub and current WCS strip pricing U.S. oil production (retained assets) Total BOE production (retained assets) Per-unit cost savings (G&A, interest & LOE) Cash flow growth Excess cash inflow (Free cash flow + divestiture proceeds) Net debt to EBITDA ratio Exceeding 2018 plan On track with 2018 plan +5% – 7% CAGR >20% by 2020 $6 – $8 billion ~1.0x – 1.5x >20% CAGR (on a per-share basis)

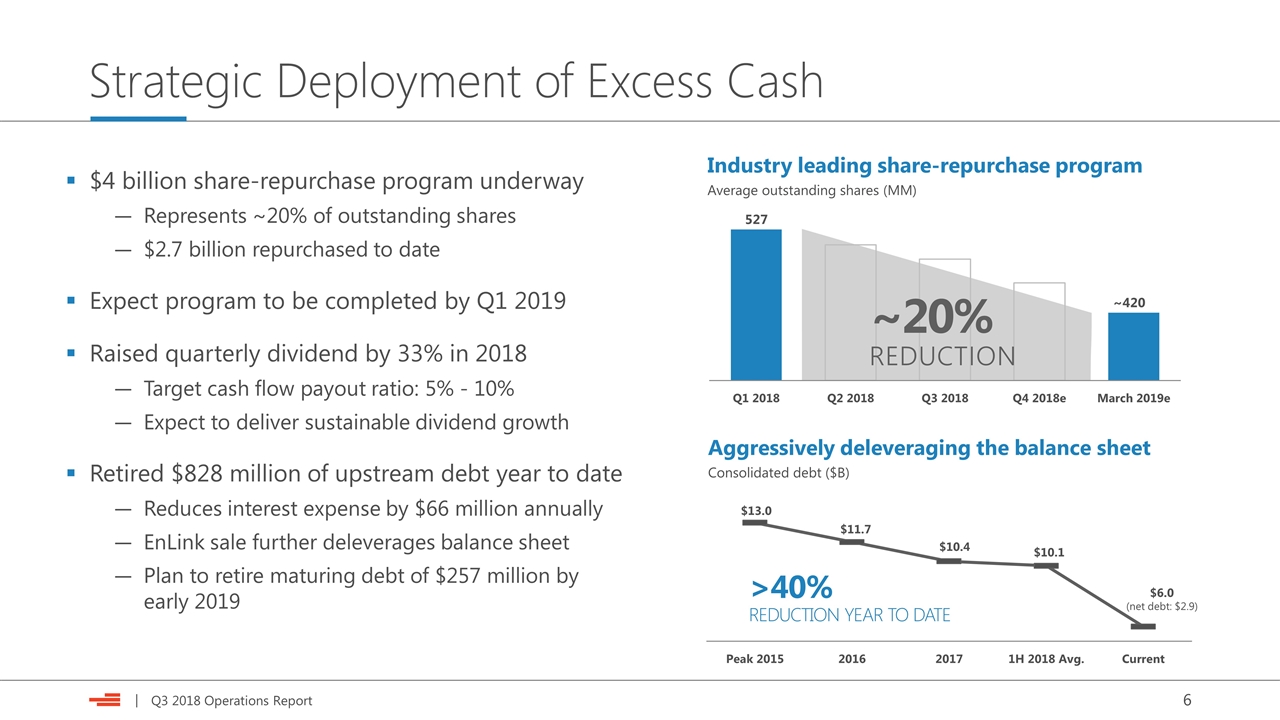

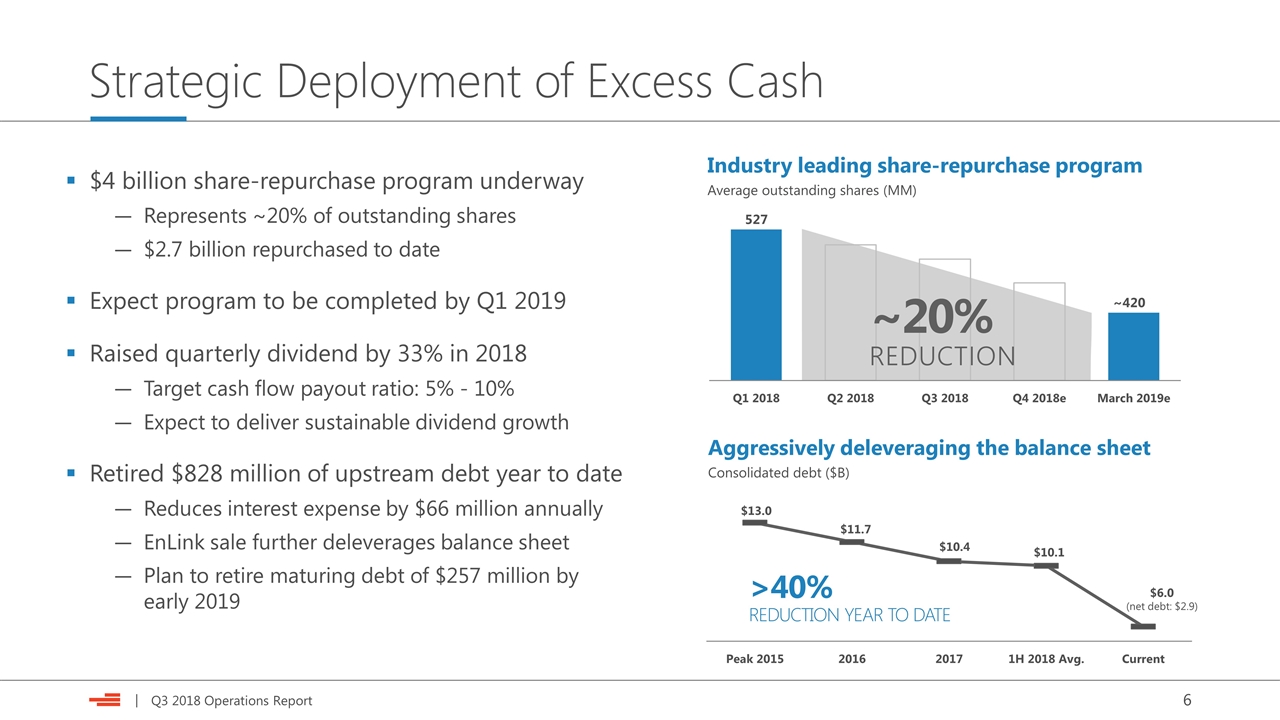

Strategic Deployment of Excess Cash $4 billion share-repurchase program underway Represents ~20% of outstanding shares $2.7 billion repurchased to date Expect program to be completed by Q1 2019 Raised quarterly dividend by 33% in 2018 Target cash flow payout ratio: 5% - 10% Expect to deliver sustainable dividend growth Retired $828 million of upstream debt year to date Reduces interest expense by $66 million annually EnLink sale further deleverages balance sheet Plan to retire maturing debt of $257 million by early 2019 Industry leading share-repurchase program Average outstanding shares (MM) ~20% REDUCTION 527 ~420 Aggressively deleveraging the balance sheet Consolidated debt ($B) >40% REDUCTION YEAR TO DATE $6.0 (net debt: $2.9)

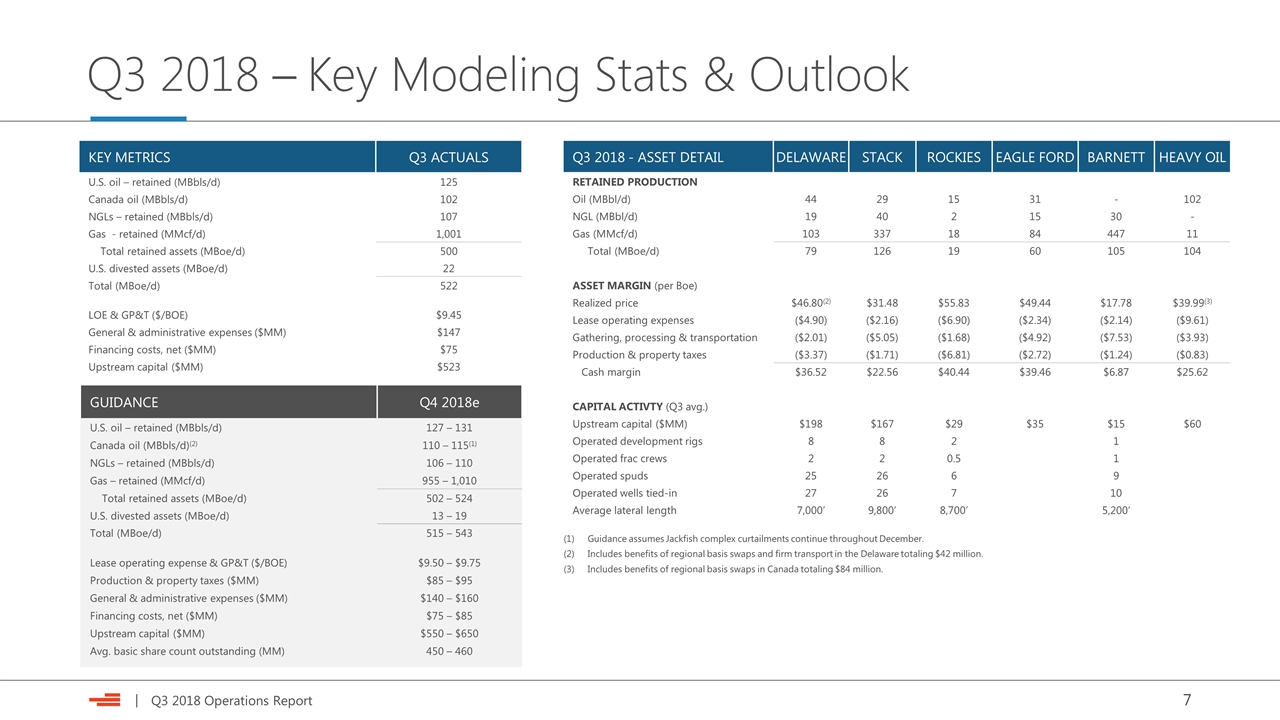

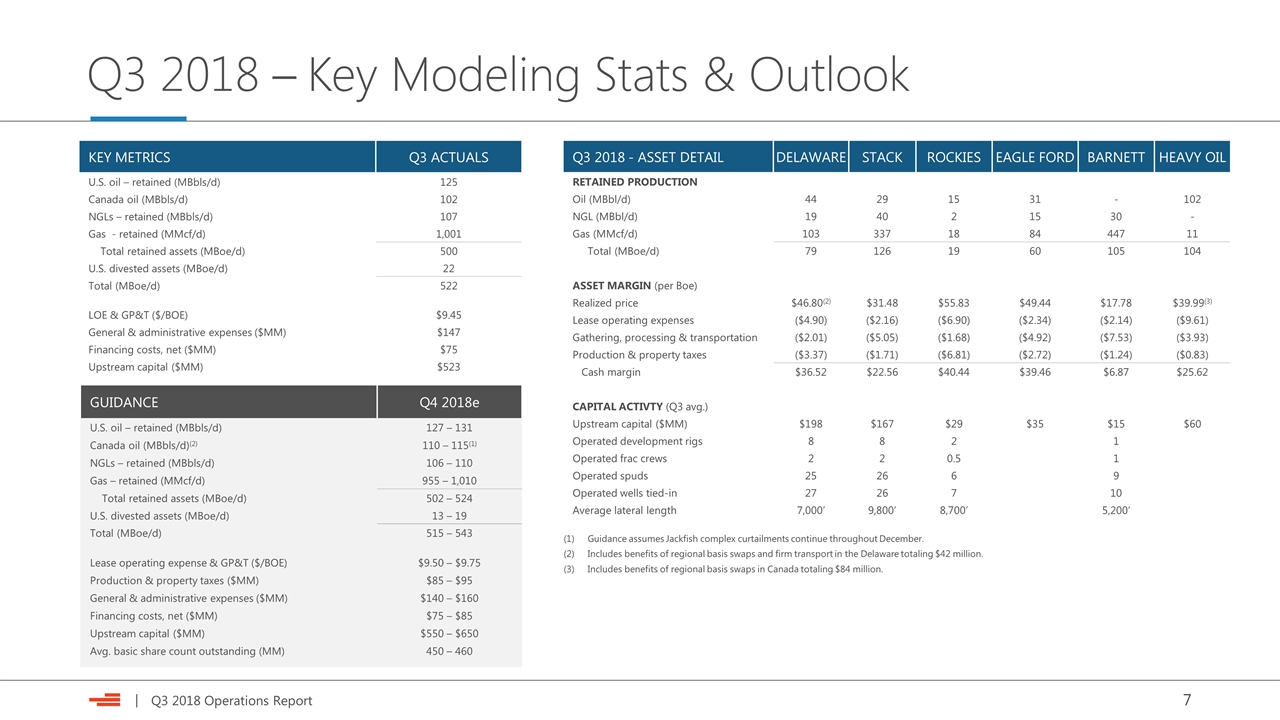

KEY METRICS Q3 ACTUALS U.S. oil – retained (MBbls/d) 125 Canada oil (MBbls/d) 102 NGLs – retained (MBbls/d) 107 Gas - retained (MMcf/d) 1,001 Total retained assets (MBoe/d) 500 U.S. divested assets (MBoe/d) 22 Total (MBoe/d) 522 LOE & GP&T ($/BOE) $9.45 General & administrative expenses ($MM) $147 Financing costs, net ($MM) $75 Upstream capital ($MM) $523 Q3 2018 - ASSET DETAIL DELAWARE STACK ROCKIES EAGLE FORD BARNETT HEAVY OIL RETAINED PRODUCTION Oil (MBbl/d) 44 29 15 31 - 102 NGL (MBbl/d) 19 40 2 15 30 - Gas (MMcf/d) 103 337 18 84 447 11 Total (MBoe/d) 79 126 19 60 105 104 ASSET MARGIN (per Boe) Realized price $46.80(2) $31.48 $55.83 $49.44 $17.78 $39.99(3) Lease operating expenses ($4.90) ($2.16) ($6.90) ($2.34) ($2.14) ($9.61) Gathering, processing & transportation ($2.01) ($5.05) ($1.68) ($4.92) ($7.53) ($3.93) Production & property taxes ($3.37) ($1.71) ($6.81) ($2.72) ($1.24) ($0.83) Cash margin $36.52 $22.56 $40.44 $39.46 $6.87 $25.62 CAPITAL ACTIVTY (Q3 avg.) Upstream capital ($MM) $198 $167 $29 $35 $15 $60 Operated development rigs 8 8 2 1 Operated frac crews 2 2 0.5 1 Operated spuds 25 26 6 9 Operated wells tied-in 27 26 7 10 Average lateral length 7,000’ 9,800’ 8,700’ 5,200’ GUIDANCE Q4 2018e U.S. oil – retained (MBbls/d) 127 – 131 Canada oil (MBbls/d)(2) 110 – 115(1) NGLs – retained (MBbls/d) 106 – 110 Gas – retained (MMcf/d) 955 – 1,010 Total retained assets (MBoe/d) 502 – 524 U.S. divested assets (MBoe/d) 13 – 19 Total (MBoe/d) 515 – 543 Lease operating expense & GP&T ($/BOE) $9.50 – $9.75 Production & property taxes ($MM) $85 – $95 General & administrative expenses ($MM) $140 – $160 Financing costs, net ($MM) $75 – $85 Upstream capital ($MM) $550 – $650 Avg. basic share count outstanding (MM) 450 – 460 Guidance assumes Jackfish complex curtailments continue throughout December. Includes benefits of regional basis swaps and firm transport in the Delaware totaling $42 million. Includes benefits of regional basis swaps in Canada totaling $84 million. Q3 2018 – Key Modeling Stats & Outlook

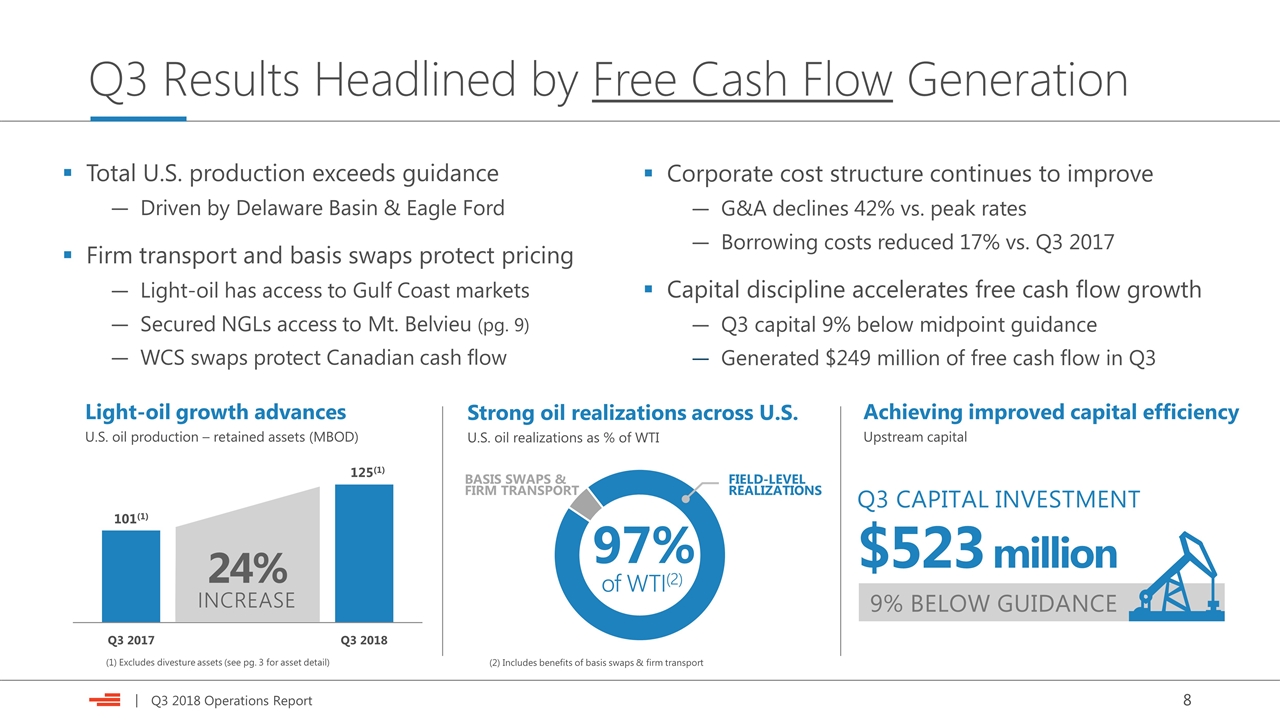

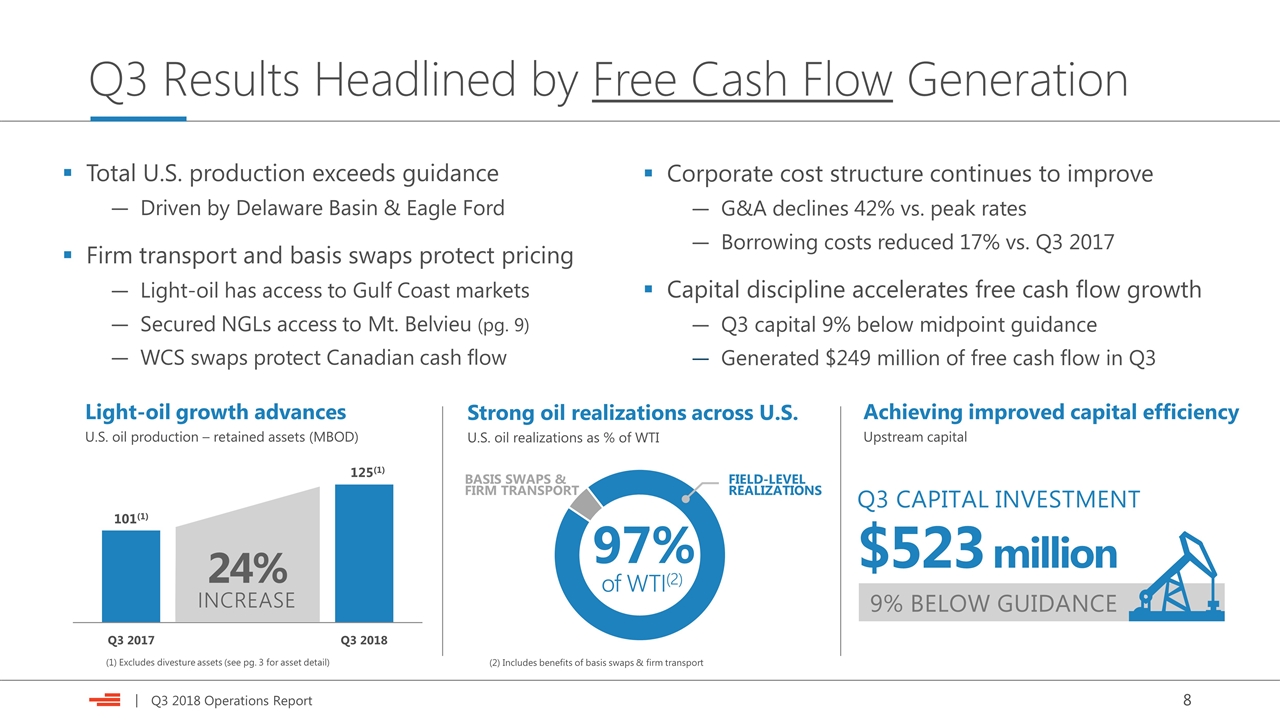

Corporate cost structure continues to improve G&A declines 42% vs. peak rates Borrowing costs reduced 17% vs. Q3 2017 Capital discipline accelerates free cash flow growth Q3 capital 9% below midpoint guidance Generated $249 million of free cash flow in Q3 Q3 Results Headlined by Free Cash Flow Generation Total U.S. production exceeds guidance Driven by Delaware Basin & Eagle Ford Firm transport and basis swaps protect pricing Light-oil has access to Gulf Coast markets Secured NGLs access to Mt. Belvieu (pg. 9) WCS swaps protect Canadian cash flow Achieving improved capital efficiency Upstream capital Strong oil realizations across U.S. U.S. oil realizations as % of WTI Light-oil growth advances U.S. oil production – retained assets (MBOD) (2) Includes benefits of basis swaps & firm transport 97% of WTI(2) BASIS SWAPS & FIRM TRANSPORT FIELD-LEVEL REALIZATIONS INCREASE 24% $523 million Q3 CAPITAL INVESTMENT 9% BELOW GUIDANCE (1) Excludes divesture assets (see pg. 3 for asset detail)

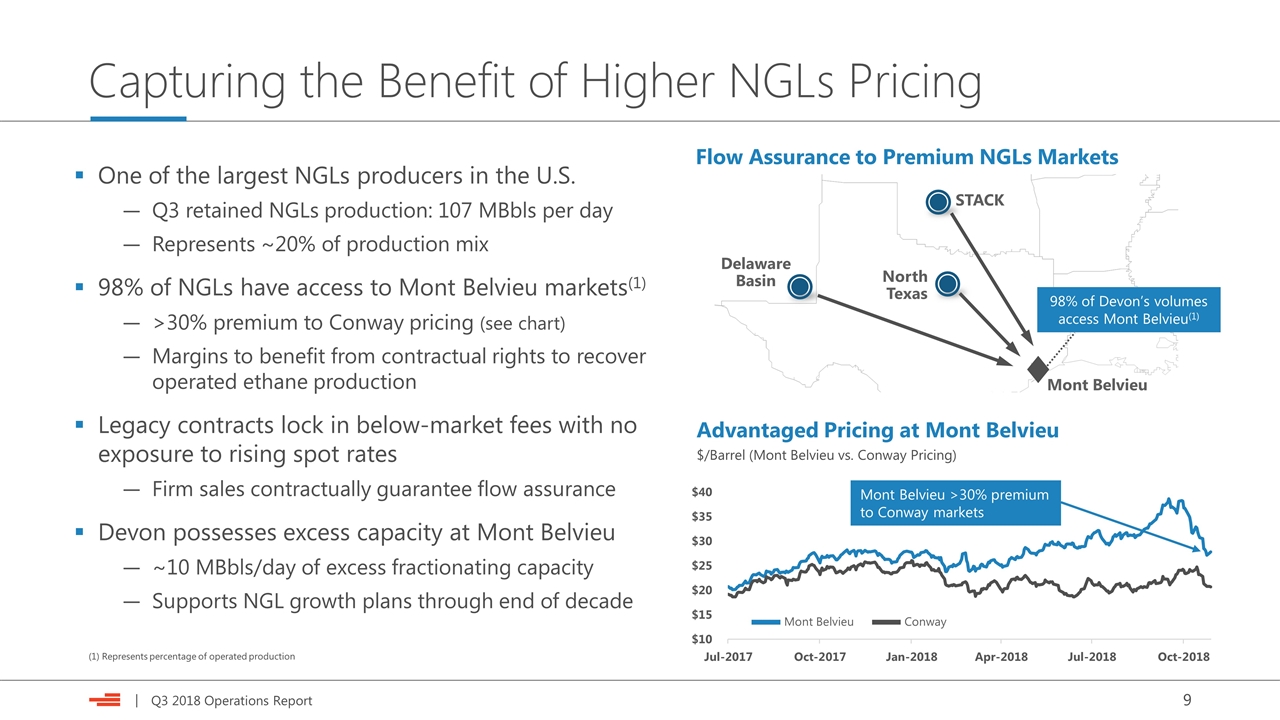

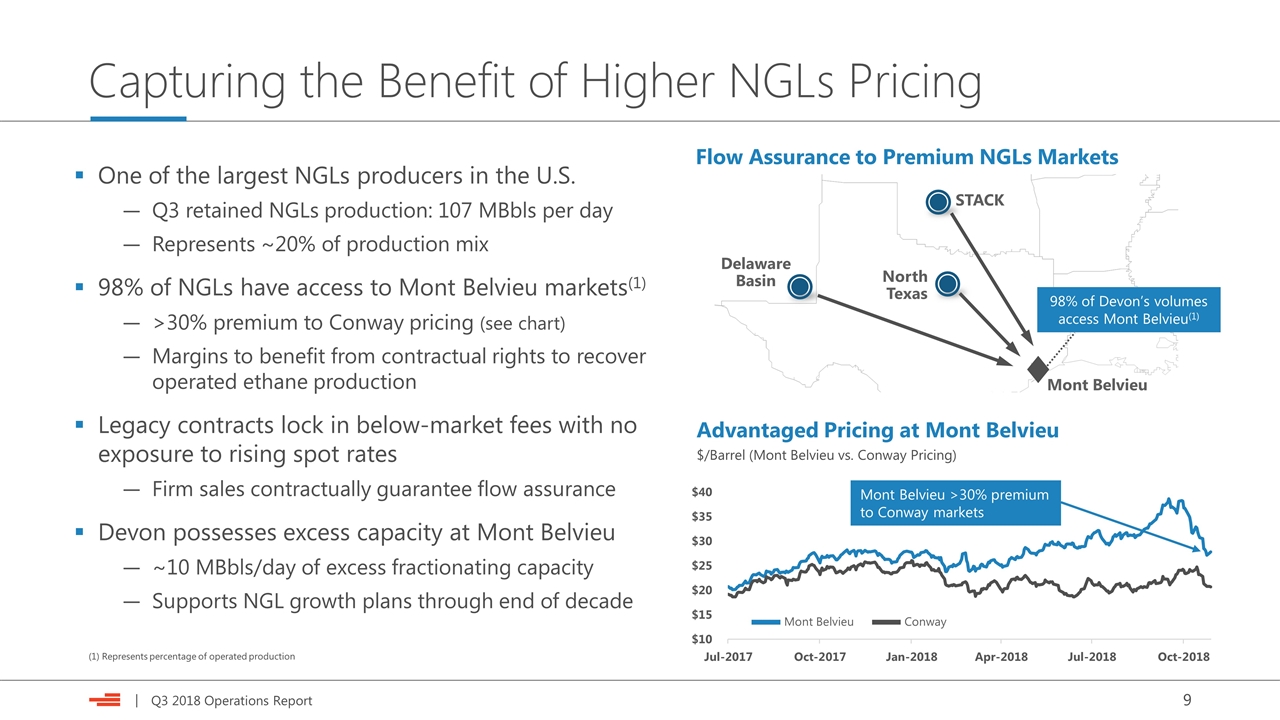

One of the largest NGLs producers in the U.S. Q3 retained NGLs production: 107 MBbls per day Represents ~20% of production mix 98% of NGLs have access to Mont Belvieu markets(1) >30% premium to Conway pricing (see chart) Margins to benefit from contractual rights to recover operated ethane production Legacy contracts lock in below-market fees with no exposure to rising spot rates Firm sales contractually guarantee flow assurance Devon possesses excess capacity at Mont Belvieu ~10 MBbls/day of excess fractionating capacity Supports NGL growth plans through end of decade Capturing the Benefit of Higher NGLs Pricing (1) Represents percentage of operated production Mont Belvieu Flow Assurance to Premium NGLs Markets STACK Delaware Basin Advantaged Pricing at Mont Belvieu $/Barrel (Mont Belvieu vs. Conway Pricing) Mont Belvieu Conway Mont Belvieu >30% premium to Conway markets North Texas 98% of Devon’s volumes access Mont Belvieu(1)

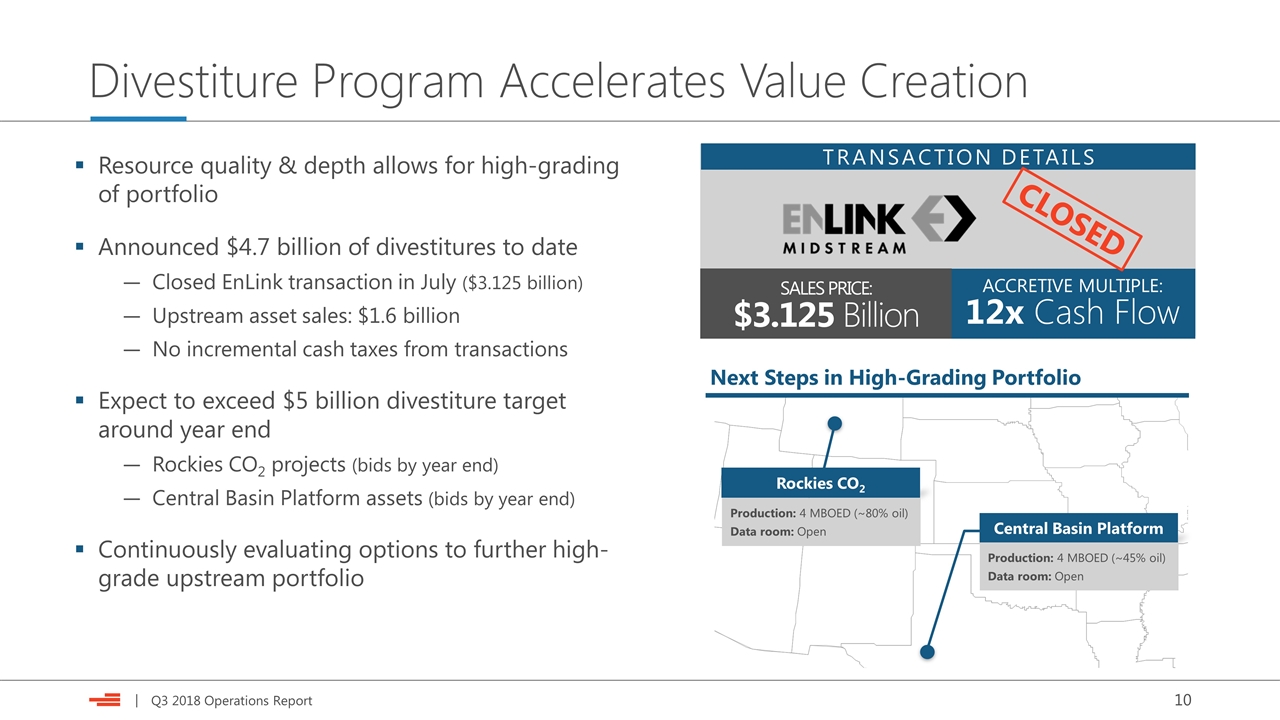

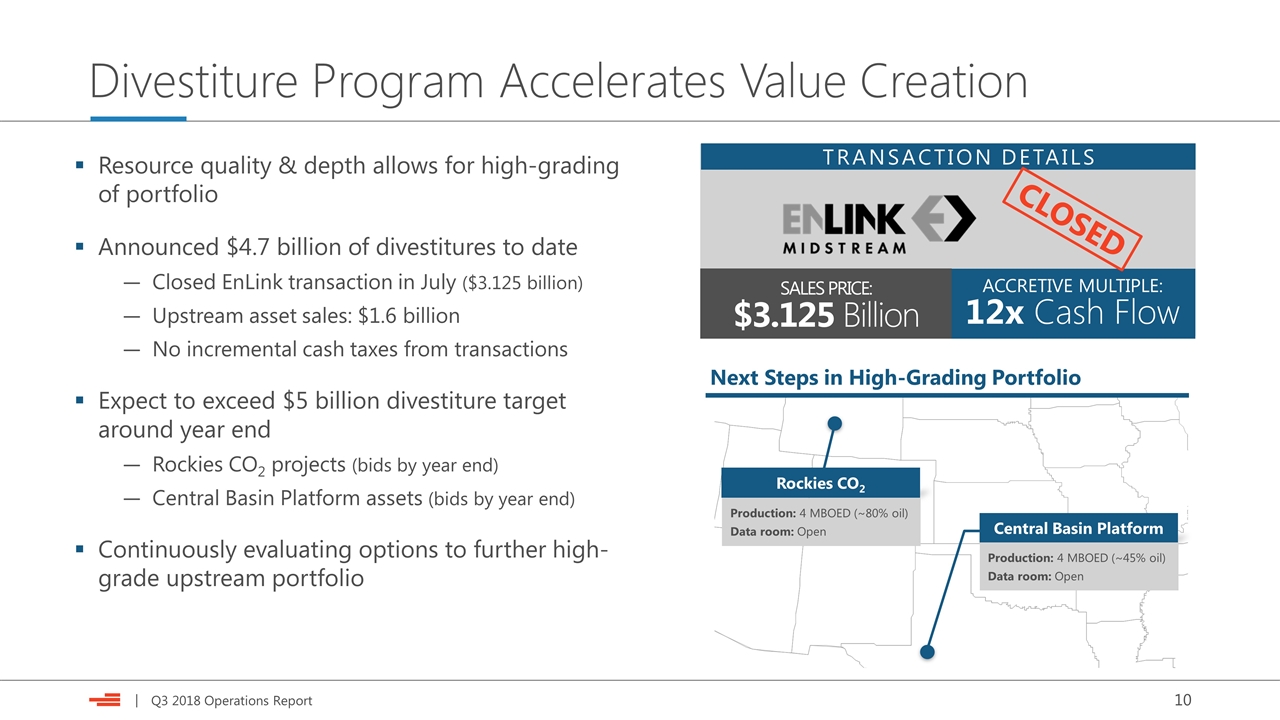

Divestiture Program Accelerates Value Creation SALES PRICE: $3.125 Billion ACCRETIVE MULTIPLE: 12x Cash Flow TRANSACTION DETAILS CLOSED Resource quality & depth allows for high-grading of portfolio Announced $4.7 billion of divestitures to date Closed EnLink transaction in July ($3.125 billion) Upstream asset sales: $1.6 billion No incremental cash taxes from transactions Expect to exceed $5 billion divestiture target around year end Rockies CO2 projects (bids by year end) Central Basin Platform assets (bids by year end) Continuously evaluating options to further high-grade upstream portfolio Next Steps in High-Grading Portfolio Rockies CO2 Central Basin Platform Production: 4 MBOED (~80% oil) Data room: Open Production: 4 MBOED (~45% oil) Data room: Open

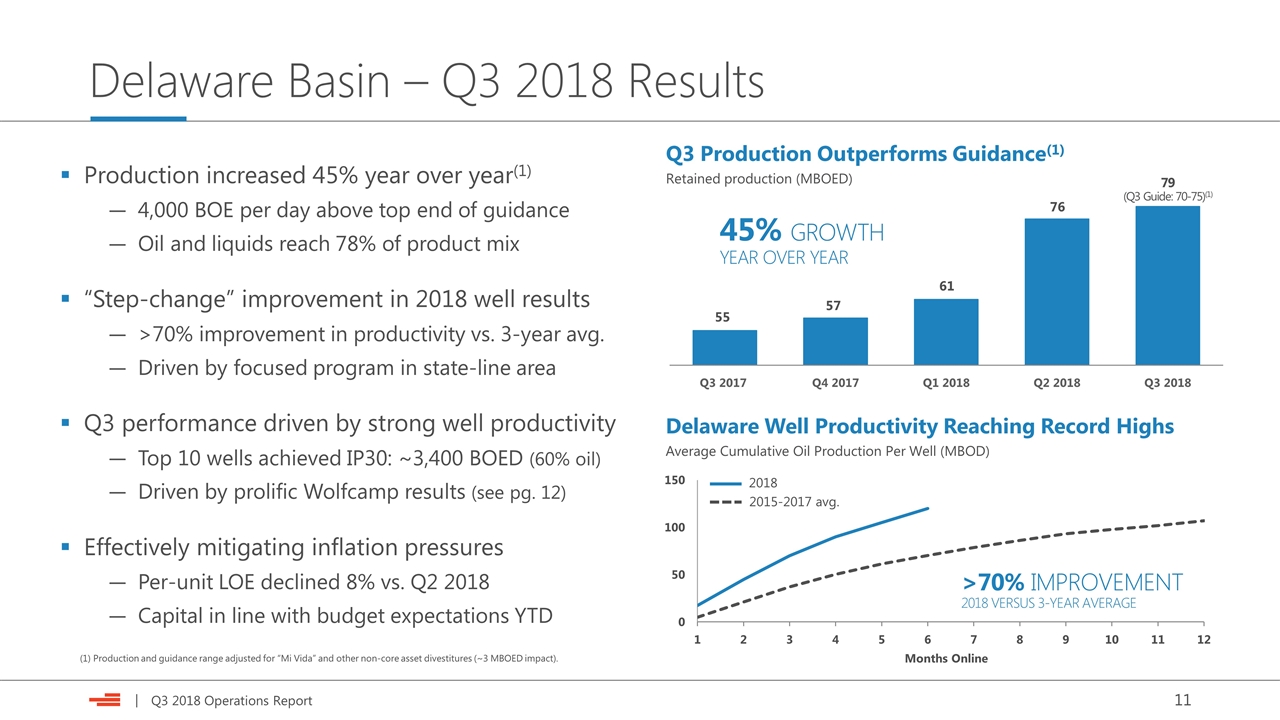

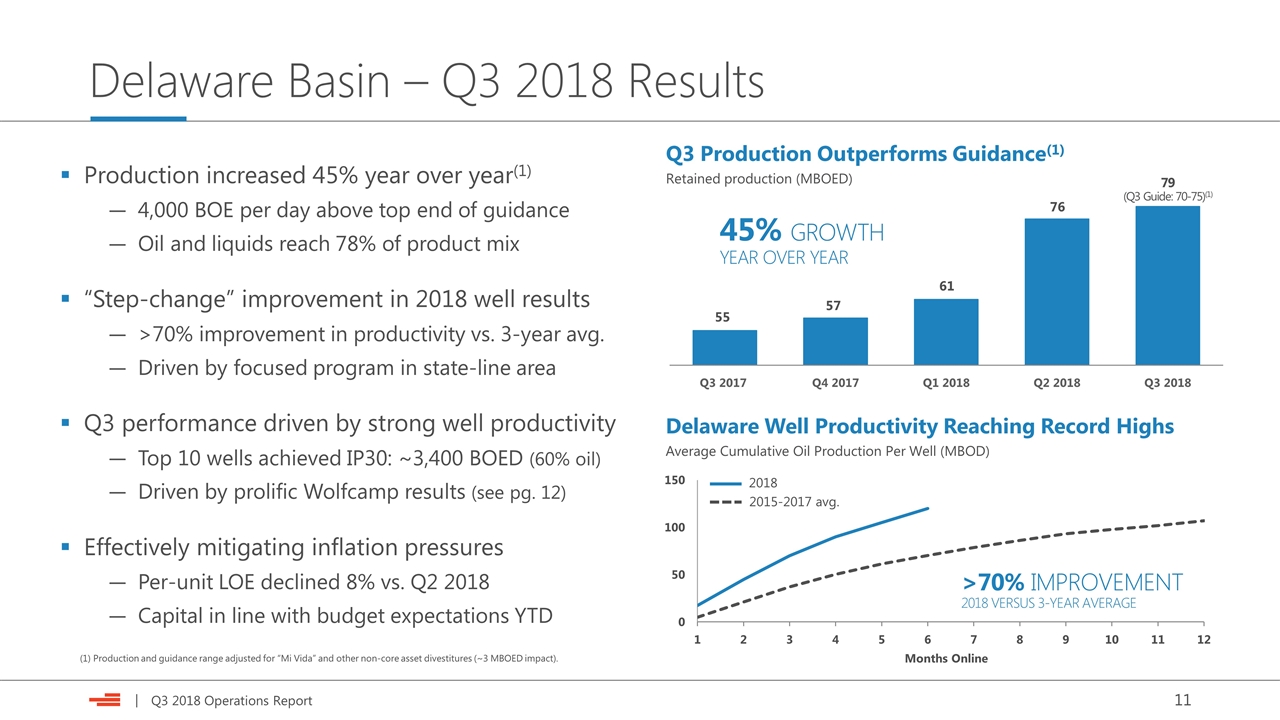

Delaware Basin – Q3 2018 Results 79 (Q3 Guide: 70-75)(1) 45% GROWTH YEAR OVER YEAR Q3 Production Outperforms Guidance(1) Retained production (MBOED) Delaware Well Productivity Reaching Record Highs Average Cumulative Oil Production Per Well (MBOD) 2018 2015-2017 avg. Months Online >70% IMPROVEMENT 2018 VERSUS 3-YEAR AVERAGE Production increased 45% year over year(1) 4,000 BOE per day above top end of guidance Oil and liquids reach 78% of product mix “Step-change” improvement in 2018 well results >70% improvement in productivity vs. 3-year avg. Driven by focused program in state-line area Q3 performance driven by strong well productivity Top 10 wells achieved IP30: ~3,400 BOED (60% oil) Driven by prolific Wolfcamp results (see pg. 12) Effectively mitigating inflation pressures Per-unit LOE declined 8% vs. Q2 2018 Capital in line with budget expectations YTD (1) Production and guidance range adjusted for “Mi Vida” and other non-core asset divestitures (~3 MBOED impact).

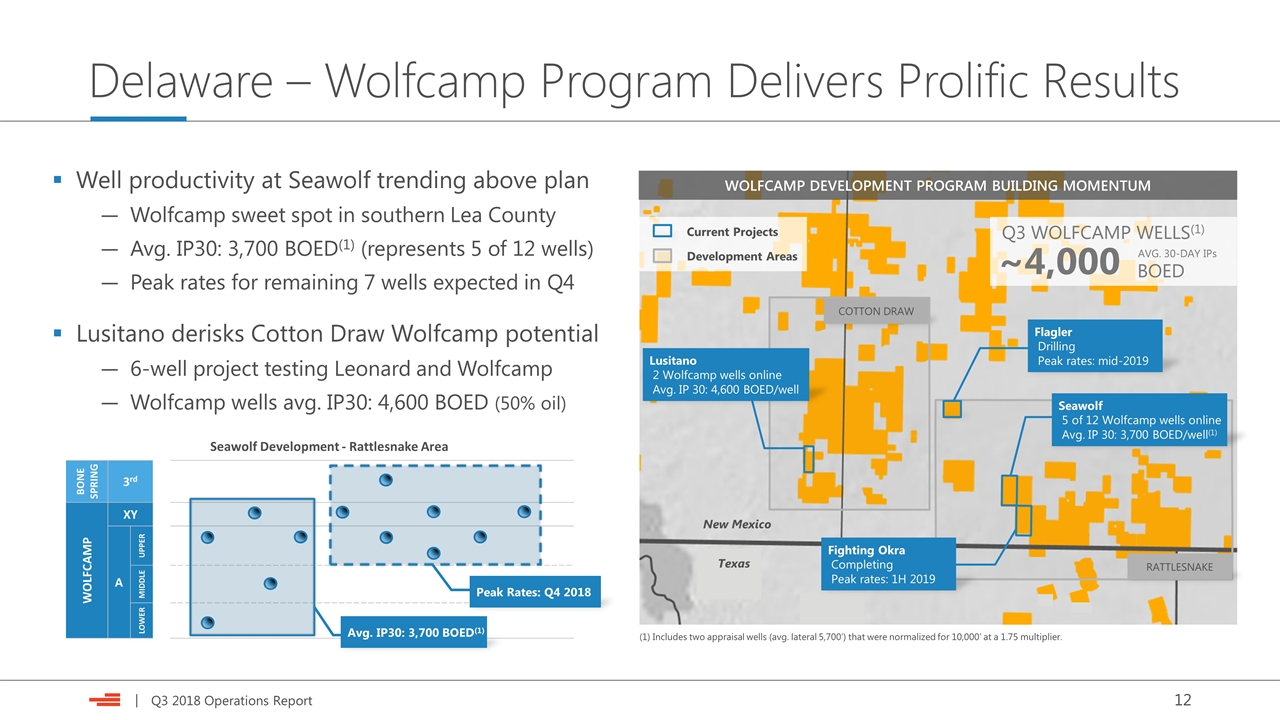

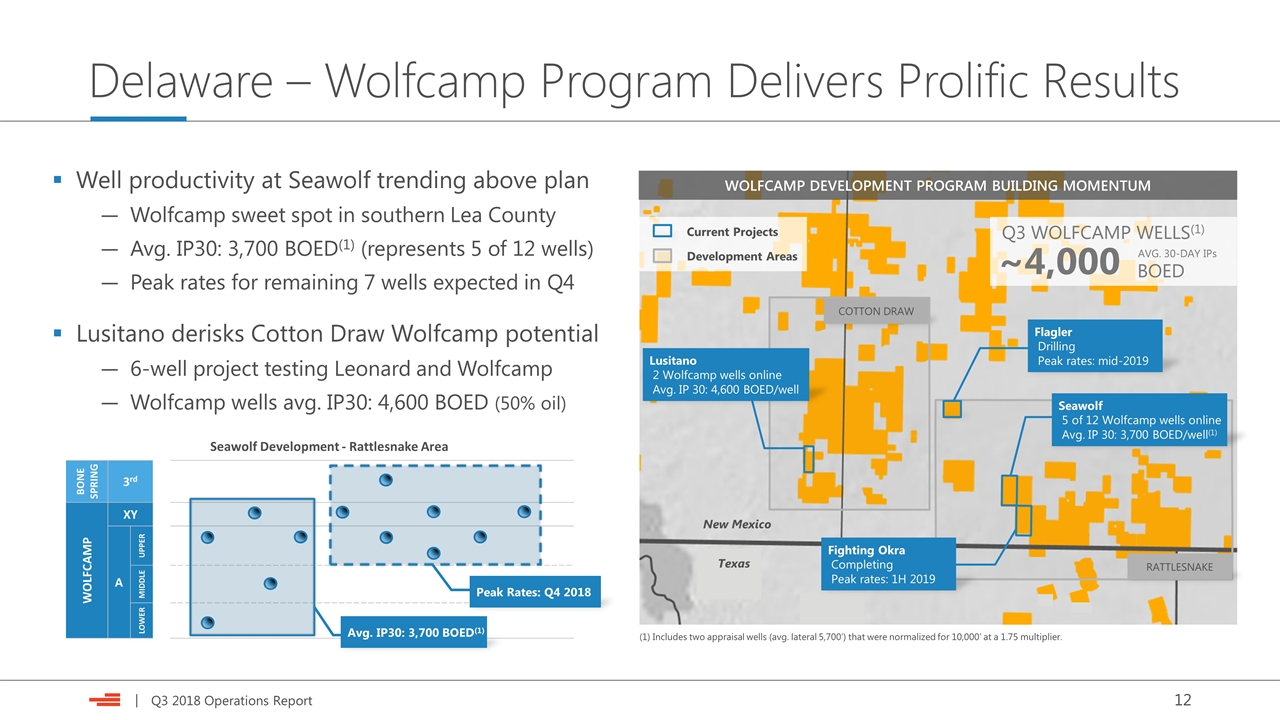

Delaware – Wolfcamp Program Delivers Prolific Results WOLFCAMP DEVELOPMENT PROGRAM BUILDING MOMENTUM Current Projects COTTON DRAW RATTLESNAKE New Mexico Texas Development Areas ~4,000 Q3 WOLFCAMP WELLS(1) BOED AVG. 30-DAY IPs Lusitano 2 Wolfcamp wells online Avg. IP 30: 4,600 BOED/well Seawolf 5 of 12 Wolfcamp wells online Avg. IP 30: 3,700 BOED/well(1) Fighting Okra Completing Peak rates: 1H 2019 BONE SPRING 3rd WOLFCAMP XY A UPPER MIDDLE LOWER Seawolf Development - Rattlesnake Area Avg. IP30: 3,700 BOED(1) Peak Rates: Q4 2018 Well productivity at Seawolf trending above plan Wolfcamp sweet spot in southern Lea County Avg. IP30: 3,700 BOED(1) (represents 5 of 12 wells) Peak rates for remaining 7 wells expected in Q4 Lusitano derisks Cotton Draw Wolfcamp potential 6-well project testing Leonard and Wolfcamp Wolfcamp wells avg. IP30: 4,600 BOED (50% oil) Flagler Drilling Peak rates: mid-2019 (1) Includes two appraisal wells (avg. lateral 5,700’) that were normalized for 10,000’ at a 1.75 multiplier.

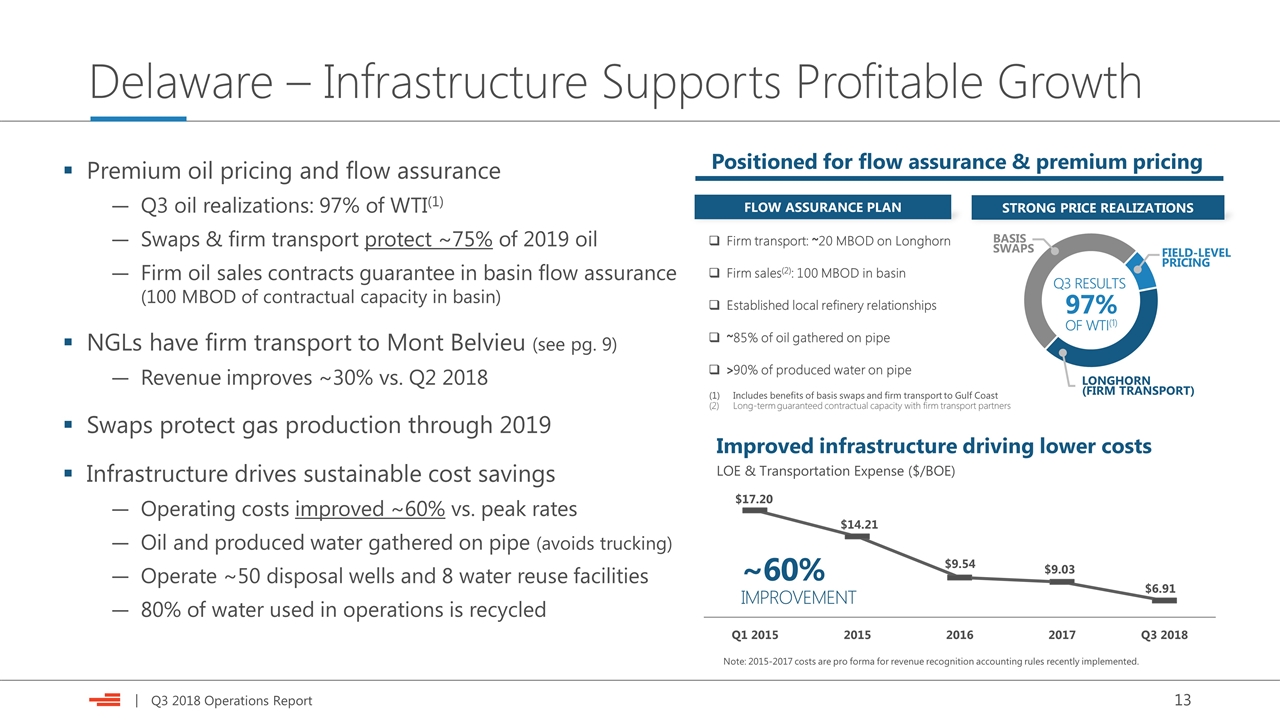

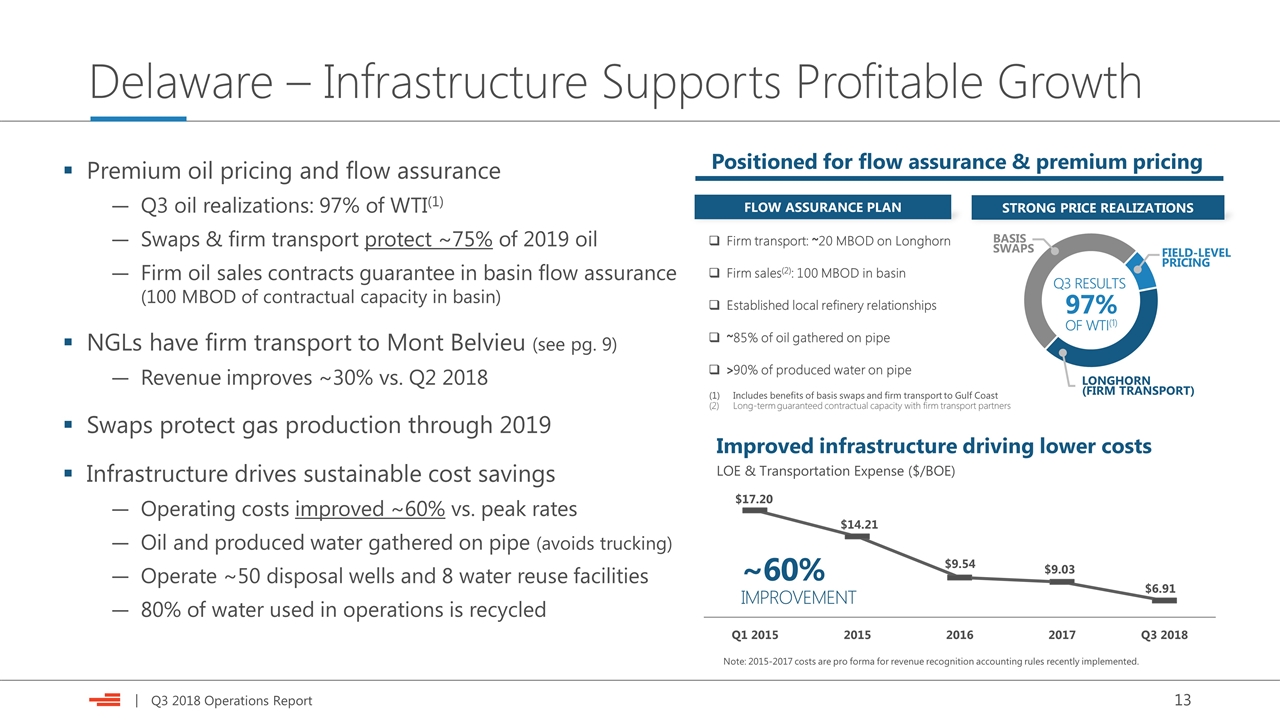

Delaware – Infrastructure Supports Profitable Growth Premium oil pricing and flow assurance Q3 oil realizations: 97% of WTI(1) Swaps & firm transport protect ~75% of 2019 oil Firm oil sales contracts guarantee in basin flow assurance (100 MBOD of contractual capacity in basin) NGLs have firm transport to Mont Belvieu (see pg. 9) Revenue improves ~30% vs. Q2 2018 Swaps protect gas production through 2019 Infrastructure drives sustainable cost savings Operating costs improved ~60% vs. peak rates Oil and produced water gathered on pipe (avoids trucking) Operate ~50 disposal wells and 8 water reuse facilities 80% of water used in operations is recycled Includes benefits of basis swaps and firm transport to Gulf Coast Long-term guaranteed contractual capacity with firm transport partners Positioned for flow assurance & premium pricing Firm transport: ~20 MBOD on Longhorn Firm sales(2): 100 MBOD in basin Established local refinery relationships ~85% of oil gathered on pipe >90% of produced water on pipe FLOW ASSURANCE PLAN STRONG PRICE REALIZATIONS 97% OF WTI(1) BASIS SWAPS FIELD-LEVEL PRICING LONGHORN (FIRM TRANSPORT) Q3 RESULTS Note: 2015-2017 costs are pro forma for revenue recognition accounting rules recently implemented. ~60% IMPROVEMENT Improved infrastructure driving lower costs LOE & Transportation Expense ($/BOE)

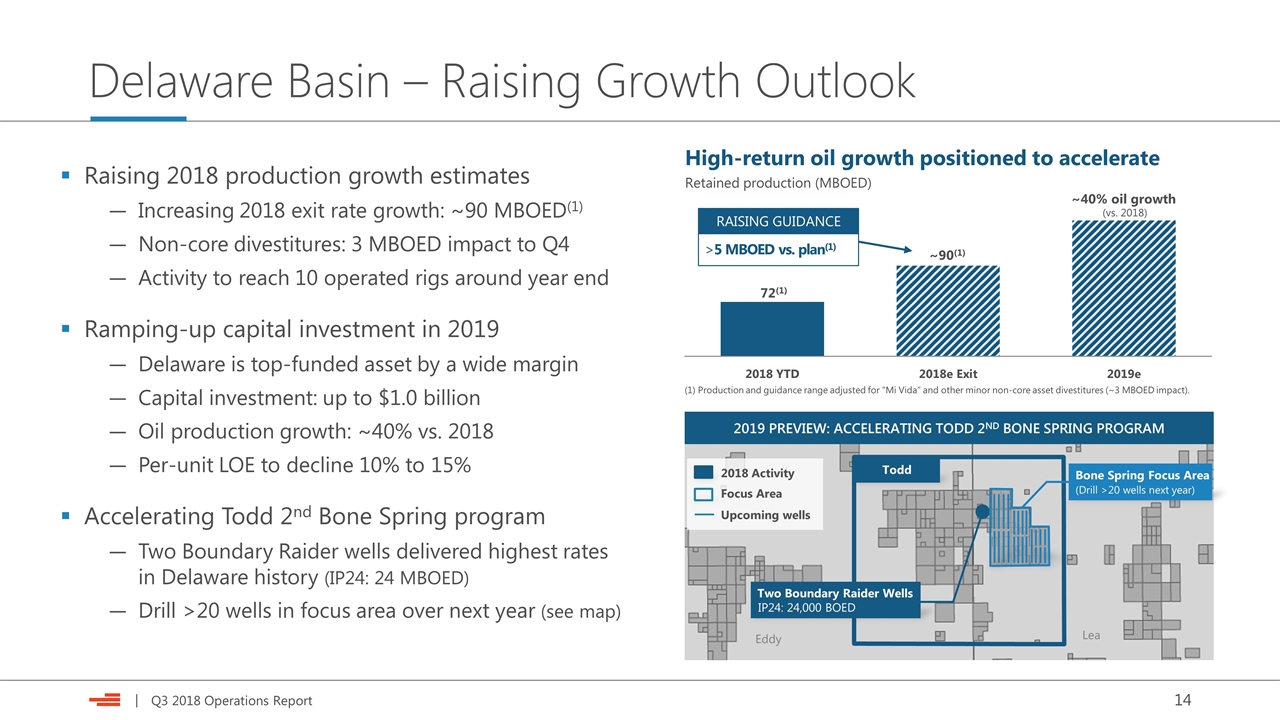

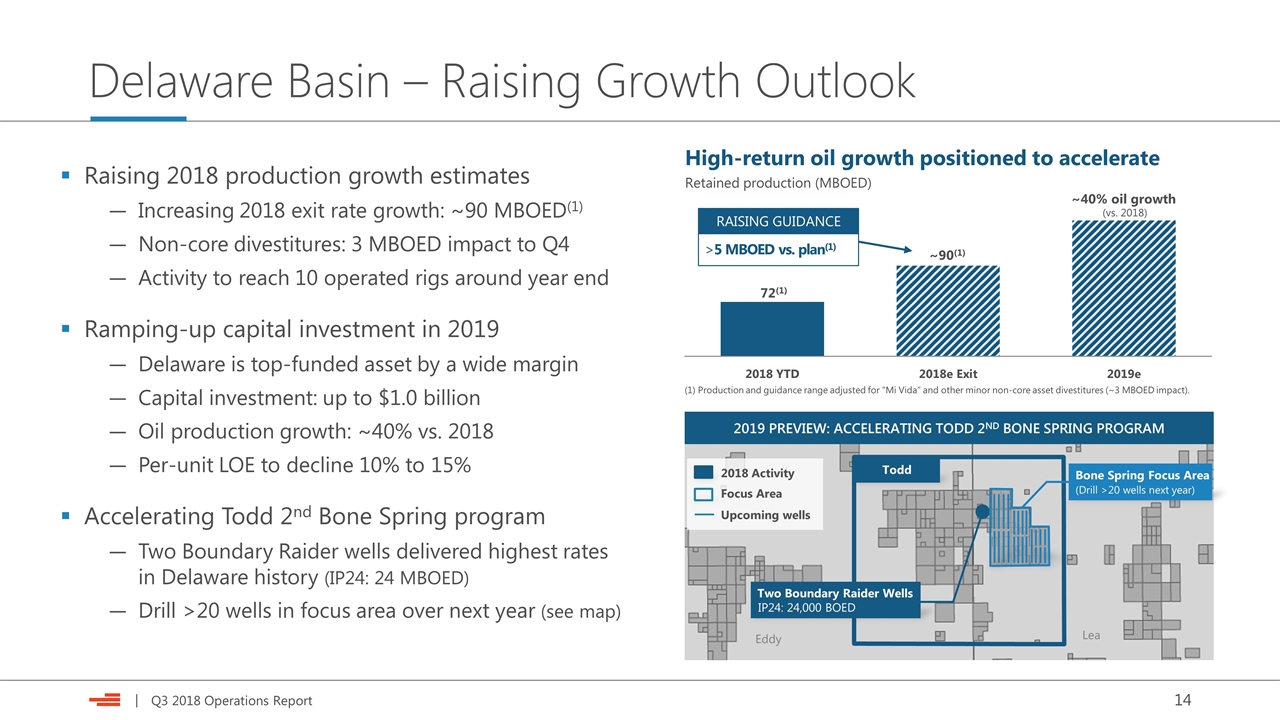

Delaware Basin – Raising Growth Outlook Raising 2018 production growth estimates Increasing 2018 exit rate growth: ~90 MBOED(1) Non-core divestitures: 3 MBOED impact to Q4 Activity to reach 10 operated rigs around year end Ramping-up capital investment in 2019 Delaware is top-funded asset by a wide margin Capital investment: up to $1.0 billion Oil production growth: ~40% vs. 2018 Per-unit LOE to decline 10% to 15% Accelerating Todd 2nd Bone Spring program Two Boundary Raider wells delivered highest rates in Delaware history (IP24: 24 MBOED) Drill >20 wells in focus area over next year (see map) Todd 2018 Activity Focus Area Bone Spring Focus Area (Drill >20 wells next year) Eddy Lea Two Boundary Raider Wells IP24: 24,000 BOED 2019 PREVIEW: ACCELERATING TODD 2ND BONE SPRING PROGRAM Upcoming wells (vs. 2018) High-return oil growth positioned to accelerate Retained production (MBOED) ~90(1) >5 MBOED vs. plan(1) RAISING GUIDANCE (1) Production and guidance range adjusted for “Mi Vida” and other minor non-core asset divestitures (~3 MBOED impact).

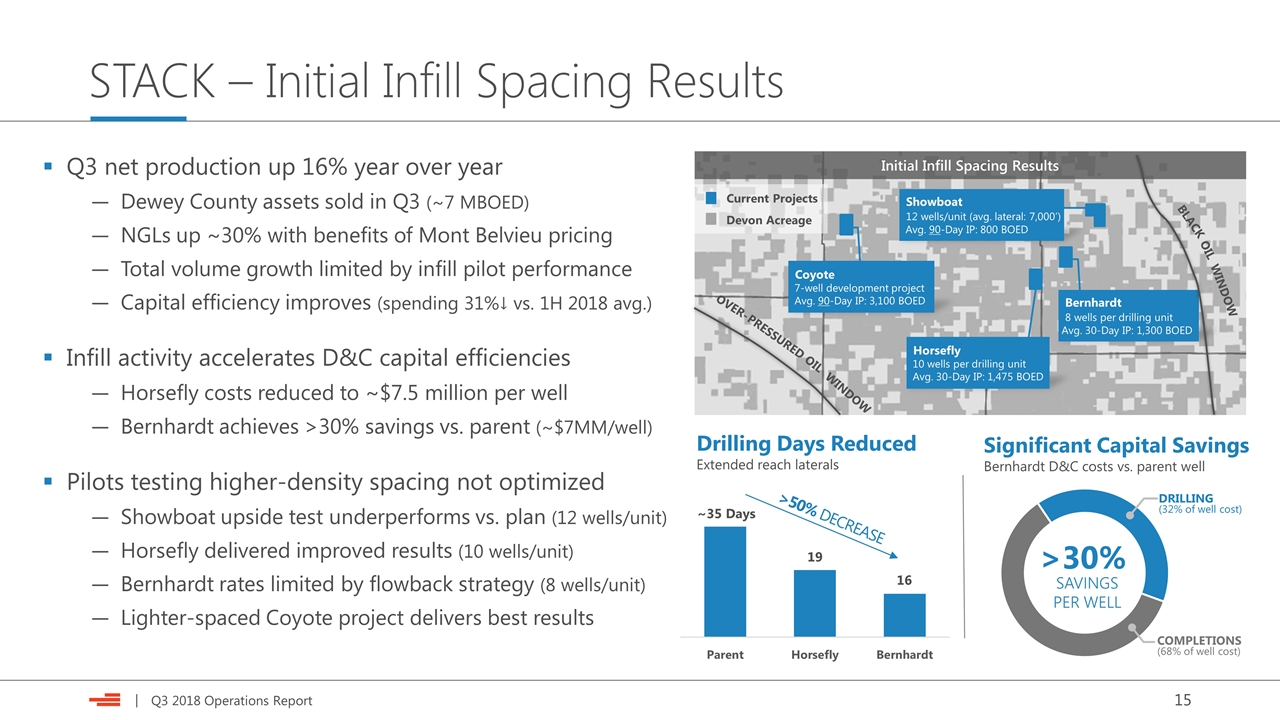

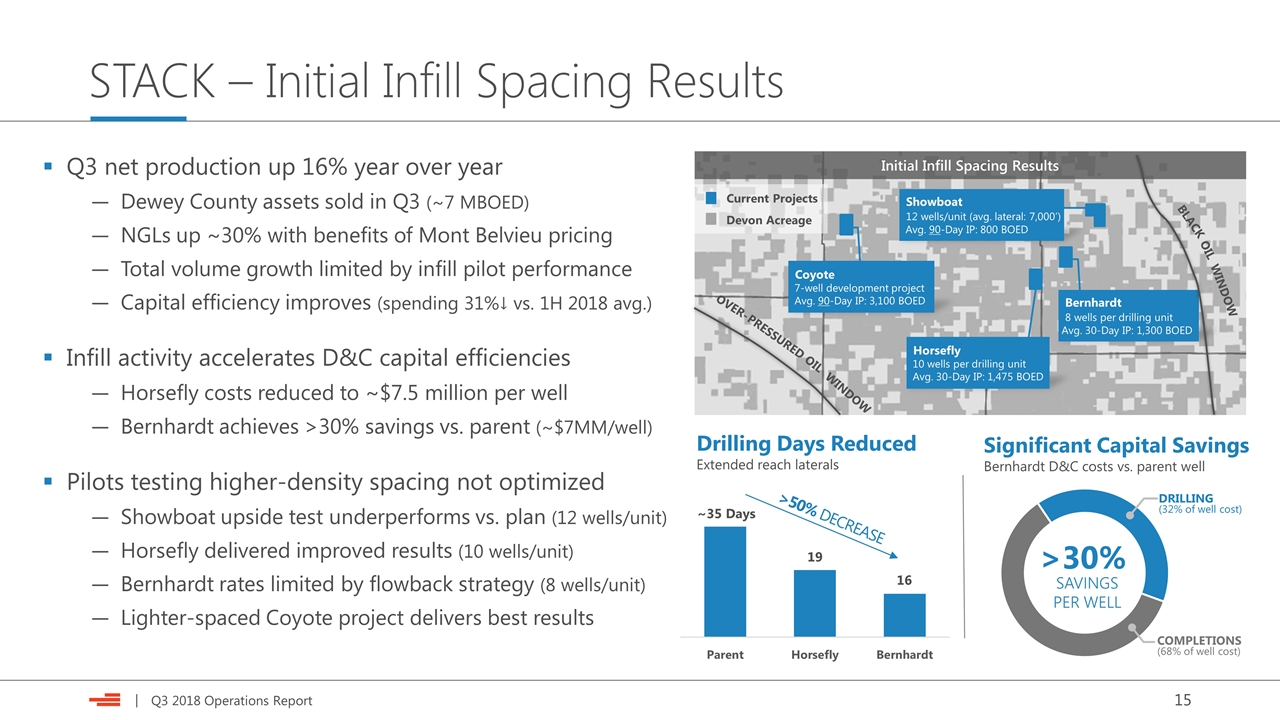

STACK – Initial Infill Spacing Results Initial Infill Spacing Results Showboat 12 wells/unit (avg. lateral: 7,000’) Avg. 90-Day IP: 800 BOED Horsefly 10 wells per drilling unit Avg. 30-Day IP: 1,475 BOED Coyote 7-well development project Avg. 90-Day IP: 3,100 BOED Bernhardt 8 wells per drilling unit Avg. 30-Day IP: 1,300 BOED BLACK OIL WINDOW OVER- PRESSURED OIL WINDOW Devon Acreage Current Projects ~35 Days 19 16 COMPLETIONS (68% of well cost) DRILLING (32% of well cost) SAVINGS PER WELL Drilling Days Reduced Extended reach laterals >30% >50% DECREASE Significant Capital Savings Bernhardt D&C costs vs. parent well Q3 net production up 16% year over year Dewey County assets sold in Q3 (~7 MBOED) NGLs up ~30% with benefits of Mont Belvieu pricing Total volume growth limited by infill pilot performance Capital efficiency improves (spending 31%↓ vs. 1H 2018 avg.) Infill activity accelerates D&C capital efficiencies Horsefly costs reduced to ~$7.5 million per well Bernhardt achieves >30% savings vs. parent (~$7MM/well) Pilots testing higher-density spacing not optimized Showboat upside test underperforms vs. plan (12 wells/unit) Horsefly delivered improved results (10 wells/unit) Bernhardt rates limited by flowback strategy (8 wells/unit) Lighter-spaced Coyote project delivers best results

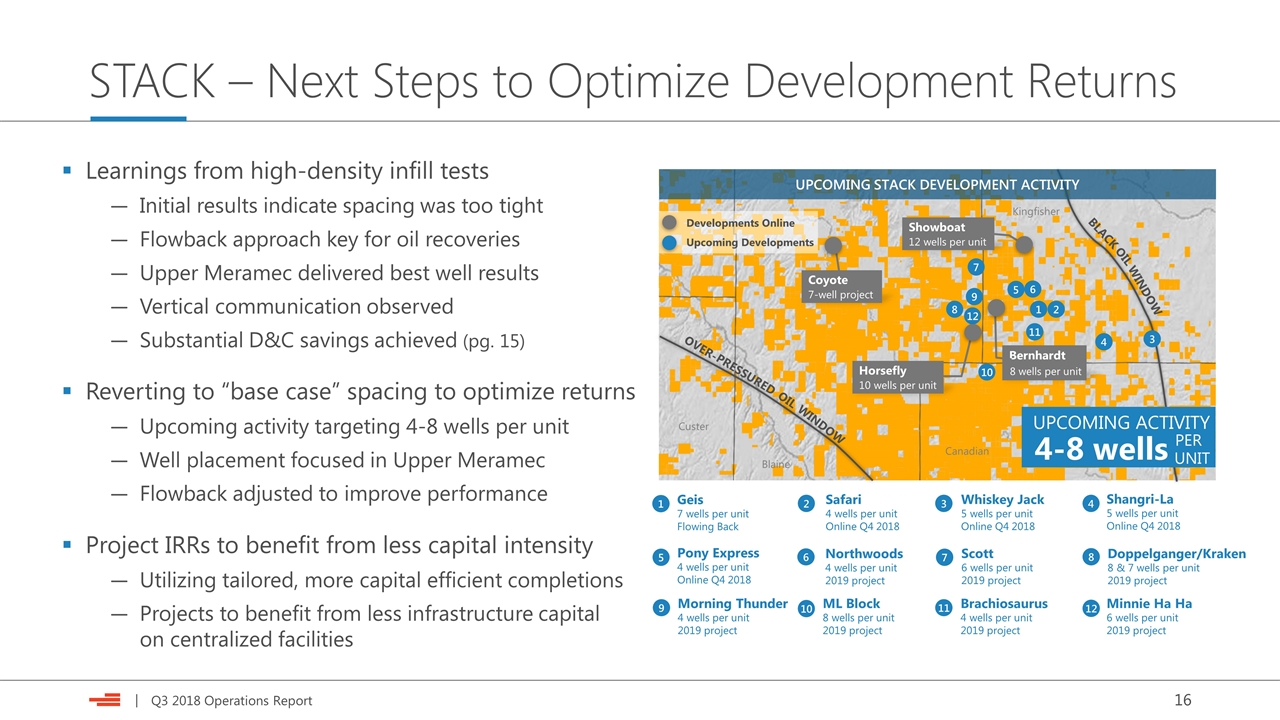

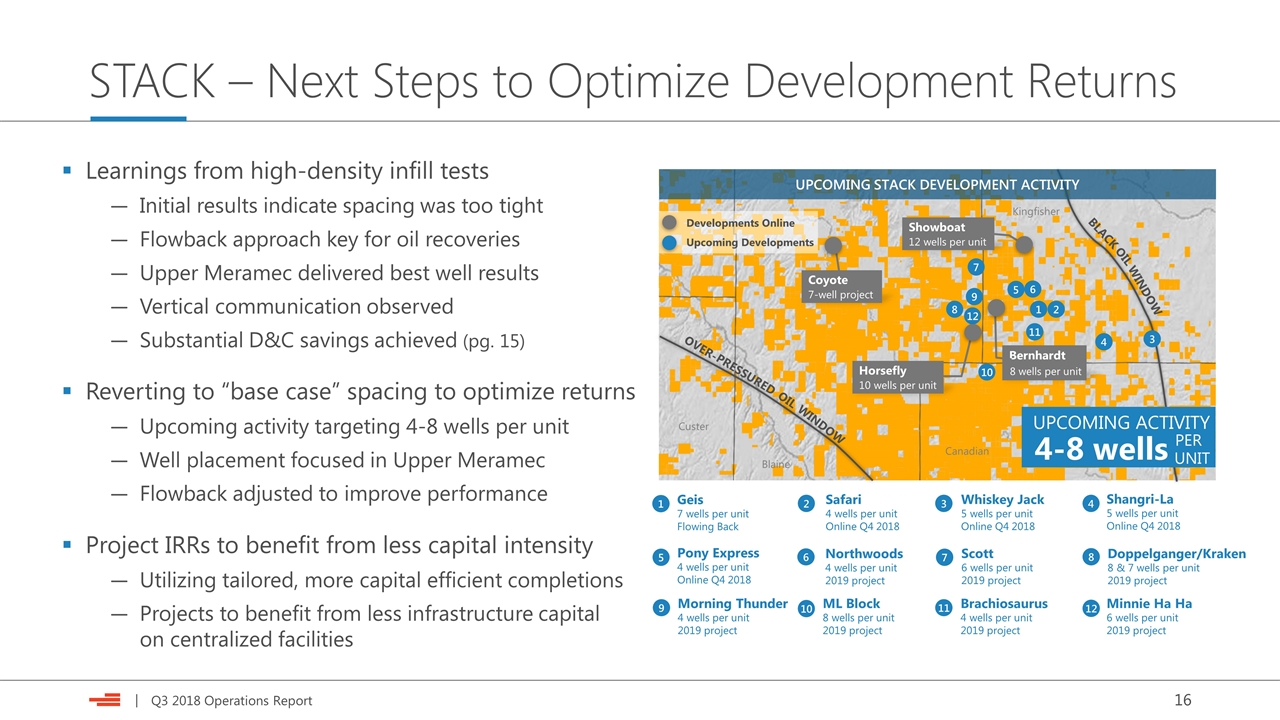

STACK – Next Steps to Optimize Development Returns Learnings from high-density infill tests Initial results indicate spacing was too tight Flowback approach key for oil recoveries Upper Meramec delivered best well results Vertical communication observed Substantial D&C savings achieved (pg. 15) Reverting to “base case” spacing to optimize returns Upcoming activity targeting 4-8 wells per unit Well placement focused in Upper Meramec Flowback adjusted to improve performance Project IRRs to benefit from less capital intensity Utilizing tailored, more capital efficient completions Projects to benefit from less infrastructure capital on centralized facilities Pony Express 4 wells per unit Online Q4 2018 ML Block 8 wells per unit 2019 project Kingfisher Canadian Custer Blaine Upcoming Developments BLACK OIL WINDOW OVER- PRESSURED OIL WINDOW UPCOMING STACK DEVELOPMENT ACTIVITY 1 5 9 Geis 7 wells per unit Flowing Back Shangri-La 5 wells per unit Online Q4 2018 Showboat 12 wells per unit 1 2 3 2 6 10 Safari 4 wells per unit Online Q4 2018 Doppelganger/Kraken 8 & 7 wells per unit 2019 project 3 7 11 Scott 6 wells per unit 2019 project 4 8 12 4-8 wells UPCOMING ACTIVITY PER UNIT Developments Online Horsefly 10 wells per unit Bernhardt 8 wells per unit 4 6 7 9 Coyote 7-well project 8 10 11 12 5 Whiskey Jack 5 wells per unit Online Q4 2018 Northwoods 4 wells per unit 2019 project Brachiosaurus 4 wells per unit 2019 project Minnie Ha Ha 6 wells per unit 2019 project Morning Thunder 4 wells per unit 2019 project

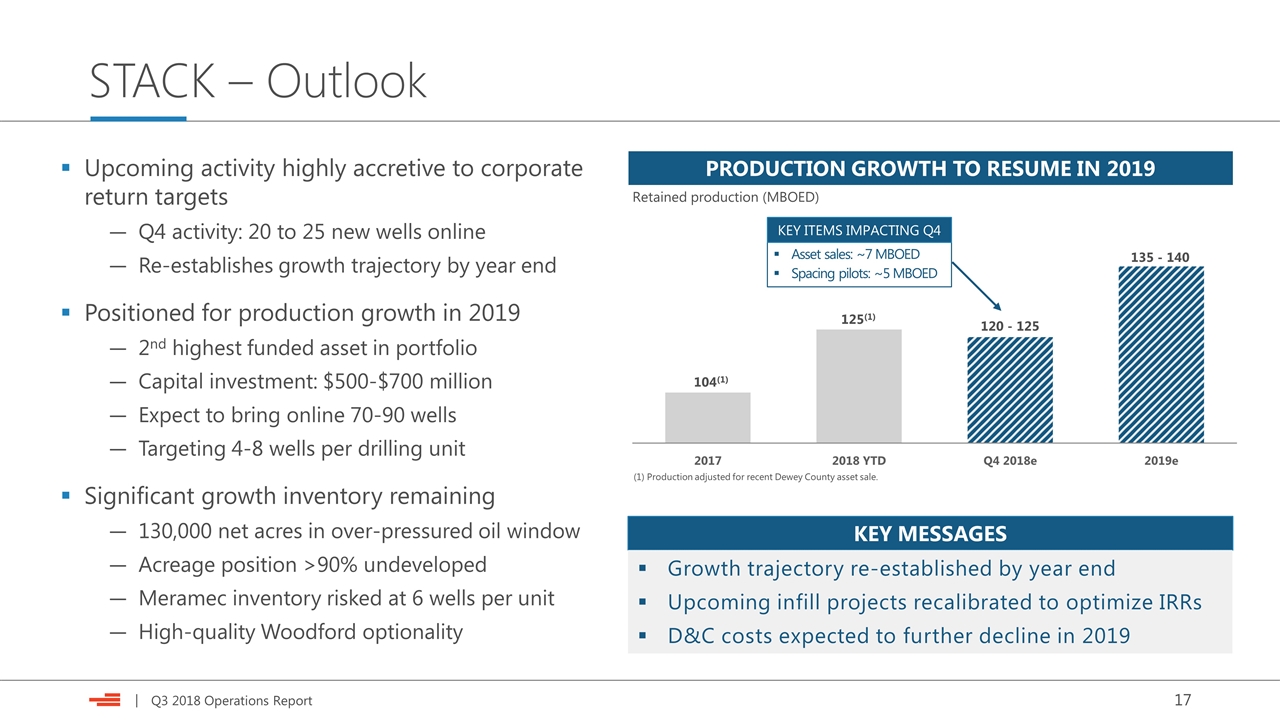

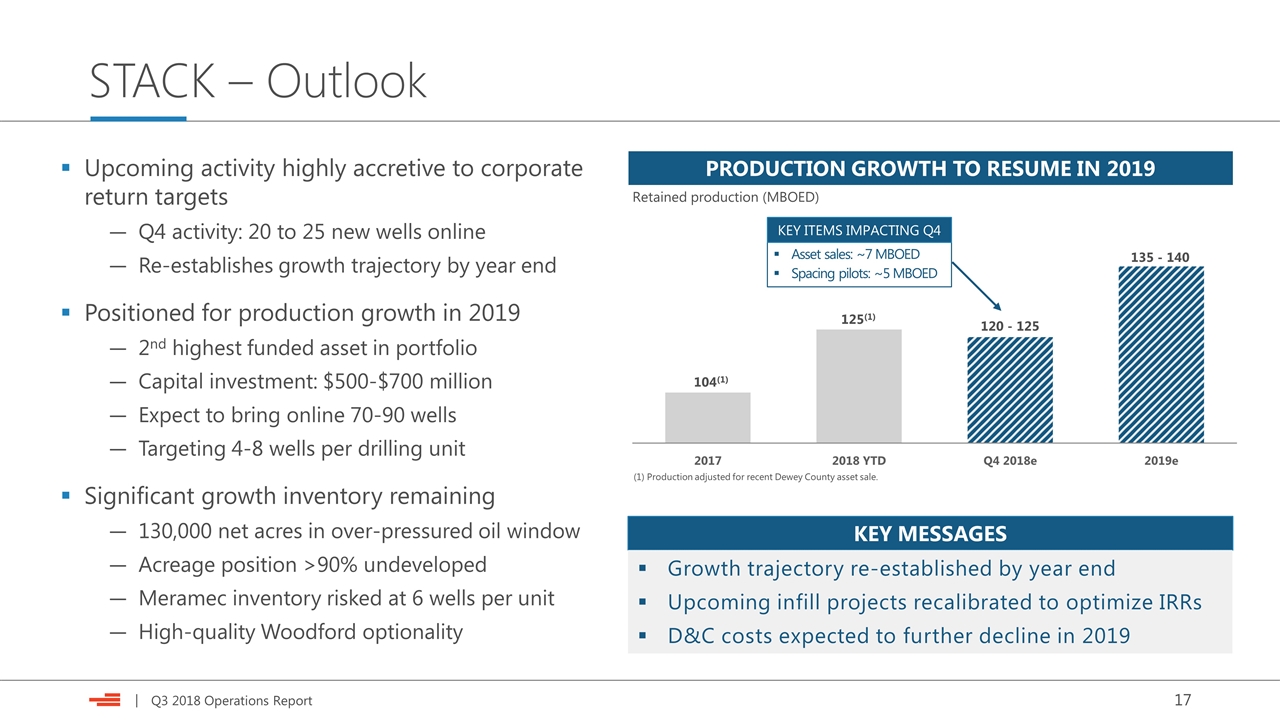

STACK – Outlook Upcoming activity highly accretive to corporate return targets Q4 activity: 20 to 25 new wells online Re-establishes growth trajectory by year end Positioned for production growth in 2019 2nd highest funded asset in portfolio Capital investment: $500-$700 million Expect to bring online 70-90 wells Targeting 4-8 wells per drilling unit Significant growth inventory remaining 130,000 net acres in over-pressured oil window Acreage position >90% undeveloped Meramec inventory risked at 6 wells per unit High-quality Woodford optionality 120 - 125 Asset sales: ~7 MBOED Spacing pilots: ~5 MBOED 125(1) 104(1) KEY ITEMS IMPACTING Q4 (1) Production adjusted for recent Dewey County asset sale. KEY MESSAGES Growth trajectory re-established by year end Upcoming infill projects recalibrated to optimize IRRs D&C costs expected to further decline in 2019 PRODUCTION GROWTH TO RESUME IN 2019 Retained production (MBOED)

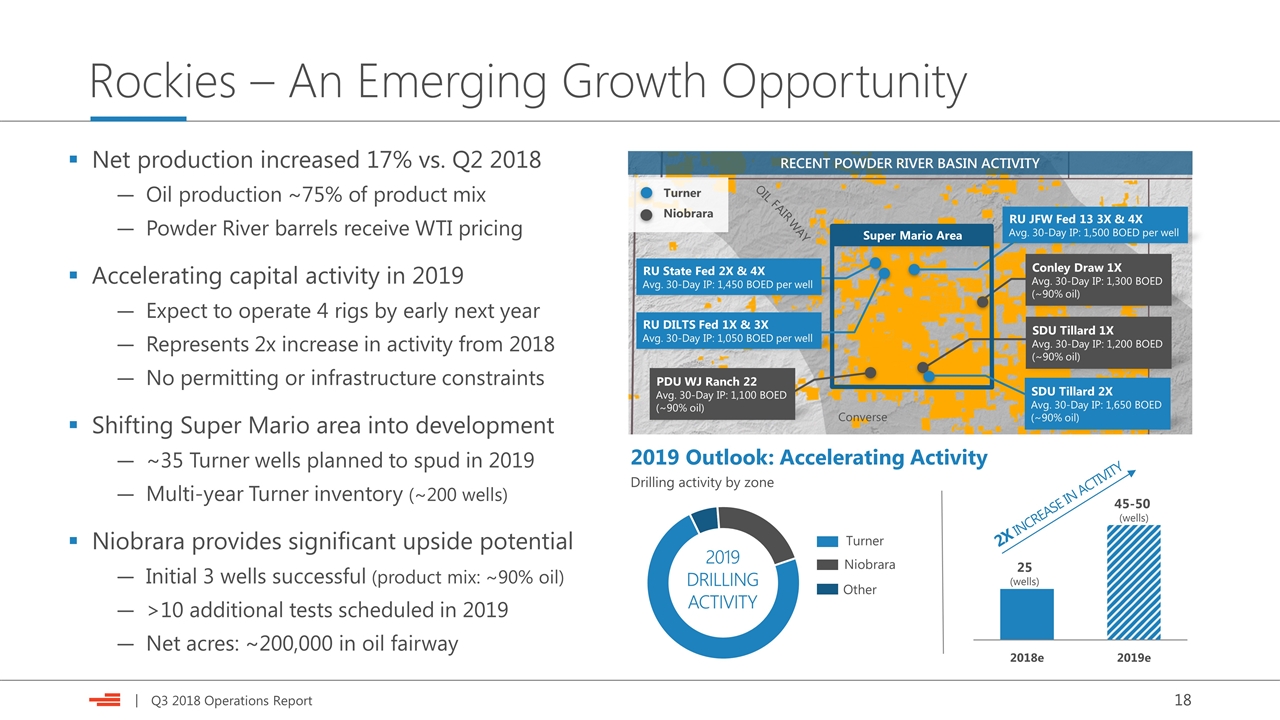

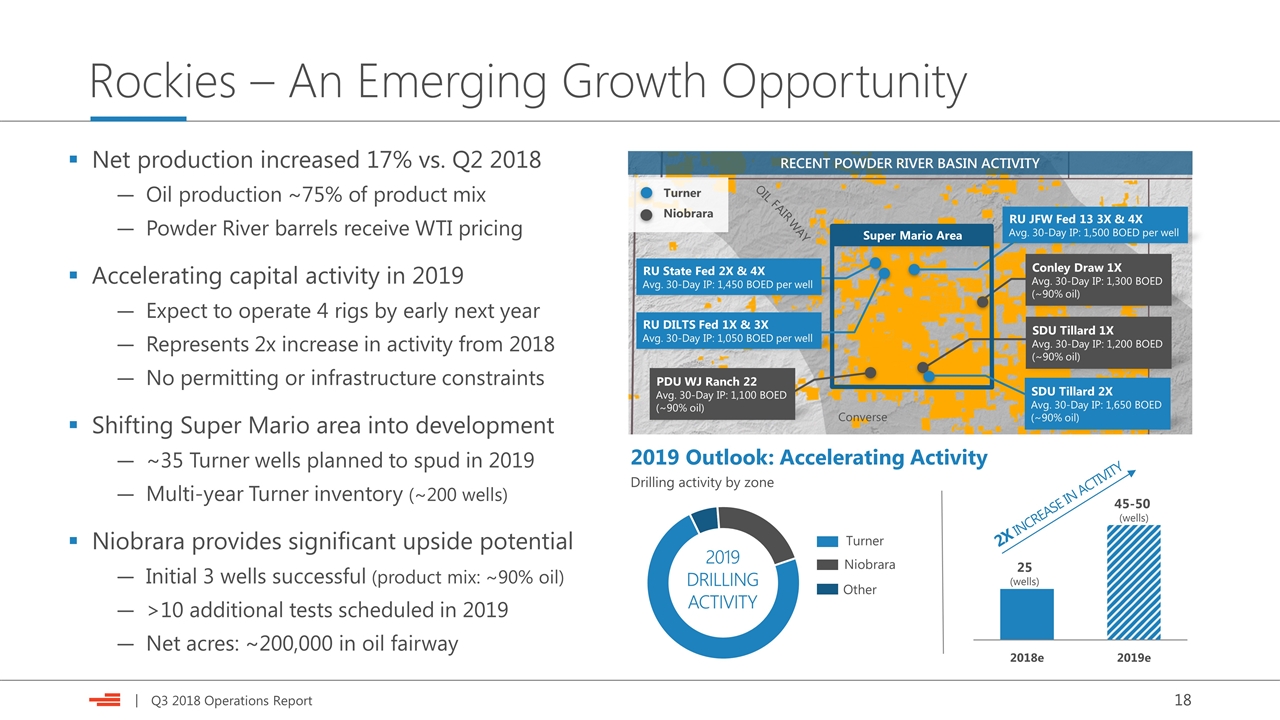

Rockies – An Emerging Growth Opportunity Net production increased 17% vs. Q2 2018 Oil production ~75% of product mix Powder River barrels receive WTI pricing Accelerating capital activity in 2019 Expect to operate 4 rigs by early next year Represents 2x increase in activity from 2018 No permitting or infrastructure constraints Shifting Super Mario area into development ~35 Turner wells planned to spud in 2019 Multi-year Turner inventory (~200 wells) Niobrara provides significant upside potential Initial 3 wells successful (product mix: ~90% oil) >10 additional tests scheduled in 2019 Net acres: ~200,000 in oil fairway 2019 Outlook: Accelerating Activity Drilling activity by zone Niobrara Other 2019 DRILLING ACTIVITY 25 (wells) 45-50 (wells) Turner RECENT POWDER RIVER BASIN ACTIVITY Super Mario Area Turner Niobrara OIL Converse FAIR WAY RU DILTS Fed 1X & 3X Avg. 30-Day IP: 1,050 BOED per well RU JFW Fed 13 3X & 4X Avg. 30-Day IP: 1,500 BOED per well Conley Draw 1X Avg. 30-Day IP: 1,300 BOED (~90% oil) SDU Tillard 1X Avg. 30-Day IP: 1,200 BOED (~90% oil) PDU WJ Ranch 22 Avg. 30-Day IP: 1,100 BOED (~90% oil) RU State Fed 2X & 4X Avg. 30-Day IP: 1,450 BOED per well SDU Tillard 2X Avg. 30-Day IP: 1,650 BOED (~90% oil)

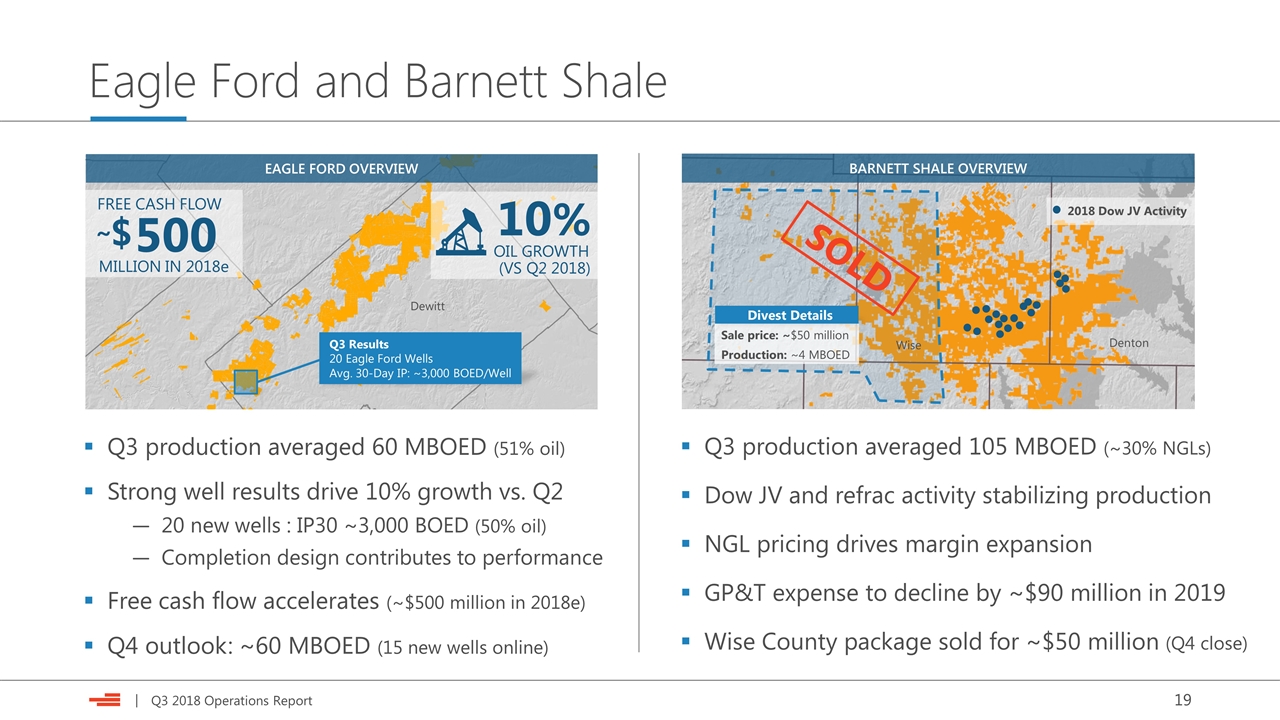

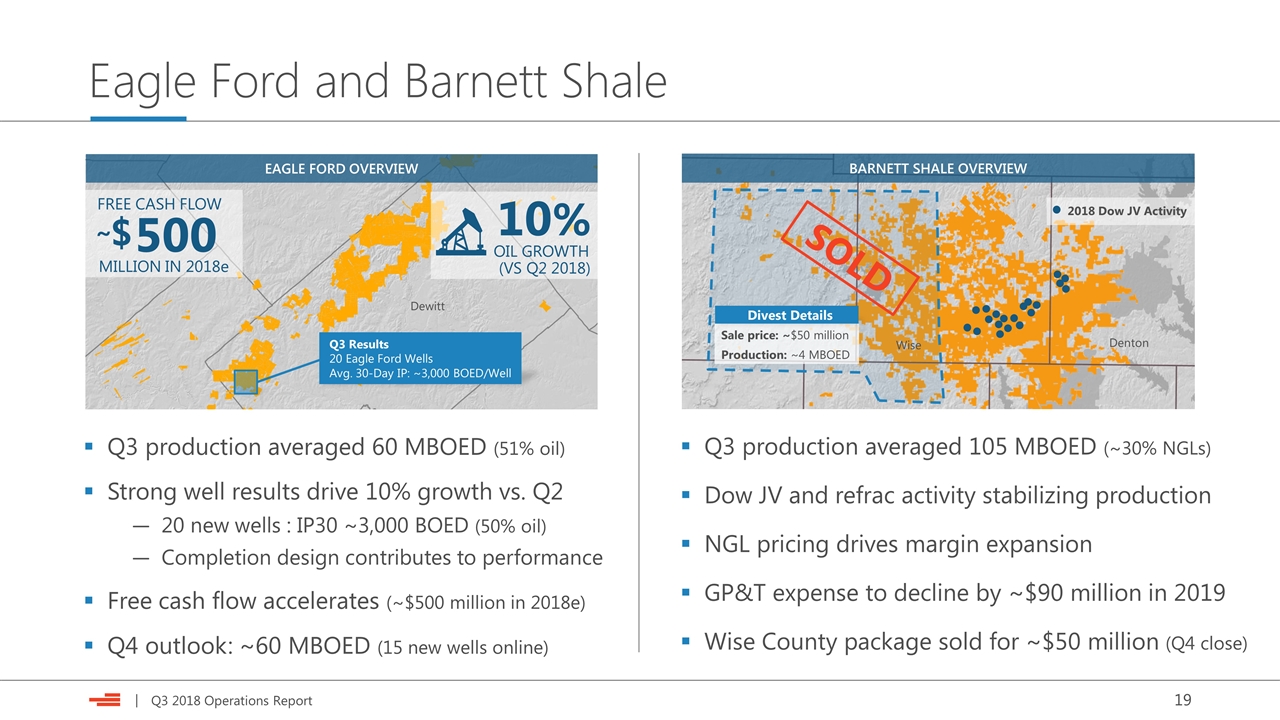

Eagle Ford and Barnett Shale Q3 Results 20 Eagle Ford Wells Avg. 30-Day IP: ~3,000 BOED/Well EAGLE FORD OVERVIEW Q3 production averaged 60 MBOED (51% oil) Strong well results drive 10% growth vs. Q2 20 new wells : IP30 ~3,000 BOED (50% oil) Completion design contributes to performance Free cash flow accelerates (~$500 million in 2018e) Q4 outlook: ~60 MBOED (15 new wells online) BARNETT SHALE OVERVIEW Sale price: ~$50 million Production: ~4 MBOED Denton Wise Dewitt Divest Details 2018 Dow JV Activity FREE CASH FLOW 500 $ Q3 production averaged 105 MBOED (~30% NGLs) Dow JV and refrac activity stabilizing production NGL pricing drives margin expansion GP&T expense to decline by ~$90 million in 2019 Wise County package sold for ~$50 million (Q4 close) MILLION IN 2018e SOLD ~ 10% OIL GROWTH (VS Q2 2018)

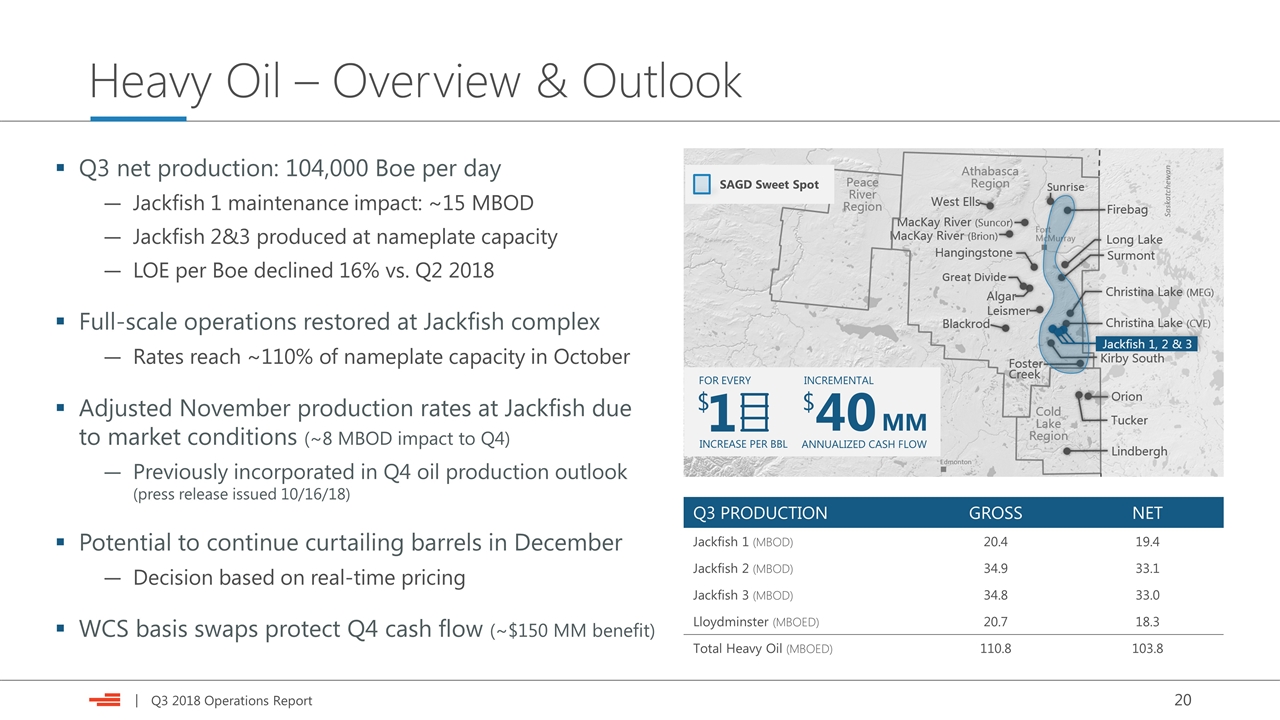

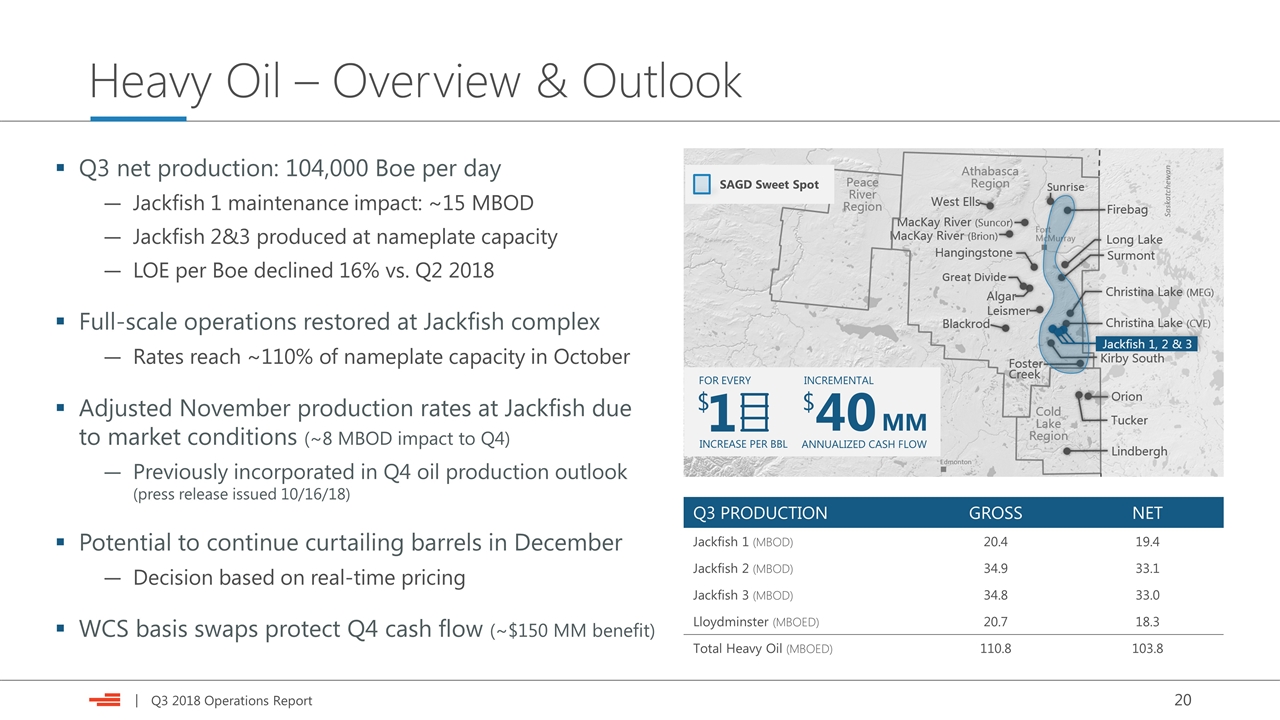

Heavy Oil – Overview & Outlook Q3 net production: 104,000 Boe per day Jackfish 1 maintenance impact: ~15 MBOD Jackfish 2&3 produced at nameplate capacity LOE per Boe declined 16% vs. Q2 2018 Full-scale operations restored at Jackfish complex Rates reach ~110% of nameplate capacity in October Adjusted November production rates at Jackfish due to market conditions (~8 MBOD impact to Q4) Previously incorporated in Q4 oil production outlook (press release issued 10/16/18) Potential to continue curtailing barrels in December Decision based on real-time pricing WCS basis swaps protect Q4 cash flow (~$150 MM benefit) SAGD Sweet Spot 1 $ INCREASE PER BBL FOR EVERY INCREMENTAL 40 MM $ ANNUALIZED CASH FLOW Q3 PRODUCTION GROSS NET Jackfish 1 (MBOD) 20.4 19.4 Jackfish 2 (MBOD) 34.9 33.1 Jackfish 3 (MBOD) 34.8 33.0 Lloydminster (MBOED) 20.7 18.3 Total Heavy Oil (MBOED) 110.8 103.8

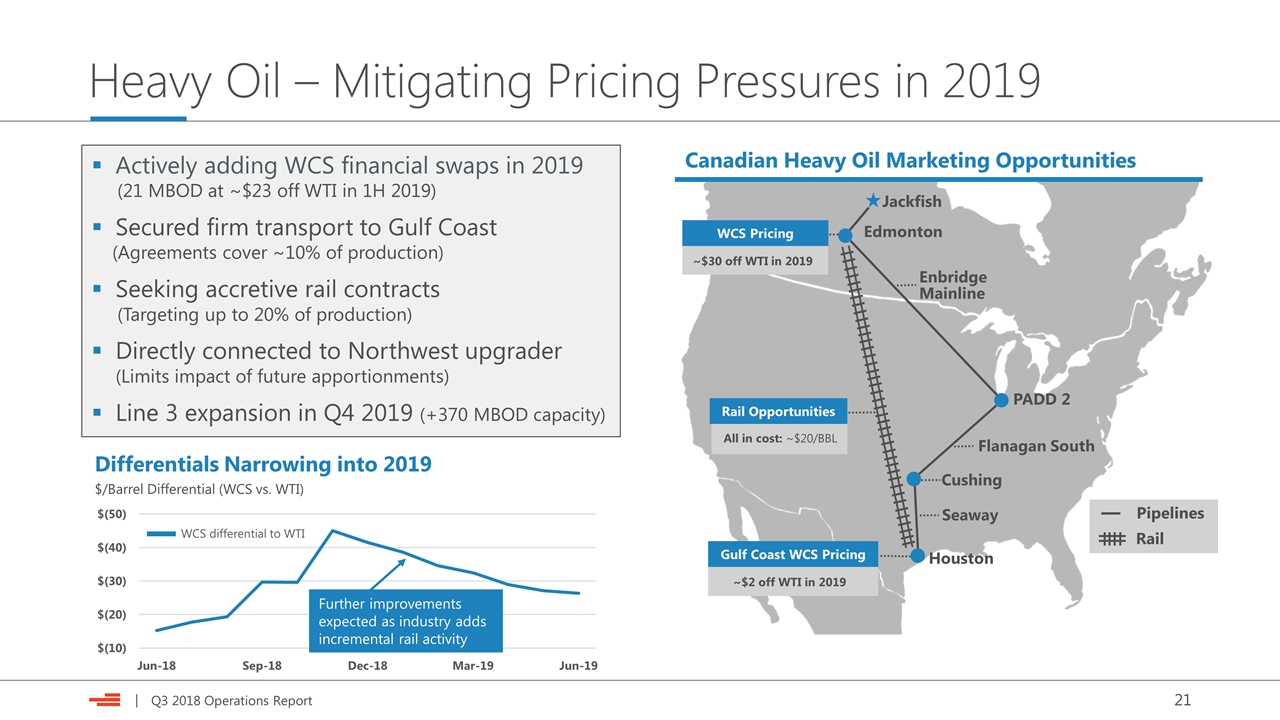

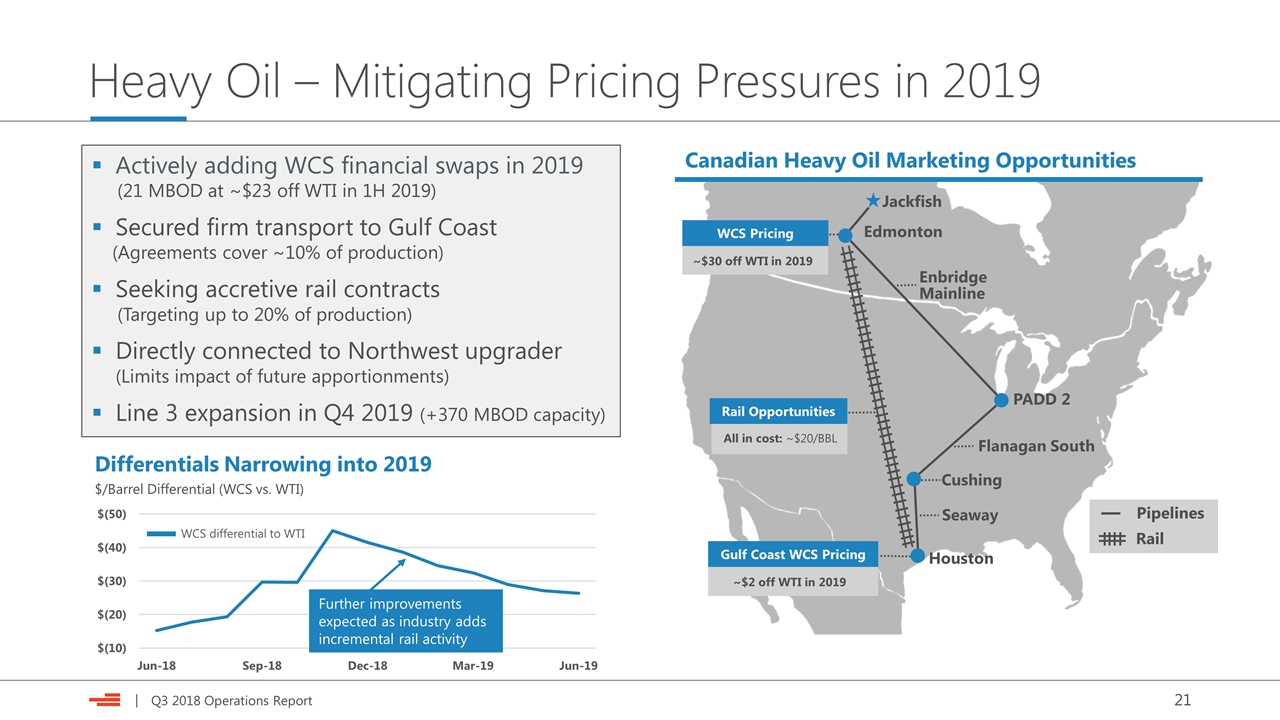

Heavy Oil – Mitigating Pricing Pressures in 2019 Actively adding WCS financial swaps in 2019 (21 MBOD at ~$23 off WTI in 1H 2019) Secured firm transport to Gulf Coast (Agreements cover ~10% of production) Seeking accretive rail contracts (Targeting up to 20% of production) Directly connected to Northwest upgrader (Limits impact of future apportionments) Line 3 expansion in Q4 2019 (+370 MBOD capacity) PADD 2 Houston Edmonton Jackfish Enbridge Mainline Flanagan South ~$30 off WTI in 2019 WCS Pricing Pipelines Rail Seaway Cushing ~$2 off WTI in 2019 Gulf Coast WCS Pricing All in cost: ~$20/BBL Rail Opportunities Canadian Heavy Oil Marketing Opportunities Differentials Narrowing into 2019 $/Barrel Differential (WCS vs. WTI) WCS differential to WTI Further improvements expected as industry adds incremental rail activity

Investor Contacts & Notices Investor Relations Contacts Scott CoodyChris Carr VP, Investor RelationsSupervisor, Investor Relations 405-552-4735405-228-2496 Email: investor.relations@dvn.com Forward-Looking Statements This presentation includes "forward-looking statements" as defined by the Securities and Exchange Commission (the “SEC”). Such statements include those concerning strategic plans, expectations and objectives for future operations, and are often identified by use of the words “expects,” “believes,” “will,” “would,” “could,” “forecasts,” “projections,” “estimates,” “plans,” “expectations,” “targets,” “opportunities,” “potential,” “anticipates,” “outlook” and other similar terminology. All statements, other than statements of historical facts, included in this presentation that address activities, events or developments that the Company expects, believes or anticipates will or may occur in the future are forward-looking statements. Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of the Company. Statements regarding our business and operations are subject to all of the risks and uncertainties normally incident to the exploration for and development and production of oil and gas. These risks include, but are not limited to: the volatility of oil, gas and NGL prices; uncertainties inherent in estimating oil, gas and NGL reserves; the extent to which we are successful in acquiring and discovering Investor Notices additional reserves; the uncertainties, costs and risks involved in oil and gas operations; regulatory restrictions, compliance costs and other risks relating to governmental regulation, including with respect to environmental matters; risks related to our hedging activities; counterparty credit risks; risks relating to our indebtedness; cyberattack risks; our limited control over third parties who operate our oil and gas properties; midstream capacity constraints and potential interruptions in production; the extent to which insurance covers any losses we may experience; competition for leases, materials, people and capital; our ability to successfully complete mergers, acquisitions and divestitures; and any of the other risks and uncertainties identified in our Form 10-K and our other filings with the SEC. Investors are cautioned that any such statements are not guarantees of future performance and that actual results or developments may differ materially from those projected in the forward-looking statements. The forward-looking statements in this presentation are made as of the date of this presentation, even if subsequently made available by Devon on its website or otherwise. Devon does not undertake any obligation to update the forward-looking statements as a result of new information, future events or otherwise. Use of Non-GAAP Information This presentation may include non-GAAP financial measures. Such non-GAAP measures are not alternatives to GAAP measures, and you should not consider these non-GAAP measures in isolation or as a substitute for analysis of our results as reported under GAAP. For additional disclosure regarding such non-GAAP measures, including reconciliations to their most directly comparable GAAP measure, please refer to Devon’s third-quarter 2018 earnings release at www.devonenergy.com. Cautionary Note to Investors The SEC permits oil and gas companies, in their filings with the SEC, to disclose only proved, probable and possible reserves that meet the SEC's definitions for such terms, and price and cost sensitivities for such reserves, and prohibits disclosure of resources that do not constitute such reserves. This presentation may contain certain terms, such as resource potential, potential locations, risked and unrisked locations, estimated ultimate recovery (EUR), exploration target size and other similar terms. These estimates are by their nature more speculative than estimates of proved, probable and possible reserves and accordingly are subject to substantially greater risk of being actually realized. The SEC guidelines strictly prohibit us from including these estimates in filings with the SEC. Investors are urged to consider closely the disclosure in our Form 10-K, available at www.devonenergy.com. You can also obtain this form from the SEC by calling 1-800-SEC-0330 or from the SEC’s website at www.sec.gov.