EXHIBIT 99.1

IIJ Announces Full Year and Fourth Quarter Financial Results for the Fiscal Year Ended March 31, 2010

TOKYO, May 14, 2010 (GLOBE NEWSWIRE) -- Internet Initiative Japan Inc. ("IIJ") (Nasdaq:IIJI) (TSE:3774) today announced its full year ("FY2009") and 4th quarter ("4Q09") consolidated financial results for fiscal year ended March 31, 2010.1

Highlights of Full FY2009 Financial Results

- Revenues were JPY68,006 million ($728.1 million), down 2.5% YoY. While connectivity and outsourcing service grew steadily, systems integration revenue was heavily affected by the decrease in IT related investments in Japan.

- Operating income was JPY3,412 million ($36.5 million), up 16.9% YoY, mainly due to the increase in connectivity and outsourcing service gross margin and the decrease in administrative expenses. Operating loss related to the ATM operation business was JPY1,000 million ($10.7 million).

- Net income attributable to IIJ2 was JPY2,234 million ($23.9 million), up 57.4% YoY.

- FY2009 year-end cash dividend forecast was revised from JPY1,000 to JPY1,250 per share of common stock (FY2009 total dividend of JPY2,250, up from JPY2,000 as previously planned).

Highlights of Fourth Quarter FY2009 Financial Results

- Revenues were JPY19,694 million ($210.9 million), up 4.0% YoY. Systems construction revenues increased due to seasonal factors and outsourcing service continuously increased YoY, respectively.

- Operating income was JPY1,404 million ($15.0 million), up 30.9% YoY, mainly due to the increase in SI gross margin and the decrease in administrative expenses.

- Net income attributable to IIJ was JPY1,101 million ($11.8 million), up 3.4% YoY.

Financial Targets for FY2010

- IIJ targets revenues of JPY71.0 billion, operating income of JPY4.3 billion, income before income tax expense (benefit)2 of JPY3.7 billion and net income attributable to IIJ of JPY2.6 billion for FY2010.

- IIJ targets cash dividend of JPY2,500 per share of common stock for FY2010 (JPY1,250 for interim-period cash dividend and JPY1,250 for fiscal year-end cash dividend)

| 1 Unless otherwise stated, all financial figures discussed in this announcement are prepared in accordance with U.S. GAAP. All financial figures are unaudited and consolidated. The translation of Japanese yen into U.S. dollars is solely for the convenience of readers outside of Japan. The rate used for the translation was JPY93.40 per US$1.00, which was the noon buying rate on March 31, 2010. | |||||||||||

| 2 Effective April 1, 2009, we have adopted ASC810, "Consolidations". | |||||||||||

Overview of Full FY2009 Financial Results and Business Outlook

"It has been truly a tough year for us with the drop in Japanese IT investments heavily affecting our revenue," said Koichi Suzuki, President and CEO of IIJ. "Yet, amid the tough economic situation, we have exceeded our full year profit target," continued Suzuki.

"Recurring revenue steadily increased YoY followed by the continuous demands for outsourcing services for cost reduction purposes. The increase in contracted number of over Gbps connectivity is also a supporting fact that demands for higher bandwidth connectivity remains. Additionally, our continuous effort for cost reduction has resulted in the improvement in profitability. Accordingly, despite the weak Japanese economy, our profit exceeded our full year target. We have also raised our FY2009 year-end cash dividend to JPY1,250 from JPY1,000 per share of common stock in response to our business results.

"We have also made achievements in the Group business strategy. We've merged two of our 100% consolidated subsidiary, which mainly provides SI, on April 1, 2010 to operate the Group more efficiently as well as to seize opportunities to further enhance our business in the IT service market. This merger will allow us to combine and strengthen our network service and SI business structure.

"As for our FY2010 business environment, although how strongly the SI revenues will return is still uncertain, we are seeing signs of recovery in systems construction along with the slow but recovering economy. We believe Japanese companies have been refraining from IT investment for more than enough time and that they will eventually need to start investing in order for them to maintain competitiveness. Our new cloud computing service "IIJ GIO" is also starting up well and are expected to contribute to revenue in the coming fiscal year. And of course, demands for higher bandwidth connectivity and outsourcing services remain. There are positive factors for our future business outlook.

"For our ATM operation business, it is currently in its starting-up phase. We are propelling to start-up a business, similar to Seven Bank's ATM operation business, and we target to reach break even at some point during the later half of FY2010."

Full FY2009 Financial Results Summary

| Operating Results Summary | ||||||

| FY2008 | FY2009 | YoY % change | ||||

| JPY millions | JPY millions | |||||

| Total Revenues | 69,731 | 68,006 | (2.5%) | |||

| Connectivity and Outsourcing Services | 35,076 | 36,972 | 5.4% | |||

| SI | 33,647 | 30,071 | (10.6%) | |||

| Equipment Sales | 985 | 756 | (23.2%) | |||

| ATM Operation Business | 23 | 207 | 781.2% | |||

| Total Costs | 56,146 | 54,050 | (3.7%) | |||

| Connectivity and Outsourcing Services | 29,318 | 30,533 | 4.1% | |||

| SI | 25,543 | 21,904 | (14.2%) | |||

| Equipment Sales | 863 | 649 | (24.8%) | |||

| ATM Operation Business | 422 | 964 | 128.2% | |||

| SG&A Expenses and R&D | 10,668 | 10,544 | (1.2%) | |||

| Operating Income | 2,917 | 3,412 | 16.9% | |||

| Income before Income Tax Expense | 2,034 | 2,859 | 40.5% | |||

| Net income attributable to IIJ | 1,419 | 2,234 | 57.4% | |||

| Segment Summary | ||||

| FY2008 | FY2009 | |||

| JPY millions | JPY millions | |||

| Net Revenues | 69,731 | 68,006 | ||

| Network services and SI business | 69,961 | 68,228 | ||

| ATM operation business | 23 | 207 | ||

| Elimination | 253 | 429 | ||

| Operating Income (Loss) | 2,917 | 3,412 | ||

| Network service and SI business | 3,663 | 4,435 | ||

| ATM operation business | (705) | (1,001) | ||

| Elimination | 41 | 22 | ||

We have omitted segment analysis because most of our revenues are dominated by Network services and systems integration business.

Full FY2009 Financial Results

Revenues

Revenues were JPY68,006 million, down 2.5% YoY.

Connectivity and Outsourcing Services revenue were JPY36,972 million, up 5.4% YoY. Connectivity service for corporate use increased by 5.4% YoY. While over 1Gbps IP reached 125 contracts at the end of FY2009 driven by demands for higher bandwidth, revenues for IP connectivity service slightly decreased YoY as a result of the decrease in volume charge revenue in 4Q09. For IIJ Mobile service, it steadily increased throughout the year contributing to total revenue, increasing by 120.9% YoY.

For connectivity service for home use, revenue increased by 4.8% YoY. The shift from ADSL to optical fiber and the increase in mobile data communication service contributed to the total growth.

For outsourcing services, each service line-ups, such as "IIJ SecureMX Service" of email related services and "IIJ Secure Web Gateway Service", increased steadily contributing to the 5.7% YoY growth in outsourcing service revenues. "IIJ Secure Web Gateway Service" prevents virus infection through a web browser and also prevents information leakage.

Contracts for mobile data communication service reached over 40,000 contracts compared to approximately 23,000 contracts as of March 2009.

SI revenues were JPY30,071 million, down 10.6% YoY. Heavily affected by the weak Japanese economy, systems construction revenues decreased by 22.5% YoY to JPY11,354 million. Systems operation and maintenance revenues decreased by 1.4% YoY to JPY18,717 million affected by cost down pressure from large accounts and by the decrease in numbers of new engagements for systems construction.

The order backlog for systems construction and equipment sales was JPY3,164 million, up 10.5% YoY and order backlog for systems operation and maintenance was JPY10,395 million, down 13.4% YoY as of March 31, 2010, respectively.

Equipment sales revenues were JPY756 million, down 23.2% YoY.

ATM Operation Business revenues were JPY207 million compared to JPY23 million in FY2008.

Cost and expense

Cost of revenues was JPY54,050 million, down 3.7% YoY.

Cost of Connectivity and Outsourcing Services revenue was JPY30,533 million, up 4.1% YoY as outsourcing related costs, network operation related costs and personnel related costs increased, respectively along with the increase in revenue. Backbone cost was JPY3,699 million, up 0.2% YoY. Gross margin was JPY6,439 million, up 11.8% YoY and gross margin ratio was 17.4%, up 1.0% YoY.

Cost of SI revenues was JPY21,904 million, down 14.2% YoY. Outsourcing related costs largely decreased as a result of reduction of full-time outsourcing personnel. Purchasing cost also decreased along with the decrease in systems construction revenues. Gross margin was JPY8,167 million, up 0.8% YoY and gross margin ratio was 27.2%, up 3.1% YoY.

Cost of Equipment Sales revenues was JPY649 million, down 24.8% YoY.

Cost of ATM Operation Business revenues was JPY964 million compared to JPY422 million in FY2008.

| Number of Contracts for Connectivity Services | ||||||

| as of March 31, 2009 | as of March 31, 2010 | YoY Change | ||||

| Connectivity Services (Corporate Use) | 48,802 | 63,998 | 15,196 | |||

| IP Service (-99Mbps) | 938 | 926 | (12) | |||

| IP Service (100Mbps-999Mbps) | 225 | 254 | 29 | |||

| IP Service (1Gbps--) | 94 | 125 | 31 | |||

| IIJ Data Center Connectivity Service | 298 | 315 | 17 | |||

| IIJ FiberAccess/F and IIJ DSL/F | 26,023 | 28,663 | 2,640 | |||

| IIJ Mobile Service3 4 | 19,698 | 32,315 | 12,617 | |||

| Others | 1,526 | 1,400 | (126) | |||

| Connectivity Services (Home Use) | 443,412 | 400,667 | (42,745) | |||

| Under IIJ Brand | 46,901 | 46,900 | (1) | |||

| hi-ho | 179,786 | 168,223 | (11,563) | |||

| OEM | 216,725 | 185,544 | (31,181) | |||

| Total Contracted Bandwidth | 530.5 Gbps | 650.4 Gbps | 119.9 Gbps | |||

| Connectivity and Outsourcing Services Revenues Breakdown | ||||||

| FY2008 | FY2009 | YoY % change | ||||

| JPY millions | JPY millions | |||||

| Connectivity Service (Corporate Use) | 13,142 | 13,847 | 5.4% | |||

| IP Service5 | 9,275 | 9,214 | (0.7%) | |||

| IIJ FiberAccess/F and IIJ DSL/F | 2,894 | 2,948 | 1.8% | |||

| IIJ Mobile Service6 | 631 | 1,395 | 120.9% | |||

| Others | 342 | 290 | (15.1%) | |||

| Connectivity Service (Home Use) | 6,538 | 6,854 | 4.8% | |||

| Under IIJ Brand | 1,009 | 1,034 | 2.5% | |||

| hi-ho | 4,971 | 5,254 | 5.7% | |||

| OEM | 558 | 566 | 1.4% | |||

| Outsourcing Services | 15,396 | 16,271 | 5.7% | |||

| Total Connectivity and Outsourcing Services | 35,076 | 36,972 | 5.4% | |||

| 3 Contracts of IIJ Mobile Service are of mobile data communication service for corporate use. | |||||||||||

| 4 The contract number of IIJ Mobile Service as of December 2009 (35,357 contracts, announced on February 12, 2010) were miscalculated by including the contract number for mobile data communication service for home use. The correct contract number of IIJ Mobile Service as of December 2009 is 29,209 contracts. | |||||||||||

| 5 IP Service revenues include revenues from the Data Center Connectivity Service. | |||||||||||

| 6 Revenue from mobile data communication service for home use is included in Connectivity service (home use). |

SG&A Expenses and R&D

Sales and marketing expenses were JPY5,405 million, up 16.7% YoY. There were increase in personnel related expenses and depreciation related to the new back-office system which began its operation during FY2009.

General and administrative expenses were JPY4,826 million, down 14.2% YoY, largely due to the decrease of outsourcing related expenses and general expenses as a result of tight cost control.

Research and development expenses were JPY313 million, down 24.6% YoY.

Operating income

Operating income was JPY3,412 million, up 16.9% YoY. While operating loss related to the ATM operation business increased, gross margin of connectivity and outsourcing service increased and general and administrative expenses decreased.

Other income (expenses)

Other income (expenses) was net other expenses of JPY553 million compared to net other expenses of JPY883 million in FY2008 as impairment losses on equity securities and interest expense decreased compared to FY2008.

Income before income tax expenses

Income before income tax expenses was JPY2,859 million, up 40.5% YoY.

Net Income

Income tax expense was JPY1,132 million compared to JPY1,003 million in FY2008. Deferred tax expenses was JPY756 million compared to JPY637 million in FY2008.

Equity in net income of equity method investees was JPY159 million compared to JPY35 million in FY2008.

Net income was JPY1,886 million, up 76.8% YoY.

Net income attributable to IIJ

Net loss attributable to noncontrolling interests was JPY348 million compared to JPY352 million in FY2008, both related to GDX Japan Inc. and Trust Networks Inc.

Net income attributable to IIJ was JPY2,234 million, up 57.4% YoY.

Full FY2009 Financial Condition

Balance Sheets

As of March 31, 2010, the balance of total assets was JPY51,115 million, a decrease of JPY1,186 million from the balance as of March 31, 2009.

For current assets, as compared to each of the respective balances as of March 31, 2009, cash and cash equivalents decreased by JPY1,423 million and accounts receivables increased by JPY1,140 million. As for current liabilities, as compared to each of the respective balances as of March 31, 2009, short-term borrowings decreased by JPY2,900 million, accounts payable increased by JPY903 million and current capital lease obligations decreased by JPY543 million. Noncurrent capital lease obligations decreased by JPY1,208 million.

The balance of other investments as of March 31, 2010 was JPY2,582 million, an increase of JPY667 million from the balance as of March 31, 2009. The breakdown of other investments were JPY1,447 million in nonmarketable equity securities, JPY867 million in available-for-sale securities and JPY268 million in other.

As of March 31, 2010, the balance of non-amortized intangible assets (excluding telephone rights) such as goodwill was JPY2,831 million and the balance of amortized intangible assets was JPY2,618 million. The breakdown of non-amortized intangible assets were JPY2,639 million in goodwill and JPY192 million in trademark. The breakdown of amortized intangible assets were JPY2,520 million in customer relationships and JPY98 million in licenses.

Total IIJ shareholders' equity as of March 31, 2010 was JPY27,320 million, an increase of JPY2,150 million from the balance as of March 31, 2009. IIJ Shareholders' equity ratio (IIJ shareholders' equity/total assets) as of March 31, 2010 was 53.4%, up 5.3 points compared to March 31, 2009.

Cash Flows

Cash and cash equivalents as of March 31, 2010 were JPY8,764 million compared to JPY10,188 million as of March 31, 2009.

Net cash provided by operating activities for FY2009 was JPY9,621 million compared to net cash provided by operating activities of JPY8,631 million for FY2008. While operating income increased mainly due to the increase in gross margin from connectivity and outsourcing service and the decrease in general and administrative expenses, there were changes in operating assets and liabilities during FY2009. The changes in operating assets and liabilities mainly resulted from the increase in accounts receivables of JPY1,179 million (decrease of JPY1,947 million for FY2008), decrease in inventories and prepaid expenses of JPY486 million (decrease of JPY467 million for FY2008) and increase in accounts payable of JPY809 million (decrease of JPY2,005 million for FY2008).

Net cash used in investing activities for FY2009 was JPY3,788 million compared to net cash used in investing activities of JPY3,328 million for FY2008, mainly due to payment of JPY3,254 million for the purchase of property and equipment (payment of JPY2,991 million for FY2008) and the purchase of other investments of JPY875 million (purchase of JPY175 million for FY2008).

Net cash used in financing activities for FY2009 was JPY7,238 million compared to net cash used in financing activities of JPY6,573 million for FY2008, mainly due to principal payments under capital leases of JPY4,083 million (payment of JPY3,954 million for FY2008), net repayment of short-term borrowings of JPY2,900 million (net repayment of JPY1,800 million for FY2008) and payments of JPY405 million for FY2008 year-end dividends and FY2009 interim period dividends.

Reconciliation of Non-GAAP Financial Measures

The following table summarizes the reconciliation of adjusted EBITDA to net income attributable to IIJ in our consolidated statements of income that are prepared in accordance with U.S. GAAP.

| Adjusted EBITDA | ||||

| FY2008 | FY2009 | |||

| JPY millions | JPY millions | |||

| Adjusted EBITDA | 8,348 | 8,718 | ||

| Depreciation and Amortization 7 | (5,431) | (5,306) | ||

| Operating Income | 2,917 | 3,412 | ||

| Other Income (Expense) | (883) | (553) | ||

| Income Tax Expense | 1,003 | 1,132 | ||

| Equity in Net Income of Equity Method Investees | 35 | 159 | ||

| Net income | 1,067 | 1,886 | ||

| Net loss attributable to noncontrolling interests | 352 | 348 | ||

| Net Income attributable to IIJ | 1,419 | 2,234 | ||

| CAPEX | ||||

| FY2008 | FY2009 | |||

| JPY millions | JPY millions | |||

| CAPEX, including capital leases | 7,006 | 5,584 | ||

| Acquisition of Assets by Entering into Capital Leases | 4,015 | 2,330 | ||

| Purchase of Property and Equipment | 2,991 | 3,254 | ||

| 7 Depreciation and amortization includes impairment loss on other intangible assets. (See IIJ's consolidated financial statements for details). |

FY2010 Financial Targets (announced on May 14, 2010)

Our targets for the fiscal year ending March 31, 2011 are as follows:

| (JPY in millions) | ||||

| Revenues | Operating Income | Income before Income Tax Expense (Benefit) | Net Income attributable to IIJ | |

| 1H FY2010 | 32,300 | 1,200 | 1,100 | 800 |

| Full FY2010 | 71,000 | 4,300 | 3,700 | 2,600 |

We target revenue of JPY71,000 million (up 4.4% YoY), operating income of JPY4,300 million (up 26.0% YoY), income before income tax expense (benefit) of JPY3,700 million (up 29.4% YoY) and net income attributable to IIJ of JPY2,600 million (up 16.4% YoY) for the full FY2010 financial targets.

We expect our connectivity and outsourcing service revenues, a recurring revenue, to continue to increase steadily along with its ordinary course of growth. As for the systems integration, while demands are expected to increase, the full recover of IT investments are still uncertain, and because the order backlog for systems operation and maintenance as of March 2010 decreased by JPY1,613 million YoY as a result of a size-down in a certain contracted account, we expect systems integration revenue to decrease compared to FY2009. As for the ATM operation business which is in its business start-up phase, while we target to reach break even at some point during the later half of FY2010, we expect operating loss of around JPY400 million related to this business for FY2010.

Presentation

Presentation Materials will be posted on our web site (http://www.iij.ad.jp/en/IR/) on May 14, 2010.

About Internet Initiative Japan Inc.

Founded in 1992, IIJ is one of Japan's leading Internet-access and comprehensive network solutions providers. IIJ and its group of companies provide total network solutions that mainly cater to high-end corporate customers. IIJ's services include high-quality systems integration and security services, Internet access, hosting/housing, and content design. Moreover, IIJ has built one of the largest Internet backbone networks in Japan, and between Japan and the United States. IIJ was listed on the U.S. NASDAQ Stock Market in 1999 and on the First Section of the Tokyo Stock Exchange in 2006.

The Internet Initiative Japan Inc. logo is available at http://www.globenewswire.com/newsroom/prs/?pkgid=4613

Statements made in this press release regarding IIJ's or management's intentions, beliefs, expectations, or predictions for the future are forward-looking statements that are based on IIJ's and managements' current expectations, assumptions, estimates and projections about its business and the industry. These forward-looking statements, such as statements regarding FY2008 revenues and operating and net profitability, are subject to various risks, uncertainties and other factors that could cause IIJ's actual results to differ materially from those contained in any forward-looking statement. These risks, uncertainties and other factors include: IIJ's ability to maintain and increase revenues from higher-margin services such as systems integration and outsourcing services; the possibility that revenues from connectivity services may decline substantially as a result of competition and other factors; the ability to compete in a rapidly evolving and competitive marketplace; the impact on IIJ's profits of fluctuations in costs such as backbone costs and subcontractor costs; the impact on IIJ's profits of fluctuations in the price of available-for-sale securities; the impact of technological changes in its industry; IIJ's ability to raise additional capital to cover its indebtedness; the possibility that NTT, IIJ's largest shareholder, may decide to exercise substantial influence over IIJ; and other risks referred to from time to time in IIJ's filings on Form 20-F of its annual report and other filings with the United States Securities and Exchange Commission.

| - | Risk from effects on the IIJ Group’s business developments by a lack of improvement of Japan’s economy, or a change in economic conditions |

| - | Risk from the IIJ Group’s dependence on other companies for telecommunication circuits, hardware components like routers and facilities such as data centers. |

| - | Risk from the IIJ Group’s failure to maintain its quality of service and operate its services properly |

| - | Risk from the possibility of an interruption of services of the IIJ Group |

| - | Risk of the IIJ Group’s failure to keep and manage its private customer information, such as personal information |

| - | Risk due to the IIJ Group’s failure to keep up with technological developments or the necessity of vast financial resources |

| - | Risk from the effects on the IIJ Group’s results of operations and financial position by increased price competition |

| - | Risk associated from the fluctuation in network rerated costs, such as cost for backbone circuit, cost for leased hardware components, cost for network facilities such as network operation centers and personnel rerated cost. |

| - | Risk affected by the failure to manage and control outsourcing costs |

| - | Risk of less achievement in business developments than expected, due to the IIJ Group’s failure to differentiate itself from its competitors |

| - | Risk of the IIJ Group’s failure to attract and control its human resources properly |

| - | Risk associated with not being able to maintain or enhance the value or performance of IIJ Group companies, and develop new businesses operated by newly established subsidiaries. |

| - | Risk arising from Nippon Telegraph and Telephone Corporation (“NTT”), our largest shareholder |

| - | Risk of failing to achieve expected revenues and profits in the future |

| - | Risk from the IIJ Group’s results of operations and financial position being affected by seasonal fluctuations especially in SI and equipment sales (revenues and income tend to increase in the fourth quarter of each fiscal year) |

| - | Risk arising from SI business due to the failing to control projects, outsourcing cost or human resources to be needed. |

| - | Risk from the impact on the IIJ Group’s results of operations and financial position by fluctuations in the stock values of companies in which it has invested |

| - | Risk it may have on IIJ Group’s results of operations and financial position by conducting M&A to pursue business expansion |

| - | Risk it may have on IIJ Group’s results of operations and financial position by recording impairment losses on its non-amortizable intangible assets |

| - | Risk from the impact on the IIJ Group’s results of operation by fluctuations in its net income affected by income tax effects |

| - | Risk associated with regulatory matters and new legislation related to the telecommunications |

| - | Risk associated with legal regulations regarding the Internet |

| - | Risk of the IIJ Group’s violation of intellectual property rights of other parties |

| - | Risk of being named as defendants in litigation |

| - | Risk of not being able to secure enough funds for the future or to finance in favorable conditions |

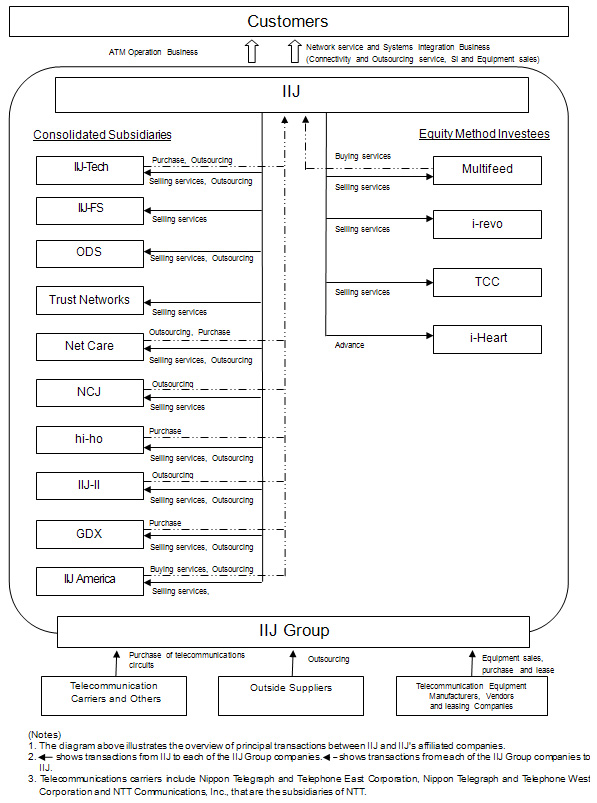

| Company name | Overview of business |

| IIJ | IIJ provides internet connectivity services, outsourcing services, systems construction, systems operation and maintenance and equipment sales as classified in its consolidated financial statements. |

| Nine consolidated subsidiaries | |

| IIJ Technology Inc. ("IIJ-Tech") | IIJ-Tech mainly provides systems design, consultation, development, construction, operation and maintenance, and supply of equipment and its operation and maintenance for the construction of systems. IIJ-Tech provides services classified into SI and equipment sales in IIJ's consolidated financial statements. |

| IIJ Financial Systems, Inc. ("IIJ-FS") | IIJ-FS mainly provides the development, operation and maintenance of systems for financial institutions. IIJ-FS provides services classified into SI in IIJ's consolidated financial statements. |

| Trust Networks Inc. (“Trust Networks”) | Operates and provides ATMs service. Trust Networks provides services classified into ATM operation business in IIJ's consolidated financial statements. |

| Net Care, Inc. ("Net Care") | Net Care mainly provides the monitoring and operation of networks and outsourced customer support and call centers. Net Care provides services classified connectivity and outsourcing services and SI in IIJ's consolidated financial statements. |

| Net Chart Japan Inc. (“NCJ”) | NCJ mainly provides network construction services, primarily for LANs, such as network installation wiring, installation and set-up of equipment, installation of applications, and operational support. NCJ provides services classified into SI in IIJ's consolidated financial statements. |

| hi-ho Inc. (“hi-ho”) | hi-ho mainly provides Internet services to personal users and Internet solutions to corporate users. hi-ho provides services classified into connectivity and outsourcing services in IIJ’s consolidated financial statements. |

| IIJ Innovation Institute Inc. ("IIJ-II") | IIJ-II engages in research and development of Internet-related basic technology development and its business incubation and provides services classified into connectivity and outsourcing services in IIJ's consolidated financial statements. |

| GDX Japan Inc. (“GDX”) | GDX mainly provides message exchange network services. GDX provides services classified into connectivity and outsourcing services in IIJ’s consolidated financial statements. |

| IIJ America Inc. ("IIJ America") | IIJ America mainly provides Internet connectivity services in the United States and constructs and operates an Internet backbone in the United States as the IIJ Group's presence in the United States. IIJ America provides services classified into connectivity and outsourcing services in IIJ's consolidated financial statements. |

| Four equity method investees | |

| Internet Multifeed Co. ("Multifeed") | Multifeed was established as a joint venture with the NTT Group and mainly operates Internet exchange, distributes high-volume Internet content, and provides housing services. |

| Internet Revolution Inc. ("i-revo") | i-revo is a consolidated subsidiary of Konami Corporation and mainly operates Internet portals. |

| Taihei Computer Co., Ltd. (“TCC”) | TCC is a consolidated subsidiary of Hirata Corporation and develops, construct, sell and operate customer loyalty reward program systems. |

| i-Heart Inc. ("i-Heart") | i-Heart was established as a joint venture with Korean companies in South Korea and provides data center services in South Korea. |

| ・ | In addition to the above, NTT is IIJ’s other affiliated company. |

| ・ | As announced on February 4, 2010, we have merged our 100% consolidated subsidiary, IIJ-Tech on April 1, 2010. On April 1, 2010, IIJ-Tech has merged its 100% consolidated subsidiary, IIJ-FS. |

| Internet Initiative Japan Inc. | |||||

| Consolidated Balance Sheets (Unaudited) | |||||

| (As of March 31, 2009 and March 31, 2010) | |||||

| As of March 31, 2009 | As of March 31, 2010 | ||||

| Thousands of JPY | % | Thousands of U.S. Dollars | Thousands of JPY | % | |

| ASSETS | |||||

| CURRENT ASSETS: | |||||

| Cash and cash equivalents | 10,187,724 | 93,838 | 8,764,415 | ||

| Accounts receivable, net of allowance for doubtful accounts of JPY 22,072 thousand and JPY 37,178 thousand at March 31, 2009 and March 31, 2010, respectively | 10,256,527 | 122,019 | 11,396,597 | ||

| Inventories | 529,756 | 8,649 | 807,803 | ||

| Prepaid expenses | 1,771,955 | 17,056 | 1,593,000 | ||

| Deferred tax assets —Current | 762,221 | 16,817 | 1,570,746 | ||

| Other current assets, net of allowance for doubtful accounts of JPY 11,720 thousand and JPY 720 thousand at March 31, 2009 and March 31, 2010, respectively | 848,586 | 8,159 | 762,081 | ||

| Total current assets | 24,356,769 | 46.6 | 266,538 | 24,894,642 | 48.7 |

| INVESTMENTS IN EQUITY METHOD INVESTEES | 947,626 | 1.8 | 12,113 | 1,131,354 | 2.2 |

| OTHER INVESTMENTS | 1,914,594 | 3.7 | 27,640 | 2,581,610 | 5.1 |

| PROPERTY AND EQUIPMENT, net of accumulated depreciation and amortization of JPY 16,444,517 thousand and JPY 17,653,271 thousand at March 31, 2009 and March 31, 2010, respectively | 13,172,891 | 25.2 | 138,867 | 12,970,152 | 25.4 |

| GOODWILL | 2,639,319 | 5.0 | 28,258 | 2,639,319 | 5.2 |

| OTHER INTANGIBLE ASSETS —Net | 3,201,806 | 6.1 | 30,184 | 2,819,187 | 5.5 |

| GUARANTEE DEPOSITS | 2,072,652 | 4.0 | 21,455 | 2,003,862 | 3.9 |

| Deferred tax assets —Noncurrent | 2,253,464 | 4.3 | 7,338 | 685,370 | 1.3 |

| OTHER ASSETS, net of allowance for doubtful accounts of JPY72,800 thousand and JPY91,319 thousand at March 31, 2009 and March 31, 2010, respectively, and net of loan loss valuation allowance of JPY 16,701thousand at March 31, 2009 and March 31 2010, respectively | 1,742,078 | 3.3 | 14,882 | 1,389,954 | 2.7 |

| TOTAL | 52,301,199 | 100.0 | 547,275 | 51,115,450 | 100.0 |

| As of March 31, 2009 | As of March 31, 2010 | ||||

| Thousands of JPY | % | Thousands of U.S. Dollars | Thousands of JPY | % | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | |||||

| CURRENT LIABILITIES: | |||||

| Short-term borrowings | 7,350,000 | 47,644 | 4,450,000 | ||

| Capital lease obligations —current portion | 3,272,257 | 29,226 | 2,729,673 | ||

| Accounts payable | 6,064,829 | 74,600 | 6,967,654 | ||

| Accrued expenses | 1,069,310 | 12,682 | 1,184,483 | ||

| Accrued retirement and pension costs —current | 11,959 | 156 | 14,539 | ||

| Deferred income | 1,255,749 | 15,473 | 1,445,174 | ||

| Other current liabilities | 763,544 | 9,875 | 922,345 | ||

| Total current liabilities | 19,787,648 | 37.8 | 189,656 | 17,713,868 | 34.7 |

| CAPITAL LEASE OBLIGATIONS —Noncurrent | 4,866,120 | 9.3 | 39,161 | 3,657,657 | 7.2 |

| ACCRUED RETIREMENT AND PENSION COSTS —Noncurrent | 1,399,592 | 2.7 | 13,941 | 1,302,054 | 2.5 |

| OTHER NONCURRENT LIABILITIES | 1,004,920 | 1.9 | 11,544 | 1,078,168 | 2.1 |

| Total Liabilities | 27,058,280 | 51.7 | 254,302 | 23,751,747 | 46.5 |

| COMMITMENTS AND CONTINGENCIES | |||||

| SHAREHOLDERS' EQUITY: | |||||

| Common-stock—authorized, 377,600 shares; issued and outstanding, 206,478 shares at March 31, 2009 and March 31, 2010 | 16,833,847 | 32.2 | 180,234 | 16,833,847 | 32.9 |

| Additional paid-in capital | 27,611,737 | 52.8 | 293,829 | 27,443,600 | 53.7 |

| Accumulated deficit | (18,549,142) | (35.5) | (179,016) | (16,720,092) | (32.7) |

| Accumulated other comprehensive income (loss) | (320,711) | (0.6) | 1,807 | 168,769 | 0.3 |

| Treasury stock—3,934 shares held by the company at March 31, 2009 and March 31, 2010 | (406,547) | (0.8) | (4,353) | (406,547) | (0.8) |

| Total Internet Initiative Japan Inc. shareholders' equity | 25,169,184 | 48.1 | 292,501 | 27,319,577 | 53.4 |

| NONCONTROLLING INTERESTS | 73,735 | 0.2 | 472 | 44,126 | 0.1 |

| Total equity | 25,242,919 | 48.3 | 292,973 | 27,363,703 | 53.5 |

| TOTAL | 52,301,199 | 100.0 | 547,275 | 51,115,450 | 100.0 |

| (Note1) The U.S. dollar amounts represent translations of yen amounts at the rate of JPY 93.40 which was the noon buying rate in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York prevailing as of March 31, 2010. | |||||

| (Note 2) The above presentation as of March 31, 2009 has been changed to conform to the presentation as of March 31, 2010. | |||||

| Internet Initiative Japan Inc. | |||||

| Consolidated Statements of Income (Unaudited) | |||||

| (For the fiscal year ended March 31, 2009 and March 31, 2010) | |||||

| Fiscal Year Ended March 31, 2009 | Fiscal Year Ended March 31, 2010 | ||||

| Thousands of JPY | % of total revenues | Thousands of U.S. Dollars | Thousands of JPY | % of total revenues | |

| REVENUES: | |||||

| Connectivity and outsourcing services: | |||||

| Connectivity (corporate use) | 13,142,393 | 148,256 | 13,847,116 | ||

| Connectivity (home use) | 6,537,370 | 73,386 | 6,854,258 | ||

| Outsourcing services | 15,395,833 | 174,210 | 16,271,256 | ||

| Total | 35,075,596 | 395,852 | 36,972,630 | ||

| Systems integration: | |||||

| Systems Construction | 14,658,502 | 121,559 | 11,353,598 | ||

| Systems Operation and Maintenance | 18,988,595 | 200,396 | 18,716,978 | ||

| Total | 33,647,097 | 321,955 | 30,070,576 | ||

| Equipment sales | 984,585 | 8,100 | 756,517 | ||

| ATM operation business | 23,452 | 2,213 | 206,657 | ||

| Total revenues | 69,730,730 | 100.0 | 728,120 | 68,006,380 | 100.0 |

| COST AND EXPENSES: | |||||

| Cost of connectivity and outsourcing services | 29,317,645 | 326,914 | 30,533,726 | ||

| Cost of systems integration | 25,542,758 | 234,515 | 21,903,699 | ||

| Cost of equipment sales | 863,031 | 6,952 | 649,315 | ||

| Cost of ATM operation business | 422,285 | 10,320 | 963,862 | ||

| Total cost | 56,145,719 | 80.5 | 578,701 | 54,050,602 | 79.5 |

| Sales and marketing | 4,630,579 | 6.6 | 57,870 | 5,405,075 | 7.9 |

| General and administrative | 5,621,870 | 8.1 | 51,670 | 4,826,006 | 7.1 |

| Research and development | 415,180 | 0.6 | 3,352 | 313,112 | 0.5 |

| Total cost and expenses | 66,813,348 | 95.8 | 691,593 | 64,594,795 | 95.0 |

| OPERATING INCOME | 2,917,382 | 4.2 | 36,527 | 3,411,585 | 5.0 |

| OTHER INCOME (EXPENSE): | |||||

| Interest income | 45,153 | 307 | 28,691 | ||

| Interest expense | (408,152) | (3,279) | (306,208) | ||

| Foreign exchange losses | (28,515) | (4) | (395) | ||

| Net gains on sales of other investments | 15,631 | 530 | 49,512 | ||

| Losses on write-down of other investments | (524,287) | (3,670) | (342,796) | ||

| Other—net | 17,276 | 200 | 18,673 | ||

| Other expense — net | (882,894) | (1.3) | (5,916) | (552,523) | (0.8) |

| INCOME FROM OPERATIONS BEFORE INCOME TAX EXPENSE AND EQUITY IN NET INCOME OF EQUITY METHOD INVESTEES | 2,034,488 | 2.9 | 30,611 | 2,859,062 | 4.2 |

| INCOME TAX EXPENSE | 1,002,711 | 1.4 | 12,121 | 1,132,093 | 1.7 |

| EQUITY IN NET INCOME OF EQUITY METHOD INVESTEES | 35,099 | 0.0 | 1,707 | 159,423 | 0.3 |

| NET INCOME | 1,066,876 | 1.5 | 20,197 | 1,886,392 | 2.8 |

| LESS: NET LOSS ATTRIBUTABLE TO NONCONTROLLING INTERESTS | 352,428 | 0.5 | 3,723 | 347,746 | 0.5 |

| NET INCOME ATTRIBUTABLE TO INTERNET INITIATIVE JAPAN INC. | 1,419,304 | 2.0 | 23,920 | 2,234,138 | 3.3 |

| Fiscal Year Ended March 31, 2009 | Fiscal Year Ended March 31, 2010 | ||||

| NET INCOME PER SHARE | |||||

| BASIC WEIGHTED-AVERAGE NUMBER OF SHARES (shares) | 205,165 | 202,544 | |||

| DILUTED WEIGHTED-AVERAGE NUMBER OF SHARES (shares) | 205,195 | 202,544 | |||

| BASIC WEIGHTED-AVERAGE NUMBER OF ADS EQUIVALENTS (ADSs) | 82,065,978 | 81,017,600 | |||

| DILUTED WEIGHTED-AVERAGE NUMBER OF ADS EQUIVALENTS (ADSs) | 82,077,978 | 81,017,600 | |||

| BASIC NET INCOME PER SHARE (JPY / U.S. Dollars / JPY) | 6,917.87 | 118.10 | 11,030.38 | ||

| DILUTED NET INCOME PER SHARE (JPY / U.S. Dollars / JPY) | 6,916.85 | 118.10 | 11,030.38 | ||

| BASIC NET INCOME PER ADS EQUIVALENT (JPY / U.S. Dollars / JPY) | 17.29 | 0.30 | 27.58 | ||

| DILUTED NET INCOME PER ADS EQUIVALENT (JPY / U.S. Dollars / JPY) | 17.29 | 0.30 | 27.58 | ||

| (Note 1) The U.S. dollar amounts represent translations of yen amounts at the rate of JPY 93.40 which was the noon buying rate in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York prevailing as of March 31, 2010. | |||||

| (Note2) The above presentation for the fiscal year ended March 31, 2009 has been changed to conform to the presentation for the fiscal year ended March 31, 2010. | |||||

| Internet Initiative Japan Inc. | ||||||||

| Consolidated Statements of Shareholders' Equity (Unaudited) | ||||||||

| (For the fiscal year ended March 31, 2008 and March 31, 2009) | (Thousands of JPY) | |||||||

| Internet Initiative Japan Inc. shareholders' equity | ||||||||

| Common Stock | ||||||||

| Total equity | Comprehensive income (loss) | Accumulated deficit | Accumulated other comprehensive income (loss) | Shares of Common Stock Outstanding | Treasury Stock | Additional Paid-in Capital | NON-CONTROLLING INTERESTS | |

| BALANCE, APRIL 1, 2008 | 25,274,815 | (19,555,489) | 90,618 | 16,833,847 | ? | 27,611,737 | 294,102 | |

| Subsidiary stock issuance | 132,061 | 132,061 | ||||||

| Comprehensive income (loss): | ||||||||

| Net Income | 1,066,876 | 1,066,876 | 1,419,304 | (352,428) | ||||

| Other Comprehensive loss, net of tax | (411,329) | (411,329) | (411,329) | |||||

| Total comprehensive income | 655,547 | 655,547 | ||||||

| Payment of dividends | (412,957) | (412,957) | ||||||

| Acquisition of treasury stock | (406,547) | (406,547) | ||||||

| BALANCE, MARCH 31, 2009 | 25,242,919 | (18,549,142) | (320,711) | 16,833,847 | (406,547) | 27,611,737 | 73,735 | |

| (For the fiscal year ended March 31, 2009 and March 31, 2010) | (Thousands of JPY) | |||||||

| Internet Initiative Japan Inc. shareholders' equity | ||||||||

| Common Stock | ||||||||

| Total equity | Comprehensive income (loss) | Accumulated deficit | Accumulated other comprehensive income (loss) | Shares of Common Stock Outstanding | Treasury Stock | Additional Paid-in Capital | NON-CONTROLLING INTERESTS | |

| BALANCE, APRIL 1, 2009 | 25,242,919 | (18,549,142) | (320,711) | 16,833,847 | (406,547) | 27,611,737 | 73,735 | |

| Subsidiary stock issuance | 150,000 | (168,137) | 318,137 | |||||

| Comprehensive income (loss): | ||||||||

| Net Income | 1,886,392 | 1,886,392 | 2,234,138 | (347,746) | ||||

| Other Comprehensive income, net of tax | 489,480 | 489,480 | 489,480 | |||||

| Total comprehensive income: | 2,375,872 | 2,375,872 | ||||||

| Payment of dividends | (405,088) | (405,088) | ||||||

| BALANCE, MARCH 31, 2010 | 27,363,703 | (16,720,092) | 168,769 | 16,833,847 | (406,547) | 27,443,600 | 44,126 | |

| (For the fiscal year ended March 31, 2009 and March 31, 2010) | (Thousands of U.S. Dollars) | |||||||

| Internet Initiative Japan Inc. shareholders' equity | ||||||||

| Common Stock | ||||||||

| Total equity | Comprehensive income (loss) | Accumulated deficit | Accumulated other comprehensive income (loss) | Shares of Common Stock Outstanding | Treasury Stock | Additional Paid-in Capital | NON-CONTROLLING INTERESTS | |

| BALANCE, APRIL 1, 2009 | 270,266 | (198,599) | (3,434) | 180,234 | (4,353) | 295,629 | 789 | |

| Subsidiary stock issuance | 1,606 | (1,800) | 3,406 | |||||

| Comprehensive income (loss): | ||||||||

| Net Income | 20,197 | 20,197 | 23,920 | (3,723) | ||||

| Other Comprehensive income, net of tax | 5,241 | 5,241 | 5,241 | |||||

| Total comprehensive income: | 25,438 | 25,438 | ||||||

| Payment of dividends | (4,337) | (4,337) | ||||||

| BALANCE, MARCH 31, 2010 | 292,973 | (179,016) | 1,807 | 180,234 | (4,353) | 293,829 | 472 | |

| (Note 1) The U.S. dollar amounts represent translations of yen amounts at the rate of JPY 93.40 which was the noon buying rate in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York prevailing as of March 31, 2010. | ||||||||

| (Note 2) The above presentation for the fiscal year ended March 31, 2009 has been changed to conform to the presentation for the fiscal year ended March 31, 2010. | ||||||||

| Internet Initiative Japan Inc. | |||

| Consolidated Statements of Cash Flows (Unaudited) | |||

| (For the fiscal year ended March 31, 2009 and March 31, 2010) | |||

| Fiscal Year Ended March 31, 2009 | Fiscal Year Ended March 31, 2010 | ||

| Thousands of JPY | Thousands of U.S. Dollars | Thousands of JPY | |

| OPERATING ACTIVITIES: | |||

| Net income | 1,066,876 | 20,197 | 1,886,392 |

| Adjustments to reconcile net income to net cash provided by operating activities: | |||

| Depreciation and amortization | 5,317,141 | 56,818 | 5,306,826 |

| Impairment loss on other intangible assets | 113,360 | -- | -- |

| Provision for retirement and pension costs, less payments | 127,662 | 2,419 | 225,915 |

| Provision for allowance for doubtful accounts and advances | 26,020 | 433 | 40,467 |

| Loss on disposal of property and equipment | 443,019 | 6,843 | 639,160 |

| Net gains on sales of other investments | (15,631) | (530) | (49,512) |

| Losses on write-down of other investments | 524,287 | 3,670 | 342,796 |

| Foreign exchange losses | 9,605 | 162 | 15,116 |

| Equity in net income of equity method investees (net of dividend) | (4,719) | (1,707) | (159,423) |

| Deferred income tax expense | 636,818 | 8,099 | 756,422 |

| Others | 1,741 | 139 | 13,000 |

| Changes in operating assets and liabilities net of effects from acquisition of business and a company: | |||

| Decrease (increase) in accounts receivable | 1,947,490 | (12,627) | (1,179,388) |

| Decrease in inventories, prepaid expenses and other current and noncurrent assets | 467,023 | 5,201 | 485,711 |

| Increase (decrease) in accounts payable | (2,005,074) | 8,660 | 808,845 |

| Increase (decrease) in income taxes payable | (188,517) | 1,026 | 95,819 |

| Increase in accrued expenses, other current and noncurrent liabilities | 163,768 | 4,207 | 392,948 |

| Net cash provided by operating activities | 8,630,869 | 103,010 | 9,621,094 |

| INVESTING ACTIVITIES: | |||

| Purchase of property and equipment | (2,991,378) | (34,835) | (3,253,629) |

| Proceeds from sales of property and equipment | -- | 2,201 | 205,548 |

| Purchase of available-for-sale securities | (187,516) | (784) | (73,236) |

| Purchase of short-term and other investments | (175,264) | (9,369) | (875,016) |

| Investment in equity method investee | -- | (244) | (22,834) |

| Proceeds from sales of available-for-sale securities | 3,417 | 1,326 | 123,880 |

| Proceeds from sales and redemption of short-term and other investments | 111,509 | 838 | 78,250 |

| Payments of guarantee deposits | (109,929) | (898) | (83,833) |

| Refund of guarantee deposits | 66,124 | 1,372 | 128,192 |

| Payments for refundable insurance policies | (52,364) | (589) | (55,020) |

| Refund from insurance policies | 7,382 | 428 | 39,959 |

| Other | (53) | -- | -- |

| Net cash used in investing activities | (3,328,072) | (40,554) | (3,787,739) |

| Fiscal Year Ended March 31, 2009 | Fiscal Year Ended March 31, 2010 | ||

| Thousands of JPY | Thousands of U.S. Dollars | Thousands of JPY | |

| FINANCING ACTIVITIES: | |||

| Proceeds from issuance of short-term borrowings with initial maturities over three months | 10,750,000 | 64,240 | 6,000,000 |

| Repayments of short-term borrowings with initial maturities over three months and long-term borrowings | (12,125,000) | (118,844) | (11,100,000) |

| Principal payments under capital leases | (3,953,833) | (43,714) | (4,082,908) |

| Net increase (decrease) in short-term borrowings with initial maturities less than three months | (425,000) | 23,554 | 2,200,000 |

| Proceeds from issuance of subsidiary stock to ?minority shareholders | -- | 1,606 | 150,000 |

| Dividends paid | (412,957) | (4,337) | (405,088) |

| Payments for acquisition of treasury stock | (406,547) | -- | -- |

| Net cash used in financing activities | (6,573,337) | (77,495) | (7,237,996) |

| EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS | (12,716) | (200) | (18,668) |

| NET DECREASE IN CASH AND CASH EQUIVALENTS | (1,283,256) | (15,239) | (1,423,309) |

| CASH AND CASH EQUIVALENTS, BEGINNING OF THE PERIOD | 11,470,980 | 109,076 | 10,187,724 |

| CASH AND CASH EQUIVALENTS, END OF THE PERIOD | 10,187,724 | 93,837 | 8,764,415 |

| ADDITIONAL CASH FLOW INFORMATION: | |||

| Interest paid | 408,712 | 3,287 | 307,045 |

| Income tax paid | 774,409 | 1,717 | 160,398 |

| NONCASH INVESTING AND FINANCING ACTIVITIES: | |||

| Acquisition of assets by entering into capital leases | 4,014,537 | 24,947 | 2,330,077 |

| Facilities purchase liabilities | 182,564 | 6,733 | 628,905 |

| (Note 1) The U.S. dollar amounts represent translations of yen amounts at the rate of JPY 93.40 which was the noon buying rate in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York prevailing as of March 31, 2010. | |||

| (Note 2) The above presentation for the fiscal year ended March 31, 2009 has been changed to conform to the presentation for the fiscal year ended March 31, 2010. | |||

Fiscal Year Ended March 31, 2009 | Fiscal Year Ended March 31, 2010 | |

| Numerator: | ||

| Net income (Thousands of Yen) | 1,419,304 | 2,234,138 |

| Denominator: | ||

| Basic weighted average number of shares of common stock outstanding | 205,165 | 202,544 |

| Effect by stock option | 30 | - |

| Diluted weighted average number of shares of common stock outstanding | 205,195 | 202,544 |

Basic net income per share (YEN) | 6,917.87 | 11,030.38 |

Diluted net income per share (YEN) | 6,916.85 | 11,030.38 |

| (1) | Results of Production |

| Fiscal Year Ended March 31, 2010 | ||

| Thousands of JPY | YoY Change (%) | |

| Systems Integration | 22,120,312 | (11.1) |

| Total | 22,120,312 | (11.1) |

| *1 | Consumption tax is not included. |

| *2 | The YoY change (%) in this table shows an increase or decrease percentage compared to the Fiscal Year ended March 31, 2009. |

| *3 | Results of production for Connectivity and Outsourcing services, equipment sales and ATM Operation Business are not included, since the Company does not produce for. |

| (2) | Results of Receiving Orders |

| Fiscal Year ended March 31, 2010 | ||||

Order received (Thousands of JPY) | YoY Change (%) | Order backlog (Thousands of JPY) | YoY Change (%) | |

Systems Integration and equipment sales | 29,514,626 | (12.1) | 13,558,534 | (8.8) |

| Total | 29,514,626 | (12.1) | 13,558,534 | (8.8) |

| *1 | Consumption tax is not included. |

| *2 | The YoY change (%) in this table shows an increase or decrease percentage compared to the fiscal year ended March 31, 2009. |

| *3 | Results of receiving orders and order backlog for Connectivity and Outsourcing services and ATM Operation Business are not included, since the Company does not produce for. |

| *4 | Systems Integration and equipment sales are totaled, as they cannot be classified properly at the stage of receiving orders. |

| (3) | Results of Sales Activities |

Fiscal Year Ended March 31, 2009 | Fiscal Year Ended March 31, 2010 | YoY Change | |

| Thousands of JPY | Thousands of JPY | % | |

| Connectivity and Outsourcing services revenue | 35,075,596 | 36,972,630 | 5.4 |

| Connectivity (corporate use) | 13,142,939 | 13,847,116 | 5.4 |

| Connectivity (home use) | 6,537,370 | 6,854,258 | 4.8 |

| Outsourcing services | 15,395,833 | 16,271,256 | 5.7 |

| Systems Integration revenue | 33,647,097 | 30,070,576 | (10.6) |

| Systems construction | 14,658,502 | 11,353,598 | (22.5) |

| Systems operation and maintenance | 18,988,595 | 18,716,978 | (1.4) |

| Equipment sales | 984,585 | 756,517 | (23.2) |

| ATM Operation Business | 23,452 | 206,657 | 781.2 |

| Total | 69,730,730 | 68,006,380 | (2.5) |

| *1 | Consumption tax is not included. |

*2 | Sales to each customer and its ratio to aggregate sales for the fiscal year ended March 31, 2009 and 2010 are omitted as the ratios are less than 0.1 (10%). |

4th Quarter FY2009 Consolidated Financial Results (3 months)

The following tables are highlight data of 4th Quarter FY2009 consolidated financial results (unaudited, from January 1, 2010 to March 31, 2010).

| Operating Results Summary | |||

| 4Q08 | 4Q09 | YoY Change | |

| JPY millions | JPY millions | ||

| Total Revenues: | 18,942 | 19,694 | 4.0% |

| Connectivity and Outsourcing Services | 9,135 | 9,372 | 2.6% |

| SI | 9,542 | 9,905 | 3.8% |

| Equipment Sales | 259 | 318 | 22.8% |

| ATM Operation Business | 6 | 99 | 1491.1% |

| Cost of Revenues: | 14,891 | 15,358 | 3.1% |

| Connectivity and Outsourcing Services | 7,466 | 7,655 | 2.5% |

| SI | 7,039 | 7,152 | 1.6% |

| Equipment Sales | 224 | 270 | 20.3% |

| ATM Operation Business | 162 | 281 | 73.5% |

| SG&A Expenses and R&D | 2,978 | 2,930 | (1.6%) |

| Operating Income | 1,073 | 1,404 | 30.9% |

| Income before Income Tax Expense | 792 | 1,076 | 35.8% |

| Net Income attributable to IIJ | 1,065 | 1,101 | 3.4% |

| Connectivity and Outsourcing Services Revenues Breakdown and Cost | |||

| 4Q08 | 4Q09 | YoY Change | |

| JPY millions | JPY millions | ||

| Connectivity and Outsourcing Services Revenues | 9,135 | 9,372 | 2.6% |

| Connectivity Service (Corporate Use) | 3,437 | 3,480 | 1.3% |

| IP Service | 2,351 | 2,257 | (4.0%) |

| IIJ FiberAccess/F and IIJ DSL/F | 736 | 752 | 2.2% |

| IIJ Mobile Service | 268 | 401 | 49.4% |

| Others | 81 | 70 | (14.2%) |

| Connectivity Service (Home Use) | 1,678 | 1,720 | 2.5% |

| Under IIJ Brand | 247 | 260 | 5.2% |

| hi-ho | 1,289 | 1,320 | 2.4% |

| OEM | 142 | 140 | (1.3%) |

| Outsourcing Services | 4,020 | 4,172 | 3.8% |

| Cost of Connectivity and Outsourcing Services | 7,466 | 7,655 | 2.5% |

| Backbone Cost (included in the cost of Connectivity and Outsourcing Service) | 916 | 954 | 4.2% |

| Connectivity and Outsourcing Services Gross Margin Ratio | 18.3% | 18.3% | ? |

| SI Revenue Breakdown and Cost | |||

| 4Q08 | 4Q09 | YoY Change | |

| JPY millions | JPY millions | ||

| SI Revenues | 9,542 | 9,905 | 3.8% |

| Systems Construction | 4,644 | 5,218 | 12.4% |

| Systems Operation and Maintenance | 4,898 | 4,687 | (4.3%) |

| Cost of SI | 7,039 | 7,152 | 1.6% |

| SI Gross Margin Ratio | 26.2% | 27.8% | ? |

| SI and Equipment Sales Order Backlog | 14,871 | 13,559 | (8.8%) |

| Equipment Sales Revenue and Cost | |||

| 4Q08 | 4Q09 | YoY Change | |

| JPY millions | JPY millions | ||

| Equipment Sales Revenues | 259 | 318 | 22.8% |

| Cost of Equipment Sales | 224 | 270 | 20.3% |

| Equipment Sales Gross Margin Ratio | 13.4% | 15.2% | ? |

| ATM Operation Business Revenue and Cost | |||

| 4Q08 | 4Q09 | YoY Change | |

| JPY millions | JPY millions | ||

| ATM Operation Business Revenues | 6 | 99 | 1491.1% |

| Cost of ATM Operation Business | 162 | 281 | 73.5% |

| Other Financial Statistics | |||

| 4Q08 | 4Q09 | YoY Change | |

| JPY millions | JPY millions | ||

| Adjusted EBITDA | 2,550 | 2,776 | 8.9% |

| CAPEX, including capital leases | 657 | 1,218 | 85.2% |

| Depreciation and amortization 7 | 1,477 | 1,372 | (7.1%) |

Reconciliation of Non-GAAP Financial Measures

The following table summarizes the reconciliation of adjusted EBITDA to net income in our consolidated statements of income that are prepared in accordance with U.S. GAAP.

| Adjusted EBITDA | ||

| 4Q08 | 4Q09 | |

| JPY millions | JPY millions | |

| Adjusted EBITDA | 2,550 | 2,776 |

| Depreciation and Amortization 7 | (1,477) | (1,372) |

| Operating Income | 1,073 | 1,404 |

| Other Income (Expense) | (281) | (328) |

| Income Tax Expense | (190) | 90 |

| Equity in Net Income (Loss) of Equity Method Investees | (10) | 32 |

| Net income | 972 | 1,018 |

| Net loss attributable to noncontrolling interests | 93 | 83 |

| Net Income attributable to IIJ | 1,065 | 1,101 |

| 7 Depreciation and amortization includes impairment loss on other intangible assets. (See IIJ's consolidated financial statements for details). |

The following table summarizes the reconciliation of capital expenditures to the purchase of property and equipment in our consolidated statements of cash flows that are prepared and presented in accordance with U.S. GAAP.

| CAPEX | ||

| 4Q08 | 4Q09 | |

| JPY millions | JPY millions | |

| CAPEX, including capital leases | 657 | 1,218 |

| Acquisition of Assets by Entering into Capital Leases | 329 | 767 |

| Purchase of Property and Equipment | 328 | 451 |

| Internet Initiative Japan Inc. | |||||

| Quarterly Consolidated Statements of Income (Unaudited) | |||||

| (Three Months ended March 31, 2009 and March 31, 2010) | |||||

| Three Months Ended March 31, 2009 | Three Months Ended March 31, 2010 | ||||

| Thousands of JPY | % of total revenues | Thousands of U.S. Dollars | Thousands of JPY | % of total revenues | |

| REVENUES: | |||||

| Connectivity and outsourcing services: | |||||

| Connectivity (corporate use) | 3,436,518 | 37,256 | 3,479,668 | ||

| Connectivity (home use) | 1,678,316 | 18,419 | 1,720,371 | ||

| Outsourcing services | 4,019,900 | 44,669 | 4,172,128 | ||

| Total | 9,134,734 | 100,344 | 9,372,167 | ||

| Systems integration: | |||||

| Systems Construction | 4,644,483 | 55,874 | 5,218,612 | ||

| Systems Operation and Maintenance | 4,897,539 | 50,177 | 4,686,575 | ||

| Total | 9,542,022 | 106,051 | 9,905,187 | ||

| Equipment sales | 258,784 | 3,403 | 317,807 | ||

| ATM operation business | 6,187 | 1,054 | 98,440 | ||

| Total revenues | 18,941,727 | 100.0 | 210,852 | 19,693,601 | 100.0 |

| COST AND EXPENSES: | |||||

| Cost of connectivity and outsourcing services | 7,466,183 | 81,963 | 7,655,368 | ||

| Cost of systems integration | 7,038,866 | 76,579 | 7,152,446 | ||

| Cost of equipment sales | 223,978 | 2,884 | 269,369 | ||

| Cost of ATM operation business | 161,698 | 3,004 | 280,609 | ||

| Total cost | 14,890,725 | 78.6 | 164,430 | 15,357,792 | 78.0 |

| Sales and marketing | 1,124,574 | 5.9 | 15,817 | 1,477,339 | 7.5 |

| General and administrative | 1,654,402 | 8.7 | 14,796 | 1,381,928 | 7.0 |

| Research and development | 198,986 | 1.1 | 773 | 72,188 | 0.4 |

| Total cost and expenses | 17,868,687 | 94.3 | 195,816 | 18,289,247 | 92.9 |

| OPERATING INCOME | 1,073,040 | 5.7 | 15,036 | 1,404,354 | 7.1 |

| OTHER INCOME (EXPENSE): | |||||

| Interest income | 12,611 | 115 | 10,701 | ||

| Interest expense | (98,006) | (696) | (65,036) | ||

| Foreign exchange gains (loss) | (18,986) | 36 | 3,409 | ||

| Losses on sales of other investments | (2,049) | 309 | 28,872 | ||

| Losses on write-down of other investments | (195,071) | (3,141) | (293,355) | ||

| Other—net | 20,789 | (140) | (13,089) | ||

| Other expense — net | (280,712) | (1.5) | (3,517) | (328,498) | (1.6) |

| INCOME FROM OPERATIONS BEFORE INCOME TAX EXPENSE AND EQUITY IN NET INCOME IN EQUITY METHOD INVESTEES | 792,328 | 4.2 | 11,519 | 1,075,856 | 5.5 |

| INCOME TAX EXPENSE (BENEFIT) | (189,718) | (1.0) | 962 | 89,902 | 0.5 |

| EQUITY IN NET INCOME (LOSS) OF EQUITY METHOD INVESTEES | (10,008) | (0.1) | 345 | 32,259 | 0.2 |

| NET INCOME | 972,038 | 5.1 | 10,902 | 1,018,213 | 5.2 |

| LESS: NET LOSS ATTRIBUTABLE TO NONCONTROLLING INTERESTS | 92,944 | 0.5 | 884 | 82,632 | 0.4 |

| NET INCOME ATTRIBUTABLE TO INTERNET INITIATIVE JAPAN INC. | 1,064,982 | 5.6 | 11,786 | 1,100,845 | 5.6 |

| Three Months Ended March 31, 2009 | Three Months Ended March 31, 2010 | ||||

| NET INCOME PER SHARE | |||||

| BASIC WEIGHTED-AVERAGE NUMBER OF SHARES (shares) | 202,544 | 202,544 | |||

| DILUTED WEIGHTED-AVERAGE NUMBER OF SHARES (shares) | 202,544 | 202,544 | |||

| BASIC WEIGHTED-AVERAGE NUMBER OF ADS EQUIVALENTS (ADSs) | 81,017,600 | 81,017,600 | |||

| DILUTED WEIGHTED-AVERAGE NUMBER OF ADS EQUIVALENTS (ADSs) | 81,017,600 | 81,017,600 | |||

| BASIC NET INCOME PER SHARE (JPY / U.S. Dollars / JPY) | 5,258.03 | 58.19 | 5,435.09 | ||

| DILUTED NET INCOME PER SHARE (JPY / U.S. Dollars / JPY) | 5,258.03 | 58.19 | 5,435.09 | ||

| BASIC NET INCOME PER ADS EQUIVALENT (JPY / U.S. Dollars / JPY) | 13.15 | 0.15 | 13.59 | ||

| DILUTED NET INCOME PER ADS EQUIVALENT (JPY / U.S. Dollars / JPY) | 13.15 | 0.15 | 13.59 | ||

| (Note 1) The U.S. dollar amounts represent translations of yen amounts at the rate of JPY 93.40 which was the noon buying rate in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York prevailing as of March 31, 2010. | |||||

| (Note 2) The above presentation for the three months ended March 31, 2009 has been changed to conform to the presentation for the three months ended March 31, 2010. | |||||

| Internet Initiative Japan Inc. | |||

| Quarterly Consolidated Statements of Cash Flows (Unaudited) | |||

| (Three Months ended March 31, 2009 and March 31, 2010) | |||

| Three Months Ended March 31, 2009 | Three Months Ended March 31, 2010 | ||

| Thousands of JPY | Thousands of U.S. Dollars | Thousands of JPY | |

| OPERATING ACTIVITIES: | |||

| Net income | 972,038 | 10,902 | 1,018,213 |

| Adjustments to reconcile net income to net cash provided by operating activities: | |||

| Depreciation and amortization | 1,476,858 | 14,693 | 1,372,362 |

| Reversal of retirement and pension costs, less payments | (67,291) | (134) | (12,506) |

| Provision for allowance for doubtful accounts and advances | 8,268 | 144 | 13,393 |

| Loss on disposal of property and equipment | 279,247 | 6,600 | 616,410 |

| Net losses (gains) on sales of other investments | 2,049 | (309) | (28,872) |

| Losses on write-down of other investments | 195,071 | 3,141 | 293,355 |

| Foreign exchange gains | (11,223) | (12) | (1,097) |

| Equity in net loss (income) of equity method investees (net of dividend) | 10,008 | (345) | (32,259) |

| Deferred income tax benefit | (335,379) | (365) | (34,059) |

| Others | (231) | 139 | 13,000 |

| Changes in operating assets and liabilities net of effects from acquisition of business and a company: | |||

| Increase in accounts receivable | (708,788) | (30,369) | (2,836,491) |

| Decrease in inventories, prepaid expenses and other current and noncurrent assets | 1,715,877 | 12,032 | 1,123,824 |

| Increase in accounts payable | 117,161 | 15,823 | 1,477,895 |

| Increase in income taxes payable | -- | 2,242 | 209,397 |

| Increase (decrease) in accrued expenses, other current and noncurrent liabilities | (373,663) | 1,798 | 167,930 |

| Net cash provided by operating activities | 3,280,002 | 35,980 | 3,360,495 |

| INVESTING ACTIVITIES: | |||

| Purchase of property and equipment | (328,364) | (4,827) | (450,852) |

| Proceeds from sales of property and equipment | -- | 292 | 27,278 |

| Purchase of available-for-sale securities | (87,524) | (472) | (44,052) |

| Purchase of short-term and other investments | (50,000) | (6,692) | (625,000) |

| Proceeds from sales of available-for-sale securities | 3,417 | 603 | 56,288 |

| Proceeds from sales and redemption of short-term and other investments | 62,627 | 230 | 21,426 |

| Payments of guarantee deposits | (27,025) | (252) | (23,583) |

| Refund of guarantee deposits | 38,775 | 679 | 63,442 |

| Payments for refundable insurance policies | (13,860) | (141) | (13,154) |

| Other | -- | (16) | (1,498) |

| Net cash used in investing activities | (401,954) | (10,596) | (989,705) |

| Three Months Ended March 31, 2009 | Three Months Ended March 31, 2010 | ||

| Thousands of JPY | Thousands of U.S. Dollars | Thousands of JPY | |

| FINANCING ACTIVITIES: | |||

| Proceeds from issuance of short-term borrowings with initial maturities over three months | 250,000 | 2,677 | 250,000 |

| Repayments of short-term borrowings with initial maturities over three months | (575,000) | (6,960) | (650,000) |

| Principal payments under capital leases | (1,106,108) | (15,255) | (1,424,846) |

| Net Increase in short-term borrowings with initial maturities less than three months | (125,000) | (2,677) | (250,000) |

| Payments for acquisition of treasury stock | (105,992) | -- | -- |

| Net cash used in financing activities | (1,662,100) | (22,215) | (2,074,846) |

| EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS | 16,329 | 25 | 2,369 |

| NET INCREASE IN CASH AND CASH EQUIVALENTS | 1,232,277 | 3,194 | 298,313 |

| CASH AND CASH EQUIVALENTS, BEGINNING OF THE PERIOD | 8,955,447 | 90,643 | 8,466,102 |

| CASH AND CASH EQUIVALENTS, END OF THE PERIOD | 10,187,724 | 93,837 | 8,764,415 |

| (Note 1) The U.S. dollar amounts represent translations of yen amounts at the rate of JPY 93.40 which was the noon buying rate in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York prevailing as of March 31, 2010. | |||

| (Note 2) The above presentation for the three months ended March 31, 2009 has been changed to conform to the presentation for the three months ended March 31, 2010. | |||

Note: The following information is provided to disclose Internet Initiative Japan Inc. ("IIJ") financial results (unaudited) for the Fiscal Year Ended March 31, 2010 ("FY2009") in the form defined by the Tokyo Stock Exchange.

Consolidated Financial Results for the Fiscal Year Ended March 31, 2010

[Under accounting principles generally accepted in the United States ("U.S. GAAP")]

May 14, 2010

Company name: Internet Initiative Japan Inc. Exchange listed: Tokyo Stock Exchange First Section

Stock code number: 3774 URL: http://www.iij.ad.jp/

Representative: Koichi Suzuki, President and Representative Director

Contact: Akihisa Watai, Managing Director and CFO TEL: (03) 5259-6500

Annual general shareholder's meeting: scheduled on June 25, 2010

Payment of dividend: Scheduled to be started on June 28, 2010

Filing of annual report (Yuka-shoken-houkokusho) to the regulatory organization in Japan: June 28, 2010 (Scheduled)

(Amounts of less than JPY one million are rounded)

1. Consolidated Financial Results for the Fiscal Year Ended March 31, 2010

(April 1, 2009 to March 31, 2010)

| (1) Consolidated Results of Operations | (% shown is YoY change) | |||||||

| Total Revenues | Operating Income | Income before Income Tax Expense | Net Income attributable to IIJ | |||||

| JPY millions | ? | JPY millions | ? | JPY millions | ? | JPY millions | ? | |

| Fiscal year ended March 31, 2010 | 68,006 | (2.5) | 3,412 | 16.9 | 2,859 | 40.5 | 2,234 | 57.4 |

| Fiscal year ended March 31, 2009 | 69,731 | 4.3 | 2,917 | (38.7) | 2,034 | (53.4) | 1,419 | (72.6) |

| Basic Net Income attributable to IIJ per Share | Diluted Net Income attributable to IIJ per Share | Shareholders' Equity Net Income to Total Shareholders' Equity | Income before Income Tax Expense to Total Assets | Total Revenues Operating Margin Ratio | |

| JPY | JPY | % | % | % | |

| Fiscal year ended March 31, 2010 | 11,030.38 | 11,030.38 | 8.5 | 5.5 | 5.0 |

| Fiscal year ended March 31, 2009 | 6,917.87 | 6,916.85 | 5.7 | 3.8 | 4.2 |

(Reference) Equity in net income of equity method investees Fiscal year ending March 31, 2010: JPY159 million

Fiscal year ending March 31, 2009: JPY35 million

(Note) Income before income tax expense represents income from operations before income tax expense and equity in net income in equity method investees, respectively, in IIJ's consolidated financial statements. Additionally, net income attributable to IIJ is equivalent to net income in the former presentation materials up to FY2008.

| (2) Consolidated Financial Position | |||||

| Total Assets | Total Equity | Shareholders' Equity | Shareholders' Equity as a percentage of Total Assets | Shareholders' Equity per share | |

| JPY millions | JPY millions | JPY millions | % | JPY | |

| March 31, 2010 | 51,115 | 27,364 | 27,320 | 53.4 | 134,882.18 |

| March 31, 2009 | 52,301 | 25,243 | 25,169 | 48.1 | 124,265.27 |

(Note) Shareholders' equity, shareholders' equity as a percentage of total assets and shareholders' equity per share represents IIJ Shareholders' equity, IIJ shareholders' equity as a percentage of total assets and IIJ shareholders' equity per share, respectively, in IIJ's consolidated financial statements..

| (3) Consolidated Cash Flow | ||||

| Operating Activities | Investing Activities | Financing Activities | Cash and Cash Equivalents (End of the Period) | |

| JPY millions | JPY millions | JPY millions | JPY millions | |

| Fiscal year ended March 31, 2010 | 9,621 | (3,788) | (7,238) | 8,764 |

| Fiscal year ended March 31, 2009 | 8,631 | (3,328) | (6,573) | 10,188 |

2. Dividends

| Dividend per Shares | |||||

| 1st quarter-end | 2nd quarter-end | 3rd quarter-end | Year-end | Total | |

| Yen | Yen | Yen | Yen | Yen | |

| Fiscal year ended March 31, 2009 | -- | 1,000.00 | -- | 1,000.00 | 2,000.00 |

| Fiscal year ending March 31, 2010 | -- | 1,000.00 | -- | 1,250.00 | 2,250.00 |

| Fiscal year ending March 31, 2011 (Target) | -- | 1,250.00 | -- | 1,250.00 | 2,500.00 |

| Total cash dividends for the year | Payout Ratio (consolidated) | Ratio of Dividends to Shareholder's Equity (consolidated) | |

| JPY millions | % | % | |

| Fiscal year ended March 31, 2009 | 409 | 28.9 | 1.6 |

| Fiscal year ending March 31, 2010 | 456 | 20.4 | 1.7 |

| Fiscal year ending March 31, 2011 (Target) | 19.5 |

3. Target of Consolidated Financial Results for the Fiscal Year Ending March 31, 2011

(April 1, 2010 through March 31, 2011)

| (% shown is YoY change) | |||||||||

| Total Revenues | Operating Income | Income before Income Tax Expense (Benefit) | Net Income Attributable to IIJ | Basic Net Income attributable to IIJ per Share | |||||

| JPY millions | % | JPY millions | % | JPY millions | % | JPY millions | % | JPY | |

| Interim Period Ending September 30, 2009 | 32,300 | 0.1 | 1,200 | 2.9 | 1,100 | 7.3 | 800 | 11.8 | 3,949.76 |

| Fiscal year ending March 31, 2009 | 71,000 | 4.4 | 4,300 | 26.0 | 3,700 | 29.4 | 2,600 | 16.4 | 12,836.72 |

4. Others

(1) Change of Condition in Consolidated Subsidiaries during the fiscal year ended March 31, 2010

(Change of Condition in Specific Consolidated Subsidiaries with a Change of Scope of Consolidation): None

Newly Established (Name: ) Excluded (Name: )

(2) Changes in Significant Accounting and Reporting Policies for Consolidated Financial Statements

1) Changes due to the revision of accounting standards: Yes

2) Others: None

(3) Number of Shares Outstanding (Shares of Common Stock)

1) The number of shares outstanding (inclusive of treasury stock):

As of March 31, 2010: 206,478 shares

As of March 31, 2009: 206,478 shares

2) The number of treasury stock:

As of March 31, 2010: 3,934 shares

As of March 31, 2009: 3,934 shares

3) The weighted average number of shares outstanding:

As of March 31, 2010: 202,544 shares

As of March 31, 2009: 205,165 shares

CONTACT: Internet Initiative Japan Inc.

IIJ Investor Relations Office

Yuko Kazama

+81-3-5259-6500

ir@iij.ad.jp

http://www.iij.ad.jp/en/IR| Name | Relationship | Its Ownership Percentage (%) | Securities Exchanges where its Shares are Listed |

| Nippon Telegraph and Telephone Corporation | IIJ is NTT's affiliate company | 30.0 (5.0) | Tokyo Stock Exchange, Inc. (First Section) Osaka Securities Exchange, Co., Ltd. (First Section) Nagoya Stock Exchange, Inc. (First Section) Fukuoka Stock Exchange Sapporo Stock Exchange New York Stock Exchange, Inc. London Stock Exchange plc. |