SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant [X] | ||

| Filed by a Party other than the Registrant [ ] | ||

| Check the appropriate box: | ||

| [ ] | Preliminary Proxy Statement | |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| [X] | Definitive Proxy Statement | |

| [ ] | Definitive Additional Materials | |

| [ ] | Soliciting Material Pursuant to §240.14a-12 | |

| United Parcel Service, Inc. | ||

| (Name of Registrant as Specified In Its Charter) | ||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): | ||||

| [X] | No fee required. | |||

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| 1) | Title of each class of securities to which transaction applies: | |||

| 2) | Aggregate number of securities to which transaction applies: | |||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| 4) | Proposed maximum aggregate value of transaction: | |||

| 5) | Total fee paid: | |||

| [ ] | Fee paid previously with preliminary materials. | |||

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1) | Amount Previously Paid: | |||

| 2) | Form, Schedule or Registration Statement No.: | |||

| 3) | Filing Party: | |||

| 4) | Date Filed: | |||

MEETING OF SHAREOWNERS

AND

PROXY STATEMENT

Thursday, May 5, 2016

8:00 a.m. Eastern Time

The Hotel du Pont

Wilmington, Delaware

Electronic Access to Proxy Materials and Annual Report:

Scan this QR code to access proxy materials via your smartphone or tablet.

| 2 |  | Notice of Annual Meeting of Shareowners and 2016 Proxy Statement |

United Parcel Service, Inc.

55 Glenlake Parkway, N.E.

Atlanta, GA 30328

March 14, 2016

Dear Shareowners:

It is my pleasure to invite you to join us at United Parcel Service, Inc.’s 2016 Annual Meeting of Shareowners. Accountability and responsiveness to shareowners are critically important and your feedback during the Annual Meeting and throughout the year is appreciated. Over the past year, I had the privilege of meeting with a number of shareowners to discuss a wide variety of business and governance topics. I would like to highlight certain improvements we made to our corporate governance practices last year after taking into account feedback from our investors.

The board drives long-term, sustainable performance and creates value by holding management accountable to sound business strategies. The board accomplishes this through vigorous risk and strategy oversight, practical incentive compensation and effective succession planning. To that end, we took a number of actions over the last year that are designed to further enhance our corporate governance practices. First, we established a Risk Committee composed entirely of independent directors. The Risk Committee assists the board in overseeing management’s identification, evaluation and mitigation of enterprise risks. The Risk Committee provides an additional level of oversight with respect to the Company’s strategic enterprise risks such as data security, privacy, technology and information security policies. Other areas of oversight include cybersecurity, cyber incident response and business continuity.

In February 2016, I had the honor of being appointed Chairman by the independent members of the Board of Directors after our non-executive Chairman and former Chief Executive Officer, Scott Davis, announced that he did not intend to stand for re-election this year. In connection with Scott’s retirement as non-executive Chairman, the board determined that it would be in the best interests of the Company to consolidate the Chairman and Chief Executive Officer positions and to create a lead independent director position, the first in UPS’s history. This structure provides continued strong independent director oversight of management while allowing clear and consistent strategic alignment throughout the Company. William “Bill” Johnson was appointed lead independent director by the independent board members in February 2016. I believe Bill will further strengthen the board’s substantial oversight and governance practices in this new role.

Our Company operates in a fast changing environment and we are intently focused on growth and innovation. We are proud of our accomplishments and excited about our potential. Our board is fully engaged in the Company’s strategic planning process, including reviewing, at least annually, our strategic plans. The board devoted significant time in the past year to understanding and evaluating UPS’s strategies associated with the rapid growth of e-commerce, strategic acquisitions, and our international growth, particularly in Europe. The board will continue to closely monitor management’s development and implementation of the Company’s strategic plans.

In conclusion, your vote is very important to us and I encourage you to vote as soon as possible. We made additional changes to our proxy statement this year that we hope will improve your ability to understand the information you need to make an informed voting decision. In addition, as we approach the Annual Meeting, I encourage you to contact us with any questions or feedback at 404-828-6059. We are grateful to those shareowners who have previously shared their views with us. We have listened, and we have taken these views into account as we continually seek ways to improve performance and increase shareowner value.

On behalf of the entire board, thank you for your continued support of UPS.

David P. Abney

Chairman and Chief Executive Officer

www.upsannualmeeting.com |  | 3 |

| Notice of UPS 2016 Annual Meeting |

| ● | Date and Time:May 5, 2016, at 8:00 a.m. Eastern Time. |

| ● | Place: Hotel du Pont, 11th and Market Streets, Wilmington, Delaware. |

| ● | Record Date:March 7, 2016. |

| ● | Distribution Date: A Notice of Internet Availability of Proxy Materials or this Proxy Statement is first being sent to shareowners on or about March 14, 2016. |

| ● | Voting: Holders of class A common stock are entitled to ten votes per share; holders of class B common stock are entitled to one vote per share. |

| ● | Admission: To attend the meeting in person you will need proof of your share ownership (see page 60 for acceptable proof of ownership) as of the record date and a form of government-issued photo identification. |

Your vote is important. Please vote as soon as possible by using the Internet or by telephone or, if you received a paper copy of the proxy card by mail, by signing and returning the proxy card. Instructions for your voting options are described on the Notice of Internet Availability of Proxy Materials or proxy card.

Important Notice regarding the availability of Proxy Materials for the Shareowner Meeting to be held on May 5, 2016. The proxy statement and annual report are available at www.proxyvote.com.

For a welcome video from David Abney, Chairman and CEO, and to view the Proxy Statement and other materials about the 2016 Annual Meeting, go to www.upsannualmeeting.com.

Questions? Call 404-828-6059 (option 2).

Norman M. Brothers, Jr.

Secretary

Atlanta, Georgia

March 14, 2016

| Items of Business |

| Voting Choices | Board Vote Recommendation | Page (for more information) | ||||||

| Company Proposals: | ||||||||

| 1. | Elect 11 directors named in this proxy statement to serve until the 2017 Annual Meeting and until their respective successors are elected and qualified | ●Vote for all nominees ●Vote against all nominees ●Vote for some nominees and against others ●Abstain from voting on one or more nominees | FOR ALL | 16 | ||||

| 2. | Ratify the appointment of Deloitte and Touche LLP as our independent registered public accounting firm for 2016 | ●Vote for ratification ●Vote against ratification ●Abstain from voting on the proposal | FOR | 49 | ||||

| Shareowner Proposals (if properly presented): | ||||||||

| 3. | Prepare an annual report on lobbying activities | ●Vote for the proposal ●Vote against the proposal ●Abstain from voting on the proposal | AGAINST | 52 | ||||

| 4. | Reduce the voting power of class A stock from ten votes per share to one vote per share | ●Vote for the proposal ●Vote against the proposal ●Abstain from voting on the proposal | AGAINST | 54 | ||||

| 5. | Adopt Holy Land Principles | ●Vote for the proposal ●Vote against the proposal ●Abstain from voting on the proposal | AGAINST | 55 | ||||

| 4 |  | Notice of Annual Meeting of Shareowners and 2016 Proxy Statement |

|

| Election of Directors |

The Board of Directors is asking you to elect 11 nominees for director.The table below provides summary information about the director nominees. The Company utilizes a majority voting standard which means that a nominee will only be elected if the number of votes cast for the nominee’s election is greater than the number of votes cast against that nominee. For more information see pages 10 and 16.

| Name | Age | Director Since | Occupation | Committee(s) | Other Public Company Boards | |||||

| Independent Directors | ||||||||||

| Rodney C. Adkins | 57 | 2013 | Former Senior Vice President of Corporate Strategy, International Business Machines | – Risk* – Compensation | 3 | |||||

| Michael J. Burns | 64 | 2005 | Former Chairman, Chief Executive Officer and President, Dana Corporation | – Audit | 0 | |||||

| William R. Johnson (lead director) | 67 | 2009 | Former Chairman, President and Chief Executive Officer, H.J. Heinz Company | – Nominating and Corporate Governance* – Executive | 2 | |||||

| Candace Kendle | 69 | 2011 | Co-founder and Former Chairman and Chief Executive Officer, Kendle International Inc. | – Audit – Risk | 1 | |||||

| Ann M. Livermore | 57 | 1997 | Former Executive Vice President, Hewlett-Packard Company | – Compensation* – Risk | 1 | |||||

| Rudy H.P. Markham | 70 | 2007 | Former Financial Director, Unilever | – Audit | 3 | |||||

| Clark T. Randt, Jr. | 70 | 2010 | Former U.S. Ambassador to the People’s Republic of China | – Compensation – Nominating and Corporate Governance | 3 | |||||

| John T. Stankey | 53 | 2014 | CEO, AT&T Entertainment Group | – Nominating and Corporate Governance – Risk | 0 | |||||

| Carol B. Tomé | 59 | 2003 | Chief Financial Officer and Executive Vice President — Corporate Services, The Home Depot, Inc. | – Audit* | 0 | |||||

| Kevin M. Warsh | 45 | 2012 | Former Member of the Board of Governors of the Federal Reserve System, Distinguished Visiting Fellow, Hoover Institution, Stanford University | – Nominating and Corporate Governance – Compensation | 0 | |||||

| Non-Independent Director | ||||||||||

| David P. Abney | 60 | 2014 | Chairman and Chief Executive Officer, United Parcel Service, Inc. | – Executive* | 1 | |||||

* Denotes chair

| Ratification of the Appointment of the Independent Registered Public Accounting Firm |

The board is asking you to ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016. We have provided summary information with respect to the fees billed for services provided to us during the fiscal years ended December 31, 2015 and 2014. For more information, see page 49.

| 2015 | 2014 | |||||

| Fees Billed: | ||||||

| Audit Fees | $ | 13,939,000 | $ | 13,575,000 | ||

| Audit-Related Fees | $ | 1,351,000 | $ | 1,107,000 | ||

| Tax Fees | $ | 797,000 | $ | 683,000 | ||

| Total | $ | 16,087,000 | $ | 15,365,000 |

www.upsannualmeeting.com |  | 5 |

| Vote on Three Shareowner Proposals |

The board is asking you to vote AGAINST the shareowner proposals requiring an annual report on lobbying activities, reducing the voting power of our class A stock and requiring adoption of the Holy Land Principles. For more information about the proposals, see page 52.

| Summary of Compensation Practices |

WE DON’T | |

| ✗ | Havechange in control or severance agreements with any of our executive officers. |

| ✗ | Have employment agreements with any of our executive officers. |

| ✗ | Provide excise tax gross-ups. |

| ✗ | Allow executive officers or directors to hedge their ownership in UPS stock. |

WE DO | |

| ✓ | Have clawback provisions for equity awards. |

| ✓ | Have robust stock ownership guidelines. |

| ✓ | Utilize three-year performance goals for revenue growth, operating return on invested capital and relative total shareowner return (“TSR”) for our long-term performance awards. |

| ✓ | Have annual equity awards granted based on prior year performance that vest 20% per year over a five year period. |

For more information, see page 24.

| Corporate Governance Highlights |

A brief overview of our corporate governance structure, policies and processes is listed below:

| ● | In May 2015, the board established a Risk Committee comprised entirely of independent board members. The Risk Committee is responsible for assisting the Board of Directors in overseeing management’s identification and evaluation of enterprise risks, including the Company’s risk management framework and the policies, procedures and practices employed to manage risks. |

| ● | In February 2016, the independent directors of the board appointed William Johnson as lead independent director to serve for a period of at least one year. |

| ● | All of our directors are independent, other than our CEO. |

| ● | We provide for majority voting in uncontested director elections. |

| ● | All directors are elected annually. |

| ● | Over 90% of director nominees are independent. |

| ● | Independent directors meet without management. |

| ● | Annual board review of company strategy. |

| ● | Annual board and committee self-evaluations. |

| 6 |  | Notice of Annual Meeting of Shareowners and 2016 Proxy Statement |

| Corporate Governance |

Our Board of Directors has adopted practices that foster effective board oversight of critical matters such as strategy, management succession planning, financial and other controls, risk management and compliance. The board reviews our major governance documents, policies and processes regularly inthe context of current corporate governance trends, regulatory changes and recognized best practices. The following sections provide an overview of our corporate governance structure and processes, including key aspects of our board operations.

The Nominating and Corporate Governance Committee is responsible for reviewing and recommending director nominees to the board, including candidates to fill any vacancies that may occur on the board. When evaluating director candidates, the Nominating and Corporate Governance Committee considers factors such as personal character, values and disciplines, ethical standards, diversity, other outside commitments, professional background and skills. This evaluation is done in the context of an assessment of the needs of the board at the time. Each director candidate is carefully evaluated to ensure that other existing and planned future commitments will not materially interfere with his or her responsibilities as a UPS director.

The Nominating and Corporate Governance Committee’s objective is to maintain a board of individuals of the highest personal character, integrity and ethical standards. The Nominating and Corporate Governance Committee also seeks candidates that reflect a range of professional backgrounds and skills relevant to our business. Our director biographies highlight the experiences and qualifications that were among the most important to the Nominating and Corporate Governance Committee and the board in concluding that the nominee should serve as a director of the Company.

The Nominating and Corporate Governance Committee may use a variety of sources to identify candidates, including recommendations from independent directors or members of management, search firms, discussions with other persons who may know of suitable candidates and shareowner recommendations. Evaluations of prospective candidates typically include a review of the candidate’s background and qualifications by the Nominating and Corporate Governance Committee, interviews with the Committee as a whole, one or more members of the Committee, or one or more other board members, and discussions of the Committee and the full board.

The Nominating and Corporate Governance Committee considers shareowner proposed director candidates on the same basis as recommendations from other sources. Shareowners who want to recommend a director candidate to the Nominating and Corporate Governance Committee may do so by submitting the name of the prospective candidate in writing to the following address: Corporate Secretary, 55 Glenlake Parkway, N.E., Atlanta, Georgia 30328. Submissions should describe the experience, qualifications, attributes and skills that make the prospective candidate a suitable director nominee. Our Bylaws set forth the requirements for direct nomination by a shareowner of persons for election to the Board of Directors. These requirements are described under “Other Information for Shareowners — Shareowner Proposals and Nominations for Director at the 2017 Annual Meeting” on page 61.

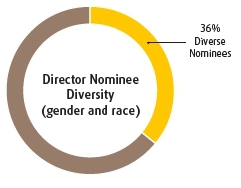

Our board believes that a variety of viewpoints contribute to a more effective decision-making process. As a result, the Nominating and Corporate Governance Committee considers diversity in identifying director nominees, including personal characteristics such as race, gender, age and cultural background, as well as diversity in experience and skills relevant to the board’s performance of its responsibilities in the oversight of a complex global business. The Nominating and Corporate Governance Committee assesses the effectiveness of its efforts at pursuing diversity through its periodic evaluation of the board’s composition. Our 11 director nominees include a diverse range of individuals, including three women, one African-American, a nominee who was raised and resides in Europe and another who spent his entire career in Asia. We also have a great degree of age diversity among our nominees, with our directors’ ages ranging between 45 and 70 years.

www.upsannualmeeting.com |  | 7 |

Board Refreshment and Succession Planning

The Nominating and Corporate Governance Committee regularly considers the long-term make up of our Board of Directors and how the members of our board change over time. The Nominating and Corporate Governance Committee also considers the experience needed for our board as our business and the markets in which we do business evolve. Our board aims to strike a balance between the knowledge that comes from longer-term service on the board with the new experience, ideas and energy that can come from adding directors to the board. Since 2009 we have added 6 new independent directors to our board and have had 4 directors retire.

We believe the average tenure for our director nominees of approximately 6.4 years reflects the balance the board seeks between different perspectives brought by long-serving directors and new directors.

Director Nominee Tenure

Years as Director

Our Corporate Governance Guidelines include director independence standards that meet the listing standards set forth by the NYSE, which require a majority of our directors to be independent. Our Corporate Governance Guidelines are available on the governance section of our investor relations website at www.investors.ups.com.

The board reviewed the independence of each director in February 2016 and considered whether there were any relationships between each director or any member of his or her immediate family, and UPS. The board also examined whether there were any relationships between an organization of which a director is a partner, shareowner or executive officer, and UPS.

This review allowed the board to determine whether any such relationships were inconsistent with a determination that a director is independent.

As a result of this review, the board affirmatively determined that the following directors are independent: Rodney Adkins, Michael Burns, William Johnson, Candace Kendle, Ann Livermore, Rudy Markham, Clark Randt, John Stankey, Carol Tomé and Kevin Warsh. Accordingly, 10 of our 11 director nominees are independent. All directors on the Audit, Compensation, Risk, and Nominating and Corporate Governance Committees are independent. In addition, the board has determined that former directors Duane Ackerman and Stuart Eizenstat were independent during the portion of 2015 that they served as directors.

In determining the independence of Michael Burns, Stuart Eizenstat, John Stankey and Carol Tomé, our board considered ordinary course relationships between UPS and the organizations that employed these directors or their immediate family members during 2015. The Board of Directors also considered that the Company and its subsidiaries may make charitable contributions to non-profit organizations where our directors or their immediate family members serve as executive officers. The board determined that none of these transactions was material to the Company, the individuals or the organizations with which they were associated.

The board selects the Chairman and the Chief Executive Officer after receiving recommendations from the Nominating and Corporate Governance Committee. The board evaluates and determines the most appropriate leadership structure for UPS at any given time. The Nominating and Corporate Governance Committee periodically evaluates and recommends whether or not to separate or combine the roles of Chairman and Chief Executive Officer.

| 8 |  | Notice of Annual Meeting of Shareowners and 2016 Proxy Statement |

Scott Davis served as our Non-Executive Chairman from his retirement as Chief Executive Officer in September 2014 until February 2016. In connection with Scott’s retirement from his role as Non-Executive Chairman and decision not to stand for re-election to the board, the board gave thoughtful consideration to its leadership structure and determined that it would be in the best interests of the Company and its shareowners to combine the roles of Chairman and Chief Executive Officer. As a result, the board appointed David Abney, our Chief Executive Officer, to the additional position of Chairman of the Board in February 2016.

The board determined that David, who has primary responsibility for managing the Company’s day-to-day operations and extensive knowledge and understanding of the Company, is best positioned to lead the board at this time and to focus the board’s attention on the issues of greatest importance to the Company and its shareowners. Having our Chief Executive Officer serve as Chairman of the Board also is consistent with the historical practice of UPS, as all ten of our previous Chief Executive Officers have also served as Chairman of the Board, and we believe that this leadership structure has been effective for the Company.

At the same time, the board recognizes the importance of providing additional, independent oversight of the board. Accordingly, in February 2016, the independent directors of the board appointed William Johnson as lead independent director to serve for a period of at least one year. Our lead independent director’s leadership authority and responsibilities include:

| ● | Presiding at meetings of the board at which the Chairman is not present, including executive sessions of the non-management and independent directors; |

| ● | Approving information sent to the board; |

| ● | Approving the agenda and schedule for board meetings to provide that there is sufficient time for discussion of all agenda items; |

| ● | Serving as liaison between the Chairman and the non-management and independent directors; |

| ● | Being available for consultation and communication with major shareowners upon request; and |

| ● | Having the authority to call executive sessions of the non-management and independent directors. |

As described above under “Director Independence,” 10 of our 11 director nominees are independent. In addition, all of the directors on each of the Audit Committee, the Compensation Committee, the Risk Committee and the Nominating and Corporate Governance Committee are independent. Each of these committees is led by a chairperson who sets the agenda for the committee and reports to the full board on the committee’s work. Our non-management directors meet in executive session without management present as frequently as they deem appropriate, typically at the time of each regular board meeting. We believe that this structure provides the best form of leadership for the Company and its shareowners at this time.

Executive Sessions of Non-Management Directors

Our non-management directors hold executive sessions without management present as frequently as they deem appropriate, typically at the time of each regular board meeting. During 2015, the chairpersons of the independent board committees rotated serving as Presiding Director of these executive sessions. Beginning in February 2016, the lead independent director determines the agenda for the session, presides at the session and, after the session, acts as a liaison between the non-management directors and the Chairman and Chief Executive Officer. The lead independent director may invite the Chairman and Chief Executive Officer to join the session for certain discussions, as he or she deems appropriate. If the non-management directors include in the executive sessions any non-independent directors, then at least once a year an executive session is held including only the independent directors.

Board and Committee Evaluations

Our board has a proven and detailed annual self-evaluation process. In addition, the charters of each of the Audit Committee, Compensation Committee, Risk Committee and Nominating and Corporate Governance Committee require an annual performance evaluation. The Nominating and Corporate Governance Committee oversees the annual self-assessment process on behalf of the board and the implementation of the annual self-assessments by the committees.

All board members and all members of the Audit, Compensation, Risk and Nominating and Corporate Governance Committees complete a detailed confidential questionnaire. The questionnaire provides for quantitative ratings in key areas and also allows directors to provide feedback and make detailed anonymous comments. The Chair of the Nominating and Corporate Governance Committee reviews the responses with the chairs of the Audit, Risk and Compensation Committees. The Chair of the Nominating and Corporate Governance Committee also discusses the board self-evaluation with the full board. Matters requiring follow-up are addressed by the Chair of the Nominating and Corporate Governance Committee or the chairs of the Audit, Risk or Compensation Committee, as appropriate.

www.upsannualmeeting.com |  | 9 |

Majority Voting and Director Resignation Policy

Our Bylaws provide for majority voting in uncontested director elections. Under the majority voting standard, directors are elected by a majority of the votes cast. This means that in order to be elected the number of votes cast for a director must exceed the number of votes cast against that director.

Any director who does not receive a majority of the votes cast must offer to resign from the board. The Nominating and Corporate Governance Committee will recommend to the board whether to accept or reject the offer to resign. The Nominating and Corporate Governance Committee will consider all relevant factors in making the recommendation. The board will act on the Nominating and Corporate Governance Committee’s recommendation within 90 days following certification of the election results. The board will consider the factors considered by the Nominating and Corporate Governance Committee and any additional relevant information. Any director who offers to resign must recuse himself or herself from the board vote, unless the number of independent directors who were successful incumbents is fewer than three. The board will promptly disclose its decision regarding any offer to resign, including its reasoning. If the board determines to accept a director’s offer to resign, the Nominating and Corporate Governance Committee will recommend whether and when to fill such vacancy or whether to reduce the size of the board.

Our board is responsible for overseeing our management of risk. In May 2015, the board established a Risk Committee comprised entirely of independent board members. The Risk Committee is responsible for assisting the Board of Directors in overseeing management’s identification and evaluation of enterprise risks, including the Company’s risk management framework and the policies, procedures and practices employed to manage risks. In particular, the Risk Committee focuses on strategic enterprise risks including, but not limited to, risks associated with technology, intellectual property and operations, such as; (a) the quality, adequacy and effectiveness of the Company’s data security, privacy, technology and information security policies, procedures, and internal controls; (b) cybersecurity and cyber incident response; and (c) business continuity and disaster recovery planning and capabilities.

The Risk Committee coordinates with the Audit Committee as necessary and appropriate to enable the Audit Committee to perform its statutory, regulatory, and other responsibilities with respect to oversight of risk assessment and risk management. Specifically, the Audit Committee is responsible for overseeing policies with respect to financial risk assessment, including guidelines to govern the process by which major financial and accounting risk assessment and management is undertaken by the Company.

The board’s other independent committees oversee risks associated with their respective areas of responsibility. For example, the Compensation Committee considers the risks to our business associated with our compensation policies and practices, with respect to both executive compensation and compensation generally. In addition, our full board regularly engages in discussions of the most significant risks that the Company has identified and how these risks are being managed. The board also receives reports on risk management from senior officers of the Company and from the committee chairs regularly. The board reviews periodic assessments from the Company’s ongoing enterprise risk management process that are designed to identify potential events that may affect the achievement of the Company’s objectives or have a material adverse effect on the Company.

The Company’s General Counsel reports directly to our Chief Executive Officer, providing him with visibility into the Company’s risk profile. The head of the Company’s compliance and internal audit functions regularly reports to the Audit Committee, and each of the General Counsel, Chief Financial Officer and the compliance and internal audit department manager have regularly scheduled private sessions with the Audit Committee. The Board of Directors believes that the work undertaken by the committees of the board, together with the work of the full board and the Company’s senior management, enables the Board of Directors to effectively oversee the Company’s management of risk.

Our board has deep experience and expertise in the area of strategy development and has significant oversight of our corporate strategy and long-range operating plans. Acting as a full board and through each independent board committee (Audit, Compensation, Nominating and Corporate Governance, and Risk), the board is fully engaged in the Company’s strategic planning process.

Setting the strategic course of the Company involves a high level of constructive engagement between management and the board. Management develops and prioritizes strategic plans, including capital return policies, on an annual basis. Management then reviews these strategic plans with the board during an annual board strategy meeting, along with the Company’s challenges, industry dynamics, and legal, regulatory and governance developments, among other factors.

| 10 |  | Notice of Annual Meeting of Shareowners and 2016 Proxy Statement |

Management provides the board with comprehensive updates throughout the year regarding the implementation and results of the Company’s strategic plans, as well as frequent updates regarding the Company’s financial performance. In addition, the CEO communicates regularly with the board on important business opportunities and developments.

This process allows the board to understand and impact the Company’s strategic plans, including plans related to mergers and acquisitions, competitive challenges, changing marketplace conditions and operational technologies. As a result, the board has substantial oversight of the development and implementation of the Company’s strategic plans and the board is able to effectively monitor the Company’s progress with respect to the strategic goals and objectives.

Succession Planning and Management Development

Succession planning and talent development are important at all levels within our organization. The board oversees management’s succession plan for key positions at the senior officer level. The board also regularly evaluates succession plans in the context of the Company’s overall business strategy and with a focus on risk management.

Potential leaders are exposed and visible to board members through formal presentations and informal events. More broadly, the board is regularly updated on key talent indicators for the overall workforce, including diversity, recruiting and development programs.

Our Board of Directors held 8 meetings during 2015. Each of our directors attended at least 75% of the total number of board and any committee meetings of which he or she was a member. Our directors are expected to attend the Annual Meeting. Ten of the twelve directors who were serving on the board at the time of our 2015 Annual Meeting attended the Annual Meeting. One director was unable to attend because of illness and the other due to an unforeseen and unavoidable business conflict.

We are committed to conducting our business in accordance with the highest ethical principles. Our Code of Business Conduct is applicable to anyone who represents our enterprise, including our executive officers and directors, and all other employees and agents of our company and our subsidiary companies. A copy of our Code of Business Conduct is available on the governance section of our investor relations website, at www.investors.ups.com.

Hedging and Pledging Company Stock

We prohibit our executive officers and directors from hedging their ownership in UPS stock. Specifically, they are prohibited from purchasing or selling derivative securities relating to UPS stock and from purchasing financial instruments that are designed to hedge or offset any decrease in the market value of UPS securities. Additionally, in 2014 we adopted a policy prohibiting our executive officers and directors from entering into future pledges of UPS stock.

Conflicts of Interest and Related Person Transactions

Our Audit Committee is responsible for overseeing our Code of Business Conduct, which includes policies regarding conflicts of interest. The Code requires employees and directors to avoid conflicts of interest, defined as situations where the person’s private interests conflict, or may appear to conflict, with the interests of UPS.

In February 2015, the board adopted a formal written related person transactions policy that revised and codified our previous practices. The policy applies to any transaction or series of transactions in which: (1) the Company or any of its subsidiaries is a participant; (2) any “related person” (executive officer, director, greater than 5% beneficial owner of the Company’s common stock, or an immediate family member of any of the foregoing) has or will have a material direct or indirect interest; and (3) the aggregate amount involved since the beginning of the Company’s last completed fiscal year will exceed or may reasonably be expected to exceed $100,000. The policy provides that related person transactions that

www.upsannualmeeting.com |  | 11 |

may arise during the year are subject to Audit Committee approval or ratification. In determining whether to approve or ratify a transaction, the Audit Committee will consider, among other factors it deems appropriate, whether the transaction is on terms no less favorable than terms generally available to an unaffiliated third-party, the extent of the related person’s interest in the transaction, whether the transaction would impair independence and whether there is a business reason for UPS to enter into the transaction. A copy of the policy is available on the governance section of our investor relations website at www.investors.ups.com.

At least annually, each director and executive officer completes a detailed questionnaire that evaluates any business relationship that may give rise to a conflict of interest, including transactions where UPS is involved and where an executive officer, a director or a related person has a direct or indirect material interest. We also review the Company’s financial systems to identify potential conflicts of interest and related person transactions. There are no related person transactions with the Company that require disclosure in this proxy statement.

The Nominating and Corporate Governance Committee reviews the information from the questionnaire and our financial systems, and makes recommendations to the Board of Directors regarding the independence of each board member.

We have immaterial normal course of business relationships with companies with which our directors are associated. The Nominating and Corporate Governance Committee reviewed these transactions and relationships that occurred in 2015 and believes they were entered into on terms that are both reasonable and competitive and did not affect director independence. Additional transactions and relationships of this nature may be expected to take place in the ordinary course of business in the future.

We are receptive to shareowner concerns, and we are committed to transparency and proactive interactions with our investors.

Our management team participates in numerous investor meetings to discuss our business, our strategy and our financial results each year. These meetings include in-person, telephone and webcast conferences, and headquarters and facility visits within the United States and in key international locations.

During the most recent proxy season, our management team contacted institutional investors representing approximately 40% of our class B common stock to discuss our executive compensation programs and corporate governance practices. We have proactively corresponded with key investors through conferences in each of the past several years, and we plan to continue to do so in the future. We have taken into account the views of our shareowners when making many of the governance and disclosure decisions in recent years, including:

| ● | Appointment of a lead independent director. |

| ● | Prohibition of hedging and future pledging by executive officers and directors. |

| ● | Disclosure about the board’s role in strategic planning. |

| ● | Enhanced disclosure and governance on political contributions. |

| ● | Added a maximum individual payout cap to our annual incentive plan. |

| ● | Enhanced executive compensation disclosure, including disclosure about how the metrics in our Long-Term Incentive Plan create long-term value for our shareowners. |

| ● | Enhanced disclosure about board refreshment and board succession planning, as well as our board self-evaluation process. |

| ● | Enhanced disclosure about diversity. |

| ● | Expanded the Audit Committee’s report in the proxy statement. |

| ● | Updated the presentation of our proxy statement to enhance readability and understanding by our shareowners. |

We inform our board through our Compensation and Nominating and Corporate Governance Committees about our conversations with key investors concerning our executive compensation and governance practices. Directors carefully consider feedback from institutional investors and other shareowners. The Compensation Committee also annually engages an independent compensation consultant to review executive compensation trends that may be important to our investors. The Compensation Committee’s consideration of shareowner feedback, along with the market information and analysis provided by its independent compensation consultant, have influenced a number of changes to our executive compensation program over the past several years:

| ● | Increased the performance-based equity in our compensation program. |

| ● | Eliminated single-trigger equity vesting following a change in control. |

| ● | Eliminated tax gross-ups. |

The design of our executive compensation program is guided by our executive compensation philosophy and core principles described in the Compensation Discussion and Analysis.

Materials from our investor presentations, including information on the work of our board and its committees, are available on our investor relations website at www.investors.ups.com.

| 12 |  | Notice of Annual Meeting of Shareowners and 2016 Proxy Statement |

Communicating with our Board of Directors

Any shareowners or interested parties who wish to communicate directly with our board, with our non-management directors as a group or with the lead independent director may do so by writing to the Corporate Secretary, 55 Glenlake Parkway, N.E., Atlanta, Georgia 30328. Please specify to whom your letter should be directed. After the communication is reviewed by the Corporate Secretary, it will be promptly forwarded to the addressee. Advertisements, solicitations for business, requests for employment, requests for contributions, matters that may be better addressed by management or other inappropriate materials will not be forwarded to our directors.

Political Contributions and Lobbying

| Overview |

Our responsible participation in the U.S. political process is important to the success of our business and the protection of shareowner value. We participate in this process in accordance with good corporate governance practices. Our Political Contributions and Lobbying Policy (“policy”) is available at www.investors.ups.com. The following discussion highlights our practices and procedures regarding political contributions and lobbying.

| Board Oversight and Processes |

Our political contributions are made in a legal, ethical and transparent manner that we believe best represents the interests of our shareowners. All political and lobbying activities are conducted only with the prior approval of our Public Affairs department and in accordance with the terms of our policy. Senior management works with Public Affairs to focus our involvement at all levels of government on furthering our business objectives and our goal of protecting and enhancing shareowner value. The president of our Public Affairs department reviews all UPS political and lobbying activities and regularly reports to the Board of Directors and to our Nominating and Corporate Governance Committee.

| ● | Our policy is overseen by the Nominating and Corporate Governance Committee, a committee composed entirely of independent directors. |

| ● | As a general policy, UPS does not make corporate political contributions or expenditures. |

| ● | Any deviations from the prohibition against corporate political contributions must be approved by the Nominating and Corporate Governance Committee and reported in UPS’s semi-annual political contribution report. |

| ● | UPS offers certain eligible employees the opportunity to make political contributions through a company-sponsored political action committee, called the UPS Political Action Committee, or UPSPAC. The UPSPAC is organized and operated on a strictly voluntary, nonpartisan basis and is registered with the Federal Election Commission. |

| Lobbying and Trade Associations |

UPS Public Affairs is responsible for coordinating our lobbying activities, including engagements with federal, state, and local governments. UPS is a member of a variety of trade associations and other tax exempt organizations that engage in lobbying. The Company may participate when involvement is consistent with specific UPS business objectives. These decisions are subject to board oversight and are regularly reviewed by the Nominating and Corporate Governance Committee.

| ● | In accordance with the terms of our policy, all lobbying activities are conducted only with the prior approval of UPS Public Affairs, which works with senior management to focus on furthering our business objectives and our goal of protecting and enhancing shareowner value. |

| ● | The Nominating and Corporate Governance Committee regularly reviews UPS’s participation in trade associations and other tax exempt organizations that engage in lobbying, to determine if our involvement is consistent with specific UPS business objectives. |

We have comprehensive policies, practices and tracking mechanisms to support and govern our lobbying activities. These mechanisms cover compliance with laws and regulations regarding the lobbying of government officials, the duty to track and report lobbying activities, and the obligation to treat lobbying costs and expenses as nondeductible for tax purposes. All lobbying contacts with covered government officials must be coordinated with and approved by the president of our Public Affairs department.

www.upsannualmeeting.com |  | 13 |

| Transparency |

We are committed to meaningful transparency and oversight with respect to our political activities. We publish a semi-annual report disclosing the following information, all of which is reviewed and approved by the Company’s Nominating and Corporate Governance Committee prior to publication:

| ● | Amounts and recipients of any federal and state political contributions and expenditures made by UPS in the United States (if any such expenditures are made); and |

| ● | Payments to trade associations that receive $50,000 or more from UPS and that use a portion of the payment for political expenditures, as reported by the trade association to UPS. |

UPS also files a publicly available federal Lobbying Disclosure Act Report each quarter, providing information on activities associated with influencing legislation through communications with any member or employee of a legislative body or with any covered executive branch official. The report also provides disclosure on expenditures for the quarter, describes the specific pieces of legislation that were the topic of communications, and identifies the individuals who lobbied on behalf of UPS. These reports are available at lobbyingdisclosure.house.gov and www.senate.gov/legislative/Public_Disclosure/LDA_reports.htm. UPS files similar periodic reports with state agencies reflecting state lobbying activities which are also publicly available.

Stakeholder engagement is an essential aspect of corporate governance. We are one of the world’s largest private employers. We serve millions of customers around the world, we operate in more than 220 countries and territories, and millions of investors include our shares in their portfolios. Engagement on environmental and sustainability issues is important to our stakeholders.

Each year we publish a sustainability report showcasing the aspirations, achievements and challenges of our commitment to balancing the social, economic and environmental aspects of our business. The report is available at www.investors.ups.com. Our success is dependent on economic stability, global trade and a society that welcomes opportunity. We understand the importance of acting responsibly as a business, an employer and a corporate citizen.

Our board delegates authority for day-to-day management of economic, environmental, and social topics to UPS management. The board oversees economic, environmental and social issues, and is in touch with stakeholder concerns through a number of processes. For example, the board is regularly briefed on issues of concern for customers, unions, employees, retirees and investors. Furthermore, the board oversees all efforts by UPS management to develop our values, strategies and policies related to economic, environmental, and social impacts.

UPS was among the first Fortune 100 companies to appoint a chief sustainability officer. Our chief sustainability officer regularly reports to the board regarding sustainability strategies, priorities, goals, and performance. In addition, members of the board review the contents of our sustainability report each year and provide feedback to the Company.

Economic, environmental and social risks are part of our comprehensive enterprise risk management program. The board reviews the effectiveness of our risk management and due diligence processes related to economic, environmental, and social topics. In addition, the board actively considers economic, environmental and social issues in connection with the board’s involvement in UPS’s strategic planning process.

Corporate Governance Guidelines and Committee Charters

Our Corporate Governance Guidelines are available on the governance section of our investor relations website at www.investors.ups.com. The charters for each of the Audit, Compensation, Nominating and Corporate Governance and Risk Committees also are available on the governance section of our investor relations website.

| 14 |  | Notice of Annual Meeting of Shareowners and 2016 Proxy Statement |

| Your Board of Directors |

Committees of the Board of Directors

Our Board of Directors has four committees composed entirely of independent directors: the Audit Committee, the Compensation Committee, the Nominating and Corporate Governance Committee and the Risk Committee. Information about each of these committees is provided below. The board also has an Executive Committee that may exercise all powers of the Board of Directors in the management of our business and affairs, except for those powers expressly reserved to the board under Delaware law or otherwise limited by the Board of Directors. David Abney is the chair of the Executive Committee. Scott Davis and William Johnson also serve on the Executive Committee. The Executive Committee held no meetings during 2015. Each member of our board’s committees, other than the Executive Committee, meets the NYSE director independence requirements.

| Audit Committee(1) | Compensation Committee(2) | Nominating and Corporate Governance Committee | Risk Committee | |||

| Carol Tomé, Chair | Ann Livermore, Chair | William Johnson, Chair | Rodney Adkins, Chair | |||

| Michael Burns | Rodney Adkins | Clark Randt, Jr. | Candace Kendle | |||

| Candace Kendle | Clark Randt, Jr. | John Stankey | Ann Livermore | |||

| Rudy Markham | Kevin Warsh | Kevin Warsh | John Stankey | |||

| Meetings in 2015:9 | Meetings in 2015:6 | Meetings in 2015:4 | Meetings in 2015:3 | |||

| Primary Responsibilities | Primary Responsibilities | Primary Responsibilities | Primary Responsibilities | |||

●Assisting the board in discharging its responsibility relating to our accounting, reporting and financial practices ●Overseeing our accounting and financial reporting processes ●Overseeing the integrity of our financial statements, our systems of disclosure controls and internal controls and our compliance with legal and regulatory requirements ●Overseeing the performance of our internal audit function ●Overseeing the engagement and performance of our independent accountants ●Discussing with management policies with respect to financial risk assessment | ●Assisting the board in discharging its responsibilities with respect to compensation of our executive officers ●Reviewing and approving the corporate goals and objectives relevant to the compensation of our Chief Executive Officer ●Evaluating the Chief Executive Officer’s performance and establishing the total compensation for the Chief Executive Officer based on this evaluation ●Reviewing and approving the compensation of other executive officers, including equity awards ●Overseeing the evaluation of risk associated with the Company’s total compensation strategy and compensation programs ●Overseeing any outside consultants retained to advise the Committee ●Recommending to the board the compensation to be paid to non-management directors | ●Considering recommendations from the Chief Executive Officer and others regarding succession planning ●Assisting the board in identifying and screening qualified director candidates, including shareowner nominees ●Recommending candidates for election or reelection to the board or to fill vacancies on the board ●Aiding in attracting qualified candidates to serve on the board ●Recommending corporate governance principles, including the structure, composition and functioning of the board and all board committees, the delegation of authority to subcommittees, board oversight of management actions and reporting duties of management | ●Overseeing management’s identification and evaluation of enterprise risks ●Overseeing and reviewing with management the Company’s risk governance framework ●Overseeing the Company’s risk identification, risk tolerance, risk assessment and management practices for strategic enterprise risks facing the Company ●Reviewing approaches to risk assessment and mitigation strategies in coordination with the board and other board committees ●Communicating with the Audit Committee as necessary and appropriate to enable the Audit Committee to perform its statutory, regulatory, and other responsibilities with respect to oversight of risk assessment and risk management | |||

| (1) | All members of the Audit Committee have been designated by the Board of Directors as audit committee financial experts. Each member of our Audit Committee meets the independence requirements of the NYSE and SEC rules and regulations, and each is financially literate. |

| (2) | Each member of our Compensation Committee meets the NYSE’s independence requirements, including the enhanced independence requirements applicable to Compensation Committee members. In addition, each member is a non-employee director as required by Rule 16b-3 under the Securities Exchange Act of 1934 and is an outside director under Section 162(m) of the Internal Revenue Code. None of the members of the Compensation Committee during 2015 (Duane Ackerman, Rodney Adkins, Stuart Eizenstat, Ann Livermore, Clark Randt, Jr. and Kevin Warsh) is or was during 2015 an employee or former employee of UPS and none had any direct or indirect material interest in or relationship with UPS outside of his or her position as a non-employee director. Furthermore, none of our executive officers serves or served during 2015 as a member of a board of directors or compensation committee of any entity that has one or more executive officers who serve on our Board of Directors or Compensation Committee. |

www.upsannualmeeting.com |  | 15 |

Proposal 1 —Director Elections

The board has nominated the 11 persons named below for election as directors at the Annual Meeting. The nominees shall serve until the next Annual Meeting and until their respective successors are elected and qualified. Each nominee is currently serving on the board and was elected by shareowners at our last Annual Meeting. If any nominee is unable to serve as a director, the board may reduce the number of directors or choose a substitute nominee.

Since last year’s Annual Meeting, Scott Davis retired from his role as Non-Executive Chairman, effective in February 2016, and he will not stand for re-election at the 2016 Annual Meeting of Shareowners.

We thank Scott for his years of dedication and service to the Company and the Board of Directors, including service as our Chairman and Chief Executive Officer and as Non-Executive Chairman of the Board.

Biographical information about the 11 nominees for director appears below, including information about the experience, qualifications, attributes and skills considered by our Nominating and Corporate Governance Committee and board in determining that the nominee should serve as a director. For additional information about how we identify and evaluate nominees for director, see “Corporate Governance — Selecting Director Nominees” on page 7.

| The Board of Directors recommends that shareowners vote FOR the election of each nominee. |

| David P. Abney | ||

Age: 60

| |||

Career

David became UPS’s Chief Executive Officer in September 2014, and Chairman of the Board in February 2016. David previously served as Chief Operating Officer since 2007, overseeing logistics, sustainability, engineering and all facets of the UPS transportation network. Before serving as COO, David was President of UPS International, leading the Company’s strategic initiative to increase its global logistics capabilities. During his career, he was also involved in a number of global acquisitions that included the Fritz Companies, Stolica, Lynx Express, and Sino-Trans in China. Earlier in his career, he served as President of SonicAir, a same-day delivery service that signaled UPS’s move into the service parts logistics sector. David began his UPS career in 1974 in Greenwood, Mississippi.

In addition to his corporate responsibilities, David serves as a Trustee of The UPS Foundationand chairman of the World Affairs Council of Atlanta. He is also a member of the President’s Export Council, the Board of Directors of Johnson Controls, and the Business Roundtable.

Reasons for election to the UPS Board

David has a thorough understanding of our strategies and operations gained through his over 40 years of service to our company, a complex, global business enterprise with a large, labor intensive workforce. He has significant experience in operations, having served as our Chief Operating Officer for seven years, including in depth knowledge of logistics. He also has significant international experience, having spent a number of years overseeing our international group. In addition, David has experience serving as a director of Johnson Controls, a global diversified technology and industrial company serving customers in more than 150 countries.

| 16 |  | Notice of Annual Meeting of Shareowners and 2016 Proxy Statement |

| Rodney C. Adkins | Career Rod is President of 3RAM Group LLC, a private company specializing in capital investments, business consulting and property management services. Rod previously served as IBM’s Senior Vice President of Corporate Strategy before retiring in 2014. Rod was previously Senior Vice President, Systems and Technology Group, a position he held since 2009, and Senior Vice President of STG development and manufacturing, a position he held since 2007. In his over 30-year career with IBM, Rod held a number of other development and management roles, including general management positions for the PC Company, UNIX Systems and Pervasive Computing. In addition, Rod currently serves on the Board of Directors of Avnet, Inc., W.W. Grainger, Inc. and PPL Corporation. Reasons for election to the UPS Board As a senior executive of a public technology company, Rod gained a broad range of experience, including experience in emerging technologies and services, global business operations, and supply chain management. He is a recognized leader in technology and technology strategy. In addition, Rod has experience serving as a director of other publicly traded companies. | |||

Age: 57 Director since 2013 Skills and Experience - Technology and technology strategy - Global business operations - Supply chain management Other Public Company Boards - W.W. Grainger, Inc. - PPL Corporation - Avnet, Inc. Former Public Company Boards - Pitney Bowes, Inc (left board in 2013) Board Committees - Risk (Chair) - Compensation | |||||

| Michael J. Burns | Career Michael was the Chairman, Chief Executive Officer and President of Dana Corporation from 2004 until his retirement in 2008. He joined Dana Corporation in 2004 after 34 years with General Motors Corporation. Michael had served as President of General Motors Europe since 1998. Dana Corporation filed a voluntary petition under Chapter 11 of the federal bankruptcy laws in March 2006. On January 31, 2008, Dana Corporation emerged from Chapter 11, prior to Michael’s departure from Dana Corporation. Reasons for election to the UPS Board Michael has years of senior leadership experience gained while managing large, complex businesses and leading an international organization that operated in a highly competitive industry. He also has experience in design, engineering, manufacturing, and sales and distribution. Michael also brings deep knowledge of technology and the supply of components and services to major vehicle manufacturers. | |||

Age: 64 | |||||

www.upsannualmeeting.com |  | 17 |

| William R. Johnson | Career Bill served as Chairman, President and Chief Executive Officer of the H.J. Heinz Company, a global packaged foods manufacturer, from 2000 until his retirement in 2013. He became President and Chief Operating Officer of Heinz in 1996, and assumed the position of President and Chief Executive Officer in 1998. Bill also serves on the Board of Directors of Emerson Electric Company and PepsiCo, Inc. Reasons for election to the UPS Board Bill has significant experience gained through over 13 years of service as the Chairman and Chief Executive Officer of H.J. Heinz, a corporation with significant international operations and a large, labor intensive workforce. He also has deep experience in operations, marketing, brand development and logistics. | |||

Age: 67 | |||||

| Candace Kendle | Career Candace is the co-founder and was, until 2011, Chairman and Chief Executive Officer of Kendle International Inc., a global clinical research organization. Prior to founding Kendle International, she earned a doctorate in pharmacy from the University of Cincinnati and has held senior faculty positions at the University of North Carolina Schools of Pharmacy and Medicine; the University of Pennsylvania School of Medicine; the Philadelphia College of Pharmacy and Science; and the University of Cincinnati College of Pharmacy. Candace serves on the Board of Directors of Emerson Electric Company. Reasons for election to the UPS Board During her tenure as Chairman and Chief Executive Officer of Kendle International, Candace gained insight and experience in executing strategic acquisitions, expansions into new markets, and product development. She also brings deep knowledge of the pharmaceutical industry as a result of her doctorate and post-doctorate work, her many years of experience as a professor and her many years of experience in the practical application of her clinical and pharmaceutical knowledge. | |||

Age: 69 | |||||

| 18 |  | Notice of Annual Meeting of Shareowners and 2016 Proxy Statement |

| Ann M. Livermore | Career Ann serves as a director of the Hewlett Packard Enterprise Company, after retiring as an executive of HP in 2011. In her last operational role at HP, Ann was Executive Vice President in charge of the server, storage, networking, software and services business. Ann joined HP in 1982 and held a variety of management positions in marketing, sales, research and development, and business management before being elected a corporate vice president in 1995. Ann is also a lecturer at the Stanford Graduate School of Business. Reasons for election to the UPS Board Ann has extensive experience in senior leadership positions at HP, one of the world’s largest information technology companies. This experience includes leading a complex global business organization with a large workforce. Through her 29 years at HP, she has gained knowledge and experience in the areas of technology, marketing, sales, research and development and business management. | |||

Age: 57 | |||||

| Rudy H.P. Markham | Career Rudy was the Financial Director of Unilever from 2000 through his retirement in 2007. He joined Unilever in 1968. From 1989 through 1998 he was based in East Asia where he held a series of increasing responsibilities, ultimately serving as Business Group President North East Asia based in Singapore. Rudy joined the board of Unilever as Strategy and Technology Director, became a member of its Executive Committee in 1998 and was subsequently appointed as Financial Director. In 2007, he retired from the board of Unilever and as Chief Financial Officer. Rudy is a director of AstraZeneca PLC and Legal and General PLC. He also is vice chairman of the supervisory board of Corbion, N.V., formerly CSM, N.V. Rudy is a British citizen and he currently resides in the U.K. Reasons for election to the UPS Board Rudy has significant experience in finance, technology and international operations that he gained through his almost 40 years of service at Unilever, one of the world’s largest consumer goods companies. Rudy also has insight into the operations of an organization with a large, global workforce, and has a unique insight into operations based in Asia. Rudy’s experience also includes service as a director of other Europe-based global public companies. | |||

Age: 70 | |||||

www.upsannualmeeting.com |  | 19 |

| Clark “Sandy” T. Randt, Jr. | Career Sandy is a former U.S. ambassador to the People’s Republic of China, where he served from 2001 until 2009. From 1994 through 2002, he was a partner resident in the Hong Kong office of Shearman & Sterling, a major international law firm, where he headed the firm’s China practice. From 1982 through 1984, Sandy served as First Secretary and Commercial Attaché at the U.S. Embassy in Beijing. In 1974, he was the China representative of the National Council for United States-China Trade, and from 1968 to 1972, he served in the U.S. Air Force Security Service. Currently, Sandy is President of Randt & Co. LLC, a company that advises firms with interests in China. Sandy also serves on the boards of Wynn Resorts, Ltd., Valmont Industries, Inc. and Qualcomm Incorporated. Reasons for election to the UPS Board Sandy has substantial experience in Asia and in facilitating business throughout Asia. He is recognized as one of America’s foremost authorities on China, and has more than 35 years of direct experience in Asia. He brings to the board experience in diplomacy and international trade. He has experience as an advisor on international matters to large, multinational corporations, and brings the experience of leading the China practice of a major international law firm. | |||

Age: 70 | |||||

| John T. Stankey | Career John has served as CEO, AT&T Entertainment Group, since 2015. He is responsible for leading strategy, marketing and operations around the development and distribution of a premier entertainment experience for customers through multiple channels anywhere. John previously served as Group President and Chief Strategy Officer of AT&T from 2012 through 2015 where he had responsibility for AT&T’s strategy and corporate development functions. John also served as President and CEO of AT&T Business Solutions, where he was responsible for serving AT&T’s business customers worldwide. John has held a number of other roles at AT&T, including President and Chief Executive Officer of AT&T Operations, Chief Technology Officer and Chief Information Officer. He is a member of the Cotton Bowl Athletic Association and is on the Board of Visitors at the Anderson Graduate School of Management at UCLA. Reasons for election to the UPS Board During his more than 30 year career at AT&T, John has gained significant experience in technology and communications services, strategic planning and execution, and global business operations. As a senior leader at one of the world’s largest communications companies, John has extensive experience managing a large, complex, multi-national business with a large, labor intensive workforce, much of which is unionized. He also has experience working with a company that has both direct to consumer and business to business offerings. | |||

Age: 53 | |||||

| 20 |  | Notice of Annual Meeting of Shareowners and 2016 Proxy Statement |

| Carol B. Tomé | Career Carol has been Executive Vice President and Chief Financial Officer of The Home Depot, Inc., one of the world’s largest retailers, since 2001. In 2007 Carol assumed the additional role of Executive Vice President — Corporate Services. Prior to that, she had been Senior Vice President — Finance and Accounting/Treasurer since 2000. From 1995 until 2000, she served as Vice President and Treasurer. Reasons for election to the UPS Board Carol has extensive experience in corporate finance gained throughout her career at Home Depot. She brings the experience of currently serving as chief financial officer of a complex, multi-national business with a large, labor intensive workforce. Carol’s past role as Chair of the Board of the Federal Reserve Bank of Atlanta also brings valuable financial experience. | |||

Age: 59 | |||||

| Kevin M. Warsh | Career Kevin was a member of the Board of Governors of the Federal Reserve from 2006 until 2011. He currently serves as a distinguished visiting fellow at Stanford University’s Hoover Institution and a lecturer at its Graduate School of Business. In addition, Kevin provides strategic consulting and advisory services to a range of businesses. From 2002 until 2006, Kevin served at the White House as President George W. Bush’s special assistant for economic policy and as executive secretary of the National Economic Council. Kevin was previously employed by Morgan Stanley & Co. in New York, becoming vice president and executive director of the company’s Mergers and Acquisitions Department. Reasons for election to the UPS Board Kevin has extensive experience in understanding and analyzing the economic environment, the financial marketplace and monetary policy. He has a deep understanding of the global economic and business environment. Kevin also brings the experience of working in the private sector for a leading investment bank gained during his tenure at Morgan Stanley & Co. | |||

Age: 45 Board Committees | |||||

We provide both cash and equity awards to our non-employee directors. Our employee directors do not receive any compensation for service as a director. Directors are reimbursed for their expenses related to board membership.

In 2015, our non-employee directors received an annual cash retainer of $100,000 and our Non-Executive Chairman of the Board received an annual cash retainer of $300,000. The chairs of the Compensation, Nominating and Corporate Governance and Risk Committees received an additional annual cash retainer of $20,000, and the chair of the Audit Committee received an additional annual cash retainer of $25,000. Our lead independent director receives an additional annual cash retainer of $25,000. Cash retainers are paid on a quarterly basis. Non-employee directors may defer retainer fees by participating in the UPS Deferred Compensation Plan, but we do not make any company or matching contributions under this plan. There are no preferential or above-market earnings in the UPS Deferred Compensation Plan.

Non-employee directors also receivean annual restricted stock unit (“RSU”) grant in the amount of $160,000. RSUs are held until the director separates from the UPS Board of Directors, at which time the RSUs are paid out in shares of class A common stock. The annual equity grant is prorated based on the portion of the year that a director serves on the board.

www.upsannualmeeting.com |  | 21 |

| 2015 Director Compensation |

The following tables set forth the cash compensation paid to our non-employee directors in 2015 and the aggregate number of stock awards granted to our non-employee directors in 2015 and outstanding as of December 31, 2015.

| 2015 Director Compensation | ||||||

| Fees | ||||||

| Earned or | ||||||

| Paid in | Stock | |||||

| Name | Cash($) | Awards($)(1) | Total($) | |||

| F. Duane Ackerman(2) | 60,000 | 0 | 60,000 | |||

| Rodney C. Adkins(3) | 110,000 | 159,922 | 269,922 | |||

| Michael J. Burns | 100,000 | 159,922 | 259,922 | |||

| D. Scott Davis(4) | 300,000 | 159,922 | 459,922 | |||

| Stuart E. Eizenstat(2) | 50,000 | 0 | 50,000 | |||

| William R. Johnson(3) | 110,000 | 159,922 | 269,922 | |||

| Candace Kendle | 100,000 | 159,922 | 259,922 | |||

| Ann M. Livermore | 120,000 | 159,922 | 279,922 | |||

| Rudy H.P. Markham | 100,000 | 159,922 | 259,922 | |||

| Clark T. Randt, Jr. | 100,000 | 159,922 | 259,922 | |||

| John T. Stankey | 100,000 | 159,922 | 259,922 | |||

| Carol B. Tomé | 125,000 | 159,922 | 284,922 | |||

| Kevin M. Warsh | 100,000 | 159,922 | 259,922 | |||

| Outstanding Director Stock Awards | ||||

| (as of December 31, 2015) | ||||

| Stock Awards | ||||

| Restricted | Phantom | |||

| Stock | Stock | |||

| Name | Units (#) | Units (#) | ||

| F. Duane Ackerman(2) | 0 | 0 | ||

| Rodney C. Adkins | 5,317 | 0 | ||

| Michael J. Burns | 14,935 | 0 | ||

| D. Scott Davis(4) | 1,640 | 0 | ||

| Stuart E. Eizenstat(2) | 0 | 0 | ||

| William R. Johnson | 15,868 | 0 | ||

| Candace Kendle | 9,470 | 0 | ||

| Ann M. Livermore | 14,935 | 2,289 | ||

| Rudy H.P. Markham | 14,935 | 0 | ||

| Clark T. Randt, Jr. | 11,508 | 0 | ||

| John T. Stankey | 2,956 | 0 | ||

| Carol B. Tomé | 14,935 | 1,082 | ||

| Kevin M. Warsh | 7,015 | 0 | ||

| (1) | The values for stock awards in this column represent the grant date fair value of the restricted stock units granted in 2015, computed in accordance with FASB ASC Topic 718. Information about the assumptions used to value these awards can be found in Note 11 “Stock-Based Compensation” in our 2015 Annual Report on Form 10-K. Restricted stock units are fully vested on the date of grant, and will be paid in shares of class A common stock following the director’s separation from service from UPS. Dividends earned on each award are reinvested in additional units at each dividend payable date. |

| (2) | Duane Ackerman and Stuart Eizenstat did not stand for re-election during the 2015 Annual Meeting of Shareowners because they both reached the mandatory retirement age established by the Board of Directors at that time. The amounts shown in the table reflect their compensation for 2015 prior to the 2015 Annual Meeting of Shareowners. The restrictions on their outstanding stock unit awards lapsed after they retired from the board. |

| (3) | In May 2015, Rodney Adkins began serving as chair of the Risk Committee and William Johnson began serving as chair of the Nominating and Corporate Governance Committee. The amounts shown in the table reflect compensation for their committee chair service during 2015. |

| (4) | Scott Davis retired as our Chief Executive Officer in September 2014 and served on the board as Non-Executive Chairman until February 2016. The amounts shown in the tables reflect his compensation and his Restricted Stock Unit award for 2015 as our Non-Executive Chairman. |

| 22 |  | Notice of Annual Meeting of Shareowners and 2016 Proxy Statement |

| Executive Compensation |

| Business Environment |

Our focus in 2015 was to continue investing in new capacity and technology while ensuring that UPS was properly compensated for the value we provided. The financial results we achieved were made possible by these investments and the determination of our people.

Throughout the year, we made changes to pricing policies and took a disciplined approach to top-line growth. These pricing initiatives enabled us to offset the strong revenue headwinds we faced from unfavorable currency conversions and lower fuel surcharge revenues.

| ● | During 2015, daily shipping volume increased 1.7 percent, with U.S. Domestic volume growing slightly faster than International. UPS demonstrated a disciplined approach to growth in 2015, declining to renew some lower-yielding contracts to improve capacity utilization and operating margins. When combined with pricing initiatives, these actions drove package yield higher in 2015. |

| ● | In the U.S. domestic segment, we saw revenue growth of 2.5 percent over the prior year. Revenue gains were dampened as falling oil prices resulted in lower fuel surcharge revenue. The combination of improved pricing and network efficiency resulted in operating profit growth and operating margin expansion. |

| ● | In the International segment, the unsteady global economy contributed to significant currency devaluation and slower growth in many regions of the world. These macro headwinds contributed to lower fuel surcharge revenue and currency fluctuations that pushed revenue down 6.5 percent for the year. Total daily shipments increased 1.2 percent, pushed higher by Export products. Total Export shipment growth in 2015 was 3.2 percent. |

| ● | Revenue for the Supply Chain and Freight segment rose 0.8 percent in 2015. Currency exchange rates changes and lower fuel surcharges contributed to slower revenue growth. Operating profit improved and operating margin expanded during the year as initiatives to improve account profitability in Forwarding and UPS Freight were implemented. |

| 2015 Compensation Actions Summary |