Jiangbo Pharmaceuticals, Inc.

25 Haihe Road, Laiyang Economic Development Zone,

Laiyang City, Yantai, Shandong Province

People’s Republic of China 265200

January 22, 2010

Via Edgar

Mr. Frank Wyman

United States Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549-3561

| | Re: | Jiangbo Pharmaceuticals, Inc. (the “Company”) |

| | Form 10-K for the Fiscal Year Ended June 30, 2008 |

Dear Mr. Wyman:

We are submitting this correspondence via EDGAR system in response to a comment letter issued by the Staff of the Securities and Exchange Commission (the “Commission”), on November 19, 2009 (the “Staff’s Letter”). The discussion below reflects our responses to the Staff’s Letter.

Item 1. Description of Business

Research and Development, page 7

| | 1. | We note your response to our prior comment one, indicating that you would file the CRDAs with the Pharmaceutical Institute of Shandong University and with the Institute of Microbiology as exhibits to your Form 10-K for the year ended June 30, 2009. We also note exhibits 10.15 and 10.16 to your most recent Form 10-K. It appears that those exhibits are translations of summaries of the two CRDAs, rather than translations of the full agreements. To the extent you only filed translations of summaries of the CRDAs, please amend your Form 10-K to file translations of the full agreements. |

RESPONSE:

The Company respectfully notes the Staff’s comment. The subject descriptions of exhibits 10.15 and 10.16 filed in our most recent Annual Report on Form 10-K was erroneously marked as summary translation of the two CRDAs. The two exhibits filed were the translation of the full CRDAs agreements. Legal contracts in People’s Republic of China (“PRC”) are generally shorter and simpler compared with the contracts drafted under the US law. The two CRDAs are standard PRC contracts and are in conformity with the general business practice in the PRC.

Consolidated Financial Statements

Note 1―Organization and business, page F-6

| | 2. | We are considering your response to prior comments four and five. Please address the following: |

| | · | In the first paragraph of your response you state that “the Company and Karmoya also meet the criteria for common control.” Please explain to us how “the Company” (we assume the legal entity) and Karmoya meet the criteria for common control prior to October 1, 2007. |

| | · | Based on your response to prior comment four, it appears that the basis for GJBT consolidating Laiyang Jiangbo is FIN46R. It is not clear from your response how you accounted for initial measurements of the assets, liabilities, and non-controlling interests of Laiyang Jiangbo, when GJFT consolidated Laiyang Jiangbo on September 21, 2007. Please explain to us how your accounting complies with paragraphs 18-21 of FIN46R. |

| | · | The consolidation of GJBT and Liayang Jiangbo did not involve the exchange of any shares or the transfer of net assets or equity interests. Please explain the factors that you considered in concluding that consolidation of Laiyang Jiangbo before GJBT became its primary beneficiary (i.e. prior to October 2, 2007) is appropriate under U.S. GAAP including why the use of the reverse acquisition accounting model is appropriate. |

RESPONSE:

The Company respectfully notes the Staff’s comment. The statement “the Company and Karmoya also meet the criteria for common control” made in our prior response was intended to indicate the common control that existed at the date of the reverse merger that occurred on October 1, 2007, and the Company accounted for the reverse merger transaction as reorganization accounting method between Karmoya International Ltd. (“Karmoya”) and the public shell company.

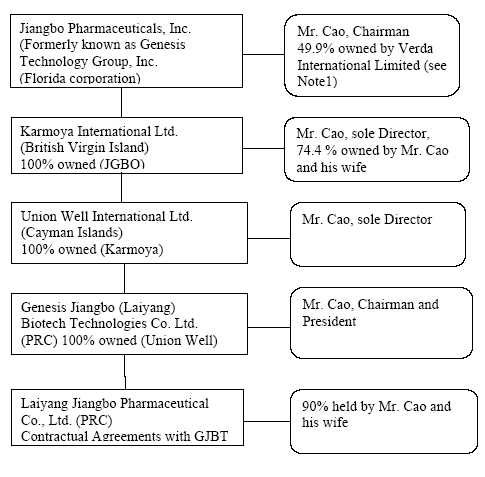

The following is a summary of the structure of Jiangbo Pharmaceuticals, Ltd. (formerly known as Genesis Technology Group, Inc.) as of the date of reverse merger:

Note 1: Verda International Limited (BVI) is wholly-owned by Mr. Cao. Additionally, Section 6.13 of the Share Acquisition and Exchange Agreement dated October 1, 2007, states that Genesis Technology Group, Inc. (“Genesis Technology”) is obligated to grant Mr. Cao super voting rights for the purpose of providing him with a majority of the voting equity securities of Genesis Technology through establishing and issuing additional class of preferred shares to Mr. Cao.

The Company believes that Genesis Jiangbo (Laiyang) Biotech Technologies Co. Ltd. (“GJBT”) is constructively held under common control with Laiyang Jiangbo Pharmaceuticals Co., Ltd. (“Laiyang Jiangbo”) since the GJBT contractual agreements were entered into, thereby, establishing GJBT as the primary beneficiary. In accordance with EITF 02-05, control is defined as an individual, enterprise, or immediate family members that holds more than 50% of the voting ownership interest of each entity.” As a result of Mr. Cao’s 49.9% ownership through Verda International Limited and the right to obtain the majority of the voting equity securities of the Company, we believe that Mr. Cao is deemed to hold the requisite 50% voting ownership interest in accordance with the EITF02-05.

The common control exists among all four entities, Jiangbo Pharmaceuticals, Inc, Karmoya, Union Well International Ltd., GJBT and Laiyang Jiangbo. Although the Company recognized that FIN46R does not provide for retroactive accounting treatment, on September 21, 2007, Laiyang Jiangbo and GJBT in substance were controlled by the same individuals, Mr. Cao and his wife. The common control factor allowed the acquisition on October 1, 2007 to be treated as a capital transaction in substance and the transaction is reflected as a recapitalization and the Company recorded the consolidation of Laiyang Jiangbo at its historical cost accordingly. Therefore, the Company has consolidated Laiyang Jiangbo at its historical cost and believes that the use of the reorganization accounting model is appropriate.

Note 3―Earnings per share, page F-16

| | 3. | Please refer to your response to prior comment seven. Based on your earnings per share calculations, it appears that assuming conversion of the $30 million debt is dilutive and not anti-dilutive. Refer to paragraph 95 of SFAS 128. Please provide us with your calculation under paragraph 27 of SFAS 128 that demonstrates how this conversion is anti-dilutive. |

RESPONSE:

The Company respectfully notes the Staff’s comment. We agree that according to paragraph 95 of SFAS 128, the conversion of the $30 million debt is not anti-dilutive. We will revise the earnings per share for the year ended June 30, 2008 in our future filings. The following is the diluted loss per share reconciliation according to SFAS 128:

| | | 2008 | |

| For the years ended June 30, 2008, 2007 and 2006 | | | |

| Net income for basic earnings per share | | $ | 22,451,060 | |

| Plus: interest expense | | | 345,833 | |

| Subtract: financing cost | | | (1,870,098 | ) |

| Subtract: debt discount | | | (32,499,957 | ) |

| Net income (loss) for diluted earnings per share | | | (11,573,162) | |

| Weighted average shares used in basic computation | | | 9,164,127 | |

| Diluted effect of stock options | | | 87,910 | |

| Diluted effect of warrants | | | 79,973 | |

| Diluted effect of $ 5,000,000 convertible note | | | 405,822 | |

| Diluted effect of $30,000,000 convertible note | | | 3,437,500 | |

| Weighted average shares used in diluted computation | | | 13,175,332 | |

| | | | | |

| Earnings (loss) per share: | | | | |

| Basic | | $ | 2.45 | |

| Diluted | | $ | (0.88) | |

| | 1. | Your response to prior comment eight does not adequately demonstrate how the capital contribution of land rights and building at fair value by majority shareholders complies with U.S. GAAP. Therefore, we repeat this comment. Also, tell us when and how these assets were obtained by the majority shareholders, including the amount and nature of any consideration paid, and explain to us why the majority shareholders did not have their own information on the historical cost basis of these capital contributions and had to reply on the PRC public record-keeping system. |

RESPONSE:

The Company respectfully notes the Staff’s comment. The land use rights and the buildings were purchased as two different groups of assets by the Company’s Chief Executive Officer, Mr. Cao, and his wife (both Mr. Cao and his wife are also majority shareholders of Laiyang Jiangbo) (collectively called “Majority Shareholders”). The first group of land use rights and the buildings were obtained in May 2002 and the second group of land use rights and the buildings were obtained in April 2003. The Majority Shareholders paid the total purchase price of approximately RMB 36 million ($4.7 million) in cash and bank notes for the two group of assets. As the Majority Shareholders are private individuals, they did not maintain completed documents for more than two years to support their historical cost basis of the two groups of assets. At the time of 2006 appraisal, the Majority Shareholders were only able to provide land use right and building ownership certificates which contained no historical cost information. Furthermore, the Chinese government record was not sophisticated enough to permit the public to verify land use rights and buildings historical purchase prices. Other than verbal verification of the historical cost basis of the two groups of assets, there was no other reliable method for verifying the amount paid by the Majority Shareholders.

In order to obtain objective evidence to support the value of the contributed assets, a qualified appraiser was engaged to perform valuation work and provide the appraisal report in order to validate the value of the contributed assets. The appraisal value of the land use right is usually determined in accordance with the selling price set by the local Chinese government authority. Additionally, the Company also researched and compared other similar property market value between 2002 and 2006 (the time of recording) and noted that the appraised value provided by the appraiser was below the market value.

As the most reliable and supported value recognized by the PRC regulation is the appraised value and the difference between the historical cost verbally communicated ($4.7 million) and appraised value ($5.1 million) is approximately $500,000, less than 1% of the Company’s total assets, the Company has determined that the appraised value is the most reliable and objective value under the U.S.GAAP and should be the recorded value for the contributed assets. Therefore, the Company has recorded the contributed assets from the majority shareholder at its historical cost basis, which complies with the U.S. GAAP.

Your prompt attention to this filing would be greatly appreciated. Should you have any questions concerning any of the foregoing, please contact Elsa Sung, our Chief Financial Officer, by telephone at (954) 903-9378.

Sincerely,

/s/ Elsa Sung

____________________

Elsa Sung

Chief Financial Officer