SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 19, 2007

INTELISYS AVIATION SYSTEMS OF AMERICA, INC.

(Exact name of registrant as specified in Charter)

Delaware | 000-26777 | |

(State or other jurisdiction of incorporation or organization) | (Commission File No.) | (IRS Employee Identification No.) |

RM 1302-3 13/F, Crocodile House II,

55 Connaught Road Central

Hong Kong

(Address of Principal Executive Offices)

(Issuer Telephone number)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

The Current Report on Form 8-K contains forward looking statements that involve risks and uncertainties, principally in the sections entitled "Description of Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” All statements other than statements of historical fact contained in this Current Report on Form 8-K, including statements regarding future events, our future financial performance, business strategy and plans and objectives of management for future operations, are forward-looking statements. We have attempted to identify forward-looking statements by terminology including “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “should,” or “will” or the negative of these terms or other comparable terminology. Although we do not make forward looking statements unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks outlined under “Risk Factors” or elsewhere in this Current Report on Form 8-K, which may cause our or our industry’s actual results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time and it is not possible for us to predict all risk factors, nor can we address the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause our actual results to differ materially from those contained in any forward-looking statements.

We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, short term and long term business operations , and financial needs. These forward-looking statements are subject to certain risks and uncertainties that could cause our actual results to differ materially from those reflected in the forward looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in this Current Report on Form 8-K, and in particular, the risks discussed below and under the heading “Risk Factors” and those discussed in other documents we file with the Securities and Exchange Commission that are incorporated into this Current Report on Form 8-K by reference. The following discussion should be read in conjunction with our annual report on Form 10-K and our quarterly reports on Form 10-Q incorporated into this Current Report on Form 8-K by reference, and the consolidated financial statements and notes thereto included in our annual and quarterly reports. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this Current Report on Form 8-K may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statement.

You should not place undue reliance on any forward-looking statement, each of which applies only as of the date of this Current Report on Form 8-K. Before you invest in our common stock, you should be aware that the occurrence of the events described in the section entitled “Risk Factors” and elsewhere in this Current Report on Form 8-K could negatively affect our business, operating results, financial condition and stock price. Except as required by law, we undertake no obligation to update or revise publicly any of the forward-looking statements after the date of this Current Report on Form 8-K to conform our statements to actual results or changed expectations.

Item 1.01 Entry Into A Material Definitive Agreement

As more fully described in Item 2.01 below, on November 19, 2007, we entered into a Stock Purchase Agreement and Share Exchange (the “Exchange Agreement”) with Keenway Limited, a company incorporated under the laws of the Cayman Islands and each of the equity owners of Keenway Limited (“Keenway”). The closing of the transaction took place on November 19, 2007 (the “Closing Date”) and resulted in the merger between us and Keenway (the “Merger”). Pursuant to the terms of the Exchange Agreement, we acquired all of the outstanding capital stock and ownership interests of Keenway (the “Interests”) from the Keenway Shareholders for an aggregate of 94,545,042 shares, or 94.5% of the Company’s common stock. In addition, Keenway agreed to pay cash of $550,000.

Keenway is a corporation formed on May 9, 2007 under the laws of Cayman Islands. Keenway holds 100% of the issued and outstanding stock and ownership of Hong Kong Yi Tat International Investment Limited, a limited company incorporated under the laws of Hong Kong Special Administration Region.

Prior to the closing of the Exchange Agreement, Chen Minhua, Fan Yanling, Extra Profit International Limited, Luck Glory International Limited a nd Zhang Xinchen were the shareholders of Keenway (the “Keenway Shareholders”). In addition, Chen Minhua and Fan Yanling were officers and directors of Keenway.

As a result of the Exchange Agreement, the Keenway Shareholders transferred all their interest in Keenway to the Company and, as a result, Keenway became a wholly owned subsidiary of the Company, which in turn, made the Company the indirect owner of the Hong Kong subsidiary of Keenway.

As a further condition of the Exchange Agreement, the current officers and directors of the Company resigned and new officers and directors of the Company were appointed.

The merger agreement contains customary terms and conditions for a transaction of this type, including representations, warranties and covenants, as well as provisions describing the merger consideration, the process of exchanging the consideration and the effect of the merger. Specifically, the Exchange Agreement also requires that the Company cancel all outstanding options, warrants and convertible preferred stock prior to the closing of the Exchange Agreement.

This transaction is discussed more fully in Section 2.01 of this Current Report. This brief discussion is qualified by reference to the provisions of the Exchange Agreement which is attached to this report as Exhibit 2.2.

Item 2.01 Completion of Acquisition or Disposition of Assets

CLOSING OF EXCHANGE AGREEMENT

As described in Item 1.01 above, on November 19, 2007, we acquired Keenway Limited, a company incorporated under the laws of the Cayman Islands, in accordance with the Exchange Agreement. The closing of the transaction took place on November 19, 2007 (the “Closing Date”). On the Closing Date, pursuant to the terms of the Exchange Agreement, we acquired all of the outstanding capital stock and ownership interests of Keenway from the Keenway Shareholders; and the Keenway Shareholders transferred and contributed all of their share interests in Keenway to us. In exchange, we issued to the Keenway Shareholders 94,545,042 shares, or approximately 94.5% of our common stock. On the Closing Date, Keenway became our wholly owned subsidiary.

Keenway owns 100% of the issued and outstanding capital stock of Hong Kong Yi Tat International Investment Limited, a limited company incorporated under the laws Hong Kong Special Administration Region. Prior to the Merger, Chen Minhua owned 43.4% of the issued and outstanding capital stock of Keenway; Fan Yanling owned 43.4% of Keenway, Extra Profit International owned 4.5% of Keenway; Luck Glory International owned 4.5% of Keenway and Zhang Xinchen owned 4.2% of the issued and outstanding capital stock of Keenway.

The Registrant was a “shell company” (as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) immediately before the completion of the Merger. Accordingly, pursuant to the requirements of Item 2.01(a)(f) of Form 8-K, set forth below is the information that would be required if the Company were filing a general form for registration of securities on Form 10-SB under the Exchange Act, reflecting the Company’s common stock, which is the only class of its securities subject to the reporting requirements of Section 13 or Section 15(d) of the Exchange Act upon consummation of the Merger, with such information reflecting the Company and its securities upon consummation of the Merger.

BUSINESS

DESCRIPTION OF BUSINESS

We were originally incorporated on June 4, 1999 as Apta Holdings, Inc. (“Apta”) in the State of Delaware. Apta was a wholly owned subsidiary of ARCA Corp. and Apta subsequently acquired all of ARCA’s assets and liabilities as part of ARCA’s merger with another company.

On November 22, 2002, Apta entered into a Share Exchange Agreement with Convergix, Inc. whereby Apta acquired all of the shares of Convergix in exchange for issuing 25,000,000 shares of Apta to the shareholders of Convergix, Inc. Pursuant to this Share Exchange Agreement, the control of Apta changed and Ralph Eisenschmid, Jock English and Malcolm Little became the new directors of Apta. As part of the Share Exchange Agreement, Apta changed its name to InteliSys Aviation Systems of America, Inc.(“InteliSys”) to better reflect its business. This name change was filed with the State of Delaware on July 21, 2003. In addition, Apta increased its authorized shares to 50,000,000 as evidenced by the Amendment filed with the State of Delaware on December 5, 2003.

Prior to June 29, 2006, InteliSys was a provider of integrated software solutions for regional, mid-sized airlines and fleet operators.

On June 29, 2006, certain of our subsidiaries which were incorporated in Canada, Convergix Inc., Cynaptec Information Systems Inc., InteliSys Aviation Systems Inc., InteliSys Acquisition Inc., and InteliSys (NS) Co. (the “Canadian Subsidiaries”), filed with the Queens Bench of the Province of New Brunswick, Canada, a Notice of Intention to make a Proposal under the Canadian Bankruptcy and Insolvency Act (the “Notice of Intention”).

On August 7, 2006, we filed with the Queens Bench of the Province of New Brunswick, Canada, a Notice of Intention to make a Proposal under the Canadian Bankruptcy and Insolvency Act (the “Notice of Intention”).

On August 31, 2006, we filed with the Queens Bench a proposal to make a settlement with our creditors pursuant to Section 50.4(1) of the Canadian Bankruptcy and Insolvency Act (the “Settlement Proposal”), in which we proposed that our debts be settled as follows: (a) Secured creditors will be paid in accordance with present arrangements or as may be arranged between them and us; (b) Holders of preferred claims under the Canadian Bankruptcy and Insolvency Act will be paid by September 30, 2006; (c) Tax liabilities owed by us to the Canadian government will be paid within 90 days after the Settlement Proposal is approved by the Queens Bench; and (d) Unsecured creditors will be paid by September 30, 2006.

On October 4, 2006, the proposal submitted by us and the proposal submitted by our subsidiaries in the Court of Queen’s Bench of the Province of New Brunswick, Canada were approved by the Court. Pursuant to such proposal, a new company consisting of our existing employees and a group of new equity investors (“Newco”) would acquire all the assets of our subsidiaries (the “Subsidiaries”). Jock English, Chief Operating Officer of our Company, would be the Chief Executive Officer and President of Newco. The consideration for such purchase would consist of $200,000 CDN in cash and $250,000 CDN in 3-year 8% notes to be issued by Newco (the “Newco Notes”). Such notes would be secured by all the assets of Newco. In addition, the beneficial ownership of Newco would be held by certain of the current employees of the Subsidiaries and irrevocably transferred to the holders of the Notes if the intellectual property of Newco was ever sold, there would be a sale of more than 51% of the initial common shares of Newco or the initiation of any process to take Newco public within 3 years of the Court Order. If the Newco Notes were in default, the 3-year period would be extended to 5 years.

In accordance with the terms of the proposal, the secured claims of the creditors of the Subsidiaries were assumed by Newco. The unsecured claims of our creditors received $1,250 CDN within two months of court approval of the proposal. After the payment of fees and any taxes owed pursuant to the Income Tax Act (Canada), the Class A Unsecured Creditors of the Subsidiaries received $150 CDN in cash for each claim, the balance of cash from the sale of assets after payment to secured creditors and the balance thereof by having their respective proportion share of the Newco Notes. We, as the Class B Creditor, did not receive any cash or Newco notes from the sale of the subsidiaries. The Class C creditors (the employees of the subsidiaries) received $50,000 CDN in Newco notes which were distributed on a prorata basis.

The Court of Queen’s Bench of the Province of New Brunswick, Canada approved the proposals on October 6, 2006. The Court issued a Court Order ordering the sale of all assets of the subsidiaries to Newco, subject to the conditions of the proposal.

On November 17, 2006, subject to the terms of the Court Order issued by the Court of Queen's Bench of the Province of New Brunswick, all assets of the Canadian Subsidiaries were sold to 627450 New Brunswick Inc.

Since November 17, 2006, we did not have any operations or revenues and had decided to attempt to acquire other assets or business operations that will maximize shareholder value.

BUSINESS DEVELOPMENT OF KEENWAY

Overview

Keenway Limited is a company incorporated under the laws of Cayman Islands and owns 100% of the issued and outstanding capital stock of Hong Kong Yi Tat International Investment Limited, a limited company incorporated under the laws of Hong Kong Special Administration Region (“Yi Tat”). Yi Tat owns 100% of the issued and outstanding capital stock of Fujian Jintai Tourism Development, a company formed under the laws of the PRC (“Fujian Jintai,” collectively, referred to herein as “Keenway” or the “Company”).

Business

Our operations are headquartered in China. We are a profitable, mid-sized Chinese company that focuses primarily on two industries:

Fujian Jintai Tourism Industrial Development Co., Ltd. is an entity that was established on October 29, 2001, and is domiciled at Floor 4, 1, Helping Street, Taining County, Fujian Province. Its primary business relates to tourism and, specifically, tourism at the Great Golden Lake. The company offers bamboo rafting, parking lot service, photography services and ethnic cultural communications.

Fujian FETV Media Co., Ltd. is the entity that concentrates on the mass media portion of the business and was established on October 9, 2004 and is domiciled in Wangjiang Tower, 18, Longgu Holiday Inn, Langqi Economic Zone, Fuzhou City. Its primary business is focused on advertisements, including media publishing, television, cultural and artistic communication activities, and performance operation and management activities.

Fujian Fuyu Advertising Co., Ltd. is an entity established on April 24, 2007 and its primary place of business is located at Room 309, (Langqi Economic Development Company), Guoyuzhou, Hongqi Administration Area, Langqi Town, Langqi Economic Zone, Fuzhou City.

These three businesses of the Company provide it with a unique opportunity to integrate industries that are at the forefront of Chinese growth. The Company’s business plan focuses around the combination of tourism and mass media and creating growth through the use of relationships established by the Company.

History and Corporate Organization

Keenway Limited was incorporated under the laws of the Cayman Islands on May 9, 2007 for the purpose of functioning as an off-shore holding company to obtain ownership interests in Hong Kong Yi Tat International Investment Co., Ltd. Its registration number is CR-187088, and its registered address of Scotia Centre, 4th Floor, P. O. Box 2804, George Town, Grand, Cayman, KY1-1112, Cayman Islands.

Mr. CHEN Minhua and Ms. FAN Yanling, his spouse, were majority shareholders of Keenway, prior to the Merger.

Merger and Revised Ownership Structure

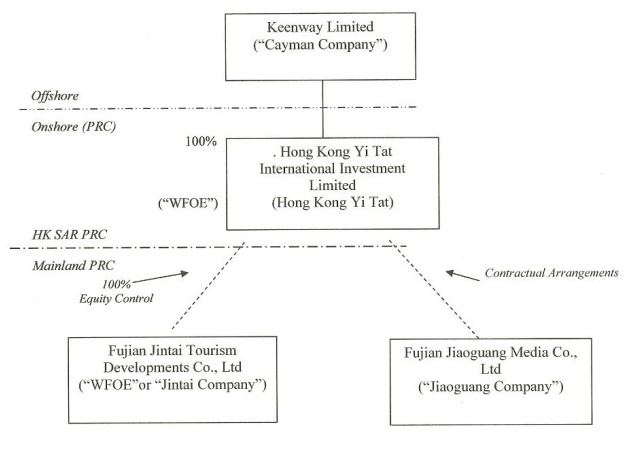

The chart below depicts the corporate structure of the Registrant as of the date of this 8-K. As depicted below, pursuant to the Merger, the Registrant owns 100% of the capital stock of Keenway Limited. Keenway Limited, incorporated in the Cayman Islands, owns 100% of Hong Kong Yi Tat International Investment Co., Ltd., a company organized in Hong Kong. Hong Kong Yi Tat International Investment Co., Ltd. wholly owns Fujian Tourism Developments Co., Ltd. and has a contractual relationship for services with Fujian Jiaoguang Media Co., Ltd. (collectively, these entities shall be referred to as the “Keenway Companies”).

THE MERGER

On November 19, 2007, Chen Minhua, Fan Yanling, Extra Profit International Limited, Luck Glory International Limited, and Zhang Xinchen (collectively, the Keenway Shareholders”), Keenway Limited, Hong Kong Yi Tat and we entered into a definitive Share Exchange Agreement (“Exchange Agreement”) which resulted in Keenway becoming our wholly owned subsidiary (the “Merger”). The Merger was accomplished by means of a share exchange in which the Keenway Shareholders exchanged all of their stock in Keenway for the transfer and additional issuance of our common stock. Under the terms of the Exchange Agreement and as a result of the Merger:

| · | Keenway became our wholly owned subsidiary; |

| · | In exchange for all of their shares of Keenway common stock, the Keenway Shareholders received 90,903,246 newly issued shares of our common stock and 3,641,796 shares of our common stock which was transferred from certain InteliSys Shareholders; |

| · | Immediately following the closing of the Merger, the Keenway Shareholders own approximately 94.5% of our issued and outstanding shares on a fully diluted basis. |

This transaction closed on November 19, 2007.

PRINCIPAL PRODUCTS

The Company is principally in the services business and does not produce or manufacture any products. Its major source of income is from services provided at tourist destinations and advertisement revenue.

MARKETING AND DISTRIBUTION METHODS OF PRODUCTS AND SERVICES

The Company operates two wholly owned subsidiaries, Fujian Jintai Tourism Development Co. and Fujian Jiaoguang Media Co.

Fujian Jintai Tourism Development Co., Ltd

The marketing strategy has two major promotional elements. The first is promoting the unique brand and scenic location through traditional advertisement mediums. These traditional channels include television, radio and print media. To cut costs, the Company has implemented a cost minimization plan whereby the majority of the media advertisement and promotion of the tourist destination is done through Fujian Jintai Tourism Development Co.'s sister company and TV media content provider, Fujian Jiaoguang Media Co. This cost minimization plan allows Fujian Jintai Tourism Development Co. to reduce its cost of advertising while maintaining a relatively high degree of exposure through Fujian Jiaoguang Media Co. and increasing consumer awareness within Fujian province.

The second element of the Company's tourist marketing effort is promotion of the scenic destinations through the attainment of nationally and internationally recognized merits of scenic achievement. To this end, the Fujian Jintai Tourism Development Co.’s park has recently received the designation of World Geological Park from the UN and ranked in China’s Top 10 Most Appealing Destinations and Top 50 Places for Foreigners to Visit. By achieving this high degree of recognition, the destination becomes visible on a massive scale increasing the draw of tourists from a provincial to an international level. The goal is to significantly increase the daily visitation rate through attainment of significant merit.

Each element of the marketing strategy has been developed in order to increase the international consumer awareness of the Company's tourist destinations, to reduce the associated costs of such awareness and to ultimately increase the usage rate and revenues of the park.

Because the tourist destination is a static product/service, its distribution mainly consists of the promotional strategies described in the paragraphs above. The services are promoted and distributed through traditional forms of advertising media. Information and marketing materials regarding the park services are distributed on site.

Fujian Jiaoguang Media Co., Ltd

The marketing efforts of Fujian Jiaoguang Media Co. can also be split into two categories. The Company acts as a content provider and also offers advertising services to third party advertisers. Each element of its marketing strategy corresponds with one of these two functions.

Content Provider: As a provider of television programming and content, the Company markets its products/services mainly through self promotion of programming on its television station, Fujian Education Television or “FETV.” By promoting its own content, Fujian Jiaoguang Media Co. can increase consumer awareness of its programming. The goal of promoting its programming is to increase its daily viewing rates and in turn increase the fees it can charge to third party advertisers.

Advertising Services: The revenues of Fujian Jiaoguang Media Co. are mainly produced by the fees it collects for distributing third party advertising content on its television station. The company markets and promotes itself through two avenues. The first element of promotion is achieved through increasing coverage and watch ratios and the second is through strategic partnerships with other media content providers. By achieving high rankings in China's television statistics, the Company becomes better known by potential advertising clients. Fujian Jiaoguang Media Co. recently achieved a 92% coverage ration within Fujian Province. With such a high degree of coverage, advertisers are willing to pay more for the Company’s services. The Company also engages in strategic partnerships with other content providers by which they share and promote each others advertising client base to one another. Oftentimes, the referring content provider will receive a finder's fee for introducing the Company to qualified advertising clients. Fujian Jiaoguang Media Co. has entered into strategic partnerships with several other media content providers in order to increase its exposure to potential advertisers.

In addition to the above mentioned marketing strategies, the Company also utilizes the resources of its sister company Fujian Jintai Tourism Development Co. to promote its content provider services. To minimize associated costs of traditional marketing efforts, Fujian Jiaoguang Media Co. advertises its programming throughout Fujian Jintai Tourism Development Co.'s scenic destinations. This avenue allows low cost advertising for the Company.

Fujian Jiaoguang Media Co.'s products/services are distributed through its television station. All program content and advertising content is distributed solely through its Fujian Education Television station.

STATUS OF PUBLICLY ANNOUNCED NEW PRODUCTS/SERVICES

We expect that our company will grow over the next few years. Currently, we own and operate the Great Golden Lake which is a tourist destination in Fujian Province. The Company expects to acquire at least one other tourist destination during the next few months. In addition, the Company intends to acquire an educational based television station in China. These acquisitions will generate growth for the Company and help the Company establish itself in these industries.

INDUSTRY AND COMPETITIVE FACTORS

Both the tourism industry and the mass media advertising industries are experiencing significant growth in China. New competitors are entering these industries at a record pace. Competition is increasing and it is beginning to become difficult to gain market share and grow. As tourism increases in China, more companies will begin to emerge and try to gain market share from the already established businesses. There are, however, certain factors that we believe will be critical for our growth:

| · | Capitalize on the rapidly growing Chinese tourism market by getting exposure to and name recognition at the most frequented tourist destinations; |

| · | Capture market share by offering services to tourists that are of exceptional quality and engage our clients and provide excellent customer support; and |

| · | Offer services at an attractive rate to appeal to the widest range of individuals. |

OUR INTELLECTUAL PROPERTY

The Company does not nor does it intend to own any patents or have any of its products or services patented. The Company has, however, obtained a trademark and the exclusive use permission for “Great Golden Lake.” This trademark has been filed with Taining County State-owned Assets Investment Operation Co., Ltd.

In the future, we intend to acquire other trademarks from companies that we acquire or file trademarks or patents in order to protect our intellectual property.

RESEARCH AND DEVELOPMENT ACTIVITIES DURING THE PRIOR TWO FISCAL YEARS

The Keenway Companies are involved in the tourist industry and mass media markets and, as such, do not have significant research and development activities. Any research and/or development that the Company worked on over the prior two fiscal years has been in connection with analyzing market trends and methods of increasing its tourist activity. The Company did not spend significant money or resources on research and development during the prior two fiscal years.

COMPLIANCE WITH ENVIRONMENTAL LAW

We comply with the Environmental Protection Law of PRC as well as applicable local regulations. In addition to statutory and regulatory compliance, we actively ensure the environmental sustainability of our operations. Penalties would be levied upon us if we fail to adhere to and maintain certain standards. Such failure has not occurred in the past, and we generally do not anticipate that it will occur in the future, but no assurance can be given in this regard.

EMPLOYEES

As of November 1, 2007, we had approximately 285 full-time employees, including 11 senior managers. The majority of our workforce is comprised of:

Fujian Jintai Tourism Development Co., Ltd:

| | | | Gender | Age of current employee | Educational level of employee | Management level | Employee catagory |

| # | Department | Total No. of employees | M | F | Under 25 | 26-35 | 36-45 | 46-55 | Over 56 | High School or | 2 year college | college | Professional | Master or above | Executive | Management | Non-Management | Full-Time | Part-Time | Temp | Other |

| 1 | Company Management | 8 | 7 | 1 | | 4 | 3 | 1 | | | | 3 | 3 | 2 | 5 | 3 | | 8 | | | |

| 2 | Office | 8 | 6 | 2 | 2 | 4 | 1 | 1 | | 2 | 2 | 2 | 2 | | | 2 | 6 | 8 | | | |

| 3 | Finance Department | 14 | 1 | 13 | 4 | 3 | 6 | 1 | | 7 | 5 | 2 | | | | 3 | 11 | 14 | | | |

| 4 | HR Department | 2 | 1 | 1 | | 1 | | 1 | | | | 2 | | | | 1 | 1 | 2 | | | |

| 5 | Quality Control Department | 8 | 4 | 4 | 3 | 2 | 3 | | | | 1 | 2 | 1 | | | 3 | 5 | 8 | | | |

| 6 | Marketing Department | 8 | 5 | 3 | 2 | 3 | 3 | | | 3 | 4 | 3 | 2 | | | | 8 | 8 | | | |

| 7 | Shanqing Stream Ngmt Dept. | 174 | 169 | 5 | 17 | 57 | 75 | 23 | 2 | 163 | 10 | 1 | | | | 8 | 166 | 139 | 35 | | |

| 8 | Golden Lake Site Mgmt | 18 | 9 | 9 | 7 | 7 | 4 | | | 4 | 11 | 3 | | | | 5 | 13 | 18 | | | |

| 9 | Customer Service | 4 | | 4 | | 3 | 1 | | | 1 | 3 | | | | | 1 | 3 | 4 | | | |

| 10 | Facilities Dept. | 1 | 1 | | | | 1 | | | 1 | | | | | | 1 | | 1 | | | |

| | Total | 245 | 203 | 42 | 35 | 84 | 97 | 27 | 2 | 181 | 36 | 18 | 8 | 2 | 5 | 27 | 213 | 210 | 35 | | |

Fujian Jiaoguang Media Co., Ltd:

| | | | Gender | Age of current employee | Educational level of employee | Management level | Employee catagory |

| # | Department | Total No. of employees | M | F | Under 25 | 26-35 | 36-45 | 46-55 | Over 56 | High School or | 2 year college | Professional Certification | Bachelor | Master or above | Executive | Management | Non-Management | Full-Time | Part-Time | Temp | Other |

| 1 | Company Management | 5 | 4 | 1 | | 2 | 1 | 2 | | | | 1 | 2 | 2 | 5 | | | 5 | | | |

| 2 | Business Department | 10 | 5 | 5 | 4 | 5 | 1 | | | 1 | 2 | 5 | 2 | | | 2 | 8 | 10 | | | |

| 3 | Promotion/Sales Dept | 9 | 5 | 4 | 5 | 4 | | | | | | 4 | 5 | | | 2 | 7 | 9 | | | |

| 4 | Editing Dept | 4 | 1 | 3 | 2 | 1 | 1 | | | | 2 | 2 | | | | 1 | 3 | 4 | | | |

| 5 | Finance Dept | 4 | 2 | 2 | | 3 | | 1 | | | 1 | 2 | 1 | | 1 | 1 | 2 | 4 | | | |

| 6 | Administrative Department | 8 | 3 | 5 | 3 | 4 | | 1 | | 2 | 1 | 3 | 2 | | | 3 | 5 | 8 | | | |

| | Total | 40 | 20 | 20 | 14 | 19 | 3 | 4 | 0 | 3 | 6 | 17 | 12 | 2 | 6 | 9 | 25 | 40 | 0 | 0 | 0 |

RISK FACTORS

You should carefully consider the risks described below together with all of the other information included in this report before making an investment decision with regard to our securities. The statements contained in or incorporated into this offering that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Relating to Our Business

| · | WE NEED TO MANAGE GROWTH IN OPERATIONS TO MAXIMIZE OUR POTENTIAL GROWTH AND ACHIEVE OUR EXPECTED REVENUES AND OUR FAILURE TO MANAGE GROWTH WILL CAUSE A DISRUPTION OF OUR OPERATIONS RESULTING IN THE FAILURE TO GENERATE REVENUE. |

In order to maximize potential growth in our current and potential markets, we believe that we must expand the scope of our services in the tourism and mass media industry. This expansion will place a significant strain on our management and our operational, accounting, and information systems. We expect that we will need to continue to improve our financial controls, operating procedures, and management information systems. We will also need to effectively train, motivate, and manage our employees. Our failure to manage our growth could disrupt our operations and ultimately prevent us from generating the revenues we expect.

| · | WE CANNOT ASSURE YOU THAT OUR INTERNAL GROWTH STRATEGY WILL BE SUCCESSFUL WHICH MAY RESULT IN A NEGATIVE IMPACT ON OUR GROWTH, FINANCIAL CONDITION, RESULTS OF OPERATIONS AND CASH FLOW. |

One of our strategies is to grow internally through increasing the customers we target for advertising campaigns and locations where we promote tourism by penetrating existing markets in PRC and entering new geographic markets in PRC as well as other parts of Asia and globally. However, many obstacles to this expansion exist, including, but not limited to, increased competition from similar businesses, international trade and tariff barriers, unexpected costs, costs associated with marketing efforts abroad and maintaining attractive foreign exchange ratios. We cannot, therefore, assure you that we will be able to successfully overcome such obstacles and establish our services in any additional markets. Our inability to implement this internal growth strategy successfully may have a negative impact on our growth, future financial condition, results of operations or cash flows.

| · | WE CANNOT ASSURE YOU THAT OUR ACQUISITION GROWTH STRATEGY WILL BE SUCCESSFUL RESULTING IN OUR FAILURE TO MEET GROWTH AND REVENUE EXPECTATIONS. |

In addition to our internal growth strategy, we have also explored the possibility of growing through strategic acquisitions. We intend to pursue opportunities to acquire businesses in PRC that are complementary or related in product lines and business structure to us. We may not be able to locate suitable acquisition candidates at prices that we consider appropriate or to finance acquisitions on terms that are satisfactory to us. If we do identify an appropriate acquisition candidate, we may not be able to negotiate successfully the terms of an acquisition, or, if the acquisition occurs, integrate the acquired business into our existing business. Acquisitions of businesses or other material operations may require debt financing or additional equity financing, resulting in leverage or dilution of ownership. Integration of acquired business operations could disrupt our business by diverting management away from day-to-day operations. The difficulties of integration may be increased by the necessity of coordinating geographically dispersed organizations, integrating personnel with disparate business backgrounds and combining different corporate cultures. We also may not be able to maintain key employees or customers of an acquired business or realize cost efficiencies or synergies or other benefits we anticipated when selecting our acquisition candidates. In addition, we may need to record write-downs from future impairments of intangible assets, which could reduce our future reported earnings. At times, acquisition candidates may have liabilities or adverse operating issues that we fail to discover through due diligence prior to the acquisition. In addition to the above, acquisitions in PRC, including state owned businesses, will be required to comply with laws of the People's Republic of China ("PRC"), to the extent applicable. There can be no assurance that any given proposed acquisition will be able to comply with PRC requirements, rules and/or regulations, or that we will successfully obtain governmental approvals which are necessary to consummate such acquisitions, to the extent required. If our acquisition strategy is unsuccessful, we will not grow our operations and revenues at the rate that we anticipate.

| · | IF WE ARE NOT ABLE TO IMPLEMENT OUR STRATEGIES IN ACHIEVING OUR BUSINESS OBJECTIVES, OUR BUSINESS OPERATIONS AND FINANCIAL PERFORMANCE MAY BE ADVERSELY AFFECTED. |

Our business plan is based on circumstances currently prevailing and the bases and assumptions that certain circumstances will or will not occur, as well as the inherent risks and uncertainties involved in various stages of development. However, there is no assurance that we will be successful in implementing our strategies or that our strategies, even if implemented, will lead to the successful achievement of our objectives. If we are not able to successfully implement our strategies, our business operations and financial performance may be adversely affected.

| · | WE MAY HAVE DIFFICULTY DEFENDING OUR INTELLECTUAL PROPERTY RIGHTS FROM INFRINGEMENT RESULTING IN LAWSUITS REQUIRING US TO DEVOTE FINANCIAL AND MANAGEMENT RESOURCES THAT WOULD HAVE A NEGATIVE IMPACT ON OUR OPERATING RESULTS. |

We regard our service marks, trademarks, trade secrets, patents and similar intellectual property as critical to our success. We rely on trademark, patent and trade secret law, as well as confidentiality and license agreements with certain of our employees, customers and others to protect our proprietary rights. We have received trademark protection for certain of our service marks and services in the People's Republic of China. No assurance can be given that our trademarks and licenses will not be challenged, invalidated, infringed or circumvented, or that our intellectual property rights will provide competitive advantages to us. There can be no assurance that we will be able to obtain a license from a third-party technology that we may need to conduct our business or that such technology can be licensed at a reasonable cost.

Presently, we provide our services mainly in PRC. To date, no trademark or patent filings have been made other than in PRC. To the extent that we market our services in other countries, we may have to take additional action to protect our intellectual property. The measures we take to protect our proprietary rights may be inadequate and we cannot give you any assurance that our competitors will not independently develop formulations, processes and services that are substantially equivalent or superior to our own or copy our products.

| · | WE DEPEND ON OUR KEY MANAGEMENT PERSONNEL AND THE LOSS OF THEIR SERVICES COULD ADVERSELY AFFECT OUR BUSINESS. |

We place substantial reliance upon the efforts and abilities of our executive officers, Chan Minhua, our Chairman and Chief Executive Officer and Fan Yanling, our Vice President of Operations. The loss of the services of any of our executive officers could have a material adverse effect on our business, operations, revenues or prospects. We do not maintain key man life insurance on the lives of these individuals.

| · | WE MAY NEVER PAY ANY DIVIDENDS TO SHAREHOLDERS. |

We have never paid any dividends and have not declared any dividends to date in 2007. Our board of directors does not intend to distribute dividends in the near future. The declaration, payment and amount of any future dividends will be made at the discretion of the board of directors, and will depend upon, among other things, the results of our operations, cash flows and financial condition, operating and capital requirements, and other factors as the board of directors considers relevant. There is no assurance that future dividends will be paid, and, if dividends are paid, there is no assurance with respect to the amount of any such dividend.

| · | MANAGEMENT EXERCISES SIGNIFICANT CONTROL OVER MATTERS REQUIRING SHAREHOLDER APPROVAL WHICH MAY RESULT IN THE DELAY OR PREVENTION OF A CHANGE IN OUR CONTROL. |

Mr. Chen Minhua, our Chairman and Chief Executive Officer, through his common stock ownership, currently has voting power equal to approximately 39.2% of our voting securities. Ms. Fan Yanling, our Vice President of Operations, through her common stock ownership, currently has voting power equal to approximately 39.2% of our voting securities. When combined with the common stock ownership of our other officers and directors, management has combined voting power in our Company equal to approximately 78.4% of our voting securities. As a result, management through such stock ownership exercises significant control over all matters requiring shareholder approval, including the election of directors and approval of significant corporate transactions. This concentration of ownership in management may also have the effect of delaying or preventing a change in control of us that may be otherwise viewed as beneficial by shareholders other than management.

| · | WE MAY INCUR SIGNIFICANT COSTS TO ENSURE COMPLIANCE WITH UNITED STATES CORPORATE GOVERNANCE AND ACCOUNTING REQUIREMENTS. |

We may incur significant costs associated with our public company reporting requirements, costs associated with newly applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002 and other rules implemented by the Securities and Exchange Commission. We expect all of these applicable rules and regulations to significantly increase our legal and financial compliance costs and to make some activities more time consuming and costly. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors or as executive officers. We are currently evaluating and monitoring developments with respect to these newly applicable rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs.

| · | WE MAY NOT BE ABLE TO MEET THE ACCELERATED FILING AND INTERNAL CONTROL REPORTING REQUIREMENTS IMPOSED BY THE SECURITIES AND EXCHANGE COMMISSION RESULTING IN A POSSIBLE DECLINE IN THE PRICE OF OUR COMMON STOCK AND OUR INABILITY TO OBTAIN FUTURE FINANCING. |

As directed by Section 404 of the Sarbanes-Oxley Act, the Securities and Exchange Commission adopted rules requiring each public company to include a report of management on the company's internal controls over financial reporting in its annual reports. In addition, the independent registered public accounting firm auditing a company's financial statements must also attest to and report on management's assessment of the effectiveness of the company's internal controls over financial reporting as well as the operating effectiveness of the company's internal controls. While we will not be subject to these requirements for the fiscal year ended December 31, 2007, we will be subject to these requirements beginning January 1, 2008.

While we expect to expend significant resources in developing the necessary documentation and testing procedures required by Section 404 of the Sarbanes-Oxley Act, there is a risk that we may not be able to comply timely with all of the requirements imposed by this rule. In the event that we are unable to receive a positive attestation from our independent registered public accounting firm with respect to our internal controls, investors and others may lose confidence in the reliability of our financial statements and our stock price and ability to obtain equity or debt financing as needed could suffer.

In addition, in the event that our independent registered public accounting firm is unable to rely on our internal controls in connection with its audit of our financial statements, and in the further event that it is unable to devise alternative procedures in order to satisfy itself as to the material accuracy of our financial statements and related disclosures, it is possible that we would be unable to file our Annual Report on Form 10-K with the Securities and Exchange Commission, which could also adversely affect the market price of our common stock and our ability to secure additional financing as needed.

| · | WE MAY HAVE DIFFICULTY RAISING NECESSARY CAPITAL TO FUND OPERATIONS AS A RESULT OF MARKET PRICE VOLATILITY FOR OUR SHARES OF COMMON STOCK. |

In recent years, the securities markets in the United States have experienced a high level of price and volume volatility, and the market price of securities of many companies have experienced wide fluctuations that have not necessarily been related to the operations, performances, underlying asset values or prospects of such companies. For these reasons, our shares of common stock can also be expected to be subject to volatility resulting from purely market forces over which we will have no control. If our business development plans are successful, we may require additional financing to continue to develop and exploit existing and new products and services related to our industries and to expand into new markets. The exploitation of our services may, therefore, be dependent upon our ability to obtain financing through debt and equity or other means.

Risks Relating to the People's Republic of China

Our business operations take place primarily in China. Because Chinese laws, regulations and policies are continually changing, our Chinese operations will face several risks summarized below.

| · | LIMITATIONS ON CHINESE ECONOMIC MARKET REFORMS MAY DISCOURAGE FOREIGN INVESTMENT IN CHINESE BUSINESSES. |

The value of investments in Chinese businesses could be adversely affected by political, economic and social uncertainties in China. The economic reforms in China in recent years are regarded by China’s central government as a way to introduce economic market forces into China. Given the overriding desire of the central government leadership to maintain stability in China amid rapid social and economic changes in the country, the economic market reforms of recent years could be slowed, or even reversed.

| · | ANY CHANGE IN POLICY BY THE CHINESE GOVERNMENT COULD ADVERSELY AFFECT INVESTMENTS IN CHINESE BUSINESSES. |

Changes in policy could result in imposition of restrictions on currency conversion, imports or the source of suppliers, as well as new laws affecting joint ventures and foreign-owned enterprises doing business in China. Although China has been pursuing economic reforms for the past two decades, events such as a change in leadership or social disruptions that may occur upon the proposed privatization of certain state-owned industries, could significantly affect the government’s ability to continue with its reform.

| · | WE FACE ECONOMIC RISKS IN DOING BUSINESS IN CHINA. |

As a developing nation, China’s economy is more volatile than that of developed Western industrial economies. It differs significantly from that of the U.S. or a Western European country in such respects as structure, level of development, capital reinvestment, resource allocation and self-sufficiency. Only in recent years has the Chinese economy moved from what had been a command economy through the 1970s to one that during the 1990s encouraged substantial private economic activity. In 1993, the Constitution of China was amended to reinforce such economic reforms. The trends of the 1990s indicate that future policies of the Chinese government will emphasize greater utilization of market forces. For example, in 1999, the Government announced plans to amend the Chinese Constitution to recognize private property, although private business will officially remain subordinated to the state-owned companies, which are the mainstay of the Chinese economy. However, there can be no assurance that, under some circumstances, the government’s pursuit of economic reforms will not be restrained or curtailed. Actions by the central government of China could have a significant adverse effect on economic conditions in the country as a whole and on the economic prospects for our Chinese operations.

| · | THE CHINESE LEGAL AND JUDICIAL SYSTEM MAY NEGATIVELY IMPACT FOREIGN INVESTORS. |

In 1982, the National People’s Congress amended the Constitution of China to authorize foreign investment and guarantee the “lawful rights and interests” of foreign investors in China. However, China’s system of laws is not yet comprehensive. The legal and judicial systems in China are still rudimentary, and enforcement of existing laws is inconsistent. Many judges in China lack the depth of legal training and experience that would be expected of a judge in a more developed country. Because the Chinese judiciary is relatively inexperienced in enforcing the laws that do exist, anticipation of judicial decision-making is more uncertain than would be expected in a more developed country. It may be impossible to obtain swift and equitable enforcement of laws that do exist, or to obtain enforcement of the judgment of one court by a court of another jurisdiction. China’s legal system is based on written statutes; a decision by one judge does not set a legal precedent that is required to be followed by judges in other cases. In addition, the interpretation of Chinese laws may be varied to reflect domestic political changes.

The promulgation of new laws, changes to existing laws and the pre-emption of local regulations by national laws may adversely affect foreign investors. However, the trend of legislation over the last 20 years has significantly enhanced the protection of foreign investment and allowed for more control by foreign parties of their investments in Chinese enterprises. There can be no assurance that a change in leadership, social or political disruption, or unforeseen circumstances affecting China’s political, economic or social life, will not affect the Chinese government’s ability to continue to support and pursue these reforms. Such a shift could have a material adverse effect on our business and prospects.

The practical effect of the Peoples Republic of China legal system on our business operations in China can be viewed from two separate but intertwined considerations. First, as a matter of substantive law, the Foreign Invested Enterprise laws provide significant protection from government interference. In addition, these laws guarantee the full enjoyment of the benefits of corporate Articles and contracts to Foreign Invested Enterprise participants. These laws, however, do impose standards concerning corporate formation and governance, which are not qualitatively different from the general corporation laws of the several states. Similarly, the Peoples Republic of China accounting laws mandate accounting practices, which are not consistent with U.S. Generally Accepted Accounting Principles. China’s accounting laws require that an annual “statutory audit” be performed in accordance with Peoples Republic of China accounting standards and that the books of account of Foreign Invested Enterprises are maintained in accordance with Chinese accounting laws. Article 14 of the Peoples Republic of China Wholly Foreign-Owned Enterprise Law requires a Wholly Foreign-Owned Enterprise to submit certain periodic fiscal reports and statements to designate financial and tax authorities, at the risk of business license revocation. Second, while the enforcement of substantive rights may appear less clear than United States procedures, the Foreign Invested Enterprises and Wholly Foreign-Owned Enterprises are Chinese registered companies, which enjoy the same status as other Chinese registered companies in business-to-business dispute resolution.

Generally, the Articles of Association provide that all business disputes pertaining to Foreign Invested Enterprises are to be resolved by the Arbitration Institute of the Stockholm Chamber of Commerce in Stockholm, Sweden, applying Chinese substantive law. Any award rendered by this arbitration tribunal is, by the express terms of the respective Articles of Association, enforceable in accordance with the “United Nations Convention on the Recognition and Enforcement of Foreign Arbitral Awards (1958).” Therefore, as a practical matter, although no assurances can be given, the Chinese legal infrastructure, while different in operation from its United States counterpart, should not present any significant impediment to the operation of Foreign Invested Enterprises.

| · | CERTAIN POLITICAL AND ECONOMIC CONSIDERATIONS RELATING TO THE PRC COULD ADVERSELY AFFECT OUR COMPANY. |

The PRC is transitioning from a planned economy to a market economy. While the PRC government has pursued economic reforms since its adoption of the open-door policy in 1978, a large portion of the PRC economy is still operating under five-year plans and annual state plans. Through these plans and other economic measures, such as control on foreign exchange, taxation and restrictions on foreign participation in the domestic market of various industries, the PRC government exerts considerable direct and indirect influence on the economy. Many of the economic reforms carried out by the PRC government are unprecedented or experimental, and are expected to be refined and improved. Other political, economic and social factors can also lead to further readjustment of such reforms. This refining and readjustment process may not necessarily have a positive effect on our operations or future business development. Our operating results may be adversely affected by changes in the PRC's economic and social conditions as well as by changes in the policies of the PRC government, such as changes in laws and regulations (or the official interpretation thereof), measures which may be introduced to control inflation, changes in the interest rate or method of taxation, and the imposition of additional restrictions on currency conversion.

| · | THE RECENT NATURE AND UNCERTAIN APPLICATION OF MANY PRC LAWS APPLICABLE TO US CREATE AN UNCERTAIN ENVIRONMENT FOR BUSINESS OPERATIONS AND THEY COULD HAVE A NEGATIVE EFFECT ON US. |

The PRC legal system is a civil law system. Unlike the common law system, the civil law system is based on written statutes in which decided legal cases have little value as precedents. In 1979, the PRC began to promulgate a comprehensive system of laws and has since introduced many laws and regulations to provide general guidance on economic and business practices in the PRC and to regulate foreign investment. Progress has been made in the promulgation of laws and regulations dealing with economic matters such as corporate organization and governance, foreign investment, commerce, taxation and trade. The promulgation of new laws, changes of existing laws and the abrogation of local regulations by national laws could have a negative impact on our business and business prospects. In addition, as these laws, regulations and legal requirements are relatively recent, their interpretation and enforcement involve significant uncertainty.

| · | THE APPROVAL OF THE CHINESE SECURITIES REGULATORY COMMISSION (“CRSC”) MAY BE REQUIRED IN CONNECTION WITH THIS OFFERING UNDER A RECENTLY ADOPTED PRC REGULATION; SINCE THIS OFFERING DID NOT COMMENCE PRIOR TO THE EFFECTIVE DATE OF THE REGULATION, WE MAY BE REQUIRED TO OBTAIN CRSC APPROVAL FOR THIS OFFERING AND WE CAN NOT CURRENTLY PREDICT THE CONSEQUENCES OF ANY FAILURE TO OBTAIN SUCH APPROVAL. |

On August 8, 2006, six PRC regulatory agencies, including the Chinese Securities Regulatory Commission, or CSRC, promulgated a regulation that became effective on September 8, 2006. This regulation, among other things, purports to require offshore special purpose vehicles, or SPVs, formed for listing purposes through acquisitions of PRC domestic companies and controlled by PRC individuals to obtain the approval of the CSRC prior to publicly listing their securities on an overseas stock exchange. While the application of this new regulation is not yet clear, we believe, based on the advice of our PRC counsel, that CSRC approval is not required in this transaction because the Company does not control the Chinese operating entities.

They strictly have contractual arrangements with the Chinese companies. Although the CSRC is expected to promulgate formal implementing rules and/or regulations and possibly other clarifications, the procedures, criteria and timing for obtaining any required CSRC approval have not been established and it is unclear when these will be established. Since this offering did not commence prior to the effective date of the regulation and our shares of common stock did not commence trading prior to the effective date of the regulation, if the CSRC determines that the Company exercises control over the Chinese operating entities, we may be required to obtain CSRC approval for this offering and we cannot currently predict the criteria, timing or procedures for obtaining the CSRC approval or the consequences of any failure to obtain such approval.

| · | RECENT PRC REGULATIONS RELATING TO THE ESTABLISHMENT OF OFFSHORE SPECIAL PURPOSE COMPANIES BY PRC RESIDENTS MAY SUBJECT OUR PRC RESIDENT SHAREHOLDERS TO PERSONAL LIABILITY AND LIMIT OUR ABILITY TO INJECT CAPITAL INTO OUR PRC SUBSIDIARIES, LIMIT OUR PRC SUBSIDIARIES’ ABILITY TO DISTRIBUTE PROFITS TO US, OR OTHERWISE ADVERSELY AFFECT US. |

SAFE issued a public notice in October 2005, or the SAFE notice, requiring PRC residents to register with the local SAFE branch before establishing or controlling any company outside of China for the purpose of capital financing with assets or equities of PRC companies, referred to in the notice as an “offshore special purpose company.” PRC residents that are shareholders of offshore special purpose companies established before November 1, 2005 were required to register with the local SAFE branch before March 31, 2006. Our current beneficial owners who are PRC residents have registered with the local SAFE branch as required under the SAFE notice. The failure of these beneficial owners to timely amend their SAFE registrations pursuant to the SAFE notice or the failure of future beneficial owners of our company who are PRC residents to comply with the registration procedures set forth in the SAFE notice may subject such beneficial owners to fines and legal sanctions and may also limit our ability to contribute additional capital into our PRC subsidiaries, limit our PRC subsidiaries’ ability to distribute dividends to our company or otherwise adversely affect our business.

Other Risks

| · | CURRENCY CONVERSION AND EXCHANGE RATE VOLATILITY COULD ADVERSELY AFFECT OUR FINANCIAL CONDITION. |

The PRC government imposes control over the conversion of Renminbi (“RMB”) into foreign currencies. Under the current unified floating exchange rate system, the People's Bank of China publishes an exchange rate, which we refer to as the PBOC exchange rate, based on the previous day's dealings in the inter-bank foreign exchange market. Financial institutions authorized to deal in foreign currency may enter into foreign exchange transactions at exchange rates within an authorized range above or below the PBOC exchange rate according to market conditions.

Pursuant to the Foreign Exchange Control Regulations of the PRC issued by the State Council which came into effect on April 1, 1996, and the Regulations on the Administration of Foreign Exchange Settlement, Sale and Payment of the PRC which came into effect on July 1, 1996, regarding foreign exchange control, conversion of Renminbi into foreign exchange by Foreign Investment Enterprises, or FIEs, for use on current account items, including the distribution of dividends and profits to foreign investors, is permissible. FIEs are permitted to convert their after-tax dividends and profits to foreign exchange and remit such foreign exchange to their foreign exchange bank accounts in the PRC. Conversion of Renminbi into foreign currencies for capital account items, including direct investment, loans, and security investment, is still under certain restrictions. On January 14, 1997, the State Council amended the Foreign Exchange Control Regulations and added, among other things, an important provision, which provides that the PRC government shall not impose restrictions on recurring international payments and transfers under current account items.

Enterprises in the PRC (including FIEs) which require foreign exchange for transactions relating to current account items, may, without approval of the State Administration of Foreign Exchange, or SAFE, effect payment from their foreign exchange account or convert and pay at the designated foreign exchange banks by providing valid receipts and proofs.

Convertibility of foreign exchange in respect of capital account items, such as direct investment and capital contribution, is still subject to certain restrictions, and prior approval from the SAFE or its relevant branches must be sought.

Since 1994, the exchange rate for Renminbi against the United States dollar has remained relatively stable, most of the time in the region of approximately RMB8.28 to $1.00. However, in 2005, the Chinese government announced that it would begin pegging the exchange rate of the Chinese Renminbi against a number of currencies, rather than just the U.S. dollar. As a result, the exchange rate for the Renminbi against the U.S. dollar became RMB8.02 to $1.00. As our operations are primarily in PRC, any significant revaluation or devaluation of the Chinese Renminbi may materially and adversely affect our cash flows, revenues and financial condition. We may not be able to hedge effectively against it in any such case. For example, to the extent that we need to convert United States dollars into Chinese Renminbi for our operations, appreciation of this currency against the United States dollar could have a material adverse effect on our business, financial condition and results of operations. Conversely, if we decide to convert Chinese Renminbi into United States dollars for other business purposes and the United States dollar appreciates against this currency, the United States dollar equivalent of the Chinese Renminbi we convert would be reduced. There can be no assurance that future movements in the exchange rate of Renminbi and other currencies will not have an adverse effect on our financial condition. Our operating companies are FIEs to which the Foreign Exchange Control Regulations are applicable. There can be no assurance that we will be able to obtain sufficient foreign exchange to pay dividends or satisfy other foreign exchange requirements in the future.

| · | IT MAY BE DIFFICULT TO AFFECT SERVICE OF PROCESS AND ENFORCEMENT OF LEGAL JUDGMENTS UPON OUR COMPANY AND OUR OFFICERS AND DIRECTORS BECAUSE THEY RESIDE OUTSIDE THE UNITED STATES. |

As our operations are presently based in PRC and a majority of our directors and all of our officers reside in PRC, service of process on our company and such directors and officers may be difficult to effect within the United States. Also, our main assets are located in PRC and any judgment obtained in the United States against us may not be enforceable outside the United States.

| · | WE MAY EXPERIENCE CURRENCY FLUCTUATION AND LONGER EXCHANGE RATE PAYMENT CYCLES WHICH WILL NEGATIVELY AFFECT THE COSTS OF OUR PRODUCTS SOLD AND THE VALUE OF OUR LOCAL CURRENCY PROFITS. |

The local currencies in the countries in which we sell our products may fluctuate in value in relation to other currencies. Such fluctuations may affect the costs of our products sold and the value of our local currency profits. While we are not conducting any meaningful operations in countries other than PRC at the present time, we may expand to other countries and may then have an increased risk of exposure of our business to currency fluctuation.

| · | SINCE MOST OF OUR ASSETS ARE LOCATED IN PRC, ANY DIVIDENDS OF PROCEEDS FROM LIQUIDATION IS SUBJECT TO THE APPROVAL OF THE RELEVANT CHINESE GOVERNMENT AGENCIES. |

Our assets are predominantly located inside PRC. Under the laws governing foreign invested enterprises in PRC, dividend distribution and liquidation are allowed but subject to special procedures under the relevant laws and rules. Any dividend payment will be subject to the decision of the board of directors and subject to foreign exchange rules governing such repatriation. Any liquidation is subject to the relevant government agency's approval and supervision as well as the foreign exchange control. This may generate additional risk for our investors in case of dividend payment and liquidation.

| · | OUR SHARES OF COMMON STOCK ARE VERY THINLY TRADED, AND THE PRICE MAY NOT REFLECT OUR VALUE AND THERE CAN BE NO ASSURANCE THAT THERE WILL BE AN ACTIVE MARKET FOR OUR SHARES OF COMMON STOCK EITHER NOW OR IN THE FUTURE. |

Our shares of common stock are very thinly traded, and the price if traded may not reflect our value. There can be no assurance that there will be an active market for our shares of common stock either now or in the future. The market liquidity will be dependent on the perception of our operating business and any steps that our management might take to bring us to the awareness of investors. There can be no assurance given that there will be any awareness generated. Consequently, investors may not be able to liquidate their investment or liquidate it at a price that reflects the value of the business. If a more active market should develop, the price may be highly volatile. Because there may be a low price for our shares of common stock, many brokerage firms may not be willing to effect transactions in the securities. Even if an investor finds a broker willing to effect a transaction in the shares of our common stock, the combination of brokerage commissions, transfer fees, taxes, if any, and any other selling costs may exceed the selling price. Further, many lending institutions will not permit the use of such shares of common stock as collateral for any loans.

| · | SALES OF OUR CURRENTLY ISSUED AND OUTSTANDING STOCK MAY BECOME FREELY TRADEABLE PURSUANT TO RULE 144 AND MAY DILUTE THE MARKET FOR YOUR SHARES AND HAVE A DEPRESSIVE EFFECT ON THE PRICE OF THE SHARES OF OUR COMMON STOCK. |

A substantial majority of our outstanding shares of common stock are "restricted securities" within the meaning of Rule 144 under the Securities Act. As restricted shares, these shares may be resold only pursuant to an effective registration statement or under the requirements of Rule 144 or other applicable exemptions from registration under the Act and as required under applicable state securities laws. Rule 144 provides in essence that a person who has held restricted securities for a period of at least one year may, under certain conditions, sell every three months, in brokerage transactions, a number of shares that does not exceed the greater of 1% of a company's outstanding shares of common stock or the average weekly trading volume during the four calendar weeks prior to the sale (the four calendar week rule does not apply to companies quoted on the OTC Bulletin Board). There is no limit on the amount of restricted securities that may be sold by a non-affiliate after the restricted securities have been held by the owner for a period of two years or more and such owner has not been an affiliate for the 90 day period prior to sale. A sale under Rule 144 or under any other exemption from the Act, if available, or pursuant to subsequent registrations of our shares of common stock, may have a depressive effect upon the price of our shares of common stock in any active market that may develop.

MANAGEMENT'S DISCUSSION AND ANALYSIS OR PLAN OF OPERATIONS

Overview

The following discussion is an overview of the important factors that management focuses on in evaluating our businesses, financial condition and operating performance and should be read in conjunction with the financial statements included in this Current Report on Form 8-K. This discussion contains forward-looking statements that involve risks and uncertainties. Actual results could differ materially from those anticipated in these forward looking statements as a result of any number of factors, including those set forth under the section entitled “Risk Factors” and elsewhere in this Current Report on Form 8-K.

Our Business

Through Keenway’s subsidiaries and certain commercial and contractual arrangements with other Chinese companies, we operate tourism and mass media companies in China. We mainly operate in Fujian Province. Our tourism business is beginning to flourish and we provide operational and management support for tourist attractions in China. Another part of our business revolves around television media and advertising through TV. Since 2004, our company has operated tourist sites and worked with tourist attractions to provide advertising through television ads and other marketing campaigns. One of our biggest attractions is the Great Golden Lake Tourist Attraction which is a scenic area hidden in a deep mountain that consists of a world-class geological park. We have been able to help them increase tourist volume from 50,000 people in 2004 to 216,000 in 2006. Its annual operational income has also grown from $523,200 US in 2004 to $2,560,400 US in 2006.

We also run a television station, FETV, which is currently the fourth most viewed among the 11 provincial medias in Fujian Province. The networks annual ad income has increased in the past two years from $1 million in 2004 (when we took it over) to over $7.6 million in 2006.

Principal Factors Affecting our Financial Performance

We believe that the following factors affect our financial performance:

o | Growth of Tourism and Mass Media in China |

China’s tourism market is growing at a record breaking pace with no signs of a slowdown. According to predictions made by the World Trade Organization, China will become the second largest tourist destination by 2010, and will become the most popular tourist destination by 2020. According to these predictions and the Company’s own estimates, the Company expects to see unprecedented growth over the next 12 months. In addition, we expect to see similar growth in the mass media market. Over the past few years, the Chinese mass media industry has sustained a growth rate of 25%. The Company views the Chinese mass media industry as still in its infancy and will continue to grow due to Chinese emerging status as a global leader.

o | PRC Regulations Promoting Tourism |

The tourism industry in China is highly regulated by the PRC government. However, after China granted the WTO access, China has been relaxing its regulations and the tourism industry in China is expanding rapidly and consists of almost 34% of the total tourism in the Asia-Pacific region. In addition, with the Olympics being held in Beijing in 2008, China is expected to relax its regulations even more. The Olympics will also promote tourism in China and encourage foreigners to visit which in turn will allow the Company to grow.

Results of Operations

The following tables set forth key components of our results of operations for the periods indicated, in dollars, and key components of our revenue for the period indicated, in dollars.

Nine months ended September 30, 2007 Compared to nine months ended September 30, 2006

| | | SEPTEMBER 30, | |

| | | 2007 | | | 2006 | |

Net revenue | | | | | | |

| Advertisement | | $ | 8,061,125 | | | $ | 5,494,646 | |

| Tourism | | | 3,547,892 | | | | 1,965,568 | |

Total | | | 11,609,017 | | | | 7,460,214 | |

Cost of revenue | | | | | | | | |

| Advertisement | | | 1,548,091 | | | | 1,500,568 | |

| Tourism | | | 141,970 | | | | 60,195 | |

Total | | | (1,690,061 | ) | | | (1,560,763 | ) |

Gross profit | | | 9,918,956 | | | | 5,899,451 | |

| | | | | | | | | |

Operating expenses | | | | | | | | |

| Selling expenses | | | 663,702 | | | | 594,035 | |

| Operating and administrative expenses | | | 1,252,119 | | | | 703,520 | |

| | | | | | | | | |

Total operating expenses | | | 1,915,821 | | | | 1,297,555 | |

| | | | | | | | | |

Income from operations | | | 8,003,135 | | | | 4,601,896 | |

| | | | | | | | | |

Other (income) expense | | | | | | | | |

| Other expenses | | | 6,344 | | | | 13,612 | |

| Interest expense | | | 179,637 | | | | 185,922 | |

| Interest income | | | (839 | ) | | | (1,130 | ) |

| Finance expense | | | 5,105 | | | | 1,519 | |

| | | | | | | | | |

Total other expenses | | | 190,247 | | | | 199,923 | |

Income before income taxes | | | 7,812,888 | | | | 4,401,973 | |

| | | | | | | | | |

Provision for income taxes | | | 79,089 | | | | - | |

| | | | | | | | | |

Net income | | | 7,733,800 | | | | 4,401,973 | |

Net Revenue:

Net revenue increased by US$4,148,803, or 55.6%, from US$7,460,214 in the nine months ended September 30, 2006 to US$11,609,017 in the nine months ended September 30, 2007.

Cost of revenue:

Cost of revenue increased by US$129,298, or 8.2%, from US$1,560,763 in the nine months ended September 30, 2006 to US$1,690,061 in the nine months ended September 30, 2007.

Gross profit:

Gross profit increased by US$4,019,505, or 68%, from US$5,899,451 in the nine months ended September 30, 2006 to US$9,918,956 in the nine months ended September 30, 2007 mainly due to the increase in advertisement revenue and tourism revenue.

Operating Expenses:

Operating expenses were US$1,297,555 in the nine months ended September 30, 2006, compared to US$1,915,821 in the nine months ended September 30, 2007. This represents a increase of US$618,266, or 47%, primarily due to a large increase in operating and administrative expenses.

Income from Operations:

Operating profit was US$4,601,896 in the nine months ended September 30, 2006 and US$8,003,135 in the nine months ended September 30, 2007. The increase of US$3,401,239, or 74%, was primarily the result of increased gross profit of US$4,019,505.

Net Income:

Net income was US$4,401,973 in the nine months ended September 30, 2006, compared to US$7,733,800 in the nine months ended September 30, 2007, an increase of US$3,331,827, or 76%.

LIQUIDITY AND CAPITAL RESOURCES

The Company currently generates its cash flow through operations which it believes will be sufficient to sustain current level operations for at least the next twelve months. In 2008, we intend to continue to work to expand our tourism services and mass media outlets, including the acquisition of a provincial-level education TV station.

To the extent we are successful in rolling out our advertising campaign programs, identifying potential acquisition targets and negotiating the terms of such acquisition, and the purchase price includes a cash component, we plan to use our working capital and the proceeds of any financing to finance such acquisition costs. Our opinion concerning our liquidity is based on current information. If this information proves to be inaccurate, or if circumstances change, we may not be able to meet our liquidity needs.

2007 – 2008 Outlook

Over the course of the next few years, we intend to grow and expand our tourism and mass media marketing businesses. We expect to acquire additional tourist areas that will enhance our reputation as a world-class company that develops and manages tourist attractions. These acquisitions will be financed either through revenues of the Company or by financings and sales of the Company’s stock or other securities. In addition, the Company expects to roll out a “chain” travel agency that attracts many Chinese tourists, both foreigners and Chinese natives exploring other Chinese cities, and will link each of its tourist attractions and self-promote each attraction. This will be accomplished by offering tours of multiple tourist attractions and travel between these tourist attractions.

With respect to the mass media, we expect to grow by acquiring another operating television network. We will be looking to acquire a provincial-level educational TV station.

PLAN OF OPERATIONS

Related Party Transactions

For a description of our related party transactions see the section of the Current Report entitled “Certain Relationships and Related Transactions.”

Quantitative and Qualitative Disclosures about Market Risk

Interest Rates. Our exposure to market risk for changes in interest rates relates primarily to our short-term investments and short-term obligations; thus, fluctuations in interest rates would not have a material impact on the fair value of these securities. At September 30, 2007, we had approximately $348,912 in cash and cash equivalents. A hypothetical 10% increase or decrease in interest rates would not have a material impact on our earnings or loss, or the fair market value or cash flows of these instruments.

Foreign Exchange Rates. The majority of our revenues derived and expenses and liabilities incurred are in Renminbi (the currency of the PRC). Thus, our revenues and operating results may be impacted by exchange rate fluctuations in the currency of Renminbi. We have not tried to reduce our exposure to exchange rate fluctuations by using hedging transactions. However, we may choose to do so in the future. We may not be able to do this successfully. Accordingly, we may experience economic losses and negative impacts on earnings and equity as a result of foreign exchange rate fluctuations. The effect of foreign exchange rate fluctuation during the year ended December 31, 2006 was not material to us.

DESCRIPTION OF PROPERTY

Tourist Locations

We currently have one tourist destination which is known as “the Great Golden Lake.” It is located between the cities Sanming and Nanping of Fujian Province and Fuzhou of Jianxi Province. This property consists of 5 scenic areas: (1) Golden Lake; (2) Shangqing River; (3) Zhuanyuan Rock; (4) Luohan Mountain; and (5) Taining Old Town. The entire property covers more than 230 kilometers.

In February of 2005, the United Nations Educational, Scientific, and Cultural Organization named the Great Golden Lake as the core spot at the Taining World Geology Park and is behind only the Wuyi Mountain as Fujian Province’s best tourist attractions.

MANAGEMENT

Appointment of New Directors

In connection with the Exchange Agreement, we appointed 3 new directors to our board and hired 3 new officers. Furthermore, concurrent with the closing of the Exchange Agreement, Mr. Ralph Eisenschmid, our former Chief Executive Officer, Chief Financial Officer, Secretary and Director, and Jock English, Director, resigned from these positions.

Within 90 days of Closing, we will hire an English and Mandarin bilingual CFO who is experienced or knowledgeable about U.S. GAAP and public company responsibilities.