UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2008

| o | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________ to ___________

Commission File No. 000-26777

China Yida Holding, Co.

(Name of small business issuer in its charter)

| DELAWARE | 22-3662292 |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

RM 1302-3 13/F, Crocodile House II 55 Connaught Road Central, Hong Kong | |

| (Address of principal executive offices) | (Zip Code) |

86-591-28308388

(Registrant’s telephone number, including area code)

| Securities registered under Section 12(b) of the Exchange Act: |

| | |

| Title of each class registered: | Name of each exchange on which registered: |

| None | None |

| |

| Securities registered under Section 12(g) of the Exchange Act: |

Common Stock, par value $0.001 (Title of class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | o | | Accelerated filer | o |

| | | | | |

Non-accelerated filer (Do not check if a smaller reporting company) | o | | Smaller reporting company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes No x

Revenues for year ended December 31, 2008: $30,599,493

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. $22,956,629

As of March 24, 2009, the registrant had 68,084,487 shares of its common stock outstanding.

Documents Incorporated by Reference: None.

TABLE OF CONTENTS

| | | | | PAGE |

| | | PART I | | |

| ITEM 1. | | Business | | 1 |

| ITEM 1A. | | Risk Factors | | 9 |

| ITEM 2. | | Properties | | 9 |

| ITEM 3. | | Legal Proceedings | | 9 |

| ITEM 4. | | Submission of Matters to a Vote of Security Holders | | 10 |

| | | | | |

| | | PART II | | |

| ITEM 5. | | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | | 10 |

| ITEM 6. | | Selected Financial Data | | 12 |

| ITEM 7. | | Management’s Discussion and Analysis of Financial Condition and Results of Operation | | 12 |

| ITEM 7A. | | Quantitative and Qualitative Disclosures About Market Risk | | 17 |

| ITEM 8. | | Financial Statements and Supplementary Data | | 18 |

| ITEM 9. | | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | | 19 |

| ITEM 9A(T). | | Controls and Procedures | | 19 |

| ITEM 9B. | | Other Information | | -- |

| | | | | |

| | | | | |

| | | PART III | | |

| ITEM 10. | | Directors, Executive Officers and Corporate Governance | | 19 |

| ITEM 11. | | Executive Compensation | | 21 |

| ITEM 12. | | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | 22 |

| ITEM 13. | | Certain Relationships and Related Transactions, and Director Independence | | 22 |

| ITEM 14. | | Principal Accounting Fees and Services | | 22 |

| | | | | |

| | | PART IV | | |

| ITEM 15. | | Exhibits, Financial Statement Schedules | | |

| | | | |

| SIGNATURES | | | |

PART I

DESCRIPTION OF BUSINESS

We were originally incorporated on June 4, 1999 as Apta Holdings, Inc. (“Apta”) in the State of Delaware. Apta was a wholly owned subsidiary of ARCA Corp. and Apta subsequently acquired all of ARCA’s assets and liabilities as part of ARCA’s merger with another company.

On November 22, 2002, Apta entered into a Share Exchange Agreement with Convergix, Inc. whereby Apta acquired all of the shares of Convergix in exchange for issuing 25,000,000 shares of Apta to the shareholders of Convergix, Inc. Pursuant to this Share Exchange Agreement, the control of Apta changed and Ralph Eisenschmid, Jock English and Malcolm Little became the new directors of Apta. As part of the Share Exchange Agreement, Apta changed its name to InteliSys Aviation Systems of America, Inc.(“InteliSys”) to better reflect its business. This name change was filed with the State of Delaware on July 21, 2003. In addition, Apta increased its authorized shares to 50,000,000 as evidenced by the Amendment filed with the State of Delaware on December 5, 2003.

Prior to June 29, 2006, InteliSys was a provider of integrated software solutions for regional, mid-sized airlines and fleet operators.

On June 29, 2006, certain of our subsidiaries which were incorporated in Canada, Convergix Inc., Cynaptec Information Systems Inc., InteliSys Aviation Systems Inc., InteliSys Acquisition Inc., and InteliSys (NS) Co. (the “Canadian Subsidiaries”), filed with the Queens Bench of the Province of New Brunswick, Canada, a Notice of Intention to make a Proposal under the Canadian Bankruptcy and Insolvency Act (the “Notice of Intention”).

On August 7, 2006, we filed with the Queens Bench of the Province of New Brunswick, Canada, a Notice of Intention to make a Proposal under the Canadian Bankruptcy and Insolvency Act (the “Notice of Intention”).

On August 31, 2006, we filed with the Queens Bench a proposal to make a settlement with our creditors pursuant to Section 50.4(1) of the Canadian Bankruptcy and Insolvency Act (the “Settlement Proposal”), in which we proposed that our debts be settled as follows: (a) Secured creditors will be paid in accordance with present arrangements or as may be arranged between them and us; (b) Holders of preferred claims under the Canadian Bankruptcy and Insolvency Act will be paid by September 30, 2006; (c) Tax liabilities owed by us to the Canadian government will be paid within 90 days after the Settlement Proposal is approved by the Queens Bench; and (d) Unsecured creditors will be paid by September 30, 2006.

On October 4, 2006, the proposal submitted by us and the proposal submitted by our subsidiaries in the Court of Queen’s Bench of the Province of New Brunswick, Canada were approved by the Court. Pursuant to such proposal, a new company consisting of our existing employees and a group of new equity investors (“Newco”) would acquire all the assets of our subsidiaries (the “Subsidiaries”). Jock English, Chief Operating Officer of our Company, would be the Chief Executive Officer and President of Newco. The consideration for such purchase would consist of $200,000 CDN in cash and $250,000 CDN in 3-year 8% notes to be issued by Newco (the “Newco Notes”). Such notes would be secured by all the assets of Newco. In addition, the beneficial ownership of Newco would be held by certain of the current employees of the Subsidiaries and irrevocably transferred to the holders of the Notes if the intellectual property of Newco was ever sold, there would be a sale of more than 51% of the initial common shares of Newco or the initiation of any process to take Newco public within 3 years of the Court Order. If the Newco Notes were in default, the 3-year period would be extended to 5 years.

In accordance with the terms of the proposal, the secured claims of the creditors of the Subsidiaries were assumed by Newco. The unsecured claims of our creditors received $1,250 CDN within two months of court approval of the proposal. After the payment of fees and any taxes owed pursuant to the Income Tax Act (Canada), the Class A Unsecured Creditors of the Subsidiaries received $150 CDN in cash for each claim, the balance of cash from the sale of assets after payment to secured creditors and the balance thereof by having their respective proportion share of the Newco Notes. We, as the Class B Creditor, did not receive any cash or Newco notes from the sale of the subsidiaries. The Class C creditors (the employees of the subsidiaries) received $50,000 CDN in Newco notes which were distributed on a prorata basis.

The Court of Queen’s Bench of the Province of New Brunswick, Canada approved the proposals on October 6, 2006. The Court issued a Court Order ordering the sale of all assets of the subsidiaries to Newco, subject to the conditions of the proposal.

On November 17, 2006, subject to the terms of the Court Order issued by the Court of Queen's Bench of the Province of New Brunswick, all assets of the Canadian Subsidiaries were sold to 627450 New Brunswick Inc.

Since November 17, 2006, we did not have any operations or revenues and had decided to attempt to acquire other assets or business operations that will maximize shareholder value.

BUSINESS DEVELOPMENT OF KEENWAY

Overview

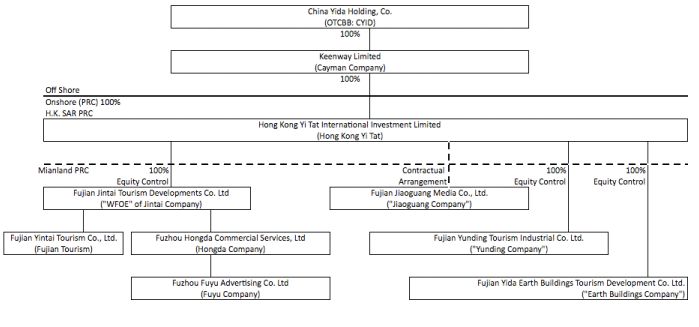

Keenway Limited is a company incorporated under the laws of Cayman Islands and owns 100% of the issued and outstanding capital stock of Hong Kong Yi Tat International Investment Limited, a limited company incorporated under the laws of Hong Kong Special Administration Region (“Yi Tat”). Yi Tat owns 100% of the issued and outstanding capital stock of Fujian Jintai Tourism Development, a company formed under the laws of the PRC (“Fujian Jintai,” collectively, referred to herein as “Keenway” or the “Company”), and 100% of the issued and outstanding capital stock of Fujian Yunding Tourism Industrial Co. Ltd., a company formed under the law of the PRC (“Yunding Company”, collectively, referred to herein as “Keenway” or the Company), and 100% of the issued and outstanding capital stock of Fujian Yida Earth Buildings Tourism Development Co. Ltd., a company formed under the law of the PRC (“Earth Buildings Company”(, collectively, referred to herein as “Keenway” or the Company).

Business

We are one of major diversified entertainment companies in China, currently covering China’s tourism, media and other entertainment-related industries.

| 1) | Tourism; and |

2) 3) | media. Other entertainment-ralted |

Through following subsidiaries and contractually binding entity located in China, we identify, manage, operate and promote tourist attractions, TV channels and stations, and other profitable entertainment-related operations.

Fujian Jintai Tourism Industrial Development Co., Ltd. (“Fujian Jintai”) is an entity that was established on October 29, 2001, and is domiciled at Floor 4, 1, Helping Street, Taining County, Fujian Province. Fujian Jintai is 100% owned by Yi Tat. Fujian Jintai owns 100% of Fuzhou Hongda Commercial Services Co., Ltd. (“Hongda”) which was incorporated on July 6, 2007 under the laws of the PRC and is located in Fuzhou City. Hongda’s wholly owned subsidiary is Fuzhou Fuyu Advertising Co., Ltd. (“Fuyu”) which is an entity established on July 31, 2007 with its primary place of business at , No. 5 Xian Fu Road, Zhang Cheng Town, Yongtai County, China. Fujian Jintai also owns 100% of Fujian Yintai Tourism Co., Ltd. (“Yintai”) was incorporated on March 20, 2008 and has its primary place of business at No. 5 Xianfu Road, Zhangcheng Town, Yongtai County, China..

Fujian Jiaoguang Media Co.Ltd (“Jiaoguang”) is incorporated on October 9, 2004 under the laws of PRC and located in Fuzhou City, Fujian Province in China. On December 30, 2004, Jiaoguang and its shareholders entered into a set of Contractual Arrangements with the Company. The relationships with the Company and its shareholders are governed by the Contractual Arrangements. The Contractual Arrangements are comprised of a series of agreements, including a Consulting Agreement and an Operating Agreement, through which the Company has the right to advise, consult, manage and operate Jiaoguang, and collect and own all of Jiaoguang’s respective net profits. Additionally, under a Proxy and Voting Agreement and a Voting Trust and Escrow Agreement, the shareholders of Jiaoguang have vested their voting control over Jiaoguang to the Company. In order to further reinforce the Company’s rights to control and operate Jiaoguang, Jiaoguang and its shareholders have granted the Company, under an Option Agreement, the exclusive right and option to acquire all of their equity interests in the Jiaoguang or, alternatively, all of the assets of the Jiaoguang. Further, the shareholders of Jiaoguang have pledged all of their rights, titles and interests in the Jiaoguang to the Company under an Equity Pledge Agreement.

Fujian Yida Earth Buildings Tourism Development Co. Ltd. (“Earth Buildings Company”) is incorporated on March 23, 2009, and is domiciled at Floor 8, 34 Nonglin Road, Postal Building, Hua’an County, Fujian Province. Fujian Jintai is 100% owned by Yi Tat.

Fujian Yunding Tourism Industrial Co. Ltd. (“Yunding Company”) is incorporated on January 21, 2009, and is domiciled at 68 Xianfu Road, Zhangcheng Town, Yongtai County, Fujian Province. Fujian Jintai is 100% owned by Yi Tat.

These subsidiaries and the contractually binding entity of the Company provide it with a unique opportunity to integrate industries that are at the forefront of Chinese growth.

History and Corporate Organization

Keenway Limited was incorporated under the laws of the Cayman Islands on May 9, 2007 for the purpose of functioning as an off-shore holding company to obtain ownership interests in Hong Kong Yi Tat International Investment Co., Ltd. Its registration number is CR-187088, and its registered address of Scotia Centre, 4th Floor, P. O. Box 2804, George Town, Grand, Cayman, KY1-1112, Cayman Islands.

Mr. CHEN Minhua and Ms. FAN Yanling, his spouse, were majority shareholders of Keenway, prior to the Merger.

Merger and Revised Ownership Structure

The chart below depicts the corporate structure of the Registrant as of the date of this 8-K. As depicted below, pursuant to the Merger, the Registrant owns 100% of the capital stock of Keenway Limited. Keenway Limited, incorporated in the Cayman Islands, owns 100% of Hong Kong Yi Tat International Investment Co., Ltd., a company organized in Hong Kong. Hong Kong Yi Tat International Investment Co., Ltd. wholly owns Fujian Tourism Developments Co., Ltd. and has a contractual relationship for services with Fujian Jiaoguang Media Co., Ltd. (collectively, these entities shall be referred to as the “Keenway Companies”).

THE MERGER

On November 19, 2007, Chen Minhua, Fan Yanling, Extra Profit International Limited, Luck Glory International Limited, and Zhang Xinchen (collectively, the Keenway Shareholders”), Keenway Limited, Hong Kong Yi Tat and we entered into a definitive Share Exchange Agreement (“Exchange Agreement”) which resulted in Keenway becoming our wholly owned subsidiary (the “Merger”). The Merger was accomplished by means of a share exchange in which the Keenway Shareholders exchanged all of their stock in Keenway for the transfer and additional issuance of our common stock. Under the terms of the Exchange Agreement and as a result of the Merger:

| · | Keenway became our wholly owned subsidiary; |

| · | In exchange for all of their shares of Keenway common stock, the Keenway Shareholders received 90,903,246 newly issued shares of our common stock and 3,641,796 shares of our common stock which was transferred from certain InteliSys Shareholders; |

| · | Immediately following the closing of the Merger, the Keenway Shareholders own approximately 94.5% of our issued and outstanding shares on a fully diluted basis. |

This transaction closed on November 19, 2007.

BUSINESS MODEL

The Company currently is comprised of its three key divisions: creation, management and marketing divisions.

Our Creation Division is comprised of our research and origination groups. Together they are dedicated to discover the value of our existing and potential operations through in‐depth studies and researches, and eventually to aviate the opportunities to pre‐grand‐opening stage. ..

Our Management Division is dedicated to realize the value of our assets through Company’s management professionals with rich experiences in China’s media, tourism and entertainment industries.

Our Marketing Division is dedicated to maximize the value of our assets and operations with efficient cross‐platform promotions through Company’s platforms currently available brought by Company’s integrated operations, network of partners, clients and other resources.

PRINCIPAL PRODUCTS

PRINCIPAL PRODUCTS AND SERVICES

The Company is principally in the services business and does not produce or manufacture any products. Its major source of income is from services provided at tourist destinations, entrance fee, advertisement and paid-programming revenue through the following operations:

Great Golden Lake: It is located between the cities Sanming and Nanping of Fujian Province and Fuzhou of Jianxi Province. This property consists of 5 scenic areas: (1) Golden Lake; (2) Shangqing River; (3) Zhuanyuan Rock; (4) Luohan Mountain; and (5) Taining Old Town. The entire property covers more than 230 kilometers. In February of 2005, the United Nations Educational, Scientific, and Cultural Organization gave the Global Geopark title to Great Golden Lake. The major source of income at Great Golden Lake is currently from services provided at the park and park entrance fee.

Dadi Tulou (Earth Buildings): On December 26, 2008, we entered into the Dadi Tulou Tourist Resources Development Agreement with the Hua’an County People’s Government in Zhangzhou, China. Pursuant to this agreement, we have begun to develop the Dadi Tulou Tourism Destination and its surrounding scenic areas located in the Hua’an County. As a world cultural heritage, Dadi Tulou is classified as a world class tourist destination. The surrounding scenic areas include the Bamboo Plant Garden, Xianzi Lake, rivers along the Xianzi Lake, Taikou Village, Shangping Wanli Building Three, and South Mountain Palace. Dadi Tulou and its surrounding scenic areas are well-developed, and can be put into operation without extensive development. The major source of income at Dadi Tulou is currently from entrance fee.

Yunding: On November 27, 2008, we entered into the Tourist Destination Cooperative Development Agreement with the Yongtai County People’s Government in Fuzhou, China. Pursuant to the agreement, the Yongtai government shall grant us the exclusive right and special authorization to develop tourist destinations in Fuzhou located at Yongtai Beixi and Jiezhukou Lake. Accordingly, we are obligated to construct, operate and manage the two tourist destinations, subject to specific terms and conditions negotiated between us and the Yongtai government. We have the exclusive right to develop both Yongtai Beixi and Jiezhukou Lake and the Yongtai government is prohibited from granting the right of development, operation and management to any third party during the existence of our agreement. The major source of income at Mountain-top will come from services provide at Mountain-top and entrance fee after the grand-opening.

Fujian Education Television: a provincial comprehensive entertainment television channel ranked the 4th place with 92% population coverage in Fujian Province. The major source of income at Fujian Education Television is from advertising.

Railroad On-board Programming: Effective February 13, 2009, we entered into a Cooperation Agreement with Railway Media Center for the purpose of collaborating with RMC to produce programs titled “Journey through China on the Train” that will be broadcast to passengers traveling on train. Pursuant to this agreement, we are obligated to plan and film the Journey Program, and RMC shall review and broadcast the Journey Program. The content of the Journey Program will focus on introduction and preview of natural resources, culture and history of tourism destinations, tourism advertisement and travel tips. RMC will appoint the program supervisor and we will appoint all the other personnel.

We and RMC agreed that the Journey Program shall be inserted into the programs produced by RMC for train passengers and be broadcast in accordance with the following rules:

| (1) | For the train line into Tibet, the Journey Program will be limited to 20’ duration, and be inserted into the program that RMC produced by themselves. The Journey Program shall be broadcast daily on a rolling basis. |

| (2) | For the high-speed motor train unit, the Journey Program will be limited to the range of 5-20 minutes, and be broadcast daily on a rolling basis. |

| (3) | For the national broadcast channels covering 18 railway bureaus, we will produce a new 20’ episode every week with its premier broadcast on Saturday evening and replay on Sunday afternoon. |

| (4) | During the Term, if RMC increases its train TV broadcast channels, the Journey Program will be inserted into these added channels and be broadcast on a rolling basis. |

The major source of income is currently from paid-programming and other advertising revenue.

MARKETING AND DISTRIBUTION METHODS OF PRODUCTS AND SERVICES

Tourist and related Operations

The current marketing strategy of our tourist and related operations has two major promotional elements. The first is promoting the unique brand and scenic location through traditional advertisement mediums. These traditional channels include television, radio and print media. To cut costs, the Company has implemented a cost minimization plan whereby the majority of the media advertisement and promotion of the tourist destination is done through the media platforms available to the Company, including Fujian Education Television and transportation on-board programming. This cost minimization plan allows our tourist and related operations to reduce its cost of advertising while maintaining a relatively high degree of exposure through our provincial TV channel province-wide and through our transportation on-board programming nation-wide.

The second element of the Company's marketing effort of tourist and related operations is promotion of the scenic destinations through the attainment of nationally and internationally recognized merits of scenic achievement. To this end, the Great Golden Lake has received the designation of the Global Geo-park title from the UN and ranked in China’s Top 10 Most Appealing Destinations and Top 50 Places for Foreigners to Visit. During the second half of 2008, Dadi Tulou was included on the World Heritage List as part of the Hua’an Tulou Group. By achieving this high degree of recognition, the destination becomes visible on a massive scale increasing the draw of tourists from a provincial to an international level. The goal is to significantly increase the daily visitation rate through attainment of significant merit.

Each element of the marketing strategy has been developed in order to increase the international consumer awareness of the Company's tourist destinations, to reduce the associated costs of such awareness and to ultimately increase the usage rate and revenues of the park.

Because the tourist destination is a static product/service, its distribution mainly consists of the promotional strategies described in the paragraphs above. The services are promoted and distributed through traditional forms of advertising media. Information and marketing materials regarding the park services are distributed on site.

Media and related Operations

The marketing efforts of our media and related operations can also be split into two elements. The first is promoting advertising revenue through program contents with high viewing rates. The second is promoting advertising revenue through larger media coverage.

Promotion through viewing rate: Through our tourist destinations, network of partners and content exchange programs, we create and promote our own educational and entertainment contents which can increase consumer awareness of its contents. The goal of promoting its programming is to increase its daily viewing rates and in turn increase the fees it can charge to third party advertisers. By achieving high rankings in China's television statistics, the Company becomes better known by potential advertising clients. With a high degree of coverage, advertisers are willing to pay more for the Company’s services. The Company also engages in strategic partnerships with other content providers by which they share and promote each others advertising client base to one another. Oftentimes, the referring content provider will receive a finder's fee for introducing the Company to qualified advertising clients.

Promotion through media coverage: we attract a lot of our advertising clients through our media coverage. For TV channels, we hope to increase our coverage to reach a national level. Our FETV channels reach a coverage rate of 92% in Fujian Province which covers approximately 28 million people. Our on-board programming on China’s railroad system currently covers approximately 1 billion passengers a year.

STATUS OF PUBLICLY ANNOUNCED NEW PRODUCTS/SERVICES

We expect that our company will grow over the next few years. Currently, we own and operate the Great Golden Lake which is a tourist destination in Fujian Province.

On December 26, 2008, we entered into the Dadi Tulou Tourist Resources Development Agreement with the Hua’an County People’s Government in Zhangzhou, China. Pursuant to this agreement, we have begun to develop the Dadi Tulou Tourism Destination and its surrounding scenic areas located in the Hua’an County. As a world cultural heritage, Dadi Tulou is classified as a world class tourist destination. The surrounding scenic areas include the Bamboo Plant Garden, Xianzi Lake, rivers along the Xianzi Lake, Taikou Village, Shangping Wanli Building Three, and South Mountain Palace. Dadi Tulou and its surrounding scenic areas are well-developed, and can be put into operation without extensive development. The Hua’an County Government and we are jointly responsible for obtaining the approval and support from the appropriate administrative agency regarding the admission ticket price of the Dati Tulou, and its surrounding scenic areas. Our cooperation and development of the scenic areas shall strictly comply with applicable world heritage maintenance guide.

On November 27, 2008, we entered into the Tourist Destination Cooperative Development Agreement with the Yongtai County People’s Government in Fuzhou, China. Pursuant to the agreement, the Yongtai government shall grant us the exclusive right and special authorization to develop tourist destinations in Fuzhou located at Yongtai Beixi and Jiezhukou Lake. Accordingly, we are obligated to construct, operate and manage the two tourist destinations, subject to specific terms and conditions negotiated between us and the Yongtai government. We have the exclusive right to develop both Yongtai Beixi and Jiezhukou Lake and the Yongtai government is prohibited from granting the right of development, operation and management to any third party during the existence of our agreement.

Effective February 13, 2009, we entered into a Cooperation Agreement with Railway Media Center (“RMC”) for the purpose of collaborating with RMC to produce programs titled “Journey through China on the Train” that will be broadcast to passengers traveling on train. Pursuant to this agreement, we are obligated to plan and film the Journey Program, and RMC shall review and broadcast the Journey Program. The content of the Journey Program will focus on introduction and preview of natural resources, culture and history of tourism destinations, tourism advertisement and travel tips. RMC will appoint the program supervisor and we will appoint all the other personnel.

We and RMC agreed that the Journey Program shall be inserted into the programs produced by RMC for train passengers and be broadcast in accordance with the following rules:

| (1) | For the train line into Tibet, the Journey Program will be limited to 20’ duration, and be inserted into the program that RMC produced by themselves. The Journey Program shall be broadcast daily on a rolling basis. |

| (2) | For the high-speed motor train unit, the Journey Program will be limited to the range of 5-20 minutes, and be broadcast daily on a rolling basis. |

| (3) | For the national broadcast channels covering 18 railway bureaus, we will produce a new 20’ episode every week with its premier broadcast on Saturday evening and replay on Sunday afternoon. |

| (4) | During the Term, if RMC increases its train TV broadcast channels, the Journey Program will be inserted into these added channels and be broadcast on a rolling basis. |

The Company expects to acquire and develop additional tourist destinations during the next few months. In addition, the Company intends to acquire an educational based television station in China. These acquisitions will generate growth for the Company and help the Company establish itself in these industries

INDUSTRY AND COMPETITIVE FACTORS

We are currently involved in the tourism and media industries in China. Both industries are experiencing significant growth in China. New competitors are entering these industries at a record pace. Competition is increasing and it is beginning to become difficult to gain market share and grow. There are, however, certain factors that we believe will be critical for our growth:

1. Proven replicable and unique business model: cross-platform marketing/promotion system through company multi-platforms

2. Successful track record of operating both business and maintaining its leading management position

3. Experienced management team with more than 70 years of combined experience in China media, tourism and entertainment industry

OUR INTELLECTUAL PROPERTY

The Company does not nor does it intend to own any patents or have any of its products or services patented. The Company has, however, obtained a trademark and the exclusive use permission for “Great Golden Lake.” This trademark has been filed with Taining County State-owned Assets Investment Operation Co., Ltd.

In the future, we intend to acquire other trademarks from companies that we acquire or file trademarks or patents in order to protect our intellectual property.

RESEARCH AND DEVELOPMENT ACTIVITIES DURING THE PRIOR TWO FISCAL YEARS

The Keenway Companies are involved in the tourist industry and mass media markets and, as such, do not have significant research and development activities. Any research and/or development that the Company worked on over the prior two fiscal years has been in connection with analyzing market trends and methods of increasing its tourist activity. The Company did not spend significant money or resources on research and development during the prior two fiscal years.

COMPLIANCE WITH ENVIRONMENTAL LAW

We comply with the Environmental Protection Law of PRC as well as applicable local regulations. In addition to statutory and regulatory compliance, we actively ensure the environmental sustainability of our operations. Penalties would be levied upon us if we fail to adhere to and maintain certain standards. Such failure has not occurred in the past, and we generally do not anticipate that it will occur in the future, but no assurance can be given in this regard.

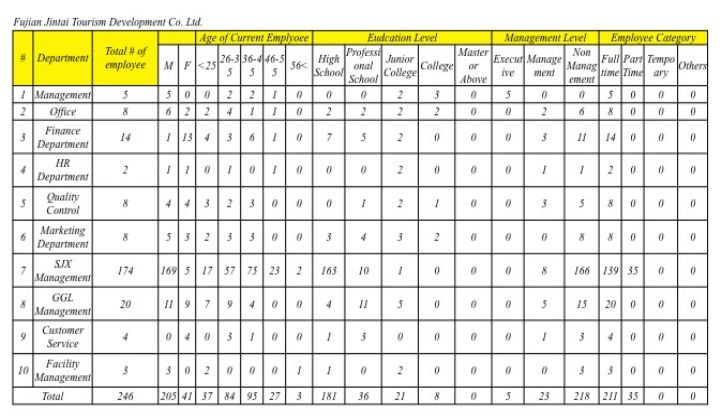

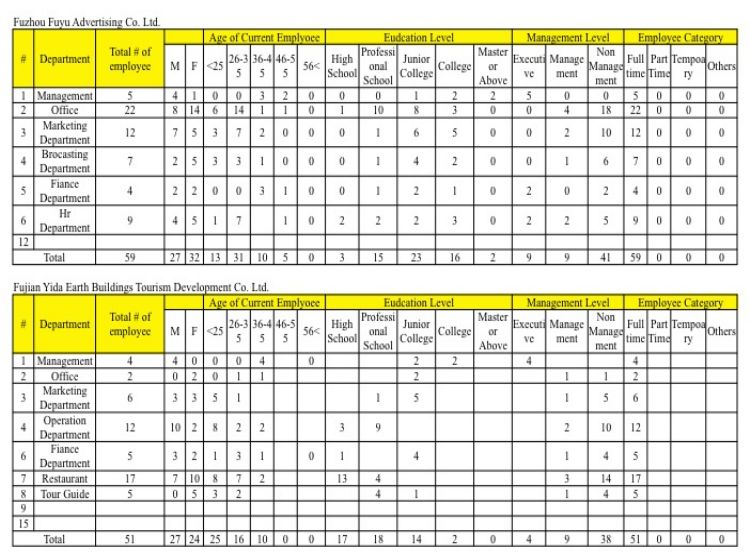

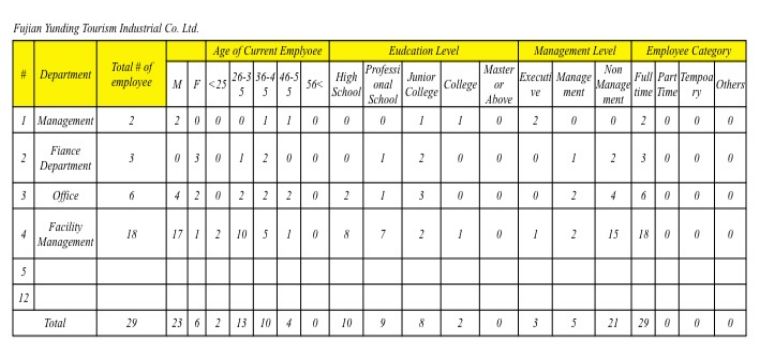

EMPLOYEES

As of December 31, 2008, we had approximately 385 full-time employees, including 16 senior managers. The majority of our workforce is comprised of:

Not applicable to smaller reporting companies.

We currently have one tourist destination which is known as “the Great Golden Lake.” It is located between the cities Sanming and Nanping of Fujian Province and Fuzhou of Jianxi Province. This property consists of 5 scenic areas: (1) Golden Lake; (2) Shangqing River; (3) Zhuanyuan Rock; (4) Luohan Mountain; and (5) Taining Old Town. The entire property covers more than 230 kilometers.

In February of 2005, the United Nations Educational, Scientific, and Cultural Organization named the Great Golden Lake as the core spot at the Taining World Geology Park and is behind only the Wuyi Mountain as Fujian Province’s best tourist attractions.

As described above, we also have the rights to develop tourist destinations at two other locations. The first location is Yongtai Beixi and Jiezhukou Lake in Fuzhou. The second property is Dadi Tulou Tourism Destination and its surrounding scenic areas located in the Hua’an County.

There are no pending legal proceedings to which the Company is a party or in which any director, officer or affiliate of the Company, any owner of record or beneficially of more than 5% of any class of voting securities of the Company, or security holder is a party adverse to the Company or has a material interest adverse to the Company. The Company’s property is not the subject of any pending legal proceedings.

On January 16, 2008, the Company received written consents in lieu of a meeting of Stockholders from holders of 78,455,584 shares representing approximately 78.45% of the 99,999,539 shares of the total issued and outstanding shares of voting stock of the Company to amend the previously authorized 1-for-100 reverse stock split to complete a 1-for-10 reverse stock split (pro-rata reduction of outstanding shares) of our issued and outstanding shares of Common Stock and to issue additional shares. There was not an increase or decrease in authorized shares nor did it affect the par value per share of the Company common stock. The effective date of the reverse stock split was February 28, 2008.

PART II

ITEM 5. MARKET FOR REGISTRANTS COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Public Market for Common Stock

Our common stock has been quoted on the OTC Bulletin Board under the symbol "IYSA.OB" since 1999. In December 2007, the symbol changed to “IAVA.OB” pursuant to a 10 for 1 reverse split. Since the end of the 2007 fiscal year and in February 2007, we effectuated another 10 for 1 reverse stock split and changed our name to China Yida Holding, Co. as a result of the reverse merger that closed on November 17, 2007. Accordingly, our symbol was changed to “CYID.OB.” The following table sets forth the range of quarterly high and sales prices of the common stock as reported on March 24, 2009 for the periods indicated:

| Price Information* |

| Financial Quarter Ended | High | Low |

| March 31, 2007 | 0.45 | 0.31 |

| June 30, 2007 | 0.25 | 1.60 |

| September 30, 2007 | 0.35 | 0.10 |

| December 31, 2007 | 4.60 | 0.10 |

| | | |

| March 31, 2008 | 3.90 | 0.75 |

| June 30, 2008 | 1.95 | 1.20 |

| September 30, 2008 | 2.10 | 0.50 |

| December 31, 2008 | 1.25 | 0.15 |

* The quotations do not reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions. All prices quoted above are adjusted according to the 10 for 1 reverse split that occurred in November 2007 and the subsequent 10 for 1 reverse split that occurred in February 2008.

The source of the high and low sales price information is Nasdaq.com.

The Securities and Exchange Commission has adopted Rule 15g-9 which establishes the definition of a “penny stock,” for purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require: (i) that a broker or dealer approve a person’s account for transactions in penny stocks and (ii) the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. In order to approve a person’s account for transactions in penny stocks, the broker or dealer must (i) obtain financial information and investment experience and objectives of the person; and (ii) make a reasonable determination that the transactions in penny stocks are suitable for that person and that person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks. The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prepared by the Commission relating to the penny stock market, which, in highlight form, (i) sets forth the basis on which the broker or dealer made the suitability determination and (ii) that the broker or dealer received a signed, written agreement from the investor prior to the transaction. Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading, and about commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

Holders

As of December 31, 2008, 68,084,487 shares of common stock are issued and outstanding. There are approximately 173 shareholders of our common stock and each shareholder of our common stock is entitled to one vote for each share on all matters submitted to a stockholder vote.

Holders of common stock do not have cumulative voting rights.

Therefore, holders of a majority of the shares of common stock voting for the election of directors can elect all of the directors. Holders of our common stock representing a majority of the voting power of our capital stock issued and outstanding and entitled to vote, represented in person or by proxy, are necessary to constitute a quorum at any meeting of our stockholders. A vote by the holders of a majority of our outstanding shares is required to effectuate certain fundamental corporate changes such as liquidation, merger or an amendment to our Articles of Incorporation.

Although there are no provisions in our charter or by-laws that may delay, defer or prevent a change in control, we are authorized, without shareholder approval, to issue shares of preferred stock that may contain rights or restrictions that could have this effect.

Holders of common stock are entitled to share in all dividends that the board of directors, in its discretion, declares from legally available funds. In the event of liquidation, dissolution or winding up, each outstanding share entitles its holder to participate pro rata in all assets that remain after payment of liabilities and after providing for each class of stock, if any, having preference over the common stock. Holders of our common stock have no pre-emptive rights, no conversion rights and there are no redemption provisions applicable to our common stock.

Dividends

Since inception we have not paid any dividends on our common stock. We currently do not anticipate paying any cash dividends in the foreseeable future on our common stock, when issued pursuant to this offering. Although we intend to retain our earnings, if any, to finance the exploration and growth of our business, our Board of Directors will have the discretion to declare and pay dividends in the future.

Payment of dividends in the future will depend upon our earnings, capital requirements, and other factors, which our Board of Directors may deem relevant.

Recent Sales of Unregistered Securities

None.

Equity Compensation Plan Information

The following table sets forth certain information as of March 24, 2009, with respect to compensation plans under which our equity securities are authorized for issuance:

| | | (a) | (b) | (c) |

| | | _________________ | _________________ | _________________ |

| | | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) |

| | | | | |

| | Equity compensation | None | | |

| | Plans approved by | | | |

| | Security holders | | | |

| | | | | |

| | Equity compensation | None | | |

| | Plans not approved | | | |

| | By security holders | | | |

| | Total | | | |

ITEM 6. SELECTED FIANANCIAL DATA

Not applicable because we are a smaller reporting company.

The following discussion should be read in conjunction with the Consolidated Financial Statements and Notes thereto appearing elsewhere in this Form 10-K. The following discussion contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 relating to future events or our future performance. Actual results may materially differ from those projected in the forward-looking statements as a result of certain risks and uncertainties set forth in this prospectus. Although management believes that the assumptions made and expectations reflected in the forward-looking statements are reasonable, there is no assurance that the underlying assumptions will, in fact, prove to be correct or that actual results will not be different from expectations expressed in this report.

Our Business

Through Keenway’s subsidiaries in China, we operate as a major diversified entertainment company in China, currently covering China’s tourism, media and other entertainment-related industries. Our business is to identify, manage, operate and promote tourist attractions, TV channels and stations, and other profitable entertainment-related operations. Since 2004, our company has operated tourist sites and worked with tourist attractions to provide advertising through television ads and other marketing campaigns.

Principal Factors Affecting our Financial Performance

We believe that the following factors affect our financial performance:

| o | Growth of Tourism and Mass Media in China |

China’s tourism market is growing at a record breaking pace with no signs of a slowdown. According to predictions made by the World Trade Organization, China will become the second largest tourist destination by 2010, and will become the most popular tourist destination by 2020. According to these predictions and the Company’s own estimates, the Company expects to see unprecedented growth over the next 12 months. In addition, we expect to see similar growth in the mass media market. Over the past few years, the Chinese mass media industry has sustained a growth rate of 25%. The Company views the Chinese mass media industry as still in its infancy and will continue to grow due to Chinese emerging status as a global leader.

| o | PRC Regulations Promoting Tourism |

The tourism industry in China is highly regulated by the PRC government. However, after China granted the WTO access, China has been relaxing its regulations and the tourism industry in China is expanding rapidly and consists of almost 34% of the total tourism in the Asia-Pacific region. In addition, with the Olympics being held in Beijing in 2008, China is expected to relax its regulations even more. The Olympics will also promote tourism in China and encourage foreigners to visit which in turn will allow the Company to grow.

Results of Operations

During the years ended December 31, 2008 and 2007, the Company is organized into two main business segments: tourism and advertisement. The following table presents a summary of operating information and certain year-end balance sheet information for the years ended December 31, 2008 and 2007:

| | | Years ended December 31, | |

| | | 2008 | | | 2007 | |

| Revenues from unaffiliated customers: | | | | | | |

| Advertisement | | $ | 23,319,235 | | | $ | 12,246,964 | |

| Tourism | | | 7,280,258 | | | | 2,330,801 | |

| Consolidated | | $ | 30,599,493 | | | $ | 14,577,765 | |

| | | | | | | | | |

| Operating income : | | | | | | | | |

| Advertisement | | $ | 16,564,398 | | | $ | 8,996,777 | |

| Tourism | | | 2,705,267 | | | | 467,452 | |

| Others | | | (273,012 | ) ) | | | (3,749 | ) |

| Consolidated | | $ | 18,996,653 | | | $ | 9,460,480 | |

| | | | | | | | | |

| Identifiable assets: | | | | | | | | |

| advertisement | | $ | 22,327,272 | | | $ | 17,287,260 | |

| Tourism | | | 31,050,807 | | | | 5,751,936 | |

| Others | | | 1,165,534 | ) | | | 841 | |

| Consolidated | | $ | 54,543,613 | | | $ | 23,040,037 | |

| | | | | | | | | |

| Net income | | | | | | | | |

| advertisement | | $ | 16,461,954 | | | $ | 8,804,241 | |

| Tourism | | | 2,084,320 | | | | 2,177,645 | |

| Others | | | (255,173 | ) ) | | | (3,736 | ) |

| Consolidated | | $ | 18,291,101 | | | $ | 10,978,150 | ) |

| | | | | | | | | |

| Interest expense: | | | | | | | | |

| advertisement | | $ | - | | | $ | 96,308 | |

| Tourism | | | 37,168 | | | | 124,750 | |

| Consolidated | | $ | 37,168 | | | $ | 221,058 | |

In accordance with Statement of Financial Accounting Standards No. 95, "Statement of Cash Flows," cash flows from the Company's operations is calculated based upon the local currencies. As a result, amounts related to assets and liabilities reported on the statement of cash flows may not necessarily agree with changes in the corresponding balances on the balance sheet.

Net Revenue:

Net revenue increased by $16,021,728 or 109.9%, from $14,577,765 in the fiscal year ended December 31, 2007 to US$30,599,493 in the fiscal year ended December 31, 2008. Our overall net revenue increased because our company is continuing to grow, specifically, our revenue increased due to the increased revenue in our media and advertising business. We have been able to capitalize on the growing Chinese economy.

Our revenue from advertisement for the fiscal year ended December 31, 2008 was $23,319,235 and for the fiscal year ended December 31, 2007 it was $12,246,964. This was a one year increase of $11,072,271 or 90.4%. This increase was the result of FETV’s successful completion of the reconstruction of its programming. The re-programming went into effect in the last 6 months of 2007 and the audience ratings increased dramatically after this went into effect. As a result, our clients increased their advertising budgets on our programs. This led to the dramatic increase from our advertising revenue.

Our revenue for our tourism increased by $4,949,457 or 312%, from $2,330,801 in the fiscal year 2007 to $7,280,258 in the fiscal year 2008 because we finished most of the infrastructure constructions on the Great Golden Lake, and Great Golden Lake’s capacity can afford more volume of visitors. From October 2007 until February 2008 we were constructing a dam to control the water level at the tourist destination. This construction of the dam is completed and the water level is now constant. Our revenue from the advertising business increased from fiscal year 2007 to fiscal year 200 and we expect it to continue to increase due to the growing Chinese economy.

Cost of revenue:

Cost of revenue increased by $5,666,001, or 273.5%, from $2,071,409 in the fiscal year ended December 31, 2007 to $7,683,410 in the fiscal year ended December 31, 2008. The cost of revenue increased because in 2008 we had high expenses to purchase licenses of TV programs.

Our cost of revenue from media for the fiscal year ended December 31, 2008 was $5,779,082 and for the fiscal year ended December 31, 2007 it was $2,000,684. This was an increase of $3,578,898 or 178.8%. The increased was the result of our successful reconstruction of our programming which led to a reduction in the speed in purchasing TV programs.

Our cost of revenue from tourism for the fiscal year ended December 31, 2008 was $1,904,329 and for the fiscal year ended December 31, 2007 it was $70,726. This was an increase of $1,833,603 or 2,693%. The increased was the result of the increasing of the promoting cost of Great Golden Lake.

Gross profit:

Gross profit increased by $10,409,727, or 83.2%, from $12,506,356 in the fiscal year ended December 31, 2007 to $22,916,082 in the fiscal year ended December 31, 2008 mainly due to the increase in advertisement revenue and tourism revenue due to increasing promotions as described above.

Operating Expenses:

Operating expenses were $3,595,876 in the fiscal year ended December 31, 2007, compared to $3,919,429 in the fiscal year ended December 31, 2008. This represents an increase of $323,553, or 8.9%, primarily due to a large increase in operations and significant business growth. The operating expenses increased due to the increase in revenues. The increase in revenues causes the company to increase its expenses in order to keep up with the increasing revenues. This is a variable expense and should fluctuate according to our revenues.

Income from Operations:

Operating profit was $8,910,480 in the fiscal year ended December 31, 2007 and $18,996,653 in the fiscal year ended December 31, 2008. The increase of $10,086,173, or 113.1%, was primarily the result of increased gross profit. Our income from operations increased because we increased our revenue at a greater rate than our expenses from operations increased.

Net Income:

Net income was $10,978,150 in the fiscal year ended December 31, 2007, compared to $ 18,191,044 in the fiscal year ended December 31, 2008, an increase of $7,212,894 or 39.65%. Our net income increased because our revenues increased.

Critical Accounting Policies

The Company’s financial statements and related public financial information are based on the application of accounting principles generally accepted in the United States (“GAAP”). GAAP requires the use of estimates; assumptions, judgments and subjective interpretations of accounting principles that have an impact on the assets, liabilities, revenue and expense amounts reported. These estimates can also affect supplemental information contained in our external disclosures including information regarding contingencies, risk and financial condition. We believe our use if estimates and underlying accounting assumptions adhere to GAAP and are consistently and conservatively applied. We base our estimates on historical experience and on various other assumptions that we believe to be reasonable under the circumstances. Actual results may differ materially from these estimates under different assumptions or conditions. We continue to monitor significant estimates made during the preparation of our financial statements.

While all these significant accounting policies impact its financial condition and results of operations, we view certain of these policies as critical. Policies determined to be critical are those policies that have the most significant impact on our consolidated financial statements and require management to use a greater degree of judgment and estimates. Actual results may differ from those estimates. Our management believes that given current facts and circumstances, it is unlikely that applying any other reasonable judgments or estimate methodologies would cause effect on our results of operations, financial position or liquidity for the periods presented in this report.

Recent Accounting Pronouncements

In December 2007, the Financial Accounting Standards Board (FASB) issued SFAS No. 160, “Noncontrolling Interests in Consolidated Financial Statements – an amendment of ARB No. 51”. This statement improves the relevance, comparability, and transparency of the financial information that a reporting entity provides in its consolidated financial statements by establishing accounting and reporting standards that require; the ownership interests in subsidiaries held by parties other than the parent and the amount of consolidated net income attributable to the parent and to the non-controlling interest be clearly identified and presented on the face of the consolidated statement of income, changes in a parent’s ownership interest while the parent retains its controlling financial interest in its subsidiary be accounted for consistently, when a subsidiary is deconsolidated, any retained non-controlling equity investment in the former subsidiary be initially measured at fair value, entities provide sufficient disclosures that clearly identify and distinguish between the interests of the parent and the interests of the non-controlling owners. SFAS No. 160 affects those entities that have an outstanding non-controlling interest in one or more subsidiaries or that deconsolidate a subsidiary. SFAS No. 160 is effective for fiscal years, and interim periods within those fiscal years, beginning on or after December 15, 2008. Early adoption is prohibited. The adoption of this statement is not expected to have a material effect on the Company's financial statements.

In March 2008, the FASB issued SFAS No. 161, “Disclosures about Derivative Instruments and Hedging Activities, an amendment of FASB Statement No. 133” (SFAS 161). This statement is intended to improve transparency in financial reporting by requiring enhanced disclosures of an entity’s derivative instruments and hedging activities and their effects on the entity’s financial position, financial performance, and cash flows. SFAS 161 applies to all derivative instruments within the scope of SFAS 133, “Accounting for Derivative Instruments and Hedging Activities” (SFAS 133) as well as related hedged items, bifurcated derivatives, and nonderivative instruments that are designated and qualify as hedging instruments. Entities with instruments subject to SFAS 161 must provide more robust qualitative disclosures and expanded quantitative disclosures. SFAS 161 is effective prospectively for financial statements issued for fiscal years and interim periods beginning after November 15, 2008, with early application permitted. We are currently evaluating the disclosure implications of this statement.

In May 2008, the FASB issued SFAS No. 162, “The Hierarchy of Generally Accepted Accounting Principles.” SFAS No. 162 identifies the sources of accounting principles and provides entities with a framework for selecting the principles used in preparation of financial statements that are presented in conformity with GAAP. The current GAAP hierarchy has been criticized because it is directed to the auditor rather than the entity, it is complex, and it ranks FASB Statements of Financial Accounting Concepts, which are subject to the same level of due process as FASB Statements of Financial Accounting Standards, below industry practices that are widely recognized as generally accepted but that are not subject to due process. The Board believes the GAAP hierarchy should be directed to entities because it is the entity (not its auditors) that is responsible for selecting accounting principles for financial statements that are presented in conformity with GAAP. SFAS 162 is effective 60 days following the SEC’s approval of PCAOB Auditing Standard No. 6, Evaluating Consistency of Financial Statements (AS/6). The adoption of FASB 162 is not expected to have a material impact on the Company’s financial position.

In May 2008, the FASB issued SFAS No. 163, “Accounting for Financial Guarantee Insurance Contracts-an interpretation of FASB Statement No. 60.” Diversity exists in practice in accounting for financial guarantee insurance contracts by insurance enterprises under FASB Statement No. 60, Accounting and Reporting by Insurance Enterprises. This results in inconsistencies in the recognition and measurement of claim liabilities. This Statement requires that an insurance enterprise recognize a claim liability prior to an event of default (insured event) when there is evidence that credit deterioration has occurred in an insured financial obligation. This Statement requires expanded disclosures about financial guarantee insurance contracts. The accounting and disclosure requirements of the Statement will improve the quality of information provided to users of financial statements. SFAS 163 is effective for financial statements issued for fiscal years beginning after December 15, 2008, and interim periods within those fiscal years. The adoption of FASB 163 is not expected to have a material impact on the Company’s financial position.

LIQUIDITY AND CAPITAL RESOURCES

The Company currently generates its cash flow through operations which it believes will be sufficient to sustain current level operations for at least the next twelve months. In addition, in February 2008, we completed a $14 million financing and we intend to use the proceeds to expand our operations and improve the “Great Golden Lake” and increase the number of visitors we can attract to the destination. In 2008, we intend to continue to work to expand our tourism services and mass media outlets, including the acquisition of a provincial-level education TV station. We expect the increased tourism in China because of the Olympic Games to positively effect the number of visitors we can attract to our tourist destinations.

To the extent we are successful in rolling out our advertising campaign programs, identifying potential acquisition targets and negotiating the terms of such acquisition, and the purchase price includes a cash component, we plan to use our working capital and the proceeds of any financing to finance such acquisition costs. Our opinion concerning our liquidity is based on current information. If this information proves to be inaccurate, or if circumstances change, we may not be able to meet our liquidity needs.

2009 – 2010 Outlook

Over the course of the next few years, we intend to grow and expand our businesses in China’s tourism, media, entertainment and other related industry. We expect to acquire additional tourist areas that will enhance our reputation as a world-class company that develops and manages tourist attractions. These acquisitions will be financed either through revenues of the Company or by financings and sales of the Company’s stock or other securities.

With respect to the mass media, we expect to grow by acquiring another operating television network.

PLAN OF OPERATIONS

Quantitative and Qualitative Disclosures about Market Risk

Interest Rates. Our exposure to market risk for changes in interest rates relates primarily to our short-term investments and short-term obligations; thus, fluctuations in interest rates would not have a material impact on the fair value of these securities. At December 31, 2008, we had approximately $8,715,048.08 in cash and cash equivalents. A hypothetical 10% increase or decrease in interest rates would not have a material impact on our earnings or loss, or the fair market value or cash flows of these instruments.

Foreign Exchange Rates. The majority of our revenues derived and expenses and liabilities incurred are in Renminbi (the currency of the PRC). Thus, our revenues and operating results may be impacted by exchange rate fluctuations in the currency of Renminbi. We have not tried to reduce our exposure to exchange rate fluctuations by using hedging transactions. However, we may choose to do so in the future. We may not be able to do this successfully. Accordingly, we may experience economic losses and negative impacts on earnings and equity as a result of foreign exchange rate fluctuations. The effect of foreign exchange rate fluctuation during the year ended December 31, 2006 was not material to us.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements, financings, or other relationships with unconsolidated entities or other persons, also known as “special purpose entities” (SPEs).

Not applicable because we are a smaller reporting company.

CHINA YIDA HOLDING CO. AND SUBSIDIARIES

FOR THE YEARS ENDED DECEMBER 31, 2008

| PAGE | F-1 | REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

| | | |

| PAGE | F-2 | BALANCE SHEET |

| | | |

| PAGE | F-3 | STATEMENT OF OPERATIONS |

| | | |

| PAGE | F-4 | STATEMENT OF CHANGES IN STOCKHOLDERS’ DEFICIENCY |

| | | |

| PAGE | F-5 | STATEMENT OF CASH FLOWS |

| | | |

| PAGES | F-6 - F-23 | NOTES TO FINANCIAL STATEMENTS |

Report of Independent Registered Public Accounting Firm

Board of Directors and Stockholders of

China Yida Holding Co. and subsidiaries

We have audited the accompanying consolidated balance sheets of China Yida Holding Co. and Subsidiaries as of December 31, 2008 and 2007, and the related consolidated statements of income, stockholders' equity, and cash flows for the two years period ended December 31, 2008. These consolidated financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall consolidated financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the consolidated financial position of China Yida Holding Co. and Subsidiaries as of December 31, 2008 and 2007, and the results of their operations and their cash flows for the two years period ended December 31, 2008, in conformity with U.S. generally accepted accounting principles.

/s/ Kabani & Company, Inc.

Certified Public Accountants

Los Angeles, California

March 25, 2009

| CHINA YIDA HOLDING CO. AND SUBSIDIARIES | |

| CONSOLIDATED BALANCE SHEETS | |

| DECEMBER 31, | |

| | | | | | | |

| ASSETS | |

| | | 2008 | | | 2007 | |

| Current assets | | | | | | |

| Cash and cash equivalents | | $ | 8,715,048 | | | $ | 726,631 | |

| Accounts receivable | | | 76,569 | | | | 21,965 | |

| Due from related party | | | - | | | | 351,450 | |

| Other current assets | | | 76,759 | | | | 36,532 | |

| Prepayments | | | 164,169 | | | | 24,173 | |

| Total current assets | | | 9,032,546 | | | | 1,160,751 | |

| | | | | | | | | |

| Property, plant and equipment, net | | | 34,173,009 | | | | 8,184,546 | |

| Construction in progress | | | 1,979,725 | | | | 278,803 | |

| Intangible assets, net | | | 9,358,333 | | | | 3,956,885 | |

| Advances | | | - | | | | 9,459,052 | |

| Total assets | | $ | 54,543,613 | | | $ | 23,040,037 | |

| | | | | | | | | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | |

| Current liabilities | | | | | | | | |

| Accounts payable and accrued expense | | $ | 65,368 | | | $ | 170,226 | |

| Loan payable | | | 1,172,591 | | | | 1,919,228 | |

| Other payable | | | 456,181 | | | | 449,507 | |

| Unearned revenue | | | 6,597 | | | | 135,945 | |

| Accrued payroll | | | - | | | | 70,762 | |

| Tax payables | | | 726,524 | | | | 1,626,099 | |

| Total current liabilities | | | 2,427,259 | | | | 4,371,767 | |

| | | | | | | | | |

| Stockholders' equity | | | | | | | | |

| Preferred stock (10,000,000 shares authorized, 1 share issued and outstanding, par value $0.001) | | | - | | | | - | |

| Common stock (100,000,000 shares authorized and 68,084,487 and 9,999,955issued and outstanding as of December 31, 2008 and December 31, 2007, par value $0.0001) | | | 27,809 | | | | 10,000 | |

| Additional paid in capital | | | 21,601,288 | | | | 8,591,847 | |

| Accumulated other comprehensive income | | | 3,134,077 | | | | 1,004,344 | |

| Retained earning | | | 27,353,180 | | | | 9,062,079 | |

| Total stockholders' equity | | | 52,116,354 | | | | 18,668,270 | |

| | | | | | | | | |

| Total liabilities and stockholders' equity | | $ | 54,543,613 | | | $ | 23,040,037 | |

| | | | | | | | | |

| The accompanying notes are an integral part of these audited consolidated financial statements. | |

| CHINA YIDA HOLDING CO. AND SUBSIDIARIES | |

| CONSOLIDATED STATEMENTS OF INCOME AND OTHER COMPREHENSIVE INCOME | |

| FOR THE YEARS ENDED DECEMBER 31, 2008 AND 2007 | |

| | |

| | | 2008 | | | 2007 | |

| Net revenue | | | | | | |

| Advertisement | | $ | 23,319,235 | | | $ | 12,246,964 | |

| Tourism | | | 7,280,258 | | | | 2,330,801 | |

| Total net revenue | | | 30,599,493 | | | | 14,577,765 | |

| | | | | | | | | |

| Cost of revenue | | | | | | | | |

| Advertisement | | | 5,779,082 | | | | 2,000,684 | |

| Tourism | | | 1,904,329 | | | | 70,726 | |

| Total cost of revenue | | | (7,683,410 | ) | | | (2,071,409 | ) |

| | | | | | | | | |

| Gross profit | | | 22,916,082 | | | | 12,506,356 | |

| | | | | | | | | |

| Operating expenses | | | | | | | | |

| Selling expenses | | | 1,456,229 | | | | 973,459 | |

| Operating and administrative expenses | | | 2,463,201 | | | | 2,622,417 | |

| Total operating expenses | | | 3,919,429 | | | | 3,595,876 | |

| | | | | | | | | |

| Income from operations | | | 18,996,653 | | | | 8,910,480 | |

| | | | | | | | | |

| Other (income) expense | | | | | | | | |

| Other income - donation income | | | - | | | | (2,437,333 | ) |

| Other expense, net | | | 22,869 | | | | 8,869 | |

| Interest expense | | | 37,168 | | | | 221,058 | |

| Interest income | | | (24,832 | ) | | | (1,775 | ) |

| Finance expense | | | - | | | | 4,742 | |

| | | | | | | | | |

| Total other expense | | | 35,205 | | | | (2,204,440 | ) |

| | | | | | | | | |

| Income before income taxes | | | 18,961,448 | | | | 11,114,920 | |

| | | | | | | | | |

| Provision for income taxes | | | 670,347 | | | | 136,770 | |

| | | | | | | | | |

| Net income | | | 18,291,101 | | | | 10,978,150 | |

| | | | | | | | | |

| Other comprehensive income | | | | | | | | |

| Foreign currency translation gain | | | 2,129,733 | | | | 961,760 | |

| | | | | | | | | |

| Other comprehensive income | | $ | 20,420,834 | | | $ | 11,939,910 | |

| | | | | | | | | |

| Basic net earnings per share | | $ | 0.32 | | | $ | 1.16 | |

| Basic weighted average shares outstanding | | | 57,581,530 | | | | 9,445,859 | |

| | | | | | | | | |

| Diluted net earnings per share | | $ | 0.32 | | | $ | 1.16 | |

| Diluted weighted average shares outstanding | | | 57,581,530 | | | | 9,445,859 | |

| | | | | | | | | |

The accompanying notes are an integral part of these audited consolidated financial statements.

| CHINA YIDA HOLDING CO. AND SUBSIDIARIES | |

| CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY | |

| FOR THE YEARS ENDED DECEMBER 31, 2008 AND 2007 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | # of shares of common stock outstanding | | | Common stock | | | Additional paid in capital | | | Other comprehensive income | | | Retained earning (accumulated deficit) | | | Total | |

| Balance at December 31, 2006 | | | 9,401,597 | | | | 940 | | | | 8,600,907 | | | | 42,584 | | | | (1,916,071 | ) | | | 6,728,360 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Recapitalization | | | 598,358 | | | | 60 | | | | (60 | ) | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Foreign currency translation | | | - | | | | - | | | | - | | | | 961,760 | | | | - | | | | 961,760 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income for the year ended December 31, 2007 | | | - | | | | - | | | | - | | | | - | | | | 10,978,150 | | | | 10,978,150 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance at December 31, 2007 | | | 9,999,955 | | | | 10,000 | | | | 8,591,847 | | | | 1,004,344 | | | | 9,062,079 | | | | 18,668,270 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Recapitalization | | | 44,751,046 | | | | 4,475 | | | | (4,475 | ) | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Shares issued for cash | | | 13,333,486 | | | | 13,334 | | | | 13,013,916 | | | | - | | | | - | | | | 13,027,250 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Foreign currency translation | | | - | | | | - | | | | - | | | | 2,129,733 | | | | - | | | | 2,129,733 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income from the year ended December 31, 2008 | | | - | | | | - | | | | - | | | | - | | | | 18,291,101 | | | | 18,291,101 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance at December 31, 2008 | | | 68,084,487 | | | $ | 27,809 | | | $ | 21,601,288 | | | $ | 3,134,077 | | | $ | 27,353,180 | | | $ | 52,116,354 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these audited consolidated financial statements.

| CHINA YIDA HOLDING CO. AND SUBSIDIARIES | |

| CONSOLIDATED STATEMENTS OF CASH FLOWS | |

| FOR THE YEARS ENDED DECEMBER 31, 2008 AND 2007 | |

| | | | | | | |

| | | 2008 | | | 2007 | |

| | | | | | | |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | |

| Net Income | | $ | 18,291,101 | | | $ | 10,978,150 | |

| Adjustments to reconcile net income to net cash | | | | | | | | |

| provided by operating activities: | | | | | | | | |

| Depreciation | | | 399,884 | | | | 357,066 | |

| Amortization | | | 4,264,777 | | | | 183,333 | |

| (Increase) / decrease in assets: | | | | | | | | |

| Accounts receivables | | | (52,128 | ) | | | 156,113 | |

| Other receivables | | | (1,061,873 | ) | | | 1,081,853 | |

| Prepaid expense | | | 79 | | | | (17,636 | ) |

| Advances | | | 6,932,750 | | | | (8,812,439 | ) |

| Increase/(decrease) in current liabilities: | | | | | | | | |

| Accounts payable and accrued expenses | | | (114,535 | ) | | | (72,670 | ) |

| Tax payable | | | (993,859 | ) | | | 1,031,136 | |

| Unearned revenue | | | (136,255 | ) | | | 101,934 | |

| Accrued payroll | | | 55,392 | | | | 28,563 | |

| Other payable | | | (203,257 | ) | | | (580,370 | ) |

| Total Adjustments | | | 9,090,975 | | | | (6,543,117 | ) |

| Net cash provided by operating activities | | | 27,382,076 | | | | 4,435,033 | |

| | | | | | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | | | | | | |

| Additions to property & equipment | | | (25,364,501 | ) | | | (188,013 | ) |

| Proceeds from loan to related party | | | - | | | | 595,290 | |

| Payments for construction in progress | | | (1,652,510 | ) | | | (2,395,927 | ) |

| Purchase of intangible assets | | | (6,476,964 | ) | | | - | |

| Net cash used in investing activities | | | (33,493,975 | ) | | | (1,988,651 | ) |

| | | | | | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | | | | | |

| Proceed from related party | | | - | | | | (1,748,987 | ) |

| Issuance of shares for cash | | | 13,027,250 | | | | - | |

| Loan payments | | | 607,928 | | | | (2,103,658 | ) |

| Net cash provided by (used in) financing activities | | | 13,635,178 | | | | (3,852,644 | ) |

| | | | | | | | | |

| EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS | | | 465,139 | | | | (83,017 | ) |

| | | | | | | | | |

| NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | | | 7,988,417 | | | | (1,489,279 | ) |

| | | | | | | | | |

| CASH AND CASH EQUIVALENTS, BEGINNING BALANCE | | | 726,631 | | | | 2,215,910 | |

| | | | | | | | | |

| CASH AND CASH EQUIVALENTS, ENDING BALANCE | | $ | 8,715,048 | | | $ | 726,631 | |

| | | | | | | | | |

| SUPPLEMENTAL DISCLOSURES: | | | | | | | | |

| Non-cash transaction: | | | | | | | | |

| Transferred to fixed asset from construction in progress | | $ | 25,320,569 | | | $ | 171,980.00 | |

| | | | | | | | | |

| Cash paid during the quarter for: | | | | | | | | |

| Income tax payments | | $ | 317,668 | | | $ | - | |

| | | | | | | | | |

| Interest payments | | $ | 109,499 | | | $ | 221,058 | |

| | | | | | | | | |

The accompanying notes are an integral part of these audited consolidated financial statements.

CHINA YIDA HOLDING CO. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. ORGANIZATION AND DESCRIPTION OF BUSINESS

China Yida Holding Co. (“the Company”, “we”, “us”, “our”) was formerly a provider of commercial reservation systems and integrated software solutions for low fare, regional, and mid-sized airlines. On November 17, 2006, subject to the terms of the Court Order issued by the Court of Queen's Bench of the Province of New Brunswick, all assets of the Canadian Subsidiaries were sold to 627450 New Brunswick Inc.

We were originally incorporated on June 4, 1999 as Apta Holdings, Inc. (“Apta”) in the State of Delaware. In August of 2003, the Company changed its name from Apta Holdings, Inc. to InteliSys Aviation Systems of America Inc ("IASA"), pursuant to a consent of the Company's shareholders, to better reflect its new business activities.

IASA was incorporated on June 4, 1999 in the State of Delaware. IASA was formerly engaged in two lines of business: owning and operating income producing real estate, and a finance business which originated and serviced loans to individuals and to businesses. The real estate business was spun off in 2000. The finance business was sold prior to December 31, 2002.

On December 31, 2002, IASA acquired 100% of the issued and outstanding common stock of CONVERGix, Inc. ("CONVERGix"), a Canadian corporation, pursuant to a share exchange agreement dated November 22, 2002. Under the share exchange agreement, IASA issued 3,295,000 shares of its common stock plus 21,788,333 of Class B Special "exchangeable shares" of Intelisys Acquisition, Inc., a 100% owned subsidiary of IASA. The exchangeable shares have equal voting rights and equal economic value as IASA common stock. These exchangeable shares may be exchanged by the holder at any time on a one-for-one basis for IASA common stock, and if not exchanged prior to December 31, 2012, will be exchanged for IASA common stock on that date. As a result of the merger, the shareholders of CONVERGix are now shareholders of IASA. In conjunction with the merger, all of the directors and officers of IASA resigned and the shareholders have appointed a new board of directors and officers, which consists of the directors and officers of CONVERGix.

The merger was accounted for as a reverse acquisition and resulted in CONVERGix becoming the accounting acquirer, whereby the historical financial statements of IASA have become those of CONVERGix.

In conjunction with the merger and recapitalization of CONVERGix, CONVERGix's 25,083,333 issued and outstanding common stock were reclassified into common stock of IASA or exchangeable shares of Intelisys Acquistion Inc., which represent IASA common stock equivalents. Because IASA was inactive at December 31, 2002, net assets acquired were Nil.

CONVERGix is incorporated under the New Brunswick Business Corporations Act in Canada and is a holding company, which holds investments in two subsidiary companies whose business activities include developing, marketing, installation and support of a suite of aviation enterprise software for the global market.

CONVERGix was incorporated on January 18, 2001 in connection with a corporate reorganization of its two subsidiary companies, Cynaptec Information Systems Inc. and InteliSys Aviation Systems Inc. Following this reorganization, CONVERGix owns 100% of the issued and outstanding common shares of Cynaptec Information Systems Inc. and 53% of the issued and outstanding common shares of InteliSys Aviation System Inc. On March 31, 2001, the Company abandoned its operations in Cynaptec Information Systems Inc. in order to concentrate on the development and marketing of the "Amelia" software product developed by InteliSys Aviation Systems Inc.

Cynaptec Information Systems Inc. owns 47% of the issued and outstanding common shares of InteliSys Aviation Systems Inc.

The reorganization on January 18, 2001 did not result in a change of control of Cynaptec Information Systems Inc. and InteliSys Aviation Systems Inc.

The consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America and include the following significant accounting policies: