SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

––––––––––––––––

POST EFFECTIVE

AMENDMENT NO.1 to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

––––––––––––––––

CHINA YIDA HOLDING, CO.

(Exact name of registrant as specified in its charter)

| |

DELAWARE (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | 22-3662292 (I.R.S. Employer Identification Number) |

| –––––––––––––––– |

RM 1302-3 13/F, Crocodile House II 55 Connaught Road Central, Hong Kong 86-591-28308388 (Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices) |

| –––––––––––––––– |

Chen Minhua Chief Executive Officer RM 1302-3 13/F, Crocodile House II 55 Connaught Road Central, Hong Kong 86-591-28308388 (Name, address, including zip code, and telephone number, including area code, of agent for service) |

Copies to: Eric Stein, Esq. Anslow & Jaclin, LLP 195 Route 9 South, Suite 204 Manalapan, New Jersey 07726 (732) 409-1212 |

| |

Approximate Date of Commencement of Proposed Sale to the Public: from time to time after the effective date of this Registration Statement as determined by market conditions and other factors.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | Large accelerated filer | o | Accelerated filer | o |

| | Non-accelerated filer | o | Smaller reporting company | x |

| | (Do not check if a smaller reporting company) | o | | |

CALCULATION OF REGISTRATION FEE

Title of EachClass Of Securities to be Registered | Amount To Be Registered | Proposed Maximum Offering Price Per Share | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee |

| Common Stock, $.001 par value(1) | 7,000,000 | $1.05 | $7,350,000 | $288.86 |

| | | | | |

| Total | 7,000,000 | | $7,350,000 | $288.86 |

| | (1) | Represents approximately 52.5% of the 13,333,334 common shares purchased by the Investors as set forth in the Securities Purchase Agreement dated March 7, 2008, attached hereto as an exhibit. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

THIS FILING DOES NOT INVOLVE THE REGISTRATION OF ANY NEW SHARES OF COMMON STOCK. RATHER, THIS FILING UPDATES THE REGISTRATION OF THE COMMON STOCK ORIGINALLY REGISTERED ON FORM S-1 (FILE NO. 333-150665), DECLARED EFFECTIVE ON SEPTEMBER 5, 2008.

The information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and neither we nor the selling stockholders are soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION DATED JUNE 10, 2009

7,000,000 shares of Common Stock

CHINA YIDA HOLDING, CO.

This prospectus relates to the sale or other disposition by the selling stockholders identified in this prospectus, or their transferees, of up to 7,000,000 shares of our common stock, which includes, 52.5% of the 13,333,334 shares of common stock and warrants to Pope Investments II LLC and the other investors (collectively, the “Investors”).

We will receive no proceeds from the sale or other disposition of the shares, or interests therein, by the selling stockholders. However, we will receive proceeds in the amount of $8,333,333.75 assuming the cash exercise of all of the warrants held by the selling stockholders, subject to certain of the warrants being exercised under a “cashless exercise” right.

Our common stock is traded on the over-the-counter electronic bulletin board. Our trading symbol is CYID. On April 17, 2008, the last bid price as reported was $1.30 per share.

The selling stockholders, and any participating broker-dealers may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, and any commissions or discounts given to any such broker-dealer may be regarded as underwriting commissions or discounts under the Securities Act. The selling stockholders have informed us that they do not have any agreement or understanding, directly or indirectly, with any person to distribute their common stock.

Brokers or dealers effecting transaction in the shares should confirm the registration of these securities under the securities laws of the states in which transactions occur or the existence of our exemption from registration.

An investment in shares of our common stock involves a high degree of risk. We urge you to carefully consider the Risk Factors beginning on page 5.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The Date of this Prospectus is June 10, 2009

| | PAGE |

| 1 |

| 8 |

| 17 |

| 18 |

| 18 |

| 18 |

| 19 |

| 21 |

| 21 |

| 22 |

| 31 |

| 31 |

| F- |

| 35 |

| 36 |

| 45 |

| | 45 |

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all the information that you should consider before investing in the common stock. You should carefully read the entire prospectus, including “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Consolidated Financial Statements, before making an investment decision .

THE COMPANY

Background

China Yida Holdings Co. was originally incorporated on June 4, 1999 as Apta Holdings, Inc. (“Apta”) in the State of Delaware. On June 29, 2006, our predecessor and certain of its subsidiaries which were incorporated in Canada, Convergix Inc., Cynaptec Information Systems Inc., InteliSys Aviation Systems Inc., InteliSys Acquisition Inc., and InteliSys (NS) Co. (the “Canadian Subsidiaries”), filed with the Queens Bench of the Province of New Brunswick, Canada, a Notice of Intention to make a Proposal under the Canadian Bankruptcy and Insolvency Act (the “Notice of Intention”).

On October 4, 2006, our proposal that we submitted to the Court of Queen’s Bench of the Province of New Brunswick, Canada was approved by the Court and the court ordered the sale of all assets of the subsidiaries subject to the conditions of the proposal.

From November 17, 2006 until we closed the Reverse Merger with China Yida, we did not have any operations or revenues and had decided to attempt to acquire other assets or business operations that will maximize shareholder value.

History of Keenway Limited and China Yida

Keenway Limited was incorporated under the laws of the Cayman Islands on May 9, 2007 for the purpose of functioning as an off-shore holding company to obtain ownership interests in Hong Kong Yi Tat International Investment Co., Ltd. Its registration number is CR-187088, and its registered address of Scotia Centre, 4th Floor, P. O. Box 2804, George Town, Grand, Cayman, KY1-1112, Cayman Islands.

Mr. CHEN Minhua and Ms. FAN Yanling, his spouse, were majority shareholders of Keenway, prior to the Merger.

Share Exchange

On November 19, 2007, Chen Minhua, Fan Yanling, Extra Profit International Limited, Luck Glory International Limited, and Zhang Xinchen (collectively, the Keenway Shareholders”), Keenway Limited, Hong Kong Yi Tat and we entered into a definitive Share Exchange Agreement (“Exchange Agreement”) which resulted in Keenway becoming our wholly owned subsidiary (the “Merger”). The Merger was accomplished by means of a share exchange in which the Keenway Shareholders exchanged all of their stock in Keenway for the transfer and additional issuance of our common stock. Under the terms of the Exchange Agreement and as a result of the Merger:

| · | Keenway became our wholly owned subsidiary; |

| · | In exchange for all of their shares of Keenway common stock, the Keenway Shareholders received 90,903,246 newly issued shares of our common stock and 3,641,796 shares of our common stock which was transferred from certain InteliSys Shareholders; |

| · | Immediately following the closing of the Merger, the Keenway Shareholders own approximately 94.5% of our issued and outstanding shares on a fully diluted basis. |

This transaction closed on November 19, 2007.

THE MERGER

On November 19, 2007, Chen Minhua, Fan Yanling, Extra Profit International Limited, Luck Glory International Limited, and Zhang Xinchen (collectively, the Keenway Shareholders”), Keenway Limited, Hong Kong Yi Tat and we entered into a definitive Share Exchange Agreement (“Exchange Agreement”) which resulted in Keenway becoming our wholly owned subsidiary (the “Merger”). The Merger was accomplished by means of a share exchange in which the Keenway Shareholders exchanged all of their stock in Keenway for the transfer and additional issuance of our common stock. Under the terms of the Exchange Agreement and as a result of the Merger:

| · | Keenway became our wholly owned subsidiary; |

| · | In exchange for all of their shares of Keenway common stock, the Keenway Shareholders received 90,903,246 newly issued shares of our common stock and 3,641,796 shares of our common stock which was transferred from certain InteliSys Shareholders; |

| · | Immediately following the closing of the Merger, the Keenway Shareholders own approximately 94.5% of our issued and outstanding shares on a fully diluted basis. |

This transaction closed on November 19, 2007.

Our operations are headquartered in China in Fuzhou City in Fujian Province. We are a profitable, mid-sized Chinese company that focuses primarily on two industries:

1) tourism; and

2) mass media.

Fujian Jintai Tourism Developments Co., Ltd. is an entity that was established on October 29, 2001, and is domiciled at Floor 4, 1, Helping Street, Taining County, Fujian Province. Its primary business relates to tourism and, specifically, tourism at the Great Golden Lake. The company offers bamboo rafting, parking lot service, photography services and ethnic cultural communications.

Fujian Jintai owns 100% of Fuzhou Hongda Commercial Services Co., Ltd. (“Hongda”) which was incorporated on July 6, 2007 under the laws of the PRC and is located in Fuzhou City. Hongda’s wholly owned subsidiary is Fuzhou Fuyu Advertising Co., Ltd. (“Fuyu”) which is an entity established on July 31, 2007 with its primary place of business at , No. 5 Xian Fu Road, Zhang Cheng Town, Yongtai County, China.

Fujian Jiaoguang Media Co., Ltd. is the entity that concentrates on the mass media portion of the business and was established on October 9, 2004 and is domiciled in Wangjiang Tower, 18, Longgu Holiday Inn, Langqi Economic Zone, Fuzhou City. Its primary business is focused on advertisements, including media publishing, television, cultural and artistic communication activities, and performance operation and management activities.

We do not have a direct ownership interest in Fujian Jiaoguang Media Co., Ltd. On December 30, 2004, Jiaoguang and its shareholders entered into a set of Contractual Arrangements with us. The relationships with the Company and its shareholders are governed by the Contractual Arrangements. The Contractual Arrangements are comprised of a series of agreements, including a Consulting Agreement and an Operating Agreement, through which the Company has the right to advise, consult, manage and operate Jiaoguang, and collect and own all of Jiaoguang’s respective net profits. Additionally, under a Proxy and Voting Agreement and a Voting Trust and Escrow Agreement, the shareholders of Jiaoguang have vested their voting control over Jiaoguang to the Company. In order to further reinforce the Company’s rights to control and operate Jiaoguang, Jiaoguang and its shareholders have granted the Company, under an Option Agreement, the exclusive right and option to acquire all of their equity interests in the Jiaoguang or, alternatively, all of the assets of Jiaoguang. Further, the shareholders of Jiaoguang have pledged all of their rights, titles and interests in Jiaoguang to the Company under an Equity Pledge Agreement. We have this organizational structure because of the Chinese limitations on foreign investments and ownership in Chinese businesses. Generally, Chinese law prohibits foreign entities from directly owning certain types of businesses, such as the media industry. We have obtained an opinion from Chinese legal counsel that this structure is legal and that the U.S. corporation can obtain the same benefits and risks with this contractual structure as they would with a direct equity ownership. The agreements and legal opinion are filed as exhibits to this Registration Statement.

These businesses of the Company provide it with a unique opportunity to integrate industries that are at the forefront of Chinese growth. The Company’s business plan focuses around the combination of tourism and mass media and creating growth through the use of relationships established by the Company.

Hong Kong Yi Tat International Investment Co., Ltd. is an entity that was created solely for the purpose of equity control of its operating entities, Fujian Jintai Tourism Industrial Development, Co, Ltd. and Fujian Jiaoguang Media, Co., Ltd. Hong Kong Yi Tat does not have any operations other than the operations of their subsidiaries. Fuzhou Fuyu Advertising Co., Ltd. is an operating entity that engages in the media industry..

Fuzhou Fuyu Advertising Co., Ltd. is the same entity as Fuzhou Fuyu Media Co., Ltd. This entity was incorporated on July 31, 2007. Before this entity was incorporated, Fujian Jiaoguang Media Co., Ltd. operated our media business. After August 1, 2007, however, Fuzhou Fuyu Advertising Co., Ltd. was the main operator of our media and advertising business.

History and Corporate Organization

Keenway Limited was incorporated under the laws of the Cayman Islands on May 9, 2007 for the purpose of functioning as an off-shore holding company to obtain ownership interests in Hong Kong Yi Tat International Investment Co., Ltd. Its registration number is CR-187088, and its registered address of Scotia Centre, 4th Floor, P. O. Box 2804, George Town, Grand, Cayman, KY1-1112, Cayman Islands.

Mr. CHEN Minhua and Ms. FAN Yanling, his spouse, were majority shareholders of Keenway, prior to the Merger.

Merger and Revised Ownership Structure

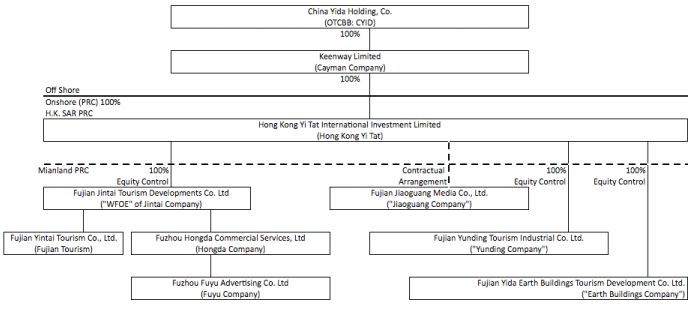

The chart below depicts the corporate structure of the Registrant as of the date of this Registration Statement. As depicted below, pursuant to the Merger, the Registrant owns 100% of the capital stock of Keenway Limited. Keenway Limited, incorporated in the Cayman Islands, owns 100% of Hong Kong Yi Tat International Investment Co., Ltd., a company organized in Hong Kong. Hong Kong Yi Tat International Investment Co., Ltd. wholly owns Fujian Tourism Developments Co., Ltd. and has a contractual relationship for services with Fujian Jiaoguang Media Co., Ltd. (collectively, these entities shall be referred to as the “Keenway Companies”).

The current structure is:

PRINCIPAL PRODUCTS AND SERVICES

The Company is principally in the services business and does not produce or manufacture any products. Its major source of income is from services provided at tourist destinations, entrance fee, advertisement and paid-programming revenue through the following operations:

Great Golden Lake: It is located between the cities Sanming and Nanping of Fujian Province and Fuzhou of Jianxi Province. This property consists of 5 scenic areas: (1) Golden Lake; (2) Shangqing River; (3) Zhuanyuan Rock; (4) Luohan Mountain; and (5) Taining Old Town. The entire property covers more than 230 kilometers. In February of 2005, the United Nations Educational, Scientific, and Cultural Organization gave the Global Geopark title to Great Golden Lake. The major source of income at Great Golden Lake is currently from services provided at the park and park entrance fee.

Dadi Tulou (Earth Buildings): On December 26, 2008, we entered into the Dadi Tulou Tourist Resources Development Agreement with the Hua’an County People’s Government in Zhangzhou, China. Pursuant to this agreement, we have begun to develop the Dadi Tulou Tourism Destination and its surrounding scenic areas located in the Hua’an County. As a world cultural heritage, Dadi Tulou is classified as a world class tourist destination. The surrounding scenic areas include the Bamboo Plant Garden, Xianzi Lake, rivers along the Xianzi Lake, Taikou Village, Shangping Wanli Building Three, and South Mountain Palace. Dadi Tulou and its surrounding scenic areas are well-developed, and can be put into operation without extensive development. The major source of income at Dadi Tulou is currently from entrance fee.

Yunding: On November 27, 2008, we entered into the Tourist Destination Cooperative Development Agreement with the Yongtai County People’s Government in Fuzhou, China. Pursuant to the agreement, the Yongtai government shall grant us the exclusive right and special authorization to develop tourist destinations in Fuzhou located at Yongtai Beixi and Jiezhukou Lake. Accordingly, we are obligated to construct, operate and manage the two tourist destinations, subject to specific terms and conditions negotiated between us and the Yongtai government. We have the exclusive right to develop both Yongtai Beixi and Jiezhukou Lake and the Yongtai government is prohibited from granting the right of development, operation and management to any third party during the existence of our agreement. The major source of income at Mountain-top will come from services provide at Mountain-top and entrance fee after the grand-opening.

Fujian Education Television: a provincial comprehensive entertainment television channel ranked the 4th place with 92% population coverage in Fujian Province. The major source of income at Fujian Education Television is from advertising.

Railroad On-board Programming: Effective February 13, 2009, we entered into a Cooperation Agreement with Railway Media Center for the purpose of collaborating with RMC to produce programs titled “Journey through China on the Train” that will be broadcast to passengers traveling on train. Pursuant to this agreement, we are obligated to plan and film the Journey Program, and RMC shall review and broadcast the Journey Program. The content of the Journey Program will focus on introduction and preview of natural resources, culture and history of tourism destinations, tourism advertisement and travel tips. RMC will appoint the program supervisor and we will appoint all the other personnel.

We and RMC agreed that the Journey Program shall be inserted into the programs produced by RMC for train passengers and be broadcast in accordance with the following rules:

| (1) | For the train line into Tibet, the Journey Program will be limited to 20’ duration, and be inserted into the program that RMC produced by themselves. The Journey Program shall be broadcast daily on a rolling basis. |

| (2) | For the high-speed motor train unit, the Journey Program will be limited to the range of 5-20 minutes, and be broadcast daily on a rolling basis. |

| (3) | For the national broadcast channels covering 18 railway bureaus, we will produce a new 20’ episode every week with its premier broadcast on Saturday evening and replay on Sunday afternoon. |

| (4) | During the Term, if RMC increases its train TV broadcast channels, the Journey Program will be inserted into these added channels and be broadcast on a rolling basis. |

The major source of income is currently from paid-programming and other advertising revenue.

THE FINANCING

On March 7, 2008, we entered into a definitive Securities Purchase Agreement for the sale of units of securities of the Company aggregating up to a maximum of $14,000,000 (the “Securities Purchase Agreement), attached hereto as Exhibit 4.1. Each unit of securities consist of: one (1) share of Company common stock, $0.001 par value per share (the “Common Stock”); and (ii) a Class A warrant to purchase an additional number of shares equal to 50% of the Common Stock. The purchase price is $1.05 per unit. In connection with the Securities Purchase Agreement, the Company entered into (i) a Registration Rights Agreement, attached hereto as Exhibit 4.2; (ii) a Lock-Up Agreement, attached hereto as Exhibit 4.3; and (iii) a Make Good Agreement, attached hereto as Exhibit 4.4 (together with the Securities Purchase Agreement, these agreements shall be referred to as the “Financing Documents”).

The private placement closed simultaneously with the signing of the Financing Documents and the Company issuing 13,333,334 shares of common stock and warrants to Pope Investments II LLC and the other investors (collectively, the “Investors”). Pursuant to its terms, the warrants can be converted into 6,666,667 shares of common stock at an exercise price of $1.25 per share (the "Warrant"). The Warrants can be exercised beginning on September 6, 2008 and will expire on September 6, 2011. A copy of the Warrant is attached hereto as Exhibit 4.5.

In connection with the private placement and as part of the Financing Documents, we also entered into a Registration Rights Agreement, whereby, we have agreed to file a registration statement on Form S-1 (or other applicable Form) within 60 days of the close of this financing.

Additionally, our majority shareholders, Chen Minhua and Fan Yanling, and we entered into a Lock-Up Agreement whereby both Fan Yanling and Chen Minhua agreed not to sell any securities for a period of 12 months after the initial registration statement associated with this financing is declared effective. Lastly, our Chairman and we entered into a Make Good Agreement whereby Chairman Chen Minhua has pledged 13,333,334 shares of his common stock of the Company as security that the Company reach certain earnings thresholds for fiscal years ended 2007 and 2008 (the “Make Good Shares”). If the Company meets these thresholds, the Make Good Shares will be released from escrow and returned to Chairman Chen Minhua. Alternatively, if the Company fails to meet the earnings requirements, the Make Good Shares will be released to the Investors as additional compensation. For the fiscal year 2007, pursuant to the Make Good Agreement, the Company had to report Earnings Per Share of at least $0.084 per shares, based on 99,999,547 fully diluted shares outstanding. The Company met this earnings threshold and had Earnings Per Share of $0.12 per share. Therefore, none of the Make Good Shares were released from escrow to the investors. Pursuant to the Make Good Agreement, all of the Make Good Shares will remain in escrow until the Company states its Earnings Per Share for fiscal year 2008. For fiscal year 2008, pursuant to the Make Good Agreement, the Company has to have Earnings Per Share of $0.22 based on 68,084,333 fully diluted shares outstanding. If the Company meets this threshold for fiscal year 2008, the Make Good Shares will be released from escrow and returned to Chairman Chen Minhua. If, however, the earnings threshold is not met, the Make Good Shares will be released to the Investors on a pro rata basis and the total number of shares to be released to the Investors shall be as follows: (i) if the fiscal year 2008 earning per share is $0.11 or less, then all of the Make Good Shares will be released to the Investors (on a pro rata basis); or (ii) if the fiscal year 2008 earnings per share is greater than $0.11 but less than $0.20, then the Investors shall receive Make Good Shares equal to 1.5 times the percentage under earnings threshold; or (iii) if the Earning Per Share is greater than $0.20 then none of the Make Good Shares will be released to the Investors. It is important to note that the Company will not be issuing any additional shares if the earnings threshold is not met. The Make Good Shares are already issued to Chairman Chen and he will be transferring his shares to the Investors if the earnings threshold is not met. Therefore, this will not dilute any shareholders, other than Chairman Chen.

THE OFFERING

| Securities Covered Hereby | 7,000,000 shares of common stock to Pope Investments II LLC and the other investors (collectively, the “Investors”). |

| | |

| Common Stock Outstanding Prior to the Offering | 68,084,487 shares |

| | |

| Common Stock to be Outstanding after the Offering | 74,751,154 shares, assuming the selling stockholders exercise all their warrants, and no conversion of other series of outstanding preferred stock nor exercise of the other outstanding warrants and options. |

| | |

| The Percentage of Outstanding Stock that this Offering Represents Compared to the Total Shares Outstanding | 9.30%, assuming the selling stockholders exercise all their warrants, and no conversion of other series of outstanding preferred stock nor exercise of the other outstanding warrants and options. |

| | |

| Use of Proceeds | We will receive no proceeds from the sale or other disposition of the shares of common stock covered hereby by the selling stockholders. However, we will receive $8,333,333.75 if all of the warrants for underlying shares included in this prospectus are exercised for cash. We will use these proceeds for general corporate purposes. |

| | |

| OTC Electronic Bulletin Board Symbol | “CYID” |

FORWARD LOOKING STATEMENTS

Information included or incorporated by reference in this prospectus may contain forward-looking statements. This information may involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from the future results, performance or achievements expressed or implied by any forward-looking statements. Forward-looking statements, which involve assumptions and describe our future plans, strategies and expectations, are generally identifiable by use of the words “may,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend” or “project” or the negative of these words or other variations on these words or comparable terminology.

This prospectus contains forward-looking statements, including statements regarding, among other things, (a) our projected sales and profitability, (b) our technology, (c) our manufacturing, (d) the regulation to which we are subject, (e) anticipated trends in our industry and (f) our needs for working capital. These statements may be found under “Management’s Discussion and Analysis or Plan of Operations” and “Business,” as well as in this prospectus generally. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the risks outlined under “Risk Factors” and matters described in this prospectus generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this prospectus will in fact occur.

Except as otherwise required by applicable laws, we undertake no obligation to publicly update or revise any forward-looking statements or the risk factors described in the prospectus, whether as a result of new information, future events, changed circumstances or any other reason after the date of this prospectus.

AVAILABLE INFORMATION

We have filed with the SEC a registration statement on Form S-1 under the Securities Act with respect to the common stock offered hereby. This prospectus, which constitutes part of the registration statement, does not contain all of the information set forth in the registration statement and the exhibits and schedule thereto, certain parts of which are omitted in accordance with the rules and regulations of the SEC. For further information regarding our common stock and our company, please review the registration statement, including exhibits, schedules and reports filed as a part thereof. Statements in this prospectus as to the contents of any contract or other document filed as an exhibit to the registration statement, set forth the material terms of such contract or other document but are not necessarily complete, and in each instance reference is made to the copy of such document filed as an exhibit to the registration statement, each such statement being qualified in all respects by such reference.

We are also subject to the informational requirements of the Exchange Act which requires us to file reports, proxy statements and other information with the SEC. Such reports, proxy statements and other information along with the registration statement, including the exhibits and schedules thereto, may be inspected at public reference facilities of the SEC at 100 F Street N.E, Washington D.C. 20549. Copies of such material can be obtained from the Public Reference Section of the SEC at prescribed rates. You may call the SEC at 1-800-SEC-0330 for further information on the operation of the public reference room. Because we file documents electronically with the SEC, you may also obtain this information by visiting the SEC’s Internet website at http://www.sec.gov.

ITEM 3. SUMMARY INFORMATION, RISK FACTORS AND RATIO OF EARNINGS TO FIXED CHARGES

The following tables set forth key components of our results of operations for the periods indicated, in dollars, and key components of our revenue for the period indicated, in dollars.

Fiscal year ended December 31, 2008 Compared to fiscal year ended December 31, 2007

| | |

| | | 2008 | | | 2007 | |

| Net revenue | | | | | | |

| Advertisement | | $ | 23,319,235 | | | $ | 12,246,964 | |

| Tourism | | | 7,280,258 | | | | 2,330,801 | |

| Total net revenue | | | 30,599,493 | | | | 14,577,765 | |

| | | | | | | | | |

| Cost of revenue | | | | | | | | |

| Advertisement | | | 5,779,082 | | | | 2,000,684 | |

| Tourism | | | 1,904,329 | | | | 70,726 | |

| Total cost of revenue | | | (7,683,410 | ) | | | (2,071,409 | ) |

| | | | | | | | | |

| Gross profit | | | 22,916,082 | | | | 12,506,356 | |

| | | | | | | | | |

| Operating expenses | | | | | | | | |

| Selling expenses | | | 1,456,229 | | | | 973,459 | |

| Operating and administrative expenses | | | 2,463,201 | | | | 2,622,417 | |

| Total operating expenses | | | 3,919,429 | | | | 3,595,876 | |

| | | | | | | | | |

| Income from operations | | | 18,996,653 | | | | 8,910,480 | |

| | | | | | | | | |

| Other (income) expense | | | | | | | | |

| Other income - donation income | | | - | | | | (2,437,333 | ) |

| Other expense, net | | | 22,869 | | | | 8,869 | |

| Interest expense | | | 37,168 | | | | 221,058 | |

| Interest income | | | (24,832 | ) | | | (1,775 | ) |

| Finance expense | | | - | | | | 4,742 | |

| | | | | | | | | |

| Total other expense | | | 35,205 | | | | (2,204,440 | ) |

| | | | | | | | | |

| Income before income taxes | | | 18,961,448 | | | | 11,114,920 | |

| | | | | | | | | |

| Provision for income taxes | | | 670,347 | | | | 136,770 | |

| | | | | | | | | |

| Net income | | | 18,291,101 | | | | 10,978,150 | |

| | | | | | | | | |

| Other comprehensive income | | | | | | | | |

| Foreign currency translation gain | | | 2,129,733 | | | | 961,760 | |

| | | | | | | | | |

| Other comprehensive income | | $ | 20,420,834 | | | $ | 11,939,910 | |

| | | | | | | | | |

| Basic net earnings per share | | $ | 0.32 | | | $ | 1.16 | |

| Basic weighted average shares outstanding | | | 57,581,530 | | | | 9,445,859 | |

| | | | | | | | | |

| Diluted net earnings per share | | $ | 0.32 | | | $ | 1.16 | |

| Diluted weighted average shares outstanding | | | 57,581,530 | | | | 9,445,859 | |

| | | | | | | | | |

Three months ended March 31, 2009 compared to three months ended March 31, 2008

| | | Three Months Ended March 31 | |

| | | 2009 | | | 2008 | |

| Net revenue | | | | | | |

| Advertisement | | $ | 6,592,187 | | | $ | 5,859,330 | |

| Tourism | | | 3,230,718 | | | | 992,954 | |

| Total net revenue | | | 9,822,906 | | | | 6,852,284 | |

| Cost of revenue | | | | | | | | |

| Advertisement | | | 1,372,523 | | | | 1,384,565 | |

| Tourism | | | 128,226 | | | | 503,035 | |

| Total cost of revenue | | | (1,500,750 | ) | | | (1,887,600) | |

| Gross profit | | | 8,322,156 | | | | 4,964,684 | |

| Operating expenses | | | | | | | | |

| Selling expenses | | | 430,647 | | | | 133,671 | |

| Operating and administrative expenses | | | 1,202,198 | | | | 352,316 | |

| Total operating expenses | | | 1,632,845 | | | | 485,987 | |

| Income from operations | | | 6,689,311 | | | | 4,478,698 | |

| Other (income) expense | | | | | | | | |

| Other expense, net | | | 1,269 | | | | 7,976 | |

| Interest expense | | | 0 | | | | 61,249 | |

| Interest income | | | (13,634 | ) | | | (1,545 | ) |

| Total other expense | | | (12,364 | ) | | | 67,681 | |

| Income before income taxes | | | 6,701,675 | | | | 4,411,017 | |

| Provision for income taxes | | | 1,730,801 | | | | 99,313 | |

| Net income | | | 4,970,874 | | | | 4,311,704 | |

| Other comprehensive income | | | | | | | | |

| Foreign currency translation gain (loss) | | | (13,028 | ) | | | 969,165 | |

| Comprehensive income | | $ | 4,957,846 | | | $ | 5,280,870 | |

| Basic net earnings per share | | $ | 0.07 | | | $ | 0.17 | |

| Basic weighted average shares outstanding | | | 68,084,487 | | | | 25,489,123 | |

| | | | | | | | | |

| Diluted net earnings per share | | $ | 0.07 | | | $ | 0.15 | |

| Diluted weighted average shares outstanding | | | 68,084,487 | | | | 28,038,142 | |

| | | | | | | | | |

The shares of our common stock being offered for resale by the selling stockholders are highly speculative in nature, involve a high degree of risk and should be purchased only by persons who can afford to lose the entire amount invested in the common stock. Before purchasing any of the shares of common stock, you should carefully consider the following factors relating to our business and prospects. If any of the following risks actually occurs, our business, financial condition or operating results could be materially adversely affected. In such case, the trading price of our common stock could decline and you may lose all or part of your investment. The risks and uncertainties described below are not the only risks facing us.

RISK FACTORS

You should carefully consider the risks described below together with all of the other information included in this report before making an investment decision with regard to our securities. The statements contained in or incorporated into this offering that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Relating to Our Business

| · | WE NEED TO MANAGE GROWTH IN OPERATIONS TO MAXIMIZE OUR POTENTIAL GROWTH AND ACHIEVE OUR EXPECTED REVENUES AND OUR FAILURE TO MANAGE GROWTH WILL CAUSE A DISRUPTION OF OUR OPERATIONS RESULTING IN THE FAILURE TO GENERATE REVENUE. |

In order to maximize potential growth in our current and potential markets, we believe that we must expand the scope of our services in the tourism and mass media industry. This expansion will place a significant strain on our management and our operational, accounting, and information systems. To date, we have not experienced strains from our expansion and have had all resources necessary to accommodate the growth. We expect, however, to continue to grow and in order to deal with the strain it will put on our resources, we will need to continue to improve our financial controls, operating procedures, and management information systems. We will also need to effectively train, motivate, and manage our employees. Our failure to manage our growth could disrupt our operations and ultimately prevent us from generating the revenues we expect. We do not have any current plans for expansion, however, we do anticipate that the business will continue to grow based on the current economic climate and will have to be ready to deal with the expansion and have the resources, including the infrastructure and management, in place to deal with the growth.

| · | WE CANNOT ASSURE YOU THAT OUR INTERNAL GROWTH STRATEGY WILL BE SUCCESSFUL WHICH MAY RESULT IN A NEGATIVE IMPACT ON OUR GROWTH, FINANCIAL CONDITION, RESULTS OF OPERATIONS AND CASH FLOW. |

One of our strategies is to grow internally through increasing the customers we target for advertising campaigns and locations where we promote tourism by penetrating existing markets in PRC and entering new geographic markets in PRC as well as other parts of Asia and globally. However, many obstacles to this expansion exist, including, but not limited to, increased competition from similar businesses, international trade and tariff barriers, unexpected costs, costs associated with marketing efforts abroad and maintaining attractive foreign exchange ratios. We cannot, therefore, assure you that we will be able to successfully overcome such obstacles and establish our services in any additional markets. Our inability to implement this internal growth strategy successfully may have a negative impact on our growth, future financial condition, results of operations or cash flows.

| · | WE CANNOT ASSURE YOU THAT OUR ACQUISITION GROWTH STRATEGY WILL BE SUCCESSFUL RESULTING IN OUR FAILURE TO MEET GROWTH AND REVENUE EXPECTATIONS. |

In addition to our internal growth strategy, we have also explored the possibility of growing through strategic acquisitions. We intend to pursue opportunities to acquire businesses in PRC that are complementary or related in product lines and business structure to us. We may not be able to locate suitable acquisition candidates at prices that we consider appropriate or to finance acquisitions on terms that are satisfactory to us. If we do identify an appropriate acquisition candidate, we may not be able to negotiate successfully the terms of an acquisition, or, if the acquisition occurs, integrate the acquired business into our existing business. Acquisitions of businesses or other material operations may require debt financing or additional equity financing, resulting in leverage or dilution of ownership. Integration of acquired business operations could disrupt our business by diverting management away from day-to-day operations. The difficulties of integration may be increased by the necessity of coordinating geographically dispersed organizations, integrating personnel with disparate business backgrounds and combining different corporate cultures.

We also may not be able to maintain key employees or customers of an acquired business or realize cost efficiencies or synergies or other benefits we anticipated when selecting our acquisition candidates. In addition, we may need to record write-downs from future impairments of intangible assets, which could reduce our future reported earnings. At times, acquisition candidates may have liabilities or adverse operating issues that we fail to discover through due diligence prior to the acquisition. In addition to the above, acquisitions in PRC, including state owned businesses, will be required to comply with laws of the People's Republic of China ("PRC"), to the extent applicable. There can be no assurance that any given proposed acquisition will be able to comply with PRC requirements, rules and/or regulations, or that we will successfully obtain governmental approvals which are necessary to consummate such acquisitions, to the extent required. If our acquisition strategy is unsuccessful, we will not grow our operations and revenues at the rate that we anticipate.

| · | IF WE ARE NOT ABLE TO IMPLEMENT OUR STRATEGIES OR EXPAND OUR MEDIA OPERATIONS AND ACQUIRE ADDITIONAL TOURIST ATTRACTIONS, OUR BUSINESS OPERATIONS AND FINANCIAL PERFORMANCE MAY BE ADVERSELY AFFECTED. |

We expanded our business in 2008 by acquiring additional tourist attractions, including Yongtai Beixi and Jiezhukou Lake, Dadi Tulou, and Geart Golden Lake, and establishing collaboration with Railway Media Center to produce programs titled “Journey through China on the Train.” Our continuous business development plan is based on a further expansion of our media services and acquisition of additional tourist attractions. There is inherent risks and uncertainties involved throughout these stages of development. There is no assurance that we will be successful in continuously expanding our media operations or acquiring additional tourist attractions, or that our strategies, even if implemented, will lead to the successful achievement of our objectives. If we are not able to successfully implement these further development strategies, our business operations and financial performance may be adversely affected.

| · | TOURISM AND MEDIA ARE COMPETITVE BUSINESS ENVIRONMENTS WHICH COULD ADVERSELY AFFECT OUR FINANCIAL PERFORMANCE. |

We operate in a competitive environment and have to compete with other tourist destinations and media outlets in order to attract visitors and customers. In order to be successful in attracting visitors or customers we may be forced to lower prices or spend more money on advertising to continue to compete with our competitors. These competitive measures may result in lower net income.

| · | ECONOMIC TURMOIL OR SUPPRESSION ON INDIVIDUAL RIGHTS MAY CAUSE A DOWNTURN IN CHINA’S TOURISM INDUSTRY. |

A downturn in the world economic markets, or just the Chinese economy, may have a negative impact on our business. Consumers with a lack of disposable incomes may decide not to vacation, or travel to the Great Golden Lake, which would negatively impact our business. Additionally, the perceived suppression of individual rights by the Chinese government may deter tourists from visiting the People’s Republic of China, which may cause a decline in visitors to our attraction.

| · | OUR RELIANCE ON ONE MAJOR ATTRACTION, THE GREAT GOLDEN LAKE, IS RISKY AND COULD HAVE A NEGATIVE IMPACT ON THE COMPANY’S GROWTH. |

The Great Golden Lake is our only major attraction. A major decline in visitors to the Great Golden Lake or a natural disaster such as an earthquake would have a material adverse affect on our business, and would negatively affect our financial condition and operating results.

| · | A FAILURE TO EXPAND OUR MEDIA OPERATIONS OR GOVERNMENT REGULATIONS RESTRICTING THE MEDIA INDUSTRY IN CHINA COULD HAVE A NEGATIVE IMPACT ON OUR OPERATIONS. |

If our advertising and media operations fail to grow this would have a negative impact on our future operating results. Further, government regulations, if enacted, restricting media content would negatively affect our media operations. Any restriction on media content would limit the potential amount of customers able to use our media services and negatively impact our financial results.

| · | WE DEPEND ON OUR KEY MANAGEMENT PERSONNEL AND THE LOSS OF THEIR SERVICES COULD ADVERSELY AFFECT OUR BUSINESS. |

We place substantial reliance upon the efforts and abilities of our executive officers, Chan Minhua, our Chairman and Chief Executive Officer and Fan Yanling, our Vice President of Operations. The loss of the services of any of our executive officers could have a material adverse effect on our business, operations, revenues or prospects. We do not maintain key man life insurance on the lives of these individuals.

| · | WE MAY NEVER PAY ANY DIVIDENDS TO SHAREHOLDERS. |

We have never paid any dividends and have not declared any dividends to date in 2008. Our board of directors does not intend to distribute dividends in the near future. The declaration, payment and amount of any future dividends will be made at the discretion of the board of directors, and will depend upon, among other things, the results of our operations, cash flows and financial condition, operating and capital requirements, and other factors as the board of directors considers relevant. There is no assurance that future dividends will be paid, and, if dividends are paid, there is no assurance with respect to the amount of any such dividend.

| · | MANAGEMENT EXERCISES SIGNIFICANT CONTROL OVER MATTERS REQUIRING SHAREHOLDER APPROVAL WHICH MAY RESULT IN THE DELAY OR PREVENTION OF A CHANGE IN OUR CONTROL. |

Mr. Chen Minhua, our Chairman and Chief Executive Officer, through his common stock ownership, currently has voting power equal to approximately 32.99% of our voting securities. Ms. Fan Yanling, our Vice President of Operations, through her common stock ownership, currently has voting power equal to approximately 32.99% of our voting securities. When combined with the common stock ownership of our other officers and directors, management has combined voting power in our Company equal to approximately 65.98% of our voting securities. As a result, management through such stock ownership exercises significant control over all matters requiring shareholder approval, including the election of directors and approval of significant corporate transactions. This concentration of ownership in management may also have the effect of delaying or preventing a change in control of us that may be otherwise viewed as beneficial by shareholders other than management.

| · | WE MAY INCUR SIGNIFICANT COSTS TO ENSURE COMPLIANCE WITH UNITED STATES CORPORATE GOVERNANCE AND ACCOUNTING REQUIREMENTS. |

We may incur significant costs associated with our public company reporting requirements, costs associated with newly applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002 and other rules implemented by the Securities and Exchange Commission. We expect all of these applicable rules and regulations to significantly increase our legal and financial compliance costs and to make some activities more time consuming and costly. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors or as executive officers. We are currently evaluating and monitoring developments with respect to these newly applicable rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs. Even though we have been a reporting company since 1999, this risk applies to us because we recently completed a share exchange with Keenway Limited whereby a Chinese operating company became our wholly owned subsidiary. This Chinese operating company is newly reporting and we are adjusting to the increased disclosure requirements for us to comply with corporate governance and accounting requirements.

| · | WE MAY NOT BE ABLE TO MEET THE ACCELERATED FILING AND INTERNAL CONTROL REPORTING REQUIREMENTS IMPOSED BY THE SECURITIES AND EXCHANGE COMMISSION RESULTING IN A POSSIBLE DECLINE IN THE PRICE OF OUR COMMON STOCK AND OUR INABILITY TO OBTAIN FUTURE FINANCING. |

As directed by Section 404 of the Sarbanes-Oxley Act, the Securities and Exchange Commission adopted rules requiring each public company to include a report of management on the company's internal controls over financial reporting in its annual reports. In addition, the independent registered public accounting firm auditing a company's financial statements must also attest to and report on management's assessment of the effectiveness of the company's internal controls over financial reporting as well as the operating effectiveness of the company's internal controls. While we will not be subject to these requirements for the fiscal year ended December 31, 2007, we will be subject to these requirements beginning January 1, 2008.

While we expect to expend significant resources in developing the necessary documentation and testing procedures required by Section 404 of the Sarbanes-Oxley Act, there is a risk that we may not be able to comply timely with all of the requirements imposed by this rule. In the event that we are unable to receive a positive attestation from our independent registered public accounting firm with respect to our internal controls, investors and others may lose confidence in the reliability of our financial statements and our stock price and ability to obtain equity or debt financing as needed could suffer.

In addition, in the event that our independent registered public accounting firm is unable to rely on our internal controls in connection with its audit of our financial statements, and in the further event that it is unable to devise alternative procedures in order to satisfy itself as to the material accuracy of our financial statements and related disclosures, it is possible that we would be unable to file our Annual Report on Form 10-K with the Securities and Exchange Commission, which could also adversely affect the market price of our common stock and our ability to secure additional financing as needed.

| · | WE MAY HAVE DIFFICULTY RAISING NECESSARY CAPITAL TO FUND OPERATIONS AS A RESULT OF MARKET PRICE VOLATILITY FOR OUR SHARES OF COMMON STOCK. |

In recent years, the securities markets in the United States have experienced a high level of price and volume volatility, and the market price of securities of many companies have experienced wide fluctuations that have not necessarily been related to the operations, performances, underlying asset values or prospects of such companies. For these reasons, our shares of common stock can also be expected to be subject to volatility resulting from purely market forces over which we will have no control. If our business development plans are successful, we may require additional financing to continue to develop and exploit existing and new products and services related to our industries and to expand into new markets. The exploitation of our services may, therefore, be dependent upon our ability to obtain financing through debt and equity or other means.

| · | WE HAVE A CONTRACTUAL RELATIONSHIP WITH FUJIAN JIAOGUANG MEDIA WHICH MAY BE IN NON-COMPLIANCE WITH PRC LAWS AND DOES NOT PROVIDE THE SAME OPERATIONAL CONTROL AS A DIRECT EQUITY INTEREST. |

Our contractual relationship with Fujian Jiaoguang Media was structured as a contractual relationship as opposed to a direct equity interest in order to comply with PRC law. We have received a PRC legal counsel attesting that this structure is in compliance with PRC law. However, PRC law may be subject to change or the government may review the structure and determine that this contractual relationship is not in compliance with PRC laws and force the termination of this relationship. Additionally, the contractual relationship between us and Fujian Jiaoguang Media does not provide us with the same operational control as a direct equity interest. Therefore, we are subject to the risks associated with contractual rights as opposed to owning the company. Such risks could include breach of contract or failure to honor the terms of the contract.

Risks Relating to the People's Republic of China

Our business operations take place in China. Because Chinese laws, regulations and policies are continually changing, our Chinese operations will face several risks summarized below.

| · | ANY CHANGE IN POLICY BY THE CHINESE GOVERNMENT COULD ADVERSELY AFFECT INVESTMENTS IN CHINESE BUSINESSES. |

Changes in policy could result in imposition of restrictions on currency conversion, imports or the source of suppliers, as well as new laws affecting joint ventures and foreign-owned enterprises doing business in China. Although China has been pursuing economic reforms for the past two decades, events such as a change in leadership or social disruptions that may occur upon the proposed privatization of certain state-owned industries, could significantly affect the government’s ability to continue with its reform.

| · | WE FACE ECONOMIC RISKS IN DOING BUSINESS IN CHINA. |

As a developing nation, China’s economy is more volatile than that of developed Western industrial economies. It differs significantly from that of the U.S. or a Western European country in such respects as structure, level of development, capital reinvestment, resource allocation and self-sufficiency. Only in recent years has the Chinese economy moved from what had been a command economy through the 1970s to one that during the 1990s encouraged substantial private economic activity. In 1993, the Constitution of China was amended to reinforce such economic reforms. The trends of the 1990s indicate that future policies of the Chinese government will emphasize greater utilization of market forces. For example, in 1999, the Government announced plans to amend the Chinese Constitution to recognize private property, although private business will officially remain subordinated to the state-owned companies, which are the mainstay of the Chinese economy. However, there can be no assurance that, under some circumstances, the government’s pursuit of economic reforms will not be restrained or curtailed. Actions by the central government of China could have a significant adverse effect on economic conditions in the country as a whole and on the economic prospects for our Chinese operations.

| · | THE CHINESE LEGAL AND JUDICIAL SYSTEM MAY NEGATIVELY IMPACT FOREIGN INVESTORS. |

In 1982, the National People’s Congress amended the Constitution of China to authorize foreign investment and guarantee the “lawful rights and interests” of foreign investors in China. However, China’s system of laws is not yet comprehensive. The legal and judicial systems in China are still rudimentary, and enforcement of existing laws is inconsistent.

Many judges in China lack the depth of legal training and experience that would be expected of a judge in a more developed country. Because the Chinese judiciary is relatively inexperienced in enforcing the laws that do exist, anticipation of judicial decision-making is more uncertain than would be expected in a more developed country. It may be impossible to obtain swift and equitable enforcement of laws that do exist, or to obtain enforcement of the judgment of one court by a court of another jurisdiction. China’s legal system is based on written statutes; a decision by one judge does not set a legal precedent that is required to be followed by judges in other cases. In addition, the interpretation of Chinese laws may be varied to reflect domestic political changes.

The promulgation of new laws, changes to existing laws and the pre-emption of local regulations by national laws may adversely affect foreign investors. However, the trend of legislation over the last 20 years has significantly enhanced the protection of foreign investment and allowed for more control by foreign parties of their investments in Chinese enterprises. There can be no assurance that a change in leadership, social or political disruption, or unforeseen circumstances affecting China’s political, economic or social life, will not affect the Chinese government’s ability to continue to support and pursue these reforms. Such a shift could have a material adverse effect on our business and prospects.

| · | CERTAIN POLITICAL AND ECONOMIC CONSIDERATIONS RELATING TO THE PRC COULD ADVERSELY AFFECT OUR COMPANY. |

The PRC is transitioning from a planned economy to a market economy. While the PRC government has pursued economic reforms since its adoption of the open-door policy in 1978, a large portion of the PRC economy is still operating under five-year plans and annual state plans. Through these plans and other economic measures, such as control on foreign exchange, taxation and restrictions on foreign participation in the domestic market of various industries, the PRC government exerts considerable direct and indirect influence on the economy. Many of the economic reforms carried out by the PRC government are unprecedented or experimental, and are expected to be refined and improved. Other political, economic and social factors can also lead to further readjustment of such reforms. This refining and readjustment process may not necessarily have a positive effect on our operations or future business development. Our operating results may be adversely affected by changes in the PRC's economic and social conditions as well as by changes in the policies of the PRC government, such as changes in laws and regulations (or the official interpretation thereof), measures which may be introduced to control inflation, changes in the interest rate or method of taxation, and the imposition of additional restrictions on currency conversion.

| · | THE RECENT NATURE AND UNCERTAIN APPLICATION OF MANY PRC LAWS APPLICABLE TO US CREATE AN UNCERTAIN ENVIRONMENT FOR BUSINESS OPERATIONS AND THEY COULD HAVE A NEGATIVE EFFECT ON US. |

The PRC legal system is a civil law system. Unlike the common law system, the civil law system is based on written statutes in which decided legal cases have little value as precedents. In 1979, the PRC began to promulgate a comprehensive system of laws and has since introduced many laws and regulations to provide general guidance on economic and business practices in the PRC and to regulate foreign investment. Progress has been made in the promulgation of laws and regulations dealing with economic matters such as corporate organization and governance, foreign investment, commerce, taxation and trade. The promulgation of new laws, changes of existing laws and the abrogation of local regulations by national laws could have a negative impact on our business and business prospects. In addition, as these laws, regulations and legal requirements are relatively recent, their interpretation and enforcement involve significant uncertainty.

| · | THE APPROVAL OF THE CHINESE SECURITIES REGULATORY COMMISSION (“CRSC”) MAY BE REQUIRED IN CONNECTION WITH THIS OFFERING UNDER A RECENTLY ADOPTED PRC REGULATION; SINCE THIS OFFERING DID NOT COMMENCE PRIOR TO THE EFFECTIVE DATE OF THE REGULATION, WE MAY BE REQUIRED TO OBTAIN CRSC APPROVAL FOR THIS OFFERING AND WE CAN NOT CURRENTLY PREDICT THE CONSEQUENCES OF ANY FAILURE TO OBTAIN SUCH APPROVAL. |

On August 8, 2006, six PRC regulatory agencies, including the Chinese Securities Regulatory Commission, or CSRC, promulgated a regulation that became effective on September 8, 2006. This regulation, among other things, purports to require offshore special purpose vehicles, or SPVs, formed for listing purposes through acquisitions of PRC domestic companies and controlled by PRC individuals to obtain the approval of the CSRC prior to publicly listing their securities on an overseas stock exchange. While the application of this new regulation is not yet clear, we believe, based on the advice of our PRC counsel, that CSRC approval is not required in this transaction because the Company does not control the Chinese operating entities. The PRC counsel is Steve Zhu of Allbright Law Offices in Shanghai. His consent to be named in this registration statement is filed as Exhibit 5.2. We strictly have contractual arrangements with the Chinese companies. Although the CSRC is expected to promulgate formal implementing rules and/or regulations and possibly other clarifications, the procedures, criteria and timing for obtaining any required CSRC approval have not been established and it is unclear when these will be established. Since this offering did not commence prior to the effective date of the regulation and our shares of common stock did not commence trading prior to the effective date of the regulation, if the CSRC determines that the Company exercises control over the Chinese operating entities, we may be required to obtain CSRC approval for this offering and we cannot currently predict the criteria, timing or procedures for obtaining the CSRC approval or the consequences of any failure to obtain such approval.

| · | RECENT PRC REGULATIONS RELATING TO THE ESTABLISHMENT OF OFFSHORE SPECIAL PURPOSE COMPANIES BY PRC RESIDENTS MAY SUBJECT OUR PRC RESIDENT SHAREHOLDERS TO PERSONAL LIABILITY AND LIMIT OUR ABILITY TO INJECT CAPITAL INTO OUR PRC SUBSIDIARIES, LIMIT OUR PRC SUBSIDIARIES’ ABILITY TO DISTRIBUTE PROFITS TO US, OR OTHERWISE ADVERSELY AFFECT US. |

SAFE issued a public notice in October 2005, or the SAFE notice, requiring PRC residents to register with the local SAFE branch before establishing or controlling any company outside of China for the purpose of capital financing with assets or equities of PRC companies, referred to in the notice as an “offshore special purpose company.” PRC residents that are shareholders of offshore special purpose companies established before November 1, 2005 were required to register with the local SAFE branch before March 31, 2006.The failure of our beneficial owners to timely amend their SAFE registrations pursuant to the SAFE notice or the failure of future beneficial owners of our company who are PRC residents to comply with the registration procedures set forth in the SAFE notice may subject such beneficial owners to fines and legal sanctions and may also limit our ability to contribute additional capital into our PRC subsidiaries, limit our PRC subsidiaries’ ability to distribute dividends to our company or otherwise adversely affect our business.

Other Risks

| · | CURRENCY CONVERSION AND EXCHANGE RATE VOLATILITY COULD ADVERSELY AFFECT OUR FINANCIAL CONDITION. |

The PRC government imposes control over the conversion of Renminbi (“RMB”) into foreign currencies. Under the current unified floating exchange rate system, the People's Bank of China publishes an exchange rate, which we refer to as the PBOC exchange rate, based on the previous day's dealings in the inter-bank foreign exchange market. Financial institutions authorized to deal in foreign currency may enter into foreign exchange transactions at exchange rates within an authorized range above or below the PBOC exchange rate according to market conditions.

State Council amended the Foreign Exchange Control Regulations on August 1, 2008. The new rule tightening restrictions on foreign exchange inflow and relaxing the treatment of foreign exchange outflow, even though the fundamental framework of the foreign exchange administration remains unchanged. Enterprises in the PRC (including FIEs) which require foreign exchange for transactions relating to current account items, may, without approval of the State Administration of Foreign Exchange, or SAFE, effect payment from their foreign exchange account or convert and pay at the designated foreign exchange banks by providing valid receipts and proofs.

Convertibility of foreign exchange in respect of capital account items, such as direct investment and capital contribution, is still subject to certain restrictions, and prior approval from the SAFE or its relevant branches must be sought.

Since 1994, the exchange rate for Renminbi against the United States dollar has remained relatively stable, most of the time in the region of approximately RMB8.28 to $1.00. However, in 2005, the Chinese government announced that it would begin pegging the exchange rate of the Chinese Renminbi against a number of currencies, rather than just the U.S. dollar. As a result, the exchange rate for the Renminbi against the U.S. dollar became RMB8.02 to $1.00. As our operations are in PRC, any significant revaluation or devaluation of the Chinese Renminbi may materially and adversely affect our cash flows, revenues and financial condition. We may not be able to hedge effectively against it in any such case. For example, to the extent that we need to convert United States dollars into Chinese Renminbi for our operations, appreciation of this currency against the United States dollar could have a material adverse effect on our business, financial condition and results of operations. Conversely, if we decide to convert Chinese Renminbi into United States dollars for other business purposes and the United States dollar appreciates against this currency, the United States dollar equivalent of the Chinese Renminbi we convert would be reduced. There can be no assurance that future movements in the exchange rate of Renminbi and other currencies will not have an adverse effect on our financial condition. Our operating companies are FIEs to which the Foreign Exchange Control Regulations are applicable. There can be no assurance that we will be able to obtain sufficient foreign exchange to pay dividends or satisfy other foreign exchange requirements in the future.

| · | IT MAY BE DIFFICULT TO AFFECT SERVICE OF PROCESS AND ENFORCEMENT OF LEGAL JUDGMENTS UPON OUR COMPANY AND OUR OFFICERS AND DIRECTORS BECAUSE THEY RESIDE OUTSIDE THE UNITED STATES. |

As our operations are presently based in PRC and a majority of our directors and all of our officers reside in PRC, service of process on our company and such directors and officers may be difficult to effect within the United States. Also, our main assets are located in PRC and any judgment obtained in the United States against us may not be enforceable outside the United States.

| · | WE MAY EXPERIENCE CURRENCY FLUCTUATION AND LONGER EXCHANGE RATE PAYMENT CYCLES WHICH WILL NEGATIVELY AFFECT THE COSTS OF OUR PRODUCTS SOLD AND THE VALUE OF OUR LOCAL CURRENCY PROFITS. |

The local currencies in the countries in which we sell our products may fluctuate in value in relation to other currencies. Such fluctuations may affect the costs of our products sold and the value of our local currency profits. While we are not conducting any meaningful operations in countries other than PRC at the present time, we may expand to other countries and may then have an increased risk of exposure of our business to currency fluctuation.

| · | SINCE MOST OF OUR ASSETS ARE LOCATED IN PRC, ANY DIVIDENDS OF PROCEEDS FROM LIQUIDATION IS SUBJECT TO THE APPROVAL OF THE RELEVANT CHINESE GOVERNMENT AGENCIES. |

Our assets are predominantly located inside PRC. Under the laws governing foreign invested enterprises in PRC, dividend distribution and liquidation are allowed but subject to special procedures under the relevant laws and rules. Any dividend payment will be subject to the decision of the board of directors and subject to foreign exchange rules governing such repatriation. Any liquidation is subject to the relevant government agency's approval and supervision as well as the foreign exchange control. This may generate additional risk for our investors in case of dividend payment and liquidation.

| · | OUR SHARES OF COMMON STOCK ARE VERY THINLY TRADED, AND THE PRICE MAY NOT REFLECT OUR VALUE AND THERE CAN BE NO ASSURANCE THAT THERE WILL BE AN ACTIVE MARKET FOR OUR SHARES OF COMMON STOCK EITHER NOW OR IN THE FUTURE. |

Our shares of common stock are very thinly traded, and the price if traded may not reflect our value. There can be no assurance that there will be an active market for our shares of common stock either now or in the future. The market liquidity will be dependent on the perception of our operating business and any steps that our management might take to bring us to the awareness of investors. There can be no assurance given that there will be any awareness generated. Consequently, investors may not be able to liquidate their investment or liquidate it at a price that reflects the value of the business. If a more active market should develop, the price may be highly volatile. Because there may be a low price for our shares of common stock, many brokerage firms may not be willing to effect transactions in the securities. Even if an investor finds a broker willing to effect a transaction in the shares of our common stock, the combination of brokerage commissions, transfer fees, taxes, if any, and any other selling costs may exceed the selling price. Further, many lending institutions will not permit the use of such shares of common stock as collateral for any loans.

| · | WE ARE SUBJECT TO THE PENNY STOCK RULES WHICH WILL MAKE THE SHARES OF OUR COMMON STOCK MORE DIFFICULT TO SELL. |

We are subject now and in the future to the SEC’s “penny stock” rules if our shares of common stock sell below $5.00 per share. Penny stocks generally are equity securities with a price of less than $5.00. The penny stock rules require broker-dealers to deliver a standardized risk disclosure document prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer must also provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson, and monthly account statements showing the market value of each penny stock held in the customer's account. The bid and offer quotations, and the broker-dealer and salesperson compensation information must be given to the customer orally or in writing prior to completing the transaction and must be given to the customer in writing before or with the customer's confirmation.

In addition, the penny stock rules require that prior to a transaction the broker dealer make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. The penny stock rules are burdensome and may reduce purchases of any offerings and reduce the trading activity for shares of our common stock. As long as our shares of common stock are subject to the penny stock rules, the holders of such shares of common stock may find it more difficult to sell their securities.

| · | SALES OF OUR CURRENTLY ISSUED AND OUTSTANDING STOCK MAY BECOME FREELY TRADEABLE PURSUANT TO RULE 144 AND MAY DILUTE THE MARKET FOR YOUR SHARES AND HAVE A DEPRESSIVE EFFECT ON THE PRICE OF THE SHARES OF OUR COMMON STOCK. |

A substantial majority of our outstanding shares of common stock are "restricted securities" within the meaning of Rule 144 under the Securities Act. As restricted shares, these shares may be resold only pursuant to an effective registration statement or under the requirements of Rule 144 or other applicable exemptions from registration under the Act and as required under applicable state securities laws. Rule 144 provides in essence that a non-affiliate of a reporting company may sell its securities after holding such securities for six (6) months provided that the company is current in its periodic filings. After one-year, non-afffiliates of reporting companies can sell their securities whether or not the reporting company is current in its periodic filings. Affiliates of reporting companies who held restricted securities for a period of at least six months may, under certain conditions, sell every three months, in brokerage transactions, a number of shares that does not exceed the greater of 1% of a company's outstanding shares of common stock or the average weekly trading volume during the four calendar weeks prior to the sale (the four calendar week rule does not apply to companies quoted on the OTC Bulletin Board). A sale under Rule 144 or under any other exemption from the Act, if available, or pursuant to subsequent registrations of our shares of common stock, may have a depressive effect upon the price of our shares of common stock in any active market that may develop.

| · | OUR SHAREHOLDERS WILL EXPERIENCE DILUTION AS A RESULT OF THE CONVERSION OF OUR CLASS A WARRANTS. |

As of June 10, 2009, we had warrants to purchase 3,333,336 shares of common stock (these warrants are convertible into common stock at a conversion price of $1.25 per share). To the extent such warrants are exercised and converted, there will be further dilution. In addition, in the event that any future financing should be in the form of securities convertible into, or exchangeable for, equity securities, investors may experience additional dilution upon the conversion or exchange of such securities.

We will not receive any portion of the proceeds from the sale or other disposition of the shares of common stock covered hereby, or interests therein, by the selling stockholders. We may receive proceeds of up to $4,166,670 if all the warrants held by the selling stockholders are exercised for cash. Management currently anticipates that any such proceeds will be utilized for working capital and other general corporate purposes. We cannot estimate how many, if any, warrants may be exercised as a result of this offering or that they will be exercised for cash.

We are obligated to bear the expenses of the registration of the shares. We anticipate that these expenses will be approximately $1,500.

We are not selling any of the common stock that we are registering. The common stock will be sold by the selling stockholders listed in this prospectus. The selling stockholders may sell the common stock at the market price as of the date of sale or a price negotiated in a private sale. Our common stock is currently quoted on the OTC Bulletin Board under the symbol “CYID.”

The information in this section is not required because there is not substantial disparity between the public offering price and the effective cash cost to officers, directors, promoters and affiliated persons of common equity acquired by them in transactions during the past five years and we were subject to the reporting requirements of section 13(a) and 15(d) of the Exchange Act immediately prior to filing the registration statement.

The table below lists the selling stockholders and other information regarding the beneficial ownership of the shares of common stock by each of the selling stockholders. The second column lists the number of shares of common stock beneficially owned by each selling stockholder, based on its ownership of the common shares and warrants, as of August 1, 2008.

The third column lists the shares of common stock being offered by this prospectus by the selling stockholders.

In accordance with the terms of a registration rights agreement with the selling stockholders, this prospectus generally covers the resale of 7,000,000 shares of common stock purchased by the Investors as set forth in the Securities Purchase Agreement dated March 7, 2008. The shares constitute approximately 52.5% of the shares of common stock sold in the financing and does not include any of the warrants that were sold to the Investors. The shares being sold have been allocated pro rata to each Investor.

| Name(1) | Shares Beneficially Owned Prior To Offering(1) | Shares to be Offered | Amount Beneficially Owned After Offering(2) | Percent Beneficially Owned After Offering (3) |

Pope Investments II LLC 5100 Poplar Avenue, Suite 805 Memphis, Tennessee 38137 (4) | 14,285,715 (10) | 5,000,000 | 9,285,715 | 12.42% |

| | | | | |

Professional Offshore Opportunity Fund, Ltd. 1400 Old Country Road, Suite 206 Westbury, New York 11590 (5) | 2,857,143 (11) | 1,000,000 | 1,857,143 | 2.4% |

| | | | | |

Jayhawk Private Equity Fund, LP 5410 West 61st Place, Suite 100 Mission, Kansas 6605 (6) | 1,343,954 (12) | 470,384 | 873,570 | 1.16% |

| | | | | |

Jayhawk Private Equity Co-Invest Fund, LP 5410 West 61st Place, Suite 100 Mission, Kansas 66205 (7) | 84,618 (13) | 29,616 | 55,002 | * |

| | | | | |

Guerrilla Partners L.P. 237 Park Avenue, 9th Floor New York, New York 10017 (8) | 428,571 (14) | 150,000 | 278,571 | * |

| | | | | |

Hua-Mei 21st Century Partners L.P. 237 Park Avenue, 9th Floor New York, New York 10017 (9) | 1,000,000 (15) | 350,000 | 650,000 | * |

| * | Less than one percent (1%). |

| ** | None of the selling shareholders are broker-dealers or affiliates of broker-dealers. |

1. Unless otherwise indicated in the footnotes to this table, the persons and entities named in the table have sole voting and sole investment power with respect to all shares beneficially owned, subject to community property laws where applicable.

2. Assumes the sale of all shares covered hereby.