UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_____________________

FORM 10-Q

_____________________

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2010

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______to______.

China Yida Holding, Co.

(Exact name of registrant as specified in the Charter)

| DELAWARE | | 000-26777 | | 50-0027826 |

(State or other jurisdiction of incorporation or organization) | | (Commission File No.) | | (IRS Employee Identification No.) |

28/F Yifa Building

No. 111 Wusi Road

Fuzhou, Fujian, P. R. China

(Address of Principal Executive Offices) (Zip Code)

(86)591-28308388

(Registrants Telephone number including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the issuer was required to file such reports), and (2)has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes o No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company filer. See definition of “accelerated filer” and “large accelerated filer” in Rule 12b-2 of the Exchange Act (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ | Smaller reporting company | x |

| (Do not check if a smaller reporting company) | | | |

Indicate by check mark whether the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Yes o No x

State the number of shares outstanding of each of the issuer’s classes of common equity, as of May 13, 2010: 19,551,785 shares of common stock.

CHINA YIDA HOLDING, CO.

FORM 10-Q

March 31, 2010

TABLE OF CONTENTS

| PART I— FINANCIAL INFORMATION | |

| | | |

| Item 1. | Financial Statements | 1 |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 19 |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | 29 |

| Item 4T. | Controls and Procedures | 30 |

| | | |

| PART II— OTHER INFORMATION | |

| | | |

| Item 1. | Legal Proceedings | 31 |

| Item 1A. | Risk Factors | 31 |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 31 |

| Item 3. | Defaults Upon Senior Securities | 31 |

| Item 4. | Submission of Matters to a Vote of Security Holders | 31 |

| Item 5. | Other Information | 31 |

| Item 6. | Exhibits | 31 |

| | | |

| SIGNATURES | 32 |

PART 1 - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

| CHINA YIDA HOLDING CO. AND SUBSIDIARIES | |

| CONSOLIDATED BALANCE SHEETS | |

| AS OF MARCH 31,2010 AND DECEMBER 31, 2009 | |

| (UNAUDITED) | |

| | | | | | | |

| ASSETS | |

| | | March 31, | | | December 31, | |

| | | 2010 | | | 2009 | |

| | | | | | | |

| Current assets | | | | | | |

| Cash and cash equivalents | | $ | 31,064,720 | | | $ | 5,776,678 | |

| Accounts receivable | | | 7,401 | | | | 2,003 | |

| Other receivable | | | 201,463 | | | | 190,424 | |

| Advances and prepayments | | | 1,509,319 | | | | 1,432,138 | |

| Total current assets | | | 32,782,902 | | | | 7,401,242 | |

| | | | | | | | | |

| Property, and equipment, net | | | 32,590,213 | | | | 32,995,885 | |

| Construction in progress | | | 45,623,520 | | | | 36,730,184 | |

| Intangible assets, net | | | 7,480,711 | | | | 7,874,938 | |

| Long term prepayments | | | 1,009,347 | | | | 1,012,230 | |

| Total assets | | $ | 119,486,694 | | | $ | 86,014,478 | |

| | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | |

| Current liabilities | | | | | | | | |

| Accounts payable | | $ | 49,802 | | | $ | 57,277 | |

| Short term loans | | | 1,726,130 | | | | 1,731,060 | |

| Other payable | | | 1,089,139 | | | | 1,145,564 | |

| Tax payables | | | 2,825,837 | | | | 2,835,655 | |

| Total current liabilities | | | 5,690,908 | | | | 5,769,555 | |

| | | | | | | | | |

| Long term debts | | | 2,483,817 | | | | 2,495,190 | |

| | | | | | | | | |

| Total liabilities | | | 8,174,725 | | | | 8,264,745 | |

| | | | | | | | | |

| Commitments and contingencies | | | | | | | | |

| | | | | | | | | |

| Stockholders' equity | | | | | | | | |

| Common stock ($0.0001 par value, 100,000,000 shares authorized, 19,551,785 and 17,062,064 issued and outstanding as of March 31, 2010 and December 31, 2009, respectively) | | | 1,955 | | | | 1,706 | |

| Additional paid in capital | | | 48,436,088 | | | | 21,711,384 | |

| Accumulated other comprehensive income | | | 2,893,396 | | | | 3,190,162 | |

| Retained earning | | | 56,680,841 | | | | 50,297,151 | |

| Statutory reserve | | | 3,299,689 | | | | 2,549,330 | |

| Total stockholders' equity | | | 111,311,970 | | | | 77,749,733 | |

| | | | | | | | | |

| Total liabilities and stockholders' equity | | $ | 119,486,694 | | | $ | 86,014,478 | |

| | | | | | | | | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

| CHINA YIDA HOLDING CO. AND SUBSIDIARIES | |

| CONSOLIDATED STATEMENTS OF INCOME AND OTHER COMPREHENSIVE INCOME | |

| FOR THE THREE MONTHS ENDED MARCH 31, 2010 AND 2009 | |

| (UNAUDITED) | |

| | | | | | | |

| | |

| | | 2010 | | | 2009 | |

| Net revenue | | | | | | |

| Advertisement | | $ | 8,767,284 | | | $ | 6,592,187 | |

| Tourism | | | 6,035,514 | | | | 3,230,718 | |

| Total net revenue | | | 14,802,799 | | | | 9,822,906 | |

| | | | | | | | | |

| Cost of revenue | | | | | | | | |

| Advertisement | | | 1,826,018 | | | | 1,372,523 | |

| Tourism | | | 1,096,832 | | | | 128,226 | |

| Total cost of revenue | | | 2,922,850 | | | | 1,500,750 | |

| | | | | | | | | |

| Gross profit | | | 11,879,949 | | | | 8,322,156 | |

| | | | | | | | | |

| Operating expenses | | | | | | | | |

| Selling expenses | | | 978,584 | | | | 430,647 | |

| Operating and administrative expenses | | | 1,283,944 | | | | 1,202,198 | |

| Total operating expenses | | | 2,262,528 | | | | 1,632,845 | |

| | | | | | | | | |

| Income from operations | | | 9,617,421 | | | | 6,689,311 | |

| | | | | | | | | |

| Other (income) expense | | | | | | | | |

| Other (income) expense, net | | | (8,853 | ) | | | 1,269 | |

| Interest income | | | (8,971 | ) | | | (13,634 | ) |

| Total other (income) expense, net | | | (17,824 | ) | | | (12,364 | ) |

| | | | | | | | | |

| Income before income taxes | | | 9,635,245 | | | | 6,701,675 | |

| | | | | | | | | |

| Provision for income taxes | | | 2,501,196 | | | | 1,730,801 | |

| | | | | | | | | |

| Net income | | | 7,134,049 | | | | 4,970,874 | |

| | | | | | | | | |

| Other comprehensive income | | | | | | | | |

| Foreign currency translation gain | | | (296,766 | ) | | | (13,028 | ) |

| | | | | | | | | |

| Other comprehensive income | | $ | 6,837,283 | | | $ | 4,957,846 | |

| | | | | | | | | |

| Basic net earnings per share | | $ | 0.38 | | | $ | 0.07 | |

| Basic weighted average shares outstanding | | | 18,918,681 | | | | 68,084,487 | |

| | | | | | | | | |

| Diluted net earnings per share | | $ | 0.37 | | | $ | 0.07 | |

| Diluted weighted average shares outstanding | | | 19,384,447 | | | | 68,084,487 | |

| | | | | | | | | |

| | | | | | | | | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

| CHINA YIDA HOLDING CO. AND SUBSIDIARIES | |

| CONSOLIDATED STATEMENTS OF CASH FLOWS | |

| FOR THE THREE MONTHS ENDED MARCH 31, 2010 AND 2009 | |

| (UNAUDITED) | |

| | | | | | | |

| | | 2010 | | | 2009 | |

| | | | | | | |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | |

| Net Income | | $ | 7,134,049 | | | $ | 4,970,874 | |

| Adjustments to reconcile net income to net cash | | | | | | | | |

| Cash provided by operating activities: | | | | | | | | |

| Depreciation | | | 367,494 | | | | 354,336 | |

| Amortization | | | 371,804 | | | | 372,242 | |

| Stock based compenstation | | | 41,997 | | | | - | |

| Changes in operating assets and liabilities: | | | | | | | | |

| Accounts receivables | | | (25,349 | ) | | | 50,501 | |

| Other receivables | | | (144,364 | ) | | | (629,516 | ) |

| Advances and prepayments | | | (79,926 | ) | | | (53,686 | ) |

| Accounts payable and accrued expenses | | | (7,314 | ) | | | (1,538 | ) |

| Tax payable | | | (1,743 | ) | | | 1,236,890 | |

| Customer deposit | | | (344 | ) | | | 22,884 | |

| Accrued payroll | | | (1,379 | ) | | | (11,746 | ) |

| Other payable | | | 98,560 | | | | 392,545 | |

| | | | | | | | | |

| Net cash provided by operating activities | | | 7,753,486 | | | | 6,703,785 | |

| | | | | | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | | | | | | |

| Additions to property & equipment | | | (55,783 | ) | | | (64,548 | ) |

| Addition to construction in progress | | | (8,998,027 | ) | | | (7,662,370 | ) |

| | | | | | | | | |

| Net cash used in investing activities | | | (9,053,809 | ) | | | (7,726,918 | ) |

| | | | | | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | | | | | |

| Issuance of shares for cash | | | 26,682,956 | | | | - | |

| Borrowings | | | - | | | | 2,167,545 | |

| | | | | | | | | |

| Net cash provided by financing activities | | | 26,682,956 | | | | 2,167,545 | |

| | | | | | | | | |

| EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS | | | (94,589 | ) | | | 107,624 | |

| | | | | | | | | |

| NET INCREASE IN CASH AND CASH EQUIVALENTS | | | 25,382,632 | | | | 1,252,036 | |

| | | | | | | | | |

| CASH AND CASH EQUIVALENTS, BEGINNING BALANCE | | | 5,776,678 | | | | 8,715,048 | |

| | | | | | | | | |

| CASH AND CASH EQUIVALENTS, ENDING BALANCE | | $ | 31,064,720 | | | $ | 9,967,084 | |

| | | | | | | | | |

| SUPPLEMENTAL DISCLOSURES: | | | | | | | | |

| | | | | | | | | |

| Cash paid during the quarter for: | | | | | | | | |

| Income tax payments | | $ | 2,525,972 | | | $ | 511,212 | |

| Interest payments | | $ | 70,403 | | | $ | 20,243 | |

| | | | | | | | | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

CHINA YIDA HOLDING CO. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. ORGANIZATION AND DESCRIPTION OF BUSINESS

China Yida Holding, Co. (“the Company”, “we”, “us”, “our”) engages in tourism and advertisement business through its subsidiaries in People's Republic of China.

Keenway Limited was incorporated under the laws of the Cayman Islands on May 9, 2007 for the purpose of functioning as an off-shore holding company to obtain ownership interests in Hong Kong Yi Tat International Investment Co., Ltd (“Hong Kong Yi Tat”), a company incorporated under the laws of Hong Kong. Immediately prior to the Merger (defined below), Mr. Chen Minhua and his wife, Ms. Fan Yanling, were the majority shareholders of Keenway Limited.

On November 19, 2007, we entered into a share exchange and stock purchase agreement with Keenway Limited, Hong Kong Yi Tai, and the then shareholders of Keenway Limited, including Chen Minhua, Fan Yanling, Zhang Xinchen, Extra Profit International Limited, and Lucky Glory International Limited (collectively, the “Keenway Limited Shareholders”), pursuant to which in exchange for all of their shares of Keenway Limited common stock, the Keenway Limited Shareholders received 2,272,582 newly issued shares of our common stock and 91,045 shares of our common stock which was transferred from some of our then existing shareholders (the “Merger”). As a result of the closing of the Merger, the Keenway Limited Shareholders owned approximately 94.5% of our then issued and outstanding shares on a fully diluted basis and Keenway Limited became our wholly owned subsidiary.

Hong Kong Yi Tat is an entity that was created solely as the holding company for the operating entities, Fujian Jintai Tourism Industrial Development, Co, Ltd., and Fujian Jiaoguang Media, Co., Ltd., and Fujian Yunding Tourism Industrial Co., Ltd., and Fujian Yida Tulou Tourism Development Cp. Ltd. Hong Kong Yi Tat does not have any operations.

Fujian Jintai Tourism Developments Co., Ltd. (“Fujian Jintai”) operates the tourism segment of our business. Its primary business relates to the operation of our tourism destinations, specifically, the Great Golden Lake.

Fujian Jintai Tourism Developments Co., Ltd. (“Fujian Jintai”) operates the tourism segment of our business. Its primary business relates to the operation of our tourism destinations, specifically, the Great Golden Lake. Fujian Jintai owns 100% of the ownership interest in Fuzhou Hongda Commercial Services Co., Ltd. (“Hongda”). Hongda does not have any operations.

On March 15, 2010, Fuzhou Hongda Commercial Services, Ltd (“Fuzhou Hongda”) entered into an equity transfer agreement with Fujian Yunding Tourism Industrial Co., Ltd (“Fujian Yunding”), pursuant to which Fuzhou Yunding acquired 100% of the issued and outstanding shares of Fuzhou Fuyu Advertising Co., Ltd (“Fuzhou Fuyu”) from Fuzhou Hongda at the aggregate purchase price of RMB 3,000,000. On March 15, Fujian Jintai Tourism Developments Co., Ltd (“Fujian Jintai”) entered into an equity transfer agreement with Fujian Yunding, pursuant to which Fujian Yunding acquired 100% of the issued and outstanding common stock of Fuzhou Yintai Tourism Co., Ltd (“Fuzhou Yintai”) from Fujian Jintai at the aggregate purchase price of RMB 5,000,000. On March 16, 2010, Fujian Yunding formed a wholly-owned subsidiary, Yongtai Yunding Resort Management Co., Ltd. (“Yuding Resort Management”) with its official address at No. 68 Xianfu Road, Zhangcheng Town, Yongtai County, China. Since the ownership of Fuzhou Hongda, Fujian Yunding, Fuzhou Fuyu, Fujian Jintai and Fuzhou Yintai were the same and they were under the control of Hong Kong Yi Tat, so the equities transfer was accounted for as a transaction between entities under common control, whereby the Company recognized the equities transferred at their carrying amounts.

On March 16, 2010, Fujian Yunding formed a wholly-owned subsidiary, Yongtai Yunding Resort Management Co., Ltd. (“Yuding Resort Management”) with its official address at No. 68 Xianfu Road, Zhangcheng Town, Yongtai County, China.

On April 12, 2010, we changed the company name of our operating subsidiary “Fujian Yunding Tourism Industrial Co., Ltd” to “Yida (Fujian) Tourism Group Limited”.

Yida (Fujian) Tourism Group Limited (f/k/a Fujian Yunding Tourism Industrial Co., Ltd, “Yida Tourism”) is engaged in the operations of our current tourism destinations, specifically the Yunding tourist destination, and the development of new tourist projects, specifically the China Yang-sheng (Nourishing Life) Paradise and the Ming Dynasty Entertainment World. Yida Tourism has 3 wholly-owned subsidiaries: Fujian Yintai, Fuzhou Fuyu and Yongtai Yunding Resort Management. Yida (Fujian) Tourism currently owns 100% of Yongtai Yunding Resort Management Co., Ltd, Fuzhou Fuyu Advertising Co., Ltd.and Fujian Yintai Tourism Co., Ltd.

Fujian Yida Tulou Tourism Development Cp. Ltd’s primary business relates to the operation of our tourism destinations, specifically, Hua’An Tulou cluster tourist destination.

Fujian Jiaoguang Media Co., Ltd. (“Fujian Jiaoguang”) concentrates on the mass media segment of our business. Its primary business is focused on advertisements, including media publishing, television, cultural and artistic communication activities, and performance operation and management activities.

The Company has adopted FASB Interpretation No. 46R "Consolidation of Variable Interest Entities" ("FIN 46R") (ASC 810), an Interpretation of Accounting Research Bulletin No. 51. FIN 46R (ASC 810) requires a Variable Interest Entity (VIE) to be consolidated by a company if that company is subject to a majority of the risk of loss for the VIE or is entitled to receive a majority of the VIE's residual returns. VIEs are those entities in which the Company, through contractual arrangements, bears the risks of, and enjoys the rewards normally associated with ownership of the entities, and therefore the company is the primary beneficiary of these entities. The results of subsidiaries or variable interest entities acquired during the year are included in the consolidated income statements from the effective date of acquisition.

ACCOUNTING AFTER INITIAL MEASUREMENT OF VIE - Subsequent accounting for the assets, liabilities, and non-controlling interest of a consolidated variable interest entity are accounted for as if the entity were consolidated based on voting interests and the usual accounting rules for which the VIE operates are applied as they would to a consolidated subsidiary as follows:

carrying ● amounts of the VIE are consolidated into the financial statements of the Company as the primary beneficiary (referred as "Primary Beneficiary" or "PB");

inter-company ● transactions and balances, such as revenues and costs, receivables and payables between or among the Primary Beneficiary and the VIE(s) are eliminated in their entirety; and

INITIAL MEASUREMENT OF VIE- The Company initially measures the assets, liabilities, and non-controlling interests of the VIEs at their fair values at the date of the acquisitions.

Because Jiaoguang and the Company’s contractual relationship comply with FIN 46R (ASC 810), the Company consolidated Jiaoguang’s financial statements as VIE.

2. BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

a. Basis of presentation

The accompanying consolidated financial statements are unaudited and have been prepared in accordance with accounting principles generally accepted in the United States of America for interim financial information, pursuant to the rules and regulations of the Securities and Exchange Commission. The results of operations for the three month periods ended March 31, 2010 and 2009 are not necessarily indicative of the results to be expected for the full year. In the opinion of management, the consolidated financial statements include all adjustments, consisting of normal recurring accruals, necessary to present fairly the Company's financial position, results of operations and cash flows. These statements should be read in conjunction with the financial statements and related notes which are part of the Company's Annual Report on Form 10-K for the year ended December 31, 2009.

The functional currency of our operating , Changchun Yongxin Dirui Medical Co., Ltd is Chinese Renminbi; however the accompanying financial statements have been translated and presented in United States Dollars ($).

b. Principle of consolidation

The accompanying consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries Jintai, Fuyu, Hongda, Yunding, Tulou, Yintai, Hong Kong Yi Tat and the accounts of the variable interest entities, Jiaoguang, collectively “the Company”. All significant inter-company accounts and transactions have been eliminated in consolidation.

c. Use of estimates

The preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the amount of revenues and expenses during the reporting periods. Management makes these estimates using the best information available at the time the estimates are made. However, actual results could differ materially from those results.

d. Cash and cash equivalents

For Statement of Cash Flows purposes, the Company considers all cash on hand and in banks, including accounts in book overdraft positions, certificates of deposit and other highly-liquid investments with maturities of three months or less, when purchased, to be cash and cash equivalents.

e. Accounts receivable

The Company's policy is to maintain reserves for potential credit losses on accounts receivable. Management reviews the composition of accounts receivable and analyzes historical bad debts, customer concentrations, customer credit worthiness, current economic trends and changes in customer payment patterns to evaluate the adequacy of these reserves. As of March 31, 2010 and December 31, 2009, the Company had accounts receivable of $7,401 and $2,003, net of allowance for doubtful accounts amounted to $19,945 and $0, respectively.

f. Advances and Prepayments

The Company advances to certain vendors for purchase of its construction material and necessary service. As of March 31, 2010 and December 31, 2009, the prepayments amounted to $1,509,319 and $1,432,138, respectively. Long term prepayments amounted to $1,009,347 and $1,012,230, respectively.

g. Property and equipment

Property and equipment are recorded at cost. Gains or losses on disposals are reflected as gain or loss in the year of disposal. The cost of improvement that extends the life of property, and equipment are capitalized. These capitalized costs may include structural improvements, equipment, and fixtures. All ordinary repair and maintenance costs are expensed as incurred.

Depreciation for financial reporting purposes is provided using the straight-line method over the estimated useful lives of the assets: 5 to 20 years for house & building; 5 to 8 years for electronic equipment; 8 years for transportation equipment; 5 to 8 years for office furniture; 26 years for lease improvements.

h. Impairment

The Company applies the provisions of Statement of Financial Accounting Standard No. 144, "Accounting for the Impairment or Disposal of Long-Lived Assets" ("FAS No. 144"), (ASC 360) issued by the Financial Accounting Standards Board ("FASB"). FAS No. 144 (ASC 360) requires that long-lived assets be reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable through the estimated undiscounted cash flows expected to result from the use and eventual disposition of the assets. Whenever any such impairment exists, an impairment loss will be recognized for the amount by which the carrying value exceeds the fair value.

The Company tests long-lived assets, including property, plant and equipment, intangible assets and construction in progress, for recoverability at least annually or more frequently upon the occurrence of an event or when circumstances indicate that the net carrying amount is greater than its fair value. Assets are grouped and evaluated at the lowest level for their identifiable cash flows that are largely independent of the cash flows of other groups of assets. The Company considers historical performance and future estimated results in its evaluation of potential impairment and then compares the carrying amount of the asset to the future estimated cash flows expected to result from the use of the asset. If the carrying amount of the asset exceeds estimated expected undiscounted future cash flows, the Company measures the amount of impairment by comparing the carrying amount of the asset to its fair value. The estimation of fair value is generally measured by discounting expected future cash flows as the rate the Company utilizes to evaluate potential investments. The Company estimates fair value based on the information available, judgments and projections are considered necessary. There was no impairment of long-lived assets as of March 31, 2010 and December 31, 2009.

i. Revenue recognition

The Company's revenue recognition policies are in compliance with Staff Accounting Bulletin (SAB) 104. Sales revenue is recognized at the date of service rendered to customers when a formal arrangement exists, the price is fixed or determinable, the services rendered, no other significant obligations of the Company exist and collectability is reasonably assured. Payments received before all of the relevant criteria for revenue recognition are satisfied are recorded as unearned revenue.

Revenues from advance resort ticket sales are recognized when the tickets are used. Revenues from our contractors who have tourism contracts with us are generally recognized over the period of the applicable agreements commencing with the tourists visit the resort.

The Company sells the television air time to third parties. The Company records advertising sales when advertisements are aired. The Company also sells admission and activities tickets for a resort which the Company has the management right.

The Company has no product return or sales discount allowance because service rendered and accepted by customers are normally not returnable and sales discount is normally not granted after service is rendered.

j. Advertising costs

The Company expenses the cost of advertising as incurred or, as appropriate, the first time the advertising takes place. Advertising costs for the three months ended March 31, 2010 and 2009 were $106,304 and $56,892, respectively.

There is a contract in force during the period from August 1, 2003 to July 31, 2010 between a related party (Xinhengji, XHJ) and a state-owned television station that provides for prepaid airtime to be purchased and utilized by the related party in return for payment of RMB 5,000,000 and purchase of suitable programming for the station in the amount of an additional RMB 5,000,000 (Educational Programming). XHJ is 80% owned by a shareholder of the Company and 20% owned by such shareholder’s mother.

XHJ has signed a contract with the Company assigning the Company to manage the commercial of the TV station. The Company shall pay RMB 5,000,000 for the air time and XHJ is obligated to pay RMB 5,000,000 to purchase the TV programs and is entitled to revenue other than the commercial revenue. It also states that if the Company helps XHJ to purchase the TV programs and if pays equal to or more than RMB 5,000,000 then the Company does not have to pay RMB 5,000,000 for airtime anymore. Any amount paid over RMB 5,000,000 by the Company will be the Company’s expenses and will not be reimbursed by XHJ. The advertising costs incurred are charged as cost of sales against specific airtime segments.

k. Income taxes

Income taxes are accounted for under the asset and liability method. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases and operating loss and tax credit carry forwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date.

l. Foreign currency translation

The Company uses the United States dollar ("U.S. dollars") for financial reporting purposes. The Company's subsidiaries maintain their books and records in their functional currency, being the primary currency of the economic environment in which their operations are conducted. In general, for consolidation purposes, the Company translates the subsidiaries' assets and liabilities into U.S. dollars using the applicable exchange rates prevailing at the balance sheet date, and the statement of income is translated at average exchange rates during the reporting period. Gain or loss on foreign currency transactions are reflected on the income statement. Gain or loss on financial statement translation from foreign currency are recorded as a separate component in the equity section of the balance sheet, as component of comprehensive income. The functional currency of the Company ’subsidiaries in China is the Chinese Renminbi and the functional currency of the US parent is the US dollar.

m. Fair values of financial instruments

Statement of Financial Accounting Standard No. 107, "Disclosures about Fair Value of Financial Instruments", (ASC 825) requires that the Company disclose estimated fair values of financial instruments.

The Company's financial instruments primarily consist of cash and cash equivalents, accounts receivable, other receivables, prepaid expenses, fixed, accounts payable, other payable, tax payable, and short and long term loans.

As of the balance sheet dates, the estimated fair values of the financial instruments were not materially different from their carrying values as presented on the balance sheet. This is attributed to the short maturities of the instruments and that interest rates on the borrowings approximate those that would have been available for loans of similar remaining maturity and risk profile at respective balance sheet dates.

n. Stock-based compensation

The Company records stock-based compensation expense pursuant to SFAS 123R (ASC 718), "Share Based Payment.” SFAS 123R (ASC 718) requires companies to measure compensation cost for stock-based employee compensation plans at fair value at the grant date and recognize the expense over the employee's requisite service period. Under SFAS 123R (ASC 718), the Company’s expected volatility assumption is based on the historical volatility of Company’s stock or the expected volatility of similar entities. The expected life assumption is primarily based on historical exercise patterns and employee post-vesting termination behavior. The risk-free interest rate for the expected term of the option is based on the U.S. Treasury yield curve in effect at the time of grant.

Stock-based compensation expense is recognized based on awards expected to vest, and there were no estimated forfeitures as the Company has a short history of issuing options. SFAS 123R (ASC 718) requires forfeitures to be estimated at the time of grant and revised in subsequent periods, if necessary, if actual forfeitures differ from those estimates.

o. Earning per share (EPS)

Earnings per share is calculated in accordance with the Statement of financial accounting standards No. 128 (SFAS No. 128), Earnings per share. SFAS No. 128 (ASC 260) superseded Accounting Principles Board Opinion No.15 (APB 15). Earnings per share for all periods presented has been restated to reflect the adoption of SFAS No. 128. (ASC 260) Basic earnings per share is based upon the weighted average number of common shares outstanding. Diluted earnings per share is based on the assumption that all dilutive convertible shares and stock options were converted or exercised. Dilution is computed by applying the treasury stock method. Under this method, options and warrants are assumed to be exercised at the beginning of the period (or at the time of issuance, if later), and as if funds obtained thereby were used to purchase common stock at the average market price during the period.

Basic and diluted earning per share was $0.38 and $0.37 for the three months ended March 31, 2010, respectively. Basic and diluted earning per share was $0.07 and $0.07 for the three months ended March 31, 2009, respectively.

p. Segment reporting

ASC 250 (SFAS 131), "Disclosure About Segments of an Enterprise and Related Information" requires use of the "management approach" model for segment reporting. The management approach model is based on the way a company's management organizes segments within the company for making operating decisions and assessing performance. Reportable segments are based on products and services, geography, legal structure, management structure, or any other manner in which management disaggregates a company.

During the three months ended March 31, 2010 and 2009, the Company is organized into two main business segments: tourism and media. The primary business relates to tourism and, specifically, tourism at the Great Golden Lake and Tulou. The Company offers bamboo rafting, parking lot service, photography services and ethnic cultural communications. The primary media business related is focused on advertisements, including media publishing, television, cultural and artistic communication activities, and performance operation and management activities.

The following table presents a summary of operating information and certain year-end balance sheet information for the three months ended March 31, 2010 and 2009:

| | | Three months ended March 31, | |

| | | 2010 | | | 2009 | |

| Revenues from unaffiliated customers: | | | | | | |

| Advertisement | | $ | 8,767,284 | | | $ | 6,592,187 | |

| Tourism | | | 6,035,515 | | | | 3,230,718 | |

| Consolidated | | $ | 14,802,799 | | | $ | 9,822,906 | |

| | | | | | | | | |

| Operating income : | | | | | | | | |

| Advertisement | | $ | 6,198,464 | | | $ | 5,000,517 | |

| Tourism | | | 3,559,780 | | | | 1,690,238 | |

| Others | | | (140,823 | ) | | | (1,444 | ) |

| Consolidated | | $ | 9,617,421 | | | $ | 6,689,311 | |

| | | | | | | | | |

| Identifiable assets: | | | | | | | | |

| Advertisement | | $ | 6,894,590 | | | $ | 21,321,818 | |

| Tourism | | | 101,205,542 | | | | 41,942,378 | |

| Others | | | 11,386,562 | | | | 42,946 | |

| Consolidated | | $ | 119,486,694 | | | $ | 63,307,142 | |

| | | | | | | | | |

| Net income | | | | | | | | |

| Advertisement | | $ | 4,622,471 | | | $ | 3,733,254 | |

| Tourism | | | 2,653,743 | | | | 1,239,247 | |

| Others | | | (142,165 | ) | | | (1,627 | ) |

| Consolidated | | $ | 7,134,049 | | | $ | 4,970,874 | |

| | | | | | | | | |

| Interest expense: | | | | | | | | |

| Advertisement | | $ | - | | | | - | |

| Tourism | | | - | | | $ | - | |

| Consolidated | | $ | - | | | $ | - | |

Others include reconciling amounts including certain assets which are excluded from segments and adjustments to eliminate inter-company transactions.

q. Statement of cash flows

In accordance with Statement of Financial Accounting Standards No. 95 (ASC 230), "Statement of Cash Flows," cash flows from the Company's operations is calculated based upon the local currencies. As a result, amounts related to assets and liabilities reported on the statement of cash flows may not necessarily agree with changes in the corresponding balances on the balance sheet.

r. Recent accounting pronouncements

In January 2010, FASB issued ASU No. 2010-01- Accounting for Distributions to Shareholders with Components of Stock and Cash. The amendments in this Update clarify that the stock portion of a distribution to shareholders that allows them to elect to receive cash or stock with a potential limitation on the total amount of cash that all shareholders can elect to receive in the aggregate is considered a share issuance that is reflected in EPS prospectively and is not a stock dividend for purposes of applying Topics 505 and 260 (Equity and Earnings Per Share). The amendments in this update are effective for interim and annual periods ending on or after December 15, 2009, and should be applied on a retrospective basis. The adoption of this ASU did not have a material impact on its consolidated financial statements.

In January 2010, FASB issued ASU No. 2010-02 – Accounting and Reporting for Decreases in Ownership of a Subsidiary – a Scope Clarification. The amendments in this Update affect accounting and reporting by an entity that experiences a decrease in ownership in a subsidiary that is a business or nonprofit activity. The amendments also affect accounting and reporting by an entity that exchanges a group of assets that constitutes a business or nonprofit activity for an equity interest in another entity. The amendments in this update are effective beginning in the period that an entity adopts SFAS No. 160, “Non-controlling Interests in Consolidated Financial Statements – An Amendment of ARB No. 51.” If an entity has previously adopted SFAS No. 160 as of the date the amendments in this update are included in the Accounting Standards Codification, the amendments in this update are effective beginning in the first interim or annual reporting period ending on or after December 15, 2009. The amendments in this update should be applied retrospectively to the first period that an entity adopted SFAS No. 160. The adoption of this ASU did not have a material impact on the Company’s consolidated financial statements.

In January 2010, FASB issued ASU No. 2010-06 – Improving Disclosures about Fair Value Measurements. This update provides amendments to Subtopic 820-10 that requires new disclosure as follows: 1) Transfers in and out of Levels 1 and 2. A reporting entity should disclose separately the amounts of significant transfers in and out of Level 1 and Level 2 fair value measurements and describe the reasons for the transfers. 2) Activity in Level 3 fair value measurements. In the reconciliation for fair value measurements using significant unobservable inputs (Level 3), a reporting entity should present separately information about purchases, sales, issuances, and settlements (that is, on a gross basis rather than as one net number). This update provides amendments to Subtopic 820-10 that clarifies existing disclosures as follows: 1) Level of disaggregation. A reporting entity should provide fair value measurement disclosures for each class of assets and liabilities. A class is often a subset of assets or liabilities within a line item in the statement of financial position. A reporting entity needs to use judgment in determining the appropriate classes of assets and liabilities. 2) Disclosures about inputs and valuation techniques. A reporting entity should provide disclosures about the valuation techniques and inputs used to measure fair value for both recurring and nonrecurring fair value measurements. Those disclosures are required for fair value measurements that fall in either Level 2 or Level 3. The new disclosures and clarifications of existing disclosures are effective for interim and annual reporting periods beginning after December 15, 2009, except for the disclosures about purchases, sales, issuances, and settlements in the roll forward of activity in Level 3 fair value measurements. These disclosures are effective for fiscal years beginning after December 15, 2010, and for interim periods within those fiscal years. The Company is currently evaluating the impact of this ASU, however, the Company does not expect the adoption of this ASU to have a material impact on its consolidated financial statements.

In February 2010, FASB issued ASU No. 2010-9 –Amendments to Certain Recognition and Disclosure Requirements. This update addresses certain implementation issues related to an entity’s requirement to perform and disclose subsequent-events procedures, removes the requirement that public companies disclose the date of their financial statements in both issued and revised financial statements. According to the FASB, the revised statements include those that have been changed to correct an error or conform to a retrospective application of U.S. GAAP. The amendment is effective for interim and annual reporting periods in fiscal year ending after June 15, 2010. The Company does not expect the adoption of this ASU to have a material impact on the Company’s consolidated financial statements.

In March 2010, FASB issued ASU No. 2010-10 –Amendments for Certain Investment Funds. This update defers the effective date of the amendments to the consolidation requirements made by FASB Statement 167 to a reporting entity’s interest in certain types of entities. The deferral will mainly impact the evaluation of reporting enterprises’ interests in mutual funds, private equity funds, hedge funds, real estate investment entities that measure their investment at fair value, real estate investment trusts, and venture capital funds. The ASU also clarifies guidance in Statement 167 that addresses whether fee arrangements represent a variable interest for all service providers and decision makers. The ASU is effective for interim and annual reporting periods in fiscal year beginning after November 15, 2009. The adoption of this ASU did not have a material impact on the Company’s consolidated financial statements.

In March 2010, FASB issued ASU No. 2010-11 –Scope Exception Related to Embedded Credit Derivatives. Embedded credit-derivative features related only to the transfer of credit risk in the form of subordination of one financial instrument to another are not subject to potential bifurcation and separate accounting as clarified by recently issued FASB guidance. Other embedded credit-derivative features are required to be analyzed to determine whether they must be accounted for separately. This update provides guidance on whether embedded credit-derivative features in financial instruments issued by structures such as collateralized debt obligations (CDOs) and synthetic CDOs are subject to bifurcation and separate accounting. The guidance is effective at the beginning of a company’s first fiscal quarter beginning after June 15, 2010. The Company does not expect the adoption of this ASU to have a material impact on the Company’s consolidated financial statements.

s. Reclassifications

Certain prior period amounts have been reclassified to conform to the current period presentation.

3. OTHER RECEIVABLES

Other receivables amounted to $201,463 and $190,424 as of March 31, 2010 and December 31, 2009, respectively. Other assets is mainly comprised of advances to and receivables from employees and other unrelated parties, interest free, and due upon demand.

4. PROPERTY AND EQUIPMENT

Property and equipment consist of the following as of March 31, 2010 and December 31, 2009:

| | | March 31, 2010 | | | December 31, 2009 | |

| Building | | $ | 34,769,146 | | | $ | 34,903,503 | |

| Electronic Equipments | | | 321,567 | | | | 303,652 | |

| Transportation Equipments | | | 226,078 | | | | 74,281 | |

| Office Furniture | | | 48,353 | | | | 128,765 | |

| Subtotal | | | 35,365,144 | | | | 35,410,201 | |

| | | | | | | | | |

| Less: Accumulated Depreciation | | | (2,774,931 | ) | | | (2,414,316 | ) |

| | | | | | | | | |

| Total | | $ | 32,590,213 | | | $ | 32,995,885 | |

Depreciation expenses for the three months ended March 31, 2010 and 2009 were $367,494 and $354,336, respectively.

5. CONSTRUCTION IN PROGRESS

Construction in progress amounted to $45,623,520 and $36,730,184 as of March 31, 2010 and December 31, 2009. It is mainly related to the constructions for the new tourist resorts which the Company has acquired management right from January 2009 in Yuding; various small ongoing projects related to the Great Golden Lake; and the construction of Tulou, the earth buildings. The amount of capitalized interest included in construction in progress amounted $70,403 and $20,243 for the three months ended March 31, 2010 and 2009, respectively. The Company will begin depreciating these assets when they are placed in service. The Company expects these projects to be completed by the third quarter 2010 and placed in service at the end of third quarter 2010.

6. INTANGIBLE ASSETS

As of March 31, 2010 and December 31, 2009, intangible assets were as follows:

| | | March 31, 2010 | | | December 31, 2009 | |

| Intangible asset | | | | | | |

| Management right of tourist resort | | $ | 5,119,878 | | | $ | 5,134,223 | |

| Advertising board | | | 6,582,701 | | | | 6,601,500 | |

| Accumulated amortization | | | (4,221,868 | ) | | | (3,860,785 | ) |

| Total | | $ | 7,480,711 | | | $ | 7,874,938 | |

The company acquired 30 years tourist resort management right in August, 2001 from unrelated parties by paying cash.

The Company entered into an agreement with one third party on February 29, 2008 and obtained five-year use rights of 30 outside advertising boards in Fuzhou city amounting to $6,582,701 (RMB45, 000,000). The term of the contact is in excess of twelve months and inures exclusive operation rights for the Company in the future 5 years. The Company expects future economic benefits from the advertising revenue generated by the 30 outside boards.

In accordance with ASC 350 (previously SFAS 142), the advertising board is a non monetary asset without physical substance that provides probable future economic benefits and has costs that can be reliably measured. An intangible asset is identifiable if it arises from contractual or other legal rights, regardless of whether those rights are transferable or separable from the entity or from other rights and obligations.

Intangible assets of the Company are reviewed annually as to whether their carrying value has become impaired. The Company considers assets to be impaired if the carrying value exceeds the future projected cash flows from related operations. The Company also re-evaluates the periods of amortization to determine whether subsequent events and circumstances warrant revised estimates of useful lives. As of March 31, 2010 the Company expects these assets to be fully recoverable.

Total intangible assets amortization expenses for the three months ended March 31, 2010 and 2009 amounted to $371,804 and $372,242 respectively. Amortization expenses for the next five years and thereafter ended March 31, 2011 amounts to $7,480,711 and consists of the following:

| Years ending March 31 | | Amount | |

| 2011 | | $ | 1,487,203 | |

| 2012 | | | 1,487,203 | |

| 2013 | | | 1,377,491 | |

| 2014 | | | 170,663 | |

| 2015 | | | 170,663 | |

| Thereafter, | | | 2,787,490 | |

7. ADVANCES AND PREPAYMENTS

The Company advances and prepays certain money as project deposits. These balances are interest free and unsecured. As of March 31, 2010 and December 31, 2009, advance and prepayments amounted to $1,509,319 and $1,432,138, respectively.

Long term prepayments related to the advances of Yunding construction projects. As of March 31, 2010 and December 31, 2009, long term prepayments amounted to $1,009,347 and $1,012,230, respectively.

8. OTHER PAYABLE

Other payables are payables due to unrelated parties other than supplier vendors. The amount was $1,089,139 and $1,145,564, due on demand and interest free as of March 31, 2010 and December 31, 2009, respectively.

9. TAX PAYABLES

Tax payables consist of the following as of March 31, 2010 and December 31, 2009:

| | | March 31, 2010 | | | December 31, 2009 | |

| City planning tax | | $ | 7,445 | | | $ | 7,140 | |

| Business tax payable | | | 220,217 | | | | 201,820 | |

| Individual income tax payable | | | 3,174 | | | | 3,317 | |

| Income tax payable | | | 2,501,170 | | | | 2,533,023 | |

| Education fee | | | 6,488 | | | | 6,625 | |

| Cultural construction fee | | | 87,343 | | | | 83,730 | |

| Total | | $ | 2,825,837 | | | $ | 2,835,655 | |

10. LOAN PAYABLE

Short term loan payables represent the loans borrowed from commercial banks that are due within one year. As of March 31, 2010 and December 31, 2009, the outstanding balances on these loans were $1,726,130 and $1,731,060, respectively, and these loans consisted of the following:

| | March 31, 2010 | | | December 31, 2009 |

| Short term loan payable | | | | |

| Loan from Construction Bank, interest rate at 5.81% per annum, due December 15, 2010, guaranteed by the Tulou’s construction. | | | 555,872 | | | | 557,460 | |

| Loan from Merchant bank of Fuzhou, interest rate at 8.66% per annum, due November 6, 2010, guaranteed by the a related party which is 80% owned by a shareholder of the Company | | | 1,170,258 | | | | 1,173,600 | |

| Total | | $ | 1,726,130 | | | $ | 1,731,060 | |

As of March 31, 2010 and December 31, 2009, the long term loan payables were as follows:

| | | March 31, 2010 | | | December 31, 2009 | |

| Loan from Taining Credit Union, interest rate at 7.02% per annum, due March 20, 2012, guaranteed by the management rights of the Great Golden Lake | | $ | 2,483,817 | | | $ | 2,495,190 | |

The interest expenses net of capitalized interest expenses are $0 and $0 for the three months ended March 31, 2010 and 2009, respectively. The Company has paid interest in the amount of $70,403 and $20,243 for the three months ended March 31, 2010 and 2009, respectively. The amount of capitalized interest included in construction in progress (Note 5) amounted $70,403 and $20,243 for the three months ended March 31, 2010 and 2009, respectively

11. OTHER (INCOME) EXPENSES

Other (income) expenses consists of the following for the three months ended March 31, 2010 and 2009:

| Other (income) expense | | 2010 | | | 2009 | |

| Other expense, net | | $ | (8,853) | | | $ | 1,269 | |

| Interest expense | | | - | | | | - | |

| Interest income | | | (8,971 | ) | | | (13,634 | ) |

| | | | | | | | | |

| Total other (income) expense, net | | $ | (17,824 | ) | | $ | (12,364 | ) |

12. INCOME TAXES

The Company is registered in Hong Kong, China and has operations in primarily two tax jurisdictions - the PRC and China (HK). For certain operations in the HK and PRC, the Company has incurred net accumulated operating losses for income tax purposes. The Company believes that it is more likely than not that these net accumulated operating losses will not be utilized in the future. Therefore, the Company has provided full valuation allowance for the deferred tax assets arising from the losses at these locations as of March 31, 2010. Accordingly, the Company has no net deferred tax assets.

The provision for income taxes from operations income consists of the following for the three months ended March 31, 2010 and 2009:

| | | 2010 | | | 2009 | |

| PRC Current Income Expense (Benefit) | | $ | 2,501,196 | | | $ | 1,730,801 | |

| | | | | | | | | |

| Total Provision for Income Tax | | $ | 2,501,196 | | | $ | 1,730,801 | |

The following is a reconciliation of the provision for income taxes at the PR and HK tax rate to the income taxes reflected in the Statement of Operations:

| | | March 31, 2010 | | March 31, 2009 |

| Tax expense (credit) at statutory rate - HK | | | 17.5% | | | | 17.5% | |

| Changes in valuation allowance | | | (17.5%) | | | | (17.5%) | |

| Foreign income tax rate | | | 25% | | | | 25% | |

| Foreign income tax benefit - PRC | | | (0%) | | | | (0%) | |

| Other (a) | | | 1% | | | | 1% | |

| Effective income tax rates | | | 26% | (a) | | | 26% | (a) |

| (a) | The 1% represents certain expenses (such as stock based compensation expense etc. incurred in the U.S. entity) incurred by the Company that are not deductible for PRC income tax for the three months ended March 31, 2010 and March 31, 2009, respectively. |

People’s Republic of China (PRC)

Pursuant to the PRC Income Tax Laws, the Company's subsidiary is generally subject to Enterprise Income Taxes ("EIT") at a statutory rate of 33%, which comprises 30% national income tax and 3% local income tax before 2008. Beginning January 1, 2008, the new Enterprise Income Tax ("EIT") law will replace the existing laws for Domestic Enterprises ("DES") and Foreign Invested Enterprises ("FIEs"). The new standard EIT rate of 25% will replace the 33% rate currently applicable to both DES and FIEs. The Company’s applicable EIT rate under new EIT law is 25% which was approved by local Tax department.

There were no significant book and tax basis difference.

13. SHAREHOLDERS’ EQUITY

1) SECURITY ISSUANCE AGREEMENT

In January 2010, the Company issued a total of 2,489,721 shares of common stock at $11.50 per share. Net proceeds of $26,682,956 have been received. Professional expenses directly related to financing have been recorded in equity.

In connection with the closing of a financing transaction on March 7, 2008, the Company granted Pope Investments II, LLC and certain other investors Class A Warrants that were exercisable for a total of 6,666,667 shares of the Company’s common stock (the “Warrant Shares”) at $1.25 per share (the “Exercise Price”), and were exercisable as of September 6, 2009 and will expire on September 6, 2011. Subject to the provisions of the Class A Warrants, warrant holders may elect to exercise the Class A Warrants on a cashless basis. Pursuant to Section 18 of the Class A Warrants, the Company shall have the option to call 50% of the Class A Warrants at a redemption price of $0.001 per share of the Warrant Shares upon the Company’s achievement of the 2008 performance threshold, and shall have the option to call 100% of the Warrant Shares underlying the then outstanding Class A Warrants upon the Company’s achievement of net income of $39,000,000 for the fiscal year of 2010.

The assumptions used for warrants issued with the share purchasing in Black Scholes calculation are as follow:

| Risk-free interest rate | | | 2.5 | % |

| Expected life of the options | | 3 year |

| Expected volatility | | | 514.17 | % |

| Expected dividend yield | | | 0 | % |

On April 14, 2009, in reliance upon Section 18 of the Class A Warrants, the Company exercised its call option to redeem a total of 3,333,331 Warrant Shares at $0.001 per share for a total of $3,336.

In June 2009, the Company effectuated a 4:1 reverse stock split (the “Split”). As a result, the remaining 3,333,336 Warrant Shares underlying the Class A Warrants were reduced to 833,337 and the Exercise Price was increased to $5 per share.

Following is a summary of the warrant activity for the three months ended March 31, 2010:

| Outstanding, December 31, 2008 | | | 6,666,667 | |

| Called back | | | (3,333,331 | ) |

| 4:1 Reverse Split | | | 833,337 | |

| Exercised during the year | | | (59,525 | ) |

| Outstanding, December 31, 2009 | | | 773,812 | |

| | | | | |

| | | | | |

| Exercised during the three months | | | - | |

| Outstanding, March 31, 2010 | | | 773,812 | |

Warrants outstanding at March 31, 2010 and related weighted average price and intrinsic value are as follows:

| Exercise Prices | | | Total Warrants Outstanding | | | Weighted Average Remaining Life (Years) | | | Total Weighted Average Exercise Price | | | Warrants Exercisable | | | Weighted Average Exercise Price | | | Aggregate Intrinsic Value | |

| | | | | | | | | | | | | | | | | | | | |

| $ | 5 | | | | 773,812 | | | | 1.43 | | | $ | 5 | | | | 773,812 | | | $ | 5 | | | $ | - | |

2) REVERSE SPLIT

The Company effecuated a 4:1 reverse stock split during the quarter ended June 30, 2009. All statements are reversely stated.

The Company effectuated a 10:1reverse stock split during the first quarter ended March 31, 2008.

3) STOCK BASED COMPENSATION

On June 10, 2009 (the “Grant Date”), the Company entered into a Non-qualified Stock Option Agreement with one of the Company’s directors, pursuant to which, the Company agrees to issue to the director non-qualified stock options (the “Stock Options”) to purchase a total of 30,000 shares of the Company’s common stock as compensation for his services to be rendered as the Company’s director. One half of the Stock Options shall vest on the sixth monthly anniversary of the Grant Date (the “First Vesting Date”) and become exercisable at an exercise price equal to the market price of the Company’s common stock on the First Vesting Date and the second half of Stock Options shall vest on the 12th monthly anniversary of the Grant Date (the “Second Vesting Date”) and become exercisable at an exercise price equal to the market price of the Company’s common stock on the Second Vesting Date.

The Company valued the stock options by the Black-Scholes model with the following assumptions:

| | | Expected | | Expected | | Dividend | | Risk Free | | Grant Date |

| | | Term | | Volatility | | Yield | | Interest Rate | | Fair Value |

| Director | | | 5.25 | | 356 | % | 0 | % | 3.11 | % | $ | 5.60 |

The following is a summary of the option activity:

| | | Number of options | |

| Outstanding as of December 31, 2008 | | | - | |

| Granted | | | 30,000 | |

| Exercised | | | - | |

| Forfeited | | | - | |

| Outstanding as of December 31, 2009 | | | 30,000 | |

| Granted | | | 30,000 | |

| Exercised | | | - | |

| Forfeited | | | - | |

| Outstanding as of March 31, 2010 | | | 30,000 | |

Following is a summary of the status of options outstanding at March 31, 2010:

| Outstanding options | | Exercisable options | |

Average Exercise price | | Number | | Average remaining contractual life (years) | | Average Exercise price | | Number | | Average remaining contractual life (years) | |

| $ | (1) | | 30,000 | | 9.25 | | $ | 14.84 | | 15,000 | | | 9.25 | |

| $ | (1) | | 30,000 | | | | $ | 14.84 | | 15,000 | | | - | |

(1) 15,000 shares shall vest on December 10, 2009 and become exercisable at an excerise price equal to $14.84 which is the market price of the Company's common stock on December 10, 2009. The remaining 15,000 shares shall vest on June 10, 2010 and become exercisable at an exercise price equal to the market price of the Company's common stock on that date.

As of March 31, 2010, there was approximately $41,997 of total unrecognized compensation expense related to un-vested share-based compensation arrangements.

For the three months ended March 31, 2010 and 2009, the Company recognized approximately $41,997 and $0, respectively, as compensation expenses for its stock option plan.

14. MAJOR CUSTOMERS AND VENDORS

There were no major customers which accounting over 10% of the total net revenue for the three months ended March 31, 2010. There are no major vendors which accounting over 10% of the total purchase for the three months ended March 31, 2010. The Company extends credit to its customers based upon its assessment of their credit worthiness and generally does not require collateral. Credit losses have not been significant.

15. CURRENT VULNERABILITY DUE TO CERTAIN CONCENTRATIONS

The Company’s practical operations are all carried out in the PRC. Accordingly, the Company’s business, financial condition, and results of operations may be influenced by the political, economic and legal environments in the PRC, and by the general state of the PRC's economy.

The Company’s operations in the PRC are subject to specific considerations and significant risks not typically associated with companies in the North America and Western Europe. These include risks associated with, among others, the political, economic and legal environments and foreign currency exchange. The Company’s results may be adversely affected by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion and remittance abroad, and rates and methods of taxation, among other things.

16. LEASE COMMITMENTS

The Company incurred rental expenses of $26,043 and $15,723 for the three months ended March 31, 2010 and 2009, respectively.

The Company does not have any future lease commitments to pay a minimum amount.

17. COMMITMENTS AND CONTIGENCIES

Commitments

The Company entered into a construction contract with an unrelated party to develop road project of Yunding tourist attraction in Janurary 2009. The project costs $10,749,597 (RMB73.28 million) and has completed $10,058,367 (RMB 68.76 million) as of March 31, 2010.

The Company entered into construction contract with an unrelated party to develop a cable car project of Yunding tourist attraction in March 2009. The project costs $7,902,304 (RMB 53.87 million) and has completed $7,514,519 (RMB 51.37 million) as of March 31, 2010.

The Company entered into a construction contract with an unrelated party to develop Tulou cluster scenic zone in April 2009. The total cost of the project is $960,833 (RMB 6.55 million) and has completed $904,024 (RMB 6.18 million) as of March 31, 2010.

The Company entered into a construction contract with an unrelated party to develop project of Yunding Tianchi in July 2009. The total contract is in the amount of $ 5,842,746 (RMB 39.83 million) and has completed $5,472,418 (RMB 37.41 million) as of March 31, 2010.

The Company entered into a construction contract with an unrelated party to develop road project of Yunding in October 2009. The total contract costs of $12,081,561 (RMB 82.36 million) and has completed $11,396,849 (RMB 77.91 million) as of March 31, 2010.

The Company entered into a construction contract with an unrelated party to develop landscape dam, water storage dam project of Yunding in January 2010. The total contract costs of $3,112,886 (RMB 21.28 million) and has completed $1,898,743 (RMB 12.98 million) as of March 31, 2010.

The Company entered into a construction contract with an unrelated party to develop tourist service center project of Yunding in January 2010. The total contract costs of $3,039,745 (RMB 20.78 million) and has completed $1,904,595 (RMB 13.02 million) as of March 31, 2010.

The Company entered into a construction contract with an unrelated party to develop cloud terrace project of Yunding in January 2010. The total contract costs of $1,647,138 (RMB 11.26 million) and has completed $735,800 (RMB 5.03 million) as of March 31, 2010.

The Company entered into a construction contract with an unrelated party to develop tourist distritution center project of Yunding Tianchi in January 2010. The total contract costs of $1,584,237 (RMB 10.83 million) and has completed $1,040,067 (RMB 7.11 million) as of March 31, 2010.

The Company entered into a construction contract with an unrelated party to develop Tulou cluster scenic zone Shangping in January 2010. The total contract costs of $2,451,690 (RMB 16.76 million) and has completed $1,315,077 (RMB 8.99 million) as of March 31, 2010.

Litigation

From time to time, the Company is a party to various legal actions arising in the ordinary course of business. The Company’s management does not expect the legal matters involving the Company would have a material impact on the Company’s consolidated financial position or results of operations

18. SUBSEQUENT EVENTS

On April 12, 2010, we changed the company name of our operating subsidiary “Fujian Yunding Tourism Industrial Co., Ltd” to “Yida (Fujian) Tourism Group Limited”. Yida (Fujian) Tourism Group Limited (f/k/a Fujian Yunding Tourism Industrial Co., Ltd) is engaged in the operations of our current tourism destinations, specifically, the Yunding tourist destination, and the development of new tourist projects, specifically the China Yang-sheng (Nourishing Life) Paradise and the Emperor Ming Taizu Cultural and Ecological Resort and Tourism.

Effective April 15, 2010, China Yida Holding, Co. and its wholly owned subsidiary, Yida (Fujian) Tourism Group Limited (f/k/a Fujian Yunding Tourism Industrial Co., Ltd, collectively, the “Company”) jointly with Anhui Xingguang Investment Group Ltd. (the “Anhui Xingguang”), a privately held company engaged in real estate and commercial development in Anhui province, entered into an Emperor Ming Taizu Cultural and Ecological Resort and Tourist Project Finance Agreement (the “Agreement”) with Anhui Province Bengbu Municipal Government (the “Government”), pursuant to which the Company and Anhui Xingguang will form a limited liability company (the “Project Company”), with a total registered capital of RMB 100 million (approximately $14.6 million) to engage in construction and development of the Ming Dynasty Entertainment World (the “Project”). The Project includes recreational developments of Royal Hot Spring World (a resort hotel), Royal Tour Town, Filial Piety Temple, and Royal Hunting Garden.

Effective April 18, 2010, China Yida Holding, Co. and its wholly owned subsidiary, Yida (Fujian) Tourism Group Limited (collectively, the “Company”) entered into a China Yang-sheng (Nourishing Life) Tourism Project Finance Agreement (the “Agreement”) with Jiangxi Province Zhangshu Municipal Government (the “Government”), pursuant to which the Company will invest in construction and development of China Yang-sheng (Nourishing Life) Paradise (the “Project”). Preliminarily, the Project includes (i) Salt Water Hot Spring SPA & Health Center, (ii) Yang-sheng Holiday Resort, (iii) World Yang-sheng Cultural Museum, (iii) International Camphor Tree Garden, (iv) Chinese Medicine and Herb Museum, (v) Yang-sheng Sports Club, (vi) Old Town of Chinese Traditional Medicine, and (vii) various other Yang-sheng related projects and tourism real estate projects.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

The following discussion should be read in conjunction with the Consolidated Financial Statements and Notes thereto appearing elsewhere in this Form 10-Q. The following discussion contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 relating to future events or our future performance. Actual results may materially differ from those projected in the forward-looking statements as a result of certain risks and uncertainties set forth in this prospectus. Although management believes that the assumptions made and expectations reflected in the forward-looking statements are reasonable, there is no assurance that the underlying assumptions will, in fact, prove to be correct or that actual results will not be different from expectations expressed in this report.

Our Business

We are a diversified entertainment enterprise focused on China's media and tourism industries headquartered in Fuzhou City, Fujian province, China. Our core business strategy is centered around the combination of tourism and media. Our tourism management business specializes in the development and management of tourism destinations and sites. We currently operate the Great Golden Lake tourist destination (Global Geo-park), Hua’An Tulou cluster (or the “Earth Buildings”) tourist destination (World Culture Heritage site), and Yunding tourist destination (Large-scale recreational park. Our media business provides operating management services including channel, column and advertisement management for the TV channels and other digital media. We currently operate the FETV (a provincial level TV channel) in Fujian province and the “Journey through China on the Train” on-board railway program on China’s high-speed trains.

Our Corporate History and Structure

Keenway Limited was incorporated under the laws of the Cayman Islands on May 9, 2007 for the purpose of functioning as an off-shore holding company to obtain ownership interests in Hong Kong Yi Tat International Investment Co., Ltd (“Hong Kong Yi Tat”), a company incorporated under the laws of Hong Kong. Immediately prior to the Merger (defined below), Mr. Chen Minhua and his wife, Ms. Fan Yanling, were the majority shareholders of Keenway Limited.

On November 19, 2007, we entered into a share exchange and stock purchase agreement with Keenway Limited, Hong Kong Yi Tat, and the then shareholders of Keenway Limited, including Chen Minhua, Fan Yanling, Zhang Xinchen, Extra Profit International Limited, and Lucky Glory International Limited (collectively, the “Keenway Limited Shareholders”), pursuant to which in exchange for all of their shares of Keenway Limited common stock, the Keenway Limited Shareholders received 2,272,582 newly issued shares of our common stock and 91,045 shares of our common stock which were transferred from some of our then existing shareholders (the “Merger”). As a result of the closing of the Merger, the Keenway Limited Shareholders owned approximately 94.5% of our then issued and outstanding shares on a fully diluted basis and Keenway Limited became our wholly owned subsidiary.

On March 15, 2010, Fuzhou Hongda Commercial Services, Ltd (“Fuzhou Hongda”) entered into an equity transfer agreement with Fujian Yunding Tourism Industrial Co., Ltd (“Fujian Yunding”) Fujian Yunding, pursuant to which Fuzhou Yunding acquired 100% of the issued and outstanding shares of Fuzhou Fuyu Advertising Co., Ltd (“Fuzhou Fuyu”) from Fuzhou Hongda at the aggregate purchase price of RMB 3,000,000. A copy of the equity transfer agreement is attached hereto as Exhibit 10.1. On March 15, Fujian Jintai Tourism Developments Co., Ltd (“Fujian Jintai”) entered into an equity transfer agreement with Fujian Yunding, pursuant to which Fujian Yunding acquired 100% of the issued and outstanding common stock of Fuzhou Yintai Tourism Co., Ltd (“Fuzhou Yintai”) from Fujian Jintai at the aggregate purchase price of RMB 5,000,000. A copy of the equity transfer agreement is attached hereto as Exhibit 10.2. On March 16, 2010, Fujian Yunding formed a wholly-owned subsidiary, Yongtai Yunding Resort Management Co., Ltd. (“Yuding Resort Management”) with its official address at No. 68 Xianfu Road, Zhangcheng Town, Yongtai County, China.

On April 12, 2010, we changed the company name of our operating subsidiary “Fujian Yunding Tourism Industrial Co., Ltd” to “Yida (Fujian) Tourism Group Limited” to better reflect our strategy of expanding our business operations in China by extending our business model through acquiring or collaborating with other domestic tourism destinations.

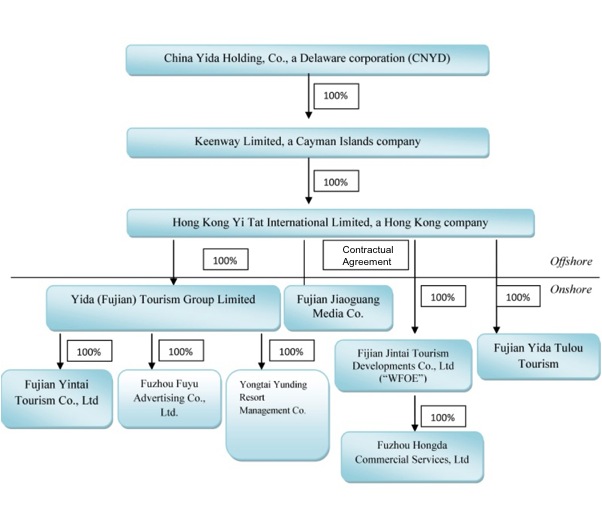

The following chart illustrates our current corporate structure:

| ● | Hong Kong Yi Tat is an entity that was created solely as the holding company for the operating entities, Fujian Jintai Tourism Industrial Development, Co, Ltd., and Fujian Jiaoguang Media, Co., Ltd., and Fujian Yida (Fujian) Tourism Group Limited, and Fujian Yida Tulou Tourism Development Co.. Ltd. Hong Kong Yi Tat does not have any operations. |

| ● | Fujian Jintai Tourism Developments Co., Ltd. (“Fujian Jintai”) operates the tourism segment of our business. Its primary business relates to the operation of our tourism destinations, specifically, the Great Golden Lake. Fujian Jintai owns 100% of the ownership interest in Fuzhou Hongda Commercial Services Co., Ltd. (“Hongda”). |

| ● | Yida (Fujian) Tourism Group Limited (f/k/a Fujian Yunding Tourism Industrial Co., Ltd, “Yida Tourism”) is engaged in the operations of our current tourism destinations, specifically the Yunding tourist destination, and the development of new tourist projects, specifically the China Yang-sheng (Nourishing Life) Paradise and the Ming Dynasty Entertainment World. Yida Tourism has 3 wholly-owned subsidiaries: Fujian Yintai, Fuzhou Fuyu and Yingding Tourism Management. |

| ● | Fujian Yida Tulou Tourism Development. Ltd’s primary business relates to the operation of our tourism destinations, specifically, Hua’An Tulou cluster tourist destination. |

| ● | Fujian Jiaoguang Media Co., Ltd. (“Fujian Jiaoguang”) concentrates on the mass media segment of our business. Its primary business is focused on advertisements, including media publishing, television, cultural and artistic communication activities, and performance operation and management activities. |

We do not have a direct ownership interest in Fujian Jiaoguang. On December 30, 2004, Jiaoguang and its shareholders entered into a set of contractual arrangements with us which governs the relationships between Fijian Jiaoguan and us. The Contractual Arrangements are comprised of a series of agreements, including a Consulting Agreement and an Operating Agreement, through which we have the right to advise, consult, manage and operate Fujian Jiaoguang, and collect and own all of Fujian Jiaoguang’s respective net profits. Additionally, under a Proxy and Voting Agreement and a Voting Trust and Escrow Agreement, the shareholders of Fujian Jiaoguang have vested their voting control over Fujian Jiaoguang to the Company. In order to further reinforce the Company’s rights to control and operate Fujian Jiaoguang, Fujian Jiaoguang and its shareholders have granted us, under an Option Agreement, the exclusive right and option to acquire all of their equity interests in the Fujian Jiaoguang or, alternatively, all of the assets of Fujian Jiaoguang. Further, the shareholders of Fujian Jiaoguang have pledged all of their rights, titles and interests in Fujian Jiaoguang to us under an Equity Pledge Agreement. We effectuated this organizational structure due to China’s limitations on foreign investments and ownership in Chinese domestic businesses. Generally, the Chinese law prohibits foreign entities from directly owning certain types of businesses, such as the media industry. We have obtained an opinion from Allbright Law Office, our Chinese legal counsel, that this structure is legal and valid and that the U.S. holding corporation can obtain the same benefits and risks with this contractual structure as it would with a direct equity ownership.

Our Business

The Great Golden Lake

The Great Golden Lake was recognized as the Global Geopark by the United Nations Educational, Scientific, and Cultural Organization (“UNESCO”) in February 2005. It is located in Taining, surrounding Sanming, Nanping of Fujian Province and Nanchang of Jiangxi Province. This world-class tourist attraction covers more than 230 square kilometers, including five (5) main scenic areas: (1) Golden Lake; (2) Shangqing River; (3) Zhuangyuan Rock; (4) Luohan Mountain; and (5) Taining Old Town.

In 2001, we entered into a tourism management revenue sharing agreement with Taining government, to operate and to manage the Great Golden Lake destination from 2001 through 2032. We have invested $30 million to improve the infrastructure, and through a well-designed marketing campaign, we have succeeded in increasing the number of the visitors from approximately 30,000 in 2001 to approximately 637,000 in 2009. Currently most visitors to the Great Golden Lake are from Fujian, Shanghai, Guangdong and Jiangxi. With easier transportation and increased marketing, we expect that the Great Golden Lake will attract more visitors from other provinces of China and even foreign countries. Our revenue from the operations of the Great Golden Lake is generated from entrance ticket fees and parking fees.

Hua’an Tulou Cluster (or the “Earth Buildings”)

The Tulou Cluster, composed of large multilayer earth buildings built by ancient wealthy families as their residence, is known for their unique round shape, ingenious structure and oriental mystery. The Tulou Cluster was recognized as a World Cultural Heritage site in 2008 by UNESCO. The Tulou Cluster is approximately 1.5 hour drive away from Xiamen City, one of China’s most famous tourist coastal cities.

In December 2008, we entered into a Tourist Resources Development Agreement with Hua’an County Government effective until 2048. Pursuant to this agreement, we began to develop the Hua’an Tulou tourist destinations with a right of priority to develop other scenic areas in Hua’an County. Hua’an Tulou cluster requires a total capital input of approximately $7.5 million to put it into infrastructure and facility constructions. The Hua’an Tulou Cluster was closed during the construction and re-opened to the public before the fourth quarter of 2009. Currently, approximately half of its visitors are from overseas, including Taiwan. We expect our revenue to be generated from the sale of entrance ticket fees, fees from rides on tour cars, and food at our restaurants.

Yunding Recreational Park

In November 2008, we entered into the Tourist Destination Cooperative Development Agreement with Yongtai County Government effective until 2048. Pursuant to the agreement, we obtained the exclusive right to develop the Yunding scenic areas, which is approximately 50 kilometer from Fuzhou. We plan to invest approximately $40 million to build the tourism, transportation and entertainment facilities. By the end of 2009, we had already invested approximately $33 million. And we expect to generate revenue from entrance fees, cable cars and other entertainment activities. We expect that the Yunding Recreational Park will be open to public during the second half of 2010.

FETV

Covering 92% of the population of Fujian province located in southeastern China with a population of over 35 million, Fujian Education Television (“FETV”), owned by the Fujian Education TV Station, is a provincial comprehensive entertainment television channel ranked #4 in ratings in Fujian province (Source: ACNielsen 2008 Survey).

Pursuant to a management agreement (the “Management Agreement”) between Fujian Education TV Station and Fujian Jiaoguang, our subsidiary, we gained 7 years management rights from the Fujian Education TV Station, from August 1, 2003 to July 31, 2010 (the “Initial Management Term”), to operate FETV at a fixed annual payment of RMB 10,000,000. Pursuant to the Management Agreement, Fujian Jiaoguang has an option to extend the Initial Management Term for an additional 5 years term commencing on July 31, 2010 (the “Extended Management Term”), provided, that we agree to a 20% increased annual payment for the management rights during the Extended Management Term, and accept other amendments to provisions in the Management Agreement.