UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registranto

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material Pursuant to Section 240.14a-12

| Cytomedix, Inc. |

| (Name of Registrant as Specified In Its Charter) |

| |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

x No fee required.

o Fee computed on table below per Exchange Act Rules 14a-6(i) (1) and 0-11.

(1)Title of each class of securities to which transaction applies: |

| |

| |

| (2) Aggregate number of securities to which transaction applies: |

| |

| |

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| |

| (4) Proposed maximum aggregate value of transaction: |

| |

| |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) Amount Previously Paid: |

| |

| |

(2) Form, Schedule or Registration Statement No. |

| |

| |

(3) Filing Party: |

| |

| |

| (4) Date Filed: |

| |

CYTOMEDIX, INC.

Notice of Annual Meeting

and

Proxy Statement

Annual Meeting to be held

on

November 3, 2006

11:00 a.m.

Cytomedix, Inc.

416 Hungerford Drive, Suite 330

Rockville, Maryland 20850

Cytomedix, Inc.

416 Hungerford Dr., Suite 330

Rockville, Maryland 20850

Cytomedix, Inc.

416 Hungerford Dr., Suite 330

Rockville, Maryland 20850

Dear Shareholder:

It is my pleasure to invite you to attend the Annual Meeting of Shareholders of Cytomedix, Inc. to be held on November 3, 2006, at 11:00 a.m. The meeting will be held at the offices of Cytomedix, Inc., located at 416 Hungerford Dr., Suite 330, Rockville, Maryland 20850.

Please mark, date, sign, and return your proxy card in the enclosed envelope at your earliest convenience, or you may also vote your shares by telephone voting which is explained in further detail on your proxy card. This will assure that your shares will be represented and voted at the meeting, even if you do not attend.

I appreciate your continued confidence in the Company and look forward to seeing you on November 3.

| | Sincerely,

Kshitij Mohan, Chief Executive Officer |

PROXY STATEMENT

FOR THE ANNUAL MEETING OF SHAREHOLDERS

| Time: | 11:00 a.m., Eastern Standard Time |

| Place: | Cytomedix, Inc. 416 Hungerford Drive, Suite 330 Rockville, Maryland 20850 |

Cytomedix, Inc. (the “Company”), on behalf of its Board of Directors, is soliciting your proxy to vote your shares at the Annual Meeting of Shareholders to be held November 3, 2006. The Company plans to hold its next annual meeting during the third quarter of 2007.

The Company’s headquarters are located at:

Cytomedix, Inc.

416 Hungerford Dr., Suite 330

Rockville, Maryland 20850

We are soliciting proxies to give all shareholders an opportunity to vote on matters that will be presented at the meeting. In the following pages of this proxy statement, you will find information on these matters. We have provided this information to assist you in voting your shares.

This proxy statement, the accompanying proxy card, the Company’s Annual Report on Form 10-KSB for fiscal year ended December 31, 2005, and the Company’s Form 10-Q for the quarter ended June 30, 2006 are being mailed to Cytomedix shareholders beginning September 29, 2006. Copies of exhibits filed with these reports will be sent to shareholders by first class mail within one day of the Company’s receipt of a written request for said exhibits. If you share an address with another security holder, only one proxy statement, Form 10-KSB, and Form 10-Q will be delivered to your household unless we have received contrary instructions from you. Upon your request, we will promptly deliver a separate copy of the proxy statement and reports to each individual shareholder at the address.

To request exhibits to the periodic reports or to obtain additional copies of the proxy statement and periodic reports, please contact the Chief Financial Officer of the Company by mail, phone or fax at the following office location:

Cytomedix, Inc.

416 Hungerford Dr., Suite 330

Rockville, Maryland 20850

(240) 499-2680 (phone)

(240) 499-2690 (fax)

If you are receiving multiple copies of annual reports or proxy statements and wish to request delivery of a single copy, you may contact us at the above address or telephone number.

MEETING INFORMATION

What are the purposes of this meeting?

The Board of Directors on behalf of Cytomedix, Inc. is seeking your affirmative vote for the following:

| | 1. | To elect six directors to serve until the next annual meeting of shareholders; |

| | 2. | To ratify the appointment of L J Soldinger Associates, LLC as its independent registered accountant for the fiscal year ending December 31, 2006; |

| | 3. | To amend the Long-Term Incentive Plan to reserve additional shares of common stock to be issued under the Plan from 4,000,000 to 5,000,000. |

| | 4. | To transact any other business that may properly come before the meeting, or any adjournments thereof. |

Who can vote?

You can vote if, as of the close of business on the record date, September 11, 2006, you were a shareholder of record of the Company’s Common Stock, Series A Convertible Preferred Stock, or Series B Convertible Preferred Stock.

Each share of the Company’s stock represents one vote. On September 11, 2006, there were issued and outstanding:

| 27,935,737 | shares of Common Stock |

| 365,970 | shares of Series A Convertible Preferred Stock |

| 83,431 | shares of Series B Convertible Preferred Stock |

How do I vote by proxy?

By mail - You may vote by completing and mailing the enclosed proxy card. If you vote by proxy, your shares will be voted in the manner you indicate at the annual meeting. If you sign your proxy card but do not specify how you want your shares to be voted, they will be voted as the Board of Directors recommends.

By telephone - You may vote by telephone by using the toll-free number 1-866-626-4508 and following the instructions on your proxy card.

What vote is required to take action?

In order for any business to be conducted, the holders of a majority of the shares entitled to vote at the meeting must be present, either in person or represented by proxy. For purposes of determining the presence of a quorum, abstentions and broker non-votes will be counted as present. A broker non-vote occurs when a broker or nominee holding shares for a beneficial owner signs and returns a proxy but does not vote on a particular proposal because the broker or nominee does not have discretionary voting power and has not received instructions from the beneficial owner. If a quorum is not present, the meeting may be adjourned or postponed by those shareholders who are represented. The meeting may be rescheduled at the time of the adjournment with no further notice of the rescheduled time. An adjournment will have no effect on the business to be conducted.

For the election of directors, the six candidates receiving the most votes will be elected as members of the Board of Directors.

The Board has recommended a proposal to ratify the appointment of L J Soldinger Associates, LLC as the Company’s independent public accountant. The passage of this proposal requires the affirmative vote of a majority of the shares present, either by proxy or in person, and entitled to vote.

The Board has recommended a proposal to amend the Company’s Long-Term Incentive Plan to increase the number of allocated shares of common stock. The passage of this proposal requires the affirmative vote of a majority of the shares present, either by proxy or in person, and entitled to vote.

Who is making this solicitation?

The Company is soliciting your vote through the use of the mail and will bear the cost of this solicitation. The Company will not employ third party solicitors, but its directors, officers, employees, and consultants may solicit proxies by mail, telephone, personal contact, or through online methods. We will reimburse their expenses for doing this. We will also reimburse brokers, fiduciaries, and custodians for their costs in forwarding proxy materials to beneficial owners of the Company’s stock. Other proxy solicitation expenses include those for preparation, mailing, returning, and tabulating the proxies.

May I revoke my proxy after I return my proxy card?

Yes, you can change or revoke your proxy by giving written notice of revocation by certified mail or hand delivery to our Chief Financial Officer at 416 Hungerford Dr., Suite 330, Rockville, Maryland 20850, as long as such notice is received prior to the meeting, or you may change or revoke your proxy by voting in person at the meeting.

Who may attend the meeting?

Only shareholders, their proxy holders, and our invited guests may attend the meeting. If you plan to attend, please bring identification, and, if you hold shares in street name, you should bring your bank or broker statement showing your beneficial ownership of Cytomedix stock in order to be admitted to the meeting.

YOUR VOTE IS IMPORTANT. Even if you plan to attend the annual meeting, we encourage you to complete and return the enclosed proxy card to ensure that your shares are represented and voted. This benefits the Company by reducing the expenses of additional proxy solicitation.

PROPOSAL 1 - ELECTION OF DIRECTORS

The Board of Directors currently consists of six directors. Kshitij Mohan, David P. Crews, David F. Drohan, Mark T. McLaughlin, Arun K. Deva, and James S. Benson were all elected at the Annual Meeting of Shareholders held on October 21, 2005.

The Nominating and Governance Committee reviewed all six director nominees and considered each of these directors and their qualifications. Upon the recommendation of the committee, the Board of Directors nominated the six director nominees. One seat on the Board remains vacant and may be filled by the Board prior to the next annual meeting if the Board so determines. The Board has not yet identified a qualified candidate to nominate to fill this position. Proxies cannot be voted for a greater number of persons that the number of nominees named. Each Director will serve until the next annual meeting and until his successor is duly elected.

The Board of Directors recommends a vote FOR James S. Benson, David P. Crews, Arun K. Deva, David F. Drohan, Mark T. McLouglin, and Kshitij Mohan as Directors to hold office until the next annual meeting of shareholders and until their successors are duly elected.

We do not know of any reason why any of these nominees would not accept the nomination. However, if any of the nominees do not accept the nomination, the persons named in the proxy will vote for the substitute nominee that the Board recommends.

PROPOSAL 2 - RATIFICATION OF APPOINTMENT OF INDEPENDENT

PUBLIC ACCOUNTANT

The Company has selected the firm of L J Soldinger Associates, LLC to audit the financial statements for fiscal year ending December 31, 2006, and the Company’s internal control over financial reporting, and seeks shareholder ratification of said appointment. The Audit Committee, which has selected L J Soldinger Associates, LLC to serve as our independent auditors, believes that L J Soldinger Associates, LLC has the personnel, professional qualifications and independence necessary to act as the Company’s independent auditors. A representative of L J Soldinger Associates, LLC will be in attendance at the annual meeting either in person or by telephone. The representative will have the opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions from shareholders.

The ratification by our stockholders of the Audit Committee’s selection of independent public accountants is not mandated by Delaware law, our bylaws or other legal requirements. However, the Audit Committee is submitting its selection of L J Soldinger Associates, LLC to our stockholders for ratification this year. If the selection of L J Soldinger Associates, LLC is ratified by our stockholders at the Annual Meeting, the Audit Committee, in its discretion, nevertheless may select and appoint a different independent accounting firm at any time. If the stockholders do not ratify the selection of L J Soldinger Associates, LLC, the Audit Committee will reconsider the retention of that firm, but the Audit Committee would not be required to select another firm as independent public accountants and may nonetheless retain L J Soldinger Associates, LLC. If the Audit Committee does select another firm to serve as the Company’s independent public accountants, whether or not the stockholders have ratified the selection of L J Soldinger Associates, LLC, the Audit Committee would not be required to call a special meeting of the stockholders to seek ratification of the selection, and in all likelihood would not call a special meeting for that purpose. In all cases, the Audit Committee will make any determination as to the selection of the Company’s independent public accountants in light of the best interests of the Company and its stockholders.

The Board of Directors recommends a vote FOR the ratification of the appointment of L J Soldinger Associates, LLC as its independent public accountant for the fiscal year ending December 31, 2006.

PROPOSAL 3 - TO AMEND THE COMPANY’S

LONG-TERM INCENTIVE PLAN

The following proposal will be presented for action at the meeting by direction of the Board of Directors:

RESOLVED, that Article 4, paragraph 4.1 of the Long-Term Incentive Plan is amended to read as follows:

The Company shall make Awards available representing up to 5,000,000 shares of common stock. 4,000,000 shares of common stock.

(New language is indicated by underlining, and language to be deleted is struck through.)

The Long-Term Incentive Plan provides currently that the Company is authorized to make awards available representing up to 4,000,000 shares of common stock. The proposal would increase the total number of shares allocated to the Plan by 1,000,000 additional shares. The Company currently has available 670,923 shares of common stock for issuance under the Plan.

The Plan permits incentive awards of options, SARs, restricted stock awards, phantom stock awards, performance unit awards, dividend equivalent awards or other stock-based awards to employees, officers, consultants, independent contractors, advisors, and directors of the Company. The Company believes that the making of awards under the Plan promotes the success and enhances the value of the Company by providing the employees, officers, consultants, independent contractors, advisors and directors of the Company with an incentive for outstanding performance. The Plan is further intended to provide flexibility to the Company in its ability to motivate, attract, and retain the services of employees, officers, consultants, independent contractors, advisors and directors upon whose judgment, interest, and special effort the successful conduct of the Company's operation is largely dependent. Accordingly, the Board believes it necessary to have sufficient shares reserved and allocated to the Plan to permit the grant of incentive awards from time to time to selected employees, officers, consultants, independent contractors, advisors and directors.

The Company has not yet determined if, how, or when the shares of common stock allocated to the Plan will be issued. The Board of Directors will issue the shares allocated to the Plan as it deems necessary to induce, compensate, and reward the Company’s employees, directors, and independent consultants and advisors. The Board will neither seek nor be required to obtain shareholder approval to direct the allocation or grant of benefits from the Plan.

The Board of Directors recommends a vote FOR the amendment to the Company’s Long-Term Incentive Plan allowing the Company to make Awards thereunder available representing up to a total of 5,000,000 shares of common stock.

OVERVIEW OF CYTOMEDIX DIRECTORS AND EXECUTIVE OFFICERS

| | | Date of Original | |

| Name | Age | Election or Appointment | Position(s) with the Company |

| James S. Benson | 67 | November 1, 2004 | Director |

| David P. Crews | 43 | September 28, 2001 | Director |

| Arun K. Deva | 61 | November 23, 2004 | Director |

| David F. Drohan | 67 | July 12, 2004 | Director |

| Mark T. McLoughlin | 50 | June 7, 2004 | Director |

| Kshitij Mohan | 61 | April 20, 2004 | Chairman of the Board |

| | | | Chief Executive Officer |

| Andrew S. Maslan | 36 | August 15, 2005 | Chief Financial Officer |

| Carelyn P. Fylling | 59 | December 1, 2001 | Vice President of Professional Services |

BIOGRAPHIES OF CURRENT DIRECTORS AND OFFICERS

JAMES S. BENSON has served as a Director since November 1, 2004. Mr. Benson has over 25 years of experience in the healthcare industry, and also serves as a director of Cryolife, Inc. Recently, he retired from the Advanced Medical Device Association (Advamed) where he served as executive vice president for technical and regulatory affairs. Prior to that, he held numerous senior positions at the Food and Drug Administration (FDA) over a twenty year period. He retired from the FDA as director of the Center for Devices and Radiological Health (CDRH). Earlier, he served as deputy commissioner of the FDA, and also as its commissioner for a one-year period. During his tenure with the FDA, Mr. Benson worked closely with other Federal Agencies and worked with Congress to craft and create various pieces of legislation including "The Food and Drug Modernization Act of 1997", "The Biomaterials Access Act of 1998" and "The Medical Device User Fee and Modernization Act of 2002". Mr. Benson earned a B.S. degree in civil engineering from the University of Maryland and a M.S. degree in nuclear engineering from the Georgia Institute of Technology.

DAVID P. CREWS has served as a Director since his election through the consent solicitation that became effective on September 28, 2001. Mr. Crews is executive vice president of Crews and Associates, Inc., a brokerage house located in Little Rock, Arkansas, founded by his father. Mr. Crews has worked at Crews & Associates for more than 19 years, specializing in the fixed income markets. He is a former partner of All American Leasing, a municipal finance firm, and also serves as vice president, secretary, and treasurer of CHASC, Inc., an entity that acquired Smith Capital Management (an investment advisory firm). Mr. Crews is also a Board Member of Pure Energy Group, Inc. (an oil and gas company).

ARUN K. DEVA has served as a Director since November 23, 2004. Mr. Deva is the founder and President of Deva & Associates, P.C., a Rockville, Maryland based mid-size accounting and consulting firm that provides accounting, auditing, litigation support, due diligence, cost-benefit analysis and other financial consulting services to many Federal agencies and corporations. He is also the founder and President of CPAMoneyWatch.com, LLC, a web based business services provider offering online accounting and business solutions to small and mid-sized businesses. Prior to establishing Deva & Associates in 1991, Mr. Deva was a partner at Touche Ross & Co. (now Deloitte & Touche). He has served as a management consultant for several public and private companies with a focus on financial restructurings, negotiations with lenders and creditors, financial reporting and disclosures, and filings with the Securities and Exchange Commission. Mr. Deva is a member of the American Institute of Certified Public Accountants, Maryland Association of Certified Public Accountants and Association of Government Accountants. He was appointed to the Maryland Banking Board by the Governor of Maryland for a six-year term ending in 2008. Mr. Deva earned his Bachelor of Commerce degree in accounting from St. Xavier's College in India and a Masters of Business Administration degree in Finance from Indiana University, Bloomington, Indiana.

DAVID F. DROHAN has served as a Director since July 12, 2004. Mr. Drohan recently retired from Baxter Healthcare Corporation where he served as Senior Vice President and President of Baxter's medication delivery business, a position he held since May 2001. In this capacity, he had direct general management responsibility for the development and worldwide marketing of intravenous products, drug-delivery and automated distribution systems, as well as anesthesia, critical care and oncology products representing $4 billion in combined annual sales. He joined Baxter in 1965 as a territory manager in New York and throughout the years has held a succession of senior positions. Prior to joining Baxter, Mr. Drohan worked for Proctor & Gamble. He is a member of the St. Louis College of Pharmacy's board of trustees, chairman of Lake County Ecomomic Development Corporation and President of the Riverside Foundation. He earned his bachelor's degree in industrial relations from Manhattan College, New York.

MARK T. McLOUGHLIN has served as a Director since June 7, 2004. Mr. McLoughlin currently serves as Vice-President and General Manager of the Scientific Products Division of Cardinal Health, Inc., one of the world's largest health care manufacturing and distribution companies. In this capacity, he has full general management responsibility for the distribution, marketing and sales of thousands of medical devices and reagents that can support more than 90% of laboratory requirements in virtually every clinical laboratory discipline. Prior to joining Cardinal, he was vice president of commercial operations for Norwood Abbey Ltd., an Australian-based medical technology company. Earlier, he was President of North American operations for Ion Beam Application, Inc., a Belgium-based global medical technology company. His executive career experience also includes Mallinckrodt, as well as positions with other healthcare companies.

DR. KSHITIJ MOHAN was appointed as Chief Executive Officer on April 20, 2004 and has served as a Director since May 7, 2004. Prior to assuming his positions in the Company, Dr. Mohan served as Chief Executive officer of International Remote Imaging Systems, Inc., the predecessor company of IRIS International. Previously, he was the Chief Regulatory and Technology Strategist for the Law Firm of King and Spalding, Senior Vice-President and Chief Technology Officer for Boston Scientific Corporation, and Corporate Vice-President of Baxter International, responsible for all corporate research and technical services and was a member of the Baxter operating management team. Prior to entering the private sector, Dr. Mohan served in various capacities within the U.S. Food and Drug Administration, including leading the science and technology programs and the office of product evaluation and approval of medical devices and between 1979 - 1983 served in the White House Office of Management and Budget with responsibilities for the national R & D policies, programs of the National Science Foundation and NASA's Aeronautical and Space Research and Technology programs. Dr Mohan has been widely published in the field of health policies, regulations and Applied Physics and served on numerous Boards including the Corporate Advisory Boards of the Schools of Engineering at Dartmouth College and the University of California at Riverside. Dr. Mohan earned a PH.D. degree in Physics from Georgetown University, a M.S. degree in Physics from the University of Colorado and a B.Sc., First Class Honors, Patna University, Patna, India.

ANDREW S. MASLAN joined the company as corporate controller on July 1, 2005, and became our Chief Financial Officer on August 15, 2005. Mr. Maslan most recently served as controller for BioReliance Corporation based in Rockville, Maryland, which was acquired by Invitrogen (Nasdaq: IVGN) in February 2004. Earlier, he held positions with two other Rockville, Maryland-based companies, serving as a principal with GlobeTraders, Inc., and senior accountant for Providence Laboratory Associates. Mr. Maslan began his professional career serving as an auditor with KPMG Peat Marwick, and is a certified public accountant licensed in the state of Maryland.

CARELYN P. FYLLING, RN, MSN, has served as the Company's Vice President of Professional Services since December 2001. Ms. Fylling was director of training and program development at the International Diabetes Center in Minneapolis, Minnesota. She also has served on the national Board of Directors of the American Diabetes Association and numerous national committees of the American Diabetes Association. Ms. Fylling received the prestigious Ames Award for Outstanding Educator in the Field of Diabetes. Subsequently, she joined Curative Health Services and helped the company grow from three employees to over 650 employees. During her 13 years at Curative, Ms. Fylling helped to design the national wound database, developed clinical protocols, conducted outcome studies, trained physicians and nurses in comprehensive wound management, wrote scientific articles and abstracts, assisted in clinical trials and marketing, and developed an Internet-based online wound care training program for health professionals. Recently, she provided independent consulting and outsourcing services to the health care industry through Fylling Associates, LLC, which she wholly owns, and through Strategic Partners, LLC, in which she holds a partnership interest.

THE BOARD OF DIRECTORS

The Board of Directors met five times in 2005. All directors were present and voting at such meetings, other than Mr. McLoughlin who was absent from the June 20, 2005, meeting, and Mr. Drohan who was absent from the September 12, 2005, meeting. As of September 18, 2006, the Board of Directors has met three times in 2006. Dr. Mohan was not present at the meeting on July 7, 2006, as this was a meeting of independent directors. All directors were present and voting at the other meetings, other than Messrs. Drohan and Deva who were absent from the February 24, 2006, meeting.

Although the Company encourages its Directors to attend annual meetings, the Company does not have a policy in place which requires the Directors’ attendance at the annual meetings. All Directors serving on the Board attended the 2005 Annual Meeting.

Shareholders may send communications to the Board or to particular Directors by sending the communications by first class mail to Cytomedix Board of Directors (or to any particular director by name), 416 Hungerford Dr., Suite 330, Rockville, Maryland 20850. All correspondence received is reviewed by the Chief Financial Officer or his office and is forwarded to the appropriate Director(s) other than items unrelated to the functions of the Board or business solicitations and advertisements.

COMMITTEES OF THE BOARD

NOMINATING AND GOVERNANCE COMMITTEE. The Nominating and Governance Committee held four meetings during 2005, and all members were present. As of September 18, 2006, the Nominating and Governance Committee has met once in 2006 and all members were present. James Benson serves as the chairman of the committee and the other members are Arun Deva and Mark McLoughlin. The Board has determined that each of the members of the Nominating Governance Committee is independent pursuant to section 121A of the American Stock Exchange Listing Standards.

The committee has the following responsibilities as set forth in its charter: To review and recommend to the Board with regard to policies for the composition of the Board; to review any director nominee candidates recommended by any director or executive officer of the Company, or by any shareholder if submitted properly; to identify, interview and evaluate director nominee candidates and have sole authority to retain and terminate any search firm to be used to assist the Committee in identifying director candidates and approve the search firm's fees and other retention terms; to recommend to the Board the slate of director nominees to be presented by the Board; to recommend director nominees to fill vacancies on the Board, and the members of each Board committee; to lead the annual review of Board performance and effectiveness and make recommendations to the Board as appropriate; and to review and recommend corporate governance policies and principles for the Company, including those relating to the structure and operations of the Board of Directors and its committees. The committee’s charter is available to shareholders on the Company’s website at www.cytomedix.com.

Pursuant to the charter, the committee will consider a director nominee’s experience, employment, background, independence and other relevant factors, and no one factor will be determinative. The committee will seek to create a Board that is, as a whole, strong in its collective knowledge and diversity of skills and experiences. When the committee reviews a potential director candidate, the committee will look specifically at the candidiate’s qualifications in light of the needs of the Board at that time. The committee will also as needed perform reference and background checks and conduct interviews of the potential candidates. In addition to shareholder recommendations duly submitted in accordance with the provisions of the Company’s Certificate of Incorporation, Bylaws and other applicable law, the committee also relies on recommendations from current directors, officers, employees, and consultants.

As stated in the committee’s charter, the committee will review any director nominee candidate recommended by shareholders. Shareholder recommendations for candidates to the Board should be submitted to the Company at least 120 days prior to the next meeting of shareholders by written notice to: Cytomedix Nominating and Governance Committeee, 416 Hungerford Dr., Suite 330, Rockville, Maryland 20850. Shareholder recommendations should include the name of the candidate as well as relevant biographical information. In evaluating candidates, the Committee will use the criteria described above and will evaluate shareholder candidates in the same manner as candidates from all other sources. In addition, the Company will consider the relationship of the submitting shareholder to the Company and the relationship of the nominee to the shareholder and to the Company.

AUDIT COMMITTEE. At a meeting of the Board of Directors on December 17, 2004, the Board of Directors formed an Audit Committee and named Arun Deva chairman of the Audit Committee. The Board has determined that Arun Deva is an Audit Committee financial expert as defined by Item 401(h) of Regulation S-K. The Board also appointed David Crews and David Drohan to serve as members of the Audit Committee. The Board has determined that each of these persons is "independent" as defined by section 121(A) of the listing standards of the American Stock Exchange. The committee met seven times in 2005, and all members were present except for a meeting on August 11, 2005, when Mr. Drohan was absent. As of September 18, 2006, the Audit Committee has met three times in 2006, and all members were present.

The Audit Committee’s primary responsibilities are to review whether or not management has maintained the reliability and integrity of the accounting policies and financial reporting and disclosure practices of the Company, established and maintained processes to ensure that an adequate system of internal controls is functioning within the Company and established and maintained processes to ensure compliance by the Company with legal and regulatory requirements that may impact its financial reporting and disclosure obligations; review the independent auditors’ qualifications and independence; and prepare a report of the Audit Committee for inclusion in the proxy statement for the Company’s annual meeting of shareholders. On March 15, 2005, the Audit Committee recommended the Audit Committee charter, and it was approved by the Board by unanimous consent. The charter is available on Cytomedix's website at www.cytomedix.com.

COMPENSATION COMMITTEE. At a meeting of the Board of Directors on December 17, 2004, the Board of Directors formed a compensation committee and appointed Mark McLoughlin to serve as the chairman of the compensation committee and David Crews and David Drohan to serve as members of the committee. The Board has determined that each of these persons is "independent" as defined by section 121(A) of the listing standards of the American Stock Exchange. The committee met two times in 2005, and all members were present. As of September 18, 2006, the Compensation Committee has not met separately.

The duties of the compensation committee include establishing any director compensation plan or any executive compensation plan or other employee benefit plan which requires stockholder approval;establishing significant long-term director or executive compensation and director or executive benefits plans which do not require stockholder approval; determinination of any other matter, such as severance agreements, change in control agreements, or special or supplemental executive benefits, within the Committee's authority; determining the overall compensation policy and executive salary plan; and determining the annual base salary, annual bonus, and annual and long-term equity-based or other incentives of each corporate officer, including the CEO. On April 6, 2005, the compensation committee recommended the compensation committee charter to the Board, and it was approved by the Board by unanimous consent. The charter is available on Cytomedix's website at www.cytomedix.com.

SECURITY OWNERSHIP OF THE BOARD AND MANAGEMENT

The following table sets forth the number and percentage of all classes of stock that as of August 31, 2006, are deemed to be beneficially owned by each director, executive officer, and the highest paid consultant of the Company. The table also sets forth the number and percentage of common stock beneficially held by the directors and executive officers as a group.

| | Name and Address of Beneficial Owner | | Amount and Nature of Beneficial Ownership (1) | | Percent of Class (1) |

| | | | | | | |

| Common Stock | | James S. Benson | | 80,000 | (2) | * |

| | | 416 Hungerford Dr., Suite 330 | | | | |

| | | Rockville, MD 20850 | | | | |

| | | | | | | |

| Common Stock | | David P. Crews | | 978,711 | (3) | 3.5% |

| | | 521 President Clinton Ave. | | | | |

| | | Little Rock, Arkansas 72201 | | | | |

| | | | | | | |

| Common Stock | | Arun K. Deva | | 80,000 | (4) | * |

| | | 416 Hungerford Dr., Suite 330 | | | | |

| | | Rockville, MD 20850 | | | | |

| | | | | | | |

| Common Stock | | David F. Drohan | | 60,000 | (5) | * |

| | | 416 Hungerford Dr., Suite 330 | | | | |

| | | Rockville, MD 20850 | | | | |

| Common Stock | | Carelyn P. Fylling | | 293,375 | (6) | * |

| | | 10952 Steamboat Loop NW | | | | |

| | | Walker, Minnesota 56484 | | | | |

| | | | | | | |

| Common Stock | | Andrew S. Maslan | | 100,000 | (7) | * |

| | | 416 Hungerford Dr., Suite 330 | | | | |

| | | Rockville, MD 20850 | | | | |

| | | | | | | |

| Common Stock | | Mark T. McLoughlin | | 80,000 | (8) | * |

| | | 416 Hungerford Dr., Suite 330 | | | | |

| | | Rockville, MD 20850 | | | | |

| | | | | | | |

| Common Stock | | Kshitij Mohan | | 1,200,000 | (9) | 4.1% |

| | | 416 Hungerford Dr., Suite 330 | | | | |

| | | Rockville, MD 20850 | | | | |

| | | | | | | |

| Common Stock | | Group consisting of Jim Benson, David Crews, Arun Deva, David Drohan, Carely Fylling, Andrew Maslan, Mark McLoughlin, and Kshitij Mohan | | 2,872,086 | | 9.3% |

* Less than 1%.

| (1) | For purposes of determining the amount of securities beneficially owned, share amounts include all Common stock owned outright plus all convertible shares, warrants, and options currently exercisable for Common stock within 60 days of the preparation of this table. The Percent of Class for Common stock is based on the number of shares of the Company’s Common stock outstanding as of August 31, 2006. Shares of Common stock issuable upon conversion of convertible notes, or the exercise of options or warrants currently exercisable, or exercisable within 60 days after August 31, 2006, are deemed outstanding for the purpose of computing the percentage ownership of the person holding such options or warrants, but are not deemed outstanding for computing the percentage ownership of any other persons. |

| (2) | Consists of 80,000 shares Mr. Benson may acquire upon the exercise of stock options. |

| (3) | Consists of 701,959 shares owned as trustee for David Paul Crews Revocable Trust, 16,752 shares owned by children, and 260,000 shares Mr. Crews may acquire upon the exercise of stock options. |

| (4) | Consists of 80,000 shares Mr. Deva may acquire upon the exercise of stock options. |

| (5) | Consists of 60,000 shares Mr. Drohan may acquire upon the exercise of stock options. |

| (6) | Consists of 4,298 shares directly owned by Ms. Fylling and 289,077 shares Ms. Fylling may acquire upon the exercise of stock options. |

| (7) | Consists of 100,000 shares Mr. Maslan may acquire upon the exercise of stock options. |

| (8) | Consists of 80,000 shares Mr. McLoughlin may acquire upon the exercise of stock options. |

| (9) | Consists of 10,000 shares directly owned by Dr. Mohan and 1,190,000 shares Dr. Mohan may acquire upon the exercise of stock options. |

In reliance upon statements filed with the SEC under Section 13(d) or 13(g) of the Securities Exchange Act of 1934 (unless we knew or had reason to know such statements were not accurate or complete) the following persons are known to us to be the beneficial owner of more than five percent of our voting securities as of August 31, 2006, as indicated below. The percent of class owned is based on 27,935,639 shares outstanding as of August 31, 2006, and including, as to each shareholder, such shareholder's convertible shares, warrants and options currently exercisable for common stock within sixty days of the preparation of this table.

| Title of Class | Name and Address of | Amount and Nature | Percent of Class |

| | Beneficial Owner | of Beneficial Owner | |

| Common Stock | Michael P. Markus | 1,388,500 shares | 5.0% |

| | 1600 Rockcliff Rd. | (Note 1) | |

| | Austin, Texas 78746 | | |

| Common Stock | David E. Jorden | 2,487,800 shares | 8.9% |

| | 600 Travis, Suite 3700 | (Note 2) | |

| | Houston, Texas 78746 | | |

| (1) | Includes 100,000 shares issuable upon exercise of warrants. Pursuant to the terms of the warrants, the reporting person cannot exercise such warrants if the exercise would result in the reporting person being the “beneficial owner” of more than 9.999% of the outstanding stock within the meaning of Rule 13d-1. |

| (2) | Includes 167,000 shares issuable upon exercise of warrants. Of this amount, 125,000 are Unit Offering warrants. Under the terms of the Unit Offering Warrants, the reporting person cannot exercise such warrants if the exercise would result in the reporting person being the “beneficial owner” of more than 9.999% of the outstanding stock within the meaning of Rule 13d-1. |

DIRECTOR COMPENSATION

The Compensation Committee met on December 23, 2004, and voted to recommend to the Board a compensation plan for directors. At a board meeting held on April 6, 2005, the Board approved the following compensation plan:

| | (a) | Directors shall be compensated $500.00 each for telephonic attendance at board and committee meetings; |

| (b) | Directors shall be compensated $1,000.00 each for physical attendance at board and committee meetings where physical attendance is requested; |

| (c) | Chairman of the Board shall be compensated $1,000.00 for telephonic attendance at board meetings and $2,000.00 for physical attendance at board meetings where physical attendance is requested. |

Directors who are employed by the Company do not receive compensation for serving as a Director. Currently, Kshitij Mohan is the only director and employee of the Company, and he serves as Chairman of the Board. Therefore, he does not receive the approved chairman compensation. The Board has not adopted a policy with regard to the timing of its equity awards.

For their service in 2005, each non-employee director was entitled to receive a ten-year option to purchase 30,000 shares of the Company’s Common stock at an exercise price of $2.55. Additionally, for their service as Audit, Compensation, and Nomination and Governance Committee chairs, Messrs. Deva, McLoughlin, and Benson each received ten-year options to purchase 10,000 shares of the Company’s Common stock at an exercise price of $2.55.

During 2005, the Company had the following executive officers: Kshitij Mohan, CEO; Carelyn P. Fylling, Vice President of Professional Services; William L. Allender, Chief Financial Officer (through August 15, 2005); Andrew S. Maslan, Chief Financial Officer (beginning August 16, 2005).

| | | | | | | | | | | | | | | Long-Term | |

| | | | | | | | | | | | | | | Compensation | |

| | | | | | | Annual Compensation | | Awards | |

| | | | | | | | | | | | | | | Securities | |

| | | | | | | | | | | Other Annual | | Underlying | |

| Name and Principal Position | | | | Year | | Salary | | Bonus | | Compensation | | Options/SARs | |

| Kshitij Mohan | | | (1 | ) | | 2005 | | $ | 300,097 | | $ | 150,000 | | | | | $ | 25,000 | | | 100,000 | |

| Chief Executive Officer | | | | | | 2004 | | | 192,709 | | | - | | | | | | 35,558 | | | 1,000,000 | |

| (Effective April 1, 2004) | | | | | | 2003 | | | - | | | - | | | | | | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Mark E. Cline | | | (2 | ) | | 2005 | | | - | | | - | | | | | | | | | - | |

| President | | | | | | 2004 | | | 72,841 | | | - | | | | | | | | | 150,000 | |

| (Resigned June 29, 2004) | | | | | | 2003 | | | 15,625 | | | - | | | | | | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Carelyn P. Fylling | | | (3 | ) | | 2005 | | | 134,815 | | | - | | | | | | | | | - | |

| VP Professional Services | | | | | | 2004 | | | 130,545 | | | - | | | | | | | | | - | |

| | | | | | | 2003 | | | 130,000 | | | - | | | | | | | | | 19,077 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Andrew S. Maslan | | | (4 | ) | | 2005 | | | 67,500 | | | - | | | | | | | | | 60,000 | |

| Chief Financial Officer | | | | | | 2004 | | | - | | | - | | | | | | | | | - | |

| (Effective August 16, 2005) | | | | | | 2003 | | | - | | | - | | | | | | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | |

| William L. Allender | | | (5 | ) | | 2005 | | | 118,688 | | | 15,000 | | | | | | | | | - | |

| Chief Financial Officeer | | | | | | 2004 | | | 100,000 | | | - | | | | | | | | | - | |

| (Resigned August 15, 2005) | | 2003 | | | 11,875 | | | - | | | | | | | | | 175,000 | |

| (1) | Pursuant to his employment agreement, Dr. Mohan received $25,000 as a “perk package” in 2005. Prior to joining the Company as CEO, Dr. Mohan was compensated under a consulting agreement and was paid $35,558, which amounts are reflected in his 2004 salary figure in the table above. Upon acceptance of the position of Chief Executive Officer, Dr. Mohan was awarded 1,000,000 ten-year options to purchase the Company’s Common stock for $1.50. Under the terms of his employment agreement, 500,000 options vested immediately, 250,000 vested in April 2005 and the remaining options vested in April 2006. Also, pursuant to this agreement, shortly after the first anniversary date of the agreement, Dr. Mohan received 100,000 ten-year options at $1.50. |

| (2) | Pursuant to his employment agreement, Mr. Cline received options to purchase 175,000 shares of the Company’s Common stock at a price of $1.50 per share. On June 29, 2004, as part of the Separation and Release Agreement between the Company and Mr. Mark Cline, 25,000 options of the 175,000 originally awarded to Mr. Cline expired. The remaining options expire on November 15, 2008. |

| (3) | Ms. Fylling was granted 19,077 ten-year options to purchase shares of Common stock at $1.25. |

| (4) | Pursuant to his employment agreement, Mr. Maslan was granted 60,000 ten-year options to purchase shares of the Company’s Common stock at an exercise price of $5.07 per share. Options to purchase 15,000 shares vested upon award. Options to purchase 15,000 shares of Common stock will vest upon the first, second and third anniversaries, respectively, of the employment agreement. |

| (5) | Mr. Allender was granted 175,000 ten-year options to purchase shares of the Company’s Common stock at an exercise price of $1.50. Pursuant to the terms of a separation agreement and release between Mr. Allender and the Company, these options have a cashless exercise provision. |

OPTION GRANTS IN LAST FISCAL YEAR TO THE

COMPANY’S EXECUTIVE OFFICERS

The following table provides all option grants to executive officers in 2005 made under the Long-Term Incentive Plan approved in conjunction with the Bankruptcy Plan and amended at the shareholders’ meeting held in October 2004.

| | | Number of | | % of Total | | | | | | | |

| | | Securities | | Options/SARs | | | | | | | |

| | | Underlying | | Granted to | | Exercise or | | Market Value | | | |

| | | Options/SARs | | Employees in | | Base Price | | on Date of | | Expiration | |

| Name and Principal Position | | Granted | | Fiscal Year | | ($/sh) | | Grant | | Date | |

| | | | | | | | | | | | |

| Kshitij Mohan | | | 100,000 | | | 63 | % | $ | 1.50 | | $ | 5.00 | | | 6/6/2015 | |

| Chief Executive Officer | | | | | | | | | | | | | | | | |

| (Effective April 1, 2004) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Mark E. Cline | | | - | | | - | | | - | | | - | | | - | |

| President | | | | | | | | | | | | | | | | |

| (Resigned June 29, 2004) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Carelyn P. Fylling | | | - | | | - | | | - | | | - | | | - | |

| VP Professional Services | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Andrew S. Maslan | | | 60,000 | | | 37 | % | | 5.07 | | | 5.07 | | | 1/11/2016 | |

| Chief Financial Officer | | | | | | | | | | | | | | | | |

| (Effective August 16, 2005) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| William L. Allender | | | - | | | - | | | - | | | - | | | - | |

| Chief Financial Officeer | | | | | | | | | | | | | | | | |

| (Resigned August 15, 2005) | | | | | | | | | | | | | | | | |

AGGREGATED OPTION EXERCISES IN FY 2005AND FY-END OPTION/SAR VALUES

| | | | | | | Number of Securities | | Value of Unexercised | |

| | | Shares | | | | Underlying Unexercised | | In-The-Money | |

| | | Acquired on | | Value | | Options/SARs at FY End | | Options/SARs at FY End | |

| Name and Principal Position | | Exercise | | Realized | | (Exercisable/Unexercisable) | | (Exercisable/Unexercisable) | |

| | | | | | | | | | |

| Kshitij Mohan | | | - | | $ | - | | | 850,000 / 250,000 | | | | |

| Chief Executive Officer | | | | | | | | | | | | | |

| (Effective April 1, 2004) | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Mark E. Cline | | | 20,000 | | | 25,950 | | | 130,000 / 0 | | | 110,500/0 | |

| President | | | | | | | | | | | | | |

| (Resigned June 29, 2004) | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Carelyn P. Fylling | | | - | | | - | | | 269,077 / 0 | | | 233,485 / 0 | |

| VP Professional Services | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Andrew S. Maslan | | | - | | | - | | | 15,000 / 45,000 | | | 0/0 | |

| Chief Financial Officer | | | | | | | | | | | | | |

| (Effective August 16, 2005) | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| William L. Allender | | | - | | | - | | | 175,000 / 0 | | | 148,750 / 0 | |

| Chief Financial Officer | | | | | | | | | | | | | |

| (Resigned August 15, 2005) | | | | | | | | | | | | | |

EMPLOYMENT AGREEMENTS

On April 20, 2004, the Company entered into an employment contract with Dr. Kshitij Mohan to serve as Chief Executive Officer. The employment contract had an initial term of two years. The term is automatically extended by one year increments on each anniversary of the effective date unless the contract is otherwise terminated in accordance with its provisions. As an inducement to enter this agreement, Dr. Mohan received 1,000,000 ten-year stock options at an exercise price of $1.50 per share. Of these options, 500,000 became immediately exercisable with the remaining 250,000 became exercisable on the first anniversary of the agreement, and the remaining 250,000 became exercisable on the second anniversary. Dr. Mohan’s base salary for the first contract year was $275,000, increasing by at least 10% on each anniversary of the agreement. Dr. Mohan is eligible for an annual bonus, upon the achievement of performance criteria agreed upon with the Board of Directors. If these criteria are met, the bonus may be up to $150,000, with a guaranteed minimum of $100,000 in the first contract year. This bonus may be paid in cash or the Company’s stock at a value of $1.50 per share at Dr. Mohan’s discretion. In addition, on the first and second anniversary of this agreement, Dr. Mohan receives 100,000 ten-year options to purchase the Company’s Common stock at an exercise price of $1.50. Dr. Mohan also receives a guaranteed “perk package” of $25,000 to be paid at the beginning of each year under the term of this agreement.

On September 4, 2002, the Company entered into an employment agreement with Ms. Carelyn P. Fylling to serve as Vice President of Professional Services. The term was for a period of one year, renewable on the first anniversary for a period of two years and in one year increments thereafter. Under the agreement, Ms. Fylling's base salary was $130,000, subject to increase upon review by the Board at the end of each calendar year. Stock options and annual bonus are at the discretion of the Board. Other benefits are in accordance with Company policy.

On June 3, 2005, the Company entered into an employment agreement with Mr. Andrew S. Maslan to serve as Corporate Controller. Employment was at will, with certain notification provisions. Mr. Maslan’s base salary was $135,000, subject to review at the end of the first calendar year. Mr. Maslan’s annual target bonus percentage is 20%, depending on the achievement of performance criteria. Mr. Maslan was also granted 60,000 ten-year options to purchase shares of the Company’s Common stock at an exercise price of $5.07.

On March 25, 2004 the Company entered into an employment agreement with Mr. William L. Allender to serve as Chief Financial Officer, with an effective date of November 15, 2003. Under this agreement, Allender was to receive a base salary $95,000, which may be increased by consent of the Board, and stock options, and is eligible for other standard Company benefits. On September 9, 2004, this agreement was amended to provide Allender with a base salary of $110,000 and to provide for bonuses of an additional $20,000 with $15,000 payable in April 2005and $5,000 in payable in September 2005. On July 15, 2005, the Company entered into a Separation Agreement with Mr. Allender, whereby he voluntarily resigned as of August 15, 2005. This agreement provided that Mr. Allender’s salary and health benefits would continue through January 22, 2006, and that his existing stock options would be extended and would include a cashless exercise provision.

COMPARISON OF STOCKHOLDER RETURN

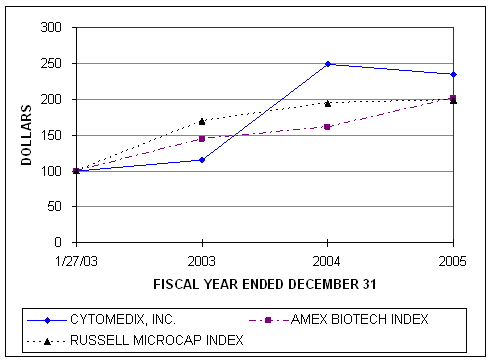

Below is a line graph comparing total cumulative return on an investment of $100 invested on January 27, 2003 in: (i) the Company’s Common Stock, (ii) an industry index, namely the AMEX Biotechnology Index, and (iii) a broad market index, namely the Russell Microcap Index. All values assume reinvestment of the full amount of all dividends, where applicable, and are calculated as of the last trading day of each fiscal year.

COMPARISON OF 35 MONTH CUMULATIVE TOTAL RETURN

AMONG CYTOMEDIX, INC., AMEX BIOTECHNOLOGY INDEX,

AND RUSSELL MICROCAP INDEX

ASSUMES $100 INVESTED ON JANUARY 27, 2003

ASSUMES DIVIDEND REINVESTED

COMPENSATION COMMITTEE REPORT

ON EXECUTIVE COMPENSATION

This report addresses the Company’s compensation policies for executive officers Compensation Committee of the Cytomedix Board of Directors for compensation reported in 2005 for Cytomedix’s Chief Executive Officer and other executive officers. The Compensation Committee is comprised entirely of independent, non-employee directors.

Compensation Policies

The Compensation Committee has responsibility for reviewing and making recommendations to the Board of Directors with respect to the Company’s overall compensation policy, including such items as (i) the establishment of any director compensation plan or any executive compensation plan or other employee benefit plan, (ii) the annual base salary, annual bonus, and annual and long-term equity-based or other incentives of each corporate officer, including the CEO; (iii) corporate goals and objectives relevant to CEO compensation, evaluate the CEO's performance in light of those goals and objectives, and recommend the CEO's compensation level based on this evaluation, which recommendation will be subject to approval by the full Board; (iv) the design and amendment of employee benefit plans, including proposals to establish, freeze, close off or terminate employee benefit plans and related trusts; (v) the Long-Term Incentive Plan, any executive or employee stock incentive or stock purchase plans, and any management incentive or management performance incentive plans or other cash incentive plans; and (iv) any other matter, such as severance agreements, change in control agreements, or special or supplemental executive benefits, within the Committee's authority:

The Compensation Committee’s overall compensation policy, which is applicable to the Cytomedix executive officers, is to position the aggregate of the compensation components at a level that is commensurate with the Company’s size and performance relative to similar companies. The Compensation Committee seeks to make compensation decisions consistent with the long-term growth and performance objectives of the Company. The Compensation Committee implements its compensation policy in a manner designed to maximize shareholder benefit by aligning the interests of employees with the interests of shareholders through the award of stock options and motivating executive officers by rewarding them based on performance.

The Company is committed to providing a competitive pay program that is fair, non-discriminatory, and attractive to quality personnel. Further, the Cytomedix pay program must be structured to achieve motivation of its employees and efficient performance. Accordingly, Cytomedix has structured its pay program to achieve these goals through an appropriate mix of cash and equity-based compensation as well as productivity-based awards.

The Company’s pay program for fiscal 2005 consisted primarily of salary, annual peformance bonuses and incentive awards in the form of stock options under the Company’s Long-Term Incentive Plan. The Compensation Committee believes that stock options awarded under the Cytomedix Long-Term Incentive Plan provide the most useful incentive to encourage executive officers and other employees to maximize productivity and efficiency because the value the such options relates to the Company’s stock price. Awards under the Long-Term Incentive Plan have the effect of more closely aligning the interests of the Company’s employees with its shareholders, while at the same time offering an attractive vehicle for the recruitment, retention, and compensation of employees.

Chief Executive Officer

With respect to the Company’s Chief Executive Officer, Kshitij Mohan, annual base salary is set in accordance with the terms of Dr. Mohan’s employment contract. Dr. Mohan’s annual base salary was $275,000 for the first year of employment, with at least a 10% increase in such level for each subsequent year. Accordingly, his annual base salary for the period of April 20, 2005, through April 19, 2006, was $302,500, and his annual base salary for the period April 20, 2006, through April 19, 2007, is $332,750.

Dr. Mohan’s annual bonus for the first year of employment was set at a minimum of $100,000, and a maximum of $150,000 if he met certain performance criteria. His annual bonus for the second year of his employment, which ended on April 19, 2006, was also $150,000 based on his achievement of certain aspects of the overall performance criteria set by the Compensation Committee with regard to the following general areas:

1. Patents and Licensing

| | · | Resolution of actual and potential infringement matters |

| | · | Development and implantation of utilization strategies |

2. Product Development

| | · | Completion of clinical trial and submission of preliminary results |

| | · | Development and implementation of regulatory strategy |

| | · | Develop strategy for submission to CMS |

3. Sales and Marketing

| | · | Finalize potential sales contracts and further development of independent sales representative network |

4. Financial Performance

| | · | Secure additional financing, if necessary |

| | · | Further development of strategic plan |

While based generally on Dr. Mohan’s merit and performance and considering his contribution to Cytomedix’s success, the specific performance criteria are set by the Compensation Committee and approved by the Board of Directors on an annual basis to reflect an appropriate balance of the Company’s short-term and long-term goals.

Submitted by the Compensation Committee

Mark T. McLoughlin, Chairperson

David P. Crews

David F. Drohan

LONG-TERM INCENTIVE PLAN

In 2002, the United States Bankruptcy Court of the Northern District of Illinois, Eastern Division confirmed the Company’s First Amended Plan of Reorganization and in doing so authorized the Company to take certain corporate actions without the need for any further action by the court or any of the officers, directors, or shareholders of the Company. Pursuant to this order, the Company adopted the Long-Term Incentive Plan (the “Plan”). The Plan was approved by a majority of the persons entitled to vote on the plan of reorganization and had like effect to shareholder approval. Originally, the Plan provided that the Company could make awards of up to 15% of the fully diluted stock of the Company on the effective date of the bankruptcy reorganization. On October 16, 2002, the Board reserved and allocated 2,336,523 shares of common stock to the Long-Term Incentive Plan, upon finding that said amount was 15% of the fully diluted stock of the Company as of the effective date of the plan of reorganization. At the annual meeting held on October 19, 2004, the shareholders approved an amendment to the Plan so that the Company may make awards of up to 4,000,000 shares of the Company’s common stock.

The Plan permits incentive awards of options, stock appreciation rights (SARs), restricted stock awards, phantom stock awards, performance unit awards, dividend equivalent awards or other stock-based awards to employees, officers, consultants, independent contractors, advisors, and directors of the Company.

The Plan is administered by the Compensation Committee. Under the Plan, the Compensation Committee has the authority to:

| | · | determine the type or types of awards to be granted to each participant; |

| | · | determine the number of awards to be granted and the number of shares of stock to which an award will relate; |

| | · | determine the terms and conditions of any award granted under the Plan, including but not limited to, the exercise price, grant price, or purchase price, any restrictions or limitations on the award, any schedule for lapse of forfeiture restrictions or restrictions on the exercisability of an award, and accelerations or waivers thereof, based in each case on such considerations as the Compensation Committee in its sole discretion determines; |

| | · | accelerate the vesting or lapse of restrictions of any outstanding award, based in each case on such considerations as the Compensation Committee in its sole discretion determines; |

| | · | determine whether, to what extent, and under what circumstances an award may be settled in, or the exercise price of an award may be paid in, cash, stock, other awards, or other property, or an award may be canceled, forfeited, or surrendered; |

| | · | prescribe the form of each award agreement, which need not be identical for each participant; |

| | · | decide all other matters that must be determined in connection with an award; |

| | · | establish, adopt or revise any rules and regulations as it may deem necessary or advisable to administer the Plan; |

| | · | make all other decisions and determinations that may be required under the Plan or as the Compensation Committee deems necessary or advisable to administer the Plan; and |

| | · | Amend any award agreement as provided in the Plan. |

Under the current Plan, the Company may make awards available representing up to 4,000,000 shares of common stock. To the extent that an award is canceled, is forfeited, terminates, expires or lapses for any reason, any shares of stock subject to the award will again be available for the grant of an award under the Plan and shares subject to SARs or other awards settled in cash will be available for the grant of an award under the Plan. The maximum number of shares of stock that may be covered by options and/or SARs granted to any one individual during any one calendar year under the Plan shall be 1,000,000. The maximum number of shares of stock that may be issued under incentive stock options granted to any one individual during any calendar year under the Plan shall be 1,000,000. The maximum fair market value (measured as of the date of grant) of any awards other than options and SARs that may be received by a participant (less any consideration paid by the participant for such award) during any one calendar year under the Plan shall be $1,000,000.

The Company is authorized to grant both nonqualified stock options and incentive stock options. For nonqualified stock options, the exercise price per share of stock under the option may be determined by the Compensation Committee. For incentive stock options, the exercise price shall not be less that the fair market value of a share of stock on the date of grant.

The Company believes that the making of awards under the Plan promotes the success and enhances the value of the Company by providing the employees, officers, consultants, independent contractors, advisors and directors of the Company with an incentive for outstanding performance. The Plan is further intended to provide flexibility to the Company in its ability to motivate, attract, and retain the services of employees, officers, consultants, independent contractors, advisors and directors upon whose judgment, interest, and special effort the successful conduct of the Company's operation is largely dependent. Accordingly, the Board believes it necessary to have sufficient shares reserved and allocated to the Plan to permit the grant of incentive awards from time to time to selected employees, officers, consultants, independent contractors, advisors and directors.

PLAN BENEFITS

The following table provides all option grants made under the Long-Term Incentive Plan during 2005 to each executive officer employed during 2005, to the current executive officers as a group, to the current non-executive directors as a group, and to all employees (other than executive officers) as a group. The Company has not yet determined how it will issue the shares allocated to the Plan.

| Name and Position | Per Share Exercise Price ($) (1) | Number of Units |

| Kshitij Mohan | $1.50 | Option to purchase 100,000 shares |

| Chief Executive Officer | | |

| | | |

| Andrew Maslan | $5.07 | Option to purchase 60,000 shares |

| Chief Financial Officer | | |

| | | |

| Executive Group | $2.84 | Options to purchase 160,000 shares |

| | | |

| Non-Executive Director | $2.35 | Options to purchase 210,000 shares |

| Group | | |

| | | |

| Non-Executive Officer | $3.48 | Options to purchase 85,000 shares |

| Employee Group | | |

(1) The current dollar values of the stock option grants are the difference between the exercise price and the fair market value of the stock. The per share exercise prices for the groups are based on the weighted average of the exercise prices for the individual grants.

EQUITY COMPENSATION PLAN INFORMATION AS OF DECEMBER 31, 2005

| Plan category | Number of securities to be issued upon exercise of outstanding options, warrants, and rights | Weighted average exercise price of outstanding options, warrants, and rights | Number of securities remaining available for future issuance |

| | (a) | (b) | (c) |

| Equity compensation plans approved by security holders | 2,782,077 | $1.73 | 910,923 |

| | | | |

| Equity compensation plans not approved by security holders | -0- | | -0- |

| | | | |

| Total | 2,782,077 | $1.73 | 910,923 |

As of December 31, 2005, 307,000 shares of common stock have been issued upon exercise of options granted pursuant to the Long Term Incentive Plan.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE DURING 2005

Section 16(a) of the Act requires our officers, directors and persons who own more than ten percent of a registered class of our equity securities within specified time periods to file certain reports of ownership and changes in ownership with the SEC. The Company is not aware of any failure to file any report required by Section 16(a) of the Exchange Act in a timely manner during the fiscal year ended December 31, 2005, by any of the current directors or executive officers. Although the Forms 3 reflecting the appointment of Messrs. McLoughlin and Drohan in 2004 were not filed within ten days of their appointments as directors, each did file a Form 4 within two days of acquiring any Cytomedix securities.

REPORT OF THE AUDIT COMMITTEE

The Audit Committee has reviewed and discussed with Cytomedix's management and LJ Soldinger Associates, LLC, the independent registered public accounting firm, together and separately, the audited financial statements contained in Cytomedix's Annual Report on Form 10-KSB for the 2005 fiscal year.

The Audit Committee has also discussed with the independent registered public accounting firm, the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees) which includes, among other items, matters related to the conduct of the audit of Cytomedix's financial statements.

The Audit Committee also received and reviewed the written disclosures and the letter from L J Soldinger Associates, LLC required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) and has discussed with L J Soldinger Associates, LLC its independence from Cytomedix.

Based on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors, and the Board has approved, that the audited financial statements be included in Cytomedix's Annual Report on Form 10-KSB for the year ended December 31, 2005, for filing with the Securities and Exchange Commission.

Submitted by the Audit Committee

Arun K. Deva, Chairperson

David P. Crews

David F. Drohan

INDEPENDENT PUBLIC ACCOUNTANTS

The Board of Directors has selected the firm of L J Soldinger Associates, LLC to audit the financial statements for fiscal year ending December 31, 2006, and seeks shareholder ratification of said appointment. A representative of L J Soldinger Associates, LLC will be in attendance at the annual meeting either in person or by telephone. The representative will have the opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions from shareholders.

AUDIT FEES AND TAX FEES

Pursuant to its charter, the Audit Committee must pre-approve audit services and permitted non-audit services (including the fees and terms thereof) to be performed for the Corporation by its independent auditor, L J Soldinger Associates, LLC. The following table presents fees for professional services rendered by L J Soldinger Associates, LLC for the fiscal years 2005 and 2004.

| Services Performed | | 2005 | | 2004 | |

| | | | | | |

| Audit Fees(1) | | $ | 200,000 | | $ | 182,000 | |

| Audit-Related Fees(2) | | | 30,000 | | | 33,000 | |

| Tax Fees(3) | | | 15,000 | | | 16,000 | |

| All Other Fees(4) | | | -- | | | -- | |

| Total Fees | | $ | 245,000 | | $ | 231,000 | |

| (1) | Audit fees represent fees billed for professional services provided in connection with the audit of the Company’s annual financial statements, reviews of its quarterly financial statements, audit services provided in connection with statutory and regulatory filings for those years and audit services provided in connection with securities registration and/or other issues resulting from that process. |

| (2) | Audit-related fees represent fees billed primarily for assurance and related services reasonably related to securities registration and/or other issues resulting from that process. |

| (3) | Tax fees principally represent fees billed for tax preparation, tax advice and tax planning services. |

| (4) | All other fees principally would include fees billed for products and services provided by the accountant, other than the services reported under the three captions above. |

| (5) | Pursuant to its charter, the Audit Committee must pre-approve audit services and permitted non-audit services (including the fees and terms thereof) to be performed for the Company by its independent auditor. |

SHAREHOLDER PROPOSALS

The Company intends to hold next year’s annual meeting in September 2007. As calculated in accordance with Rule 14a-8(d) under the Exchange Act, the deadline for providing for submitting shareholder proposals for inclusion in the Company’s proxy statement for the next annual meeting is a reasonable time before the Company begins to print and mail its proxy materials. Notice of a shareholder proposal submitted outside the processes of Rule 14a-8 under the Exchange Act will be considered untimely unless it is received by the Company within a reasonable time before the Company begins to mail its proxy materials as provided in Rule 14a-4(c)(1).

OTHER MATTERS

The Board of Directors knows of no other matters which will come before the meeting. However, if any matters other than those set forth in the notice should be properly presented for action, the persons named in the proxy intend to take such action as will be in harmony with the policies of the Company and, in that connection, will use their discretion.

INCORPORATION BY REFERENCE

Exhibits filed with the Company’s 10-KSB for year ended December 31, 2005, and the Company’s 10-Q for the period ended June 30, 2006, are hereby incorporated by reference. Copies of the exhibits will be sent to shareholders by first class mail, without charge, within one day of the Company’s receipt of a written or oral request for said exhibits.

To request exhibits, please send your written request to:

Cytomedix, Inc.

416 Hungerford Dr., Suite 330

Rockville, Maryland 20850

Telephone: 240.499.2680

Facsimile: 240.499-2690

Appendix

CYTOMEDIX, INC.

LONG-TERM INCENTIVE PLAN

ARTICLE 1

PURPOSE

1.1 GENERAL. The purpose of the Cytomedix, Inc. Long-Term Incentive Plan (the “Plan”) is to promote the success, and enhance the value, of Cytomedix, Inc. (the “Company”), and its related companies by linking the personal interests of the employees, officers, consultants, independent contractors, advisors and directors of the Company and its related companies to those of Company shareholders and by providing such persons with an incentive for outstanding performance. The Plan is further intended to provide flexibility to the Company in its ability to motivate, attract, and retain the services of employees, officers, consultants, independent contractors, advisors and directors upon whose judgment, interest, and special effort the successful conduct of the Company’s operation is largely dependent. Accordingly, the Plan permits the grant of incentive awards from time to time to selected employees, officers, consultants, independent contractors, advisors and directors.

ARTICLE 2

DEFINITIONS

2.1 DEFINITIONS. When a word or phrase appears in this Plan with the initial letter capitalized, and the word or phrase does not commence a sentence, the word or phrase shall generally be given the meaning ascribed to it in this Section or in Section 1.1 unless a clearly different meaning is required by the context. The following words and phrases shall have the following meanings:

| (a) | “Award” means any Option, Stock Appreciation Right, Restricted Stock Award, Phantom Stock Award, Performance Unit Award, Dividend Equivalent Award, or Other Stock-Based Award, or any other right or interest relating to Stock or cash, granted to a Participant under the Plan. |

| (b) | “Award Agreement” means any written agreement, contract, or other instrument or document evidencing an Award. |

| (c) | “Board” means the Board of Directors of the Company. |

| (d) | “Code” means the Internal Revenue Code of 1986, as amended from time to time. |

| (e) | “Compensation Committee” means the Compensation Committee of the Board described in Article 3. |

| (f) | “Company” means Cytomedix, Inc., a Delaware corporation. |

| (g) | “Disability” means a “permanent and total disability” as defined in Code Section 22(e) (3). |

| (h) | “Dividend Equivalent” means a right granted to a Participant under Article 12 of the Plan. |

| (i) | “Effective Date” means the date the Plan of Reorganization is confirmed by the Bankruptcy Court. |

| (j) | “Fair Market Value”, on any date, means (i) if the Stock is listed on a national securities exchange or is traded over the Nasdaq National Market or is quoted on an interdealer quotation system, the closing sales price on such exchange or over such system on such date or, in the absence of reported sales on such date, the closing sales price on the immediately preceding date on which sales were reported, or (ii) if the Stock is not listed on a national securities exchange or traded over the Nasdaq National Market, the fair market value shall be as determined by an independent appraiser selected by the Compensation Committee from time to time or as determined in good faith by the Compensation Committee in its sole discretion. |

| (k) | “Incentive Stock Option” means an Option that is intended to meet the requirements of Code Section 422 or any successor provision thereto. |

| (l) | “Non-Qualified Stock Option” means an Option that is not an Incentive Stock Option. |

| (m) | “Option” means a right granted to a Participant under Article 7 of the Plan. |

| (n) | “Other Stock-Based Award” means a right, granted to a Participant under Article 12 of the Plan. |

| (o) | “Parent” means a corporation or other entity which owns or beneficially owns a majority of the outstanding voting stock or voting power of the Company. For Incentive Stock Options, “Parent” means a “parent corporation” of the Company as defined in Code Section 424(e). |

| (p) | “Participant” means a person who, as an employee, officer, consultant, independent contractor, advisor or director of the Company, a Parent or any Subsidiary, has been granted an Award under the Plan. |

| (q) | “Performance Unit” means a right granted to a Participant under Article 8 of the Plan. |

| (r) | “Phantom Stock” means a right granted to a Participant under Article 10 of the Plan. |

| (s) | “Plan” means the Cytomedix, Inc. Long-Term Incentive Plan. |

| (t) | “Restricted Stock” means Stock granted to a Participant under Article 10 of the Plan. |

| (u) | “Retirement” means a Participant’s termination of employment after attaining age 65. |

| (v) | “Stock” means the common stock of the Company, and such other securities of the Company as may be substituted for Stock pursuant to Article 15. |

| (w) | “Stock Appreciation Right” or “SAR” means a right granted to a Participant under Article 7 of the Plan. |