Exhibit 99.1

|

Raymond James 31st Annual Institutional Investors Conference March 2010

|

Forward-Looking Statements

This presentation contains “forward-looking statements” which are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The forward-looking statements are based on the Company’s current expectations and beliefs concerning future developments and their potential effects on the Company. There can be no assurance that actual developments will be those anticipated by the Company. Actual results may differ materially from those projected as a result of significant risks and uncertainties, including non-receipt of the expected payments, changes in interest rates, effect of the performance of financial markets on investment income and fair values of investments, development of claims and the effect on loss reserves, accuracy in projecting loss reserves, the impact of competition and pricing environments, changes in the demand for the Company’s products, the effect of general economic conditions, adverse state and federal legislation, regulations and regulatory investigations into industry practices, developments relating to existing agreements, heightened competition, changes in pricing environments, and changes in asset valuations. The Company undertakes no obligation to publicly update any forward-looking statements as a result of events or developments subsequent to the presentation.

2.

|

Argo Group Today

Bermuda Headquarters

Major business segment locations

London Brussels

An international specialty underwriter of property/casualty insurance and reinsurance products

Headquartered in Bermuda

Operations in 50 states and worldwide

Total capitalization of $2.0 billion

Operations conducted through four business segments

Our Strategy

Deploy capital in the international specialty market for maximum return

Continuous focus on new business development and organic growth

Grow strategically through acquisitions Prudent management of our balance sheet and investment portfolio

Maximize shareholder value through our focus on Return on Capital

3.

|

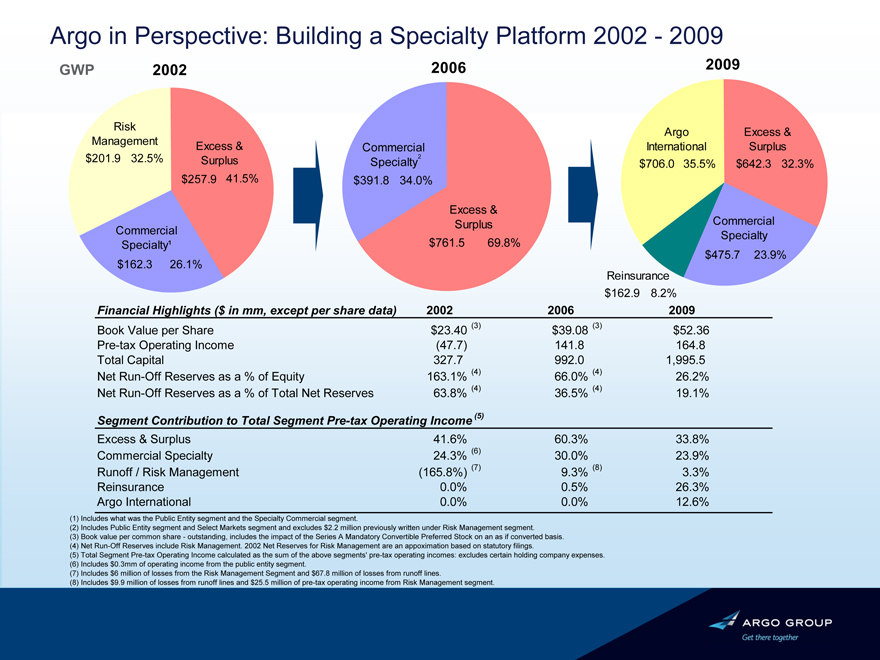

Argo in Perspective: Building a Specialty Platform 2002—2009

GWP 2002

Risk

Management Excess & $201.9 32.5% Surplus $257.9 41.5%

Commercial Specialty¹ $162.3 26.1%

2006

Commercial Specialty2 $391.8 34.0%

Excess & Surplus $761.5 69.8%

2009

Argo Excess & International Surplus $706.0 35.5% $642.3 32.3%

Commercial Specialty $475.7 23.9%g

Reinsurance $162.9 8.2%

Financial Highlights ($ in mm, except per share data) 2002 2006 2009

Book Value per Share $23.40 (3) $39.08 (3) $52.36

Pre-tax Operating Income (47.7) 141.8 164.8

Total Capital 327.7 992.0 1,995.5

Net Run-Off Reserves as a % of Equity 163.1% (4) 66.0% (4) 26.2%

Net Run-Off Reserves as a % of Total Net Reserves 63.8% (4) 36.5% (4) 19.1%

Segment Contribution to Total Segment Pre-tax Operating Income (5)

Excess & Surplus 41.6% 60.3% 33.8%

Commercial Specialty 24.3% (6) 30.0% 23.9%

Runoff / Risk Management (165.8%) (7) 9.3% (8) 3.3%

Reinsurance 0.0% 0.5% 26.3%

Argo International 0.0% 0.0% 12.6%

(1) Includes what was the Public Entity segment and the Specialty Commercial segment.

(2) Includes Public Entity segment and Select Markets segment and excludes $2.2 million previously written under Risk Management segment.

(3) Book value per common share - outstanding, includes the impact of the Series A Mandatory Convertible Preferred Stock on an as if converted basis. (4) Net Run-Off Reserves include Risk Management. 2002 Net Reserves for Risk Management are an appoximation based on statutory filings.

(5) Total Segment Pre-tax Operating Income calculated as the sum of the above segments’ pre-tax operating incomes: excludes certain holding company expenses. (6) Includes $0.3mm of operating income from the public entity segment.

(7) Includes $6 million of losses from the Risk Management Segment and $67.8 million of losses from runoff lines.

(8) Includes $9.9 million of losses from runoff lines and $25.5 million of pre-tax operating income from Risk Management segment.

|

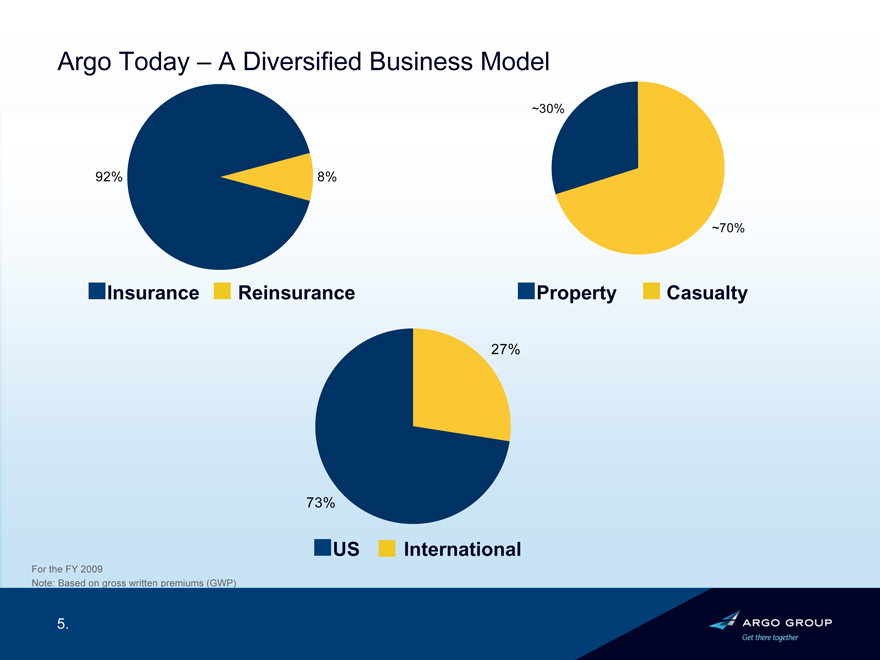

Argo Today – A Diversified Business Model

92% 8%

Insurance Reinsurance

~30%

~70%

Property Casualty

27%

73%

US International

For the FY 2009

Note: Based on gross written premiums (GWP)

5.

|

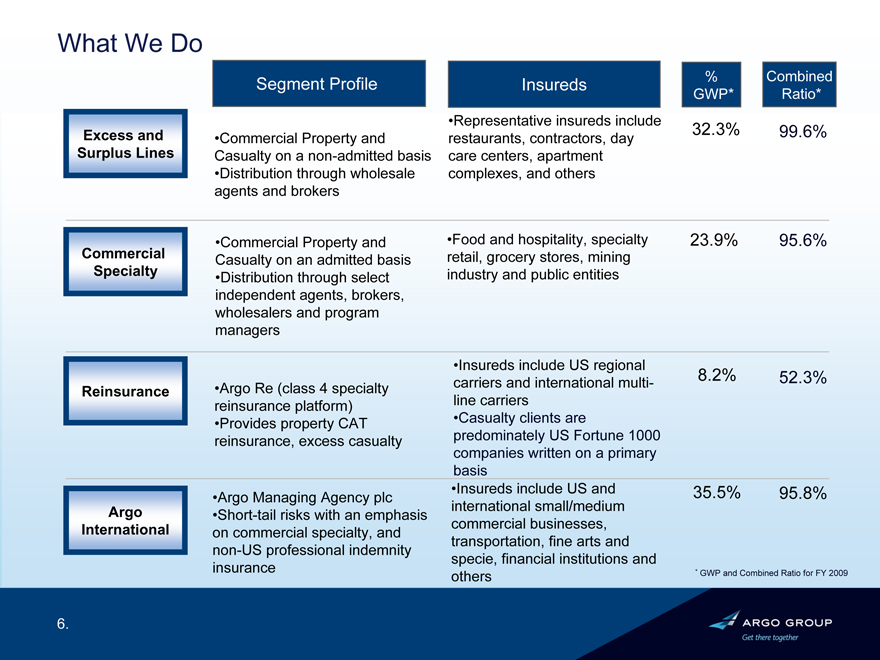

What We Do

Segment Profile % Combined Insureds GWP* Ratio*

Excess and Surplus Lines

Commercial Specialty

Reinsurance

Argo International

•Representative insureds include

32.3% 99.6% •Commercial Property and restaurants, contractors, day Casualty on a non-admitted basis care centers, apartment •Distribution through wholesale complexes, and others agents and brokers

•Commercial Property and Casualty on an admitted basis •Distribution through select independent agents, brokers, wholesalers and program managers

•Food and hospitality, specialty retail, grocery stores, mining industry and public entities

23.9% 95.6%

•Argo Re (class 4 specialty reinsurance platform) •Provides property CAT reinsurance, excess casualty

•Insureds include US regional carriers and international multiline carriers •Casualty clients are predominately US Fortune 1000 companies written on a primary basis

8.2% 52.3%

•Argo Managing Agency plc •Short-tail risks with an emphasis on commercial specialty, and non-US professional indemnity insurance

•Insureds include US and international small/medium commercial businesses, transportation, fine arts and specie, financial institutions and others

35.5% 95.8%

* GWP and Combined Ratio for FY 2009

6.

|

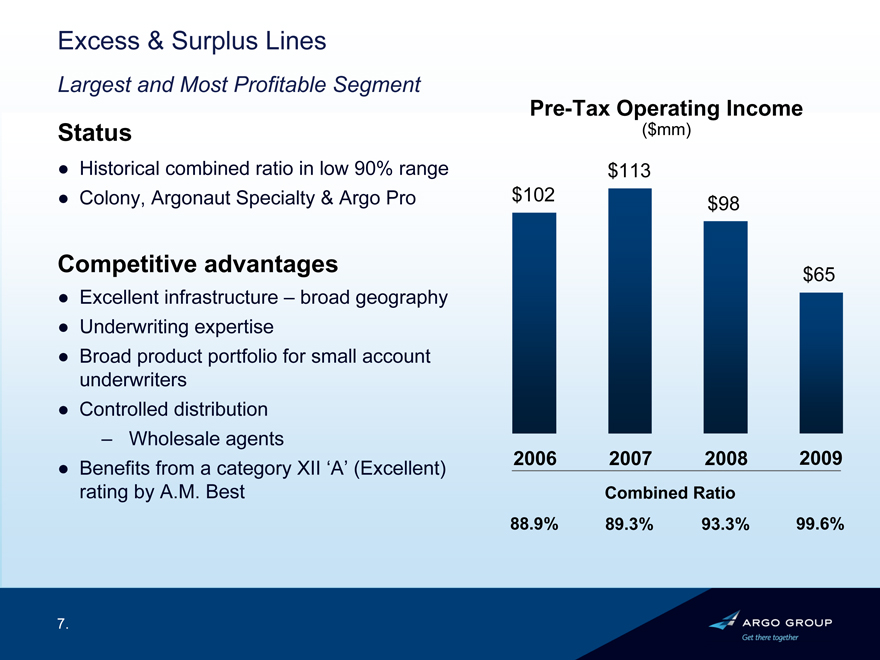

Status

Excess & Surplus Lines

Largest and Most Profitable Segment

•Historical combined ratio in low 90% range

•Colony, Argonaut Specialty & Argo Pro

Competitive advantages

•Excellent infrastructure – broad geography

•Underwriting expertise

•Broad product portfolio for small account underwriters

•Controlled distribution

– Wholesale agents

•Benefits from a category XII ‘A’ (Excellent) rating by A.M. Best

Pre-Tax Operating Income

($mm)

$113 $102 $98

$65

2006 2007 2008 2009

Combined Ratio

88.9% 89.3% 93.3% 99.6%

7.

|

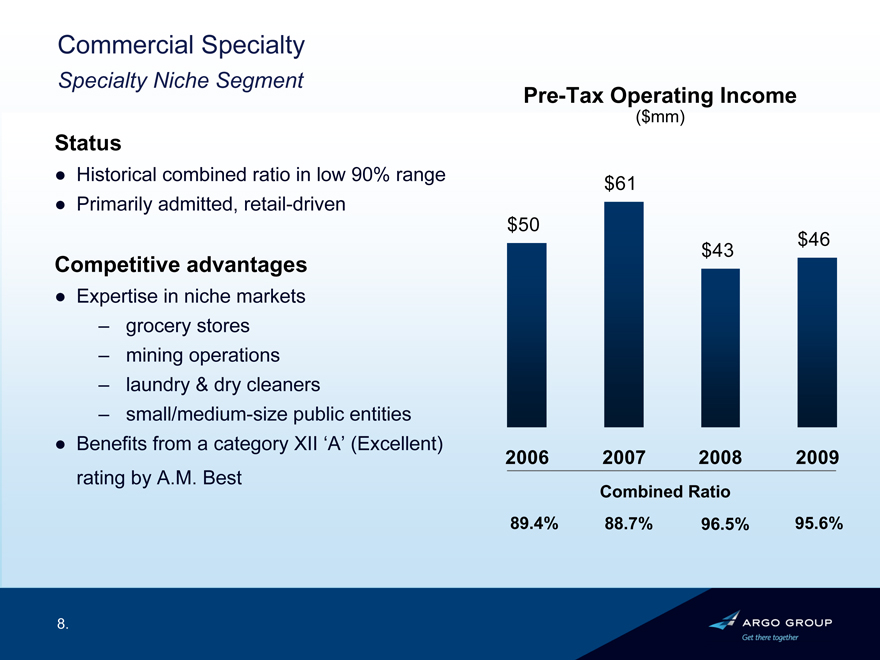

Commercial Specialty

Specialty Niche Segment

Status

•Historical combined ratio in low 90% range

•Primarily admitted, retail-driven

Competitive advantages

•Expertise in niche markets – grocery stores – mining operations – laundry & dry cleaners

– small/medium-size public entities

•Benefits from a category XII ‘A’ (Excellent) rating by A.M. Best

Pre-Tax Operating Income

($mm)

$61

$50 $46 $43

2006 2007 2008 2009 Combined Ratio

89.4% 88.7% 96.5% 95.6%

8.

|

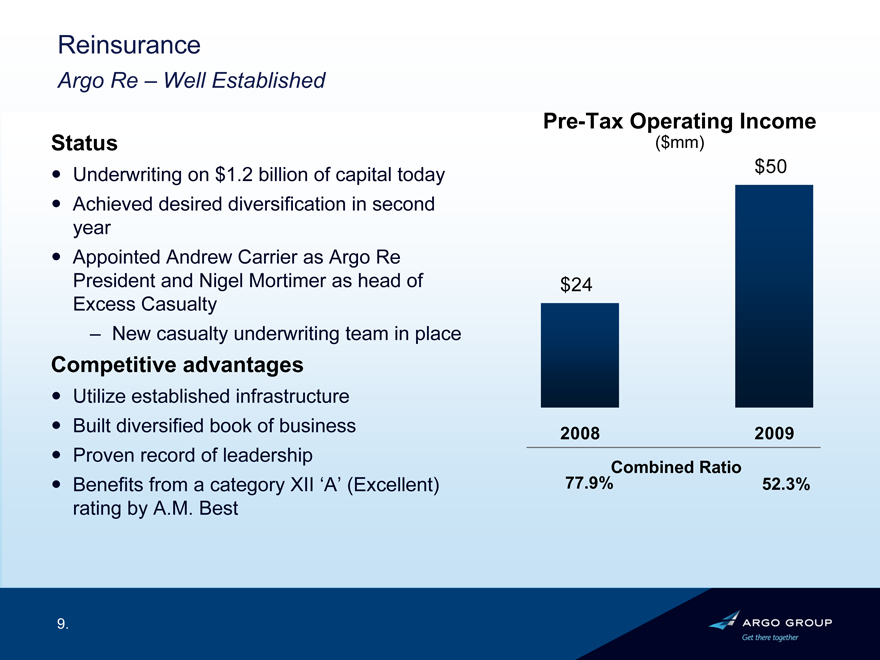

Reinsurance Argo Re – Well Established Status Underwriting on $1.2 billion of capital today Achieved desired diversification in second year

Appointed Andrew Carrier as Argo Re President and Nigel Mortimer as head of Excess Casualty – New casualty underwriting team in place Competitive advantages Utilize established infrastructure Built diversified book of business Proven record of leadership

Benefits from a category XII ‘A’ (Excellent) rating by A.M. Best Pre-Tax Operating Income ($mm) $50 $24 2008 2009 77.9%Combined Ratio 52.3% 9.

|

Argo International Lloyd’s Underwriting Agency Status

Acquired Heritage in May 2008 Appointed Julian Enoizi as CEO in June 2009 Worldwide property

– Direct and Facultative – North American and International Binding Authority Non-U.S. liability

– Professional indemnity – General liability Competitive advantages Specialist knowledge Access to decision makers

Carries the Lloyd’s market ratings of ‘A’ (Excellent) rating by A.M. Best, and ‘A+’ by S&P

Pre-Tax Operating Income ($mm) $24 $11 2008¹ 2009 Combined Ratio 102% 96% Note: 1Data is for the full year ending Dec. 31, 2008

10.

|

Combined Business Mix

Established platform to write business worldwide and penetrate niche markets

Specialty Insurance

• Excess & Surplus Lines

• Commercial Specialty

36% 56% 8%

Argo International (Lloyd’s)

• Worldwide property insurance

• Non-U.S. liability

As of December 31, 2009

Reinsurance/Insurance

• Quota share reinsurance of business partners

• Property reinsurance

• Excess casualty and professional liability insurance

11.

|

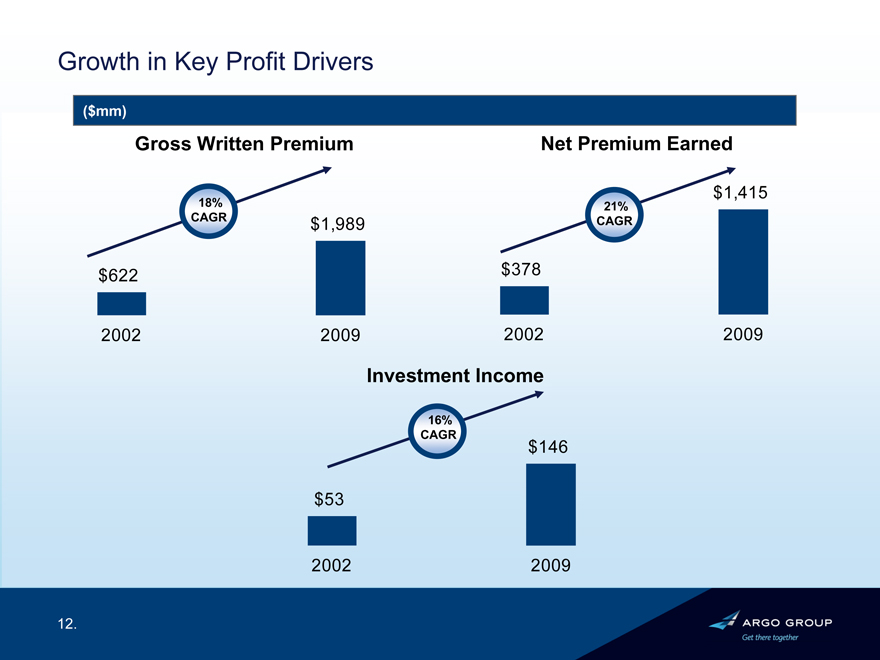

Growth in Key Profit Drivers

($mm)

Gross Written Premium

Net Premium Earned

18% CAGR

$1,989

$622

2002 2009

$1,415

21% CAGR

$378

2002 2009

Investment Income

16% CAGR

$146

$53

2002 2009

12.

|

Growth of Book Value

BVPS Growth Since 2002

$52.36

12.2%

CAGR

$45.15

$44.18

$39.08

$33.52

$30.36

$27.22

$23.40

2002

2003

2004

2005

2006

2007

2008

2009

* Book value per common share - outstanding, includes the impact of the Series A Mandatory Convertible Preferred Stock on an as if converted basis. Preferred stock had fully converted into common shares as of Dec. 31, 2007.

13.

|

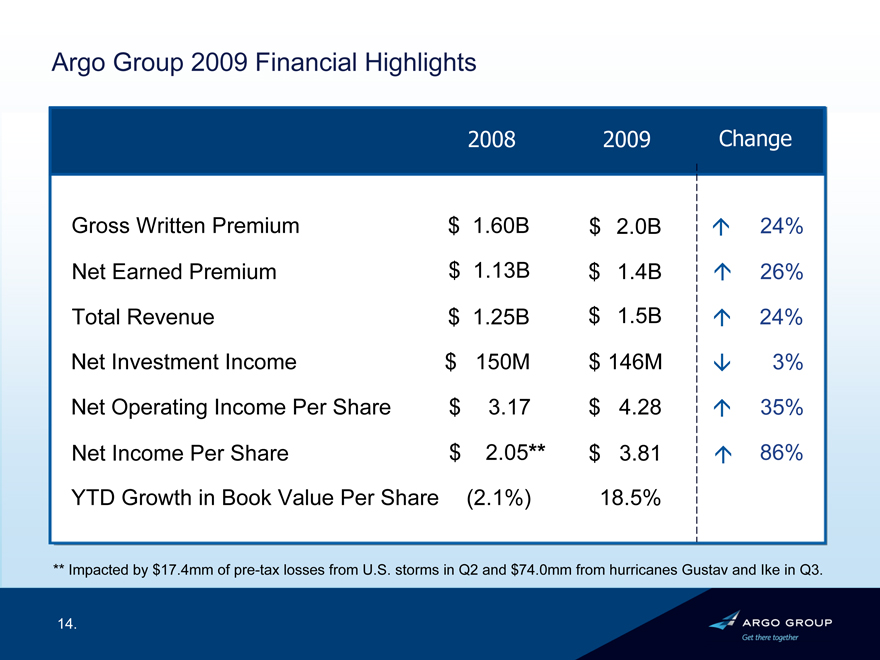

Argo Group 2009 Financial Highlights

2008 2009 Change

Gross Written Premium $ 1.60B $ 2.0B 24%

Net Earned Premium $ 1.13B $ 1.4B 26%

Total Revenue $ 1.25B $ 1.5B 24%

Net Investment Income $ 150M $ 146M 3%

Net Operating Income Per Share $ 3.17 $ 4.28 35%

Net Income Per Share $ 2.05** $ 3.81 86%

YTD Growth in Book Value Per Share(2.1%) 18.5%

** Impacted by $17.4mm of pre-tax losses from U.S. storms in Q2 and $74.0mm from hurricanes Gustav and Ike in Q3.

14.

|

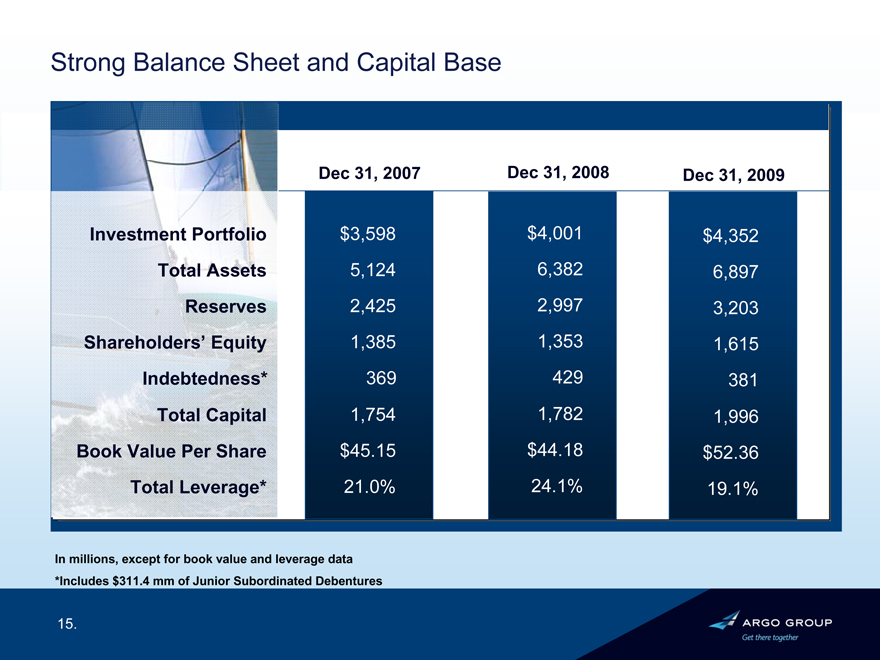

Strong Balance Sheet and Capital Base

Dec 31, 2007 Dec 31, 2008 Dec 31, 2009

Investment Portfolio $3,598 $4,001 $4,352

Total Assets 5,124 6,382 6,897

Reserves 2,425 2,997 3,203

Shareholders’ Equity 1,385 1,353 1,615

Indebtedness* 369 429 381

Total Capital 1,754 1,782 1,996

Book Value Per Share $45.15 $44.18 $52.36

Total Leverage* 21.0% 24.1% 19.1%

In millions, except for book value and leverage data

*Includes $311.4 mm of Junior Subordinated Debentures

15.

|

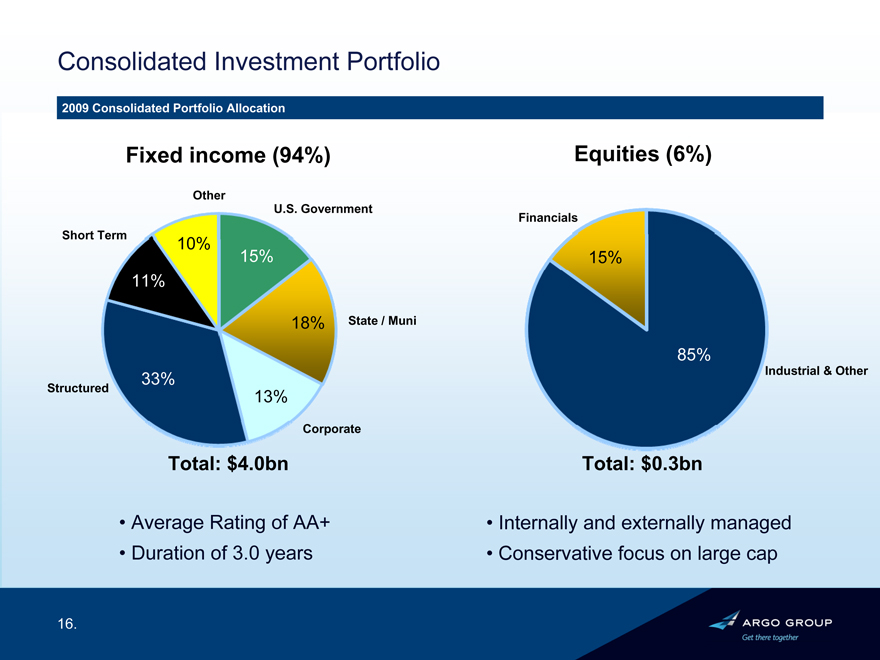

Consolidated Investment Portfolio

2009 Consolidated Portfolio Allocation

Total: $4.0bn

16.

Fixed income (94%)

Equities (6%)

Other

U.S. Government

Short Term

10%

15%

11%

18% State / Muni

33%

Structured

13%

Corporate

Financials

15%

85%

Industrial & Other

Total: $0.3bn

• Average Rating of AA+

• Duration of 3.0 years

• Internally and externally managed

• Conservative focus on large cap

|

Focus Areas for the Coming Year

Internal External

Investments in people Focus on clients

Investment in IT Focus on distribution partners

Expense savings Focus on the competitive environment

Controlled expansion in the US and

London

Levers to Drive a Profitable Organization

Premiums / Risk Selection

Investment Leverage / Yields

Financial Leverage / Capital Structure

Infrastructure Cost

17.

|

Why Argo?

• Broadly diversified insurance and reinsurance platform

• Deep product expertise in niche focus areas

• Proven track record of growth and profitability

• Proven ability to manage through insurance cycle

• Prudent risk management and controls

• Strong leadership

• Significant room for future growth

• ROE driven focus

18.

|

Thank you

Q&A