Investor Presentation November 2010 Exhibit 99.1 |

2. Forward-Looking Statements This presentation contains “forward-looking statements” which are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The forward-looking statements are based on the Company's current expectations and beliefs concerning future developments and their potential effects on the Company. There can be no assurance that actual developments will be those anticipated by the Company. Actual results may differ materially from those projected as a result of significant risks and uncertainties, including non-receipt of the expected payments, changes in interest rates, effect of the performance of financial markets on investment income and fair values of investments, development of claims and the effect on loss reserves, accuracy in projecting loss reserves, the impact of competition and pricing environments, changes in the demand for the Company's products, the effect of general economic conditions, adverse state and federal legislation, regulations and regulatory investigations into industry practices, developments relating to existing agreements, heightened competition, changes in pricing environments, and changes in asset valuations. The Company undertakes no obligation to publicly update any forward-looking statements as a result of events or developments subsequent to the presentation. |

3. Argo Group Today An international specialty underwriter of property/casualty insurance and reinsurance products Multinational underwriter with global reach 1,331 employees across five countries Total capitalization of $2.0 billion Operations conducted through four business segments Excess & Surplus Lines – U.S. wholesale distribution, top 10 in market share Commercial Specialty – U.S. niche retail distribution Reinsurance – Event driven business, 7.7% of group premium International Specialty – Lloyd’s syndicate Dedicated product development team A.M. Best Rating of A XII (Excellent) Risk exposure in 134 territories NASDAQ: AGII |

4. Our Strategy Deploy capital in the international specialty market for maximum return Provide our clients with insurance solutions by continuously focusing on new business development and organic growth Strategically grow our platform and gain access to new markets through acquisitions Dedicated to attracting top tier talent to leverage our platform Manage balance sheet risk by maintaining relatively low financial leverage and a prudent investment portfolio Maximize shareholder value through growth in book value per share |

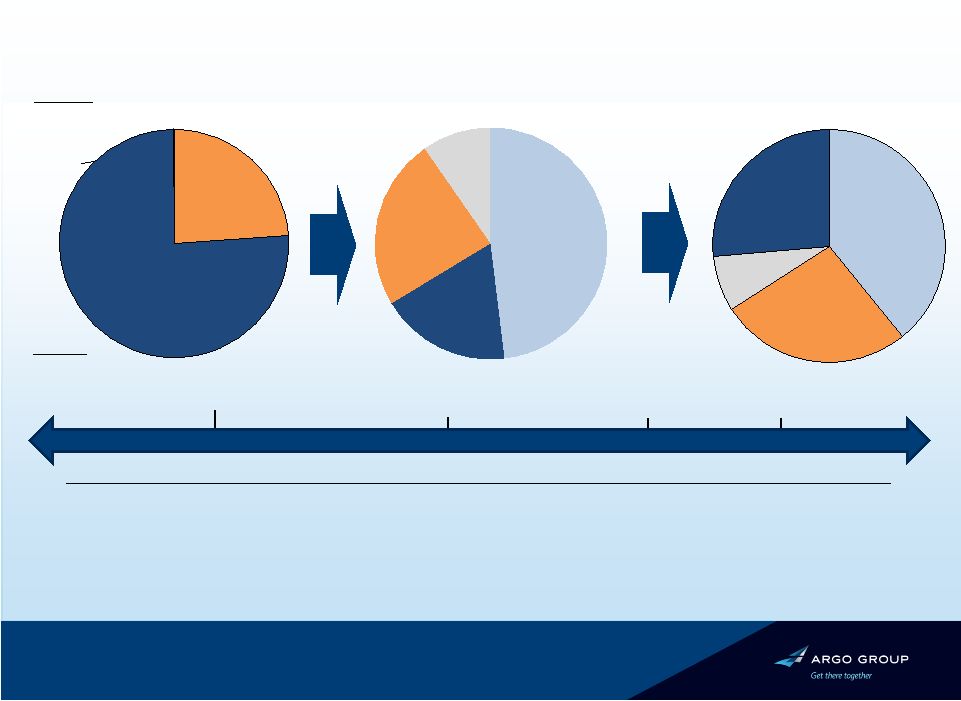

5. We have successfully diversified our portfolio and become a global specialty insurance underwriter 2004 2010 NEP Split 2000 Excess & Suprlus Lines, 48.1% Risk Management, 18.3% Specialty Commercial, 23.8% Public Entity, 9.7% Financial Highlights ($mm, except per share data) 2000 2004 (1) LTM 2010 Book Value per Share 23.03 30.36 58.30 Pre-tax Operating Income (2) (152.5) 55.5 101.7 Total Capital 501.1 716.8 2,001.4 Notes 1 Book value per common share includes impact of the Series A Mandatory Convertible Preferred Stock on an as if converted basis. 2 Excludes foreign currency exchange gains and losses and realized investment gains and losses. 2001 – Acquires Colony and Rockwood. Founds Trident 2007 – Completes merger with PXRE; Forms Argo Re 2008 – Rebranded Argo Group; Acquired Heritage and its Lloyd’s syndicate 2009 – Introduces Casualty and Professional Risks Division Timeline Excess & Surplus Lines, 39.2% Commercial Specialty, 26.6% Reinsurance, 7.7% International Specialty, 26.5% Specialty Commercial, 23.9% Specialty Workers' Compensation , 75.9% Public Entity, 0.2% |

6. Argo Today: What We Do Combined Ratio* Insureds Segment Profile * GWP and Combined Ratio for YTD 2010 % GWP* 74% Reinsurance • Insureds include US regional carriers and international multi- line carriers • Casualty clients are predominately US Fortune 1000 companies written on a primary basis • Argo Re (class 4 specialty reinsurance platform) • Provides property CAT reinsurance, excess casualty 13% Excess and Surplus Lines • Commercial Property and Casualty on a non-admitted basis • Distribution through wholesale agents and brokers 33% 99% • Representative insureds include restaurants, contractors, day care centers, apartment complexes, and others Commercial Specialty 101% 27% • Commercial Property and Casualty on an admitted basis • Distribution through select independent agents, brokers, wholesalers and program managers • Food and hospitality, specialty retail, grocery stores, mining industry and public entities Argo International • Argo Managing Agency plc • Short-tail risks with an emphasis on commercial property, and non-US professional indemnity insurance 110% 27% • Insureds include US and international small/medium commercial businesses, transportation, fine arts and specie and others |

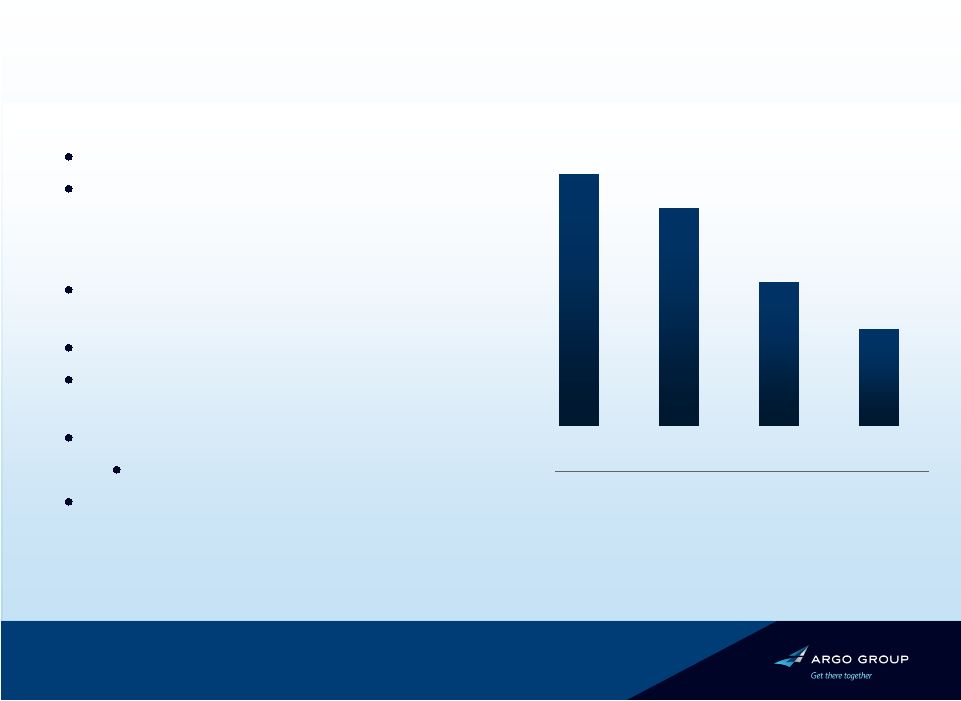

7. Pre-Tax Operating Income ($mm) Commercial Specialty Specialty Niche Segment Status Historical combined ratio in low 90% range Primarily admitted, retail-driven Competitive advantages Expertise in niche markets – grocery stores – mining operations – laundry & dry cleaners – small/medium-size public entities Benefits from a category XII ‘A’ (Excellent) rating by A.M. Best 89% 97% 96% Combined Ratio 101% |

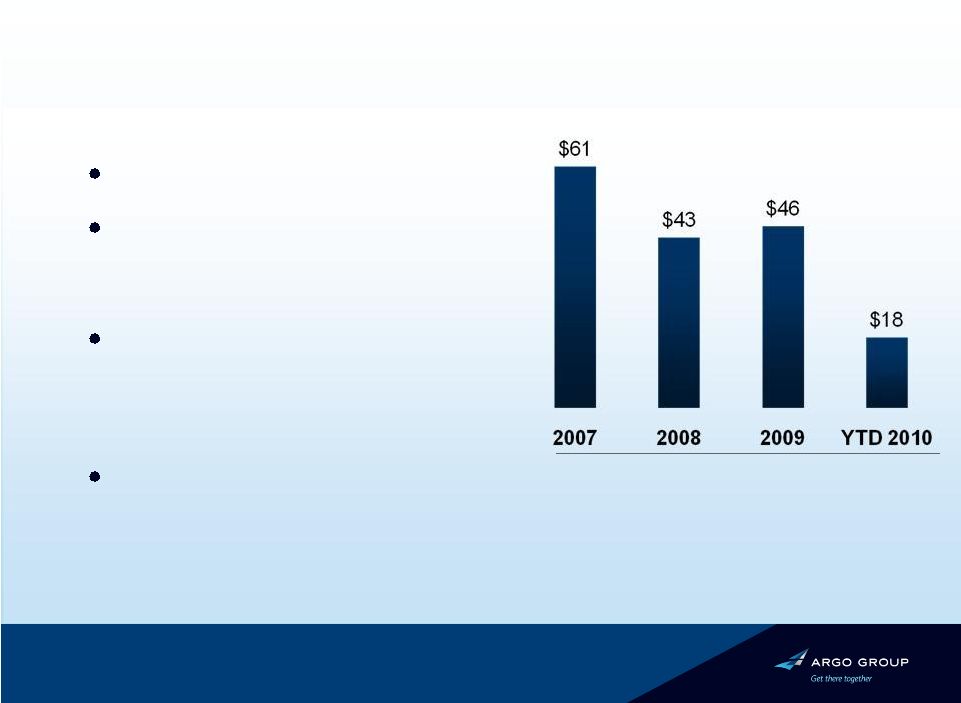

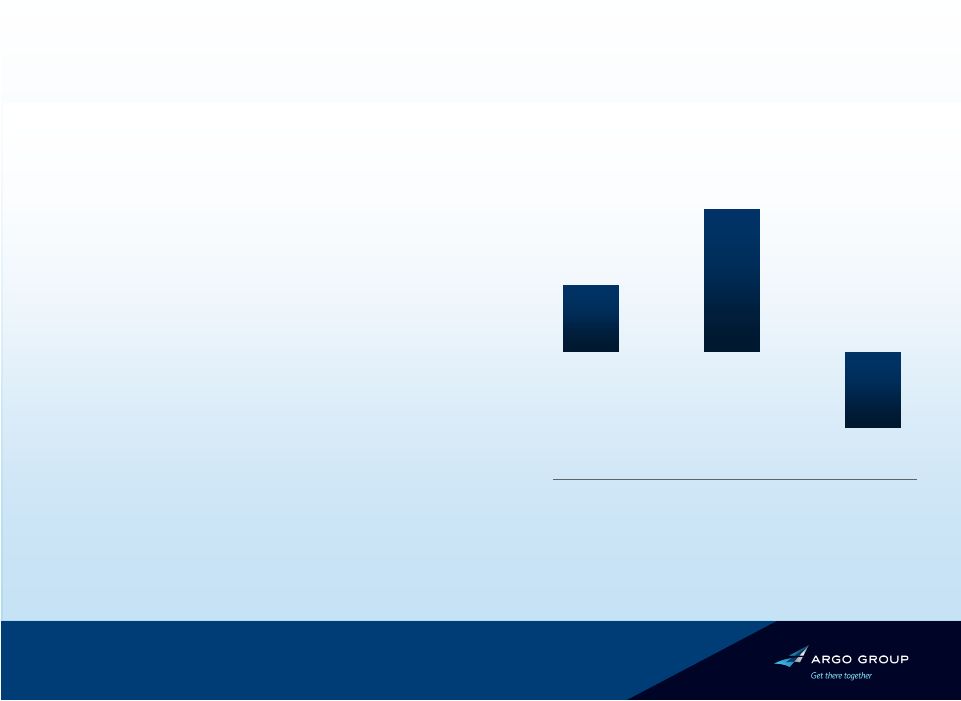

$113 $98 $65 $44 2007 2008 2009 YTD 2010 8. Pre-Tax Operating Income ($mm) Excess & Surplus Lines Largest and Most Profitable Segment Status Combined ratio 90% over cycle Colony, Argonaut Specialty & Argo Pro Competitive advantages Excellent infrastructure – broad geography Underwriting expertise Broad product portfolio for small account underwriters Controlled distribution Wholesale agents Benefits from a category XII ‘A’ (Excellent) rating by A.M. Best 99% Combined Ratio 89% 93% 100% |

$11 $24 ($13) 2008¹ 2009 YTD 2010² 9. Status • Acquired Heritage in May 2008 • Worldwide property • Direct and Facultative • North American and International Binding Authority • Non-U.S. liability • Professional indemnity • General liability Competitive advantages • Specialist knowledge • Carries the Lloyd’s market ratings of ‘A’ (Excellent) rating by A.M. Best, and ‘A+’ by S&P Argo International Lloyd’s Underwriting Agency 110%² 102% Pre-Tax Operating Income ($mm) Note: 1 Data is for the full year ending Dec. 31, 2008 2 Includes 9.2 points of catastrophe losses Combined Ratio 96% |

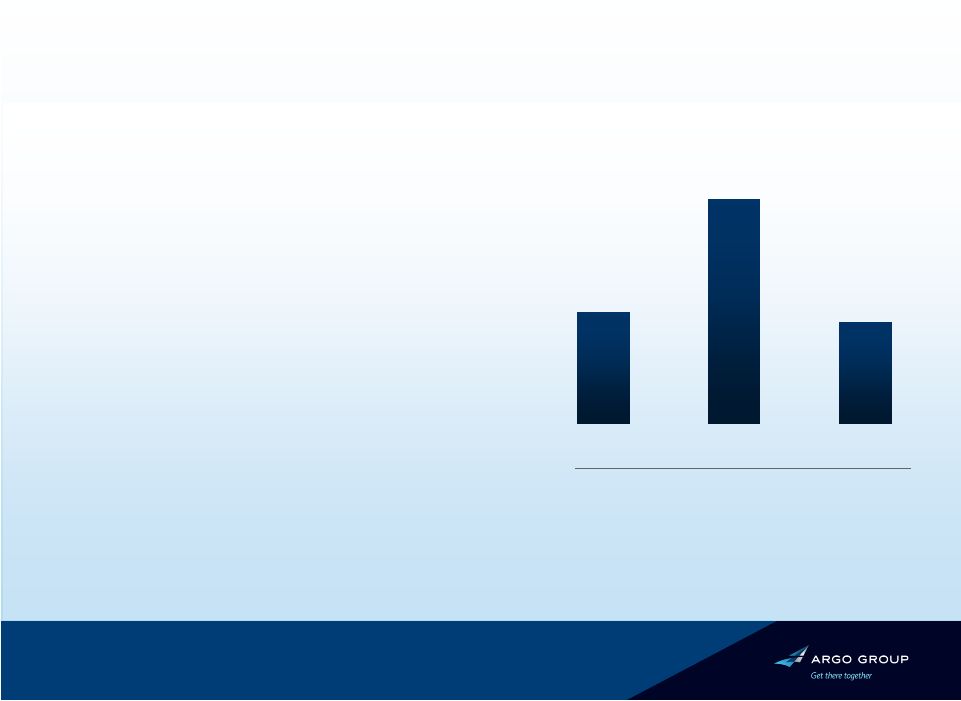

$25 $50 $23 2008 2009 YTD 2010 10. Status • Underwriting on $1.2 billion of capital today • Achieved desired diversification in second year • Appointed Andrew Carrier as Argo Re President and Nigel Mortimer as head of Excess Casualty Competitive advantages • Utilize established infrastructure • Built diversified book of business • Proven record of leadership • Benefits from a category XII ‘A’ (Excellent) rating by A.M. Best Reinsurance Argo Re – Well Established 74% 78% Pre-Tax Operating Income ($mm) Combined Ratio 52% |

11. Combined Business Mix – Established platform to write business worldwide and penetrate niche markets Reinsurance/Insurance Quota share reinsurance of business partners Property reinsurance Excess casualty and professional liability insurance 60% 13% 27% As of September 30, 2010 Worldwide property insurance Non-US Liability Excess & Surplus Lines Commercial Specialty Specialty Insurance |

12. Growth in Key Profit Drivers Net Premium Earned Gross Written Premium Investment Income 18% CAGR 21% CAGR 16% CAGR ($mm) $622 $1,989 2002 2009 $378 $1,415 2002 2009 $53 $146 2002 2009 |

13. $23.40 $27.22 $30.36 $33.52 $39.08 $45.15 $44.18 $52.36 $58.30 2002 2003 2004 2005 2006 2007 2008 2009 2010-Q3 * Book value per common share - outstanding, includes the impact of the Series A Mandatory Convertible Preferred Stock on an as if converted basis. Preferred stock had fully converted into common shares as of Dec. 31, 2007. Growth of Book Value BVPS Growth Since 2002 13% CAGR |

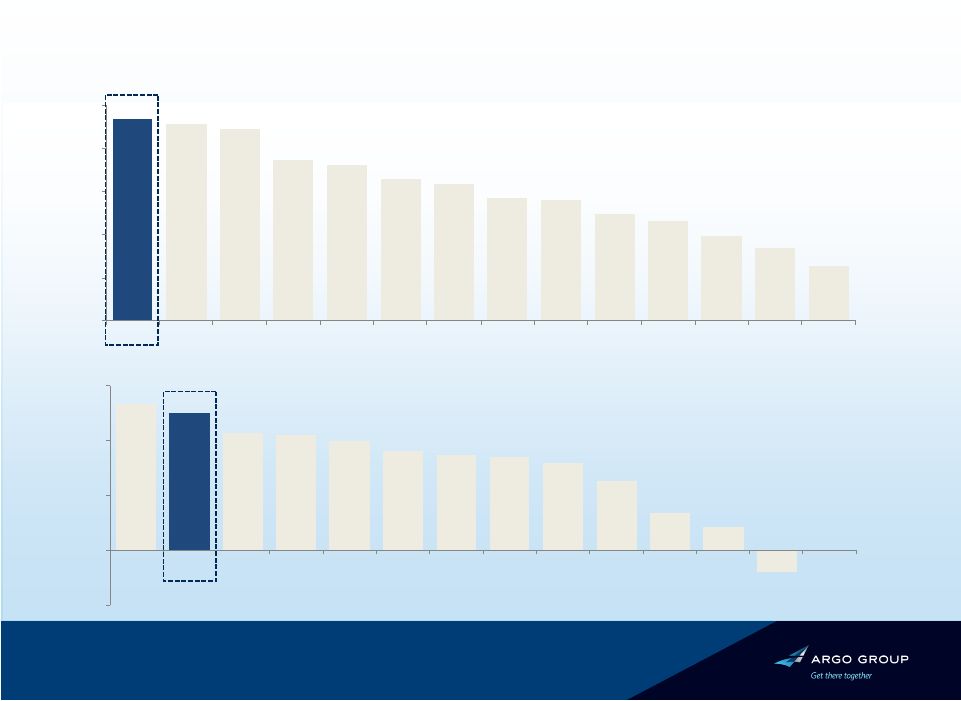

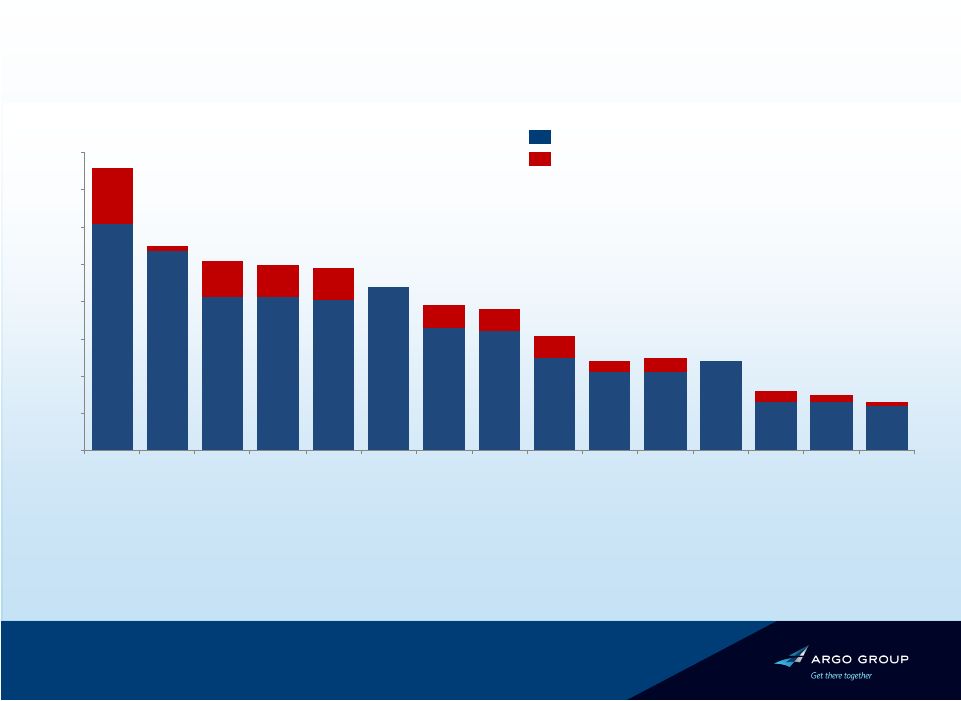

23.4% 22.8% 22.3% 18.6% 18.1% 16.4% 15.8% 14.2% 14.0% 12.4% 11.6% 9.8% 8.5% 6.3% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% AGII ALTE NAVG AHL HCC GBLI ACGL AXS WRB MKL ENH AWH RLI SIGI 14. Peer Comparison – Book Value and Book Value Per Share Growth Book Value Growth from 2002 – Q3 2010 Book Value Per Share Growth from 2002 – Q3 2010 13.3% 12.5% 10.7% 10.5% 9.9% 9.1% 8.7% 8.5% 7.9% 6.3% 3.4% 2.1% (2.0%) NA (5.0%) 0.0% 5.0% 10.0% 15.0% ACGL AGII AXS ENH AHL WRB NAVG HCC MKL RLI ALTE SIGI GBLI AWH |

6.1% 5.4% 4.1% 4.1% 4.1% 4.4% 3.3% 3.2% 2.5% 2.1% 2.1% 2.4% 1.3% 1.3% 1.2% 1.5% 0.2% 1.0% 0.9% 0.8% 0.6% 0.6% 0.6% 0.3% 0.4% 0.3% 0.2% 0.1% 7.6% 5.5% 5.1% 5.0% 5.0% 4.4% 3.8% 3.8% 3.1% 2.5% 2.4% 2.4% 1.6% 1.5% 1.3% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% VR MRH PTP RE FSR PRE RNR AHL TRH AXS AWH ENH AGII ACGL ALTE 15. Exceptional Catastrophe Exposure Management Chilean Earthquake / Windstorm Xynthia Ultimate Net Losses as a % of 12/31/09 Common Equity ($ in millions) 2 Initial Estimate Revised Estimate 2 1 3 1 1 1 4 2 5 2 6 Source: Company filings and press releases; losses are generally disclosed net of tax and net of reinstatement premiums. (1) Q2 net losses reflect only losses from the Chilean earthquake. Initial losses include the Chilean earthquake and Windstorm Xynthia. (2) Q2 net losses reflect Q1 estimates plus reported development, if any. (3) Initial loss estimate reflects 50% to 90% of Reuters consensus net operating earnings prior to the earthquake, based on disclosure that net income would remain positive for the quarter. (4) Initial estimates based on Chile and Xynthia, ultimate losses include the Chilean, Haitian, and Baja earthquakes, Xynthia and the Australian hailstorms. Based on international catastrophe losses being two-thirds of total catastrophe losses as disclosed in the earnings conference call. (5) Initial estimate is as of the first quarter conference call. Both initial and revised estimates reflect only the Chilean earthquake. (6) Pro forma; includes losses from Harbor Point and Max Capital prior to the merger. Expressed as a percentage of combined 12/31/09 equity prior to the special dividend. |

16. Argo Group 2009 Financial Highlights 2008 2009 Change Gross Written Premium 24% Net Earned Premium 25% Total Revenue 24% Net Operating Income Per Share 35% Net Income Per Share 86% ** Impacted by $17.4M of pre-tax losses from U.S. storms in Q2 and $74M from hurricanes Gustav and Ike in Q3. Net Investment Income 3% YTD Growth in Book Value Per Share $ 1.6B $ 1.1B $ 1.2B $ 3.17 $ 2.05** $ 150M (2.1%) $ 2.0B $ 1.4B $ 1.5B $ 4.28 $ 3.81 $ 146M 18.5% |

17. Argo Group 2010 Third Quarter Results 2009 Nine Months 2010 Nine Months Change Gross Written Premium $ 1.6B 25% Net Earned Premium $ 1.1B 15% Total Revenue $ 1.2B 8% Net Operating Income Per Share $ 4.07 54% Net Income Per Share $ 2.48 7% Net Investment Income $ 113M 11% YTD Growth in Book Value Per Share 15.5% $ 1.2B $ 937M $ 1.1B $ 1.86 $ 2.31 $ 101M 11.3% |

18. Strong Balance Sheet and Capital Base In millions except for book value and leverage data **Includes $311mm of Junior Subordinated Debentures Dec 31, 2008 2,997 24.1% 1,782 1,353 6,382 $3,995 429 $44.18 Dec 31, 2009 3,203 19.1% 1,996 1,615 6,897 $4,334 381 $52.36 Sep 30, 2010 3,230 1,675 6,676 $4,341 $58.30 374 2,049 18.3% Reserves Total Leverage* Total Capital Shareholders’ Equity Total Assets Investment Portfolio Indebtedness* Book Value Per Share |

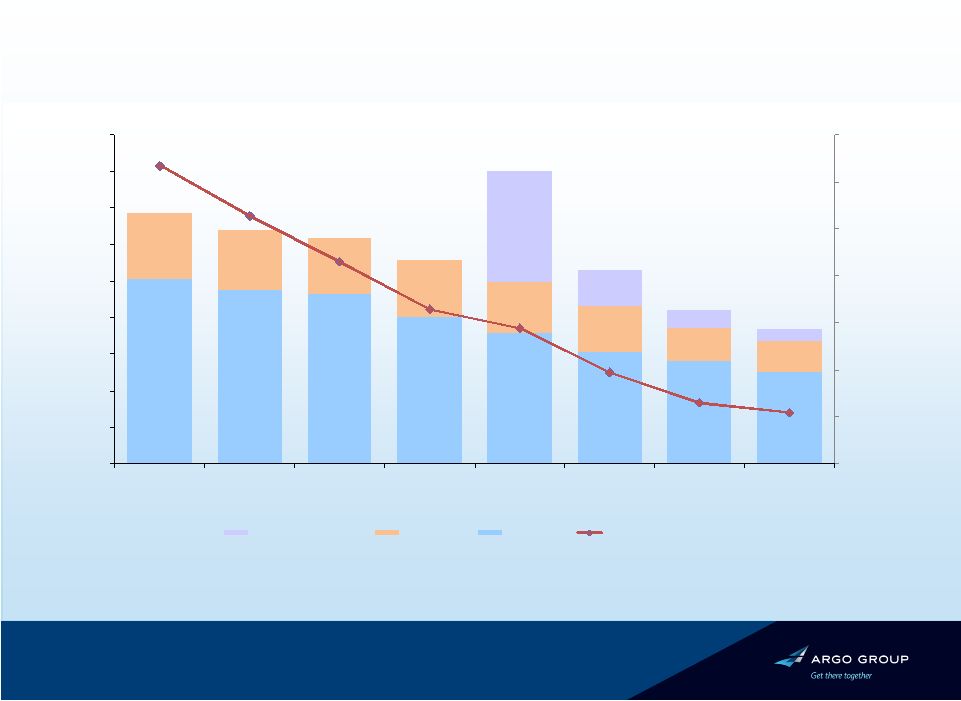

$505mm $476mm $463mm $402mm $357mm $306mm $280mm $249mm $180mm $162mm $154mm $157mm $141mm $125mm $93mm $86mm $302mm (a) $98mm $50mm $34mm 127.0% 105.7% 86.2% 66.0% 57.9% 39.1% 26.2% 22.0% 0.0% 20.0% 40.0% 60.0% 80.0% 100.0% 120.0% 140.0% $0.0 $100.0 $200.0 $300.0 $400.0 $500.0 $600.0 $700.0 $800.0 $900.0 2003 2004 2005 2006 2007 2008 2009 Q3 2010 PXRE Runoff A&E WC Net-Run-Off Reserves as a % Equity $685mm $617mm $638mm $529mm $801mm $559mm $423mm $369mm 19. Run-Off Reserves Net Run-Off Reserve Summary 2003- Q3 2010 (b) Note: WC represents Risk Management and A&E represents IROC; 12/31/2002 net runoff reserves were internally approximated to be $450mm for Risk Management and $245mm for IROC. (a) Includes $104.2mm of net reserves related to PXRE Reinsurance Company sold in 2008. (b) Risk Management Reserves include reserves for other run-off lines |

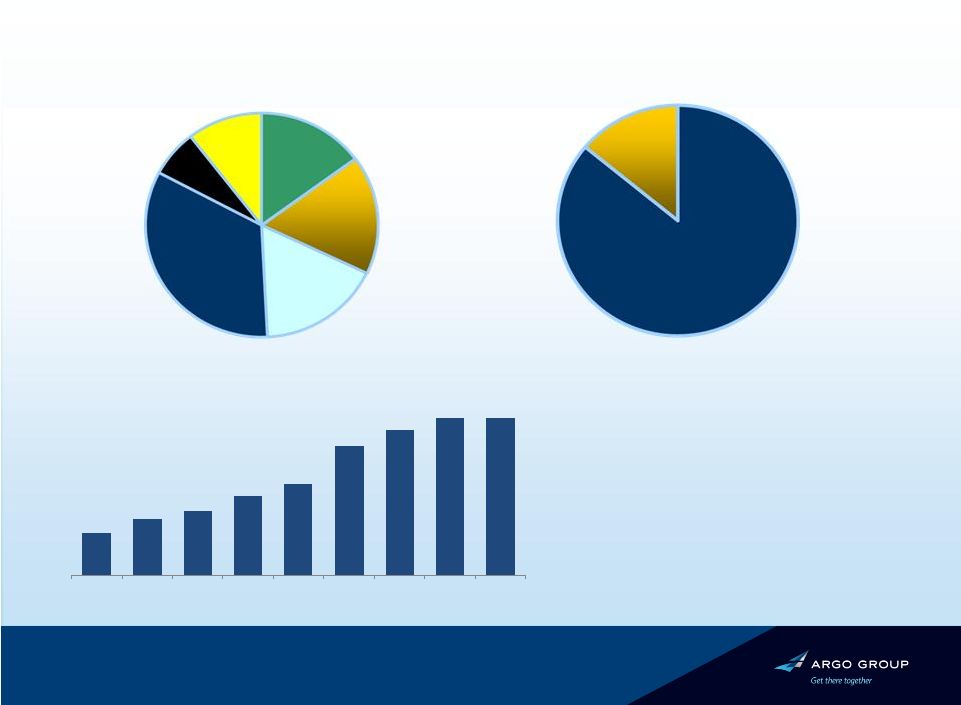

20. • Internally and externally managed • Conservative focus on large cap • Average Rating of AA • Duration of 3.2 years Invested Assets ($mm) $1,181 $1,553 $1,784 $2,173 $2,514 $3,556 $3,995 $4,334 $4,341 2002 2003 2004 2005 2006 2007 2008 2009 Q3 2010 Conservative Investment Portfolio Fixed income (94%) Equities (6%) Total: $3.9bn Total: $0.4bn 34% 15% 17% 17% 7% U.S. Government State / Muni Corporate Structured Short Term Other 10% Financials Industrial & Other 14% 86% |

21. Key Areas of Focus Going Forward • Improve our expense structure – Implementing a shared services model for our back office and non-core functions – Evaluating outsourcing opportunities • Capital management – constantly evaluating our capital structure to ensure we are adequately and efficiently capitalized • Investment portfolio – analyzing our risk-return threshold and allocating our investments accordingly to increase yield • New business development – prudently evaluating new specialty products and new geographies which will be accretive to ROE over time |

22. Why Argo? • Broadly diversified insurance and reinsurance platform • Deep product expertise in niche focus areas • Proven track record of growth and profitability • Proven ability to manage through insurance cycle • Prudent risk management and controls • Strong leadership • Significant room for future growth • ROE driven focus |

Thank you Q&A |