UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the registrantx Filed by a party other than the registrant¨

Check the appropriate box:

| ¨ | Preliminary proxy statement |

| ¨ | Confidential, for use of the Commission only (as permitted by Rule 14a-6(e) (2)) |

| x | Definitive proxy statement. |

| ¨ | Definitive additional materials. |

| ¨ | Soliciting material pursuant to Section 240.14a-12 |

ARGO GROUP INTERNATIONAL HOLDINGS, LTD.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of filing fee (check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11/ |

| | 1. | Title of each class of securities to which transaction applies: |

| | 2. | Aggregate number of securities to which transaction applies: |

| | 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4. | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | 1. | Amount Previously Paid: |

| | 2. | Form, Schedule or Registration Statement No.: |

Argo House

110 Pitts Bay Road

Pembroke HM 08, Bermuda

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

The Annual General Meeting (the “Annual General Meeting”) of Argo Group International Holdings, Ltd. (“Argo Group”), a Bermuda exempted company limited by shares, will be held on May 3, 2011 at 10:30 am local time at 110 Pitts Bay Road, Hamilton, Bermuda and at any adjournments or postponements thereof.

The Annual General Meeting is called for the following purposes:

| 1. | To elect three Class I directors to the Argo Group Board of Directors (the “Board” or “Board of Directors”) for a term of three years (Proposal 1); |

| 2. | To vote on a proposal to approve, on an advisory, non-binding basis, the compensation of our Named Executive Officers (Proposal 2); |

| 3. | To vote on a proposal to select, on an advisory, non-binding basis, the frequency of the shareholder vote on the compensation of our Named Executive Officers (Proposal 3); |

| 4. | To consider and approve the recommendation of the Audit Committee of our Board of Directors that Ernst & Young LLP be appointed as our independent auditors for the fiscal year ending December 31, 2011 and to refer the determination of the independent auditors’ remuneration to the Audit Committee of our Board of Directors (Proposal 4). |

The Board has fixed the close of business on March 11, 2011 as the record date for determining those shareholders who will be entitled to vote at the Annual General Meeting.

The vote of each shareholder is important. I urge you to access the proxy materials on the internet or to request an electronic or a paper copy of them as promptly as possible. This will ensure that you will be able to complete your proxy card in a timely manner so that your shares will be voted at the Annual General Meeting.

|

| By Order of the Board of Directors |

|

|

| David J. Doyle |

| Secretary |

March 14, 2011

WHETHER YOU PLAN TO BE PRESENT AT THE ANNUAL GENERAL MEETING OR NOT, YOU ARE REQUESTED TO SUBMIT YOUR PROXY EITHER ELECTRONICALLY OR, IF YOU REQUEST A PAPER COPY, BY COMPLETING, SIGNING AND RETURNING THE PROXY CARD TO ENSURE THAT YOUR SHARES WILL BE REPRESENTED.

TABLE OF CONTENTS

Argo House

110 Pitts Bay Road

Pembroke HM 08, Bermuda

PART 1

PROXY STATEMENT

This proxy statement is furnished in connection with the solicitation by Argo Group International Holdings, Ltd. (“Argo Group” or the “Company”) of the enclosed proxy to vote shares of Argo Group’s Common Shares (the “Common Shares”) at the Annual General Meeting of shareholders (the “Annual General Meeting”) to be held on May 3, 2011, at 10:30 am local time at 110 Pitts Bay Road, Hamilton, Bermuda and at any postponements or adjournments thereof.

As permitted by rules adopted by the SEC and by the statutory provisions of the Companies Act 1981 of Bermuda, Argo Group is making this proxy statement, the proxy card and the annual report to shareholders (the “proxy materials”) available to shareholders electronically via the Internet. A notice (the “Notice”) which includes instructions on how to access and review the proxy materials and how to submit your proxy online will be mailed to shareholders no later than March 24, 2011. Shareholders may request a printed copy of the proxy materials by following the instructions included in the Notice. In addition Argo Group will post copies of the 2010 Annual Report on Form 10-K and this proxy statement on its web site atwww.argolimited.com. The reference to Argo Group’s web site does not incorporate by reference the information contained in the web site and such information should not be considered a part of this proxy statement.

The Annual General Meeting to which the Notice and this proxy statement apply is being convened solely for the purposes discussed in this document. Shares represented by duly executed proxies in the accompanying form received before the Annual General Meeting will be voted at the Annual General Meeting. Any shareholder giving a proxy has the power to revoke it at any time before it is voted by filing with the Secretary of Argo Group either an instrument revoking the proxy or a duly executed proxy bearing a later date. Proxies may also be revoked by any shareholder present at the Annual General Meeting who expresses a desire to vote in person. If a shareholder specifies a choice on any matter to be acted upon by means of the ballot provided in the accompanying proxy, the shares will be voted accordingly. If no specification is made, the shares represented by the proxy will be voted in favor of the proposals set forth in this Notice.

Argo Group will bear the cost of preparing, assembling and mailing this Proxy Statement and the material enclosed herewith. Our directors, officers and employees may solicit proxies orally or in writing, without additional compensation. Argo Group will also request that banks, brokerage houses and other custodians, nominees and fiduciaries send proxy materials to the beneficial owners of Argo Group Common Shares and will, if requested, reimburse the record holders for their reasonable out-of-pocket expenses in so doing.

VOTING SECURITIES AND VOTING RIGHTS

Securities Outstanding

March 11, 2011 has been fixed as the record date for the determination of shareholders entitled to notice of and to vote at the Annual General Meeting or any adjournments or postponements thereof. On that date, there were 27,445,071 Common Shares issued, outstanding and entitled to vote. Argo Group has no other voting securities outstanding. Pursuant to Argo Group’s Bye-Laws, a majority of all the shares entitled to vote, present in person or represented by proxy, will constitute a quorum for the transaction of business at the Annual General Meeting.

Each shareholder of record is entitled to one vote per share held on all matters submitted to a vote of shareholders. Proposals in this proxy statement will be decided as follows:

| | 1. | In accordance with our Bye-Laws, proposals 1 and 4 will be decided by an ordinary resolution; that is, a resolution passed by a simple majority of votes entitled to vote on such matter cast in person or by proxy. |

1

| | 2. | Proposal 2 will be approved on an advisory, non-binding basis if it is passed by a simple majority of votes entitled to vote on such matter cast in person or by proxy. |

| | 3. | The option in Proposal 3 that receives the greatest number of votes cast in person or by proxy will be deemed to be the option selected by the shareholders on an advisory, non-binding basis. |

A resolution put to a vote at the Annual General Meeting will be decided on by a show of hands, unless a poll has been demanded pursuant to our Bye-Laws. Shares represented at the Annual General Meeting whose votes are withheld on any matter, shares that are represented by “broker non-votes” (that is, shares held by brokers or nominees that are represented at the Annual General Meeting but with respect to which the broker or nominee has not received voting instructions from the beneficial owner and is not empowered to vote on a particular proposal) and the shares that abstain from voting on any particular matter are not included in the tabulation of the shares voting on such matter, but are counted for quorum purposes. Member brokerage firms of the New York Stock Exchange, Inc. that hold shares in street name for beneficial owners, to the extent that such beneficial owners do not furnish voting instructions with respect to any or all proposals submitted for shareholder action, may vote in their discretion upon the proposal for the ratification of the appointment of Ernst & Young LLP.

Under our Bye-Laws, absent a Board waiver, no person is entitled to exercise voting power on a matter in excess of a maximum limitation of 9.5% of the votes conferred on all of our shares entitled to vote on such matter, after taking into consideration all votes held directly, indirectly, beneficially or through attribution.

CORPORATE GOVERNANCE

Director Independence

The Board of Directors has determined that each of its directors except Mark E. Watson III, the Chief Executive Officer of Argo Group, is “independent” in accordance with the applicable corporate governance listing standards of the Nasdaq Stock Market, Inc. (“Nasdaq”) as currently in effect.

Board Leadership Structure

The Board of Directors has chosen to separate the position of Principal Executive Officer (held by the Company’s Chief Executive Officer) from the position of Board Chairman. The Company believes that this separation of positions is the most appropriate structure for effectively dealing with both management and risk oversight because it creates a lead director that is independent from management whose job duties include, but are not limited to, chairing meetings of the independent directors.

Code of Business Ethics and Conduct

The Company has adopted a Code of Business Ethics and Conduct (the “Ethics Code”) that applies to all its directors, officers and employees, including the principal executive officer and the principal financial officer. A copy of the Ethics Code is available through the Company’s web site atwww.argolimited.com. In addition, copies of the Ethics Code can be obtained, free of charge, upon written request to Investor Relations, 110 Pitts Bay Road, Pembroke HM 08, Bermuda. Any amendments to or waivers of the Ethics Code that apply to the Company’s Board or its executive officers will be disclosed on the web site. The reference to the Company’s web site does not incorporate by reference the information contained in the web site and such information should not be considered a part of this proxy statement.

Committees and Meetings of the Board of Directors

During 2010, the standing Committees of the Board of Directors were the Executive Committee, the Audit Committee, the Investment Committee, the Human Resources Committee, and the Corporate Governance and Nominating Committee. The Board of Directors has no other committees. While Argo Group does not have a policy requiring directors to attend the Annual General Meeting, a meeting of the Board of Directors is customarily held on the same day as the Annual General Meeting and Argo Group encourages directors to attend the shareholder meeting. All of the directors attended the Company’s Annual General Meeting held in May of 2010.

During 2010, the Board of Directors met 4 times, the Executive Committee did not meet, the Audit Committee met 4 times, the Investment Committee met 5 times, the Human Resources Committee met 4 times, and the Corporate Governance and Nominating Committee met 3 times. During that time, all directors attended 75% or more of the meetings of the Board of Directors and of the Committees of the Board on which they served. The independent directors met in executive session 3 times.

2

Executive Sessions of Independent Directors

In order to promote open discussion among the independent directors, the Board of Directors schedules regular executive sessions, at least 2 times each year, in which those directors meet without management participation. Any interested party may contact the independent directors as a group by using the procedures set forth below under “Shareholder Communication with Board Members.”

Board Committees

Executive Committee

The Executive Committee consists of Messrs. Woods, De Leon, and Watson. The Executive Committee may exercise all powers and authority of the Board of Directors in the management of the business of the Company.

Audit Committee

The Audit Committee consists of Messrs. Browne, De Leon, Josephson, Maresh (until his retirement from the Board of Directors in May 2010), Power and Ms. Nealon (upon her appointment to the Board of Directors in February 2011), each of whom is “independent” as defined by Rule 4200(a)(15) of the Nasdaq’s listing standards, and also meets the additional independence and other requirements for audit committee membership under Rule 4350(d)(2) of those standards.

The Audit Committee assists the Board of Directors in its oversight of the quality and integrity of the accounting, auditing, and financial reporting processes of the Company. The Audit Committee is primarily responsible for, among other things, (a) review of quarterly and annual financial results and other financial information, (b) the appointment, replacement, compensation and oversight of independent auditors, (c) reviewing all recommendations of the auditors with respect to accounting methods and internal controls of the Company, (d) reviewing and approving in advance audit and non-audit services and reviewing the scope of the audits conducted by the auditors, and (e) overseeing the Company’s internal audit procedures. The Audit Committee’s role includes discussing with management, internal audit and the independent auditors the Company’s processes to manage its business and financial risk, and processes for compliance with significant applicable legal and regulatory requirements. The Board of Directors has adopted a written charter that specifies the scope of the Audit Committee’s responsibilities, which is available on the Company’s web site atwww.argolimited.com. The reference to the Company’s web site does not incorporate by reference the information contained in the web site and such information should not be considered a part of this proxy statement.

In connection with performing its oversight role related to the audited consolidated financial statements contained in the Company’s Annual Report on Form 10-K, the Audit Committee has:

| | • | | reviewed and discussed the audited consolidated financial statements with management and with representatives from Ernst &Young LLP (“E&Y”); |

| | • | | discussed with E&Y the matters required to be discussed by Statement on Auditing Standards No. 61 as amended (Communication With Audit Committees) as adopted by the Public Company Accounting Oversight Board (“PCAOB”); and |

| | • | | received from E&Y the written disclosures and the letter regarding E&Y’s independence as required byPCAOB Rule 3526,Communication with Audit Committees Concerning Independenceand discussed the independence of E&Y with representatives of E&Y. |

Based on these reviews and discussions, the Audit Committee recommended to the Board of Directors that the Company’s audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2010, for filing with the Securities and Exchange Commission.

AUDIT COMMITTEE:

Mural Josephson, Chairman

F. Sedgwick Browne

Hector De Leon

John R. Power, Jr.

Audit Committee Financial Expert

Mural Josephson is qualified as an “audit committee financial expert” within the meaning of applicable SEC rules and regulations governing the composition of the Audit Committee. In addition, the Audit Committee has determined that he has the appropriate experience and background to satisfy the “financial sophistication” requirements of Nasdaq’s listing standards.

3

Investment Committee

The Investment Committee consists of Messrs. Cash, El-Hage (upon his appointment to the Board of Directors in February 2011), Tonelli, Watson and Woods. The Investment Committee sets the Company’s investment policy. All investment transactions are ratified by the full Board of Directors. The Board of Directors has adopted a written charter for the Investment Committee that specifies the scope of the Investment Committee’s responsibilities, which is available on the Company’s web site atwww.argolimited.com. The reference to the Company’s web site does not incorporate by reference the information contained in the web site and such information should not be considered a part of this proxy statement.

Human Resources Committee

The Human Resources Committee consists of Messrs. Browne, Cash, De Leon, Power and Woods, each of whom is “independent” in accordance with the applicable corporate governance listing standards of Nasdaq as currently in effect. Discussions of the Human Resources Committee’s role and the Company’s Compensation Philosophy begin on page 17. The Board of Directors has adopted a written charter that specifies the scope of the Human Resources Committee’s responsibilities, which is available on the Company’s web site atwww.argolimited.com. The reference to the Company’s web site does not incorporate by reference the information contained in the web site and such information should not be considered a part of this proxy statement.

Human Resources Committee Interlocks and Insider Participation

None of the members of the Human Resources Committee during the fiscal year 2010 or as of the date of this proxy statement is or has been an officer or employee of the Company and no executive officer of the Company served on the Human Resources Committee or board of any company that employed any member of the Company’s Human Resources Committee or Board of Directors.

Board Risk Oversight

The Board of Directors is responsible for overseeing the Company’s risk policies including, but not limited to, oversight of its risk tolerance and appetite. Risk management is a collaborative effort of management, the Company’s Board of Directors and key functions within the Company that are focused on risk, including risks associated with the Company’s compensation plans.

The Company’s risk oversight framework begins at the departmental level. Each business department is charged with the task of identifying, assessing, measuring, monitoring, reporting, and mitigating risks associated with the department’s respective functions and responsibilities. The Company’s Risk Committee, consisting of senior management including the Company’s Chief Executive Officer and its Chief Financial Officer, plays a key role in risk oversight by coordinating, facilitating, and overseeing the effectiveness and integrity of the Company’s risk management activities. The Risk Committee is also charged with establishing the methodology and tools used to identify and evaluate risks and, where risks are outside the Company’s risk appetite, ensuring that there is an appropriate response. The Company’s Chief Risk Officer reports to the Risk Committee. The Company’s Internal Audit department provides another level of risk oversight by independently assessing the effectiveness of the Company’s risk management processes and practices including the risks associated with the Company’s compensation plans and by providing timely feedback on the effectiveness of the Company’s risk oversight process. The Vice President of Internal Audit reports directly to the Audit Committee.

The Company believes that the foregoing corporate risk oversight framework is structured in a way that enables the Company to take an active approach to risk management. Through the efforts of management, the Company’s internal risk oversight functions and the Board of Directors, the Company believes it is able to limit unnecessary risks while accepting certain other risks which may be beneficial to the Company and its shareholders.

Corporate Governance and Nominating Committee

The Corporate Governance and Nominating Committee consists of Messrs. Browne, Power and Woods, each of whom is “independent” in accordance with the applicable director independence standards of Nasdaq as currently in effect. The purpose of the Corporate Governance and Nominating Committee is to establish criteria for Board member selection and retention, to identify individuals qualified to become Board members, and to recommend to the Board of Directors the individuals to be nominated and re-nominated for election as directors. The Board of Directors has adopted Corporate Governance Guidelines and a written charter for the Corporate Governance and Nominating Committee that specifies the scope of the Committee’s responsibilities, copies of which are available on the Company’s web site atwww.argolimited.com. The reference to the Company’s web site does not incorporate by reference the information contained in the web site and such information should not be considered a part of this proxy statement.

Director Qualifications and Diversity

The Corporate Governance and Nominating Committee assesses several factors when evaluating director nominees including, but not limited to, the current needs of the Board and the nominee’s: (i) integrity, honesty and accountability; (ii) successful leadership experience and strong business acumen; (iii) forward-looking, strategic focus; (iv) collegiality; (v) independence and absence of conflicts of interests; and (vi) ability to devote necessary time to meet director responsibilities. The

4

Corporate Governance and Nominating Committee will ultimately recommend nominees that it believes will enhance the Board’s ability to oversee, in an effective manner, the management of the affairs and business of the Company and to monitor its evolution into a complex, global enterprise. While the Corporate Governance and Nominating Committee does not have a formal policy with regard to the consideration of diversity in identifying director nominees, the Corporate Governance and Nominating Committee seeks a diverse and appropriate balance of members who have the experience, qualifications, attributes and skills that are necessary to oversee a publicly traded, financially complex, growth oriented, international organization that operates in multiple regulatory environments when considering the overall composition of the Board. In addition, the Corporate Governance and Nominating Committee seeks directors with experience in a variety of professional disciplines and business ventures that can provide diverse perspectives on the Company’s operations. The Committee evaluates the types of backgrounds that are needed to strengthen and balance the Board based on the foregoing factors and will nominate candidates to fill vacancies accordingly. For a discussion of the specific experiences, qualifications, attributes or skills that led the Corporate Governance and Nominating Committee to conclude that each director should serve on the Company’s Board of Directors, see the biographical information section beginning on page 8.

Process for Nominating Directors

The Corporate Governance and Nominating Committee identifies director nominees from various sources such as officers, directors, shareholders and third party consultants to assist in identifying and evaluating potential nominees. The Corporate Governance and Nominating Committee will consider and evaluate a director candidate recommended by a shareholder in the same manner as a candidate recommended by a current director.

Shareholders wishing to recommend a director candidate to serve on the Board may do so by providing advance written notice to the Company. To make a director nomination at the 2012 Annual General Meeting, a shareholder must follow the same procedures required for submitting a shareholder proposal. See “Shareholder Proposals for 2012 Annual General Meeting” beginning on page 33. Notices should be sent to Argo Group International Holdings, Ltd. c/o David J. Doyle, Secretary, Clarendon House, 2 Church Street, Hamilton HM 11, Bermuda. The notice must set forth: (a) the name and address of the shareholder who intends to make the nomination and of the person or persons to be nominated; (b) the number and class of all shares of each class of capital shares of the Company beneficially owned by the person or persons to be nominated; (c) a representation that the nominating shareholder is a shareholder of record of the Company’s shares entitled to vote at such meeting, including setting forth the number and class of all shares of each class of capital shares of the Company beneficially owned by the nominating shareholder, and that he or she intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice; (d) a description of all arrangements or understandings between the shareholder and each nominee and any other person or persons (naming such person or persons) pursuant to which the nomination or nominations are to be made by the shareholder; (e) such other information regarding each nominee proposed by such shareholder as would be required to be included in a proxy statement filed pursuant to the proxy rules of the United States SEC, had the nominee been nominated, or intended to be nominated, by the Board; and (f) the signed consent of each nominee to serve as a director of the Company if so elected. The presiding officer of the Annual General Meeting may refuse to acknowledge the nomination of any person not made in compliance with the foregoing procedure.

Shareholder Communication with Board Members

The Company has a process for shareholders to communicate with the Board of Directors, a specific director or the non-management or independent directors as a group. Shareholders may send written communications to Argo Group International Holdings, Ltd. c/o David J. Doyle, Secretary, Clarendon House, 2 Church Street, Hamilton HM 11, Bermuda. The Secretary will review the communication and forward such communication to the individual director or directors to whom the communication is directed, if any. If the communication does not specify a recipient, the Secretary will forward it to the full Board of Directors or to the director or directors the Secretary believes is most appropriate.

Related Person Transactions

Policy for Evaluating Related Person Transactions

The Board of Directors has adopted a written policy relating to the Audit Committee’s review and approval of transactions with related persons that are required to be disclosed in proxy statements by SEC regulations (“related person transactions”). A “related person” is defined under the applicable SEC regulation and includes our directors, executive officers and 5% or more beneficial owners of our Common Shares. Management administers procedures adopted by the Board of Directors with respect to related person transactions and the Audit Committee reviews and approves all such transactions. At times, it may be advisable to initiate a transaction before the Audit Committee has evaluated it, or a transaction may begin before discovery of a related person’s participation. In such instances, management consults with the Chairman of the Audit Committee to determine the appropriate course of action. Approval of a related person transaction requires the vote of the majority of disinterested directors on the Audit Committee. In approving any related person transaction, the Audit Committee must determine that the transaction is fair and reasonable to the Company. The Audit Committee periodically reports on its activities to the Board of Directors. The written policy relating to the Audit Committee’s review and approval of related person transactions is available on our web site under “Corporate Governance” atwww.argolimited.com. The reference to the Company’s web site does not incorporate by reference the information contained in the web site and such information should not be considered a part of this proxy statement.

5

The Audit Committee has determined that there were no related person transactions with the Company during 2010.

BENEFICIAL OWNERSHIP

Security Ownership of Principal Shareholders and Management

The following table sets forth certain information regarding the beneficial ownership of Argo Group common shares (“Common Shares”) as of March 11, 2011 of each person known to Argo Group to beneficially own more than 5% of the Common Shares.

| | | | |

| | | Common Shares (1) |

Name and Address of Beneficial Owner | | Number of Shares

Beneficially Owned | | Percent of Class |

Wells Fargo & Company / MN

420 Montgomery Street

San Francisco, CA 94104 | | 2,611,599 | | 9.52% |

Dimensional Fund Advisors LP

Palisades West

6300 Bee Cave Road, Building One

Austin, TX 78746 | | 2,134,994 | | 7.78% |

BlackRock, Inc.

40 East 52nd Street

New York, NY 10022 | | 1,909,677 | | 6.96% |

| (1) | The information in this table is based on information reported on a Schedule 13G filed with the Securities and Exchange Commission as of 12/31/2010. |

| | • | | The Wells Fargo & Company Form 13G was filed on behalf of a number of its subsidiaries. Certain of these shares are shared in terms of voting and /or dispositive power by various subsidiaries including with Wells Capital Management Incorporated and is the aggregate amount owned beneficially by each. |

| | • | | The BlackRock, Inc. Form 13G was filed on behalf of a number of its subsidiaries including Barclays Global Investors. |

| | • | | Dimensional Fund Advisors LP, an investment adviser registered under Section 203 of the Investment Advisors Act of 1940, furnishes investment advice to four investment companies registered under the Investment Company Act of 1940, and serves as investment manager to certain other commingled group trusts and separate accounts (such investment companies, trusts and accounts, collectively referred to as the “Funds”). In certain cases, subsidiaries of Dimensional Fund Advisors LP may act as an adviser or sub-adviser to certain Funds. In its role as investment advisor, sub-adviser and/or manager, neither Dimensional Fund Advisors LP or its subsidiaries (collectively, “Dimensional”) possess voting and/or investment power over the securities of the Issuer that are owned by the Funds, and may be deemed to be the beneficial owner of the shares of the Issuer held by the Funds. However, all securities reported in the Schedule 13 are owned by the Funds. Dimensional disclaims beneficial ownership of such securities. |

6

The following table sets forth certain information regarding the beneficial ownership of the Common Shares as of March 11, 2011 of (i) each director of Argo Group, (ii) each individual who has been identified as a Named Executive Officer (“Named Executive Officer” or “NEO”) of Argo Group or its subsidiaries, and (iii) all directors and individuals who have been identified as NEOs of Argo Group or its subsidiaries as a group:

| | | | | | | | |

Name of Beneficial Owner | | Number of Shares

Beneficially Owned (1) (2) | | | Percent of

Class (1) | |

Gary V Woods | | | 21,333 | | | | * | |

F Sedgwick Browne | | | 19,089 | | | | * | |

H Berry Cash | | | 19,262 | | | | * | |

Hector De Leon | | | 19,783 | | | | * | |

Mural R Josephson | | | 15,607 | | | | * | |

John R Power, Jr | | | 20,684 | | | | * | |

John H. Tonelli | | | 5,000 | | | | * | |

Mark E Watson III | | | 558,484 | | | | 2.03 | % |

Jay S. Bullock | | | 75,398 | | | | .27 | % |

Julian Enoizi | | | 9,090 | | | | * | |

Barbara C Bufkin | | | 77,541 | | | | .28 | % |

Total(a) | | | 841,271 | | | | 3.07 | % |

(a) All directors and individuals identified as senior executives of Argo Group and its subsidiaries as a group (11 persons) | | | | | | | | |

| * | Less than .1% of the outstanding Common Shares |

| (1) | The information in this table is based on information supplied directly to Argo Group by directors and on information reported on Forms 3, 4 or 5 or on any Schedule 13G filed with the Securities and Exchange Commission. A person is deemed to be the beneficial owner of shares if such person, either alone or with others, has the power to vote or to dispose of such shares. Shares beneficially owned by a person include shares to which the person has the right to acquire beneficial ownership within 60 days of the Record Date, including stock options that were exercisable on March 11, 2011 or that become exercisable within 60 days after March 11, 2011. Unless otherwise indicated in the footnotes below, the persons and entities named in this table have sole voting and dispositive power with respect to all shares beneficially owned, subject to community property laws where applicable. Mr. El-Hage and Ms. Nealon, who became directors in February 2011, did not own any Argo common shares as of March 11, 2011. |

| (2) | Includes the following shares to which the person has the right to acquire beneficial ownership within 60 days, including stock options that were exercisable on March 11, 2011 or that become exercisable within 60 days after March 12, 2011: Mr. Woods – 16,742; Mr. Browne – 16,357; Mr. Cash – 16,742, Mr. De Leon – 16,742; Mr. Josephson – 14,857, Mr. Power – 16,742; Mr. Tonelli – 5,000; Mr. Watson – 277,657; Mr. Bullock – 52,839; Ms. Bufkin – 64,998 and Mr. Enoizi – 10,750. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), requires directors, executive officers and holders of more than 10% of Common Shares to file with the Securities and Exchange Commission reports regarding their ownership and changes in ownership of Argo Group’s securities. Argo Group believes that during 2010 all reports for the registrant’s executive officers, directors and 10% shareholders that were required to be filed under Section 16(a) of the Exchange Act were timely filed.

7

PROPOSAL 1

ELECTION OF DIRECTORS

Our Bye-Laws provide for the election of directors by our shareholders. Each class of directors serves for a term of three (3) years. In accordance with the Bye-Laws, our Board of Directors is divided into three classes (Classes I, II and III). The classes are determined by dividing the number of directors by 3. If this results in a whole number, there will be an equal number of directors in each class. If this results in a fraction of 1/3, one additional director will be placed into Class III. If this results in a fraction of 2/3 one director will be placed into Class II and one into Class III. The Company’s Bye-Laws further provide that the Board may re-designate directors to different classes so that they conform to the preceding formula. A classified board structure is common among Bermuda domiciled companies and is consistent with the board structure of the Company’s peer group.

Three Class I directors are to be elected at the 2011 Annual General Meeting. The Committee has nominated H. Berry Cash, John R. Power, Jr. and Mark E. Watson III to stand for reelection. Mr. Cash and Mr. Watson are both presently serving on the Board. as Class I directors. Mr. Power is presently serving on the Board as a Class II director and was reclassified as a Class I director this year. If elected, the three nominees will serve as Class I directors for three-year terms until the Annual General Meeting of shareholders in 2014 or until their successors have been elected and qualified. It is intended that proxies will be voted in favor of these persons. If, for any reason, any of the nominees is not able or willing to serve as a director when the election occurs (a situation which is not presently contemplated), it is intended that the proxies will be voted for the election of a substitute nominee in accordance with the judgment of the proxy holder.

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE FOR THE ELECTION OF THE NOMINEES LISTED ABOVE AS DIRECTORS AND, UNLESS DIRECTED OTHERWISE, IT IS THE INTENTION OF THE PROXIES NAMED IN THE FORM OF PROXY THAT ACCOMPANIES THIS PROXY STATEMENT TO VOTE FOR SUCH NOMINEES AS DIRECTORS.

Biographical information for the three Class I nominees to be elected this year:

H. Berry Cash (72) became a director of the Company immediately following the merger of Argonaut Group and PXRE in August 2007. Mr. Cash had been a director of Argonaut since May 2005. Mr. Cash has been a general partner of InterWest Partners, a venture capital fund, since 1985. Mr. Cash has also served on the board of directors of Ciena Corporation since April 1994, Silicon Laboratories Inc. since December 1997, and First Acceptance Corporation since November 1996. Mr. Cash also served as a director of i2 Technologies, Inc. from January 1996 until April of 2009. In addition to his capital raising experience, Mr. Cash brings to the Board a strong background in information technology, which plays an integral role in the Company’s operations. Due to his experience in the venture capital sector, Mr. Cash also brings perspectives to the Board associated with the capitalization and management of organizations through the corporate life cycle.

John R. Power, Jr. (55) became a director of the Company immediately following the merger of Argonaut Group and PXRE in August 2007. Mr. Power had been a director of Argonaut since January 2000. He is currently President of the Patrician Group, a private investment firm located in Lisle, Illinois. Mr. Power has also been a director of certain financial subsidiaries of CNH Global, N.V. since January 1997. Mr. Power brings to the Board skills and attributes derived from a finance and commercial and investment banking background. In addition, due to his past and present service as a director of other publicly traded companies, Mr. Power has experience with the design and implementation of effective compensation programs that benefit the Company in his role as Chair of the Human Resources Committee. Mr. Power’s prior service on the audit and executive committees of other publicly traded companies gives him a range of experiences and skills that compliment his current committee assignments with the Company.

Mark E. Watson III (46) became a director of the Company immediately following the merger of Argonaut Group and PXRE in August 2007. He has been President and Chief Executive Officer of Argo Group since the merger. He was President and Chief Executive Officer of Argonaut from January 2000 until the merger after having joined Argonaut as a director in June of 1999. He was a principal of Aquila Capital Partners, a San Antonio, Texas-based investment firm from 1998 to 1999 and served from 1992 to 1997 as a director and Executive Vice President, General Counsel and Secretary of Titan Holdings, Inc., a publicly traded property and casualty insurance holding company. Prior to that, Mr. Watson was an attorney with the New York based law firm Kroll & Tract from 1989 to 1992 where he represented international insurance and reinsurance companies. Due to his lengthy tenure, having previously held several executive positions at Titan Holdings, Inc. which was ultimately sold to USF&G Specialty Insurance Company, Mr. Watson brings to the Board a wealth of experience in the specialty property and casualty insurance sector. In his role as President and Chief Executive Officer of the Company, Mr. Watson brings to the Board critical insight into the Company’s operating environment and growth strategy. Mr. Watson has been a member of the Board of Governors of the Property Casualty Insurers Association of America since June 2005 and has been a director of Houston International Insurance Group, Ltd. since December 22, 2010.

8

Biographical information for the directors whose terms will expire in 2012 and 2013:

The following biographical information is for the three Class II directors whose terms will expire in 2012:

Nabil N. El-Hage (52) was appointed as a director of the Company in February 2011. Mr. El-Hage is an independent consultant specializing in the corporate governance area. During 2009 and 2010, Mr. El-Hage served as Senior Associate Dean for External Relations and an Adjunct Professor of Business Administration at Harvard Business School; from 2005 until June 2009, Mr. El-Hage had been a Professor of Management Practice at Harvard Business School in the Finance Area. From January 2003 to June 2005, he was a Senior Lecturer at Harvard Business School. Mr. El-Hage originally joined the faculty of Harvard Business School in 1984. Prior to 2003, Mr. El-Hage gained experience in venture capital with TA Associates, Levant Capital Partners and Advent International as well as operating experience as the Chief Financial Officer of The Westwood Group, Inc. He also served from 1995 to 2003 as Chairman and from 1995 to 2002 as Chief Executive Officer of Jeepers! Inc., a private equity-financed national chain of indoor theme parks. Mr. El-Hage has been a trustee of the MassMutual Premier Funds since 2003 and a trustee of the MML Series Investment Fund II since 2005. He has been Chairman of the Board or Trustees of both entities since 2006. Mr. El-Hage was also a director of Virtual Radiologic Corporation from May 2007 until July 2010. Mr. El-Hage’s diverse areas of expertise, including his unique knowledge of management, finance and corporate governance practices, will allow him to bring a great deal of knowledge and perspective to the Company.

Mural R. Josephson (62) continued as a director of the Company following the merger of Argonaut Group and PXRE in August 2007. Mr. Josephson had been a director of PXRE since August 2004. Mr. Josephson retired from Kemper Insurance Companies (“Kemper”) in 2002. During his 5-year tenure at Kemper, he held key management positions, including senior vice president and chief financial officer and senior vice president of finance. Prior to joining Kemper, Mr. Josephson held several senior level positions at KPMG, including 19 years as an audit partner. While at KPMG, he was a member of the National Insurance Practice Committee and a member of the Professional Practice Review Committee. Mr. Josephson has been a director of Health Markets, Inc., an insurance holding company, since May of 2003 and is currently chairman of its Audit Committee. He has also been a director of SeaBright Holdings, Inc., a NYSE traded insurance holding company, and its wholly owned subsidiary, SeaBright Insurance Company, since July of 2004 and is the Chairman of its Audit Committee. In addition to his historical knowledge of PXRE’s operations and his extensive background in the insurance sector, Mr. Josephson brings to the Board experience, qualifications and skills that are specific to the Company’s accounting, internal control and audit functions. Due to his background, Mr. Josephson also possesses financial reporting expertise and a level of financial sophistication that qualifies him as a financial expert in his role as the Chair of the Audit Committee.

Gary V. Woods (67) became a director of the Company immediately following the merger of Argonaut Group and PXRE in August 2007. Mr. Woods had been a director of Argonaut since March 2000 and Chairman of the Board of Directors of Argonaut since April 2001. Mr. Woods has been President of McCombs Enterprises since 1979. He also serves on the boards of directors of Avalon Advisors, LLC, the Southwest Research Institute and the Cancer Therapy and Research Center Foundation. Mr. Woods brings to the Board an entrepreneurial background with experience in overseeing complex business organizations. As President of McCombs Enterprises, Mr. Woods has successfully funded and promoted numerous growth companies in a diverse array of industries, both domestically and internationally, providing him with the necessary skills and qualifications to serve as the Chairman of the Company’s Board of Directors.

The following biographical information is for the four Class III directors whose terms will expire in 2013:

F. Sedgwick Browne (68) continued as a director of the Company following the merger of Argonaut Group and PXRE in August 2007. Mr. Browne had been a director of PXRE since 1999. Mr. Browne served as Vice-Chairman of the board of directors of PXRE from 2003 until the merger. He retired as counsel at Sidley Austin Brown & Wood LLP (now known as Sidley Austin LLP), a law firm, on September 30, 2004. Mr. Browne previously was a partner at Morgan, Lewis & Bockius LLP and prior thereto at Lord Day & Lord, Barrett Smith, where he specialized in the insurance and reinsurance industry. Mr. Browne is also a past trustee and director of the Swiss Reinsurance US Group and of the Winterthur Swiss Insurance US Group. In addition to his historical knowledge of PXRE’s operations, Mr. Browne brings to the Board a corporate transactional background that is specific to the Company’s operations in the insurance sector. Mr. Browne also possesses financial reporting expertise and the legal experience and qualifications necessary to guide the Company through the myriad of regulatory requirements currently imposed on publicly traded companies.

Hector De Leon (64) became a director of the Company immediately following the merger of Argonaut Group and PXRE in August 2007. Mr. De Leon had been a director of Argonaut since February 2003. Mr. De Leon is the managing partner of De Leon & Washburn, P.C., a law firm in Austin, Texas, which he founded in 1977. Prior to 1977, Mr. De Leon was the General Counsel of the Texas State Insurance Board. From February 1985 to November 1997, Mr. De Leon served as a director of Titan Holdings, Inc., a publicly traded property and casualty insurance holding company. Mr. De Leon brings to the Board experience and skills relating to the insurance regulatory environment in which the Company operates combined with a corporate legal background. In addition, Mr. De Leon’s experience includes prior service as a director of a publicly traded, growth oriented, specialty property and casualty insurance holding company.

9

Kathleen A. Nealon (57) was appointed as a director of the Company in February 2011. Ms. Nealon’s international career includes significant experience with risk management, compliance and regulatory issues with global companies. Ms. Nealon was the group head of legal and compliance at Standard Chartered Plc in London from 2001 until her retirement in 2004 where she also held additional international legal and compliance positions from 1992 to 2001. Prior to Standard Chartered Plc, Ms. Nealon practiced international banking and regulatory law in New York for 14 years. She currently serves on the board of directors of Cable and Wireless Communications Plc, a company resulting from the de-merger of Cable and Wireless Plc in 2010. Ms. Nealon is also the Co-Chair of the European Advisory Board of Georgetown Law School and serves on the advisory council of the Institute of Business Ethics. Ms. Nealon also served on the boards of directors of Shire Plc from 2006 to 2010 and Halifax Bank of Scotland Plc from 2004 to 2009 when it was merged into Lloyds Bank Plc. Ms. Nealon brings to the Board specialized expertise in the areas of corporate governance, compliance and risk management specific to the banking and financial services industry.

John H. Tonelli (46) became a director in 2010. Mr. Tonelli has been the Chief Executive Officer of Advanced Global Investments, Ltd., a New York based investment company with holdings in Eastern Europe, the Middle East and Latin America, since 2009. Mr. Tonelli has over twenty years of experience in finance, working both as an investment banker and as an attorney. Mr. Tonelli has advised the governments of Argentina, Chile, Paraguay and Uruguay on a wide variety of matters, including privatizations, debt and equity financings, and infrastructure projects. He has been a director of Converse Bank since August, 2009. From 2003 to 2009, Mr. Tonelli was a Senior Managing Director with J.P. Morgan & Co., Inc. and Bear Stearns & Co. Inc. where he was Head of International Project Finance and Emerging Markets Structured Finance. From 1999 to 2003, he was the founder and chief executive officer of International Venture Partners, LLC, an NASD member broker-dealer specializing in emerging markets. From 1992 to 1999, Mr. Tonelli was an attorney with Cadwalader, Wickersham & Taft where he was head of the Latin American practice group and founded the firm’s project finance group. Mr. Tonelli brings to the Board specialized expertise in finance and emerging markets that will benefit the Company’s international growth strategy.

Non-Employee Director Compensation

| | | | | | | | | | | | | | | | | | | | |

| (a) | | (b) | | | (c) | | | (d) | | | (e) | | | (f) | |

Name | | Fees Earned or

Paid in Cash

(1) | | | Stock Awards

(2a) | | | Option Awards

(3) | | | All Other

Compensation

(4) | | | Total | |

Gary V. Woods (a) (e) (h) | | $ | 118,000 | | | $ | 0 | | | $ | 42,750 | | | $ | 0 | | | $ | 160,750 | |

F. Sedgwick Browne (d) (h) | | $ | 121,000 | | | $ | 0 | | | $ | 42,750 | | | $ | 0 | | | $ | 163,750 | |

H. Berry Cash (f) (h) | | $ | 117,000 | | | $ | 0 | | | $ | 42,750 | | | $ | 0 | | | $ | 159,750 | |

Hector De Leon (b) (d) (h) | | $ | 127,000 | | | $ | 0 | | | $ | 42,750 | | | $ | 0 | | | $ | 169,750 | |

Mural R. Josephson (c) | | $ | 121,000 | | | $ | 0 | | | $ | 42,750 | | | $ | 0 | | | $ | 163,750 | |

John R. Power, Jr. (d) (g) | | $ | 128,000 | | | $ | 0 | | | $ | 42,750 | | | $ | 0 | | | $ | 170,750 | |

John H. Tonelli (f) | | $ | 106,250 | | | $ | 0 | | | $ | 42,750 | | | $ | 0 | | | $ | 149,000 | |

|

Former Directors | |

Frank W. Maresh | | $ | 22,500 | | | $ | 31,800 | | | $ | 20,100 | | | $ | 164,163 | | | $ | 238,563 | |

References next to each director’s name in column (a) above refer to the applicable committee legend included in the committee section of the Non-Employee Director Fees Schedule on page 12. Amounts described in the tables above and below are for all periods during 2010 except for Mr. Maresh who retired from the Board of Directors in May 2010 and Mr. Tonelli who was elected to the Board of Directors in May 2010.

10

| 1. | The following table details the breakdown of fees earned by all Argo Group non-employee directors during 2010, reported in column (b) of the preceding table. |

| | | | | | | | | | | | |

Director | | Cash Portion of Fees

Earned for 2010

Service | | | Fees Earned for

2010 Service and

Contributed to the

Non-qualified

Directors Deferred

Compensation Plan | | | Total Fees Earned or Paid in

Cash for 2010 Service | |

Gary V. Woods | | $ | 0 | | | $ | 118,000 | | | $ | 118,000 | |

F. Sedgwick Browne | | $ | 121,000 | | | $ | 0 | | | $ | 121,000 | |

H. Berry Cash | | $ | 117,000 | | | $ | 0 | | | $ | 117,000 | |

Hector De Leon | | $ | 127,000 | | | $ | 0 | | | $ | 127,000 | |

Mural R. Josephson | | $ | 60,500 | | | $ | 60,500 | | | $ | 121,000 | |

John R. Power, Jr. | | $ | 64,000 | | | $ | 64,000 | | | $ | 128,000 | |

John H. Tonelli | | $ | 106,250 | | | $ | 0 | | | $ | 106,250 | |

|

Former Directors | |

Frank W. Maresh | | $ | 22,500 | | | $ | 0 | | | $ | 22,500 | |

| 2. | The aggregate number of stock units and stock option awards owned by each of the non-employee directors and outstanding at December 31, 2010 was: |

| | | | | | | | |

Name | | Stock Units

(#) | | | Stock Options

(#) | |

Gary Woods | | | 6,500 | | | | 18,242 | |

F. Sedgwick Browne | | | 3,249 | | | | 17,857 | |

H. Berry Cash | | | 1,676 | | | | 18,242 | |

Hector De Leon | | | 3,527 | | | | 18,242 | |

Mural R. Josephson | | | 3,908 | | | | 16,357 | |

John R. Power, Jr. | | | 5,144 | | | | 18,242 | |

John Tonelli | | | 1,669 | | | | 5,000 | |

|

Former Directors | |

Frank W. Maresh | | | 0 | | | | 0 | |

| 3. | The expense related to options is the ASC TOPIC 718 Fair Market Value on the grant date and is the maximum possible value. |

| | | | | | | | | | | | |

Name | | ASC TOPIC 718

Expense (a) | | | GAAP

Fair Value on the

Grant Date | | | Market Value at

12/31/2010 | |

Gary V. Woods | | $ | 71,971 | | | $ | 42,750 | | | $ | 28,200 | |

F. Sedgwick Browne | | $ | 71,971 | | | $ | 42,750 | | | $ | 28,200 | |

H. Berry Cash | | $ | 71,971 | | | $ | 42,750 | | | $ | 28,200 | |

Hector De Leon | | $ | 71,971 | | | $ | 42,750 | | | $ | 28,200 | |

Mural R. Josephson | | $ | 71,971 | | | $ | 42,750 | | | $ | 28,200 | |

John R. Power, Jr | | $ | 71,971 | | | $ | 42,750 | | | $ | 28,200 | |

John H. Tonelli | | $ | 28,500 | | | $ | 42,750 | | | $ | 28,200 | |

|

Former Directors | |

Frank W. Maresh (a) | | $ | 95,371 | | | $ | 51,900 | | | $ | 0 | |

| | (a) | Expense related to the Restricted Stock grant of 1,000 shares and 5,000 options given upon retirement from the Board for Mr. Maresh is the amount reported for financial purposes during the fiscal year and is calculated under ASC TOPIC 718 based on grant date value. |

11

| 4. | Mr. Maresh received distribution of his deferred compensation after he retired from the Board. |

Argo Group Deferred Compensation Plan for Non-Employee Directors

The Argo Group International Holdings Ltd. Deferred Compensation Plan for Non-Employee Directors was adopted on February 12, 2008. The plan provides that:

| | a. | A director may defer 0%, 50% or 100% of cash compensation. Deferred amounts are credited with interest, compounded quarterly at a rate 2% above the prime commercial lending rate. |

| | b. | Argo Group will match 75% of the amount deferred. The Argo Group match will be converted into Stock Units based on the closing price of the Company’s stock on the date that the deferred amount would otherwise be earned. The hypothetical value of a Stock Unit at any point in time will be equal to the market value of Argo Group stock on NASDAQ at the point in time. |

| | c. | Distributions will occur six months after the date on which a participant ceases to be a member of the Board, the date on which a Change of Control occurs or December 1, 2017, whichever comes first and will be made in cash. |

| | d. | Each Director will receive an initial grant of 1,650 stock units. |

Non-Employee Director Fees Schedule

| | |

Retainer (paid quarterly) | | $75,000 annual retainer, paid quarterly, of which $40,000 ($10,000 per quarter) is paid subject to attendance at Board meetings. |

| |

Board Meetings | | Travel and Attendance = $2,000 per day Audit Committee Travel and Attendance = $1,000 per special meeting Travel outside the U.S. at request of Chairman = $2,000 per day Meeting of Executive Committee = $2,000 per special meeting Meeting of the Corporate Governance and Nominating Committee = $2,000 per meeting |

| |

Committee fees (paid quarterly) | | (a) Chair, Executive Committee = $15,000 annual retainer (b) Member, Executive Committee = $8,000 annual retainer (c) Chair, Audit Committee = $20,000 annual retainer (d) Member, Audit Committee = $10,000 annual retainer (e) Chair, Investment Committee = $10,000 annual retainer (f) Member, Investment Committee = $8,000 annual retainer (g) Chair, Human Resources Committee = $15,000 annual retainer (h) Member, Human Resources Committee = $8,000 annual retainer |

Director Stock Ownership

All Argo Group directors are required to meet Argo Group’s Stock Ownership Guidelines which are discussed on page 20 of the Compensation Discussion & Analysis.

12

PROPOSAL 2

ADVISORY VOTE ON THE COMPENSATION OF THE NAMED EXECUTIVE OFFICERS AS DISCLOSED IN THIS

PROXY

The Dodd-Frank Wall Street Reform and Consumer Protection Act enacted in July 2010 (the “Dodd-Frank Act”), included a requirement that companies provide shareholders with an opportunity to vote on an advisory, non-binding basis on the compensation of the Company’s NEOs, as disclosed in the Compensation Discussion & Analysis and related tables in the proxy statement in which the vote is included. This vote is on the compensation reported for the NEOs in the proxy for the prior year and has been named Say-on-Pay.

As discussed more fully in the Executive Summary of the Compensation Discussion and Analysis section which begins on page 14 and the discussion which follows it, the Company’s compensation program is intended both to retain superior, productive employees and to attract new talent necessary to continue the company’s expansion both internationally and in the United States. The program is designed to align the interests and motivations of employees with the creation and protection of shareholder value. The program includes three main components: base salary, cash incentive awards and long-term incentive awards. The components of the program interact to provide both short-term and long-term incentives for our NEOs.

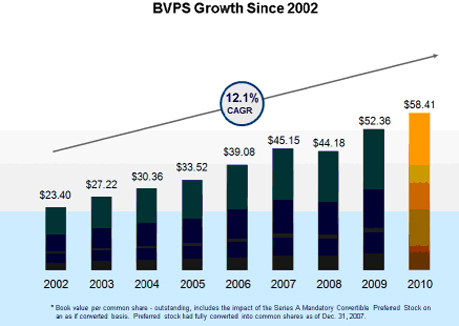

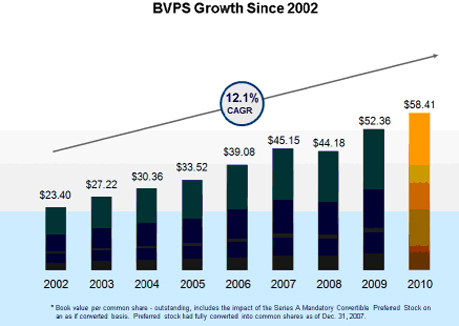

Since 2002, the Company’s book value has grown at a compounded rate of 12.1% per year. During this time the Company transformed itself from being primarily a California-based workers compensation carrier to an international specialty carrier. The Company believes that its NEOs were instrumental in achieving these results and the compensation packages designed for them were intended both to reward them for their current achievements and to incent them to continue to excel in the future. We believe that this will result in increased shareholder value over time. Accordingly, the Company requests shareholder approval of the following resolution:

“RESOLVED, that the Company’s stockholders approve, on an advisory, non-binding basis, the compensation of the Named Executive Officers as disclosed in the Compensation Discussion and Analysis, compensation tables and narrative discussion included herein.”

An advisory vote is not binding upon the Company. However, the Human Resources Committee, which is responsible for designing and administering the Company’s executive compensation program, values the opinions expressed by shareholders and will consider the outcome of the vote when making future compensation decisions related to the NEOs.

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE TO APPROVE THIS PROPOSAL. IT IS THE INTENTION OF THE PROXIES NAMED IN THE FORM OF THE PROXY THAT ACCOMPANIES THIS PROXY STATEMENT TO VOTE FOR THE APPROVAL OF SUCH PROPOSAL.

NAMED EXECUTIVE OFFICERS

The following table sets forth, for the individuals who are currently serving as NEOs of Argo Group and its subsidiaries, such person’s name, age and position with Argo Group and its principal subsidiaries. Each such executive officer serves at the pleasure of the Board of Directors.

| | | | | | |

Name | | Position | | Age | |

| Mark E. Watson III | | President and Chief Executive Officer, Argo Group | | | 46 | |

| Jay S. Bullock | | Executive Vice President and Chief Financial Officer, Argo Group | | | 46 | |

| Barbara C. Bufkin | | Senior Vice President, Business Development, Argo Group | | | 55 | |

| Julian Enoizi | | President & Chief Executive Officer – Argo International | | | 43 | |

Business Experience of Named Executive Officers

Mark E. Watson III has been President and Chief Executive Officer of Argo Group since August 2007. He had previously been President and Chief Executive Officer of Argonaut since January 2000. A description of Mr. Watson’s business experience can be found on page 8, “Biographical information for the three Class I nominees to be elected this year”.

Jay S. Bullock was appointed Chief Financial Officer of Argo Group on May 13, 2008. He joined Argo Group from Bear Stearns & Co. Inc. where he was a Senior Managing Director and Head of Bear Stearns’ Insurance Investment Banking Group. While at Bear Stearns, Mr. Bullock focused on the insurance sector. In this role, he advised on company acquisitions, mergers and sales as well as all forms of public and private financings and restructurings. During this period, he was an advisor to Argonaut Group, Argo Group’s predecessor company, on a number of transactions. Prior to joining Bear Stearns in 2000, Mr. Bullock was a Managing Director at First Union Securities. He is an honors graduate of Southern Methodist University and received his MBA from The McColl School of Business, Queen’s College, Charlotte, North Carolina. Mr. Bullock also holds the designation of Certified Public Accountant (CPA).

13

Barbara C. Bufkin was appointed Senior Vice President, Business Development of Argo Group on August 2007. She began working with Argonaut Group as a reinsurance consultant in 2001 and formally joined the company as Vice President, Corporate Business Development in September, 2002. In 2007, after the merger with PXRE, she agreed to relocate to Bermuda and assumed responsibility for new business strategies and development as well as ceded reinsurance for Argo Group. She has spent her entire career in reinsurance and insurance. Before she joined Argonaut, she held a number of senior positions with Swiss Re subsidiaries and a number of executive positions as a reinsurance intermediary with Sedgwick Group and EW Blanch. She graduated cum laude from the State University of New York at Buffalo, with a B.A. in Philosophy. She is an alumna of Leadership Texas, Stanford Executive Education, and Wharton Executive Education. She was a Director of the Southwestern Insurance Information Service for eight years. In 2000, she was nominated to the Texas Women’s Hall of Fame and in 2004 she was selected to the Class of Leadership America.

Julian Enoizi was appointed President and Chief Executive Officer of Argo International on June 1, 2009. He joined the Company from CNA where he first oversaw the successful turnaround of CNA Continental Europe as President of that organization beginning in 2002 and then went on to lead CNA Europe through a period of profitable expansion as President of CNA Europe, a position he assumed in 2005. Prior to joining CNA, he held senior executive roles with AIG Europe and Chubb Insurance Company of Europe based in London, Paris and Brussels. He is a graduate of the University of Birmingham. He holds an LLB (Hons) degree in Law and French Law, a Diplome D’Etudes Juridiques Francaises from the University of Limoges and qualified and practiced as a lawyer in London and Brussels before embarking on his insurance career. He is fluent in French, Italian and also speaks Spanish. He is active on the international speaking circuit, participating at industry conferences world-wide. He is currently Chairman of the Insurance Leadership Group. He is also a member of the Worshipful Company of Insurers. As previously announced, Mr. Enoizi resigned from the Company effective on March 4, 2011.

COMPENSATION OF EXECUTIVE OFFICERS

The information referenced in Item 11 of the Company’s Form 10-K for the year ended December 31, 2010 can be found under the “Compensation Discussion and Analysis,” “Executive Compensation” and “Human Resources Committee Interlocks and Insider Participation” headings of this Proxy Statement.

COMPENSATION DISCUSSION AND ANALYSIS

Executive Summary

The business of underwriting insurance is cyclical. Because not all lines of business in all geographic regions follow the same path during a cycle, we believe that a company with a diverse underwriting platform, both by line of business and geography, is best positioned to succeed across the underwriting cycle. The existence of a diverse platform allows a company to deploy capital in the most attractive product lines while reducing its presence in lines where the competition is more aggressive. To this end, the Company has developed a platform with operations in Bermuda, the United States, the United Kingdom, Europe and the Middle East offering products in both the insurance and reinsurance businesses. The Company is continuing to focus on both product and geographic expansion to add to the diversity of its operations.

During periods of intense competition and depressed prices, or soft markets, insurers often choose to examine and strengthen their strategies and platforms while constraining underwriting. During the current prolonged soft market period, Argo Group has focused on initiatives intended to position the Company for success across the cycle and in the next hard market. In particular, we believe that companies that are able to act quickly when a hard market materializes are likely to benefit the most from it.

14

2010 Performance

During 2010 Argo Group:

| | • | | Focused on creating shareholder value and financial strength: |

| | • | | Book value per share increased by 11.6%. We view growth in book value per share as the most comprehensive assessment of our ability to create shareholder value. We believe the compound annual growth in our book value presents a compelling record. As shown in the table below, since 2002 our book value per share has compounded at an annual rate of 12.1%. We believe this is the most relevant measurement period since it represents the point after which current management actions are most clearly reflected in the financial results. We believe our record compares well with any of our peers or direct competitors. |

| | • | | The company remains well capitalized. As we have said in the past, during periods of market contraction we may choose to return a portion of what we deem to be excess capital to our shareholders. To this end we repurchased $106.5 million or 3.2 million shares of our common stock, reinstituted a regular quarterly dividend and made dividend payments of $.48 per share during 2010. Importantly, we were able to return this capital while maintaining our financial strength and retaining sufficient capital to support our existing operations and take advantage of opportunities as they arise. |

| | • | | Focused on our operations: |

| | • | | We continued our effort to create an organization that is more easily expanded or contracted in response to market conditions. |

| | • | | We realigned the operating platform for some of our business units to make interaction with customers and business partners more effective. Specifically: |

| | • | | We launched Alteris, a complete solutions provider for MGAs. This was accomplished by combining and expanding some of our existing operations. Alteris will give distribution and risk bearing partners better access to the services they need through a full-service national distribution network. |

| | • | | We combined Colony and Argonaut Specialty to create Colony Specialty. This allows us to take advantage of the well known Colony brand while making it easier for our wholesale partners to access a more simplified line of products. As well, it creates a more nimble organization, allowing us to take advantage of new opportunities and be more responsive to our customers. |

| | • | | We entered new areas of the market that we believe will produce acceptable and attractive rates of return. This was most frequently accomplished by hiring experienced teams of people. For example: |

| | • | | After significantly reducing and re-underwriting its existing book of business, Argo International turned its attention to building out its product platform. This included hiring an experienced team to underwrite an energy and marine segment. |

15

| | • | | We renewed our focus on growth through new initiatives both by expanding our geographic footprint and introducing innovative products to address the needs of our customers. Specifically: |

| | • | | Alteris launched a residential lease guarantee program, a commercial janitorial program and a national winery program. |

| | • | | Focused on the improving the efficiency of our support functions both to offer better quality and more responsive services to our operating units. Specifically by: |

| | • | | Building a global shared service organization. |

| | • | | Ongoing efforts to consolidate and leverage technologies that reduce the cost of doing business and make our processes more efficient. An example of this initiative included implementing IT solutions which streamlined policy administration, claims and billing in our Commercial Specialty segment; and |

| | • | | Reviewing all systems and support functions to identify areas that could be provided more efficiently and cost effectively by someone else. |

Overview of Company’s Compensation Philosophy

The Company’s compensation program is intended both to retain superior, productive employees and attract new talent necessary to continue the Company’s expansion both internationally and in the United States. The program is designed to align the interests and motivations of employees with the creation and protection of shareholder value. The program includes three main components: base salary, annual cash incentive awards and long-term incentive awards. The components of the program interact to provide both short-term and long-term incentives for our NEOs. Specifically:

| | • | | Base salaries and benefit packages are set at levels which allow the Company to attract and retain high quality employees and to compensate them for the valuable skills and experiences required to successfully fulfill their roles. |

| | • | | Annual cash incentive awards are determined by the extent to which agreed upon financial and individual performance goals are achieved by the Company and by the NEO for the year. At the beginning of the year, the Human Resources Committee establishes a number of financial and individual performance goals and the target incentive opportunities for each NEO that are expressed as a percentage of base salary. At the end of the year, the Committee evaluates the overall performance of the Company and the contributions of the NEOs to that performance, as well as the extent to which each NEO achieved his or her individual performance goals in order to determine the appropriate award. The Committee considers the performance measures collectively for each of the NEO’s rather than applying a formula or weighting to any one or more measures. Performance is judged by the Committee taking into account actual achievements and the facts and circumstances that existed during the year. |

| | • | | Long-term equity incentive awards combined with the requirements of the Stock Ownership Guidelines encourage a long-term focus and align NEO interests with those of Argo Group’s shareholders. The Long-Term Incentive Plan is both performance and time vested. NEOs are awarded grants at the beginning of the year subject to the completion of specific performance goals designed to support the Company’s strategic plan during the year. The portion of an award that is available to vest over time is determined by the extent to which the NEO completes his or her goals. All NEOs are required to comply with the Stock Ownership Guidelines. |

A complete discussion of the Company’s Compensation Philosophy including the Stock Ownership Guidelines begins on page 18.

2010 Compensation Decisions

During 2010, the Company took the following compensation actions related to the NEOs:

| | • | | Because of the current economic climate, no adjustments to base salaries were made by the Human Resources Committee with the exception of Mr. Bullock whose base salary was increased to $500,000 from $450,000 effective in April 2010. |

| | • | | The Human Resources Committee determined the cash incentive awards based on its analysis of the Company’s and each individual NEO’s performance during the year. Financial metrics considered in 2010 included growth in book value per share, return on equity, income before tax and the combined ratio achieved by the Company. The individual performance metrics included among other things the execution of the Company’s capital management program, development of expense management initiatives and growth initiatives including the continued expansion of the Company’s global platform. After considering these metrics collectively for each of the NEOs, the Committee determined that Mr. Watson should receive an award of $495,000 (49.5 % of target), Mr. Bullock should receive an award of $310,000 (49.6% of target), and Ms. Bufkin should receive an award of $235,000 (89.5% of target). |

16

| | • | | Long-Term Incentive Plan goals are designed to support the Company’s strategic goals and are established for participating employees in the first quarter of each year. During 2010, NEOs achieved between 79% and 92% of the agreed upon goals and as a result between 79% and 92% of the individual grants will be allowed to vest subject to the NEO’s continued employment with the Company. |

| | • | | The Company had employment agreements with Mr. Watson and with Mr. Bullock that were scheduled to expire in 2011. Because the Company recognizes it is in an industry that competes aggressively for talented individuals, the Company decided to enter into new agreements with both Mr. Watson and Mr. Bullock to enhance the Company’s ability to retain them. The Company has been executing on a multi-year strategy to expand into an international specialty underwriter. This strategy involves diversification both geographically and by line of business and provides the Company with the flexibility to take advantage of opportunities as they arise around the world. The Company believes that this strategy provides a stable platform for long-term growth in shareholder value. Mr. Watson and Mr. Bullock have been instrumental in crafting and executing the expansion and the Company believes it is important to maintain their leadership as the Company continues to pursue this strategy. The Company also believes that Mr. Watson and Mr. Bullock demonstrated their commitment to Argo Group through their purchases of the Company’s stock during 2010. |

The new employment agreements contain provisions that are materially more favorable to the Company than provisions in the previous agreements including: (a) the change-of-control payout multiple was reduced from 5 times salary to 2.99 times salary; (b) the gross-up provision was removed; and (c) the period post termination to receive continuation of benefits was reduced from 3 years to 18 months. In addition, the new agreements contain provisions that are designed to encourage the individuals to remain with the Company over the life of the agreements. As an incentive for Mr. Watson and Mr. Bullock to enter into these agreements the Company decided to provide them with retention grants. Mr. Watson was awarded $3,000,000 and Mr. Bullock received $1,500,000. The employment arrangements include transfer restrictions on stock owned by Mr. Watson through March 14, 2014 and the right to recover a portion of the retention grant paid to Mr. Bullock if his employment is voluntarily terminated prior to March 15, 2014. The Company believes that the structure of both the agreements and the retention grants are beneficial to the economic and operational stability of the organization as it continues its expansion.

A complete discussion of the 2010 Compensation decisions including the goals for the Long Term Incentive Plan, individual performance achievement by the NEOs related to the Long-Term Incentive Plans and details on the terms of the employment agreements is included in the 2010 Compensation Decisions section beginning on page 21.

Human Resources Committee Role

The Human Resources Committee of the Board has responsibility for establishing, implementing and monitoring adherence with Argo Group’s compensation philosophy. The Human Resources Committee strives to ensure that the total compensation paid to our management is fair, reasonable, competitive and aligned with performance.

The Human Resources Committee has the authority to consult with management and to engage the services of outside advisors, experts and others to assist it. In conjunction with input from management and outside consultants the committee makes decisions on the appropriate measures to incorporate into its process. In determining the amount and form of compensation for Argo Group’s senior executives, the Human Resources Committee receives and considers recommendations from Argo Group’s management, including recommendations regarding the compensation for the NEOs. When evaluating management’s recommendations, the Committee considers the compensation levels of the Company’s competition, data from other publicly traded firms and the NEO’s specific circumstances and performance. This process helps to develop the proper level and mix of compensation to best motivate and reward and retain the Company’s employees.

During 2010 the Human Resources Committee retained Hewitt Associates to provide it with U.S. and international compensation information including: (i) a review of the 2010 proxy; (ii) long term incentive modeling; and (iii) advice on section 457A compliance. The information was provided directly to the Human Resources Committee. At the end of 2010 the Human Resources Committee retained Meridian Compensation Partners, LLC to review the 2011 proxy since the individual consultant advising the Committee transitioned to Meridian from Hewitt. During 2010, neither Hewitt nor Meridian performed any projects directly for Argo Group management.