Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

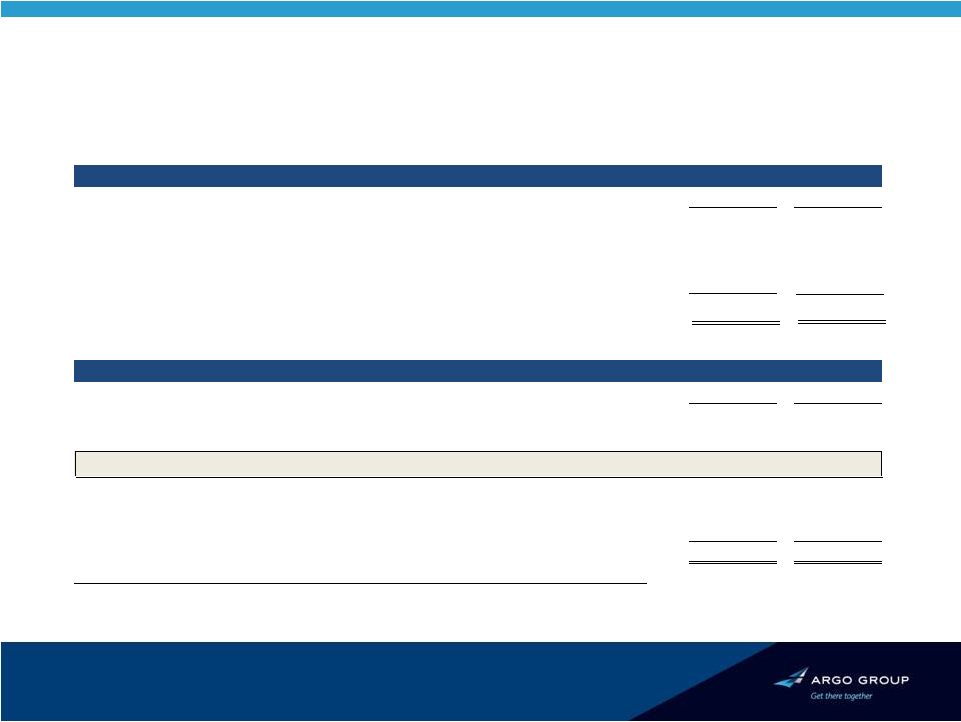

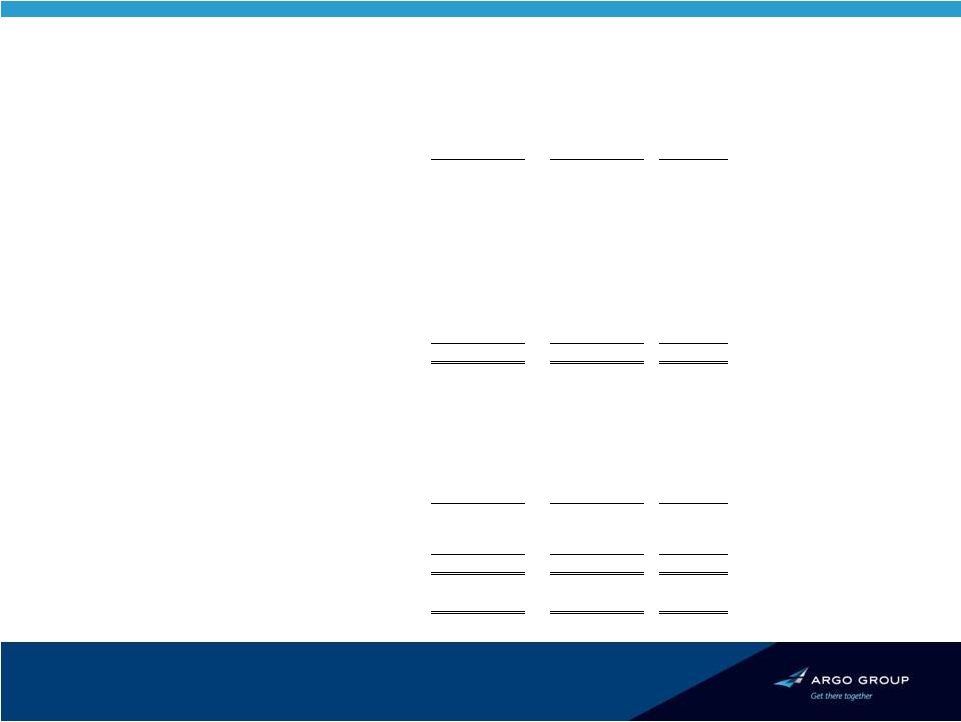

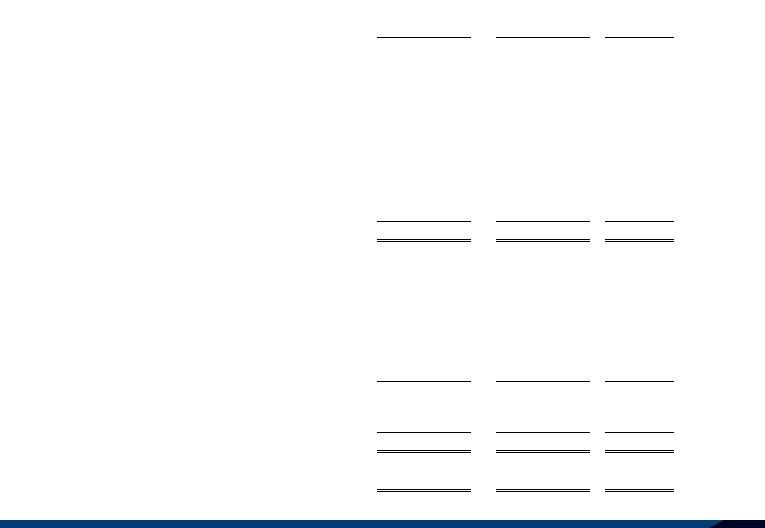

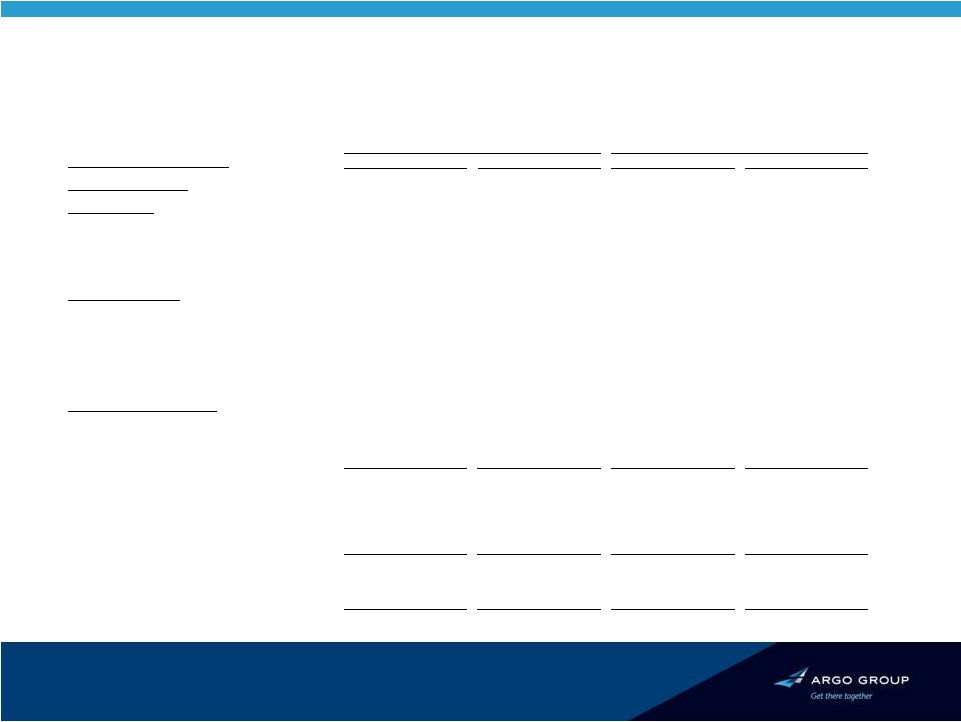

Filing tables

Filing exhibits

ARGO-PA similar filings

- 7 May 12 Argo Group Announces 2012 First Quarter Financial Results

- 5 Mar 12 This presentation contains “forward-looking statements” which are made pursuant to the safe harbor

- 15 Feb 12 Results of Operations and Financial Condition

- 16 Nov 11 This presentation contains “forward-looking statements” which are made pursuant to the safe harbor

- 4 Nov 11 Results of Operations and Financial Condition

- 7 Sep 11 Regulation FD Disclosure

- 4 Aug 11 Results of Operations and Financial Condition

Filing view

External links