Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

Filing exhibits

ARGO-PA similar filings

- 8 Feb 16 Argo Group Reports Fourth Quarter Operating Income of $25.8 Million or $0.90 Per Diluted Share

- 3 Nov 15 Regulation FD Disclosure

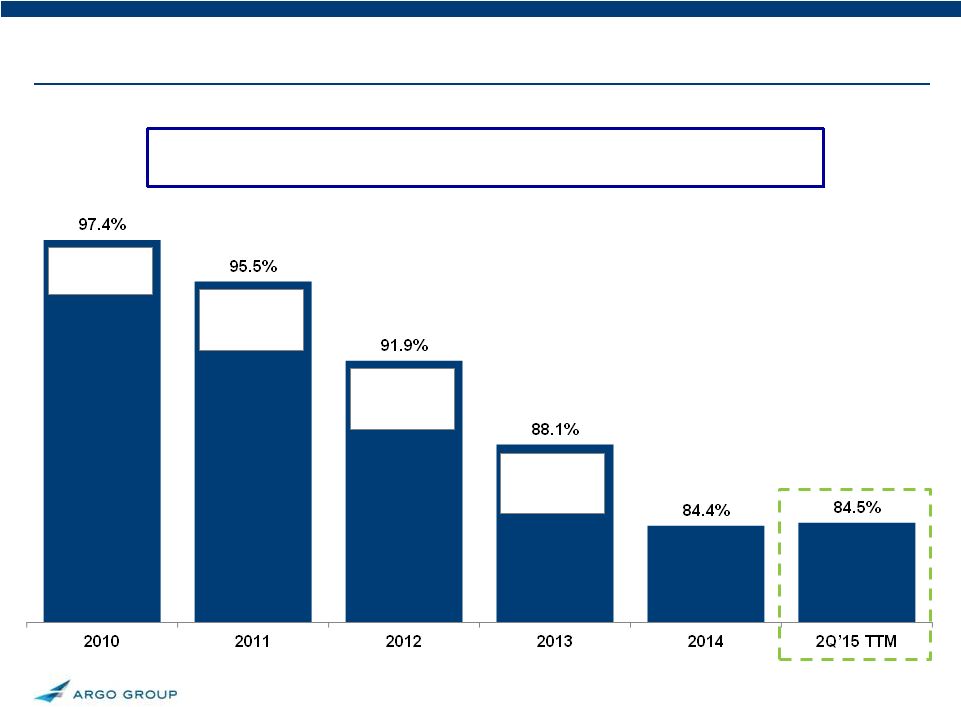

- 26 Oct 15 Argo Group Reports Third Quarter 2015 Net Income of $1.24 Per Diluted Share

- 13 Aug 15 This presentation contains “forward-looking statements” which are made pursuant to the safe

- 4 Aug 15 Argo Group Reports Second Quarter 2015 Net Income of $0.98 Per Diluted Share; Declares Quarterly Cash Dividend of $0.20 Per Share

- 5 May 15 Regulation FD Disclosure

- 4 May 15 Argo Group Reports 93.6% Combined Ratio and 14.2% Annualized Net Income Return on Average Shareholders Equity for the First Quarter 2015

Filing view

External links