Management Transition Compensation

As noted above, the Company undertook a number of leadership changes in 2019. The compensation adjustments made in connection with the 2019 management transitions were determined based on market data and the negotiations of the parties.

Mr. Watson

On December 6, 2019, the Company and Mr. Watson entered into a Separation Agreement and Release (the “Separation Agreement”) to set out the terms of Mr. Watson’s separation from the Company. Under the terms of the Separation Agreement, Mr. Watson continued to serve as a full-time,non-executive employee of the Company through December 31, 2019 (the “separation date”) and continued to receive his existing base salary during such period as well as medical, welfare and health insurance benefit plans on the same terms and conditions as were in effect for Mr. Watson prior to the termination of his tenure as an executive employee. Mr. Watson was not entitled to receive any annual cash incentive awards.

Effective as of the date on which the Separation Agreement became fully enforceable and binding, Mr. Watson fully vested in his unvested restricted stock from each of his (i) March 10, 2016 grant (11,285 shares), (ii) March 29, 2017 grant (14,558 shares), (iii) March 27, 2018 grant (10,500 shares) and (iv) March 15, 2019 grant (41,013 shares). All of Mr. Watson’s vested share appreciation rights will remain vested and fully exercisable without restriction, and will be governed by the terms of the underlying award agreements, provided that following the separation date, Mr. Watson will not be bound to any restrictive covenant or post-termination obligation, duty or restriction under such award agreements, other than certain obligations relating to confidential information. The Company paid Mr. Watson (a) an amount equal to $1,750,000 within two business days after the Separation Agreement became fully enforceable and binding, and (b) an amount equal to $725,833.33. The 73,481 performance-based restricted shares granted by the Company to Mr. Watson on November 5, 2018 were forfeited by Mr. Watson on December 31, 2019 in connection with Mr. Watson’s separation. The compensation reported in the 2019 Summary Compensation Table includes the separation payments paid to Mr. Watson under the Separation Agreement as well as compensation relating to the accelerated vesting of his outstanding equity awards pursuant to the terms of the Separation Agreement.

The Separation Agreement included a general release of claims by Mr. Watson in favor of the Company and superseded all prior agreements between Mr. Watson and the Company, including Mr. Watson’s employment agreement with the Company, dated November 5, 2018 (the “Employment Agreement”), except for certain provisions of the Employment Agreement set forth in the Separation Agreement, which will survive, including provisions relating tonon-disclosure of confidential information, return of Company property, mutualnon-disparagement, cooperation following termination of employment, indemnification and clawback.

Mr. Rehnberg

During fiscal 2019, we executed a new employment agreement with Kevin J. Rehnberg, in connection with his promotion to Group Chief Administrative Officer and Head of the Americas. Mr. Rehnberg’s employment agreement replaced and superseded the employment agreement previously entered into between the Company and Mr. Rehnberg and terminates as of December 31, 2022. The new employment agreement provided that Mr. Rehnberg would receive an annualized base salary of $750,000 and may be eligible to earn annual incentive awards in the sole discretion of the Company with an annual target participation rate of $863,000 and long-term incentive awards with an annual target participation rate of $1,000,000. In addition, as discussed further in the 2019 Potential Payments Upon Termination or a Change in Control section, Mr. Rehnberg’s employment agreement also entitles him to severance benefits in connection with certain qualifying terminations of employment.

In connection with Mr. Rehnberg’s appointment as Interim President and Chief Executive Officer, his annual base salary was increased from $750,000 to $975,000. On March 11, 2020, in connection with his appointment as President and Chief Executive Officer, we executed a new employment agreement with Mr. Rehnberg. This agreement replaces and supersedes the agreement we entered into with him in 2019. The Company’s Current Report on Form 8-K filed with the SEC on March 13, 2020 contains a summary of Mr. Rehnberg’s new agreement.

46

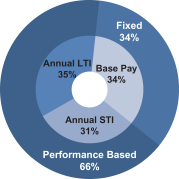

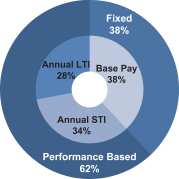

Pay for performance by structuring a significant percentage of target annual compensation in the form of variable,at-risk compensation

Pay for performance by structuring a significant percentage of target annual compensation in the form of variable,at-risk compensation No guaranteed annual salary increases or bonuses

No guaranteed annual salary increases or bonuses