Office of Finance

January 24, 2022

Page 4

The Company’s Approach to Evaluating Materiality

In accordance with SAB No. 99, the Company considers both quantitative and qualitative factors to determine whether an error in the Company’s previously issued financial statements is material. The misstatement of an item in a financial statement is material if, in the light of surrounding circumstances, the magnitude of the item is such that it is probable that the judgment of a reasonable person relying upon the report, specifically users of the Company’s financial statements, would have been changed or influenced by the inclusion or correction of the item. SAB No. 99 states the following with respect to quantitative materiality threshold:

“The use of a percentage as a numerical threshold, such as 5%, may provide the basis for a preliminary assumption that – without considering all relevant circumstances – a deviation of less than the specified percentage with respect to a particular item on the registrant’s financial statements is unlikely to be material. The staff has no objection to such a “rule of thumb” as an initial step in assessing materiality. But quantifying, in percentage terms, the magnitude of a misstatement is only the beginning of an analysis of materiality; it cannot appropriately be used as a substitute for a full analysis of all relevant considerations.”

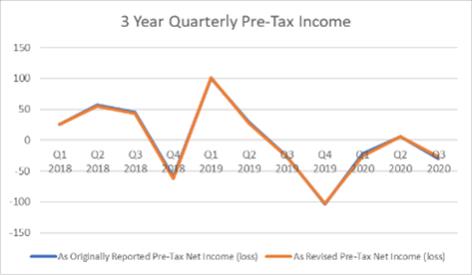

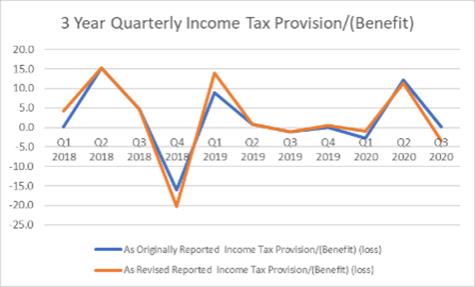

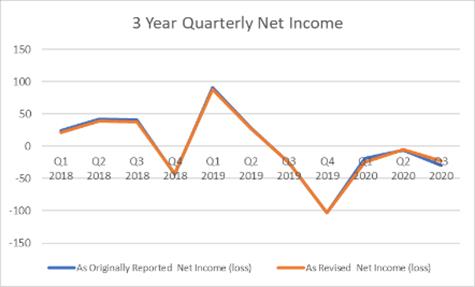

In response to this guidance, the Company first established a materiality threshold to initially guide it in its evaluation. The Company then performed a full analysis of all relevant considerations in reaching its conclusion that correcting the cumulative effect of these errors in the Company’s 2020 Financial Statements would materially misstate the 2020 financial statements, but the errors were not material to the Company’s previously issued 2018 Financial Statements and 2019 Financial Statements, or the related quarterly financial statements included in Forms 10-Q filed during those periods.

Quantitative Assessment of Materiality

The Company considers the materiality of any errors to the financial information presented in its public earnings releases and periodic filings, including the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in its periodic filings on Forms 10-K and 10-Q (which includes both GAAP and non-GAAP measures) based on what management believes users of our financial statements, in particular investors and analysts, would consider important if materially misstated.

The financial results for insurance companies traditionally include a number of non-GAAP measures, adjusting for the financial impact from catastrophe events and prior year reserve development. Because catastrophe events and prior year reserve development generate an inherent level of volatility in an insurance company’s financial results, analysts and investors review financial results that include and exclude the impact of both of these items when evaluating an insurance company. As a global insurance provider, management (like its analysts and investors) considers the impact of such items when evaluating the Company’s financial results and performance. Therefore, management believes it is important to consider the impact of these errors on the financial results that both include and exclude catastrophe events and prior year development.

The Company considered Pre-Tax Net Income (adjusted for the financial impacts from catastrophe events and prior year reserve development) for the 5-year period, 2016-2020, as a basis for determining the quantitative materiality threshold. The table below provides the Pre-Tax Net Income, adjusted for Catastrophe Losses and Prior Year Reserve Development to arrive at Adjusted Pre-Tax Net Income, for each of the past five fiscal years. Then, applying a 5% threshold (as further explained below) to the three-year rolling average Adjusted Pre-Tax Income for 2018, 2019 and 2020, management established a quantitative materiality threshold for income statement items as follows:

| | | | | | | | | | | | | | | | | | | | | | | | |

Year | | Pre-Tax

Net

Income

(loss) | | | Catastrophe

Losses* | | | Prior Year

Reserve

Development

(Favorable)/

Unfavorable | | | Adjusted Pre-Tax

Net Income | | | 3-Year

Average

Adjusted Pre-

Tax Net

Income

($) (in

millions) | | | Quantitative

Materiality

Threshold

($)

(in millions) | |

2016 | | | 181.9 | | | | 61.7 | | | | (33.3 | ) | | | 210.3 | | | | N/A | | | | N/A | |

2017 | | | 39.9 | | | | 145.1 | | | | (8.2 | ) | | | 176.8 | | | | N/A | | | | N/A | |

2018 | | | 61.0 | | | | 61.9 | | | | (18.0 | ) | | | 104.9 | | | | 164.0 | | | | 8.2 | |

2019 | | | 0 | | | | 34.3 | | | | 138.1 | | | | 172.5 | | | | 151.4 | | | | 7.6 | |

2020 | | | (46.4 | ) | | | 186.8 | | | | 7.7 | | | | 148.1 | | | | 141.8 | | | | 7.1 | |

| * | Includes the impact of reinstatement premiums. |