Exhibit (c)(i)

CONFIDENTIAL WORKING DRAFT – FOR DISCUSSION PURPOSES ONLY Project Celtic Discussion Materials 8 July 2009 Morgan Stanley

CONFIDENTIAL WORKING DRAFT – FOR DISCUSSION PURPOSES ONLY Project Celtic Morgan Stanley Beat Consensus EPS Estimate Met Consensus EPS Estimate Missed Consensus EPS Estimate Current Valuation(4) ($MM, except where noted) Share price(1) $1.18 % Disc. to LTM High (2) (73.4%) % Prem. to LTM Low (2) 131.4% FDSO(3) 71.5 Equity Value $84.3 Plus: Debt 22.0 Less: Cash (48.6) Aggregate Value $57.8 Celtic Share Price Evolution Since announcement of KPN Transaction Celtic Closing Share Price 21-Jun-06 Celtic announces KPN transaction 18-Dec-06 Celtic extends close date of KPN transaction from 31-Dec-06 to 30-Apr-07 27-Apr-07 Celtic extends close date of KPN transaction from 30-Apr-07 to 31-Oct-07 3-May-07 Celtic announces delay in 1Q 2007 10Q filing and only details selected results 1-Oct-07 Celtic completes KPN transaction 23-Mar-07 Celtic announces delay in 2006 10K filing 10-Nov-06 Celtic announces delay in 10Q filing 14-Jan-08 Celtic announces TDC transaction 1-Apr-08 Celtic completes TDC transaction Price ($) $15 $12 $9 $6 $3 $0 June-06 Dec-06 Jun-07 Dec-07 Jun-08 Dec-08 Jul-09 Volume (MM) 3.5 3.0 2.5 2.0 1.5 1.0 0.5 0.0 Volume Price Notes Source FactSet 1. Based on closing share price as of 7/7/09 2. Based on intraday LTM high and low 3. FDSO includes treasury stock impact of 1.3 million options issued in 1Q 2009 assuming an exercise price equal to the 1Q 2009 VWAP of $0.96 4. Balance sheet data as of 3/31/09 5. Jeffries & Company had discontinued coverage of Celtic prior to Celtic’s 1Q 2009 earnings release

CONFIDENTIAL WORKING DRAFT – FOR DISCUSSION PURPOSES ONLY Project Celtic Morgan Stanley Price/Volume Distribution Analysis Historical Closing Price / Volume Distribution(1) $ $12.00 $10.00 $8.00 $6.00 $4.00 $2.00 $0.00 $10.75 $10.65 $5.70 $4.26 $4.32 $3.38 $1.64 $1.44 $1.39 $8.67 $4.90 $3.54 $3.05 $3.06 $1.20 $0.54 $0.70 $1.18 Current Stock Price: $1.18(1) 3Q 2007 4Q 2007 1Q 2008 2Q 2008 3Q 2008 4Q 2008 1Q 2009 2Q 2009 3Q 2009TD VWAP: $9.67 $6.73 $4.56 $3.57 $3.65 $1.84 $0.96 $1.11 $1.33 Volume Traded (MMs): 12.1 14.6 8.9 9.7 6.9 6.1 4.3 4.7 0.3 Total Volume as %(2) of Public Float: 42% 51% 31% 34% 24% 21% 15% 17% 1% <25% 25%-50% 50%-75% 75%-100% Source FactSet, Thomson Financial Group Notes 1. Current price as of 7/7/09 2. Public float per Thomson Financial Group of ~ 28.6 million shares (as of 7/7/09); excludes shares held by KPN and various insiders

CONFIDENTIAL WORKING DRAFT – FOR DISCUSSION PURPOSES ONLY Project Celtic Morgan Stanley Historical Price Performance Summary L2Y LTM L6M L3M Celtic (88.1%) (62.1%) (25.3%) 63.9% Nasdaq (34.6%) (22.2%) 9.2% 11.8% S&P 500 (42.5%) (29.6%) (2.8%) 8.0% Sel. Alt. Carriers (Avg.) (64.5%) (47.7%) 70.4% 27.0% Rapid Link 42.9% (37.5%) (16.7%) 92.3% IDT(2) (94.3%) (67.4%) 55.9% 49.1% Level 3 (78.5%) (47.9%) 43.8% 41.8% Global Crossing (55.8%) (50.9%) 8.8% 21.1% Arbinet (70.3%) (53.2%) 16.1% 13.2% Fusion Tel. (84.3%) (63.3%) (52.2%) 10.0% deltathree (87.0%) 16.4% 552.0% 5.2% Vonage (88.5%) (77.4%) (44.4%) (16.7%) Relative Share Price Performance Since Announcement of KPN Transaction Indexed Share Price 175 150 125 100 75 50 25 0 21-Jun-06 18-Oct-06 14-Feb-07 13-Jun-07 10-Oct-07 6-Feb-08 4-Jun-08 1-Oct-08 28-Jan-09 7-Jul-09 Nasdaq: (18%) S&P: (30%) Selected Alternative Carriers: (80%) Celtic: (87%) Celtic Selected Alternative Carriers(1) Nasdaq S&P 500 Source FactSet Notes 1. Equal-weighted index comprised of Level 3, Global Crossing, Vonage, Arbinet, IDT, Fusion Telecommunications, deltathree and Rapid Link 2. Denotes price performance for Class B shares

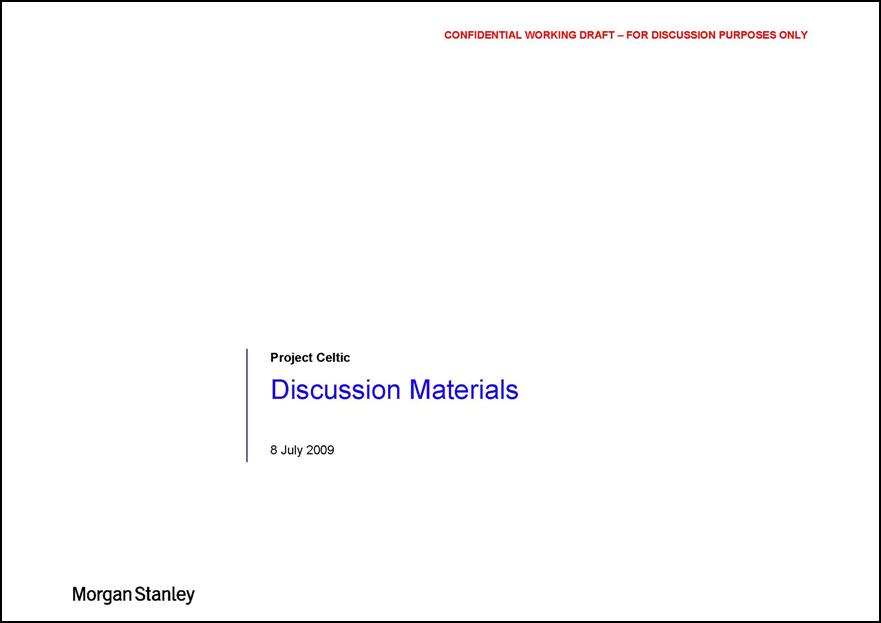

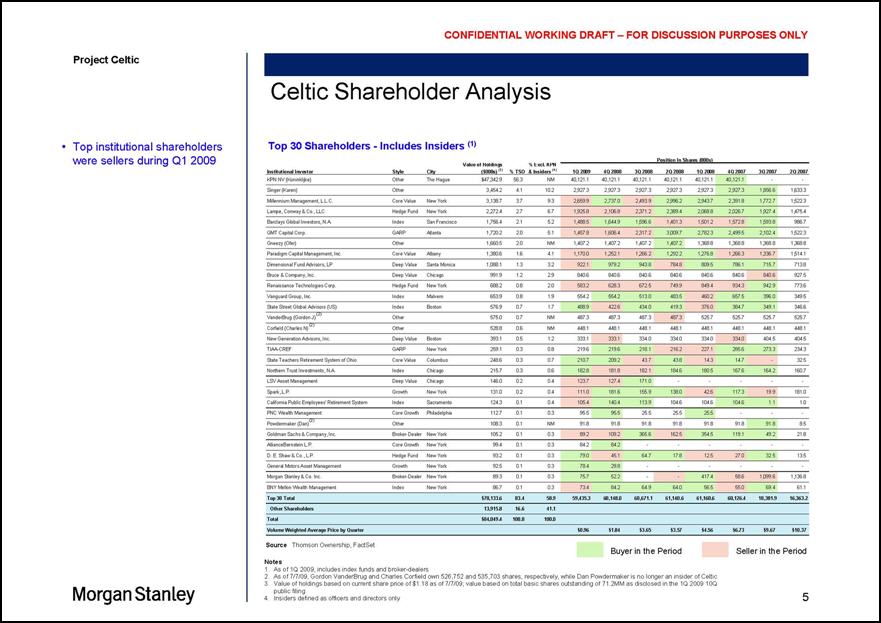

CONFIDENTIAL WORKING DRAFT – FOR DISCUSSION PURPOSES ONLY Project Celtic Top institutional shareholders were sellers during Q1 2009 Morgan Stanley Celtic Shareholder Analysis Top 30 Shareholders – Includes Insiders(1) Position in Shares (000s) Institutional Investor Style City Value of Holdings($000s)(3) % TSO % Excl. KPN & Insiders(4) 1Q 2009 4Q 2008 3Q 2008 2Q 2008 1Q 2008 4Q 2007 3Q 2007 2Q 2007 KPN NV (Koninklijke) Other The Hague $47,342.9 56.3 NM 40,121.1 40,121.1 40,121.1 40,121.1 40,121.1 40,121.1 - - Singer (Karen) Other 3,454.2 4.1 10.2 2,927.3 2,927.3 2,927.3 2,927.3 2,927.3 2,927.3 1,856.6 1,633.3 Millennium Management L.L.C. Core Value New York 3,138.7 3.7 9.3 2,659.9 2,737.0 2,493.9 2,996.2 2,943.7 2,391.8 1,772.7 1,522.3 Lampe, Conway & Co., LLC Hedge Fund New York 2,272.4 2.7 6.7 1,925.8 2,106.8 2,371.2 2,389.4 2,068.8 2,026.7 1,927.4 1,475.4 Barclays Global Investors, N.A. Index San Francisco 1,756.4 2.1 5.2 1,488.5 1,644.9 1,596.6 1,401.3 1,501.2 1,572.8 1,593.8 986.7 GMT Capital Corp. GARP Atlanta 1,720.2 2.0 5.1 1,457.8 1,606.4 2,317.2 3,009.7 2,782.3 2,499.5 2,102.4 1,522.3 Gneezy (Ofer) Other 1,660.5 2.0 NM 1,407.2 1,407.2 1,407.2 1,407.2 1,368.8 1,368.8 1,368.8 1,368.8 Paradigm Capital Management Inc. Core Value Albany 1,380.6 1.6 4.1 1,170.0 1,252.1 1,266.2 1,292.2 1,276.8 1,266.3 1,336.7 1,514.1 Dimensional Fund Advisors, LP Deep Value Santa Monica 1,088.1 1.3 3.2 922.1 979.2 943.8 784.8 809.5 786.1 715.7 713.8 Bruce &Company, Inc. Deep Value Chicago 991.9 1.2 2.9 840.6 840.6 840.6 840.6 840.6 840.6 840.6 927.5 Renaissance Technologies Corp. Hedge Fund New York 688.2 0.8 2.0 583.2 628.3 672.5 749.9 849.4 934.3 942.9 773.6 Vanguard Group, Inc. Index Malvern 653.9 0.8 1.9 554.2 554.2 513.0 483.5 460.2 657.5 396.0 349.5 State Street Global Advisors (US) Index Boston 576.9 0.7 1.7 488.9 422.6 434.0 419.3 376.0 384.7 349.1 346.6 VanderBrug (Gordon J)(2) Other 575.0 0.7 NM 487.3 487.3 487.3 487.3 525.7 525.7 525.7 525.7 Corfield (Charles N) (2) Other 528.8 0.6 NM 448.1 448.1 448.1 448.1 448.1 448.1 448.1 448.1 New Generation Advisors, Inc. Deep Value Boston 393.1 0.5 1.2 333.1 333.1 334.0 334.0 334.0 334.0 404.5 404.5 TIAA-CREF GARP New York 259.1 0.3 0.8 219.6 219.6 218.1 216.2 227.1 285.6 273.3 234.3 State Teachers Retirement System of Ohio Core Value Columbus 248.6 0.3 0.7 210.7 209.2 43.7 43.8 14.3 14.7- 32.5 Northern Trust Investments, N.A. Index Chicago 215.7 0.3 0.6 182.8 181.8 182.1 184.6 180.5 167.6 164.2 160.7 LSV Asset Management Deep Value Chicago 146.0 0.2 0.4 123.7 127.4 171.0 - - - - - Spark, LP. Growth New York 131.0 0.2 0.4 111.0 181.6 155.9 138.0 42.6 117.3 19.9 181.0 California Public Employees’ Retirement System Index Sacramento 124.3 0.1 0.4 105.4 140.4 113.9 104.6 104.6 104.6 1.1 1.0 PNC Wealth Management Core Growth Philadelphia 112.7 0.1 0.3 95.5 95.5 25.5 25.5 25.5 - - - Powdermaker (Dan)(2) Other 108.3 0.1 NM 91.8 91.8 91.8 91.8 91.8 91.8 91.8 8.5 Goldman Sachs & Company, Inc. Broker-Dealer New York 105.2 0.1 0.3 89.2 109.2 365.6 162.5 354.5 119.1 49.2 21.8 AllianceBernstein L.P. Core Growth New York 99.4 0.1 0.3 84.2 84.2 - - - - - - D. E. Shaw & Co., L.P. Hedge Fund New York 93.2 0.1 0.3 79.0 45.1 64.7 17.8 12.5 27.0 32.5 13.5 General Motors Asset Management Growth New York 92.5 0.1 0.3 78.4 29.8 - - - - - - Morgan Stanley & Co. Inc. Broker-Dealer New York 89.3 0.1 0.3 75.7 52.2- - 417.4 58.6 1,099.6 1,136.8 BNY Mellon Wealth Management Index New York 86.7 0.1 0.3 73.4 84.2 64.9 64.0 56.5 55.0 69.4 61.1 Top 30 Total $70,133.6 83.4 58.9 59,435.3 60,148.0 60,671.1 61,140.6 61,160.6 60,126.4 18,381.9 16,363.2 Other Shareholders 13,915.8 16.6 41.1 Total $84,049.4 100.0 100.0 Volume Weighted Average Price by Quarter $0.96 51.84 53.65 53.57 54.56 56.73 59.87 $10.37 Source Thomson Ownership, FactSet Buyer in the Period Seller in the Period Notes 1. As of 10 2009, includes index funds and broker-dealers 2. As of 7/7/09, Gordon VanderBrug and Charles Corfield own 526,752 and 535,703 shares, respectively, while Dan Powdermaker is no longer an insider of Celtic 3. Value of holdings based on current share price of $1.18 as of 7/7/09; value based on total basic shares outstanding of 71.2MM as disclosed in the 1Q 2009 10Q public filing 4. Insiders defined as officers and directors only

CONFIDENTIAL WORKING DRAFT - FOR DISCUSSION PURPOSES ONLY Project Celtic Key performance metrics have deteriorated during last several quarters driven by price and volume declines Growth Trend 2Q 2008 to 1Q 2009 % Growth Minutes of Use Trading (20.5%) Retail 5.2% Outsourced (8.2%) Total (16.9%) ARPM Trading (15.2%) Retail 10.4% Outsourced (23.0%) Total (14.9%) Revenue Trading (32.7%) Retail 15.8% Outsourced (29.2%) Total (29.2%) First quarter that reflects TDC acquisition Morgan Stanley Review of Celtic Operating Performance Key Performance Metrics Since 2007 (1) Minutes of Use (MM) 7,000 5,600 5,600 4,200 2,800 1,400 0 425 587 4,541 1Q 2007 467 640 4,749 2Q 2007 512 738 4,972 3Q 2007 500 622 4,888 4Q 2007 510 523 4,776 1Q 2008 698 543 4,940 2Q 2008 713 677 4,456 3Q 2008 658 614 4,419 4Q 2008 641 571 3,925 1Q 2009 Total YoY Growth: 4.6% 5.5% (6.0%) (5.3%) (11.6%) Average Revenue Per Minute (ARPM) (Cents) 12.00 10.00 8.00 6.00 4.00 2.00 0.00 5.66 4.34 9.99 5.85 1Q 2007 5.69 4.35 10.64 5.94 2Q 2007 5.68 4.34 10.37 5.91 3Q 2007 5.59 4.05 10.39 5.83 4Q 2007 5.32 3.93 9.85 5.59 1Q 2008 5.51 3.84 9.72 5.84 2Q 2008 5.34 4.35 9.89 5.78 3Q 2008 5.00 4.18 8.12 5.27 4Q 2008 4.67 4.24 7.48 4.97 1Q 2009 YoY ARPM Growth: (4.4%) (1.7%) (2.2%) (9.6%) (11.1%) Revenue (MM) 375 300 225 150 75 0 43 26 257 1Q 2007 50 28 270 2Q 2007 53 32 282 3Q 2007 52 25 274 4Q 2007 50 21 254 1Q 2008 68 21 272 2Q 2008 71 29 238 3Q 2008 53 26 221 4Q 2008 48 24 183 1Q 2009 Total YoY Growth: 0.0% 3.8% (8.0%) (14.5%) (21.4%) Trading Retail Outsourced Total Note 1. Based on Celtic Investor Presentation May 2009 (Publicly Available)

CONFIDENTIAL WORKING DRAFT - FOR DISCUSSION PURPOSES ONLY Project Celtic Celtic completed its acquisition of TDC’s non-Nordic international wholesale voice business for ~ $11MM in cash on 4/1/08 Management estimated the acquisition added ~ $80MM of annual revenue Jefferies Research estimated an EBITDA margin of ~ 3.0% TDC results included from 2Q 2008 onwards Prior periods are not pro forma for the acquisition Morgan Stanley Review of Celtic Operating Performance Summary Financials Since 2007 Celtic Summary Financials (1) Pro Forma Pro Forma Pro Forma 1Q 2007 2Q 2007 3Q 2007 4Q 2007 1Q 2008 2Q 2008 3Q 2008 4Q 2008 1Q 2009 Revenue $324.8 $347.7 $367.5 $350.6 $324.9 $360.8 $338.0 $299.8 $255.5 % Growth (YoY) 0.0% 3.8% (8.0%) (14.5%) (21.4%) Gross Profit 32.2 36.9 33.9 39.3 35.4 37.5 32.4 31.0 31.0 % Revenue 9.9% 10.6% 9.2% 11.2% 10.9% 10.4% 9.6% 10.3% 12.1% % Growth (YoY) 9.9% 1.6% (4.4%) (21.1%) (12.4%) EBITDA (2) 12.2 14.0 9.6 13.9 10.6 12.0 9.7 7.5 9.1 % Revenue 3.8% 4.0% 2.6% 4.0% 3.3% 3.3% 2.9% 2.5% 3.6% % Growth (YoY) (13.1%) (14.3%) 1.0% (46.0%) (14.2%) Operating Profit (3) 3.5 6.1 1.4 0.3 1.7 3.5 1.2 (0.3) 0.6 % Revenue 1.1% 1.8% 0.4% 0.1% 0.5% 1.0% 0.4% (0.1%) 0.2% % Growth (YoY) (51.4%) (42.6%) (14.3%) NM (64.7%) Net Income (3) $1.5 $3.7 $0.7 ($2.0) ($2.1) $0.0 $3.3 ($17.5) ($1.7) % Revenue 0.5% 1.1% 0.2% (0.6%) (0.6%) 0.0% 1.0% (5.8%) (0.7%) % Growth (YoY) NM (100.0%) 371.4% NM NM Source Celtic Investor Presentation May 2009 (Publicly Available) Notes 1. 1Q 2007 to 3Q 2007 reflect the pro forma combined results of Celtic and KGCS (as per May 2009 Celtic Investor Presentation) 2. Includes stock-based compensation. Excludes merger related expenses, acquisition activity related expenses, option analysis expense, retroactive regulatory fees & other, and purchase accounting adjustments 3. Excludes goodwill impairments (tax expense has not been adjusted in 2008)

CONFIDENTIAL WORKING DRAFT — FOR DISCUSSION PURPOSES ONLY Project Celtic Jefferies & Company terminated coverage of Celtic in February 2009 Declines in estimates from early / mid 2008 to February 2009 followed the trends in Celtic's underlying business Morgan Stanley Evolution of Celtic Analyst Estimates Based on Estimates From Jefferies & Company (1) 2008 Revenue Estimates ($MM) 1,750 1,500 1,250 1,000 Date of Report: (4.7%)(2) 1,388 4/29/08 1,421 7/23/08 1,362 10/22/08 1,324 2/6/09 2009 Revenue Estimates ($MM) 1,750 1,500 1,250 1,000 (18.1%)(2) 1,535 4/29/08 1,578 7/23/08 1,400 10/22/08 1,257 2/6/09 2010 Revenue Estimates ($MM) 1,750 1,500 1,250 1,000 (23.8%)(2) 1,674 4/29/08 1,721 7/23/08 1,411 10/22/08 1,275 2/6/09 2008 EBITDA Estimates (3) ($MM) 75 50 25 0 Date of Report (23.6%)(2) 52 4/29/08 50 7/23/08 42 10/22/08 40 2/6/09 2009 EBITDA Estimates (3) ($MM) 75 50 25 0 ($45.3%) (2) 64 4/29/08 62 7/23/08 45 10/22/08 35 2/6/09 2010 EBITDA Estimates (3) ($MM) 75 50 25 0 (45.9%)(2) 70 4/29/08 68 7/23/08 46 10/22/08 38 2/6/09 Source Jefferies & Company Research Notes 1. Jefferies & Company terminated coverage of Celtic following 2/6/09 report 2. Percentages represent change between 2/6/09 vs. 4/29/08 estimates 3. EBITDA post stock-based compensation expense

CONFIDENTIAL WORKING DRAFT - FOR DISCUSSION PURPOSES ONLY Project Celtic Preliminary KPN Scenario (3) (MM) 2009E Minutes 20,698 Revenue $1,015.5 % Growth (YoY) (23.3%) Gross Profit 121.8 % Margin 12.0% % Growth (YoY) (10.7%) EBITDA 38.9 % Margin 3.8% % Growth (YoY) (2.4%) Morgan Stanley Performance Compared to Celtic Board Plan (1) Based on YTD May Results (2) YTD May Comparison (MM) YTD May ‘09 Actual % Change to 2008 2009 2009 2008 2009 Actual Board Plan (1) Actual (2) Actual Board Plan Minutes 9,968 9,732 8,291 (16.8%) (14.8%) Net Revenue $566.6 $525.3 $414.7 (26.8%) (21.1%) Gross Profit 59.6 50.5 50.9 (14.6%) 0.8% % Margin 10.5% 9.6% 12.3% EBITDA 15.5 11.4 15.0 (3.2%) 31.6% % Margin 2.7% 2.2% 3.6% Illustrative ‘09 Trend Analysis (MM) YTD May Actual YTD May ’08 Actual as of % of Full Year Implied 2009 Run-Rate (4) ‘09 Run-Rate % Change to 2008 Actual 2009 Board Plan 2009 Prelim. KPN Scenario Minutes 8,291 42.4% 19,569 (16.8%) (18.5%) (5.5%) Net Revenue $414.7 42.8% $968.8 (26.8%) (26.2%) (4.6%) Gross Profit 50.9 43.7% 116.4 (14.6%) (9.2%) (4.4%) EBITDA 15.0 38.9% 38.5 (3.2%) 2.4% (0.9%) Notes 1. Based on Celtic Board Plan for 2009 dated December 12, 2008 2. Based on May 2009 management letter prepared by Celtic management 3. Based on preliminary forecasts for Celtic prepared by management of KPN 4. Calculated as follows: (2009 YTD May Actual) / (2008 YTD May Actual as % of Full Year 2008)

CONFIDENTIAL WORKING DRAFT - FOR DISCUSSION PURPOSES ONLY Project Celtic Projected CAGRs Preliminary KPN Scenario (1) Jefferies & Company Scenario (2) 2008A - 2014E Revenue (3.2%) 0.1% EBITDA (4.4%) (0.6%) LFCF 0.5% (16.3%) 2009E - 2014E Revenue 1.4% 1.1% EBITDA (4.8%) 1.8% LFCF 16.7% (15.5%) LFCF Bridge (5) ($MM, except where noted) Preliminary KPN Scenario (1) Jefferies & Company Scenario (2) Celtic Board Plan (3) 2009E EBITDA (post comp) $39 $35 $38 Less: Capex (13) (15) (15) Less: Net Interest Expense (1) (1) 0 Less: Cash Taxes (2) (6) (3) Less: Change in WC (6) (18) (3) 4 Plus: Stock-Based Comp.(7) 3 3 4 LFCF $8 $14 $28 2014E EBITDA (post comp) $30 $38 Less: Capex (13) (28) Less: Net Interest Expense (0) (1) Less: Cash Taxes (4) (6) Less: Change in WC 1 (2) Plus: Stock-Based Comp. 4 4 LFCF $18 $6 Review of Illustrative Financial Scenarios Celtic Standalone Projections: 2009E - 2014E Revenue ($MM) 1,500 1,200 900 600 300 0 1,016 1,257 1,313 2009E 1,023 1275 2010E 1,037 1,289 2011E 1,054 1,304 2012E 1,071 1,316 2013E 1,089 1,329 2014E % Growth (23.3%)/(5.0%)/(0.8%) 0.8%/1.5% 1.4%/1.1% 1.6%/1.1% 1.6%/1.0% 1.7%/0.9% EBITDA (4) ($MM) 50 40 30 20 10 0 39 35 38 2009E 35 38 2010E 34 38 2011E 32 38 2012E 30 38 2013E 30 38 2014E % Margin 3.8%/2.8%/2.9% 3.4%/3.0% 3.3%/3.0% 3.0%/3.0% 2.8%/2.9% 2.8%/2.9% LCCF (5) ($MM) 30 25 20 15 10 5 0 8 14 28 2009E 24 15 2010E 23 10 2011E 21 10 2012E 18 6 2013E 18 6 2014E % Margin 0.8%/1.1%/2.1% 2.4%/1.1% 2.2%/0.7% 2.0%/0.8% 1.7%/0.5% 1.6%/0.4% Preliminary KPN Scenario (1) Jefferies & Company Scenario (2) Celtic Board Plan (3) Notes 1. Based on preliminary forecasts for Celtic prepared by management of KPN 2. Based on projections published by Jefferies & Company on 2/6/09, which was the last report published before analyst discontinued coverage 3. Based on Celtic Board Plan for 2009 dated December 12, 2008 4. EBITDA post stock-based compensation expense 5. LFCF defined as Cash Flow from Operations – Capex; Preliminary KPN Scenario and Jefferies & Company Scenario both assume a constant $22.0MM of debt outstanding each year at a floating rate of LIBOR + 275bps and an interest rate on cash balances of 1.0% 6. Preliminary KPN Scenario change in working capital projected holding 2008A days receivable and days payable constant in the projected period 7. Celtic Board Plan stock-based compensation assumed to be $3.7MM which represents the incentive compensation per the Plan dated of December 12, 2008

CONFIDENTIAL WORKING DRAFT - FOR DISCUSSION PURPOSES ONLY Project Celtic Trading statistics for selected alternative carriers provided for illustrative purposes only Comparability with Celtic for valuation purposes is limited given Celtic’s unique business model and financial profile Historical Trading Relationship Celtic Multiple / Alt. Carrier Multiple (4) (%) 100.0% 80.0% 60.0% 40.0% 20.0% 0.0% 10% 30% AV/LTM Revenue 31% 35% AV/LTM EBITDA Current Since 2008 (5) Source FactSet, Company Filings Morgan Stanley Current Trading Multiples Analysis As of 7/7/09 Celtic & Selected Alternative Carriers ($MM, except where noted) Price as of 7/7/09 Equity Value Aggregate Value (1) AV/Revenue (2) AV/EBITDA(2) 2008A 2009E 2010E 2008A 2009E 2010E Celtic (3) $1.18 $84 $58 0.04x 0.05x 0.05x 1.5x 1.6x 1.5x Selected Alternative Carriers (Ranked by Equity Value) Level 3 $1.38 $2,282 $7,289 1.69x 1.90x 1.92x 8.0x 7.8x 7.5x Global Crossing 8.54 523 1,389 0.54x 0.55x 0.52x 5.1x 4.2x 3.5x Vonage 0.35 55 250 0.28x 0.28x 0.28x 5.9x 3.0x 2.9x Arbinet 1.80 40 22 0.05x NA NA 3.4x NA NA IDT (Class B) 1.73 41 6 0.00x 0.00x 0.00x NM NM NM Fusion Telecommunications 0.11 6 10 0.20x NA NA NM NA NA deltathree 0.16 12 9 0.47x NA NA NM NA NA Rapid Link 0.05 3 16 0.90x NA NA NM NA NA Source Company Filings, FactSet, Wall Street Research Notes 1. Level 3 and Global Crossing AV based on market value of debt 2. Multiples not meaningful because of negative EBITDA 3. Equity value includes impact of 1.3 million options issued in 1Q 2009, weighted average exercise price assumed to be $0.96, the VWAP during 1Q 2009; Celtic 2009 and 2010 metrics based on last available estimates from Jefferies and Company, from 2/6/09 4. Chart shows the average relationship between Celtic and each of the selected alternative carriers displayed in the chart above. Relationship defined as Celtic multiple as percentage of alternative carrier multiple 5. Since 2/4/08

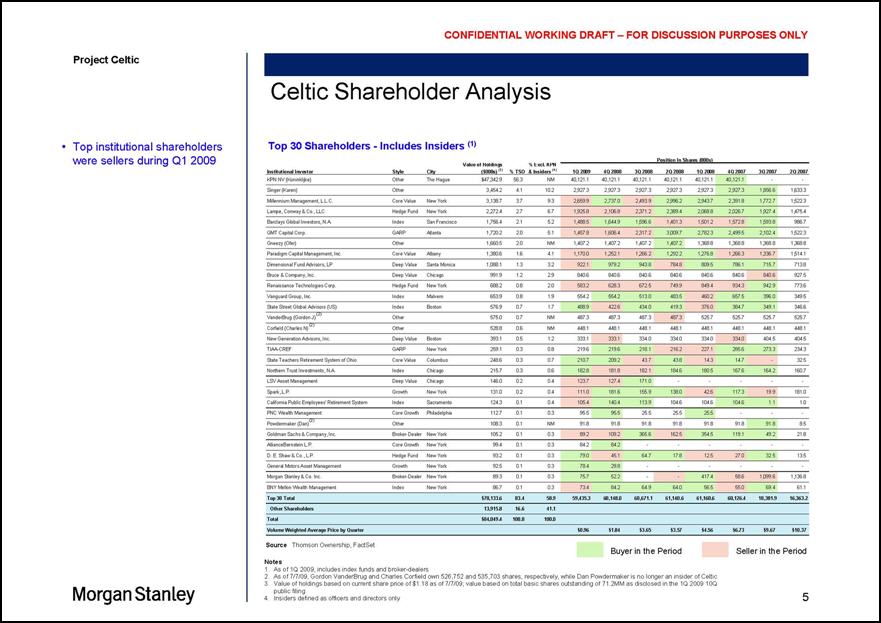

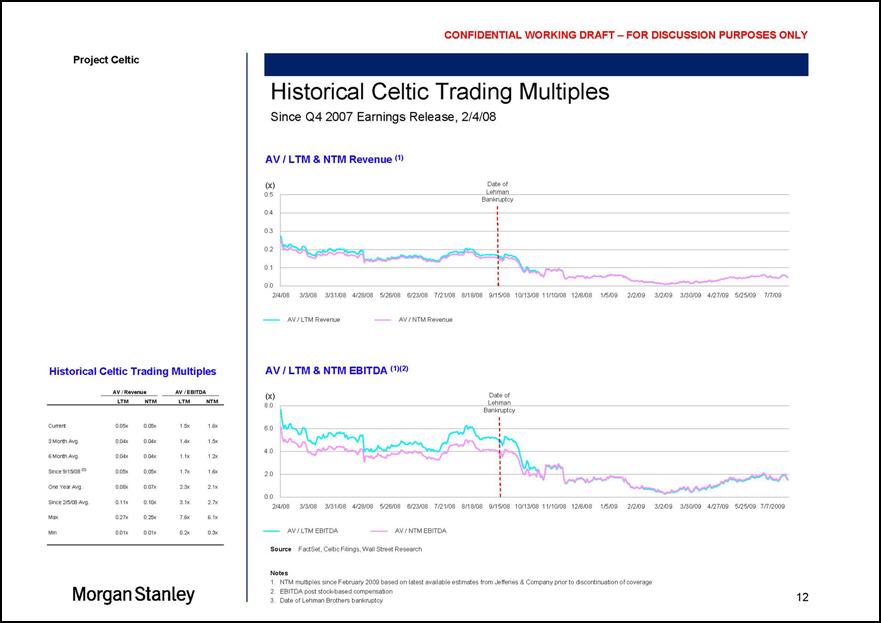

CONFIDENTIAL WORKING DRAFT - FOR DISCUSSION PURPOSES ONLY Project Celtic Historical Celtic Trading Multiples AV / Revenues AV / EBITDA LTM NTM LTM NTM Current 0.05x 0.05x 1.5x 1.6x 3 Month Avg. 0.04x 0.04x 1.4x 1.5x 6 Month Avg. 0.04x 0.04x 1.1x 1.2x Since 9/15/08 (3) 0.05x 0.05x 1.7x 1.6x One Year Avg. 0.08x 0.07x 2.3x 2.1x Since 2/5/08 Avg. 0.11x 0.10x 3.1x 2.7x Max 0.27x 0.25x 7.6x 6.1x Min 0.01x 0.01x 0.2x 0.3x Morgan Stanley Historical Celtic Trading Multiples Since Q4 2007 Earnings Release, 2/4/08 AV / LTM & NTM Revenue(1) (X) 0.5 0.4 0.3 0.2 0.1 0.0 2/4/08 3/3/08 3/31/08 4/28/08 5/26/08 6/23/08 7/21/08 8/18/08 Date of Lehman Bankruptcy 9/15/08 10/13/08 11/10/08 12/8/08 1/5/09 2/2/09 3/2/09 3/30/09 4/27/09 5/25/09 7/7/09 AV / LTM Revenue AV / NTM Revenue AV / LTM & NTM EBITDA (1)(2) (X) 8.0 6.0 4.0 2.0 0.0 2/4/08 3/3/08 3/31/08 4/28/08 5/26/08 6/23/08 7/21/08 8/18/08 Date of Lehman Bankruptcy 9/15/08 10/13/08 11/10/08 12/8/08 1/5/09 2/2/09 3/2/09 4/27/09 5/25/09 7/7/2009 AV / LTM EBITDA AV / NTM EBITDA Source FactSet, Celtic Filings, Wall Street Research Notes 1. NTM multiples since February 2009 based on latest available estimates from Jefferies & Company prior to discontinuation of coverage 2. EBITDA post stock-based compensation 3. Date of Lehman Brothers bankruptcy

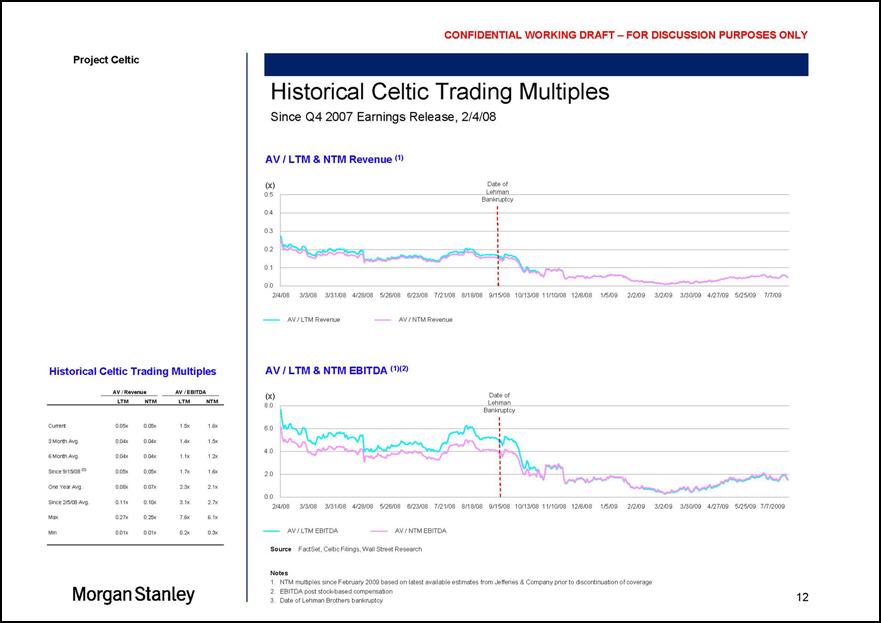

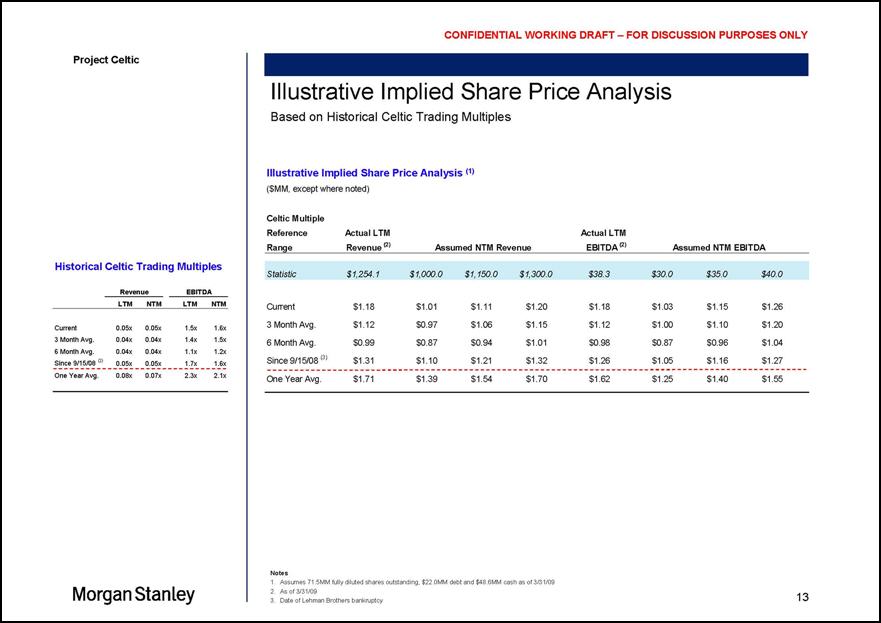

CONFIDENTIAL WORKING DRAFT - FOR DISCUSSION PURPOSES ONLY Project Celtic Historical Celtic Trading Multiples Revenue EBITDA LTM NTM LTM NTM Current 0.05x 0.05x 1.5x 1.6x 3 Month Avg. 0.04x 0.04x 1.4x 1.5x 6 Month Avg. 0.04x 0.04x 1.1x 1.2x Since 9/15/08 (2) 0.05x 0.05x 1.7x 1.6x One Year Avg. 0.08x 0.07x 2.3x 2.1x Morgan Stanley Illustrative Implied Share Price Analysis Based on Historical Celtic Trading Multiples Illustrative Implied Share Price Analysis (1) ($MM, except where noted) Celtic Multiple Reference Actual LTM Actual LTM Range Revenue (2) Assumed NTM Revenue EBITDA (2) Assumed NTM EBITDA Statistic $1,254.1 $1,000.0 $1,150.0 $1,300.0 $38.3 $30.0 $35.0 $40.0 Current $1.18 $1.01 $1.11 $1.20 $1.18 $1.03 $1.15 $1.26 3 Month Avg. $1.12 $0.97 $1.06 $1.15 $1.12 $1.00 $1.10 $1.20 6 Month Avg. $0.99 $0.87 $0.94 $1.01 $0.98 $0.87 $0.96 $1.04 Since 9/15/08 (3) $1.31 $1.10 $1.21 $1.32 $1.26 $1.05 $1.16 $1.27 One Year Avg. $1.71 $1.39 $1.54 $1.70 $1.62 $1.25 $1.40 $1.55 Notes 1. Assumes 71.5MM fully diluted shares outstanding, $22.0MM debt and $48.6MM cash as of 3/31/09 2. As of 3/31/09 3. Date of Lehman Brothers bankruptcy

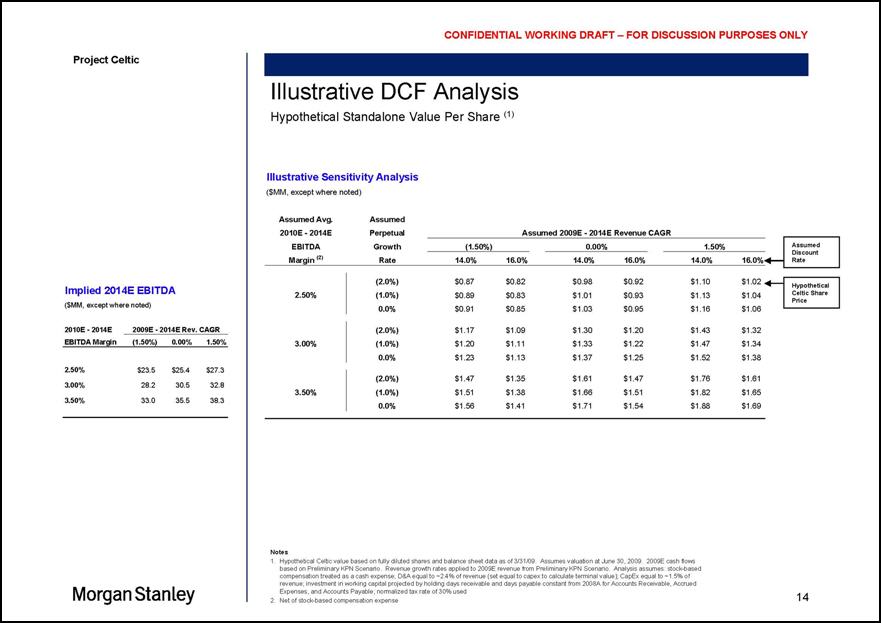

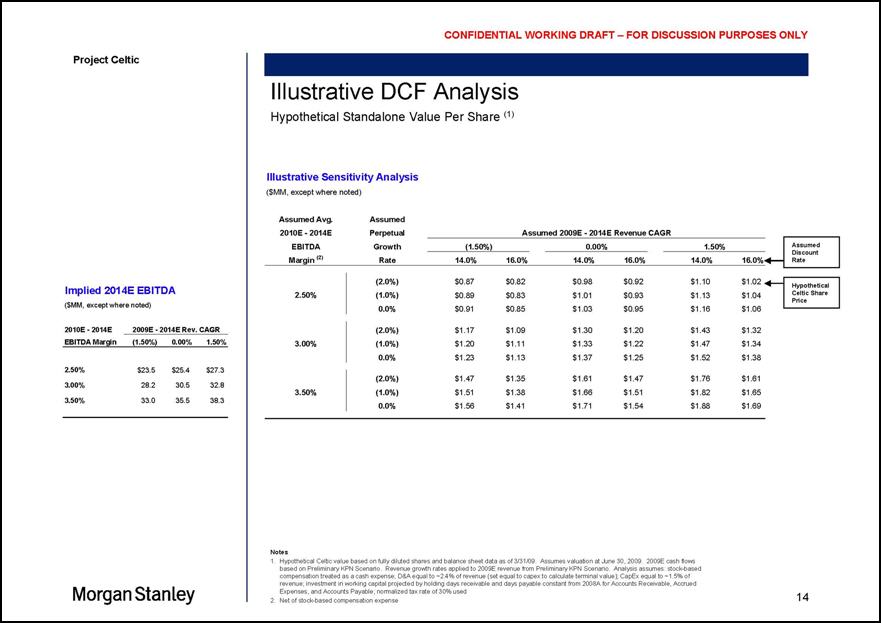

CONFIDENTIAL WORKING DRAFT - FOR DISCUSSION PURPOSES ONLY Project Celtic Implied 2014E EBITDA ($MM, except where noted) 2010E - 2014E 2009E - 2014E Rev. CAGR EBITDA Margin (1.50%) 0.00% 1.50% 2.50% $23.5 $25.4 $27.3 3.00% 28.2 30.5 32.8 3.50% 33.0 35.5 38.3 Morgan Stanley Illustrative DCF Analysis Hypothetical Standalone Value Per Share (1) Illustrative Sensitivity Analysis ($MM, except where noted) Assumed Avg 2010E - 2014E EBITDA Margin (2) Assumed Perpetual Growth Rate Assumed 2009E - 2014E Revenue CAGR (1.50%) 0.00% 1.50% 14.0% 16.0% 14.0% 16.0% 14.0% 16.0% Assumed Discount Rate 2.50%}(2.0%) $0.87 $0.82 $0.98 $0.92 $1.10 $1.02 Hypothetical Celtic Share Price (1.0%) $0.89 $0.83 $1.01 $0.93 $1.13 $1.04 0.0% $0.91 $0.85 $1.03 $0.95 $1.16 $1.06 3.00%}(2.0%) $1.17 $1.09 $1.30 $1.20 $1.43 $1.32 (1.0%) $1.20 $1.11 $1.33 $1.22 $1.47 $1.34 0.0% $1.23 $1.13 $1.37 $1.25 $1.52 $1.38 3.50%}(2.0%) $1.47 $1.35 $1.61 $1.47 $1.76 $1.61 (1.0%) $1.51 $1.38 $1.66 $1.51 $1.82 $1.65 0.0% $1.56 $1.41 $1.71 $1.54 $1.88 $1.69 Notes 1. Hypothetical Celtic value based on fully diluted shares and balance sheet data as of 3/31/09. Assumes valuation at June 30, 2009. 2009E cash flows based on Preliminary KPN Scenario. Revenue growth rates applied to 2009E revenue from Preliminary KPN Scenario. Analysis assumes: stock-based compensation treated as a cash expense; D&A equal to -2.4% of revenue (set equal to capex to calculate terminal value); CapEx equal to -1.5% of revenue; investment in working capital projected by holding days receivable and days payable constant from 2008A for Accounts Receivable, Accrued Expenses, and Accounts Payable; normalized tax rate of 30% used 2. Net of stock-based compensation expense

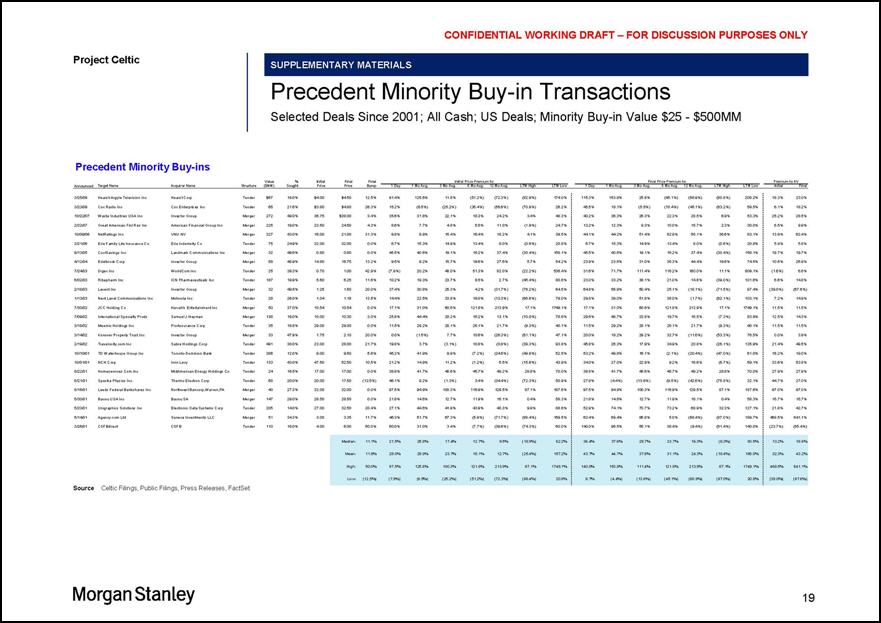

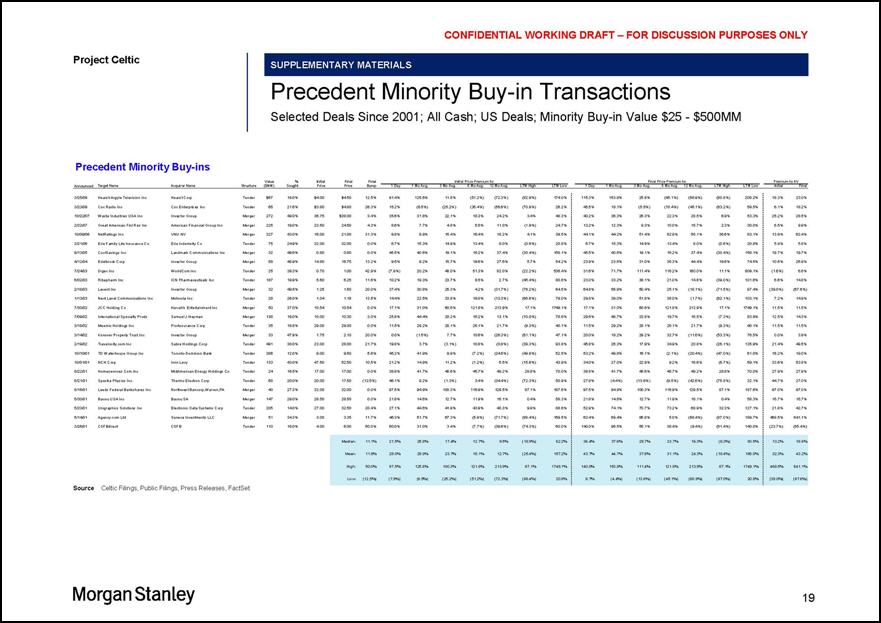

CONFIDENTIAL WORKING DRAFT - FOR DISCUSSION PURPOSES ONLY Project Celtic Morgan Stanley Precedent Transaction Observations Reviewed 26 minority buy-in deals between $25MM - $500MM since 2001 Universe limited to all-cash transactions involving U.S. targets where majority shareholder owned less than 90% Summary statistics Median deal size of $68MM Median affiliate ownership of ~73% Premium Paid Summary (%) Initial Price Final Price Median Mean Median Mean 1 Day Prior Aggregate Value 13% 32% 19% 43% 1 Day Prior Price 21 % 29% 36% 44% 1 Month Avg. Price 26% 30% 38% 45% 3 Month Avg. Price 17% 24% 29% 38% Source Celtic Filings, Public Filings, Press Releases, FactSet

CONFIDENTIAL WORKING DRAFT - FOR DISCUSSION PURPOSES ONLY Project Celtic Celtic’s substantial net cash position should be considered when assessing transaction premiums Morgan Stanley Pricing Considerations Illustrative Pricing Matrix ($MM, except where noted) Assumed Buy-in Offer Price Equity Value (1) Aggregate Value (2) Buy-In Amount (3)% Premium to Aggregate Value % Premium to Price (4) 1 Day 1 Day 1 Mo Avg. 3 Mo Avg. 6 Mo Avg. LTM High LTM Low Statistic $57.8 $1.18 $1.28 $1.13 $1.03 $4.44 $0.51 $1.00 $71 $45 $31 (23%) (15%) (22%) (12%) (3%) (77%) 96% $1.10 79 52 34 (10%) (7%) (14%) (3%) 7% (75%) 116% $1.20 86 59 37 3% 2% (6%) 6% 17% (73%) 135% $1.30 93 66 41 15% 10% 2% 15% 26% (71%) 155% $1.40 100 74 44 28% 19% 9% 23% 36% (68%) 175% $1.50 108 81 47 40% 27% 17% 32% 46% (66%) 194% $1.60 115 88 50 53% 36% 25% 41% 56% (64%) 214% $1.70 122 96 53 65% 44% 33% 50% 65% (62%) 233% $1.80 129 103 57 78% 53% 41% 59% 75% (59%) 253% $1.90 137 110 60 91% 61% 48% 68% 85% (57%) 273% $2.00 144 117 63 103% 69% 56% 76% 95% (55%) 292% Precedent Minority Buy-Ins (5) Initial Median 13% 21% 26% 17% 13% (19%) 62% Mean 32% 29% 30% 24% 18% (25%) 157% High 469% 98% 126% 100% 122% 87% 1749% Low (39%) (8%) (7%) (25%) (51%) (88%) 21% Final Median 19% 36% 38% 29% 24% (8%) 84% Mean 43% 44% 45% 38% 31% (18%) 185% High 641% 140% 154% 111% 122% 87% 1749% Low (68%) 7% (4%) (14%) (45%) (87%) 21% Source Celtic Filings, Public Filings, Press Releases, FactSet Notes 1. Balance sheet as of 3/31/09, assumes 71.5MM basic shares outstanding and dilution from options as per 10K as of 12/31/08, options dilution includes impact of 1.3 million options issued in 1Q 2009, weighted average exercise price assumed to be $0.96, the VWAP during 1Q 2009 2. Assumes total debt of $22.0MM and cash of $48.6MM as of 3/31/09 3. Based on KPN ownership of 56.3% of Celtic 4. Based on share price as of 7/7/09 5. Based on selected deals since 2001; all cash; US deals; minority buy-in value $25 - $500MM

CONFIDENTIAL WORKING DRAFT - FOR DISCUSSION PURPOSES ONLY Project Celtic Morgan Stanley Appendix A Supplementary Materials

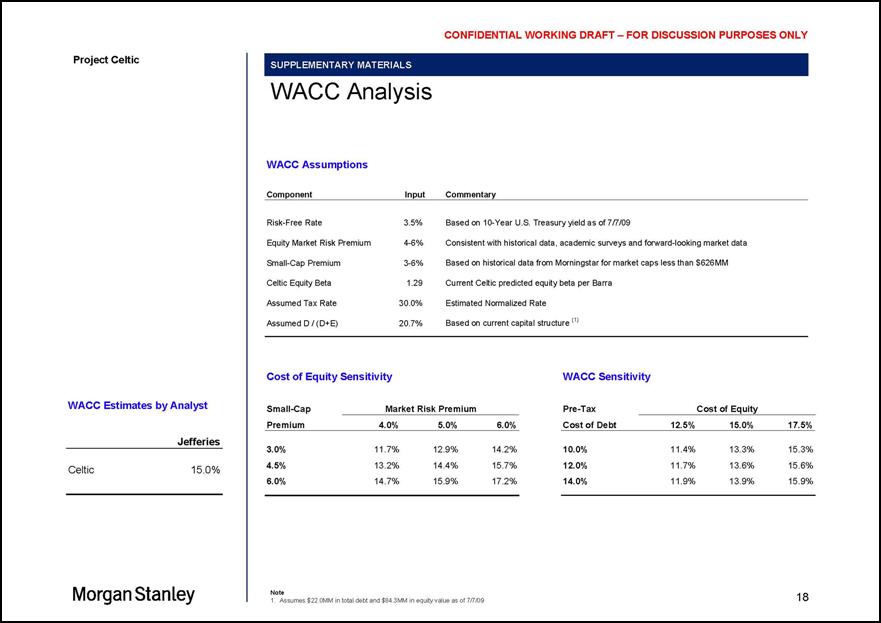

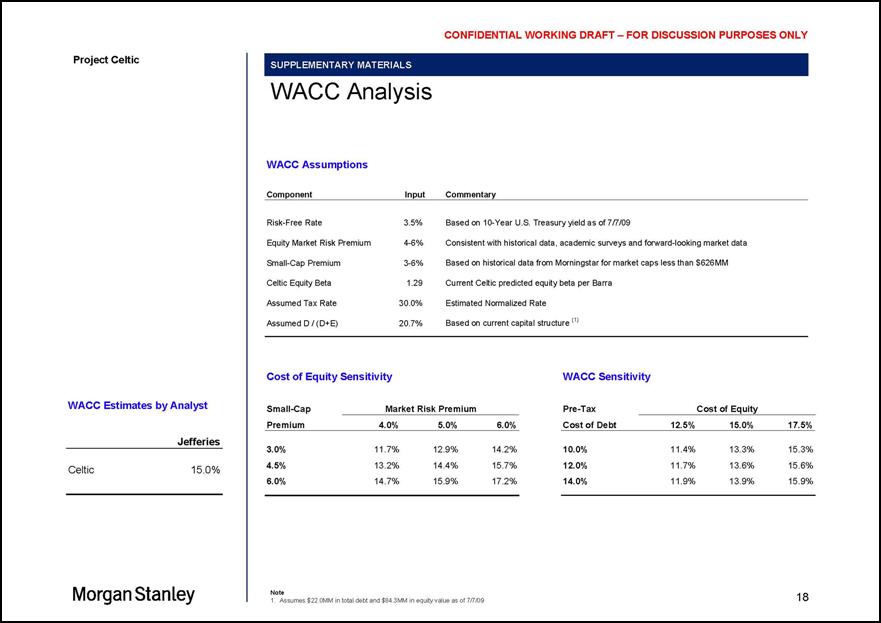

CONFIDENTIAL WORKING DRAFT - FOR DISCUSSION PURPOSES ONLY Project Celtic WACC Estimates by Analyst Jefferies Celtic 15.0% Morgan Stanley Supplementary Materials WACC Analysis WACC Assumptions Component Input Commentary Risk-Free Rate 3.5% Based on 10-Year U.S. Treasury yield as of 7/7/09 Equity Market Risk Premium 4-6% Consistent with historical data, academic surveys and forward-looking market data Small-Cap Premium 3-6% Based on historical data from Morningstar for market caps less than $626MM Celtic Equity Beta 1.29 Current Celtic predicted equity beta per Barra Assumed Tax Rate 30.0% Estimated Normalized Rate Assumed D / (D+E) 20.7% Based on current capital structure (1) Cost of Equity Sensitivity Small-Cap Premium Market Risk Premium 4.0% 5.0% 6.0% 3.0% 11.7% 12.9% 14.2% 4.5% 13.2% 14.4% 15.7% 6.0% 14.7% 15.9% 17.2% WACC Sensitivity Pre-Tax Cost of Debt Cost of Equity 12.5% 15.0% 17.5% 10.0% 11.4% 13.3% 15.3% 12.0% 11.7% 13.6% 15.6% 14.0% 11.9% 13.9% 15.9% Note 1. Assumes $22.0MM in total debt and $84.3MM in equity value as of 7/7/09

CONFIDENTIAL WORKING DRAFT - FOR DISCUSSION PURPOSES ONLY Project Celtic Supplementary Materials Precedent Minority Buy-in Transactions Selected Deals Since 2001; All Cash; US Deals; Minority Buy-in Value $25 - $500MM Precedent Minority Buy-ins Announced Target Name Acquiror Name Structure Value ($MM) % Sought Initial Price Final Price Final Bump Initial Price Premium to: Final Price Premium to: Premium to AV: 1 Day 1 Mo Avg. 3 Mo Avg. 6 Mo Avg. 12 Mo Avg. LTM High LTM Low 1 Day 1 Mo Avg. 3 Mo Avg. 6 Mo Avg. 12 Mo Avg. LTM High LTM Low Initial Final 3/25/09 Hearst-Argyle Television Inc Hearst Corp Tender 567 18.0% $4.00 $4.50 12.5% 91.4% 125.6% 11.8% (51.2%) (72.3%) (82.9%) 174.0% 115.3% 153.8% 25.8% (45.1%) (68.9%) (80.8%) 208.2% 18.3% 23.0% 3/23/09 Cox Radio Inc Cox Enterprises Inc Tender 65 21.6% $3.80 $4.80 26.3% 15.2% (6.5%) (25.2%) (35.4%) (56.6%) (70.9%) 26.2% 45.5% 18.1% (5.5%) (18.4%) (45.1%) (63.2%) 59.5% 6.1% 18.2% 10/22/07 Waste industries USA Inc Investor Group Merger 272 49.0% 36.75 $38.00 3.4% 35.6% 31.8% 22.1% 18.3% 24.2% 3.4% 48.3% 40.2% 36.3% 26.3% 22.3% 28.5% 6.9% 53.3% 25.2% 28.5% 2/22/07 Great American Finl Res Inc American Financial Group Inc Merger 225 19.0% 23.50 24.50 4.3% 8.6% 7.7% 4.8% 5.5% 11.0% (1.9%) 24.7% 13.2% 12.3% 9.3% 10.0% 15.7% 2.3% 30.0% 6.5% 9.9% 10/09/06 NetRatings Inc VNU NV Merger 327 43.0% 16.00 21.00 31.3% 9.8% 9.9% 15.4% 16.4% 18.2% 4.1% 39.5% 4.41% 44.2% 51.4% 52.8% 55.1% 36.6% 83.1% 13.9% 62.4% 3/21/06 Erie Family Life insurance Co Erie Indemnity Co Tender 75 24.9% 32.00 32.00 0.0% 6.7% 15.3% 14.9% 13.4% 8.0% (0.6%) 20.8% 6.7% 15.3% 14.9% 13.4% 8.0% (0.6%) 20.8% 5.8% 5.8% 9/13/05 CoolSavings Inc Landmark Communications Inc Merger 32 49.6% 0.80 0.80% 0.0% 45.5% 40.6% 19.1% 18.2% 37.4% (30.4%) 158.1% 45.5% 40.6% 19.1% 16.2% 37.4% (30.4%) 158.1% 19.7% 19.7% 4/12/04 Edelbrock Corp Investor Group Merger 58 48.9% 14.80 16.75 13.2% 9.5% 9.2% 15.7% 19.6% 27.6% 5.7% 54.2% 23.9% 23.6% 31.0% 35.3% 44.4% 19.6% 74.5% 10.6% 26.9% 7/24/03 Digex Inc WorldCom Inc Tender 25 39.3% 0.70 1.00 42.9% (7.9%) 20.2% 48.0% 51.3% 82.0% (22.2%) 536.4% 31.6% 71.7% 111.4% 116.2% 160.0% 11.1% 809.1% (1.6%) 6.6% 6/02/03 Ribapharm Inc ICN Pharmaceuticals Inc Tender 187 19.9% 5.60 6.25 11.6% 10.2% 19.3% 23.7% 8.5% 2.7% (45.4%) 80.6% 23.0% 33.2% 38.1% 21.0% 14.6% (39.0%) 101.6% 6.6% 14.8% 2/18/03 Lexent Inc Investor Group Merger 32 49.5% 1.25 1.50 20.0% 37.4% 30.8% 25.3% 4.2% (31.7%) (76.2%) 64.5% 64.8% 56.9% 50.4% 25.1% (18.1%) (71.5%) 97.4% (39.0%) (67.6%) 1/13/03 Next Level Communications Inc Motorola Inc Tender 28 26.0% 1.04 1.18 13.5% 14.4% 22.5% 33.8% 19.0% (13.3%) (66.6%) 79.0% 29.8% 39.0% 51.8% 35.0% (1.7%) (62.1%) l03.l% 7.2% 1.49% 7/30/02 JCC Holding Co Harrah’s Entertainment Inc. Merger 50 37.0% 10.54 10.54 0.0% 17.1% 31.0% 60.6% 121.8% 213.9% 17.1% 1749.1% 17.1% 31.0% 60.6% 121.8% 213.9% 17.1% 1749.1% 11.5% 11.5% 7/09/02 International Specialty Prods Samuel J Heyman Merger 138 19.0% 10.00 10.30 3.0% 25.8% 44.4% 20.2% 16.2% 13.1% (10.0%) 78.6% 29.6% 48.7% 23.8% 19.7% 16.5% (7.3%) 83.9% 12.5% 14.3% 3/18/02 Meemic Holdings Inc ProAssurance Corp Tender 35 18.8% 29.00 29.00 0.0% 11.5% 29.2% 28.1% 26.1% 21.7% (9.3%) 40.1% 11.5% 29.2% 28.1% 26.1% 21.7% (9.3%) 40.1% 11.5% 11.5% 3/14/02 Konover Property Trust Inc Investor Group Merger 33 47.9% 1.75 2.10 20.0% 0.0% (1.5%) 7.7% 10.6% (26.3%) (61.1%) 47.1% 20.0% 18.2% 29.2% 32.7% (11.6%) (53.3%) 76.5% 0.0% 3.9% 2/19/02 Travelocity.com Inc Sabre Holdings Corp Tender 491 30.0% 23.00 28.00 21.7% 19.8% 3.7% (3.l%) 10.8% (0.8%) (39.3%) 93.8% 45.8% 26.3% 17.9% 34.9% 20.8% (26.1%) 135.9% 21.4% 49.5% 10/10/01 TD Waterhouse Group Inc Toronto-Dominion Bank Tender 386 12.0% 9.00 9.50 5.6% 45.2% 41.9% 9.9% (7.2%) (24.5%) (49.8%) 52.5% 53.2% 49.8% 16.1% (2.1%) (20.4%) (47.0%) 61.0% 16.2% 19.0% 10/01/01 NCH Corp Irvin Levy Tender 133 43.0% 47.50 52.50 10.5% 21.2% 14.9% 11.2% (1.2%) 5.5% (15.8%) 43.9% 34.0% 27.0% 22.9% 9.2% 16.6% (6.7%) 59.1% 33.6% 53.8% 8/22/01 Homeservices Com Inc MidAmerican Energy Holdings Co Tender 24 16.5% 17.00 17.00 0.0% 38.8% 41.7% 48.6% 45.7% 49.2% 28.8% 70.0% 38.8% 41.7% 48.6% 45.7% 49.2% 28.8% 70.0% 27.9% 27.9% 8/21/01 Spectra Physics Inc Thermo Electron Corp Tender 68 20.0% 20.00 17.50 (12.5%) 46.1% 9.2% (1.3%) 3.4% (34.4%) (72.3%) 50.9% 27.8% (4.4%) (13.6%) (9.5%) (42.6%) (75.8%) 32.1% 44.7% 27.0% 8/16/01 Leeds Federal Bankshares Inc Northwest Bancorp, Warren,PA Merger 40 27.3% 32.00 32.00 0.0% 97.5% 94.9% 100.3% 116.9% 129.5% 87.1% 187.6% 97.5% 94.9% 100.3% 116.9% 129.5% 87.1% 187.6% 97.0% 97.0% 5/30/01 Bacou USA Inc Bacou SA Merger 147 29.0% 28.50 28.50 0.0% 21.8% 14.6% 12.7% 11.9% 16.1% 0.4% 58.3% 21.8% 14.6% 12.7% 11.9% 16.1% 0.4% 58.3% 16.7% 16.7% 5/23/01 Unigraphics Solutions Inc Electronic Data Systems Corp Tender 205 14.0% 27.00 32.50 20.4% 27.1% 44.6% 41.9% 43.9% 40.3% 9.9% 88.6% 52.9% 74.1% 70.7% 73.2% 68.9% 32.3% 127.1% 21.8% 42.7% 5/14/01 Agency.com Ltd Seneca Investments LLC Merger 51 34.3% 3.00 3.35 11.7% 46.3% 51.7% 67.3% (5.9%) (71.7%) (88.4%) 159.5% 63.4% 69.4% 86.8% 5.0% (68.4%) (87.0%) 189.7% 468.5% 641.1% 3/26/01 CSFBdirect CSFB Tender 110 18.0% 4.00 6.00 50.0% 60.0% 31.0% 3.4% (7.7%) (39.6%) (74.3%) 60.0% 140.0% 96.5% 55.1% 38.4% (9.4%) (61.4%) 140.0% (23.7%) (55.4%) Median: 11.1% 21.5% 25.8% 17.4% 12.7% 9.5% (18.9%) 62.2% 36.4% 37.8% 26.7% 23.7% 16.3% (8.3%) 83.5% 13.2% 18.6% Mean: 11.9% 29.0% 29.9% 23.7% 18.1% 12.7% (25.4%) 157.2% 43.7% 44.7% 37.8% 31.1% 24.3% (18.4%) 185.0% 32.3% 43.2% High: 50.0% 97.5% 125.6% 106.3% 121.8% 213.9% 87.1% 1749.1% 140.6% 153.8% 111.4% 121.8% 213.9% 87.1% 1749.1% 468.5% 641.1% Low: (12.5%) (7.9%) (6.5%) (25.2%) (51.2%) (72.3%) (88.4%) 20.8% 6.7% (4.4%) (13.8%) (45.1%) (88.9%) (87.0%) 20.8% (39.0%) (67.6%) Source Celtic Filings, Public Filings, Press Releases, FactSet Morgan Stanley