QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12

|

iBASIS, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

Dear Shareholder:

You are cordially invited to attend the 2003 Annual Meeting of Shareholders of iBasis, Inc., which will be held at our offices, located at 20 Second Avenue, Burlington, Massachusetts 01803, on Thursday, May 29, 2003 at 10:00 a.m., local time.

The Notice of Annual Meeting of Shareholders and a Proxy Statement, which describe the formal business to be conducted at the meeting, accompany this letter. Our 2002 Annual Report on Form 10-K is also enclosed for your information.

All shareholders are invited to attend the Annual Meeting. However, to ensure your representation at the Annual Meeting, you are urged to complete, date, sign and return the enclosed Proxy Card (a postage-prepaid envelope is enclosed for that purpose).

Your shares cannot be voted unless you date, sign, and return the enclosed proxy card, vote electronically via the Internet, vote by telephone, or attend the annual meeting in person. Regardless of the number of shares you own, your careful consideration of, and vote upon, the matters before the shareholders are important.

| | | Sincerely, |

|

|

Ofer Gneezy

President and Chief Executive Officer |

iBASIS, INC.

20 Second Avenue

Burlington, Massachusetts 01803

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be Held on May 29, 2003

TO OUR SHAREHOLDERS:

The 2003 Annual Meeting of Shareholders of iBasis, Inc., a Delaware corporation, will be held on Thursday, May 29, 2003, at 10:00 a.m., local time, at our offices, located at 20 Second Avenue, Burlington, Massachusetts 01803. The purposes of the Annual Meeting are:

- 1.

- To elect two (2) Class 1 directors each to hold office for a three-year term and until each director's successor has been duly elected and qualified;

- 2.

- To ratify the appointment of the firm of Deloitte & Touche LLP, as independent auditors for iBasis for the fiscal year ending December 31, 2003; and

- 3.

- To transact such other business as may properly come before the meeting or any adjournment thereof.

Shareholders of record on the books of iBasis at the close of business onApril 7, 2003 will be entitled to notice of and to vote at the Annual Meeting.

Please sign, date, and return the enclosed proxy card in the enclosed postage-paid envelope, or vote via the Internet or by telephone, as instructed in the proxy materials, at your earliest convenience. If you return the proxy, you may nevertheless attend the Annual Meeting and vote your shares in person.

All of our shareholders are cordially invited to attend the Annual Meeting.

| | | By Order of the Board of Directors, |

| | |  |

| | | Jonathan D. Draluck

Vice President Business Affairs,

General Counsel and Secretary |

Burlington, Massachusetts

April 7, 2003 | | |

It is important that your shares be represented at the Annual Meeting. Whether or not you plan to attend the Annual Meeting, please vote by signing, dating, and returning the enclosed proxy card in the enclosed envelope, which requires no postage if mailed from within the United States, or vote via the Internet or by telephone as instructed in the proxy materials.

iBASIS, INC.

20 Second Avenue

Burlington, Massachusetts 01803

PROXY STATEMENT

Annual Meeting of Shareholders To Be Held on Thursday, May 29, 2003

Proxies enclosed with this Proxy Statement are solicited by the Board of Directors of iBasis, Inc., a Delaware corporation, for use at the Annual Meeting of Shareholders to be held on Thursday, May 29, 2003 at 10:00 a.m., local time, at our offices, 20 Second Avenue, Burlington, Massachusetts 01803, and any adjournments thereof.

Registered shareholders may vote their shares by mailing their signed proxy card, via the Internet, or by telephone, as directed in the proxy materials. We believe that the procedures that have been put in place are consistent with the requirements of applicable law.

Shares represented by duly executed proxies received by iBasis prior to the Annual Meeting will be voted as instructed in the proxy on each matter submitted to the vote of shareholders. If any duly executed proxy is returned without voting instructions, the persons named as proxies thereon intend to vote all shares represented by such proxyFOR the election of the nominees for directors named below andFOR the ratification of Deloitte & Touche LLP as independent auditors. The Board of Directors of iBasis is not aware of any other matters to be presented at the Annual Meeting. If any other matter should be presented at the Annual Meeting upon which a vote may properly be taken, shares represented by all duly executed proxies received by iBasis will be voted with respect thereto in accordance with the best judgment of the persons named in the proxies.

Any shareholder may revoke a proxy at any time prior to its exercise by delivering a later-dated proxy, by written notice of revocation to our Secretary at the address set forth below, or by voting in person at the Annual Meeting. If a shareholder does not intend to attend the Annual Meeting, any written proxy or notice should be returned for receipt by iBasis, not later than the close of business on Wednesday, May 28, 2003. We have retained EquiServe Trust Company N.A. and the Altman Group to organize the distribution and return of the proxy materials. EquiServe is paid $15,000 annually for various services, including those rendered in connection with our Annual Meeting. The Altman Group will be paid approximately $1,500 to distribute the proxy materials. iBasis will bear the cost of solicitation of proxies relating to the Annual Meeting.

Only shareholders of record as of the close of business onApril 7, 2003, the record date, will be entitled to notice of and to vote at the Annual Meeting and any adjournments thereof. As of the record date, there were 44,649,942 shares (excluding treasury shares) of common stock, $0.001 par value, issued and outstanding. These shares of common stock are the only securities of iBasis entitled to vote at the Annual Meeting. Shareholders are entitled to cast one vote for each share of common stock held of record on the record date.

An Annual Report on Form 10-K, containing audited financial statements for the fiscal year ended December 31, 2002, accompanies this Proxy Statement. The mailing address of iBasis' principal executive offices is 20 Second Avenue, Burlington, Massachusetts 01803.

This Proxy Statement and the proxy enclosed herewith were first mailed to shareholders on or aboutApril 21, 2003.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information regarding beneficial ownership of our common stock as of April 7, 2003 by:

- •

- each person we know owns beneficially more than five percent (5%) of our common stock;

- •

- each of our directors;

- •

- each of our executive officers; and

- •

- all directors and executive officers as a group.

Beneficial ownership is determined in accordance with the rules and regulations of the Securities and Exchange Commission. In computing the number of shares beneficially owned by a person and the percentage of ownership of that person, shares of common stock subject to options held by that person that are currently exercisable or exercisable within 60 days of April 7, 2003 are deemed outstanding. These shares, however, are not deemed outstanding for the purposes of computing the percentage ownership of any other person. Except as indicated in the footnotes to this table and pursuant to applicable community property laws, each shareholder named in the table has sole voting and investment power with respect to the shares set forth opposite such shareholder's name. Unless otherwise indicated, the address for each of the following shareholders is c/o iBasis, Inc., 20 Second Avenue, Burlington, Massachusetts 01803.

| | Shares Beneficially Owned

| |

|---|

Directors, Executive Officers and 5% Shareholders

| |

|---|

| | Number

| | Percent

| |

|---|

| Ofer Gneezy (1) | | 4,028,432 | | 9.00 | % |

| Menlo Ventures VII, L.P. and affiliated entities (2) | | 3,430,351 | | 7.52 | |

| Gordon J. VanderBrug (3) | | 1,765,250 | | 3.92 | |

| Charles N. Corfield (4) | | 1,414,416 | | 3.14 | |

| Charles Skibo (5) | | 160,000 | | * | |

| Paul H. Floyd (6) | | 75,000 | | * | |

| W. Frank King (7) | | 58,250 | | * | |

| Richard G. Tennant (8) | | 56,250 | | * | |

| David Lee (9) | | 55,000 | | * | |

| Dan Powdermaker 10) | | 37,881 | | * | |

| Sean O'Leary (11) | | 26,371 | | * | |

| All executive officers and directors as a group (11 persons)(12) | | 11,107,201 | | | |

- *

- Represents less than 1% of the outstanding shares of common stock.

- (1)

- Includes 147,498 shares of common stock issuable upon exercise of options within 60 days of April 7, 2003. Also includes 50,000 shares held by The Ofer Gneezy 1999 Family Trust for the benefit of Mr. Gneezy's children. Mr. Gneezy disclaims beneficial ownership of the shares held be the Ofer Gneezy 1999 Family Trust. Mr. Gneezy is our President, Chief Executive Officer, and one of our directors.

- (2)

- Includes 3,292,083 shares held by Menlo Ventures VII, L.P. and 138,268 held by Menlo Entrepreneurs Fund VII, L.P. The address for Menlo Ventures is 3000 Sand Hill Road, Building 4, Suite 100, Menlo Park, California 94025.

- (3)

- Includes 119,998 shares of common stock issuable upon exercise of options within 60 days of April 7, 2003. Also includes 1,317,345 shares held by the G.J. & C.E. VanderBrug Family Limited Partnership. Dr. VanderBrug disclaims beneficial ownership of the shares held by the G.J. & C.E. VanderBrug Family Limited Partnership, except to the extent of his pecuniary interest therein.

2

Does not include 29,230 shares of common stock held by Dr. VanderBrug's spouse. Dr. VanderBrug disclaims beneficial ownership of the shares held by his spouse. Dr. VanderBrug is our Executive Vice President and Assistant Secretary and one of our directors.

- (4)

- Includes 70,000 shares of common stock issuable upon exercise of options within 60 days of April 7, 2003. Also includes 1,114,416 shares held by the Charles N. Corfield Trust u/a/d 12/19/91, a revocable trust of which Mr. Corfield is the sole trustee. Mr. Corfield is one of our directors.

- (5)

- Includes 160,000 shares of common stock issuable upon exercise of options within 60 days of April 7, 2003. Mr. Skibo is one of our directors.

- (6)

- Includes 45,000 shares of common stock issuable upon exercise of options within 60 days of April 7, 2003. Mr. Floyd is our Senior Vice President, R&D, Engineering and Operations.

- (7)

- Includes 57,500 shares of common stock issuable upon exercise of options within 60 days of April 7, 2003. Dr. King is one of our directors.

- (8)

- Includes 56,250 shares of common stock issuable upon exercise of options within 60 days of April 7, 2003. Mr. Tennant is our Vice President of Finance and Administration and our Chief Financial Officer.

- (9)

- Includes 40,000 shares of common stock issuable upon exercise of options within 60 days of April 7, 2003. Mr. Lee is one of our directors.

- (10)

- Includes 22,500 shares of common stock issuable upon exercise of options within 60 days of April 7, 2003. Mr. Powdermaker is our Senior Vice President of Worldwide Sales.

- (11)

- Includes 26,249 shares of common stock issuable upon exercise of options within 60 days of April 7, 2003. Mr. O'Leary is our Senior Vice President of Marketing.

- (12)

- Includes 744,995 shares of common stock issuable upon the exercise of options within 60 days of April 7, 2003 and certain shares held by affiliates of such directors and executive officers.

Equity Compensation Plan

The following table provides information as of December 31, 2002 with respect to the shares of the Company's common stock that may be issued under its existing equity compensation plans.

Plan Category

| | Number of Securities to be issued upon exercise of outstanding options, warrants and rights (a)

| | Weighted-average exercise price of outstanding options, warrants and rights (b)

| | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))

|

|---|

| Equity compensation plans approved by security holders (1) | | 2,555,641 | | $ | 2.67 | | 6,444,359 |

| Equity compensation plans not approved by security holders | | 0 | | | — | | 0 |

| Total | | 2,555,641 | | $ | 2.67 | | 6,444,359 |

- (1)

- Consists of the 1997 Stock Incentive Plan (as amended).

Litigation Involving our Officers and Directors

In October 2002, the officers and directors named as defendants in consolidated class actions suits alleging violations of securities laws related to our public offerings of common stock were dismissed from the suits for the time being.

3

EXECUTIVE COMPENSATION AND OTHER INFORMATION

CONCERNING DIRECTORS AND EXECUTIVE OFFICERS

Executive Officers

The executive officers of iBasis, and their ages as of April 7, 2003, are as follows.

Name

| | Age

| | Position

|

|---|

| Executive Officers | | | | |

Ofer Gneezy |

|

51 |

|

President and Chief Executive Officer |

| Gordon J. VanderBrug | | 60 | | Executive Vice President and Assistant Secretary |

| Dan Powdermaker | | 39 | | Senior Vice President, Worldwide Sales |

| Paul H. Floyd | | 45 | | Senior Vice President, R&D, Engineering and Operations |

| Richard G. Tennant | | 58 | | Vice President, Finance and Administration and Chief Financial Officer |

| Sean O'Leary | | 38 | | Senior Vice President, Marketing |

Mr. Gneezy has served as President, Chief Executive Officer and as director of iBasis since our formation in August 1996. From 1994 to 1996, Mr. Gneezy served as President of Acuity Imaging, Inc., a multinational company focused on the industrial automation industry. From 1980 to 1994, Mr. Gneezy was an executive of Automatix, Inc. (a predecessor to Acuity Imaging), an industrial automation company, most recently serving as its President and Chief Executive Officer. Since July 2000, Mr. Gneezy has served as a director of NMS Communications, which provides communication solutions for wireless and wireline networks.

Dr. VanderBrug has served as Executive Vice President and as a director of iBasis since October 1996. From 1991 to 1996, Dr. VanderBrug was the Director of Marketing, Electronic Imaging Systems of Polaroid Corporation. In 1980, Dr. VanderBrug co-founded Automatix, Inc. Dr. VanderBrug received his B.A. in mathematics from Calvin College, a M.A. in mathematics from Wayne State University, and his Ph.D. in computer science from the University of Maryland.

Mr. Powdermaker has served as Senior Vice President, Worldwide Sales of iBasis since July 2002. An early member of the iBasis management team, Dan has spent the past five years developing relationships with carriers and service providers around the world and establishing the sales force to support these customers and partners. He worked to bring iBasis' initial US customers onto The iBasis Network™, has served as Vice President of Sales for Asia and most recently as Vice President, Europe, the Middle East and Africa. Prior to joining iBasis, Dan worked in sales management for AT&T Global Markets, a networking services division of AT&T focused on the world's 2,000 largest telecommunications users.

Mr. Floyd has served as Senior Vice President, R&D, Engineering and Operations since September 2001. From April 2001 to September 2001, Mr. Floyd was our Vice President of Research and Development. Prior to joining iBasis, Mr. Floyd was a Senior Vice President of DSL Business at Paradyne Networks, Inc., a manufacturer of high-speed broadband access products and technology that support and manage high-bandwidth applications and network traffic. From 1996 to 2000, Mr. Floyd served as Vice President of Research and Development and Engineering at Paradyne.

Mr. Tennant has served as Vice President, Finance and Administration and Chief Financial Officer since October 2001. From 2000 to 2001, Mr. Tennant was the Vice President, Chief Financial Officer and Treasurer of ScoreBoard, Inc., a software company providing optimization solutions for wireless carriers. Before joining ScoreBoard and from 1999 to 2000, Mr. Tennant served as Senior Vice President and Chief Financial Officer of Orbcomm Global, L.P., the world's first commercial provider of global low-earth satellite data and messaging services. From 1997 to 1999, Mr. Tennant also served

4

as Senior Vice President and Chief Financial Officer to Information Resource Engineering, now known as SafeNet, Inc., a developer and manufacturer of security and encryption products for computer data networks.

Mr. O'Leary has served as Senior Vice President, Marketing since August 2002. He joined iBasis in late 2000 and initially served as Vice President, Internet Telephony. From 1998 to 2000, Mr. O'Leary served as vice president of Marketing for SBC's Southern New England Telephone (SNET) subsidiary. In his seven-year tenure within SBC/SNET, O'Leary also held the position of Vice President of Marketing for both the company's Business Markets group and Custom Business Group. While at SBC/SNET, O'Leary also served as vice president of Corporate Development. From 1986 to 1993, Mr. O'Leary provided strategic consultation to major telecommunications clients at Mercer Management Consulting in Washington, D.C.

5

Summary Compensation

The following table sets forth information concerning the annual and long-term compensation in each of the last three fiscal years for our Chief Executive Officer and the next four most highly compensated executive officers.

| |

| |

| |

| |

| | Long-Term

Compensation

Awards

Securities

| |

|

|---|

| | Annual Compensation (1)

| |

|

|---|

| |

| |

| |

| | Other Annual

Compensation

| | All Other

Compensation

|

|---|

| | Year

| | Salary

| | Bonus

| | Underlying Options

|

|---|

Ofer Gneezy

President and Chief Executive Officer | | 2002

2001

2000 | | $

| 200,000

200,000

203,846 | | $

| 0

0

150,000 |

(2) | $

$

| 0

0

0 | | 170,000

50,000

40,000 | | $

| 0

0

0 |

Gordon J. VanderBrug

Executive Vice President and Assistant Secretary |

|

2002

2001

2000 |

|

|

180,000

180,000

183,462 |

|

|

0

0

135,000 |

(2) |

|

0

0

0 |

|

140,000

50,000

30,000 |

|

|

0

0

0 |

Paul H. Floyd (3)

Senior Vice President of Operations |

|

2002

2001 |

|

|

180,000

126,923 |

|

|

0

0 |

|

|

0

62,400 |

(5) |

60,000

235,000 |

(4)

|

|

0

0 |

Richard G. Tennant (6)

Chief Financial Officer, Vice President, Finance and Administration |

|

2002

2001 |

|

|

175,000

35,897 |

|

|

0

0 |

|

|

0

48,000 |

(7) |

150,000

150,000 |

|

|

0

0 |

Dan Powdermaker (8),

Senior Vice President, Worldwide Sales |

|

2002 |

|

|

150,000 |

|

|

0 |

|

|

260,347 |

(9) |

30,000 |

(10) |

|

0 |

- (1)

- Excludes certain perquisites and other benefits, the amount of which did not exceed 10% of the employee's total salary and bonus.

- (2)

- Bonus was earned for year ended December 31, 2000, but paid in February 2001.

- (3)

- Mr. Floyd became Senior Vice President, R&D, Engineering, and Operations in September 2001.

- (4)

- Mr. Floyd voluntarily surrendered 175,000 stock options for no value, as of December 23, 2002, pursuant to iBasis' Tender Offer Statement and Offer to Exchange Outstanding Stock Options on Schedule TO, filed with the Securities and Exchange Commission on November 25, 2002 (the "Exchange Offer"). In accordance with the terms of the Exchange Offer, new options will be granted to Mr. Floyd on or after June 24, 2003. Pursuant to the Exchange Offer for every option to purchase one share of common stock that Mr. Floyd surrendered, he will receive a new option to purchase one share of common stock.

- (5)

- Mr. Floyd received approximately $62,400 in moving and relocation expenses in 2001.

- (6)

- Mr. Tennant became Vice President, Finance and Administration and Chief Financial Officer in October 2001.

- (7)

- Mr. Tennant received approximately $48,000 for relocation assistance in 2001.

- (8)

- Mr. Powdermaker became Senior Vice President, Worldwide Sales in July, 2002.

- (9)

- Mr. Powdermaker received $142,471 in sales commissions and $117,876 in reimbursement of living expenses at his London post.

6

- (10)

- Mr. Powdermaker voluntarily surrendered 120,000 stock options for no value, as of December 23, 2002, pursuant to iBasis' Exchange Offer. In accordance with the terms of the Exchange Offer, new options will be granted to Mr. Powdermaker on or after June 24, 2003. Pursuant to the Exchange Offer, for every option to purchase one share of common stock that Mr. Powdermaker surrendered, he will receive a new option to purchase one share of common stock.

The following table contains information concerning options to purchase common stock that we granted during the year ended December 31, 2002 to each of the officers named in the summary compensation table.

| |

| |

| |

| |

| | Potential Realizable

Value at

Assumed Annual

Rates of

Stock Appreciation

for Option Term (2)

|

|---|

| | Individual Grants

|

|---|

| |

| | Percent of Total

Options Granted

to Employees

in 2002

| |

| |

|

|---|

| | Number of

Securities Underlying

Options Granted (1)

| | Exercise

Price Per

Share

| | Expiration

on Date

|

|---|

| | 5%

| | 10%

|

|---|

| Ofer Gneezy | | 0 | | N/A | | N/A | | N/A | | N/A | | N/A |

| Gordon J. VanderBrug | | 0 | | N/A | | N/A | | N/A | | N/A | | N/A |

| Paul H. Floyd | | 0 | | N/A | | N/A | | N/A | | N/A | | N/A |

| Richard G. Tennant | | 0 | | N/A | | N/A | | N/A | | N/A | | N/A |

| Dan Powdermaker | | 0 | | N/A | | N/A | | N/A | | N/A | | N/A |

Aggregated Option Exercises In Last Fiscal Year And Fiscal Year-End Option Values

The following table contains information concerning option holdings for the year ended December 31, 2002, and such date with respect to each of the officers named in the summary compensation table.

| |

| |

| | Number of Shares

Underlying Unexercised

Options at Year End

| | Value of Unexercised

In-the-Money Options

at Year End (1)

|

|---|

| | Shares

Acquired on

Exercise

| | Value

Realized

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Ofer Gneezy | | 0 | | $ | 0 | | 129,999 | | 40,001 | | $ | 0 | | $ | 0 |

| Gordon J. VanderBrug | | 0 | | | 0 | | 103,749 | | 36,251 | | | 0 | | | 0 |

| Paul H. Floyd (2) | | 0 | | | 0 | | 30,000 | | 30,000 | | | 0 | | | 0 |

| Richard G. Tennant | | 0 | | | 0 | | 37,500 | | 112,500 | | | 0 | | | 0 |

| Dan Powdermaker (3) | | | | | | | 15,000 | | 15,000 | | | 0 | | | 0 |

- (1)

- Value is determined by subtracting the exercise price from $0.33, the closing price of our common stock on the OTCBB on December 31, 2002, multiplied by the number of shares underlying the options.

- (2)

- See previous description.

- (3)

- See previous description.

Employment Agreements

We currently have employment agreements in effect with Mr. Gneezy, our President and Chief Executive Officer, Dr. VanderBrug, our Executive Vice President and Assistant Secretary, Mr. Powdermaker, our Senior Vice President, Worldwide Sales, Mr. Floyd, our Senior Vice President, R&D, Engineering and Operations, Mr. Tennant, our Vice President, Finance and Administration and Chief Financial Officer and Mr. O'Leary, our Senior Vice President, Marketing.

7

iBasis and Mr. Gneezy are parties to an employment agreement, dated as of August 11, 1997, governing his employment with iBasis as President and Chief Executive Officer. Under the terms of the employment agreement, Mr. Gneezy is paid a base salary of $125,000, and is eligible to receive an annual bonus at the discretion of the Board of Directors. iBasis and Dr. VanderBrug are parties to an employment agreement, dated as of August 11, 1997, governing his employment with iBasis as Executive Vice President. Under the terms of the employment agreement, Dr. VanderBrug is paid a base salary of $115,000, and is eligible to receive an annual bonus at the discretion of the Board of Directors. In 2002, Mr. Gneezy and Dr. VanderBrug earned $200,000 and $180,000 in base salary, respectively. iBasis also has employment agreements with Messrs. Powdermaker, Floyd, Tennant, and O'Leary for serving in their capacities of Senior Vice President, Worldwide Sales, Senior Vice President, R&D, Engineering and Operations, Vice President, Finance and Administration and Chief Financial Officer, and Senior Vice President, Marketing, respectively. Under the terms of the employment agreements, Mr. Powdermaker is paid a base salary of $150,000, Mr. Floyd is paid a base salary of $180,000, Mr. Tennant is paid a base salary of $175,000, and Mr. O'Leary is paid a base salary of 160,000. Each officer is eligible for a bonus.

We may terminate the employment agreements with Messrs. Gneezy and VanderBrug "for cause" or at any time upon at least thirty days prior written notice, and Messrs. Gneezy and Mr. VanderBrug may terminate their employment agreements "for good reason" or at any time upon at least thirty days prior written notice. We may terminate the employment agreement with Messrs. Powdermaker, Floyd, Tennant and O'Leary at any time and each may terminate his employment agreement at any time. If we terminate either of Messrs. Gneezy and VanderBrug without cause or if either resigns for good reason, we must continue to pay his base salary and continue to provide health benefits for one year. If, within six months following an acquisition or change of control, we terminate Messrs. Powdermaker, Floyd, Tennant, or O'Leary without cause or if any resigns for good reason, we must continue to pay his base salary and health benefits for nine months.

The employment agreements with executive officers entitle them to life insurance, health insurance and other employee fringe benefits to the extent that we make benefits of this type available to our other employees. All intellectual property that the officers may invent, discover, originate or make during their term of their employment shall be the exclusive property of iBasis. Each of the officers may not, during or after the term of his employment, disclose or communicate any confidential information without iBasis' prior written consent. The agreements with Messrs. Gneezy and VanderBrug also provide that in the event of an acquisition or change in control, each of their options and restricted shares, if any, shall automatically become fully vested immediately prior to such event, and each such option shall remain exercisable until the expiration of such option or until it sooner terminates in accordance with its terms. The agreements with Messrs. Powdermaker, Floyd, Tennant and O'Leary provide that in the event that we terminate the employment of the officer without cause, or the officer terminates his employment with "good reason," in either case within six months after the occurrence of an acquisition or change in control, then such officer's options shall immediately vest and become exercisable.

In general, "good reason" as used in the employment agreements of our executive officers means any material change in the compensation, position, and location of employment or responsibilities of the employee. "For cause" generally means gross negligence or willful misconduct of the employee, a breach of the employment agreement or the commission of a crime.

Our employment agreements with Messrs. Floyd, Tennant and O'Leary also contain provisions relating to each officer's relocation expenses.

8

Compensation Committee Report on Executive Compensation

The Compensation Committee of the Board of Directors administers our executive compensation. The Compensation Committee, which is composed of three directors, establishes and administers our executive compensation policies and plans and administers our stock option and other equity-related compensation plans. The Compensation Committee considers internal and external information in determining officers compensation, including outside survey data.

Compensation Philosophy

iBasis' compensation policies for executive officers are based on the belief that the interests of executives should be closely aligned with those of the shareholders. The compensation policies are designed to achieve the following objectives:

- •

- Offer compensation opportunities that attract highly qualified executives, reward outstanding initiative and achievement, and retain the leadership and skills necessary to build long-term shareholder value.

- •

- Maintain a significant portion of executives' total compensation at risk, tied to both the annual and long-term financial performance of iBasis and the creation of shareholder value.

- •

- Further the iBasis' short and long-term strategic goals and values by aligning compensation with business objectives and individual performance.

Compensation Program

iBasis' executive compensation program has three major integrated components, base salary, annual incentive awards, and long term incentives.

Base Salary. Base salary levels for executive officers are determined annually by reviewing the competitive pay practices of Internet telephony companies of similar size and market capitalization, the skills, performance level, and contribution to the business of individual executives, and the needs of the company. Overall, the Compensation Committee believes that base salaries for executive officers are approximately competitive with median base salary levels for similar positions in these Internet telephony companies.

Incentive Awards. iBasis' executive officers are eligible to receive cash bonus awards designed to motivate executives to attain short-term and longer-term corporate and individual management goals. During the second quarter of 2001, iBasis suspended these bonus programs for all executives and employees in an effort to reduce operational costs.

Long Term Incentives. The Compensation Committee believes that stock options are an excellent vehicle for compensating its directors, officers and employees. iBasis provides long term incentives through its 1997 Stock Incentive Plan, as amended (the "Plan"), the purpose of which is to create a direct link between compensation and shareholder value. Stock options are granted at fair market value and vest in installments, generally over two or four years. When determining option awards for an executive officer, the Compensation Committee considers the executive's current contribution to company performance, its executive retention needs, the anticipated contribution to meeting iBasis' long-term strategic performance goals, and industry practices and norms. Long-term incentives granted in prior years, existing levels of stock ownership, and whether past incentives are still effective are other factors also taken into consideration. Because the receipt of value by an executive officer under a stock option is dependent upon an increase in the price of iBasis' common stock, this portion of the executive's compensation is directly aligned with an increase in shareholder value.

9

In 2002, no executive officer received stock option grants, however, the Board of Directors did approve the Exchange Offer, which allowed employees and executives, other than those executives also serving as directors, to surrender options that had an exercise price of $1 or more per share under the Plan in exchange for options to be granted on or after June 24, 2003. The new options will have an exercise price equal to the fair market value of a share of common stock of iBasis. Messrs. Floyd, Powdermaker and O'Leary surrendered options pursuant to the Exchange Offer.

Chief Executive Officer Compensation

The Chief Executive Officer's base salary, annual incentive award and long-term incentive compensation are determined by the Compensation Committee. For the year ended December 31, 2002, Mr. Gneezy received $200,000 for his annualized base salary, the same amount he received in 2001. Mr. Gneezy did not receive a bonus for the last fiscal year.

Section 162(m) of the Internal Revenue Code limits the tax deduction of $1 million for compensation paid to certain executives of public companies. Having considered the requirements of Section 162(m), the Compensation Committee believes grants made pursuant to iBasis' 1997 Stock Incentive Plan meet the requirement that such grants be "performance based" and are, therefore, exempt from the limitations on deductibility. Historically, the combined salary and bonus of each executive officer has been well below the $1 million limit. The Compensation Committee's present intention is to comply with Section 162(m) unless the Compensation Committee feels that the necessary changes in iBasis' accounting methods in order to do so would not be in the best interest of iBasis or its shareholders.

| | | Respectfully Submitted by the Compensation Committee, |

|

|

Ofer Gneezy

Charles Skibo

Charles N. Corfield |

10

Audit Committee Report

The Audit Committee of the Board of Directors is composed of three directors, each of whom is independent as defined by Nasdaq National Market listing rules. The Audit Committee operates under a written Audit Committee Charter, recently revised to conform to standards and requirements adopted by the Securities Exchange Commission. A copy of the revised Audit Committee Charter is attached as Appendix A of this Proxy Statement.

The Audit Committee is responsible for, among other things, monitoring the integrity and adequacy of iBasis' financial information, control systems, and reporting practices, and for recommending to the Board of Directors for adoption by the shareholders the Audit Committee's selection of independent auditors for iBasis. The Audit Committee has selected and the Board of Directors has approved the selection of Deloitte & Touche LLP ("Deloitte & Touche") as iBasis' independent auditor.

The Audit Committee has reviewed and discussed the company's audited financial statements with management, which has primary responsibility for the financial statements. The Audit Committee has discussed with Deloitte & Touche the matters that are required to be discussed by Statement on Auditing Standards No. 61, "Communication with Audit Committees." The Audit Committee has discussed with Deloitte & Touche the auditors' independence from iBasis and its management and has received from Deloitte & Touche the written disclosures and the letter required by Independence Standards Board Standard No. 1, "Independence Discussions with Audit Committees."

The Audit Committee has considered whether the services provided by Deloitte & Touche are compatible with maintaining the independence of Deloitte & Touche and has concluded that the independence of Deloitte & Touche is maintained and not compromised by the services provided.

Based on the review and discussion referred to above, the Audit Committee recommended to the Board of Directors, and the Board of Directors has approved, that the audited financial statements be included in iBasis' Annual Report on Form 10-K for the year ended December 31, 2002, for filing with the Securities and Exchange Commission.

| | | Respectfully Submitted by the Audit Committee, |

|

|

W. Frank King

Charles N. Corfield

David Lee |

11

Compensation Committee Interlocks and Insider Participation

With the exception of Mr. Gneezy, no member of the Compensation Committee is an officer or employee of ours. Mr. Skibo served as the President of iBasis Speech Solutions, a wholly-owned subsidiary of iBasis from November 2001 until its sale in July 2002. Mr. Skibo was not a member of the Compensation Committee during that period. None of our executive officers serves as a member of the board of directors or compensation committee of any other entity that has one or more executive officers serving as a member of our Board of Directors or the Compensation Committee.

Compensation of Directors

In 2002, our directors did not receive cash compensation for their services as directors. However, directors were reimbursed for travel expenses. We maintain directors' and officers' liability insurance and our by-laws provide for mandatory indemnification of directors and officers to the fullest extent permitted by Delaware law. In addition, our certificate of incorporation limits the liability of our directors to either iBasis or its shareholders for breaches of the directors' fiduciary duties to the fullest extent permitted by Delaware law.

Following his appointment to the board of directors in May 2002, Mr. Lee received an option to purchase 80,000 shares of common stock with 25% of the shares vesting immediately and the remainder vesting 25% each year on the date of the Annual Meeting provided Mr. Lee still serves as a director. All options were granted under the Plan.

Section 16(a)—Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities and Exchange Act of 1934, as amended, requires our officers, directors, and persons who own more than ten percent (10%) of a registered class of the Company's equity securities to file reports of ownership on Forms 3, 4, and 5 with the Securities and Exchange Commission and the Company. Based on the Company's review of copies of such forms, all officers, directors and 10% holders complied with his obligations with respect to transactions in securities of the Company during the year ended December 31, 2002.

12

Stock Performance Graph

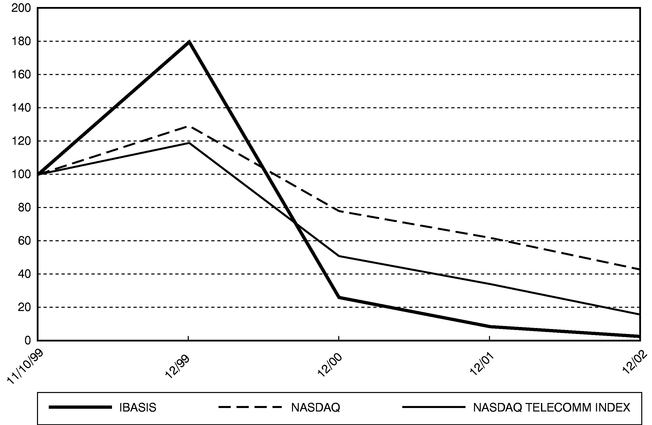

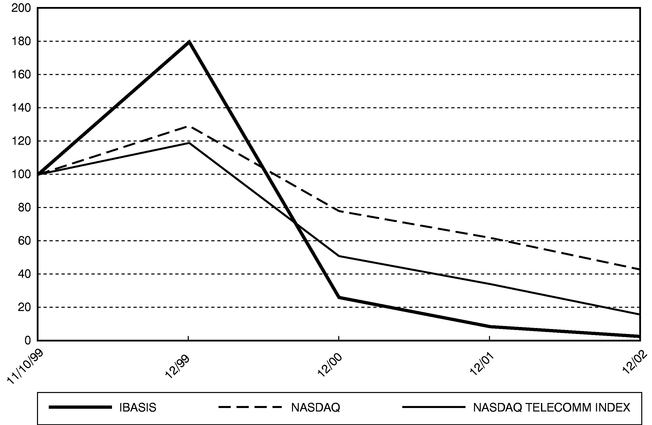

The following graph compares the percentage change in the cumulative total shareholder return on our common stock with the cumulative total return of the Nasdaq Stock Market (U.S.) Composite Index and the Nasdaq Stock Market Telecommunications Index (IXTC-O) for the period from November 9, 1999 (the date of our initial public offering) through December 31, 2002. For purposes of the graph, it is assumed that the value of the investment in our common stock and each index was 100 on November 9, 1999 and that all dividends were reinvested. The first datapoint reflected for iBasis is the initial public offering price of the common stock.

COMPARISON OF 37 MONTH CUMULATIVE TOTAL RETURN* AMONG IBASIS, INC.,

THE NASDAQ STOCK MARKET (U.S.) INDEX AND

THE NASDAQ TELECOMMUNICATIONS INDEX

- *

- $100 invested on 11/9/99 in stock or index—including reinvestment of dividends. Fiscal year ending December 31.

Cumulative Total Return

| | 11/09/99

| | 12/99

| | 12/00

| | 12/01

| | 12/02

|

|---|

| IBASIS | | 100 | | 179.69 | | 25.78 | | 8.19 | | 2.06 |

| NASDAQ STOCK MARKET (U.S.) INDEX | | 100 | | 129.89 | | 78.13 | | 61.99 | | 42.55 |

| NASDAQ STOCK MARKET TELECOMMUNICATIONS INDEX | | 100 | | 119.18 | | 50.76 | | 33.98 | | 15.63 |

13

PROPOSAL NO. 1—ELECTION OF DIRECTORS

The Board of Directors is divided into three classes. Each class serves a three-year term. The Class 1 Directors' term will expire at the Annual Meeting. All directors will hold office until their successors have been duly elected and qualified.

The Board of Directors has nominated Gordon J. VanderBrug and David Lee, for re-election as Class 1 Directors, each to hold office until the Annual Meeting of Shareholders to be held in 2006 and until his respective successor is duly elected and qualified. Shares represented by all proxies received by the Board of Directors and not marked so as to withhold authority to vote for Messrs. VanderBrug and Lee will be votedFOR their election.

There is one vacancy of a Class 3 Director as a result of Mr. Redfield's resignation on July 29, 2002. Mr. Redfield's resignation was not due to a disagreement with iBasis, its operations, policies or management. The by-laws of iBasis provide that the majority of the Board of Directors may fill a vacancy on the Board of Directors. After a suitable search, the Board of Directors intends to fill the Class 3 Director vacancy with a qualified candidate that shall hold office until 2005.

The following table sets forth information on the nominees to be elected at the Annual Meeting and each director whose term of office will extend beyond the Annual Meeting.

Nominee or Director's Name

| | Age

| | Position(s) Held

| | Director

Since

| | Year Term

Will Expire

| | Class of

Director

|

|---|

| Ofer Gneezy (1)(3) | | 51 | | President, Chief Executive Officer, and Director | | 1996 | | 2005 | | 3 |

| Gordon J. VanderBrug | | 60 | | Executive Vice President, Assistant Secretary, Director | | 1996 | | 2003 | | 1 |

| Charles N. Corfield (1)(2) | | 42 | | Director | | 1997 | | 2005 | | 3 |

| W. Frank King (2)(3)(4) | | 63 | | Director | | 2001 | | 2004 | | 2 |

| David Lee (2)(4) | | 65 | | Director | | 2002 | | 2003 | | 1 |

| Charles M. Skibo (1)(3)(4) | | 64 | | Director | | 1999 | | 2004 | | 2 |

| Vacancy | | | | | | | | 2005 | | 3 |

- (1)

- Member of the Compensation Committee

- (2)

- Member of the Audit Committee

- (3)

- Member of the Strategic Committee

- (4)

- Member of the Shareholder Litigation Committee

Mr. Gneezy has served as President, Chief Executive Officer and as director of iBasis since our formation in August 1996. From 1994 to 1996, Mr. Gneezy served as President of Acuity Imaging, Inc., a multinational company focused on the industrial automation industry. From 1980 to 1994, Mr. Gneezy was an executive of Automatix, Inc. (a predecessor to Acuity Imaging), an industrial automation company, most recently serving as its President and Chief Executive Officer. Since July 2000, Mr. Gneezy has served as a director of NMS Communications, which provides communication solutions for wireless and wireline networks.

Dr. VanderBrug has served as Executive Vice President and as a director of iBasis since October 1996. From 1991 to 1996, Dr. VanderBrug was the Director of Marketing, Electronic Imaging Systems of Polaroid Corporation. In 1980, Dr. VanderBrug co-founded Automatix, Inc. Dr. VanderBrug received his B.A. in mathematics from Calvin College, a M.A. in mathematics from Wayne State University, and his Ph.D. in computer science from the University of Maryland.

14

Mr. Corfield has been a director of iBasis since September 1997. Since 1999, Mr. Corfield has been a director of BeVocal and since 2000, the Chief Executive Officer of SandCherry Networks. Mr. Corfield serves on the board of directors of Liberate Technologies, a web-based, enhanced television company. Mr. Corfield co-founded Frame Technology, a software company, in 1986 and was a member of its board of directors and its Chief Technology Officer until Adobe Systems acquired it in 1995.

Dr. King has been a private investor since November 1998 and a director of iBasis since June 2001. From 1992 to 1998, he was Chief Executive Officer and director of PSW Technologies, Inc. (formerly a division of Pencom, Inc.), a provider of software services. From 1988 to 1992, Dr. King was Senior Vice President of Development of Lotus Development Corporation, and for the previous 19 years he served in various positions with IBM Corporation, including his last position as Vice President of Development for the entry system division. He is also director of NMS Communications, Inc., eOn Communications Corporation, Aleri, Inc., Concero, Inc., and Perficient, Inc.

Mr. Skibo has been a director of iBasis since September 1999. He served as President of iBasis Speech Solutions, Inc. from November 2001 to July 2002. From January 1999 to September 2001, Mr. Skibo served as the Chief Executive Officer and Chairman of Colo.com, a company that provided facilities and co-location services to communication and information technology industries. Colo.com filed for bankruptcy in June 2001. Since 1994, Mr. Skibo has served as Chairman and Chief Executive Officer of Strategic Enterprises and Communications, Inc., a venture capital firm. Mr. Skibo also serves as Chairman and Chief Executive Officer of Allied Telecommunications, a communications company. From 1985 to 1987, Mr. Skibo was President and CEO of US Sprint and its predecessor company, U.S. Telecom.

Mr. Lee has been a director of iBasis since May 2002. Mr. Lee has founded, served as chairman, and held senior executive positions at several communications technology companies, including ITT Corporation. Mr. Lee joined ITT after that company acquired Qume Corporation, a company he had co-founded in 1973. At ITT Qume, Mr. Lee held the positions of Executive Vice President from 1978 to 1981, and President, from 1981 through 1983. Mr. Lee later became President and Chairman of Data Technology Corporation and is currently Chairman of the Board of eOn Communications Corporation, Cortelco, and Cidco Communications. Mr. Lee also serves as a Regent for the University of California. Through his service on the Advisory Committee on Trade Policy and Negotiation for Presidents Bush (senior) and Clinton, and his current role on President George W. Bush's Council on the 21st Century Workforce, Mr. Lee is one of the world's foremost experts on US-China commerce and the Chinese telecommunications industry. In addition to his executive and governmental positions, Mr. Lee is a member of the Board of Directors of the Pacific International Center for High Technology Research (PICHTR), ESS Technology Inc., and Linear Technology Corporation.

The Board of Directors held a total of eight meetings during the year ended December 31, 2002. The Board of Directors has the following four committees:

Compensation Committee—determines the compensation of our senior management and administers the stock option plans. Its members are Messrs. Gneezy, Corfield, and Skibo. The committee convened four times last year.

Audit Committee—recommends engagement of the iBasis' independent auditors, consults with the iBasis' auditors concerning the scope of the audit, reviews the results of their examination, reviews and approves any material accounting policy changes affecting the company's operating results, and reviews the company's financial controls. Messrs. Corfield, King, and Lee are members of the Audit Committee. It convened seven times last year.

15

Strategic Committee—has in the past evaluated a strategic course for iBasis. The Strategic Committee did not meet last year. Its members are Messrs. Gneezy, King, and Skibo.

Shareholder Litigation Committee—was formed to evaluate, accept and/or reject settlement proposals in connection with the several class action lawsuits filed against the Corporation and certain of its current and past officers and directors, as well as against the investment banking firms that underwrote the Corporation's initial public offering. The Shareholder Litigation Committee did not meet last year. Its members are Messrs. King, Lee, and Skibo.

With the exception of David Lee, each of the directors attended at least 75% of the meetings of the Board of Directors and committees of the Board on which the director served during the year.

The Board of Directors has no standing nominating committee. Our Board of Directors searches and reviews suitable candidates for director nominations.

Certain Transactions

As previously announced, on August 5, 2002, we completed an agreement with our primary equipment vendor to reduce our capital lease obligations and related future cash commitments. Mr. Carl Redfield, a former director who served on our Board of Directors from September 1999 until July 2002, is an officer of the equipment vendor.

During 2002, iBasis paid Mr. Skibo, a current director, approximately $168,325 for serving as President of iBasis Speech Solutions, Inc., a wholly-owned subsidiary of iBasis.

The Board of Directors unanimously recommends a vote "FOR" the election of each nominee listed above.

PROPOSAL NO. 2—RATIFICATION OF SELECTION OF AUDITORS

The Board of Directors has appointed the firm of Deloitte & Touche, certified public accountants, to serve as independent auditors for the fiscal year ending December 31, 2003. Deloitte & Touche has served as iBasis' independent auditors since 2002. If the shareholders do not ratify the selection of Deloitte & Touche, the Board of Directors may consider selection of other independent certified public accountants to serve as independent auditors, but no assurances can be made that the Board of Directors will do so or that any other independent certified public accountants would be willing to serve. Representatives from Deloitte & Touch are expected to be present at the Annual Meeting and will have the opportunity to make a statement if they desire to do so. It is also expected that they will be available to respond to appropriate questions.

The Board of Directors unanimously recommends a vote "FOR" the ratification of appointment of iBasis' auditors.

Fiscal 2002 Audit Firm Fee Summary

During the fiscal year ended December 31, 2002, the Company retained its principal auditor, Deloitte & Touche LLP, to provide services in the following categories and amounts:

Audit Fees. Deloitte & Touche LLP billed the Company an aggregate of $359,000 in fees for professional services rendered in connection with the audit of the Company's financial statements for the 2002 fiscal year, reviews of the financial information for the quarters in the fiscal year and accounting consultations relating to accounting matters in fiscal year 2002.

In addition, during the 2002 fiscal year Deloitte & Touche LLP billed the Company an aggregate of $234,000 in fees for professional services rendered in connection with audit of the Company's financial statements for the 2001 fiscal year.

16

Financial Information Systems and Implementation Fees. There were no services rendered by Deloitte & Touche for financial information systems design and implementation for fiscal 2002

All Other Fees. During the 2002 fiscal year Deloitte & Touche LLP billed the Company an aggregate of $123,000 in fees for tax compliance work and benefit plan audit.

The Audit Committee annually considers and recommends to the Board of Directors the selection of iBasis' independent auditors. As recommended by the Audit Committee, the Board of Directors decided as of May 14, 2002 (the day following the date of iBasis' Quarterly Report on Form 10-Q) that it would no longer engage Arthur Andersen as iBasis' independent auditors and engaged Deloitte & Touche to serve instead as of the second quarter of 2002 and for the remainder of the fiscal year ending December 31, 2002 and thereafter, until a successor is duly appointed.

Arthur Andersen's reports on iBasis' consolidated financial statements for the 2001 and 2000 fiscal years did not contain an adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles.

During iBasis' 2001 and 2000 fiscal years and through May 13, 2002 (the date of iBasis' Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2002), there were no disagreements with Arthur Andersen on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure which, if not resolved to Arthur Andersen's satisfaction, would have caused it to make reference to the subject matter in connection with its report on iBasis' consolidated financial statements for such years; and there were no reportable events, as listed in Item 304(a)(1)(v) of SEC Regulation S-K.

During iBasis' 2001 and 2000 fiscal years and until May 13, 2002, iBasis did not consult Deloitte & Touche with respect to the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on iBasis' consolidated financial statements, or any other matters or reportable events listed in Items 304(a)(2)(i) and (ii) of SEC Regulation S-K.

VOTING PROCEDURES

The affirmative vote of a plurality of the shares of iBasis' common stock present or represented at the Annual Meeting and entitled to vote is required for the election of the Class 1 Directors and the ratification of Deloitte & Touche as independent auditors. For purposes of determining whether our proposals have received the required vote, abstentions will not be included in the vote totals for the purposes of the election of a Director or the ratification of Deloitte & Touche, and therefore will have no affect on the outcome of this vote. In instances where brokers are prohibited from exercising discretionary authority for beneficial holders who have not returned a proxy (so-called "broker non-votes"), those shares will not be included in the vote totals and, therefore, will have no effect on the outcome of the vote. Shares that abstain or for which the authority to vote is withheld on certain matters will, however, be treated as present for quorum purposes on all matters.

OTHER BUSINESS

The Board of Directors knows of no business that will be presented for consideration at the Annual Meeting other than that stated above. If other business should come before the Annual Meeting, the persons named in the proxies solicited hereby, each of whom is an iBasis employee, may vote all shares subject to such proxies with respect to any such business in the best judgment of such persons.

17

SHAREHOLDER PROPOSALS

It is currently contemplated that the 2004 Annual Meeting of Shareholders will be held on or about May 31, 2004. Proposals of shareholders intended for inclusion in the proxy statement to be furnished to all shareholders entitled to vote at the next annual meeting of iBasis must be received at our principal executive offices not later than December 10, 2003. It is suggested that proponents submit their proposals by certified mail, return receipt requested.

18

ANNUAL REPORT ON FORM 10-K

A copy of iBasis' Annual Report on Form 10-K for the year ended December 31, 2002 will be furnished to shareholders together with this Proxy Statement. Copies of the Annual Report on Form 10-K are available without charge to each shareholder, upon written request to the Investors Relations department at our principal executive offices at 20 Second Avenue, Burlington, Massachusetts 01803.

Dated: April 7, 2003

19

Appendix A

iBASIS, INC.

REVISED AUDIT COMMITTEE CHARTER

Organization

There shall be a committee of the Board of Directors to be known as the Audit Committee (the "Audit Committee"). The independence and financial expertise of the Audit Committee, and its duties and responsibilities, shall be consistent with applicable law.

Statement of Policy

The Audit Committee shall provide assistance to the corporate directors in fulfilling their responsibility to the stockholders, potential stockholders, and investment community relating to corporate accounting, reporting practices of the corporation, and the quality and integrity of the financial reports of the corporation. In so doing, it is the responsibility of the Audit Committee to maintain free and open means of communication between the directors, the independent auditors, the internal auditors, and the financial management of the corporation. The Audit Committee shall be responsible for recommending an independent auditing firm to the Board of Directors, the independent auditor's qualifications, independence, fees and retention. In addition, the Audit Committee shall be responsible for overseeing the performance of the corporation's independent auditors, and the corporation's compliance with associated legal and regulatory requirements including preparation of the report contained in the corporation's annual proxy statement. The Independent auditors of the corporation shall be primarily accountable to the Audit Committee.

Responsibilities

In carrying out its responsibilities, and consistent with applicable law, the Audit Committee seeks to ensure to the directors and stockholders that the corporate accounting and reporting practices of the corporation are in accordance with best practices and are of the highest quality. Specifically, the Audit Committee will:

- 1.

- Review and report on the "independence" of Audit Committee members, as that term is defined by applicable law.

- 2.

- Review and recommend to the directors the independent auditors to be selected to audit the financial statements of the corporation and its divisions and subsidiaries and receive from any potential auditor a written statement of all relationships of the auditor to the corporation.

- 3.

- Oversee the corporation's independent auditors. Meet with the independent auditors and financial management of the corporation to review the scope of the proposed audit for the current year and the audit procedures to be utilized, and at the conclusion thereof review such audit, including any comments or recommendations of the independent auditors.

- 4.

- Determine the audit fee for the independent auditors is appropriate and that the corporation will receive a complete and comprehensive audit for such fee.

- 5.

- Approve, in advance the provision of all permissible non-audit services by the independent auditor.

- 6.

- Have the authority to engage and determine the funding for independent counsel and other advisors, as required by law.

- 7.

- If a Audit Committee Financial Expert is to be selected to become a member of the Audit Committee, consider whether a person has, through education and experience as a public accountant or auditor or as a principal financial officer, controller or principal accounting

iBASIS, INC.

c/o EQUISERVE TRUST COMPANY, N.A.

P.O. BOX 8694

EDISON, NJ 08818-8694

Voter Control Number

Your vote is important. Please vote immediately.

| | | |

|

| | | Vote-by-Internet | | | | | | Vote-by-Telephone |

1. |

|

Log on to the Internet and go to

http://www.eproxyvote.com/ibas |

|

OR |

|

1. |

|

Call toll-free

1-877-PRX-VOTE (1-877-779-8683) |

2. |

|

Enter your Voter Control Number listed above and follow the easy steps outlined on the secured website. |

|

|

|

2. |

|

Enter your Voter Control Number listed above and follow the easy recorded instructions. |

| | | |

|

If you vote over the Internet or by telephone, please do not mail your card.

DETACH HERE IF YOU ARE RETURNING YOUR PROXY CARD BY MAIL

ý Please mark

votes as in

this example.

| 1. | | ELECTION OF NOMINEES FOR DIRECTOR. | | 2. | | PROPOSAL TO RATIFY AND APPOINT DELOITTE & TOUCHE LLP AS INDEPENDENT AUDITORS. | | FOR

o | | AGAINST

o | | ABSTAIN

o |

| | | Nominees: (01) Gordon VanderBrug

(02) David Lee | | | | | | | | | | |

FOR

ALL | | o | | o | | WITHHOLD

VOTE FOR

ALL | | |

FOR

ALL

EXCEPT | | o

| | |

| | | Write the name of the nominee(s) for which you withheld authority on the line above. | | |

| | | MARK HERE IF YOU PLAN TO ATTEND THE MEETING | | o | | MARK HERE FOR ADDRESS CHANGE AND NOTE AT LEFT | | o |

|

|

Please sign exactly as your name(s) appear(s) hereon. All holders must sign. |

|

|

Corporation or partnership, please sign in full corporate or partnership name by authorized person. |

| Signature: _____________________________ | | Date:__________ | | Signature: _____________________________ | | Date:__________ |

DETACH HERE

PROXY

iBASIS, INC.

PROXY FOR 2003 ANNUAL MEETING OF SHAREHOLDERS

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned shareholder of iBasis, Inc., a Delaware corporation, hereby acknowledges receipt of the Notice of Annual Meeting of Shareholders and Proxy Statement, each dated April 7, 2003, and hereby appoints Ofer Gneezy and Gordon VanderBrug, and each of them, jointly and severally, as proxies and attorneys-in-fact, with full power of substitution, on behalf and in the name of the undersigned, to represent the undersigned at the 2003 Annual Meeting of Shareholders of iBasis, Inc. to be held on Thursday, May 29, 2003 at 10:00 a.m., local time, at our offices, 20 Second Avenue, Burlington, Massachusetts 01803 and at any adjournment or adjournments thereof, and to vote all shares of Common Stock which the undersigned would be entitled to vote, if personally present, on the matters set forth on the reverse side and, in accordance with their discretion, on any other business that may come before the meeting, and revokes all proxies previously given by the undersigned with respect to the shares covered hereby.

THIS PROXY WILL BE VOTED AS DIRECTED, OR IF NO CONTRARY DIRECTION IS INDICATED, WILL BE VOTED FOR THE ELECTION OF DIRECTORS AND FOR THE PROPOSAL TO RATIFY AND APPOINT DELOITTE & TOUCHE LLP AS INDEPENDENT AUDITORS AND AS SAID PROXIES DEEM ADVISABLE ON SUCH OTHER MATTERS AS MAY PROPERLY COME BEFORE THE MEETING.

SEE REVERSE

SIDE | | CONTINUED AND TO BE SIGNED ON REVERSE SIDE | | SEE REVERSE

SIDE |

QuickLinks

Annual Meeting of Shareholders To Be Held on Thursday, May 29, 2003Security Ownership of Certain Beneficial Owners and ManagementEXECUTIVE COMPENSATION AND OTHER INFORMATION CONCERNING DIRECTORS AND EXECUTIVE OFFICERSVOTING PROCEDURESOTHER BUSINESSSHAREHOLDER PROPOSALSANNUAL REPORT ON FORM 10-KAppendix A Revised Audit Charter