QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material Pursuant to §240.14a-12 | |

iBASIS, INC. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

April 13, 2005

Dear Stockholder:

You are cordially invited to attend the 2005 Annual Meeting of Stockholders of iBasis, Inc., which will be held at our offices, located at 20 Second Avenue, Burlington, Massachusetts 01803, on Thursday, May 26, 2005 at 10:00 a.m., local time.

The Notice of Annual Meeting of Stockholders and a Proxy Statement, which describe the formal business to be conducted at the annual meeting, accompany this letter. Our 2004 Annual Report on Form 10-K is also enclosed for your information.

All stockholders are invited to attend the annual meeting. However, to ensure your representation at the annual meeting, you are urged to vote by proxy by following one of these steps as promptly as possible:

- (a)

- Vote via the Internet (see instructions on the enclosed proxy card);

- (b)

- Vote via telephone (toll-free) in the United States or Canada (see instructions on the enclosed proxy card); or

- (c)

- Complete, date, sign and return the enclosed proxy card (a postage-prepaid envelope is enclosed).

Your shares cannot be voted unless you follow the instructions listed above or attend the annual meeting in person. The matters before the stockholders are important, please consider and vote upon these matters regardless of the number of shares you own.

Sincerely,

Ofer Gneezy

President and Chief Executive Officer

iBASIS, INC.

20 Second Avenue

Burlington, Massachusetts 01803

NOTICE OF 2005 ANNUAL MEETING OF STOCKHOLDERS

To be Held on May 26, 2005

TO OUR STOCKHOLDERS:

The 2005 Annual Meeting of Stockholders of iBasis, Inc., a Delaware corporation, will be held on Thursday, May 26, 2005, at 10:00 a.m., local time, at our offices, located at 20 Second Avenue, Burlington, Massachusetts 01803. The purpose of the annual meeting is:

- 1.

- To elect three (3) Class 3 directors each to hold office for a three-year term and until each director's successor has been duly elected and qualified;

- 2.

- to approve the Amended and Restated 1997 Stock Incentive Plan (the "Plan") to increase the number of shares authorized for issuance under the Plan from 9,000,000 to 14,000,000 shares;

- 3.

- To ratify the appointment of the firm of Deloitte & Touche LLP, as independent auditors for iBasis for the fiscal year ending December 31, 2005; and

- 4.

- To transact such other business as may properly come before the meeting or any adjournment thereof.

Our Board of Directors has fixed April 12, 2005 as the record date for determination of stockholders entitled to notice of, and to vote at, the annual meeting. Accordingly, only stockholders of record at the close of business on April 12, 2005 will be entitled to notice of, and to vote at such meeting or any adjournments thereof.

Please vote your proxy as promptly as possible by following one of these steps:

- (a)

- Vote via the Internet (see instructions on the enclosed proxy card);

- (b)

- Vote via telephone (toll-free) in the United States or Canada (see instructions on the enclosed proxy card); or

- (c)

- Complete, date, sign and return the enclosed proxy card (a postage-prepaid envelope is enclosed).

The Internet and telephone voting procedures are designed to authenticate stockholders' identities, to allow stockholders to vote their shares, and to confirm that their instructions have been properly recorded. Specific instructions to be followed by any registered stockholder interested in voting via the Internet or telephone are set forth on the enclosed proxy card and must be completed by 11:59 P.M. on May 25, 2005. If you return the proxy by any of the methods listed above and wish to change your vote, you may nevertheless attend the annual meeting and vote your shares in person.

All of our stockholders are cordially invited to attend the annual meeting.

By Order of the Board of Directors,

Jonathan D. Draluck

Vice President Business Affairs,

General Counsel & Secretary

Burlington, Massachusetts

April 13, 2005

It is important that your shares be represented at the annual meeting. Whether or not you plan to attend the annual meeting, please vote by signing, dating, and returning the enclosed proxy card in the enclosed envelope, which requires no postage if mailed from within the United States, or vote via the Internet or by telephone as instructed in the proxy materials.

iBASIS, INC.

20 Second Avenue

Burlington, Massachusetts 01803

PROXY STATEMENT

Annual Meeting of Stockholders To Be Held on Thursday, May 26, 2005

Proxies enclosed with this proxy statement are solicited by the Board of Directors of iBasis, Inc., a Delaware corporation ("iBasis" or the "Company") for use at the Annual Meeting of Stockholders to be held on Thursday, May 26, 2005 at 10:00 a.m., local time, at our offices, 20 Second Avenue, Burlington, Massachusetts 01803, and any adjournments or postponement of such meeting. The purposes of the annual meeting and the matters to be acted upon are set forth in the accompanying Notice of 2005 Annual Meeting of Stockholders to be held on May 26, 2005.

Registered stockholders may vote their shares via the Internet, via telephone, or by mailing their signed proxy card, as directed in the proxy materials. The Internet and telephone voting procedures are designed to authenticate stockholders' identities, to allow stockholders to vote their shares, and confirm that their instructions have been properly recorded. We believe that the procedures that have been put in place are consistent with the requirements of applicable law.

Shares represented by duly executed proxies received by iBasis prior to the annual meeting will be voted as instructed in the proxy on each matter submitted to the vote of stockholders. If any duly executed proxy is returned without voting instructions, the persons named as proxies thereon intend to vote all shares represented by such proxyFOR the election of the nominees for directors named below,FOR the approval of the Amended and Restated 1997 Stock Incentive Plan andFOR the ratification of Deloitte & Touche LLP as independent auditors. The Board of Directors is not aware of any other matters to be presented at the annual meeting. If any other matter should be presented at the annual meeting upon which a vote may properly be taken, shares represented by all duly executed proxies received by iBasis will be voted with respect thereto in accordance with the best judgment of the persons named in the proxies.

Any stockholder may revoke a proxy at any time prior to its exercise by delivering a later-dated proxy, by written notice of revocation to our Secretary at the address set forth below, or by voting in person at the annual meeting. If a stockholder does not intend to attend the annual meeting, any written proxy or notice should be returned for receipt by iBasis, not later than the close of business on Wednesday, May 25, 2005. All costs of distribution and solicitation of proxies will be borne by us. We have retained EquiServe Trust Company N.A. and The Altman Group to organize the distribution and return of the proxy materials. EquiServe is paid $15,000 annually for various services, including those rendered in connection with our annual meeting. The Altman Group will be paid approximately $7,500, plus reimbursement of expenses, to distribute the proxy materials and solicit the vote of stockholders.

Only stockholders of record as of the close of business onApril 12, 2005, the record date, will be entitled to notice of and to vote at the annual meeting and any adjournments or postponements thereof. As of the record date, there were 65,182,402 shares (excluding treasury shares) of common stock, $0.001 par value, issued and outstanding. These shares of common stock are the only securities of iBasis entitled to vote at the annual meeting. Stockholders are entitled to cast one vote for each share of common stock held of record on the record date.

An Annual Report on Form 10-K, containing audited financial statements for the fiscal year ended December 31, 2004, accompanies this Proxy Statement. Our mailing address is 20 Second Avenue, Burlington, Massachusetts 01803.

This proxy statement and the proxy enclosed herewith were first mailed to stockholders on or about April 21, 2005.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information regarding beneficial ownership of our common stock as of April 12, 2005 by:

- •

- each person we know owns beneficially more than five percent (5%) of our common stock;

- •

- each of our directors;

- •

- each of our executive officers; and

- •

- all directors and executive officers as a group.

Beneficial ownership is determined in accordance with the rules and regulations of the Securities and Exchange Commission (the "SEC"). In computing the number of shares beneficially owned by a person and the percentage of ownership of that person, both shares of common stock subject to options and warrants held by that person that are currently exercisable or exercisable within 60 days of April 12, 2005, and shares of common stock subject to convertible securities held by that person that are currently convertible or convertible within 60 days of April 12, 2005 are deemed outstanding. These shares, however, are not deemed outstanding for the purposes of computing the percentage ownership of any other person. Except as indicated in the footnotes to this table and pursuant to applicable community property laws, each stockholder named in the table has sole voting and investment power with respect to the shares set forth opposite such stockholder's name. Unless otherwise indicated, the address for each of the following stockholders is c/o iBasis, Inc., 20 Second Avenue, Burlington, Massachusetts 01803.

| | Shares Beneficially Owned | ||||

|---|---|---|---|---|---|

| Directors, Executive Officers and 5% Shareholders | |||||

| Number | Percent | ||||

| LC Capital Master Fund(1) c/o Lampe Conway & Co. LLC 680 Fifth Avenue, Suite 1202 New York, NY 10019 | 7,184,076 | 11.02 | % | ||

| JMG Triton Offshore Fund, Ltd.(2) JMG Capital Partners, L.P. 11601 Wilshire Blvd., Suite 2180 Los Angeles, CA 90025 | 6,091,593 | 9.35 | % | ||

| Singer Children's Management Trust(3) c/o Romulus Holdings, Inc. 560 Sylvan Ave Englewood Cliffs, NJ 07632 | 6,289,605 | 9.65 | % | ||

| Loeb Partners Corporation(4) 61 Broadway New York, NY 10006 | 5,228,554 | 8.02 | % | ||

| Ofer Gneezy(5) | 4,273,932 | 6.56 | % | ||

| Gordon J. VanderBrug(6) | 1,804,522 | 2.77 | % | ||

| Charles N. Corfield(7) | 1,464,416 | 2.25 | % | ||

| Charles Skibo(8) | 210,000 | * | |||

| David Lee(9) | 101,666 | * | |||

| W. Frank King(10) | 170,750 | * | |||

| Peter D. Aquino(11) | 40,000 | * | |||

| Richard G. Tennant(12) | 193,000 | * | |||

| Paul H. Floyd(13) | 291,875 | * | |||

| Dan Powdermaker(14) | 209,129 | * | |||

| All executive officers and directors as a group (10 persons)(15) | 8,759,290 | 13.44 | % | ||

- *

- Represents less than 1% of the outstanding shares of common stock.

2

- (1)

- According to information submitted to the Company as of April 12, 2005, includes 3,275,676 shares of common stock which LC Capital Master Fund has the right to acquire within 60 days of April 12, 2005, including 1,383,784 shares of common stock upon the conversion of 63/4% Convertible Subordinated Notes due in June 2009 ("New Subordinated Notes") and 1,891,892 shares of common stock upon the conversion of 8% Secured Convertible Notes due in June 2007 ("New Secured Notes").

- (2)

- According to information submitted to the Company as of April 12, 2005, includes the following amounts exercisable or convertible within 60 days of April 12, 2005: (a) 2,162,160 shares of common stock upon the conversion of New Secured Notes held by JMG Triton Offshore Fund, Ltd. (the "Fund"), (b) 2,162,160 shares of common stock upon the conversion of New Secured Notes held by JMG Capital Partners, L.P. ("JMG Partners"), (c) 1,292,273 warrants to purchase shares of common stock held by the Fund, and (d) 475,000 warrants to purchase shares of common stock held by JMG Partners. The Fund is an international business company organized under the laws of the British Virgin Islands. The Fund's investment manager is Pacific Assets Management LLC, a Delaware limited liability company ("Pacific Assets"). Pacific Assets has voting and dispositive power over the Fund's investments. The equity interests of Pacific Assets are owned by Pacific Capital Management, Inc., a Delaware corporation ("Pacific") and Asset Alliance Holding Corp., a Delaware corporation ("Asset Alliance"). The equity interests of Pacific are owned by Messrs. Roger Richter, Jonathan M. Glaser and Daniel A. David. Messrs. Glaser and Richter have sole investment discretion over the Fund's portfolio holdings. JMG Partners is a California limited partnership. Its general partner is JMG Capital Management, LLC (the "Manager"), a Delaware limited liability company and an investment adviser. The Manager has voting and dispositive power over JMG Partners' investments. The equity interests of the Manager are owned by JMG Capital Management, Inc. ("JMG Capital"), a Delaware corporation, and Asset Alliance. Jonathan M. Glaser is the Executive Officer and Director of JMG Capital and has sole investment discretion over JMG Partners' portfolio holdings.

- (3)

- According to information submitted to the Company as of April 12, 2005, includes the following amounts which Singer Children's Management Trust has the right to acquire within 60 days of April 12, 2005: 666,100 warrants to purchase shares of common stock at an exercise price of $0.65 per share, 669,586 warrants to purchase shares of common stock at an exercise price of $1.85 per share, 235,000 warrants to purchase shares of common stock at an exercise price of $2.10 per share, 1,827,027 shares of common stock upon conversion of New Subordinated Notes, and 1,891,892 shares of common stock upon conversion of New Secured Notes.

- (4)

- According to information submitted to the Company as of April 12, 2005, includes 2,702,703 shares of common stock upon conversion of New Subordinated Notes and 4,045,054 shares of common stock upon conversion of New Secured Notes.

- (5)

- Includes 227,500 shares of common stock issuable upon exercise of options within 60 days of April 12, 2005. Also includes 50,000 shares held by The Ofer Gneezy 1999 Family Trust for the benefit of Mr. Gneezy's children. Mr. Gneezy disclaims beneficial ownership of the shares held by the Ofer Gneezy 1999 Family Trust. Mr. Gneezy is our President, Chief Executive Officer, Treasurer and one of our directors.

- (6)

- Includes 197,500 shares of common stock issuable upon exercise of options within 60 days of April 12, 2005. Also includes 1,177,345 shares held by the G.J. & C.E. VanderBrug Family Limited Partnership. Dr. VanderBrug disclaims beneficial ownership of the shares held by the G.J. & C.E. VanderBrug Family Limited Partnership, except to the extent of his pecuniary interest therein. Does not include 29,230 shares of common stock held by Dr. VanderBrug's spouse. Dr. VanderBrug disclaims beneficial ownership of the shares held by his spouse. Dr. VanderBrug is our Executive Vice President, Assistant Secretary and one of our directors.

- (7)

- Includes 120,000 shares of common stock issuable upon exercise of options within 60 days of April 12, 2005. Also includes 1,344,416 shares held by the Charles N. Corfield Trust u/a/d 12/19/91, a revocable trust of which Mr. Corfield is the sole trustee. Mr. Corfield is one of our directors.

3

- (8)

- Includes 210,000 shares of common stock issuable upon exercise of options within 60 days of April 12, 2005. Mr. Skibo is one of our directors.

- (9)

- Includes 86,666 shares of common stock issuable upon exercise of options within 60 days of April 12, 2005. Mr. Lee is one of our directors.

- (10)

- Includes 170,000 shares of common stock issuable upon exercise of options within 60 days of April 12, 2005. Dr. King is one of our directors.

- (11)

- Includes 40,000 shares of common stock issuable upon exercise of options within 60 days of April 12, 2005. Mr. Aquino is one of our directors.

- (12)

- Includes 180,000 shares of common stock issuable upon exercise of options within 60 days of April 12, 2005. Mr. Tennant is our Vice President of Finance and Administration and our Chief Financial Officer.

- (13)

- Includes 261,875 shares of common stock issuable upon exercise of options within 60 days of April 12, 2005. Mr. Floyd is our Senior Vice President, R&D, Engineering and Operations.

- (14)

- Includes 183,748 shares of common stock issuable upon exercise of options within 60 days of April 12, 2005. Mr. Powdermaker is our Senior Vice President of Worldwide Sales.

- (15)

- Includes 1,677,289 shares of common stock issuable upon the exercise of options within 60 days of April 12, 2005 and certain shares held by affiliates of such directors and executive officers.

Equity Compensation Plan

The following table provides information as of December 31, 2004 with respect to the shares of our common stock that may be issued under our existing equity compensation plan.

| Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) | Weighted-average exercise price of outstanding options, warrants and rights (b) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | ||||

|---|---|---|---|---|---|---|---|

| Equity compensation plans approved by security holders(1) | 6,568,539 | $ | 1.51 | 338,393 | |||

| Equity compensation plans not approved by security holders | 0 | — | 0 | ||||

| Total | 6,568,539 | $ | 1.51 | 338,393 | |||

- (1)

- Consists of the 1997 Stock Incentive Plan (as amended).

4

EXECUTIVE COMPENSATION AND OTHER INFORMATION

CONCERNING DIRECTORS AND EXECUTIVE OFFICERS

Executive Officers

The executive officers of iBasis, and their ages as of April 12, 2005, are as follows.

| Name | Age | Position | ||

|---|---|---|---|---|

| Executive Officers | ||||

| Ofer Gneezy | 53 | President, Chief Executive Officer and Treasurer | ||

| Gordon J. VanderBrug | 62 | Executive Vice President and Assistant Secretary | ||

| Dan Powdermaker | 41 | Senior Vice President of Worldwide Sales | ||

| Paul H. Floyd | 47 | Senior Vice President of R&D, Engineering and Operations | ||

| Richard G. Tennant | 60 | Vice President of Finance and Administration and Chief Financial Officer |

Mr. Gneezy, co-founder, has served as our President, Chief Executive Officer, Treasurer and one of our directors since our formation in August 1996. From 1994 to 1996, Mr. Gneezy served as President of Acuity Imaging, Inc., a multinational company focused on the industrial automation industry. From 1980 to 1994, Mr. Gneezy was an executive of Automatix, Inc. (a predecessor to Acuity Imaging), an industrial automation company, most recently having served as its President and Chief Executive Officer. Since July 2000, Mr. Gneezy has served as a director and a member of the Audit Committee of NMS Communications Corporation, which provides communication solutions for wireless and wireline networks. Mr. Gneezy graduated from Tel-Aviv University, is a graduate of the Advanced Management Program at Harvard University's Graduate School of Business Administration and has a Masters of Science in engineering from M.I.T.

Dr. VanderBrug, co-founder, has served as our Executive Vice President, Assistant Secretary and one of our directors since October 1996. From 1991 to 1996, Dr. VanderBrug was the Director of Marketing, Electronic Imaging Systems of Polaroid Corporation. In 1980, Dr. VanderBrug co-founded Automatix, Inc. Dr. VanderBrug received his B.A. in mathematics from Calvin College, an M.A. in mathematics from Wayne State University, and his Ph.D. in computer science from the University of Maryland.

Mr. Powdermaker has served as our Senior Vice President of Worldwide Sales since June 2002. An early member of the iBasis management team, Mr. Powdermaker has spent the past seven years at iBasis developing relationships with carriers and service providers around the world and establishing the sales force to support these customers and partners. He worked to bring iBasis' initial US customers onto The iBasis Network™, has served as Vice President of Sales for Asia and more recently as Vice President, Europe, the Middle East and Africa. Prior to joining iBasis, Mr. Powdermaker worked in sales management for AT&T Global Markets, a networking services division of AT&T focused on the world's 2,000 largest telecommunications users.

Mr. Floyd has served as our Senior Vice President of R&D, Engineering and Operations since September 2001. Beginning April 2001, Mr. Floyd was our Vice President of Research and Development. Prior to joining iBasis, Mr. Floyd was a Senior Vice President of DSL Business at Paradyne Networks, Inc., a manufacturer of high-speed broadband access products and technology that support and manage high-bandwidth applications and network traffic. From 1996 to 2000, Mr. Floyd served as Vice President of Research and Development and Engineering at Paradyne.

Mr. Tennant has served as our Vice President of Finance and Administration and Chief Financial Officer since October 2001. From 2000 to 2001, Mr. Tennant was the Vice President, Chief Financial Officer and Treasurer of ScoreBoard, Inc., a software company providing optimization solutions for

5

wireless carriers. From 1999 to 2000, Mr. Tennant served as Senior Vice President and Chief Financial Officer of Orbcomm Global, L.P., the world's first commercial provider of global low-earth satellite data and messaging services. From 1997 to 1999, Mr. Tennant served as Senior Vice President and Chief Financial Officer to Information Resource Engineering, now known as SafeNet, Inc., a developer and manufacturer of security and encryption products for computer data networks.

Summary Compensation

The following table sets forth information concerning the annual and long-term compensation in each of the last three fiscal years for our Chief Executive Officer and the next four most highly compensated executive officers.

| | Annual Compensation (1) | Long-Term Compensation Awards | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Year | Salary | Bonus | Other Annual Compensation | Securities Underlying Options | All Other Compensation | ||||||||||

| Ofer Gneezy President, Chief Executive Officer and Treasurer | 2004 2003 2002 | $ | 200,000 200,000 200,000 | $ | 0 0 0 | $ | 0 0 0 | 40,000 120,000 0 | $ | 0 0 0 | ||||||

Gordon J. VanderBrug Executive Vice President and Assistant Secretary | 2004 2003 2002 | 180,000 180,000 180,000 | 0 0 0 | 0 0 0 | 40,000 120,000 0 | 0 0 0 | ||||||||||

Paul H. Floyd Senior Vice President of Operations | 2004 2003 2002 | 180,000 180,000 180,000 | 0 0 0 | 0 0 0 | 40,000 275,000 0 | (2) | 0 0 0 | |||||||||

Richard G. Tennant Chief Financial Officer, Vice President, Finance and Administration | 2004 2003 2002 | 175,000 175,000 175,000 | 0 0 0 | 0 0 0 | 40,000 100,000 0 | 0 0 0 | ||||||||||

Dan Powdermaker (3), Senior Vice President, Worldwide Sales | 2004 2003 2002 | 150,000 150,000 150,000 | 0 0 0 | 136,485 241,472 260,347 | (4) (6) | 40,000 220,000 0 | (5) | 0 0 0 | ||||||||

- (1)

- Excludes certain perquisites and other benefits, the amount of which did not exceed 10% of the employee's total salary and bonus.

- (2)

- Mr. Floyd voluntarily surrendered 175,000 stock options on December 23, 2002, pursuant to iBasis' Tender Offer Statement and Offer to Exchange Outstanding Stock Options on Schedule TO, filed with the SEC on November 25, 2002 (the "Exchange Offer"). In accordance with the terms of the Exchange Offer, 175,000 new options were granted to Mr. Floyd on June 24, 2003. Pursuant to the Exchange Offer, for each option to purchase one share of common stock that Mr. Floyd surrendered, he received a new option to purchase one share of common stock. Mr. Floyd was also granted 100,000 stock options on August 11, 2003.

- (3)

- Mr. Powdermaker became Senior Vice President, Worldwide Sales in July, 2002.

- (4)

- Mr. Powdermaker received $103,240 in sales commissions and $138,232 in reimbursement of living expenses while working at our London office.

- (5)

- Mr. Powdermaker voluntarily surrendered 120,000 stock options on December 23, 2002, pursuant to the Exchange Offer. In accordance with the terms of the Exchange Offer, 120,000 new stock options were granted to Mr. Powdermaker on June 24, 2003. Pursuant to the Exchange Offer, for each option to purchase one share of common stock that Mr. Powdermaker surrendered, he received a new option to purchase one share of common stock. Mr. Powdermaker was also granted 100,000 stock options on August 11, 2003.

- (6)

- Mr. Powdermaker received $142,471 in sales commissions and $117,876 in reimbursement of living expenses while working at our London office.

6

The following table contains information concerning options to purchase common stock that we granted during the year ended December 31, 2004 to each of the officers named in the summary compensation table.

| | | | | | Potential Realizable Value at Assumed Annual Rates of Stock Appreciation for Option Term (2) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Individual Grants | ||||||||||||||

| | Number of Securities Underlying Options Granted (1) | Percent of Total Options Granted to Employees in 2003 | | | |||||||||||

| | Exercise Price Per Share | Expiration on Date | |||||||||||||

| | 5% | 10% | |||||||||||||

| Ofer Gneezy | 40,000 | 3.01 | % | $ | 2.12 | 9/14/14 | $ | 53,330 | $ | 135,149 | |||||

| Gordon J. VanderBrug | 40,000 | 3.01 | 2.12 | 9/14/14 | 53,330 | 135,149 | |||||||||

| Paul H. Floyd | 40,000 | 3.01 | 2.12 | 9/14/14 | 53,330 | 135,149 | |||||||||

| Richard G. Tennant | 40,000 | 3.01 | 2.12 | 9/14/14 | 53,330 | 135,149 | |||||||||

| Dan Powdermaker | 40,000 | 3.01 | 2.12 | 9/14/14 | 53,330 | 135,149 | |||||||||

- (1)

- Shares underlying the retention options vest over a four-year period, with 6.25% of the shares vesting on each of the first sixteen three-month anniversaries after the grant date.

- (2)

- The 5% and 10% assumed annual rates of compounded stock price appreciation are mandated by SEC rules and do not represent an estimate or projection of our future stock prices. Actual gains, if any, on stock option exercises and common stock holdings are dependent on future performance of our common stock and overall stock market conditions. There can be no assurance that the amounts reflected in the table will be achieved.

Aggregated Option Exercises In Last Fiscal Year And Fiscal Year-End Option Values

The following table contains information concerning option holdings for the year ended December 31, 2004, and such date with respect to each of the officers named in the summary compensation table.

| | | | Number of Shares Underlying Unexercised Options at Year End | Value of Unexercised In-the-Money Options at Year End (1) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Shares Acquired on Exercise | | |||||||||||||

| | Value Realized | ||||||||||||||

| | Exercisable | Unexercisable | Exercisable | Unexercisable | |||||||||||

| Ofer Gneezy | 0 | $ | 0 | 210,000 | 120,000 | $ | 255,900 | $ | 143,100 | ||||||

| Gordon J. VanderBrug | 0 | 0 | 180,000 | 120,000 | $ | 228,700 | $ | 143,100 | |||||||

| Paul H. Floyd | 0 | 0 | 225,000 | 150,000 | $ | 314,750 | $ | 174,750 | |||||||

| Richard G. Tennant | 0 | 0 | 146,250 | 143,750 | $ | 245,975 | $ | 186,625 | |||||||

| Dan Powdermaker | 0 | 0 | 153,749 | 136,251 | $ | 212,224 | $ | 157,976 | |||||||

- (1)

- Value is determined by subtracting the exercise price from $2.46, the closing price of our common stock on the OTCBB on December 31, 2004, multiplied by the number of shares underlying the options.

Employment Agreements with Executive Officers

We currently have employment agreements in effect with Mr. Gneezy, Dr. VanderBrug, Mr. Powdermaker, Mr. Floyd and Mr. Tennant.

iBasis and Mr. Gneezy are parties to an employment agreement, dated as of August 11, 1997, governing his employment with iBasis as President, Chief Executive Officer and Treasurer. Under the terms of the employment agreement, Mr. Gneezy is paid a base salary determined by the Compensation Committee of the Board of Directors, and is eligible to receive an annual bonus at the

7

discretion of such committee. iBasis and Dr. VanderBrug are parties to an employment agreement, dated as of August 11, 1997, governing his employment with iBasis as Executive Vice President and Assistant Secretary. Under the terms of the employment agreement, Dr. VanderBrug is paid a base salary determined by the Compensation Committee, and is eligible to receive an annual bonus at the discretion of such committee. In 2004, Mr. Gneezy and Dr. VanderBrug earned $200,000 and $180,000 in base salary, respectively. iBasis also has employment agreements with Messrs. Powdermaker, Floyd, and Tennant, for serving in their respective capacities. Under the terms of their employment agreements, Mr. Powdermaker is paid a base salary of $150,000, Mr. Floyd is paid a base salary of $180,000, and Mr. Tennant is paid a base salary of $175,000. Each officer is eligible for a bonus, although the bonus programs were suspended in 2004, in an effort to reduce operating expenses.

We may terminate the employment agreements with Messrs. Gneezy and VanderBrug "for cause" or at any time upon at least thirty days prior written notice, and Messrs. Gneezy and Mr. VanderBrug may terminate their employment agreements "for good reason" or at any time upon at least thirty days prior written notice. We may terminate the employment agreement with Messrs. Powdermaker, Floyd, and Tennant at any time and each may terminate his employment agreement at any time. If we terminate either of Messrs. Gneezy and VanderBrug without cause or if either resigns for good reason, we must continue to pay his base salary and continue to provide health benefits for one year. If, within six months following an acquisition or change of control, we terminate Messrs. Powdermaker, Floyd, or Tennant, without cause, or if any resigns for good reason, we must continue to pay each officer's base salary and health benefits for nine months.

The executive officers are entitled to life insurance, health insurance and other employee fringe benefits to the extent that we make benefits of this type available to our other employees. All intellectual property that the officers may invent, discover, originate or make during their term of their employment is the exclusive property of iBasis. The officers may not, during or after the term of their employment, disclose or communicate any confidential information without iBasis' prior written consent. Their employment agreements also contain certain non-competition and non-solicitation provisions that are in effect during their employment with iBasis and continue after termination. The agreements with Messrs. Gneezy and VanderBrug also provide that in the event of an acquisition or change in control, each of their options and restricted shares, if any, shall automatically become fully vested immediately prior to such event, and each such option shall remain exercisable until the expiration of such option or until it sooner terminates in accordance with its terms. The agreements with Messrs. Powdermaker, Floyd, and Tennant provide that in the event that we terminate the employment of the officer without cause, or the officer terminates his employment with "good reason," in either case within six months after the occurrence of an acquisition or change in control, then such officers options shall immediately vest and become exercisable.

In general, "good reason" as used in the employment agreements of our executive officers means any material change in the compensation, position, and location of employment or responsibilities of the employee. "For cause" generally means gross negligence or willful misconduct of the employee, a breach of the employment agreement or the commission of a crime.

Our employment agreements with Messrs. Floyd, Tennant and Powdermaker also contain provisions relating to each officer's relocation expenses.

8

Compensation Committee Report on Executive Compensation(1)

The Compensation Committee of the Board of Directors administers our overall compensation policies. In particular, the Compensation Committee, which is composed of three directors, establishes and administers our executive compensation policies and plans and administers our stock option and other equity-related compensation plans. The Compensation Committee considers internal and external information in determining officer compensation, including outside survey data.

- (1)

- Notwithstanding anything to the contrary set forth in any of iBasis' previous filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate future filings, including this Proxy Statement, in whole or in part, the Compensation Committee Report on Executive Compensation shall not be incorporated by reference into any such filings.

Compensation Philosophy

iBasis' compensation policies have been designed to achieve the following objectives:

- •

- Offer compensation opportunities that attract highly qualified executives, reward outstanding initiative and achievement, and retain the leadership and skills necessary to build long-term stockholder value.

- •

- Maintain a significant portion of executives' total compensation at risk, tied to both the annual and long-term financial performance of iBasis and the creation of stockholder value.

- •

- Further iBasis' short and long-term strategic goals and values by aligning compensation with business objectives and individual performance.

Compensation Program

iBasis' compensation program has three major integrated components, base salary, annual incentive awards, and long term incentives. In addition, the compensation program is comprised of various benefits, including life insurance, health insurance and other employee fringe benefits.

Base Salary. Base salaries have generally been frozen since the third quarter of 2001. Base salary levels for new employees have been determined as needed by reviewing the pay practices of competitor companies of similar size and market capitalization, the skills, performance level, and contribution to the business of individual executives, and the needs of the company. Effective as of the first quarter of 2005, certain employees have received modest salary increases.

Incentive Awards. iBasis' executive officers are eligible to receive cash bonus awards designed to motivate them to attain short-term and longer-term corporate and individual management goals. During the second quarter of 2001, iBasis suspended these bonus programs for all executives and employees in an effort to reduce operational costs. A new executive bonus plan has been considered by the Committee, effective as of the first quarter of 2005. The plan will award bonuses in part based on iBasis' financial performance.

Long Term Incentives. iBasis provides long term incentives through its 1997 Stock Incentive Plan, as amended (the "Plan"). Stock options are granted at fair market value and vest in installments, generally over two or four years. When determining option awards for an executive officer, the Compensation Committee considers the executive's current contribution to company performance, its executive retention needs, the anticipated contribution to meeting iBasis's long-term strategic performance goals, and industry practices and norms. Long-term incentives granted in prior years, existing levels of stock ownership, and whether past incentives are still effective are other factors also taken into consideration. Because the receipt of value by an executive officer under a stock option is

9

dependent upon an increase in the price of iBasis' common stock, this portion of the executive's compensation is directly aligned with an increase in stockholder value.

In 2004, Messrs. Gneezy, VanderBrug, Floyd, Powdermaker and Tennant each received options to purchase 40,000 shares of our common stock. Each option becomes exercisable on a quarterly basis, in a series of 16 installments, vesting 6.25% of the optioned shares, provided, that individually, each remains an employee of iBasis on each vesting date. The exercise price for each option is $2.12, the closing price of a share of our common stock on the OTCCB on the date of the grant, September 14, 2004. Each option expires on September 14, 2014. All options were granted under the Plan and the first installment became exercisable on December 14, 2004.

Chief Executive Officer Compensation

The Chief Executive Officer's base salary, annual incentive award and long-term incentive compensation are determined by the Compensation Committee. For the year ended December 31, 2004, Mr. Gneezy received $200,000 for his annualized base salary, the same amount he received in 2003. Mr. Gneezy did not receive a bonus for the last fiscal year.

Section 162(m) of the Internal Revenue Code of 1986, as amended (the "Code"), limits the tax deduction to $1 million for compensation paid to certain executives of public companies. This deduction limitation does not apply to compensation that constitutes "qualified performance-based compensation" within the meaning of Section 162(m) of the Code and the regulations promulgated thereunder. In any case, the combined salary and bonus of each executive officer has been below the $1 million limit. The Compensation Committee's present intention is to structure executive compensation to minimize the application of the deduction limitation of Section 162(m) of the Code unless the Compensation Committee feels that the necessary changes in iBasis' accounting methods in order to do so would not be in the best interest of iBasis or its stockholders.

Respectfully Submitted by the Compensation Committee,

Charles N. Corfield

Ofer Gneezy

Charles Skibo

10

The Audit Committee of the Board of Directors is composed of three directors, Charles Corfield, David Lee and W. Frank King, each of whom is independent as defined by Nasdaq National Market listing rules. Each committee member is able to read and understand fundamental financial statements, including the balance sheet, income statement, and cash flow statement of iBasis. Dr. King acts as the committee's financial expert. His employment experience results in his financial sophistication and ability to serve as the committee's financial expert, as he served as Chief Executive Officer and director of PSW Technologies, Inc. from 1992 to 1998, and as Senior Vice President of Development of Lotus Development from December 1988 to 1992.

- (1)

- Notwithstanding anything to the contrary set forth in any of iBasis' previous filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate future filings, including this Proxy Statement, in whole or in part, the Audit Committee Report shall not be incorporated by reference into any such filings.

The Audit Committee operates under a written Audit Committee Charter, revised in March 2003 to conform to standards and requirements adopted by the Securities Exchange Commission.

The Audit Committee is responsible for, among other things, monitoring the integrity and adequacy of iBasis' financial information, control systems, and reporting practices, and for recommending to the Board of Directors adoption by the stockholders of the Audit Committee's selection of independent auditors for iBasis. The Audit Committee has selected and the Board of Directors has approved the selection of Deloitte & Touche LLP ("Deloitte & Touche") as iBasis' independent auditor.

The Audit Committee has reviewed and discussed iBasis' audited financial statements with management, which has primary responsibility for the financial statements. The committee has discussed with Deloitte & Touche the matters that are required to be discussed by Statement on Auditing Standards No. 61, "Communication with Audit Committees." It has also discussed with Deloitte & Touche the auditors' independence from iBasis and its management and has received from Deloitte & Touche the written disclosures and the letter required by Independence Standards Board Standard No. 1, "Independence Discussions with Audit Committees."

The Audit Committee has considered whether the services provided by Deloitte & Touche are compatible with maintaining the independence of Deloitte & Touche and has concluded that the independence of Deloitte & Touche is maintained and not compromised by the services provided.

Based on the review and discussion referred to above, the Audit Committee recommended to the Board of Directors, and the Board of Directors has approved, that the audited financial statements be included in iBasis' Annual Report on Form 10-K for the year ended December 31, 2004, for filing with the Securities and Exchange Commission.

Respectfully Submitted by the Audit Committee,

Charles N. Corfield

W. Frank King

David Lee

11

Compensation Committee Interlocks and Insider Participation

With the exception of Mr. Gneezy, no member of the Compensation Committee is an officer or employee of ours. Mr. Skibo served as the President of iBasis Speech Solutions, a wholly-owned subsidiary of iBasis, from November 2001 until its sale in July 2002. Mr. Skibo was not a member of the Compensation Committee during that period. None of our executive officers serves as a member of the Board of Directors or compensation committee of any other entity that has one or more executive officers serving as a member of our Board of Directors or the Compensation Committee.

Compensation of Directors

In 2004, each of our non-employee directors earned $15,000 in cash compensation for their services as directors. Neither Mr. Gneezy nor Dr. VanderBrug received additional compensation for serving as directors of iBasis. The directors who do not live in the Boston Metropolitan area were also reimbursed for travel expenses. We maintain directors' and officers' liability insurance and our by-laws provide for mandatory indemnification of directors and officers to the fullest extent permitted by Delaware law. In addition, our certificate of incorporation limits the liability of our directors to either iBasis or its stockholders for breaches of the directors' fiduciary duties to the fullest extent permitted by Delaware law.

In 2004, Messrs. Gneezy and VanderBrug each received options to purchase 40,000 shares of common stock. Each option becomes exercisable on a quarterly basis, in a series of 16 installments, vesting 6.25% of the optioned shares, provided that, individually, each remains an employee of iBasis on each vesting date. The exercise price for each option is $2.12, the closing price of a share of our common stock on the OTCCB on the date of the grant, September 14, 2004. Each option expires on September 14, 2014. All options were granted under the Plan and the first installment became exercisable on December 14, 2004.

In 2004 upon his appointment to the Board of Directors, Mr. Aquino received options to purchase 80,000 shares of common stock. 25% of Mr. Aquino's options became exercisable immediately on August 5, 2004, the date of grant, with the remaining options to become exercisable in a series of three installments of 25% of the option shares, with the first installment to become exercisable at the 2005 Annual Meeting of Stockholders and with each additional installment to become exercisable at each of the next two annual meetings of stockholders in years 2006 and 2007, respectively, provided, that Mr. Aquino continues to be a director of iBasis on each applicable date. All options were granted under the Plan.

Section 16(a)—Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities and Exchange Act of 1934, as amended, requires our officers and directors, as well as persons who own more than ten percent (10%) of a registered class of iBasis' equity securities to file reports of ownership on Forms 3, 4, and 5 with the SEC and with us. Based on our review of copies of such forms, all officers, directors and 10% holders complied with applicable obligations with respect to transactions in securities of iBasis during the year ended December 31, 2004.

Code of Ethics

We adopted a Code of Ethics that applies to our Chief Executive Officer, Chief Financial Officer, as well as the Vice-President Finance and Controller. This Code of Ethics is available on our web site, at www.ibasis.net (under "Investor Relations"). We intend to post any amendments or waivers of the Code of Ethics on our web site. You may obtain a free copy of this code by writing to our Investor Relations Department, iBasis, Inc., 20 Second Avenue, Burlington, MA 01803, orir@ibasis.net.

12

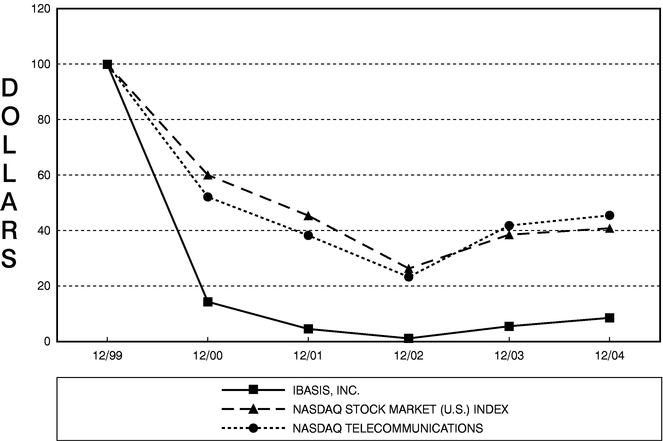

The following graph compares the percentage change in the cumulative total stockholder return on our common stock with the cumulative total return of the Nasdaq Stock Market (U.S.) Composite Index and the Nasdaq Stock Market Telecommunications Index (IXTC-O) for the period from December 31, 1999 through December 31, 2004. For purposes of the graph, it is assumed that the value of the investment in our common stock and each index was 100 on December 31, 1999 and that all dividends were reinvested.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG IBASIS, INC., THE NASDAQ STOCK MARKET (U.S.) INDEX

AND THE NASDAQ TELECOMMUNICATIONS INDEX

- *

- $100 invested on 12/31/99 in stock or index—including reinvestment of dividends. Fiscal year ending December 31.

| Cumulative Total Return | 12/99 | 12/00 | 12/01 | 12/02 | 12/03 | 12/04 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| IBASIS | 100.00 | 14.35 | 4.56 | 1.15 | 5.53 | 8.56 | ||||||

| NASDAQ STOCK MARKET (U.S.) INDEX | 100.00 | 60.09 | 45.44 | 26.36 | 38.55 | 40.87 | ||||||

| NASDAQ STOCK MARKET TELECOMMUNICATIONS INDEX | 100.00 | 52.17 | 38.29 | 23.31 | 41.85 | 45.52 |

13

ELECTION OF DIRECTORS

The Board of Directors is divided into three classes. Each class serves a three-year term. The Class 3 Directors' term will expire at the annual meeting. All directors will hold office until their successors have been duly elected and qualified.

The Board of Directors has nominated Ofer Gneezy, Charles N. Corfield and Peter D. Aquino for re-election as Class 3 Directors, each to hold office until the annual meeting of stockholders to be held in 2008 and until his respective successor is duly elected and qualified. Shares represented by all proxies received by the Board of Directors and not marked so as to withhold authority to vote for Messrs. Gneezy, Corfield and Aquino will be votedFOR their election.

The following table sets forth information on the nominees to be elected at the annual meeting and each director whose term of office will extend beyond the annual meeting.

| Nominee or Director's Name | Age | Position(s) Held | Director Since | Year Term Will Expire | Class of Director | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| Ofer Gneezy(1) | 53 | President, Chief Executive Officer, Treasurer and Director | 1996 | 2008 | 3 | |||||

| Gordon J. VanderBrug | 62 | Executive Vice President, Assistant Secretary and Director | 1996 | 2006 | 1 | |||||

| Charles N. Corfield(1)(2)(4) | 44 | Director | 1997 | 2008 | 3 | |||||

| W. Frank King(2)(3)(4) | 65 | Director | 2001 | 2007 | 2 | |||||

| David Lee(2)(3)(4) | 67 | Director | 2002 | 2006 | 1 | |||||

| Charles M. Skibo(1)(3) | 66 | Director | 1999 | 2007 | 2 | |||||

| Peter D. Aquino(4)(5) | 43 | Director | 2004 | 2008 | 3 |

- (1)

- Member of the Compensation Committee.

- (2)

- Member of the Audit Committee.

- (3)

- Member of the Shareholder Litigation Committee.

- (4)

- The Board of Directors has determined these directors to be independent in accordance with Nasdaq National Market listing rules.

- (5)

- Designated pursuant to an agreement with the majority purchasers of our 8% Secured Convertible Notes due June 2007, as more fully described in the section titled "Certain Relationships and Related Transactions."

Mr. Corfield has been a director of iBasis since September 1997. Since 1999, Mr. Corfield has been a director of BeVocal and since 2000, the Chief Executive Officer of SandCherry Networks. Mr. Corfield serves on the board of directors of Liberate Technologies, a web-based, enhanced television company. Mr. Corfield co-founded Frame Technology, a software company, in 1986 and was a member of its board of directors and its Chief Technology Officer until Adobe Systems acquired it in 1995.

Dr. King has been a private investor since November 1998 and a director of iBasis since June 2001. From 1992 to 1998, he was Chief Executive Officer and director of PSW Technologies, Inc. (formerly a division of Pencom, Inc.), a provider of software services. From 1988 to 1992, Dr. King was Senior Vice President of Development of Lotus Development Corporation, and for the previous 19 years he served in various positions with IBM Corporation, including his last position as Vice President of Development

14

for the entry system division. He is also director of NMS Communications, Inc., eOn Communications Corporation, Aleri, Inc., Concero, Inc., and Covi, Inc.

Mr. Skibo has been a director of iBasis since September 1999. He served as President of iBasis Speech Solutions, Inc. from November 2001 to July 2002. From January 1999 to September 2001, Mr. Skibo served as the Chief Executive Officer and Chairman of Colo.com, a company that provided facilities and co-location services to communication and information technology industries. Colo.com filed for bankruptcy in June 2001. Since September 2004, Mr. Skibo has served as the Chief Executive Officer and as a director of HouseRaising, Inc., a public company focused on software and custom home building services. Since 1994, Mr. Skibo has also served as Chairman and Chief Executive Officer of Strategic Enterprises and Communications, Inc., a venture capital firm. In addition, Mr. Skibo serves as Chairman and Chief Executive Officer of Allied Telecommunications and as a director of ICO, a satellite based internet company. From 1985 to 1987, Mr. Skibo was President and CEO of US Sprint and its predecessor company, U.S. Telecom.

Mr. Lee has been a director of iBasis since May 2002. Mr. Lee has founded, served as chairman, and held senior executive positions at several communications technology companies, including ITT Corporation. Mr. Lee joined ITT after that company acquired Qume Corporation, a company he had co-founded in 1973. At ITT Qume, Mr. Lee held the positions of Executive Vice President from 1978 to 1981, and President, from 1981 through 1983. Mr. Lee later became President and Chairman of Data Technology Corporation. Mr. Lee is currently Chairman of the Board of eOn Communications Corporation and Cortelco, and is a director of ESS Technology Inc. and Linear Technology Corporation. Mr. Lee also serves as a Regent for the University of California. Through his service on the Advisory Committee on Trade Policy and Negotiation for Presidents Bush (senior) and Clinton, and his recent role on President George W. Bush's Council on the 21st Century Workforce, Mr. Lee is one of the world's foremost experts on US-China commerce and the Chinese telecommunications industry.

Mr. Aquino has been a director of iBasis since August 2004. Mr. Aquino has been the President, Chief Executive Officer and a director of RCN Corporation since December 2004. Mr. Aquino was previously Senior Managing Director of Capital & Technology Advisors LLC, a telecommunications advisory firm, since 2001. From 1995 to 2001, Mr. Aquino was a partner with Wave International, Inc., a telecommunications venture capital firm. Prior to 1995, Mr. Aquino spent twelve years with Bell Atlantic (now Verizon) in various senior management positions. Mr. Aquino is a director of Neon Communications.

Board Meetings and Committees

The directors hold regular meetings, attend special meetings, as required, and spend such time on the affairs of iBasis as their duties require. During the fiscal year ended December 31, 2004, the Board of Directors held six meetings and took action by unanimous written consent in lieu of meetings of the Board of Directors on four occasions. During the year, each of the directors attended at least 75% of the meetings of the Board of Directors and, in accordance with their membership on each, the audit and compensation committees of the Board, except Mr. Lee, who attended 66% of the Audit Committee meetings.

Our Board of Directors has the following three committees:

Compensation Committee—administers our overall compensation policies and stock option plans. Its members are Messrs. Gneezy, Corfield, and Skibo. The committee convened six times last year.

Audit Committee—is responsible for, among other things, monitoring the integrity and adequacy of iBasis' financial information, control systems, and reporting practices, and for recommending to the Board of Directors adoption by the stockholders of the Audit Committee's selection of independent auditors for iBasis. Its members are Messrs. Corfield, King, and Lee, each of whom is independent, as

15

defined by Rule 4200(a)(15) of the Nasdaq National Market listing rules. The committee convened nine times last year and held four executive sessions with Deloitte & Touche in conjunction with the regularly scheduled meetings.

Shareholder Litigation Committee—was formed to evaluate and accept and/or reject settlement proposals in connection with the several class action lawsuits filed against iBasis and certain of its current and past officers and directors, as well as, against the investment banking firms that underwrote our public offerings, as disclosed in our Form 10-K. Its members are Messrs. King, Lee, and Skibo.

In addition, the Board of Directors formerly maintained a Strategic Committee that evaluated and recommended a strategic course for iBasis. The Strategic Committee had remained dormant since November 8, 2001, subsequent to which time, our entire Board of Directors has participated in such discussions. The Strategic Committee was dissolved in March 2004.

Mr. Gneezy and Mr. VanderBrug attended our 2004 Annual Meeting of Stockholders. We do not require attendance at our annual meeting by non-employee members of our Board of Directors.

Procedures for Nominating Directors. Our Board of Directors has no standing nominating committee. It does not delegate the responsibility for selecting new directors as it believes that all of its members should be involved in this process. Members of our Board of Directors search and review suitable candidates for director nominations. In evaluating director nominees, our Board of Directors considers a number of factors that it deems are in the best interest of iBasis and its stockholders, although there are no stated minimum criteria for director nominees. Our Board of Directors does, however, believe it appropriate for at least one, and, preferably, several, members of the Board of Directors to meet the criteria for an "audit committee financial expert" as defined by SEC rules. We also believe it appropriate for certain key members of management to participate as members of the Board of Directors.

Our by-laws contain provisions that address the process by which a stockholder may nominate a candidate for director. Historically, we have not had a formal policy concerning stockholder nominations to the Board of Directors, however, the absence of such a policy does not mean that a nomination would not have been considered had one been received. To date, we have not received any nominations from stockholders requesting that the Board of Directors consider a candidate for inclusion among the slate of nominees in our proxy statement. The Board of Directors would consider any candidate proposed in good faith by a stockholder. To do so, a stockholder should send the candidate's name, credentials, contact information, and his or her consent to be considered as a candidate to our Secretary, iBasis, Inc., 20 Second Avenue, Burlington, MA 01803. Such notice must be delivered to the Secretary not less than 120 nor more than 150 days prior to the first anniversary of the date of our proxy statement delivered to stockholders in connection with the preceding year's annual meeting. The proposing stockholder should also include his or her contact information and a statement of his or her share ownership (how many shares owned and for how long).

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE "FOR" THE ELECTION OF EACH NOMINEE LISTED ABOVE.

16

APPROVAL OF THE AMENDED AND RESTATED 1997 STOCK INCENTIVE PLAN

The Board of Directors has directed that there be submitted to the stockholders a proposal to approve the Amended and Restated 1997 Stock Incentive Plan (the "Plan") to increase the number of shares available for issuance from 9,000,000 to 14,000,000 shares. In August 1997, our Board of Directors approved the Plan, which was amended in December 1998, in September 1999, in December 2000 and in March 2005. A copy of the Plan as proposed to be amended and restated is attached hereto asAppendix A and a summary of it follows after the next paragraph.

Reasons for Amending the Plan

The Board of Directors believes that iBasis' long-term success is dependent upon its ability to attract and retain outstanding employees, directors and consultants and to provide such persons with a proprietary interest or to increase their proprietary interest in iBasis' success, to encourage them to remain in the employ or as directors or consultants of iBasis and to assist in attracting new employees, directors, and consultants to iBasis. The purpose of the Plan is to provide iBasis with a critical tool to make that happen. The Board of Directors believes that the Plan has been and continues to be efficient and effective in fulfilling its purpose. Stock option awards make up a crucial part of the compensation package iBasis can offer both to existing personnel and persons being recruited. Stock awards align management's interests directly with those of the stockholders, as the value of stock awards is directly linked to the market value of the Company's stock. As of March 31, 2005, only 337,480 shares remain available for new grants. Increasing the shares for the Plan would allow the Company to continue this effective program.

Summary Description of the Plan

The Plan provides for the grant of "incentive stock options" ("incentive stock options") within the meaning of Section 422 of the Internal Revenue Code of 1986, as amended (the "Code"), options that do not meet the requirements of Section 422 of the Code ("nonqualified options") and restricted stock awards. Employees (including officers and employee directors), directors, consultants and advisors are eligible for nonqualified options and restricted stock awards. Only employees are eligible for incentive stock options. A maximum of 9,000,000 shares of common stock have currently been authorized for issuance under Plan.

No participant in our Plan may, in any year, be granted options or restricted stock awards with respect to more than 1,000,000 shares of common stock.

The exercise price of options granted under our stock incentive plan shall not be less than 100% of the fair market value of the common stock on the date of grant, or 110% in the case of incentive stock options issued to an employee who at the time of grant owns more than 10% of the total combined voting power of all classes of iBasis stock. The options become exercisable at such time or times, during such periods, and for such numbers of shares as shall be determined by the Compensation Committee and expire after a specified period that may not exceed ten years from the date of grant.

The Compensation Committee may, in its discretion, provide for the acceleration of one or more outstanding options and the vesting of unvested shares held as restricted stock awards upon occurrence of a change of control of iBasis.

In the event of a merger, consolidation, or sale, transfer, or other disposition of all, or substantially all, of our assets, the Compensation Committee may, in its discretion, provide for the automatic acceleration of one or more outstanding options that are assumed or replaced and do not otherwise accelerate by reason of the transaction. In addition, the Compensation Committee may similarly provide for the termination of any of our repurchase rights that may be assigned in connection with the

17

merger, consolidation, or sale, transfer, or other disposition of all or substantially all of our assets, in the event that a holder of restricted stock's employment, directorship or consulting or advising relationship should subsequently terminate following the transaction.

The Plan is not subject to any provisions of the Employee Retirement Income Security Act of 1974, as amended.

The Board of Directors may amend, modify, suspend or terminate the Plan at any time, subject to applicable law and the rights of holders of outstanding options and restricted stock awards. The Plan will terminate on August 11, 2007, unless the Board of Directors terminates it prior to that time.

Certain Federal Tax Consequences

Following are certain federal tax consequences to U.S. citizens and residents of awards under the Plan. It is based on the provisions of the Code and applicable IRS regulations and rulings. The Internal Revenue Code is subject to amendment, and continuing interpretation by the IRS. This summary describes only the principal tax consequences in the circumstances described and does not take into account special rules that might apply in limited and individual cases.

Nonqualified options.

Grant. An optionee will not have to report any taxable income when he or she receives a nonqualified option.

Exercise with Cash. An optionee will have to report taxable income if he or she exercises a nonqualified option with cash. The taxable amount is the difference between the value of the shares on the date the option is exercised and the amount paid for the shares. This income will be taxed to an optionee just as any other income an optionee receives as compensation for services. This income, together with the amount paid for the shares, will then be an optionee's basis in the shares for purposes of determining taxable gain or loss on any later sale of the shares.

Sale of Shares. An optionee may also have to report taxable gain or loss when he or she sells a share received on exercising a nonqualified option. The amount of reportable gain or loss will be measured by the difference between the amount received from selling that share and the optionee's basis in the share. Any such gain or loss will be a capital gain or loss. Capital gains qualify to be taxed at lower rates than the rates which apply to compensation income if the optionee has held the share more than one year.

Incentive Stock Options.

Grant. An optionee will not have to report any taxable income when he or she receives an incentive stock option.

Exercise with Cash. In most cases an optionee will not have to report any taxable income when an incentive stock option is exercised with cash. However, the federal income tax system includes a separate tax, the alternative minimum tax, intended to ensure that taxpayers cannot completely eliminate all income taxes through the use of various special provisions of the Internal Revenue Code. For purposes of calculating whether an optionee owes any alternative minimum tax, the optionee will have to report the difference between the value of the shares on the date the option is exercised and the amount paid for the shares as though it were taxable compensation income. As a result, and depending on an optionee's particular circumstances, an alternative minimum tax may have to be paid when an incentive stock option is exercised.

18

Sale of Shares. An optionee may have to report taxable gain or loss selling a share received on exercising an incentive stock option. The amount of reportable gain or loss will be measured by the difference between the amount received from selling that share and the optionee's basis in the share. Any such gain or loss will usually be capital gain or loss. However, if an optionee has a gain when selling a share received on exercising an incentive stock option, some or all of that gain will be taxed as compensation income if that share is sold

- •

- within two years from the date the option is received, or

- •

- within one year after the option is exercised.

A sale of shares within the above time periods is known as a disqualifying disposition. In the case of a disqualifying disposition, an optionee will have to report as additional compensation income a portion of the gain he or she otherwise would report on selling shares equal to the difference between the value of the share at the date the option is exercised and the amount paid for the share on exercise. This compensation income is not subject to income and employment tax withholding, but is reported by iBasis to the IRS.

Restricted Stock Awards.

Grant and Lapse of Restrictions. When an award of stock is received which is subject to a substantial risk of forfeiture the holder will not have to report any taxable income except as follows:

- •

- If the holder makes an "83(b) election" (described below), at the date the restricted stock award is received, he or she will have to report compensation income equal to the difference between the value of the shares and the price paid for the shares, if any. Value is determined without regard to the risk of forfeiture that applies to the award.

- •

- If the holder does not make an "83(b) election," at the date or dates the substantial risk of forfeiture which applies to the award expire, the holder will have to report compensation income equal to the difference between the then value of the shares and the price paid for the shares, if any.

83(b) Elections. An 83(b) election is a special tax election made to have any risk of forfeiture that otherwise applies to a holder's restricted stock award disregarded for tax purposes. An 83(b) election has three effects. First, the holder will have to report compensation income, if any, at the time the shares are received rather than later as the risk of forfeiture expires. Second, the amount of compensation income will be based on the value of the shares when the shares are received (disregarding the risk of forfeiture) rather than based on the value as the risk of forfeiture expires. Third, the date the holder is first treated as holding the shares for purposes of later determining whether he or she qualifies for the tax rates that apply to capital gains or losses will be the date the award is received rather than the date or dates the risk of forfeiture which applies to the award expires. An 83(b) election must be made within 30 days of receiving a restricted stock award, and generally cannot be revoked once made.

Sale of Shares. The holder may have to report taxable gain or loss when he or she sells the shares received as a restricted stock award. The amount of reported gain or loss will be measured by the difference between the amount received on selling those shares and the holder's basis in the shares. The holder's basis in the shares is the amount paid for the shares, if any,plus the amount of compensation income previously reported in connection with the restricted stock award. Any such gain or loss will be gain or loss. Any such gain will qualify for lower tax rates than the rates which apply to compensation income if the holder held the awarded shares more than one year after the date the shares were received, if he or she made an 83(b) election, or the date or dates the risk of forfeiture which applies to the award expires, otherwise.

19

Forfeiture of Shares. If a holder should forfeit a restricted stock award, the tax consequences will be the same as if the holder sold the shares. However, if an 83(b) election has been made and the shares are subsequently forfeited, only the amount paid for the shares will be taken into account for purposes of determining whether the holder has a capital loss.

Stock Grants. When a holder receives an award of shares which is not subject to any substantial risk of forfeiture, the holder will have to report compensation income equal to the difference between the value of the shares and the price paid for the shares, if any. This amount of income, together with the price paid for the shares, will then be the basis in the shares for purposes of determining whether the holder has any taxable gain or loss on a later sale of the shares.

Termination and Amendment of the Plan

The Board at any time may terminate, or amend or modify in any respect, the Plan. Approval of the stockholders of iBasis, however, is required for certain amendments or modifications. Notwithstanding the foregoing, no amendment or modification to the terms of an outstanding option or restricted stock award may be made without the consent of the holder of such option or award.

Stockholder approval is required for any amendment or modification to the Plan that would change the eligibility requirements of the Plan, extend the term of the Plan, or increase the number of shares of common stock subject to grant as options or restricted stock awards under the Plan.

Administration

The Compensation Committee administers our Plan and has the authority to make all determinations required under our Plan, including the eligible persons to whom, and the time or times at which, options or restricted stock awards may be granted, the exercise price or purchase price (if any) of each option or restricted stock award, whether each option is intended to qualify as an incentive stock option or a nonqualified stock option, and the number of shares subject to each option or restricted stock award. The Compensation Committee also has authority to:

- •

- interpret our Plan;

- •

- determine the terms and provisions of the option or restricted stock award instruments; and

- •

- make all other determinations necessary or advisable for administration of our Plan.

The Committee has authority to prescribe, amend, and rescind rules and regulations relating to our Plan. Subject to the provisions of the Plan, the Compensation Committee has full and final authority in its discretion to determine the persons to be granted options. Each determination, interpretation, or other action made or taken pursuant to the provisions of the Plan by the Board of Directors or the Compensation Committee shall be final and shall be binding and conclusive for all purposes and upon all persons, including without limitation, iBasis, its stockholders, the Compensation Committee and each of the members thereof, and the directors, officers, and employees of iBasis, the holders of options under the Plan, and their respective successors in interest. The Board of Directors has the power to change the membership of the Compensation Committee at any time, to fill vacancies therein and to discharge the Compensation Committee in its entirety at any time, either with or without cause, and to reclaim any administrative power previously delegated to the Committee.

As of March 31, 2005, 6,535,374 stock options were outstanding under the Plan. No restricted stock awards have been granted under the Plan. Additional information regarding options granted in 2004 to certain executive officers of the Company under the Plan is set forth in the table captioned "Individual Grants" on page 7 (the "Named Officers"), and additional information regarding outstanding options is set forth in the table captioned "Equity Compensation Plan" on page 4. Because

20

grants are discretionary, the Company is not able to predict the amount, types or recipients of future grants.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE "FOR" THE APPROVAL OF THE AMENDED AND RESTATED 1997 STOCK INCENTIVE PLAN.

RATIFICATION OF SELECTION OF AUDITORS

Our Board of Directors has appointed the firm of Deloitte & Touche, certified public accountants, to serve as independent auditors for the fiscal year ending December 31, 2005. Deloitte & Touche has served as iBasis' independent auditors since 2002. If the stockholders do not ratify the selection of Deloitte & Touche, the Board of Directors may consider selection of other independent certified public accountants to serve as independent auditors, but no assurances can be made that the Board of Directors will do so or that any other independent certified public accountants would be willing to serve. Representatives from Deloitte & Touche are expected to be present at the annual meeting and will have the opportunity to make a statement if they desire to do so. It is also expected that they will be available to respond to appropriate questions.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE "FOR" THE RATIFICATION OF APPOINTMENT OF IBASIS' AUDITORS.

Audit and Non-Audit Fees

The following table presents fees for audit services rendered by Deloitte & Touche for the audit of our annual financial statements for the years ended December 31, 2004 and 2003 and fees billed for other services rendered by Deloitte & Touche during those periods.

| | Fiscal 2004 | Fiscal 2003 | ||||

|---|---|---|---|---|---|---|

| Deloitte & Touche, LLP | ||||||

| Audit Fees(1) | $ | 393,266 | $ | 436,436 | ||

| Audit-Related Fees(2) | 144,767 | 24,785 | ||||

| Tax Service Fees(3) | 158,823 | 179,328 | ||||

| Subtotal | 696,856 | 640,549 | ||||

| All Other Fees | 0 | 0 | ||||

| Total | $ | 696,856 | $ | 640,549 | ||

- (1)

- Audit Fees—Audit fees billed to iBasis by Deloitte & Touche for auditing our annual financial statements and reviewing the financial statements included in iBasis' Quarterly Reports on Form 10-Q.

- (2)

- Audit-Related Fees—Audit-related fees billed to iBasis by Deloitte & Touche include fees related to the audit of our employee benefit plan, accounting consultations and review of registration statements filed by iBasis.

- (3)

- Tax Fees—Tax fees billed to iBasis by Deloitte & Touche include fees related to the preparation of our original and amended tax returns, claims for refunds, payment-planning services and tax advice related to employee benefit plans and merger and acquisition activity.

Policy on Audit Committee Pre-Approval of Audit and Non-Audit Services of Independent Auditor

The Audit Committee's policy is to pre-approve all audit and non-audit services provided by the independent auditors. These services may include audit services, audit-related services, tax services and

21